Exhibit 99.1

Forward-looking statements This presentation and the accompanying oral commentary contain forward-looking statements that involve risks, uncertainties, and assumptions. If the risks or uncertainties ever materialize or the assumptions prove incorrect, our results may differ materially from those expressed or implied by such forward-looking statements. All statements other than statements of historical fact could be deemed forward-looking, including, but not limited to, any expectations regarding investment returns; any projections of financial information; any statements about historical results that may suggest trends for our business; any statements of the plans, strategies, and objectives of management for future operations, including our manufacturing and process development; any statements of expectation or belief regarding future events, potential markets or market size, technology developments, our product pipeline, clinical data, enforceability of our intellectual property rights, competitive strengths or our position within the industry; any statements regarding the anticipated benefits of our Celgene collaboration or other strategic transactions; and any statements of assumptions underlying any of the items mentioned. These statements are based on estimates and information available to us at the time of this presentation and are not guarantees of future performance. Actual results could differ materially from our current expectations as a result of many risks and uncertainties, including but not limited to, risks associated with: the success, cost, and timing of our product development activities and clinical trials; our ability to obtain regulatory approval for and to commercialize our product candidates; our ability to establish a commercially-viable manufacturing process and manufacturing infrastructure; regulatory requirements and regulatory developments; the effects of competition and technological advances; our dependence on third-party collaborators and other contractors in our research and development activities, including for the conduct of clinical trials and the manufacture of our product candidates; our dependence on Celgene for the development and commercialization outside of North America of product candidates for which Celgene exercises an option; our ability to obtain, maintain, or protect intellectual property rights related to our product candidates; among others. For a further description of the risks and uncertainties that could cause actual results to differ from those expressed in these forward-looking statements, as well as risks relating to our business in general, see our Annual Report on Form 10-K filed with the Securities and Exchange Commission on February 29, 2016 and our other periodic reports filed from time to time with the Securities and Exchange Commission. Except as required by law, we assume no obligation and do not intend to update these forward-looking statements or to conform these statements to actual results or to changes in our expectations.

Building the leading T cell company Significant advances in CD19-directed product candidates with a go-to-market strategy defined in ALL and NHL Progress with potential best-in-class product candidates and platform Broad program in solid organ tumors in significant areas of unmet need Building platform and self-sustaining research capability to support leadership in the engineered T cell space With Celgene, global manufacturing, development, and commercial capabilities to bring engineered T cells to market globally

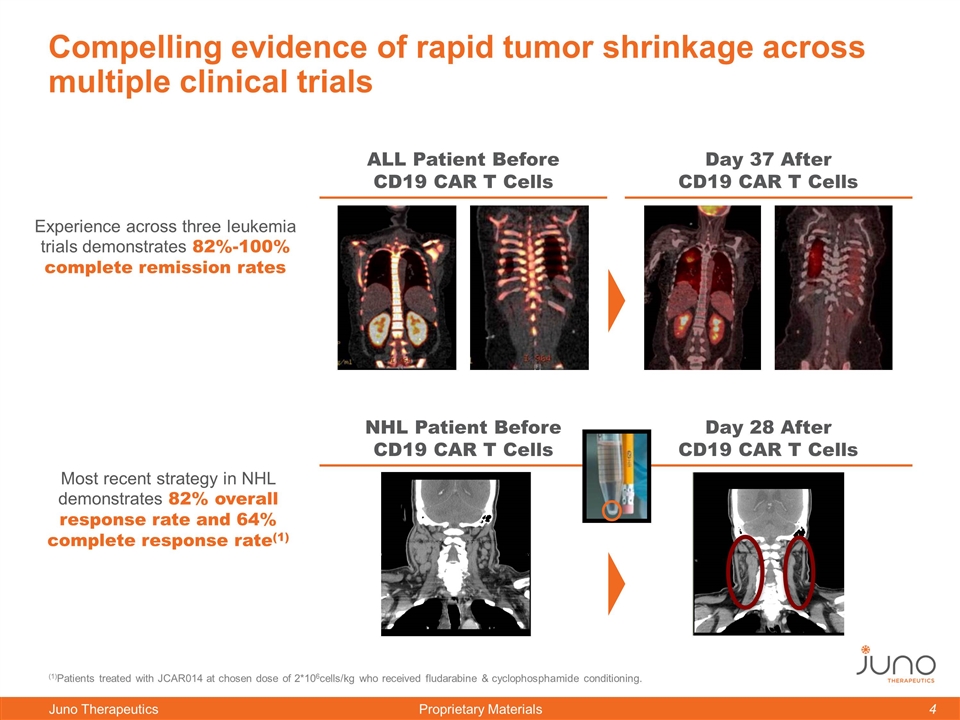

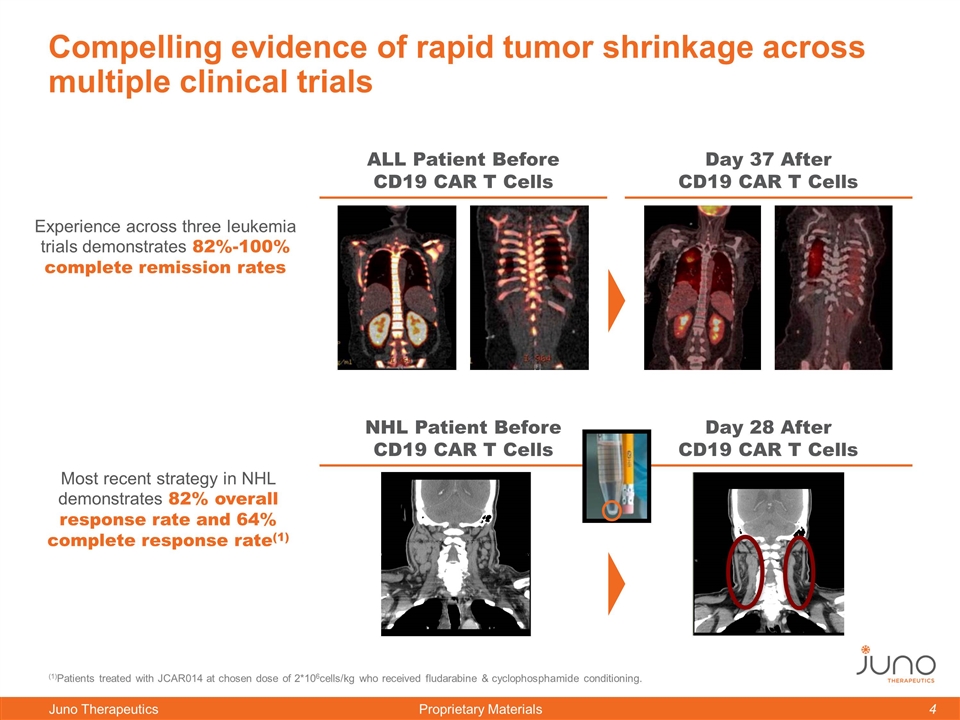

Compelling evidence of rapid tumor shrinkage across multiple clinical trials Experience across three leukemia trials demonstrates 82%-100% complete remission rates Most recent strategy in NHL demonstrates 82% overall response rate and 64% complete response rate(1) Day 37 After CD19 CAR T Cells ALL Patient Before CD19 CAR T Cells Day 28 After CD19 CAR T Cells NHL Patient Before CD19 CAR T Cells (1)Patients treated with JCAR014 at chosen dose of 2*106cells/kg who received fludarabine & cyclophosphamide conditioning.

