Hamilton Insurance Group, Ltd. has requested confidential treatment of this registration statement and

associated correspondence pursuant to Rule 83 of the Securities and Exchange Commission.

| | | | | |

|

787 Seventh Avenue New York, NY 10019-6099 Tel: 212 728 8000 Fax: 212 728 8111 |

August 16, 2023

VIA EDGAR AND OVERNIGHT DELIVERY

United States Securities and Exchange Commission

Division of Corporation Finance

Office of Finance

100 F Street, N.E.

Washington, D.C. 20549

| | | | | | | | |

| Attention: | | Sarmad Makhdoom |

| | Michael Henderson |

| | Tonya K. Aldave |

| | Chris Windsor |

| | |

| Re: | | Hamilton Insurance Group, Ltd. |

| | Amendment No. 1 to Draft Registration Statement on Form S-1 |

| | Submitted June 20, 2023 |

| | CIK No. 0001593275 |

Ladies and Gentlemen:

On behalf of our client, Hamilton Insurance Group, Ltd., a Bermuda exempted company (the “Company”), set forth below are the Company’s responses to the comment letter dated July 5, 2023 sent to Pina Albo, the Company’s Chief Executive Officer, from the staff of the U.S. Securities and Exchange Commission (the “Staff”) relating to Amendment No. 1 to the Confidential Draft Registration Statement on Form S-1 confidentially submitted on June 20, 2023 (the “Registration Statement”).

The Company is confidentially submitting, electronically via EDGAR, Amendment No. 2 (the “Amendment”) to the Registration Statement which, among other things, reflects certain revisions in response to the comment letter and updates the disclosure in the Registration Statement including updates to the Company’s interim financial information to include the period ended June 30, 2023.

The Company is seeking confidential treatment for the Registration Statement, including this Amendment, and this letter pursuant to Rule 83 of the Securities and Exchange Commission. The Company will publicly file the Registration Statement, as amended, and non-public draft submissions at least 15 days prior to any road show or, in the absence of a road show, at least 15 days prior to the requested effective date of the Registration Statement, as amended.

For ease of reference, each of the Staff’s comments is reproduced below in italics and is followed by the Company’s response. In addition, unless otherwise indicated, all references to page numbers in such responses are to page numbers in the Amendment. Capitalized terms used in this letter but not otherwise defined herein shall have the meaning ascribed to such term in the Amendment.

BRUSSELS CHICAGO FRANKFURT HOUSTON LONDON LOS ANGELES MILAN

NEW YORK PALO ALTO PARIS ROME SAN FRANCISCO WASHINGTON

Hamilton Insurance Group, Ltd. has requested confidential treatment of this registration statement and

associated correspondence pursuant to Rule 83 of the Securities and Exchange Commission.

Securities and Exchange Commission

August 16, 2023

Page 2

General

1.We note your response to our prior comment 2 and reissue in part. Please balance your disclosure relating to “strong balance sheet” by also including your net losses for the last fiscal year, as well as your cumulative losses. In particular, your presentation should clarify how the balance sheet allows you to absorb periods where catastrophic or other significant events cause you to owe significant payouts on our policies or your reinsurance obligations.

Response

In response to the Staff’s comment, the Company has revised the disclosures relating to its “strong balance sheet” on pages 4, 8, 82, 151 and 155 of the Amendment to include discussion of the net loss attributable to common shareholders for the year ended December 31, 2022, the Company's cumulative inception-to-date net income attributable to common shareholders and the Company’s demonstrated ability to withstand catastrophe and other significant loss events across the underwriting cycle.

2.We note your disclosure on page F-100 that “certain of Hamilton Group’s shareholders that own an aggregate of 62.0 million Class A, Class B and Class C shares” have liquidity rights upon the occurrence of a trigger event. Please disclose who these shareholders are, define the trigger event in the prospectus, and disclose any material risks to investors. In addition, tell us if these shareholders are your affiliates and how they acquired the shares.

Response

The Company respectfully advises the Staff that none of the referenced Class A, Class B and Class C shareholders of the Company that own an aggregate of 62.0 million common shares will have liquidity rights following the initial public offering (the “IPO”). The shareholders’ agreement in effect prior to the consummation of the IPO, which provides the liquidity rights to certain of the Company's shareholders, will terminate upon the consummation of the IPO. At the consummation of the IPO, a new shareholders agreement will be effective and will not include any liquidity rights for any shareholders of the Company. Therefore, there are no material risks to investors relating to liquidity rights.

