SAFE HARBOR: Some of the information contained in this presentation includes forward looking statements. Such statements are subject to a number of risks and uncertainties which could cause actual results in the future to differ materially and adversely from those described in the forward-looking statements. Investors should consult the Company's filings with the Securities and Exchange Commission for a description of the various risks and uncertainties which could cause such a difference before deciding whether to invest.

|

| | | | |

| Table of Contents | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | Page |

| | Financial Statement Data | | |

| | | Consolidated and combined statement of operations (unaudited) | 1 |

| | | Consolidated balance sheets (unaudited) | 2 |

| | | Components of minimum rents and other revenue | 3 |

| | | Calculation of funds from operations (FFO) | 4 |

| | | Net operating income growth for comparable properties | 5 |

| | | | |

| | Debt Information | | |

| | | Total debt maturities | 6 |

| | | EBITDA and key balance sheet metrics | 7 |

| | | | | |

| | Operational Data | | |

| | | Occupancy and rent metrics | 8 |

| | | Releasing spreads | 9 |

| | | Top 10 tenants | | 10 |

| | | Lease expirations | 11 |

| | | | | |

| | Development Activity | | |

| | | Capital expenditures | 12 |

| | | Major redevelopment projects | 13 |

| | | | |

| | Other | | |

| | | WP Glimcher property information | 14-21 |

| | | Glossary of terms | 22 |

|

| | | | | | | | | |

| CONSOLIDATED AND COMBINED STATEMENT OF OPERATIONS | |

| WP Glimcher | | | | |

| (Unaudited, dollars in thousands, except per share data) | | | | |

| | | | | | |

| | | Three Months Ended March 31, | |

| | | 2015 | | 2014 | |

| | | | | | |

| | Revenue: | | | | |

| | Minimum rent (see components on page 3) | $ | 162,704 |

| | $ | 106,637 |

| |

| | Overage rent | 3,263 |

| | 2,110 |

| |

| | Tenant reimbursements | 69,227 |

| | 47,168 |

| |

| | Other (see components on page 3) | 2,528 |

| | 2,054 |

| |

| | Total revenue | 237,722 |

| | 157,969 |

| |

| | | | | | |

| | Expenses: | | | | |

| | Property operating expenses | (41,079 | ) | | (26,140 | ) | |

| | Real estate taxes | (30,565 | ) | | (19,947 | ) | |

| | Repairs and maintenance | (9,488 | ) | | (7,150 | ) | |

| | Advertising and promotion | (2,687 | ) | | (1,952 | ) | |

| | Total recoverable expenses | (83,819 | ) | | (55,189 | ) | |

| | Depreciation and amortization | (92,184 | ) | | (45,968 | ) | |

| | Provision for credit losses | (698 | ) | | (786 | ) | |

| | General and administrative | (9,700 | ) | | — |

| |

| | Merger and transaction costs | (20,810 | ) | | — |

| |

| | Ground rent and other costs | (2,748 | ) | | (1,119 | ) | |

| | Total operating expenses | (209,959 | ) | | (103,062 | ) | |

| | | | | | |

| | Operating Income | 27,763 |

| | 54,907 |

| |

| | | | | | |

| | Interest expense, net | (37,122 | ) | | (13,917 | ) | |

| | Income and other taxes | (445 | ) | | (75 | ) | |

| | Equity in income of unconsolidated real estate entities, net | 216 |

| | 345 |

| |

| | Gain on sale of interest in property | — |

| | 242 |

| |

| | | | | | |

| | Net (loss) income | (9,588 | ) | | 41,502 |

| |

| | Net (loss) income attributable to noncontrolling interests | (2,296 | ) | | 7,110 |

| |

| | Net (loss) income attributable to common shareholders | (7,292 | ) | | 34,392 |

| |

| | Less: Preferred share dividends | (4,978 | ) | | — |

| |

| | Net (loss) income to common shareholders | $ | (12,270 | ) | | $ | 34,392 |

| |

| | | | | | |

| | (Loss) earnings per common share, basic and diluted | $ | (0.07 | ) | | $ | 0.22 |

| |

SUPPLEMENTAL INFORMATION | 1

|

| | | | | | | | |

| CONSOLIDATED BALANCE SHEETS | | | |

| WP Glimcher | | | |

| (Unaudited, dollars in thousands) | | | |

| | | | | |

| | | March 31, | | December 31, |

| | | 2015 | | 2014 |

| | Assets: | | | |

| | Investment properties at cost | $ | 8,378,533 |

| | $ | 5,292,665 |

|

| | Less: accumulated depreciation | 2,172,119 |

| | 2,113,929 |

|

| | | 6,206,414 |

| | 3,178,736 |

|

| | | | | |

| | Cash and cash equivalents | 255,616 |

| | 108,768 |

|

| | Tenant accounts receivable and accrued revenue, net | 72,256 |

| | 69,616 |

|

| | Investment in unconsolidated subsidiaries, at equity | 15,949 |

| | — |

|

| | Deferred costs and other assets | 479,629 |

| | 170,883 |

|

| | Total assets | $ | 7,029,864 |

| | $ | 3,528,003 |

|

| | | | | |

| | Liabilities: | | | |

| | Mortgage notes payable | $ | 2,757,416 |

| | $ | 1,435,114 |

|

| | Bonds payable | 249,930 |

| | — |

|

| | Unsecured term loan | 500,000 |

| | 500,000 |

|

| | Revolving credit facility | 413,750 |

| | 413,750 |

|

| | Bridge loan | 941,570 |

| | — |

|

| | Series G Cumulative Redeemable Preferred Stock (called for redemption) | 117,500 |

| | — |

|

| | Accounts payable, accrued expenses, intangibles, and deferred revenues | 345,049 |

| | 194,014 |

|

| | Distributions payable | 5,750 |

| | — |

|

| | Cash distributions and losses in partnerships and joint ventures, at equity | 15,344 |

| | 15,298 |

|

| | Other liabilities | 14,653 |

| | 11,786 |

|

| | Total liabilities | 5,360,962 |

| | 2,569,962 |

|

| | | | | |

| | Redeemable noncontrolling interests | 6,145 |

| | — |

|

| | | | | |

| | Equity: | | | |

| | Stockholders' equity | | | |

| | Series H Cumulative Redeemable Preferred Stock | 104,251 |

| | — |

|

| | Series I Cumulative Redeemable Preferred Stock | 98,325 |

| | — |

|

| | Common stock | 19 |

| | 16 |

|

| | Capital in excess of par value | 1,215,096 |

| | 720,921 |

|

| | Retained earnings | 13,383 |

| | 68,114 |

|

| | Accumulated other comprehensive loss | (340 | ) | | — |

|

| | Total stockholders' equity | 1,430,734 |

| | 789,051 |

|

| | Noncontrolling interests | 232,023 |

| | 168,990 |

|

| | Total equity | 1,662,757 |

| | 958,041 |

|

| | Total liabilities, redeemable noncontrolling interests and equity | $ | 7,029,864 |

| | $ | 3,528,003 |

|

SUPPLEMENTAL INFORMATION | 2

|

| | | | | | | | |

| COMPONENTS OF MINIMUM RENTS AND OTHER REVENUE |

| WP Glimcher | | | |

| (dollars in thousands) | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | Three Months Ended March 31, |

