UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

___________________________________

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| | | | | |

| ☐ | Preliminary Proxy Statement |

| |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| ☒ | Definitive Proxy Statement |

| |

| ☐ | Definitive Additional Materials |

| |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

HAMILTON INSURANCE GROUP, LTD.

_________________________________________________________________________________________________

(Name of Registrant as Specified In Its Charter)

_________________________________________________________________________________________________

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | | | | | | | | | | | |

| ☒ | | No fee required. |

| ☐ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| | 1 | | Title of each class of securities to which transaction applies: |

| | 2 | | Aggregate number of securities to which transaction applies: |

| | 3 | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4 | | Proposed maximum aggregate value of transaction: |

| | 5 | | Total fee paid: |

| ☐ | | Fee paid previously with preliminary materials. |

| ☐ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | 1 | | Amount Previously Paid: |

| | 2 | | Form, Schedule or Registration Statement No.: |

| | 3 | | Filing Party: |

| | 4 | | Date Filed: |

April 25, 2024

Dear Shareholder,

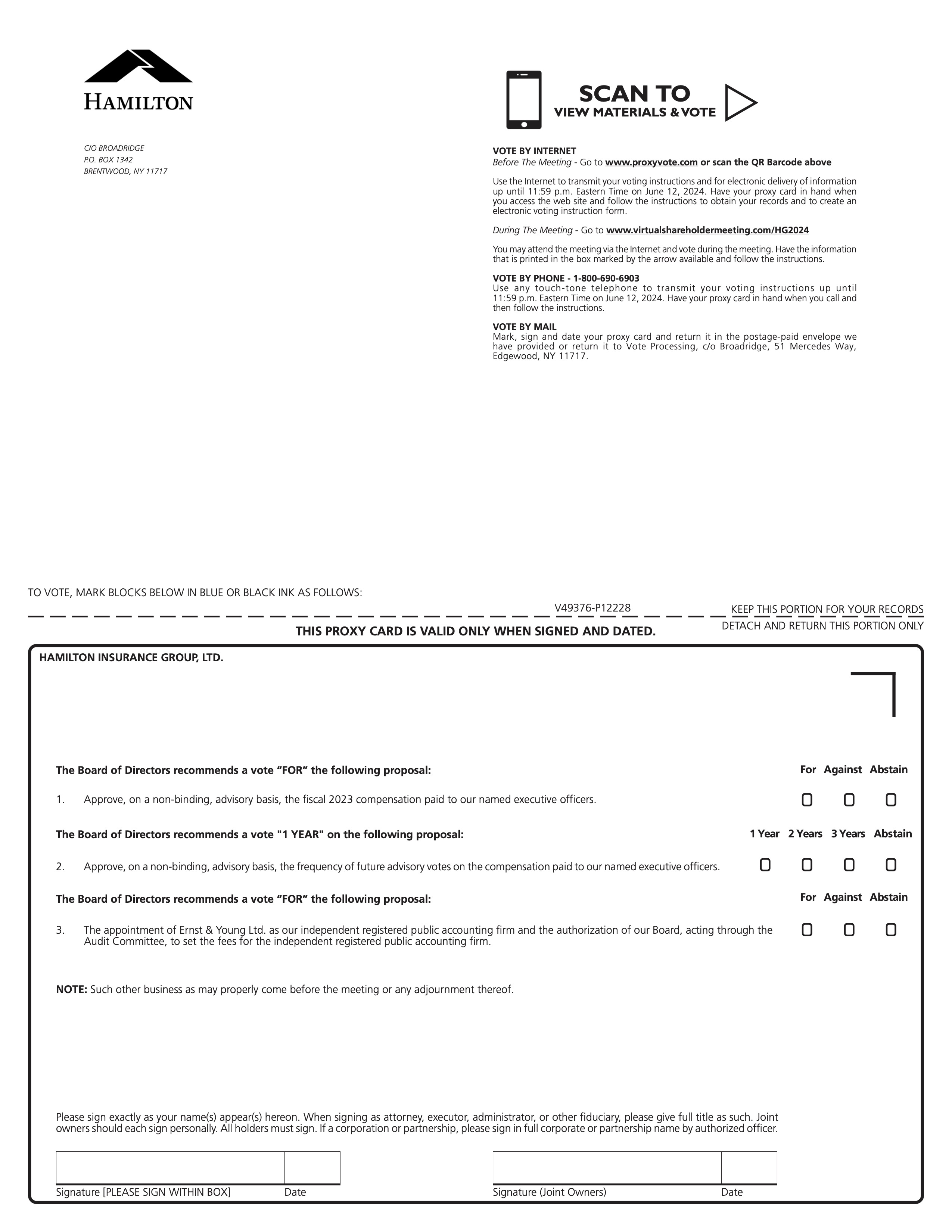

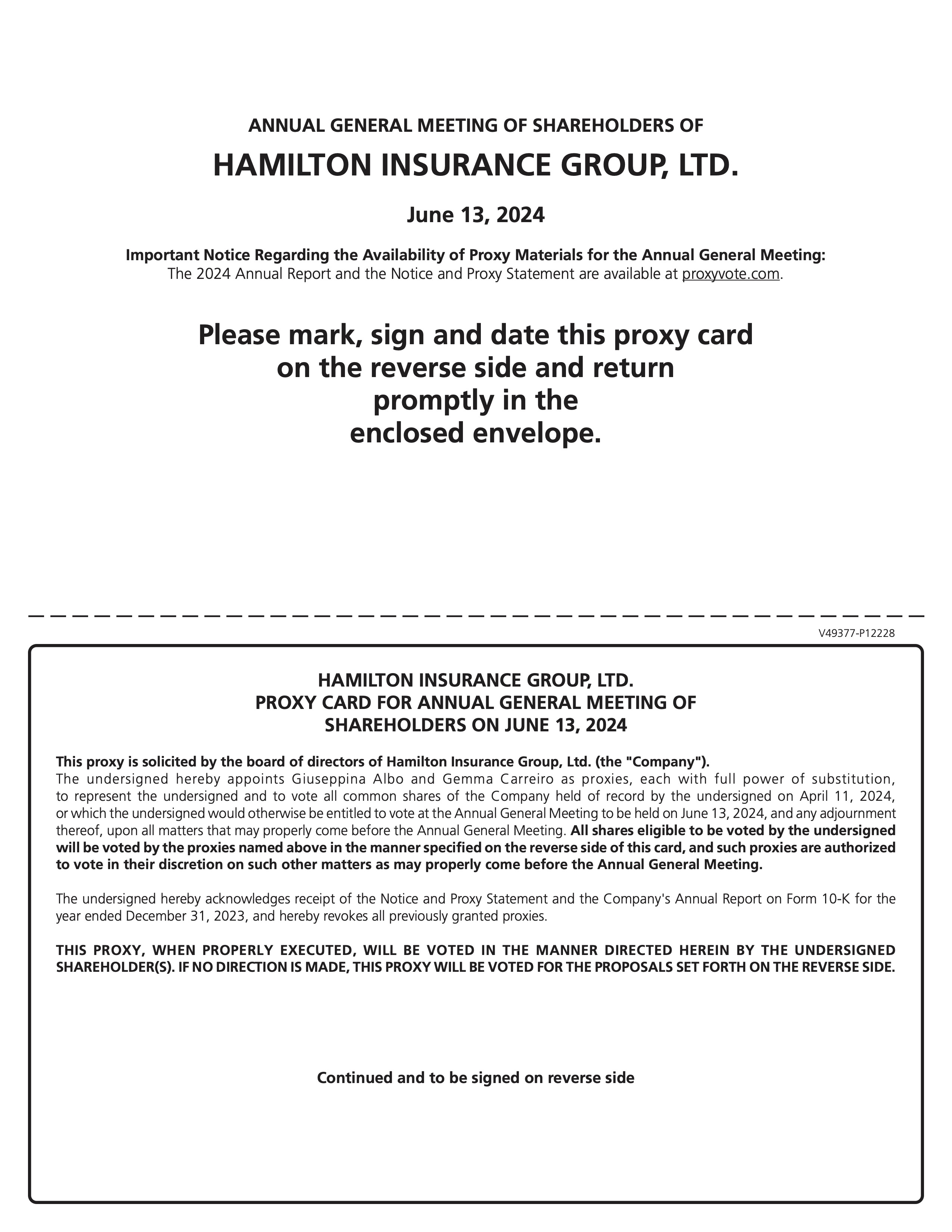

We are pleased to invite you to attend the 2024 Annual General Meeting of Shareholders ("Annual General Meeting") of Hamilton Insurance Group, Ltd. ("Hamilton" or the "Company"), to be held virtually on June 13, 2024 at 9am Eastern Time ("ET"). The meeting can be attended by accessing the following link: www.virtualshareholdermeeting.com/HG2024

The attached Notice of 2024 Annual General Meeting of Shareholders and proxy statement provide important information about the meeting and will serve as your guide to the business to be conducted at the meeting. During the Annual General Meeting, we will make available information relating to the operations of Hamilton. Representatives from our Board of Directors, Executive Management and independent registered public accounting firm, Ernst & Young Ltd. ("EY") will be present to respond to questions from Shareholders.

Please vote via the internet or by telephone at your earliest convenience by following the voting instructions on your Notice of 2024 Annual General Meeting of Shareholders, or, if you have requested or received a paper copy of the proxy statement, you can vote by marking, signing, dating and returning the proxy card or voter instruction form sent to you in the envelope. This will ensure that your shares will be represented and voted at the meeting even if you do not attend.

Thank you for your continued support.

Sincerely,

David A. Brown, Chairman

Notice of 2024 Annual General

Meeting of Shareholders

Meeting Details

| | | | | | | | |

DATE June 13, 2024 | TIME 9am ET | VIRTUAL MEETING www.virtualshareholdermeeting.com/HG2024 |

Matters to Be Voted On

The principal business of the Annual General Meeting will be:

| | | | | |

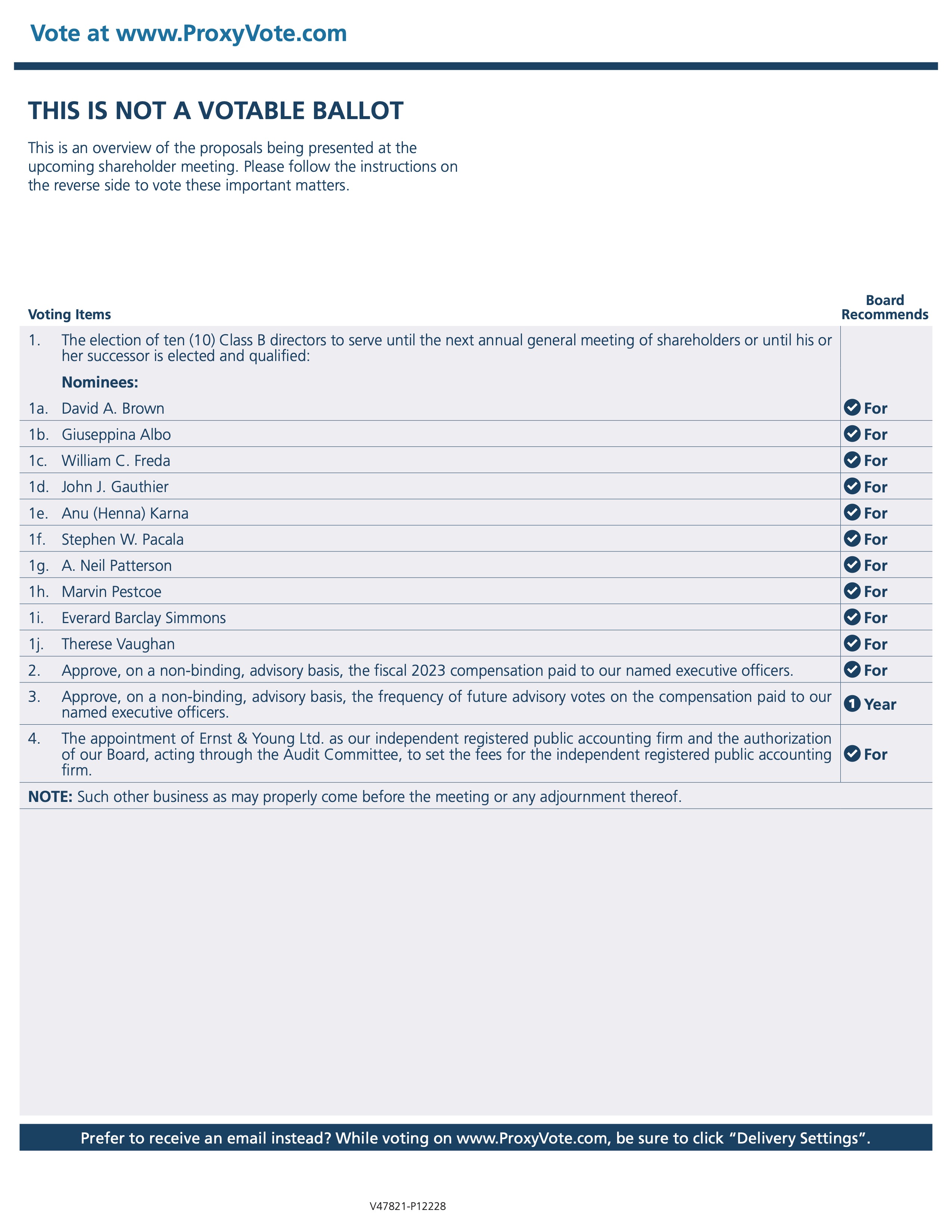

| 1 | To elect 10 Class B Directors to serve until the 2025 annual general meeting of shareholders or until their successors are duly elected and qualified |

| 2 | To approve, on a non-binding advisory basis, the compensation paid to our named executive officers |

| 3 | To approve, on a non-binding advisory basis, the frequency of future advisory votes on the compensation of the Company’s named executive officers |

| 4 | To appoint EY to act as our independent registered public accounting firm for the fiscal year ending December 31, 2024, and to authorize the Board of Directors, acting through the Audit Committee, to set the fees for the independent registered public accounting firm |

| 5 | To transact any other business as may properly come before the meeting or any adjournment or postponement thereof |

Important Notice Regarding the Availability of Proxy Materials for the Annual General Meeting. This Notice of 2024 Annual General Meeting of Shareholders and the attached proxy statement are being distributed or made available, as the case may be, on or about April 25, 2024.

