- NAVI Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Navient (NAVI) DEF 14ADefinitive proxy

Filed: 9 Apr 20, 4:59pm

| Filed by the registrant ☒ | Filed by a party other than the registrant ☐ |

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e) (2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to Section 240.14a-1 |

| Payment of filing fee (check the appropriate box): | ||

| ☒ | No fee required. | |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 | |

| (1) | Title of each class of securities to which transaction applies: | |

| (2) | Aggregate number of securities to which transaction applies: | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| (4) | Proposed maximum aggregate value of transaction: | |

| (5) | Total fee paid: | |

| ☐ | Fee paid previously with preliminary materials. | |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. | |

| (1) | Amount Previously Paid: | |

| (2) | Form, Schedule or Registration Statement No.: | |

| (3) | Filing Party: | |

| (4) | Date Filed: | |

|  |

John (Jack) F. Remondi President and Chief Executive Officer | Linda A. Mills Chair of the Board of Directors |

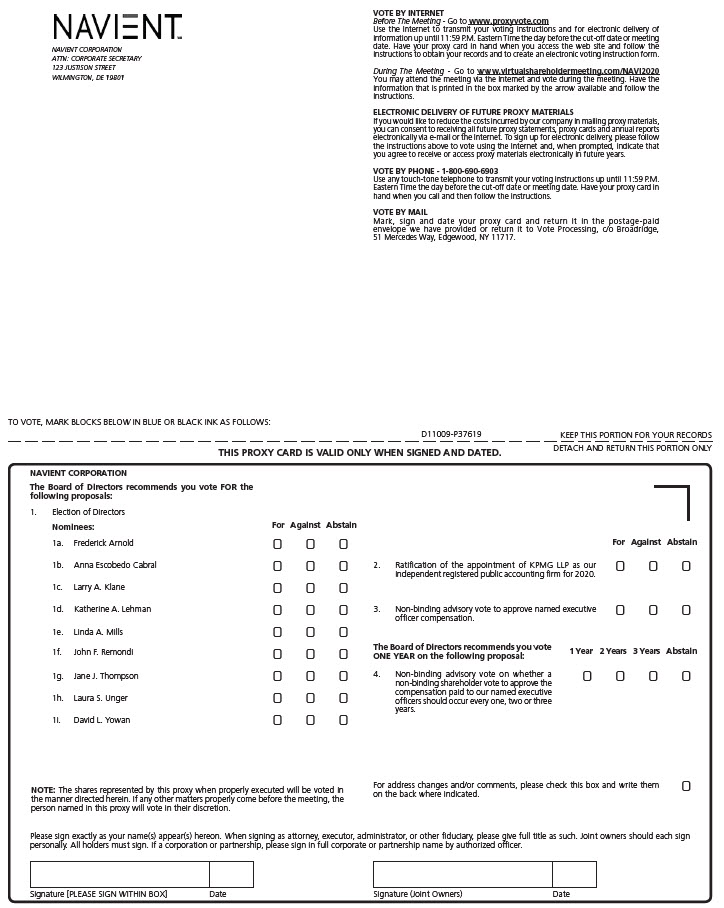

| Date: | Wednesday, May 20, 2020 | |

| Time: | 8:00 a.m., Eastern Daylight Time | |

| Access: | Meeting Live via the Internet Please visit www.virtualshareholdermeeting.com/NAVI2020 | |

Items of Business: | ||

| (1) | Elect the 9 nominees named in the proxy statement to serve as directors for one-year terms or until their successors have been duly elected and qualified; | |

| (2) | Ratify the appointment of KPMG LLP as Navient’s independent registered public accounting firm for 2020; | |

| (3) | Approve, in a non-binding advisory vote, the compensation paid to Navient’s named executive officers; | |

| (4) | To hold a non-binding advisory vote on whether a shareholder vote to approve the compensation paid to our named executive officers should occur every one, two or three years; | |

| (5) | Act on such other business as may properly come before the Annual Meeting or any adjournment or postponement of the meeting. |

| By Order of the Board of Directors, | |

| |

Mark L. Heleen Secretary |

| PROXY SUMMARY | 1 | |

Annual Meeting of Shareholders | 1 | |

Meeting Agenda Voting Matters | 1 | |

Board and Governance Practices | 2 | |

Board of Directors Composition | 3 | |

Our Director Nominees | 4 | |

| GENERAL INFORMATION | 5 | |

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING AND VOTING | 6 | |

| OVERVIEW OF PROPOSALS | 11 | |

PROPOSAL 1 — ELECTION OF DIRECTORS | 12 | |

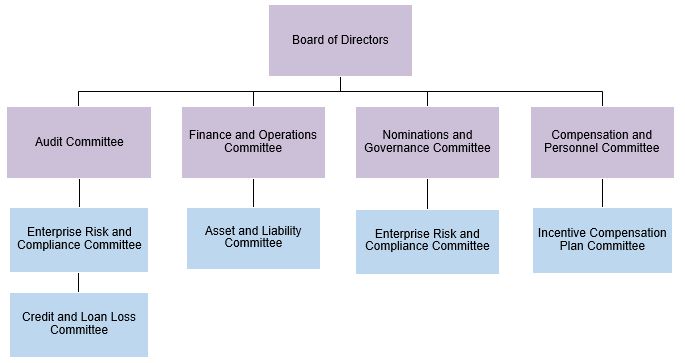

| CORPORATE GOVERNANCE | 20 | |

Role and Responsibilities of the Board of Directors | 20 | |

| Board Governance Guidelines | 20 | |

Board Leadership Structure | 21 | |

Board Succession Planning | 21 | |

Management Succession Planning | 21 | |

Director Independence | 22 | |

Board of Directors Meetings and Attendance at Annual Meeting | 22 | |

Committee Membership | 22 | |

Compensation Consultant and Independence | 25 | |

Compensation Committee Interlocks and Insider Participation | 25 | |

The Board of Directors’ Role in Risk Oversight | 26 | |

| Risk Assessment of Compensation Policies | 28 | |

Nominations Process | 28 | |

Proxy Access | 29 | |

| Director Orientation and Continuing Education | 30 | |

Shareholder Engagement and Communications with the Board | 30 | |

Policy on Political Contributions, Disclosure and Oversight | 31 | |

Code of Business Conduct | 31 | |

Policy on Review and Approval of Transactions with Related Parties | 31 | |

DIRECTOR COMPENSATION | 32 | |

| Director Compensation Elements | 32 | |

Share Ownership Guidelines | 32 | |

Anti-Hedging and Pledging Policy | 33 | |

Policy on Rule 10b5-1 Trading Plans | 33 | |

Other Compensation | 33 | |

Deferred Compensation Plan for Directors | 33 | |

| Director Compensation Table | 34 | |

PROPOSAL 2 — RATIFICATION OF THE APPOINTMENT OF THE INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 36 | |

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 37 | |

Fees Paid to Independent Registered Public Accounting Firms for 2019 and 2018 | 37 | |

Pre-approval Policies and Procedures | 37 | |

REPORT OF THE AUDIT COMMITTEE | 38 | |

| OWNERSHIP OF COMMON STOCK | 39 | |

OWNERSHIP OF COMMON STOCK BY DIRECTORS AND EXECUTIVE OFFICERS | 40 | |

EXECUTIVE OFFICERS | 42 | |

PROPOSAL 3 — ADVISORY VOTE ON EXECUTIVE COMPENSATION | 43 | |

PROPOSAL 4 — ADVISORY VOTE ON SAY-ON-PAY FREQUENCY | 44 | |

EXECUTIVE COMPENSATION | 45 | |

Compensation and Personnel Committee Report | 45 | |

Compensation Discussion and Analysis | 46 | |

Summary Compensation Table | 66 | |

Grants of Plan-Based Awards | 67 | |

Outstanding Equity Awards at Fiscal Year End | 68 | |

Option Exercises and Stock Vested | 70 | |

Pension Benefits | 70 | |

| Non-Qualified Deferred Compensation | 70 | |

| Arrangements with Named Executive Officers | 71 | |

Potential Payments upon Termination or Change in Control | 72 | |

Actual Payments Upon Termination | 74 | |

CEO Pay Ratio | 74 | |

OTHER MATTERS | 75 | |

Certain Relationships and Related Transactions | 75 | |

Other Matters for the 2020 Annual Meeting | 75 | |

| Shareholder Proposals for the 2021 Annual Meeting | 75 | |

Proxy Access Procedures | 76 | |

Solicitation Costs | 76 | |

Householding | 76 | |

| DATE AND TIME: | LOCATION: | RECORD DATE: |

May 20, 2020 8:00 a.m. local time | Virtual Meeting Only Live via the Internet Please Visit www.virtualshareholdermeeting.com/NAVI2020 | March 23, 2020 |

