t tribune PUBLISHING

INVESTOR PRESENTATION

July 2014

Disclaimer

Cautionary Statement Regarding Forward-Looking Statements and Projections

The statements contained in this presentation include certain forward-looking statements that are based largely on our current expectations and reflect various estimates and assumptions by us. Forward-looking statements are subject to certain risks, trends and uncertainties that could cause actual results and achievements to differ materially from those expressed in such forward-looking statements. Such risks, trends and uncertainties, which in some instances are beyond our control, are described under the heading “Risk Factors” in the most recent Tribune Publishing Company’s Form 10 amendment filed with the Securities and Exchange Commission, and include:

competition and other economic conditions including fragmentation of the media landscape and competition from other media alternatives;

changes in advertising demand, circulation levels and audience shares;

our ability to develop and grow our online businesses;

our reliance on revenue from printing and distributing third-party publications;

changes in newsprint prices;

macroeconomic trends and conditions;

our reliance on third party vendors for various services;

our ability to adapt to technological changes;

adverse results from litigation, governmental investigations or tax-related proceedings or audits;

our ability to realize benefits or synergies from acquisitions or divestitures or to operate our businesses effectively following acquisitions or divestitures;

our ability to attract and retain employees;

our ability to satisfy pension and other postretirement employee benefit obligations;

changes in accounting standards;

the effect of labor strikes, lock-outs and labor negotiations;

regulatory and judicial rulings;

our indebtedness and ability to comply with covenants applicable to our anticipated debt financing;

our adoption of fresh-start reporting which has caused our combined financial statements for periods subsequent to December 31, 2012 to not be comparable to prior periods;

our ability to satisfy future capital and liquidity requirements; and

our ability to access the credit and capital markets at the times and in the amounts needed and on acceptable terms.

The words “believe,” “expect,” “anticipate,” “estimate,” “could,” “should,” “intend,” “may,” “plan,” “seek” and similar expressions generally identify forward-looking statements. Whether or not any such forward-looking statements are in fact achieved will depend on future events, some of which are beyond our control. Readers are cautioned not to place undue reliance on such forward-looking statements, which are being made as of the date of this information statement. We undertake no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise.

1 t tribune PUBLISHING

Disclaimer (cont’d)

Basis of Presentation and Statements Relating to Non-U.S. GAAP Financial Measures

As a result of the consummation of the Plan of Reorganization (the “Plan”) filed by Tribune Company, the parent company of Tribune Publishing Company (“Tribune Publishing” or the “Company”), and the transactions contemplated thereby, the Company, since December 31, 2012 (the “Effective Date”), has been operating its businesses under a new capital structure and has been subject to “fresh-start reporting” in accordance with Financial Accounting Standards Board Accounting Standards Codification (“ASC”) Topic 852, “Reorganizations.” The financial information contained in the presentation for periods ended on or prior to December 30, 2012 does not reflect the impact of “fresh-start reporting.” The financial condition and results of operations for periods ended on or prior to December 30, 2012 have not been adjusted to reflect any changes in the Company’s capital structure as a result of the Plan nor have they been adjusted to reflect any changes in the fair value of assets and liabilities as a result of the adoption of fresh-start reporting.

Note on Presentation of Financial Data

The Company’s fiscal year ends every year on the last Sunday in December. Every five or six years, the Company’s fiscal year has 53 weeks rather than 52 weeks. The Company’s 2012 fiscal year was a 53 week year, with the extra week occurring in the fourth quarter.

Adjusted EBITDA

Adjusted EBITDA is defined as net income before income taxes, interest income, interest expense, depreciation and amortization, equity income and losses, pension expense, stock-based compensation, certain unusual and non-recurring items (including severance and transaction-related costs), write-down of investments, non-operating items and reorganization items. Our management uses Adjusted EBITDA (a) as a measure of operating performance; (b) for planning and forecasting in future periods; and (c) in communications with our Board of Directors concerning our financial performance. Adjusted EBITDA is a financial measure that is not calculated in accordance with accounting principles generally accepted in the United States of America (GAAP). This non-GAAP measure is presented because it is used by management to evaluate our operating performance. We believe the presentation of Adjusted EBITDA enhances investors’ overall understanding of the financial performance of our business as a stand-alone company. In addition, Adjusted EBITDA, or a similarly calculated measure, is expected to be used as the basis for certain financial maintenance covenants that we will be subject to in connection with our entry into the Senior Credit Facilities. We believe Adjusted EBITDA is helpful in highlighting operating trends because it excludes the results of decisions that are outside the control of management and that can differ significantly from company to company depending on long-term strategic decisions regarding capital structure, the tax jurisdictions in which companies operate, age and book depreciation of facilities and capital investments. Since not all companies use identical calculations, our presentation of Adjusted EBITDA may not be comparable to other similarly titled measures of other companies and should not be used by investors as a substitute or alternative to net income or any measure of financial performance calculated and presented in accordance with GAAP. Instead, we believe Adjusted EBITDA should be used to supplement our financial measures derived in accordance with GAAP to provide a more complete understanding of the trends affecting the business.

We note that Adjusted EBITDA does not reflect the potential impact resulting from the distribution and Tribune Publishing operating as a stand-alone public company, including any modification to the affiliation agreement between CareerBuilder and Tribune Publishing as a result of the distribution, the impact of affiliation agreements between Classified Ventures and our newspapers that may not be renewed or may be renewed on different terms or rental expense to be incurred by Tribune Publishing related to lease agreements with Tribune for certain facilities and office space. See “Unaudited Pro Forma Combined Financial Statements” in the Form 10 and the notes thereto.

Although Adjusted EBITDA is frequently used by investors and securities analysts in their evaluations of companies, Adjusted EBITDA has limitations as an analytical tool, and you should not consider it in isolation or as a substitute for, or more meaningful than, amounts determined in accordance with GAAP. Some of the limitations to using non-GAAP measures as an analytical tool are:

they do not reflect our interest income and expense, or the requirements necessary to service interest or principal payments on our debt;

they do not reflect future requirements for capital expenditures or contractual commitments;

although depreciation and amortization charges are non-cash charges, the assets being depreciated and amortized will often have to be replaced in the future, and non-GAAP

measures do not reflect any cash requirements for such replacements

During the course of this presentation, certain other non-U.S. GAAP financial information will be presented. See pages 30, 31 and 32 for a reconciliation of these non-U.S. GAAP measures to the most similar GAAP measures.

Partial Economics – Partial Economics as used herein is defined as “assumes reasonable case with 50% economics from affiliation agreement.”

No Economics – No Economics as used herein is defined as “assumes no economic benefit from affiliation agreements.”

2 t tribune PUBLISHING

Introduction

3 t tribune PUBLISHING

Senior Management Team

John (Jack) H. Griffin Jr., Chief Executive Officer

John B. Bode, Chief Financial Officer

Bill Adee, Executive Vice President of Digital

Sandy J. Martin, VP / Corporate Finance & Investor Relations

4 t tribune PUBLISHING

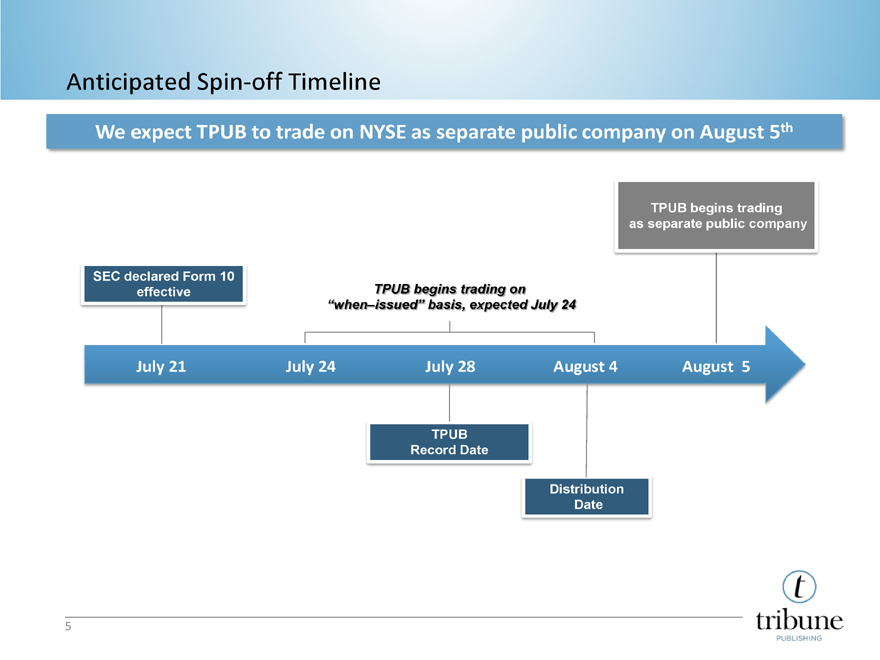

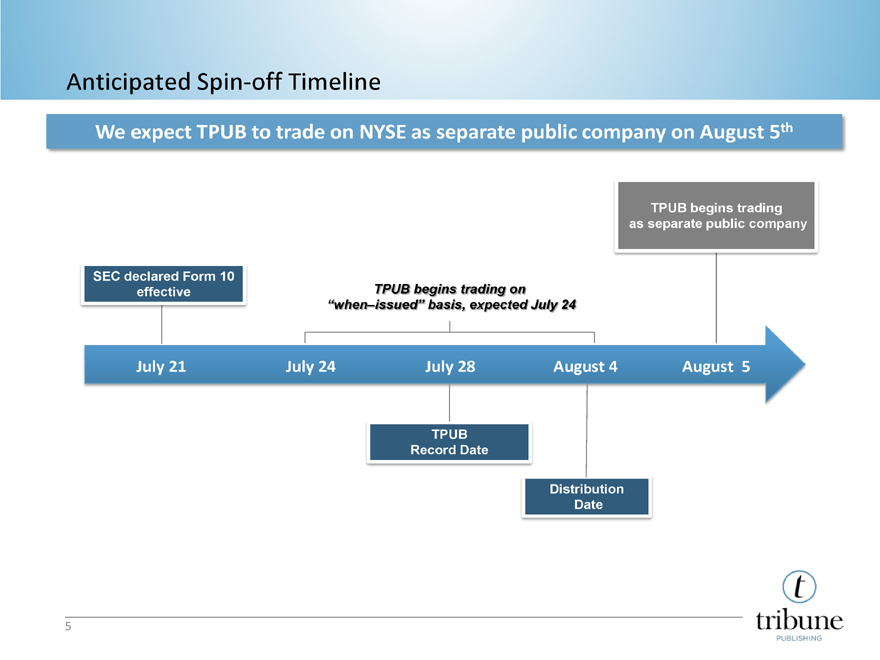

Anticipated Spin-off Timeline

We expect TPUB to trade on NYSE as separate public company on August 5th

TPUB begins trading as separate public company

SEC declared Form 10 effective TPUB begins trading on “when–issued” basis, expected July 24

