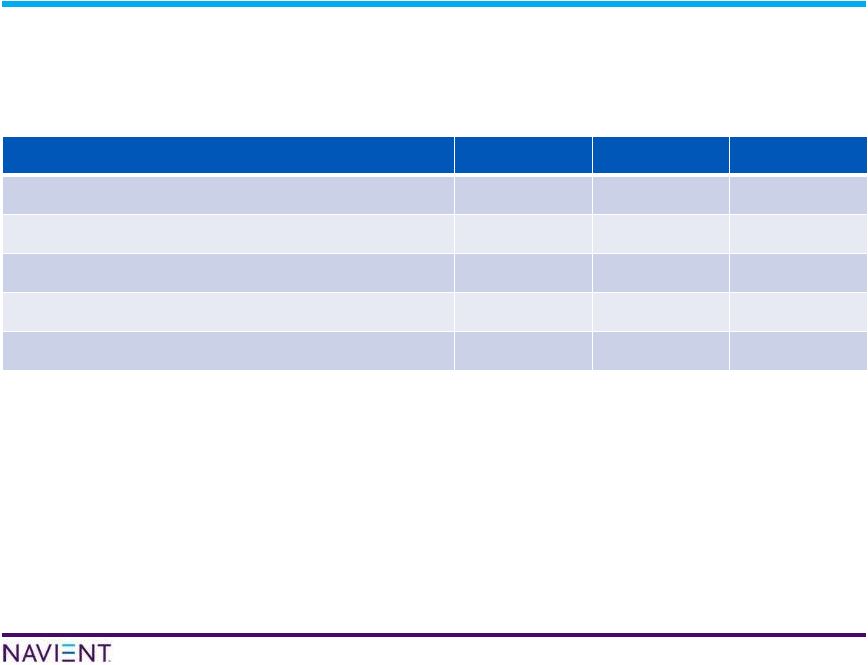

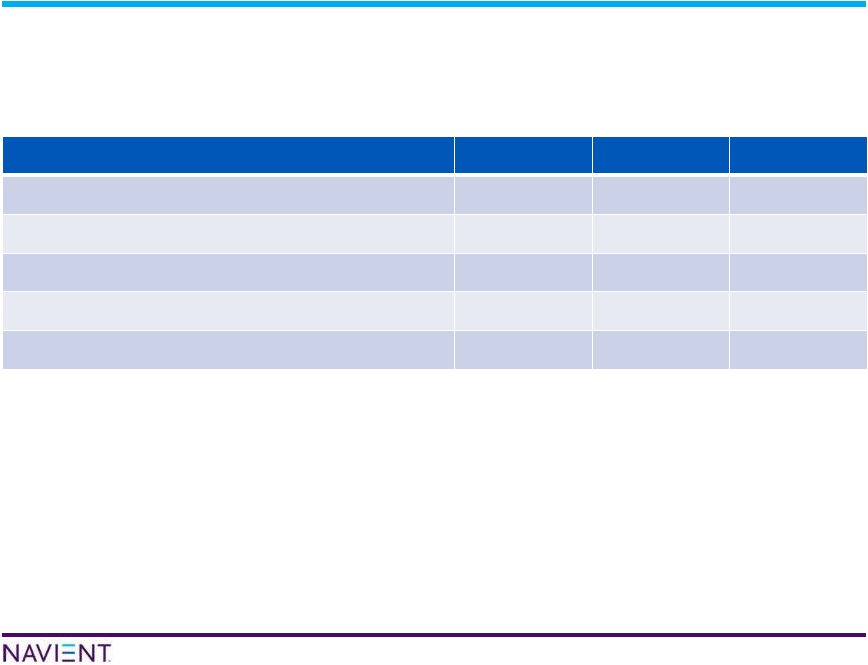

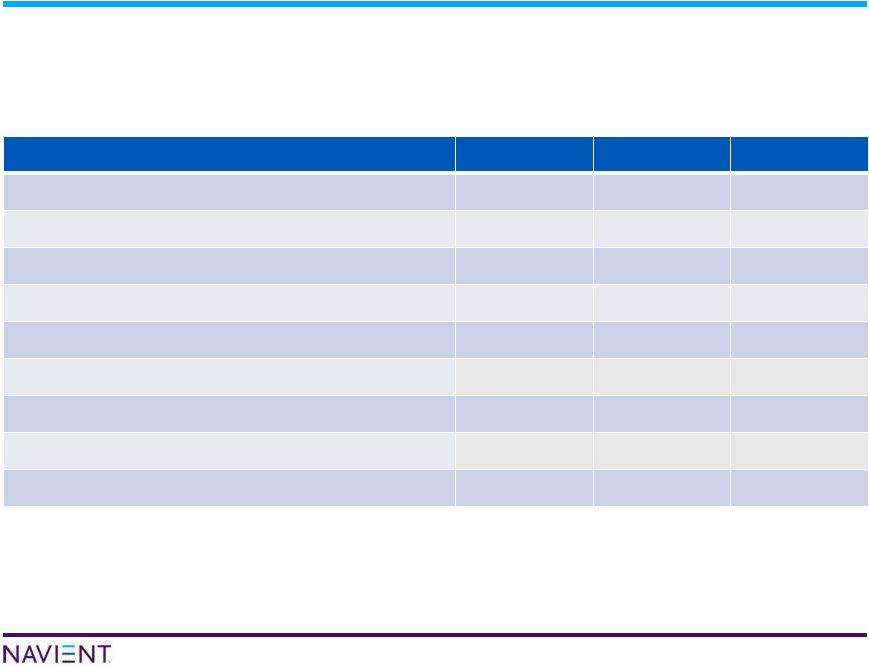

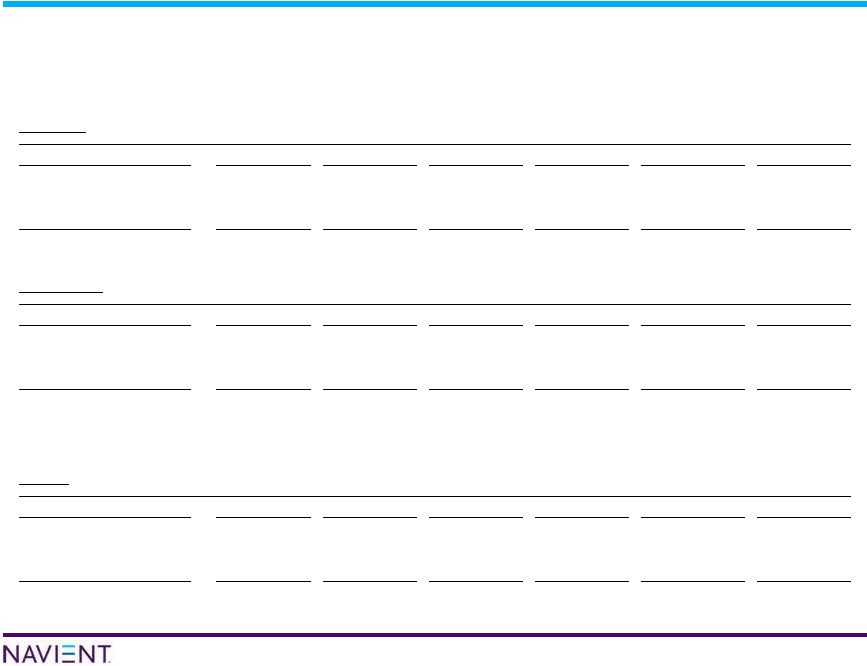

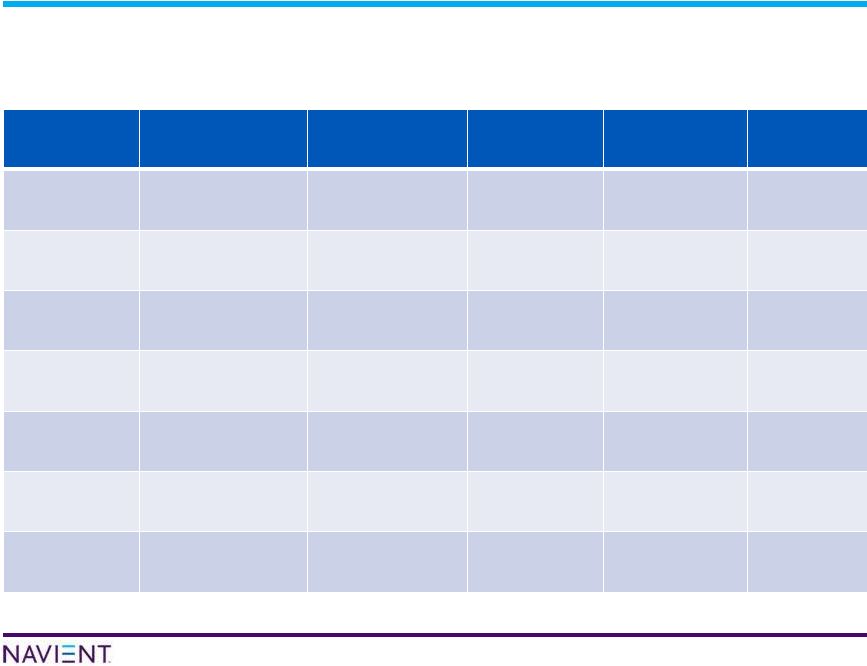

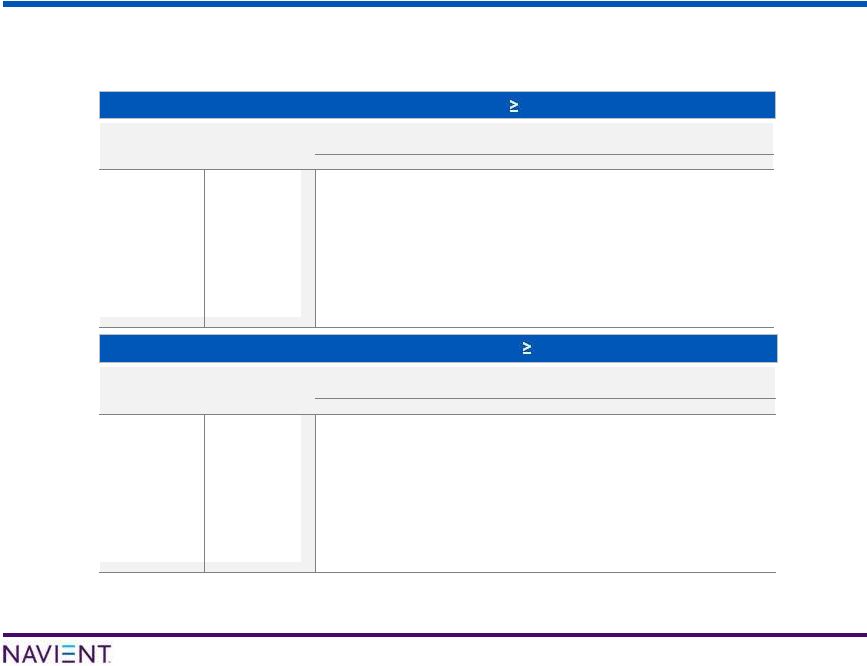

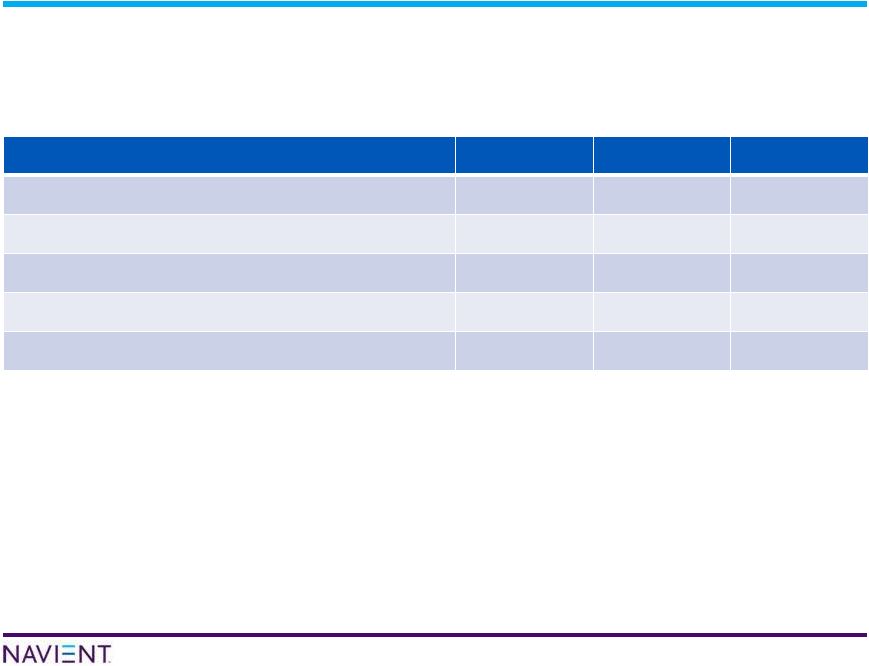

37 Confidential and proprietary information © 2014 Navient Solutions, Inc. All rights reserved. Navient Private Education Loan Programs Smart Option Undergraduate/Graduate/ Med/Law/MBA Direct-to-Consumer (DTC) Consolidation Career Training Origination Channel School School Direct-to-Consumer Lender School Typical Borrower Student Student Student College Graduates Student Typical Co-signer Parent Parent Parent Parent Parent, Spouse Typical Loan $10k avg orig bal, 10 yr avg term, in-school payments of interest only, $25 or fully deferred $10k avg orig bal, 15 yr term, deferred payments $12k avg orig bal, 15 yr term, deferred payments $43k avg orig bal, 15-30 year term depending