Filed by Santa Maria Energy Corporation

Pursuant to Rule 425 Under the Securities Act of 1933

Subject Company: Santa Maria Energy Corporation

Registration Statement No. 333-192902

This filing relates to a proposed business combination involving Hyde Park Acquisition Corp. II, a Delaware corporation (“HPAC”), Santa Maria Energy Holdings, LLC, a Delaware limited liability company (“SME”), and Santa Maria Energy Corporation, a Delaware corporation (“SMEC”).

ADDITIONAL INFORMATION ABOUT THE TRANSACTION AND WHERE TO FIND IT

SMEC has filed with the Securities and Exchange Commission (“SEC”) a registration statement on Form S-4, which includes a preliminary joint proxy statement of Hyde Park and SME and related materials in connection with the proposed business combination and also constitutes a preliminary prospectus with respect to the SMEC securities to be offered in the proposed business combination. The registration statement on Form S-4 has not yet been declared effective and the preliminary joint proxy statement/prospectus is not yet final and will be further amended. Hyde Park and SME will mail a definitive proxy statement/prospectus and related materials to their respective stockholders and unitholders. STOCKHOLDERS OF HYDE PARK, UNITHOLDERS OF SME AND OTHER INTERESTED PERSONS ARE URGED TO READ THE JOINT PROXY STATEMENT/PROSPECTUS AND OTHER RELEVANT DOCUMENTS FILED WITH THE SEC IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED BUSINESS COMBINATION. The definitive joint proxy statement/prospectus will be mailed to stockholders of Hyde Park and unitholders of SME as of a record date to be established for voting on the transaction by SME and Hyde Park, respectively. Stockholders of Hyde Park will also be able to obtain copies of the joint proxy statement/prospectus, without charge, once available, at the SEC’s Internet site at www.sec.gov or by directing a request to: Hyde Park Acquisition Corp. II, 500 Fifth Avenue, 50th Floor, New York, NY, 10110, tel. (212) 644-3450, Attention: Carol Zelinski. Unitholders of SME will also be able to obtain copies of the joint proxy statement/prospectus, without charge, once available, at the SEC’s Internet site at www.sec.gov or by directing a request to: Santa Maria Energy Holdings, LLC, 2811 Airpark Drive, Santa Maria, California, 93455, tel. (805) 938-3320, Attention: Beth Marino.

PARTICIPANTS IN THE SOLICITATION

Hyde Park, SME and their respective directors and officers may be deemed participants in the solicitation of proxies to Hyde Park’s stockholders with respect to the proposed business combination. A list of the names of Hyde Park’s directors and officers and a description of their interests in Hyde Park is contained in Hyde Park’s annual report on Form 10-K for the fiscal year

ended December 31, 2012, which was filed with the SEC, and is also contained in the registration statement on Form S-4 (and the definitive joint proxy statement/prospectus for the proposed business combination) for the special meetings when available. A list of the names of the directors and officers of SME and a description of their interests in SME are contained in the registration statement on Form S-4 (and will be included in the definitive joint proxy statement/prospectus for the proposed business combination) and the other relevant documents filed with the SEC.

FORWARD LOOKING STATEMENTS

This communication may include “forward looking statements.” Forward-looking statements may be identified by the use of words such as “anticipate,” “believe,” “expect,” “estimate,” “plan,” “outlook,” and “project” and other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. Such forward looking statements with respect to revenues, earnings, performance, strategies, prospects and other aspects of the businesses of Hyde Park, SME and the combined company after completion of the proposed business combination are based on current expectations that are subject to risks and uncertainties.

A number of factors could cause actual results or outcomes to differ materially from those indicated by such forward looking statements. These factors include, but are not limited to: (1) the occurrence of any event, change or other circumstances that could give rise to the termination of the merger agreement, (2) the outcome of any legal proceedings that may be instituted against Hyde Park, SME or others relating to the merger agreement and the transactions contemplated thereby; (3) the inability to complete the transactions contemplated by the merger agreement due to the failure to obtain approval of the stockholders of the Hyde Park or the unitholders of SME or to satisfy other conditions to closing in the merger agreement, (4) delays in obtaining, adverse conditions contained in, or the inability to obtain necessary regulatory approvals or complete regulatory reviews, if any, required to complete the transactions contemplated by the merger agreement; (5) the risk that the proposed business combination disrupts current plans and operations as a result of the announcement and consummation of the transactions described herein; (6) the ability to recognize the anticipated benefits of the transactions, which may be affected by, among other things, competition, the ability of the combined company to grow and manage growth profitably, maintain relationships with customers, obtain adequate supply of products and retain its key employees; (7) costs related to the proposed business combination; (8) changes in applicable laws or regulations; (9) the possibility that SME may be adversely affected by other economic, business and/or competitive factors; and (10) other risks and uncertainties indicated from time to time in filings with the SEC by Hyde Park and SMEC, including under the sections “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” and elsewhere in the registration statement on Form S-4 (including the joint proxy statement/prospectus).

Readers are cautioned not to place undue reliance upon any forward-looking statements, which speak only as of the date made, and SMEC, Hyde Park and SME undertake no obligation to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise.

Roadshow Presentation

January 2014

Public Company Disclosures

Additional Information about the Proposed Transactions and Where to Find It

In connection with the proposed transactions, the Company has filed with the SEC a registration statement on Form S-4 that includes a joint proxy statement of Santa Maria Energy and HPAC that also constitutes a prospectus of the Company. Each of HPAC and the Company also plan to file other relevant documents with the SEC regarding the proposed transactions. INVESTORS ARE URGED TO READ THE JOINT PROXY STATEMENT/PROSPECTUS AND OTHER RELEVANT DOCUMENTS FILED WITH THE SEC IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. You may obtain a free copy of the joint proxy statement/prospectus (if and when it becomes available) and other relevant documents filed by the Company and HPAC with the SEC at the SEC’s website at www.sec.gov. You may also obtain these documents by contacting the Company at (805) 938-3320 or via e-mail at bmarino@santamariaenergy.com or by contacting HPAC’s Investor Relations department at (212)-644-3450 or via email at info@hphllc.com.

Participants in the Solicitation

HPAC and Santa Maria Energy and their respective directors and executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies in respect of the proposed transactions. Information regarding the directors and officers of the participants and a description of their direct and indirect interests, by security holdings or otherwise, is contained in the joint proxy statement/prospectus and other relevant materials to be filed with the SEC regarding the proposed transactions when they become available. Investors should read the joint proxy statement/prospectus carefully when it becomes available before making any voting or investment decisions. You may obtain free copies of these documents from HPAC or Santa Maria Energy using the sources indicated above.

This document shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended.

Cautionary Note Regarding Forward-Looking Statements

This Presentation contains forward-looking statements concerning the proposed transactions, their financial and business impact, management’s beliefs and objectives with respect thereto, and management’s current expectations for future operating and financial performance, based on assumptions currently believed to be valid. Forward-looking statements are all statements other than statements of historical facts. The words

“anticipates,” “may,” “can,” “plans,” “believes,” “estimates,” “expects,” “projects,” “intends,” “likely,” “will,” “should,” “to be,” and any similar expressions or other words of similar meaning are intended to identify those assertions as forward-looking statements. It is uncertain whether the events anticipated will transpire, or if they do occur what impact they will have on the results of operations and financial condition of HPAC or Santa Maria Energy. These forward-looking statements involve significant risks and uncertainties that could cause actual results to differ materially from those anticipated, including but not limited to the ability of the parties to satisfy the conditions precedent and consummate the proposed transactions, the timing of consummation of the proposed transactions, the ability of the Company to integrate the acquired operations, the ability to implement the anticipated business plans following closing and achieve anticipated benefits and savings, and the ability to realize opportunities for growth. Other important economic, political, regulatory, legal, technological, competitive and other uncertainties are identified in the documents filed with the SEC by the Company and HPAC from time to time, including their respective Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K. The forward-looking statements included in this Presentation are made only as of the date hereof. Neither HPAC nor Santa Maria Energy undertakes any obligation to update the forward-looking statements included in this Presentation to reflect subsequent events or circumstances.

|

|

Santa Maria Energy Presenters

David Pratt

Santa Maria Energy: Chief Executive Officer and President

Beth Marino

Santa Maria Energy: Executive Vice President, General Counsel and Secretary

Kevin McMillan

Santa Maria Energy: Executive Vice President, Chief Financial Officer and Treasurer

Kevin Yung

Santa Maria Energy: Executive Vice President, Operations

Laurence Levy

Hyde Park Acquisition Corporation: Chief Executive Officer

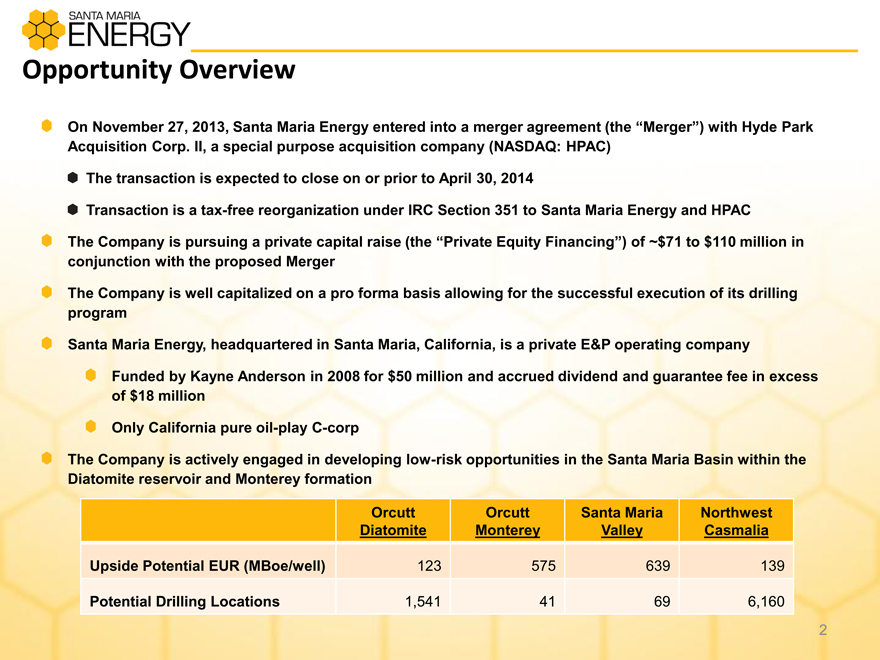

Opportunity Overview

On November 27, 2013, Santa Maria Energy entered into a merger agreement (the “Merger”) with Hyde Park

Acquisition Corp. II, a special purpose acquisition company (NASDAQ: HPAC)

The transaction is expected to close on or prior to April 30, 2014

Transaction is a tax-free reorganization under IRC Section 351 to Santa Maria Energy and HPAC

The Company is pursuing a private capital raise (the “Private Equity Financing”) of ~$71 to $110 million in conjunction with the proposed Merger

The Company is well capitalized on a pro forma basis allowing for the successful execution of its drilling program

Santa Maria Energy, headquartered in Santa Maria, California, is a private E&P operating company

Funded by Kayne Anderson in 2008 for $50 million and accrued dividend and guarantee fee in excess of $18 million

Only California pure oil-play C-corp

The Company is actively engaged in developing low-risk opportunities in the Santa Maria Basin within the Diatomite reservoir and Monterey formation

