UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________

Form 10-K

___________________________

| | | | | |

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2024

OR

| | | | | |

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ___________ to ___________

________________________________________________

Shopify Inc.

(Exact name of registrant as specified in its charter)

________________________________________________

| | | | | | | | | | | | | | |

| Canada | 001-37400 | 98-0486686 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | | | |

| 151 O'Connor Street, Ground Floor | | 148 Lafayette Street |

| Ottawa, | Ontario | | New York, | New York |

| Canada | K2P 2L8 | | USA | 10012 |

| (Address of Principal Executive Offices) |

Registrant’s Telephone Number, Including Area Code: (613) 241-2828 x 1045

________________________________________________

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Class A Subordinate Voting Shares | SHOP | New York Stock Exchange |

Securities registered pursuant to section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,”and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | |

| Large accelerated filer | x | | Accelerated filer | ☐ |

| | | | |

| Non-accelerated filer | ☐ | | Smaller reporting company | ☐ |

| | | | |

| | | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. x

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. o

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No x

The aggregate market value of the registrant's Class A Subordinate Voting Shares held by non-affiliates, based on the closing price of the Class A Subordinate Voting Shares as reported by the New York Stock Exchange on June 28, 2024, the end of the registrant's most recently completed second fiscal quarter, was $79,793,497,805.

The registrant had 1,215,528,049 Class A Subordinate Voting Shares, 79,292,685 Class B Restricted Voting Shares and 1 Founder Share issued and outstanding as of February 7, 2025.

DOCUMENTS INCORPORATED BY REFERENCE

Not applicable.

EXPLANATORY NOTE

Shopify Inc., a corporation existing under the Canada Business Corporations Act, qualifies as a foreign private issuer in the United States ("U.S.") for purposes of the Securities Exchange Act of 1934, as amended. Although, as a foreign private issuer, Shopify Inc. is not required to do so, Shopify Inc. has chosen to file annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K with the U.S. Securities and Exchange Commission ("SEC") instead of filing the reporting forms available to foreign private issuers.

Shopify Inc. intends to prepare and file a management information circular and related materials under Canadian requirements. As Shopify Inc.'s management information circular is not filed pursuant to Regulation 14A, Shopify Inc. may not incorporate by reference information required by Part III of this Annual Report on Form 10-K from its management information circular. Accordingly, in reliance upon and as permitted by General Instruction G(3) to Form 10-K, Shopify Inc. will be filing an amendment to this Annual Report on Form 10-K containing the Part III information no later than 120 days after the end of the fiscal year covered by this Annual Report on Form 10-K.

Shopify Inc.

Form 10-K

For the Fiscal Year Ended December 31, 2024

TABLE OF CONTENTS

General Matters

Information Contained in this Annual Report on Form 10-K

In this Annual Report on Form 10-K "we", "our", "Shopify" and the "Company" refer to Shopify Inc. and its consolidated subsidiaries, unless the context requires otherwise. References to our "solutions" means the combination of products and services that we offer to merchants, and references to "our merchants" as of a particular date means the total number of unique shops that are paying for a subscription to our platform. Words importing the singular, where the context requires, include the plural and vice versa and words importing any gender include all genders.

Shopify, the associated Shopify logo and the shopping bag design are registered trademarks of Shopify Inc. or its subsidiaries. All other trademarks and brand names used herein are the property of their respective owners.

Presentation of Financial Information

We prepare and report our consolidated financial statements in accordance with accounting principles generally accepted in the United States of America ("U.S. GAAP"). Our reporting currency is U.S. dollars, and we express all amounts in this Annual Report on Form 10-K in U.S. dollars, except where otherwise indicated. All references in this Annual Report on Form 10-K to "dollars", "$" and "USD" refer to United States dollars.

Forward-Looking Statements

This Annual Report on Form 10-K contains forward-looking statements under the provisions of the U.S. Private Securities Litigation Reform Act of 1995, Section 27A of the U.S. Securities Act of 1933 (as amended, the "Securities Act"), Section 21E of the U.S. Securities Exchange Act of 1934 (as amended, the "Exchange Act") and forward-looking information within the meaning of applicable Canadian securities legislation.

In some cases, you can identify forward-looking statements by terminology such as "enable", "may", "might", "will", "should", "could", "expects", "intends", "plans", "anticipates", "believes", "predicts", "potential", "continue", "become", "seek", "strive" or the negative of these terms or other similar words. Any forward-looking statements are based on our management’s perception of historic trends, current conditions and expected future developments, as well as other assumptions that management believes are appropriate in the circumstances. In addition, any statements or information that refer to expectations, beliefs, plans, projections, objectives, performance or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking. In particular, forward-looking statements include, but are not limited to, statements about:

•our ability to: expand, grow and retain our merchant base; localize features; offer more sales channels that can connect to our platform; increase and extend the functionality of our platform; catalyze merchants' sales growth; leverage emerging technologies, including artificial intelligence ("AI"); enhance our ecosystem and partner programs; provide a high level of merchant service and support; hire key talent and retain and motivate qualified personnel; and maximize long-term value;

•our products and solutions enabling and increasing the probability of merchant success;

•the expected impact of seasonality on our current and future business;

•the ability to grow our addressable markets and meet merchant needs;

•our expectation that we will continue to invest in data analytics, machine learning and AI;

•our expectations regarding the development of emerging technologies, including AI, and potential applications to our business;

•our intentions regarding future growth and investments to drive future growth, the impact of those investments and our ability to manage such growth effectively;

•our intention to further tailor our sales strategies to attract larger volume brands;

•expansion of our platform's capabilities;

•the growth and strengthening of our third-party ecosystem and partner program, including through the formation of strategic partnerships;

•our current and future relationships with referral partners;

•our ability to quickly distribute new versions of our platform;

•our assumptions regarding competitive factors in our markets and the expectation of increased competition;

•our ability to continuously enhance, protect and safeguard our intellectual property;

•the possibility that we may experience cybersecurity attacks in the future and future efforts to harden our infrastructure to build resilience in the face of such threats;

•our expectations of legislation and government regulation and the impact on our platform;

•our beliefs regarding future macroeconomic conditions and the impact on the Company and our merchants, including pressure from inflation and international trade risks and trade protection measures, such as the imposition of or an increase in tariffs;

•our expectations regarding future Monthly Recurring Revenue ("MRR");

•the impact of strategic decisions on short-term revenue or profitability;

•the need to devote additional resources to improve our operational infrastructure and continue to enhance its scalability;

•our expectation regarding general and administrative expenses in the future;

•the expansion of our platform and offerings internationally;

•our ability to maintain our corporate culture as we execute with a remote-first global workforce;

•our expectations regarding the adoption of our platform and solutions by Shopify Plus merchants and enterprise-level businesses;

•our intention to pursue additional relationships with other third parties;

•our expectations regarding future investment in the business, including with respect to key talent, sales and marketing, research and development, the creation and implementation of new products and services, the functionality of our platform, merchant service and support, security and operational requirements, our network infrastructure, acquisitions and the expansion of our international operation;

•our ability to optimize marketing spend and successfully sell to and support enterprise merchants in order to drive growth;

•the use of our Flex Comp compensation system to attract, retain and motivate qualified personnel, and our intention to issue equity awards as key components of our overall compensation and employee attraction and retention efforts;

•our expectation that as our consumer-facing offerings evolve and grow in popularity, the risk of additional laws and regulations impacting our business will also increase;

•our intention to continue our use and development of open source software;

•potential acquisitions and investments;

•the exploration, expansion and evolution of other products, models, structures and additional markets for our lending and financing products;

•our expectations with respect to changes in our pricing models;

•requirements upon a fundamental change, conversion or maturity of our 0.125% convertible senior notes due 2025 (the "Notes");

•our expectation that we will not pay any cash dividends in the foreseeable future;

•issuances of Class B restricted voting shares and preferred shares;

•redemption of the Founder Share;

•our intention to invest our future earnings, if any, to fund our growth; and

•our expectations with respect to adapting our current facilities.

