Exhibit 99.1

Exhibit 99.1

Bank of America Merrill Lynch 2015 Leveraged Finance Conference

December 3, 2015

Forward-Looking Statements; Non-GAAP Financial

Measures

The following information is current as of December 3, 2015 (unless otherwise noted) and should be read in connection with Navient Corporation’s (Navient) Annual Report on Form 10-K for the year ended December 31, 2014 (the “2014 Form 10-K”), filed by Navient with the Securities and Exchange Commission (the “SEC”) on February 27, 2015 and subsequent reports filed by Navient with the SEC. Definitions for capitalized terms in this presentation not defined herein can be found in our 2014 Form 10-K. This presentation contains forward-looking statements and information based on management’s current expectations as of the date of this presentation. Statements that are not historical facts, including statements about the company’s beliefs, opinions or expectations and statements that assume or are dependent upon future events, are forward-looking statements. Forward-looking statements are subject to risks, uncertainties, assumptions and other factors that may cause actual results to be materially different from those reflected in such forward-looking statements. These factors include, among others, the risks and uncertainties set forth in Item 1A “Risk Factors” and elsewhere in Navient’s 2014 Form 10-K and subsequent filings with the SEC; increases in financing costs; limits on liquidity; increases in costs associated with compliance with laws and regulations; changes in accounting standards and the impact of related changes in significant accounting estimates; any adverse outcomes in any significant litigation to which the company is a party; credit risk associated with the company’s exposure to third parties, including counterparties to the company’s derivative transactions; risks inherent in the government contracting environment, including the possible loss of government contracts and potential civil and criminal penalties as a result of governmental investigations or audits; and changes in the terms of student loans and the educational credit marketplace (including changes resulting from new laws and the implementation of existing laws). The company could also be affected by, among other things: changes in its funding costs and availability; reductions to its credit ratings or the credit ratings of the United States of America; failures of its operating systems or infrastructure, or those of third-party vendors; risks related to cybersecurity including the potential disruption of its systems or potential disclosure of confidential customer information; damage to its reputation; failures to successfully implement cost-cutting initiatives and adverse effects of such initiatives on its business; failures or delays in the planned conversion to our servicing platform of the Wells Fargo portfolio of Federal Family Education Loan Program (“FFELP”) loans or any other FFELP or Private Education Loan portfolio acquisitions; risks associated with restructuring initiatives; risks associated with the April 30, 2014 separation of Navient and SLM Corporation into two distinct, publicly traded companies, including failure to achieve the expected benefits of the separation; changes in the demand for educational financing or in financing preferences of lenders, educational institutions, students and their families; changes in law and regulations with respect to the student lending business and financial institutions generally; increased competition including from banks, other consumer lenders and other loan servicers; the creditworthiness of its customers; changes in the general interest rate environment, including the rate relationships among relevant money-market instruments and those of its earning assets vs. its funding arrangements; changes in general economic conditions; the company’s ability to successfully effectuate any acquisitions and other strategic initiatives; and changes in the demand for debt management services.

The preparation of the company’s consolidated financial statements also requires management to make certain estimates and assumptions including estimates and assumptions about future events. These estimates or assumptions may prove to be incorrect. All forward-looking statements contained in this presentation are qualified by these cautionary statements and are made only as of the date of this presentation. The company does not undertake any obligation to update or revise these forward-looking statements to conform the statement to actual results or changes in its expectations.

Navient reports financial results on a GAAP basis and also provides certain core earnings performance measures. When compared to GAAP results, core earnings exclude the impact of: (1) the financial results of the consumer banking business for historical periods prior to the April 30, 2014 spin-off as well as related restructuring and reorganization expenses incurred in connection with the spin-off, including the restructuring initiated in the second quarter of 2015; (2) unrealized, mark-to-market gains/losses on derivatives; and (3) goodwill and acquired intangible asset amortization and impairment. Navient provides core earnings measures because this is what management uses when making management decisions regarding Navient’s performance and the allocation of corporate resources. Navient core earnings are not defined terms within GAAP and may not be comparable to similarly titled measures reported by other companies. For additional information, see “Core Earnings — Definition and Limitations” in Navient’s third quarter earnings release for a further discussion and a complete reconciliation between GAAP net income and core earnings.

Confidential and proprietary information © 2015 Navient Solutions, Inc. All rights reserved. 2

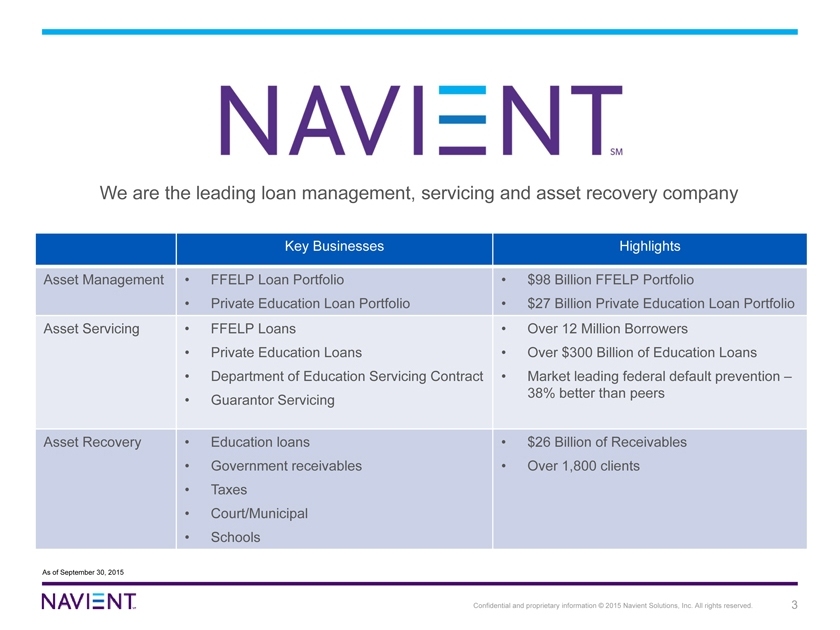

We are the leading loan management, servicing and asset recovery company

Asset Management

Asset Servicing

Asset Recovery

Key Businesses

Highlights

FFELP Loan Portfolio

Private Education Loan Portfolio FFELP Loans Private Education Loans

Department of Education Servicing Contract Guarantor Servicing

Education loans

Government receivables Taxes Court/Municipal Schools

$98 Billion FFELP Portfolio

$27 Billion Private Education Loan Portfolio Over 12 Million Borrowers Over $300 Billion of Education Loans Market leading federal default prevention – 38% better than peers

$26 Billion of Receivables Over 1,800 clients

Confidential and proprietary information © 2015 Navient Solutions, Inc. All rights reserved. 3