Orcutt Orcutt Santa Maria Northwest

Diatomite Monterey Valley Casmalia

Upside Potential EUR (MBoe/well) 123 575 639 139

Potential Drilling Locations 1,541 41 69 6,160

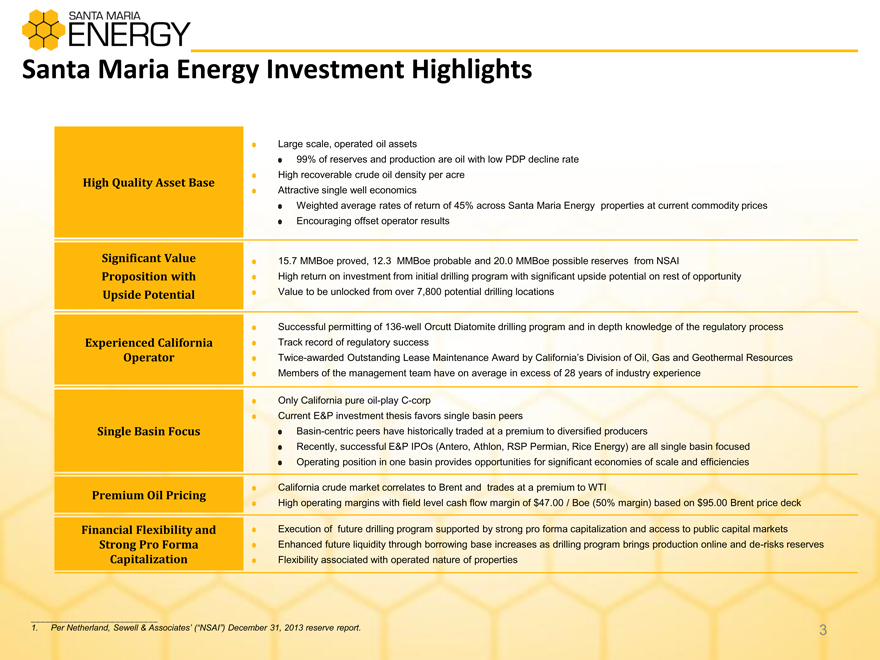

Santa Maria Energy Investment Highlights

High Quality Asset Base

Significant Value Proposition with Upside Potential

Experienced California Operator

Single Basin Focus

Premium Oil Pricing

Financial Flexibility and Strong Pro Forma Capitalization

Large scale, operated oil assets

99% of reserves and production are oil with low PDP decline rate High recoverable crude oil density per acre Attractive single well economics

Weighted average rates of return of 45% across Santa Maria Energy properties at current commodity prices Encouraging offset operator results

15.7 MMBoe proved, 12.3 MMBoe probable and 20.0 MMBoe possible reserves from NSAI

High return on investment from initial drilling program with significant upside potential on rest of opportunity Value to be unlocked from over 7,800 potential drilling locations

Successful permitting of 136-well Orcutt Diatomite drilling program and in depth knowledge of the regulatory process Track record of regulatory success

Twice-awarded Outstanding Lease Maintenance Award by California’s Division of Oil, Gas and Geothermal Resources

Members of the management team have on average in excess of 28 years of industry experience

Only California pure oil-play C-corp

Current E&P investment thesis favors single basin peers

Basin-centric peers have historically traded at a premium to diversified producers

Recently, successful E&P IPOs (Antero, Athlon, RSP Permian, Rice Energy) are all single basin focused Operating position in one basin provides opportunities for significant economies of scale and efficiencies

California crude market correlates to Brent and trades at a premium to WTI

High operating margins with field level cash flow margin of $47.00 / Boe (50% margin) based on $95.00 Brent price deck

Execution of future drilling program supported by strong pro forma capitalization and access to public capital markets

Enhanced future liquidity through borrowing base increases as drilling program brings production online and de-risks reserves Flexibility associated with operated nature of properties

1. Per Netherland, Sewell & Associates’ (“NSAI”) December 31, 2013 reserve report.

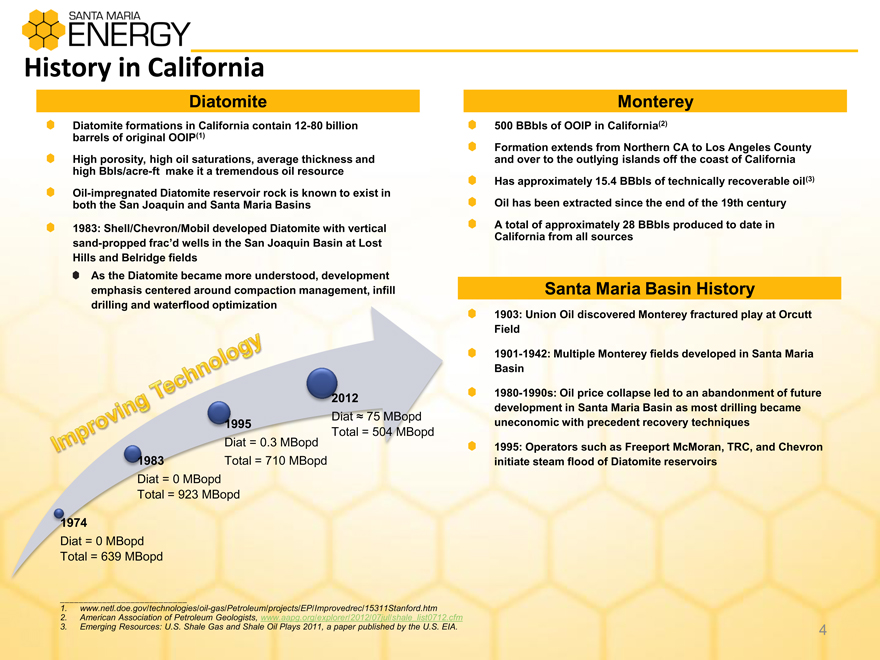

History in California

Diatomite Monterey

Diatomite formations in California contain 12-80 billion barrels of original OOIP(1) High porosity, high oil saturations, average thickness and high Bbls/acre-ft make it a tremendous oil resource

Oil-impregnated Diatomite reservoir rock is known to exist in both the San Joaquin and Santa Maria Basins

1983: Shell/Chevron/Mobil developed Diatomite with vertical sand-propped frac’d wells in the San Joaquin Basin at Lost Hills and Belridge fields As the Diatomite became more understood, development emphasis centered around compaction management, infill drilling and waterflood optimization

500 BBbls of OOIP in California(2)

Formation extends from Northern CA to Los Angeles County and over to the outlying islands off the coast of California

Has approximately 15.4 BBbls of technically recoverable oil(3) Oil has been extracted since the end of the 19th century

A total of approximately 28 BBbls produced to date in California from all sources

Santa Maria Basin History

1903: Union Oil discovered Monterey fractured play at Orcutt Field

1901-1942: Multiple Monterey fields developed in Santa Maria Basin

1980-1990s: Oil price collapse led to an abandonment of future development in Santa Maria Basin as most drilling became uneconomic with precedent recovery techniques

1995: Operators such as Freeport McMoran, TRC, and Chevron initiate steam flood of Diatomite reservoirs

2012

Diat 75 MBopd

Total = 504 MBopd

opd

MBopd

Total = 923 MBopd

Diat = 0 MBopd

Total = 923 MBopd

Diat = 0.3 MBopd

Total = 710 MBopd

1974

Diat = 0 MBopd

Total = 639 MBopd

1. www.netl.doe.gov/technologies/oil-gas/Petroleum/projects/EP/Improvedrec/15311Stanford.htm

2. American Association of Petroleum Geologists, www.aapg.org/explorer/2012/07jul/shale_list0712.cfm

3. Emerging Resources: U.S. Shale Gas and Shale Oil Plays 2011, a paper published by the U.S. EIA.

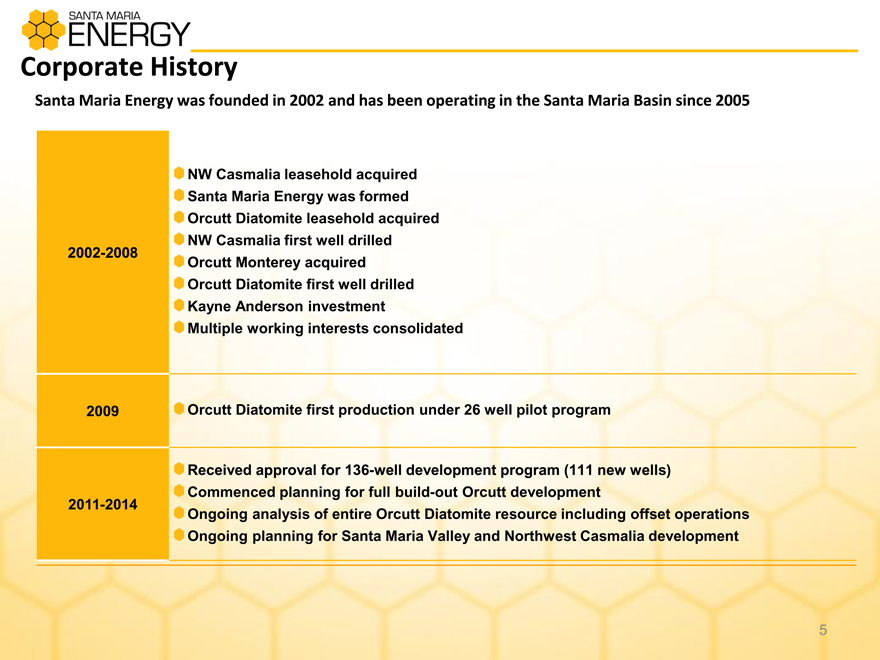

Corporate History

Santa Maria Energy was founded in 2002 and has been operating in the Santa Maria Basin since 2005

2002-2008

2009

2011-2014

NW Casmalia leasehold acquired Santa Maria Energy was formed Orcutt Diatomite leasehold acquired NW Casmalia first well drilled Orcutt Monterey acquired Orcutt Diatomite first well drilled Kayne Anderson investment Multiple working interests consolidated

Orcutt Diatomite first production under 26 well pilot program

Received approval for 136-well development program (111 new wells) Commenced planning for full build-out Orcutt development

Ongoing analysis of entire Orcutt Diatomite resource including offset operations Ongoing planning for Santa Maria Valley and Northwest Casmalia development

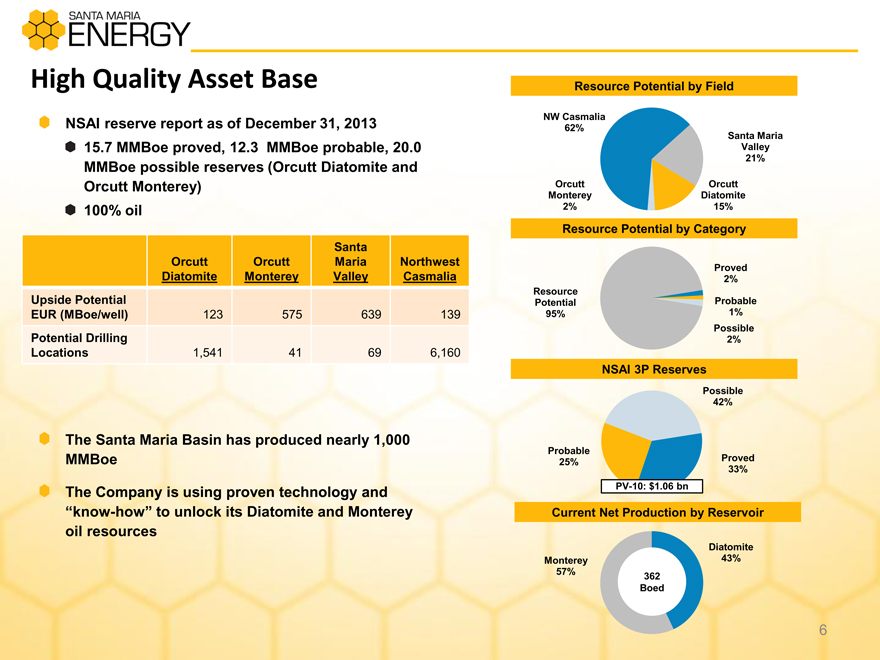

High Quality Asset Base

NSAI reserve report as of December 31, 2013 15.7 MMBoe proved, 12.3 MMBoe probable, 20.0 MMBoe possible reserves (Orcutt Diatomite and Orcutt Monterey) 100% oil