Unique Investment Management Relationship with Two Sigma, page 5

3.Revise this section to balance your discussion of the annualized returns on your investments through Two Sigma from 2014 through 2022, to indicate the recent performance of the funds, including fair value declines for the Futures fund in both 2022 and in the first quarter of 2023.

Response

In response to the Staff’s comment, the Company has revised the discussion of the annualized returns on investments through Two Sigma on pages 5, 83, 98-99 and 152 of the Amendment to indicate the performance of the fund for the years ended December 31, 2022 and November 30, 2021 and 2020, as well as for the six months ended June 30, 2023 and 2022. The revised disclosure also provides additional context regarding the manner in which the performance of the underlying

Hamilton Insurance Group, Ltd. has requested confidential treatment of this registration statement and

associated correspondence pursuant to Rule 83 of the Securities and Exchange Commission.

Securities and Exchange Commission

August 16, 2023

Page 3

investment portfolios are monitored in relation to performance, risk management and compensation paid to the Two Sigma.

Prospectus Summary

Proprietary technology infrastructure, page 7

4.Revise this section, and other appropriate sections, to discuss the extent to which you are dependent on Two Sigma to support your technological infrastructure, including the pricing of policies and/or your risk calculations.

Response

The Company respectfully advises the Staff that the Company does not rely on Two Sigma to support its technological infrastructure.

Risks Related to Our Investment Strategy, page 42

5.We note your disclosure about reported management and governance difficulties within Two Sigma. Based on news reporting related to the underlying disagreements reported in the Form ADV, it appears that the “C-level officers” who are unable to agree are Dr. Siegel and Mr. Overdeck, the co-chairmen and CEOs of Two Sigma. The two gentlemen are labeled as “Two Sigma Key Persons” and are also members of your Board. Please add a separately captioned risk factor to address material risks to you that could result if the “C-level officers” are deadlocked in managing Two Sigma or their disagreements materially impact the decisions of your Board.

Response

The Company respectfully advises the Staff that it does not foresee any material risks to the Company that could result if Mr. Siegel and Mr. Overdeck are deadlocked in managing Two Sigma or disagreements that could materially impact the decisions of the Company’s Board of Directors (the “Board”). The risk of disagreements materially impacting the decisions of the Company’s Board is low. Mr. Siegel and Mr. Overdeck are two of a minimum of eleven directors on the Board of the Company, and Mr. Siegel and Mr. Overdeck each have a fiduciary obligation under Bermuda law to act in the best interest of the Company.

While there is a risk that disagreements may impact the execution of client mandates at Two Sigma, the Company has the right to terminate the three-year commitment period, pursuant to the commitment agreement, dated July 1, 2023 (the “Commitment Agreement”), in the event that either of Mr. Siegel or Mr. Overdeck ceases to be involved in the management of Two Sigma. The Company has revised the disclosure on page 44-45 of the Amendment to reflect this information. Further, the Company has the right to reduce the minimum commitment to 60% of the net tangible assets of the Company at any time, without reason or permission. As a result, the Company does not consider a scenario in which Mr. Siegel and Mr. Overdeck are deadlocked in managing Two Sigma to have a material effect on the Company.

Hamilton Insurance Group, Ltd. has requested confidential treatment of this registration statement and

associated correspondence pursuant to Rule 83 of the Securities and Exchange Commission.

Securities and Exchange Commission

August 16, 2023

Page 4

We do not have control over the Two Sigma Hamilton Fund, page 43

6.We note your disclosure on page 45 related to the June 20, 2023 ADV filing, in which Two Sigma disclosed that disagreements within Two Sigma’s management, including the lack of governance structures to settle agreements, could present a material risk to meeting client mandates. Revise this risk factor, as well as other appropriate risk factors to specifically address how this disclosure could impact the relevant risks you face based on your reliance upon Two Sigma, and the limitations on your ability to divest your interests in the funds, should the risk begin to threaten the value of your investments through the fund.

Response

In response to the Staff’s comment, the Company has revised the disclosure on page 45 of the Amendment to highlight the circumstances in which the Company can divest its interests in the funds or terminate the Commitment Agreement.