Your vote is very important. Whether or not you plan to attend the Annual General Meeting, please vote at your earliest convenience by following the instructions in the Notice of Annual General Meeting or the proxy card you received in the mail. You may revoke your proxy at any time before it is voted. Please refer to "Voting and Meeting Information" for additional information. The Form 10-K for the year ended December 31, 2023 filed with the United States Securities and Exchange Commission ("SEC") is available electronically on our website.

Gemma Carreiro

Secretary and General Counsel

April 25, 2024

Table of Contents

When used in this proxy statement, the terms "we", "us", "our", "the Company" and "Hamilton" refer to Hamilton Insurance Group, Ltd.

Cautionary Note Regarding Forward-Looking Statements

Certain matters we discuss in this proxy statement may constitute forward-looking statements pursuant to the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by the use of terms such as “believes,” “expects,” “may,” “will,” “target,” “should,” “could,” “would,” “seeks,” “intends,” “plans,” “contemplates,” “estimates,” or “anticipates,” or similar expressions which concern our strategy, plans, projections or intentions. These forward-looking statements appear in a number of places throughout this proxy statement and relate to matters such as our industry, growth strategy, goals and expectations concerning our market position, future operations, margins, profitability, capital expenditures, liquidity and capital resources and other financial and operating information. By their nature, forward-looking statements: speak only as of the date they are made; are not statements of historical fact or guarantees of future performance; and are subject to risks, uncertainties, assumptions, or changes in circumstances that are difficult to predict or quantify. Our expectations, beliefs, and projections are expressed in good faith and we believe there is a reasonable basis for them. However, there can be no assurance that management’s expectations, beliefs and projections will be achieved and actual results may vary materially from what is expressed in or indicated by the forward-looking statements.

Factors that can cause results to differ materially include those described under “Special Note Regarding Forward-Looking Statements” in Hamilton's most recent Form 10-K filed with the SEC and available on our website. There may be other factors that could cause our actual results to differ materially from the forward-looking statements. You should evaluate all forward-looking statements made in this proxy statement in the context of these risks and uncertainties.

We caution you that the risks, uncertainties, and other factors referenced above may not contain all of the risks, uncertainties and other factors that are important to you. In addition, we cannot assure you that we will realize the results, benefits, or developments that we expect or anticipate or, even if substantially realized, that they will result in the consequences or affect us or our business in the way expected. All forward-looking statements in this proxy statement apply only as of the date of this proxy statement and are expressly qualified in their entirety by the cautionary statements. We undertake no obligation to publicly update or revise any forward-looking statements to reflect subsequent events or circumstances.

Proxy Statement Summary

Annual General Meeting Information

•Date and Time: June 13, 2024 at 9am ET

•Virtual Meeting: www.virtualshareholdermeeting.com/HG2024

•Record Date: April 11, 2024

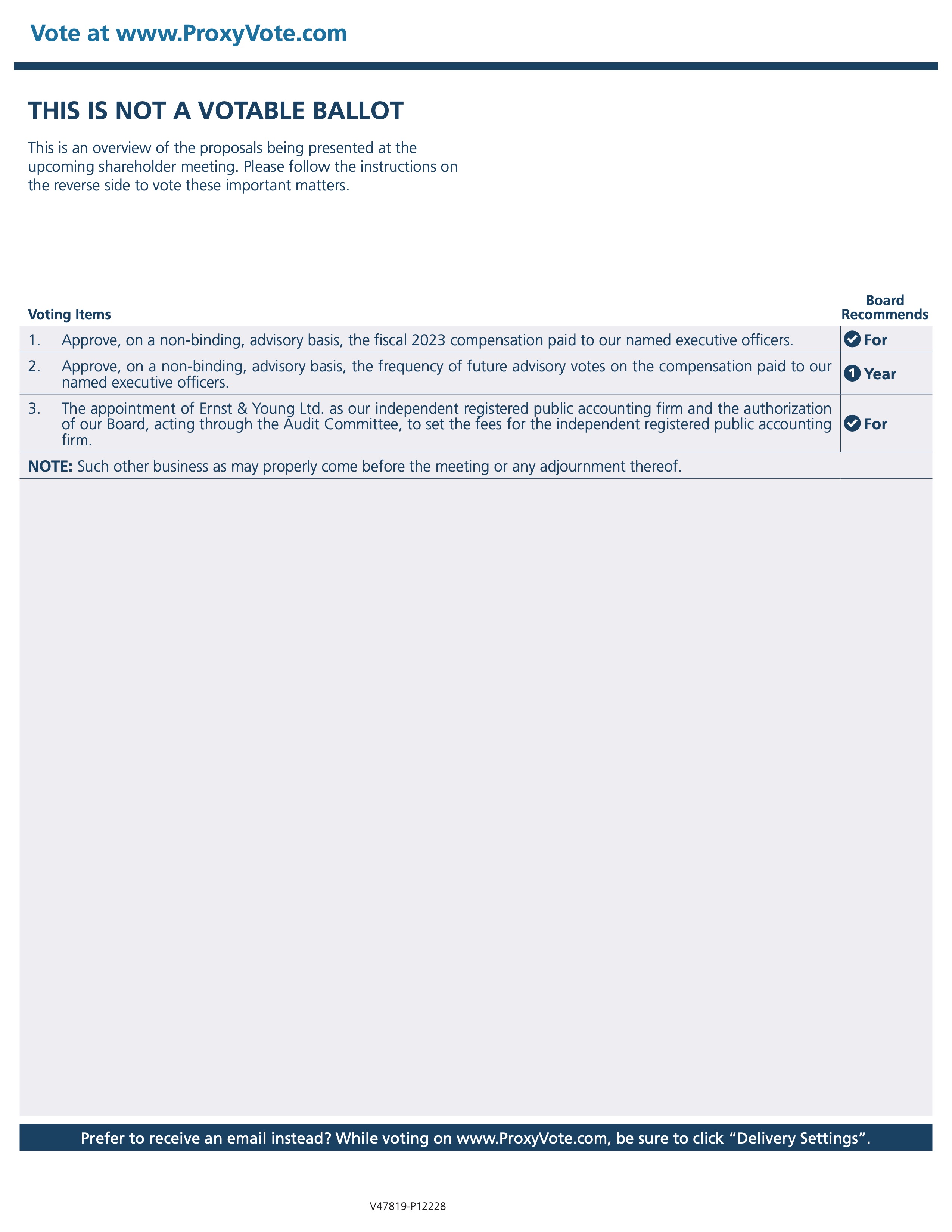

Proposals

This proxy statement summary highlights information regarding Hamilton and certain information included elsewhere in this proxy statement. You should read the entire proxy statement before voting. You should also review our annual report to shareholders and 10-K for detailed information regarding our financial and operating performance for the year ended December 31, 2023, including the audited financial statements and related notes included in the report.

| | | | | | | | | | | | | | |

| Proposal | Board Recommendation | Vote Required to Adopt Proposal | Page Ref. |

| 1 | Election of Class B directors | FOR each Nominee | The affirmative vote of a plurality of the common shares voted by holders present in person or by proxy at the Annual General Meeting at which holders of the majority of the common shares are present and entitled to vote thereon. Broker non-votes and abstentions will have no effect on this proposal | 9 |

| 2 | Non-binding advisory vote on fiscal year 2023 compensation paid to our named executive officers | FOR | The affirmative vote of a majority of the votes cast by holders of common shares present in person or by proxy at the Annual General Meeting and entitled to vote thereon. Broker non-votes and abstentions will have no effect on this proposal | 39 |

| 3 | Non-binding advisory vote on the frequency of future advisory votes on the compensation of our named executive officers | 1 YEAR

| The option of every one, two or three years that receives the highest number of votes cast by shareholders will reflect the frequency for future say-on-pay votes that has been selected by shareholders. Broker non-votes and abstentions will have no effect on this proposal | 40 |

| 4 | Appointment of Ernst & Young, Hamilton, Bermuda, to act as our independent registered public accounting firm for the fiscal year ending December 31, 2024 and to authorize the Board of Directors, acting through the Audit Committee, to set the fees for the independent registered public accounting firm | FOR | The affirmative vote of a majority of the votes cast by holders of common shares present in person or by proxy at the Annual General Meeting and entitled to vote thereon. Abstentions will have no effect on this proposal. | 81 |

| | | | | | | | | | | |

| Hamilton Insurance Group, Ltd. | 2024 Proxy Statement | | 1 |

We may also transact any other business that may properly come before the meeting. As of the date of this proxy statement, we are not aware of any business to be presented for consideration other than the matters described in this proxy statement.