Factors that may cause actual results to differ materially from current expectations may include, but are not limited to, risks and uncertainties that are discussed in greater detail in Part I, Item 1A "Risk Factors" and Part II, Item 7A "Quantitative and Qualitative Disclosures About Market Risk" of this Annual Report on Form 10-K.

Although we believe that the plans, intentions, expectations, assumptions and strategies reflected in our forward-looking statements are reasonable, these statements relate to future events or our future financial performance, and involve known and unknown risks, uncertainties and other factors which are, in some cases, beyond our control. If one or more of these risks or uncertainties occur, or if our underlying assumptions prove to be incorrect, actual results may vary significantly from those implied or projected by the forward-looking statements. In addition, we operate in a highly competitive and rapidly changing environment. New risks and uncertainties emerge from time to time, and it is not possible for us to predict all risks and uncertainties that could have an impact on the forward-looking statements contained in this Annual Report on Form 10-K. No forward-looking statement is a guarantee of future results. These statements are inherently uncertain and investors are cautioned not to unduly rely upon these statements. You should read this Annual Report on Form 10-K and the documents that we reference in this Form 10-K completely and with the understanding that our actual future results may be materially different from any future results expressed or implied by these forward-looking statements.

The forward-looking statements in this Annual Report on Form 10-K represent our views as of the date of this Form 10-K. We anticipate that subsequent events and developments may cause our views to change. However, while we may elect to update these forward-looking statements at some point in the future, we have no current intention of doing so except to the extent required by applicable law. Therefore, these forward-looking statements do not represent our views as of any date other than the date of this Annual Report on Form 10-K.

Part I

Item 1: Business

Overview

Shopify is a leading global commerce technology company, offering trusted tools to start, scale, market and run a business of any size. Shopify's mission is to make commerce better for everyone with a platform and services that are engineered for simplicity and reliability, while delivering a better shopping experience for consumers everywhere.

Shopify's business is designed to empower our merchants by offering a comprehensive, multi-channel commerce platform that supports their business as it grows. This platform allows merchants to seamlessly manage, market and sell their products across various sales channels, including online storefronts, physical retail spaces, social media and more. Emphasizing merchant-first innovation, Shopify provides an integrated back-end system to streamline operations, from managing inventory and transaction management to building relationships with buyers. With a robust and continuously updated infrastructure, Shopify's goal is to provide merchants with cutting-edge technology to thrive in a competitive market.

Our Merchants

We believe we can help merchants of all verticals and sizes, from aspirational entrepreneurs to companies with large-scale, direct-to-consumer or business to business ("B2B") operations, or both, realize their potential at all stages of their business life cycle. Our merchants represent a wide array of retail verticals and business sizes and no single merchant has ever represented more than five percent of our total revenues in a single reporting period. As of December 31, 2024, we had millions of merchants from more than 175 countries using our platform, geographically dispersed as follows: 45% in the United States, 30% in Europe, the Middle East and Africa, 15% in Asia Pacific, Australia and China, 5% in Canada and 5% in Latin America (Mexico and South America).

