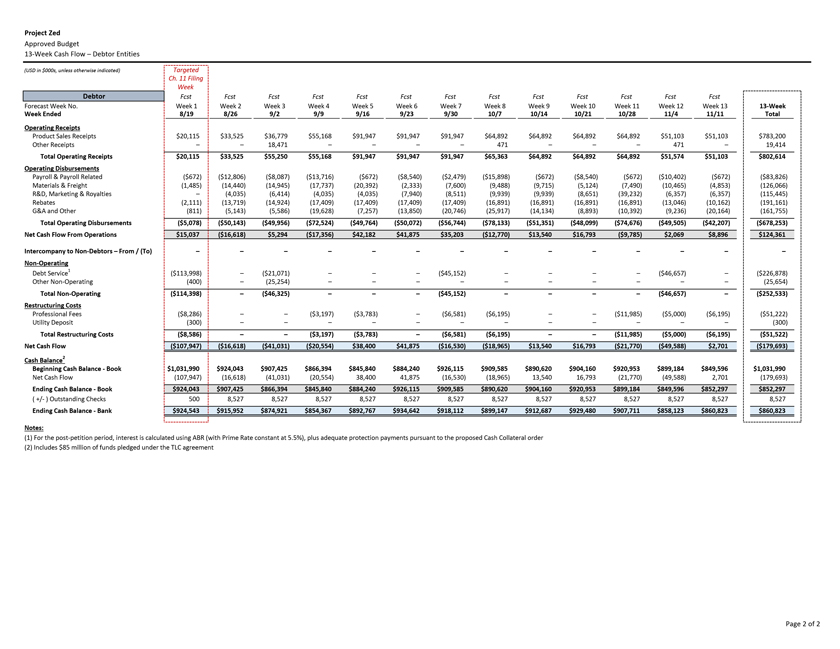

Project Zed Approved Budget 13-Week Cash Flow – Debtor Entities (USD in $000s, unless otherwise indicated) Targeted Ch. 11 Filing Week Debtor Fcst Fcst Fcst Fcst Fcst Fcst Fcst Fcst Fcst Fcst Fcst Fcst Fcst 13 Forecast Week No. Week 1 Week 2 Week 3 Week 4 Week 5 Week 6 Week 7 Week 8 Week 9 Week 10 Week 11 Week 12 Week 13 13-Week Week Ended 8/19 8/26 9/2 9/9 9/16 9/23 9/30 10/7 10/14 10/21 10/28 11/4 11/11 Total Operating Receipts Product Sales Receipts $20,115 $33,525 $36,779 $55,168 $91,947 $91,947 $91,947 $64,892 $64,892 $64,892 $64,892 $51,103 $51,103 $783,200 Other Receipts – – 18,471 – – – – 471 – – – 471 – 19,414 Total Operating Receipts $20,115 $33,525 $55,250 $55,168 $91,947 $91,947 $91,947 $65,363 $64,892 $64,892 $64,892 $51,574 $51,103 $802,614 Operating Disbursements Payroll & Payroll Related ($672) ($12,806) ($8,087) ($13,716) ($672) ($8,540) ($2,479) ($15,898) ($672) ($8,540) ($672) ($10,402) ($672) ($83,826) Materials & Freight (1,485) (14,440) (14,945) (17,737) (20,392) (2,333) (7,600) (9,488) (9,715) (5,124) (7,490) (10,465) (4,853) (126,066) R&D, Marketing & Royalties – (4,035) (6,414) (4,035) (4,035) (7,940) (8,511) (9,939) (9,939) (8,651) (39,232) (6,357) (6,357) (115,445) Rebates (2,111) (13,719) (14,924) (17,409) (17,409) (17,409) (17,409) (16,891) (16,891) (16,891) (16,891) (13,046) (10,162) (191,161) G&A and Other (811) (5,143) (5,586) (19,628) (7,257) (13,850) (20,746) (25,917) (14,134) (8,893) (10,392) (9,236) (20,164) (161,755) Total Operating Disbursements ($5,078) ($50,143) ($49,956) ($72,524) ($49,764) ($50,072) ($56,744) ($78,133) ($51,351) ($48,099) ($74,676) ($49,505) ($42,207) ($678,253) Net Cash Flow From Operations $15,037 ($16,618) $5,294 ($17,356) $42,182 $41,875 $35,203 ($12,770) $13,540 $16,793 ($9,785) $2,069 $8,896 $124,361 Intercompany to Non-Debtors – From / (To) – – – – – – – – – – – – – – Non-Operating Debt Service1 ($113,998) – ($21,071) – – – ($45,152) – – – – ($46,657) – ($226,878) Other Non-Operating (400) – (25,254) – – – – – – – – – – (25,654) Total Non-Operating ($114,398) – ($46,325) – – – ($45,152) – – – – ($46,657) – ($252,533) Restructuring Costs Professional Fees ($8,286) – – ($3,197) ($3,783) – ($6,581) ($6,195) – – ($11,985) ($5,000) ($6,195) ($51,222) Utility Deposit (300) – – – – – – – – – – – – (300) Total Restructuring Costs ($8,586) – – ($3,197) ($3,783) – ($6,581) ($6,195) – – ($11,985) ($5,000) ($6,195) ($51,522) Net Cash Flow ($107,947) ($16,618) ($41,031) ($20,554) $38,400 $41,875 ($16,530) ($18,965) $13,540 $16,793 ($21,770) ($49,588) $2,701 ($179,693) Cash Balance2 Beginning Cash Balance - Book $1,031,990 $924,043 $907,425 $866,394 $845,840 $884,240 $926,115 $909,585 $890,620 $904,160 $920,953 $899,184 $849,596 $1,031,990 Net Cash Flow (107,947) (16,618) (41,031) (20,554) 38,400 41,875 (16,530) (18,965) 13,540 16,793 (21,770) (49,588) 2,701 (179,693) Ending Cash Balance - Book $924,043 $907,425 $866,394 $845,840 $884,240 $926,115 $909,585 $890,620 $904,160 $920,953 $899,184 $849,596 $852,297 $852,297 ( +/- ) Outstanding Checks 500 8,527 8,527 8,527 8,527 8,527 8,527 8,527 8,527 8,527 8,527 8,527 8,527 8,527 Ending Cash Balance - Bank $924,543 $915,952 $874,921 $854,367 $892,767 $934,642 $918,112 $899,147 $912,687 $929,480 $907,711 $858,123 $860,823 $860,823 Notes: (1) For the post-petition period, interest is calculated using ABR (with Prime Rate constant at 5.5%), plus adequate protection payments pursuant to the proposed Cash Collateral order (2) Includes $85 million of funds pledged under the TLC agreement