Santa

Orcutt Orcutt Maria Northwest

Diatomite Monterey Valley Casmalia

Upside Potential

EUR (MBoe/well) 123 575 639 139

Potential Drilling

Locations 1,541 41 69 6,160

The Santa Maria Basin has produced nearly 1,000 MMBoe

The Company is using proven technology and

“know-how” to unlock its Diatomite and Monterey oil resources

Resource Potential by Field

NW Casmalia

62%

Santa Maria

Valley

21%

Orcutt Orcutt

Monterey Diatomite

2% 15%

Resource Potential by Category

Proved

2%

Resource

Potential Probable

95% 1%

Possible

2%

NSAI 3P Reserves

Possible

42%

Probable

25% Proved

33%

PV-10: $1.06 bn

Current Net Production by Reservoir

Diatomite

Monterey 43%

57% 362

Boed

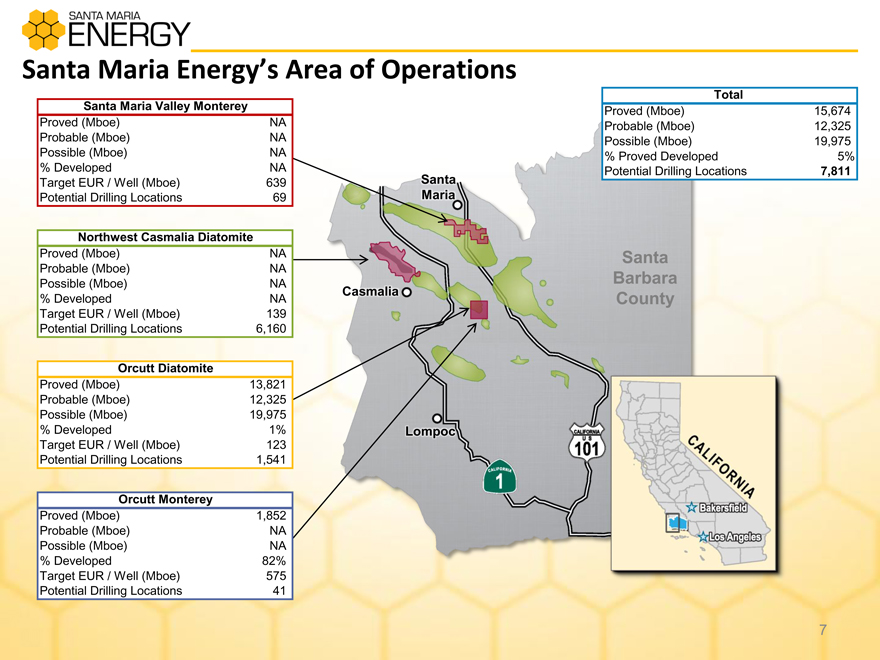

Santa Maria Energy’s Area of Operations

Santa Maria Valley Monterey

Proved (Mboe) NA

Probable (Mboe) NA

Possible (Mboe) NA

% Developed NA

Target EUR / Well (Mboe) 639

Potential Drilling Locations 69

Northwest Casmalia Diatomite

Proved (Mboe) NA

Probable (Mboe) NA

Possible (Mboe) NA

% Developed NA

Target EUR / Well (Mboe) 139

Potential Drilling Locations 6,160

Orcutt Diatomite

Proved (Mboe) 13,821

Probable (Mboe) 12,325

Possible (Mboe) 19,975

% Developed 1%

Target EUR / Well (Mboe) 123

Potential Drilling Locations 1,541

Orcutt Monterey

Proved (Mboe) 1,852

Probable (Mboe) NA

Possible (Mboe) NA

% Developed 82%

Target EUR / Well (Mboe) 575

Potential Drilling Locations 41

Santa Maria

Casmalia

Lompoc

Total

Proved (Mboe) 15,674

Probable (Mboe) 12,325

Possible (Mboe) 19,975

% Proved Developed 5%

Potential Drilling Locations 7,811

Santa Barbara County

7

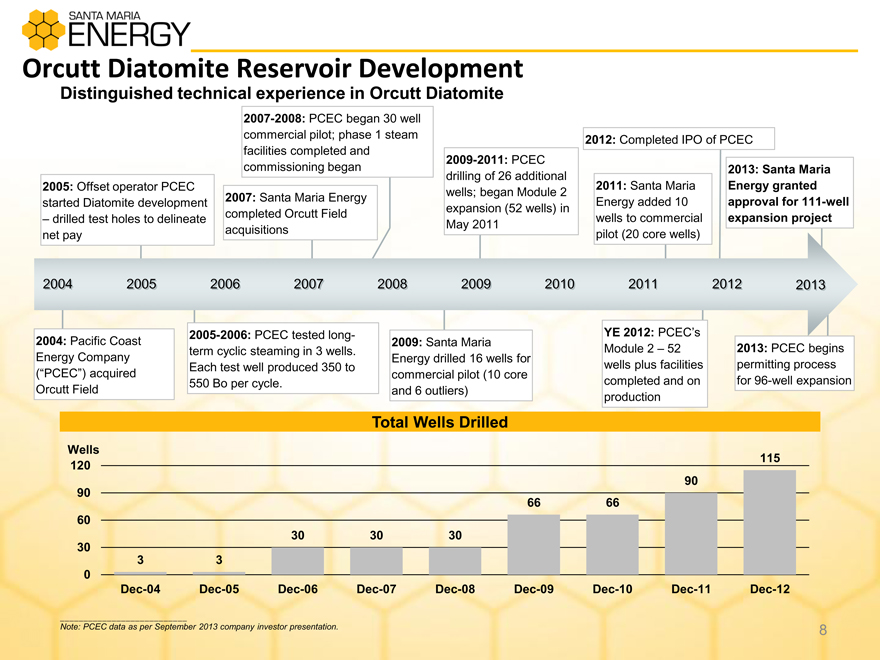

Orcutt Diatomite Reservoir Development

Distinguished technical experience in Orcutt Diatomite

2007-2008: PCEC began 30 well commercial pilot; phase 1 steam facilities completed and commissioning began

2012: Completed IPO of PCEC

2005: Offset operator PCEC started Diatomite development – drilled test holes to delineate net pay

2007: Santa Maria Energy completed Orcutt Field acquisitions

2009-2011: PCEC drilling of 26 additional wells; began Module 2 expansion (52 wells) in May 2011

2011: Santa Maria Energy added 10 wells to commercial pilot (20 core wells)

2013: Santa Maria Energy granted approval for 111-well expansion project

2004 2005 2006 2007 2008 2009 2010 2011 2012 2013

2004: Pacific Coast Energy Company

(“PCEC”) acquired

Orcutt Field

2005-2006: PCEC tested long-term cyclic steaming in 3 wells. Each test well produced 350 to 550 Bo per cycle.

2009: Santa Maria

Energy drilled 16 wells for commercial pilot (10 core and 6 outliers)

YE 2012: PCEC’s

Module 2 – 52 wells plus facilities completed and on production

2013: PCEC begins permitting process for 96-well expansion

Total Wells Drilled

Wells

120 115

90

90

66 66

60

30 30 30

30

0

Dec-04 Dec-05 Dec-06 Dec-07 Dec-08 Dec-09 Dec-10 Dec-11 Dec-12

Note: PCEC data as per September 2013 company investor presentation.

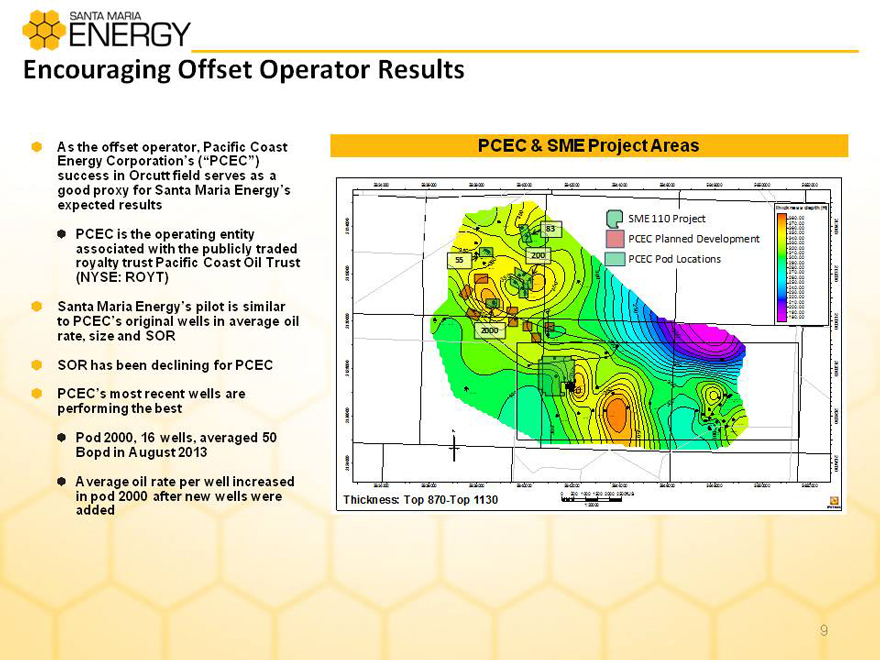

Encouraging Offset Operator Results

As the offset operator, Pacific Coast

Energy Corporation’s (“PCEC”) success in Orcutt field serves as a good proxy for Santa Maria Energy’s expected results

PCEC is the operating entity associated with the publicly traded royalty trust Pacific Coast Oil Trust (NYSE: ROYT)

Santa Maria Energy’s pilot is similar to PCEC’s original wells in average oil rate, size and SOR

SOR has been declining for PCEC

PCEC’s most recent wells are performing the best

Pod 2000, 16 wells, averaged 50 Bopd in August 2013

Average oil rate per well increased in pod 2000 after new wells were added

PCEC & SME Project Areas

5834000 5836000 5838000 5840000 5842000 5844000 5846000 5848000 5850000 5852000

Thickness depth [ft]

350 SME 110 Project 380.00

370.00

290.00 83 360.00

322.00 334.00 350.00 2134000

297.08 PCEC Planned Development 330.00 340.00

350 351.00 320.00

310.00

330.42

343.48

55 344.00 350 200 PCEC Pod Locations 290.00 300.00

341.00 280.00

270.00

260.00

350 359.92322.24 300 250.00 2132000

363.35

327.00 350 325.00 240.00

347.00 230.00

353.00 220.00

210.00

373.00 375.00 250 200.00

190.00

333.00350 180.00

290.00 301.00 336.00 2130000

2000 200

307.00 300

289.76

322.00

337.71

350 250 214.00 2128000

303.46

301.00

366.00 300

348.00

327.341.003400.00

305.00 330.00342.370.0 00 327.00350

300 341.370.0 00

368.00

311.00300.00

300 339.00 297.00

292.00 312.00

377.00

343.00 350.00 270.00 327.00

317.00 324.00 306.00

301.00 2126000

318.00

314.00 299.00 327.00

307.00

269.00 316.330.0000

300 350 300295.00 304.00

2124000

5834000 5836000 5838000 5840000 5842000 5844000 5846000 5848000 5850000 5852000

0 500 1000 1500 2000 2500ftUS

Thickness: Top 870-Top 1130

1:20000

9

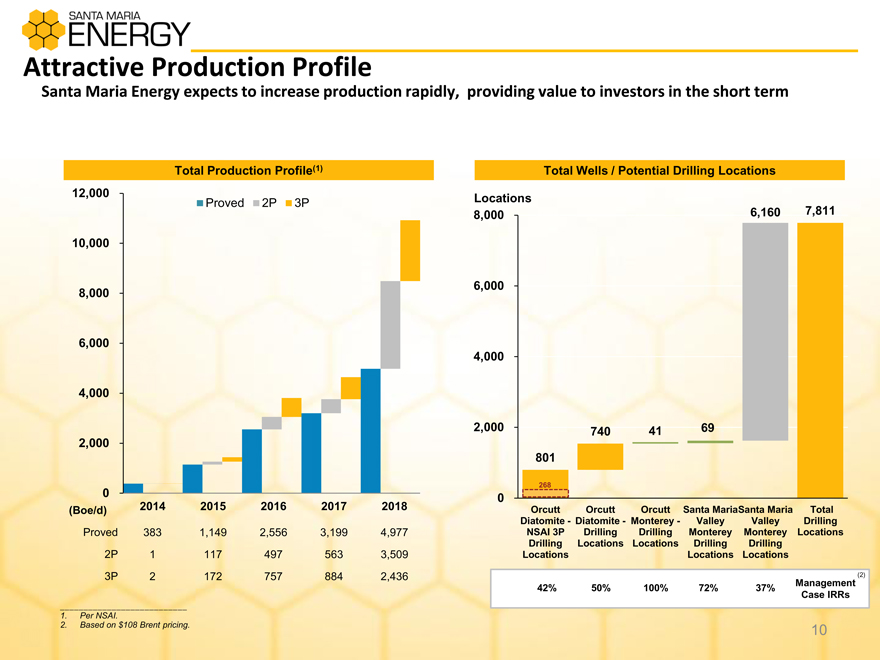

Attractive Production Profile

Santa Maria Energy expects to increase production rapidly, providing value to investors in the short term

Total Production Profile(1)