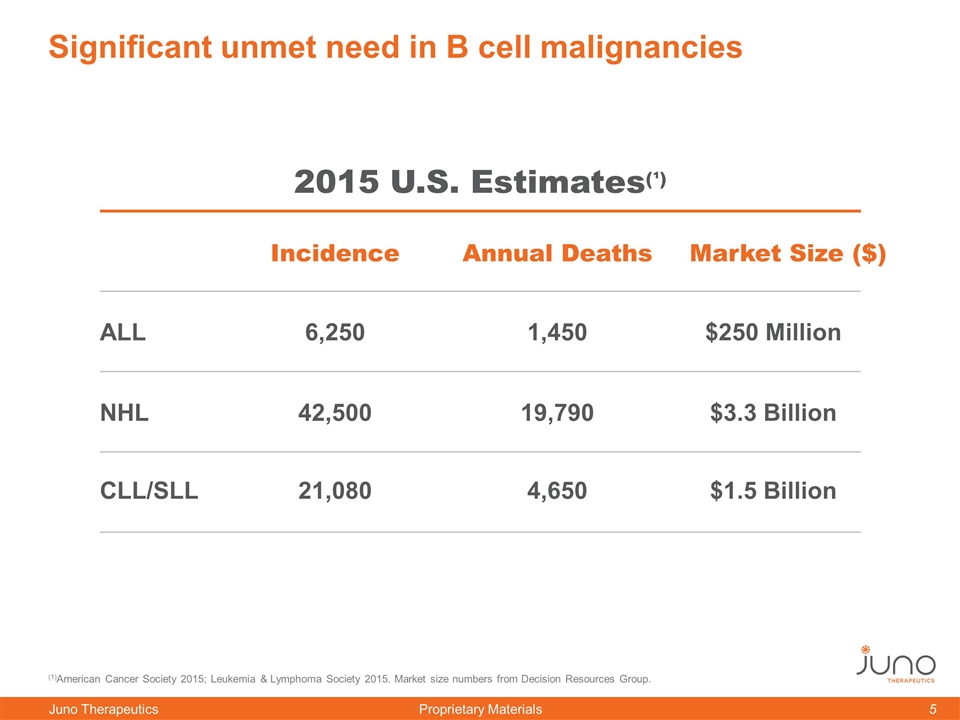

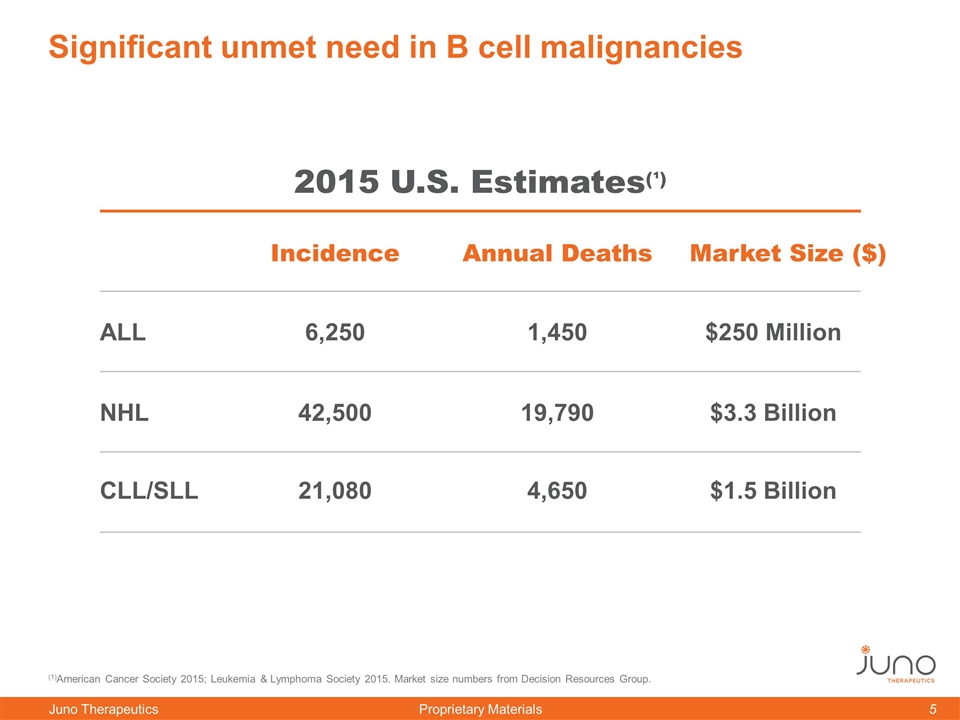

Significant unmet need in B cell malignancies (1)American Cancer Society 2015; Leukemia & Lymphoma Society 2015. Market size numbers from Decision Resources Group. Incidence Annual Deaths ALL NHL CLL/SLL 6,250 42,500 21,080 1,450 19,790 4,650 2015 U.S. Estimates(¹) Market Size ($) $250 Million $3.3 Billion $1.5 Billion