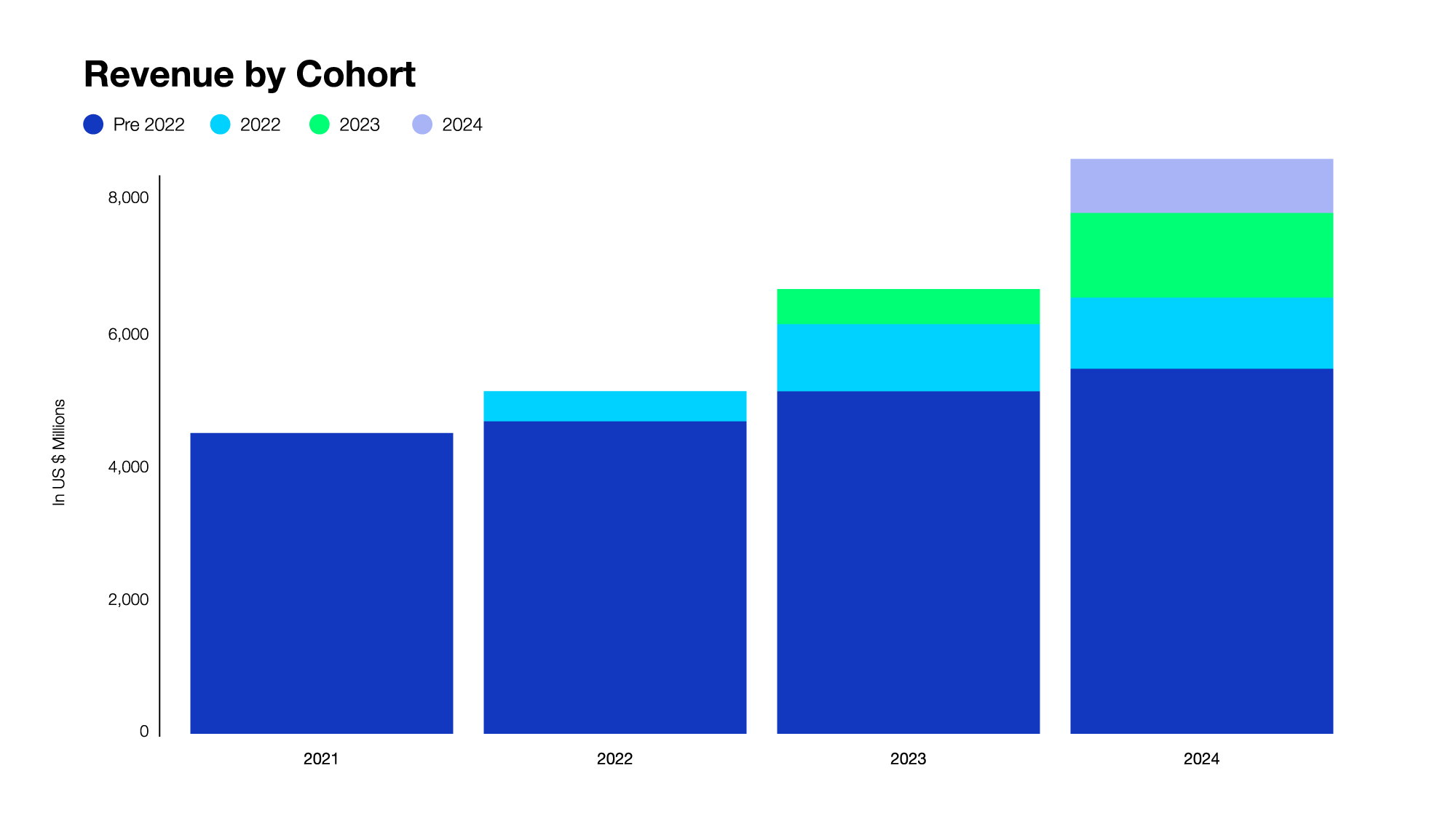

Shopify's products are designed to enable our merchants' success, which drives our business model. Over time, historical merchant cohorts (the group of merchants that join the platform in a given year) have increased their sales, adopted additional merchant solutions, upgraded their subscription plans and purchased additional apps. Over time, revenue from these historical cohorts has increased and growth in revenue from merchants that remain on the Shopify platform has more than offset decreases in revenues from merchants leaving the platform (as shown in the chart below). Moreover, the total annual revenue generated by each of our previous cohorts has grown on a generally consistent basis. We intend to grow our base of merchants by both inspiring entrepreneurship through marketing programs and trial experiences and continuing to improve the ease with which merchants can get a new or existing business up and running with Shopify.

Ecosystem

A rich ecosystem of app developers, theme designers and other partners, such as digital and service professionals, marketers, photographers and affiliates has evolved around the Shopify platform. We believe our partner ecosystem helps drive the growth of our merchant base by extending the functionality of the Shopify platform through the development of apps, which in turn further accelerates growth of the ecosystem. As of December 31, 2024, more than 16,000 apps were available in the Shopify App Store.

Our Offerings

Our business model has two revenue components: a recurring subscription component that we call subscription solutions and a merchant success-based component that we call merchant solutions.

Subscription Solutions

We generate subscription solutions revenues primarily through the sale of subscriptions to our platform and from variable platform fees, as well as through the sale of subscriptions to our Point of Sale Pro ("POS Pro") offering, the sale of apps, the registration of domain names and the sale of themes.

We offer pricing plans designed to meet the needs of our current and prospective merchants. While most merchants subscribe to our Basic and Shopify plans, the majority of our gross merchandise volume ("GMV") has been generated from merchants subscribing to our Shopify Plus plan and enterprise offerings. GMV is the total dollar value of orders facilitated through our platform including certain apps and channels for which a revenue-sharing arrangement is in place in the period, net of refunds, and inclusive of shipping and handling, duty and value-added taxes. GMV does not represent revenue earned by us. Offered at a starting rate that is several times that of our Advanced plan, the Shopify Plus plan solves for the complexity of merchants as they grow and scale globally, offering additional functionality and support, including features like Shopify Audiences for customer acquisition, B2B features for selling wholesale and Launchpad for ecommerce automation. We have also launched localized pricing plans in select countries where we bill in local currency in order to attract more merchants to our platform.

Our subscription plans typically have a one-month term, although merchants can elect to make an annual commitment. Merchants who sign on to Shopify Plus initially have annual or multi-year subscription terms. Subscription terms generally renew automatically unless notice of cancellation is provided in advance. POS Pro subscriptions fees are charged on a per month and per location basis, with an option to elect an annual commitment.

Merchant Solutions

We offer a variety of merchant solutions to augment those provided through our subscriptions and to address the broad array of functionality merchants commonly require, including accepting payments, securing working capital and shipping. We believe that offering merchant solutions creates additional value for our merchants by passing on our economies of scale, saving them time and money by making additional functionality available within a single centralized commerce platform, and creates additional value for Shopify by increasing merchants’ use of our platform.

We principally generate merchant solutions revenues from payment processing fees and currency conversion fees from Shopify Payments, our fully integrated payment processing service that allows our merchants to accept and process payment cards online and offline. We also generate merchant solutions revenue from other product offerings including our lending and financial products (to merchants in eligible geographies), referral fees from partners and the sale of shipping labels.

Research and Development

Shopify is building products and solutions for commerce that enable merchants of all sizes around the world to successfully start and scale their businesses on Shopify. We strive to increase the probability of a merchant's future success by finding and supporting solutions that enable merchant discovery and allow merchants to develop a commerce presence across multiple channels and geographies. We expect to continue to leverage emerging technologies including data analytics, machine learning and AI in our products, to help our merchants increase productivity, improve workflows, make smarter decisions and spend less time on operational tasks. For example, Shopify Magic provides a suite of AI-enabled features integrated across the Shopify platform and Sidekick offers merchants an AI-enabled commerce assistant. Research and development at Shopify is currently focused on product management, product development and product design to accomplish these goals.

We also invest in developing the tools to make it easier for our ecosystem partners to build on and for Shopify to extend the functionality and flexibility of the platform. We believe that by deepening and expanding the range of solutions we offer to give merchants and by offering new and better ways to market and sell their products, we will be able to grow our addressable market and meet the needs of merchants in years ahead.

Strategy

We have focused on rapidly growing our business and plan to continue making investments to drive future growth. We believe that our investments will increase our global revenue base and strengthen our ability to increase sales to our merchants. Our growth strategy is driven by our mission: make commerce better for everyone. Key elements of our growth strategy include growing and expanding our merchant base and the types of merchants we serve and helping our existing merchants continue to grow through continued innovation in our platform and the products we offer to our merchants as well as further growing and developing our ecosystem of partners. We continue to build with a focus on adding the most value for our merchants to help them be successful not just today, but in the years to come. We believe that fueling our merchants' success drives Shopify's success.

Seasonality

Our business is affected by seasonality due to holiday demand, which historically has resulted in higher GMV and revenue during our fourth quarter, which ends on December 31. We believe that this seasonality has affected and will continue to affect our quarterly results. In addition, while we have historically generated higher merchant solutions revenues in our fourth quarter than in other quarters, our continued growth has partially masked seasonal trends to date. In connection with expected continued growth of our merchant solutions offerings, we believe that our business may become more seasonal in the future and that historical patterns in our business may not be a reliable indicator of our future performance.

Human Capital

Shopify is a company designed for world-class crafters. We value employees who are merchant-obsessed and thrive on change. Teams at Shopify experiment, observe and iterate to make commerce better for everyone. In 2024, we launched “~Mastery” in support of talent growth and development. “~Mastery” is a talent system that is built for and rewards those who show up better to work every day on the continuous journey to improve their craft.

Shopify has a remote-first work environment for employees, gathering in-person periodically during the year to connect and solve complex problems. Teams align through “Local Access” in certain cities, in-person team events or “Bursts” and key company moments, which in 2024, included a company-wide Summit, held in Toronto, Canada. These in-person moments foster connection and drive mission alignment and impact. Employees also have the opportunity to tackle novel problems and projects through Hack Days, which, in 2024 included in-person collaboration in cross-company teams.

