As filed with the Securities and Exchange Commission on November 1, 2023.

Registration No. 333-275000

United States

Securities and Exchange Commission

Washington, D.C. 20549

Amendment No. 1

to

Form S-1

Registration Statement

Under

The Securities Act of 1933

Hamilton Insurance Group, Ltd.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Bermuda | 6331 | 98-1153847 |

| (State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial

Classification Code Number) | (I.R.S. Employer

Identification Number) |

Wellesley House North, 1st Floor

90 Pitts Bay Road

Pembroke HM 08 Bermuda

Telephone: (441) 405-5200

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Corporation Service Company

80 State Street

Albany, NY 12207-2543

Tel: 1-800-927-9801 ext. 66899

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With copies to:

| | | | | |

Michael Groll Matthew B. Stern Willkie Farr & Gallagher LLP 787 7th Avenue New York, New York 10019 (212) 728-8000 | Richard D. Truesdell, Jr. Derek J. Dostal Davis Polk & Wardwell LLP 450 Lexington Avenue New York, New York 10017 (212) 450-4000 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement is declared effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box: ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | |

| Large accelerated filer | ☐ | | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | | Smaller reporting company | ☐ |

| | | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED NOVEMBER 1, 2023.

PRELIMINARY PROSPECTUS

15,000,000 Shares

Hamilton Insurance Group, Ltd.

Class B Common Shares

______________________

This is an initial public offering of Class B common shares of Hamilton Insurance Group, Ltd., an exempted company limited by shares incorporated under the laws of Bermuda. We are offering 6,250,000 Class B common shares and the selling shareholders identified in this prospectus, including certain of our directors and officers, are offering 8,750,000 Class B common shares. The selling shareholders have also granted the underwriters an option to purchase up to 2,250,000 additional Class B common shares. We will not receive any proceeds from the sale of Class B common shares by the selling shareholders.

Following this offering, we will have three classes of authorized common shares: Class A common shares, Class B common shares and Class C common shares. The rights of the holders of Class A common shares, Class B common shares and Class C common shares are identical, except with respect to voting and conversion. Subject to the voting cutback in our bye-laws (the “Bye-laws”), each Class A common share and Class B common share is entitled to one vote per share. All Class C common shares have no voting rights, except as otherwise required by law. Following this offering, our Class A common shares and our Class C common shares will automatically convert into shares of our Class B common shares, on a share-for-share basis, upon transfers following this offering. See “Description of Share Capital” herein for further information.

Prior to this offering, there has been no public market for our Class B common shares. We currently expect that the initial public offering price of our Class B common shares will be between $16.00 and $18.00 per share. We intend to apply to list our Class B common shares on the New York Stock Exchange (the “NYSE”) under the symbol “HG.”

Hopkins Holdings, LLC (“Hopkins Holdings”), one of our current shareholders, and certain of our directors, have given non-binding indications of interest that they may purchase in this offering up to approximately 260,000 Class B common shares at the same price as the price to the public. Hopkins Holdings and such directors are not obligated to purchase any such Class B common shares and the aggregate amount purchased by them, if any, may be different from this amount. The underwriters will not receive any underwriting discounts or commissions on any Class B common shares sold to Hopkins Holdings or such directors with respect to a maximum of 260,000 Class B common shares. The number of Class B common shares available for sale to the general public will be reduced to the extent Hopkins Holdings or such directors purchase such Class B common shares. See “Underwriting.”

______________________

Investing in our Class B common shares involves risk. See “Risk Factors” beginning on page 28 to read about factors you should consider before buying our Class B common shares. Neither the Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

| | | | | | | | | | | |

| Per Share | | Total |

Initial public offering price | $ | | $ |

Underwriting discounts and commissions(1) | $ | | $ |

Proceeds, before expenses, to us | $ | | $ |

Proceeds, before expenses, to the selling shareholders | $ | | $ |

__________________

(1)Excludes up to 260,000 Class B common shares that may be purchased in this offering by Hopkins Holdings and certain directors of the Company, for which the underwriters would not receive any underwriting discounts or commissions. Any such Class B common shares that are not purchased by Hopkins Holdings and such directors would be subject to the same underwriting discounts and commissions as the other Class B common shares sold in this offering. Please see the section entitled “Underwriting” for a description of compensation payable to the underwriters.

The underwriters have the option to purchase up to an additional 2,250,000 Class B common shares from the selling shareholders at the initial public offering price, less the underwriting discounts and commissions, within 30 days of the date of this prospectus. We will not receive any of the proceeds from the sale of shares by the selling shareholders upon such exercise.

The underwriters expect to deliver the shares against payment in New York, New York on or about , 2023.

______________________

| | | | | | | | | | | | | | |

| Barclays | | Morgan Stanley |

| Citigroup | | Wells Fargo Securities |

| BMO Capital Markets | Dowling & Partners Securities LLC | JMP Securities A CITIZENS COMPANY | Keefe, Bruyette & Woods A Stifel Company | Commerzbank |

Prospectus dated , 2023.

We, the selling shareholders and the underwriters have not authorized anyone to provide you with different information or to make any other representations, and we, the selling shareholders and the underwriters take no responsibility for, and can provide no assurance as to the reliability of, any information others may give you other than the information contained in this prospectus and any free writing prospectus that we may provide to you in connection with this offering. We and the selling shareholders are offering to sell, and seeking offers to buy, our Class B common shares only under circumstances and in jurisdictions where it is lawful to do so. Neither we, the selling shareholders nor any of the underwriters are making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should not assume that the information contained in this prospectus is accurate as of any date other than its date. Our business, financial condition, results of operations and prospects may have changed since that date.

For investors outside the United States: Neither we, the selling shareholders nor any of the underwriters have done anything that would permit this offering or the possession or distribution of this prospectus in any jurisdiction where action for those purposes is required, other than in the United States. Persons outside of the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of our Class B common shares and the distribution of this prospectus outside of the United States.

TABLE OF CONTENTS

MARKET, RANKING AND OTHER INDUSTRY DATA

The data included in this prospectus regarding markets, ranking and other industry information are based on published industry sources, and our own internal estimates are based on our management’s knowledge and experience in the markets in which we operate. Data regarding the industry in which we compete and our market position and market share within this industry are inherently imprecise and are subject to significant business, economic and competitive uncertainties beyond our control, but we believe they generally indicate size, position and market share within this industry. Our own estimates are based on information obtained from our customers, suppliers, trade and business organizations and other contacts in the markets in which we operate. We are responsible for all of the disclosure in this prospectus, and we believe these estimates to be accurate as of the date of this prospectus or such other date stated in this prospectus. While we believe that each of the publications used throughout this prospectus is prepared by reputable sources, neither we nor the underwriters have independently verified market and industry data from third-party sources. While we believe our internal company research and estimates are reliable, such research and estimates have not been verified by any independent source. In addition, assumptions and estimates of our and our industry’s future performance are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in “Risk Factors.” These and other factors could cause our future performance to differ materially from our assumptions and estimates. See “Special Note Regarding Forward-Looking Statements.” As a result, you should be aware that market, ranking, and other similar industry data included in this prospectus, and estimates and beliefs based on that data, may not be reliable. Neither we nor the underwriters can guarantee the accuracy or completeness of any such information contained in this prospectus.

TRADEMARKS, SERVICE MARKS AND TRADE NAMES

We own or license the trademarks, service marks and trade names that we use in connection with the operation of our business, including our domain names. Solely for convenience, any trademarks, service marks and trade names referred to in this prospectus are presented without the ®, SM and ™ symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensors to these trademarks, service marks and trade names. All trademarks, service marks and trade names appearing in this prospectus are the property of their respective owners.

CERTAIN DEFINITIONS

Abbreviations and definitions of certain insurance, reinsurance, financial and other terms used in this prospectus are defined in the “Glossary of Selected Terms” section of this prospectus.

EXCHANGE CONTROLS

We intend to apply for and expect to receive consent under the Exchange Control Act 1972 (and its related regulations) from the Bermuda Monetary Authority (the “BMA”) for the issue and transfer of the common shares to and between residents and non-residents of Bermuda for exchange control purposes, provided that the common shares remain listed on an appointed stock exchange, which includes the NYSE. In granting such consent, neither the BMA nor any other relevant Bermuda authority or government body accepts any responsibility for our financial soundness or the correctness of any of the statements made or opinions expressed in this prospectus.

