EXHIBIT 1.3

MANAGEMENT’S DISCUSSION AND ANALYSIS

February 14, 2017

In this Management's Discussion and Analysis ("MD&A"), "we", "us", "our", "Shopify" and "the Company" refer to Shopify Inc. and its consolidated subsidiaries, unless the context requires otherwise. In this MD&A, we explain Shopify's results of operations and cash flows for the fourth quarter and the fiscal years ending December 31, 2016, 2015 and 2014, and our financial position as of December 31, 2016. You should read this MD&A together with our audited consolidated financial statements and the accompanying notes for the fiscal years ended December 31, 2016, 2015 and 2014. Additional information regarding Shopify, including our 2016 annual information form and our annual report on Form 40-F for the year ended December 31, 2016, is available on our website at www.shopify.com, or at www.sedar.com and www.sec.gov.

Our audited consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America ("U.S. GAAP"). All amounts are in U.S. dollars except where otherwise indicated.

Our MD&A is intended to enable readers to gain an understanding of Shopify’s results of operations, cash flows and financial position. To do so, we provide information and analysis comparing our results of operations, cash flows and financial position for the most recently completed fiscal year with the preceding fiscal year. We also provide analysis and commentary that we believe will help investors assess our future prospects. In addition, we provide “forward-looking statements” that are not historical facts, but that are based on our current estimates, beliefs and assumptions and which are subject to known and unknown important risks, uncertainties, assumptions and other factors that could cause actual results to differ materially from current expectations. Forward-looking statements are intended to assist readers in understanding management's expectations as of the date of this MD&A and may not be suitable for other purposes. See “Forward-looking statements” below.

In this MD&A, references to our “solutions” means the combination of products and services that we offer to merchants, and references to “our merchants” as of a particular date means the total number of unique shops that are paying for a subscription to our platform.

Forward-looking statements

This MD&A contains forward-looking statements under the provisions of the United States Private Securities Litigation Reform Act of 1995, Section 27A of the U.S. Securities Act of 1933, as amended, and Section 21E of the U.S. Securities Exchange Act of 1934, and forward-looking information within the meaning of applicable Canadian securities legislation.

In some cases, you can identify forward-looking statements by words such as “may”, "might", “will”, “should”, “could”, “expects”, “intends”, “plans”, “anticipates”, “believes”, “estimates”, “predicts”, “projects”, “potential”, “continue”, or the negative of these terms or other similar words. In addition, any statements or information that refer to expectations, beliefs, plans, projections, objectives, performance or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking. In particular, forward-looking statements in this MD&A include, but are not limited to, statements about:

| |

| • | our revenue growth objectives and expectations about future profitability; |

| |

| • | the achievement of advances in, and expansion of, our platform and our solutions; |

| |

| • | the intended growth of our business and making acquisitions and investments, and our expectation that such acquisitions and investments will help drive our growth; |

| |

| • | our ability to generate revenue while controlling costs and expenses; |

| |

| • | our ability to increase sales to our merchants; |

| |

| • | our belief that our business may become more seasonal in the future, and that historical patterns may not be a reliable indicator of our future performance; |

| |

| • | our expectation that the cost of subscription solutions will increase; |

| |

| • | our expectation that the cost of merchant solutions will increase; |

| |

| • | our expectation that our gross margin percentage on subscription solutions will fluctuate modestly; |

| |

| • | our expectation that our gross margin percentage on merchant solutions may increase over time; |

| |

| • | our expectation that our additional higher-margin merchant solutions offerings, such as Shopify Shipping and Shopify Capital, will become a larger component of our merchant solutions revenue; |

| |

| • | our expectation that we will continue to expand Shopify Payments internationally; |

| |

| • | our plan to continue to expand sales and marketing efforts, including adding outbound sales personnel and expanding our marketing activities; |

| |

| • | our expectation that sales and marketing expenses will increase, but over time will decrease as a percentage of total revenues; |

| |

| • | our expectation that research and development expenses will increase, but over time will decrease as a percentage of total revenues; |

| |

| • | our expectation that general and administrative expenses will increase, but over time may decrease as a percentage of total revenues; |

| |

| • | our belief that we have sufficient liquidity to meet our current and planned financial obligations; and |

| |

| • | our expectations regarding potential contingent obligations. |

The forward-looking statements contained in this MD&A are based on our management’s perception of historic trends, current conditions and expected future developments, as well as other assumptions that management believes are appropriate in the circumstances, which include, but are not limited to:

| |

| • | our belief that monthly recurring revenue ("MRR") is most closely correlated with the long-term value of our merchant relationships; |

| |

| • | our ability to expand our merchant base; |

| |

| • | our growth rate, subscription renewal activity, the timing and extent of spending to support development of our platform and expansion of sales and marketing activities; |

| |

| • | our ability to retain merchants as they grow their businesses on our platform; |

| |

| • | our ability to increase sales and revenues from both new and existing merchants; |

| |

| • | assumptions about the growth of our merchants’ revenues; |

| |

| • | our ability to reach economies of scale; |

| |

| • | our ability to reach profitability; |

| |

| • | our ability to offer more sales channels that can connect to the platform; |

| |

| • | our ability to develop new solutions to extend the functionality of our platform; |

| |

| • | assumptions as to the mix of subscription plans that our merchants select; |

| |

| • | assumptions as to the timing of infrastructure expansion projects; |

| |

| • | our ability to predict future commerce trends and technology; |

| |

| • | our ability to enhance our ecosystem and partner programs; |

| |

| • | our ability to provide a high level of merchant service and support; |

| |

| • | our ability to hire, retain and motivate qualified personnel; |

| |

| • | our ability to develop processes, systems and controls to enable our internal support functions to scale with the growth of our business; |

| |

| • | our expectations on future costs of compliance associated with being a public company; |

| |

| • | our belief that our investments in marketing initiatives will continue to be effective in growing the number of merchants using our platform; |

| |

| • | our belief that our investments will increase our revenue base, improve the retention of this base and strengthen our ability to increase sales to our merchants; |

| |

| • | our belief that our merchant solutions make it easier for merchants to start a business and grow on our platform; |

| |

| • | our assumptions regarding the principal competitive factors in our market; |

| |

| • | our future expenses and financing requirements; |

| |

| • | our ability to protect against currency, interest rate, concentration of credit and inflation risks; |

| |

| • | our critical accounting policies and estimates; and |

| |

| • | our ability to obtain sufficient space for our growing employee base. |

Factors that may cause actual results to differ materially from current expectations may include, but are not limited to, risks and uncertainties that are discussed in greater detail in the "Risk Factors" section of our Annual Information Form for the year ended December 31, 2016 and elsewhere in this MD&A, including but not limited to risks relating to:

| |

| • | our rapid growth and managing our growth; |

| |

| • | our history of losses and our potential inability to achieve profitability; |

| |

| • | our limited operating history in new and developing markets; |

| |

| • | our ability to innovate; |

| |

| • | a denial of service attack or security breach; |

| |

| • | payments processed through Shopify Payments; |

| |

| • | our reliance on third party suppliers to provide the technology we offer through Shopify Payments and Shopify Shipping, and our reliance on a single supplier for Shopify Payments; |

| |

| • | the security of personally identifiable information we store relating to merchants and their customers; |

| |

| • | serious software errors or defects; |

| |

| • | exchange rate fluctuations that may negatively affect our results of operations; |

| |

| • | our potential inability to achieve or maintain data transmission capacity; |

| |

| • | the reliance of our growth in part on the success of our strategic relationships with third parties; |

| |

| • | our potential failure to maintain a consistently high level of customer service; |

| |

| • | the limited number of data centers we use; |

| |

| • | ineffective operations of our solutions when accessed through mobile devices; |

| |

| • | changes to technologies used in our platform or new versions or upgrades of operating systems and internet browsers; |

| |

| • | the impact of worldwide economic conditions, including the resulting effect on spending by small and medium-sized businesses ("SMBs") or their customers; |

| |

| • | potential claims by third parties of intellectual property infringement; |

| |

| • | our potential inability to obtain, maintain and protect our intellectual property rights and proprietary information or prevent third parties from making unauthorized use of our technology; |

| |

| • | our use of "open source" software; |

| |

| • | our potential inability to generate traffic to our website through search engines and social networking sites; |

| |

| • | our potential failure to effectively maintain, promote and enhance our brand; |