Proposals | Board Voting Recommendations | Page | |

| 1. | Election of each director nominee | FOR EACH NOMINEE | 12 |

| 2. | Ratification of the appointment of KPMG as Navient’s independent registered public accounting firm for 2020 | FOR | 36 |

| 3. | Non-binding advisory shareholder vote to approve the compensation paid to our named executive officers | FOR | 43 |

| 4. | Non-binding advisory shareholder vote on whether a non-binding advisory shareholder vote to approve the compensation paid to our named executive officers should occur every one, two or three years | ONE YEAR | 44 |

| 2020 Proxy Statement |  | 1 |

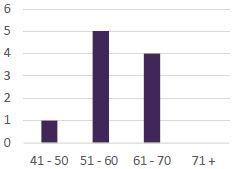

| Separate Chair and CEO | Yes | |

| Average Age of Directors | 60 | |

| Number of Independent Directors | 9 | |

| Annual Elections of Directors | Yes | |

| Majority Voting for Directors (uncontested elections) | Yes | |

| Board Meetings Held in 2019 (average director attendance 94.8%) | 32 | |

| Annual Self-Evaluation of the Board and Each Committee | Yes | |

| Annual Equity Grant to Directors | Yes | |

| Director Stock Ownership Guidelines | Yes | |

| Independent Directors Meet without Management Present | Yes | |

| Mandatory Retirement Age for Directors | Yes | |

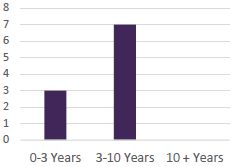

| Tenure Limit for Directors | Yes | |

| Proxy Access | Yes | |

| Anti-Hedging and Anti-Pledging Policy | Yes | |

| Code of Business Conduct for Directors and Officers | Yes | |

| Enhanced Compensation Recovery/Clawback Policy | Yes | |

| Annual Advisory Approval of Executive Compensation | 94% | |

| Independent Compensation Consultant | Yes | |

| Double-Trigger Change in Control | Yes | |

| Active Board and Management Succession and Planning | Yes | |

| Executive Stock Ownership Guidelines | Yes | |

| No Employment Agreements for Executives | Yes | |

| No Excessive Perquisites | Yes | |

| No Above-Market Earnings on Deferred Compensation | Yes |

| 2020 Proxy Statement |  | 2 |

Frederick Arnold | Marjorie L. Bowen (1) | Anna Escobedo Cabral | Larry A. Klane (1) | Katherine A. Lehman | Linda A. Mills | John (Jack) F. Remondi | Jane J. Thompson | Laura S. Unger | David L. Yowan | ||

| Skills and Experience | |||||||||||

| Board of Directors Experience | X | X | X | X | X | X | X | X | X | X | |

Industry Experience (2) | X | X | X | X | X | X | X | ||||

| Executive Leadership | X | X | X | X | X | X | X | X | X | X | |

| Business Operations | X | X | X | X | X | X | X | X | |||

| Finance/Capital Allocation | X | X | X | X | X | X | X | X | X | ||

Financially Literate (3) | X | X | X | X | X | X | X | X | X | X | |

Audit Committee Financial Expert (4) | X | X | X | X | X | X | |||||

| Regulatory/Policy/Legal | X | X | X | X | X | X | X | ||||

| Mergers/Acquisitions | X | X | X | X | X | X | X | X | X | ||

| Higher Education | X | X | X | X | |||||||

| Human Capital Management/Compensation | X | X | X | X | X | X | X | X | |||

| Corporate Governance | X | X | X | X | X | X | X | X | X | X | |

| Technology/Systems | X | X | X |

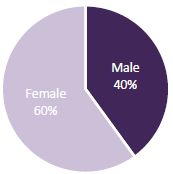

| Board Gender Diversity | Director Age Distribution | Director Tenure |

|  |  |

| (1) | Ms. Bowen and Mr. Klane joined the Board on May 1, 2019. Ms. Bowen is not being nominated by the Board for reelection, and her tenure as a director will end when her current term expires at our 2020 Annual Meeting. |

| (2) | Directors with professional experience in the financial services, consumer lending or business processing services industries. |

| (3) | Directors who are able to read and understand financial statements. |

| (4) | Directors determined by the Board to be audit committee financial experts, as that term is defined under rules promulgated by the SEC. |

| 2020 Proxy Statement |  | 3 |

| Director | Standing Committee Memberships(3) | Other Public | ||||||||

| Name | Age(1) | Since(2) | Occupation and Experience | Independent | EC | AC | CC | NGC | FOC | Boards |

| Frederick Arnold | 66 | 2018 | Financial Executive | Yes | M | M | 1 | |||

| Anna Escobedo Cabral | 60 | 2014 | Partner, Cabral Group, LLC | Yes | M | C | M | 0 | ||

| Larry A. Klane | 59 | 2019 | Co-Founding Principal, Pivot Investment Partners LLC | Yes | M | M | 0 | |||

| Katherine A. Lehman | 45 | 2014 | Managing Partner, Hilltop Private Capital, Private Equity Investor | Yes | M | M | C | 1 | ||

| Linda A. Mills | 70 | 2014 | President, Cadore Group LLC | Yes | C | 1 | ||||

| John (Jack) F. Remondi | 57 | 2013 | President and Chief Executive Officer, Navient | No | M | 1 | ||||

| Jane J. Thompson | 68 | 2014 | CEO, Jane J. Thompson Financial Services | Yes | M | C | M | 2 | ||

| Laura S. Unger | 59 | 2014 | President, Unger, Inc. | Yes | M | M | C | 2 | ||

| David L Yowan | 63 | 2017 | EVP and Corporate Treasurer American Express Company | Yes | M | M | 0 | |||

| (1) | Ages are as of April 9, 2020. |

| (2) | For purposes of this chart and the director tenure chart on the immediately preceding page, we are considering a Director’s prior service with SLM Corporation and its publicly held predecessors prior to our separation transaction in 2014. |

| (3) | Membership as of December 31, 2019. |

| EC | Executive Committee | NGC | Nominations and Governance Committee | C | Chair |

| AC | Audit Committee | FOC | Finance and Operations Committee | M | Member |

| CC | Compensation and Personnel Committee |

| 2020 Proxy Statement |  | 4 |

| 2020 Proxy Statement |  | 5 |

| 2020 Proxy Statement | 6 |

| 2020 Proxy Statement | 7 |

| VOTE BY INTERNET BEFORE THE MEETING |  | Vote your shares at www.proxyvote.com. Votes submitted via the Internet must be received by 11:59 p.m., Eastern Daylight Time, on May 19, 2020. Please have your Notice of Internet Availability or proxy card available when you log on. |  | If you hold shares directly in your name as a shareholder of record, you may either vote or be represented by another person at the Annual Meeting by executing a legal proxy designating that person as your proxy to vote your shares. If you hold your shares in street name, you must obtain a legal proxy from your broker, bank, trustee or other nominee and present it to the inspector of elections with your ballot to be able to vote at the Annual Meeting. To request a legal proxy, please follow the instructions at www.proxyvote.com | |||

| VOTE BY PHONE |  | Call the toll-free number (1-800-690-6903). You may call this toll-free telephone number, which is available 24-hours a day, and follow the pre-recorded instructions. Please have your Notice of Internet Availability or proxy card available when you call. If you hold your shares in street name, your broker, bank, trustee or other nominee may provide you additional instructions regarding voting your shares by telephone. Votes submitted telephonically must be received by 11:59 p.m., Eastern Daylight Time, on May 19, 2020. | |||||

| VOTE BY MAIL |  | If you hold your shares in a street name through a broker, bank, trustee or other nominee and want to vote by mail, you must request paper copies of the proxy materials. Once you receive your paper copies, you will need to complete, sign and date the voting instruction form and return it in the prepaid return envelope provided. Your voting instruction form must be received no later than the close of business on May 19, 2020. | |||||

| VOTE BY INTERNET DURING THE MEETING |  | Go to www.virtualshareholdermeeting.com/NAVI2020. | |||||

| Vote must be submitted by the close of polls during the Annual Meeting. | |||||||

| 2020 Proxy Statement | 8 |

| • | “FOR” the election of each of the director nominees named in Proposal 1; |

| • | “FOR” ratification of the appointment of Navient’s independent registered public accounting firm, as set forth in Proposal 2; |

| • | “FOR” approval, on a non-binding advisory basis, of the compensation paid to our named executive officers as set forth in this proxy statement as Proposal 3; and |

| • | “ONE YEAR” on a non-binding advisory basis as to whether a non-binding advisory shareholder vote to approve the compensation paid to our named executive officers should occur every one, two or three years. |

| • | Delivering a written notice of revocation to Navient’s Corporate Secretary at the Office of the Corporate Secretary, 123 Justison Street, Wilmington, Delaware 19801; |

| • | Submitting another timely vote via the Internet, by telephone or by mailing a new proxy (following the instructions listed under the “How do I vote?” section above); or |

| • | If you are eligible to vote during the Annual Meeting, you also can revoke your proxy or voting instructions and change your vote during the Annual Meeting by logging into the website at www.virtualshareholdermeeting.com/NAVI2020 and following the voting instructions. |

| 2020 Proxy Statement | 9 |

| Proposal | Voting Options | Vote Required for Approval | Abstentions | Broker Non-Votes | Broker Discretionary Vote Permitted | Board's Voting Recommendation | |

| 1. | Election of Directors | "FOR" or "AGAINST" | Affirmative vote of the holders of a majority of the votes cast. | NOT COUNTED | NOT COUNTED | NO | FOR the election of each of the director nominees |

| 2. | Ratify the appointment of KPMG LLP as Navient’s independent registered public accounting firm for 2020 | "FOR" or "AGAINST" or "ABSTAIN" from voting | Affirmative vote of the holders of a majority of shares deemed present or represented by proxy and entitled to vote on the proposal. | COUNTED as votes Against | NOT COUNTED | YES | FOR |

| 3. | Approve, in a non- binding advisory vote, the compensation paid to Navient’s named executive officers | "FOR" or AGAINST" or ABSTAIN" from voting | Affirmative vote of the " holders of a majority " of shares deemed present or represented by proxy and entitled to vote on the proposal. | COUNTED as votes Against | NOT COUNTED | NO | FOR |

| 4. | Non-binding advisory vote as to whether a non-binding advisory vote to approve the compensation paid to our named executive officers should occur every one, two or three years | “ONE YEAR” or “TWO YEARS” or “THREE YEARS” or “ABSTAIN” from voting | Affirmative vote of the holders of a plurality of shares deemed present or represented by proxy and entitled to vote on the proposal. | NOT COUNTED | NOT COUNTED | NO | ONE YEAR |

| 2020 Proxy Statement | 10 |

| • | Proposal 1 requests the election of the director nominees named in this proxy statement to the Board of Directors. |

| • | Proposal 2 requests ratification of the appointment of KPMG LLP as Navient’s independent registered public accounting firm for the fiscal year ending December 31, 2020. |

| • | Proposal 3 requests the approval, in a non-binding advisory vote, of the compensation paid to our named executive officers as set forth in this proxy statement. |

| • | Proposal 4 requests a recommendation, in a non-binding advisory vote, as to whether a non-binding advisory vote to approve the compensation paid to our named executive officers should occur every one, two or three years. |

| 2020 Proxy Statement | 11 |

| 2020 Proxy Statement | 12 |

Name and Age Service as a Director | Position, Principal Occupation, Business Experience and Directorships |