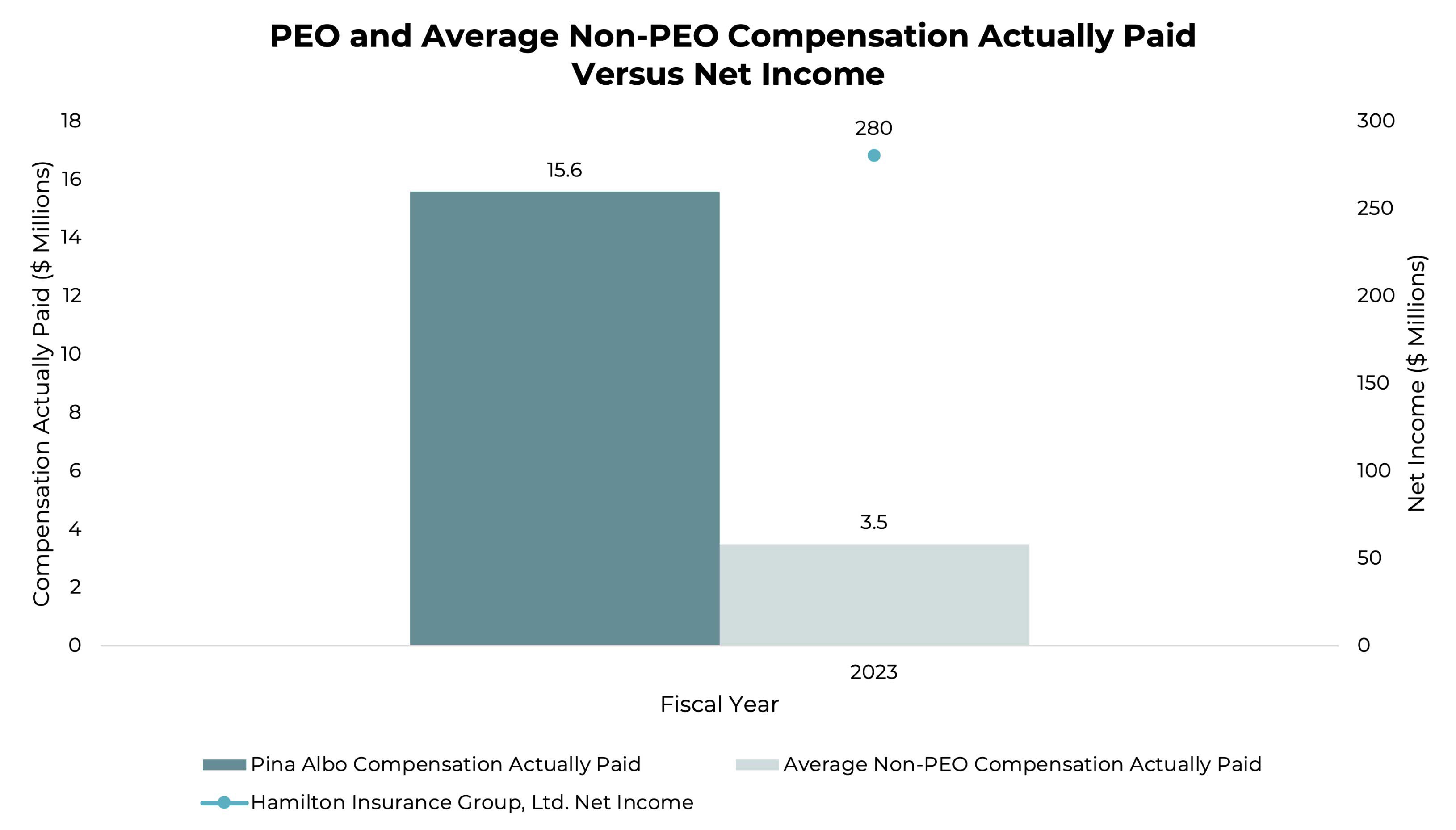

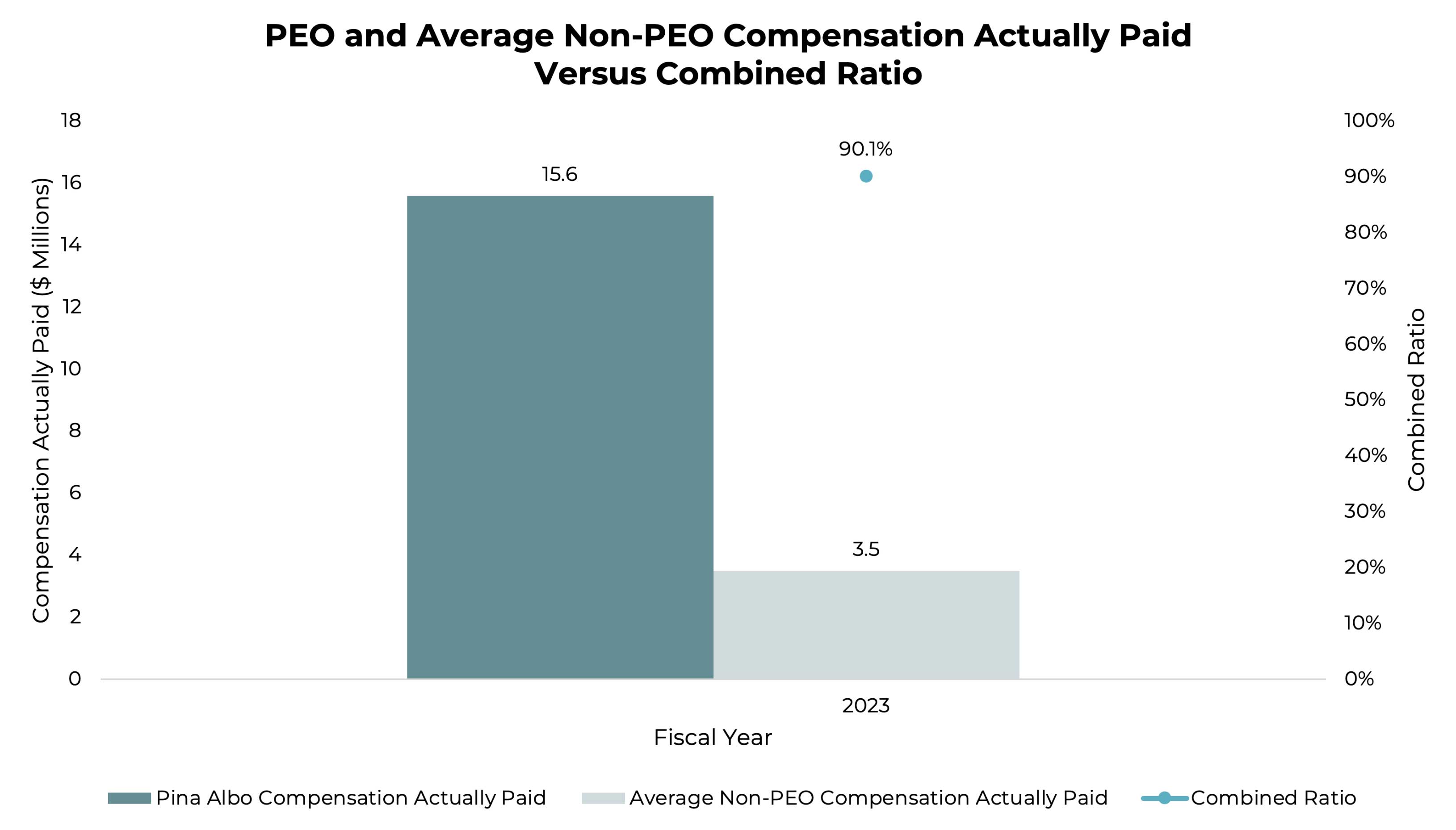

2023 Company Financial Performance

| | | | | | | | |

| FINANCIAL PERFORMANCE | |

| • Net income of $258.7 million | • Gross premiums written of

$1,951.0 million | • Underwriting income of

$129.9 million |

• Return on average equity

("ROE") of 13.9% | • Net premiums earned of

$1,318.5 million | • Combined ratio of 90.1% |

• Net investment income of

$218.3 million | | |

1.Underwriting income and corporate expenses are non-GAAP financial measures. A reconciliation of non-GAAP financial measures is included in “Appendix A.”

Corporate Citizenship

At Hamilton, we are proud to have dynamic and talented colleagues, who are focused on building a company that benefits of all our stakeholders. In this context, we are committed, both as underwriters and as global citizens, to applying our business strengths to make a meaningful impact on society. Hamilton strives to be a responsible (re)insurer in all aspects of its operations and business practices by considering and recognising its impact to society and communities, the environment and climate change for current and future generations and for all its stakeholders. For more information on the Company’s corporate citizenship initiatives, see "Corporate Governance – Corporate Citizenship & Sustainability."

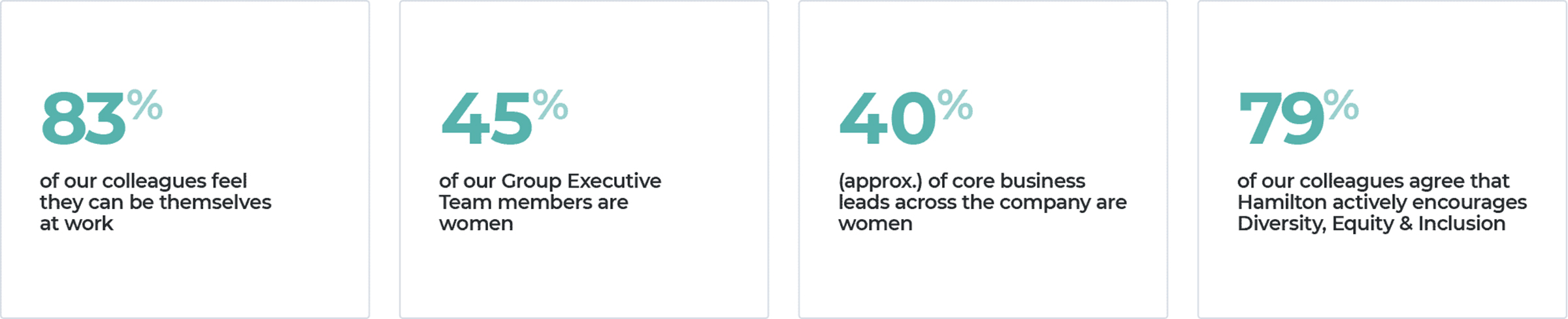

Human Capital Management

Executing our Hamilton business imperatives and supporting our corporate tagline, “In good company.”, starts with our talented team and is supported by our inclusive, entrepreneurial, and collaborative Hamilton culture. This in turn allows us to attract, engage and retain top talent, a process we actively manage via our ‘Magnet for Talent’ business imperative.

For additional information on our human capital management, please refer to "Corporate Governance - Human Capital Management."