| |

| • | our potential inability to hire, retain and motivate qualified personnel; |

| |

| • | our dependence on the continued services and performance of our senior management and other key employees; |

| |

| • | activities of merchants or the content of their shops; |

| |

| • | international sales and the use of our platform in various countries; |

| |

| • | our reliance on computer hardware, purchased or leased, software licensed from and services rendered by third parties, in order to provide our solutions and run our business, sometimes by a single-source supplier; |

| |

| • | our potential inability to compete successfully against current and future competitors; |

| |

| • | our pricing decisions for our solutions; |

| |

| • | acquisitions and investments; |

| |

| • | provisions of our financial instruments; |

| |

| • | our potential inability to raise additional funds as may be needed to pursue our growth strategy or continue our operations, on favorable terms or at all; |

| |

| • | unanticipated changes in effective tax rates or adverse outcomes resulting from examination of our income or other tax returns; |

| |

| • | new tax laws could be enacted or existing laws could be applied to us or our merchants; |

| |

| • | being required to collect federal, state and local business taxes and sales and use taxes in additional jurisdictions or for past sales; |

| |

| • | our tax loss carryforwards; |

| |

| • | our dependence upon consumers’ and merchants’ access to, and willingness to use, the internet for commerce; |

| |

| • | challenges in expanding into new geographic regions; |

| |

| • | Shopify Capital and offering merchant cash advances; |

| |

| • | ownership of our shares; |

| |

| • | our sensitivity to interest rate fluctuations; |

| |

| • | our concentration of credit risk, and the ability to mitigate that risk using third parties; and |

Although we believe that the plans, intentions, expectations, assumptions and strategies reflected in our forward-looking statements are reasonable, these statements relate to future events or our future financial performance, and involve known and unknown risks, uncertainties and other factors which are, in some cases, beyond our control. If one or more of these risks or uncertainties occur, or if our underlying assumptions prove to be incorrect, actual results may vary significantly from those implied or projected by the forward-looking statements. No forward-looking statement is a guarantee of future results. You should read this MD&A and the documents that we reference in this MD&A completely and with the understanding that our actual future results may be materially different from any future results expressed or implied by these forward-looking statements.

The forward-looking statements in this MD&A represent our views as of the date of this MD&A. We anticipate that subsequent events and developments may cause our views to change. However, while we may elect to update these forward-looking statements at some point in the future, we have no current intention of doing so except to the extent required by applicable law. Therefore, these forward-looking statements do not represent our views as of any date other than the date of this MD&A.

Overview

Shopify provides the leading cloud-based, multi-channel commerce platform designed for small and medium-sized businesses. Merchants use our software to run their business across all of their sales channels, including web and mobile storefronts, physical retail locations, social media storefronts, and marketplaces. As the number of channels over which merchants transact continues to expand, the importance of a multi-channel platform that is both fully integrated and easy to use increases. The Shopify platform provides merchants with a single view of their business and customers across all of their sales channels and enables them to manage products and inventory, process orders and payments, ship orders, build customer relationships and leverage analytics and reporting all from one integrated back office.

Commerce transacted over mobile devices continues to grow more rapidly than desktop transactions. For several years Shopify has focused on enabling mobile commerce and our merchants are now able to offer their customers the ability to quickly and securely check out by using Apple Pay, and in the future Android Pay, on the web. Using Shopify Mobile, merchants have the ability to set-up, track, and manage their business on the go.

The Shopify platform has been engineered to enterprise-level standards and functionality while being designed for simplicity and ease-of-use. We have also designed our platform with a robust technical infrastructure able to manage large spikes in traffic and with an app ecosystem to integrate additional functionality. We are constantly innovating and enhancing our platform, with our continuously deployed, multi-tenant architecture ensuring all of our merchants are always using the latest technology.

A rich ecosystem of app developers, theme designers and other partners has evolved around the Shopify platform. With approximately 11,000 active partners referring merchants over the last year, we have built a strong, symbiotic relationship with our partners that continues to grow. We believe this ecosystem has grown in part due to the platform’s functionality, which is highly extensible and can be expanded through our application program interface ("API") and the approximately 1,400 apps available in the Shopify App Store. This ecosystem helps drive the growth of our merchant base, which in turn further accelerates growth of the ecosystem.

Our mission is to make commerce better for everyone, and we believe we can help merchants of nearly all sizes and retail verticals realize their potential. While our platform can scale to meet the needs of larger merchants, we focus on

selling to SMBs. As of December 31, 2016, we had more than 377,500 merchants from approximately 175 countries using our platform. Most of our merchants are on subscription plans that cost less than $50 per month, which is in line with our focus of providing cost effective solutions for early stage businesses. In the year ended December 31, 2016, our platform processed Gross Merchandise Volume ("GMV") of $15.4 billion, representing an increase of 99.5% from the year ended December 31, 2015. A detailed description of this metric is presented below in the section entitled, “Key Performance Indicators.”

Our business has experienced rapid growth. During the year ended December 31, 2016 our total revenue was $389.3 million, an increase of 89.7% versus the year ended December 31, 2015. Our business model has two revenue streams: a recurring subscription component we call subscription solutions and a merchant success-based component we call merchant solutions.

In the year ended December 31, 2016, subscription solutions revenues accounted for 48.4% of our total revenues (54.6% in the year ended December 31, 2015). We offer a range of plans that increase in price depending on additional features and economic considerations. Our highest-end plan, Shopify Plus, has grown rapidly since its launch in November 2014. Offered at a starting rate that is several times that of our Shopify Advanced plan, Shopify Plus caters to merchants with higher-volume sales and offers additional functionality, scalability and support requirements, including a dedicated Merchant Success Manager. Tesla, Nestle, GE, Red Bull and Kylie Cosmetics are among the approximately 2,500 Shopify Plus merchants seeking a reliable, cost-effective and scalable commerce solution. The flexibility of our pricing plans is designed to help our merchants grow in a cost-effective manner and to provide more advanced features and support as their business needs evolve.

Revenue from subscription solutions is generated through the sale of subscriptions to our platform as well as from the sale of themes, apps and the registration of domain names. Our merchants typically enter into monthly subscription agreements. As described in the "Key Components of Results of Operations," the revenue from these agreements is recognized ratably over the relative period and therefore we have deferred revenue on our balance sheet. We do not consider this deferred revenue balance to be a good indicator of future revenue. Instead, we believe Monthly Recurring Revenue ("MRR") is most closely correlated with the long-term value of our merchant relationships. Subscription solutions revenues increased from $112.0 million in the year ended December 31, 2015 to $188.6 million in the year ended December 31, 2016, representing an increase of 68.4%. As of December 31, 2016, MRR totaled $18.5 million, representing an increase of 62.9% relative to MRR at December 31, 2015. A detailed description of this metric is presented below in the section entitled, “Key Performance Indicators.”

We offer a variety of merchant solutions that are designed to add value to our merchants and augment our subscription solutions. During the year ended December 31, 2016, merchant solutions revenues accounted for 51.6% of total revenues (45.4% in the year ended December 31, 2015). We principally generate merchant solutions revenues from payment processing fees from Shopify Payments. Shopify Payments is a fully integrated payment processing service that allows our merchants to accept and process payment cards online and offline. Beginning with the launch of Shopify Payments in 2013, we have seen significant growth in the revenues generated from our merchant solutions. In addition to payment processing fees from Shopify Payments, we also generate merchant solutions revenue from transaction fees, Shopify Shipping, Shopify Capital, referral fees from partners, and sales of point-of-sale ("POS") hardware. Our merchant solutions revenues are directionally correlated with the level of GMV that our merchants process through our platform. Merchant solutions revenues increased from $93.3 million in the year ended December 31, 2015, to $200.7 million in the year ended December 31, 2016, representing an increase of 115.2%.

Our business model is driven by our ability to attract new merchants, retain existing merchants and increase sales to both new and existing merchants. The total number of merchants using our platform grew from more than 243,000 as of December 31, 2015 to more than 377,500 as of December 31, 2016. As at December 31, 2016, our merchants were geographically dispersed as follows: United States of America, 58%; United Kingdom, 10%; Canada, 7%; Australia, 7%; and the rest of the world, which represents approximately 175 countries, 18%. Our merchants represent a wide array of retail verticals and business sizes and no single merchant has ever represented more than five percent of our total revenues in a single reporting period. We believe that our future success is dependent on many factors, including our ability to expand our merchant base, retain merchants as they grow their businesses on our platform, offer more sales channels that can connect to the platform, develop new solutions to extend the functionality of our platform,

enhance our ecosystem and partner programs, provide a high level of merchant service and support, and hire, retain and motivate qualified personnel. As of December 31, 2016, Shopify had more than 1,900 employees and consultants.