Jack Remondi, 57 Director since May 2013 | President and Chief Executive Officer Navient Corporation Directorships of Other Public Companies: CubeSmart Real Estate Investment Trust (NYSE: CUBE) — 2009 to present Former Directorships of Other Public Companies: SLM Corporation Other Professional and Leadership Experience: Chairman, Reading is Fundamental Trustee, Nellie Mae Education Foundation Skills, Experience and Qualifications: Mr. Remondi has been the Company’s President and Chief Executive Officer since April 2014. He was SLM Corporation’s President and Chief Executive Officer from May 2013 to April 2014, President and Chief Operating Officer from January 2011 to May 2013 and its Vice Chairman and Chief Financial Officer from January 2008 to January 2011. Mr. Remondi has a nearly 30-year history in the student loan and business services industry with Navient and its predecessors, in a variety of leadership roles, including as chief executive officer, chief operating officer and chief financial officer. He has the in-depth knowledge of our industry, customers, investors and competitors, as well as the relationships, to lead our company. Mr. Remondi brings to our Board of Directors a unique historical perspective of Navient, its operations and the evolution of the student loan industry, and he provides valuable insights to our Board in the areas of finance, accounting, portfolio management, business operations and student/consumer lending. |

| 2020 Proxy Statement | 13 |

Name and Age Service as a Director | Position, Principal Occupation, Business Experience and Directorships |

Linda Mills, 70 Chair of the Board since June 2019 Director since May 2014 | President Cadore Group LLC Business Experience: President, Cadore Group LLC, a management and IT consulting company — 2015 to present Corporate Vice President, Operations, Northrop Grumman — 2013 to 2015 Corporate Vice President & President, Information Systems and Information Technology Sectors, Northrop Grumman — 2008 to 2012 Directorships of Other Public Companies: American International Group, Inc. (NYSE: AIG) — 2015 to present Other Professional and Leadership Experience: Board Member, Smithsonian National Air & Space Museum Senior Advisory Group and Former Board Member, Northern Virginia Technology Council Former Board Member, Wolf Trap Foundation for the Performing Arts Skills, Experience and Qualifications: Ms. Mills’ extensive experience in leading businesses and operations for large, complex multinational companies brings a valuable perspective to our Board of Directors in the areas of operations, financial management, strategic re-positioning, risk management, technology, federal, state and local government contracting, and cybersecurity risk. Through insights gained as a director on the board of another large, publicly traded corporation in a highly regulated industry, as well as her service on many nonprofit boards, Ms. Mills brings a unique and wide range of valuable strategic and operational perspectives to our Board. |

| 2020 Proxy Statement | 14 |

Name and Age Service as a Director | Position, Principal Occupation, Business Experience and Directorships |

Frederick Arnold, 66 Director since August 2018 | Financial Executive Business Experience: Chief Financial Officer, Convergex Group, LLC — July 2015 to May 2017 Executive Vice President and Chief Financial Officer, Capmark Financial Group, Inc. — September 2009 to January 2011 Executive Vice President of Finance, Masonite Corporation — February 2006 to September 2007 Executive Vice President, Strategy and Development, Willis North America — 2001 to 2003 Chief Administrative Officer, Willis Group Holdings Ltd. — 2000 to 2001 Chief Financial and Administrative Officer, Willis North America — 2000 Directorships of Other Public Companies: Valaris plc (NYSE: VAL) — 2019 to Present Former Directorships of Other Public Companies: Syncora Holdings Ltd. FS KKR Capital Corp. Corporate Capital Trust CIFC Corp. Other Professional and Leadership Experience: Current Chairman of the Board, Lehman Brothers Holdings Inc. Director, Lehman Commercial Paper Inc. Skills, Experience and Qualifications: Mr. Arnold spent 20 years as an investment banker primarily at Lehman Brothers and Smith Barney, where he served as managing director and head of European corporate finance. His experience originating and executing mergers and acquisitions and equity financings across a wide variety of industries and geographies, as well as his other board experience, brings a valuable perspective to our Board of Directors. Subsequent to his employment at Lehman Brothers and Smith Barney, Mr. Arnold spent 15 years in various senior financial positions at a number of private equity-owned portfolio companies. |

| 2020 Proxy Statement | 15 |

Name and Age Service as a Director | Position, Principal Occupation, Business Experience and Directorships |

Anna Escobedo Cabral, 60 Director since December 2014 | Partner Cabral Group, LLC Business Experience: Partner, Cabral Group — 2018 to present Senior Advisor, Inter-American Development Bank — 2009 to 2018 Treasurer of the United States, U.S. Department of the Treasury — 2004 to 2009 Director, Smithsonian Institution’s Center for Latino Initiatives — 2003 to 2004 CEO, Hispanic Association on Corporate Responsibility — 1999 to 2003 Staff Director & Chief Clerk, U.S. Senate Committee on the Judiciary — 1993 to 1999 Executive Staff Director, U.S. Senate Task Force on Hispanic Affairs — 1991 to 1999 Other Professional and Leadership Experience: Vice Chair, Hispanic Diversity Advisory Committee, Comcast NBCU Trustee, Jessie Ball duPont Fund Chair, BBVA Microfinance Foundation Board Former Member, NatureBridge Regional Advisory Committee Former Member, NatureBridge Board of Directors Former Chair, Financial Services Roundtable Retirement Security Council Former Member, Providence Hospital Foundation Board Former Member, American Red Cross Board of Directors Former Member, Sewall Belmont House Board of Directors Former Member, Martha’s Table Board of Directors Skills, Experience and Qualifications: Through her extensive experience in public policy, government, public affairs, corporate social responsibility, international development, and financial literacy, as well as her experience as a chief operating officer in the nonprofit sector, Ms. Cabral provides our Board with insights and judgment regarding regulatory policy and the political and legislative process. |

Larry A. Klane, 59 Director since May 2019 | Co-Founding Principal Pivot Investment Partners LLC Business Experience: Global Financial Institutions Leader, Cerberus Capital Management — 2012 to 2013 Chair, Korea Exchange Bank — 2010 to 2012 CEO, Korea Exchange Bank — 2009 to 2012 President of Global Financial Services, Capital One — 2000 to 2008 Managing Director, Bankers Trust/Deutsche Bank — 1994 to 2000 Former Directorships of Other Public Companies: VeriFone Systems, Inc. Aozora Bank Ltd. Other Professional and Leadership Experience: Director, Goldman Sachs Bank USA Former Director, Nexi Group S.p.A. Former Director, Ethoca Limited Skills, Experience and Qualifications: Mr. Klane brings an important strategic and operational perspective to our Board given his extensive background in financial services and payment services, including his service in various leadership positions in the financial services industry. |

| 2020 Proxy Statement | 16 |

Name and Age Service as a Director | Position, Principal Occupation, Business Experience and Directorships |

Katherine A. Lehman, 45 Director since November 2014 | Private Equity Investor Business Experience: Managing Partner, Hilltop Private Capital — 2016 to Present Managing Director and Deal Team Leader, Lincolnshire Management — 2009 to 2016 Other Investment Roles, Lincolnshire Management — 2001 to 2009 Directorships of Other Public Companies: Stella-Jones (TSX: SJ) — 2016 to present Chair of the Board Other Professional and Leadership Experience: Director, American Track Services Director, Spiral Holding Former Board Member, The Robert Toigo Foundation Former Board Member, True Temper Sports Former Board Member, Gruppo Fabbri Former Board Member, PADI Holding Company Former Board Member, Bankruptcy Management Solutions Skills, Experience and Qualifications: Ms. Lehman’s experience in private equity and financial services, along with her investment evaluation, portfolio oversight and board experience enable her to provide strategic and operational expertise in the areas of finance, review and analysis of investments, mergers and acquisitions, integration and operations, accounting and business, which assist our Board of Directors in evaluating our business and growth plans. |

| 2020 Proxy Statement | 17 |

Name and Age Service as a Director | Position, Principal Occupation, Business Experience and Directorships |

Jane J. Thompson, 68 Director since March 2014 | Chief Executive Officer Jane J. Thompson Financial Services LLC Business Experience: Chief Executive Officer, Jane J. Thompson Financial Services LLC, a management consulting firm — 2011 to present President, Financial Services, Walmart Stores, Inc. — 2002 to 2011 Executive Vice President, Credit, Home Services, Online and Corporate Planning, Sears, Roebuck and Co. — 1988 to 1999 Consultant/Partner, McKinsey & Company — 1978 to 1988 Directorship of Other Public Companies: OnDeck Capital, Inc. (NYSE: ONDK) — 2014 to present Chair of Nominating Committee Mitek Systems, Inc. (Nasdaq: MITK) — 2017 to present Former Directorships of Other Public Companies: Blackhawk Network Holdings, Inc. VeriFone Systems, Inc. The Fresh Market Other Professional and Leadership Experience: Chair, Pangea Universal Holdings, Inc. Member, Commercial Club of Chicago Former Member and Chair, The Chicago Network Former Member and Board Member, The Economic Club of Chicago Former Member, Center for Financial Services Innovation Board Former Member, CFPB Consumer Advisory Board Former Member and Chair, Boys & Girls Clubs of Chicago Board Former Member, Lurie Children’s Hospital of Chicago Board of Trustees Former Trustee, Bucknell University Former Member, Corporate Advisory Board, Darden Graduate School of Business, University of Virginia Former Member, Corporate Advisory Board, Walton Graduate School of Business, University of Arkansas Skills, Experience and Qualifications: Ms. Thompson brings a unique depth and breadth of expertise to our Board of Directors in the areas of consumer behavior, financial services, consumer lending, finance and financial services regulation. She has extensive experience in consumer lending, as well as management experience with large, publicly traded businesses. Combined with other leadership roles in business—including service as a director of several public companies and as a member of various audit, compensation, risk management and governance committees—Ms. Thompson brings valuable insights to our Board in a variety of areas. |

| 2020 Proxy Statement | 18 |

Name and Age Service as a Director | Position, Principal Occupation, Business Experience and Directorships |