July 21 July 24 July 28 August 4 August 5

TPUB Record Date

Distribution Date

5 t tribune PUBLISHING

Spin-Off Overview and Rationale

Overview

In July 2013, Tribune Company announced its plans to separate Tribune Publishing from Tribune Media in a tax-free spin-off, which is scheduled to be completed on August 4th

The distribution ratio will be 1 Tribune Publishing share per 4 Tribune Company shares or approximately 25mm diluted shares outstanding

The Company will be listed on the New York Stock Exchange under the ticker ‘TPUB’

In connection with the spin-off, Tribune Publishing expects to raise a $350mm Senior Term Loan Facility and have access to an undrawn $140mm Senior ABL Facility (subject to closing conditions)

Proceeds from the term loan will be used to pay a special dividend to Tribune Company of up to $275mm, pay related transaction fees and expenses, and for general corporate purposes

Tribune Publishing expects to initiate a regular quarterly cash dividend in the fourth quarter of 2014 at an annual rate of $0.70 per share

Rationale

Optimize capital structure and leverage level

Enhance the core business with greater financial, operational and strategic focus

Relief from certain regulations that restrict Tribune Publishing from entering into certain markets as a result of current cross-ownership restrictions

Directly align management incentives with Tribune Publishing shareholders

6 t tribune PUBLISHING

Company Highlights and Strategy

7 t tribune PUBLISHING

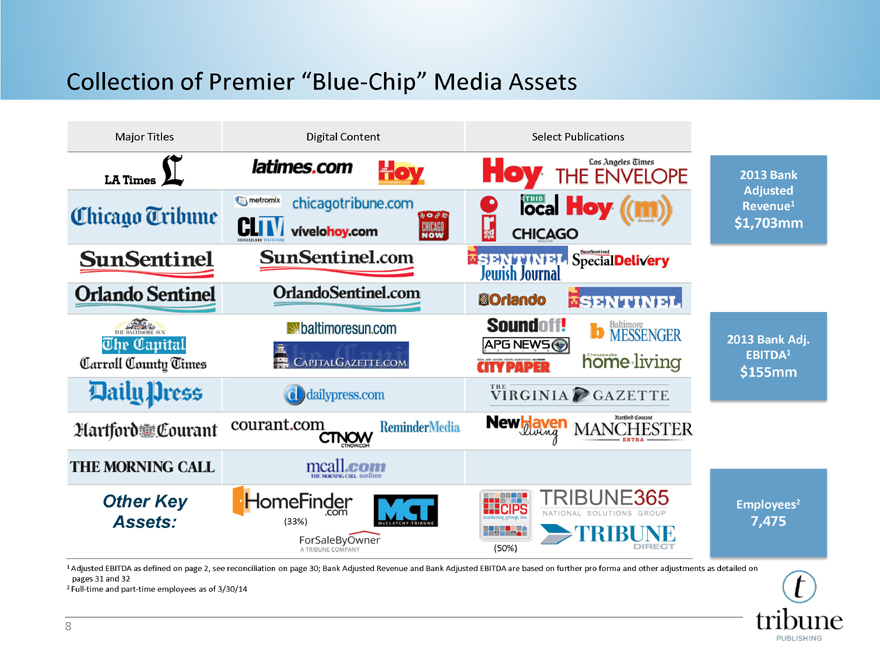

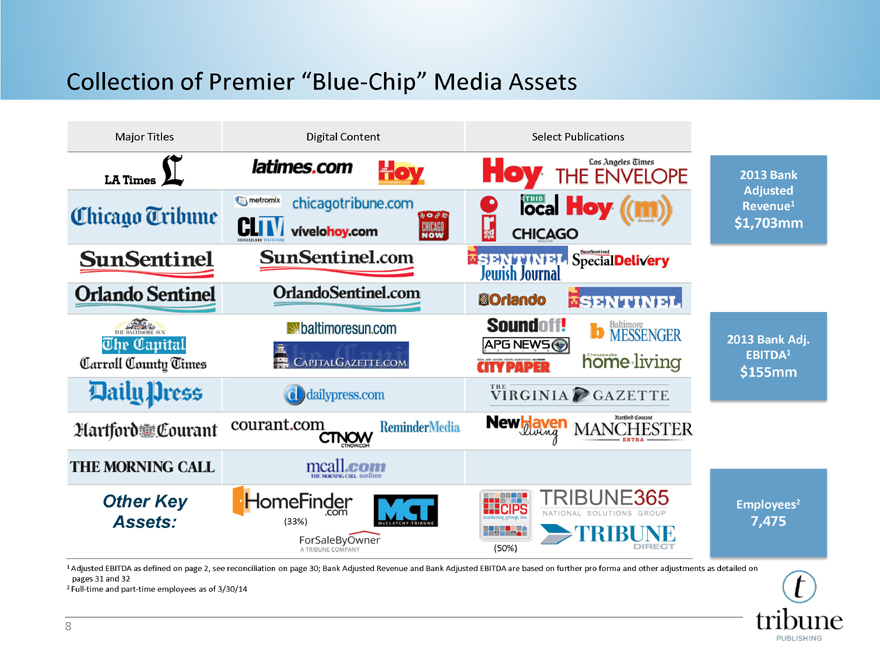

Collection of Premier “Blue-Chip” Media Assets

Major Titles

LA Times L

Chicago Tribune

SunSentinel

Orlando Sentinel

THE BALTIMORE SUN

THE CAPITAL

Carroll County Times

Daily Press

Hartford Courant

THE MORNING CALL

Other Key Assets:

Digital Content

Latimes.com Hoy

m metromix chicagotribune.com

CLTV CHICAGOLAND TELEVISION vivelohoy.com CHICAGO NOW

SunSentinel.com

OrlandoSentinel.com

baltimoresun.com

CAPITALGAZETTE.COM

ddailypress.com

courant.com ReminderMedia

CTNOW CTNOW.COM

mcall.com

THE MORNING CALL online

HomeFinder.com

(33%) MCT McCLATCHY-TRIBUNE

ForSaleByOwner

A TRIBUNE COMPANY

Select Publications

Hoy Los Angeles Times THE ENVELOPE

i red eye TRIB local Hoy (m)

CHICAGO

SENTINEL Jewish Journal SunSentinel SpecialDelivery

Orlando SENTINEL

Soundoff!

APG NEWS ONLINE

b Baltimore MESSENGER

CITYPAPER Chesapeake home+living

THE VIRGINIA GAZETTE

NewHaven living

Hartford Courant MANCHESTER EXTRA

CIPS

marketing group, inc.

(50%)

TRIBUNE365 NATIONAL SOLUTIONS GROUP

TRIBUNE DIRECT

2013 Bank

Adjusted

Revenue1

$1,703mm

2013 Bank Adj.

EBITDA1

$155mm

Employees2

7,475

1 Adjusted EBITDA as defined on page 2, see reconciliation on page 30; Bank Adjusted Revenue and Bank Adjusted EBITDA are based on further pro forma and other adjustments as detailed on pages 31 and 32

2 Full-time and part-time employees as of 3/30/14

8 t tribune PUBLISHING

Key Investment Highlights

Leader in Multimedia Local News & Information

Trusted, Award-Winning Premium Content

Compelling Suite of Advertising Solutions

Diverse Portfolio of Iconic Brands and Products

Deep Multi-Platform Audience Engagement

Strong Free Cash Flow & Conservative Capital Structure

Deep & Experienced Management Team

9 t tribune PUBLISHING

Leading Iconic Brands with Deep, Local Market Reach

Market Los Angeles, CA Chicago, IL South Florida Orlando, FL Baltimore, MD Annapolis, MD Carroll County, MD Hartford, CT Newport News, VA Allentown, PA 5

DMA Rank 2 3 16 18 27 27 27 30 45 54

Iconic Brands Daily LA Times L latimes.com Chicago Tribune chicagotribune.com SunSentinel SunSentinel.com Orlando Sentinel OrlandoSentinel.com THE SUN baltimoresun.com The Capital CAPITALGAZETTE.COM Carroll County Times Hartford Courant courant.com Daily Press ddailypress.com THE MORNING CALL mcall.com THE MORNING CALL online

Circulation (000s)1 673 440 163 151 174 29 21 120 52 80

Sunday 956 790 218 258 296 34 25 181 85 128

Print Local Market Leadership2 #1 #1 #1 #1 #1 #2 #3 #1 #2 #35

Digital (mm)3 Unique Visitors 25 12 3 4 4 0.5 0.3 2 1 1

Page Views 118 107 22 23 22 3 1 17 4 9

Digital Local Market Leadership4 #1 #1 #1 #1 #1 NA NA #1 #1 #55

Ranked #1 amongst local print and digital competition in the majority of our markets

Note: Circulation and digital traffic statistics may include minimal duplication among the media properties; DMA source Nielsen estimates as of September 2013

1 Alliance for Audited Media; Includes print and digital circulation; Total circulation is average for six months ended March 31, 2014; DMA net combined audience except for Sun Sentinel which is NDM net combined audience

2 Kantar Media/TNS; Ranking based on total media market advertising spend within the respective DMA for April 2013 – March 2014

