- CIO Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

CORRESP Filing

City Office REIT (CIO) CORRESPCorrespondence with SEC

Filed: 10 Jan 14, 12:00am

599 LEXINGTON AVENUE | NEW YORK | NY | 10022-6069

WWW.SHEARMAN.COM | T +1.212.848.4000 | F +1.212.848.7179

January 10, 2014

VIA EDGAR AND HAND DELIVERY

U.S. Securities and Exchange Commission

Division of Corporation Finance

100 F Street, N.E.

Washington, DC 20549-0404

Attention: Tom Kluck, Legal Branch Chief

Re: City Office REIT, Inc.

Confidential Draft Registration Statement on Form S-11

Originally Submitted December 6, 2013

Registration Statement on Form S-11

Filed January 7, 2014

CIK No. 0001593222

Dear Mr. Kluck:

On behalf of City Office REIT, Inc. (the “Company”), we are today filing with the U.S. Securities and Exchange Commission (the “Commission”) Amendment No. 1 (the “Amendment No. 1”) to the Company’s registration statement on Form S-11 (the “Registration Statement”), which was originally submitted to the staff of the Commission (the “Staff”) on a confidential basis pursuant to Title I, Section 106 under the Jumpstart Our Business Startups Act (the “JOBS Act”) on December 6, 2013 (the “Confidential Submission”) and initially filed with the Commission on January 7, 2014, for the proposed initial public offering of its common stock. The Amendment No. 1 is being filed with the Commission in response to comments received from the Staff contained in your letter dated January 3, 2014 (the “Comment Letter”) in connection with the Company’s Confidential Submission. For convenience of reference, we have recited the Staff’s comments in the Comment Letter in bold face type and have followed each comment with the Company’s response. In addition, capitalized terms used but not defined herein shall have the meanings assigned to such terms in Amendment No. 1. Page references included in the Company’s responses are to those contained in the Amendment No. 1. We have also enclosed with the copy of this letter that is being transmitted via overnight courier hardcopies of the Amendment No. 1, including copies marked to show changes from the Confidential Submission.

| ABU DHABI | BEIJING | BRUSSELS | FRANKFURT | HONG KONG | LONDON | MILAN | NEW YORK | PALO ALTO PARIS | ROME | SAN FRANCISCO | SÃO PAULO | SHANGHAI | SINGAPORE | TOKYO | TORONTO | WASHINGTON, DC |

| SHEARMAN & STERLINGLLP IS A LIMITED LIABILITY PARTNERSHIP ORGANIZED IN THE UNITED STATES UNDER THE LAWS OF THE STATE OF DELAWARE, WHICH LAWS LIMIT THE PERSONAL LIABILITY OF PARTNERS. |

General

1. Please supplementally provide us with copies of all written communications, as defined in Rule 405 under the Securities Act, that you, or anyone authorized to do so on your behalf, present to potential investors in reliance on Section 5(d) of the Securities Act, whether or not they retain copies of the communications. Similarly, please supplementally provide us with any research reports about you that are published or distributed in reliance upon Section 2(a)(3) of the Securities Act of 1933 added by Section 105(a) of the Jumpstart Our Business Startups Act by any broker or dealer that is participating or will participate in your offering.

Response: The Company acknowledges the Staff’s comment and in accordance with Rule 418 promulgated under the Securities Act and Rule 83 of the Commission’s Rules on Information and Requests (17 C.F.R. §200.83), we will supplementally provide to the Staff the “testing-the-waters” slide presentation to potential investors who are qualified institutional buyers that the Company used in reliance on Section 5(d) of the Securities Act. The Company advises the Staff that the Company did not leave hard copies of the slide presentation for retention by potential investors and the slide presentation was not sent electronically to potential investors. In accordance with Rule 418(b), the Company hereby requests that such materials be returned to the Company following completion of the Staff’s review thereof. The Company has not presented any other written communications, as defined in Rule 405 under the Securities Act, to potential investors in reliance on Section 5(d) of the Securities Act, and the Company has not authorized anyone to do so on its behalf. The Company represents that to the extent that there are any other written communications, as defined in Rule 405 under the Securities Act, that the Company, or anyone authorized to do so on its behalf, presents to potential investors in reliance on Section 5(d) of the Securities Act in the future, the Company will supplementally provide such materials to the Staff for review.

The Company also advises the Staff that the representatives of the underwriters have advised the Company that no research reports about the Company have been published or distributed in reliance upon Section 2(a)(3) of the Securities Act or Section 105(a) of the JOBS Act by any broker or dealer that is participating or will participate in the offering. The Company will supplementally provide to the Staff research reports, if any, that are published or distributed in reliance upon Section 2(a)(3) of the Securities Act or Section 105(a) of the JOBS Act if the Company becomes aware that any reports are published or distributed.

Industry and Market Data, page ii

2. Please provide us with support for all quantitative and qualitative business and industry data used throughout the prospectus. Clearly mark the specific language in the supporting materials. Please also tell us whether the material is being provided pursuant to Rule 418 of the Securities Act of 1933 and if such material should be returned to the registrant upon completion of the staff review process.

2

Response: The Company will supplementally provide supporting materials for all quantitative and qualitative business and industry data used throughout the prospectus. The materials will be marked to indicate the specific language that supports each statement. As requested, the materials will be accompanied by a cover letter indicating that the material is being provided pursuant to Rule 418 promulgated under the Securities Act and Rule 83 of the Commission’s Rules on Information and Requests (17 C.F.R. §200.83) and that such material should be returned to the Company upon completion of the Staff’s review.