Laura S. Unger, 59 Director since November 2014 | President Unger, Inc. Business Experience: President, Unger, Inc., a financial services consulting firm — 2018 to present Special Advisor, Promontory Financial Group — 2010 to 2014 Independent Consultant to JPMorgan — 2003 to 2009 Commissioner, U.S. Securities and Exchange Commission — 1997 to 2002 (including six months as Acting Chairman) Counsel, U.S. Senate Committee on Banking, Housing & Urban Affairs — 1990 to 1997 Directorships of Other Public Companies: CIT Group (NYSE: CIT) — 2010 to present Nomura Holdings, Inc. (NYSE: NMR) — 2018 to present Former Directorships of Other Public Companies: CA Technologies Ambac Financial Group, Inc. Other Professional and Leadership Experience: Board Member, Children’s National Medical Center Director, Nomura Securities, Inc. Director, Nomura Global Financial Products Skills, Experience and Qualifications: Ms. Unger has significant corporate governance expertise as a member or chair of boards and board committees of public companies and her service at the U.S. Securities and Exchange Commission. Her government, public policy and legal and regulatory experience, together with her extensive leadership experience at government agencies, provides our Board of Directors with perspectives into regulatory policy and the political and legislative process. |

David L. Yowan, 63 Director since March 2017 | Consumer Financial Services Executive American Express Company Business Experience: Executive Vice President and Treasurer, American Express Company — 2006 to present Senior Treasury Management, American Express Company — 1999 to 2006 Senior Vice President, North American Consumer Bank Treasury, Citigroup — 1987 to 1998 Skills, Experience and Qualifications: Mr. Yowan’s extensive experience in consumer financial services including his long tenure with the world’s largest payment card issuer makes him a valuable addition to Navient’s Board of Directors. His insight and experience in risk management, balance sheet management, asset securitization and strategy make him ideally suited to assist our Board in overseeing financial, operational and credit risk management. |

| 2020 Proxy Statement | 19 |

| • | Review Navient’s long-term strategies and set long-term performance metrics; |

| • | Review and approve Navient’s annual business plan and multi-year strategic plan, regularly review performance against such plans and ensure alignment between the Company’s actions and its longer- term strategic objectives; |

| • | Review risks affecting Navient and its processes for managing those risks, and oversee management performance with regard to various aspects of risk management, compliance and governance; |

| • | Select, evaluate and compensate the Chief Executive Officer; |

| • | Plan for succession of the Chief Executive Officer and members of the executive management team; |

| • | Review and approve major transactions; |

| • | Through its Audit Committee, select and oversee Navient’s independent registered public accounting firm; |

| • | Oversee financial matters, including financial reporting, financial controls and capital allocation; |

| • | Recommend director candidates for election by shareholders and plan for the succession of directors; and |

| • | Evaluate the Board’s composition, succession, and effectiveness. |

| • | A majority of the members of the Board of Directors must be independent directors and all members of the Audit, Compensation and Personnel, and Nominations and Governance Committees must be independent. |

| • | All directors stand for re-election each year and must be elected by a majority of the votes cast in uncontested elections. |

| • | No individual is eligible for nomination to the Board after the earlier of (i) their 75th birthday or (ii) after having served in the aggregate more than 20 years on the Board. |

| • | The Board of Directors has separated the roles of Chair of the Board and CEO, and an independent, non-executive director serves as Chair. |

| 2020 Proxy Statement | 20 |

| • | Independent members of the Board of Directors and its committees meet in executive session, outside the presence of management or the CEO at several times during each Board meeting as well as at the end of each Board and committee meeting. The Chair of the Board (or the applicable committee chair) presides over these sessions. |

| • | Navient maintains stock ownership and retention guidelines for directors and executive officers and has a policy prohibiting the hedging or pledging of its stock. |

| • | The Board of Directors and each committee conduct performance reviews annually through a combination of online questionnaires and individual director interviews. |

| • | The Board of Directors and its committees may engage their own advisors. |

1 | Our Board Governance Guidelines state: “…individuals will not be nominated for election to the Board after the earlier to occur of (i) their 75th birthday or, (ii) after they have served more than 20 years on the Board.” |

| 2020 Proxy Statement |  | 21 |

| 2020 Proxy Statement |  | 22 |

Audit Committee | Compensation and Personnel Committee | Executive Committee | Finance and Operations Committee | Nominations and Governance Committee | Special Committee | |

| Frederick Arnold | X | X | ||||

Marjorie L. Bowen (1) | X | X | ||||

| Anna Escobedo Cabral | CHAIR | X | X | |||

Larry A. Klane (2) | X | X | ||||

| Katherine A. Lehman | X | X | CHAIR | X | ||

Linda A. Mills (3) | CHAIR | X | ||||

| John F. Remondi | X | |||||

Jane J. Thompson (4) | CHAIR | X | X | |||

| Laura S. Unger | X | X | CHAIR | X | ||

David L. Yowan (5) | X | X | X | |||

| Number of Meetings in 2019 | 10 | 7 | 4 | 10 | 13 | 15 |

| (1) | Ms. Bowen was appointed to the Board on May 1, 2019. Ms. Bowen is not being nominated by the Board for reelection, and her tenure as a director will end when her current term expires at our 2020 Annual Meeting. |

| (2) | Mr. Klane was appointed to the Board on May 1, 2019. |

| (3) | Ms. Mills served as a member of the Finance and Operations Committee and the Compensation and Personnel Committee until her appointment as Chair of the Board on June 6, 2019. For the remainder 2019, she served as Chair of the Executive Committee and as an ex officio member of the Special Committee. |

| (4) | Ms. Thompson served on the Finance and Operations Committee until June 6, 2019, when she became a member of the Nominations and Governance Committee. |

| (5) | Mr. Yowan served on the Audit Committee until June 6, 2019, when he became a member of the Compensation and Personnel Committee. |

2 | In connection with the Canyon Agreement, the terms of which are discussed on page 30 of this proxy statement, William M. Diefenderfer, III elected not to stand for re-election to the Board at the 2019 Annual Meeting. Before his departure, Mr. Diefenderfer served as Chairman of the Board and Chair of the Executive Committee. Barry L. Williams agreed to retire from the Board of Directors in connection with the Canyon Agreement. Mr. Williams served as a member of the Compensation and Personnel Committee, the Nomination and Governance Committee, and the Finance and Operations Committee at various times during 2019 until his retirement from the Board effective August 9, 2019. |

| 2020 Proxy Statement |  | 23 |

| 2020 Proxy Statement |  | 24 |

3 | Mr. Williams served on the Compensation Committee until his retirement in August 2019. Ms. Mills also served on the Compensation Committee until her appointment to Chair of the Board on June 6, 2019. |

| 2020 Proxy Statement |  | 25 |

| 2020 Proxy Statement |  | 26 |

| Enterprise Risk Domain | Board Committee | Risk Description | |

| Credit | Finance and Operations Committee | Risk resulting from an obligor's failure to meet the terms of any contract with the Company or otherwise fail to perform as agreed. | |

| Market | Finance and Operations Committee | Risk resulting from changes in market conditions, such as interest rates, spreads, commodity prices or volatilities. | |

| Funding and Liquidity | Finance and Operations Committee | Risk arising from the Company's inability to meet its obligations when they come due without incurring unacceptable losses. | |

| Compliance | Audit Committee Finance and Operations Committee | Risk arising from violations of, or non-conformance with, laws, rules, regulations, prescribed practices, internal policies, and procedures, or ethical standards. | |

| Legal | Audit Committee Finance and Operations Committee | Risk manifested by claims made through the legal system, including litigation brought against the Company. Legal risk may arise from a product, a transaction, a business relationship, property (real, personal, or intellectual), employee conduct, or a change in law or regulation. | |

| Operational | Finance and Operations Committee Compensation and Personnel Committee | Risk resulting from inadequate or failed internal processes, personnel and systems, inadequate product design and testing, or from external events. | |

| Reputational and Political | Nominations and Governance Committee | Risk from stakeholder perceptions regarding actual or alleged violations of law, our internal code of conduct or other employee misconduct. | |

| Governance | Nominations and Governance Committee | Risk of not establishing and maintaining a control environment that aligns with stakeholder and regulatory expectations, including tone at the top and board performance. | |

| Strategic | Executive Committee | Risk from adverse business decisions or improper implementation of business strategies. |

| 2020 Proxy Statement |  | 27 |

| • | Knowledge of Navient’s business; |

| • | Proven record of accomplishment; |

| • | Willingness to commit the time necessary for Board of Director service; |

| • | Integrity and sound judgment; |

| 2020 Proxy Statement |  | 28 |

| • | Willingness to represent the best interests of all shareholders and effectively oversee management performance; |

| • | Ability to challenge and stimulate management; and |

| • | Independence. |

| • | Finance, including capital allocation; |

| • | Accounting/audit; |

| • | Corporate governance; |

| • | Executive leadership; |

| • | Information security and cybersecurity; |

| • | Financial services, including financial technology and innovation; |

| • | Capital markets; |

| • | Business operations and operating efficiency; |

| • | Mergers and acquisitions; |

| • | Higher education; |

| • | Consumer credit; |

| • | Business processing solutions and outsourcing; |

| • | Consumer marketing and product development, including customer experience; |

| • | Government/Regulatory; and |

| • | Legal. |

| 2020 Proxy Statement |  | 29 |

4 | On May 4, 2019, Canyon reported on Form 13D/A filed with the SEC that it beneficially owned 25,435,480 or 9.6% of the Company’s outstanding shares. |

5 | Form 8-K filed with the SEC on May 3, 2019 is available at https://www.sec.gov/Archives/edgar/data/1593538/000119312519136955/0001193125-19-136955-index.htm. |

6 | Form DEF 14A filed on April 30, 2019 is available at https://www.sec.gov/Archives/edgar/data/1593538/000119312519126546/0001193125-19-126546-index.htm. |