| | | 2015 | | 2014 |

| | | | | |

| | Components of Minimum Rents: | | | |

| | | | | |

| | Base rent | $ | 147,159 |

| | $ | 97,871 |

|

| | Mark-to-market adjustment | 4,638 |

| | 244 |

|

| | Straight-line rents | 1,595 |

| | 176 |

|

| | Temp tenant rents | 9,312 |

| | 8,346 |

|

| | Total Minimum Rents | $ | 162,704 |

| | $ | 106,637 |

|

| | | | | |

| | Components of Other Revenue: | | | |

| | Sponsorship and other ancillary property income | $ | 1,275 |

| | $ | 854 |

|

| | Lease termination income | 470 |

| | 218 |

|

| | Other | 783 |

| | 982 |

|

| | Total Other Revenue | $ | 2,528 |

| | $ | 2,054 |

|

SUPPLEMENTAL INFORMATION | 3

|

| | | | | | | | | |

| CALCULATION OF FUNDS FROM OPERATIONS (INCLUDING PRO-RATA SHARE OF JOINT VENTURES) | |

| WP Glimcher | | | | | |

| (in thousands, except per share data) | | | | | |

| | | | | | |

| | | Three Months Ended March 31, | |

| | | 2015 | | 2014 | |

| Funds from Operations ("FFO"): | | | | | |

| Net (loss) income | | $ | (9,588 | ) | | $ | 41,502 |

| |

| Less: Preferred dividends and distributions on preferred operating partnership units | | (5,028 | ) | | — |

| |

| Real estate depreciation and amortization, including joint venture impact | | 91,682 |

| | 47,134 |

| |

| Noncontrolling interest portion of depreciation and amortization | | (33 | ) | | — |

| |

| Gain on sale of interest in property | | — |

| | (242 | ) | |

| Net income attributable to noncontrolling interest holders in properties | | 3 |

| | — |

| |

| FFO | | $ | 77,036 |

| | $ | 88,394 |

| |

| | | | | | |

| Adjusted Funds from Operations: | | | | | |

| FFO | | $ | 77,036 |

| | $ | 88,394 |

| |

| Add back: Glimcher merger and transaction costs | | 20,810 |

| | — |

| |

| Add back: Bridge loan fee amortization | | 4,120 |

| | — |

| |

| Adjusted FFO | | $ | 101,966 |

| | $ | 88,394 |

| |

| | | | | | |

| Weighted average common shares outstanding - diluted (1) | | 213,975 |

| | 186,738 |

| |

| | | | | | |

| FFO per diluted share | | $ | 0.36 |

| | $ | 0.47 |

| |

| Total adjustments | | 0.11 |

| | — |

| |

| Adjusted FFO per diluted share | | $ | 0.47 |

| | $ | 0.47 |

| |

| | | | | | |

| (1) FFO per share in 2015 has been calculated using 215,044 common shares, which includes common stock equivalents. | |

| | | | |

| | | | | | |

| | | | |

| | | Three Months Ended March 31, | |

| | | 2015 | | 2014 | |

| Supplemental Disclosure of Amounts included in FFO: | | | | | |

| Deferred leasing costs | | $ | 5,418 |

| | $ | 2,725 |

| |

| Non-cash stock compensation expense | | $ | 2,316 |

| | $ | — |

| |

| Straight-line adjustment as an increase to minimum rents | | $ | 1,595 |

| | $ | 176 |

| |

| Straight-line and fair market value adjustment to ground lease expense recorded as an increase to other operating expense | | $ | 202 |

| | $ | 207 |

| |

| Fair value of debt amortized as a decrease to interest expense | | $ | 4,460 |

| | $ | 112 |

| |

| Mark-to-market adjustment as an increase to base rents | | $ | 4,638 |

| | $ | 244 |

| |

SUPPLEMENTAL INFORMATION | 4

|

| | | | | | | | | | | | | | | |

| NET OPERATING INCOME GROWTH FOR COMPARABLE PROPERTIES | |

| WP Glimcher | | | | | | | | |

| Including Pro-Rata Share of Unconsolidated Properties | |

| (dollars in thousands) | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | Three Months Ended March 31, | |

| | 2015 | | 2014 | | Variance $ | | Variance % | |

| | | | | | | | | |

| Comparable Net Operating Income (Comp NOI) | | | | | | | | |

| Revenue: | | | | | | | | |

| Minimum rent | $ | 153,890 |

| | $ | 152,740 |

| | $ | 1,150 |

| | 0.8 | % | |

| Overage rent | 2,977 |

| | 2,823 |

| | 154 |

| | 5.5 | % | |

| Tenant reimbursements | 69,851 |

| | 68,916 |

| | 935 |

| | 1.4 | % | |

| Other | 5,887 |

| | 5,870 |

| | 17 |

| | 0.3 | % | |

| Total revenue | 232,605 |

| | 230,349 |

| | 2,256 |

| | 1.0 | % | |

| | | | | | | | | |

| Expenses: | | | | | | | | |

| Recoverable | (80,595 | ) | | (79,666 | ) | | (929 | ) | | 1.2 | % | |

| Property operating | (1,654 | ) | | (1,678 | ) | | 24 |

| | -1.4 | % | |

| Ground rent | (1,982 | ) | | (1,954 | ) | | (28 | ) | | 1.4 | % | |

| Total operating expenses | (84,231 | ) | | (83,298 | ) | | (933 | ) | | 1.1 | % | |

| | | | | | | | | |

| Comp NOI - Total portfolio | $ | 148,374 |

| | $ | 147,051 |

| | $ | 1,323 |

| | 0.9 | % | |

| | | | | | | | | |

| Comp NOI - Malls | $ | 115,291 |

| | $ | 115,161 |

| | $ | 130 |

| | 0.1 | % | |

| Comp NOI - Community centers | $ | 33,083 |

| | $ | 31,890 |

| | $ | 1,193 |

| | 3.7 | % | |

| | | | | | | | | |

| Net (loss) income | $ | (9,588 | ) | | $ | 41,502 |

| | $ | (51,090 | ) | | | |

| Income and other taxes | 445 |

| | 75 |

| | 370 |

| | | |

| Interest expense | 37,122 |

| | 13,917 |

| | 23,205 |

| | | |

| Gain on sale of interest in property | — |

| | (242 | ) | | 242 |

| | | |

| Income from unconsolidated entities | (216 | ) | | (345 | ) | | 129 |

| | | |

| Straight-line rents | (1,728 | ) | | (149 | ) | | (1,579 | ) | | | |

| Fair value rent amortization | (4,638 | ) | | (244 | ) | | (4,394 | ) | | | |

| Management fee allocation | 5,217 |

| | 3,501 |

| | 1,716 |

| | | |

| Termination income and outparcel sales | (507 | ) | | (1,018 | ) | | 511 |

| | | |

| Other adjustments for comp | 468 |

| | 216 |

| | 252 |

| | | |

| Operating income | 26,575 |

| | 57,213 |

| | (30,638 | ) | | | |

| General and administrative | 9,700 |

| | — |

| | 9,700 |

| | | |

| Merger and transaction costs | 20,810 |

| | — |

| | 20,810 |

| | | |

| Depreciation and amortization | 92,184 |

| | 45,968 |

| | 46,216 |

| | | |

| NOI of consolidated properties | $ | 149,269 |

| | $ | 103,181 |

| | $ | 46,088 |

| | | |

| | | | | | | | | |

| NOI of unconsolidated properties | 2,300 |

| | 10,437 |

| | (8,137 | ) | | | |

| Adjustments for comp (SL & management fee allocation) | 152 |

| | 211 |

| | (59 | ) | | | |

| Less: partner share on comp NOI | (2,380 | ) | | (2,499 | ) | | 119 |

| | | |

| NOI from sold properties | 67 |

| | 39 |

| | 28 |

| | | |

| Total NOI of our portfolio | $ | 149,408 |

| | $ | 111,369 |

| | $ | 38,039 |

| | | |

| | | | | | | | | |

| Less: NOI from non-comparable properties (1) | (2,524 | ) | | (589 | ) | | (1,935 | ) | | | |

| Adjustment to include Glimcher NOI from prior to merger (1) | 7,843 |

| | 43,499 |

| | (35,656 | ) | | | |

| Less: NOI from non-core properties (2) | (6,353 | ) | | (7,228 | ) | | 875 |

| | | |

| Comparable NOI | $ | 148,374 |

| | $ | 147,051 |

| | $ | 1,323 |

| | | |

| Comparable NOI percentage change | | | | | 0.9 | % | | | |

| | | | | | | | | |

| (1) NOI excluded from comparable property NOI relates to properties not owned and operating in all periods reported. The assets acquired as part of the Glimcher merger are included in Comp NOI. | |

| (2) NOI from seven non-core properties. | |

SUPPLEMENTAL INFORMATION | 5

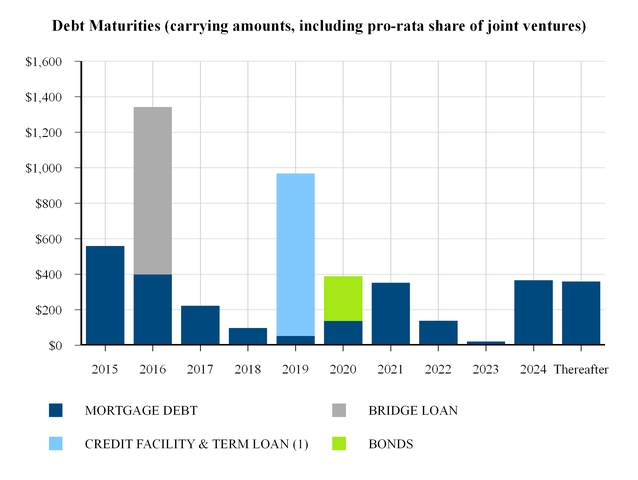

TOTAL DEBT MATURITIES

WP Glimcher

(dollars in thousands)