SERVICE OF PROCESS AND ENFORCEMENT OF CIVIL LIABILITIES

We are a Bermuda exempted company. As a result, the rights of holders of our common shares will be governed by Bermuda law and our memorandum of association and the Bye-laws. The rights of shareholders under Bermuda law may differ from the rights of shareholders of companies incorporated in other jurisdictions. Some of our directors and officers are not residents of the United States, and a substantial portion of our assets are located outside the United States. As a result, it may be difficult for investors to effect service of process on those persons in the United States or to enforce in the United States judgments obtained in U.S. courts against us or those persons based on the civil liability provisions of the U.S. securities laws. It is uncertain whether courts in Bermuda will enforce judgments obtained in other jurisdictions, including the United States, against us or our directors or officers under the securities laws of those jurisdictions or entertain actions in Bermuda against us or our directors or officers under

the securities laws of other jurisdictions. However, investors may serve us with process in the United States with respect to actions against us arising out of or in connection with the U.S. federal securities laws relating to offers and sales of the securities covered hereunder by serving Corporation Service Company, our U.S. agent irrevocably appointed for that purpose.

BASIS OF PRESENTATION

Presentation of Financial Information

References to “Hamilton,” “Hamilton Group,” the “Company,” “we,” “us” and “our” refer to Hamilton Insurance Group, Ltd., together with its consolidated subsidiaries. Amounts in this prospectus and the consolidated financial statements included in this prospectus are presented in U.S. dollars rounded to the nearest thousand, unless otherwise noted. Certain amounts presented in tables are subject to rounding adjustments and, as a result, the totals in such tables may not sum. The accounting policies set out in the audited consolidated financial statements contained elsewhere in this prospectus have been consistently applied to all periods presented.

In 2022, we changed our fiscal year from November 30 to December 31.

Non-GAAP Measures

We present our results of operations in a way that we believe will be the most meaningful and useful to investors, analysts, rating agencies and others who use our financial information to evaluate our performance. Some of the measurements are considered non-generally accepted accounting principles (“non-GAAP”) financial measures under SEC rules and regulations. For example, in this prospectus, we present underwriting income (loss), a non-GAAP financial measure as defined in Item 10(e) of SEC Regulation S-K. We believe that non-GAAP financial measures, which may be defined and calculated differently by other companies, help explain and enhance the understanding of our results of operations. However, these measures should not be viewed as a substitute for those determined in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”). Where appropriate, reconciliations of our non-GAAP measures to the most comparable GAAP figures are included. For further discussion, see “Management's Discussion and Analysis of Financial Condition and Results of Operations—Non-GAAP Measures.”

PROSPECTUS SUMMARY

This summary highlights certain significant aspects of our business and this offering. This is a summary of information contained elsewhere in this prospectus, is not complete and does not contain all of the information that you should consider before making your investment decision. You should carefully read the entire prospectus, including the information presented under the sections entitled “Risk Factors” and “Special Note Regarding Forward-Looking Statements” and the consolidated financial statements and the notes thereto, before making an investment decision. This summary contains forward-looking statements that involve risks and uncertainties.

Unless otherwise indicated or the context otherwise requires, references in this Prospectus Summary to “Hamilton,” the “Hamilton Group,” the “Company,” “we,” “our,” and “us” refer to Hamilton Insurance Group, Ltd., together with its consolidated subsidiaries. References to the “selling shareholders” refer to the selling shareholders named in this prospectus.

Our Company

Overview of Our Business

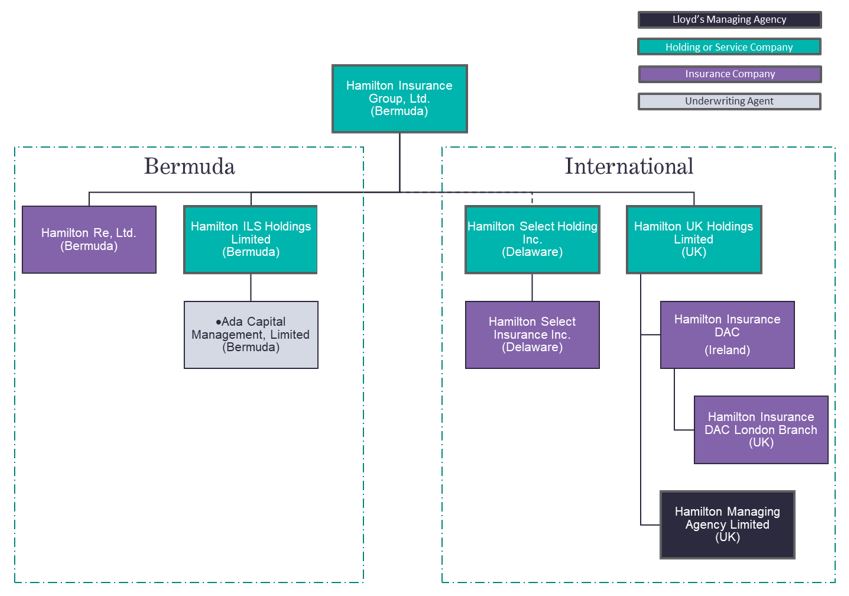

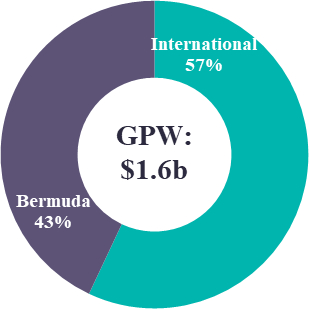

We are a global specialty insurance and reinsurance company founded in Bermuda in 2013. We harness multiple drivers to create shareholder value. These include diverse underwriting operations supported by proprietary technology and a team of over 500 full-time employees, a strong balance sheet, and a unique investment management relationship with Two Sigma Investments, LP (“Two Sigma”). We operate globally, with underwriting operations in Lloyd’s of London (“Lloyd’s”), Ireland, Bermuda, and the United States. We are led by an entrepreneurial and experienced management team that have almost tripled our gross premiums written over the last five years, from $571 million for the year ended November 30, 2018 to $1.6 billion for the year ended December 31, 2022, while also reducing our combined ratio by 22 percentage points. We believe the combined effects of organic premium growth, strategic acquisition, new market developments and continuous platform cost optimization leave us well positioned to capitalize on the favorable market conditions across the lines of business written by our established and scaled underwriting platforms.

We operate three principal underwriting platforms (Hamilton Global Specialty, Hamilton Select and Hamilton Re) that are categorized into two reporting business segments (International and Bermuda):

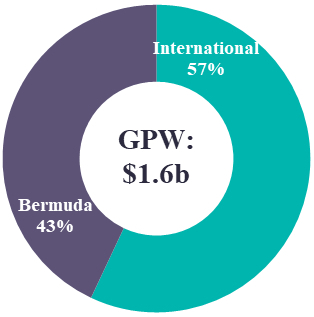

•International: Accounting for 57% of gross premiums written for the year ended December 31, 2022, International consists of business written out of our Lloyd’s syndicate and subsidiaries based in the United Kingdom, Ireland, and the United States, and includes the Hamilton Global Specialty and Hamilton Select platforms.

◦Hamilton Global Specialty focuses predominantly on commercial specialty and casualty insurance for medium to large-sized accounts and specialty reinsurance products written by Lloyd’s Syndicate 4000 and Hamilton Insurance DAC (“HIDAC”). Syndicate 4000, a leading Lloyd’s syndicate, generates a significant portion of premium from the U.S. Excess & Surplus (“E&S”) market and has ranked among the most profitable and least volatile syndicates at Lloyd’s over the last 10 years.

◦Hamilton Select, our recently launched U.S. domestic E&S carrier, writes casualty insurance for small to mid-sized clients in the hard-to-place niche of the U.S. E&S market. We believe it presents meaningful and profitable growth opportunities in the near to long term, further expanding our footprint in the U.S. E&S market.