12,000

Proved 2P 3P

10,000

8,000

6,000

4,000

2,000

0

(Boe/d) 2014 2015 2016 2017 2018

Proved 383 1,149 2,556 3,199 4,977

2P 1 117 497 563 3,509

3P 2 172 757 884 2,436

Total Wells / Potential Drilling Locations

Locations

8,000 6,160 7,811

6,000

4,000

2,000 740 41 69

801

268

0

Orcutt Orcutt Orcutt Santa MariaSanta Maria Total

Diatomite—Diatomite—Monterey— Valley Valley Drilling

NSAI 3P Drilling Drilling Monterey Monterey Locations

Drilling Locations Locations Drilling Drilling

Locations Locations Locations

42% 50% 100% 72% 37% Management

Case IRRs

1. Per NSAI.

2. Based on $108 Brent pricing.

10

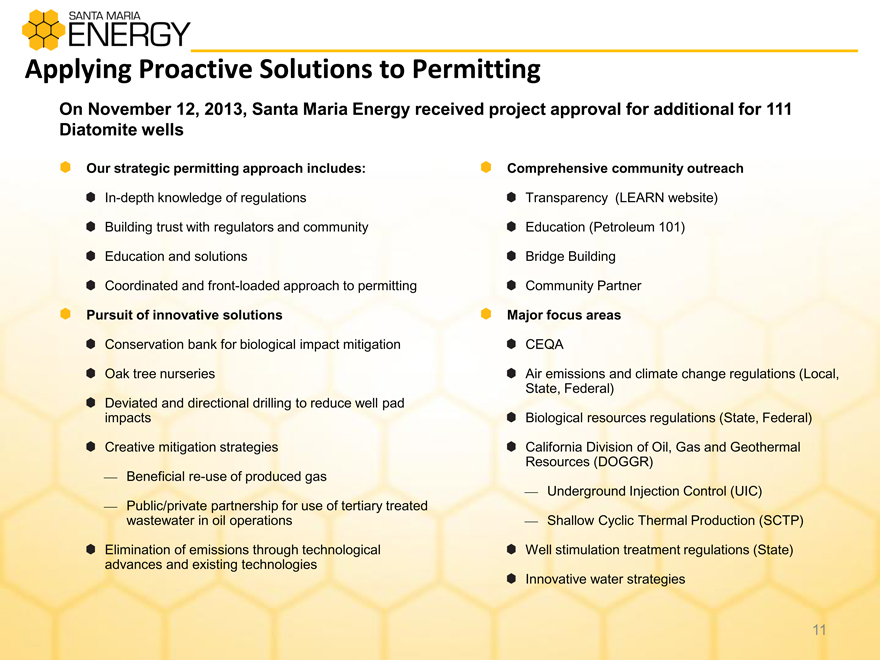

Applying Proactive Solutions to Permitting

On November 12, 2013, Santa Maria Energy received project approval for additional for 111 Diatomite wells

Our strategic permitting approach includes: Comprehensive community outreach

In-depth knowledge of regulations Transparency (LEARN website)

Building trust with regulators and community Education (Petroleum 101)

Education and solutions Bridge Building

Coordinated and front-loaded approach to permitting Community Partner

Pursuit of innovative solutions Major focus areas

Conservation bank for biological impact mitigation CEQA

Oak tree nurseries Air emissions and climate change regulations (Local,

State, Federal)

Deviated and directional drilling to reduce well pad

impacts Biological resources regulations (State, Federal)

Creative mitigation strategies California Division of Oil, Gas and Geothermal

Resources (DOGGR)

Beneficial re-use of produced gas

Underground Injection Control (UIC)

Public/private partnership for use of tertiary treated

wastewater in oil operations Shallow Cyclic Thermal Production (SCTP)

Elimination of emissions through technological Well stimulation treatment regulations (State)

advances and existing technologies

Innovative water strategies

11

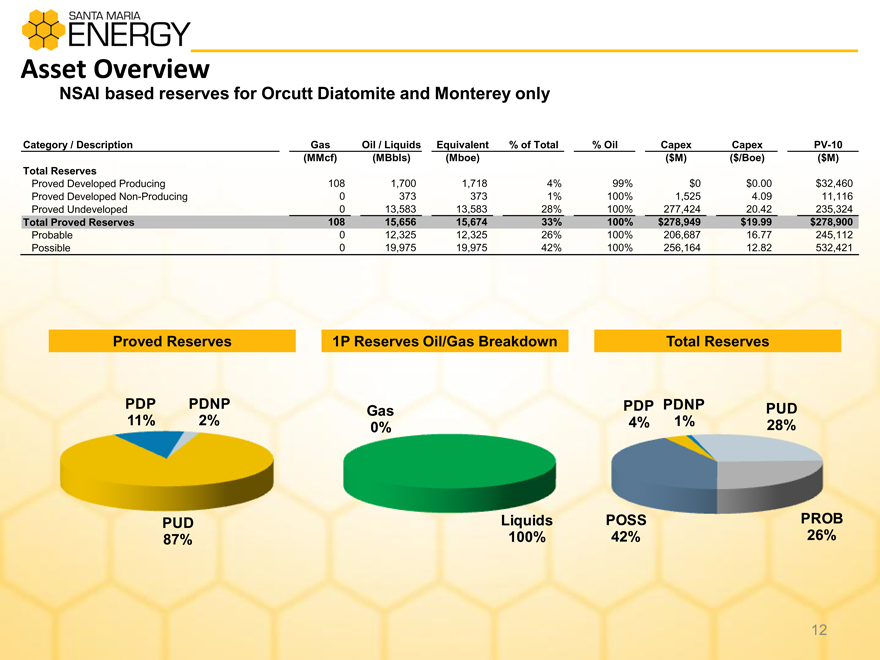

Asset Overview

Asset Overview

NSAI based reserves for Orcutt Diatomite and Monterey only

Category / Description Gas Oil / Liquids Equivalent % of Total % Oil Capex Capex PV-10

(MMcf) (MBbls) (Mboe) ($M) ($/Boe) ($M)

Total Reserves

Proved Developed Producing 108 1,700 1,718 4% 99% $0 $0.00 $32,460

Proved Developed Non-Producing 0 373 373 1% 100% 1,525 4.09 11,116

Proved Undeveloped 0 13,583 13,583 28% 100% 277,424 20.42 235,324

Total Proved Reserves 108 15,656 15,674 33% 100% $278,949 $19.99 $278,900

Probable 0 12,325 12,325 26% 100% 206,687 16.77 245,112

Possible 0 19,975 19,975 42% 100% 256,164 12.82 532,421

Proved Reserves 1P Reserves Oil/Gas Breakdown Total Reserves

PDP PDNP Gas PDP PDNP PUD

11% 2% 0% 4% 1% 28%

Liquids POSS PROB

100% 42% 26%

12

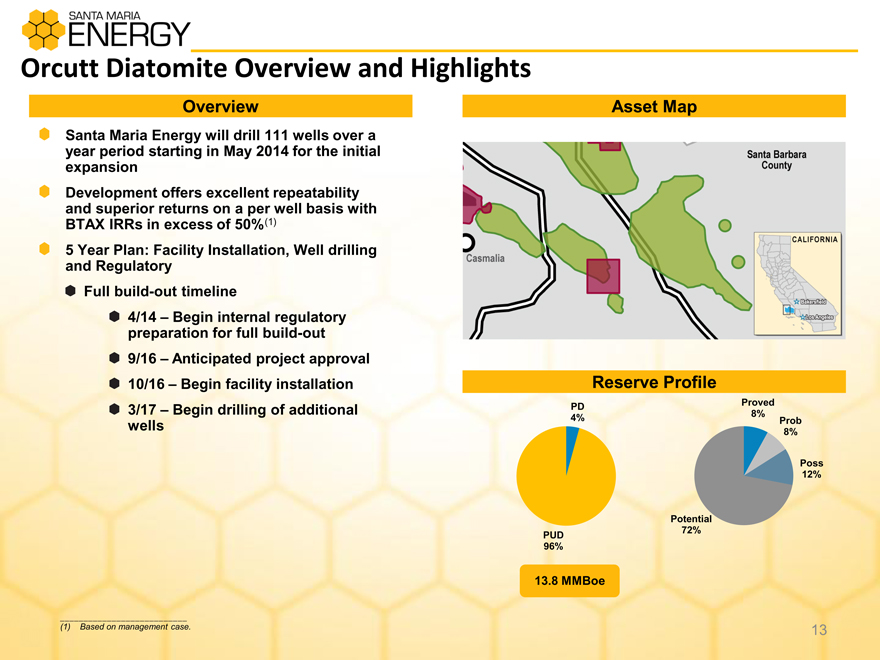

Orcutt Diatomite Overview and Highlights

Overview

Santa Maria Energy will drill 111 wells over a year period starting in May 2014 for the initial expansion Development offers excellent repeatability and superior returns on a per well basis with BTAX IRRs in excess of 50% (1)

5 Year Plan: Facility Installation, Well drilling and Regulatory Full build-out timeline 4/14 – Begin internal regulatory preparation for full build-out 9/16 – Anticipated project approval 10/16 – Begin facility installation 3/17 – Begin drilling of additional wells

Asset Map

Reserve Profile

PD Proved

4% 8% Prob

8%

Poss

12%

Potential

PUD 72%

96%

13.8 MMBoe

(1) Based on management case.

13

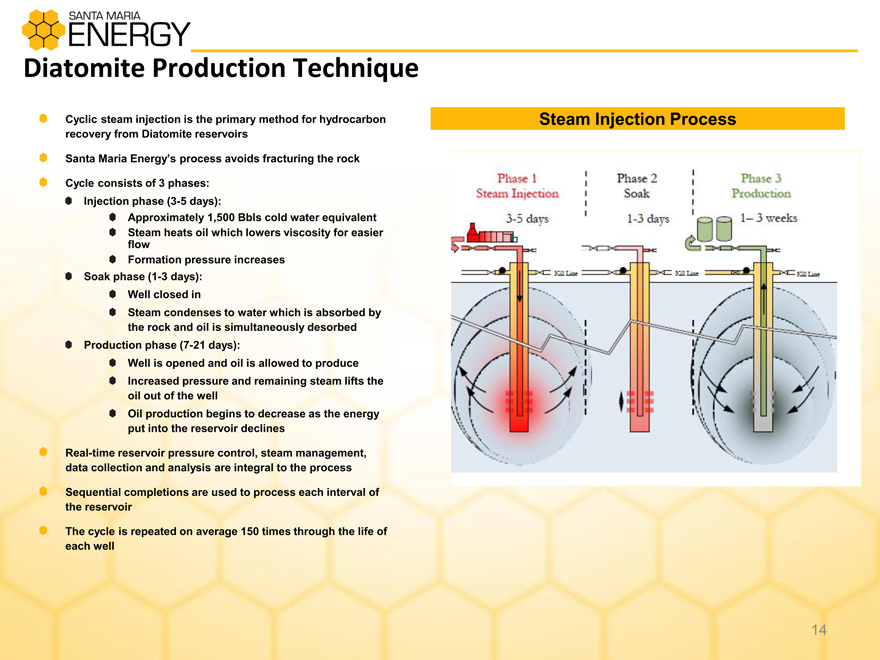

Diatomite Production Technique

Cyclic steam injection is the primary method for hydrocarbon recovery from Diatomite reservoirs

Santa Maria Energy’s process avoids fracturing the rock

Cycle consists of 3 phases: Injection phase (3-5 days):

Approximately 1,500 Bbls cold water equivalent Steam heats oil which lowers viscosity for easier flow Formation pressure increases Soak phase (1-3 days): Well closed in Steam condenses to water which is absorbed by the rock and oil is simultaneously desorbed Production phase (7-21 days): Well is opened and oil is allowed to produce Increased pressure and remaining steam lifts the oil out of the well Oil production begins to decrease as the energy put into the reservoir declines

Real-time reservoir pressure control, steam management, data collection and analysis are integral to the process