(1) Assumes full exercise of extension options.

SUPPLEMENTAL INFORMATION | 6

|

| | | | | | | | | | |

| EBITDA AND KEY BALANCE SHEET METRICS | | | | | |

| WP Glimcher | | | | | |

| (dollars in thousands) | | | | | |

| | | | | | | |

| | | | Three Months Ended

March 31, | |

| | | | 2015 | | 2014 | |

| | Calculation of EBITDA: | | | | | |

| | Net (loss) income | | $ | (9,588 | ) | | $ | 41,502 |

| |

| | Interest expense, net | | 37,122 |

| | 13,917 |

| |

| | Income and other taxes | | 445 |

| | 75 |

| |

| | Depreciation and amortization | | 92,184 |

| | 45,968 |

| |

| | EBITDA | | 120,163 |

| | 101,462 |

| |

| | Merger and transaction costs | | 20,810 |

| | — |

| |

| | Add back: Bridge loan fee amortization | | 4,120 |

| | — |

| |

| | Gain on sale of interest in property | | — |

| | (242 | ) | |

| | Adjusted EBITDA | | $ | 145,093 |

| | $ | 101,220 |

| |

| | | | | | | |

| | | | As of

March 31, 2015 | | | |

| | Key Balance Sheet Metrics: | | Ratio | | | |

| | Total indebtedness to Total assets | | 54.1% | | | |

| | Secured indebtedness to Total assets | | 30.4% | | | |

| | Consolidated EBITDA / Annual service charge | | 3.26x | | | |

| | Total unencumbered assets / Total unsecured indebtedness | | 222% | | | |

Note: Balance sheet metrics above are based upon the bond covenants definitions using the trailing 12 months of EBITDA for all properties including the Glimcher assets.

SUPPLEMENTAL INFORMATION | 7

|

| | | | | |

| OCCUPANCY AND RENT METRICS | | | | |

| WP Glimcher | | | | |

| As of March 31, 2015 | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | March 31,

2015 | | March 31,

2014 | |

| | | | | | |

| | Malls: | | | | |

| | | | | | |

| | Occupancy | 89.9% | | 91.3% | |

| | | | | | |

| | Occupancy cost | 12.7% | | 13.0% | |

| | | | | | |

| | Base minimum rent PSF | $26.68 | | $26.48 | |

| | | | | | |

| | | | | | |

| | Community centers: | | | | |

| | Occupancy | 95.2% | | 93.8% | |

| | | | | | |

| | Base minimum rent PSF | $12.79 | | $12.36 | |

| | | | | | |

| | | | | | |

| | Total portfolio: | | | | |

| | Occupancy | 91.9% | | 92.3% | |

| | | | | | |

| | Base minimum rent PSF | $21.11 | | $20.79 | |

| | | | | | |

| | | | | | |

| | Note: Properties acquired from Glimcher in January 2015 are included in each period reported. |

| | The Company's seven non-core malls are excluded from these metrics. |

SUPPLEMENTAL INFORMATION | 8

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| RELEASING SPREADS | | | | | | | | | | | | | | | | | | |

| WP Glimcher | | | | | | | | | | | | | | | | | | |

| For the trailing 12 months ended March 31, 2015 | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Square Footage of Openings | | Opening Rate PSF | | Closing Rate PSF | | Releasing Spread | | | | | | | | | | | | | | |

| | | | | | $ | | % | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Community centers: | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| New | | 120,185 |

| | $ | 22.21 |

| | $ | 24.26 |

| | $ | 2.05 |

| | 9.2 | % | | | | | | | | | | | | | | |

| Renewal | | 255,799 |

| | $ | 19.28 |

| | $ | 19.86 |

| | $ | 0.58 |

| | 3.0 | % | | | | | | | | | | | | | | |

| All Deals | | 375,984 |

| | $ | 20.27 |

| | $ | 21.27 |

| | $ | 1.00 |

| | 4.9 | % | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Malls: | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| New | | 261,198 |

| | $ | 36.97 |

| | $ | 38.70 |

| | $ | 1.73 |

| | 4.7 | % | | | | | | | | | | | | | | |

| Renewal | | 1,198,216 |

| | $ | 37.79 |

| | $ | 39.04 |

| | $ | 1.25 |

| | 3.3 | % | | | | | | | | | | | | | | |

| All Deals | | 1,459,414 |

| | $ | 37.64 |

| | $ | 38.98 |

| | $ | 1.34 |

| | 3.6 | % | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Total Portfolio: | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| New | | 381,383 |

| | $ | 32.31 |

| | $ | 34.15 |

| | $ | 1.85 |

| | 5.7 | % | | | | | | | | | | | | | | |

| Renewal | | 1,454,015 |

| | $ | 34.70 |

| | $ | 35.67 |

| | $ | 0.97 |

| | 2.8 | % | | | | | | | | | | | | | | |

| All Deals | | 1,835,398 |

| | $ | 34.19 |

| | $ | 35.35 |

| | $ | 1.16 |

| | 3.4 | % | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Note :The Company's seven non-core malls are excluded from these metrics. | | |

SUPPLEMENTAL INFORMATION | 9

|

| | | | | | | | | |

| TOP 10 TENANTS | | | | | | | | |

| WP Glimcher | | | | | | | | |

| As of March 31, 2015 | | | | | | | | |

| | | | | | | | | | |

| | Non-Anchor Stores

(Ranked by Percent of Total Minimum Rents) |

| | Tenant Name | | Number

of Stores | | GLA of

Stores | | Percent of Total GLA in Portfolio | | Percent of Total Base Minimum Rent (1) |

| | | | | | | | | | |

| | Signet Jewelers, Ltd. | | 180 | | 237,996 | | 0.3% | | 3.2% |

| | L Brands, Inc. | | 141 | | 661,295 | | 1.0% | | 2.7% |

| | Foot Locker, Inc. | | 125 | | 510,085 | | 0.7% | | 2.2% |

| | Ascena Retail Group Inc. | | 119 | | 602,777 | | 0.9% | | 1.6% |

| | Luxottica Group | | 104 | | 279,597 | | 0.4% | | 1.3% |

| | Genesco Inc. | | 133 | | 212,247 | | 0.3% | | 1.3% |

| | American Eagle Outfitters, Inc. | | 53 | | 300,373 | | 0.4% | | 1.3% |

| | The Gap, Inc. | | 43 | | 508,440 | | 0.7% | | 1.2% |

| | The Finish Line, Inc. | | 52 | | 294,975 | | 0.4% | | 1.2% |

| | Claire's Stores Inc. | | 89 | | 113,819 | | 0.2% | | 0.8% |

| | | | | | | | | | |

| | Anchor Stores

(Ranked by Total GLA) |

| | Tenant Name | | Number

of Stores | | GLA of

Stores | | Percent of Total GLA in Portfolio | | Percent of Total Base Minimum Rent (1) |