As of September 30, 2015

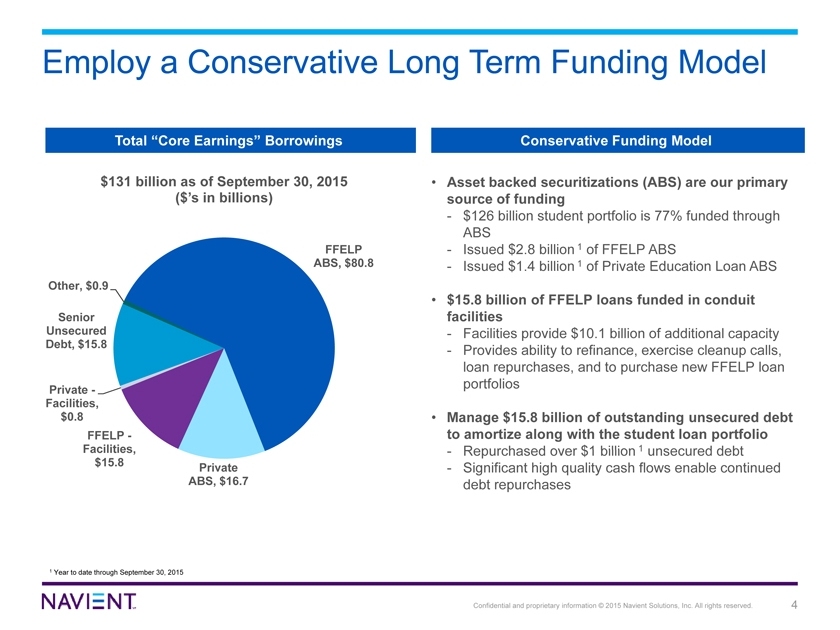

Employ a Conservative Long Term Funding Model

Total “Core Earnings” Borrowings Conservative Funding Model

$131 billion as of September 30, 2015

($’s in billions)

Other, $0.9

Senior Unsecured

Debt, $15.8

Private—

Facilities, $0.8

FFELP—Facilities, $15.8

Private ABS, $16.7

FFELP ABS, $80.8

Asset backed securitizations (ABS) are our primary source of funding

- $126 billion student portfolio is 77% funded through ABS

- Issued $2.8 billion 1 of FFELP ABS

- Issued $1.4 billion 1 of Private Education Loan ABS

$15.8 billion of FFELP loans funded in conduit facilities

- Facilities provide $10.1 billion of additional capacity

- Provides ability to refinance, exercise cleanup calls, loan repurchases, and to purchase new FFELP loan portfolios

Manage $15.8 billion of outstanding unsecured debt to amortize along with the student loan portfolio

- Repurchased over $1 billion 1 unsecured debt

- Significant high quality cash flows enable continued debt repurchases

1 Year to date through September 30, 2015

Confidential and proprietary information © 2015 Navient Solutions, Inc. All rights reserved. 4

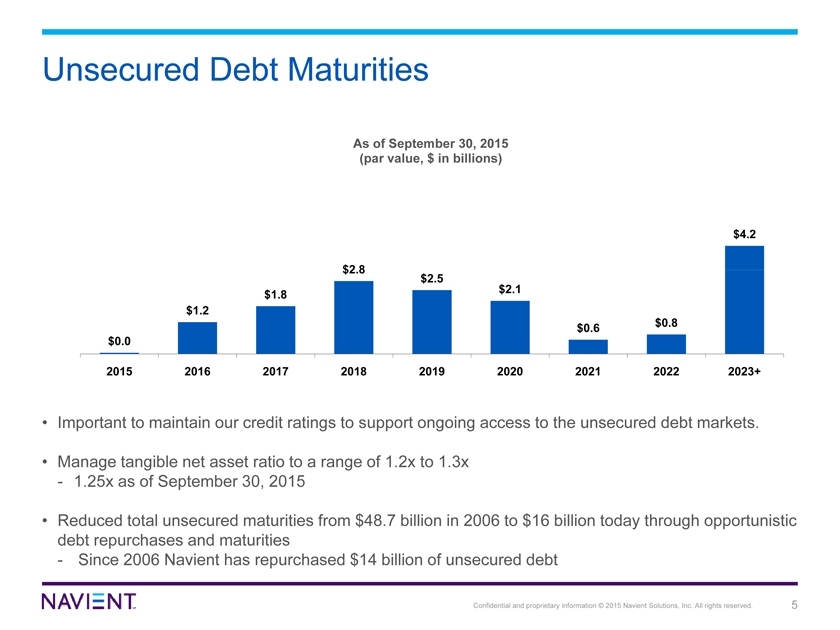

Unsecured Debt Maturities

As of September 30, 2015 (par value, $ in billions)

$4.2

$2.8

$2.5

$2.1

$1.8

$1.2

$0.8

$0.6

$0.0

2015 2016 2017 2018 2019 2020 2021 2022 2023+

Important to maintain our credit ratings to support ongoing access to the unsecured debt markets.

Manage tangible net asset ratio to a range of 1.2x to 1.3x

- 1.25x as of September 30, 2015

Reduced total unsecured maturities from $48.7 billion in 2006 to $16 billion today through opportunistic debt repurchases and maturities

- Since 2006 Navient has repurchased $14 billion of unsecured debt

Confidential and proprietary information © 2015 Navient Solutions, Inc. All rights reserved. 5

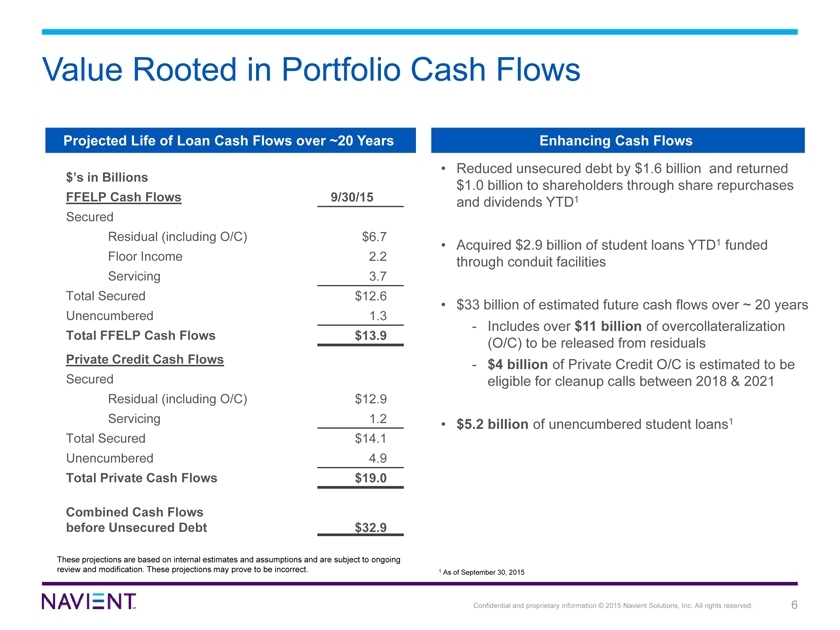

Value Rooted in Portfolio Cash Flows

Projected Life of Loan Cash Flows over ~20 Years

$’s in Billions

FFELP Cash Flows 9/30/15

Secured

Residual (including O/C) $6.7

Floor Income 2.2

Servicing 3.7

Total Secured $12.6

Unencumbered 1.3

Total FFELP Cash Flows $13.9

Private Credit Cash Flows

Secured

Residual (including O/C) $12.9

Servicing 1.2

Total Secured $14.1

Unencumbered 4.9

Total Private Cash Flows $19.0

Combined Cash Flows

before Unsecured Debt $32.9

These projections are based on internal estimates and assumptions and are subject to ongoing review and modification. These projections may prove to be incorrect.