We are intentional in building a culture and environment that empowers our talented people. We measure employee engagement through regular pulse checks, including a semi-annual survey. In a 2024 company-wide employee survey, nine out of ten respondents indicated that they would recommend their team at Shopify to an ambitious and hardworking friend. We offer wellness resources and programs across four pillars: financial, mental, physical and social wellness, including an Employee Assistance Program that provides employees with confidential help for any work, health or life concern. As of December 31, 2024, Shopify had approximately 8,100 employees worldwide.

Technology

The Shopify platform is a multi-tenant cloud-based system that is engineered for high scalability, reliability and performance. Open source has played a major role at Shopify from the beginning given our founder's active role on the core team that built Ruby on Rails, the technology that powers much of the Shopify platform. Our platform's cloud-based architecture is designed to support sudden traffic spikes and to provide high reliability to our merchants. The Shopify platform is "single branch" software, which means that all of our merchants use the latest version of Shopify, which eliminates the need to maintain older versions of the platform and enables us to quickly distribute new versions. We also maintain a focus on security, with firewalls, advanced encryption, intrusion detection systems and two-factor authentication and additional safeguards for credit card processing on the platform.

Maintaining the integrity and security of our technology infrastructure is critical to our business, and we plan to invest further in our infrastructure to meet our merchants' needs and maintain their trust. Our investment plans include increasingly optimizing our cloud-based infrastructure to deliver local performance and global reach to more merchants than ever before, with consistent levels of availability, performance and resilience.

Sustainability

Shopify is a company that wants to see the next century and has taken many steps to build a sustainable business, including removing and reducing emissions from building and home office energy usage and business travel and leveraging Google Cloud for platform operations. In 2019, Shopify launched the Sustainability Fund which is designed to identify and support impactful carbon-removal and reduction technologies and projects. Shopify is also a founding member of Frontier, alongside Stripe, Alphabet and McKinsey, among others, with a goal to collectively purchase over $1 billion of permanent carbon removal by the end of 2030. Merchants can also choose to address carbon associated with shipping their orders by adding the Shopify Planet app to their store.

Competition

Our market is transforming, competitive and highly fragmented, and we expect competition to increase in the future. We believe the principal competitive factors in our market are:

•vision for commerce and product strategy;

•simplicity and ease of use for merchants and their buyers;

•integration of multiple sales channels;

•embedding of commerce functionality onto more surfaces;

•cost-effective solutions;

•significant app ecosystem;

•breadth and depth of functionality;

•pace of innovation;

•powerful data analytics;

•ability to leverage emerging technologies, including AI;

•ability to scale;

•security and reliability;

•support for a merchant’s brand development; and

•brand recognition and reputation.

With respect to each of these factors, we believe that we compare favorably to our competitors.

The growth of ecommerce may attract new entrants or new offerings from existing competitors. Additionally, some merchants may select one or more integrated or standalone offerings from other providers such as:

•ecommerce software vendors;

•content management systems;

•payment processors;

•POS providers;

•domain registrars;

•shipping label providers;

•fulfillment service providers;

•alternative lenders;

•financial services;

•cross-border services providers; and

•marketplaces.

For additional information regarding these and other laws, regulations and rules that affect us and our business, see Part I, Item 1A, "Risk Factors" in this Annual Report on Form 10-K.

Intellectual Property

Our intellectual property and proprietary rights are important to our business. In our efforts to safeguard them, we rely on a combination of copyright, trade secret, trade dress, domain names, trademarks, patents and other rights in Canada, Ireland, Singapore and the United States, and other jurisdictions in which we conduct business. We also have confidentiality agreements, assignment agreements and license agreements with employees, contractors, merchants, distributors and other third parties, which limit access to and use of our proprietary intellectual property. Although we rely, in part, upon these legal and contractual protections, we believe that factors such as the skills and ingenuity of our employees, as well as the functionality and frequent enhancements to our platform, make our intellectual property difficult to replicate.

Government Regulation

We are subject to a number of foreign and domestic laws and regulations that may affect companies conducting business on the internet, many of which are still evolving and could be interpreted in ways that could adversely affect our business. For example, concern about the use of software as service platforms for illegal conduct, such as money laundering or supporting terrorist activities, may in the future result in legislation or other governmental action that could require changes to our platform. Similarly, legislation or other governmental action around online platforms that might be used to facilitate, enable or host the distribution of illegal or otherwise harmful content, goods or services, may require changes to our platform.

We are subject to U.S. and Canadian laws and regulations that may govern or restrict our business and activities in certain countries and with certain persons, including the economic sanctions regulations administered by the U.S. Treasury Department’s Office of Foreign Assets Control, the sanctions regulations administered or enforced by the Office of the Superintendent of Financial Institutions in

Canada, and the export control laws administered by the U.S. Commerce Department’s Bureau of Industry and Security, the U.S. State Department’s Directorate of Defense Trade Controls and the Canadian Export and Import Controls Bureau. We are currently subject to a variety of laws and regulations in Canada, the United States, the European Economic Area and elsewhere related to financial services. Depending on how our merchant solutions, including our payments and lending products, evolve, we may be subject to additional laws in Canada and other jurisdictions worldwide.

We are also subject to federal, state, provincial and foreign laws that may relate to cybersecurity, privacy and the protection of data. Some jurisdictions have enacted laws requiring companies to notify individuals and regulators of data security breaches involving certain types of personal information and our agreements with certain merchants require us to notify them in the event of a security incident. Additionally, some jurisdictions as well as our contracts with certain merchants require us to use industry-standard or reasonable measures to safeguard personal information or confidential information, and thereby mitigate the risk of a security incident. We also expect the enactment of future laws and regulations regarding cybersecurity, privacy and the protection of data, that will likely apply to our business. These laws and other obligations may create regulatory, liability and reputational risks for Shopify.

We could also be subject to liability and/or governmental regulation related to the content of merchants’ shops, products and services or other activities of our merchants and/or partners in various jurisdictions around the world. In many jurisdictions, new laws, regulations or rules relating to the liability of providers of online services for activities of their customers and other third parties are currently being proposed and debated, or otherwise being tested in court. This liability could relate to a number of different types of legal claims or concerns, including concerns relating to unfair competition, unfair, deceptive and abusive practices, copyright and trademark infringement, defamation, invasion of privacy or other torts, products liability and other theories based on the nature of the relevant goods, services or content. Any legislation, court ruling or other governmental regulation or action that imposes liability on providers of online services in connection with the activities of their customers or their customers’ users could adversely affect our business. In such circumstances we may also be subject to liability under applicable law, which may not be fully mitigated by our terms of service. Any liability attributed to us could adversely affect our brand, reputation, ability to expand our merchant base and financial results.

For additional information regarding these and other laws, regulations and rules that affect us and our business, see Part I, Item 1A, "Risk Factors" in this Annual Report on Form 10-K.

Additional Information

Additional information about Shopify is available on our website at www.shopify.com, on the website maintained by the SEC at www.sec.gov or the website maintained by the Canadian Securities Administrators at www.sedarplus.ca. The aforementioned information is made available in accordance with legal requirements and is not, unless otherwise specifically stated, incorporated by reference into this Annual Report on Form 10-K.