3 ComScore data – 13 month average from March 2013 to March 2014 for Total Digital Platform

4 Based on total digital market audience reach % yearly average as compared to digital presence of local peers within same DMA

5 The Morning Call focuses on the Lehigh Valley region within the Philadelphia DMA (#4); Ranks 3rd and 5th for print and digital local market leadership in the Philadelphia DMA respectively

10 t tribune PUBLISHING

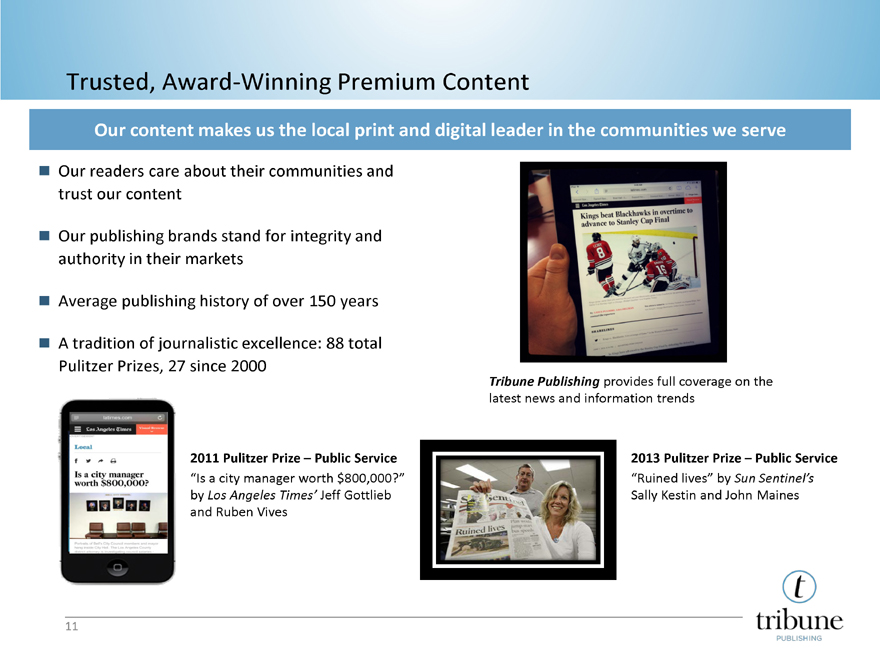

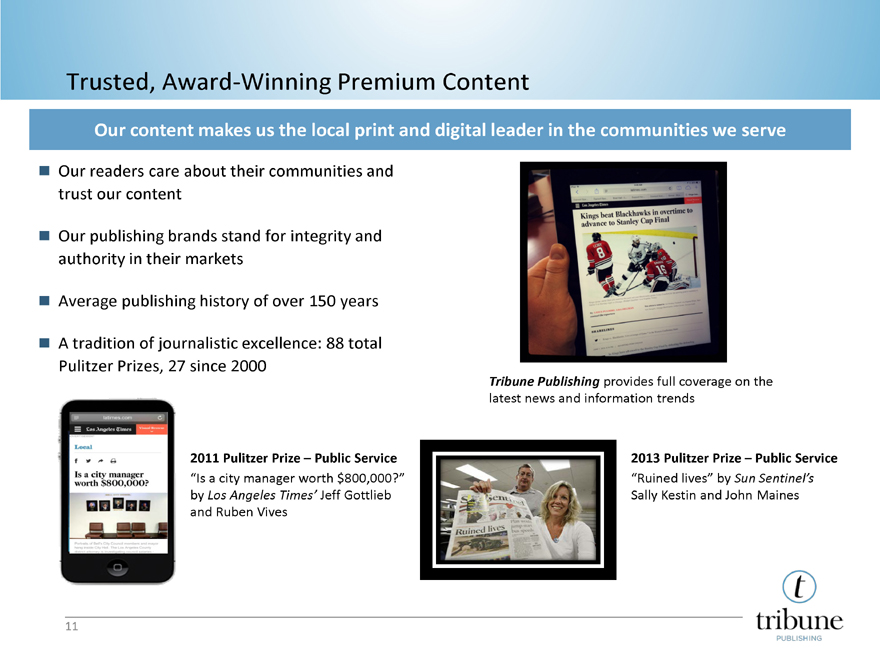

Trusted, Award-Winning Premium Content

Our content makes us the local print and digital leader in the communities we serve

Our readers care about their communities and trust our content

Our publishing brands stand for integrity and authority in their markets

Average publishing history of over 150 years

A tradition of journalistic excellence: 88 total Pulitzer Prizes, 27 since 2000

Tribune Publishing provides full coverage on the latest news and information trends

2011 Pulitzer Prize – Public Service

“Is a city manager worth $800,000?” by Los Angeles Times’ Jeff Gottlieb and Ruben Vives

2013 Pulitzer Prize – Public Service

“Ruined lives” by Sun Sentinel’s Sally Kestin and John Maines

11 t tribune PUBLISHING

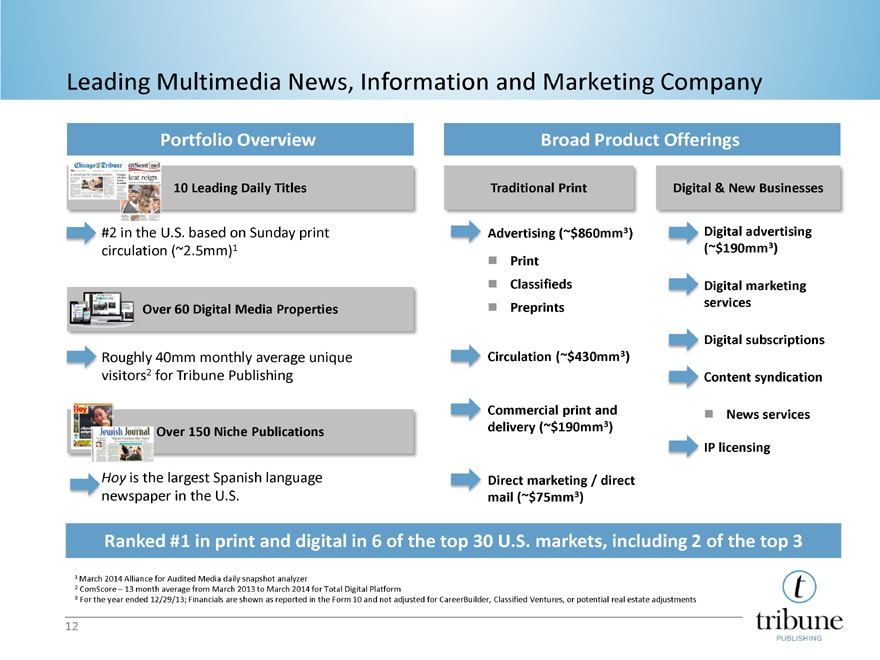

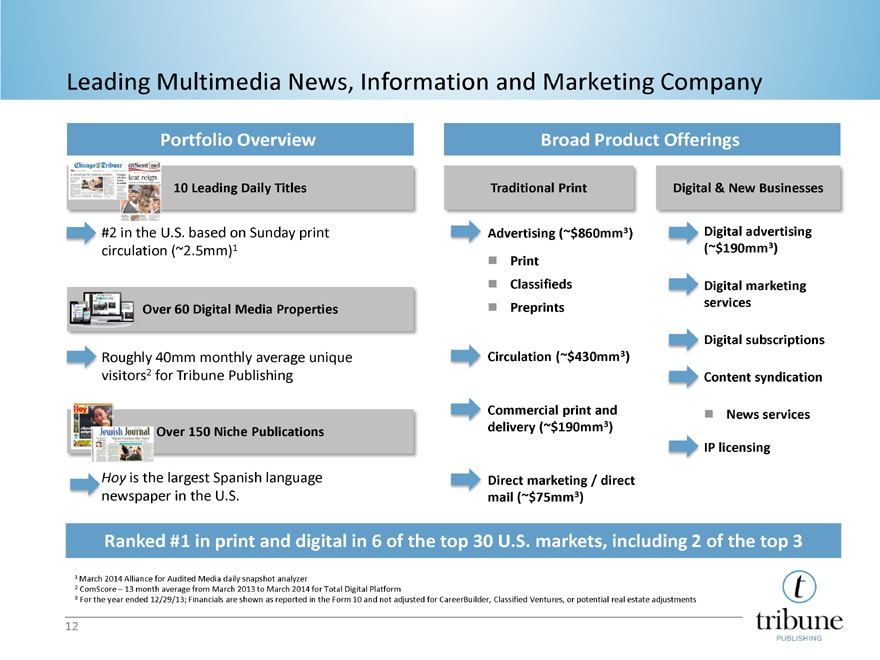

Leading Multimedia News, Information and Marketing Company

Portfolio Overview

10 Leading Daily Titles

#2 in the U.S. based on Sunday print circulation (~2.5mm)1

Over 60 Digital Media Properties

Roughly 40mm monthly average unique visitors2 for Tribune Publishing

Over 150 Niche Publications

Hoy is the largest Spanish language newspaper in the U.S.