Prospectus Summary

Our Properties, page 2

3. Please revise the property tables on page 2 and in the business section, to reflect the impact of abatement upon annualized base rent and provide such disclosure on a per square foot bases. Alternatively, please tell us why the difference between annualized base rent and effective annual rent is not material.

Response: The Company has revised footnote 4 to the property table on page 2 and footnote 3 to the property table on page 82 to reflect the impact of abatement upon annualized base rent and provided such disclosure on a per square foot basis.

Our Competitive Strengths, page 3

4. Please revise your disclosure so that your management’s years of experience are not aggregated. Also revise accordingly the disclosure on page 7 and elsewhere discussing the combined years of experience of the principals of the advisor.

Response: The Company has revised the disclosure on pages 3, 7, 77, 79, 101, and 102 so that the years of experience of management and the principals of the Advisor are not aggregated.

5. We note your disclosure that Mr. Maretic has acted as chief financial officer of an entity with more than $250 million in gross revenue. Please remove this disclosure from the prospectus or advise us why such performance measure of another company is relevant to this offering.

Response: The Company has revised the Amendment No. 1 on pages 3 and 79 to remove the disclosure that Mr. Maretic has acted as chief financial officer of an entity with more than $250 million in gross revenue.

Our Advisor and the Advisory Agreement, page 7

6. Please briefly discuss in the summary the limited circumstances in which the Advisor is entitled to receive a termination payment from the company and disclose the amount of such payment or how it is calculated.

3

Response: The Company has revised the description of the Advisory Agreement on page 7 to describe the circumstances in which the Advisor is entitled to receive a termination payment from the Company and how such payment is calculated.

Conflicts of Interest, page 8

7. Please discuss whether the Advisor intends to provide management and/or advisory services to other entities.

Response: The Company has revised the disclosure on pages 8 and 117 to reflect that the Advisor has advised the Company that it does not currently intend to provide management or advisory services to other entities but may decide to do so in the future.

Some of the leases at our properties contain “go-dark” provisions…, page 25

8. We note your disclosure on page 1 of the prospectus that “as of September 30, 2013, approximately 61.5% of the base rental revenue from our initial properties was derived from tenants in these markets that are federal or state governmental agencies…” Please tell us whether the tenants that are governmental agencies have the right to terminate their lease agreements without paying penalty for early termination. If so, please revise this risk factor to so state or tell us why it is not material.

Response: The Company has revised the risk factor to reflect that approximately 33.4% of the base rental revenue from the initial properties is derived from tenants that are federal or state governmental agencies, most of which may, under certain circumstances, vacate the leased premises before the stated terms of the leases expire with little or no liability.

Structure and Formation of Our Company, page 43

Formation Transactions, page 43

9. In tabular format, for each property or interest to be acquired, please disclose the percentage ownership you will acquire, the fair value of the property or interest, the number of OP units to be issued, the amount of debt to be assumed, and the amount of debt to be repaid. In addition, please include this disclosure in your pro forma introduction on page F-2.

Response: The Company has added a table on page 45 disclosing the percentage ownership of the properties the Company will acquire and the debt each property will secure, since the Company is not assuming or repaying any debt. This table has also been included in the pro forma introduction on pageF-2. The Company respectfully advises the Staff that it is unable to disclose the number of common units issued for each initial property because the properties will be acquired by the operating partnership as two portfolios, and the acquisitions will be valued at the portfolio level rather than the individual property level.

4

10. We note your disclosure on page F-2 of a probable incurrence of a not yet specified amount of debt to finance the acquisition of the Cherry Creek interest. It does not appear that you have disclosed this probable debt in your discussion of the formation transactions nor have you included this probable debt in your table of Consolidated Indebtedness to be Outstanding After this Offering on page 65. Please revise or advise.

Response: The Company has revised the disclosure on page F-2 to remove the bullet point regarding the probable incurrence of a not yet specified amount of debt to finance the acquisition of the Cherry Creek interest. As disclosed throughout the Amendment No. 1, the Company expects to enter into a new $118.5 million non-recourse mortgage loan secured by the Cherry Creek property, along with the AmberGlen, City Center and Corporate Parkway properties, prior to, or concurrently with, the closing of this offering. The Company states on page F-2 that the unaudited pro forma condensed consolidated financial statements of the Predecessor for the nine months ended September 30, 2013 (unaudited) and for the year ended December 31, 2012 have been adjusted to give effect to “the incurrence of a new $118.5 million mortgage loan.” On January 6, 2014, the Predecessor entered into a $50 million loan to finance the acquisition of its interest in the Cherry Creek property. This loan will be repaid with a portion of the new $118.5 million mortgage.

11. As part of the formation transactions, it appears that you will acquire additional interests in Cherry Creek, Washington Group Plaza and City Center and that you will dispose of a portion of the interest in AmberGlen. Please disclose these transactions within your discussion of the formation transactions.

Response: As discussed in the fifth bullet point under “Structure and Formation of Our Company—Formation Transactions,” the Company discloses that as part of the formation transactions, “Second City Group will contribute to our operating partnership their entire interests in the Property Ownership Entities…” and that “[a]s a result, we will acquire a 100% interest in each of the Washington Group Plaza, Cherry Creek and we will acquire an approximately 76% interest in the AmberGlen property, 90% interest in the Central Fairwinds property and 95% interest in the City Center property. The parties retaining the remaining interests in the AmberGlen, Central Fairwinds and City Center properties at the conclusion of the formation transactions will not receive any common units, common stock or cash from us.” The Company respectfully notes that it does not intend to dispose of its interest in the AmberGlen property and hereby confirms to the Staff that it does not disclose in the Amendment No. 1 that it will dispose of a portion of its interest in the AmberGlen property. GCC Amberglen Investments LP will dispose of nine percent of its ownership interest in the AmberGlen property before it contributes its interest to City Office REIT Operating Partnership, L.P. Please see the response to Comment 25.