We are a "foreign private issuer" as such term is defined in Rule 3b-4 under the Exchange Act, and are not subject to the same requirements that are imposed upon U.S. domestic issuers by the SEC. Although, as a foreign private issuer, we are not required to do so, we have chosen to file annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K with the SEC instead of filing the reporting forms available to foreign private issuers. We will make available free of charge, through our website, annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act, as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC.

Item 1A: Risk Factors

In addition to any other risks contained in this Annual Report on Form 10-K, including the section titled "Management’s Discussion and Analysis of Financial Condition and Results of Operations" and our audited financial statements and related notes, the risks described below are the principal risks that could have a material and adverse effect on our business, financial condition, results of operations, cash flows, future prospects or the trading price of our Class A subordinate voting shares. This Annual Report

on Form 10-K also contains forward-looking statements that involve risks and uncertainties. Our actual results could differ materially from those anticipated in the forward-looking statements as a result of a number of factors, including the risks described below. See "Forward-Looking Statements" in this Annual Report on Form 10-K.

Risk Factors Summary

Our business is subject to a number of risks, including risks that may prevent us from achieving our business objectives or may adversely affect our business, financial condition, results of operations, cash flows and prospects. These risks are discussed more fully below under the headings "Risks Related to Our Business and Industry" and "Risks Related to Ownership of our Shares" and include, but are not limited to:

Risks Related to Our Operations

•Our ability to attract and retain merchants, increase sales to both new and existing merchants and sustain and manage our growth effectively;

•Our dependence on senior management and other key employees, as well as our ability to retain and motivate qualified personnel, hire key talent and maintain and adapt our corporate culture;

•Our reliance on third parties to provide key services for our business, including cloud hosting and Shopify Payments;

•Our limited operating history in new and developing markets and new geographic regions, as well as risks associated with international sales and the use of our platform in various countries;

•Undetected errors or defects in our software or hardware or issues related to data transmission capacity;

Risks Related to Personal Information, Cybersecurity and Intellectual Property

•Unauthorized access to personal information, security breaches and cyberattacks;

•Our intellectual property rights and proprietary information and the unauthorized use of such rights and information by third parties;

•Our use of open source software;

Risks Related to our Industry

•Failure to maintain, promote and enhance our brand including by failing to meet merchants' evolving needs or due to activities of our merchants or partners;

•Our ability to compete successfully against current and future competitors;

•The impact of worldwide economic conditions, including measures that effect international trade, such as tariffs, and the resulting impact on spending by merchants and their buyers;

•The impact of seasonal fluctuations on our business;

•The success of our strategic relationships with third parties and the impact of these relationships impact on our growth;

•Our use of AI and machine learning, including associated risks and the developing regulatory environment;

•Changes to technologies used in our platform or technologies through which merchants and their buyers interface with our platform;

Risks Related to Laws and Regulations

•Changing laws and regulations, including those related to data privacy, competition, online liability, consumer protection, financial services, anti-money laundering, sanctions, anti-corruption and securities laws, among others;

•Claims by third parties, governmental claims, litigation, disputes or other proceedings, as well as regulatory requirements, fees and other risks that could be costly or result in additional compliance obligations;

•Unanticipated changes in tax laws or adverse outcomes from tax examinations;

Financial Risks

•Our ability to maintain profitability and our intention to continue to make investments in our business in the future to drive future growth, including with respect to key talent, sales and marketing, research and development, new products and our network infrastructure, among others;

•Potential future acquisitions, divestitures and investments;

•Risks associated with Shopify Payments, Shopify Capital and our other financing and lending solutions;

Risks Related to Ownership of our Securities

•Our share capital structure and its effect on the influence of holders of Class A subordinate voting shares, including the Founder Share, which has the effect of concentrating a degree of voting power with our founder and CEO; and

•Volatility in the market price of our Class A subordinate voting shares.

*****

Risks Related to Our Business and Industry

Our growth may not be sustainable and depends on our ability to attract new merchants, retain existing merchants, retain revenue from existing merchants and increase sales to both new and existing merchants.

We principally generate revenues through the sale of subscriptions to our platform and the sale of additional solutions to our merchants. Our merchants have no obligation to renew their subscriptions after their subscription term expires, and new merchants joining our platform may decide not to continue or renew their subscriptions for reasons outside of our control. As a result, even though merchant growth has been strong in recent years, there can be no assurance that we will be able to retain these merchants.

Our costs associated with generating revenue from new merchants are substantially higher than costs associated with subscription renewals or costs associated with generating sales of additional solutions to existing merchants. Therefore, if we are unable to retain revenue from existing merchants or if we are unable to increase revenues from existing merchants, even if such lost revenues are offset by an increase in revenue from new merchants or an increase in other revenues, our operating results could be adversely impacted.

A portion of our business consists of small and medium-sized businesses. Small and medium-sized businesses tend to be more susceptible than larger businesses to general economic conditions and other business-related risks, which has, and may continue to, contribute to merchant turnover. These businesses may be particularly susceptible to changes in economic conditions, including pressure from inflation, declines in consumer spending, international trade risks and/or the imposition of trade protection measures (such as the imposition of or an increase in tariffs or import and export licensing and control requirements), global supply chain disruptions and shortages including events impacting shipping and fulfillment all of which may negatively impact a merchant’s business and in turn, negatively impact our business. Large merchants generally require higher service levels and have more complex needs than small and medium-sized businesses. As we look to further tailor our sales strategies to attract large volume brands, we may face elevated costs, extended onboarding cycles and decreased predictability in finalizing the sale of products and services to these merchants. If we fall short of meeting the requirements of these merchants, it could impede our ability to grow within the enterprise market.

We may also fail to attract new merchants, retain existing merchants, retain revenue from existing merchants or increase sales to both new and existing merchants as a result of a number of other factors, including: reductions in our current or potential merchants’ spending levels; a decline in consumer spending, including as a result of deteriorating macroeconomic conditions; competitive factors affecting the global market for commerce services, including the introduction of competing platforms, discount pricing and other strategies that may be implemented by our competitors; our ability to execute on our

growth strategy and operating plans including new solutions offerings; concerns relating to actual or perceived data incidents and security breaches; the frequency and severity of any system outages; technological changes or problems; our ability to expand into new markets and internationally; a decline in the number of entrepreneurs globally; a decline in our merchants’ level of satisfaction with our platform and merchants’ usage of our platform; the fact that difficulty and cost to switch to a competitor may not be significant for many of our merchants; changes in our relationships with third parties, including our partners, app developers, theme designers, referral sources, vendors and payment processors; the timeliness and success of new products and services we may offer in the future; our ability to integrate emerging technologies into our products; and our focus on long-term value over short-term results, meaning that we may make strategic decisions that may not maximize our short-term revenue or profitability if we believe that the decisions are consistent with our mission and will improve our financial performance over the long-term. Due to these factors and the continued evolution of our business, our historical revenue growth rate and operating margin may not be indicative of future performance.