Broad Product Offerings

Traditional Print

Advertising (~$860mm3)

Print

Classifieds

Preprints

Circulation (~$430mm3)

Commercial print and

delivery (~$190mm3)

Direct marketing / direct

mail (~$75mm3)

Digital & New Businesses

Digital advertising

(~$190mm3)

Digital marketing services

Digital subscriptions Content syndication News services IP licensing

Ranked #1 in print and digital in 6 of the top 30 U.S. markets, including 2 of the top 3

1 March 2014 Alliance for Audited Media daily snapshot analyzer

2 ComScore – 13 month average from March 2013 to March 2014 for Total Digital Platform

3 For the year ended 12/29/13; Financials are shown as reported in the Form 10 and not adjusted for CareerBuilder, Classified Ventures, or potential real estate adjustments

12 t tribune PUBLISHING

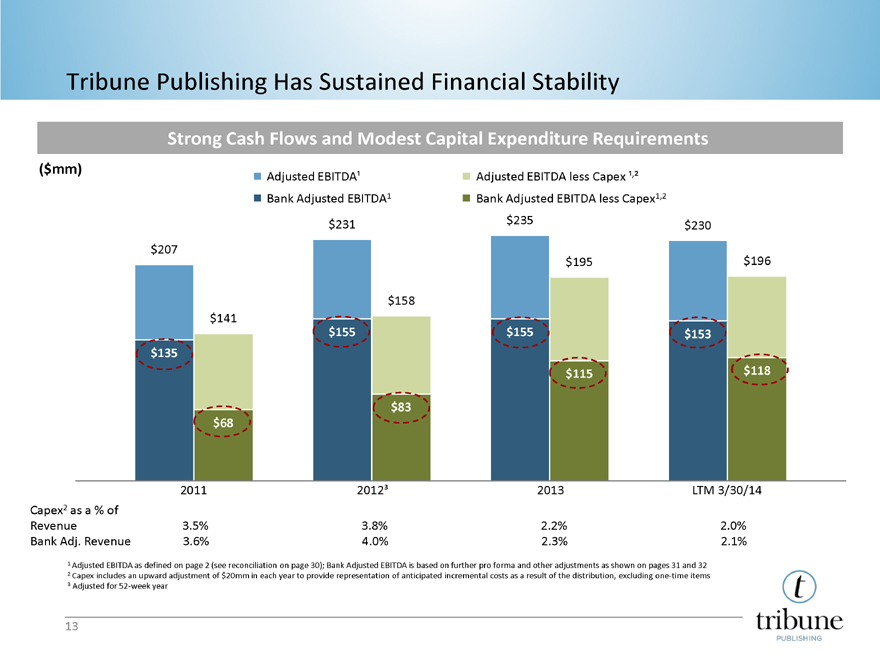

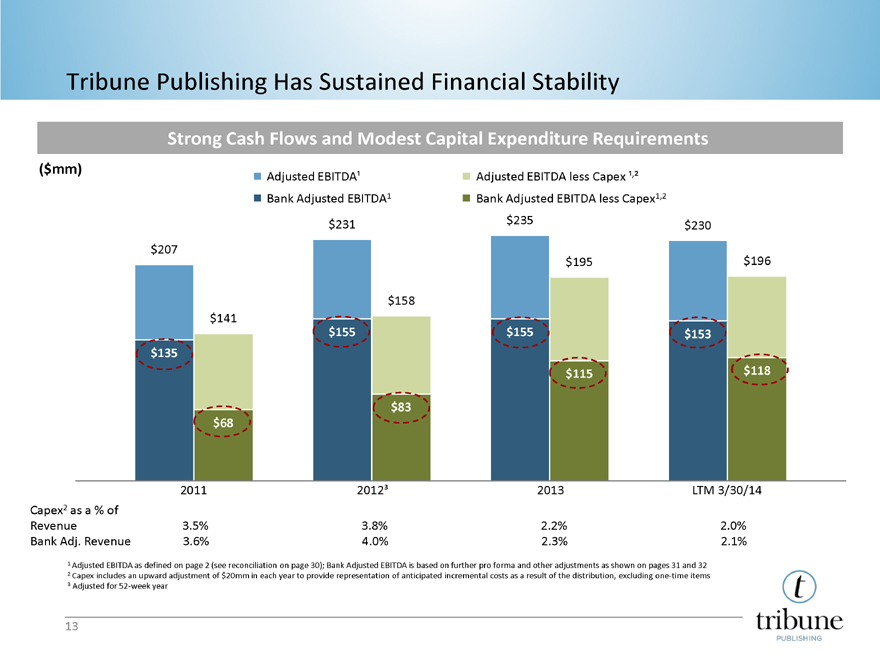

Tribune Publishing Has Sustained Financial Stability

Strong Cash Flows and Modest Capital Expenditure Requirements

($mm)

Adjusted EBITDA1

Adjusted EBITDA less Capex 1,2

Bank Adjusted EBITDA1

Bank Adjusted EBITDA less Capex1,2

$231 $235 $230 $207 $195 $196 $158 $141 $155

$155 $153 $135 $115 $118 $83 $68 2011 20123

2013 LTM 3/30/14

Capex2 as a % of

Revenue

3.5%

3.8%

2.2%

2.0%

Bank Adj. Revenue

3.6%

4.0%

2.3%

2.1%

1 Adjusted EBITDA as defined on page 2 (see reconciliation on page 30); Bank Adjusted EBITDA is based on further pro forma and other adjustments as shown on pages 31 and 32

2 Capex includes an upward adjustment of $20mm in each year to provide representation of anticipated incremental costs as a result of the distribution, excluding one-time items

3 Adjusted for 52-week year

13 t tribune PUBLISHING

Our 7 Strategic Principles

1 Build on Our Leading Local Market Presence

2 Strategically Manage Our Core Business

3 Accelerate Innovation and the Digital Transition

4 Monetize Our Content on Digital Platforms

5 Continue Successful Revenue Diversification

6 Leverage Operating Platform for Opportunistic Consolidation

7 Maintain Disciplined Cost Management and Financial Policies

14 t tribune PUBLISHING

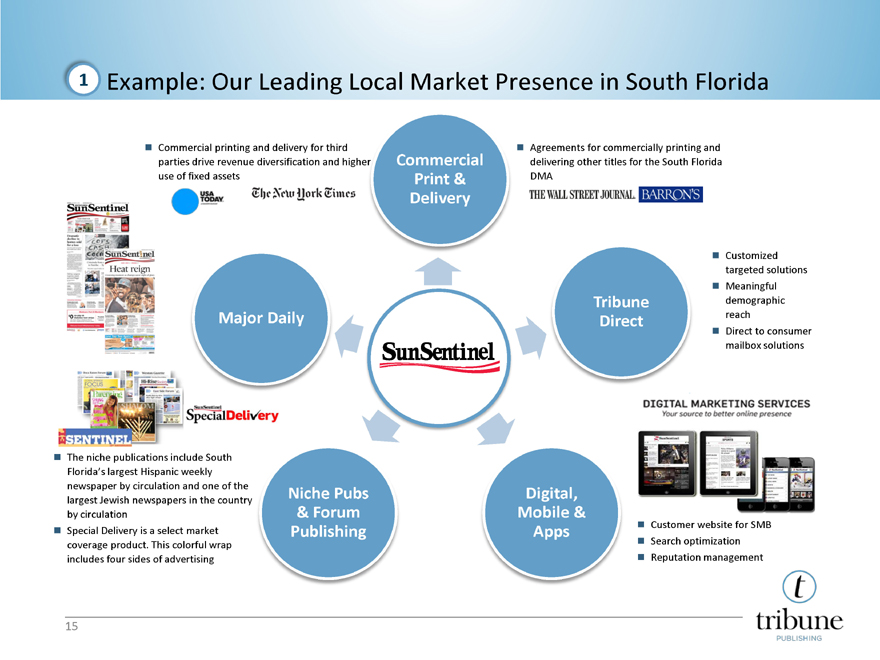

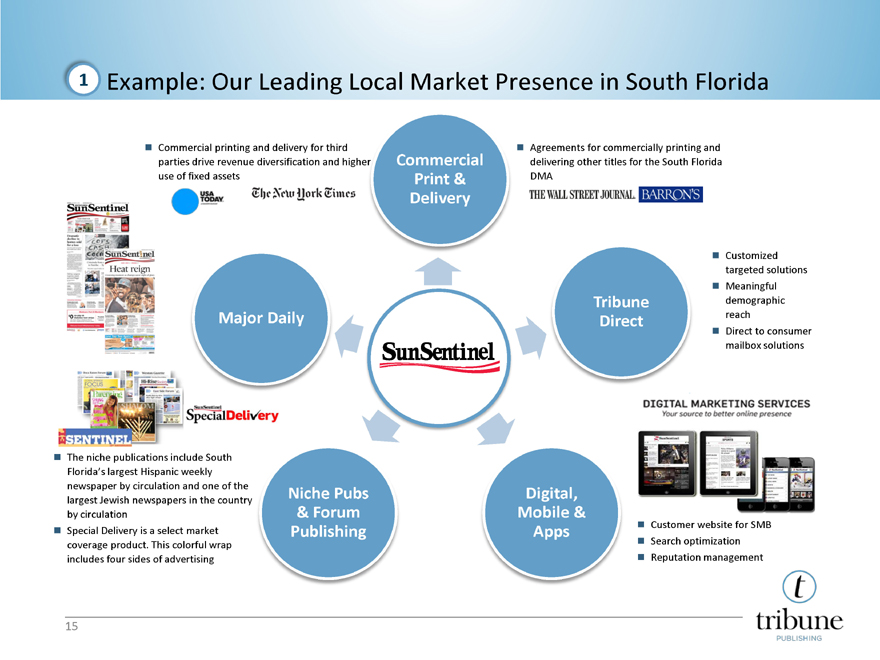

1 Example: Our Leading Local Market Presence in South Florida

Commercial printing and delivery for third parties drive revenue diversification and higher use of fixed assets

USA TODAY

The New York Times

SunSentinel

SunSentinel

Heat reign

SunSentinel

Special delivery

SENTINEL

The niche publications include South Florida’s largest Hispanic weekly newspaper by circulation and one of the largest Jewish newspapers in the country by circulation

Special Delivery is a select market coverage product. This colorful wrap includes four sides of advertising

Major Daily

Commercial Print & Delivery

Niche Pubs & Forum Publishing

SunSentinel

Digital, Mobile & Apps

Tribune Direct

Agreements for commercially printing and delivering other titles for the South Florida DMA

THE WALL STREET JOURNAL BARRON’S

Customized targeted solutions

Meaningful demographic reach

Direct to consumer mailbox solutions

DIGITAL MARKETING SERVICES

Your source to better online presence

Customer website for SMB

Search optimization

Reputation management

15 t tribune PUBLISHING

2 Strategically Manage Our Core Business

We are highly focused on driving our core publishing revenue streams

Advertising

Advertising sales forces are structured and incentivized to cross-sell print and digital Advertising categories are highly diversified

Tribune Publishing is a leader in pre-print advertising

Deploying research, data and analytics for greater targeting

Dedicated units, e.g. as Tribune 365 & 435 Digital, to develop branded and native advertising

Hyper-local is an advertising focus and strength

Circulation

Targeted pricing strategies have produced growth in circulation revenue and yield

Strategic bundling of print and digital offerings is winning new loyal customers

Company goal is to incentivize print customers to activate digital accounts

Consumer marketing programs are focused on retaining high value audience segments

Aggressive “win-back” programs are in place to re-connect with lost print audience

16 t tribune PUBLISHING

3 Accelerate Innovation and the Digital Transition

NGUX scheduled to roll out across remaining Tribune Publishing properties in 2014

Tribune Publishing Has Been a Digital Pioneer…

Tribune has been instrumental in the growth and success of Cars.com and CareerBuilder

Tribune Publishing is developing new video capabilities for advertising and editorial products

…And Will Continue to Innovate

New digital vertical and affinity products are under development to fuel further digital growth

Data tools are expected to power growth in local digital advertising and geolocation programs

Investments in staff and capabilities will drive growth in digital marketing services for clients (SEO, SEM, Web development, etc.)