Risk Factors

The Managing Member, Two Sigma and their respective affiliates, page 46

7.We note recent press articles that state that Two Sigma participates in the reinsurance market. Revise this risk factor to discuss any of your insurance activities that Two Sigma competes with Hamilton, either directly, or by providing services to your direct competitors.

Response

The Company respectfully advises the Staff that, to the Company’s knowledge, Two Sigma does not participate in reinsurance underwriting activities and the Company does not view Two Sigma as a direct or indirect competitor of the Company. Based on conversations between the Company and Two Sigma, the Company believes that recent press attention noting Two Sigma’s participation in reinsurance was actually a reference to the ownership and other relationships that certain Two Sigma personnel and entities have with the Company.

Two Sigma and certain of its affiliates provide investment management services to numerous clients, which can include entities that are engaged in various insurance-related activities. While Two Sigma is not restricted from managing capital for such entities, the Company understands that these services are generally provided in the ordinary course of Two Sigma’s operations. In contrast, the Company’s relationship with Two Sigma includes an investment through a dedicated fund of one, in which the Company is the only investor, and has been paired with a meaningful long-term commitment agreement.

The Company also notes that Two Sigma is affiliated with Insurance Quantified, which is an underwriting technology company that provides commercial property and casualty insurance companies and managing general agents with data and analytics to grow their business and improve underwriting profitability. Insurance Quantified does not underwrite or provide risk coverage. Accordingly, Insurance Quantified does not compete with the Company.

Hamilton Insurance Group, Ltd. has requested confidential treatment of this registration statement and

associated correspondence pursuant to Rule 83 of the Securities and Exchange Commission.

Securities and Exchange Commission

August 16, 2023

Page 5

International Segment

Net Premiums Earned, page 98

8.We note your response to comment 17 and your revised disclosures. Please revise the disclosures for each of your reportable segments (International and Bermuda) to include details of the impacts on your net premiums earned and any other noted trends by the key products listed for each segment on pages 13-14.

Response

In response to the Staff’s comment, the Company has revised the International and Bermuda reportable segment disclosures on pages 102, 106, 120 and 123 of the Amendment to include details of the impact on net premiums earned and noted trends by the key products listed for each segment.

Credit Facilities, page 135

9.We note your response to our prior comment 20. For each credit facility that has been utilized by Hamilton or its subsidiaries during the past year, revise to disclose the nature of the rate paid. Also, since many of these facilities will expire within a year, please revise to state their short term nature and provide management’s views about the possibility of extending the agreements with the respective creditor.

Response

In response to the Staff’s comment, the Company has revised the disclosure on pages 142-43 and F-100-01 of the Amendment to include the nature of the rate paid and provide additional details regarding the renewal processes.

Two Sigma Hamilton Fund, page 139

10.Please revise your disclosures to discuss the performance of each of your investments in Two Sigma Funds (e.g. Two Sigma Futures Portfolio, LLC, Two Sigma Spectrum Portfolio, LLC, and Two Sigma Equity Spectrum Portfolio, LLC), including a discussion of the related unrealized gains/losses.

Response

In response to the Staff’s comment, the Company has revised the disclosure on pages 98-99 and 109 of the Amendment to discuss the performance of the Company’s investments in Two Sigma Funds, including a discussion of related unrealized gains/losses.

Business, page 143

11.We note that on pages 7 and 15 you discuss the “Hamilton View of Risk” and how it impacts your pricing and risk management models. In this section, or in another appropriate section of the

Hamilton Insurance Group, Ltd. has requested confidential treatment of this registration statement and

associated correspondence pursuant to Rule 83 of the Securities and Exchange Commission.

Securities and Exchange Commission

August 16, 2023

Page 6

registration statement, please discuss in further detail the inputs that contribute to the HVR, and how management uses the view to manage the business.

Response

In response to the Staff’s comment, the Company has revised the disclosure on pages 8 and 154 of the Amendment to discuss in further detail the inputs that contribute to the Hamilton View of Risk and how management uses the view to manage the business.