Enhancing Cash Flows

Reduced unsecured debt by $1.6 billion and returned $1.0 billion to shareholders through share repurchases and dividends YTD1

Acquired $2.9 billion of student loans YTD1 funded through conduit facilities

$33 billion of estimated future cash flows over ~ 20 years

- Includes over $11 billion of overcollateralization (O/C) to be released from residuals

- $4 billion of Private Credit O/C is estimated to be eligible for cleanup calls between 2018 & 2021

$5.2 billion of unencumbered student loans1

1 As of September 30, 2015

Confidential and proprietary information © 2015 Navient Solutions, Inc. All rights reserved. 6

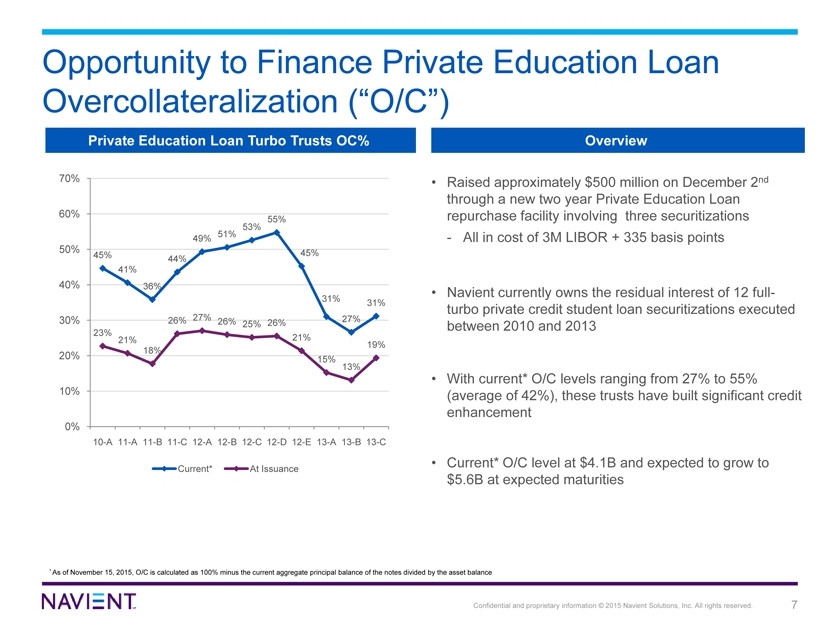

Opportunity to Finance Private Education Loan

Overcollateralization (“O/C”)

Private Education Loan Turbo Trusts OC%

70%

60%

53% 55%

51%

49%

50% 45%

45% 44%

41%

40% 36%

31%

31%

30% 26% 27% 27%

26% 25% 26%

23%

21% 21%

19%

18%

20% 15%

13%

10%

0%

10-A 11-A 11-B 11-C 12-A 12-B 12-C 12-D 12-E 13-A 13-B 13-C

Current* At Issuance

* As of November 15, 2015, O/C is calculated as 100% minus the current aggregate principal balance of the notes divided by the asset balance

Overview

Raised approximately $500 million on December 2nd through a new two year Private Education Loan repurchase facility involving three securitizations

- All in cost of 3M LIBOR + 335 basis points

Navient currently owns the residual interest of 12 full-turbo private credit student loan securitizations executed between 2010 and 2013

With current* O/C levels ranging from 27% to 55%

(average of 42%), these trusts have built significant credit enhancement

Current* O/C level at $4.1B and expected to grow to $5.6B at expected maturities

Confidential and proprietary information © 2015 Navient Solutions, Inc. All rights reserved. 7

Update on FFELP ABS Environment

Navient is working with the rating agencies and developing actions to support our investors and the continued investment-grade ratings status of our FFELP ABS

- Navient submitted formal response to Moody’s on October 19th

- Fitch announced a comment deadline of December 31, 2015

Launched process to extend the Legal Final Maturity Date on bonds in select trusts

Exercised cleanup call option on 18 trusts totaling $1.5 billion since 20141 and funded the associated loans through conduit facilities

Amended 33 trusts to include 10% optional servicer purchase rights and have exercised loan repurchased rights of $449 million since 20141

1 As of October 31, 2015

Confidential and proprietary information © 2015 Navient Solutions, Inc. All rights reserved. 8

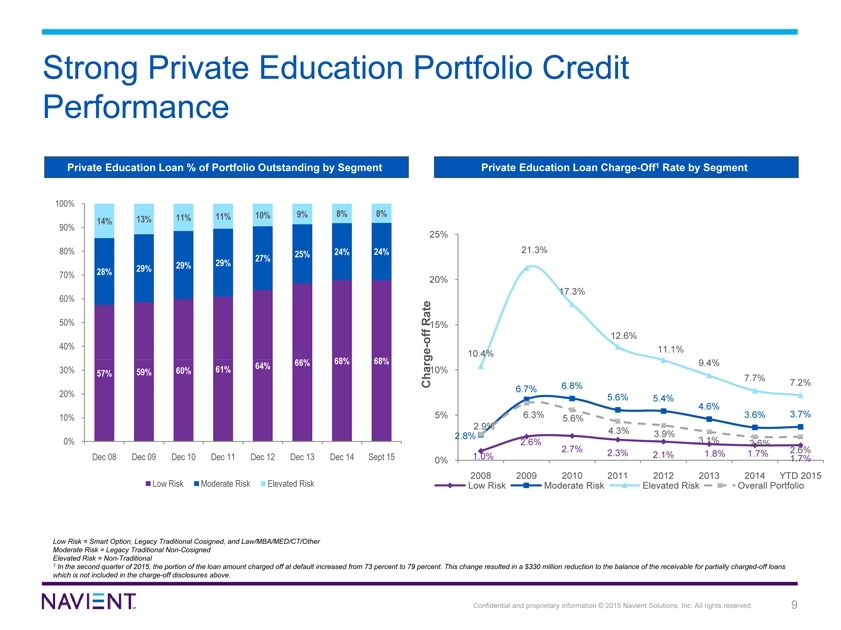

Strong Private Education Portfolio Credit

Performance

Private Education Loan % of Portfolio Outstanding by Segment

Private Education Loan Charge-Off1 Rate by Segment

100%

11% 11% 10% 9% 8% 8% 90% 14% 13% 80% 25% 24% 24% 27% 29% 29% 28% 29%

70% 60% 50%

40%

66% 68% 68% 30% 61% 64% 57% 59% 60%

20%

10%

0%

Dec 08 Dec 09 Dec 10 Dec 11 Dec 12 Dec 13 Dec 14 Sept 15

Low Risk Moderate Risk Elevated Risk

25%

21.3%

20%

17.3%

Rate 15% off 12.6%

- 11.1% 10.4%

9.4%

10% 7.7%

Charge 6.8% 7.2%

6.7% 5.6%

5.4% 4.6%

5% 6.3% 3.6% 3.7%

2.9% 5.6%

4.3% 3.9%

2.8%

2.6% 2.7% 3.1% 2.6%

2.3% 1.8% 1.7% 2.6%

1.0% 2.1% 1.7% 0% 2008 2009 2010 2011 2012 2013 2014 YTD 2015 Low Risk Moderate Risk Elevated Risk Overall Portfolio

Low Risk = Smart Option, Legacy Traditional Cosigned, and Law/MBA/MED/CT/Other Moderate Risk = Legacy Traditional Non-Cosigned Elevated Risk = Non-Traditional

1 In the second quarter of 2015, the portion of the loan amount charged off at default increased from 73 percent to 79 percent. This change resulted in a $330 million reduction to the balance of the receivable for partially charged-off loans which is not included in the charge-off disclosures above.