We have focused on rapidly growing our business and plan to continue making investments to drive future growth. We believe that our investments will increase our revenue base, improve the retention of this base and strengthen our ability to increase sales to our merchants. If we are unable to achieve our revenue growth objectives, we may not be able to achieve profitability.

Key Performance Indicators

Key performance indicators, which we do not consider to be non-GAAP measures, that we use to evaluate our business, measure our performance, identify trends affecting our business, formulate financial projections and make strategic decisions include Monthly Recurring Revenue ("MRR"), Gross Merchandise Volume ("GMV") and Monthly Billings Retention Rate ("MBRR"). Our key performance indicators may be calculated in a manner different than similar key performance indicators used by other companies.

The following table sets forth the key performance indicators that we use to evaluate our business for the years ended December 31, 2016 and 2015.

|

| | | | | | | |

| | Years ended December 31, |

| | 2016 | | 2015 |

| | (in thousands) |

| Monthly Recurring Revenue | $ | 18,461 |

| | $ | 11,335 |

|

| Gross Merchandise Volume | $ | 15,374,166 |

| | $ | 7,706,661 |

|

| Monthly Billing Retention Rate | over 100% | | over 100% |

Monthly Recurring Revenue

We calculate MRR at the end of each period by multiplying the number of merchants who have subscription plans with us at the period end date by the average monthly subscription plan fee in effect on the last day of that period, assuming they maintain their subscription plans the following month. MRR allows us to average our various pricing plans and billing periods into a single, consistent number that we can track over time. We also analyze the factors that make up MRR, specifically the number of paying merchants using our platform and changes in our average revenue earned from subscription plan fees per paying merchant. In addition, we use MRR to forecast monthly, quarterly and annual subscription plan revenue which makes up the majority of our subscriptions solutions revenue. We had $18.5 million of MRR as at December 31, 2016.

Gross Merchandise Volume

GMV is the total dollar value of orders processed directly through our platform in the period, net of refunds, and inclusive of shipping and handling, duty and value-added taxes. GMV does not represent revenue earned by us. However, the volume of GMV processed through our platform is an indicator of the success of our merchants and the strength of our platform. Our merchant solutions revenues are also directionally correlated with the level of GMV processed through our platform. For the years ended December 31, 2016 and 2015, we processed GMV of $15.4 billion and $7.7 billion respectively.

Monthly Billings Retention Rate

MBRR is calculated as of the end of each month by considering the cohort of merchants on the Shopify platform as of the beginning of the month and dividing total billings attributable to this cohort in the then-current month by total billings attributable to this cohort in the immediately preceding month. Billings include billings from subscriptions, recurring apps (net of developer cost), Shopify Payments fees, transaction fees, and Shopify Shipping fees (net of

shipping costs). For annual fiscal periods, we report the average MBRR over the preceding 12 months. We use MBRR to evaluate our ability to maintain and expand our relationships with merchants.

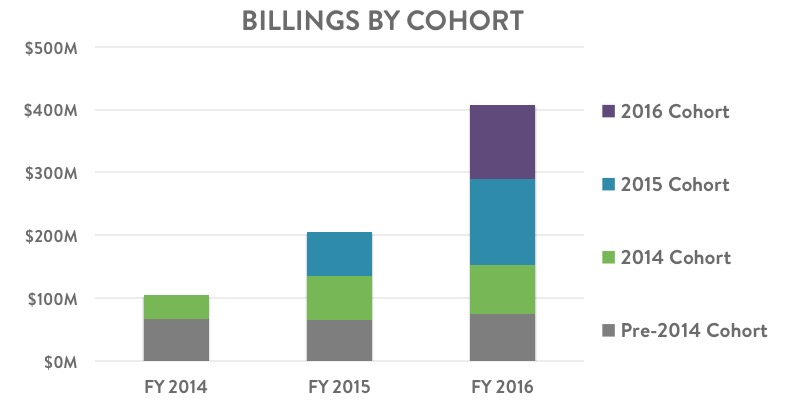

To provide a deeper understanding of our merchant economics, the chart below displays the annual billings for merchant cohorts that joined the Shopify platform at different times in our history and demonstrates that a merchant decline within any cohort has been largely offset by increased billings from remaining merchants within that cohort. This shows what we believe to be one of the most powerful drivers of our business model: as our merchants have grown their businesses and become more successful, they have consumed more of our merchant solutions and upgraded to higher subscription plans or purchased additional apps.

Factors Affecting the Comparability of our Results

Change in Revenue Mix

As a result of introducing Shopify Payments, our revenues from merchant solutions and associated costs have increased significantly. Merchant solutions are intended to complement subscription solutions by providing additional value to our merchants and increasing their use of our platform. Gross profit margins on merchant solutions are typically lower than on subscription solutions due to the associated third-party costs of providing these solutions. As a result, the introduction of Shopify Payments and the resultant shift in the mix of revenue sources has affected our overall gross margin percentage. More specifically, while our total revenues have increased in recent periods, principally as a result of Shopify Payments, our overall gross margin percentage has decreased in these periods. Although Shopify Payments is inherently a lower gross margin solution, we view this revenue stream as beneficial to our operating margins as Shopify Payments requires significantly less sales and marketing and research and development expense than Shopify’s core subscription business. Shopify Payments is also designed to drive higher retention among merchant subscribers.

Seasonality

Our merchant solutions revenues are directionally correlated with the level of GMV that our merchants process through our platform. Our merchants typically process additional GMV during the holiday season. As a result, we have historically generated higher merchant solutions revenues in our fourth quarter than in other quarters. While we believe that this seasonality has affected and will continue to affect our quarterly results, our rapid growth has largely masked seasonal trends to date. As a result of the continued growth of our merchant solutions offerings, we believe that our

business may become more seasonal in the future and that historical patterns in our business may not be a reliable indicator of our future performance.

Foreign Currency Fluctuations

While most of our revenues are denominated in U.S. dollars, a significant portion of our operating expenses are incurred in Canadian dollars. As a result, our results of operations will be adversely impacted by an increase in the value of the Canadian dollar relative to the U.S. dollar. In addition, a portion of Shopify Payments revenue is based on the local currency of the country in which the applicable merchant is located and these transactions expose us to currency fluctuations to the extent non-U.S. dollar based payment processing and other merchant solutions revenues increase.

Key Components of Results of Operations

Revenues

We derive revenues from subscription solutions and merchant solutions.

Subscription Solutions

We principally generate subscription solutions revenues through the sale of subscriptions to our platform. We also generate associated subscription solutions revenues from the sale of themes, apps, and the registration of domain names.

We offer subscription plans with various price points, from entry level plans to Shopify Plus, a plan for merchants with higher-volume sales; and offers additional functionality, scalability and support. Our subscription plans typically have a one-month term, although a small number of our merchants have annual or multi-year subscription terms. Subscription terms automatically renew unless notice of cancellation is provided in advance. Merchants purchase subscription plans directly from us. Subscription fees are paid to us at the start of the applicable subscription period, regardless of the length of the subscription period. As subscription fees are received in advance of providing the related services, we record deferred revenue on our consolidated balance sheet for the unearned revenue and recognize revenue ratably over the related subscription period. These subscription fees are non-refundable.

We also generate additional subscription solutions revenues from merchants that have subscription plans with us through the sale of themes, apps, and the registration of domain names. Revenues from the sale of themes and apps are recognized at the time of the transaction. The right to use domain names is sold separately and is recognized on a ratable basis over the contractual term, which is typically an annual term. Revenues from the sale of apps are recognized net of amounts attributable to the third-party app developers, while revenues from the sale of themes and domains are recognized on a gross basis. Revenues from the sale of themes, apps, and the registration of domain names have been classified within subscription solutions on the basis that they are typically sold at the time the merchant enters into the subscription arrangement or because they are charged on a recurring basis.