Investments, page 162

12.We note your response to our prior comment 26 and reissue in part. Please describe material terms of any agreements you have signed with DWS Investment Management Americas, Inc. and Conning Asset Management Limited. In particular, please discuss any provisions that would impact Hamilton’s ability to liquidate its holdings in the fixed income portfolio in the event that additional liquidity was required. File your agreements with DWS and Conning as exhibits to the registration statement or advise.

Response

The Company respectfully acknowledges the Staff’s comment, and in response the Company notes that there are no provisions within the agreements signed with either DWS Investment Management Americas, Inc. (“DWS”) and Conning Asset Management Limited (“Conning”) that would prevent the Company’s ability to liquidate its holdings in the fixed income portfolios if additional liquidity were required.

The Company also respectfully advises the Staff that the investment management agreements (each, an “IMA” and together, the “IMAs”) with DWS and Conning do not constitute material agreements required to be filed pursuant to Item 601(b)(10) of Regulation S-K. Both IMAs were entered into in the ordinary course of business and are terminable upon (i) 30 days' prior written notice to the investment manager, with respect to the IMA between DWS and the Company and the IMA between Conning and Hamilton Managing Agency or (ii) 60 days' prior written notice to the investment manager with respect to the IMA between Conning and Hamilton Insurance DAC.

Composition of the Board of Directors of Hamilton, page 182

13.We note your disclosure here that “as many as four shareholders will each have the right to appoint one director if such shareholder continues to hold a prescribed number of common shares.” Please identify the four shareholders who have the right to appoint a director to your board and quantify the number of shares they are required to hold to continue to have this right.

Response

In response to the Staff’s comment, the Company has revised the disclosure on page 177-78 of the Amendment to identify the four shareholders who have the right to appoint a director on the board and to quantify the number of shares they are required to hold to continue to have this right.

Hamilton Insurance Group, Ltd. has requested confidential treatment of this registration statement and

associated correspondence pursuant to Rule 83 of the Securities and Exchange Commission.

Securities and Exchange Commission

August 16, 2023

Page 7

Consolidated Balance Sheets, page F-7

14.We reissue prior comment 30 in part. Please provide us with a detailed analysis and revise your related disclosures, including references to ASC 810, of your determination that you are the primary beneficiary of TS Hamilton Fund. Further, we note that you disclose on page 95 that Total realized and unrealized gains (losses) on investments and net investment income (loss) - TSHF is net of management fees and expenses and gross of incentive allocations. Please tell us your basis in the accounting literature for your presentation.

Response

Regarding Primary Beneficiary of TS Hamilton Fund and Related Disclosure

The Company respectfully acknowledges the Staff’s comment and provides the following analysis on how it determined that it was the primary beneficiary of the TS Hamilton Fund:

General Information Pertaining to the Company’s Investment in TS Hamilton Fund

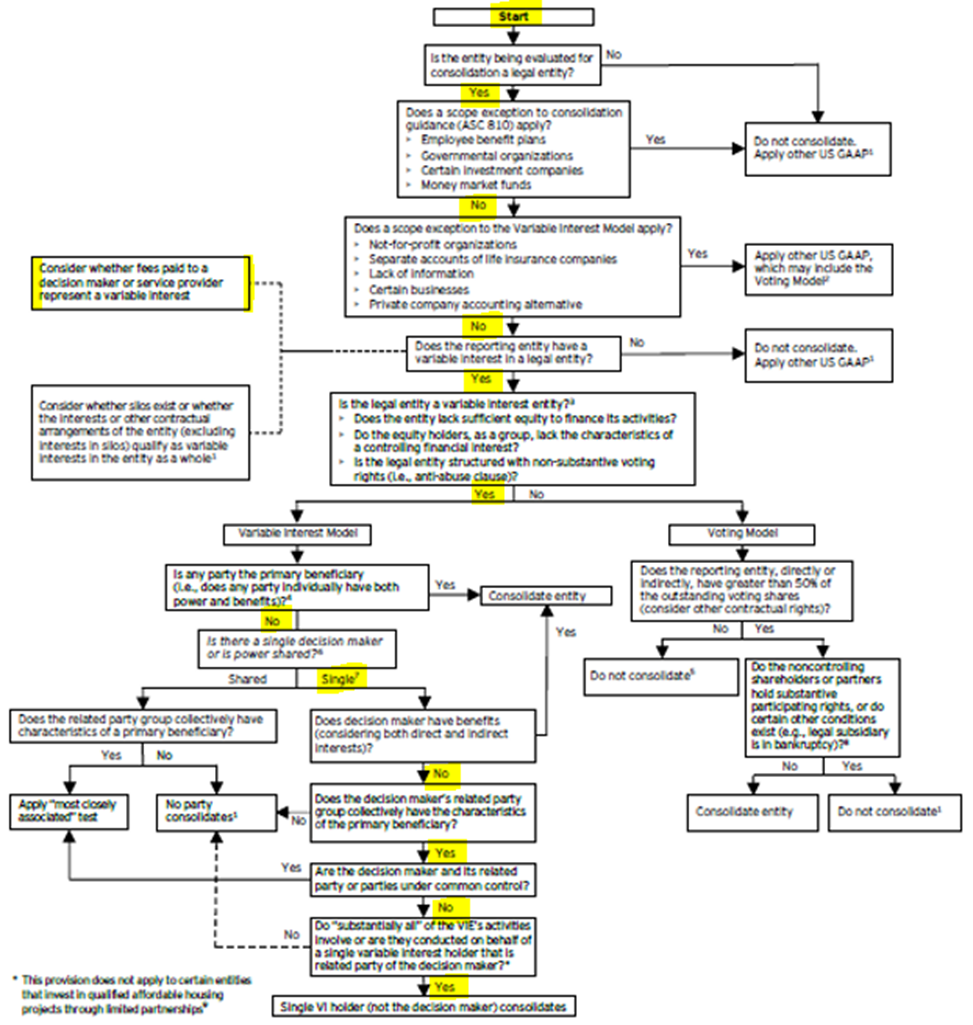

1.The consolidation analysis of the TS Hamilton Fund is based on the guidance of Accounting Standards Codification (ASC) Topic 810 – Consolidation (“ASC 810”).

2.The TS Hamilton Fund is a legal entity and was evaluated for consolidation in accordance with ASC 810-10-15-14.

3.None of the scope exceptions available under either ASC 810-10-15-12 or ASC 810-10-15-17 apply.

4.The TS Hamilton Fund was evaluated as a limited partnership given it is controlled by a Managing Member (defined below) that is akin to a general partner and it was determined to be a VIE because the Company, which is the holder of the equity investment at risk (99.99%), does not have either substantive kick-out rights, or, through its voting rights or similar rights, the ability to direct the activities of the TS Hamilton Fund that most significantly impact the TS Hamilton Fund’s economic performance (see Note 4, Variable Interest Entities ). In this evaluation the Company makes reference to ASC 810-10-15-14b1.

5. Two Sigma Principals, LLC, as the managing member (the “Managing Member”), has the power to direct the activities of the TS Hamilton Fund that most significantly impact its economic performance; however, the Managing Member does not have any direct or indirect variable interests in the TS Hamilton Fund as per ASC 810-10-25-38 or 48 through 54 (see Note 4, Variable Interest Entities).

6.The fee arrangement between the Managing Member and the TS Hamilton Fund did not meet any of the criteria of ASC 810-10-55-37. The investment management fees paid to the Managing Member are compensation for the services provided and are commensurate with the level of effort required to provide those services, and the service arrangement includes terms, conditions, or amounts that are customarily present in arrangements for similar services negotiated at arm’s length as per ASC 810-10-25-38H (see Note 3, Investments).

Hamilton Insurance Group, Ltd. has requested confidential treatment of this registration statement and

associated correspondence pursuant to Rule 83 of the Securities and Exchange Commission.

Securities and Exchange Commission

August 16, 2023

Page 8

7.The Company is the reporting entity and has a direct variable interest in the TS Hamilton Fund based on its 99.99% ownership interest in the TS Hamilton Fund (per ASC 810-10-55-16 through 55-41) and its resulting obligation to absorb the TS Hamilton Fund losses and right to receive its returns. As the Company does not have power, it was determined not to be the primary beneficiary on its own.

8.For the purpose of applying the guidance in ASC 810-10-25, the Company has determined the related party group consisting of the Company and the Managing Member has the characteristics of the primary beneficiary. The Company has determined that the Managing Member and the Company are a related party group that is not under common control (see Note 1, Organization and Note 3, Investments).