Use of Proceeds, page 48

12. We note your disclosure that you will use a not yet specified amount to acquire interests in your initial properties. Please tell us and revise your filing to disaggregate amounts based on different uses, such as repayment of debt associated with these properties, cash payments to former owners, etc.

Response: The Company advises the Staff that intended use of the net proceeds from the offering is disaggregated based on different uses. The Company discloses in the “Use of Proceeds” sections on pages 13 and 48 that it expects to use a portion of the net proceeds to acquire interests in its initial properties. The Company does not anticipate using any of the net proceeds to repay debt. The Company respectfully notes that the table in footnote E to Note 1 – Adjustments to the Unaudited Pro Forma Consolidated Balance Sheet

5

as of September 30, 2013 on page F-7 discloses the repayment of the existing mortgage loan secured by the City Center, Central Fairwinds, AmberGlen and Corporate Parkway properties and the existing mortgage loan secured by the Cherry Creek property as well as the new mortgage loan that will be secured by the AmberGlen, Cherry Creek, City Center and Corporate Parkway properties.

13. On page F-29, you disclose that you will use a portion of the net proceeds to pay fees in connection with the assumption of debt and repay investor loans that were made to several of the contributing entities. It does not appear that you have disclosed these items in your use of proceeds section. Please revise or advise. To the extent you are using proceeds to repay related party debt, please explicitly disclose the amount of proceeds that will be paid to related parties for the repayment of such debt.

Response: The Company has revised the disclosure on page F-29 to remove that the Company will use a portion of the net proceeds to pay fees in connection with the assumption of debt and repay investor loans that were made to several of the contributing entities. As reflected in the “Use of Proceeds” sections on pages 13 and 48, the Company discloses that it intends to use the net proceeds from the offering to acquire interests in its initial properties and for general working capital purposes. The Company currently does not anticipate using the net proceeds to pay any material fees in connection with the new $118.5 million non-recourse mortgage loan, the new $11 million senior revolving credit facility or the existing $35 million mortgage loan that will remain secured by the Washington Group Plaza property.

Capitalization, page 50

14. Please revise your table to present the pro forma effects of the formation transactions separately from the offering.

Response: The Company has revised the capitalization table on page 50 to present the pro forma effects of the formation transactions separately from the offering.

Dilution, page 51

15. Please revise your table to show the increase in pro forma net tangible book value per share from the formation transactions and the offering separately.

Response: The Company has revised the dilution table on page 51 to present the net increase/decrease in pro forma net tangible book value per share from the formation transactions and the net increase/decrease in pro forma net tangible book value per share attributable to the offering separately.

Management’s Discussion and Analysis of Financial Condition and Results of Operations, page 54

Results of Operations, page 60

16. We note you have multiple factors that impact your results of operations for several line items. Please revise your filing to separately quantify the impact from each factor.

6

Response: The Company has revised the disclosure on pages 60 to 64 to quantify the impact of each factor on the Company’s results of operations.

17. Please revise your disclosure to discuss the relative impact of changes in same store results and non-same store results. Please also disclose how you define “same store” for these purposes.

Response: The Company acknowledges the Staff’s comment and advises the Staff that the Company has revised the disclosure on pages 60 to 64 to quantify the relative impact on the Company’s results of operations attributable to properties owned throughout the entirety of each of the periods being presented (i.e. “same store” results) as well as the impact on the Company’s results from other factors.

18. Here or elsewhere, as applicable, please include a more detailed discussion of leasing activity during the periods presented, including the amount of new leases and renewed leases executed, the amount of leases that were not renewed, and leasing costs, including tenant improvements costs and leasing commissions (as applicable). Also provide quantitative disclosure comparing new rents on new and renewed leases to prior rents.

Response: The Company acknowledges the Staff’s comment and has added a table on page 95 that includes the amount of new leases and renewed leases executed, the amount of leases that were not renewed and leasing costs, including tenant improvements costs, and leasing commissions.

Liquidity and Capital Resources, page 64

19. We note from the predecessor’s statement of cash flows that a significant cash outflow for investing activities related to additions to real estate properties. Please clarify whether any of these amounts related to capitalized personnel costs (i.e. salaries) or capitalized fees paid to your advisor. To the extent such capitalized costs are applicable and material, please quantify and disclose capitalized personnel costs and capitalized fees for all periods presented and discuss fluctuations in within your MD&A.

Response: The Company acknowledges the Staff’s comment and advises the Staff that cash outflows for investing activities related to additions to real estate properties and did not relate to capitalized personnel costs or capitalized fees paid to the Advisor.

Contractual Obligations and Other Long-Term Liabilities, page 66

20. Please revise your filing to provide a contractual obligations table on a pro forma basis.

Response: The Company acknowledges the Staff’s comment and has added a contractual obligations table on a pro forma basis on page 66.

7

Cash Flows, page 66

Comparison of Nine Months Ended September 30, 2013 to Nine Months Ended September 30, 2012, page 66

21. You disclose that the decrease in net cash provided by operating activities was primarily due to a decrease in restricted cash. It appears that restricted cash increased and that such increase caused a decrease in your net cash. Please revise or advise.

Response: The Company has revised the disclosure on page 66 to disclose that net cash provided by operating activities decreased primarily due to anincrease in restricted cash.

Other Relationships, page 175

22. Please revise to identify each underwriter that has a material relationship with you and state, with specificity, the nature of the relationship. Refer to Item 508(a) of Regulation S-K.