•Bermuda: Accounting for 43% of our gross premiums written for the year ended December 31, 2022, Bermuda consists of the Hamilton Re platform, made up of Hamilton Re, Ltd. (“Hamilton Re”) and Hamilton Re US. Hamilton Re writes property, casualty and specialty reinsurance business on a global basis and also offers high excess Bermuda market specialty insurance products, predominantly for large U.S. commercial risks. Hamilton Re US writes casualty and specialty reinsurance business on a global basis.

Our evolution into a specialty insurance and reinsurance company reached a significant turning point in 2018 with the hiring of Pina Albo, our Group CEO and the start of our strategic business transformation (the “Strategic Transformation”). Ms. Albo is a 30+ year veteran in the insurance industry, having served as a member of the Board of Executive Management at Munich Re, where she had a 25-year career, as well as serving on the Board of RGA Reinsurance Company (a Fortune 500 public company) and recently being appointed as the first female Chair of the Association of Bermuda Insurers and Reinsurers. The Strategic Transformation commenced in 2018, when we set a new strategy and business priorities and was propelled by the appointment of an experienced management team focused on employing rigorous risk selection and creating sustainable underwriting profitability. The Strategic Transformation also included enhancing corporate governance, re-underwriting and repositioning our business to increase the focus on casualty and specialty insurance and reinsurance lines, decreasing volatility by reducing our expense ratio and exposure to legacy liabilities, and investing in business-enabling technology. The Strategic Transformation also involved focusing on both profitable organic and inorganic growth and was accelerated in 2019 when we acquired Pembroke Managing Agency and related entities, which included Pembroke Managing Agency (subsequently renamed Hamilton Managing Agency), Lloyd’s Syndicate 4000 and Ironshore Europe DAC (“IEDAC,” subsequently renamed Hamilton Insurance DAC or HIDAC) (all acquired entities hereinafter referred to as “PMA”). This acquisition doubled and diversified our premium base, increased our underwriting expertise and operational capabilities, and provided us with a fully-scaled Lloyd’s platform. As a result of the strategic actions taken in the context of the Strategic Transformation, in the five years since 2018, we increased gross premiums written at a compound annual rate of approximately 30%,1 reduced our combined ratio significantly, optimized the portfolio mix by increasing the contribution from specialty insurance and strengthened our balance sheet. While the Strategic Transformation is complete, we continuously review our portfolio to optimize underwriting returns and opportunities, and drive additional benefits by regular collaboration with our Group Underwriting Committee (“GUC”). We believe Hamilton is consequently well positioned to deliver growth and profitability in the current attractive market environment and across all market cycles.

Our proprietary technology has been a critical part of our Strategic Transformation by enabling the growth of our business and the execution of our strategy. This technology includes a catastrophe modeling and risk accumulation tool (Hamilton Analytics and Risk Platform or “HARP”), a global underwriting submission system (“Timeflow”), an efficient end-to-end specialty insurance underwriting workbench (Multi-line Insurance Toolkit or “MINT”), and a business intelligence and management information system (Hamilton Insights). Unlike many of our peers, we are not burdened by legacy systems and have modernized, cloud-based core platforms, which have enabled us to design and implement our proprietary systems to be a competitive advantage for our business.

The growth of our business is supported by a strong balance sheet. As of December 31, 2022, Hamilton had total assets of $5.8 billion, total invested assets of $3.3 billion and shareholders’ equity of $1.7 billion. Our total invested assets of $3.3 billion includes $1.3 billion of securities in our fixed maturity trading portfolio and short-term investments, or 39% of our total invested assets, with an average credit rating of Aa3 and of which 100% are investment grade. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Financial Condition, Liquidity and Capital Resources—Cash and Investments” for further detail by investment class. We also enjoy a low debt-to-capital ratio of 7.9% at June 30, 2023, which compares favorably to our peers and provides us with meaningful financial flexibility to execute against our strategy. The Company had a net loss attributable to common shareholders of $98.0 million for the year ended December 31, 2022. Cumulatively, since the inception of the Company to December 31, 2022, our net income attributable to common shareholders was $561.6 million. The Company has demonstrated its ability to withstand catastrophe and other significant loss events across changing market cycles and we believe it is well placed to take advantage of the current hard market conditions. Our prudent reserving approach fortifies our financial position and has resulted in reserve releases every year since inception.2

Our Lloyd’s syndicate benefits from financial strength ratings of “A” (Excellent) from A.M. Best Rating Services, Inc. (“A.M. Best”), “A+” from S&P Global Ratings (“S&P Global”), “AA-” from Kroll Bond Rating Agency (“KBRA”) and “AA-” from Fitch Ratings Ltd. (“Fitch”), all of which are Nationally Recognized Statistical Rating Organizations (“NRSROs”) as defined by the SEC. Our other insurance and reinsurance subsidiaries hold an

1 Gross premiums written from 2018 to 2022 were $571 million, $731 million, $1,087 million, $1,447 million, and $1,647 million, respectively.

2 Excluding the U.S. GAAP accounting impact of a loss portfolio transfer purchased in 2020.

“A-” (Excellent) rating from A.M. Best and an “A” rating from KBRA, each with a positive outlook. We believe these ratings demonstrate the financial strength of our insurance and reinsurance platforms and facilitate our ability to capitalize on new opportunities with our policyholders, cedants and distribution partners.

Unique Investment Management Relationship with Two Sigma

Our diversified underwriting model is complemented by a unique and long-term investment management relationship with Two Sigma. Founded in 2001, Two Sigma is a premier investment manager with a strong track record and approximately $60 billion of assets under management across affiliates as of April 1, 2023. Driven by a differentiated application of technology and data science, Two Sigma has over 2,000 employees across affiliates, including an experienced and diverse team of over 1,000 employees in research and development.

Two Sigma manages $1.6 billion of our assets as of December 31, 2022 via our investment in the Two Sigma Hamilton Fund. The portion of our total invested assets managed by Two Sigma has declined from 80% in 2018 to 49% in 2022 and is expected to continue to decline naturally as our underwriting platforms and fixed income portfolio grow. The Two Sigma Hamilton Fund is a dedicated fund-of-one managed by Two Sigma with exposures to certain Two Sigma macro and equity strategies.3 The Two Sigma Hamilton Fund has been designed to provide low-correlated absolute returns, primarily by combining multiple hedged and leveraged systematic investment strategies with proprietary risk management, investment, optimization and execution techniques. The Two Sigma Hamilton Fund invests in a broad set of financial instruments and is primarily focused on liquid strategies in global equity, futures and foreign exchange (FX) markets, exchange-listed and over-the-counter (OTC) options (and their underlying instruments) and other derivatives. This liquidity profile fits well with our business, while also providing the benefit of access to a dedicated fund-of-one.

Two Sigma has broad discretion to allocate invested assets to different opportunities. Its current investments include Two Sigma Futures Portfolio, LLC (“FTV”), Two Sigma Spectrum Portfolio, LLC (“STV") and Two Sigma Equity Spectrum Portfolio, LLC (“ESTV”). The Two Sigma Hamilton Fund’s trading and investment activities are not limited to these systematic (and certain non-systematic) investment strategies and proprietary risk management, investment, optimization, and execution techniques (collectively, the “Techniques”) and the Two Sigma Hamilton Fund is permitted to pursue any investment strategy and/or Technique that Two Sigma determines in its sole discretion to be appropriate for the Two Sigma Hamilton Fund from time to time. In any given period, the performance of these individual portfolios may vary materially; however, the performance and risk profile of the Two Sigma Hamilton Fund is monitored at the overall fund level, rather than at the portfolio level. This is consistent with the manner in which investment management fees and performance incentive allocations are determined (i.e., fees and performance incentives are determined on by the overall performance of the fund, rather than the performance of each portfolio).