Sequential completions are used to process each interval of the reservoir

The cycle is repeated on average 150 times through the life of each well

Steam Injection Process

14

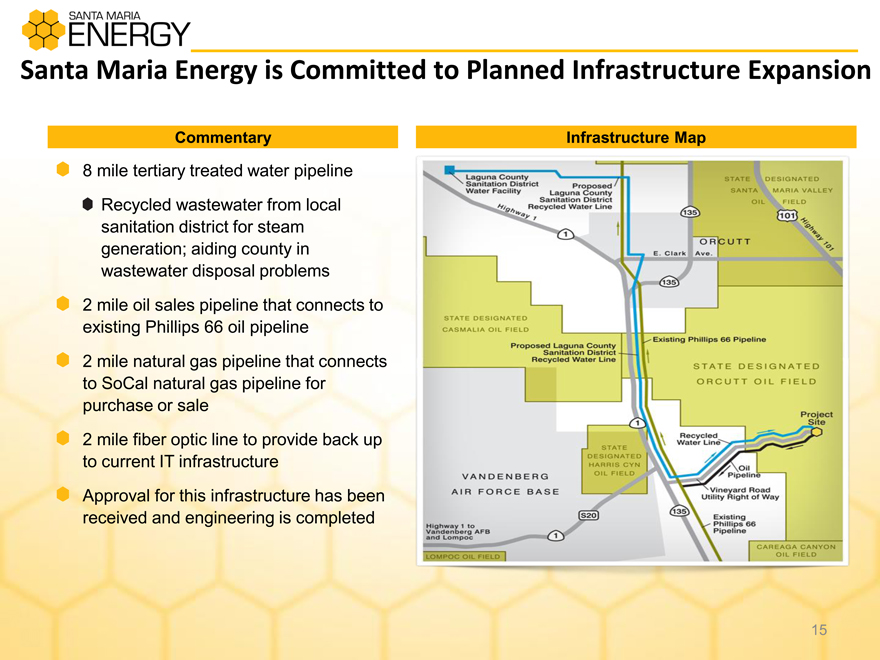

Santa Maria Energy is Committed to Planned Infrastructure Expansion

Commentary

8 | | mile tertiary treated water pipeline |

Recycled wastewater from local sanitation district for steam generation; aiding county in wastewater disposal problems

2 | | mile oil sales pipeline that connects to existing Phillips 66 oil pipeline |

2 | | mile natural gas pipeline that connects to SoCal natural gas pipeline for purchase or sale |

2 | | mile fiber optic line to provide back up to current IT infrastructure |

Approval for this infrastructure has been received and engineering is completed

Infrastructure Map

15

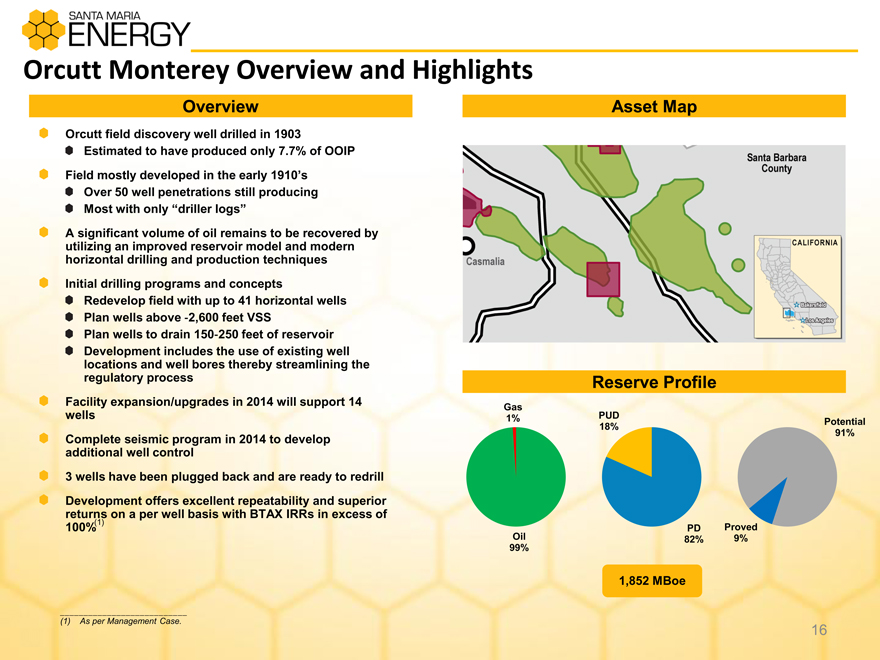

Orcutt Monterey Overview and Highlights

Overview

Orcutt field discovery well drilled in 1903

Estimated to have produced only 7.7% of OOIP

Field mostly developed in the early 1910’s

Over 50 well penetrations still producing

Most with only “driller logs”

A significant volume of oil remains to be recovered by utilizing an improved reservoir model and modern horizontal drilling and production techniques

Initial drilling programs and concepts

Redevelop field with up to 41 horizontal wells

Plan wells above - 2,600 feet VSS

Plan wells to drain - 150250 feet of reservoir Development includes the use of existing well locations and well bores thereby streamlining the regulatory process

Facility expansion/upgrades in 2014 will support 14 wells

Complete seismic program in 2014 to develop additional well control

3 | | wells have been plugged back and are ready to redrill |

Development offers excellent repeatability and superior returns (1) on a per well basis with BTAX IRRs in excess of 100%

Asset Map

Reserve Profile

Gas

1% PUD Potential

18% 91%

PD Proved

Oil 82% 9%

99%

1,852 MBoe

(1) As per Management Case.

16

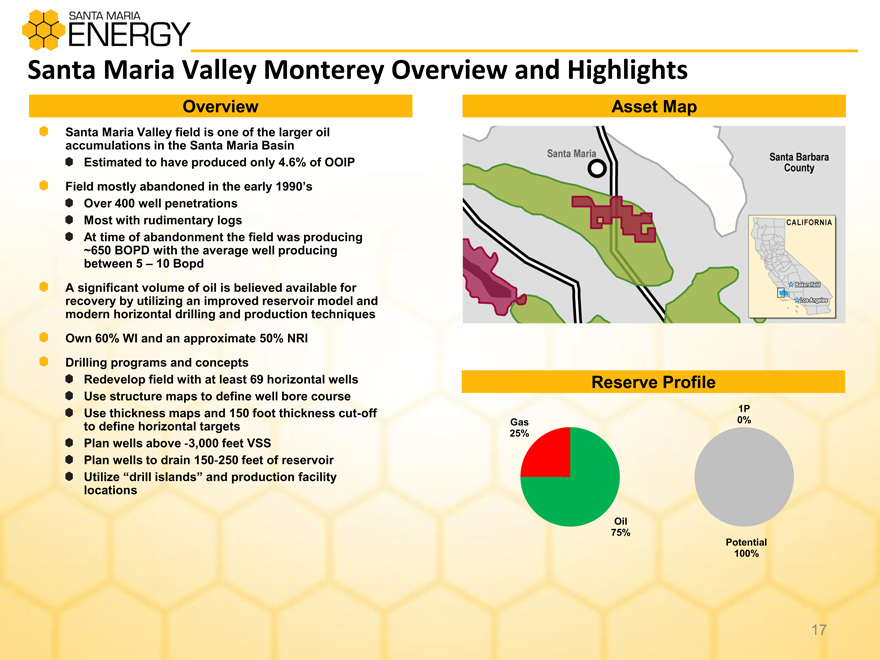

Santa Maria Valley Monterey Overview and Highlights

Overview

Santa Maria Valley field is one of the larger oil accumulations in the Santa Maria Basin Estimated to have produced only 4.6% of OOIP

Field mostly abandoned in the early 1990’s

Over 400 well penetrations Most with rudimentary logs

At time of abandonment the field was producing ~650 BOPD with the average well producing between 5 – 10 Bopd

A significant volume of oil is believed available for recovery by utilizing an improved reservoir model and modern horizontal drilling and production techniques

Own 60% WI and an approximate 50% NRI

Drilling programs and concepts

Redevelop field with at least 69 horizontal wells Use structure maps to define well bore course Use thickness maps and 150 foot thickness cut-off to define horizontal targets Plan wells above - 3,000 feet VSS

Plan wells to drain 150 - 250 feet of reservoir

Utilize “drill islands” and production facility locations

Asset Map

Reserve Profile

1P

Gas 0%

25%

Oil

75%

Potential

100%

17

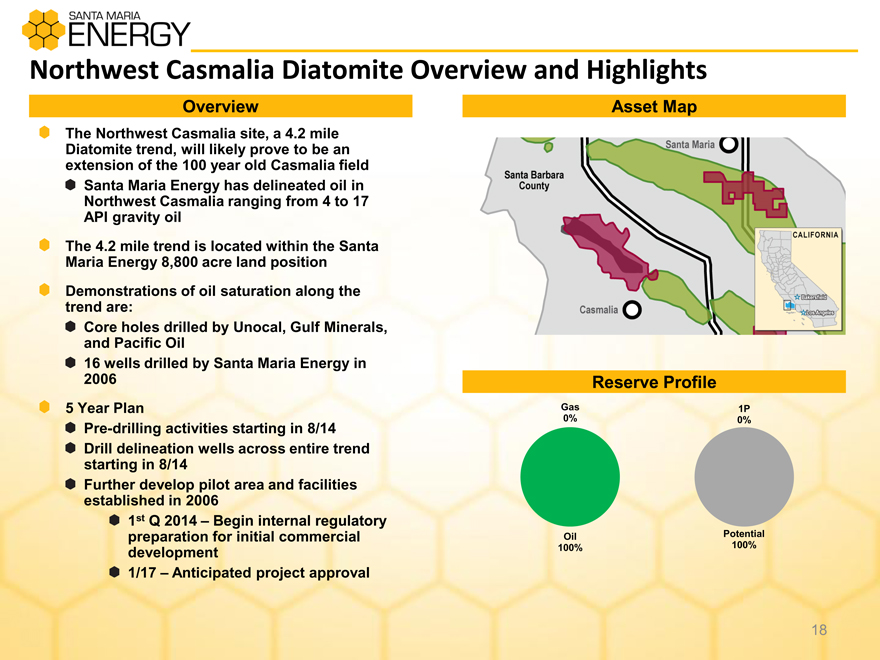

Northwest Casmalia Diatomite Overview and Highlights

Overview

The Northwest Casmalia site, a 4.2 mile Diatomite trend, will likely prove to be an extension of the 100 year old Casmalia field Santa Maria Energy has delineated oil in Northwest Casmalia ranging from 4 to 17 API gravity oil

The 4.2 mile trend is located within the Santa Maria Energy 8,800 acre land position

Demonstrations of oil saturation along the trend are: Core holes drilled by Unocal, Gulf Minerals, and Pacific Oil 16 wells drilled by Santa Maria Energy in 2006

Pre-drilling activities starting in 8/14 Drill delineation wells across entire trend starting in 8/14 Further develop pilot area and facilities established in 2006 1st Q 2014 – Begin internal regulatory preparation for initial commercial development 1/17 – Anticipated project approval