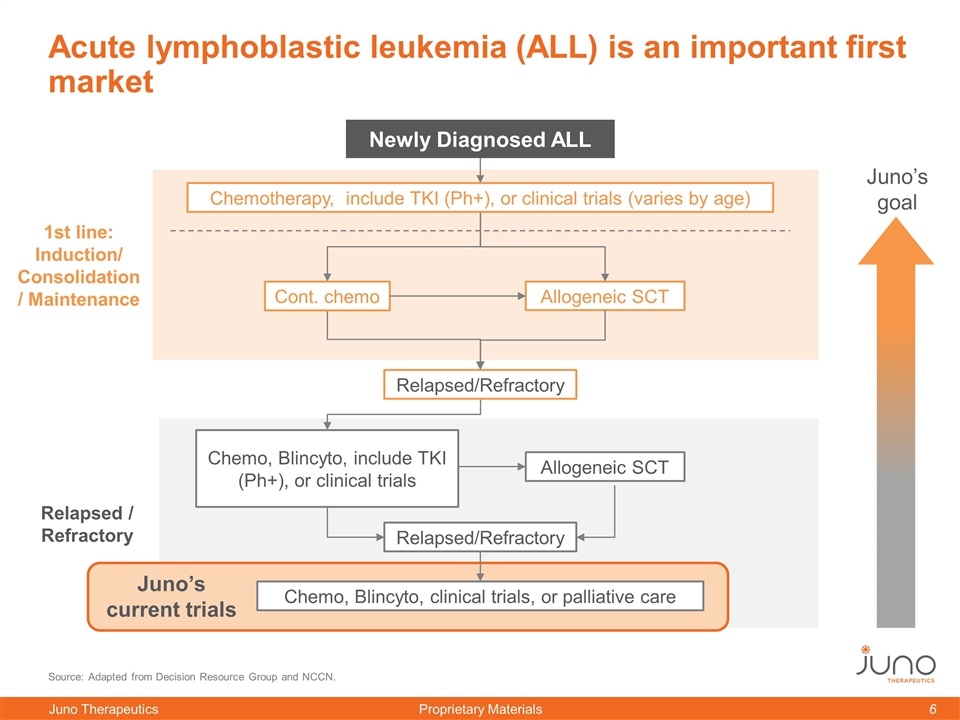

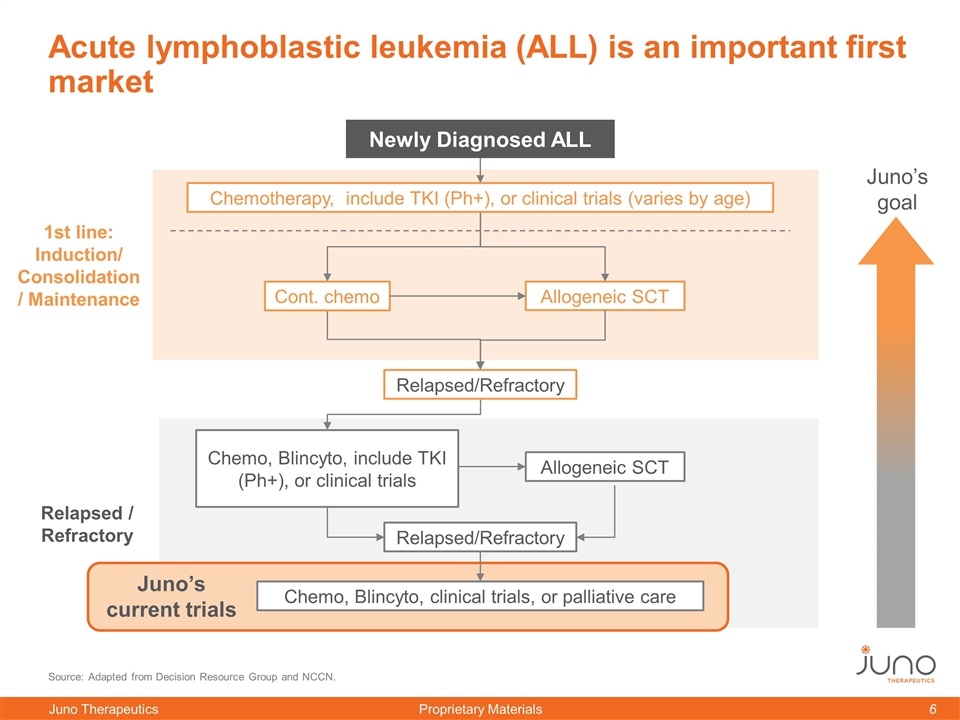

Source: Adapted from Decision Resource Group and NCCN. Relapsed/Refractory Chemo, Blincyto, include TKI (Ph+), or clinical trials Relapsed/Refractory Chemo, Blincyto, clinical trials, or palliative care 1st line: Induction/ Consolidation/ Maintenance Relapsed / Refractory Acute lymphoblastic leukemia (ALL) is an important first market Juno’s goal Chemotherapy, include TKI (Ph+), or clinical trials (varies by age) Newly Diagnosed ALL Allogeneic SCT Juno’s current trials Cont. chemo Allogeneic SCT