| | | | | | | | | | |

| | Sears Holding Corporation (including Kmarts) | | 60 | | 8,353,804 | | 12.2% | | 1.2% |

| | JCPenney Company, Inc. | | 49 | | 6,202,632 | | 9.1% | | 1.4% |

| | Macy's, Inc. | | 36 | | 6,027,126 | | 8.8% | | 0.5% |

| | Dillard's, Inc. | | 28 | | 3,902,495 | | 5.7% | | 0.1% |

| | The Bon-Ton Stores, Inc. | | 19 | | 1,856,405 | | 2.7% | | 0.9% |

| | Target Corporation | | 12 | | 1,625,339 | | 2.4% | | 0.0% |

| | Kohl's Corporation | | 15 | | 1,277,064 | | 1.9% | | 0.9% |

| | Belk, Inc. | | 13 | | 1,070,585 | | 1.6% | | 0.1% |

| | Dick's Sporting Goods, Inc. | | 15 | | 840,330 | | 1.2% | | 1.3% |

| | Burlington Stores, Inc. | | 10 | | 814,577 | | 1.2% | | 0.8% |

| | | | | | | | | | |

| | (1) Total base minimum rent represents 2015 combined base rental revenues |

SUPPLEMENTAL INFORMATION | 10

|

| | | | | | | | | | | | | |

| LEASE EXPIRATIONS | | | | | | | |

| WP Glimcher | | | | | | |

| As of March 31, 2015 |

| | | | | | | | | |

| | In-line Stores and Freestanding |

| | | Number of Leases Expiring | | Square

Feet | | Average Base

Minimum Rent PSF | | Percentage of Gross Annual Rental Revenues |

| | Year | | | | | | | |

| | Month To Month Leases | 336 |

| | 869,096 |

| | $ | 24.53 |

| | 3.4 | % |

| | 2015 | 390 |

| | 913,803 |

| | $ | 25.90 |

| | 3.8 | % |

| | 2016 | 1,017 |

| | 3,217,414 |

| | $ | 24.26 |

| | 12.5 | % |

| | 2017 | 860 |

| | 2,806,057 |

| | $ | 24.39 |

| | 11.0 | % |

| | 2018 | 662 |

| | 2,038,964 |

| | $ | 26.89 |

| | 8.8 | % |

| | 2019 | 557 |

| | 1,924,478 |

| | $ | 26.11 |

| | 8.1 | % |

| | 2020 | 368 |

| | 1,572,347 |

| | $ | 24.11 |

| | 6.1 | % |

| | 2021 | 227 |

| | 1,075,073 |

| | $ | 23.33 |

| | 4.0 | % |

| | 2022 | 246 |

| | 1,078,113 |

| | $ | 24.43 |

| | 4.2 | % |

| | 2023 | 301 |

| | 1,416,388 |

| | $ | 23.52 |

| | 5.3 | % |

| | 2024 | 238 |

| | 924,940 |

| | $ | 27.12 |

| | 4.0 | % |

| | 2025 and Thereafter | 187 |

| | 902,186 |

| | $ | 24.11 |

| | 3.5 | % |

| | Specialty Leasing Agreements w/ terms in excess of 12 months | 856 |

| | 1,892,634 |

| | $ | 11.65 |

| | 3.5 | % |

| | | | | | | | | |

| | Anchors |

| | | Number of Leases Expiring | | Square

Feet | | Average Base

Minimum Rent PSF | | Percentage of Gross Annual Rental Revenues |

| | Year | | | | | | | |

| | Month To Month Leases | 2 |

| | 47,081 |

| | $ | 9.36 |

| | 0.1 | % |

| | 2015 | 15 |

| | 979,105 |

| | $ | 4.75 |

| | 0.7 | % |

| | 2016 | 39 |

| | 1,826,428 |

| | $ | 6.74 |

| | 2.0 | % |

| | 2017 | 33 |

| | 2,232,961 |

| | $ | 4.81 |

| | 1.7 | % |

| | 2018 | 45 |

| | 2,514,052 |

| | $ | 7.42 |

| | 3.0 | % |

| | 2019 | 34 |

| | 2,167,505 |

| | $ | 6.14 |

| | 2.1 | % |

| | 2020 | 51 |

| | 2,723,792 |

| | $ | 7.11 |

| | 3.1 | % |

| | 2021 | 28 |

| | 2,269,920 |

| | $ | 7.09 |

| | 2.6 | % |

| | 2022 | 17 |

| | 986,203 |

| | $ | 6.66 |

| | 1.1 | % |

| | 2023 | 26 |

| | 1,232,950 |

| | $ | 8.35 |

| | 1.7 | % |

| | 2024 | 16 |

| | 851,919 |

| | $ | 7.29 |

| | 1.0 | % |

| | 2025 and Thereafter | 49 |

| | 4,924,676 |

| | $ | 3.32 |

| | 2.6 | % |

| | Specialty Leasing Agreements w/ terms in excess of 12 months | — |

| | — |

| | $ | 0.00 |

| | 0.0 | % |

| | | | | | | | | |

SUPPLEMENTAL INFORMATION | 11

|

| | | | | | | | | |

| CAPITAL EXPENDITURES | | | | |

| WP Glimcher | | | | | |

| (dollars in thousands) | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | Three Months

Ended

March 31, 2015 | | Three Months

Ended

March 31, 2014 |

| | | | | | |

| | New Developments | | $ | 744 |

| | $ | 789 |

|

| | Redevelopments, Renovations, and Expansions | | $ | 24,746 |

| | $ | 30,063 |

|

| | | | | | |

| | Property Capital Expenditures: | | | | |

| | Non-anchor stores tenant improvements and allowances | | $ | 7,763 |

| | $ | 9,402 |

|

| | Operational capital expenditures | | 1,629 |

| | 2,679 |

|

| | Total Property Capital Expenditures | | $ | 9,392 |

| | $ | 12,081 |

|

| | | | | | |

| | Note: Properties acquired from Glimcher in January 2015 are included in both periods presented. |

SUPPLEMENTAL INFORMATION | 12

|

| | | | | | | | | | | | | | | | |

| MAJOR REDEVELOPMENT PROJECTS | | | | | | |

| WP Glimcher | | | | | | | | |

| (dollars in thousands) | | | | | | | | |

| | | | | | | | | | | | | | | |

| | Property Name | | City | | St | Estimated

Total Costs (2) | | Estimated

Project Yield (2) | | Costs

Incurred

to Date (1) | | Estimated

Completion (2) | | Description |

| | | | | | | | | | | | | | | |

| | Current Projects: | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | Fairfield Town Center | | Houston | | TX | $75,000 - $85,000 | | 8% - 9% | | $ | 2,800 |

| | 2016/2017 | | Multi-phase retail development |

| | | | | | | | | | | | | | | |

| | Gateway Center | | Austin | | TX | $7,000 - $9,000 | | 8% - 9% | | $ | 0 |

| | 2016 2Q | | Add Saks Fifth Avenue OFF 5TH |

| | | | | | | | | | | | | | | |

| | Jefferson Valley Mall | | Yorktown Hts | | NY | $32,000 - $36,000 | | 7% - 8% | | $ | 1,900 |

| | 2017 2Q | | Redevelop center and add Dick's Sporting Goods |

| | | | | | | | | | | | | | | |

| | Mall at Fairfield Commons | | Dayton | | OH | $18,000 - $20,000 | | 7% - 8% | | $ | 1,100 |

| | 2015 4Q | | Demolish former department store & replace with restaurants |

| | | | | | | | | | | | | | | |

| | Polaris Fashion Place | | Columbus | | OH | $24,000 - $28,000 | | 8% - 9% | | $ | 10,100 |

| | 2015 4Q | | New Dick's Sporting Goods and Field & Stream anchors |

| | | | | | | | | | | | | | | |

| | Rockaway Commons | | Rockaway | | NJ | $8,000 - $10,000 | | 13% - 14% | | $ | 1,000 |

| | 2015 4Q | | Re-anchor with Nordstrom Rack & additional junior anchor |

| | | | | | | | | | | | | | | |

| | Scottsdale Quarter - Phase III | | Scottsdale | | AZ | $115,000 - $125,000 | | 7% - 8% | | $ | 47,200 |

| | 2015/2016 | | Multi-use addition to existing center |

| | | | | | | | | | | | | | | |

| | Town Center Plaza | | Leawood | | KS | $30,000 - $35,000 | | 7% - 8% | | $ | 6,000 |

| | 2015/2016 | | New Arhaus, Restoration Hardware, and pedestrian walkway |

| | | | | | | | | | | | | | | |

| | Total major projects | | | | | $300,000 - $350,000 | | 7% - 9% | | $ | 70,100 |

| | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | (1) Project costs exclude the allocation of internal costs such as labor, interest, and taxes. |

| | | | | | | | | | | | | | | |

| | (2) Estimated total costs, project yield, and completion are subject to adjustment as a result of changes (some of which are not under the direct control of the company) that are inherent in the development process. |

| | | | | | | | | | | | | | | |

| | Note that the project yield excludes any NOI benefit to the property that is indirectly related to the redevelopment, although each project does benefit other aspects of the mall. |