| | | | | | | | | | | |

| Hamilton Insurance Group, Ltd. | 2024 Proxy Statement | | 2 |

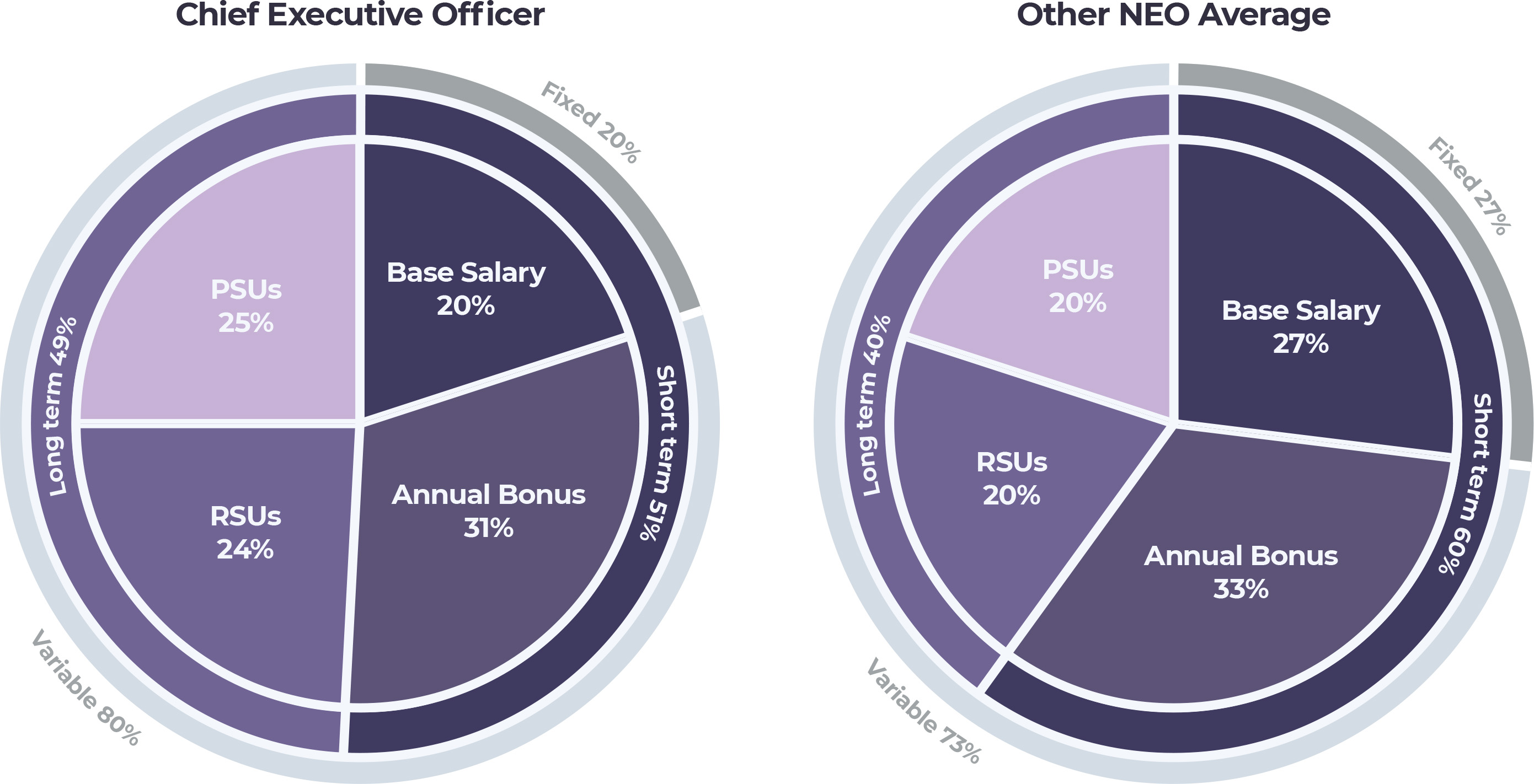

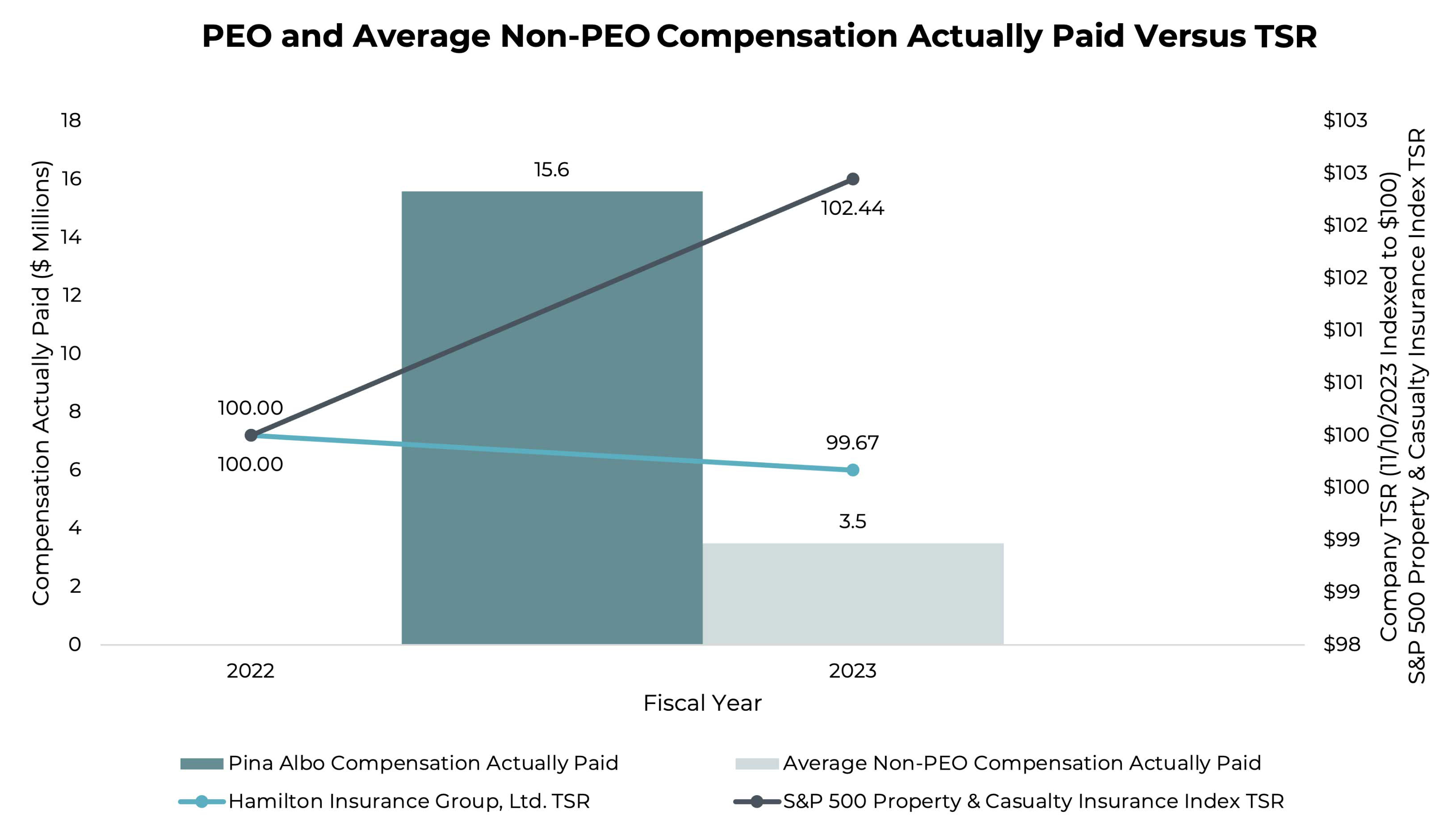

Executive Compensation Highlights

Our executive compensation program is guided by our overarching philosophy of only paying for demonstrable performance. We believe that our executive compensation program is reasonable, competitive, and appropriately balances the goals of attracting, motivating, rewarding, and retaining our executive officers. We emphasize performance-based compensation that appropriately rewards our executive officers for delivering financial, operational, and strategic results that meet or exceed pre-established goals. We endeavor to maintain sound governance standards consistent with our executive compensation policies and practices.

| | | | | |

| What We Do |

| Pay for Performance | The majority of total executive compensation is variable and at-risk |

| Independent Compensation Committee | Our Compensation and Personnel Committee is comprised solely of independent directors |

| Independent Compensation Consultant | The Compensation and Personnel Committee engaged an independent compensation consultant to assist with its compensation review for the fiscal year ended December 31, 2023 |

| Clawback | Under our clawback policy, incentive compensation for our executive officers will be subject to clawback if we are required to restate our financial statements due to material noncompliance with a financial reporting requirement or to correct an error that is not material to previously issued financial statements but would result in a material misstatement if the error were corrected or left uncorrected |

| Share Ownership Guidelines | We have guidelines for executive officers to maintain meaningful levels of share ownership |

| Caps on Annual Bonuses and Equity Grants | Our annual cash incentive plan and equity awards have upper limits on the amounts of cash and equity that may be earned, respectively |

| Double Trigger Change-in-Control Severance and Acceleration | The Company has entered into employment agreements with NEOs that provide certain financial benefits if there is both a change in control and a qualifying termination of employment (a “double trigger”). A change in control alone will not trigger severance pay or accelerated vesting of equity awards |

| Peer Data | We utilize compensation peer sets comprised of companies based on industry sector, revenue and market capitalization as a reference for compensation decisions, and these peer sets are reviewed on an annual basis |

| Multi-year Vesting and Earn-out Requirements | The equity awards granted to our executive officers vest or are earned over multi-year periods, consistent with current market practice and our retention objectives |

| Risk Mitigation | Our executive compensation program is designed, in part, to manage business and operational risk and to discourage short-term risk taking at the expense of long-term results |

| What We Don't Do |

| No Perks | We do not provide perquisites to executive officers |

| No Excise Tax Gross-Ups | We do not provide excise tax gross-ups on change-in-control payments |

| No Hedging or Pledging of Company Shares | We do not permit our executive officers and directors to pledge or hedge their Company shares |

| No Guaranteed Performance Bonuses | We do not provide guaranteed performance bonuses to our NEOs at any minimum levels of payment under our annual cash incentive plan |

| No Dividend Equivalents on Unvested Performance Awards | We do not pay dividends or dividend equivalents on performance-based awards unless and until the performance awards are earned and vested |

For more information on executive compensation, see "Compensation Discussion and Analysis" and "Executive Compensation."

| | | | | | | | | | | |

| Hamilton Insurance Group, Ltd. | 2024 Proxy Statement | | 3 |

Corporate Governance Highlights

Corporate governance is a key area of focus for our Board of Directors ("Board of Directors" or "Board"). Our current governance practices include the below, a number of which are discussed in further detail throughout this proxy statement:

•Regular shareholder engagement

•Our Board of Directors is composed of a majority of independent directors and the Audit, Compensation and Personnel, and Nominating and Corporate Governance Committees are composed of only independent directors

•None of our directors serve on the board of directors of more than four other publicly-held corporations

•There is no stockholder rights plan ("poison pill")

•All Class B Shareholders have the right to vote on the election of the Class B Directors on an annual basis

•Independent Chairman

•Our Board of Directors and each committee holds quarterly executive sessions without management present

•Our Board of Directors provides oversight of key risks that impact the Company's ability to achieve its strategy

•Our Board of Directors regularly reviews committee charters and key governance policies

•Our Board is engaged in an ongoing refreshment process with a plan to increase director diversity and ensure coverage of the key skill-sets identified by the Board

Questions and Answers about the 2024 Annual Meeting

Please see “Shareholder Proposals for 2025 Annual Meeting” and “Voting and Meeting Information” for important information about the Annual Meeting, proxy materials, voting, deadlines for shareholder proposals and other important information.

| | | | | | | | | | | |

| Hamilton Insurance Group, Ltd. | 2024 Proxy Statement | | 4 |

Board of Directors

The Company entered into a Shareholders Agreement dated November 14, 2023 (the "Shareholders Agreement") with certain shareholders who, together with their affiliates, owned at least 5% of our issued and outstanding common shares as at the date of the Shareholders Agreement. These shareholders include: Sango Holdings (being Sango Hoken Holdings, LLC), Hopkins Holdings (being Hopkins Holdings, LLC), the Blackstone Investor (collectively being, BSOF Master Fund L.P. and BSOF Master Fund II L.P.) and the Magnitude Investor (collectively being, Magnitude Master Fund, a sub trust of the Magnitude Master Series Trust, Magnitude Institutional, Ltd., Magnitude Partners Master Fund, L.P., and Magnitude Insurance Master Fund, LLC), including any permitted transferee of any of the foregoing. The Shareholders Agreement provides that each such shareholder has the right to appoint a director to the Board of Directors (each a "Shareholder Director"), subject to the maintenance of certain ownership thresholds. See "Certain Relationships and Related Party Transactions". The remaining directors are elected by the holders of our Class B common shares (“Class B Directors”) for an annual term expiring at each annual general meeting or until their successors are elected or appointed or their office is otherwise vacated.

Currently, the Shareholder Directors are H. Hawes Bostic, III and Antonio Ursano, Jr. and the Class B Directors are David A. Brown, Giuseppina (Pina) Albo, Russell Fradin, William C. Freda, John J. Gauthier, Anu (Henna) Karna, Stephen W. Pacala, A. Neil Patterson, Marvin Pestcoe, Everard Barclay Simmons and Therese Vaughan. The former Hopkins Holdings and Sango Holdings appointed directors, John A. Overdeck and David M. Siegel, resigned from the Board of Directors effective October 15, 2023 due to potential conflicts of interest between their roles at Two Sigma and their roles as directors of the Company. Following the resignation of Mr. Overdeck, Hopkins Holdings appointed Mr. Ursano as its appointed director. Mr. Ursano has indicated to the Company that he intends to serve as a director on the Board of Directors of the Company on an interim basis while Hopkins Holdings identifies a director to replace Mr. Ursano. Following the resignation of Mr. Siegel, Sango Holdings has retained its right to appoint one director pursuant to the terms of the Shareholders Agreement. The former Blackstone Investor director, Peter Koffler, resigned from the Board of Directors effective on October 15, 2023. Following the resignation of the Blackstone Investor director, the Blackstone Investor retained its right to appoint one director pursuant to the terms of the Shareholders Agreement. However, on January 18, 2024 the Blackstone Investor submitted to the Company an irrevocable waiver of its director appointment rights under the Shareholders Agreement.

On October 15, 2023, the Board of Directors nominated John J. Gauthier and Anu (Henna) Karna to serve as Class B Directors on the Board of Directors and they were both elected to serve on the Board of Directors by the holders of our Class B common shares at a special general meeting held on October 24, 2023.

Effective March 11, 2024, the Board of Directors noted and accepted the resignation of D. Pauline Richards, former director and former Chair of the Company's Audit Committee, and appointed Therese Vaughan and A. Neil Patterson to serve as Class B Directors on the Board of Directors. Mr. Patterson was also appointed as Chair of the Company's Audit Committee.

Immediately following the 2024 Annual General Meeting, it is intended that Mr. Gauthier be appointed to serve as the Chair of the Compensation and Personnel Committee and Mr. Pacala be appointed to serve as Chair of the Nominating and Corporate Governance Committee.

| | | | | | | | | | | |

| Hamilton Insurance Group, Ltd. | 2024 Proxy Statement | | 5 |

Our Bye-laws provide that our Board of Directors may appoint such officers as it may determine which provides the Board of Directors with the flexibility to combine or separate the positions of Chairperson of the Board and Chief Executive Officer should it determine that utilizing one or the other structure would be in the best interests of the Company. David A. Brown, a non-executive director, continues to serve as Chairperson of the Board.

Our Board of Directors has concluded that our current leadership structure is appropriate at this time. However, our Board of Directors will continue to periodically review our leadership structure and may make such changes in the future as it deems appropriate.