Confidential and proprietary information © 2015 Navient Solutions, Inc. All rights reserved. 9

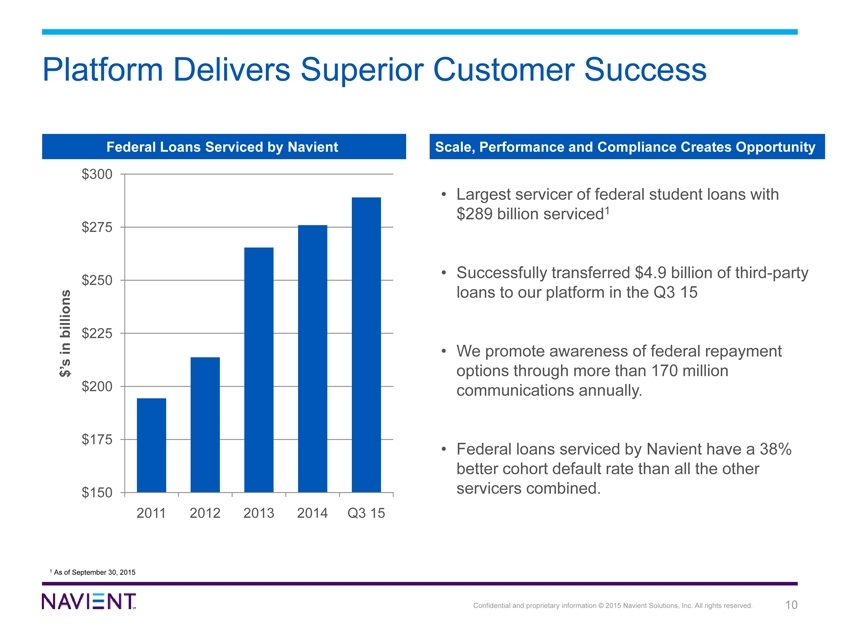

Platform Delivers Superior Customer Success

Federal Loans Serviced by Navient

$300

$275

$250 billions $225 in $ ’s $200

$175

$150

2011 2012 2013 2014 Q3 15

1 As of September 30, 2015

Scale, Performance and Compliance Creates Opportunity

Largest servicer of federal student loans with $289 billion serviced1

Successfully transferred $4.9 billion of third-party loans to our platform in the Q3 15

We promote awareness of federal repayment options through more than 170 million communications annually.

Federal loans serviced by Navient have a 38% better cohort default rate than all the other servicers combined.

Confidential and proprietary information © 2015 Navient Solutions, Inc. All rights reserved. 10

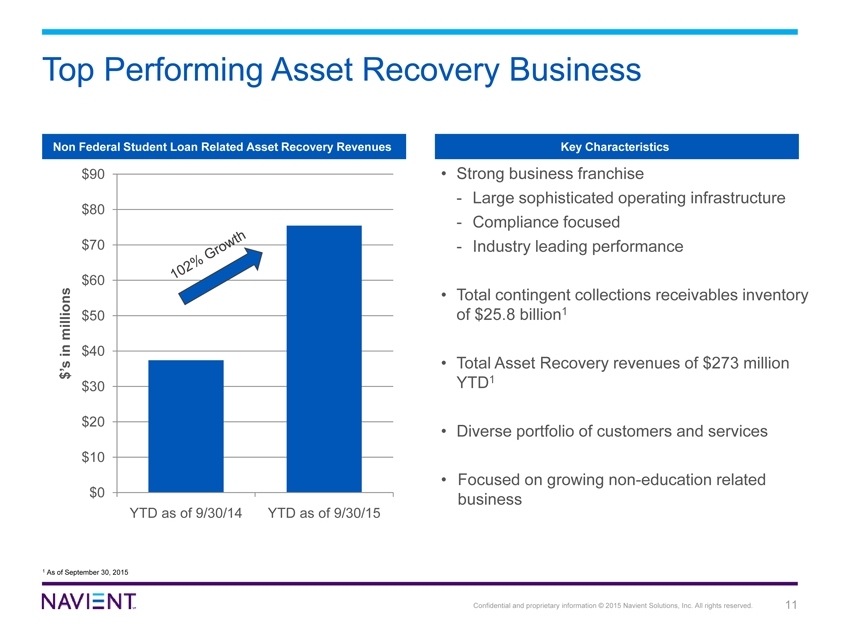

Top Performing Asset Recovery Business

Non Federal Student Loan Related Asset Recovery Revenues

$90

$80

$70

$60

millions $50

in $40

’s

$

$30

$20

$10

$0

YTD as of 9/30/14 YTD as of 9/30/15

1 As of September 30, 2015

Key Characteristics

Strong business franchise

- Large sophisticated operating infrastructure

- Compliance focused

- Industry leading performance

Total contingent collections receivables inventory of $25.8 billion1

Total Asset Recovery revenues of $273 million YTD1

Diverse portfolio of customers and services

Focused on growing non-education related business

Confidential and proprietary information © 2015 Navient Solutions, Inc. All rights reserved. 11

Summary

Significant and predictable cash flow generation

Ability to service unsecured debt and support ABS investors through long-term conservative funding approach

Efficient and large-scale, customer-focused operating platforms

Growing non-student loan related fee businesses

Confidential and proprietary information © 2015 Navient Solutions, Inc. All rights reserved. 12

Appendix

Confidential and proprietary information © 2015 Navient Solutions, Inc. All rights reserved. 13

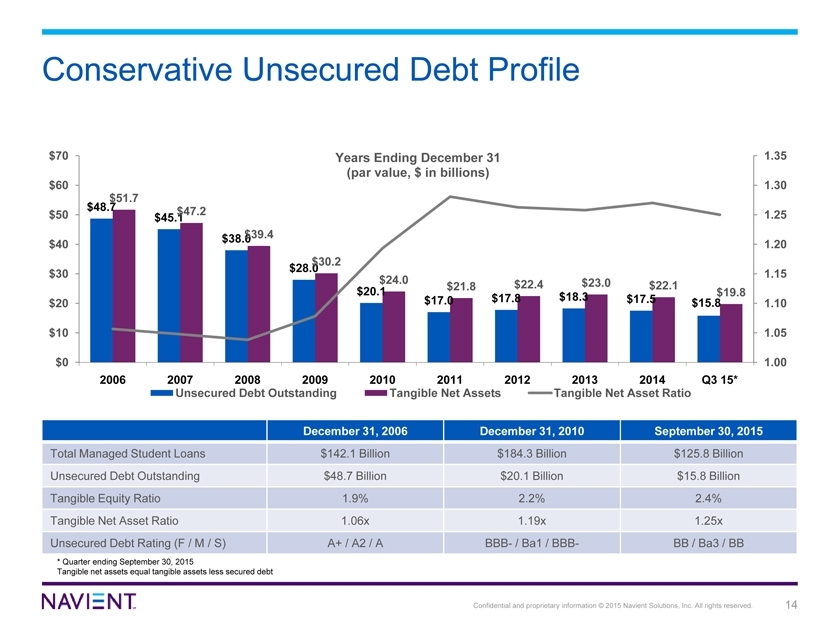

Conservative Unsecured Debt Profile

Years Ending December 31 (par value, $ in billions)