Response: The Company advises the Staff that, to the extent applicable, it will add disclosure that is required by Item 508(a) of Regulation S-K in a future pre-effective amendment to the Registration Statement.

Financial Statements

Pro Forma Condensed Consolidated Financial Statements, page F-2

Notes and Management’s Assumptions to Unaudited Pro Forma Consolidated Financial Statements, page F-6

1. Adjustments to the Unaudited Pro Form Consolidated Balance Sheet as of September 30, 2013, page F-6

23. We note your adjustment A and that you have determined that City Office Predecessor is the accounting acquirer. Per page F-13, you have disclosed that the predecessor does not represent a legal entity. In light of the predecessor not being a legal entity, please tell us and expand your filing to clarify who is the accounting acquirer and how you made that determination. Please refer to paragraphs 10 through 15 of ASC 805-10-55.

Response: The Company advises the Staff that the term “accounting acquirer” was incorrectly used to describe the Predecessor. The Company has revised Note 1 – Adjustments to the Unaudited Pro Forma Consolidated Balance Sheet as of September 30, 2013 to the pro forma consolidated financial statements on page F-6 as follows:

“City Office REIT, Inc. and the Predecessor are under common control. Accordingly, pursuant to the planned contribution transaction, the Predecessor’s assets and liabilities will be recorded at their historical cost basis.”

8

The formation transactions do not meet the definition of an acquisition under ASC 805 “Business Combinations.” The parties disposing of their property interests in the formation transactions are a combination of entities under common control. Therefore, the guidance in paragraphs 10 through 15 of ASC 805-10-55 does not apply.

24. We note your adjustment B for the acquisition of a controlling interest in Cherry Creek. Please tell us how you determined it was not necessary to record lease intangibles for this acquisition. To the extent you determine that it is necessary to record lease intangibles, please revise this adjustment and adjustment DD accordingly. Further, please expand your disclosure regarding how you determine the fair values of the acquired assets and liabilities.

Response: The Company acknowledges the Staff’s comment and advises the Staff that at the time of the Confidential Submission, the purchase price allocations for the Company’s acquisition of its controlling interest in Cherry Creek had not been prepared. A preliminary allocation is currently being completed and will be included in a future pre-effective amendment to the Registration Statement. Footnote DD and related footnote disclosure to Note 2 – Adjustments to the Unaudited Pro Forma Consolidated Statements of Operations for the Nine Months Ended September 30, 2013 and for the Year Ended December 31, 2012 to the pro forma consolidated financial statements on page F-7 will be revised.

25. We note your adjustment C for the elimination of minority partners’ economic participation incentives. Please clarify the nature of this item and how it will be accounted for in your pro forma financial statements. Further, please clarify that you will be disposing of 9% of the predecessor’s interest in AmberGlen.

Response: The Company acknowledges the Staff’s comment and advises the Staff that the minority partners’ economic participation incentives provide for payments to the minority partners to provide them with an agreed-upon preferred rate of return that is in excess of their ownership percentage when certain return thresholds are met under the terms of the applicable limited partnership agreement. The Predecessor will pay a one-time cash amount in full satisfaction of these economic participation incentives as part of the formation transactions. The payment will be accounted as an equity transaction.

The Company also advises the Staff that with respect to the AmberGlen property, GCC Amberglen Investments LP will dispose of nine percent of its ownership interest in the AmberGlen property before it contributes its interest to City Office REIT Operating Partnership, L.P. in the formation transactions in full satisfaction of the economic participation incentives of the minority interest. This transaction will be accounted for as an equity transaction. The Company revised footnote C to Note 2 – Adjustments to the Unaudited Pro Forma Consolidated Statements of Operations for the Nine Months Ended September 30, 2013 and for the Year Ended December 31, 2012 to the pro forma consolidated financial statements on page F-6 to reflect the financial impact of this transaction.

26. We note your adjustments C and CC are for changes in the ownership interest in multiple entities. Please provide a detail within adjustments C and CC to disaggregate the impact to the financial statement line items for each entity with an ownership change.

9

Response: The Company acknowledges the Staff’s comment and has added tables in footnotes C and CC to Note 2 – Adjustments to the Unaudited Pro Forma Consolidated Statements of Operations for the Nine Months Ended September 30, 2013 and for the Year Ended December 31, 2012 to the pro forma consolidated financial statements on pages F-6 and F-7 that disaggregates the impact to the financial statement line items for each entity with an ownership change.

2. Adjustments to Unaudited Pro Forma Consolidated Statements of Operations…, page F-7

27. We note your adjustment DD for the acquisition of a controlling interest in Cherry Creek. Please tell us how you reflected the change in straight-line rental income due a new lease inception date. Further, it appears that you will obtain a new mortgage loan in conjunction with this acquisition; please tell us how you reflected the change in interest expense. To the extent the interest rate is variable, please specifically disclose the interest rate assumed and the effects of a 1/8% change in that assumed interest rate.

Response: The Company acknowledges the Staff’s comment and advises the Staff that thestraight-line rental income will be calculated based on cash flow associated with the lease from the date of the most recent acquisition. The new non-recourse mortgage loan will be a fixed rate loan. Therefore, the Company does not expect that there will be any changes in the interest rate of the loan. The Company revised footnote 2 on page 65 to reflect that the loan is fixed rate.

The Company also advises the Staff that the Company revised footnote FF to Note 2 – Adjustments to the Unaudited Pro Forma Consolidated Statements of Operations for the Nine Months Ended September 30, 2013 and for the Year Ended December 31, 2012 to the pro forma consolidated financial statements on page F-6 to disclose that no interest expense in the pro forma is reflected from the loan as it is expected to be paid off by the Predecessor as part of the formation transactions.

