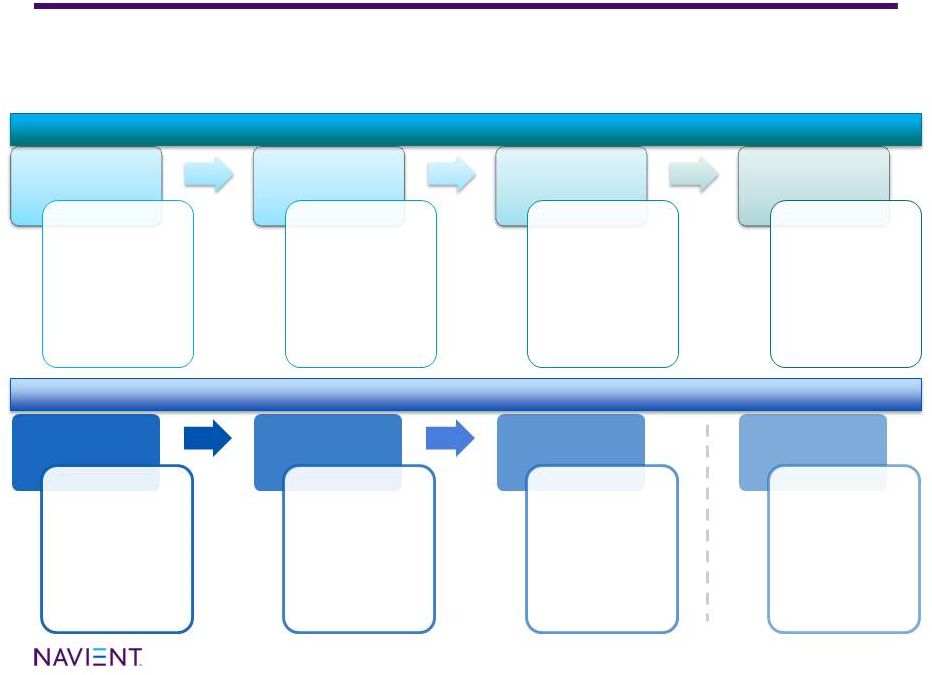

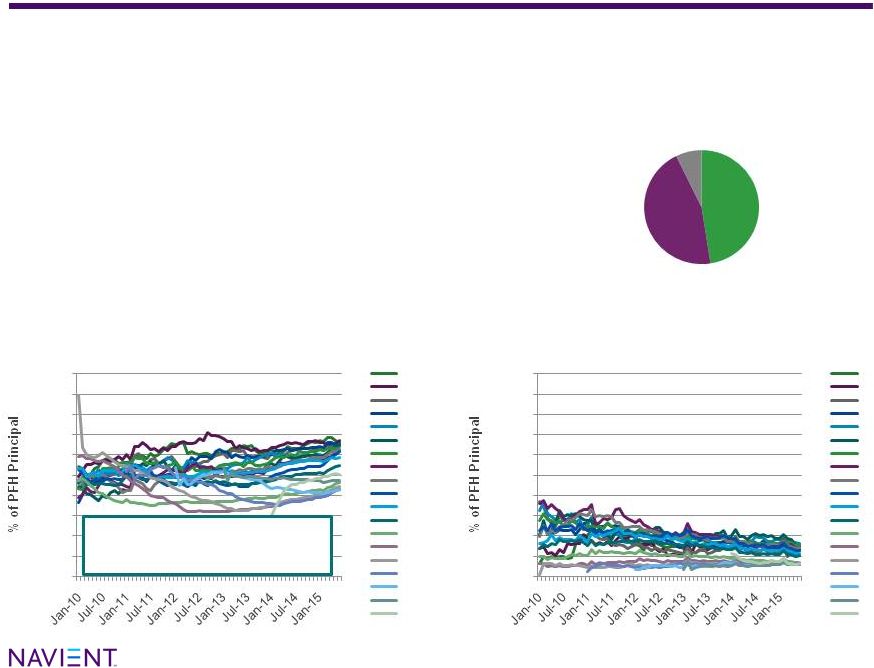

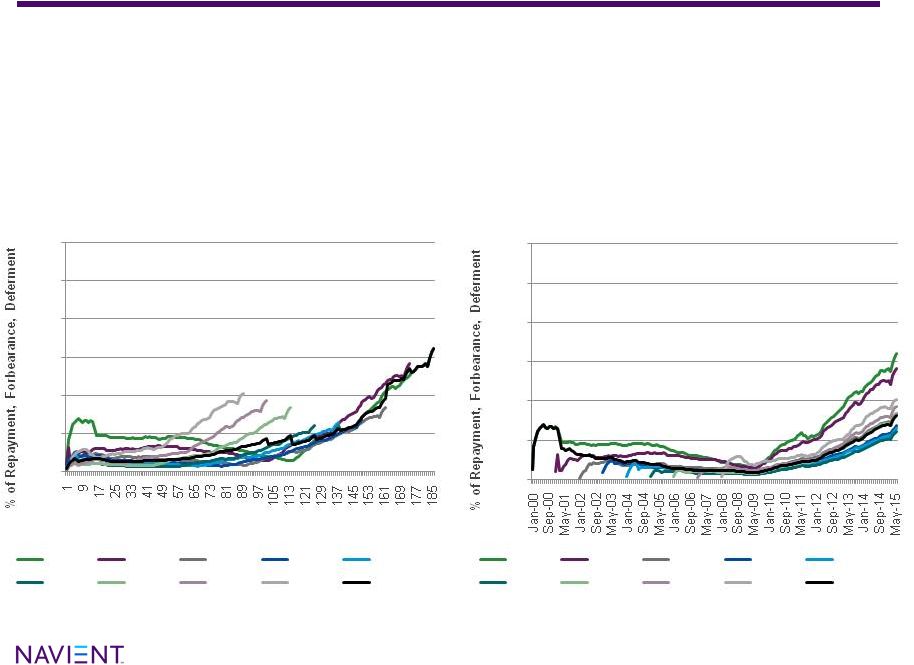

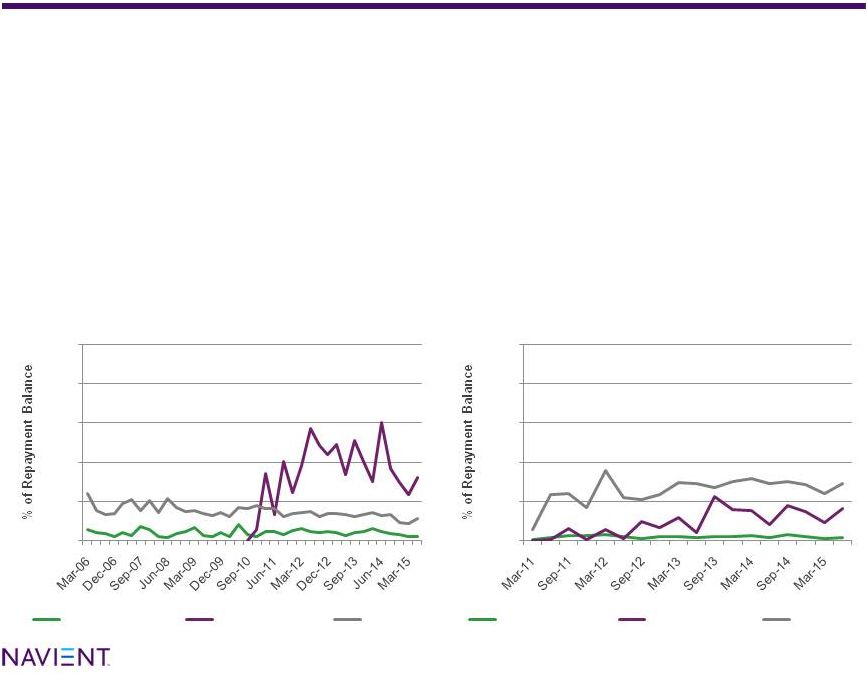

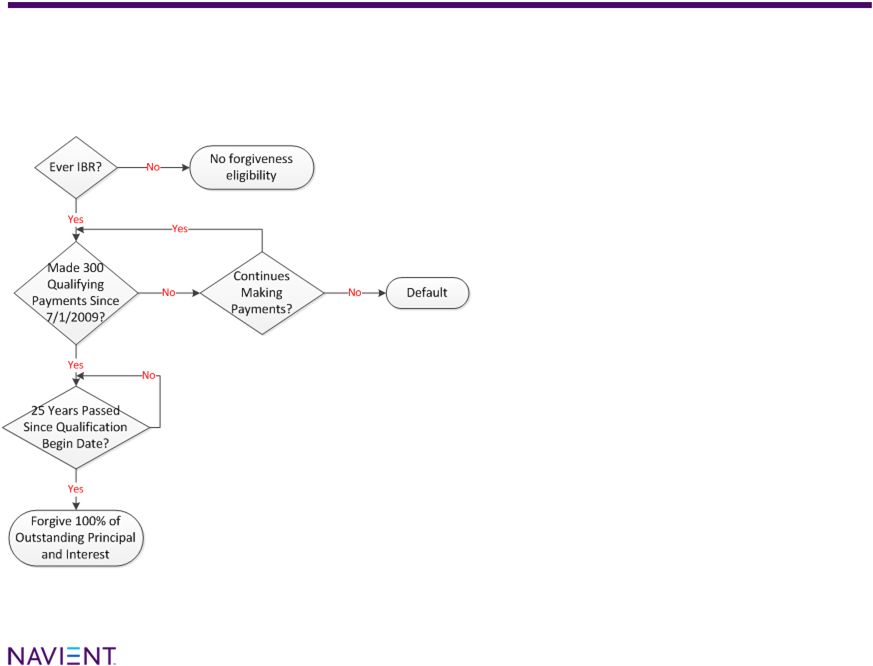

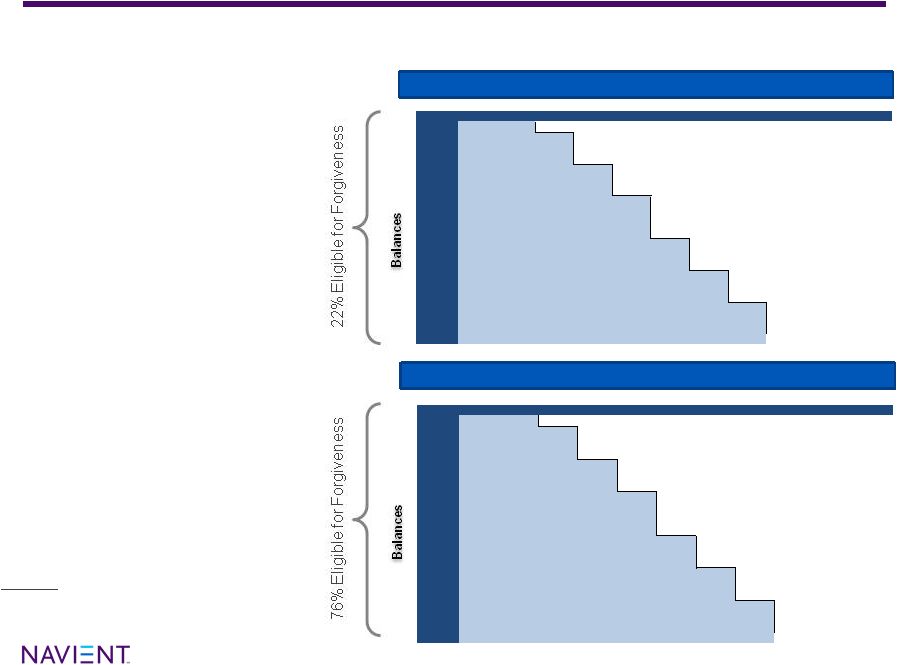

© 2015 Navient Solutions, Inc. All rights reserved. 25 Income-Based Repayment Program Structure Partial Financial Hardship (PFH) Eligibility: If the calculated IBR Payment is lower than the loan’s regular payment, a Partial Financial Hardship exists. Borrower must recertify eligibility every 12 months. Parent PLUS loans are ineligible. Payment Determination: 15% x [AGI – (1.5 x HHS Poverty Guideline for Family Size and State)] / 12 Term: The remaining term is set as the end date for the current PFH