$70

$60

$51.7

$48.7 $47.2

$50 $45.1

$40 $38.0 $39.4 $30

$20

$10

$0

2006 2007 2008

$30.2

$28.0

$24.0 $22.4 $23.0

$21.8 $22.1

$20.1 $19.8

$17.0 $17.8 $18.3 $17.5

$15.8

2009 2010 2011 2012 2013 2014 Q3 15*

1.35

1.30

1.25

1.20

1.15

1.10

1.05

1.00

Unsecured Debt Outstanding Tangible Net Assets Tangible Net Asset Ratio

December 31, 2006 December 31, 2010 September 30, 2015

Total Managed Student Loans $142.1 Billion $184.3 Billion $125.8 Billion

Unsecured Debt Outstanding $48.7 Billion $20.1 Billion $15.8 Billion

Tangible Equity Ratio 1.9% 2.2% 2.4%

Tangible Net Asset Ratio 1.06x 1.19x 1.25x

Unsecured Debt Rating (F / M / S) A+ / A2 / A BBB- / Ba1 / BBB- BB / Ba3 / BB

* Quarter ending September 30, 2015

Tangible net assets equal tangible assets less secured debt

Confidential and proprietary information © 2015 Navient Solutions, Inc. All rights reserved. 14

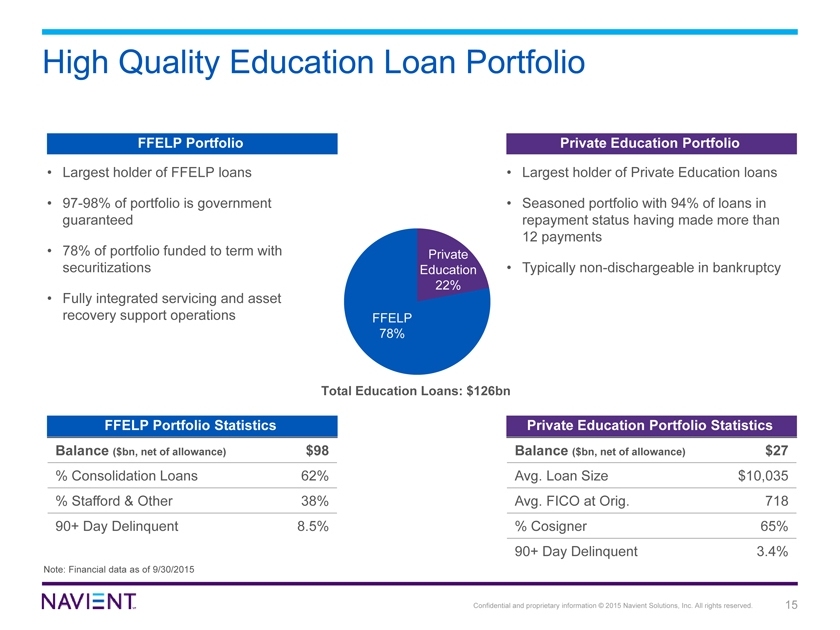

High Quality Education Loan Portfolio

FFELP Portfolio

Largest holder of FFELP loans

97-98% of portfolio is government guaranteed

78% of portfolio funded to term with securitizations

Fully integrated servicing and asset recovery support operations

Private Education Portfolio

Largest holder of Private Education loans

Seasoned portfolio with 94% of loans in repayment status having made more than 12 payments

Typically non-dischargeable in bankruptcy

Private Education 22%

FFELP 78%

Total Education Loans: $126bn

FFELP Portfolio Statistics

Balance ($bn, net of allowance) $98

% Consolidation Loans 62%

% Stafford & Other 38%

90+ Day Delinquent 8.5%

Note: Financial data as of 9/30/2015

Private Education Portfolio Statistics

Balance ($bn, net of allowance) $27

Avg. Loan Size $10,035

Avg. FICO at Orig. 718

% Cosigner 65%

90+ Day Delinquent 3.4%

Confidential and proprietary information © 2015 Navient Solutions, Inc. All rights reserved. 15

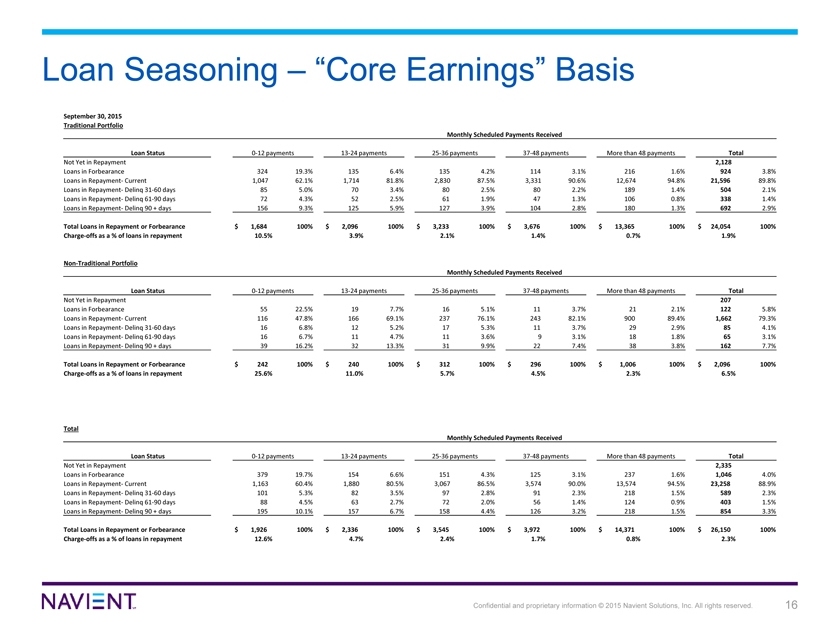

Loan Seasoning – “Core Earnings” Basis

September 30, 2015 Traditional Portfolio

Monthly Scheduled Payments Received

Loan Status 0-12 payments 13-24 payments 25-36 payments 37-48 payments More than 48 payments Total

Not Yet in Repayment 2,128

Loans in Forbearance 324 19.3% 135 6.4% 135 4.2% 114 3.1% 216 1.6% 924 3.8%

Loans in Repayment- Current 1,047 62.1% 1,714 81.8% 2,830 87.5% 3,331 90.6% 12,674 94.8% 21,596 89.8%

Loans in Repayment- Delinq 31-60 days 85 5.0% 70 3.4% 80 2.5% 80 2.2% 189 1.4% 504 2.1%

Loans in Repayment- Delinq 61-90 days 72 4.3% 52 2.5% 61 1.9% 47 1.3% 106 0.8% 338 1.4%