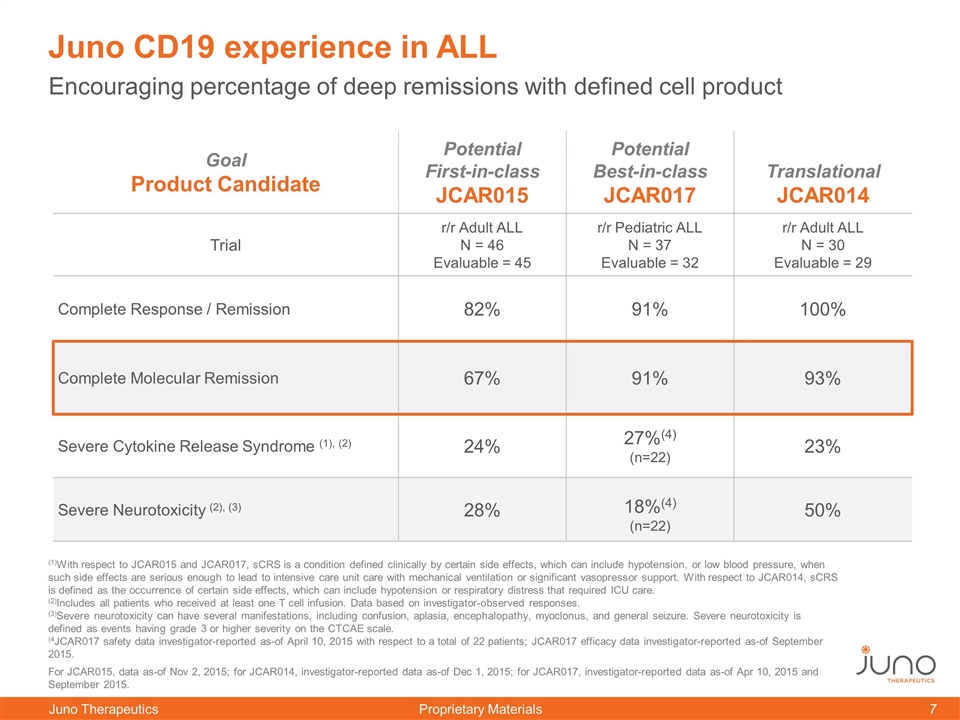

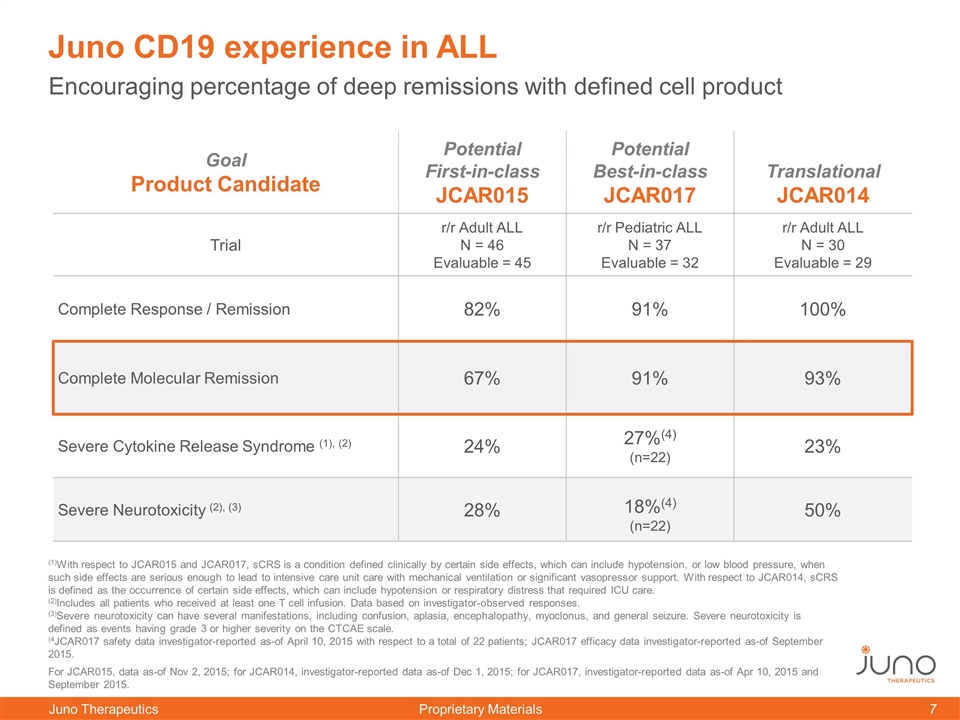

Encouraging percentage of deep remissions with defined cell product Juno CD19 experience in ALL Goal Product Candidate Potential First-in-class JCAR015 Potential Best-in-class JCAR017 Translational JCAR014 Trial r/r Adult ALL N = 46 Evaluable = 45 r/r Pediatric ALL N = 37 Evaluable = 32 r/r Adult ALL N = 30 Evaluable = 29 Complete Response / Remission 82% 91% 100% Complete Molecular Remission 67% 91% 93% Severe Cytokine Release Syndrome (1), (2) 24% 27%(4) (n=22) 23% Severe Neurotoxicity (2), (3) 28% 18%(4) (n=22) 50% (1)With respect to JCAR015 and JCAR017, sCRS is a condition defined clinically by certain side effects, which can include hypotension, or low blood pressure, when such side effects are serious enough to lead to intensive care unit care with mechanical ventilation or significant vasopressor support. With respect to JCAR014, sCRS is defined as the occurrence of certain side effects, which can include hypotension or respiratory distress that required ICU care. (2)Includes all patients who received at least one T cell infusion. Data based on investigator-observed responses. (3)Severe neurotoxicity can have several manifestations, including confusion, aplasia, encephalopathy, myoclonus, and general seizure. Severe neurotoxicity is defined as events having grade 3 or higher severity on the CTCAE scale. (4JCAR017 safety data investigator-reported as-of April 10, 2015 with respect to a total of 22 patients; JCAR017 efficacy data investigator-reported as-of September 2015. For JCAR015, data as-of Nov 2, 2015; for JCAR014, investigator-reported data as-of Dec 1, 2015; for JCAR017, investigator-reported data as-of Apr 10, 2015 and September 2015.