Merchant Solutions

We generate merchant solutions revenues from payment processing fees from Shopify Payments, transaction fees, Shopify Shipping, Shopify Capital, referral fees from partners, and sales of POS hardware.

The significant majority of merchant solutions revenues are generated from Shopify Payments. Revenue from processing payments is recognized at the time of the transaction. For Shopify Payments transactions, fees are determined based in part on a percentage of the dollar amount processed plus a per transaction fee, where applicable.

For subscription plans where the merchant does not sign up for Shopify Payments, we typically charge a transaction fee based on a percentage of GMV processed. We bill our merchants for transaction fees at the end of a 30-day billing cycle or when predetermined billing thresholds are surpassed and any fees that have not been billed are accrued as an unbilled receivable at the end of the reporting period.

Shopify Shipping was launched in the United States in September 2015 and in Canada in September 2016, and allows merchants to buy and print shipping labels and track orders directly within the Shopify platform. We bill our merchants when they have purchased shipping labels in excess of predetermined billing thresholds, and any charges that have not been billed are accrued as unbilled receivables at the end of the reporting period. For Shopify Shipping, fees are determined based on the type of labels purchased or the arrangement negotiated with third parties. In the case of the former, we recognize revenue from Shopify Shipping net of shipping costs, as we are the agent in the arrangement with merchants.

Shopify Capital, a merchant cash advance ("MCA") program, was launched in the United States in April 2016 to help eligible merchants secure financing and accelerate the growth of their business by providing access to simple, fast, and convenient working capital. We apply underwriting criteria prior to purchasing the eligible merchant's future receivables to help ensure collectability. Under Shopify Capital, we purchase a designated amount of future receivables at a discount. The purchase price is paid to the merchant at the time the MCA is entered into, and the merchant remits a fixed percentage of their daily sales until the outstanding balance has been remitted. As cash remittances are collected by us, a portion is recognized ratably as a reduction to the merchant's receivable balance, and a portion, which is related to the discount, is recognized ratably as merchant solutions revenue. We have mitigated some of the risks associated with Shopify Capital by entering into an agreement with a third party to insure merchant cash advances offered by Shopify Capital.

We also generate merchant solutions revenues in the form of referral fees from partners to whom we direct business and with whom we have an arrangement in place. Pursuant to terms of the agreements with our partners, these revenues can be recurring or non-recurring. Where the agreement provides for recurring payments to us, we typically earn revenues so long as the merchant that we have referred to the partner continues to use the services of the partner. Non-recurring revenues generally take the form of one-time payments that we receive when we initially refer the merchant to the partner. In either case, we recognize referral revenues when we are entitled to receive payment from the partner pursuant to the terms of the underlying agreement.

In connection with Shopify POS, a sales channel that lets merchants sell their products and accept payments in-person from a mobile device, we sell compatible hardware products which are sourced from third-party vendors. We recognize revenues from the sale of POS hardware when title passes to the merchant in accordance with the shipping terms of the sale.

For a discussion of how we expect seasonal factors to affect our merchant solutions revenue, see “Factors Affecting the Comparability of our Results—Seasonality.”

Cost of Revenues

Cost of Subscription Solutions

Cost of subscription solutions consists primarily of costs associated with hosting infrastructure, billing processing fees and operations and merchant support expenses. Operations and merchant support expenses include costs associated with our data and network infrastructure and personnel-related costs directly associated with operations and merchant support, including salaries, benefits and stock-based compensation, as well as allocated overhead. Overhead associated with facilities, information technology and depreciation is allocated to our cost of revenues and operating expenses based on headcount.

Additionally, cost of subscription solutions includes costs we are required to pay to third-party developers in connection with sales of themes. Our paid themes are primarily designed by third-party developers who earn fees for each theme sold by us. The amount paid to the third-party developer varies depending on whether the developer has agreed to provide ongoing support to the merchant in connection with the merchant’s use of the theme.

Also included as cost of subscription solutions are domain registration fees and amortization of internal use software relating to the capitalized costs associated with the development of the platform and data infrastructure.

We expect that cost of subscription solutions will increase in absolute dollars as we continue to invest in growing our business, and as the number of merchants utilizing the platform increases along with the costs of supporting those merchants. Over time, we expect that our subscription solutions gross margin percentage will fluctuate modestly based on the mix of subscription plans that our merchants select and the timing of expenditures related to infrastructure expansion projects.

Cost of Merchant Solutions

Cost of merchant solutions primarily consists of costs that we incur when transactions are processed using Shopify Payments, such as credit card interchange and network fees (charged by credit card providers such as Visa, MasterCard and American Express) as well as third-party processing fees. Cost of merchant solutions also consists of costs associated with hosting infrastructure and operations and merchant support expenses, including personnel-related costs directly associated with merchant solutions such as salaries, benefits and stock-based compensation, as well as allocated overhead. Overhead associated with facilities, information technology and depreciation is allocated to our cost of revenues and operating expenses based on headcount.

Cost of merchant solutions also includes costs associated with POS hardware, such as the cost of acquiring the hardware inventory, including hardware purchase price, expenses associated with our use of a third-party fulfillment company, shipping and handling and inventory adjustments. Also included within cost of merchant solutions is amortization of internal use software relating to capitalized costs associated with the development of merchant solutions.

We expect that the cost of merchant solutions will increase in absolute dollars in future periods as the number of merchants utilizing these solutions increases and the volume processed also grows. We believe that we may see increases in our gross margin percentage of merchant solutions as additional higher-margin merchant solutions offerings, such as Shopify Shipping and Shopify Capital, become a larger component of our merchant solutions revenue and we continue to expand Shopify Payments internationally.

Operating Expenses

Sales and Marketing

Sales and marketing expenses consist primarily of marketing programs, partner referral payments related to merchant acquisitions, employee-related expenses for marketing, business development and sales, as well as the portion of merchant support required for the onboarding of prospective new merchants. Other costs within sales and marketing include commissions, travel-related expenses and corporate overhead allocations. Costs to acquire merchants are expensed as incurred. We plan to continue to expand sales and marketing efforts to attract new merchants, retain existing merchants and increase revenues from both new and existing merchants. This growth will include adding sales personnel and expanding our marketing activities to continue to generate additional leads and build brand awareness. Over time, we expect sales and marketing expenses will decline as a percentage of total revenues.

Research and Development

Research and development expenses consist primarily of employee-related expenses for product management, product development and product design, contractor and consultant fees and corporate overhead allocations. We continue to focus our research and development efforts on adding new features and solutions, and increasing the functionality and enhancing the ease of use of our platform. While we expect research and development expenses to increase in absolute dollars as we continue to increase the functionality of our platform, over the long term we expect our research and development expenses will decline as a percentage of total revenues.

General and Administrative

General and administrative expenses consist of employee-related expenses for finance and accounting, legal, data analytics, administrative, human resources and IT personnel, professional fees, expected and actual losses related to Shopify Payments and Shopify Capital, other corporate expenses and corporate overhead allocations. We expect that

general and administrative expenses will increase on an absolute dollar basis but may decrease as a percentage of total revenues as we focus on processes, systems and controls to enable our internal support functions to scale with the growth of our business. We also anticipate continued increases to general and administrative expenses as we incur the costs of compliance associated with being a public company, including increased accounting and legal expenses.

Other Income (Expenses)

Other income (expenses) consists primarily of transaction gains or losses on foreign currency and interest income net of interest expense.