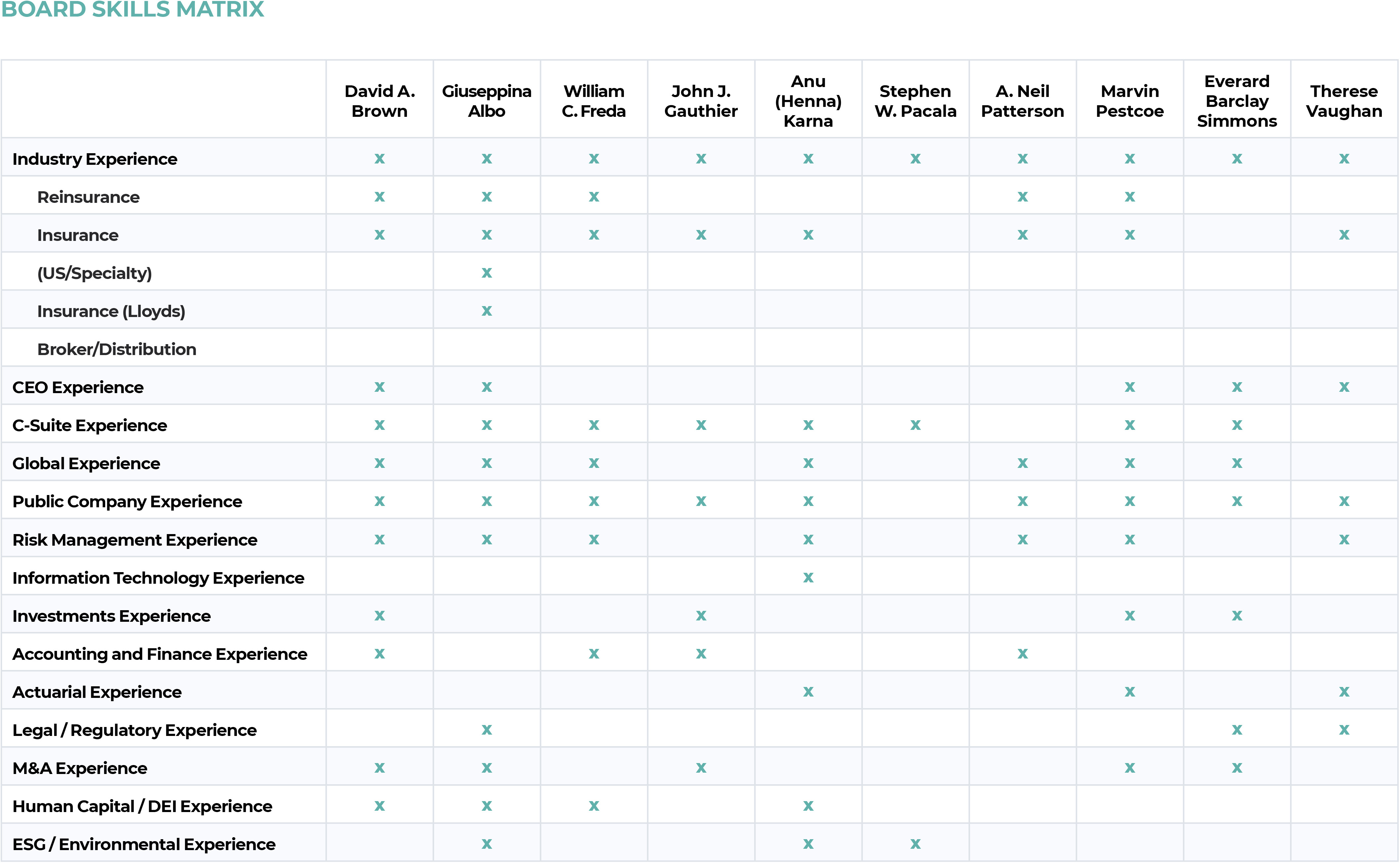

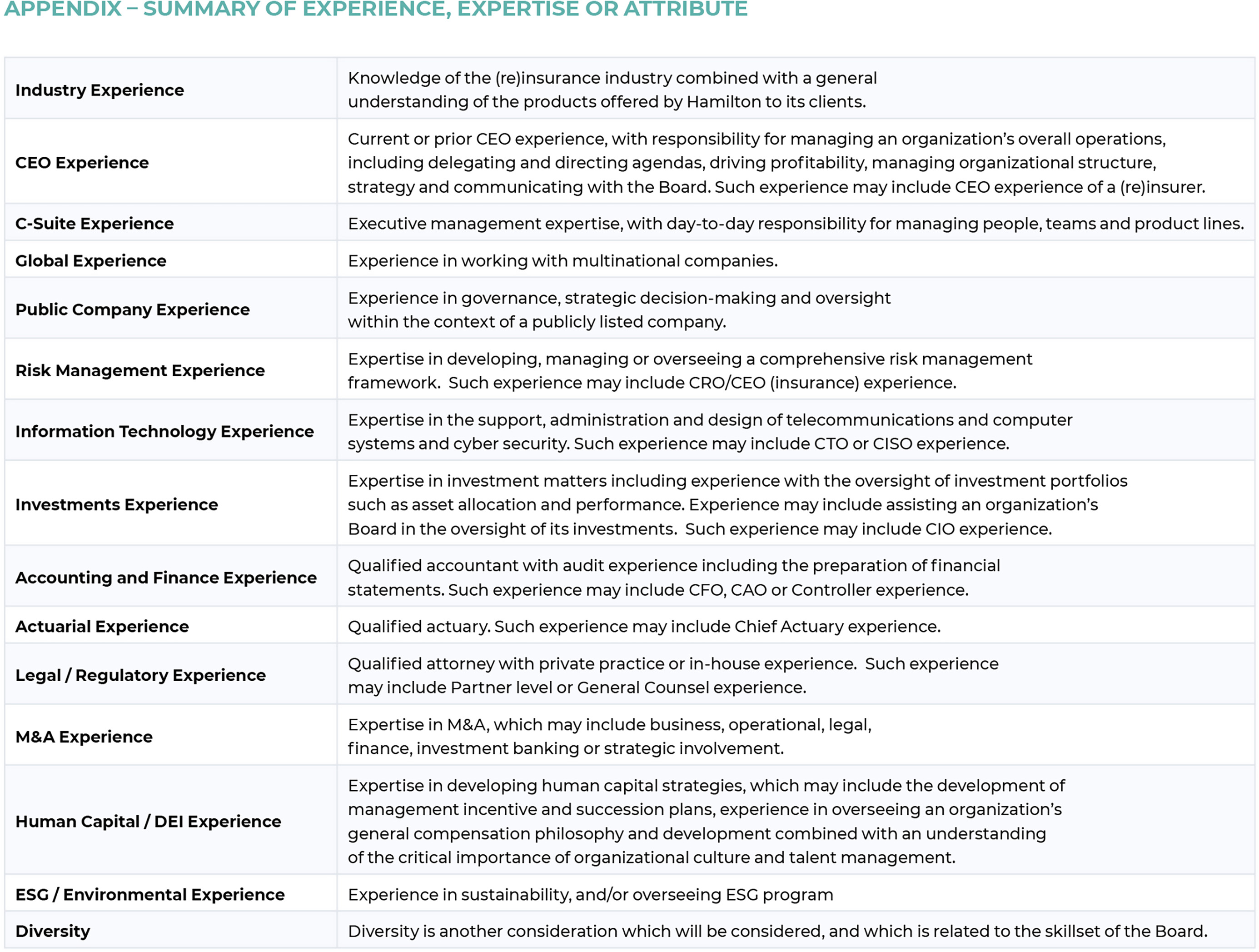

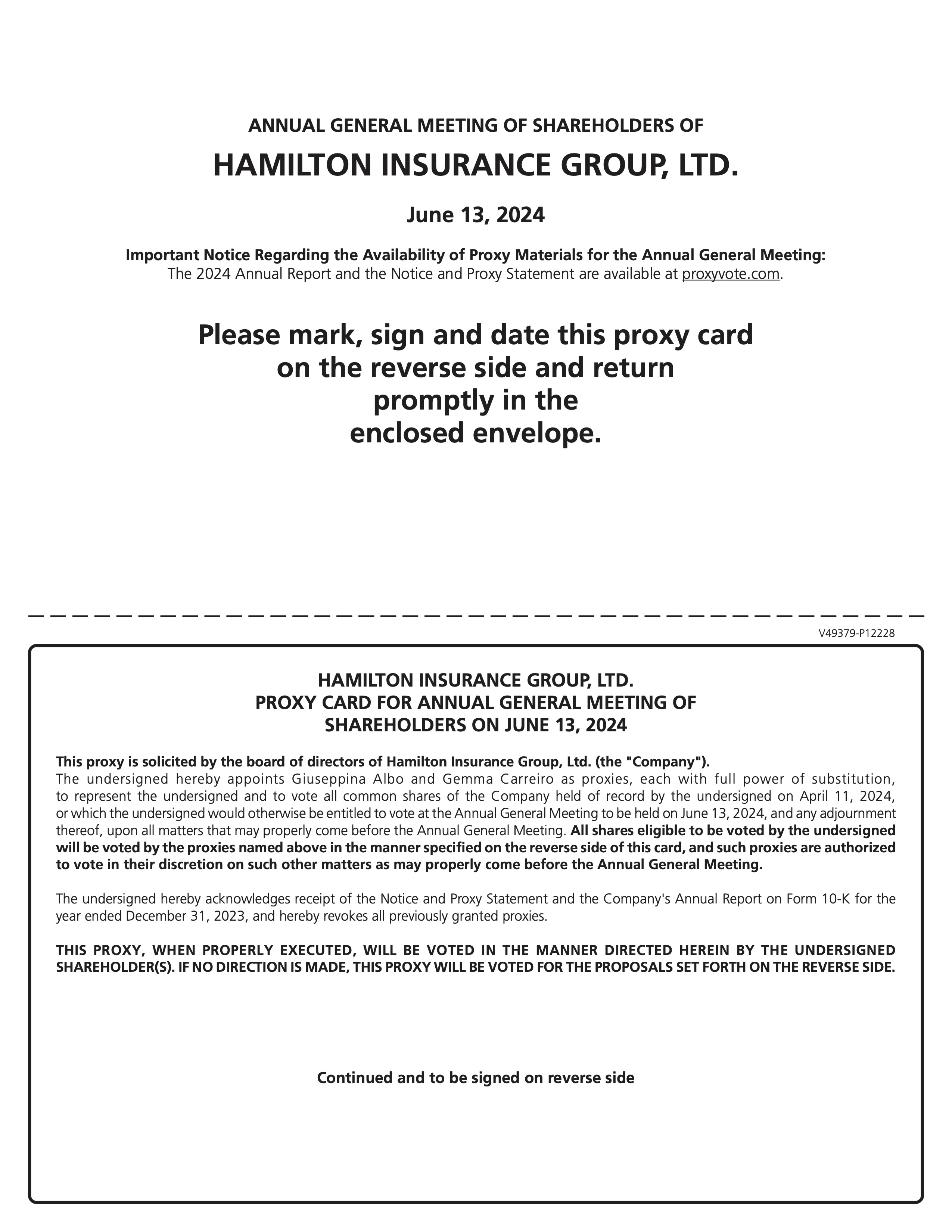

Skills, Qualifications and Experience of Directors

The Nominating and Corporate Governance Committee is responsible for, among other things, identifying, evaluating and recommending individuals qualified for positions on the Board and recommending to the Board the Class B director nominees for each annual meeting of shareholders. Among other things, and consistent with criteria approved by the Board, the Committee assesses nominees' general understanding of various business disciplines and the Company's business, analytical ability, independence, diversity of experience, viewpoints and backgrounds and willingness to devote adequate time to Board duties.

As reflected in the chart below, we believe that our Board offers a wide range of skills and experience:

| | | | | | | | | | | |

| Hamilton Insurance Group, Ltd. | 2024 Proxy Statement | | 6 |

Board Refreshment Process

The Board views continuous and experienced leadership as a valuable asset to the Company. There are no term limits imposed on director tenure. The Nominating and Corporate Governance Committee will, however, review each director’s continuation on the Board every year, subject to the provisions of the Company’s Shareholders Agreement and Bye-laws regarding the rights of certain shareholders to appoint directors.

Directors shall be required to retire from the Board when they reach the age of 75 except in special circumstances as determined by the Nominating and Corporate Governance Committee in light of the then-ascertainable facts and circumstances, including the needs of the Company and the skills and attributes of such Director. The Nominating and Corporate Governance Committee shall periodically review the retirement policy to ensure it remains appropriate in light of the Company’s needs.

| | | | | | | | | | | |

| Hamilton Insurance Group, Ltd. | 2024 Proxy Statement | | 7 |

Board Diversity

The Nominating and Corporate Governance Committee expects the Board of Directors to foster, cultivate and preserve an inclusive culture. The Nominating and Corporate Governance Committee will consider gender, identity, age, race, nationality, national origin, ethnicity, disability status and sexual orientation in the composition of the Board of Directors. The Board of Directors shall evaluate each individual in the context of the Board of Directors as a whole with the objective of retaining a group that is best equipped to help ensure the Company’s success and represent shareholders’ interests through sound judgment.

Although there is no specific policy regarding diversity in identifying director nominees, both the Nominating and Corporate Governance Committee and the Board of Directors seek the talent and backgrounds that would be most helpful in selecting director nominees. In particular, the Nominating and Corporate Governance Committee considers whether a director candidate, if elected, assists in achieving a mix of board members that represents a diversity of background and experience.

| | | | | | | | | | | |

| Hamilton Insurance Group, Ltd. | 2024 Proxy Statement | | 8 |

PROPOSAL ONE:

Election of Class B Directors

Our business and affairs are managed under the direction of our Board of Directors. Our Bye-laws provide that our Board of Directors consist of not less than eleven (11) directors or more than fifteen (15) directors as the Board of Directors may determine from time to time. The Board of Directors presently consists of thirteen (13) directors, including eleven (11) Class B directors and two (2) Shareholder Directors.

At the 2024 Annual General Meeting, ten (10) Class B directors are to be elected, each to hold office until the next annual general meeting of shareholders or until his or her successor is elected and qualified. They will join the two (2) Shareholder Directors who are appointed in accordance with the Shareholders Agreement and the Company's Bye-laws. As such, after the 2024 Annual General Meeting the Board of Directors will consist of twelve (12) directors including ten (10) Class B directors and two (2) Shareholder Directors.

Recommendation | | | | | | | | |

| | |

| The Board of Directors recommends that shareholders vote their shares "FOR" the election of each of the ten (10) Class B directors nominated by our Board of Directors and named in this proxy statement as a director to serve until the next annual general meeting or until his or her successor is elected and qualified | |

| | |

Vote Required

To be approved, the election of Class B directors requires the affirmative vote from a plurality of the Class B common shares voted by holders present in person or by proxy at the Annual General Meeting at which holders of the majority of the Class B common shares are present, and entitled to vote thereon, subject to voting limitations as set out in the Company's Bye-laws. Broker non-votes and abstentions will have no effect on this proposal.