In the long term, we anticipate that our growth rate will decline over time to the extent that the number of merchants using our platform increases and we achieve higher market penetration rates. If our growth rate declines, investors' perception of our business may be adversely affected and the trading price of our Class A subordinate voting shares could decline as a result. To the extent our growth rate slows, our business performance will become increasingly dependent on our ability to retain and increase revenue from existing merchants.

Our business could be harmed if we fail to manage our growth effectively.

The scalability and flexibility of our platform depends on the functionality of our technology and network infrastructure and its ability to handle increased traffic and demand for bandwidth. The growth in merchants using our platform and the orders processed through our platform have increased the amount of data and requests that we process. Any problems with the transmission of increased data and requests could result in harm to our brand or reputation. Moreover, as our business grows, we will need to devote additional resources to improving our operational infrastructure and continuing to enhance its scalability in order to maintain the performance of our platform. Moreover, we may face integration challenges as well as potential unknown liabilities and reputational concerns in connection with partners we work with or companies we may acquire or control. If we are unable to manage operational and integration challenges, or suffer unknown liabilities and reputational damage, our business may be adversely affected.

We intend to further expand our overall business with no assurance that our revenues will continue to grow. While we intend to expand our business without significant additional hiring in the near term, we may be unable to achieve that expansion without increasing our headcount. As we grow, we will be required to continue to improve our financial controls and procedures, and we may not be able to do so effectively.

Our business is highly competitive. We may not be able to compete successfully against current and future competitors.

We face competition in various aspects of our business and we expect such competition may intensify in the future, as existing and new competitors introduce new services or enhance existing services and as our business continues to evolve and expand into new areas. We have competitors with longer operating histories, larger customer bases, greater brand recognition, greater experience and more extensive commercial relationships in certain jurisdictions, and greater financial, technical, marketing and other resources than we do. Some of our larger competitors may be able to leverage a larger installed customer base and distribution network to adopt more aggressive pricing policies and offer more attractive sales terms, which could cause us to lose potential sales or to sell our solutions at lower prices. We also face competition from niche companies that offer particular products that attempt to address certain of the problems that our platform solves or to address certain merchant needs. Our potential new or existing competitors may be able to develop products and services better received by merchants or may be able to respond more quickly and effectively than we can to new or changing opportunities, technologies, regulations or merchant requirements.

Competition may intensify as our competitors enter into business arrangements or alliances or raise additional capital, or as established companies in other market segments or geographic markets expand

into our market segments or geographic markets. For instance, certain competitors could use strong positions in one or more markets to gain a competitive advantage against us in areas where we operate by, among other things: integrating competing platforms, applications or features into products they control; making acquisitions; or making access to our platform more difficult including by changing the terms of service related to their products, which could impact our and our merchants’ ability to offer services or adversely impact our results of operations and those of our merchants. For example, large technology platforms have imposed and are considering imposing, or may provide its users the ability to impose, restrictions on the ability of other parties to access or use data from their customers and users. These practices may impact our merchants' ability to market and sell their offerings, which could affect the demand for our platform and lead to the loss of current or prospective merchants or other business relationships. Competitors may also be more established in international markets with a better understanding of local customs, providing them a competitive advantage. We also expect new entrants to offer competitive services and merchants may also seek to build their own solutions, including using advanced tools such as AI, and particularly in markets where development costs are lower. If we cannot compete successfully against current and future competitors, our business, results of operations and financial condition could be negatively impacted.

We store personal information including of our merchants and their buyers and users of our apps. If the security of this information is compromised or is otherwise accessed without authorization, our reputation may be harmed and we may be exposed to liability and loss of business.

We store personal information, credit card information and other confidential information of our merchants and their buyers, our partners and consumers with whom we have a direct relationship. Mobile applications integrated with Shopify and the third-party apps available for our platform may also store personal information, credit card information and/or other confidential information. While we use technology to monitor for compliance with eligibility requirements for certain Shopify offerings, we do not proactively and comprehensively monitor all content on all of our merchants’ shops, or the information provided to us through the applications integrated with Shopify, and, therefore, we do not control the substance of the content on our platform, which may include personal information. Additionally, we use dozens of third-party service providers and subprocessors to help us operate our business and deliver services to merchants and their buyers. These service providers and subprocessors may store or access personal information, credit card information and/or other confidential information.

There have been in the past, and may be in the future, successful attempts to obtain or to provide unauthorized access to the personal or confidential information of our partners, our merchants, our merchants’ buyers and consumers with whom we have a direct relationship, including as a result of breaches of a secure network by an unauthorized party, software vulnerabilities or coding errors, human error or malfeasance, including employee, contractor or vendor theft or misuse, or other misconduct. The security measures we have integrated into our internal networks and platform, which are designed to prevent or minimize security breaches, may not function as expected or may not be sufficient to protect our internal networks and platform against certain attacks. In addition, techniques used to obtain unauthorized access to networks in which data is stored or through which data is transmitted change frequently and are becoming increasingly sophisticated. As a result, we, and third parties we work with, including service providers we use and third-party apps or other services used by our merchants, may be unable to anticipate these techniques, detect the attacks for long periods of time or implement adequate preventative measures. The unauthorized release, unauthorized access or compromise of personal or confidential information of our partners, our merchants, our merchants’ buyers and consumers with whom we have a direct relationship could have a material adverse effect on our business, reputation, financial condition and results of operations. Even if such a data breach did not arise out of our actions or inaction, or if it were to affect one or more of our competitors or our merchants’ competitors, rather than Shopify itself, the resulting consumer concern could negatively affect our merchants and/or our business.

We are also subject to federal, state, provincial and foreign laws regarding cybersecurity and the protection of data. Some jurisdictions have enacted laws requiring companies to notify individuals and government regulators of security breaches involving certain types of personal information and our agreements with certain merchants and partners require us to notify them in the event of certain security incidents. Additionally, some jurisdictions, as well as our contracts with certain merchants, require us to use industry-standard or reasonable measures to safeguard personal information or confidential information. These laws, which may focus on individuals’ financial and payment related

information, are increasingly relevant to us, as we continue to collect and store more payment information from buyers directly through services such as Shop Pay.

Our failure to comply with legal or contractual requirements around the privacy and security of personal information could lead to significant fines and penalties imposed by regulators, as well as claims by our merchants, their buyers or other relevant stakeholders. These proceedings or violations could force us to incur significant expenses in defense or settlement of these proceedings, result in the imposition of monetary liability or injunctive relief, divert management’s time and attention, increase our costs of doing business and materially adversely affect our reputation and the demand for our solutions. In addition, if our security measures fail to protect credit card information adequately, we could be liable to our partners, our merchants, their buyers and consumers with whom we have a direct relationship, for their losses, as well as our payments processing partners under our agreements with them. As a result, we could be subject to fines and higher transaction fees, we could face regulatory or other legal action and our merchants could end their relationships with us. There can be no assurance that the limitations of liability in our contracts would be enforceable or adequate or would otherwise protect us from any such liabilities or damages with respect to any particular claim. We cannot be sure that our existing insurance coverage and coverage for errors and omissions will continue to be available on acceptable terms or will be available in sufficient amounts to cover one or more large claims, or that our insurers will not deny coverage as to any future claim. The successful assertion of one or more large claims against us that exceeds our available insurance coverage, or changes in our insurance policies, including premium increases or the imposition of large deductible or co-insurance requirements, could have an adverse effect on our business, financial condition and results of operations.