Results of Operations

The following table sets forth our consolidated statement of operations for the years ended December 31, 2016, 2015, and 2014.

|

| | | | | | | | | | | |

| | Years ended December 31, |

| | 2016 | | 2015 | | 2014 |

| | (in thousands, except share and per share data) |

| Revenues: | | | | | |

| Subscription solutions | $ | 188,606 |

| | $ | 111,979 |

| | $ | 66,668 |

|

| Merchant solutions | 200,724 |

| | 93,254 |

| | 38,350 |

|

| | 389,330 |

| | 205,233 |

| | 105,018 |

|

Cost of revenues(1): | | | | | |

| Subscription solutions | 39,478 |

| | 24,531 |

| | 16,790 |

|

| Merchant solutions | 140,357 |

| | 67,447 |

| | 25,620 |

|

| | 179,835 |

| | 91,978 |

| | 42,410 |

|

| Gross profit | 209,495 |

| | 113,255 |

| | 62,608 |

|

| Operating expenses: | | | | | |

Sales and marketing(1) | 129,214 |

| | 70,374 |

| | 45,929 |

|

Research and development(1)(2) | 74,336 |

| | 39,722 |

| | 25,915 |

|

General and administrative(1)(3) | 43,110 |

| | 20,915 |

| | 12,379 |

|

| | 246,660 |

| | 131,011 |

| | 84,223 |

|

| Loss from operations | (37,165 | ) | | (17,756 | ) | | (21,615 | ) |

| Other income (expense) | 1,810 |

| | (1,034 | ) | | (696 | ) |

| Net loss | $ | (35,355 | ) | | $ | (18,790 | ) | | $ | (22,311 | ) |

Net loss per share—basic and diluted(4) | $ | (0.42 | ) | | $ | (0.30 | ) | | $ | (0.57 | ) |

| Weighted average shares used to compute net loss per share attributable to shareholders | 83,988,597 |

| | 61,716,065 |

| | 38,940,252 |

|

(1) Includes stock-based compensation expense and related payroll taxes as follows:

|

| | | | | | | | | | | |

| | Years ended December 31, |

| | 2016 | | 2015 | | 2014 |

| | (in thousands) |

| Cost of revenues | $ | 718 |

| | $ | 345 |

| | $ | 259 |

|

| Sales and marketing | 4,444 |

| | 1,351 |

| | 696 |

|

| Research and development | 15,364 |

| | 6,373 |

| | 2,776 |

|

| General and administrative | 4,495 |

| | 2,419 |

| | 712 |

|

| | $ | 25,021 |

| | $ | 10,488 |

| | $ | 4,443 |

|

(2) Net of refundable tax credits of nil, $1,058 and $1,295 and for the years ended December 31, 2016, 2015 and 2014, respectively.

(3) Includes sales and use taxes of nil, $566, and $2,182, for the years ended December 31, 2016, 2015 and 2014, respectively.

(4) For the periods preceding our initial public offering, does not give effect to the conversion of Series A, Series B and Series C convertible preferred shares, which occurred upon the consummation of our initial public offering on May 27, 2015.

The following table sets forth our consolidated statement of operations as a percentage of total revenues for the years ended December 31, 2016, 2015, and 2014.

|

| | | | | | | | |

| | Years ended December 31, |

| | 2016 | | 2015 | | 2014 |

| Revenues | | | | | |

| Subscription solutions | 48.4 | % | | 54.6 | % | | 63.5 | % |

| Merchant solutions | 51.6 | % | | 45.4 | % | | 36.5 | % |

| | 100.0 | % | | 100.0 | % | | 100.0 | % |

| Cost of revenues | | | | | |

| Subscription solutions | 10.1 | % | | 12.0 | % | | 16.0 | % |

| Merchant solutions | 36.1 | % | | 32.9 | % | | 24.4 | % |

| | 46.2 | % | | 44.8 | % | | 40.4 | % |

| Gross profit | 53.8 | % | | 55.2 | % | | 59.6 | % |

| Operating expenses | | | | | |

| Sales and marketing | 33.2 | % | | 34.3 | % | | 43.7 | % |

| Research and development | 19.1 | % | | 19.4 | % | | 24.7 | % |

| General and administrative | 11.1 | % | | 10.2 | % | | 11.8 | % |

| Total operating expenses | 63.4 | % | | 63.8 | % | | 80.2 | % |

| Loss from operations | (9.6 | )% | | (8.7 | )% | | (20.6 | )% |

| Other income (expenses) | 0.5 | % | | (0.5 | )% | | (0.7 | )% |

| Net loss | (9.1 | )% | | (9.2 | )% | | (21.2 | )% |

The following table sets forth our consolidated revenues by geographic location for the years ended December 31, 2016, 2015, and 2014.

|

| | | | | | | | | | | |

| | Years ended December 31, |

| | 2016 | | 2015 | | 2014 |

| | (in thousands) | | |

| Revenues: | | | | | |

| Canada | $ | 26,893 |

| | $ | 14,691 |

| | $ | 7,729 |

|

| United States | 284,095 |

| | 144,748 |

| | 72,149 |

|

| United Kingdom | 25,958 |

| | 15,436 |

| | 7,912 |

|

| Australia | 18,163 |

| | 10,531 |

| | 6,420 |

|

| Rest of World | 34,221 |

| | 19,827 |

| | 10,808 |

|

| Total Revenues | $ | 389,330 |

| | $ | 205,233 |

| | $ | 105,018 |

|

The following table sets forth our consolidated revenues by geographic location as a percentage of total revenues for the years ended December 31, 2016, 2015, and 2014.

|

| | | | | | | | |

| | Years ended December 31, |

| | 2016 | | 2015 | | 2014 |

| Revenues: | | | | | |

| Canada | 6.9 | % | | 7.2 | % | | 7.4 | % |

| United States | 72.9 | % | | 70.5 | % | | 68.7 | % |

| United Kingdom | 6.7 | % | | 7.5 | % | | 7.5 | % |

| Australia | 4.7 | % | | 5.1 | % | | 6.1 | % |

| Rest of World | 8.8 | % | | 9.7 | % | | 10.3 | % |

| Total Revenues | 100.0 | % | | 100.0 | % | | 100.0 | % |

Discussion of the Results of Operations for the years ended December 31, 2016, 2015, and 2014.

Revenues

|

| | | | | | | | | | | | | | | | | |

| | Years ended December 31, | | 2016 vs 2015 | | 2015 vs 2014 |

| | 2016 | | 2015 | | 2014 | | % Change | | % Change |

| | (in thousands, except percentages) |

| Revenues: | | | | | | | | | |

| Subscription solutions | $ | 188,606 |

| | $ | 111,979 |

| | $ | 66,668 |

| | 68.4 | % | | 68.0 | % |

| Merchant solutions | 200,724 |

| | 93,254 |

| | 38,350 |

| | 115.2 | % | | 143.2 | % |

| | $ | 389,330 |

| | $ | 205,233 |

| | $ | 105,018 |

| | 89.7 | % | | 95.4 | % |

| Percentage of revenues: | | | | | | | | | |

| Subscription solutions | 48.4 | % | | 54.6 | % | | 63.5 | % | | | | |

| Merchant solutions | 51.6 | % | | 45.4 | % | | 36.5 | % | | | | |

| Total revenues | 100.0 | % | | 100.0 | % | | 100.0 | % | | | | |

Subscription Solutions

Subscription solutions revenues increased $76.6 million, or 68.4%, for the year ended December 31, 2016 compared to the same period in 2015. Subscription solutions revenues increased $45.3 million, or 68.0%, for the year ended December 31, 2015 compared to the same period in 2014. The increase in both periods was primarily a result of growth in the number of merchants using our platform.

Merchant Solutions

Merchant solutions revenues increased $107.5 million, or 115.2%, for the year ended December 31, 2016 compared to the same period in 2015. The increase in merchant solutions revenues was primarily a result of Shopify Payments revenue growing by $88.4 million in 2016 compared to the same period in 2015. This increase was a result of an increase in the number of merchants using our platform, expansion into new geographical regions, and an increase in adoption of Shopify Payments by our merchants, each of which drove additional GMV that was processed using Shopify Payments. As at December 31, 2016 Shopify Payments penetration was as follows: United States, 87%; Canada, 87%; United Kingdom, 77%; Australia, 64%; and Ireland, 27%. Additionally, revenue from transaction fees and referral fees from partners increased by $7.9 million and $3.6, respectively, during the year ended December 31, 2016 as a result of the increase in GMV processed through our platform compared to the same period in 2015. Merchant solutions also includes Shopify Shipping and Shopify Capital, which contributed to the merchant solutions revenue growth of $3.3 million and $2.1 million, respectively, in the year ended December 31, 2016.

Merchant solutions revenues increased $54.9 million, or 143.2%, for the year ended December 31, 2015 compared to the same period in 2014. The increase in merchant solutions revenues was primarily a result of Shopify Payments revenue growing by $46.8 million in 2015 compared to the same period in 2014.