status plus 120 months. Subsidy: Available for subsidized loans; if the PFH payment does not cover accrued interest, subsidy available for first 3 years of PFH enrollment (excluding time spent in economic hardship deferment). Capitalization: If applicable, at transition out of PFH to Permanent Standard or Expedited Standard. Permanent Standard Eligibility: This is the default repayment plan once a borrower is no longer eligible for PFH . Payment Determination: 120 month payment based on balance that originally entered PFH. Term: The remaining term is set as the number of months it will take to amortize the loan based on the Permanent Standard payment amount. Subsidy: Same as non-IBR loans: available to subsidized loans in deferment. Capitalization: Same as non-IBR loans: occurs upon transition from non-payment status into repayment Expedited Standard Eligibility: A borrower may elect to exit the IBR program entirely, which is known as Expedited Standard. Payment Determination: Based on balance at the time of entry into Expedited Standard. May opt to enter other repayment programs available under the FFELP, after making at least one payment. Term: The loan’s original statutory term minus payments made to date, including PFH and Permanent Standard payments. Subsidy: Same as non-IBR loans: available to subsidized loans in deferment. Capitalization: Same as non-IBR loans: occurs upon transition from non-payment status into repayment Forgiveness Eligible Forgiveness Eligible Forgiveness Unlikely |