Class B Director Nominees

The Nominating and Corporate Governance Committee has recommended, and our Board of Directors has approved, David A. Brown, Giuseppina (Pina) Albo, William C. Freda, John J. Gauthier, Anu (Henna) Karna, Stephen W. Pacala, A. Neil Patterson, Marvin Pestcoe, Everard Barclay Simmons and Therese Vaughan as Class B director nominees for election as directors at the Annual General Meeting. If elected, each such nominee will serve as a director until the 2025 annual general meeting or until his or her successor is duly elected and qualified. The current term for Russell Fradin, a current director, will expire immediately following the Annual General Meeting.

| | | | | | | | | | | |

| Hamilton Insurance Group, Ltd. | 2024 Proxy Statement | | 9 |

| | | | | | | | | | | | | | |

| Name | Age | Committees | Position | Since |

| David A. Brown | 66 | Compensation and Personnel and Underwriting and Risk | Independent Director | 2013 |

| Giuseppina (Pina) Albo | 61 | | CEO and Director | 2018 |

| William C. Freda | 71 | Compensation and Personnel, Audit, Nominating and Governance | Independent Director | 2014 |

| John J. Gauthier | 62 | Compensation and Personnel and Investment | Independent Director | 2023 |

| Anu (Henna) Karna | 47 | Audit, Nominating and Governance and Underwriting and Risk | Independent Director | 2023 |

| Stephen W. Pacala | 67 | Compensation and Personnel, Nominating and Governance and Underwriting and Risk | Independent Director | 2013 |

| A. Neil Patterson | 60 | Audit and Nominating and Governance | Independent Director | 2024 |

| Marvin Pestcoe | 63 | Audit, Underwriting and Risk and Investment | Independent Director | 2020 |

| Everard Barclay Simmons | 51 | Audit and Investment | Independent Director | 2023 |

| Therese Vaughan | 67 | Nominating and Corporate Governance and Underwriting and Risk | Independent Director | 2024 |

Class B Director Nominee Biographies

| | | | | |

David A. Brown | Mr. Brown has served as a director of the Company since 2013 and currently serves as Chair of the Board of Directors. He also has served as non-executive Chair of Hamilton Re, Ltd. (Hamilton Re) since 2015. Mr. Brown previously served as the Chief Executive Officer at Flagstone Reinsurance Holdings Ltd. from September 2005 until its sale in November 2012. Mr. Brown was also the Chief Executive Officer of Centre Solutions from 1994 to 1997, and was a partner with Ernst & Young, Bermuda until 1993. In addition, Mr. Brown has experience serving on the boards of various organizations. Mr. Brown has served as Deputy Chair at the Bermuda Stock Exchange since 2020 (and previously held the role of Chair from 2000 to 2020), as Chair of the Board of Argus Insurance Group since February 2020, as a director of MIAX Pearl Exchange since April 2021 and as Chairman of Bermuda Commercial Bank since July 2021. Mr. Brown is also a member of the Institute of Chartered Accountants of Bermuda and a fellow of the Institute of Chartered Accountants in England and Wales. We believe Mr. Brown’s business and leadership experience in the reinsurance industry and his expertise in accounting qualifies him to serve on the Company’s Board of Directors. |

| | | | | | | | | | | |

| Hamilton Insurance Group, Ltd. | 2024 Proxy Statement | | 10 |

| | | | | |

Giuseppina (Pina) Albo | Ms. Albo has served as Chief Executive Officer of the Company and a member of its Board of Directors since January 2018. Ms. Albo started her career as a lawyer in Toronto, Canada, followed by a 25-year career at Munich Re in increasingly senior positions leading to her last position as Member of the Board of Executive Management where her responsibilities included P&C business and operations in Europe and Latin America. Since 2019, Ms. Albo has sat on the Board of Directors for Reinsurance Group of America, Incorporated and in January 2023, was appointed as the first female Chair of the Association of Bermuda Insurers and Reinsurers. Since 2018, she has also served as an ambassador for the Insurance Supper Club, an international organization that aims to improve networking opportunities for women across the finance and insurance industries. Ms. Albo has been recognized for contributions to the insurance industry and has received numerous awards including the Association of Professional Insurance Women’s “Woman of the Year” (2011). She was also designated “Top Influencer” in Insurance Business America’s List of “Hot 100” (2014) and placed on Intelligent Insurer’s list of “Top 100 Women in Re/insurance” (2014 and 2015). Ms. Albo holds a Maîtrise en Droit, International and European Community Law, from L’Université d’Aix-Marseille III, Aix-en-Provence, France; a Juris Doctor from Osgoode Hall Law School, York University, Toronto, Canada; and a Bachelor of Arts degree in Languages from the University of Winnipeg, Manitoba, Canada. We believe Ms. Albo’s extensive experience in the insurance industry and in leadership positions qualifies her to serve on the Company’s Board of Directors. |

| | | | | |

William C. Freda | Mr. Freda has served as a director of the Company since 2014 and Chair of the Nominating and Corporate Governance committee since May 2023. As senior partner and vice chair of Deloitte, LLP, Mr. Freda served Deloitte’s most significant clients and maintained key relationships, acting as a strategic liaison to the marketplace as well as to professional and community organizations. He joined Deloitte in 1974 and served on a wide range of multinational engagements for many of Deloitte’s largest and most strategic clients. Mr. Freda’s many senior positions at Deloitte included Chair of the Risk Committee and the Audit Committee of Deloitte Touche Tohmatsu Limited’s Board of Directors, Managing Partner of Deloitte’s US Client Initiatives, and member of the US Executive Committee. Mr. Freda is a graduate of Bentley University. He is a member of the Board of Directors of Guardian Life Insurance Company and State Street Corporation. We believe Mr. Freda’s key insight and perspective on risk management, international expansion and client relationships gained through his extensive experience interacting with audit committees, boards of directors and senior management qualifies him to serve on the Company’s Board of Directors. |

| | | | | | | | | | | |

| Hamilton Insurance Group, Ltd. | 2024 Proxy Statement | | 11 |

| | | | | |

John J. Gauthier | Mr. Gauthier has served as a director of the Company since October 2023. He served as President of Allied World Financial Services Company, Inc. from 2012 until his retirement in 2018 and as Chief Investment Officer of Allied World Assurance Company Holdings, AG. from 2008 to 2018. Before joining Allied World, Mr. Gauthier was a Managing Director with Goldman Sachs Asset Management and held positions of increasing responsibility with Conning Asset Management culminating in a position as Director of Investment Strategy for Conning’s property-casualty insurer clients. Prior to joining Conning Asset Management, Mr. Gauthier held positions at General Reinsurance/New England Asset Management and The Travelers. Mr. Gauthier holds a Bachelor of Science degree in Computer Information Systems from Quinnipiac College and a Master of Business Administration, Finance from The Wharton School of the University of Pennsylvania. He is a Principal at JJG Advisory, LLC, a consulting business, and at Talcott Capital Partners, LLC, an investor advisory business. Mr. Gauthier is a member of the boards of directors of Reinsurance Group of America, Incorporated, The Hartford Funds, and Middlesex (CT) Health Systems. Mr. Gauthier served on the Board of Directors of Crescent Acquisition Corporation from 2018-2021. We believe Mr. Gauthier’s extensive financial and business experience in leadership positions qualifies him to serve on the Company’s Board of Directors. |

| | | | | |

Anu (Henna) Karna | Ms. Karna has served as a director of the Company since October 2023. She has more than 25 years of experience leading innovation across digital/data in high-tech, CPG, risk management, and insurance industries. Dr. Karna has led businesses and advised Fortune 50 companies on digital innovation and disruption and has designed and developed patent-pending technology and applications in the field of genetic algorithms, behavioral analytics, deep neural nets and digital-data technologies. Most recently, Dr. Karna served as the General Manager, Managing Director, Global Insurance & Risk Management Solutions at Google from November 2020 to March 2023. Prior to Google, she served as Executive Vice President and Global Chief Data Officer at AXA XL from 2017 to 2020, as President of Verisk Digital Services, as Vice President, Digital Customer Strategy for Verisk Analytics and as Managing Director & Global Actuarial Chief Information Officer for AIG. Earlier in her career, Dr. Karna held positions at Affinnova, John Hancock Insurance and held cryptology-related roles for the government. Dr. Karna holds a Bachelor of Science from Worcester Polytechnic Institute, a Masters and Doctorate from the University of Massachusetts, Lowell and a Master of Business Administration from the Massachusetts Institute of Technology. She is a member of the board of directors of Essent Group Ltd. We believe Dr. Karna’s extensive experience in the insurance and tech industries as well as in leadership positions qualifies her to serve on the Company’s Board of Directors. |

| | | | | |

Stephen W. Pacala | Mr. Pacala has served as a director of the Company since 2013. He has also served as a Professor and Director at Princeton University since 1992. From 1982 to 1992 he served as an associate professor at the University of Connecticut. Mr. Pacala is also a member of President Biden’s Council of Advisors on Science and Technology, the American Academy of Arts and Sciences, and the National Academy of Sciences. Mr. Pacala is a previous recipient of the MacArthur Award, Mercer Award and the David Starr Jordan Prize. Mr. Pacala holds a Bachelor of Arts degree from Dartmouth College and a Ph.D. in biology from Stanford University. We believe Mr. Pacala’s extensive experience in climate-related matters and in leadership positions qualifies him to serve on the Company’s Board of Directors. |

| | | | | | | | | | | |

| Hamilton Insurance Group, Ltd. | 2024 Proxy Statement | | 12 |

| | | | | |

A. Neil Patterson

| Mr. Patterson has served as a director of the Company and as chair of our audit committee since March 2024. Neil Patterson is a recently retired Chairman of the KPMG group of entities in Bermuda. He spent the majority of his career with KPMG, having joined the firm in 1989. He was a client facing lead audit partner from 1997 until his retirement on December 31, 2020; providing audit and advisory services to financial services clients in Bermuda. He was the Risk Management Partner for KPMG in Bermuda for over twenty years and was the Risk Management Partner for KPMG’s sub regional firm (The KPMG Islands Group) for fifteen years. Mr. Patterson became the Bermuda firm’s Office Managing Partner in 2008 and served for nine years, he then took on the role of Chairman until his retirement. From 2012 until 2015, Mr. Patterson served as the Managing Partner of KPMG’s regional firm; The KPMG Islands Group (KIG). In this capacity, he was also a member of KPMG’s Board of Directors for its European, Middle East and Africa (EMA) firm. From 2016 to 2020 Mr. Patterson served as a member of KPMG’s Global Insurance Advisory Group, a sub-committee of KPMG’s global board. The Group advises the KPMG global board on insurance matters affecting KPMG member firms around the world. Mr. Patterson is very active in the Bermuda community. In 2019 he co-founded Ignite Bermuda, the island’s first privately funded business incubator and accelerator. Ignite’s purpose is to help Bermudian entrepreneurs succeed in business, diversify economic ownership and create jobs through education, mentoring and support. To date over 500 Bermudian entrepreneurs and small businesses have benefited from the programme. In 2021 he co-founded Bermuda Investor Community Limited. BICL is designed to enhance the flow of capital from angel investors into the entrepreneurial community in Bermuda. It provides coaching and advisory services to entrepreneurs seeking capital and promotes an electronic platform where investors and entrepreneurs can enter into transactions. We believe Mr. Patterson's extensive financial and audit experience qualifies him to serve on the Company’s Board of Directors. |

| | | | | |

Marvin Pestcoe

| Mr. Pestcoe has served as a director of the Company since 2020 and Chair of our Underwriting & Risk Committee as of May 2023. He also currently serves as non-executive Chair of Hamilton Select Insurance LLC. Mr. Pestcoe served as Executive Chair and Chief Executive Officer of Langhorne Re from January 2019 to April 2021 and continued as a director of Langhorne Re until March 2023. He is also currently a director at Catalina Insurance and a director and a director of Aisix Solutions (formerly Minerva Intelligence). Mr. Pestcoe previously held senior positions in PartnerRe (2001 to 2017) and Swiss Re New Markets (1997 to 2001), and has over 40 years of experience in insurance, reinsurance and investments including a range of executive roles and leadership positions that focused on profit center management, investments, corporate strategy, data analytics and risk management. Mr. Pestcoe is also a Fellow of the Casualty Actuarial Society and a member of the American Academy of Actuaries. We believe Mr. Pestcoe’s expertise in insurance, reinsurance and investing and business leadership experience qualifies him to serve on the Company’s Board of Directors. |

| | | | | | | | | | | |

| Hamilton Insurance Group, Ltd. | 2024 Proxy Statement | | 13 |

| | | | | |

Everard Barclay Simmons

| Mr. Simmons has served as a director of the Company since August 2023. Mr. Simmons is Chair and CEO at advisory firm Rose Investment Limited and Chair of the Bermuda Public Funds Investment Committee with responsibility for advising on the investment of Bermuda’s pension funds. He was formerly an investment banker with Goldman Sachs in New York and returned to Bermuda in 2006 as Managing Partner of a Bermuda law firm where he worked until 2019. Mr. Simmons is a graduate of the University of Kent at Canterbury, where he graduated with a law degree, the Inns of Court School of Law where he qualified as a barrister, and Harvard Business School where he graduated with a Master in Business Administration. He is a member of the boards of Petershill Partners plc and Argus Group Holdings Limited and is a former Chair of Butterfield Bank. We believe Mr. Simmons’ extensive financial and business experience in leadership positions qualifies him to serve on the Company’s Board of Directors. |

| | | | | |

Therese Vaughan | Ms. Vaughan has served as a director of the Company since March 2024. Ms. Vaughan is a seasoned educator, corporate director, and internationally recognized expert in insurance regulation. She was the CEO of the National Association of Insurance Commissioners and served over 10 years as Iowa Insurance Commissioner—the state’s longest-serving and first female insurance commissioner. Ms. Vaughan represented the US insurance regulatory system internationally, as a member of the Executive Committee of the International Association of Insurance Supervisors and of the steering committing for the US/EU Insurance Dialogue Project. She chaired the Joint Forum, a Basel, Switzerland-based group of banking, insurance, and securities supervisors. Ms. Vaughan recently served as a director of AIG, and is on the Board of Verisk Analytics, Wellmark Blue Cross and Blue Shield, WestBank, and the Food Bank of Iowa. We believe Ms. Vaughan’s extensive experience in insurance regulatory oversight and in leadership positions qualifies her to serve on the Company’s Board of Directors. |

| | | | | | | | |

| | |

| The Board of Directors recommends a vote "FOR" the election of the Class B Director nominees | |

| | |

| | | | | | | | | | | |

| Hamilton Insurance Group, Ltd. | 2024 Proxy Statement | | 14 |

Shareholder Directors

Set forth below, and not for nomination or election at the Annual General Meeting, are the biographies of the two current Shareholder Directors:

| | | | | |

H. Hawes Bostic, III

| Mr. Bostic has served as a director of the Company since 2022 and chair of our investment committee as of May 2023. He is also a Partner at Magnitude Capital, where he has been a member of the investment team since 2005. Previously, Mr. Bostic traded equity derivatives and convertible bonds for KBC Financial Products from 1999 to 2002 and worked as a trader at the D.E. Shaw group from 1998 to 1999. Mr. Bostic began his career in business consulting in 1995. In addition, since 2018, Mr. Bostic has served on the board of The In Kind Project, a non-profit that provides community programming in the arts for children of all backgrounds. He graduated with a Bachelor of Arts in English Literature from the University of Virginia and is a CFA Charterholder. We believe Mr. Bostic’s investing expertise and business leadership experience qualifies him to serve on the Company’s Board of Directors. Mr. Bostic was appointed as a director of the Company pursuant to the Magnitude Investor’s right under the Shareholders Agreement to appoint a director to the Board of Directors. |

| | | | | |

Antonio Ursano, Jr.