28. We note your adjustment EE. Please tell us how you determined that the costs to operate the entity as a public company are factually supportable. To the extent you remove the adjustment for these costs, we would not object if you include your estimate of these costs in a footnote to the pro forma financial statements.

Response: The Company acknowledges the Staff’s comment and advises the Staff that the costs to operate the entity as a public company are either (i) supported by actual contracts, invoices or vendor quotes or (ii) estimated by management based on similar charges incurred in conjunction with an entity becoming a public company. As a result, the Company believes that these items are factually supportable.

29. We note your adjustment FF and your disclosure that it reflects the amortization of the associated financing costs for two loans. This disclosure appears to only address one loan, the $118.5 million loan. Please advise or revise. Further, it appears that the $118.5 million loan is a variable rate loan; as such, please specifically disclose the interest rate assumed and the effects of a 1/8% change in that assumed interest rate.

10

Response: The Company acknowledges the Staff’s comment and advises the Staff that the amortization of the deferred financing costs relate to the new $118.5 million non-recourse mortgage loan and the new $11 million senior revolving credit facility. The Company has added disclosure on the new $11 million senior revolving credit facility in footnote FF to Note 2 – Adjustments to the Unaudited Pro Forma Consolidated Statements of Operations for the Nine Months Ended September 30, 2013 and for the Year Ended December 31, 2012 to the pro forma consolidated financial statements on page F-6.

The Company also advises the Staff that the new non-recourse mortgage loan will be a fixed rate loan. Therefore, the Company does not expect that there will be any changes in the interest rate of the loan. The Company revised footnote 2 on page 65 to reflect that the loan is fixed rate and that the interest on the loan will be determined at the closing of this offering. The Company also revised footnote FF to Note 2 – Adjustments to the Unaudited Pro Forma Consolidated Statements of Operations for the Nine Months Ended September 30, 2013 and for the Year Ended December 31, 2012 to the pro forma consolidated financial statements on page F-6 to disclose that no interest expense in the pro forma is reflected from the new senior revolving credit facility because the pro forma assumes that no acquisition will be made.

30. We note your adjustment GG. Please tell us if the advisory agreement replaces any other agreements that were in effect for the periods presented. To the extent you have recorded management fee expense that will no longer be recorded and is replaced with the fees calculated in accordance with the new agreement, please tell us if you have removed these old management fees.

Response: The Company acknowledges the Staff’s comment and advises the Staff that the Advisory Agreement does not replace any other agreement that was in effect for the periods presented. Accordingly, there are no historical management fees to remove from the pro forma consolidated financial statements.

31. We note shares will be granted to your advisor at the completion of this offering. Please tell us how you determined it was not necessary to record an adjustment for the related compensation expense.

Response: The Company acknowledges the Staff’s comment and added footnote HH to Note 2 – Adjustments to the Unaudited Pro Forma Consolidated Statements of Operations for the Nine Months Ended September 30, 2013 and for the Year Ended December 31, 2012 to the pro forma consolidated financial statements on page F-7 to reflect the expense of stock based compensation granted to the Advisor as part of the formation transactions for the periods presented.

Financial Statements of City Office REIT, Inc. Predecessor, page F-8

Notes to Combined Financial Statements, page F-13

1. Organization and Description of Business, page F-13

32. Please clarify your basis for your determination that the Predecessor and its related assets and liabilities are under common control. Please provide additional information regarding the ownership of the entities owning the properties, including organization charts.

11

Response: As described herein, Samuel Belzberg has common control of the Predecessor and its related assets and liabilities.

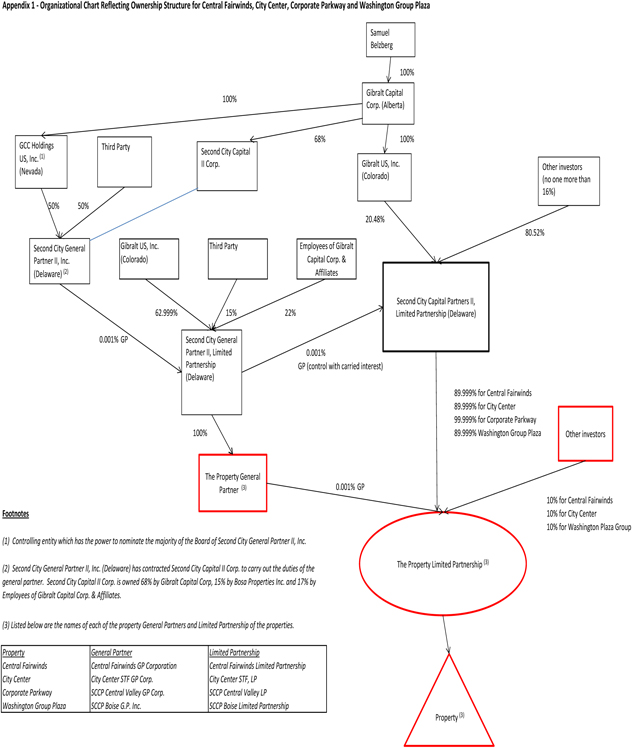

As depicted in the organizational chart attached hereto as Appendix 1, the following describes how the City Center, Central Fairwinds, Washington Group Plaza and Corporate Parkway properties are ultimately controlled by Gibralt Capital Corp.