SUPPLEMENTAL INFORMATION | 13

|

| | | | | | | | | | | | | | | | | | | | | | | |

| WP GLIMCHER PROPERTY INFORMATION | | | | | | | | |

| As of March 31, 2015 | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | Debt Information |

| | | | | | | | | | | | | | | | | | | | | Indebtedness |

| Property Name | | St | | City | | Legal

Ownership (1) | | Total

Center

Square Feet | | Total

WPG Owned Square Feet | | Total

Tenant Owned Square Feet | | Maturity Date (2) | | Interest Rate | | Type | | Total | | WP Glimcher

Share |

| Malls | | | | | | | | | | | | | | | | | | | | | | |

| Anderson Mall | | SC | | Anderson | | 100% | | 671,028 |

| | 315,839 | | 355,189 | | 12/1/2022 | | 4.61% | | Fixed | | $19,849 | | $19,849 |

| Arbor Hills | | MI | | Ann Arbor | | 93% | | 87,395 |

| | 87,395 | | — | | 1/1/2026 | | 4.27% | | Fixed | | $25,499 | | $23,620 |

| Arboretum, The | | TX | | Austin | | 100% | | 194,956 |

| | 194,956 | | — | | | | | | | | | | |

| Ashland Town Center | | KY | | Ashland | | 100% | | 434,310 |

| | 330,920 | | 103,390 | | 7/6/2021 | | 4.90% | | Fixed | | $39,716 | | $39,716 |

| Bowie Town Center | | MD | | Bowie

(Wash, D.C.) | | 100% | | 578,402 |

| | 277,104 | | 301,298 | | | | | | | | | | |

| Boynton Beach Mall | | FL | | Boynton Beach (Miami) | | 100% | | 1,102,240 |

| | 590,688 | | 511,552 | | | | | | | | | | |

| Brunswick Square | | NJ | | East Brunswick (New York) | | 100% | | 760,640 |

| | 289,345 | | 471,295 | | 3/1/2024 | | 4.80% | | Fixed | | $75,874 | | $75,874 |

| Charlottesville Fashion Square | | VA | | Charlottesville | | 100% | | 576,903 |

| | 353,200 | | 223,703 | | 4/1/2024 | | 4.54% | | Fixed | | $49,292 | | $49,292 |

| Chautauqua Mall | | NY | | Lakewood | | 100% | | 427,590 |

| | 422,614 | | 4,976 | | | | | | | | | | |

| Chesapeake Square | | VA | | Chesapeake

(VA Beach) | | 75% | | 759,928 |

| | 560,419 | | 199,509 | | 2/1/2017 | | 5.84% | | Fixed | | $63,656 | | $47,742 |

| Clay Terrace | | IN | | Carmel (Indianapolis) | | 100% | | 501,730 |

| | 482,854 | | 18,876 | | 10/1/2015 | | 5.08% | | Fixed | | $115,000 | | $115,000 |

| Colonial Park Mall | | PA | | Harrisburg | | 100% | | 739,187 |

| | 371,741 | | 367,446 | | | | | | | | | | |

| Cottonwood Mall | | NM | | Albuquerque | | 100% | | 1,043,950 |

| | 409,873 | | 634,077 | | 4/6/2024 | | 4.82% | | Fixed | | $103,594 | | $103,594 |

| Dayton Mall | | OH | | Dayton | | 100% | | 1,443,520 |

| | 785,239 | | 658,281 | | 9/1/2022 | | 4.57% | | Fixed | | $82,000 | | $82,000 |

| Edison Mall | | FL | | Fort Myers | | 100% | | 1,054,445 |

| | 572,153 | | 482,292 | | | | | | | | | | |

| Forest Mall (3) | | WI | | Fond Du Lac | | 100% | | 500,899 |

| | 249,569 | | 251,330 | | | | | | | | | | |

| Grand Central Mall | | WV | | Parkersburg | | 100% | | 848,124 |

| | 742,301 | | 105,823 | | 7/6/2020 | | 6.05% | | Fixed | | $42,344 | | $42,344 |

SUPPLEMENTAL INFORMATION | 14

|

| | | | | | | | | | | | | | | | | | | | | | | |

| WP GLIMCHER PROPERTY INFORMATION | | | | | | | | |

| As of March 31, 2015 | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | Debt Information |

| | | | | | | | | | | | | | | | | | | | | Indebtedness |

| Property Name | | St | | City | | Legal

Ownership (1) | | Total

Center

Square Feet | | Total

WPG Owned Square Feet | | Total

Tenant Owned Square Feet | | Maturity Date (2) | | Interest Rate | | Type | | Total | | WP Glimcher

Share |

| Malls | | | | | | | | | | | | | | | | | | | | | | |

| Great Lakes Mall | | OH | | Mentor

(Cleveland) | | 100% | | 1,287,311 |

| | 580,178 | | 707,133 | | | | | | | | | | |

| Gulf View Square (3) | | FL | | Port Richey (Tampa) | | 100% | | 754,763 |

| | 400,117 | | 354,646 | | | | | | | | | | |

| Indian Mound Mall | | OH | | Newark | | 100% | | 556,817 |

| | 464,156 | | 92,661 | | | | | | | | | | |

| Irving Mall | | TX | | Irving

(Dallas) | | 100% | | 1,052,944 |

| | 489,400 | | 563,544 | | | | | | | | | | |

| Jefferson Valley Mall | | NY | | Yorktown Heights (New York) | | 100% | | 554,927 |

| | 389,235 | | 165,692 | | | | | | | | | | |

| Knoxville Center (3) | | TN | | Knoxville | | 100% | | 960,709 |

| | 506,097 | | 454,612 | | | | | | | | | | |

| Lima Mall | | OH | | Lima | | 100% | | 743,186 |

| | 543,364 | | 199,822 | | | | | | | | | | |

| Lincolnwood Town Center | | IL | | Lincolnwood (Chicago) | | 100% | | 421,991 |

| | 421,991 | | — | | 4/1/2021 | | 4.26% | | Fixed | | $52,209 | | $52,209 |

| Lindale Mall | | IA | | Cedar Rapids | | 100% | | 712,940 |

| | 462,187 | | 250,753 | | | | | | | | | | |

| Longview Mall | | TX | | Longview | | 100% | | 638,564 |

| | 194,479 | | 444,085 | | | | | | | | | | |

| Malibu Lumber Yard | | CA | | Malibu | | 100% | | 31,479 |

| | 31,479 | | — | | | | | | | | | | |

| Mall at Fairfield Commons, The | | OH | | Beavercreek | | 100% | | 1,008,714 |

| | 859,302 | | 149,412 | | | | | | | | | | |

| Mall at Johnson City, The | | TN | | Johnson City | | 100% | | 570,995 |

| | 495,587 | | 75,408 | | 5/6/2020 | | 6.76% | | Fixed | | $52,074 | | $52,074 |

| Maplewood Mall | | MN | | St. Paul (Minneapolis) | | 100% | | 908,006 |

| | 325,527 | | 582,479 | | | | | | | | | | |

| Markland Mall | | IN | | Kokomo | | 100% | | 418,019 |

| | 414,539 | | 3,480 | | | | | | | | | | |

| Melbourne Square | | FL | | Melbourne | | 100% | | 705,656 |

| | 420,838 | | 284,818 | | | | | | | | | | |

| Merritt Square Mall | | FL | | Merritt Island | | 100% | | 810,972 |

| | 475,299 | | 335,673 | | 9/1/2015 | | 5.35% | | Fixed | | $53,297 | | $53,297 |