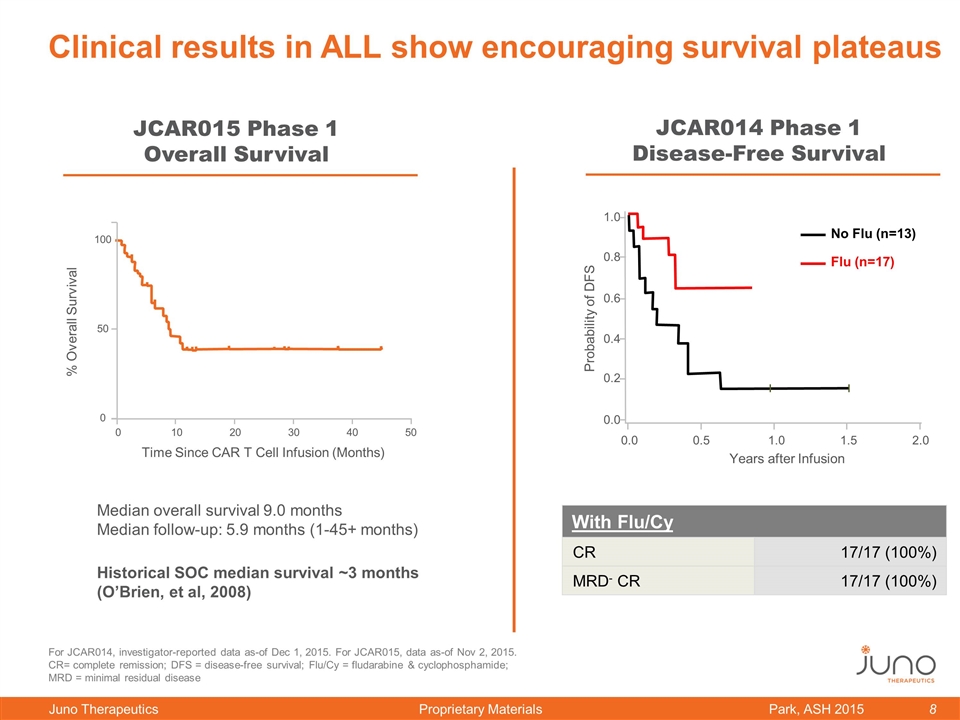

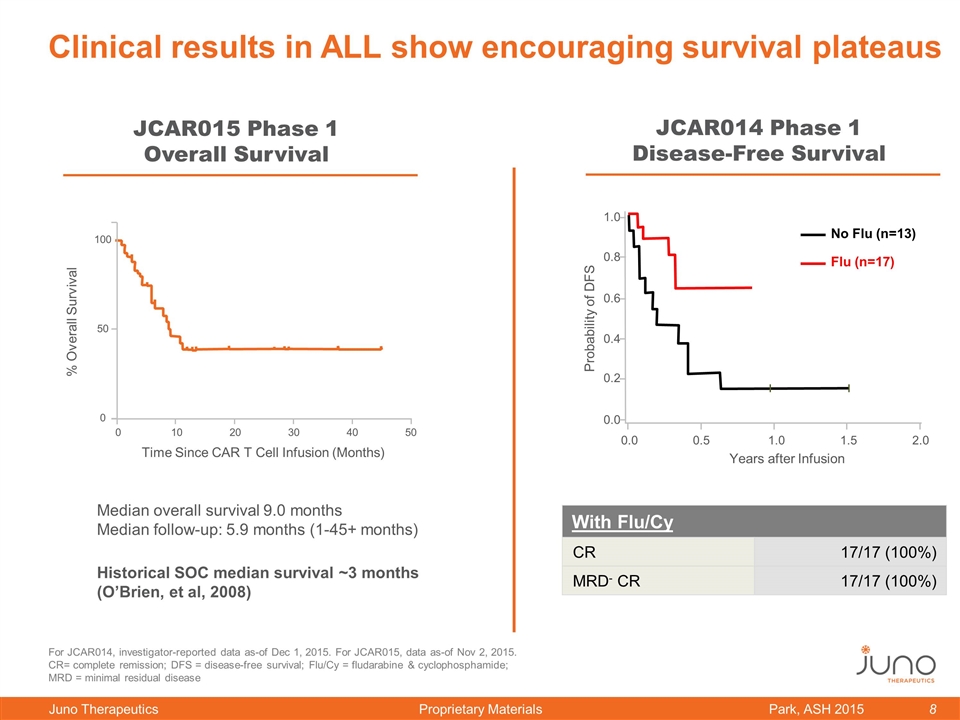

Clinical results in ALL show encouraging survival plateaus Park, ASH 2015 Median overall survival 9.0 months Median follow-up: 5.9 months (1-45+ months) Historical SOC median survival ~3 months (O’Brien, et al, 2008) 0 50 100 0 10 20 30 40 50 Time Since CAR T Cell Infusion (Months) % Overall Survival JCAR015 Phase 1 Overall Survival Years after Infusion Probability of DFS 0.0 0.5 1.0 1.5 2.0 0.0 0.2 0.4 0.6 0.8 1.0 No Flu (n=13) Flu (n=17) With Flu/Cy CR 17/17 (100%) MRD- CR 17/17 (100%) JCAR014 Phase 1 Disease-Free Survival For JCAR014, investigator-reported data as-of Dec 1, 2015. For JCAR015, data as-of Nov 2, 2015. CR= complete remission; DFS = disease-free survival; Flu/Cy = fludarabine & cyclophosphamide; MRD = minimal residual disease

JCAR018: Increasing selection pressure in B cell malignancies The two mechanisms for relapse with CD19 CAR T cells are loss of CAR T cells and loss of CD19 CD22-directed CAR addresses CD19 epitope loss Data at ASH were encouraging with CMRs and the Phase I dose-escalation study is ongoing First clinical milestone paid to Opus Bio in 1Q16; more data expected later in 2016 Multiple options to incorporate targeting CD22 in improving the number of durable, long-term remissions

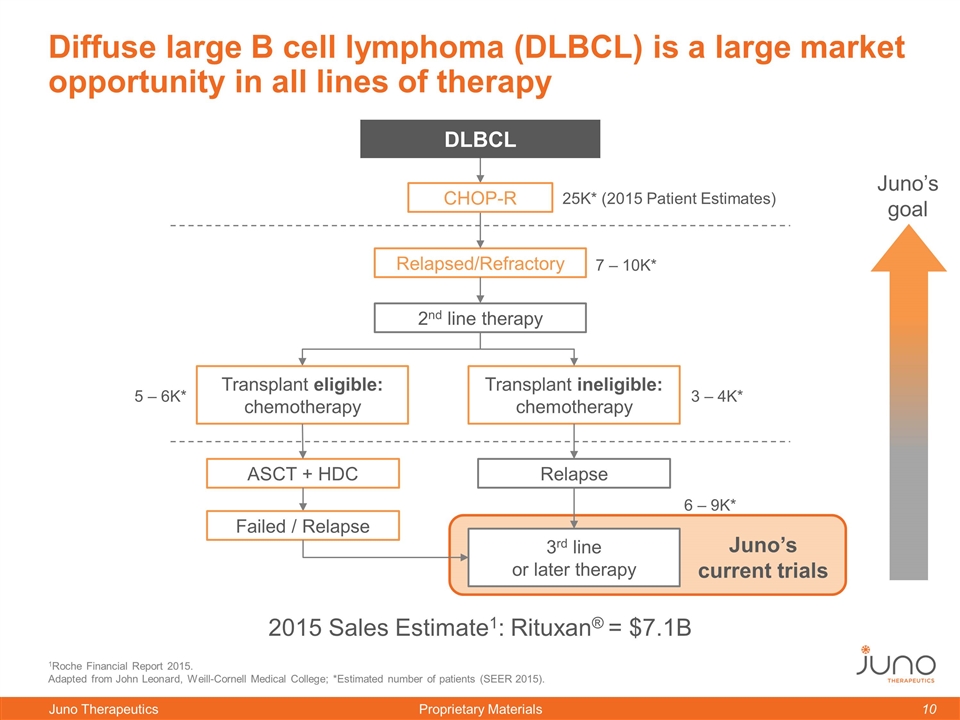

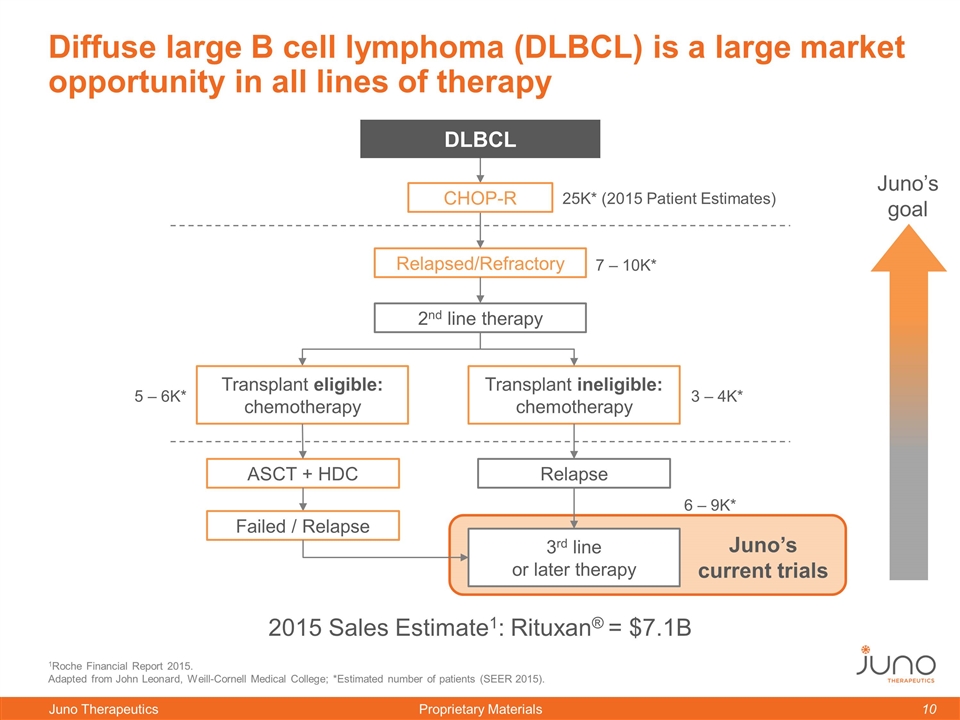

1Roche Financial Report 2015. Adapted from John Leonard, Weill-Cornell Medical College; *Estimated number of patients (SEER 2015). Relapsed/Refractory Transplant ineligible: chemotherapy Diffuse large B cell lymphoma (DLBCL) is a large market opportunity in all lines of therapy Juno’s goal CHOP-R DLBCL 2015 Sales Estimate1: Rituxan® = $7.1B 3rd line or later therapy 25K* (2015 Patient Estimates) Transplant eligible: chemotherapy 7 – 10K* 5 – 6K* 3 – 4K* 6 – 9K* Juno’s current trials ASCT + HDC Failed / Relapse 2nd line therapy Relapse