Asset Map

Reserve Profile

Gas 1P

0% 0%

Oil Potential

100% 100%

18

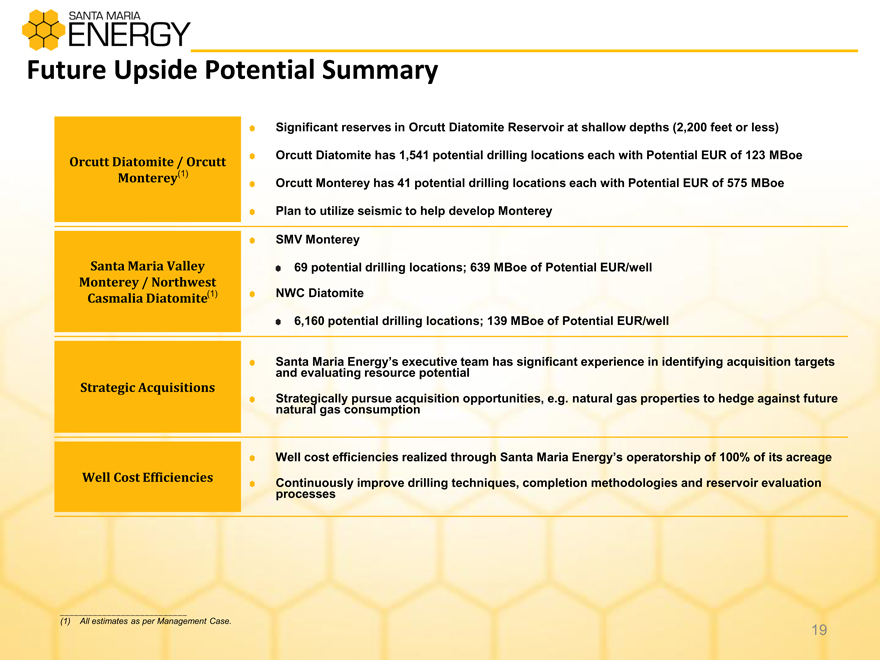

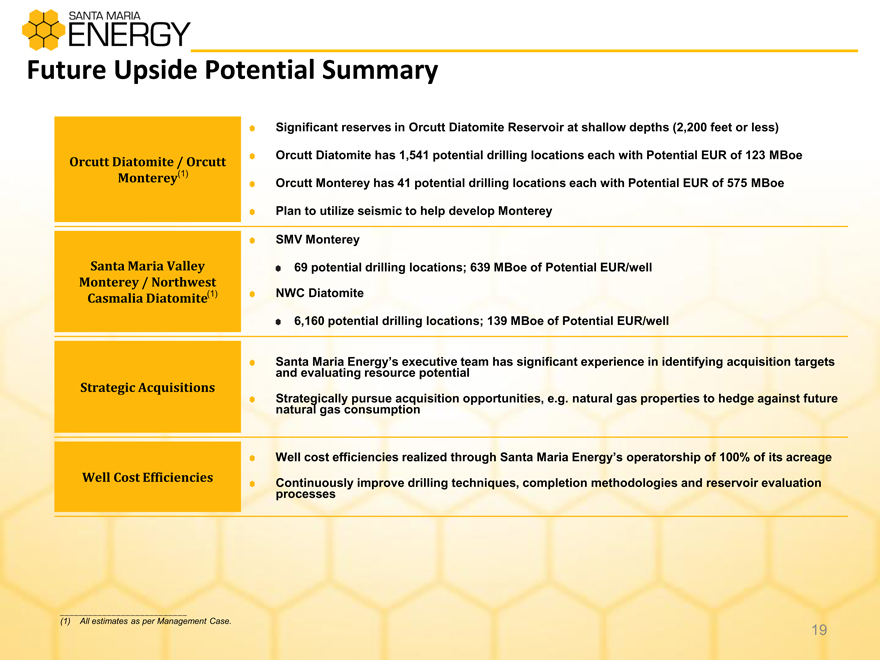

Future Upside Potential Summary

Significant reserves in Orcutt Diatomite Reservoir at shallow depths (2,200 feet or less)

Orcutt Diatomite / Orcutt Orcutt Diatomite has 1,541 potential drilling locations each with Potential EUR of 123 MBoe

Monterey(1) Orcutt Monterey has 41 potential drilling locations each with Potential EUR of 575 MBoe

Plan to utilize seismic to help develop Monterey

SMV Monterey

Santa Maria Valley 69 potential drilling locations; 639 MBoe of Potential EUR/well

Monterey / Northwest

Casmalia Diatomite(1) NWC Diatomite

6,160 potential drilling locations; 139 MBoe of Potential EUR/well

Santa Maria Energy’s executive team has significant experience in identifying acquisition targets

and evaluating resource potential

Strategic Acquisitions

Strategically pursue acquisition opportunities, e.g. natural gas properties to hedge against future

natural gas consumption

Well cost efficiencies realized through Santa Maria Energy’s operatorship of 100% of its acreage

Well Cost Efficiencies Continuously improve drilling techniques, completion methodologies and reservoir evaluation

processes

(1) | | All estimates as per Management Case. |

19

Financial Overview

Focus on highest return projects All production inputs are engineered Preserve financial strength

Ensure plenty of capital availability to execute drilling program

Keep strong balance sheet to remain flexible / take advantage of acquisition opportunities Target long-term Debt / EBITDA at or less than 3.5x Active hedging program Designed to protect cash flows Allows Santa Maria Energy’s core drilling program to remain intact

20

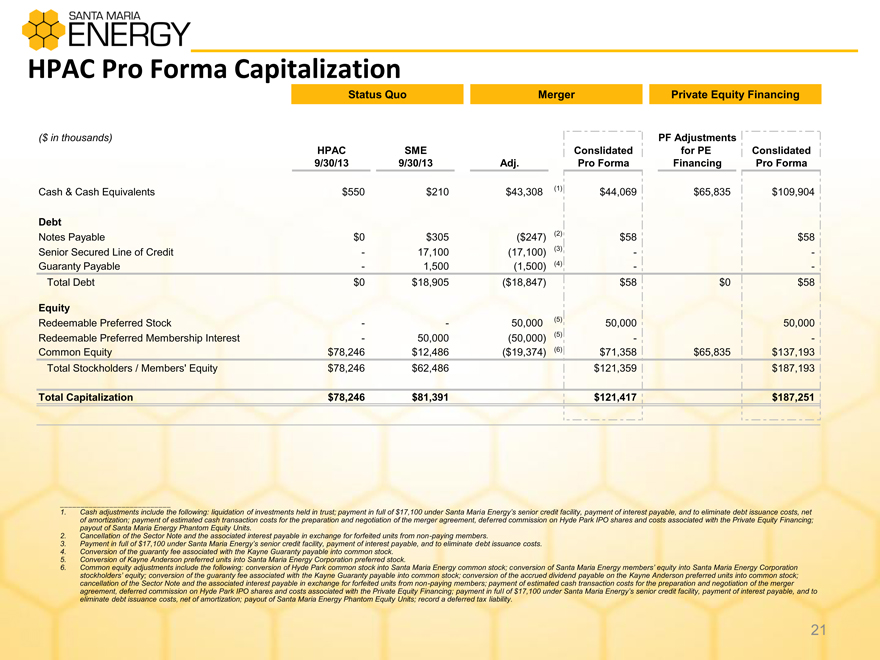

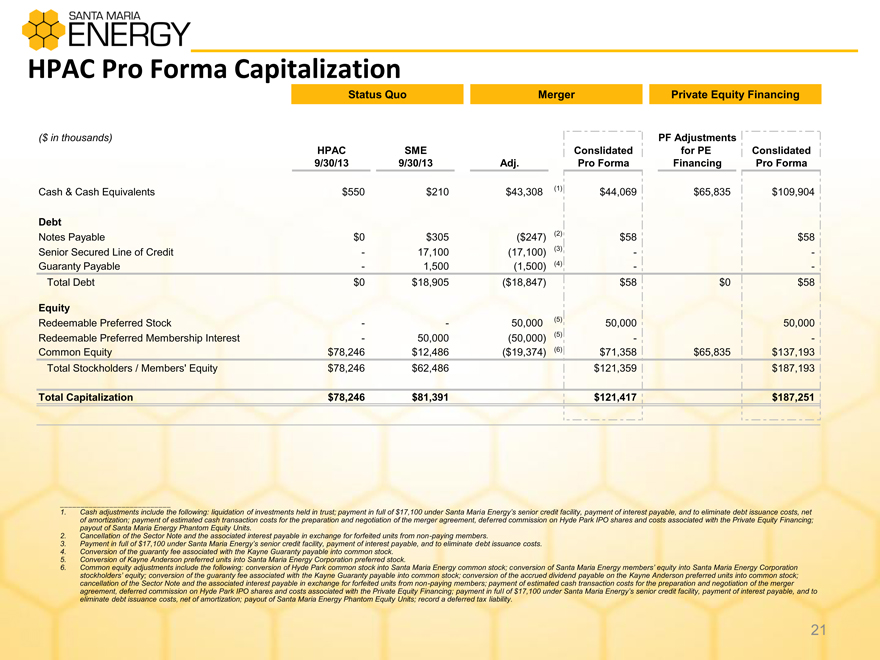

HPAC Pro Forma Capitalization

Status Quo Merger Private Equity Financing

($ in thousands) PF Adjustments

HPAC SME Conslidated for PE Conslidated

9/30/13 9/30/13 Adj. Pro Forma Financing Pro Forma

Cash & Cash Equivalents $550 $210 $43,308 (1) $44,069 $65,835 $109,904

Debt

Notes Payable $0 $305 ($247) (2) $58 $58

Senior Secured Line of Credit — 17,100 (17,100) (3) — -

Guaranty Payable — 1,500 (1,500) (4) — -

Total Debt $0 $18,905 ($18,847) $58 $0 $58

Equity

Redeemable Preferred Stock —— 50,000 (5) 50,000 50,000

Redeemable Preferred Membership Interest — 50,000 (50,000) (5) — -

Common Equity $78,246 $12,486 ($19,374) (6) $71,358 $65,835 $137,193

Total Stockholders / Members’ Equity $78,246 $62,486 $121,359 $187,193

Total Capitalization $78,246 $81,391 $121,417 $187,251

Cash adjustments include the following: liquidation of investments held in trust; payment in full of $17,100 under Santa Maria Energy’s senior credit facility, payment of interest payable, and to eliminate debt issuance costs, net of amortization; payment of estimated cash transaction costs for the preparation and negotiation of the merger agreement, deferred commission on Hyde Park IPO shares and costs associated with the Private Equity Financing; payout of Santa Maria Energy Phantom Equity Units.

Cancellation of the Sector Note and the associated interest payable in exchange for forfeited units from non-paying members.

Payment in full of $17,100 under Santa Maria Energy’s senior credit facility, payment of interest payable, and to eliminate debt issuance costs.

Conversion of the guaranty fee associated with the Kayne Guaranty payable into common stock.

Conversion of Kayne Anderson preferred units into Santa Maria Energy Corporation preferred stock.

Common equity adjustments include the following: conversion of Hyde Park common stock into Santa Maria Energy common stock; conversion of Santa Maria Energy members’ equity into Santa Maria Energy Corporation stockholders’ equity; conversion of the guaranty fee associated with the Kayne Guaranty payable into common stock; conversion of the accrued dividend payable on the Kayne Anderson preferred units into common stock; cancellation of the Sector Note and the associated interest payable in exchange for forfeited units from non-paying members; payment of estimated cash transaction costs for the preparation and negotiation of the merger agreement, deferred commission on Hyde Park IPO shares and costs associated with the Private Equity Financing; payment in full of $17,100 under Santa Maria Energy’s senior credit facility, payment of interest payable, and to eliminate debt issuance costs, net of amortization; payout of Santa Maria Energy Phantom Equity Units; record a deferred tax liability.