on balance, immediate repayment $9k avg orig bal, up to 15 yr term, immediate payments Origination Period March 2009 to April 2014 All history through 2014 2004 through 2008 2006 through 2008 1998 through 2014 Certification and Disbursement School certified and disbursed School certified and disbursed Borrower self-certified, disbursed to borrower Proceeds to lender to pay off loans being consolidated School certified and disbursed Borrower Underwriting FICO, custom credit score model, and judgmental underwriting Primarily FICO Primarily FICO FICO and Debt-to-Income FICO, Debt-to-Income and judgmental underwriting Borrowing Limits $200,000 $100,000 Undergraduate, $150,000 Graduate $130,000 $400,000 Cost of attendance plus up to $6,000 for expenses Current ABS Sec. Criteria For-Profit; FICO > 670 For-Profit; FICO > 670 FICO > 670 For-Profit; FICO > 670 FICO > 670 Non-Profit; FICO > 640 Non-Profit; FICO > 640 Non-Profit; FICO > 640 School UW No No No No Yes Historical Risk-Based Pricing L + 2% to L + 14% P-1.5% to P+7.5% P+1% to P+6.5% P - 0.5% to P + 6.5% P+0% to P+9% L+0% to L+15% L+6% to L+12% L+6.5% to L+14% Dischargeable in Bankruptcy No No No No Yes Additional Characteristics Made to students and parents primarily through college financial aid offices to financial aid offices to fund 2- fund 2-year, 4-year and graduate school college tuition, room and board Also available on a limited basis to students and parents Med and MBA Loan brands to fund non-degree granting secondary education, including community college, part time, technical and trade school programs Both Title IV and non-Title IV schools (1) Made to students and parents through college year, 4-year and graduate school college tuition, room and board Signature, Excel, Law, Title IV schools only (1) Freshmen must have a co- signer with limited exceptions Co-signer stability test (minimum 3 year repayment history) Terms and underwriting criteria similar to Undergraduate, Graduate, Med/Law/MBA with primary differences being: Marketing channel No school certification Disbursement of proceeds directly to borrower Title IV schools only (1) Freshmen must have a co- signer with limited exceptions Co-signer stability test (minimum 3 year repayment history) Loans made to students and parents to refinance one or more private education loans Student must provide proof community college, part time, of graduation in order to obtain loan Loans made to students and parents to fund non- degree granting secondary education, including technical, trade school and tutorial programs Both Title IV and non-Title IV schools (1) (1) Title IV Institutions are post-secondary institutions that have a written agreement with the Secretary of Education that allows the institution to participate in any of the Title IV federal student financial assistance programs and the National Early Intervention Scholarship and Partnership (NEISP) programs. |