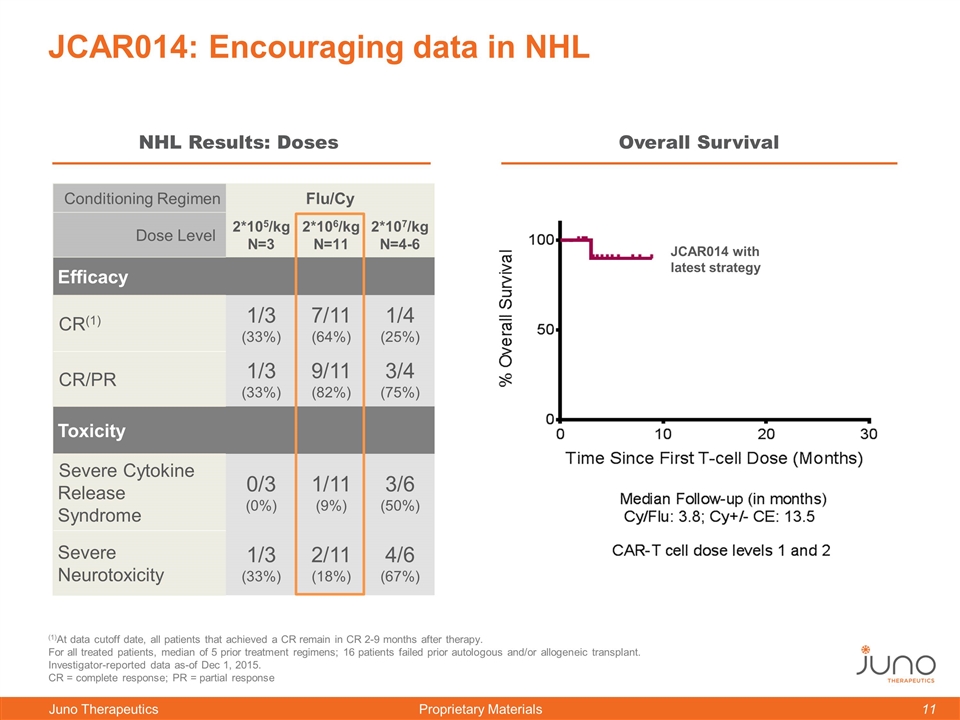

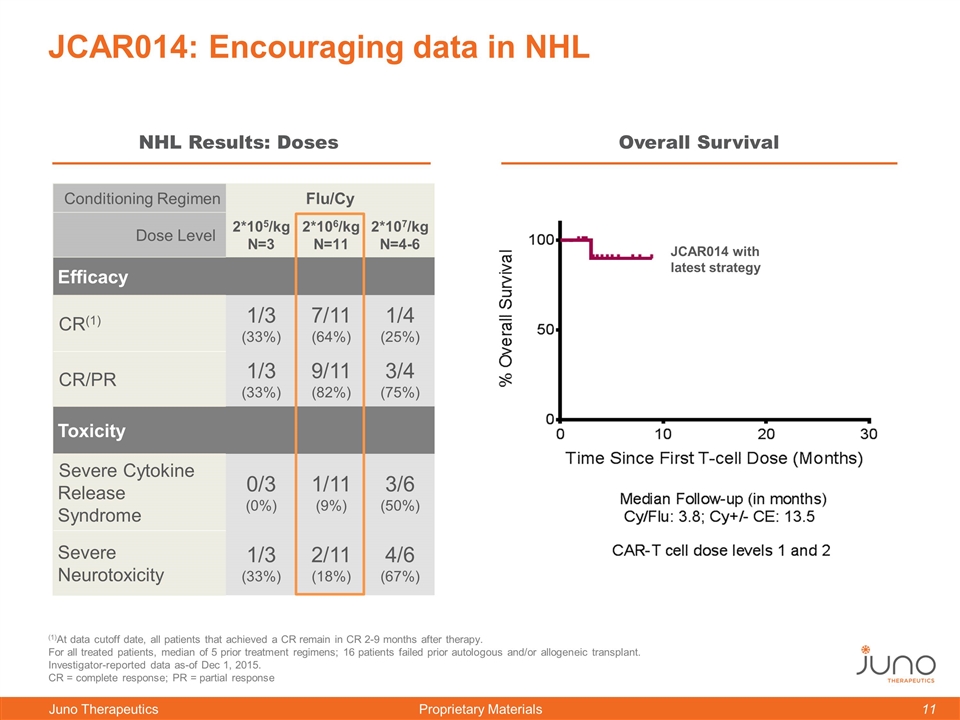

Conditioning Regimen Flu/Cy Dose Level 2*105/kg N=3 2*106/kg N=11 2*107/kg N=4-6 Efficacy CR(1) 1/3 (33%) 7/11 (64%) 1/4 (25%) CR/PR 1/3 (33%) 9/11 (82%) 3/4 (75%) Toxicity Severe Cytokine Release Syndrome 0/3 (0%) 1/11 (9%) 3/6 (50%) Severe Neurotoxicity 1/3 (33%) 2/11 (18%) 4/6 (67%) JCAR014: Encouraging data in NHL NHL Results: Doses Overall Survival (1)At data cutoff date, all patients that achieved a CR remain in CR 2-9 months after therapy. For all treated patients, median of 5 prior treatment regimens; 16 patients failed prior autologous and/or allogeneic transplant. Investigator-reported data as-of Dec 1, 2015. CR = complete response; PR = partial response JCAR014 with latest strategy