Cost of Revenues

|

| | | | | | | | | | | | | | | | | |

| | Years ended December 31, | | 2016 vs 2015 | | 2015 vs 2014 |

| | 2016 | | 2015 | | 2014 | | % Change | | % Change |

| | (in thousands, except percentages) |

| Cost of revenues: | | | | | | | | | |

| Cost of subscription solutions | $ | 39,478 |

| | $ | 24,531 |

| | $ | 16,790 |

| | 60.9 | % | | 46.1 | % |

| Cost of merchant solutions | 140,357 |

| | 67,447 |

| | 25,620 |

| | 108.1 | % | | 163.3 | % |

| Total cost of revenues | $ | 179,835 |

| | $ | 91,978 |

| | $ | 42,410 |

| | 95.5 | % | | 116.9 | % |

| Percentage of revenues: | | | | | | | | | |

| Cost of subscription solutions | 10.1 | % | | 12.0 | % | | 16.0 | % | | | | |

| Cost of merchant solutions | 36.1 | % | | 32.9 | % | | 24.4 | % | | | | |

| | 46.2 | % | | 44.8 | % | | 40.4 | % | | | | |

Cost of Subscription Solutions

Cost of subscription solutions increased $14.9 million, or 60.9%, for the year ended December 31, 2016 compared to the same period in 2015. The increase was primarily due to an increase in the costs necessary to support a greater number of merchants using our platform, resulting in a $4.6 million increase in employee-related costs, a $3.3 million increase in third-party infrastructure costs, a $2.9 million increase in amortization from our investment in software and hardware relating to our data centers, a $2.1 million increase in credit card fees for processing merchant billings, and a $1.9 million increase in payments to third-party theme developers and domain registration providers. Although cost of subscription solutions increased in terms of dollars, it decreased as a percentage of revenues from 12.0% in 2015 to 10.1% in 2016. The decrease was principally a result of a decrease in overall support costs which decreased as a percentage of revenue in 2016 as we shifted our support team to more of a remote-based model and from operational efficiencies gained after building out our second data center in 2015. Additionally, there was a decrease in lower-margin theme revenue as a percentage of total subscription solutions revenue.

Cost of subscription solutions increased $7.7 million, or 46.1%, for the year ended December 31, 2015 compared to the same period in 2014. The increase was primarily due to an increase in the costs necessary to support a greater number of merchants using our platform.

Cost of Merchant Solutions

Cost of merchant solutions increased $72.9 million, or 108.1%, for the year ended December 31, 2016 compared to the same period in 2015. The increase was primarily due to the increase in GMV processed through Shopify Payments, which resulted in payment processing fees, including interchange fees, increasing for the year ended December 31, 2016 as compared to 2015. Cost of sales associated with POS hardware also increased by $1.1 million for the year ended December 31, 2016.

Cost of merchant solutions increased $41.8 million, or 163.3%, for the year ended December 31, 2015 compared to the same period in 2014. The increase was primarily due to the increase in GMV processed through Shopify Payments, which resulted in payment processing fees, including interchange fees, increasing for the year ended December 31, 2015 as compared to the same period in 2014.

Gross Profit

|

| | | | | | | | | | | | | | | | | |

| | Years ended December 31, | | 2016 vs 2015 | | 2015 vs 2014 |

| | 2016 | | 2015 | | 2014 | | % Change | | % Change |

| | (in thousands, except percentages) |

| Gross profit | $ | 209,495 |

| | $ | 113,255 |

| | $ | 62,608 |

| | 85.0 | % | | 80.9 | % |

| Percentage of total revenues | 53.8 | % | | 55.2 | % | | 59.6 | % | | | | |

Gross profit increased $96.2 million, or 85.0%, for the year ended December 31, 2016 compared to the same period in 2015. As a percentage of total revenues, gross profit decreased from 55.2% in the year ended December 31, 2015 to 53.8% in the year ended December 31, 2016, due to the faster growth of merchant solutions revenue compared to subscription solutions revenue. Merchant solutions are intended to complement subscription solutions by providing additional value to our merchants and increasing their use of our platform. The lower gross margin percentage on merchant solutions is primarily due to third-party costs associated with providing payment-processing services such as credit card interchange and network fees charged by credit card providers such as Visa, MasterCard and American Express, as well as third-party processing fees.

Gross profit increased $50.6 million, or 80.9%, for the year ended December 31, 2015 compared to the same period in 2014. As a percentage of total revenues, gross profit decreased from 59.6% in the year ended December 31, 2014 to 55.2% in the year ended December 31, 2015, principally due to the faster growth of merchant solutions revenue compared to subscription solutions revenue.

Operating Expenses

Sales and Marketing

|

| | | | | | | | | | | | | | | | | |

| | Years ended December 31, | | 2016 vs 2015 | | 2015 vs 2014 |

| | 2016 | | 2015 | | 2014 | | % Change | | % Change |

| | (in thousands, except percentages) |

| Sales and marketing | $ | 129,214 |

| | $ | 70,374 |

| | $ | 45,929 |

| | 83.6 | % | | 53.2 | % |

| Percentage of total revenues | 33.2 | % | | 34.3 | % | | 43.7 | % | | | | |

Sales and marketing expenses increased $58.8 million, or 83.6%, for the year ended December 31, 2016 compared to the same period in 2015, primarily due to an increase of $29.4 million in marketing programs, such as advertisements on search engines and social media, to support the growth of our business. We believe the strong investment we are making in external marketing programs and internal ones, such as Shopify Unite, the Company's annual Partner and Developer conference, our Build a Business competition, our retail tours, and the Shopify Blog, continue to be effective in growing the number of merchants using our platform. During the year ended December 31, 2016 the total number of merchants increased 62.5% to more than 377,500. In addition to external marketing spending, employee-related costs, including facilities expense, increased by $26.0 million in the year ended December 31, 2016, primarily resulting from total sales and marketing headcount growth of 91%. Costs for consulting services increased $2.1 million in the year ended December 31, 2016. Software license costs also increased by $1.3 million as a result of supporting both the growth in our headcount and the growth of our business as we continue to use new software tools to effectively scale our operations as we enter into various new business activities. Sales and marketing expenses as a percentage of revenue have decreased year over year as revenue from merchant solutions generally requires significantly less marketing expense than Shopify's core subscription business.

Sales and marketing expenses increased $24.4 million, or 53.2%, for the year ended December 31, 2015 compared to the same period in 2014, primarily due to an increase of $15.0 million in marketing programs. In addition to external marketing spending, employee-related costs, including facilities expense, increased by $8.4 million. Software license costs also increased by $0.8 million.

Research and Development

|

| | | | | | | | | | | | | | | | | |

| | Years ended December 31, | | 2016 vs 2015 | | 2015 vs 2014 |

| | 2016 | | 2015 | | 2014 | | % Change | | % Change |

| | (in thousands, except percentages) |

| Research and development | $ | 74,336 |

| | $ | 39,722 |

| | $ | 25,915 |

| | 87.1 | % | | 53.3 | % |

| Percentage of total revenues | 19.1 | % | | 19.4 | % | | 24.7 | % | | | | |

Research and development expenses increased $34.6 million, or 87.1%, for the year ended December 31, 2016 compared to the same period in 2015, due to an increase of $30.3 million in employee-related costs (including a $9.0 million increase in stock-based compensation) resulting from the growth in research and development headcount by 63%. Allocated facilities expenses also increased $2.6 million in the year ended December 31, 2016 relative to the year ended December 31, 2015 as a result of the facilities expansion in all of our locations to support the growth in our employee base. Software license costs increased by $1.2 million as a result of the growth of both our business and headcount.

Research and development expenses increased $13.8 million, or 53.3%, for the year ended December 31, 2015 compared to the same period in 2014, due to an increase of $12.4 million in employee-related costs; and allocated facilities expenses increase of $1.4 million; and a software license costs increase of $0.4 million. These increases were offset by increased capitalization of $1.0 million in software development costs versus 2014.