We have entered into a Commitment Agreement (defined below) with Two Sigma, which includes a bilateral rolling three-year commitment period that automatically renews each year, until a non-renewal notice is provided by either party. The historical returns of the funds managed by Two Sigma (including the Two Sigma Hamilton Fund) are not necessarily indicative of future results. The Two Sigma Hamilton Fund produced returns, net of investment management fees and performance incentive allocations, of 4.6%, 17.7% and (4.6%) for each of the years ended December 31, 2022 and November 30, 2021 and 2020, respectively. The Two Sigma Hamilton Fund produced returns, net of investment management fees and performance incentive allocations, of 2.1% and 10.6% for the six months ended June 30, 2023 and 2022, respectively. Hamilton pays arm’s-length management and incentive fees under this agreement. Our annualized return of 12.8% from 2014 to 2022 from the Two Sigma Hamilton Fund is net of these fees and incentive allocations. See “Risk Factors—Risks Related to Our Investment Strategy—We do not have control over the Two Sigma Hamilton Fund” for more information.

3 For the avoidance of doubt, Two Sigma serves as the investment manager of the Two Sigma Hamilton Fund. The Company is not a client of Two Sigma pursuant to the Investment Act of 1940, as amended.

Our ESG Principles

Good corporate citizenship underscores everything we do. Our environmental, social, and corporate governance (“ESG”) approach is based on being a responsible corporate and global citizen and was affirmed through two separate external assessments.

We apply a four-pillar philosophy across all areas of our business:

1.Accountability: We focus on employing equitable governance and oversight in an effort to ensure the best outcome for all of our stakeholders.

2.Social Impact: We have an inclusive culture underpinned by teamwork and collaboration. As part of that, we have had an engaged and active Diversity, Equity and Inclusion (“DEI”) Committee since 2018, made up of employee representatives from each of our key locations, across functions and seniority. We also have a diverse senior management team, with three of four of our group & underwriting platform CEOs being women. Notably, 45% of our Group Executive team and approximately 40% of our underwriting and claims leaders are female.

3.Underwriting: We are supportive of companies that are involved in the transition to alternative energy sources such as renewable energy, including wind and solar, and rolled out ESG-specific underwriting guidelines in the third quarter of 2022.

4.Investments: We strive to deploy our invested capital responsibly with established guidelines that are regularly monitored to align with our corporate values. Our investment managers are guided by the United Nations Principles for Responsible Investment.

Our Competitive Strengths

We believe that our corporate tagline, “In good company” embodies who we are as an organization. As a good corporate citizen, we strive to ensure that everyone we interact with – our clients and business partners, our people, our shareholders and the communities we serve – feel they are in good company with Hamilton. Our promise is enhanced by the strengths of our differentiated business model, which includes:

Scaled, diversified, and global specialty insurance and reinsurance operations

The scale we have built since inception provides significant competitive advantages in the global markets we serve. We have grown our book both organically when market conditions were favorable, through product expansion and increasing client and broker channel distribution and inorganically, through the strategic acquisition of PMA in 2019.

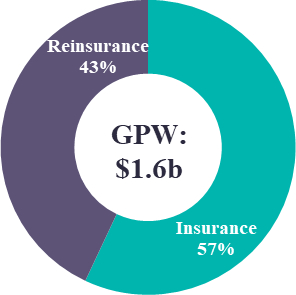

Our business mix is well-balanced between insurance and reinsurance, and is diversified across geographies, risks, clients and products, with a majority of our business coming from specialty and casualty lines. Since 2018, our portfolio has evolved from 32% to 57% insurance, with reinsurance declining from 68% to 43% based on premium volume. For the year ended December 31, 2022, we recorded $1.6 billion of gross premiums written through our three principal underwriting platforms, with access to key markets around the world.

We believe that the scale and breadth of our book of business, our multiple underwriting platforms and product offerings allows us to dynamically respond to and manage market cycles, thus providing for more consistent performance and reduced volatility. We expect our recently launched Hamilton Select platform will continue to add business diversification and growth in the profitable hard-to-place niche of the U.S. E&S market, as well as the other markets they serve. Hamilton Global Specialty and Hamilton Re will also provide growth prospects in the U.S. E&S market. Overall, we believe our disciplined approach to scale, risk assessment, and diversification enables us to deliver on our goals of long-term profitability.

Disciplined and data-driven underwriting approach

Our underwriting platforms are each led by teams of experienced underwriters who are specialized in their product areas and able to set terms and conditions in several lines of business. Their expertise is supplemented by our strong technical tools, which provide the insights that enable our underwriters to intelligently price and structure our products and portfolio, maintain diversification, and in turn deliver attractive risk-adjusted profitability. Our underwriters adhere to a disciplined underwriting philosophy and guidelines, seeking to underwrite only profitable risks. Our underwriters regularly review their books of business, to ensure they are growing in the most profitable areas and restructure or do not renew underperforming accounts, thus optimizing our business portfolio. They benefit from quarterly discussions with our GUC which also reviews underwriting results, suggests strategic portfolio shifts, reviews risk appetites and tolerances for new and existing products and considers emerging risks and mitigation strategies together with our underwriting and executive leadership. Our review and risk selection processes are enhanced by our business intelligence and global management information system, Hamilton Insights, which is being expanded to provide all our underwriters with real-time data and self-service report generation to inform their underwriting decisions. Examples of the portfolio enhancing measures undertaken in the context of our Strategic Transformation since 2018 include: the launching of Hamilton Select and Hamilton Re US, growth of professional insurance lines, the strategic purchase of a Loss Portfolio Transfer (“LPT”) in 2020 on certain casualty risks for Lloyd’s Years of Account (“YOA”) in 2016, 2017 and 2018 and exit/remediation of unprofitable lines of business (e.g., agriculture and property binder business). The platforms have also benefited from group-wide, third-party best practice reviews commissioned by our GUC and the fact that variable compensation is tied primarily to underwriting profitability.

We actively manage our risk exposure on a centralized basis in order to allocate capital efficiently and optimize our returns. For example, we monitor tolerances for natural catastrophe risks utilizing probable maximum loss (“PMLs”) for multiple regions and perils and we have reduced our PMLs as a result of proactive portfolio management. We believe our average annual current year natural catastrophe losses as measured as a percentage of tangible book value were lower than those of many of our peers as a direct result of these actions for the five-year period from 2018 to 2022. We now see an opportunity to strategically deploy PML capacity to gain access to well-priced property insurance and reinsurance business as well as other profitable non-property lines of business.

Our methodical and disciplined approach to underwriting, bolstered by our experienced underwriting talent, collaboration with our GUC, strong analytics platforms, and the actions taken as part of the Strategic Transformation have resulted in a reduction in our combined ratio by 22 percentage points since 2018. Our combined ratio for the year ended December 31, 2022, adjusted for Ukraine losses, was 96.4%. Additionally, the combined ratio for our International Segment for the year ended December 31, 2022, adjusted for Ukraine losses, was 92.5% and the combined ratio for our Bermuda Segment for the year ended December 31, 2022, adjusted for Ukraine losses, was 101.0%. In addition, through responsible management actions and technological efficiencies, we have reduced our expense ratio by 4 percentage points since 2019.

Separately, the Company’s combined ratio was 87.7% and 87.9% for the three months ended December 31, 2022 and March 31, 2023, respectively. The International Segment’s combined ratio was 90.9% and 89.1% for the three months ended December 31, 2022 and March 31, 2023, respectively and the Bermuda Segment’s combined ratio was 83.6% and 86.9% for the three months ended December 31, 2022 and March 31, 2023, respectively.

Proprietary technology infrastructure

Underpinning our business is sophisticated proprietary technology and analytics platforms. Unburdened by legacy systems, our technological capabilities enable operational efficiencies as we continue to scale and allow for nimble decision-making in a competitive marketplace.

We have built proprietary systems including HARP, a catastrophe modeling and portfolio accumulation management platform used for all our natural catastrophe-exposed risks. Reflecting decades of industry experience, HARP enables precise modifications and loads to be applied to vendor catastrophe model results to produce the Hamilton View of Risk (“HVR”), the basis upon which all of our catastrophe modeling and accumulation management is conducted. HARP produces rapid management information and portfolio analytics to aid decision-

making, and supports structural features such as reinstatement premium protections, cascading layers and trailing deductibles that many third-party systems are unable to handle. We believe HARP is one of the most sophisticated and user-friendly risk and exposure management systems in the industry.