New native apps for Tribune Publishing properties will also launch in 2014

Aggressively rolling out the All Access consumer model and Digital Only subscription programs

Next Generation User Experience (“NGUX”) launched at latimes.com to rave reviews

“The Los Angeles Times is introducing a redesign tonight that moves the 132-year-old newspaper closer to the vanguard of mobile-first web design” – GIZMODO

“The best surprise, in my view: that in 2014 a newspaper the size of the Los Angeles Times can stop and rethink its website to offer us a textbook example of how it can be done.” – AD AGE

“…the site also provides a kind of choose-your-own-adventure twist, letting readers switch between sections in the scroll without disrupting the flow.” – NIEMAN

Initial NGUX Results

35% increase in page views per visit1

1 Omniture statistics for latimes.com as of 6/9/14

17 t tribune PUBLISHING

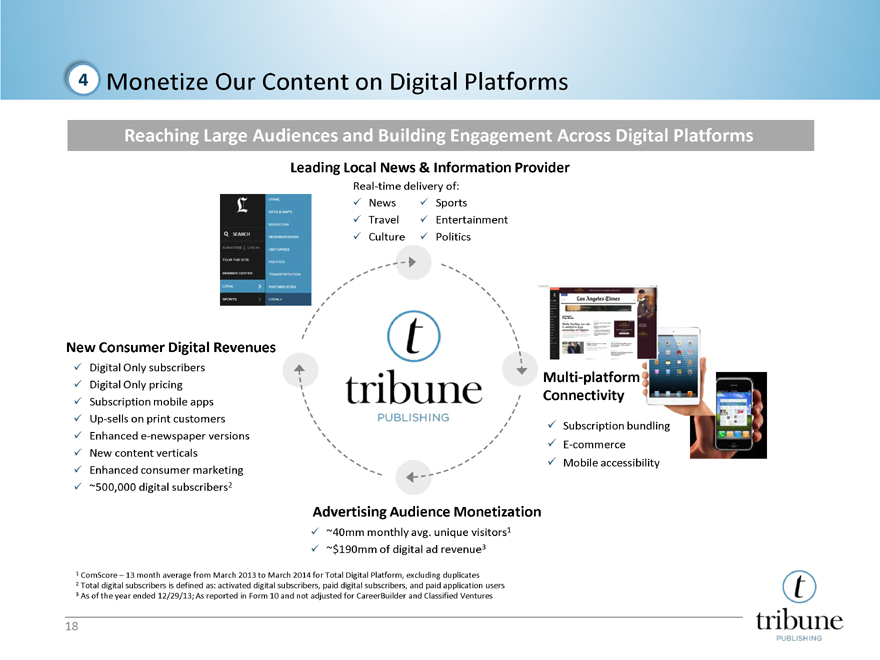

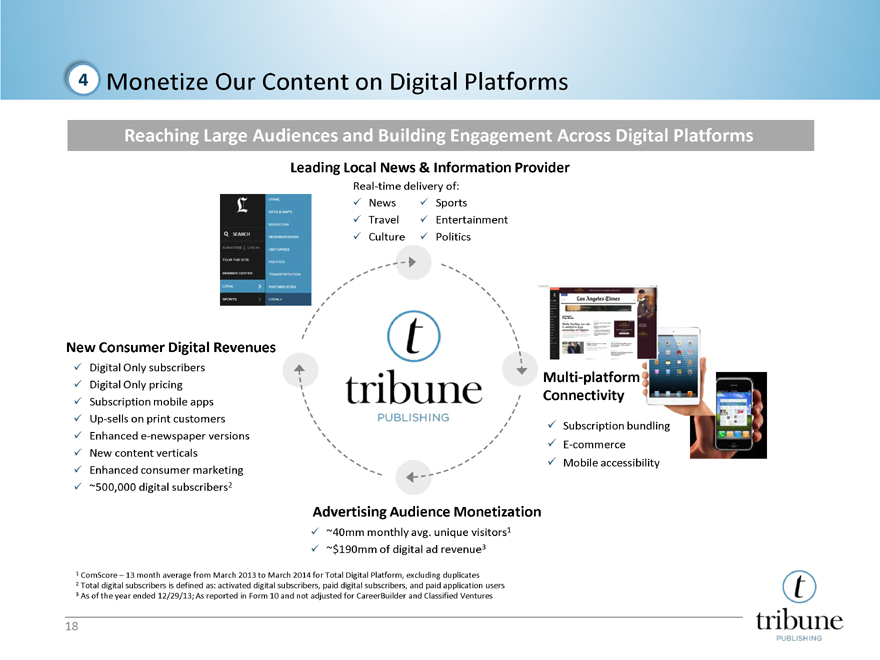

4 Monetize Our Content on Digital Platforms

Reaching Large Audiences and Building Engagement Across Digital Platforms

Leading Local News & Information Provider

Real-time delivery of:

News Sports

Travel Entertainment

Culture Politics

New Consumer Digital Revenues

Digital Only subscribers

Digital Only pricing

Subscription mobile apps

Up-sells on print customers

Enhanced e-newspaper versions

New content verticals

Enhanced consumer marketing

~500,000 digital subscribers2

t tribune PUBLISHING

Multi-platform Connectivity

Subscription bundling

E-commerce

Mobile accessibility

Advertising Audience Monetization

~40mm monthly avg. unique visitors1

~$190mm of digital ad revenue3

1 ComScore – 13 month average from March 2013 to March 2014 for Total Digital Platform, excluding duplicates

2 Total digital subscribers is defined as: activated digital subscribers, paid digital subscribers, and paid application users

3 As of the year ended 12/29/13; As reported in Form 10 and not adjusted for CareerBuilder and Classified Ventures

18 t tribune PUBLISHING

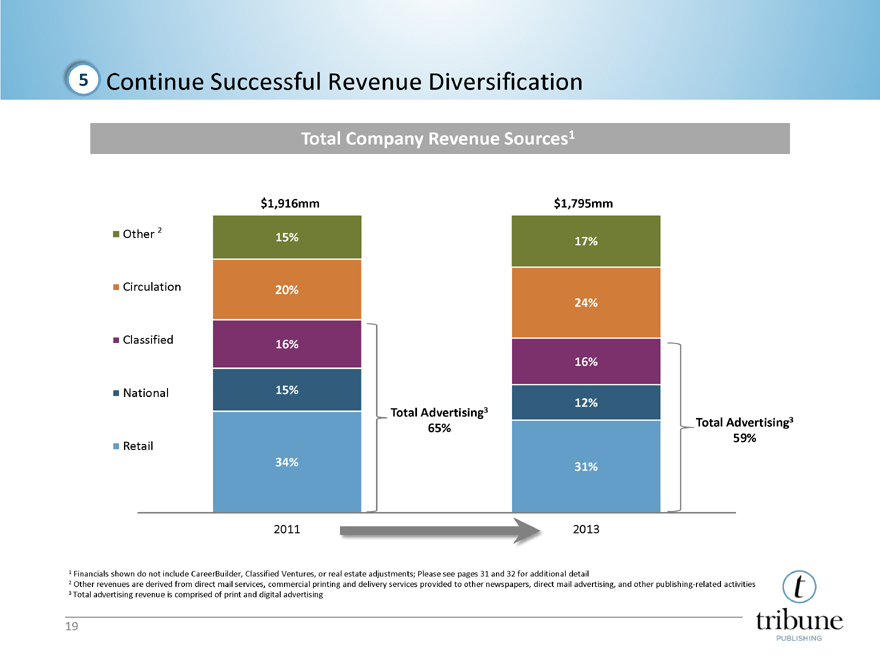

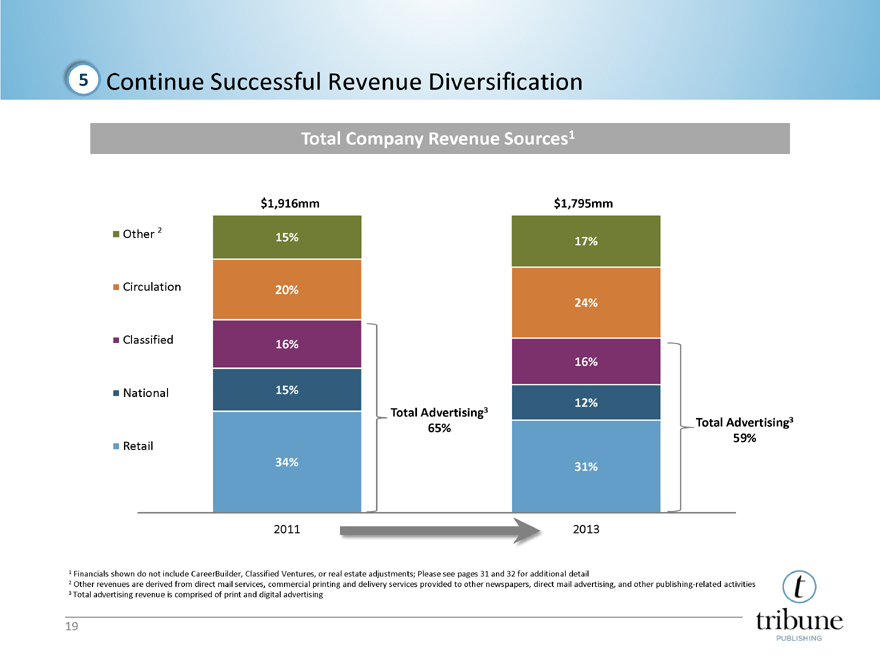

5 Continue Successful Revenue Diversification

Total Company Revenue Sources1

$1,916mm

Other 2

15%

Circulation 20%

Classified 16%

National 15%

Retail

34%

Total Advertising3 65%

$1,795mm

17%

24%

16%

12%

31%

Total Advertising3 59%

2011 2013

1 Financials shown do not include CareerBuilder, Classified Ventures, or real estate adjustments; Please see pages 31 and 32 for additional detail