Loans in Repayment- Delinq 90 + days 156 9.3% 125 5.9% 127 3.9% 104 2.8% 180 1.3% 692 2.9%

Total Loans in Repayment or Forbearance $ 1,684 100% $ 2,096 100% $ 3,233 100% $ 3,676 100% $ 13,365 100% $ 24,054 100%

Charge-offs as a % of loans in repayment 10.5% 3.9% 2.1% 1.4% 0.7% 1.9%

Non-Traditional Portfolio

Monthly Scheduled Payments Received

Loan Status 0-12 payments 13-24 payments 25-36 payments 37-48 payments More than 48 payments Total

Not Yet in Repayment 207

Loans in Forbearance 55 22.5% 19 7.7% 16 5.1% 11 3.7% 21 2.1% 122 5.8%

Loans in Repayment- Current 116 47.8% 166 69.1% 237 76.1% 243 82.1% 900 89.4% 1,662 79.3%

Loans in Repayment- Delinq 31-60 days 16 6.8% 12 5.2% 17 5.3% 11 3.7% 29 2.9% 85 4.1%

Loans in Repayment- Delinq 61-90 days 16 6.7% 11 4.7% 11 3.6% 9 3.1% 18 1.8% 65 3.1%

Loans in Repayment- Delinq 90 + days 39 16.2% 32 13.3% 31 9.9% 22 7.4% 38 3.8% 162 7.7%

Total Loans in Repayment or Forbearance $ 242 100% $ 240 100% $ 312 100% $ 296 100% $ 1,006 100% $ 2,096 100%

Charge-offs as a % of loans in repayment 25.6% 11.0% 5.7% 4.5% 2.3% 6.5%

Total

Monthly Scheduled Payments Received

Loan Status 0-12 payments 13-24 payments 25-36 payments 37-48 payments More than 48 payments Total

Not Yet in Repayment 2,335

Loans in Forbearance 379 19.7% 154 6.6% 151 4.3% 125 3.1% 237 1.6% 1,046 4.0%

Loans in Repayment- Current 1,163 60.4% 1,880 80.5% 3,067 86.5% 3,574 90.0% 13,574 94.5% 23,258 88.9%

Loans in Repayment- Delinq 31-60 days 101 5.3% 82 3.5% 97 2.8% 91 2.3% 218 1.5% 589 2.3%

Loans in Repayment- Delinq 61-90 days 88 4.5% 63 2.7% 72 2.0% 56 1.4% 124 0.9% 403 1.5%

Loans in Repayment- Delinq 90 + days 195 10.1% 157 6.7% 158 4.4% 126 3.2% 218 1.5% 854 3.3%

Total Loans in Repayment or Forbearance $ 1,926 100% $ 2,336 100% $ 3,545 100% $ 3,972 100% $ 14,371 100% $ 26,150 100%

Charge-offs as a % of loans in repayment 12.6% 4.7% 2.4% 1.7% 0.8% 2.3%

Confidential and proprietary information © 2015 Navient Solutions, Inc. All rights reserved. 16

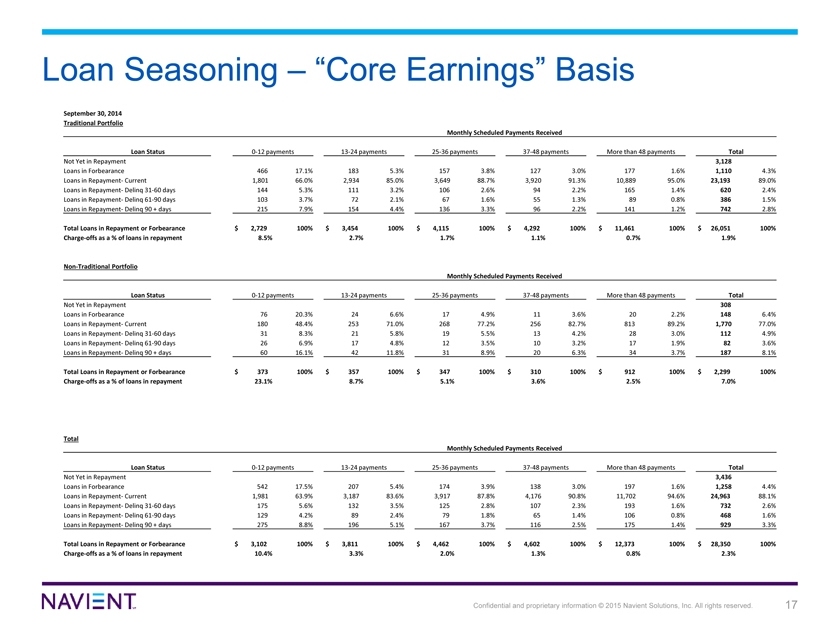

Loan Seasoning – “Core Earnings” Basis

September 30, 2014 Traditional Portfolio

Monthly Scheduled Payments Received

Loan Status 0-12 payments 13-24 payments 25-36 payments 37-48 payments More than 48 payments Total

Not Yet in Repayment 3,128

Loans in Forbearance 466 17.1% 183 5.3% 157 3.8% 127 3.0% 177 1.6% 1,110 4.3%

Loans in Repayment- Current 1,801 66.0% 2,934 85.0% 3,649 88.7% 3,920 91.3% 10,889 95.0% 23,193 89.0%

Loans in Repayment- Delinq 31-60 days 144 5.3% 111 3.2% 106 2.6% 94 2.2% 165 1.4% 620 2.4%

Loans in Repayment- Delinq 61-90 days 103 3.7% 72 2.1% 67 1.6% 55 1.3% 89 0.8% 386 1.5%

Loans in Repayment- Delinq 90 + days 215 7.9% 154 4.4% 136 3.3% 96 2.2% 141 1.2% 742 2.8%

Total Loans in Repayment or Forbearance $ 2,729 100% $ 3,454 100% $ 4,115 100% $ 4,292 100% $ 11,461 100% $ 26,051 100%

Charge-offs as a % of loans in repayment 8.5% 2.7% 1.7% 1.1% 0.7% 1.9%

Non-Traditional Portfolio

Monthly Scheduled Payments Received

Loan Status 0-12 payments 13-24 payments 25-36 payments 37-48 payments More than 48 payments Total

Not Yet in Repayment 308

Loans in Forbearance 76 20.3% 24 6.6% 17 4.9% 11 3.6% 20 2.2% 148 6.4%

Loans in Repayment- Current 180 48.4% 253 71.0% 268 77.2% 256 82.7% 813 89.2% 1,770 77.0%

Loans in Repayment- Delinq 31-60 days 31 8.3% 21 5.8% 19 5.5% 13 4.2% 28 3.0% 112 4.9%

Loans in Repayment- Delinq 61-90 days 26 6.9% 17 4.8% 12 3.5% 10 3.2% 17 1.9% 82 3.6%

Loans in Repayment- Delinq 90 + days 60 16.1% 42 11.8% 31 8.9% 20 6.3% 34 3.7% 187 8.1%

Total Loans in Repayment or Forbearance $ 373 100% $ 357 100% $ 347 100% $ 310 100% $ 912 100% $ 2,299 100%