The HVR enables us to manage natural catastrophe risk on a consistent basis, including pricing, underwriting, reserving, planning, capital modelling and accumulation management decisions. We believe that HVR is materially complete and appropriate to the current risk landscape. We accomplish this through vendor catastrophe models that serve as a baseline and our proprietary tools, the mainstay of which is HARP, that allow us to make a number of significant adjustments, and our model intelligence team that evaluates models and recommends changes. HVR utilizes a long-term trend in its baseline and adjusts it to consider a combination of short-term variability such as warm sea-surface temperature, non-modeled perils, secondary uncertainty and severity loads (such as missing exposures, loss adjustment expenses, and potential model miss). In aggregate, HVR produces loss estimates materially in excess of those provided by the baseline vendor models, but nonetheless may not be predictive of catastrophic events.

Our proprietary suite of technology also includes Timeflow (a global underwriting submission system), which enables us to digitize our submission intake process and orchestrate data entry across multiple systems, MINT (an underwriting workbench), which will, when fully deployed, enable our underwriters at Hamilton Select to fully digitize the quote/bind/endorsement process and Hamilton Insights (our business intelligence and management information system), which is used by underwriters to gain insights on our business and make informed decisions.

Differentiated asset management capabilities with Two Sigma to further enhance returns

We have a unique asset management strategy as our investment-grade fixed income investment portfolio is complemented by our separate portfolio managed by Two Sigma within the Two Sigma Hamilton Fund. Our ability to generate positive risk-adjusted yields through our complementary investment portfolios differentiates us from our peers who generally only have traditional investment allocations, concentrated primarily in investment-grade, long-only fixed income securities.

The Two Sigma Hamilton Fund is designed to provide low-correlated absolute returns and high liquidity. Two Sigma seeks to control risk systematically through the use of proprietary portfolio management and risk management systems and techniques. From 2014 to 2022, the Two Sigma Hamilton Fund produced an annualized return on invested assets of 12.8%, net of fees and incentive allocations. Our current allocation to the Two Sigma Hamilton Fund is approximately half of our invested assets. Our fixed income portfolio consists of traditional investment-grade fixed income securities which are conservative, fixed maturity and short-term investments (average credit rating of “Aa3” and duration of 3.2 years at December 31, 2022) and are managed by two other third-party investment managers. We believe that this balanced approach and unique access to the Two Sigma Hamilton Fund allows us to optimize our investment returns and drive additional shareholder returns that complement our underwriting operations.

Strong balance sheet with significant financial flexibility

As of December 31, 2022, we had consolidated GAAP shareholders’ equity of $1.7 billion, with limited intangibles. Our financial leverage ratio was 7.9% at June 30, 2023, which is meaningfully below many of our competitors. Our capital position is enhanced by a highly liquid investment strategy, with assets in the Two Sigma Hamilton Fund diversified across investment strategies, instruments and thousands of positions in liquid global markets. As of December 31, 2022, 99% of the Two Sigma Hamilton Fund positions are level 1 assets as classified by ASC 820.

The Company had a net loss attributable to common shareholders of $98.0 million for the year ended December 31, 2022. Cumulatively, since the inception of the Company to December 31, 2022, our net income attributable to common shareholders was $561.6 million. The Company has demonstrated its ability to withstand catastrophe and other significant loss events across changing market cycles and we believe it is well placed to take advantage of the current hard market conditions.

Our balance sheet is supported by our robust reserve position, which is comfortably above the estimate of our external actuarial selected indications. Because we commenced operations in 2013, did not assume the loss and loss adjustment expense (“LAE”) reserves predating 2019 from the acquisition of PMA and purchased an LPT in 2020 on certain casualty risks for Lloyd’s YOA in 2016, 2017 and 2018, we have less exposure to legacy liabilities than many of our competitors. We have also posted favorable prior year reserve development since inception, averaging an annual release of 2.7 loss ratio points.4

Our Lloyd’s syndicate benefits from financial strength ratings of “A” (Excellent) from A.M. Best, “A+” from S&P Global, “AA-” from KBRA and “AA-” from Fitch, all of which are NRSROs as defined by the SEC. Our other insurance and reinsurance subsidiaries hold an “A-” (Excellent) rating from A.M. Best and an “A” rating from KBRA, each with a positive outlook. Maintaining strong ratings helps us demonstrate our financial strength to our policyholders, cedants and distribution partners and continues to unlock business.

Highly entrepreneurial and experienced leadership team fostering a distinctive and attractive culture

We consider ourselves a magnet for talent at all levels. Our executive officers are highly qualified and have an average of more than 20 years (and collectively over 230 years) of relevant experience in insurance and reinsurance. We are led by our Group Chief Executive Officer, Pina Albo, who has over 30 years of industry experience and was previously a Member of the Board of Executive Management of Munich Re, and the first North American woman to hold such a role. Several of our executive officers have long histories of working together at other organizations and have held senior management positions at large, established carriers. Members of our executive and management team have joined us from a number of reputable carriers such as AIG, AXIS, Chubb, CNA, Everest, Kinsale, Munich Re, Partner Re and Renaissance Re.

Our corporate tag-line, “In good company” underpins our employee value proposition and embodies our inclusive, entrepreneurial, and collaborative culture which drives our success in recruitment, development and retention of leading industry talent. Based on our most recent bi-annual engagement pulse survey, 84% of our workforce say that Hamilton is a great place to work, and 91% say we collaborate across teams to get the job done. Underscoring our culture is a strong commitment to DEI. Notably, 45% of our Group Executive team and approximately 40% of our underwriting and claims leads are female.

Our Strategy

We are a global specialty insurance and reinsurance company enhanced by data and technology, focused on producing sustainable underwriting profitability and delivering significant shareholder value. We intend to keep growing our diverse book of business by responding to changing market conditions, prudently managing our capital, and driving sustainable shareholder returns. The key pillars of our strategy include:

Prudently managing capital across different underwriting cycles

We seek to prudently manage our capital with the objective of effectively navigating different market conditions and generating strong underwriting margins throughout all market cycles. Our scaled and diversified platforms and product offerings, and our broad industry relationships provide significant opportunity to underwrite our chosen classes of property, casualty and specialty insurance and reinsurance as market opportunities arise. Leveraging our disciplined underwriting approach, balance sheet strength and flexibility, and real-time technology prowess, we can respond dynamically to capture opportunities as markets evolve.

We believe the current market conditions for insurance and reinsurance are favorable for all our underwriting platforms, and particularly favorable for property-exposed reinsurance lines. Given our broad product offering, we believe Hamilton Re is particularly well positioned to increase our writings across multiple lines of business and to negotiate attractive program structures as well as favorable terms and conditions. Hamilton Global Specialty is also capitalizing on current positive market conditions across its specialty insurance and reinsurance offerings. For example, our political violence team is currently growing its portfolio in an environment with much stronger pricing and improved terms and conditions, given much greater demand for that product. We have also entered new lines of

4 Excluding the U.S. GAAP accounting impact of a loss portfolio transfer purchased in 2020.

business where we see opportunity, such as the recent addition of marine hull. Hamilton Select is also benefiting from the increased flow of business and favorable market conditions in the U.S. E&S market where it is focused.

We believe our approach to managing capital across market cycles will allow us to grow our capital and fund the continued scaling of our business with our own resources. Our prudent approach to capital management may also allow us to return excess capital to investors over time, which may take the form of ordinary dividends, special dividends or share buybacks.

Driving sustainable underwriting profitability

One of our key strategic priorities is to produce sustainable underwriting profitability on the business we write and we believe we are well-positioned to do so following the Strategic Transformation. Our data-driven and disciplined underwriting processes position us to intelligently price and structure our products and our business portfolio. Our experienced underwriting, actuarial and catastrophe modeling teams rely on our strong technical tools and insights to inform underwriting decisions and drive additional benefits by regular collaboration with our GUC.

We maintain trusted and long-standing relationships with our clients and brokers, who we believe will continue to provide us with increased access to attractive business. Our disciplined underwriting approach has resulted in a reduction in our combined ratio by 22 percentage points since 2018 and improvement in our expense ratio every year since 2019. We expect to continue to leverage our robust underwriting processes, highly experienced teams, broad access to clients and brokers and real time analytics to address our clients’ needs and to garner attractive opportunities across all our underwriting platforms.