7 | Form DEF 14A filed on May 8, 2019 is available at https://www.sec.gov/Archives/edgar/data/1593538/000119312519141633/0001193125-19-141633-index.htm. |

| 2020 Proxy Statement |  | 30 |

| 2020 Proxy Statement |  | 31 |

| Director Compensation Elements |

| 2019 Compensation Elements | Compensation Value |

| Annual Cash Retainer | $100,000 |

| Additional Cash Retainer for Independent Board Chair | 50,000 |

| Additional Cash Retainer for Audit Committee Chair | 30,000 |

| Additional Cash Retainer for Compensation and Personnel Committee Chair | 25,000 |

| Additional Cash Retainer for Other Committee Chairs | 20,000 |

| Annual Equity Award | 130,000 |

| Additional Equity Award for Independent Board Chair | 65,000 |

| 2020 Proxy Statement |  | 32 |

| • | All Rule 10b5-1 trading plans must be pre-cleared by the Company’s Securities Trading Compliance Officer. |

| • | A trading plan may be entered into, modified or terminated only during an open trading window and while not in possession of material non-public information. |

| • | Once adopted, the person must not exercise any influence over the amount of securities to be traded, the price at which they are to be traded or the date of the trade. |

| 2020 Proxy Statement |  | 33 |

Fees Earned or Paid in Cash(1) | Stock Awards(2) | All Other Compensation(3) | Total | |

| Name | ($) | ($) | ($) | ($) |

| Frederick Arnold | 100,000 | 129,992 | 58 | 230,050 |

Marjorie L. Bowen(4) | 81,666 | 100,082 | 34 | 181,782 |

| Anna Escobedo Cabral | 130,000 | 129,992 | 58 | 260,050 |

William M. Diefenderfer, III(5) | 37,500 | 195,000 | 29 | 232,529 |

Larry A. Klane(6) | 81,666 | 100,071 | 34 | 181,771 |

| Katherine A. Lehman | 120,000 | 129,992 | 58 | 250,050 |

Linda A. Mills(7) | 137,500 | 173,618 | 58 | 311,176 |

Jane J. Thompson(8) | 125,000 | 130,000 | 58 | 255,058 |

Laura S. Unger(9) | 120,000 | 130,000 | 58 | 250,058 |

Barry L. Williams(10) | 50,000 | 129,992 | 39 | 180,031 |

| David L. Yowan | 100,000 | 129,992 | 58 | 230,050 |

| (1) | This table includes all fees earned or paid in fiscal year 2019. Unless timely deferred under the Director Deferred Compensation Plan, annual cash retainers are paid in quarterly installments beginning shortly after the Company’s annual meeting of shareholders in May each year. Thus, the amounts paid (or deferred) in 2019 include the fourth and final quarterly payment for the period from May 2018 to May 2019, and three quarterly payments for the period from May 2019 to May 2020. |

| (2) | The grant date fair market value for each share of restricted stock granted in 2019 to directors is based on the closing market price of the Company’s Common Stock on the grant date. Additional details on accounting for stock-based compensation can be found in “Note 2–Significant Accounting Policies” and “Note 11–Stock-Based Compensation Plans and Arrangements” to the audited consolidated financial statements included in the 2019 Annual Report on Form 10-K. Stock awards are rounded down to the nearest whole share to avoid the issuance of fractional shares. As noted in the footnotes below, certain directors timely elected to receive a credit under the Director Deferred Compensation Plan in lieu of their 2019 annual equity retainer. Plan credits are automatically invested in a notional Company stock fund and are not subject to rounding for fractional shares. |

| (3) | All Other Compensation is detailed in a table on the following page. |

| (4) | Ms. Bowen joined the Board on May 1, 2019, and her compensation for 2019 was pro-rated accordingly. Ms. Bowen timely elected to receive a credit under the Director Deferred Compensation Plan in lieu of her 2019 annual equity retainer, with the credit being automatically invested in a notional Company stock fund. |

| (5) | Mr. Diefenderfer elected not to stand for reelection to the Board in June 2019, and his cash compensation for 2019 was pro-rated accordingly. Mr. Diefenderfer timely elected to receive a credit under the Director Deferred Compensation Plan in lieu of his 2019 annual equity retainer, with the credit being automatically invested in a notional Company stock fund. Because Mr. Diefenderfer elected not to stand for reelection to the Board in June 2019, he forfeited this credit when he departed the Board. |

| (6) | Mr. Klane joined the Board on May 1, 2019, and his compensation for 2019 was pro-rated accordingly. |

| (7) | Ms. Mills was elected as Chair of the Board effective June 6, 2019, and her annual cash retainer was adjusted accordingly. She also received an additional stock award at the time she became Chair of the Board. |

| (8) | Ms. Thompson timely elected to receive a credit under the Director Deferred Compensation Plan in lieu of her 2019 annual equity retainer, with the credit being automatically invested in a notional Company stock fund. |

| (9) | Ms. Unger timely elected to receive a credit under the Director Deferred Compensation Plan in lieu of her 2019 annual equity retainer, with the credit being automatically invested in a notional Company stock fund. Ms. Unger also elected to defer her annual cash retainer under the Director Deferred Compensation Plan. |

| (10) | Mr. Williams retired from the Board effective August 9, 2019, and his cash compensation for 2019 was pro-rated accordingly. |

| 2020 Proxy Statement |  | 34 |

Life Insurance Premiums(A) | Total | |

| Name | ($) | ($) |

| Frederick Arnold | 58 | 58 |

| Marjorie L. Bowen | 34 | 34 |

| Anna Escobedo Cabral | 58 | 58 |

| William M. Diefenderfer III | 29 | 29 |

| Larry A. Klane | 34 | 34 |

| Katherine A. Lehman | 58 | 58 |

| Linda A. Mills | 58 | 58 |

| Jane J. Thompson | 58 | 58 |

| Laura S. Unger | 58 | 58 |

| Barry L. Williams | 39 | 39 |

| David L. Yowan | 58 | 58 |

| (A) | The amount reported is the annual premium paid by Navient to provide a life insurance benefit of up to $100,000. |

| 2020 Proxy Statement |  | 35 |

| 2020 Proxy Statement |  | 36 |

| 2019 | 2018 | |

| Audit Fees | $4,132,351 | $3,353,617 |

| Audit-Related Fees | $1,021,909 | $1,017,232 |

| Tax Fees | $378,881 | $822,374 |

| All Other Fees | - | - |

| Total | $5,533,141 | $5,193,223 |

| 2020 Proxy Statement |  | 37 |

| 2020 Proxy Statement |  | 38 |

| Name and Address of Beneficial Owner | Shares | Percent |

The Vanguard Group, Inc. (1) | 27,510,806 | 12.44% |

| 100 Vanguard Blvd. | ||

| Malvern, PA 19355 | ||

BlackRock Inc. (2) | 19,358,945 | 10% |

| 40 East 52nd Street | ||

| New York, NY 10022 | ||

Dimensional Fund Advisors LP (3) | 14,752,125 | 6.67% |

| Building One | ||

| 6300 Bee Cave Road | ||

| Austin, Texas 78746 | ||

| (1) | This information is based on the Schedule 13G/A filed with the SEC by The Vanguard Group, Inc., on February 11, 2020. The Vanguard Group, Inc., directly and through its subsidiaries, has sole power to vote or direct the voting of 101,258 shares of Common Stock, shared voting power of 40,510 shares, sole power to dispose of or direct the disposition of 27,396,166 shares of Common Stock, and shared power to dispose of or direct the disposition of 114,640 shares of Common Stock. According to this Schedule 13G/A, Vanguard Fiduciary Trust Company, a wholly owned subsidiary of The Vanguard Group, Inc., beneficially owns 74,130 shares of Common Stock; and Vanguard Investments Australia, Ltd., a wholly owned subsidiary of The Vanguard Group, Inc., beneficially owns 67,638 shares of Common Stock. |

| (2) | This information is based on the Schedule 13G/A filed with the SEC by BlackRock, Inc. on March 9, 2020. BlackRock, Inc. has sole power to vote or direct the voting of 18,451,823 shares of Common Stock and has sole power to dispose of or direct the disposition of for 19,358,945 shares of Common Stock. |

| (3) | This information is based on the Schedule 13G filed with the SEC by Dimensional Fund Advisors LP on February 12, 2020. Dimensional Fund Advisors LP, an investment adviser registered under Section 203 of the Investment Advisors Act of 1940, furnishes investment advice to four investment companies registered under the Investment Company Act of 1940, and serves as investment manager or sub-adviser to certain other commingled funds, group trusts and separate accounts (such investment companies, trusts and accounts, collectively referred to as the “Funds”). The Funds directly have sole power to vote or direct the voting of 14,374,107 shares of Common Stock, and sole power to dispose of or direct the disposition of 14,752,125 shares of Common Stock. |

| 2020 Proxy Statement |  | 39 |

Director Nominees | Shares (1) | Vested Options (2) | Total Beneficial Ownership (3) | Percent of Class |

| Frederick Arnold | 28,551 | - | 28,551 | * |

Marjorie L. Bowen(4) | 12,218 | - | 12,218 | * |

Anna Escobedo Cabral(5) | 56,348 | - | 56,348 | * |

Larry A. Klane(6) | 11,952 | - | 11,952 | * |

| Katherine A. Lehman | 59,565 | - | 59,565 | * |

| Linda A. Mills | 76,002 | - | 76,002 | * |

Jane J. Thompson(7) | 62,162 | - | 62,162 | * |

Laura S. Unger(8) | 58,909 | - | 58,909 | * |

David L. Yowan(9) | 40,039 | - | 40,039 | * |

| Named Executive Officers | ||||

Jack Remondi(10) | 2,590,375 | 111,358 | 2,701,733 | 1.38% |

Christian Lown(11) | 316,849 | - | 316,849 | * |

John Kane(12) | 464,527 | 36,553 | 501,080 | * |

Mark Heleen(13) | 286,085 | - | 286,085 | * |

Steve Hauber(14) | 144,510 | 19,529 | 164,039 | * |

| Directors and Current Officers as a Group | 4,208,092 | 167,440 | 4,375,532 | 2.24% |