Charge-offs as a % of loans in repayment 23.1% 8.7% 5.1% 3.6% 2.5% 7.0%

Total

Monthly Scheduled Payments Received

Loan Status 0-12 payments 13-24 payments 25-36 payments 37-48 payments More than 48 payments Total

Not Yet in Repayment 3,436

Loans in Forbearance 542 17.5% 207 5.4% 174 3.9% 138 3.0% 197 1.6% 1,258 4.4%

Loans in Repayment- Current 1,981 63.9% 3,187 83.6% 3,917 87.8% 4,176 90.8% 11,702 94.6% 24,963 88.1%

Loans in Repayment- Delinq 31-60 days 175 5.6% 132 3.5% 125 2.8% 107 2.3% 193 1.6% 732 2.6%

Loans in Repayment- Delinq 61-90 days 129 4.2% 89 2.4% 79 1.8% 65 1.4% 106 0.8% 468 1.6%

Loans in Repayment- Delinq 90 + days 275 8.8% 196 5.1% 167 3.7% 116 2.5% 175 1.4% 929 3.3%

Total Loans in Repayment or Forbearance $ 3,102 100% $ 3,811 100% $ 4,462 100% $ 4,602 100% $ 12,373 100% $ 28,350 100%

Charge-offs as a % of loans in repayment 10.4% 3.3% 2.0% 1.3% 0.8% 2.3%

Confidential and proprietary information © 2015 Navient Solutions, Inc. All rights reserved. 17

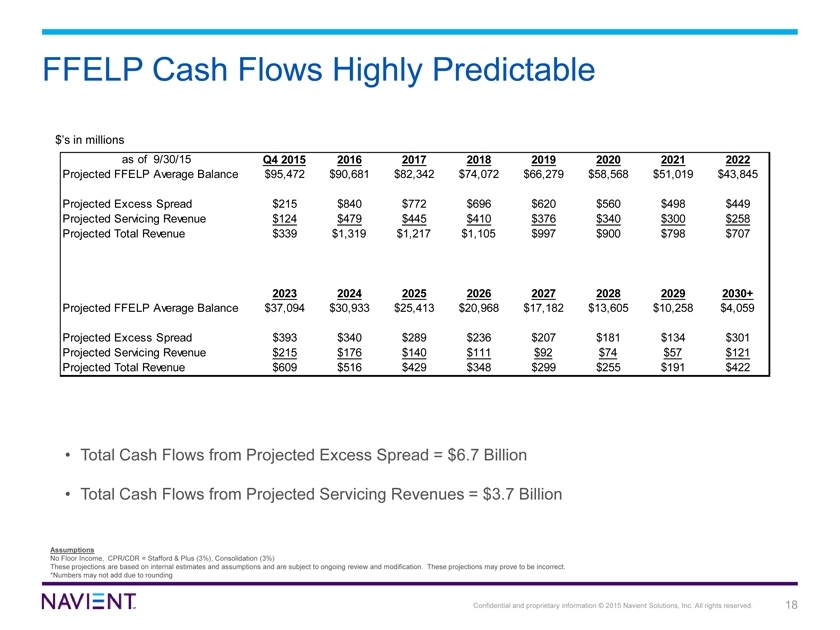

FFELP Cash Flows Highly Predictable

$’s in millions

as of 9/30/15 Q4 2015 2016 2017 2018 2019 2020 2021 2022

Projected FFELP Average Balance $95,472 $90,681 $82,342 $74,072 $66,279 $58,568 $51,019 $43,845

Projected Excess Spread $215 $840 $772 $696 $620 $560 $498 $449

Projected Servicing Revenue $124 $479 $445 $410 $376 $340 $300 $258

Projected Total Revenue $339 $1,319 $1,217 $1,105 $997 $900 $798 $707

2023 2024 2025 2026 2027 2028 2029 2030+

Projected FFELP Average Balance $37,094 $30,933 $25,413 $20,968 $17,182 $13,605 $10,258 $4,059

Projected Excess Spread $393 $340 $289 $236 $207 $181 $134 $301

Projected Servicing Revenue $215 $176 $140 $111 $92 $74 $57 $121

Projected Total Revenue $609 $516 $429 $348 $299 $255 $191 $422

Total Cash Flows from Projected Excess Spread = $6.7 Billion

Total Cash Flows from Projected Servicing Revenues = $3.7 Billion

Assumptions

No Floor Income, CPR/CDR = Stafford & Plus (3%), Consolidation (3%)

These projections are based on internal estimates and assumptions and are subject to ongoing review and modification. These projections may prove to be incorrect. *Numbers may not add due to rounding

Confidential and proprietary information © 2015 Navient Solutions, Inc. All rights reserved. 18

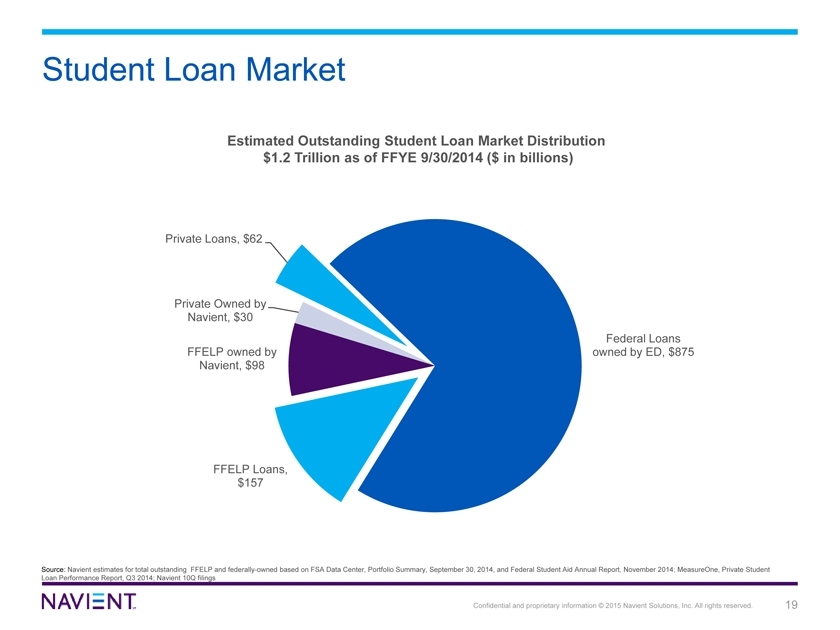

Student Loan Market

Estimated Outstanding Student Loan Market Distribution $1.2 Trillion as of FFYE 9/30/2014 ($ in billions)

Private Loans, $62

Private Owned by Navient, $30

Federal Loans FFELP owned by owned by ED, $875 Navient, $98

FFELP Loans, $157

Source: Navient estimates for total outstanding FFELP and federally-owned based on FSA Data Center, Portfolio Summary, September 30, 2014, and Federal Student Aid Annual Report, November 2014; MeasureOne, Private Student Loan Performance Report, Q3 2014; Navient 10Q filings

Confidential and proprietary information © 2015 Navient Solutions, Inc. All rights reserved. 19