Pursuing disciplined and opportunistic growth across all Hamilton Platforms

We see growth opportunities in both the insurance and reinsurance markets in which we operate and intend to pursue disciplined growth across all our underwriting platforms. In recent years the E&S market has benefited from a strong rate environment and increased submissions as business has shifted into the non-admitted market from the admitted market. Non-admitted insurers are able to cover unique and hard-to-place risks because they have flexibility of rate and form and can accommodate the unique needs of insureds who are unable to obtain coverage from admitted carriers.

We access the attractive U.S. E&S insurance market via all three of our underwriting platforms.

•Hamilton Global Specialty writes E&S business on both its Lloyd’s and HIDAC platforms. It is an established specialty insurance market with specialized underwriting talent and strong broker and client relationships across the casualty, specialty and property insurance lines and is well positioned for growth in this market.

•Hamilton Re is also well positioned for scalable growth in the U.S. E&S insurance market given strong market conditions, with established teams in place for property insurance, excess casualty insurance and the newly-launched financial lines insurance.

•Hamilton Select, launched in 2021, further increases our access to the U.S. E&S insurance market at an opportune time. Hamilton Select plans to grow in the hard-to-place niche of the E&S market focused on small to medium sized risks, a segment which is expected to produce profitable results in all market cycles. Hamilton Select has a leadership and underwriting team with experience in its chosen hard-to-place niche from Kinsale as well as other recognized companies and also benefits from extensive distribution relationships in this attractive market segment.

We believe the access our three underwriting platforms have to U.S. E&S insurance business will allow us to build a robust and diversified book of business and achieve our profitable growth objectives throughout various market cycles.

Reinsurance business offers a particularly attractive opportunity given the favorable rating environment and reduction of capacity at this time in the cycle and is expected to accelerate growth opportunities for us in the near term. A number of factors, including economic and social inflation, combined with rising interest rates and increases

in the frequency and severity of natural catastrophe events in recent years, have created a supply/demand imbalance and are driving the most favorable market conditions seen in decades. We are a recognized market with deep client and broker relationships and have low counter-party credit concentration with many of our insurance partners, providing ample headroom for us to grow. We are well positioned to deploy capital quickly, efficiently and profitably through writing more reinsurance business, as well as retaining more of our own business.

Generating strong risk-adjusted returns for shareholders

Our strong, sustainable underwriting operations are complemented by our unique investment portfolio, which consists of (i) the Two Sigma Hamilton Fund, which has produced an annualized return of 12.8% from 2014 to 2022, net of fees and incentive allocation, and (ii) our investment grade fixed income portfolio which is currently benefiting from strong interest rates. We plan to continue to optimize our investment portfolio through a balanced allocation of invested assets and maintain the flexibility to adjust this allocation as needed. We believe our strategy of disciplined underwriting growth, balanced with our investment platform, will drive our ability to create shareholder value.

Our Market Opportunity

We believe we have significant opportunities to capture profitable risk-adjusted returns from sustained favorable property and casualty insurance and reinsurance market conditions due to our scale, disciplined underwriting, and financial and operating flexibility as well as our low counterparty credit concentration. The global macroeconomic and social environment continues to drive favorable demand for insurance and reinsurance products. Increased interest rates have resulted in mark-to-market losses in investment portfolios, causing several of our competitors to recognize balance sheet impairments, thereby reducing their underwriting capacity. In recent years, rate increases have been required to keep pace with the increased frequency and severity of natural catastrophe events globally, which has been impacted by changing weather patterns, inflation, increased geopolitical tensions and other risks that have grown or emerged. As a result, the global commercial insurance industry has seen 22 consecutive quarters of price increases. We believe that the combination of these factors, particularly those listed below, will continue to drive market opportunities for our business:

•Continued growth of the E&S market: We access the attractive U.S. E&S market via all three of our underwriting platforms and believe that such access to U.S. E&S business will allow us to build a robust and diversified book of business and achieve our profitable growth objectives throughout various market cycles. The non-admitted U.S. insurance market, also known as the U.S. E&S or surplus lines market, is experiencing a period characterized by surging growth and attractive rates and terms and conditions. E&S insurance focuses on insureds that generally cannot purchase insurance from standard market or admitted market insurers due to perceived risk related to their businesses. E&S carriers are generally permitted to craft the terms of the insurance contract to suit the particular risk they are assuming. Also, E&S carriers are, for the most part, free of rate regulation. More specifically:

◦Most states require an agent to seek coverage from the standard or admitted market and verify they were declined by that market before they may seek coverage from the surplus lines market through a licensed surplus lines broker. This process is often referred to as “diligent effort.” Additionally, some states use “export lists” to regulate the flow of business between the admitted and non-admitted markets. An export list outlines the types of insurance products and coverages the state allows to go to the surplus lines market without a diligent search of the standard market.

◦Standard market carriers are generally required to use approved insurance forms and to charge rates that have been authorized by or filed with state insurance departments; they are backed by a state guarantee fund. U.S. E&S business is not backed by any state’s guarantee fund, and in many states may only write coverage for an insured after they have been denied coverage by the standard market and signed declarations stating that the insured is aware that it will not have access to any state guarantee funds should these subsidiaries be unable to satisfy their obligations. Consequently, Hamilton Select, Hamilton Global Specialty and Hamilton Re may be able to provide more restrictive coverage and thereby limit exposure to loss by either excluding coverage or providing a sub-limit on

coverage. As coverage is not available in the standard market, non-admitted carriers may be able to charge premiums exceeding the standard market risk charge for a narrower scope of coverage. The non-admitted market coverage form is typically modified to address the specific risk characteristics of accounts that are pushed out of the admitted market, and the pricing is adjusted to reflect the elevated risk potential. The non-admitted market policy wording may be modified to further restrict and limit coverage, and the pricing may be surcharged to account for the elevated risk for these distressed commercial accounts. It is management’s belief that non-admitted business is expected to produce profitable results in all market cycles.

◦Recently, there has been a persistent flow of business from the admitted market into the non-admitted E&S channels, resulting generally in compound rate increases across the E&S market in the United States. In addition, the macroeconomic and social environment continues to drive demand for specialized insurance solutions due to both increasing and more complex risks. Based on publicly available industry data, the growth of the U.S. E&S market has outperformed the property & casualty industry average over the last five years. We have capitalized on this growth via the insurance products offered by both our Hamilton Global Specialty and Hamilton Re platforms for some time, and most recently, with the launch of our Hamilton Select platform. Hamilton Select operates exclusively in the U.S. E&S market, offering insurance to small to mid-sized hard-to-place commercial risks, an attractive niche of the E&S market.

•Greater demand for insurance and reinsurance from our clients because of the macroeconomic environment: Global economic and industrial development, greater product awareness and distribution, economic and social inflation and increases in natural catastrophes and geopolitical tensions, such as the conflict in Ukraine, continue to drive an increase in our clients’ need for insurance and reinsurance products underwritten by strong, trusted companies. While we are no longer covering the Ukraine/Russia conflict due to policy exclusions, opportunities have arisen in the lines of business that were impacted by the conflict, such as aviation, war and terror, and marine and energy. These lines of business are generally written on a worldwide basis and have seen higher pricing and more favorable terms and conditions since the Ukraine/Russia conflict started in February 2022.

•Hard market with attractive pricing and investment environment for the medium term: Significant annual industry-wide losses since Hurricanes Harvey, Irma and Maria in 2017, including the coronavirus (“COVID-19”) pandemic, the ongoing conflict in Ukraine and more recently Hurricane Ian in 2022, have led to significant year-on-year rate increases across multiple classes of business including property catastrophe, casualty and specialty lines. Many insurers that sustained increased losses have reevaluated their portfolios and exited certain classes of business, creating a shortfall of capacity in certain lines and new opportunities for us. We believe that the hard market conditions will continue to provide opportunities for us to capitalize on these favorable conditions as well as provide access to new business and clients, and achieve significant rate increases and improved terms and conditions, while allowing us to maintain disciplined risk selection. In addition, we believe that increased interest rates in our fixed income portfolio, as well as our exclusive access to Two Sigma investment strategies, will allow us to complement our underwriting income with attractive investment returns.