| A. | Second City General Partner II, Limited Partnership (“SCGP II LP”) controls (through its 100% ownership interests) the general partners (collectively the “Property General Partners”) of each of the following limited partnerships (collectively the “Property Limited Partnerships”): |

| • | the limited partnership that owns the City Center property, |

| • | the limited partnership that owns the Central Fairwinds property, |

| • | the limited partnership that owns the Washington Group Plaza property, and |

| • | the limited partnership that owns the Corporate Parkway property. |

| B. | Second City Capital Partners II Limited Partnership (“SCCP II”) holds the following limited partnership interests in the Property Limited Partnerships: |

| • | a 89.999% interest in the limited partnership that owns the City Center property, |

| • | a 89.999% interest in the limited partnership that owns the Central Fairwinds property, |

| • | a 89.999% interest in the limited partnership that owns the Washington Group Plaza property, and |

| • | a 99.999% interest in the limited partnership that owns the Corporate Parkway property. |

| C. | The Company has assessed the rights of the limited partners of the Property Limited Partnerships in accordance with ASC 810-20 to determine whether they overcome the presumption of control by the Property General Partners. As SCCP II holds a majority of the limited partnership units of each of the Property Limited Partnerships, and a majority of limited partnership units are needed to remove the general partner, the removal rights of the other limited partners are not relevant. The Company has also determined that the other limited partners do not have substantive participating rights. The Property General Partners and SCCP II are all controlled by SCGP II LP. Accordingly, the Company has concluded underASC 810-20 that the Property General Partners control the Property Limited Partnerships. |

| D. | SCGP II LP is the general partner of SCCP II. The Company has assessed the rights of the limited partners of SCCP II in accordance with ASC 810-20 to determine whether they overcome the presumption of control by the SCGP II LP as general partner. The removal rights of the limited partners of SCCP II are only exercisable with cause (i.e., they restrict the limited partners’ ability to remove the general partner to situations that include fraud, illegal acts or willful negligence permitted by the existing general partner) and are therefore not substantive. The Company has also determined that the limited partners of SCCP II do not have any substantive participating rights. Accordingly, the Company has concluded under ASC 810-20 that SCGP II LP controls SCCP II. |

12

| E. | The Company has further concluded that SCGP II LP controls the Property Limited Partnerships through its control of (i) the Property General Partners, which are the general partners of the Property Limited Partnerships and (ii) SCCP II which holds the majority of the limited partner units of the Property Limited Partnerships. |

| F. | SCGP II LP is controlled by its general partner, Second City General Partner II, Inc. The limited partners of SCGP II LP have the following participating interests: 62.999% by Gibralt, US Inc., 15% by a third party and 22% by Gibralt employee partners. Second City General Partner II, Inc. can only be removed as general partner by a resolution of limited partners holding 75% or more of the aggregate participating interests held by limited partners, provided that the third party has consented to such resolution. The third party can only consent to a removal resolution to be voted on and cannot remove the general partner by itself. The Company has also determined that the third party and the Gibralt employee partners do not have any substantive participating rights. |

| G. | Second City General Partner II, Inc. is 50% owned by GCC Holdings US, Inc. (“GCC”) and 50% owned by a third party. Under a shareholder agreement between the third party and GCC, GCC has the right to nominate a majority of the board of directors (two out of three board members). GCC controls the board through this majority. Second City General Partner II, Inc. has also contracted Second City Capital II Corp. (which is 68% owned by Gibralt Capital Corporation) to carry out its duties as general partner. |

Under the shareholder agreement between the third party and GCC, if the third party objects to and votes against two consecutive property acquisitions, then the third party has the right to request an additional independent director acceptable to each of GCC and the third party be appointed to the board. This right does not impact GCC’s control of Second City General Partner II, Inc. at any time prior to an additional board member being appointed because an acquisition can proceed over the third party’s objection, as there are no veto rights in the shareholder agreement. There have been no such objections from the third party, no such director has been appointed, and effective November 2013 no further property acquisitions will be proposed.

Accordingly, the Company has concluded that GCC controls Second City General Partner II, Inc. through its 50% ownership interest and its right to nominate a majority of the board of directors.

GCC is 100% owned and controlled by Gibralt Capital Corp. In turn, Samuel Belzberg owns 100% of the voting shares of, and accordingly controls, Gibralt Capital Corp. Therefore, the Company has determined that the City Center, Central Fairwinds, Washington Group Plaza and Corporate Parkway properties are ultimately commonly controlled by Samuel Belzberg.

13

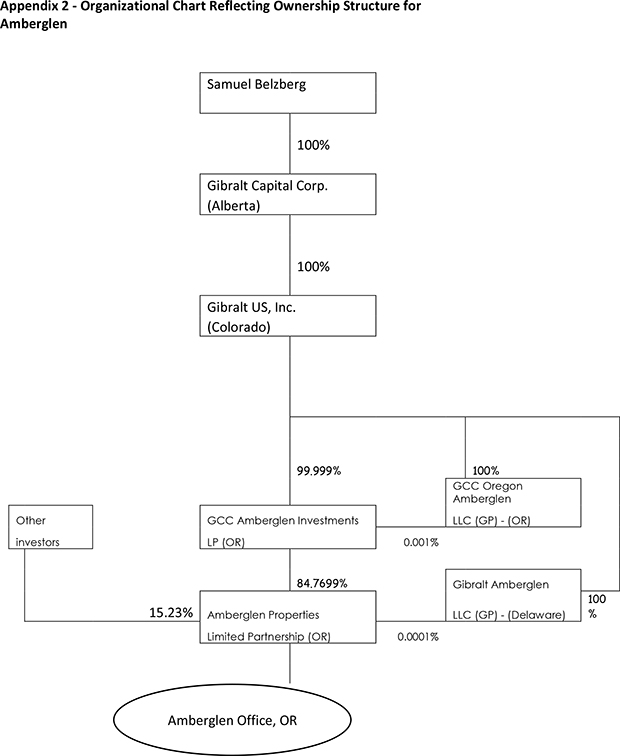

The following analysis next outlines how Gibralt Capital Corp. controls the limited partnership that holds the AmberGlen property (see Appendix 2 for organization chart).