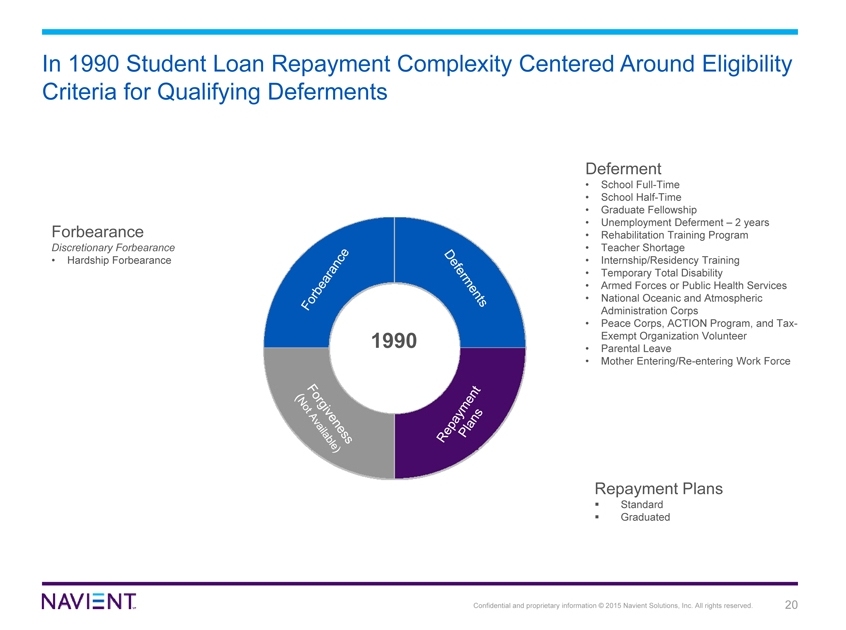

In 1990 Student Loan Repayment Complexity Centered Around Eligibility Criteria for Qualifying Deferments

Forbearance

Discretionary Forbearance

Hardship Forbearance

1990

Deferment

School Full-Time

School Half-Time

Graduate Fellowship

Unemployment Deferment – 2 years

Rehabilitation Training Program

Teacher Shortage

Internship/Residency Training

Temporary Total Disability

Armed Forces or Public Health Services

National Oceanic and Atmospheric Administration Corps

Peace Corps, ACTION Program, and Tax-Exempt Organization Volunteer

Parental Leave

Mother Entering/Re-entering Work Force

Repayment Plans

Standard Graduated

Confidential and proprietary information © 2015 Navient Solutions, Inc. All rights reserved. 20

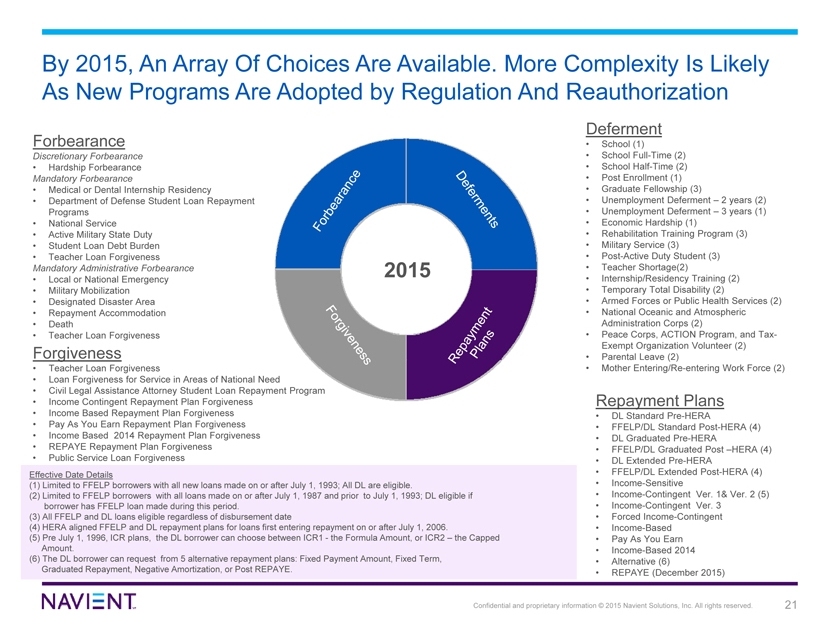

By 2015, An Array Of Choices Are Available. More Complexity Is Likely As New Programs Are Adopted by Regulation And Reauthorization

Forbearance

Discretionary Forbearance

Hardship Forbearance

Mandatory Forbearance

Medical or Dental Internship Residency

Department of Defense Student Loan Repayment Programs

National Service

Active Military State Duty

Student Loan Debt Burden

Teacher Loan Forgiveness

Mandatory Administrative Forbearance

Local or National Emergency

Military Mobilization

Designated Disaster Area

Repayment Accommodation

Death

Teacher Loan Forgiveness

Forgiveness

Teacher Loan Forgiveness

Loan Forgiveness for Service in Areas of National Need

Civil Legal Assistance Attorney Student Loan Repayment Program

Income Contingent Repayment Plan Forgiveness

Income Based Repayment Plan Forgiveness

Pay As You Earn Repayment Plan Forgiveness

Income Based 2014 Repayment Plan Forgiveness

REPAYE Repayment Plan Forgiveness

Public Service Loan Forgiveness

Effective Date Details

(1) Limited to FFELP borrowers with all new loans made on or after July 1, 1993; All DL are eligible.

(2) Limited to FFELP borrowers with all loans made on or after July 1, 1987 and prior to July 1, 1993; DL eligible if borrower has FFELP loan made during this period.

(3) All FFELP and DL loans eligible regardless of disbursement date

(4) HERA aligned FFELP and DL repayment plans for loans first entering repayment on or after July 1, 2006.

(5) Pre July 1, 1996, ICR plans, the DL borrower can choose between ICR1—the Formula Amount, or ICR2 – the Capped Amount.

(6) The DL borrower can request from 5 alternative repayment plans: Fixed Payment Amount, Fixed Term, Graduated Repayment, Negative Amortization, or Post REPAYE.

Deferment

School (1)

School Full-Time (2)

School Half-Time (2)

Post Enrollment (1)

Graduate Fellowship (3)

Unemployment Deferment – 2 years (2)

Unemployment Deferment – 3 years (1)

Economic Hardship (1)

Rehabilitation Training Program (3)

Military Service (3)

Post-Active Duty Student (3)

Teacher Shortage(2)

Internship/Residency Training (2)

Temporary Total Disability (2)

Armed Forces or Public Health Services (2)

National Oceanic and Atmospheric Administration Corps (2)

Peace Corps, ACTION Program, and Tax-Exempt Organization Volunteer (2)

Parental Leave (2)

Mother Entering/Re-entering Work Force (2)

Repayment Plans

• DL Standard Pre-HERA

FFELP/DL Standard Post-HERA (4)

DL Graduated Pre-HERA

FFELP/DL Graduated Post –HERA (4)

DL Extended Pre-HERA

FFELP/DL Extended Post-HERA (4)

Income-Sensitive

Income-Contingent Ver. 1& Ver. 2 (5)

Income-Contingent Ver. 3

Forced Income-Contingent

Income-Based

Pay As You Earn

Income-Based 2014

Alternative (6)

REPAYE (December 2015)

Confidential and proprietary information © 2015 Navient Solutions, Inc. All rights reserved. 21