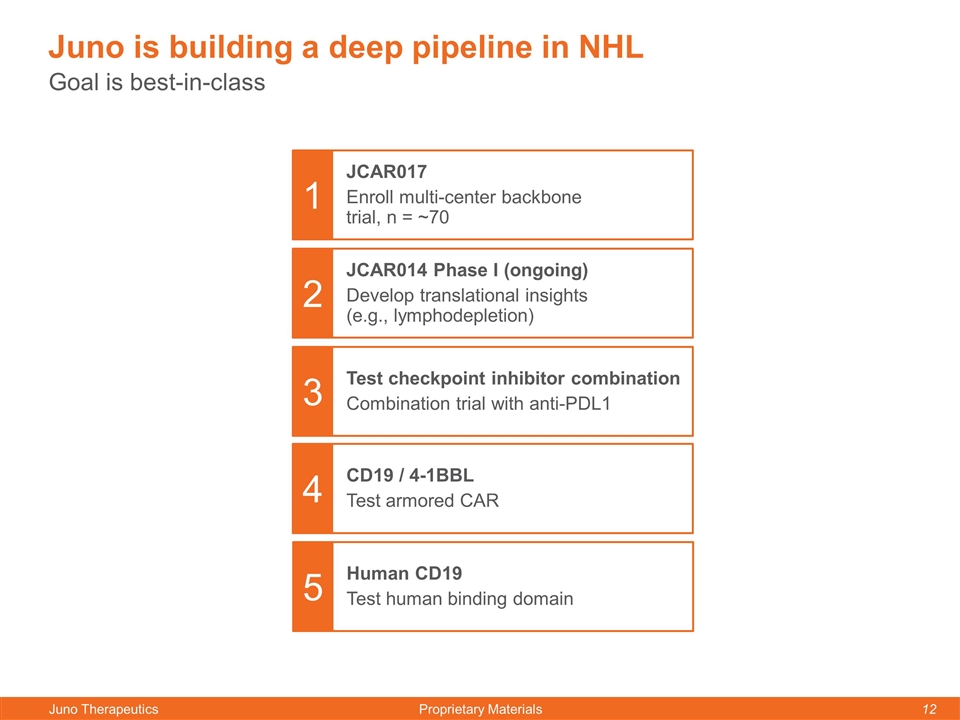

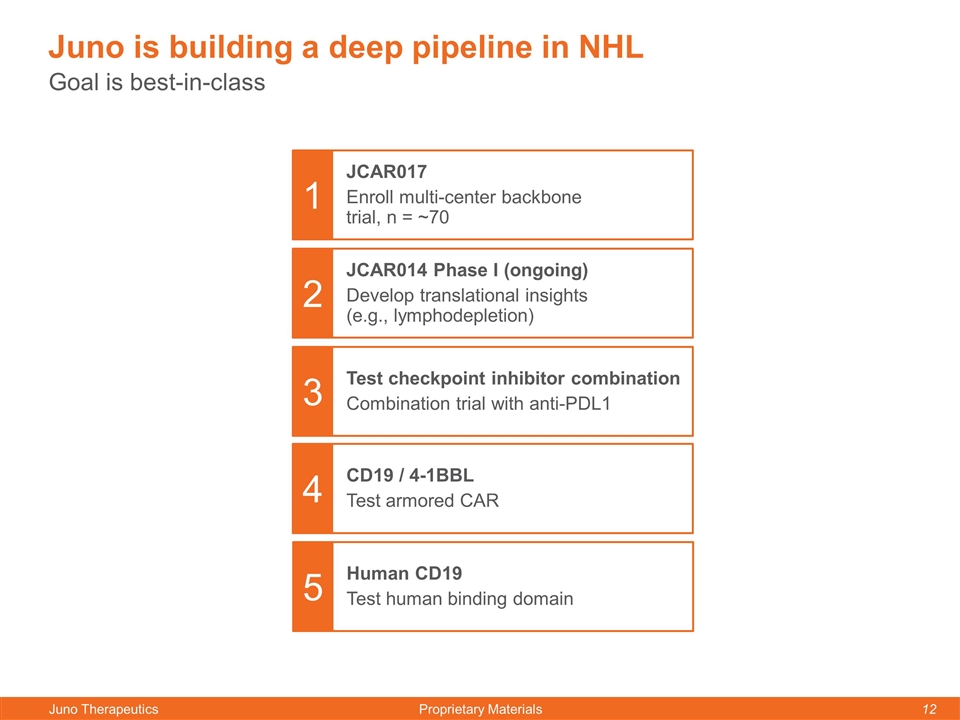

Goal is best-in-class Juno is building a deep pipeline in NHL JCAR017 Enroll multi-center backbone trial, n = ~70 JCAR014 Phase I (ongoing) Develop translational insights (e.g., lymphodepletion) Test checkpoint inhibitor combination Combination trial with anti-PDL1 CD19 / 4-1BBL Test armored CAR 1 2 3 4 Human CD19 Test human binding domain 5