2 Other revenues are derived from direct mail services, commercial printing and delivery services provided to other newspapers, direct mail advertising, and other publishing-related activities

3 Total advertising revenue is comprised of print and digital advertising

19 t tribune PUBLISHING

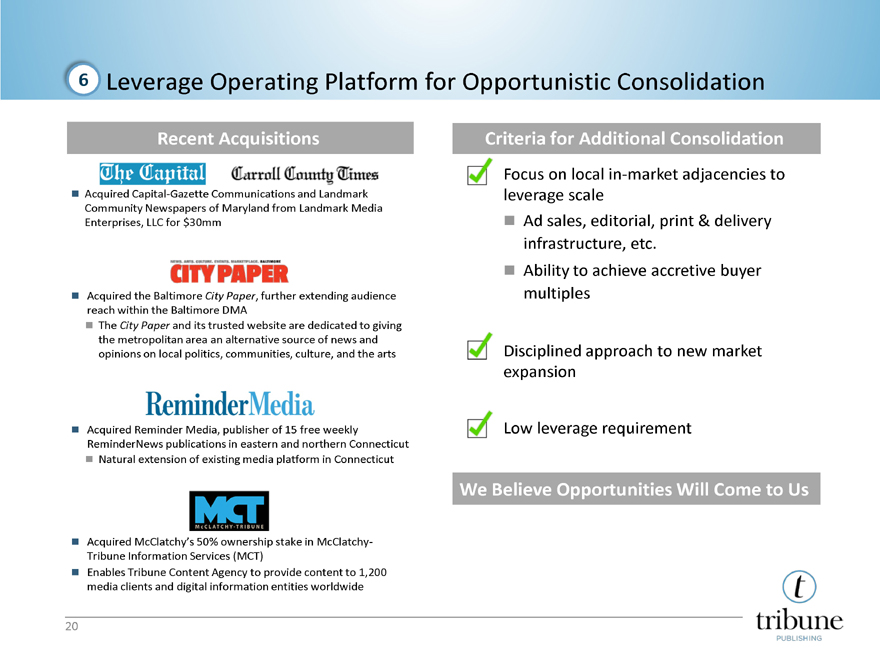

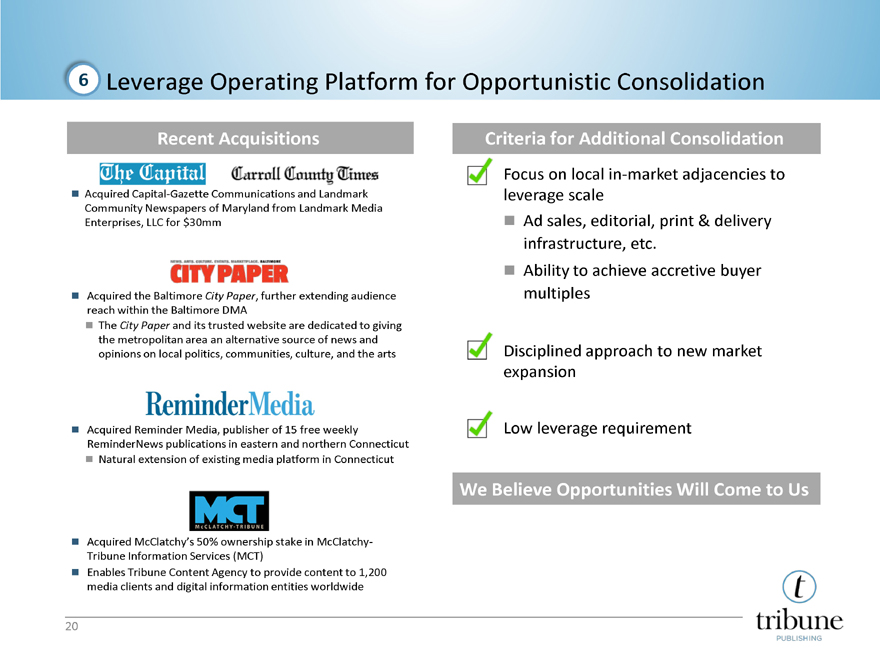

6 Leverage Operating Platform for Opportunistic Consolidation

Recent Acquisitions

The Capital Carroll County Times

Acquired Capital-Gazette Communications and Landmark Community Newspapers of Maryland from Landmark Media Enterprises, LLC for $30mm

CITY PAPER

Acquired the Baltimore City Paper, further extending audience reach within the Baltimore DMA

The City Paper and its trusted website are dedicated to giving the metropolitan area an alternative source of news and opinions on local politics, communities, culture, and the arts

ReminderMedia

Acquired Reminder Media, publisher of 15 free weekly

ReminderNews publications in eastern and northern Connecticut

Natural extension of existing media platform in Connecticut

MCT McCLATCHY TRIBUNE

Acquired McClatchy’s 50% ownership stake in McClatchy- Tribune Information Services (MCT)

Enables Tribune Content Agency to provide content to 1,200 media clients and digital information entities worldwide

Criteria for Additional Consolidation

Focus on local in-market adjacencies to leverage scale

Ad sales, editorial, print & delivery infrastructure, etc.

Ability to achieve accretive buyer multiples

Disciplined approach to new market expansion

Low leverage requirement

We Believe Opportunities Will Come to Us

20 t tribune PUBLISHING

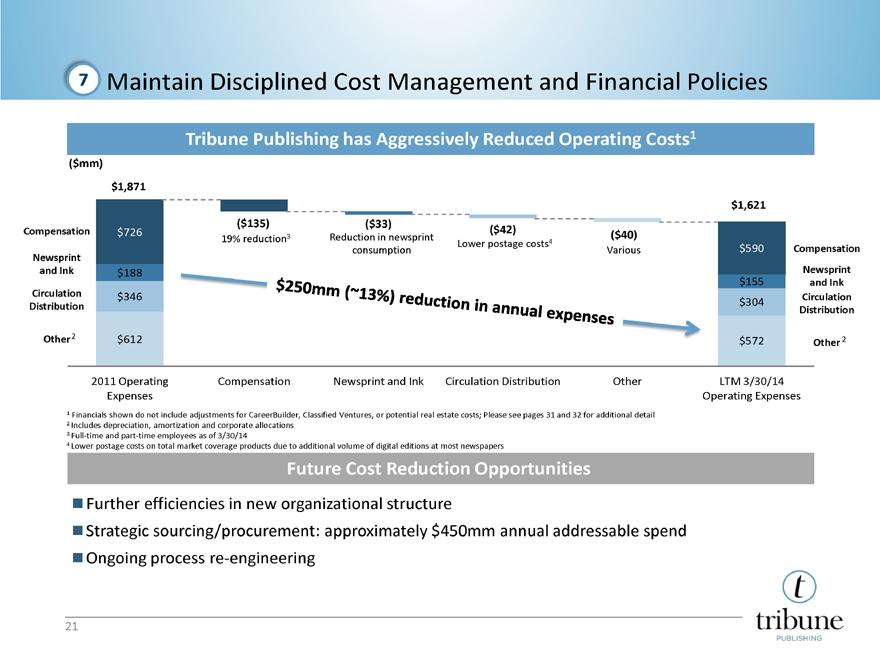

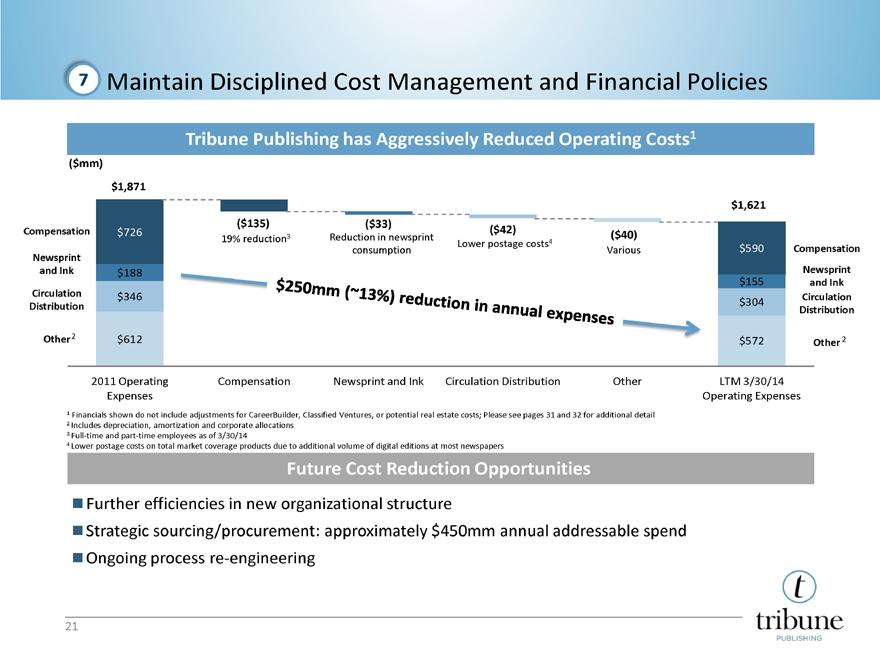

7 Maintain Disciplined Cost Management and Financial Policies

Tribune Publishing has Aggressively Reduced Operating Costs1

($mm)