| (14 Persons) | ||||

| * | Less than one percent |

| (1) | Shares of Common Stock and stock units held directly or indirectly, including vested deferred stock units and unvested deferred stock units that may vest within 60 days of March 3, 2020, credited to Company-sponsored retirement and deferred compensation plans. Totals for named executive officers include (i) restricted stock units (“RSUs”) that vest and are converted into shares only upon the passage of time, (ii) performance stock units (“PSUs”) that vest and are converted into shares upon the satisfaction of pre-established performance conditions, and (iii) associated dividend equivalent units (“DEUs”) issued on outstanding RSUs and PSUs. The individuals holding such RSUs, PSUs and DEUs have no voting or investment power over these units. |

| (2) | Shares that may be acquired within 60 days of March 3, 2020, through the exercise of stock options. The stock options held by our officers are net- settled pursuant to their terms (i.e., shares are withheld upon exercise to cover the aggregate exercise price, and the net resulting shares are delivered to the option holder). Net-settled stock options therefore are shown on a “spread basis,” with out-of-the-money options shown as 0. |

| (3) | Total of columns 1 and 2. Except as otherwise indicated and subject to community property laws, each owner has sole voting and sole investment power with respect to the shares listed. |

| (4) | For Ms. Bowen, 12,218 shares are deferred stock units credited to a Company-sponsored deferred compensation plan account. Ms. Bowen is not being nominated by the Board for reelection, and her tenure as a director will end when her current term expires at our 2020 Annual Meeting. |

| (5) | For Ms. Cabral, 38,122 shares are deferred stock units credited to a Company-sponsored deferred compensation plan account. |

| (6) | For Mr. Klane, 4,610 shares are deferred stock units credited to a Company-sponsored deferred compensation plan account. |

| (7) | For Ms. Thompson, 55,901 shares are deferred stock units credited to a Company-sponsored deferred compensation plan account. |

| (8) | For Ms. Unger, 18,011 shares are deferred stock units credited to a Company-sponsored deferred compensation plan account. |

| 2020 Proxy Statement |  | 40 |

| (9) | For Mr. Yowan, 10,564 shares are deferred stock units credited to a Company-sponsored deferred compensation plan account. |

| (10) | Mr. Remondi’s share ownership includes 250 shares held as custodian for his child. 930,530 of the shares reported in this column are RSUs, PSUs or DEUs over which Mr. Remondi has no voting or dispositive control. |

| (11) | 259,418 of the shares reported in this column are RSUs, PSUs, or DEUs over which Mr. Lown has no voting or dispositive control. |

| (12) | 207,265 of the shares reported in this column are RSUs, PSUs or DEUs over which Mr. Kane has no voting or dispositive control. 1,250 shares are deferred stock units credited to a Company-sponsored deferred compensation plan account. |

| (13) | 144,125 of the shares reported in this column are RSUs, PSUs or DEUs over which Mr. Heleen has no voting or dispositive control. |

| (14) | 96,724 of the shares reported in this column are RSUs, PSUs or DEUs over which Mr. Hauber has no voting or dispositive control. |

| 2020 Proxy Statement |  | 41 |

| Name and Age | Position and Business Experience |

Christian Lown 50 | • Chief Financial Officer, Navient — March 2017 to present • Managing Director and Co-Head, Global Financial Technology Group, North America Banks and Diversified Finance, Morgan Stanley — 2006 to March 2017 • Vice President, Financial Institutions Group — UBS AG — 2003 to 2006 • Associate, Financial Institutions Group, Credit Suisse First Boston — 2001 to 2003 |

John Kane 51 | • Group President, Business Processing Solutions, Navient — June 2015 to present • Chief Operating Officer, Navient — April 2014 to June 2015 • Senior Vice President — Enterprise Project Management, SLM Corporation — March 2013 to April 2014 • Senior Vice President — Credit, SLM Corporation — August 2011 to March 2013 • Senior Vice President — Collections, SLM Corporation — 2008 to 2011 • Senior Vice President — Consumer Credit Operations, MBNA/Bank of America — 1990 to 2008 |

Mark L. Heleen 57 | • Chief Legal Officer and Secretary, Navient — February 2015 to present • Senior Vice President and Senior Deputy General Counsel, Navient — June 2014 to February 2015 • Senior Attorney, Cadwalader Wickersham & Taft LLP — August 2013 to June 2014 • Independent Consultant — January 2011 to August 2013 • Executive Vice President and General Counsel, SLM Corporation — February 2009 to December 2010 • Various roles in the Office of the General Counsel, SLM Corporation — July 1998 to February 2009 |

Steve Hauber 45 | • Chief Risk and Compliance Officer, Navient — June 2017 to present • Chief Audit Officer, Navient — April 2014 to June 2017 • Chief Audit Officer, SLM Corporation — January 2011 to April 2014 |

| 2020 Proxy Statement |  | 42 |

| 2020 Proxy Statement |  | 43 |

| 2020 Proxy Statement |  | 44 |

| 2020 Proxy Statement |  | 45 |

| • | Jack Remondi, President and Chief Executive Officer |

| • | Christian Lown, Chief Financial Officer |

| • | John Kane, Group President, Business Processing Solutions |

| • | Mark Heleen, Chief Legal Officer and Secretary |

| • | Steve Hauber, Chief Risk and Compliance Officer |

| 2020 Proxy Statement |  | 46 |

Navient’s 2019 Performance | |||

Provide Consistent Return to Shareholders | Successfully Manage Our Liquidity Needs | Pursue Loan Portfolio Acquisitions | |

2019 Performance Highlights | • Returned $587 million to our shareholders through dividends and share repurchases, representing a 97% payout ratio • Adjusted Diluted “Core Earnings” Per Share of $2.64, beating the target in our 2019 annual incentive plan by 36% | • Issued $2.7 billion in FFELP loan asset-backed securities (“ABS”) and $4.1 billion in private education loan ABS • Retired $2 billion of senior unsecured debt • Reduced the interest expense we otherwise would have incurred in 2019 by over $90 million | • Acquired $20 billion in education loans during 2017-19, which added to our consistent and predictable cash flows |

Annual Incentive Measures | • Adjusted Diluted “Core Earnings” Per Share8 • Adjusted “Core Earnings” Operating Expenses9 | • Adjusted Diluted “Core Earnings” Per Share • Adjusted “Core Earnings” Operating Expenses | • Adjusted Diluted “Core Earnings” Per Share • Adjusted “Core Earnings” Operating Expenses |

Long-term Incentive Measures | • Grow Intrinsic Value of Company • Cumulative Net Student Loan Cash Flows10 | • Grow Intrinsic Value of Company • Cumulative Net Student Loan Cash Flows | • Pursue Opportunistic Loan Portfolio Acquisitions • Cumulative Net Student Loan Cash Flows |

| Increase Business Processing EBITDA | Grow Our Consumer Lending Business | Improve Performance of Our Private Eduation Loan Portfolio | |

2019 Performance Highlights | • Increased Business Processing EBITDA by 11% from 2018 but fell below the target in our 2019 annual incentive plan | • Originated $4.9 billion in private education refinance loans, significantly above the $3.65 billion target in our 2019 annual incentive plan | • Reduced private education loan delinquency rate 22% from 2018 • Due to improved laon performance, we were able to reduce our private education loan provision by $73 million from 2018 |

Annual Incentive Measures | • Business Processing EBITDA11 | • Consumer Lending New Loan Volume • Adjusted Diluted “Core Earnings” Per Share | • Private Education Loan Gross Defaults • Adjusted Diluted “Core Earnings” Per Share |

Long-term Incentive Measures | • Revenue from Growth Businesses • Improve Margins in Fee Businesses | • Grow Intrinsic Value of Company • Cumulative Net Student Loan Cash Flows | • Grow Intrinsic Value of Company |

8 | Adjusted Diluted “Core Earnings” Per Share excludes net restructuring and regulatory-related charges, as well as certain extraordinary items such as strategic corporate transactions or other unusual or unplanned events. Adjusted Diluted “Core Earnings” Per Share is a non-GAAP financial measure that does not represent a comprehensive basis of accounting. For more information on the definition of Adjusted Diluted “Core Earnings” Per Share please refer to page 30 of our 2019 Annual Report filed on Form 10-K on February 27, 2020. For a reconciliation of our non-GAAP financial measures with GAAP results, please refer to the discussion on pages 37–52 of our 2019 Annual Report, or refer to the Investor Relations section of our website located at http://www.navient.com/about/investors/. |

9 | Adjusted “Core Earnings” Operating Expenses excludes net restructuring and regulatory-related charges, as well as certain extraordinary items such as strategic corporate transactions or other unusual or unplanned events. Adjusted “Core Earnings” Operating Expenses is a non-GAAP financial measure that does not represent a comprehensive basis of accounting. For more information on the definition of Adjusted “Core Earnings” Operating Expenses and for a reconciliation of non-GAAP financial measures with GAAP results, please refer to our Investor Presentation for Fourth Quarter and Full Year 2019 on the Investor Relations section of our website located at http://www.navient.com/about/investors/. |

10 | “Cumulative Net Student Loan Cash Flows” is a non-GAAP financial measure that does not represent a comprehensive basis of accounting. For more information on the definition of cumulative net student loan cash flows, please refer to the definition at footnote 16. |

11 | Earnings Before Interest, Taxes, Depreciation and Amortization Expense (“EBITDA”) is a non-GAAP financial measure that does not represent a comprehensive basis of accounting. For more information on the definition of EBITDA and for a reconciliation of non-GAAP financial measures with GAAP results, please refer to the discussion on page 45 of our 2019 Annual Report filed on Form 10-K on February 27, 2020, or refer to the Investor Relations section of our website located at http://www.navient.com/about/investors/. |

| 2020 Proxy Statement |  | 47 |

| 2019 MIP Performance Metric | Weight | Rationale |

Adjusted Diluted “Core Earnings” Per Share12 | 35% | • Measures overall management effectiveness |

• Promotes shareholder value | ||

• Key financial metric for investors | ||

| Consumer Lending New Loan Volume | 20% | • Emphasizes growth in strategic businesses |

• Offers refinance opportunities to our existing customers, which helps retain and grow our customer base | ||