General and Administrative

|

| | | | | | | | | | | | | | | | | |

| | Years ended December 31, | | 2016 vs 2015 | | 2015 vs 2014 |

| | 2016 | | 2015 | | 2014 | | % Change | | % Change |

| | (in thousands, except percentages) |

| General and administrative | $ | 43,110 |

| | $ | 20,915 |

| | $ | 12,379 |

| | 106.1 | % | | 69.0 | % |

| Percentage of total revenues | 11.1 | % | | 10.2 | % | | 11.8 | % | | | | |

General and administrative expenses increased $22.2 million, or 106.1%, for the year ended December 31, 2016 compared to the same period in 2015, due to an increase of $11.7 million in employee-related costs, a $5.1 million increase in actual and expected losses associated with Shopify Payments and Shopify Capital, $1.7 million in software license costs, $1.6 million in allocated facilities expense, $1.3 million in professional service fees, and $0.5 million in finance costs, which includes insurance, listing fees, and board expenses. The increase in employee-related costs was associated with higher general and administrative headcount, which, along with the increase in allocated facilities expense and software license costs, was a result of the growth of our business. The increase in professional fees was attributable to higher fees for legal, accounting and tax services, resulting from the increased compliance obligations of being a public company. General and administrative expenses as a percentage of revenue increased year over year as a result of losses associated with the growth in Shopify Payments and Shopify Capital.

General and administrative expenses increased $8.5 million, or 69.0%, for the year ended December 31, 2015 compared to the same period in 2014, due to an increase of $5.3 million in employee-related costs; a $1.4 million increase in actual and expected losses associated with Shopify Payments and Shopify Capital; $0.8 million in allocated facilities expense, $0.7 million in software license costs, $1.0 million in insurance costs and $1.3 million in professional service fees, offset by a decrease of $1.9 million in sales tax expenses.

Other Income (Expenses)

|

| | | | | | | | | | | | | | | |

| | Years ended December 31, | | 2016 vs 2015 | | 2015 vs 2014 |

| | 2016 | | 2015 | | 2014 | | % Change | | % Change |

| | (in thousands, except percentages) |

| Other income (expenses), net | $ | 1,810 |

| | $ | (1,034 | ) | | $ | (696 | ) | | * | | * |

| |

| * | Not a meaningful comparison |

In the year ended December 31, 2016 we had other income of $1.8 million compared to other expenses of $1.0 million in the same period in 2015, a positive change of $2.8 million. In the year ended December 31, 2016 the amount was primarily driven by investment income of $1.5 million, compared to the same period in 2015 when the amount was primarily driven by foreign exchange losses of $1.2 million.

Other expenses increased by $0.3 million in the year ended December 31, 2015 compared to the same period in 2014 . The increase was primarily a result of recognizing $1.2 million of foreign exchange losses due to fluctuations in foreign exchange rates in the year ended December 31, 2015, as compared to $0.8 million in the year ended December 31, 2014.

Profit (Loss)

|

| | | | | | | | | | | | | | | |

| | Years ended December 31, | | 2016 vs 2015 | | 2015 vs 2014 |

| | 2016 | | 2015 | | 2014 | | % Change | | % Change |

| | (in thousands, except share and per share data) |

| Net loss | $ | (35,355 | ) | | $ | (18,790 | ) | | $ | (22,311 | ) | | * | | * |

| Basic and diluted net loss per share attributable to shareholders | $ | (0.42 | ) | | $ | (0.30 | ) | | $ | (0.57 | ) | | | | |

| Weighted average shares used to compute basic and diluted net loss per share attributable to shareholders | 83,988,597 |

| | 61,716,065 |

| | 38,940,252 |

| | | | |

| |

| * | Not a meaningful comparison |

The basic and diluted net loss per share attributable to shareholders for the year ended December 31, 2016, is not necessarily comparable with the same periods in 2015 or 2014 as a result of our Initial Public Offering (“IPO”) of Class A subordinate voting shares and the conversion of all issued and outstanding convertible preferred shares into Class B multiple voting shares, both of which occurred in May 2015.

Quarterly Results of Operations

The following table sets forth our results of operations for the three months ended December 31, 2016 and 2015.

|

| | | | | | | |

| | Three months ended December 31, |

| | 2016 | | 2015 |

| | (in thousands, except share and per share data) |

| | |

| Revenues: | | | |

| Subscription solutions | $ | 56,387 |

| | $ | 34,608 |

|

| Merchant solutions | 73,996 |

| | 35,565 |

|

| | 130,383 |

| | 70,173 |

|

Cost of revenues(1): | | | |

| Subscription solutions | 11,593 |

| | 7,662 |

|

| Merchant solutions | 50,655 |

| | 26,044 |

|

| | 62,248 |

| | 33,706 |

|

| Gross profit | 68,135 |

| | 36,467 |

|

| Operating expenses: | | | |

Sales and marketing(1) | 39,016 |

| | 22,527 |

|

Research and development(1) | 24,472 |

| | 13,541 |

|

General and administrative(1) | 13,952 |

| | 6,918 |

|

| Total operating expenses | 77,440 |

| | 42,986 |

|

| Loss from operations | (9,305 | ) | | (6,519 | ) |

| Other income (expense): | | | |

| Interest income, net | 698 |

| | 102 |

|

| Foreign exchange gain (loss) | (260 | ) | | 110 |

|

| | 438 |

| | 212 |

|

| Net loss | $ | (8,867 | ) | | $ | (6,307 | ) |

| Basic and diluted net loss per share attributable to shareholders | $ | (0.10 | ) | | $ | (0.08 | ) |

| Weighted average shares used to compute net loss per share attributable to shareholders | 89,137,155 |

| | 77,996,629 |

|

(1) Includes stock-based compensation expense and related payroll taxes as follows:

|

| | | | | | | |

| | Three months ended December 31, |

| | 2016 | | 2015 |

| | (in thousands) |

| Cost of revenues | $ | 216 |

| | $ | 147 |

|

| Sales and marketing | 1,424 |

| | 670 |

|

| Research and development | 5,462 |

| | 3,520 |

|

| General and administrative | 1,396 |

| | 872 |

|

| | $ | 8,498 |

| | $ | 5,209 |

|

Revenues

|

| | | | | | | | | | |

| | Three months ended December 31, | | 2016 vs. 2015 |

| | 2016 | | 2015 | | % Change |

| | (in thousands, except percentages) |

| Revenues: | | | | | |

| Subscription solutions | $ | 56,387 |

| | $ | 34,608 |

| | 62.9 | % |

| Merchant solutions | 73,996 |

| | 35,565 |

| | 108.1 | % |

| | $ | 130,383 |

| | $ | 70,173 |

| | 85.8 | % |

| Percentage of revenues: | | | | | |

| Subscription solutions | 43.2 | % | | 49.3 | % | | |

| Merchant solutions | 56.8 | % | | 50.7 | % | | |

| Total revenues | 100.0 | % | | 100.0 | % | | |

Subscription Solutions

Subscription solutions revenues increased $21.8 million, or 62.9%, for the three months ended December 31, 2016 compared to the same period in 2015. The year over year increase was primarily a result of growth in MRR which was largely driven by the higher number of merchants using our platform.

Merchant Solutions

Merchant solutions revenues increased $38.4 million, or 108.1%, for the three months ended December 31, 2016 compared to the same period in 2015. The increase in merchant solutions revenues was primarily a result of Shopify Payments revenue growing in the three months ended December 31, 2016 compared to the same period in 2015. This increase was a result of an increase in the number of merchants using our platform, expansion into new geographical regions, and an increase in adoption of Shopify Payments by our merchants, which drove additional GMV of $2.2 billion that was processed using Shopify Payments for the three months ended December 31, 2016. This compares to $1.0 billion in the same period in 2015.

In addition to the increase in revenue from Shopify Payments, revenue from transaction fees, referral fees from partners, and Shopify Shipping increased during the three months ended December 31, 2016 compared to the same period in 2015, as a result of the increase in GMV processed through our platform compared to the same period in 2015. The introduction of Shopify Capital in 2016 resulted in a $1.5 million increase in merchant solutions revenue during the three months ended December 31, 2016 compared to the same period in 2015.