•Need for strong and experienced counterparties given limited capacity: Some of our competitors with sustained and increased underwriting losses or reduced balance sheet capacity have exited or reduced writing in selected lines of business, causing a supply dislocation in the market relative to the growing demand for risk capacity in certain lines such as property insurance and reinsurance. We are a valued, established and proven industry partner and, given the strength and flexibility of our balance sheet, the breadth of our product offerings, our low counterparty credit concentration and our recognized and experienced team, we have the ability to expand our business where opportunities arise. Our growing and extensive client and broker relationships, the clarity of our risk appetite and the consistency of our approach resonates well with our business partners and we believe will afford us increased access to attractive new business. In light of this, we believe we can continue our proven track record of being responsive to our clients’ needs, while maintaining disciplined underwriting and risk-adjusted returns for our shareholders.

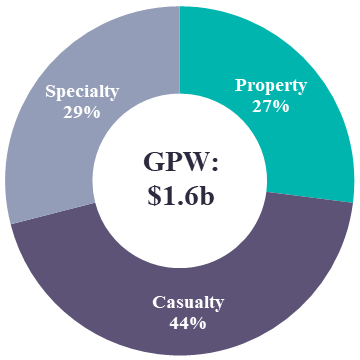

Our Business

We operate three principal underwriting platforms, categorized into two reporting business segments: International and Bermuda. Our three underwriting platforms, with dedicated and experienced leadership, provide us with access to diversified and profitable key markets around the world. Across these global operations, we generated $1.6 billion of gross premiums written for the year ended December 31, 2022.

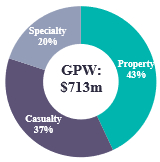

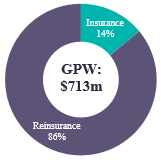

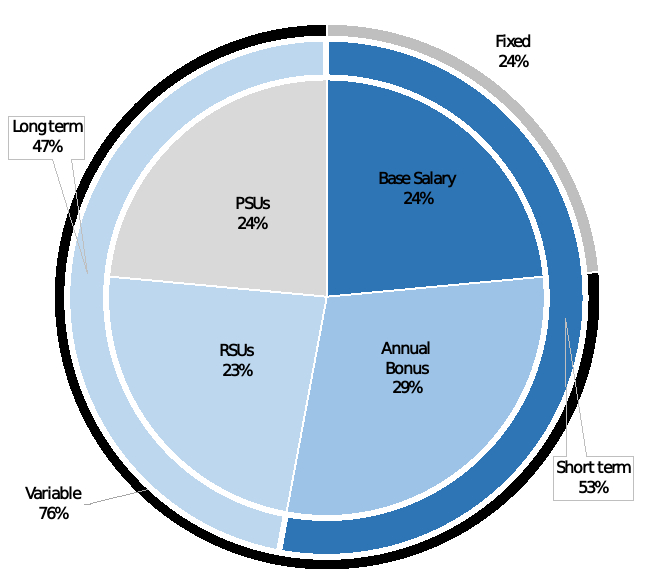

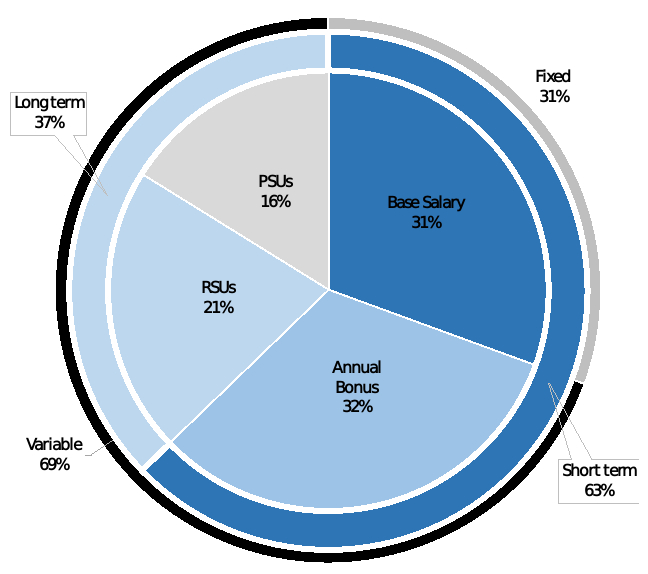

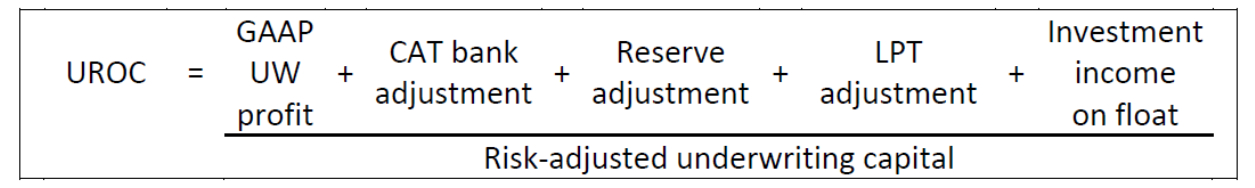

The following charts represent our gross premiums written by reporting segment, insurance and reinsurance mix, and class of business for the year ended December 31, 2022:

| | | | | | | | |

Gross Premiums Written:

By Segment | Gross Premiums Written:

Insurance / Reinsurance | Gross Premiums Written:

Class of Business |

| | |

For a full description of our business, see the section entitled “Business” on page 150. International

| | | | | |

Gross Premiums Written:

Class of Business | Gross Premiums Written:

Insurance / Reinsurance |

| |

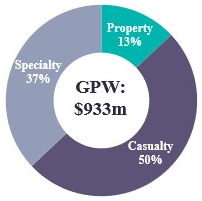

Our International Segment includes both the Hamilton Global Specialty and Hamilton Select platforms.

Hamilton Global Specialty focuses predominantly on commercial specialty and casualty insurance products for medium to large-sized accounts and specialty reinsurance for a variety of global insurance companies. Its business is distributed via Lloyd’s Syndicate 4000 and HIDAC in Ireland.

Hamilton Select, our recently launched U.S. domestic E&S carrier, writes casualty insurance for small to mid-sized commercial clients in the hard-to-place niche of the U.S. E&S market. Hamilton Select does not write any property business.

Across the International Segment, insurance business made up approximately 90% of gross premiums written, while specialty reinsurance makes up approximately 10% at December 31, 2022.

Property business written by Hamilton Global Specialty accounted for 13% of gross premiums written as of the year ended December 31, 2022. Our underwriting strategy is to minimize catastrophe exposure. The property book is predominantly made up of U.S. E&S insurance business with a weighting in favor of the industrial and commercial sectors, binding authority business, comprising non-standard commercial and residential risks, and specialist sectors, including terrorism, power generation, engineering and nuclear risks. The property insurance book is written on both a direct and facultative basis, as well as through a specialist property binders division.

Casualty business within our International Segment accounted for 50% of gross premiums written as of the year ended December 31, 2022. Key casualty products include:

•Financial Lines: Our financial lines book targets corporate entities rather than retail exposure. It covers a broad range of financial institutions globally including, but not limited to, asset managers, funds, building societies, financial exchanges, retail and commercial banks, private equity and venture capital firms.

•Professional Lines: Our professional lines book covers international professional indemnity (“PI”), U.S. PI, medical malpractice and directors & officers (“D&O”). It is delivered through a mixture of multi-class facilities for small businesses or via bespoke products designed for more specialized risks.

•Environmental: We help manage risks in the areas of pollution liability – aimed at safeguarding business owners from pollution claims arising from a variety of environmental threats related to liability from managing, leasing or owning real estate assets, professional liability, contractors pollution liability, commercial general liability, and manuscript solutions.

•Excess Casualty: Our industry class offering is broad and includes Fortune 500/1,000 and other companies across a large spectrum. We also provide cover for U.S. construction companies for both practice and project-specific policies over a wide range of construction from mid-size commercial projects to major infrastructure projects. We target U.S.-domiciled entities with U.S. and global exposures.

•Cyber: Our cyber book is global and focused on financial institutions, utilities, retailers, and the healthcare and hospitality industries. It includes cyber liability as well as optional coverage including technology errors and omissions, payment card industry fines and penalties, cybercrime, and fraudulent instruction.