SUPPLEMENTAL INFORMATION | 15

|

| | | | | | | | | | | | | | | | | | | | | | | |

| WP GLIMCHER PROPERTY INFORMATION | | | | | | | | |

| As of March 31, 2015 | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | Debt Information |

| | | | | | | | | | | | | | | | | | | | | Indebtedness |

| Property Name | | St | | City | | Legal

Ownership (1) | | Total

Center

Square Feet | | Total

WPG Owned Square Feet | | Total

Tenant Owned Square Feet | | Maturity Date (2) | | Interest Rate | | Type | | Total | | WP Glimcher

Share |

| Malls | | | | | | | | | | | | | | | | | | | | | | |

| Mesa Mall | | CO | | Grand Junction | | 100% | | 873,831 |

| | 431,127 | | 442,704 | | 6/1/2016 | | 5.79% | | Fixed | | $87,250 | | $87,250 |

| Morgantown Mall | | WV | | Morgantown | | 100% | | 555,372 |

| | 555,372 | | — | | | | | | | | | | |

| Muncie Mall | | IN | | Muncie | | 100% | | 635,710 |

| | 385,910 | | 249,800 | | 4/1/2021 | | 4.19% | | Fixed | | $36,441 | | $36,441 |

| New Towne Mall | | OH | | New Philadelphia | | 100% | | 509,561 |

| | 509,561 | | — | | | | | | | | | | |

| Northlake Mall (3) | | GA | | Atlanta | | 100% | | 962,969 |

| | 576,569 | | 386,400 | | | | | | | | | | |

| Northtown Mall | | MN | | Blaine | | 100% | | 547,854 |

| | 547,854 | | — | | | | | | | | | | |

| Northwoods Mall | | IL | | Peoria | | 100% | | 693,481 |

| | 220,512 | | 472,969 | | | | | | | | | | |

| Oak Court Mall | | TN | | Memphis | | 100% | | 849,266 |

| | 363,449 | | 485,817 | | 4/1/2021 | | 4.76% | | Fixed | | $39,458 | | $39,458 |

| Oklahoma City Properties | | OK | | Oklahoma City | | 99% | | 288,135 |

| | 288,135 | | — | | | | | | | | | | |

| Orange Park Mall | | FL | | Orange Park (Jacksonville) | | 100% | | 959,525 |

| | 556,345 | | 403,180 | | | | | | | | | | |

| Paddock Mall | | FL | | Ocala | | 100% | | 551,988 |

| | 321,431 | | 230,557 | | | | | | | | | | |

| Pearlridge Center | | HI | | Aiea | | 100% | | 1,139,762 |

| | 1,139,762 | | — | | 11/1/2015 | | 4.60% | | Fixed | | $171,388 | | $171,388 |

| Polaris Fashion Place | | OH | | Columbus | | 100% | | 1,437,685 |

| | 685,466 | | 752,219 | | 3/1/2025 | | 3.90% | | Fixed | | $225,000 | | $225,000 |

| Port Charlotte Town Center | | FL | | Port Charlotte | | 80% | | 764,698 |

| | 480,489 | | 284,209 | | 11/1/2020 | | 5.30% | | Fixed | | $45,450 | | $36,360 |

| Richmond Town Square (3) | | OH | | Richmond Heights (Cleveland) | | 100% | | 1,011,775 |

| | 541,824 | | 469,951 | | | | | | | | | | |

| River Oaks Center (3) | | IL | | Calumet City (Chicago) | | 100% | | 1,192,571 |

| | 688,312 | | 504,259 | | | | | | | | | | |

| River Valley Mall | | OH | | Lancaster | | 100% | | 521,578 |

| | 521,578 | | — | | 1/11/2016 | | 5.65% | | Fixed | | $45,573 | | $45,573 |

SUPPLEMENTAL INFORMATION | 16

|

| | | | | | | | | | | | | | | | | | | | | | | |

| WP GLIMCHER PROPERTY INFORMATION | | | | | | | | |

| As of March 31, 2015 | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | Debt Information |

| | | | | | | | | | | | | | | | | | | | | Indebtedness |

| Property Name | | St | | City | | Legal

Ownership (1) | | Total

Center

Square Feet | | Total

WPG Owned Square Feet | | Total

Tenant Owned Square Feet | | Maturity Date (2) | | Interest Rate | | Type | | Total | | WP Glimcher

Share |

| Malls | | | | | | | | | | | | | | | | | | | | | | |

| Rolling Oaks Mall | | TX | | San Antonio | | 100% | | 882,347 |

| | 286,039 | | 596,308 | | | | | | | | | | |

| Rushmore Mall | | SD | | Rapid City | | 100% | | 829,234 |

| | 752,758 | | 76,476 | | 2/1/2019 | | 5.79% | | Fixed | | $94,000 | | $94,000 |

| Scottsdale Quarter | | AZ | | Scottsdale | | 100% | | 541,386 |

| | 541,386 | | — | | 5/22/2015 | | 3.27% | | Variable | | $130,000 | | $130,000 |

| | | | | | | | | | | | | | | 10/1/2015 | | 4.91% | | Fixed | | $65,179 | | $65,179 |

| Seminole Towne Center | | FL | | Sanford

(Orlando) | | 45% | | 1,104,689 |

| | 591,399 | | 513,290 | | 5/6/2021 | | 5.97% | | Fixed | | $57,125 | | $25,706 |

| Southern Hills Mall | | IA | | Sioux City | | 100% | | 794,372 |

| | 550,425 | | 243,947 | | 6/1/2016 | | 5.79% | | Fixed | | $101,500 | | $101,500 |

| Southern Park Mall | | OH | | Youngstown | | 100% | | 1,204,703 |

| | 1,009,139 | | 195,564 | | | | | | | | | | |

| Sunland Park Mall | | TX | | El Paso | | 100% | | 922,165 |

| | 327,228 | | 594,937 | | | | | | | | | | |

| Outlet Collection | Seattle, The | | WA | | Seattle | | 100% | | 921,472 |

| | 921,472 | | — | | 1/12/2018 | | 1.68% | | Variable | | $86,500 | | $86,500 |

| Town Center at Aurora | | CO | | Aurora

(Denver) | | 100% | | 1,082,834 |

| | 342,893 | | 739,941 | | 4/1/2021 | | 4.19% | | Fixed | | $55,000 | | $55,000 |

| Town Center Crossing & Plaza | | KS | | Leawood | | 100% | | 605,164 |

| | 483,931 | | 121,233 | | 2/1/2027 | | 4.25% | | Fixed | | $36,462 | | $36,462 |

| | | | | | | | | | | | | | | 2/1/2027 | | 5.00% | | Fixed | | $73,307 | | $73,307 |

| Towne West Square | | KS | | Wichita | | 100% | | 936,978 |

| | 440,445 | | 496,533 | | 6/1/2021 | | 5.61% | | Fixed | | $48,433 | | $48,433 |

| Valle Vista Mall | | TX | | Harlingen | | 100% | | 650,504 |

| | 492,104 | | 158,400 | | 5/10/2017 | | 5.35% | | Fixed | | $40,000 | | $40,000 |

| Virginia Center Commons (3) | | VA | | Glen Allen | | 100% | | 785,049 |

| | 444,141 | | 340,908 | | | | | | | | | | |

| Waterford Lakes Town Center | | FL | | Orlando | | 100% | | 960,164 |

| | 685,664 | | 274,500 | | | | | | | | | | |

| Weberstown Mall | | CA | | Stockton | | 100% | | 856,817 |

| | 283,493 | | 573,324 | | 6/8/2016 | | 5.90% | | Fixed | | $60,000 | | $60,000 |