The AmberGlen property is 100% owned by the Amberglen Properties Limited Partnership. The general partner of this limited partnership is Gibralt Amberglen LLC.

The Company has assessed Amberglen Properties Limited Partnership in accordance withASC 810-20 to determine whether or not the rights of the limited partners overcome the presumption of control by the general partner, Gibralt Amberglen LLC (GP). As GCC Amberglen Investments LP holds a majority of the limited partnership units, and a majority of limited partnership units are needed to remove the general partner, the removal rights of the other limited partners are not relevant. The Company has also determined that the other limited partners of Amberglen Properties Limited Partnership do not have any substantive participating rights.

GCC Oregon Amberglen LLC (GP) controls Gibralt Amberglen LLC (GP) through a 100% ownership interest.

Gibralt US Inc. controls GCC Oregon Amberglen LLC (GP) through a 100% ownership interest and GCC Amberglen Investments LP through a 99.99% ownership interest. As Gibralt US Inc. controls both the limited partner and general partner of Amberglen Properties Limited Partnership, the Company has concluded that Gibralt US Inc. controls the Amberglen Properties Limited Partnership.

Gibralt Capital Corp. has a 100% interest in Gibralt US Inc. and has control through its interest.

As a result, the limited partnerships that own the five properties outlined above are all under common control of Gibralt Capital Corp. Gibralt Capital Corp., in turn, is controlled by Samuel Belzberg, who owns 100% of the voting shares of Gibralt Capital Corp.

As of September 30, 2013, Cherry Creek was owned by a limited partnership in which SCCP II owned a 42% limited partnership interest. An unrelated third party owned a 42% limited partnership interest in and the general partner of this limited partnership. (The remaining 16% limited partnership interest is held by other third parties.) A supermajority (greater than 75%) of the limited partnership interests is required to remove the general partner. As the owner of the general partner also holds a 42% limited partnership interest, SCCP II is unable to exercise its removal rights and accordingly does not control the limited partnership that owns Cherry Creek. Therefore, the Company has determined that Cherry Creek is controlled by a third party and is not under control of Samuel Belzberg.

2. Summary of Significant Accounting Policies, page F-13

Business Combinations, page F-14

33. Please revise your filing to clarify your accounting policy for amortization of acquired in place lease intangible assets. This comment also applies to the financial statements of ROC-SCCP Cherry Creek I, LP.

14

Response: The Company has revised the accounting policy Note 2 – Summary of Significant Accounting Policies to the Predecessor’s financials on page F-15 for the Predecessor and Note 2 – Summary of Significant Accounting Policies to the financials for ROC-SCCP Cherry Creek I, LP on page F-36 for amortization of acquired in place lease intangible assets.

Revenue Recognition, page F-15

34. We note your disclosure that renewal options with rental terms that are lower than those in the primary terms are excluded from the straight-line rent calculation if the renewals are not reasonably assured. Please tell us and revise your filing to disclose how you determine if the renewals are reasonably assured or not. Within your response, please reference the authoritative accounting literature management relied upon. This comment also applies to the financial statements of ROC-SCCP Cherry Creek I, LP.

Response: The Company acknowledges the Staff’s comment and advises the Staff that there are not any circumstances in which renewal options exist with rental terms that are lower than those in the primary terms. Accordingly, the Company has removed the disclosure that was located on page F-15 of the Confidential Submission stating “that renewal options with rental terms that are lower than those in the primary terms are excluded from the straight-line rent calculation if the renewals are not reasonably assured.”

| 10. | Future Minimum Rent Schedule, page F-25 |

35. We note your disclosure that certain leases allow for the tenant to terminate the lease if the property is deemed obsolete and that the tenant must make a termination payment. Please tell us how you considered this termination clause in your determination of the lease term. Within your response, please reference the authoritative accounting literature management relied upon. This comment also applies to the financial statements of ROC- SCCP Cherry Creek I, LP.

Response: The Company acknowledges the Staff’s comment and advises the Staff that certain lease agreements for the Predecessor and ROC-SCCP Cherry Creek I, LP allow for tenants to terminate the lease early. The Company has determined that the lease imposes a penalty on the lessee in such amount that continuation of the lease appears, at the time of lease inception, to be reasonably assured.

The Company has relied upon the guidance in ASC 840-20 as set out below for the purposes of determining the lease term:

“That portion of the lease term that is cancelable only under any of the following conditions:

a) Upon the occurrence of some remote contingency

b) With the permission of the lessor

c) If the lessee enters into a new lease with the same lessor

d) If the lessee incurs a penalty in such amount that continuation of the lease appears, at inception, reasonably assured.”

15

The Company also advises the Staff that the Company has determined that for the Predecessor and ROC-SCCP Cherry Creek I, LP, certain of its state government tenants have the right to terminate their leases if they do not appropriate rent in their respective annual budgets. The Company has determined that the occurrence of its state tenants not appropriating rent in their respective annual budgets is a remote contingency and accordingly, the Company has determined that the lease term includes all future lease payments payable under the lease agreement. Accordingly, the Company has revised Note 10 – Future Minimum Rent Schedule to the Predecessor’s financials on page F-25 and Note 7 – Future Minimum Rent Schedule for the ROC-SCCP Cherry Creek I, LP financials on page F-26 to describe the previously noted termination rights.