Security breaches, improper access to or disclosure of our data, merchant data and buyer data other hacking and phishing attacks on our systems or other cybersecurity incidents could impact or interrupt service to our merchants, their buyers and others who use our services, harm our reputation, subject us to significant liability and adversely affect our business and financial results.

We operate in an industry that is prone to cyberattacks. Our products and services involve the collection, storage, processing and transmission of a large amount of data. Failure to prevent or mitigate security breaches and improper access to or disclosure of our data, merchant data and data of buyers shopping with our merchants, including personal information, or payment information from merchants and their customers, could result in the loss, modification, disclosure, destruction or other misuse of such data, which could harm our business and reputation and diminish our competitive position. In addition, computer malware, viruses, social engineering (such as spear phishing attacks), scraping and general hacking continue to be prevalent in our industry. As a result of our increased visibility, the size of our merchant base and the increasing amount of confidential information we process, we believe that we are increasingly a target for such breaches and attacks, in particular because attackers tend to focus their efforts on popular offerings with a large user base. Our remote-first work environment could also impact the security of our platform and systems as well as our ability to prevent attacks or respond to them quickly.

We have experienced such attacks in the past and may experience such attacks in the future. Such attacks may result in an interruption of service on our platform or the loss or unauthorized disclosure of confidential information. For example, we have been subject to system interruptions and delays including as a result of distributed denial of service ("DDoS attacks"), a technique used by hackers to take an internet service offline by overloading its servers. A DDoS attack or security breach could delay or interrupt service to our merchants and their buyers and may deter buyers from visiting our merchants’ shops.

We have a defense-in-depth approach to resist such attacks and minimize our risks, but we cannot guarantee that our approach and infrastructure are or will be adequate to prevent cyberattacks, network and service interruption, system failure or data loss or misuse, or detect security breaches. We cannot provide any assurances that we will be able to react in a timely manner to any cyberattack or other security incident, or that our remediation efforts will be successful. Our business and operations span numerous countries and involve thousands of employees, contractors, merchants, developers, partners and other third parties. At any given time, we face known and unknown cybersecurity risks and threats that are not fully mitigated. We expect to continue to harden our infrastructure to adapt to evolving tactics, techniques and procedures to make us more resilient.

Moreover, our platform, our apps and third-party apps available for our platform have been in the past, and in the future could be breached if vulnerabilities in our platform or third-party apps are exploited by unauthorized third parties or due to employee, contractor or vendor error, malfeasance, or otherwise. Such exploitation may expose merchant or buyer data and negatively impact Shopify’s business and reputation, regardless of the fact that the breach may be outside of Shopify’s control (for example, in connection with a breach of a third-party application). Further, third parties may attempt to fraudulently induce employees, contractors, merchants or partners into disclosing sensitive information such as usernames, passwords or other information or otherwise compromise the security of our internal networks, electronic systems and/or physical facilities in order to gain access to our data or our merchants’ data. Because techniques used to obtain unauthorized access change frequently and the size and severity of attacks and security breaches are increasing across the industry, we may be unable to implement adequate preventative measures or stop attacks or security breaches while they are occurring.

Any actual or perceived security incident could damage our reputation and brand, expose us to a risk of litigation and possible liability and require us to expend significant capital and other resources to respond to and/or alleviate problems caused by a security incident. Many jurisdictions have enacted laws requiring companies to notify individuals, customers or government regulators of data security breaches involving certain types of personal data and our agreements with certain merchants and partners require us to notify them in the event of a security incident. In addition, we have provided in the past, and may provide in the future, voluntary notification to merchants, customers or individuals of data security incidents, regardless of any legal or contractual obligation to do so. Any such notifications may be costly, could lead to negative publicity, scrutiny and/or fines from regulators and may cause our merchants to lose confidence in the effectiveness of our data security measures. Moreover, if a high profile security breach occurs with respect to a competitor, retailer or other commerce-related platform, merchants and buyers may lose trust in our business model or commerce more generally, which could adversely impact our and our merchants’ businesses. Any of these events could harm our reputation or subject us to significant liability, and materially and adversely affect our business and financial results.

If we fail to improve and enhance the functionality, performance, reliability, design, security and scalability of our platform and innovate and introduce new solutions in a manner that responds to our merchants’ evolving needs, our business may be adversely affected.

The markets in which we compete are characterized by constant change and innovation and we expect them to continue to evolve rapidly. Our success has been based on our ability to identify and anticipate the needs of our merchants and design and maintain a platform that provides them with the tools they need to operate their businesses. Our ability to attract new merchants, retain revenue from existing merchants and increase sales to both new and existing merchants will depend in large part on our ability to continue to improve and enhance the functionality, performance, reliability, design, security and scalability of our platform and to innovate and introduce new solutions. If we fail to anticipate and address merchants' rapidly changing needs and expectations or adapt to emerging trends, our reputation could be harmed and our business, operating results and financial condition could suffer.

Furthermore, we expect adoption of our platform and solutions by Shopify Plus merchants and enterprise-level businesses to increase. As the number of merchants with higher volume sales increases, so does the need for us to offer increased functionality, performance, reliability, scalability and support, which requires us to devote additional resources to such efforts. To the extent we are not able to enhance our platform’s functionality to satisfy these requirements, our business, operating results, reputation and financial condition could be adversely affected.

We may experience difficulties with software development that could delay or prevent the development, introduction or implementation of new solutions and enhancements. We must also continually update, test and enhance our software platform. The continual improvement and enhancement of our platform requires significant investment and we may not have the resources to make such investment. We may make significant investments in new solutions or enhancements that may not achieve expected returns and such solutions or enhancements may not result in our ability to recoup our investments in a timely manner, or at all. The improvement and enhancement of the functionality, performance, reliability, design, security and scalability of our platform is expensive and complex, and to the extent we are not

able to execute on these efforts in a manner that responds to our merchants’ evolving needs, our business, operating results and financial condition will be adversely affected.

The impact of worldwide economic conditions, including the resulting effect on spending by merchants or their buyers, may adversely affect our business, operating results and financial condition.

Our performance is subject to worldwide economic conditions and their impact on levels of spending by merchants and their buyers. These conditions are impacted by events outside of our control, which may have a long-term impact on the global economy. A portion of the merchants that use our platform are small businesses. Such merchants may be disproportionately affected by economic downturns or disruptions, especially if they sell discretionary goods, and may choose to allocate their spending to items other than our platform, especially in times of economic uncertainty or recessions.

Economic downturns, financial market volatility or other negative macroeconomic factors such as tariffs or inflation, have in the past and may in the future impact buyer confidence and spending, and adversely impact consumer spending, which could result in merchants who use our platform going out of business or deciding to stop using our services in order to conserve cash, or otherwise adversely affect the amount of commerce transacting through our platform and our ability to generate revenue. Challenging economic conditions may also adversely affect third parties with whom we have entered into relationships and upon which we depend in order to grow our business. Uncertain and adverse economic conditions may also lead to increased refunds and chargebacks, any of which could adversely affect our business.