21

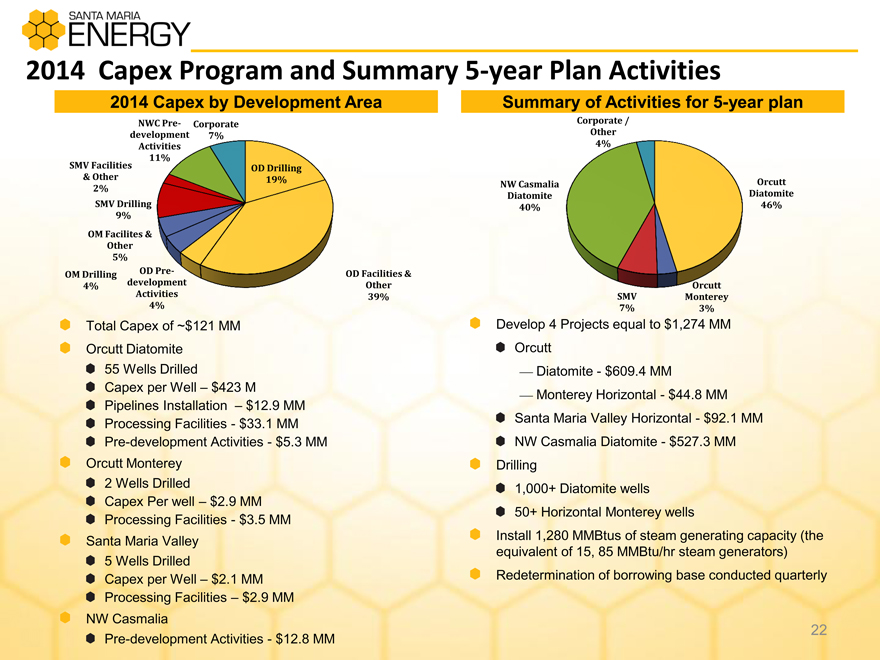

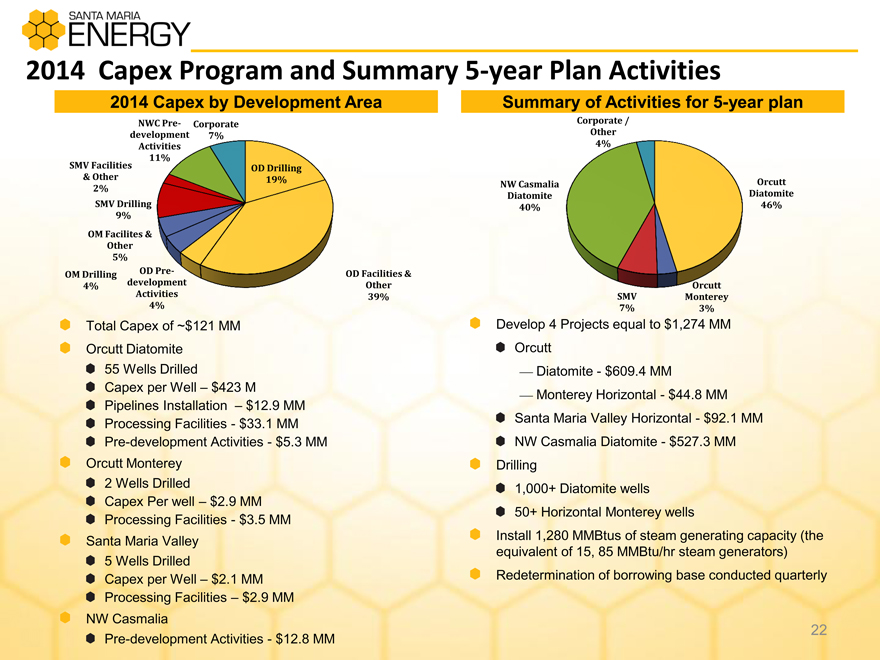

2014 Capex Program and Summary 5-year Plan Activities

2014 Capex by Development Area Summary of Activities for 5-year plan

NWC Pre- Corporate Corporate /

development 7% Other

Activities 4%

11%

SMV Facilities OD Drilling

& Other 2% 19% NW Casmalia Orcutt

Diatomite Diatomite

SMV Drilling 40% 46%

9%

OM Facilites &

Other

5%

OM Drilling OD Pre- OD Facilities &

4% development Other Orcutt

Activities 39% SMV Monterey

4% 7% 3%

Total Capex of ~$121 MM Orcutt Diatomite

55 Wells Drilled

Capex per Well – $423 M

Pipelines Installation – $12.9 MM Processing Facilities—$33.1 MM Pre-development Activities—$5.3 MM

Orcutt Monterey

Capex Per well – $2.9 MM Processing Facilities—$3.5 MM

Santa Maria Valley

Capex per Well – $2.1 MM Processing Facilities – $2.9 MM

NW Casmalia

Pre-development Activities—$12.8 MM

Develop 4 Projects equal to $1,274 MM

Orcutt

Diatomite—$609.4 MM

Monterey Horizontal—$44.8 MM

Santa Maria Valley Horizontal—$92.1 MM

NW Casmalia Diatomite—$527.3 MM

Drilling

1,000+ Diatomite wells

50+ Horizontal Monterey wells

Install 1,280 MMBtus of steam generating capacity (the

equivalent of 15, 85 MMBtu/hr steam generators)

Redetermination of borrowing base conducted quarterly

22

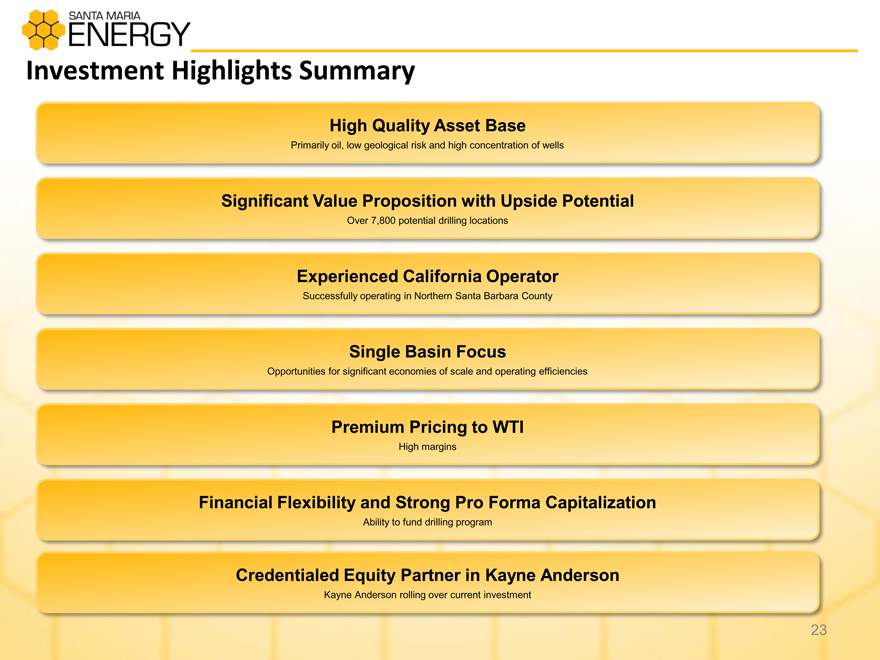

Investment Highlights Summary

High Quality Asset Base

Primarily oil, low geological risk and high concentration of wells

Significant Value Proposition with Upside Potential

Over 7,800 potential drilling locations

Experienced California Operator

Successfully operating in Northern Santa Barbara County

Single Basin Focus

Opportunities for significant economies of scale and operating efficiencies

Premium Pricing to WTI

High margins

Financial Flexibility and Strong Pro Forma Capitalization

Ability to fund drilling program

Credentialed Equity Partner in Kayne Anderson

Kayne Anderson rolling over current investment

23

Appendix

Experienced Management Team

Santa Maria Energy’s operational, legal and technical management personnel have on average 28 years of relevant experience

MANAGEMENT TEAM

DAVID PRATT 30+ years of extensive transaction, management and executive experience with

Chief Executive Officer and public and private companies working on domestic and international projects

President in the upstream oil and gas industry

KEVIN MCMILLAN

Executive Vice President, 30+ years of experience with United Meridian, other independents and public

accounting, with a focus on both domestic and international financial

Chief Financial Officer transactions

& Treasurer

KEVIN YUNG 15+ years of process and production engineering as well as project

Executive Vice President, management and facilities design of both thermal E&P projects and

Operations manufacturing processes

BETH MARINO 16+ years of legal experience working with a wide range of clients with focus

Executive Vice President, on regulatory, financing, business transactions, mergers & acquisitions,

General Counsel compliance and general corporate matters

& Secretary

RAMON ELIAS 35+ years in petroleum industry with Texaco, Pemex, and others, specializing

in thermal operations; lead inventor on patents for production of oil from

Vice President – Reservoir shallow formations and expert in the steaming techniques vital to oil recovery

Engineering involving Diatomite

24

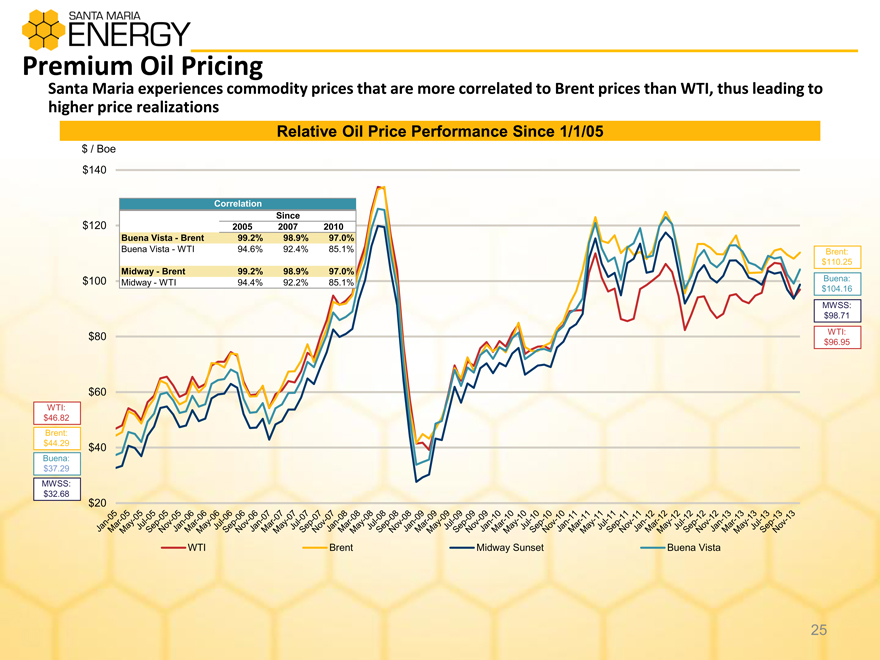

Premium Oil Pricing

Santa Maria experiences commodity prices that are more correlated to Brent prices than WTI, thus leading to higher price realizations

Relative Oil Price Performance Since 1/1/05

$ / Boe

$140

Correlation

Since

$120 2005 2007 2010

Buena Vista - Brent 99.2% 98.9% 97.0%

Buena Vista - WTI 94.6% 92.4% 85.1% Brent:

$110.25

Midway - Brent 99.2% 98.9% 97.0%

$100 Midway - WTI 94.4% 92.2% 85.1% Buena:

$104.16

MWSS:

$98.71

$80 WTI:

$96.95

$60

WTI:

$46.82

Brent:

$44.29 $40

Buena:

$37.29

MWSS:

$32.68

$20

WTI Brent Midway Sunset Buena Vista

Jan-05 Mar-05 May-05 Jul-05 Sep-05 Nov-05

Jan-06 Mar-06 May-06 Jul-06 Sep-06 Nov-06

Jan-07 Mar-07 May-07 Jul-07 Sep-07 Nov-07

Jan-08 Mar-08 May-08 Jul-08 Sep-08 Nov-08

Jan-09 Mar-09 May-09 Jul-09 Sep-09 Nov-09

Jan-10 Mar-10 May-10 Jul-10 Sep-10 Nov-10

Jan-11 Mar-11 May-11 Jul-11 Sep-11 Nov-11

Jan-12 Mar-12 May-12 Jul-12 Sep-12 Nov-12

Jan-13 Mar-13 May-13 Jul-13 Sep-13 Nov-13

25

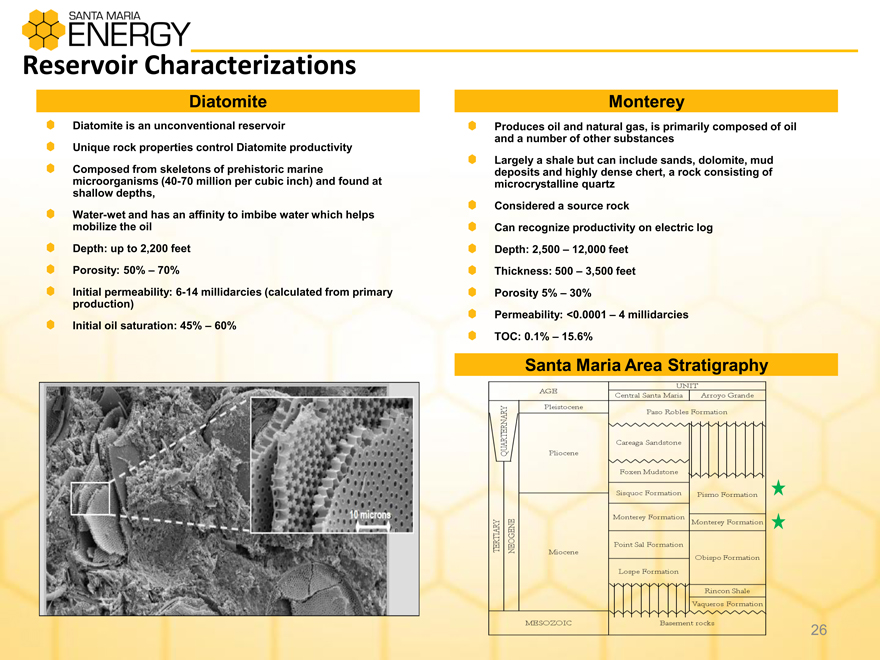

Reservoir Characterizations

Diatomite

Diatomite is an unconventional reservoir

Unique rock properties control Diatomite productivity

Composed from skeletons of prehistoric marine microorganisms (40-70 million per cubic inch) and found at shallow depths,

Water-wet and has an affinity to imbibe water which helps mobilize the oil

Depth: up to 2,200 feet

Porosity: 50% – 70%

Initial permeability: 6-14 millidarcies (calculated from primary production)

Initial oil saturation: 45% – 60%

Monterey

Produces oil and natural gas, is primarily composed of oil and a number of other substances