SUPPLEMENTAL INFORMATION | 17

|

| | | | | | | | | | | | | | | | | | | | | | | |

| WP GLIMCHER PROPERTY INFORMATION | | | | | | | | |

| As of March 31, 2015 | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | Debt Information |

| | | | | | | | | | | | | | | | | | | | | Indebtedness |

| Property Name | | St | | City | | Legal

Ownership (1) | | Total

Center

Square Feet | | Total

WPG Owned Square Feet | | Total

Tenant Owned Square Feet | | Maturity Date (2) | | Interest Rate | | Type | | Total | | WP Glimcher

Share |

| Malls | | | | | | | | | | | | | | | | | | | | | | |

| West Ridge Mall | | KS | | Topeka | | 100% | | 995,609 |

| | 391,498 | | 604,111 | | 3/6/2024 | | 4.84% | | Fixed | | $42,573 | | $42,573 |

| Westminster Mall | | CA | | Westminster

(Los Angeles) | | 100% | | 1,203,700 |

| | 431,009 | | 772,691 | | 4/1/2024 | | 4.65% | | Fixed | | $83,824 | | $83,824 |

| WestShore Plaza | | FL | | Tampa | | 100% | | 1,076,374 |

| | 847,912 | | 228,462 | | 10/1/2017 | | 3.65% | | Variable | | $119,600 | | $119,600 |

| | | | | | | | | | | | | | | | | | | | | | | |

| Community Centers | | | | | | | | | | | | | | | | | | | | | | |

| Bloomingdale Court | | IL | | Bloomingdale (Chicago) | | 100% | | 686,640 |

| | 375,095 | | 311,545 | | 11/1/2015 | | 8.15% | | Fixed | | $24,611 | | $24,611 |

| Bowie Town Center Strip | | MD | | Bowie

(Wash, D.C.) | | 100% | | 106,589 |

| | 40,927 | | 65,662 | | | | | | | | | | |

| Canyon View | | CO | | Grand Junction | | 100% | | 43,054 |

| | 43,054 | | — | | 11/6/2023 | | 5.47% | | Fixed | | $5,533 | | $5,533 |

| Charles Towne Square | | SC | | Charleston | | 100% | | 71,794 |

| | 71,794 | | — | | | | | | | | | | |

| Chesapeake Center | | VA | | Chesapeake (Virginia Beach) | | 100% | | 305,853 |

| | 128,972 | | 176,881 | | | | | | | | | | |

| Concord Mills Marketplace | | NC | | Concord (Charlotte) | | 100% | | 230,683 |

| | 216,870 | | 13,813 | | 11/1/2023 | | 4.82% | | Fixed | | $16,000 | | $16,000 |

| Countryside Plaza | | IL | | Countryside (Chicago) | | 100% | | 403,756 |

| | 204,295 | | 199,461 | | | | | | | | | | |

| Dare Centre | | NC | | Kill Devil Hills | | 100% | | 168,673 |

| | 109,154 | | 59,519 | | | | | | | | | | |

| DeKalb Plaza | | PA | | King of Prussia (Philadelphia) | | 100% | | 101,911 |

| | 44,091 | | 57,820 | | | | | | | | | | |

| Empire East | | SD | | Sioux Falls | | 100% | | 301,438 |

| | 167,616 | | 133,822 | | | | | | | | | | |

| Fairfax Court | | VA | | Fairfax

(Wash, D.C.) | | 100% | | 249,488 |

| | 245,999 | | 3,489 | | | | | | | | | | |

| Fairfield Town Center | | TX | | Houston | | 100% | | 108,000 |

| | — | | 108,000 | | | | | | | | | | |

SUPPLEMENTAL INFORMATION | 18

|

| | | | | | | | | | | | | | | | | | | | | | | |

| WP GLIMCHER PROPERTY INFORMATION | | | | | | | | |

| As of March 31, 2015 | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | Debt Information |

| | | | | | | | | | | | | | | | | | | | | Indebtedness |

| Property Name | | St | | City | | Legal

Ownership (1) | | Total

Center

Square Feet | | Total

WPG Owned Square Feet | | Total

Tenant Owned Square Feet | | Maturity Date (2) | | Interest Rate | | Type | | Total | | WP Glimcher

Share |

| Community Centers | | | | | | | | | | | | | | | | | | | | | | |

| Forest Plaza | | IL | | Rockford | | 100% | | 434,838 |

| | 414,542 | | 20,296 | | 10/10/2019 | | 7.50% | | Fixed | | $17,270 | | $17,270 |

| Gaitway Plaza | | FL | | Ocala | | 88% | | 208,051 |

| | 207,251 | | 800 | | | | | | | | | | |

| Gateway Centers | | TX | | Austin | | 100% | | 512,652 |

| | 403,649 | | 109,003 | | | | | | | | | | |

| Greenwood Plus | | IN | | Greenwood (Indianapolis) | | 100% | | 155,319 |

| | 146,091 | | 9,228 | | | | | | | | | | |

| Henderson Square | | PA | | King of Prussia (Philadelphia) | | 100% | | 107,371 |

| | 53,615 | | 53,756 | | 4/1/2016 | | 4.43% | | Fixed | | $12,863 | | $12,863 |

| Keystone Shoppes | | IN | | Indianapolis | | 100% | | 29,080 |

| | 29,080 | | — | | | | | | | | | | |

| Lake Plaza | | IL | | Waukegan (Chicago) | | 100% | | 215,568 |

| | 124,939 | | 90,629 | | | | | | | | | | |

| Lake View Plaza | | IL | | Orland Park (Chicago) | | 100% | | 367,370 |

| | 311,961 | | 55,409 | | | | | | | | | | |

| Lakeline Plaza | | TX | | Cedar Park (Austin) | | 100% | | 387,240 |

| | 356,803 | | 30,437 | | 10/10/2019 | | 7.50% | | Fixed | | $16,179 | | $16,179 |

| Lima Center | | OH | | Lima | | 100% | | 233,878 |

| | 173,878 | | 60,000 | | | | | | | | | | |

| Lincoln Crossing | | IL | | O'Fallon

(St. Louis) | | 100% | | 243,326 |

| | 37,861 | | 205,465 | | | | | | | | | | |

| MacGregor Village | | NC | | Cary | | 100% | | 144,301 |

| | 144,301 | | — | | | | | | | | | | |

| Mall of Georgia Crossing | | GA | | Buford

(Atlanta) | | 100% | | 440,670 |

| | 317,535 | | 123,135 | | 10/6/2022 | | 4.28% | | Fixed | | $23,989 | | $23,989 |

| Markland Plaza | | IN | | Kokomo | | 100% | | 90,527 |

| | 80,977 | | 9,550 | | | | | | | | | | |

| Martinsville Plaza | | VA | | Martinsville | | 100% | | 102,105 |

| | 94,760 | | 7,345 | | | | | | | | | | |

| Matteson Plaza | | IL | | Matteson (Chicago) | | 100% | | 272,336 |

| | 180,936 | | 91,400 | | | | | | | | | | |

| Morgantown Commons | | WV | | Morgantown | | 100% | | 230,843 |

| | 230,843 | | — | | | | | | | | | | |

SUPPLEMENTAL INFORMATION | 19

|

| | | | | | | | | | | | | | | | | | | | | | | |

| WP GLIMCHER PROPERTY INFORMATION | | | | | | | | |

| As of March 31, 2015 | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | Debt Information |

| | | | | | | | | | | | | | | | | | | | | Indebtedness |

| Property Name | | St | | City | | Legal

Ownership (1) | | Total

Center

Square Feet | | Total

WPG Owned Square Feet | | Total

Tenant Owned Square Feet | | Maturity Date (2) | | Interest Rate | | Type | | Total | | WP Glimcher