| Mr. Ursano has served as a director of the Company since October 2023. He is also the Managing Partner and Co-Founder of Insurance Advisory Partners LLC. Mr. Ursano previously served as the Group Chief Financial Officer of the Company from September 2019 to July 2021. Prior to joining the Company, he was President of TigerRisk Partners, LLC from 2015 to 2021, Chief Executive Officer of Willis Capital Markets Advisory from 2009 to 2015 and Vice Chairman and Global Head of the Financial Institutions Group at Banc of America Securities from 1999 to 2009. Mr. Ursano has over 36 years of experience in the insurance industry and in investment banking. We believe that Mr. Ursano’s extensive experience in the insurance and reinsurance industry and in investment banking and business leadership experience qualifies him to serve on the Company’s Board of Directors. Mr. Ursano was appointed as a director of the Company pursuant to Hopkins Holdings, LLC’s right under the Shareholders Agreement to appoint a director to the Board of Directors. Mr. Ursano was appointed as a director of the Company pursuant to the Hopkins Holdings right under the Shareholders Agreement to appoint a director to the Board of Directors. See “Certain Relationships and Related Party Transactions—IAP Engagement Letter.” |

Directors Not Continuing in Office

D. Pauline Richards retired from the Board of Directors with effect from March 11, 2024. The current term for Russell Fradin, a current director, will expire immediately following the Annual General Meeting. The Company gratefully acknowledges and thanks both Ms. Richards and Mr. Fradin for their years of service and dedication to our Board of Directors.

| | | | | | | | | | | |

| Hamilton Insurance Group, Ltd. | 2024 Proxy Statement | | 15 |

Corporate Governance

Corporate Governance Highlights

Corporate governance is a key factor in our ability to deliver shareholder value. Highlights of our corporate governance standards include:

•Majority independent Board of Directors

•No "over-boarding" - our directors may not serve on the board of directors of more than four other publicly held companies

•Independent Committees - each of our Audit, Compensation and Personnel and Nominating and Corporate Governance Committees are entirely comprised of independent directors

•Robust corporate governance framework - the Company is committed to conducting its business with the highest level of ethical conduct and the Board of Directors has adopted a Corporate Governance Framework, a Code of Conduct and Ethics and, when combined with the Charters of the standing Board Committees, provides for a robust framework. Copies of these documents are available on our Company website

•Active Board refreshment process

•Access to structured Board continuing education modules to remain up to date with current 'hot topics' impacting our industry

Director Independence

The Board of Directors affirmatively determines on an annual basis whether each director qualifies as an independent director pursuant to the NYSE listing standards and each independent director is expected to promptly disclose to the Board any existing or proposed relationships or transactions that could impact his or her independence. Members of the Audit Committee and the Compensation and Personnel Committee must meet the additional independence requirements set forth under the Securities Exchange Act of 1934 and the applicable provisions of the NYSE Listed Company Manual. The Nominating and Corporate Governance Committee undertakes an annual review of the independence of all non-employee directors and makes recommendations to the Board of Directors.

Our Board currently consists of thirteen (13) directors, eleven (11) of whom are independent. Our Board of Directors recently undertook a review of the independence of our directors and considered whether any director has a material relationship with us that could compromise that director’s ability to exercise independent judgment in carrying out that director’s responsibilities. The Board has made these determinations primarily on the basis of a review of each director's responses to questions regarding employment and compensation history, family relationships and affiliations and discussions with the directors. The Board also considers the recommendations of the Nominating and Corporate Governance Committee, which thoughtfully assess independence, as well as seeks the advice of outside counsel experienced with these matters. Our Board of Directors has affirmatively determined that David A. Brown, Hawes Bostic, III, Russell Fradin, William C. Freda, John J. Gauthier, Anu (Henna) Karna, Stephen W. Pacala, A. Neil Patterson, Marvin Pestcoe, Everard Barclay Simmons and Therese Vaughan are each an “independent director,” as defined under the Exchange Act and the rules of the NYSE. Giuseppina (Pina) Albo is not independent as she serves as our Chief Executive Officer. Antonio Ursano, Jr. is not independent as he is the

| | | | | | | | | | | |

| Hamilton Insurance Group, Ltd. | 2024 Proxy Statement | | 16 |

Managing Partner and Co-Founder of Insurance Advisory Partners LLC, which company in 2023 received payments from the Company which exceeded the greater of $1 million or 2% of such company's consolidated gross revenues. In making these determinations, our Board of Directors considered the current and prior relationships that each director has or had with our Company and all other facts and circumstances our Board of Directors deemed relevant in determining their independence, including the beneficial ownership of our share capital by each director, and the transactions involving them described in the section titled “Certain Relationships and Related Party Transactions.” Accordingly, in accordance with the listing standards of the NYSE, a majority of our directors are independent.

Board and Committee Evaluations

We firmly believe that a robust Board and Committee evaluation process is essential to good corporate governance. Our Corporate Governance Guidelines provide that the Board will conduct a self-evaluation to determine the effectiveness of the Board and its committees annually. The purpose of this review is not to single out the performance of particular directors, but to improve the performance of the Board of Directors' as a whole. The Board and the Nominating and Corporate Governance Committee review, evaluate and, as necessary or advisable, revise the framework for effectiveness and compliance with legal requirements and compliance with the NYSE. This framework is subject to modification by the Board upon recommendation by the Nominating and Corporate Governance Committee.

Certain Relationships and Related Party Transactions

The following is a summary of certain relationships and related party transactions.

Shareholder Agreement

The Company is party to a Shareholders Agreement with certain shareholders who, together with their respective affiliates, own at least five percent (5%) of our issued and outstanding common shares providing for certain rights. At this time, those shareholders include Sango Holdings, Hopkins Holdings, the Blackstone Investor and the Magnitude Investor. The Shareholders Agreement provides each such shareholder with certain rights, including the right to appoint a director to the Board of Directors, subject to the maintenance of certain ownership thresholds.

The Shareholders Agreement also provides that the Company will obtain and maintain directors’ and officers’ liability insurance and fiduciary liability insurance, which includes coverage for prior acts, with insurers of recognized financial responsibility in such amounts as the Board of Directors determines to be prudent and customary for the Company’s business and operations, to the extent that coverage is available at a reasonable cost, or as otherwise provided for in the indemnification agreements. See "Indemnification Agreements" for additional information regarding directors' and officers' liability insurance coverage.

Registration Rights Agreement

We have entered into the registration rights agreement, dated December 23, 2013, with certain of our existing shareholders pursuant to which we have provided such shareholders with certain demand and piggy-back registration rights with respect to our common shares.

| | | | | | | | | | | |

| Hamilton Insurance Group, Ltd. | 2024 Proxy Statement | | 17 |

Commitment Agreement and Investment Management Agreement

The Company and Hamilton Re, Ltd., a subsidiary of the Company ("Hamilton Re"), are party to a Commitment Agreement (the "Commitment Agreement") and the Two Sigma Hamilton Fund investment management agreement (the "Two Sigma Hamilton Fund IMA") with Two Sigma and Two Sigma Principals, LLC (the managing member of the Two Sigma Hamilton Fund (the "Managing Member")). Under the Commitment Agreement, Hamilton Re is required to maintain an investment in the Two Sigma Hamilton Fund, LLC ("Two Sigma Hamilton Fund") in an amount up to the lesser of (i) $1.8 billion or (ii) 60% of Hamilton’s net tangible assets for a rolling three-year period commencing on July 1, 2023. The Commitment Agreement renews for a new three-year period unless a non-renewal notice is provided by either party in accordance with the Commitment Agreement. Effective July 1, 2023, a revised investment management agreement with Two Sigma requires Two Sigma Hamilton Fund to incur a management fee of 2.5% of the non-managing members' equity in the net asset value of the Two Sigma Hamilton Fund per annum (previously 3%). The management fee for the years ended December 31, 2023 and 2022, the month ended December 31, 2021 and the year ended November 30, 2021 was $45.2 million, $53.1 million, $4.3 million and $48.7 million, respectively.

The Two Sigma Hamilton Fund Limited Liability Company Agreement

Under the terms of the revised limited liability company agreement of the Two Sigma Hamilton Fund between Hamilton Re and the Managing Member, the Managing Member remains entitled to an incentive allocation equal to 30% of Two Sigma Hamilton Fund’s net profits, subject to high watermark provisions, and adjusted for withdrawals and any incentive allocation to the Managing Member. In the event there is a net loss during a quarter and a net profit during any subsequent quarter, the Managing Member is entitled to a modified incentive allocation whereby the regular incentive allocation will be reduced by 50% until subsequent cumulative net profits are credited in an amount equal to 200% of the previously allocated net losses. The Managing Member is also entitled to receive a revised additional incentive allocation as of the end of each fiscal year (or on any date Hamilton Re withdraws all or a portion of its capital), in an amount equal to 25% of the Excess Profits (previously 20%). "Excess Profits" for any given fiscal year (or other such accounting period) means the net profits over 10% for such fiscal year (previously 15%), net of management fees and expenses and gross of incentive allocations, but only after recouping previously unrecouped net losses. To the extent Hamilton Re contributes capital other than at the beginning of a fiscal year or withdraws capital other than at the end of a fiscal year, the additional incentive allocation hurdle with respect to such capital is prorated. The aggregate incentive allocation (inclusive of the additional incentive allocation) for the years ended December 31, 2023 and 2022, the month ended December 31, 2021 and the year ended November 30, 2021 was $21.5 million, $68.0 million, $Nil and $61.6 million, respectively.

Ada Re

Our wholly owned subsidiary, Ada Capital Management Limited ("ACML"), is a Bermuda insurance agent that provides certain underwriting services to Ada Re, Ltd. ("Ada Re"). Ada Re is a non-consolidated special purpose insurer funded by investors and formed to provide fully collateralized reinsurance and retrocession to both the wholly owned operating platforms of Hamilton Re and third-party cedants. As of December 31, 2023, John A. Overdeck and trusts for the benefit of certain members of his immediate family indirectly beneficially own 60% of the outstanding non-voting preference shares of Ada Re. Mr. Overdeck does not have any interest in any voting shares of Ada Re.

| | | | | | | | | | | |

| Hamilton Insurance Group, Ltd. | 2024 Proxy Statement | | 18 |

Mr. Overdeck and trusts for the benefit of certain members of his immediate family have, together, contributed approximately $189 million to Ada Re strategies between 2021 and 2023.

Mr. Overdeck was a member of our Board of Directors in 2023 and, through Hopkins Holdings, which is managed by Mr. Overdeck, beneficially owns Class A common shares of the Company.

IAP Engagement Letter

Pursuant to an engagement letter, we retained Insurance Advisory Partners LLC (“IAP”), a FINRA member, to act as financial advisor to us with respect to evaluating various strategic and financial alternatives including any capital raise by us, including on November 14, 2023 where the Company consummated an initial public offering of its Class B Common Shares ("IPO") (the “IAP Engagement Letter”). Mr. Ursano, one of our directors, is the Managing Partner and Co-Founder of IAP. Pursuant to the IAP Engagement Letter, the Company paid IAP a retainer of $0.1 million and a transaction fee of $1.0 million in connection with our IPO. The Company also reimbursed IAP for all reasonable and documented out-of-pocket expenses incurred in connection with specified matters, and has provided for indemnification of IAP. The advisory agreement expired on January 8, 2024 and was not renewed.

Indemnification Agreements

Our Bye-laws provide that we will indemnify our directors and officers in respect of their actions and omissions, except in respect of their fraud or dishonesty. Pursuant to our Bye-laws, our shareholders have agreed to waive any claim or right of action that such shareholders may have, whether individually or by or in right of the Company, against our directors or officers for any act or failure to act in the performance of such director’s or officer’s duties with or for the Company, except in respect of any fraud or dishonesty of such director or officer. Our Bye-laws also permit us to purchase and maintain insurance for the benefit of any director or officer in respect of any loss or liability attaching to such director or officer in respect of any negligence, default, breach of duty or breach of trust, whether or not we may otherwise indemnify such director or officer. The Company intends to maintain a directors’ and officers’ liability policy for such a purpose.