Largely a shale but can include sands, dolomite, mud deposits and highly dense chert, a rock consisting of microcrystalline quartz

Considered a source rock

Can recognize productivity on electric log Depth: 2,500 – 12,000 feet Thickness: 500 – 3,500 feet Porosity 5% – 30% Permeability: <0.0001 – 4 millidarcies TOC: 0.1% – 15.6%

Santa Maria Area Stratigraphy

26

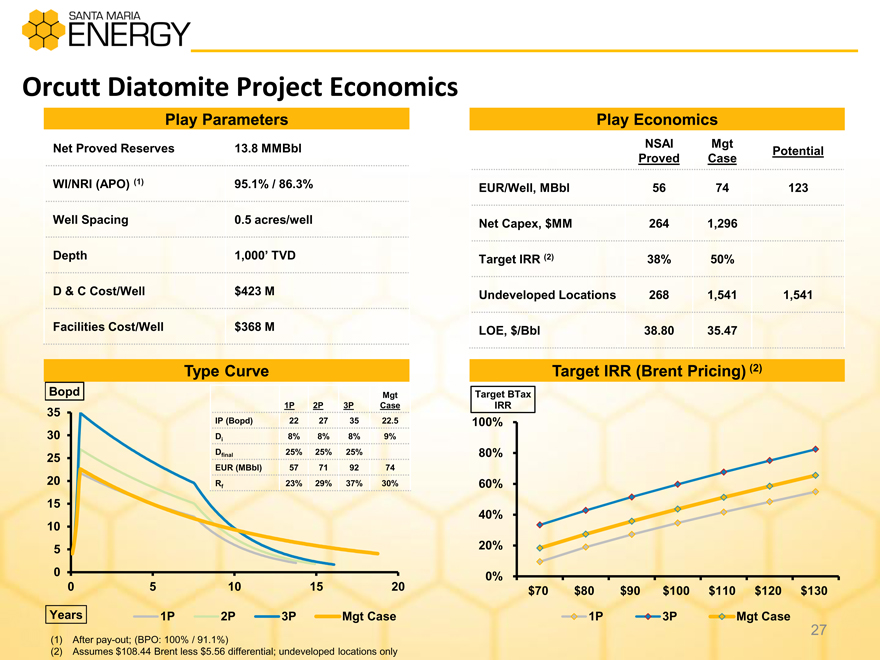

Orcutt Diatomite Project Economics

Play Parameters

Net Proved Reserves 13.8 MMBbl

WI/NRI (APO) (1) 95.1% / 86.3%

Well Spacing 0.5 acres/well

Depth 1,000’ TVD

D & C Cost/Well $ 423 M

Facilities Cost/Well $ 368 M

Play Economics

NSAI Mgt Potential

Proved Case

EUR/Well, MBbl 56 74 123

Net Capex, $MM 264 1,296

Target IRR (2) 38% 50%

Undeveloped Locations 268 1,541 1,541

LOE, $/Bbl 38.80 35.47

Type Curve

Bopd Mgt

1P 2P 3P Case

35

IP (Bopd) 22 27 35 22.5

30 Di 8% 8% 8% 9%

25 Dfinal 25% 25% 25%

EUR (MBbl) 57 71 92 74

20 Rf 23% 29% 37% 30%

15

10

0

0 5 10 15 20

Years 1P 2P 3P Mgt Case

(1) | | After pay-out; (BPO: 100% / 91.1%) |

(2) | | Assumes $108.44 Brent less $5.56 differential; undeveloped locations only |

Target IRR (Brent Pricing) (2)

Target BTax

IRR

100%

80%

60%

40%

20%

0%

$70 $80 $90 $100 $110 $120 $130

1P 3P Mgt Case

27

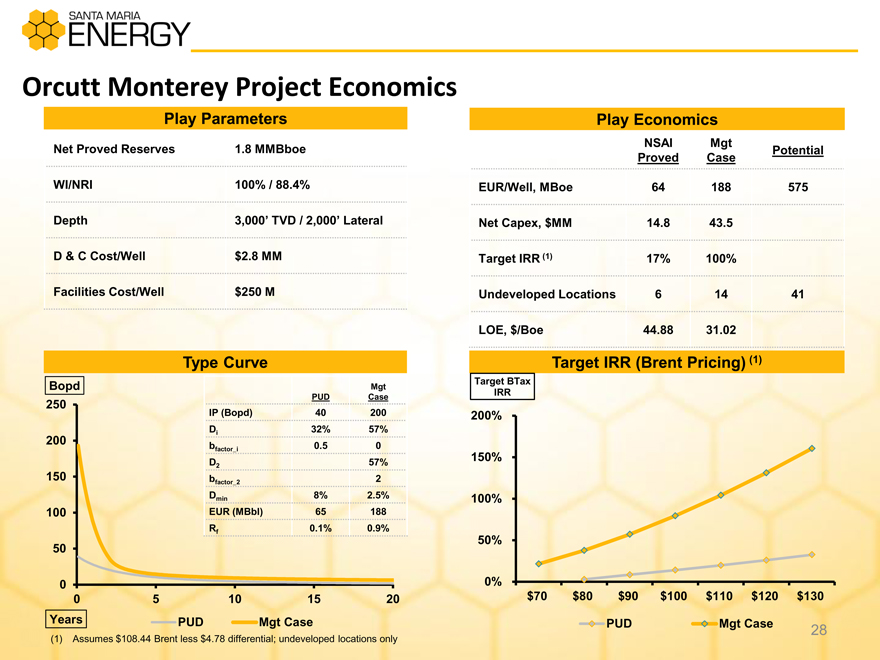

Orcutt Monterey Project Economics

play parameters

Net Proved Reserves 1.8 MMBboe

WI/NRI 100% / 88.4%

Depth 3,000’ TVD / 2,000’ Lateral

D & C Cost/Well $ 2.8 MM

Facilities Cost/Well $ 250 M

Play Economics

NSAI Mgt Potential

Proved Case

EUR/Well, MBoe 64 188 575

Net Capex, $MM 14.8 43.5

Target IRR (1) 17% 100%

Undeveloped Locations 6 14 41

LOE, $/Boe 44.88 31.02 Type Curve Bopd Mgt PUD Case 250 IP (Bopd) 40 200 Di 32% 57% 200 b 0.5 0 factor_i

D2 57% 150 bfactor_2 2

Dmin 8% 2.5% 100 EUR (MBbl) 65 188

Rf 0.1% 0.9% 50

0

0 5 10 15 20

Years PUD Mgt Case

(1) | | Assumes $108.44 Brent less $4.78 differential; undeveloped locations only |

Target IRR (Brent Pricing) (1)

Target BTax

IRR

200%

150%

100%

50%

0%

$70 $80 $90 $100 $110 $120 $130

PUD Mgt Case

28

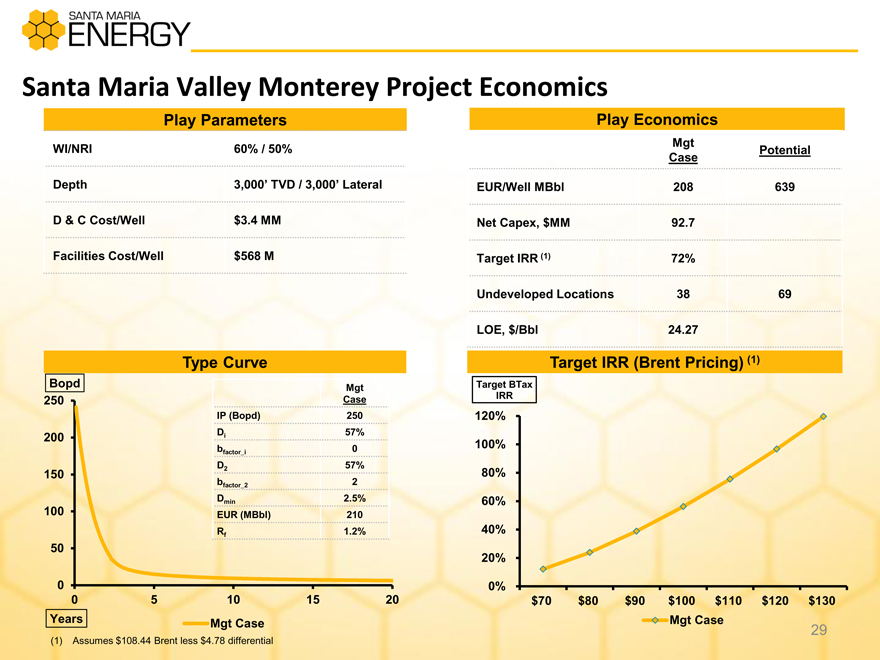

Santa Maria Valley Monterey Project Economics

Play Parameters Play Economics

Mgt

WI/NRI 60% / 50% Potential

Case

Depth 3,000’ TVD / 3,000’ Lateral EUR/Well MBbl 208 639

D & C Cost/Well $3.4 MM Net Capex, $MM 92.7

Facilities Cost/Well $568 M Target IRR (1) 72%

Undeveloped Locations 38 69

LOE, $/Bbl 24.27

Type Curve Target IRR (Brent Pricing) (1)

Bopd Mgt Target BTax

250 Case IRR

IP (Bopd) 250 120%

200 Di 57%

b 0 100%

factor_i

D2 57%

150 80%

bfactor_2 2

Dmin 2.5% 60%

100 EUR (MBbl) 210

Rf 1.2% 40%

50

20%

0 0%

0 5 10 15 20 $70 $80 $90 $100 $110 $120 $130

Years Mgt Case Mgt Case

29

(1) | | Assumes $108.44 Brent less $4.78 differential |

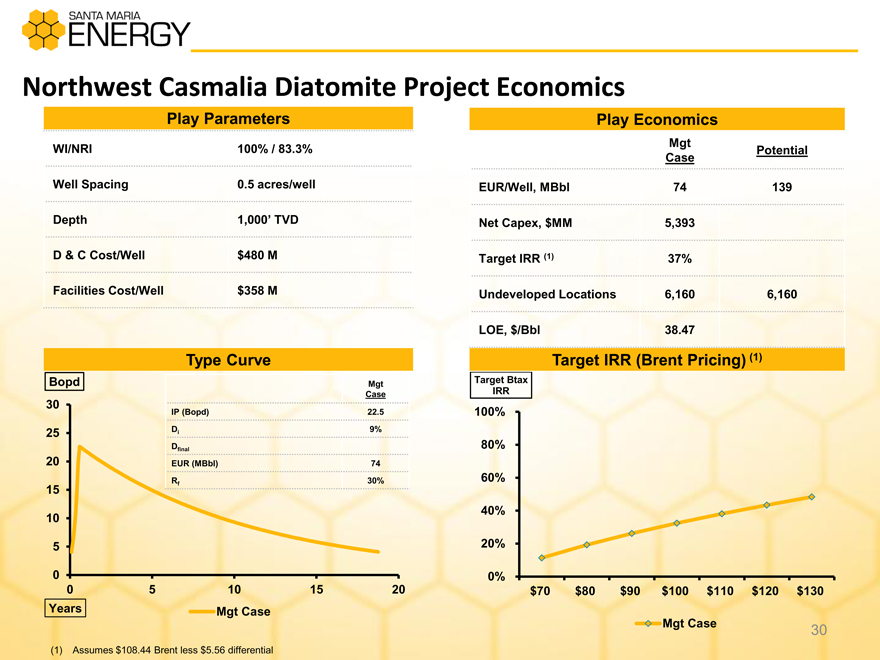

Northwest Casmalia Diatomite Project Economics

Play Parameters Play Economics

Mgt

WI/NRI 100% / 83.3% Potential

Case

Well Spacing 0.5 acres/well EUR/Well, MBbl 74 139

Depth 1,000’ TVD Net Capex, $MM 5,393

D & C Cost/Well $480 M Target IRR (1) 37%

Facilities Cost/Well $358 M Undeveloped Locations 6,160 6,160

LOE, $/Bbl 38.47

Type Curve Target IRR (Brent Pricing) (1)

Bopd Mgt Target Btax

Case IRR

30 IP (Bopd) 22.5 100%

25 Di 9%

Dfinal 80%

20 EUR (MBbl) 74

Rf 30% 60%

15

10 40%

0 0%

0 5 10 15 20 $70 $80 $90 $100 $110 $120 $130

Years Mgt Case

Mgt Case 30

(1) | | Assumes $108.44 Brent less $5.56 differential |