9.The Company has concluded that substantially all of the activities of the TS Hamilton Fund either involve or are conducted on behalf of the Company which is the single variable interest holder (excluding the Managing Member as the single decision maker) in a related party group that is not under common control (per ASC 810-10-25-44B). This is supported by the fact that the TS Hamilton Fund was formed specifically for the Company’s benefit, the Company will absorb virtually all of the TS Hamilton Fund’s returns or losses (less the fee paid to the Managing Member) and that there are no other third-party investors and no other parties that hold a variable interest in the TS Hamilton Fund.

Hamilton Insurance Group, Ltd. has requested confidential treatment of this registration statement and

associated correspondence pursuant to Rule 83 of the Securities and Exchange Commission.

Securities and Exchange Commission

August 16, 2023

Page 9

Consolidation Analysis

The following diagram illustrates the flow of the Company's accounting analysis:

The Company consolidates the results of the TS Hamilton Fund based on the requirements of ASC 810 utilizing the following analysis and specific codification references:

Hamilton Insurance Group, Ltd. has requested confidential treatment of this registration statement and

associated correspondence pursuant to Rule 83 of the Securities and Exchange Commission.

Securities and Exchange Commission

August 16, 2023

Page 10

Step 1 – Does the Company, which is the reporting entity, own a variable interest in the TS Hamilton Fund, which is the legal entity in question?

Yes. The Company is the reporting entity and owns 99.99% of the equity of the TS Hamilton Fund, which is a legal entity that engages in the buying and selling of investments. The TS Hamilton Fund was designed and created as an investment vehicle for the Company. The value of the Company’s economic interest in the TS Hamilton Fund will vary depending upon the performance of the investment strategies utilized by the TS Hamilton Fund. This step of the Company’s analysis relies primarily on ASC 810-10-25-20 through 33.

We also considered whether the fees paid to the Managing Member as the entity with the decision-making power represented a variable interest. The Managing Member receives the following investment management fees (see Note 3, Investments):

•3% of the non-managing members' equity in the net asset value of the TS Hamilton Fund per annum (2.5% as of July 1, 2023);

•an incentive allocation equal to 30% of TS Hamilton Fund’s net profits, subject to high watermark provisions, and adjusted for withdrawals and any incentive allocation to the Managing Member; and

•an additional incentive allocation as of the end of each fiscal year in an amount equal to 20% of the Excess Profits (25% as of July 1, 2023), meaning the net profits over 15% (10% as of July 1, 2023) for such fiscal year, net of management fees and expenses and gross of incentive allocations, but only after recouping previously unrecouped net losses.

The Company determined that the investment management fee is not a variable interest because it is compensation for the services provided and is commensurate with the level of effort required by the Managing Member to provide those services and the service arrangement includes terms, conditions, or amounts that are customarily present in arrangements for similar services negotiated at arm’s length. This step of the Company’s analysis relies primarily on ASC 810-10-25-38H.

Step 2 – Is the TS Hamilton Fund a variable interest entity (VIE)?

Yes. The TS Hamilton Fund was determined to be a VIE because the Company, which is the holder of 99.99% of the equity investment at risk, does not have, through voting rights or similar rights, the ability to direct the activities of the TS Hamilton Fund that most significantly impact the TS Hamilton Fund’s economic performance. The Company’s equity in the TS Hamilton Fund is GAAP equity. The equity at risk obligates the Company to bear the first risk of economic loss (up to the full amount of its equity investment) and gives the Company the right to receive 99.99% of the benefit of the economic return with respect to the assets of the TS Hamilton Fund, less fees. This step of the Company’s analysis relies primarily on ASC 810-10-15-14.

Hamilton Insurance Group, Ltd. has requested confidential treatment of this registration statement and

associated correspondence pursuant to Rule 83 of the Securities and Exchange Commission.

Securities and Exchange Commission

August 16, 2023

Page 11

Step 3 – Does the Company individually have power to direct the most significant activities of the TS Hamilton Fund?

No, the Company does not have any control over the most significant activities of the TS Hamilton Fund. The Managing Member, through the investment agreement, has the power to direct the activities of the TS Hamilton Fund that most significantly impact its economic performance. Although the Company and the Managing Member were both significantly involved in the design of the TS Hamilton Fund, the Managing Member has primary decision making rights with respect to the assets of the TS Hamilton Fund, subject to the servicing standard of the investment management agreement, which obligates the Managing Member to make decisions that require it to act in good faith and maximize the value of the TS Hamilton Fund’s assets.