Cost of Revenues

|

| | | | | | | | | | |

| | Three months ended December 31, | | 2016 vs. 2015 |

| | 2016 | | 2015 | | % Change |

| | (in thousands, except percentages) |

| Cost of revenues: | | | | | |

| Cost of subscription solutions | $ | 11,593 |

| | $ | 7,662 |

| | 51.3 | % |

| Cost of merchant solutions | 50,655 |

| | 26,044 |

| | 94.5 | % |

| Total cost of revenues | $ | 62,248 |

| | $ | 33,706 |

| | 84.7 | % |

| Percentage of revenues: | | | | | |

| Cost of subscription solutions | 8.9 | % | | 10.9 | % | | |

| Cost of merchant solutions | 38.9 | % | | 37.1 | % | | |

| | 47.7 | % | | 48.0 | % | | |

Cost of Subscription Solutions

Cost of subscription solutions increased $3.9 million, or 51.3%, for the three months ended December 31, 2016 compared to the same period in 2015. The increase was primarily due to an increase in the costs necessary to support a greater number of merchants using our platform, resulting in an increase in: employee-related costs, payments to third-party theme developers and domain registration providers, amortization related to our data centers, credit card fees for processing merchant billings and third-party infrastructure costs. Although cost of subscription solutions increased in terms of dollars, it decreased as a percentage of revenues from 10.9% in the three months ended December 31, 2015 to 8.9% in the three months ended December 31, 2016. The decrease was a result of a decrease in lower-margin theme revenue as a percentage of total subscription solutions revenue; savings on credit card fees for processing merchant billings; and because of continued operational efficiencies as a result of investments we made in our data centers in prior periods.

Cost of Merchant Solutions

Cost of merchant solutions increased $24.6 million, or 94.5%, for the three months ended December 31, 2016 compared to the same period in 2015. The increase was primarily due to the increase in GMV processed through Shopify Payments, which resulted in higher payment processing fees, including interchange fees, increasing for the three months ended December 31, 2016 as compared to the same period in 2015.

Gross Profit

|

| | | | | | | | | | |

| | Three months ended December 31, | | 2016 vs. 2015 |

| | 2016 | | 2015 | | % Change |

| | (in thousands, except percentages) |

| Gross profit | $ | 68,135 |

| | $ | 36,467 |

| | 86.8 | % |

| Percentage of total revenues | 52.3 | % | | 52.0 | % | | |

Gross profit increased $31.7 million, or 86.8%, for the three months ended December 31, 2016 compared to the same period in 2015. As a percentage of total revenues, gross profit increased from 52.0% in the three months ended December 31, 2015 to 52.3% in the three months ended December 31, 2016, principally due to higher margins on Shopify Payments versus the same period in 2015, as well as the introduction and growth of the higher margin merchant solutions products: Shopify Shipping and Shopify Capital. On a stand-alone basis, both subscription solutions and merchant solutions

gross margins increased year over year. Merchant solutions are designed to complement subscription solutions by providing additional value to our merchants and increasing their use of our platform.

Operating Expenses

Sales and Marketing

|

| | | | | | | | | | |

| | Three months ended December 31, | | 2016 vs. 2015 |

| | 2016 | | 2015 | | % Change |

| | (in thousands, except percentages) |

| Sales and marketing | $ | 39,016 |

| | $ | 22,527 |

| | 73.2 | % |

| Percentage of total revenues | 29.9 | % | | 32.1 | % | | |

Sales and marketing expenses increased $16.5 million, or 73.2%, for the three months ended December 31, 2016 compared to the same period in 2015, due to an increase of $7.2 million in marketing programs, such as advertisements on search engines and social media, to support the growth of our business; an increase of $8.2 million in employee-related costs, including allocated facilities expense ($0.8 million of which related to stock-based compensation and related payroll taxes); and an increase of $0.7 million in consulting services year over year.

Research and Development

|

| | | | | | | | | | |

| | Three months ended December 31, | | 2016 vs. 2015 |

| | 2016 | | 2015 | | % Change |

| | (in thousands, except percentages) |

| Research and development | $ | 24,472 |

| | $ | 13,541 |

| | 80.7 | % |

| Percentage of total revenues | 18.8 | % | | 19.3 | % | | |

Research and development expenses increased $10.9 million, or 80.7%, for the three months ended December 31, 2016 compared to the same period in 2015, due to an increase of $9.1 million in employee-related costs ($1.8 million of which related to stock-based compensation and related payroll taxes), a $1.0 million increase in allocated facilities expenses, and an increase in depreciation relating to computer hardware and software of $0.3 million, all as a result of the growth in our employee base. Costs for consulting services also increased by $0.4 million for the three months ended December 31, 2016 compared to the same period in 2015.

General and Administrative

|

| | | | | | | | | | |

| | Three months ended December 31, | | 2016 vs. 2015 |

| | 2016 | | 2015 | | % Change |

| | (in thousands, except percentages) |

| General and administrative | $ | 13,952 |

| | $ | 6,918 |

| | 101.7 | % |

| Percentage of total revenues | 10.7 | % | | 9.9 | % | | |

General and administrative expenses increased $7.0 million, or 101.7%, for the three months ended December 31, 2016 compared to the same period in 2015, due to an increase of $3.4 million in employee-related costs ($0.5 million of which related to stock-based compensation and related payroll taxes), a $2.0 million increase in actual and expected losses associated with Shopify Payments and Shopify Capital, an increase of $0.5 million in allocated facilities expense, an increase of $0.4 million in software license costs, and an increase of $0.3 million in professional service fees.

Other Income (Expenses) |

| | | | | | | | | |

| | Three months ended December 31, | | 2016 vs. 2015 |

| | 2016 | | 2015 | | % Change |

| | (in thousands, except percentages) |

| Other income (expenses), net | $ | 438 |

| | $ | 212 |

| | * |

| |

| * | Not a meaningful comparison |

In the three months ended December 31, 2016 we had other income of $0.4 million, compared to other income of $0.2 million in the same period in 2015. In the three months ended December 31, 2016 the amount was driven by a year-over-year increase in interest income of $0.6 million, offset by a year-over-year increase in foreign exchange losses of $0.4 million.

Summary of Quarterly Results

The following table sets forth selected unaudited quarterly results of operations data for each of the eight quarters ended December 31, 2016. The information for each of these quarters has been derived from unaudited condensed consolidated financial statements that were prepared on the same basis as the audited annual financial statements and, in the opinion of management, reflects all adjustments, which includes only normal recurring adjustments, necessary for the fair presentation of the results of operations for these periods in accordance with U.S. GAAP. This data should be read in conjunction with our interim unaudited financial statements and audited consolidated financial statements and related notes for the relevant period. These quarterly operating results are not necessarily indicative of our operating results for a full year or any future period.

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended |

| | Dec 31, 2016 | | Sep 30, 2016 | | June 30, 2016 | | Mar 31, 2016 | | Dec 31,

2015 | | Sep 30,

2015 | | June 30, 2015 | | Mar 31,

2015 |

| | (in thousands, except per share data) |

| Revenues: | | | | | | | | | | | | | | | |

| Subscription solutions | $ | 56,387 |

| | $ | 49,839 |

| | $ | 43,674 |

| | $ | 38,706 |

| | $ | 34,608 |

| | $ | 29,560 |

| | $ | 25,459 |

| | $ | 22,352 |

|

| Merchant solutions | 73,996 |

| | 49,739 |

| | 42,973 |

| | 34,016 |

| | 35,565 |

| | 23,226 |

| | 19,467 |

| | 14,996 |

|

| | 130,383 |

| | 99,578 |

| | 86,647 |

| | 72,722 |

| | 70,173 |

| | 52,786 |

| | 44,926 |

| | 37,348 |

|

Cost of revenues: (1) | | | | | | | | | | | | | | | |

| Subscription solutions | $ | 11,593 |

| | 10,555 |

| | 9,098 |

| | 8,232 |

| | 7,662 |

| | 6,414 |

| | 5,422 |

| | 5,033 |

|

| Merchant solutions | 50,655 |

| | 35,271 |

| | 30,026 |

| | 24,405 |

| | 26,044 |

| | 17,005 |

| | 14,068 |

| | 10,330 |

|

| | 62,248 |

| | 45,826 |

| | 39,124 |

| | 32,637 |

| | 33,706 |

| | 23,419 |

| | 19,490 |

| | 15,363 |

|

| Gross profit | 68,135 |

| | 53,752 |

| | 47,523 |

| | 40,085 |

| | 36,467 |

| | 29,367 |

| | 25,436 |

| | 21,985 |

|

| Operating expenses: | | | | | | | | | | | | | | | |

Sales and marketing(1) | 39,016 |

| | 32,777 |

| | 29,413 |

| | 28,008 |

| | 22,527 |

| | 18,216 |

| | 16,091 |

| | 13,540 |

|

Research and development(1) | 24,472 |

| | 19,462 |

| | 16,732 |

| | 13,670 |

| | 13,541 |

| | 10,068 |

| | 8,800 |

| | 7,313 |

|