Specialty business within our International Segment accounted for 37% of gross premiums written as of the year ended December 31, 2022. Key specialty products include:

•Accident & Health (“A&H”): Our A&H book includes individual and group accidental death and disability, worldwide excess of loss, medical expenses and kidnap and ransom cover.

•War and Terrorism: Our war and terrorism book offers cover for physical loss or damage and business interruption from terrorism, riots strikes and civil commotion and from war. It is written on a worldwide basis. We also cover Political Risk / Political Violence (“PR/PV”) which covers confiscation and contract frustration and trade credit on a worldwide basis.

•Fine Art & Specie: Our fine art & specie book includes specie & fine art and high value cargo. It is written via a selective number of specialist partners and also through Hamilton’s consortium which writes on behalf of third-party capital, providing additional capacity as required.

•Marine/Energy: Our marine and energy book includes both traditional marine liability and energy liability. This product area includes international onshore and offshore energy business.

Bermuda

| | | | | |

Gross Premiums Written:

Class of Business | Gross Premiums Written:

Insurance / Reinsurance |

| |

Our Bermuda Segment encompasses the Hamilton Re platform on which we write property, casualty and specialty reinsurance business on a global basis as well as high excess insurance products, predominantly to large U.S.-based commercial clients. Hamilton Re US writes casualty and specialty reinsurance business predominantly for U.S.-domiciled insurers. Reinsurance business accounted for 86% of gross premiums written as of the year ended December 31, 2022, while insurance business accounted for 14%. Our reinsurance business is written on either a proportional or on an excess of loss basis.

Property business written by Hamilton Re accounted for 43% of gross premiums written as of the year ended December 31, 2022. The property reinsurance business provides proportional, aggregate, excess of loss and retrocessional products on a global basis, which generally cover natural and man-made catastrophes. Hamilton Re’s property insurance business provides both insurance and facultative coverage for business interruption, machinery breakdown, natural perils, and physical loss or damage globally, and predominantly to large U.S.-based commercial clients.

Casualty business in our Bermuda Segment is written by both Hamilton Re and Hamilton Re US and accounted for 37% of gross premiums written as of the year ended December 31, 2022. It is comprised of both insurance and reinsurance business. Casualty insurance business is written in Bermuda only, and exclusively on an excess of loss basis. Casualty reinsurance business is written by both the Hamilton Re and the Hamilton Re US teams and is written on a proportional and excess of loss basis covering worldwide exposures. Key casualty products include:

•General Liability: We protect a wide variety of general liability covers including premises, products completed operations and liquor liability. We offer treaty capacity globally on a proportional and excess of loss basis.

•Umbrella & Excess Casualty: We protect umbrella and excess casualty programs written on occurrence, claims-made or integrated-occurrence bases. We offer treaty capacity globally on a proportional and excess of loss basis.

•Professional Liability: We protect a wide variety of professional lines, including D&O, employment practices liability, lawyers’ professional liability, and errors and omissions liability. We offer treaty capacity on pro rata and excess of loss bases. Our coverage is worldwide with an emphasis on North America.

•Workers’ Compensation & Employers’ Liability: We protect workers’ compensation and employers’ liability cover globally on both a proportional and excess of loss basis.

•Personal Motor: Our product protects motor liability, property damage and personal accident for all types of motor policies. We offer treaty capacity on a proportional, excess of loss or retrocessional basis. Our current emphasis is in the United Kingdom.

Specialty business accounted for 20% of gross premiums written as of the year ended December 31, 2022. The book is comprised of reinsurance only and covers several sub-classes, written on both a proportional and excess of loss basis. Key specialty products include:

•Aviation & Space: Our aviation & space book covers airline, airport, aerospace, satellite launches and orbits, and general aviation risks globally on a proportional, excess of loss or retrocessional basis.

•Marine/Energy: Our marine and energy book covers a broad portfolio of global marine and energy risks, including marine hull, marine liability including international group, cargo, and upstream, midstream and downstream energy risks which are on a proportional, excess of loss or retrocessional basis.

•Crisis Management: Our crisis management book covers risks associated with war, terrorism and political violence. We also have the capacity to offer risks associated with contingency, piracy and kidnap and ransom cover. Our products can be provided globally on a proportional or excess of loss basis.

•Mortgage: We provide excess of loss reinsurance predominantly to government-sponsored entities of U.S. residential mortgages.

•Financial Lines: Financial lines reinsurance includes political risk, trade credit, surety and other credit-related products. We offer proportional, excess of loss, stop loss or retrocessional capacity on a worldwide basis.

Our Distribution Channels

Our insurance and reinsurance business is primarily sourced through wholesale and retail brokers worldwide, including Aon, Marsh McLennan, WTW, AJ Gallagher and a number of other U.S., Bermuda and London market wholesale brokers. Some of our products, such as those in our accident and health account, are also distributed through managing general agents (“MGAs”) and managing general underwriters (“MGUs”). We believe our distribution relationships are differentiated and strengthened by the knowledge and experience of our senior management team and the long history of industry partnerships they have developed over many years.

Our International Segment writes business through several large national and international brokers and a number of smaller specialized brokers. Our 10 largest brokers accounted for an aggregate of approximately 59% of gross premiums written in 2022, with the largest broker, Marsh McLennan, accounting for approximately 15% of gross premiums written. The second largest broker, Aon, accounted for approximately 10% of gross premiums written.

Our Bermuda Segment business is accessed through wholesale and reinsurance brokers. The largest broker, Marsh McLennan, accounted for approximately 41% of gross premiums written. The second-largest broker, Aon, accounted for approximately 30% of gross premiums written in 2022.

Outwards Reinsurance and Retrocession

We strategically purchase reinsurance and retrocession from third parties, which enhances our business by protecting capital and reducing our exposure to volatility from adverse claims events (either large single events or an accumulation of related losses). For example, we seek to limit our exposure to no more than 17.5% of our shareholders’ equity to a 1 in 100-year Atlantic Hurricane event (i.e., the largest single Atlantic Hurricane event in a calendar year with a probability of 1/100). We use outwards reinsurance and retrocession to help us achieve this target.

Based upon HVR, we have modelled that the probability of a single event exhausting the full limit of our core outwards excess of loss property catastrophe coverage for the remainder of 2023 is approximately 1%. We also have the ability to adjust our models for the potential increase in frequency of these events. Our catastrophe modeling and accumulation management in respect of natural catastrophe exposures is managed within our proprietary platform, HARP, and is performed using the HVR. The HVR incorporates bespoke loads and adjustments at various levels of granularity, which in aggregate represents a material load over and above the loss exposure produced from the unadjusted vendor models that we use. The adjustments include allowance for the potential for increased frequency

and severity of natural catastrophes over time, as well as for several other factors that could cause us to be exposed to increasing claims trends from natural catastrophes. See “––Our Competitive Strengths––Proprietary technology infrastructure” for additional information on the HVR.

Our reinsurance purchases include a variety of quota share and excess of loss treaties and facultative placements. In 2022, we ceded 32% of premium from the International Segment and 18% from the Bermuda Segment.

We carefully manage our counterparty credit risk by selecting outwards partners of adequate financial strength. For the outwards program placed for 2023, all of the effective outwards limit is ceded to reinsurers and retrocessionaires with a credit rating of “A-” (Excellent) by A.M. Best (or an equivalent rating by S&P Global), or better, or who are collateralized.

Recent Developments

We are currently finalizing our unaudited condensed consolidated financial statements for the three and nine months ended September 30, 2023 and 2022. While our unaudited condensed consolidated financial statements for such periods are not yet available, based on the information currently available to us, we preliminarily estimate the following:

Selected Financial Results For Three months ended September 30, 2023 and 2022 (Unaudited)

•Gross premiums written are expected to be approximately $474.1 million for the three months ended September 30, 2023, an increase of 18% compared to $400.8 million for the three months ended September 30, 2022.

•Net premiums earned are expected to be approximately $337.0 million for the three months ended September 30, 2023, an increase of 14% compared to $294.9 million for the three months ended September 30, 2022.

•The combined ratio for the three months ended September 30, 2023 is expected to be approximately 92.6%. The combined ratio for the three months ended September 30, 2022 was 122.5%.