• Loan volume is a key focus in order to scale this growing business | ||

• All loan volume is subject to the Company’s Board-approved risk and return guidelines (e.g., regarding consumer credit quality, cost-to-acquire, net interest margin) | ||

Business Processing EBITDA13 | 20% | • Emphasizes profitable growth in strategic businesses |

• Growth helps to offset company-wide expenses as our legacy loan portfolio amortizes | ||

Adjusted “Core Earnings” Operating Expenses14 | 15% | • Focuses management attention on expense reduction as our legacy loan portfolio amortizes |

• Key financial metric for investors, which is also critical to the achievement of our Adjusted Diluted “Core Earnings” Per Share goal | ||

| Private Education Loan Gross Defaults | 10% | • Enhances the profitability of our private education loan portfolio |

• Aids our private education student loan customers | ||

• Key financial metric for investors |

| 2019 Management Incentive Plan | ||||||||

| 2019 Performance Metric | Performance Target | 2019 Actual Performance | Payout Factor | Weighting | Performance Score | |||

| Adjusted Diluted “Core Earnings” Per Share | $ | 1.94 | $ | 2.64 | 150.0% | 35% | 52.5% | |

| Consumer Lending New Loan Volume (millions) | $ | 3,651 | $ | 4,903 | 150.0% | 20% | 30.0% | |

| Business Processing EBITDA (millions) | $ | 60 | $ | 49 | 55.0% | 20% | 11.0% | |

Adjusted “Core Earnings” Operating Expenses15 (millions) | $ | 949 | $ | 965 | 82.7% | 15% | 12.4% | |

| Private Education Loan Gross Defaults (millions) | $ | 459 | $ | 428 | 130.5% | 10% | 13.1% | |

| Overall Performance Score: | 119.0% | |||||||

12 | See footnote 8 above. |

13 | See footnote 11 above. |

14 | See footnote 9 above. |

15 | Excludes $6 million in regulatory-related expenses, $6 million in restructuring expenses and $12.5 million in expenses relating to the Canyon Agreement. For additional information pertaining to the Canyon Agreement, please refer to “Shareholder Engagement and Communications with the Board” above. |

| 2020 Proxy Statement |  | 48 |

| 2017-19 PSU Performance Metric | Weight | Rationale |

| Cumulative Net Student Loan Cash Flows | 50% | • Promotes successful management of our loan portfolios |

• Critical driver of shareholder value, supporting dividends, share repurchases and debt payments | ||

• Supports growth of strategic businesses, including consumer lending | ||

| Cumulative Revenue from Growth Businesses | 30% | • Emphasizes strategic growth as our legacy loan portfolio amortizes |

• Offsets Company-wide expenses as our legacy loan portfolio amortizes | ||

| Strategic Objectives | 20% | • Focuses management on critical, long-term strategic goals |

| 2017-19 Performance Stock Units | ||||||||

| 2017-19 Performance Metric | Performance Target | 2017-19 Actual Performance | Payout Factor | Weight | Performance Score | |||

Cumulative Net Student Loan Cash Flows16 (millions) | $ | 7,850 | $ | 8,818 | 135% | 50% | 67% | |

Cumulative Revenue from Growth Businesses17 (millions) | $ | 995 | $ | 839 | 65% | 30% | 20% | |

| Strategic Objectives | 110% | 20% | 22% | |||||

• Pursue Opportunistic Loan Portfolio Acquisitions • Capture Operating Efficiencies in Asset Servicing • Improve Margins in Fee Businesses • Build Strong Relationships with State and Federal Regulators • Grow Intrinsic Value of Company | ||||||||

| Overall Performance Score: | 109% |

16 | Cumulative Net Student Loan Cash Flows is a non-GAAP financial measure that does not represent a comprehensive basis of accounting. Cumulative Net Student Loan Cash Flows include aggregate cash flows net of secured borrowings from student loans realized for the fiscal years 2017, 2018 and 2019, including student loan cash flows realized from new acquisitions, but excluding the impact of cash flows for fiscal years beyond 2019 that are accelerated through securitizing or pledging unencumbered student loans or through loan sales. |

17 | Cumulative Revenue from Growth Businesses includes that portion of the Company’s aggregate revenue for fiscal years 2017-19 from non-federal-loan-related businesses. |

| 2020 Proxy Statement |  | 49 |

| 2017-19 Performance Stock Units | |

| 2017-19 Strategic Objectives | Achievements |

| Pursue Opportunistic Loan Portfolio Acquisitions | • Acquired $20 billion in student loans between 2017-19, significantly enhancing cash flows from our amortizing loan portfolio |

• Exceeded acquisition targets by 100% | |

| Capture Operating Efficiencies in Asset Servicing | • Reduced direct servicing unit cost between 2017-19 while improving customer satisfaction |

• Continued to implement automation and system enhancements, as well as program and procedural improvements, that have driven down expenses and improved efficiency | |

| Improve Margins in Fee Businesses | • Business Processing EBITDA margins significantly improved over three-year period. |

| • Implemented operational improvements to improve efficiency and increase revenue, including robotic process automations and call optimization efforts | |

| • Secured several large-scale healthcare revenue cycle management engagements | |

| Build Strong Relationships with State and Federal Regulators | • Established or reestablished dialogue with various regulatory bodies |

• Received positive examinations from key federal and state regulators | |

| • Continued to execute on strategy to provide fact-based responses to ongoing litigation | |

| Grow Intrinsic Value of Company | • Private education loan delinquencies reached historic lows |

| • Reduced the interest expense we otherwise would have incurred through a variety of financing initiatives | |

• Value delivered to shareholders through dividends and share repurchases | |

| • Maintained stable ratings with all three credit rating agencies | |

| 2020 Proxy Statement |  | 50 |

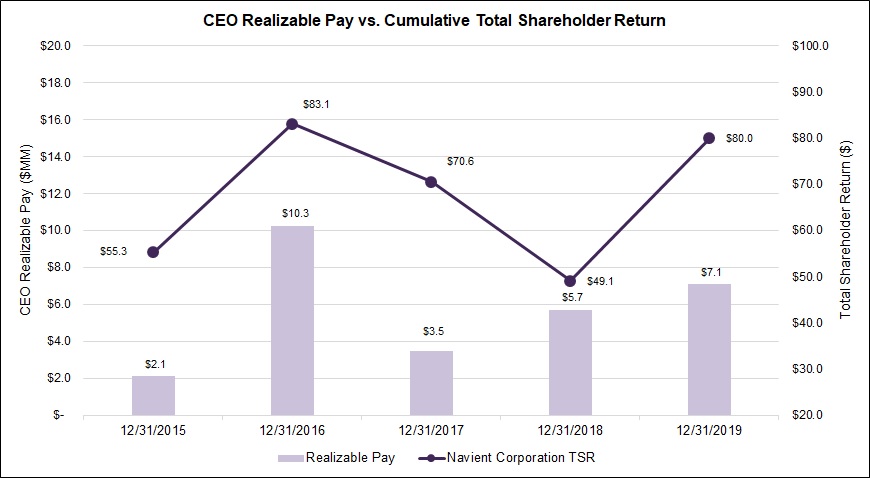

| Year | Base Salary ($) | Annual Incentive Compensation ($) | PSUs ($) | RSUs ($) | Stock Options ($) | Total ($) | ||

| 2019 | 1,000,000 | 1,785,000 | 1,926,497 | 2,391,606 | 0 | 7,103,103 | ||

| 2018 | 1,000,000 | 1,896,000 | 2,309,255 | 517,094 | 0 | 5,722,349 | ||

| CEO Realizable Pay | 2017 | 1,000,000 | 1,444,500 | 0 | 1,032,553 | 0 | 3,477,053 | |

| 2016 | 1,000,000 | 1,666,500 | - | 2,067,157 | 5,527,226 | 10,260,883 | ||

| 2015 | 1,000,000 | 735,000 | - | 370,201 | 0 | 2,105,201 |

18 | For 2019, the Committee decided to discontinue the prior practice of granting stock options as part of the Company’s long-term incentive program. Our 2019 long-term incentive program is described in greater detail beginning on page 60. |

| 2020 Proxy Statement |  | 51 |

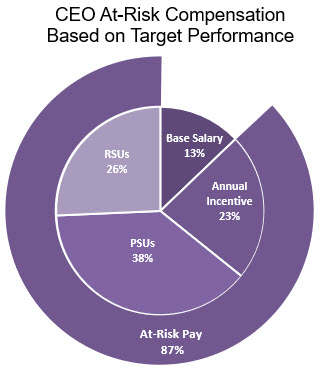

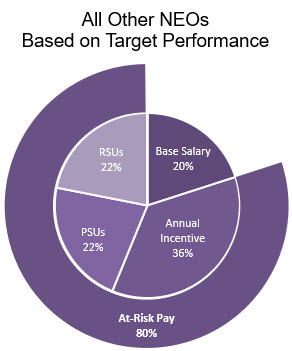

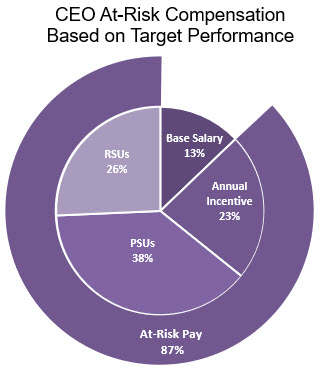

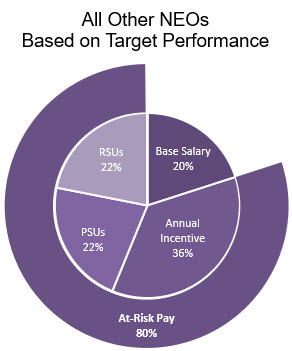

| • | Align Compensation with Shareholder Interests. For 2019, 87% of the total direct compensation opportunity provided to our CEO was at-risk and aligned with shareholder value, including incentive awards that depend upon the attainment of specific performance objectives, the value of Navient’s Common Stock or both. This feature of our executive compensation program is highlighted in the charts below. |