The Managing Member earns market-based management fees that are commensurate with its investment management duties. Additionally, the Managing Member owns an insignificant (0.01%) equity in the TS Hamilton Fund. Therefore, the Managing Member does not have a significant direct or indirect interest in the TS Hamilton Fund. The Managing Member has an insignificant (0.01%) obligation to absorb losses incurred by the TS Hamilton Fund and it has an insignificant right (0.01%) to receive benefits from its economic performance, exclusive of its investment fees. The Managing Member may only be removed for cause. The Company determined that the Managing Member does not have characteristics of a primary beneficiary on its own given their fee arrangement does not represent variable interest.

This step of the Company’s analysis relies primarily on ASC 810-10-15-14(b), ASC 810-10-25-38 through 38G, and ASC 810-10-25-42 through 44B. The Company further considered, in Step 5 below, that the Company and the Managing Member constitute a related party group as determined per ASC 810-10-25-42 that is not under common control in the determination of whether the Company is the primary beneficiary of the TS Hamilton Fund.

Step 4 – Does the Company have the obligation to absorb losses of the TS Hamilton Fund and receive economic benefits of the TS Hamilton Fund, in both instances in amounts that are significant to the VIE taken as a whole?

Yes. The Company owns 99.99% of the equity in the TS Hamilton Fund, thus providing credit support, bearing first risk of economic loss to the extent of its investment in the TS Hamilton Fund, and entitling it to such economic returns as the TS Hamilton Fund may generate. Both the Company’s obligation to absorb losses of the legal entity and receive economic benefits from the legal entity are significant to the VIE.

This step of the Company’s analysis relies primarily on ASC 810-10-15-14(b), ASC 810-10-25-24, and ASC 810-10-55-16 through 55-41. The Company determined that it does not have characteristics of a primary beneficiary on its own given it does not have power. Based on this evaluation, the Company further considered, in Step 5 below, that the Company and the Managing Member constitute a related party group as determined per ASC 810-10-25-42 that is not under common control to determine whether the Company is the primary beneficiary of the TS Hamilton Fund.

Hamilton Insurance Group, Ltd. has requested confidential treatment of this registration statement and

associated correspondence pursuant to Rule 83 of the Securities and Exchange Commission.

Securities and Exchange Commission

August 16, 2023

Page 12

Step 5 – Does the related party group consisting of the Company and the Managing Member have power and significant economic exposure, and do substantially all the activities of the TS Hamilton Fund relate to one member of the related party group?

The Managing Member and the Company are related parties, but they are not under common control because they are not subsidiaries of a common parent, and neither is in a parent-subsidiary relationship with the other. Furthermore, while the related party group has the power to direct the activities of the TS Hamilton Fund that most significantly impact its economic performance and holds a significant economic interest in the TS Hamilton Fund, no one party has both. While the Company owns 99.99% of the TS Hamilton Fund’s equity, it is the Managing Member that has the power to direct the activities of the TS Hamilton Fund that most significantly impact the TS Hamilton Fund’s economic performance, but the Managing Member does not have a variable interest in the TS Hamilton Fund.

Based on the facts and circumstances, the Company performed an assessment utilizing the guidance in ASC 810-10-25-44 to determine the primary purpose of the Managing Member, and to which related party, if any, do substantially all the activities of the TS Hamilton Fund relate. The analysis concluded that the principle purpose of the TS Hamilton Fund is to conduct investing activities which are substantially all on behalf of, and primarily benefit, the Company within the related party group and the Company is therefore the primary beneficiary and the entity that should consolidate the results of the TS Hamilton Fund. This step of the Company’s analysis relies primarily on ASC 810-10-25-44 through 44B.