Share |

| Community Centers | | | | | | | | | | | | | | | | | | | | | | |

| Muncie Towne Plaza | | IN | | Muncie | | 100% | | 172,617 |

| | 172,617 | | — | | 10/10/2019 | | 7.50% | | Fixed | | $6,727 | | $6,727 |

| North Ridge Shopping Center | | NC | | Raleigh | | 100% | | 169,641 |

| | 164,241 | | 5,400 | | 12/1/2022 | | 3.41% | | Fixed | | $12,500 | | $12,500 |

| Northwood Plaza | | IN | | Fort Wayne | | 100% | | 208,076 |

| | 79,877 | | 128,199 | | | | | | | | | | |

| Palms Crossing | | TX | | McAllen | | 100% | | 392,305 |

| | 358,468 | | 33,837 | | 8/1/2021 | | 5.49% | | Fixed | | $36,514 | | $36,514 |

| Plaza at Buckland Hills, The | | CT | | Manchester | | 100% | | 329,885 |

| | 218,986 | | 110,899 | | | | | | | | | | |

| Richardson Square | | TX | | Richardson (Dallas) | | 100% | | 517,265 |

| | 41,354 | | 475,911 | | | | | | | | | | |

| Rockaway Commons | | NJ | | Rockaway

(New York) | | 100% | | 238,253 |

| | 229,145 | | 9,108 | | | | | | | | | | |

| Rockaway Town Plaza | | NJ | | Rockaway

(New York) | | 100% | | 371,908 |

| | 70,632 | | 301,276 | | | | | | | | | | |

| Royal Eagle Plaza | | FL | | Coral Springs (Miami) | | 100% | | 202,952 |

| | 191,999 | | 10,953 | | | | | | | | | | |

| Shops at Arbor Walk, The | | TX | | Austin | | 100% | | 458,468 |

| | 280,314 | | 178,154 | | 8/1/2021 | | 5.49% | | Fixed | | $41,268 | | $41,268 |

| Shops at North East Mall, The | | TX | | Hurst

(Dallas) | | 100% | | 365,039 |

| | 365,039 | | — | | | | | | | | | | |

| St. Charles Towne Plaza | | MD | | Waldorf (Wash, D.C.) | | 100% | | 391,597 |

| | 330,047 | | 61,550 | | | | | | | | | | |

| Tippecanoe Plaza | | IN | | Lafayette | | 100% | | 90,522 |

| | 85,811 | | 4,711 | | | | | | | | | | |

| University Center | | IN | | Mishawaka | | 100% | | 150,441 |

| | 100,441 | | 50,000 | | | | | | | | | | |

| University Town Plaza | | FL | | Pensacola | | 100% | | 565,538 |

| | 216,194 | | 349,344 | | | | | | | | | | |

| Village Park Plaza | | IN | | Carmel (Indianapolis) | | 100% | | 575,576 |

| | 290,037 | | 285,539 | | | | | | | | | | |

| Washington Plaza | | IN | | Indianapolis | | 100% | | 50,107 |

| | 50,107 | | — | | | | | | | | | | |

SUPPLEMENTAL INFORMATION | 20

|

| | | | | | | | | | | | | | | | | | | | | | | |

| WP GLIMCHER PROPERTY INFORMATION | | | | | | | | |

| As of March 31, 2015 | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | Debt Information |

| | | | | | | | | | | | | | | | | | | | | Indebtedness |

| Property Name | | St | | City | | Legal

Ownership (1) | | Total

Center

Square Feet | | Total

WPG Owned Square Feet | | Total

Tenant Owned Square Feet | | Maturity Date (2) | | Interest Rate | | Type | | Total | | WP Glimcher

Share |

| Community Centers | | | | | | | | | | | | | | | | | | | | | | |

| West Ridge Plaza | | KS | | Topeka | | 100% | | 254,480 |

| | 99,987 | | 154,493 | | 3/6/2024 | | 4.84% | | Fixed | | $10,643 | | $10,643 |

| West Town Corners | | FL | | Altamonte Springs (Orlando) | | 88% | | 385,403 |

| | 236,785 | | 148,618 | | | | | | | | | | |

| Westland Park Plaza | | FL | | Orange Park (Jacksonville) | | 88% | | 163,259 |

| | 163,259 | | — | | | | | | | | | | |

| White Oaks Plaza | | IL | | Springfield | | 100% | | 387,911 |

| | 235,128 | | 152,783 | | 10/10/2019 | | 7.50% | | Fixed | | $13,452 | | $13,452 |

| Whitehall Mall | | PA | | Whitehall | | 100% | | 613,417 |

| | 598,543 | | 14,874 | | 11/1/2018 | | 7.00% | | Fixed | | $10,086 | | $10,086 |

| Wolf Ranch | | TX | | Georgetown (Austin) | | 100% | | 627,284 |

| | 415,098 | | 212,186 | | | | | | | | | | |

| Total | | | | | | | | 68,347,860 |

| | 43,097,615 | | 25,250,245 | | | | | | | | $2,766,102 | | $2,707,800 |

| | | | | | | | | | | | | | | | | | | | | | | |

| Footnotes: | | | | | | | | | | | | | | | | | | | | | | |

| (1) Direct and indirect interests in some joint venture properties are subject to preferences on distributions and/or capital allocation in favor of other partners. | |

| (2) Assumes full exercise of extension options. | |

| (3) Non-core property | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

SUPPLEMENTAL INFORMATION | 21

|

| | | |

| GLOSSARY OF TERMS | | |

| | | | |

| | | | |

| | - Average rent PSF | | Average base minimum rent charge in effect for the reporting period for all tenants that qualify to be included in the occupancy as defined below. |

| | - EBITDA | | Net income/(loss) attributable to the company before interest, depreciation and amortization, gains/losses on sale of operating properties, impairment charges, income taxes and unrealized remeasurement adjustment of derivative instrument. |

| | - Funds from operation (FFO) | | Funds From Operation ("FFO") is a supplemental non-GAAP measure utilized to evaluate the operating performance of real estate companies. The National Association of Real Estate Investment Trusts ("NAREIT") defines FFO as net income/(loss) attributable to common shareholders computed in accordance with generally accepted accounting principles ("GAAP"), excluding (i) gains or losses from sales of operating real estate assets and (ii) extraordinary items, plus (iii) depreciation and amortization of operating properties and (iv) impairment of depreciable real estate and in substance real estate equity investments and (v) after adjustments for unconsolidated partnerships and joint ventures calculated to reflect funds from operations on the same basis. |

| | - Gross leasable area (GLA) | | Measure of the total amount of leasable space in a property. |

| | - Net operating income (NOI) | | Revenues from all rental property less operating and maintenance expenses, real estate taxes and rent expense including the company's pro-rata share of real estate joint ventures. Excludes non-recurring items such as termination income and sales from outparcels. |

| | - Occupancy | | Occupancy is the percentage of total owned square footage (GLA) which is leased as of the last day of the reporting period. For malls, all company owned space except for mall anchors, mall majors, mall freestanding, office and mall outlots in the calculation. For community lifestyle centers, all owned GLA other than office are included in the calculation. |

| | - Occupancy cost | | Percent of tenant's total occupancy cost (rent and reimbursement of CAM, tax and insurance) to tenant sales for mall stores of 10,000 sf or less. |

| | - Re-leasing Spreads | | Releasing Spread is a ‘‘same space’’ measure that compares opening and closing rates on individual spaces, including spaces greater than 10,000 square feet. The Opening Rate is the average of the initial cash Total Rent PSF for spaces leased during the trailing 12-month period, and includes new leases and existing tenant renewals, amendments and relocations (including expansions and downsizings). The Closing Rate is the average of the final cash Total Rent PSF as of the month the tenant terminates or closes. Total Rent PSF includes Base Minimum Rent, common area maintenance (CAM) and base percentage rent. It includes leasing activity on all spaces occupied by tenants as long as the opening and closing dates are within 24 months of one another. |

SUPPLEMENTAL INFORMATION | 22