|  |

| • | Pay for Performance. As illustrated above, more than 50% of the full-year total compensation at target for our NEOs is delivered through annual incentives and PSUs that are earned based on achievement of enterprise-wide goals that impact shareholder value. |

| • | Reward Annual Performance. The annual incentive award component of our NEOs’ total compensation is designed to reward achievement of key annual goals that are aligned with the Company’s annual business plan, and conversely to be lower or zero in periods in which those key annual goals are only partially achieved or not achieved at all. |

| • | Reward Long-term Growth. The total compensation paid to our NEOs is weighted toward long-term equity-based incentives. These awards align pay with sustained performance and shareholder value creation. |

| 2020 Proxy Statement |  | 52 |

| • | Retention of Top Executives. Our NEOs have base salaries and benefits that are competitive and not excessive, therefore permitting Navient to attract, motivate and retain executives who can drive and lead our success. |

| 2020 Proxy Statement |  | 53 |

| 2019 Navient Peer Group | |||||

| Company | Total Assets(1) | Net Income(2) | Market Cap(1) | ||

| Customer Account Management | |||||

| Alliance Data Systems Corporation | $26,495 | $278 | $5,168 | ||

Automatic Data Processing, Inc. (3) | 49,059 | 2,463 | 73,775 | ||

DST Systems, Inc. (4) | 3,079 | 267 | 4,982 | ||

Total System Services, Inc. (5) | 7,707 | 617 | 23,586 | ||

| The Western Union Company | 8,759 | 1,058 | 11,228 | ||

| Asset and Risk Management | |||||

| The Charles Schwab Corporation | 294,005 | 3,704 | 61,095 | ||

| Comerica Incorporated | 73,402 | 1,198 | 10,343 | ||

| Fifth Third Bancorp | 169,369 | 2,512 | 21,815 | ||

| Lincoln National Corporation | 334,761 | 886 | 11,703 | ||

| Voya Financial, Inc. | 169,051 | -351 | 8,220 | ||

| High Volume Operations | |||||

| Discover Financial Services | 113,996 | 2,957 | 26,588 | ||

| Fiserv, Inc. | 77,539 | 893 | 78,616 | ||

| Global Payments Inc. | 44,480 | 431 | 54,868 | ||

Paychex, Inc. (6) | 8,702 | 1,078 | 30,484 | ||

Worldpay, Inc. (7) | 27,097 | 293 | 41,981 | ||

25th Percentile | $17,627 | $362 | $10,785 | ||

| Median | 49,059 | 893 | 23,586 | ||

75th Percentile | 141,524 | 1m831 | 48,425 | ||

| Navient Corporation | $94,903 | $597 | $3,024 | ||

| Rank | 6 of 16 | 11 of 16 | 16 of 16 | ||

| Percentile | 67 | 34 | 0 | ||

| (1) | Total assets and market capitalization reflect each company’s most recent fiscal year end except for Automatic Data Processing, Inc., DST Systems, Inc., Total System Services, Inc., Paychex, Inc. and Worldpay, Inc. Please see footnotes (3), (4), (5), (6) and (7) for more information. |

| (2) | Net income (in millions in accordance with GAAP) for each company’s most-recently-ended fiscal year, as reflected in each company’s Annual Report on Form 10-K filed with the SEC. Except as otherwise noted below, each company’s most recent fiscal year ended December 31, 2019. |

| (3) | Automatic Data Processing's most recent fiscal year end is June 30, 2019. Total assets reflect the most-recent fiscal quarter end and net income reflects 12-month trailing as of December 31, 2019. Market capitalization reflects common shares outstanding at December 31, 2019, multiplied by the per share closing price of the company’s common stock on December 31, 2019, the last trading date of the year. |

| (4) | DST Systems, Inc. was acquired by SS&C Technologies Holdings, Inc. on April 16, 2018. Market capitalization reflects common shares outstanding at April 16, 2018, multiplied by the per share closing price of the company’s common stock on April 16, 2018, the company's last day of trading. All other metrics are as of March 31, 2018, the most recent quarter end with publicly disclosed financial data. |

| (5) | Total System Services, Inc. was acquired by Global Payments Inc. on September 17, 2019. Market capitalization reflects common shares outstanding at September 17, 2019, multiplied by the per share closing price of the company’s common stock on September 17, 2019, the company's last day of trading. All other metrics are as of June 30, 2019, the most recent quarter end with publicly disclosed financial data. |

| (6) | Paychex's most recent fiscal year end is May 31, 2019. Total assets reflect the most-recent fiscal quarter end and net income reflects 12-month trailing as of November 30, 2019. Market capitalization reflects common shares outstanding at December 31, 2019, multiplied by the per share closing price of the company’s common stock on December 31, 2019, the last trading date of the year. |

| (7) | Worldpay, Inc. was acquired by Fidelity National Information Services, Inc. on July 31, 2019. Market capitalization reflects common shares outstanding at July 31, 2019, multiplied by the per share closing price of the company’s common stock on July 31, 2019, the company's last day of trading. All other metrics are as of June 30, 2019, the most recent quarter end with publicly disclosed financial data. |

| 2020 Proxy Statement |  | 54 |

| 2020 Navient Peer Group | |||||

| Company | Total Assets(1) | Net Income(2) | Market Cap(1) | ||

| Alliance Data Systems Corporation | $26.495 | $278 | $5,168 | ||

| Ally Financial Inc. | 180,644 | 1,715 | 11,615 | ||

| Comerica Incorporated | 73,402 | 1,198 | 10,343 | ||

| Conduent Incorporated | 4,514 | -1,934 | 1,311 | ||

| Discover Financial Services, Inc. | 113,996 | 2,957 | 26,588 | ||

| Fifth Third Bancorp | 169,369 | 2,512 | 21,815 | ||

| KeyCorp | 144,988 | 1,717 | 19,936 | ||

MAXIMUS, Inc. (3) | 1,990 | 244 | 4,759 | ||

Paychex, Inc. (4) | 8,702 | 1,078 | 30,484 | ||

| Regions Financial Corporation | 126,240 | 1,582 | 16,553 | ||

| Santander Consumer USA Holdings, Inc. | 48,934 | 994 | 7,944 | ||

| SLM Corporation | 32,686 | 578 | 3,762 | ||

| Synchrony Financial | 104,826 | 3,747 | 23,269 | ||

| The Western Union Company | 8,759 | 1,058 | 11,228 | ||

25th Percentile | $13,193 | $682 | $5,862 | ||

| Median | 61,168 | 1,138 | 11,421 | ||

75th Percentile | 123,179 | 1,717 | 21,345 | ||

| Navient Corporation | $94,9903 | $597 | $3,024 | ||

| Rank | 7 of 15 | 11 of 15 | 14 of 15 | ||

| Percentile | 59 | 23 | 5 | ||

| (1) | Total assets and market capitalization reflect each company’s most recent fiscal year end except for MAXIMUS, Inc. and Paychex Inc. Please see footnotes (3) and (4) for more information. |

| (2) | Net income (in millions in accordance with GAAP) for each company’s most-recently-ended fiscal year, as reflected in each company’s Annual Report on Form 10-K filed with the SEC. Except as otherwise noted below, each company’s most recent fiscal year ended December 31, 2019. |

| (3) | MAXIMUS' most recent fiscal year end is September 30, 2019. Total assets reflect the most-recent fiscal quarter end and net income reflects 12-month trailing as of December 31, 2019. Market capitalization reflects common shares outstanding at December 31, 2019, multiplied by the per share closing price of the company’s common stock on December 31, 2019, the last trading date of the year. |

| (4) | Paychex's most recent fiscal year end is May 31, 2019. Total assets reflect the most-recent fiscal quarter end and net income reflects 12- month trailing as of November 30, 2019. Market capitalization reflects common shares outstanding at December 31, 2019, multiplied by the per share closing price of the company’s common stock on December 31, 2019, the last trading date of the year. |

| 2020 Proxy Statement |  | 55 |

| Compensation Element | Objective | Type of Compensation | |

| Base Salary | To provide a base level of cash compensation consistent with the executive’s level of responsibility. | Fixed cash compensation. Reviewed annually and adjusted as appropriate. | |

| Annual Incentives | To encourage and reward our NEOs for achieving annual corporate and individual performance goals. | Variable compensation. Performance-based. Payable in cash. | |

| Long-term Incentives | To motivate and retain senior executives by aligning their interests with those of shareholders through sustained performance and growth. | Multi-year variable compensation. Generally payable in performance stock units (“PSUs”) and/or restricted stock units (“RSUs”). PSUs are subject to performance vesting based on cumulative three-year performance, with each award being settled in stock at the end of the performance period to the degree that goals are met. RSUs are subject to time-based vesting, with each award vesting in 1/3 increments over a three-year period. For 2019, total long-term incentive value was provided 60% in PSUs and 40% in RSUs for our CEO and split equally between PSUs and RSUs for our other NEOs. |

| 2020 Proxy Statement |  | 56 |

|  |

Navient NEOs | 2019 Base Salary | 2018 Base Salary | 2017 Base Salary | |||||

| Mr. Remondi | $ | 1,000,000 | $ | 1,000,000 | $ | 1,000,000 | ||

| Mr. Lown | $ | 400,000 | $ | 400,000 | $ | 400,000 | ||

| Mr. Kane | $ | 460,000 | $ | 460,000 | $ | 460,000 | ||

| Mr. Heleen | $ | 385,000 | $ | 385,000 | $ | 385,000 | ||

| Mr. Hauber* | $ | 350,000 | $ | 310,000 | $ | - | ||

| * | Mr. Hauber was not a named executive officer of the Company in 2017. |

| 2020 Proxy Statement |  | 57 |

| 2019 MIP Performance Metric | Weight | Rationale |

Adjusted Diluted “Core Earnings” Per Share19 | 35% | • Measures overall management effectiveness |

• Promotes shareholder value | ||

• Key financial metric for investors | ||

| Consumer Lending New Loan Volume | 20% | • Emphasizes growth in strategic businesses |

• Offers refinance opportunities to our existing customers, which helps retain and grow our customer base | ||