$1,871

($135)

($33)

$1,621

Compensation

$726

19% reduction3

Reduction in newsprint consumption

($42) Lower postage costs4

($40) Various

$590

Compensation

Newsprint and Ink

$188

Newsprint

and Ink

Circulation

Distribution

Other 2

$250mm (~13%) reduction in annual expenses

$155

Circulation Distribution

$346

$304

Other 2

$612

$572

2011 Operating Expenses

Compensation

Newsprint and Ink

Circulation Distribution

Other

LTM 3/30/14 Operating Expenses

1 Financials shown do not include adjustments for CareerBuilder, Classified Ventures, or potential real estate costs; Please see pages 31 and 32 for additional detail

2 Includes depreciation, amortization and corporate allocations

3 Full-time and part-time employees as of 3/30/14

4 Lower postage costs on total market coverage products due to additional volume of digital editions at most newspapers

Future Cost Reduction Opportunities

Further efficiencies in new organizational structure

Strategic sourcing/procurement: approximately $450mm annual addressable spend

Ongoing process re-engineering

21 t tribune PUBLISHING

Financial Profile

22 t tribune PUBLISHING

Q1 2014 Performance Update

On a standalone basis, Bank Adjusted EBITDA would have increased 4% excluding management fee

In Q1 2014, total operating revenue declined by $24mm or 5% due to:

$19mm decline in advertising revenues primarily from declines in Chicago and Los Angeles

Digital gains of 5% in the national and classified categories were able to partially offset declines

Circulation volume decreases mitigated by subscription price increases

Total cash operating expenses decreased $7mm or 2% due to lower compensation, newsprint and ink, and circulation distribution expenses

Compensation expenses decreased due to reduction in headcount

Newsprint and ink declines based on overall print volume declines

Cash expenses include $9mm of corporate management fees

Transaction related expenses were $6mm

Three Months Ended Change

($mm) Mar. 31, 2013 Actual Mar. 30, 2014 Actual ‘14 vs. ‘13 %

Revenue

Retail $129.5 $113.3 (12%)

National 53.8 51.0 (5%)

Classified 68.7 68.7 -

Total Advertising $252.0 $233.0 (8%)

Circulation 107.1 107.3 -

Other 81.4 76.2 (6%)

Total Revenue $440.5 $416.5 (5%)

Bank Adjusted Revenues1 $418.0 $392.5 (6%)

Expenses

Compensation $151.4 $143.7 (5%)

Newsprint and Ink 42.9 35.5 (17%)

Circulation Distribution 78.7 73.5 (7%)

Corporate Allocations 26.3 26.1 (1%)

Corporate Management Fee2 5.7 9.1 58%

Other3 97.7 107.8 10%

Total Operating Expenses $402.9 $395.8 (2%)

Non-Cash Expense Adjustment4 (4.5) (4.3) (4%)

Total Cash Operating Expenses $398.4 $391.5 (2%)

Intercompany Rent 0.0 8.4 N/M

Transaction-Related and Other

Non-Recurring Costs 5 2.3 6.7 191%

Adjusted EBITDA1 $44.5 $40.2 (10%)

Bank Adjusted EBITDA1 $25.0 $22.9 (9%)

Employees6 7,974 7,475 (6%)

1 Adjusted EBITDA as defined on page 2, see reconciliation on page 30; Bank Adjusted Revenue and Bank Adjusted EBITDA are based on further pro forma and other adjustments as detailed on pages 31 and 32

2 Management fee will not be an on-going expense as a separate public company; It will be replaced by public company costs in compensation and other expenses

3 Other expenses includes depreciation, amortization and other expenses; Please see page 30 for additional detail

4 Non-cash expense adjustment includes depreciation, amortization, allocated depreciation from Tribune Company, stock-based compensation and pension expense; Please see page 30 for additional detail

5 Transaction-related and other non-recurring costs include severance and related charges and other non-recurring costs; Please see page 30 for additional detail

6 Full-time and part-time employees as of period end 3/31/13 or 3/30/14, as applicable

23 t tribune PUBLISHING

Historical Financials

Revenue ($mm)

Revenue Bank Adjusted Revenue1

$1,916 $1,882 $1,795

$1,832 $1,793 $1,703 $441 $417

$418 $393

% growth 2011 20122 2013 Q1’13 Q1’14

Revenue (1.8%) (4.6%) (5.4%)

Bank Adj. Revenue (2.0%) (5.2%) (6.1%)

Capital Expenditures3 ($mm)

$66 $72

$40

$11 $6

% 2011 2012 2013 Q1’13 Q1’14

Revenue 3.5% 3.8% 2.2% 2.5% 1.5%

Bank Adj.

Revenue 3.6% 4.0% 2.3% 2.7% 1.6%

Adjusted EBITDA ($mm)

Adjusted EBITDA1 Bank Adjusted EBITDA1

$231 $235

$207

$135 $155 $155 $45 $40

$25 $23

2011 20122 2013 Q1’13 Q1’14

% margin

Adj. EBITDA 10.8% 12.3% 13.1% 10.1% 9.7%

Bank Adj. EBITDA 7.4% 8.7% 9.1% 6.0% 5.8%

Adjusted EBITDA – Capex ($mm)

Adjusted EBITDA1 – Capex3 Bank Adjusted EBITDA1 – Capex3

$195

$141 $158

$68 $83 $115 $33 $34

$14 $17

% conversion4 2011 20122 2013 Q1’13 Q1’14

Adj. EBITDA 68.0% 68.7% 83.1% 74.9% 84.8%

Bank Adj. EBITDA 51.0% 53.5% 74.3% 55.4% 73.3%

1 Adjusted EBITDA as defined on page 2, see reconciliation on page 30; Bank Adjusted Revenue and Bank Adjusted EBITDA are based on further pro forma and other adjustments as detailed on pages 31 and 32

2 Based on 52-week year

3 Capex includes an upward adjustment of $20mm in each year to provide representation of anticipated incremental costs following the separation, excluding one-time items

4 % conversion defined as respective EBITDA less Capex divided by respective EBITDA

24

t tribune PUBLISHING

Bridge from 2013 Adjusted EBITDA to Bank Adjusted EBITDA

($mm)

$235

($28)

($17)

$155

($34)

2013 Adjusted EBITDA1 Real Estate CareerBuilder (50%)2 Classified Ventures (100%) 2 2013 Bank Adjusted EBITDA 1

Real Estate includes annual operating lease payments for properties owned by Tribune Company

CareerBuilder adjustment represents Partial Economics2 from affiliation agreement

Classified Ventures adjustment assumes No Economics2 from affiliation agreements

1 Adjusted EBITDA as defined on page 2, see reconciliation on page 30; Bank Adjusted Revenue and Bank Adjusted EBITDA are based on further pro forma and other adjustments as detailed on pages 31 and 32

2 Partial Economics and No Economics as defined on page 2

25 t tribune PUBLISHING

Capital Structure and Capital Policy

Pro Forma Capitalization

Pro Forma as of 3/30/14

Pricing Maturity Amount ($mm) xBank Adjusted EBITDA2

Cash & Cash Equivalents1 $52

$140mm ABL Facility L+1504 5 years -

Term Loan B L+4755 7 years 350

Total Debt $350 2.3x

Net Debt $298 2.0x

LTM Bank Adjusted EBITDA2 $153

LTM Bank Adjusted EBITDA2 Less Capex3 $118

Disciplined Capital Policy

Allocating capital to create value

Investment in the business

Repayment of debt

Strategic acquisitions

Direct returns to shareholders

1 Excludes cash of $25mm that is intended to cash-back LCs and includes existing cash of ~$8.5mm on the balance sheet

2 Adjusted EBITDA as defined on page 2 (see reconciliation on page 30); Bank Adjusted EBITDA is based on further pro forma and other adjustments as shown on pages 31 and 32

3 Capex includes an upward adjustment of $20mm to provide representation of anticipated incremental costs as a result of the distribution, excluding one-time items

4 Undrawn pricing: 25 bps

5 1% Libor floor

26 t tribune PUBLISHING

Appendix

27 t tribune PUBLISHING

Board of Directors

Eddy W. Hartenstein – Non-Executive Chairman of the Board of Directors

Mr. Hartenstein has served as Publisher and CEO of the Los Angeles Times since August, 2008

Prior to Tribune Company’s January, 2013 change of ownership, he was also President and CEO of Tribune Company

He served as DirecTV’s Chairman and CEO from its inception in 1990 through 2004, when the company was sold to News Corp.

Currently, he serves on the boards of Broadcom Corporation, City of Hope, SanDisk and Sirius XM Radio, where he also serves as lead independent director

John (Jack) H. Griffin, Jr. – CEO

Prior to joining Tribune Publishing, Mr. Griffin served as co-founder and CEO of Empirical Media Advisors, LLC, a consulting firm advising national media properties from May, 2012

From September, 2010 until February, 2011, Mr. Griffin was CEO of Time Inc.

He served as the President of various publishing and digital operating groups at Meredith Corp. from 2003 to 2010

David Dibble

Mr. Dibble was EVP, Central Technology at Yahoo!, Inc. from November, 2008 to December, 2013

From 2005 to 2007, Mr. Dibble served as CTO and EVP at First Data Corporation

Prior to that, he had served in various senior technology roles at JPMorgan Chase & Co., Charles Schwab & Co. and Fidelity Investments. Mr. Dibble also currently serves as a director of Hubub, Inc

Philip Franklin

Mr. Franklin is currently the SVP and CFO of Littelfuse, Inc.