Furthermore, we hold marketable securities in our cash management program and from strategic partnerships and investments that are subject to general credit, liquidity, market, foreign exchange and interest rate risks, which may be exacerbated by certain events that affect the global financial markets. If global credit and equity markets decline for extended periods, or if there is a downgrade of the securities within our cash management program portfolio, the investment portfolio may be adversely affected and we could determine that our investments have experienced an other-than-temporary decline in fair value, requiring impairment charges that could adversely affect our financial results. Thus, if general macroeconomic conditions deteriorate, our business and financial results could be adversely affected.

We currently rely on two suppliers to provide the technology we offer through Shopify Payments.

At present, we have payment service provider agreements with Stripe, Inc. ("Stripe") and PayPal, Inc. ("PayPal") and their respective affiliates (together, our "Payment Service Providers"). Upon completion of the existing term, the Stripe agreement automatically renews every 12 months, unless either party terminates the agreement earlier. The PayPal agreement, following its initial term, automatically renews every 12 months, unless either party terminates the agreement earlier. These agreements directly support Shopify Payments and, at this time, any disruption or problems with our Payment Service Providers or their services could have an adverse effect on our reputation, results of operations and financial results. We have the ability, under our current agreements, to integrate alternative payment service providers for Shopify Payments. However, if our Payment Service Providers were to terminate their relationships with us before an alternative payment service provider was fully integrated, we could incur substantial delays and expense, and the quality and reliability of such alternative payment service provider may not be comparable.

Our growth depends in part on the success of our strategic relationships with third parties.

We anticipate that the growth of our business will continue to depend on third-party relationships, including strategic partnerships and relationships with software developers, affiliates, payment processors, technology, fulfillment and shipping partners, providers of online sales channels, providers of AI technology and solutions, systems integrators and other partners. We rely on computer hardware and software licensed from and services rendered by third parties in order to provide our solutions and run our business, sometimes by a single-source supplier. Identifying, negotiating and documenting relationships with third parties requires significant time and resources as does integrating third-party content and technology. Some of the third parties that sell our services, or provide additional services on our platform, have direct contractual relationships with our merchants, and therefore we risk the loss of such merchants if the third parties fail to perform their obligations. Our agreements with cloud hosting,

technology, content and consulting providers are typically non-exclusive and do not prohibit such service providers from working with our competitors or from offering competing services. These third-party providers may choose to terminate their relationship with us or to make material changes to their businesses, products or services.

The success of our platform depends, in part, on our ability to integrate third-party apps, themes and other offerings into our third-party ecosystem. Third-party developers and partners may change the features of their apps, themes and other offerings or alter the terms governing the use of their offerings in a manner that is adverse to us and our merchants. If third-party apps and themes change such that we do not or cannot maintain the compatibility of our platform with these apps and themes, or if we fail to ensure there are third-party apps and themes that our merchants desire to add to their shops, demand for our platform could decline and merchants may see decreased sales, which in turn would impact our operating results. These third-party apps can be subject to disruptions for reasons beyond our control that could have an adverse effect on us. We are also dependent on the interoperability of our platform with third-party mobile devices and mobile operating systems, as well as web browsers and application stores that we do not control. If we are unable to maintain technical inter-operation, our merchants may not be able to effectively integrate our platform with other systems and services they use. We may also be unable to maintain our relationships with certain third-party vendors if we are unable to integrate our platform with their offerings. In addition, third-party developers may refuse to partner with us or limit or restrict our access to their offerings. Partners may also impose additional restrictions on the ability of third parties like Shopify and our merchants to access or use data from their customers or users. Such changes could functionally limit or terminate our ability to use these third-party offerings with our platform, which could negatively impact our solution offerings and harm our business. If we fail to integrate our platform with new third-party offerings that our merchants want or need, or do not adapt to the data transfer requirements of such third-party offerings, we may not be able to offer the functionality that our merchants and their buyers expect, which would negatively impact our offerings and, as a result, harm our business.

We also rely on third parties to manufacture certain of our POS products. We require suppliers of our products to comply with laws and standards on labor, health and safety, the environment, human rights and business ethics, but we do not directly control them or their practices or standards. If any of these suppliers violates laws or implements practices or standards regarded as unethical, corrupt or non-compliant, we could experience and have in the past experienced supply chain disruptions, government actions or fines, litigation, merchant and other stakeholder dissatisfaction and canceled orders, which may damage our reputation and impact our business operations.

Our competitors may be effective in providing incentives to third parties to favor their products or services or to prevent or reduce subscriptions to our platform. In addition, third-party service providers may not perform as expected under our agreements or under their agreements with our merchants, and we or our merchants may in the future have disagreements or disputes with such providers. If we lose access to products or services from a particular supplier, or experience a significant disruption in the supply of products or services from a current supplier, especially a single-source supplier, it could have an adverse effect on our business and operating results.

Our use of AI and machine learning may present additional risks, including risks associated with the use of AI algorithms and tools, the data sets used to train AI-powered models, the content produced by AI and the complex, developing regulatory environment.

Shopify does not currently develop its own foundational AI models, rather, we develop ways to incorporate AI-powered tools into select products we offer to merchants, in order to support elements of their business operations as well as into certain of our internal business operations. We are making investments in expanding the AI capabilities available in our products, including the ongoing deployment and improvement of existing machine learning and AI technologies. AI algorithms may be flawed and datasets may be insufficient or contain biased information. AI tools and algorithms may rely on third-party AI with unclear intellectual property rights or interests. Intellectual property ownership and license rights, including copyright, of generative and other AI output, have not been fully interpreted by courts or lawmakers, and we cannot predict how future interpretations may impact our business. Certain jurisdictions have enacted, or are considering the enactment, of comprehensive legal compliance frameworks specifically related to AI. Any failure or perceived failure by us, our service providers or our

merchants to comply with such requirements, if applicable, could have an adverse impact on our business. Additionally, AI decisions or output that are based (partially or solely) on automated processing or profiling, inappropriate or controversial data practices, or insufficient disclosures regarding AI-generated content, may: undermine the decisions, predictions, analysis or solutions AI tools produce; lead to unintentional bias or discrimination; or impair the acceptance of AI solutions, subjecting us to legal liability, regulatory investigations, or competitive, reputational or other harm, which may negatively impact the value of our business, our intellectual property and our brand. The rapid evolution of AI and machine learning may require us to allocate additional resources to help implement AI and machine learning in a responsible and ethical way, in order to minimize unintended or harmful impacts, and may also require us to make investments in the development of proprietary datasets, machine learning models or other systems, which could be costly and negatively impact our profitability.

Our limited operating history in new and developing markets and new geographic regions may increase the risk that our growth and expansion efforts will not be successful.

We operate in new and developing markets that may not develop as we expect and elements of our business strategy are new and subject to ongoing development. We have encountered and will continue to encounter risks and difficulties frequently experienced by growing companies in rapidly changing industries, including increasing and unforeseen expenses as we continue to grow our business. If we do not manage these risks successfully, our business, results of operations and prospects could be harmed.