Response – Updated Disclosure Regarding Primary Beneficiary of TS Hamilton Fund

In response to the Staff’s comment, the Company has revised the disclosures in Note 5, Variable Interest Entities, as follows:

TS Hamilton Fund meets the definition of a VIE principally because the Managing Member does not hold substantive equity at risk in the entity but controls all of the decision making authority over it. Therefore, the Company assessed its ownership in the VIE to determine if it is the primary beneficiary. The Managing Member is a related party to the Company and collectively they hold all of the variable interest. The Company performed an assessment of all relevant facts and circumstances and determined that it is the entity within the related party group for whom substantially all of the activities of the VIE are conducted. As a result, the Company concluded that it is the primary beneficiary of TS Hamilton Fund.

Response - Accounting Basis for Presentation of Total Realized and Unrealized Gains (Losses)

The Company respectfully acknowledges the Staff’s comment and advises the Staff that the presentation of Total Realized and Unrealized Gains (Losses) on Investments and Net Investment Income (Loss) on page 95 mirrors the presentation of the consolidated statements of operations and comprehensive income (loss) in the Company's audited US GAAP financial statements.

As discussed in further detail in the Company's above response, as primary beneficiary, the Company consolidates the TS Hamilton Fund results subject to ASC 810: Consolidation, wherein

Hamilton Insurance Group, Ltd. has requested confidential treatment of this registration statement and

associated correspondence pursuant to Rule 83 of the Securities and Exchange Commission.

Securities and Exchange Commission

August 16, 2023

Page 13

ASC 810-10-25-15, Retention of Specialized Accounting for Investments in Consolidation, provides that for the purposes of consolidating a subsidiary subject to guidance in an industry-specific Topic, an entity shall retain the industry-specific guidance applied by that subsidiary.

TS Hamilton Fund meets the definition of an investment company. As such, TS Hamilton Fund is subject to the guidance in ASC 946: Financial Services: Investment Companies, in which ASC 946-20-05-10 permits either a) recognition of fees paid to managing partner as partnership expenses, b) allocations of net income from the limited partner’s capital account to the general partner’s account or c) a combination of a) and b). Further, these amounts may be presented in either d) the statement of operations or e) the statement of changes in partners’ capital. These elections are made at the inception of the fund and are outlined in its offering memorandum.

TS Hamilton Fund makes the following payments to the Managing Member:

•3% of the non-managing members' equity in the net asset value of the TS Hamilton Fund per annum (2.5% as of July 1, 2023);

•an incentive allocation equal to 30% of TS Hamilton Fund’s net profits, subject to high watermark provisions, and adjusted for withdrawals and any incentive allocation to the Managing Member; and

•an additional incentive allocation as of the end of each fiscal year in an amount equal to 20% of the Excess Profits (25% as of July 1, 2023), meaning the net profits over 15% (10% as of July 1, 2023) for such fiscal year, net of management fees and expenses and gross of incentive allocations, but only after recouping previously unrecouped net losses.

TS Hamilton Fund recognizes the 3% fees through the statement of operations. The incentive allocation equal to 30% of TS Hamilton Fund’s net profits and the additional incentive allocation equal to 20% of the Excess Profits are reflected as an allocation from the limited partner’s account to the general partner’s account on the statement of changes in member’s equity. Therefore, upon consolidation, the Company retains this specialized investment accounting (see the Company's statement of operations and comprehensive income (loss) and Note 4, Variable Interest Entities) whereby the 3% management fee is reflected in the net investment income (loss) line item on the Company’s consolidated statements of operations and comprehensive income (loss) and the incentive allocation and additional incentive allocation are reflected as net income attributable to non-controlling interest.

* * * *

Hamilton Insurance Group, Ltd. has requested confidential treatment of this registration statement and

associated correspondence pursuant to Rule 83 of the Securities and Exchange Commission.

Securities and Exchange Commission

August 16, 2023

Page 14

We hope that the foregoing has been responsive to the Staff’s comments. Should you have any questions relating to the foregoing, please contact the undersigned at (212) 728-8616 or mgroll@willkie.com. Thank you.

| | |

| Sincerely, |

|

|

| Michael Groll |

| Willkie Farr & Gallagher LLP |

Enclosures

| | | | | |

| cc: | Pina Albo – Chief Executive Officer, Hamilton Insurance Group, Ltd. |

| Craig Howie – Chief Financial Officer, Hamilton Insurance Group, Ltd. |

| Gemma Carreiro – Group General Counsel, Hamilton Insurance Group, Ltd. |

| |

| Matthew B. Stern, Willkie Farr & Gallagher LLP |