Prior to joining Littelfuse in 1998, he was VP and CFO of OmniQuip International

Previously, Mr. Franklin served as CFO for Monarch Marking Systems, a subsidiary of Pitney Bowes, and Hill Refrigeration. Mr. Franklin also currently serves as a director of TTM Technologies, Inc., where he is Chairman of the audit committee

Renetta McCann

Ms. McCann is currently Chief Talent Officer at the advertising agency Leo Burnett Company, where she has led the People & Culture department and overseen the agency’s U.S. recruitment, training, benefits and talent management since September, 2012

Prior to that, Ms. McCann was a contract consultant at BPI, a human capital consulting firm, from January, 2012 to September, 2012

Earlier in her career, Ms. McCann held various influential positions over two decades at Leo Burnett

Ellen Taus

Ms. Taus has been the CFO and Treasurer of The Rockefeller Foundation since 2008

Prior to that, Ms. Taus served as the CFO of Oxford University Press USA

From 1999 to 2003, Ms. Taus served as CFO for the Electronic Publishing Division of The New York Times Company after having been the company’s VP and Treasurer for three years

28

t tribune PUBLISHING

Historical Income Statement

($mm)

2011 2012 2013 Q1 2013 Q1 2014

Revenues

Retail $652.3 $615.2 $558.4 $129.5 $113.3

National 277.8 247.3 213.6 53.8 51.0

Classified 311.5 295.8 280.9 68.7 68.7

Total Advertising $1,241.6 $1,158.2 $1,052.9 $252.0 $233.0

Circulation 390.4 424.6 428.6 107.1 107.3

Other 283.9 330.9 313.6 81.4 76.2

Total Revenues $1,915.9 $1,913.8 $1,795.1 $440.5 $416.5

Expenses

Compensation $725.6 $725.3 $597.9 $151.4 $143.7

Newsprint and ink 188.1 190.6 162.2 42.9 35.5

Circulation distribution 345.7 326.4 309.3 78.7 73.5

Depreciation 80.6 80.3 21.9 5.3 2.7

Amortization 5.7 6.4 6.6 1.7 1.6

Corporate allocations 151.7 159.1 140.8 32.1 35.2

Other 373.9 384.2 390.0 90.8 103.5

Total Operating Expenses $1,871.4 $1,872.2 $1,628.6 $402.9 $395.8

Operating Profit $44.6 $41.7 $166.5 $37.7 $20.8

Loss on equity investments, net ($0.9) ($2.3) ($1.2) ($0.4) ($0.3)

Interest income (expense), net 0.1 (0.0) 0.0 0.0 0.0

Write-down of investment - (6.1) - - -

Other non-operating loss, net (0.0) - - - -

Reorganization items, net 0.4 (1.4) (0.3) 0.1 0.0

Income Before Income Taxes $44.2 $31.7 $165.1 $37.4 $20.4

Income tax expense (benefit) 2.5 3.3 71.0 16.2 8.7

Net Income $41.6 $28.4 $94.1 $21.2 $11.8

Adjusted EBITDA1 $206.9 $230.8 $234.7 $44.5 $40.2

1 Adjusted EBITDA as defined on page 2; see reconciliation on page 30

29 t tribune PUBLISHING

Reconciliation of Net Income to Adjusted EBITDA

($mm)

2011 2012 2013 Q1 2013 Q1 2014

Net Income $41.6 $28.4 $94.1 $21.2 $11.8

Income tax expense 2.5 3.3 71.0 16.2 8.7

Reorganization items, net (0.4) 1.4 0.3 (0.1) 0.0

Other non-operating loss 0.0 - - - -

Write-down of investment - 6.1 - - -

Interest expense (income), net (0.1) 0.0 (0.0) (0.0) 0.0

Loss on equity investments, net 0.9 2.3 1.2 0.4 0.3

Depreciation 80.6 80.3 21.9 5.3 2.7

Amortization 5.7 6.4 6.6 1.7 1.6

Allocated depreciation from Tribune Company1 20.0 21.2 17.1 3.4 4.8

Transaction-related costs2 - - 18.5 0.9 6.1

Severance and related charges 14.1 13.6 15.6 1.5 0.3

1-week adjustment3 - (7.4) - - -

Intercompany rent4 - - 7.5 - 8.4

Stock-based compensation - - 1.7 - 0.7

Pension expense (credit) 39.2 66.8 (23.8) (5.9) (5.5)

Other non-recurring costs5 2.7 8.4 3.1 0.0 0.3

Adjusted EBITDA6 $206.9 $230.8 $234.7 $44.5 $40.2

1 Represents the allocation of depreciation for certain assets of Tribune and it affiliates that support Tribune Publishing, including technology service center assets

2 Transaction-related costs represent professional fees incurred in connection with the distribution, as well as costs associated with employee retention programs

3 Since the year ended Dec. 30, 2012 was a 53-week year (based on our fiscal calendar), the 1-week adjustment allows for comparability with other fiscal years presented, which are 52-week years

4 Intercompany rent represents rental expense recorded by Tribune Publishing for facilities owned by Tribune Company and its affiliates pursuant to related party lease agreements. This intercompany rent expense is added back to net income for better comparability between periods presented as Tribune Publishing began accounting for these related party leases on Dec. 1, 2013

5 Other non-recurring costs include the write-down of certain software projects and real estate assets, one-time litigation settlements and certain other non-recurring costs such as lease terminations

6 We note that Adjusted EBITDA does not reflect the potential impact resulting from the distribution and Tribune Publishing operating as a stand-alone public company, including any modification to the affiliation agreement between CareerBuilder and Tribune Publishing as a result of the distribution, the impact of affiliation agreements between Classified Ventures and our newspapers that may not be renewed or may be renewed on different terms or rental expense to be incurred by Tribune Publishing related to lease agreements with Tribune Company for certain facilities and office space. We expect that these items will have a material negative impact on Adjusted EBITDA following the distribution. See pages 31 and 32 for details

30 t tribune PUBLISHING

Bank Adjusted EBITDA Details

Bank Adjusted EBITDA Details by Category

($mm)

2011 20121

2013 Q1 2013 Q1 2014 LTM Q1 2014

Adjusted EBITDA2 $207 $231 $235 $45 $40 $230

CareerBuilder (CB)

Lost Revenues ($46) ($46) ($44) ($11) ($10) ($43)

Reduction in Fees (COGS) 5 5 5 1 2 6

Reduction in Selling Costs (SG&A) 4 4 4 1 1 4

Total CareerBuilder Adjustment (No Economics) ($36) ($36) ($35) ($9) ($7) ($33)

Classified Ventures (CV)

Lost Revenues ($61) ($66) ($71) ($17) ($19) ($73)

Reduction in Fees (COGS) 20 21 24 5 7 26

Reduction in Selling Costs (SG&A) 11 11 13 4 4 13

Total Classified Ventures Adjustment (No Economics) ($30) ($34) ($34) ($8) ($8) ($34)

Real Estate (RE)

Rent Expense Adjustment (COGS / SG&A) ($24) ($24) ($28) ($7) ($6) ($27)

Total Real Estate Adjustment 3 ($24) ($24) ($28) ($7) ($6) ($27)

Memo: Total CB/CV/RE EBITDA Adjustments (No Economics) (90) (93) (97) (24) (21) (94)

Adjusted EBITDA Post Spin-Off $117 $137 $137 $20 $19 $136

Incremental Bank Adjusted EBITDA Adjustments

Addback Partial Economics of CareerBuilder 4 18 18 17 5 4 16

Bank Adjusted EBITDA $135 $155 $155 $25 $23 $153

Note: COGS means Cost of Goods Sold, and SG&A means Selling, General & Administrative

1 Based on 52-week year

2 Adjusted EBITDA as defined on page 2; See reconciliation on page 30

3 The real estate adjustment represents rental expense for facilities leased by Tribune Publishing from Tribune Company and its affiliates pursuant to related party lease agreements, net of savings resulting from Tribune Publishing no longer managing certain facilities. The 2013 adjustment is higher as Tribune Publishing’s 2013 results already reflect the savings for no longer managing certain properties that were transferred at the end of 2012 to Tribune. The 2013 real estate adjustment also reflects lease amendments to be executed that will lower future rentals by approximately $4mm

4 Partial Economics and No Economics as defined on page 2

31 t tribune PUBLISHING

Bank Adjusted EBITDA Details (cont’d)

Bank Adjusted Revenue, Operating Expense, and EBITDA Details

($mm)

2011 20121 2013 Q1 2013 Q1 2014 LTM Q1 2014

Revenue $1,916 $1,882 $1,795 $441 $417 $1,771

Less: CareerBuilder (CB) Adjustment (46) (46) (44) (11) (10) (43)

Less: Classified Ventures (CV) Adjustment (61) (66) (71) (17) (19) (73)

Adjusted Revenue $1,809 $1,770 $1,681 $413 $388 $1,656

Addback Partial Economics of CareerBuilder 2 23 23 22 6 5 22

Bank Adjusted Revenue $1,832 $1,793 $1,703 $418 $393 $1,677

Operating Expenses $1,871 $1,872 $1,629 $403 $396 $1,621

Less: CareerBuilder Adjustment (9) (10) (9) (2) (3) (10)

Less: Classified Ventures Adjustment (31) (32) (36) (9) (11) (38)

Plus: Real Estate (RE) Adjustments 3 24 24 28 7 6 27

Adjusted Operating Expenses $1,855 $1,854 $1,611 $399 $388 $1,600

Addback Partial Economics of CareerBuilder 2 5 5 5 1 2 5

Bank Adjusted Operating Expenses $1,859 $1,859 $1,616 $400 $389 $1,605

Adjusted EBITDA 4 $207 $231 $235 $45 $40 $230

Less: CB/CV/RE EBITDA Adjustments (No Economics) (90) (93) (97) (24) (21) (94)

Plus: Partial Economics of CareerBuilder 2 18 18 17 5 4 16

Bank Adjusted EBITDA $135 $155 $155 $25 $23 $153

1 Based on 52-week year

2 Partial Economics and No Economics as defined on page 2

3 The real estate adjustment represents rental expense for facilities leased by Tribune Publishing from Tribune and its affiliates pursuant to related party lease agreements, net of savings resulting from Tribune Publishing no longer managing certain facilities. The 2013 adjustment is higher as Tribune Publishing’s 2013 results already reflect the savings for no longer managing certain properties that were transferred at the end of 2012 to Tribune. The 2013 real estate adjustment also reflects lease amendments to be executed that will lower future rentals by approximately $4mm

4 Adjusted EBITDA as defined on page 2; see reconciliation on page 30

32 t tribune PUBLISHING