In addition, the Company has determined that for the Predecessor there are two leases with government tenants representing approximately 5.4% of total future minimum lease payments as at September 30, 2013 that have currently exercisable rights to terminate their leases before the stated expirations. For these two leases, the Company has revised the lease term to include only the noncancellable portion. The Company has determined that the corresponding impact of revising the lease term for these two leases has an inconsequential impact to its calculation of revenue. The Company has revised the disclosure set out in Note 10 – Future Minimum Rent Schedule to the Predecessor’s financials on page F-25 to remove the cancellable portion of the lease term from the future minimum rent schedules.

The Company has also revised the disclosure set out in Washington Group Plaza, Boise Note 3 – Rental Revenue on page F-47 to remove the cancellable portion of the lease term from the future minimum rent schedules for these same two leases with government tenants.

36. We note your disclosure that certain leases provide the tenant with the right to purchase the leased property at a stipulated price. Please tell us how you considered this purchase right in your determination of the lease classification. Within your response, please reference the authoritative accounting literature management relied upon. This comment also applies to the financial statements of ROC-SCCP Cherry Creek I, LP.

Response: The Company acknowledges the Staff’s comment and advises the Staff that there are no situations in which the tenant has the right to purchase the leased property at a stipulated price in either the Predecessor or ROC-SCCP Cherry Creek I, LP. The tenants’ right to purchase the leased property is only specific to ROC-SCCP Cherry Creek I, LP and that right is at fair market value. Accordingly, the Company removed the disclosure that was located on page F-25 of the Confidential Submission stating that “[i]n addition, certain leases provide the tenant with the right to purchase the leased property at fair market value or a stipulated price” and revised the disclosure on page F-43 of Amendment No. 1 to remove the following: “or at a stipulated price.”

Financial Statements of ROC-SCCP Cherry Creek I, LP, page F-30

Notes to Financial statements, page F-35

5. Mortgage Loan Payable, page F-41

37. Please clarify for us the nature of the interest rate swap with owners and tell us how you determined it should not be recorded in the financial statements of this entity. Within your response, please reference the authoritative accounting literature management relied upon.

16

Response: The Company acknowledges the Staff’s comment and advises the Staff that the interest rate swap for the Cherry Creek property is between a third-party financial institution and two counterparties, ROC-SCCP Cherry Creek II, LP and ROC-SCCP Cherry Creek I, LP. The swap is recorded in the books and records of ROC-SCCP Cherry Creek II, LP and was taken out to economically hedge variable interest rate risk for a mortgage payable recorded in the books and records of ROC-SCCP Cherry Creek II, LP. ROC-SCCP Cherry Creek II, LP has made all cash payments under the terms of the interest rate swap agreement, including the final termination payment, as this swap was terminated in December 2013 when the related debt was repaid. The Company has revised the disclosure to clarify the parties to the swap, and to reflect the termination of the swap, on page F-39 of Amendment No. 1.

Statements of Revenues and Certain Expenses for Washington Group Plaza, Boise, page F-43

Notes to Statements of Revenues and Certain Expenses, page F-45

2. Basis of Presentation and Significant Accounting Policies, page F-45

Revenue Recognition, page F-45

38. Please disclose the difference between the rental revenue recorded and the amount of lease payments due. This comment also applies to the Statements of Revenues and Certain Expenses for Corporate Parkway.

Response: The Company acknowledges the Staff’s comment and has revised Note 2 – Rental Revenue to the statements of revenues and certain expenses of Washington Group Plaza, Boise and Corporate Parkway to reflect the difference between the rental revenue recorded and the amount of lease payments due.

In addition, the Company has revised Note 3 – Rental Revenue to the statements of revenues and certain expenses of Washington Group Plaza, Boise on page F-45 to disclose the dollar amount of tenants’ proportional share of common area, real estate taxes and other operating expenses included in Rental Revenue recorded in the Statements of Revenues and Certain Expenses for the Washington Group Plaza property for the year ended December 31, 2012 and the three months ended March 31, 2013. The Company has also added the following additional disclosure in Note 3 – Rental Revenue to the statements of revenues and certain expenses of Washington Group Plaza, Boise on page F-45, directly below the table showing future minimum rents:

“Leases generally require reimbursement of the tenant’s proportional share of common area, real estate taxes and other operating expenses, which are excluded from the amounts above.”

The Company respectfully advises the Staff that similar disclosure has not been provided for the Corporate Parkway property because the sole lease is on a triple net basis, meaning that common area, real estate taxes and other operating expenses are paid directly by the tenant.

17

Item 36. Financial Statements and Exhibit, page II-3

39. We note that you will be filing all exhibits by amendment. If you are not in a position to file the legal and tax opinions with the next amendment, please provide us with draft copies for our review.

Response: The Company acknowledges the Staff’s comment and advises the Staff that it will supplementally provide draft copies of the legal and tax opinion opinions as promptly as practicable.

* * * *

We thank you for your prompt attention to this filing. We hope the foregoing answers are responsive to your comments. If you have any questions, please feel free to contact me at (212) 848-7325. We would appreciate the opportunity to discuss any remaining questions or concerns with you at your convenience.

| Respectfully yours, |

| /s/ Stephen T. Giove |

Enclosures

| cc: | Folake Ayoola, U.S. Securities and Exchange Commission |

Jennifer Monick, U.S. Securities and Exchange Commission

Kevin Woody, U.S. Securities and Exchange Commission

Anthony Maretic, City Office REIT, Inc.

James Farrar, City Office REIT, Inc.

18

19

20