In connection with the consummation of our IPO, we entered into separate indemnification agreements with each of our directors and executive officers and the former Blackstone Investor director, Peter Koffler, and each of John A. Overdeck and David M. Siegel (who each resigned effective on October 15, 2023), which contain customary terms for public companies. These indemnification agreements required us to obtain directors’ and officers’ liability insurance, which includes coverage for prior acts and actions relating to our IPO, with reputable insurance companies.

The indemnification agreements and our Bye-laws require us to indemnify these individuals to the fullest extent permitted by applicable law against liabilities that may arise by reason of their service to us, and to advance expenses incurred as a result of any proceeding against them as to which they could be indemnified. The indemnification provided under the indemnification agreements is not exclusive of any other indemnity rights. There is currently no pending material litigation or proceeding involving any of our directors.

Policies and Procedures for Related-Party Transactions

We have adopted a related person transactions policy and implemented procedures for reviewing transactions with “related parties,” which we define to include our executive officers, directors and nominees

| | | | | | | | | | | |

| Hamilton Insurance Group, Ltd. | 2024 Proxy Statement | | 19 |

for director, any immediate family member or affiliated entity of any of our executive officers, directors or nominees for director and any person (and his or her immediate family members and affiliated entities) or entity (including affiliates) that is a beneficial owner of 5% or more of any class of our outstanding voting securities. This policy covers, with certain exceptions set forth in Item 404 of Regulation S-K under the Securities Act, any transaction, arrangement or relationship, or any series of similar transactions, arrangements or relationships, in which we were or are to be a participant, where the amount involved exceeds $120,000 and a related person had or will have a direct or indirect material interest. Pursuant to this policy, an appropriate committee of our Board of Directors must approve the terms, arrangements and policies of, and provide ongoing oversight over, all transactions with a related party in which the amount involved exceeds $120,000. In conducting its initial and ongoing reviews, the Audit Committee takes into account, among other factors it deems appropriate, the terms of the transaction, including whether the transaction is on terms no less favorable than terms generally available to an unaffiliated third-party under the same or similar circumstances, the extent of the related-party’s interest in the transaction, the qualifications and performance of the related party and other business considerations that would be applied to similar arrangements with unaffiliated parties. Under the policy, if we should discover related party transactions that have not been approved, the Audit Committee will determine the appropriate action, including ratification, rescission or amendment of the transaction.

| | | | | | | | | | | |

| Hamilton Insurance Group, Ltd. | 2024 Proxy Statement | | 20 |

Board Committees

Our Board maintains Audit, Compensation and Personnel, Nominating and Corporate Governance, Investment and Underwriting and Risk Committees (each a Committee). Current copies of the charters for the Audit, Compensation and Personnel and Nominating and Corporate Governance Committees, as well as our Corporate Governance Guidelines, are available on our website at www.hamiltongroup.com. The table below summarizes the Company's committee membership as of April 25, 2024 for each Committee. Additionally, the table identifies the independent directors - as indicated by an asterisk (*), as determined by our Board based on the NYSE listing standards and our Corporate Governance Guidelines.

| | | | | | | | | | | | | | | | | |

| Name | Audit | Compensation and Personnel | Nominating and Corporate Governance | Underwriting and Risk | Investment |

| David A. Brown (Chair of Board of Directors) * | | X | | X | |

| Giuseppina (Pina) Albo (Chief Executive Officer) | | | | | |

| H. Hawes Bostic, III (Chair of Investment) * | | | | | X |

| Russell Fradin (Chair of Compensation and Personnel) * | | X | | | X |

| William C. Freda (Chair of Nominating and Governance) * | X | X | X | | |

| John J. Gauthier * | | X | | | X |

| Anu (Henna) Karna * | X | | X | X | |

| Stephen W. Pacala * | | X | X | X | |

| A. Neil Patterson (Chair of Audit) * | X | | X | | |

| Marvin Pestcoe (Chair of Underwriting and Risk) * | X | | | X | X |

| Everard Barclay Simmons * | X | | | | X |

| Antonio Ursano, Jr. | | | | X | |

| Therese Vaughan * | | | X | X | |

| 2023 Meetings | 4 | 4 | 4 | 4 | 4 |

Audit Committee. The purpose of the Audit Committee is to prepare the Audit Committee report required by the SEC to be included in our proxy statement and to assist our Board of Directors with respect to its oversight of (1) our risk management policies and procedures; (2) the audits and integrity of our financial statements, and the effectiveness of internal control over financial reporting; (3) our compliance with legal and regulatory requirements; (4) the qualifications, performance and independence of the outside auditors; (5) the performance of our internal audit function; (6) the evaluation of related party transactions; (7) pre-approving audit and non-audit services and fees; and (8) the establishment and maintenance of procedures for the receipt, retention and treatment of complaints regarding accounting, internal accounting controls, auditing matters, or federal and state rules and regulations, and the confidential, anonymous submission by our employees of concerns regarding questionable accounting or auditing matters.

Compensation and Personnel Committee. The purpose of the Compensation and Personnel Committee is to assist our Board of Directors in discharging its responsibilities relating to (1) setting our compensation philosophy and compensation of our executive officers and directors, (2) monitoring our equity-based and

| | | | | | | | | | | |

| Hamilton Insurance Group, Ltd. | 2024 Proxy Statement | | 21 |

certain incentive compensation plans, (3) preparing the Compensation and Personnel Committee report required to be included in our proxy statement or annual report under the rules and regulations of the SEC when such disclosure is required by SEC rules and (4) appointing and overseeing any compensation consultants.

Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee is responsible for, among other things, (1) reviewing board structure, composition and practices and making recommendations on these matters to our Board of Directors, (2) reviewing, soliciting and making recommendations to our Board of Directors and shareholders with respect to candidates for election to the Board of Directors, (3) overseeing our Board of Directors’ performance and self-evaluation process, reviewing the compensation payable to board and committee members and providing recommendations to our Board of Directors in regard thereto, and (4) developing and reviewing a set of corporate governance principles.

Investment Committee. The Investment Committee establishes our investment policy and guidelines and monitors our investment results and performance against our investment objectives, guidelines, benchmarks, and risk appetite contained in the investment policy. Our investment policy contains guidelines on permitted assets and prohibited asset classes, minimum criteria for credit quality, duration benchmarks, liquidity requirements and sustainability parameters.

Underwriting and Risk Committee. The Underwriting and Risk Committee is responsible for, among other things, overseeing, reviewing and evaluating the Company's policies, guidelines, performance, risk management, processes and procedures relating to the underwriting of (re)insurance risks undertaken by the Company and enterprise risk management activities (including the risk management framework employed by management). The Underwriting and Risk Committee also reviews and makes recommendations to the Board of Directors regarding underwriting matters.

Meetings of the Board and its Committees

Pursuant to our Corporate Governance Guidelines, we expect our directors to regularly attend meetings of the Board and the Committees of which they are members, and to spend the time and effort needed to properly discharge their responsibilities, including by keeping themselves informed about the business and operations of the Company. Each director is also encouraged to attend the Company's annual meeting of the shareholders. Our Board met five (5) times during the year ended December 31, 2023. No director attended fewer than 75% of the total number of meetings of the Board and the total number of meetings of all committees of the Board on which the director served (during the period that each director served on the Board or such Committee).

Meetings of Non-Management Directors

The Board believes that one of the key elements of effective, independent oversight is for the independent directors to meet in executive session on a regular basis without the presence of management. In 2023, the independent directors met in executive session at each of our four regularly scheduled Board meetings.

| | | | | | | | | | | |

| Hamilton Insurance Group, Ltd. | 2024 Proxy Statement | | 22 |

Compensation and Personnel Committee Interlocks and Insider Participation

During the fiscal year ended December 31, 2023, each of David A. Brown, William C. Freda, John Gauthier, Stephen W. Pacala and Russell Fradin served on our Compensation and Personnel Committee. Other than David A. Brown, who served as the interim Chief Executive Officer of the Company from May 14, 2017 until January 22, 2018 and interim Chief Executive Officer of Hamilton Re from August 1, 2020 until October 5, 2020, none of our Compensation and Personnel Committee members have served as an officer or employee of the Company. None of our executive officers currently serve, or in the past year have served, as a member of the Board of Directors or Compensation and Personnel Committee, or other Board committee performing equivalent functions, of any entity that has one or more executive officers serving on our Compensation and Personnel Committee or our Board of Directors. None of the members of the Compensation and Personnel Committee have any other relationship required to be disclosed under this caption under the rules of the SEC.

Board Leadership Structure

The Board reviews the Company's leadership structure from time to time to ensure that we have a strong and independent Board. The Board has determined that the role of independent lead director is not currently necessary as our Chair of the Board, David A. Brown, is a non-management / independent director. All directors, with the exception of our Chief Executive Officer, Giuseppina (Pina) Albo, and Antonio Ursano, Jr., Shareholder Director, are independent as defined under the applicable listing standards of the NYSE.

Consideration of Director Nominees

The Nominating and Corporate Governance Committee will consider candidates recommended by shareholders to be nominated to our Board for election at the Annual General Meeting. A shareholder who wishes to submit a candidate for consideration must be a shareholder of record at the time that such shareholder submits a candidate for nomination and must be entitled to vote for the candidate at the meeting. If the shareholder (or a qualified representative of the shareholder) does not appear at the Annual General Meeting to present a nomination or other proposed business, such nomination shall be disregarded or such proposed business shall not be transacted, as the case may be, notwithstanding that proxies in respect of such vote may have been received by the Company. To be timely, a shareholder’s notice shall be delivered to or mailed and received by the Secretary at the registered office of the Company not less than 90 days nor more than 120 days prior to the first anniversary of the preceding year’s annual general meeting; provided, however, that in the event that the annual general meeting is called for a date that is not within thirty (30) days before or after such anniversary date, notice by the shareholder in order to be timely must be so received by the Secretary at the registered office of the Company no earlier than 120 days prior to such meeting and no later than the later of (i) 70 days prior to the date of such meeting and (ii) the close of business on the fourth (4th) day following the day on which such notice of the date of the annual general meeting was mailed or such public disclosure of the date of the annual general meeting was made, whichever first occurs. The notice must include:

| | | | | | | | | | | |

| Hamilton Insurance Group, Ltd. | 2024 Proxy Statement | | 23 |

•The name and address of such shareholder (as they appear in the Company's Register of Members) and any such beneficial owner

•The class or series and number of shares of the Company which are held of record or are beneficially owned by such shareholder and by any such beneficial owner

•A description of any agreement, arrangement or understanding between or among such shareholder and any such beneficial owner, any of their respective affiliates or associates, and any other person or persons (including their names) in connection with the proposal of such nomination or other business

•A representation that the shareholder is a holder of record of shares of the Company entitled to vote at such general meeting and that that shareholder (or qualified representative of that shareholder) intends to appear in person or by proxy at the general meeting to bring such nomination or other business before the general meeting

•A representation as to whether such shareholder or any such beneficial owner intends or is part of a group that intends to (i) deliver a proxy statement and/or form of proxy to holders of at least the percentage of the voting power of the Company’s outstanding shares required to approve or adopt the proposal or to elect each such nominee and/or (ii) otherwise to solicit proxies from shareholder in support of such proposal or nomination.

A shareholder shall also comply with all applicable requirements of the Securities Exchange Act of 1934.

Communications with Board of Directors

Shareholders and other interested parties may send communications to our Board by sending written notice to our Corporate Secretary at our headquarters at Wellesley House North, 1st Floor, 90 Pitts Bay Road, Pembroke HM 08, Bermuda. The notice may specify whether the communication is directed to the entire Board, to the non-management directors or to a particular Board committee or other director. Our Corporate Secretary will handle routine inquiries and requests for information or will otherwise determine whether the communication is made for a valid purpose and is relevant to the Company and its business and, if the Corporate Secretary so determines, will forward the communication to our Chair of the Board, to the non-management directors or to the appropriate committee chair or director. At each meeting of our Board, our Corporate Secretary presents a summary of all communications received since the last meeting that were not forwarded and makes those communications available to the directors upon request.

Board Oversight of Risk and Risk Management

Although management is responsible for the day-to-day management of the risks our Company faces, our Board of Directors and its committees take an active role in overseeing management of our risks, and the Board has ultimate responsibility for the oversight of risk management. The Board regularly reviews information regarding our operational, financial, legal and strategic risks. Specifically, senior management attends quarterly meetings of the Board, provides presentations on operations including significant risks, and is available to address any questions or concerns raised by our Board.

Our committees assist the Board in fulfilling its risk oversight responsibilities. The Audit Committee coordinates the Board's oversight of risks including our management policies and procedures; the audits and integrity of our financial statements and the effectiveness of internal control over financial reporting; our compliance with legal and regulatory requirements; and the evaluation of related party transactions. Additionally, the Audit Committee assists the Board in fulfilling its oversight responsibilities with respect to

| | | | | | | | | | | |

| Hamilton Insurance Group, Ltd. | 2024 Proxy Statement | | 24 |