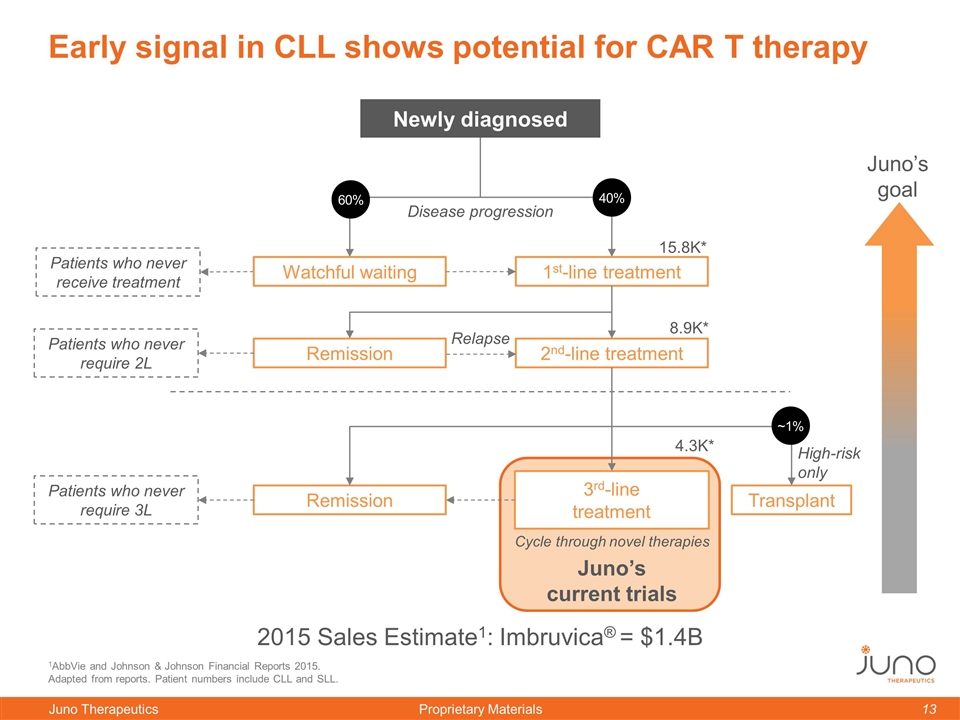

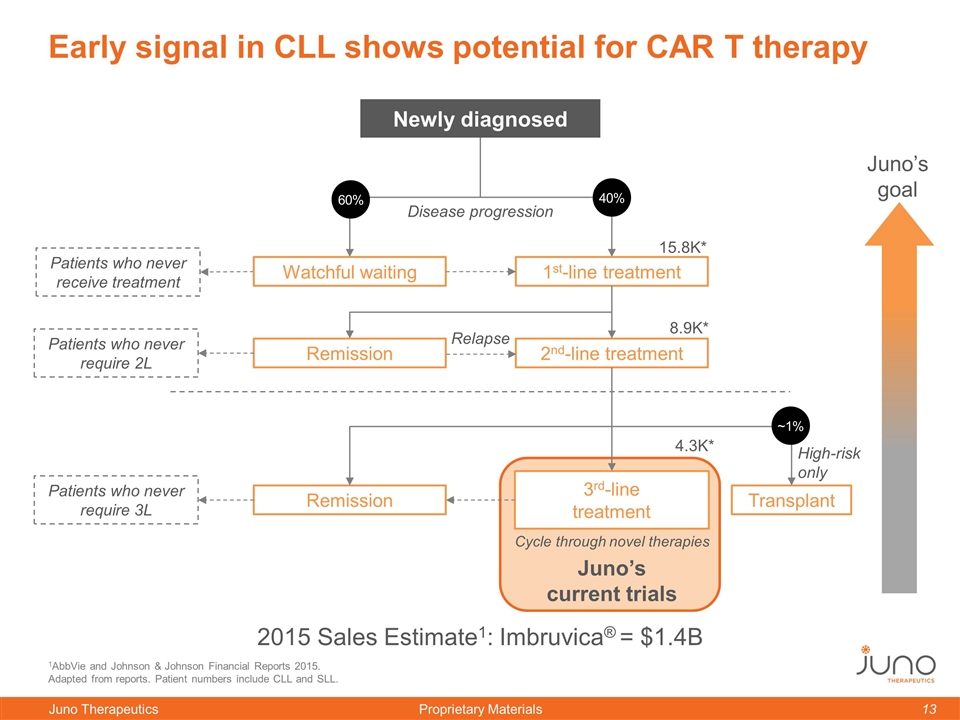

1AbbVie and Johnson & Johnson Financial Reports 2015. Adapted from reports. Patient numbers include CLL and SLL. Watchful waiting 1st-line treatment 2nd-line treatment Early signal in CLL shows potential for CAR T therapy Juno’s goal Newly diagnosed 2015 Sales Estimate1: Imbruvica® = $1.4B 3rd-line treatment Disease progression Remission 15.8K* 4.3K* Patients who never receive treatment 60% 40% Relapse 8.9K* Patients who never require 2L Cycle through novel therapies Remission Patients who never require 3L Transplant ~1% High-risk only Juno’s current trials

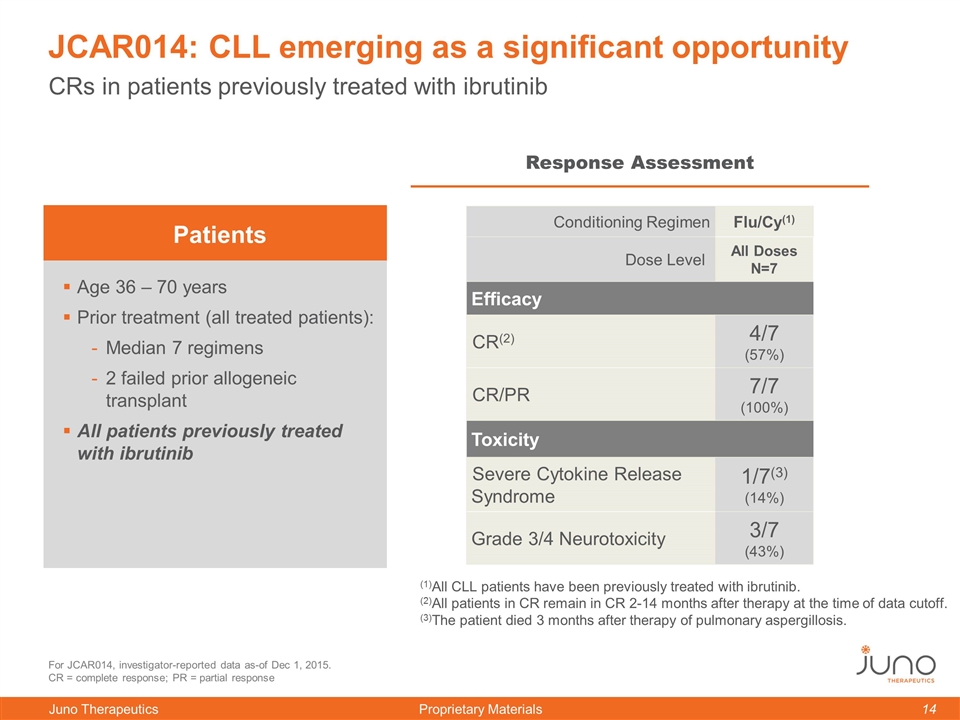

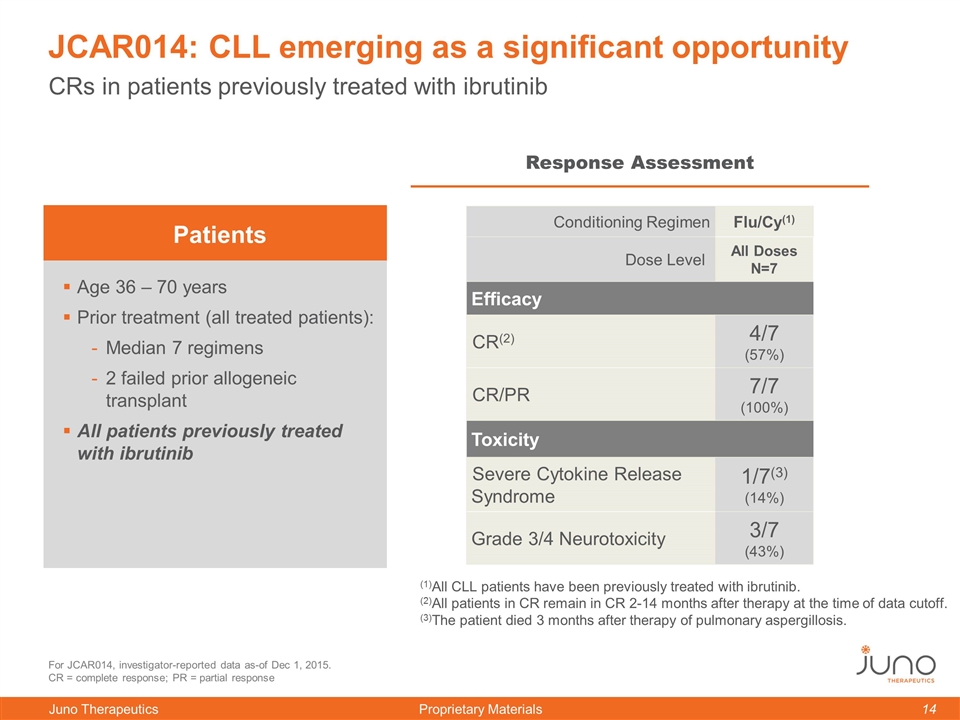

CRs in patients previously treated with ibrutinib JCAR014: CLL emerging as a significant opportunity Response Assessment Age 36 – 70 years Prior treatment (all treated patients): Median 7 regimens 2 failed prior allogeneic transplant All patients previously treated with ibrutinib Patients For JCAR014, investigator-reported data as-of Dec 1, 2015. CR = complete response; PR = partial response Conditioning Regimen Flu/Cy(1) Dose Level All Doses N=7 Efficacy CR(2) 4/7 (57%) CR/PR 7/7 (100%) Toxicity Severe Cytokine Release Syndrome 1/7(3) (14%) Grade 3/4 Neurotoxicity 3/7 (43%) (1)All CLL patients have been previously treated with ibrutinib. (2)All patients in CR remain in CR 2-14 months after therapy at the time of data cutoff. (3)The patient died 3 months after therapy of pulmonary aspergillosis.

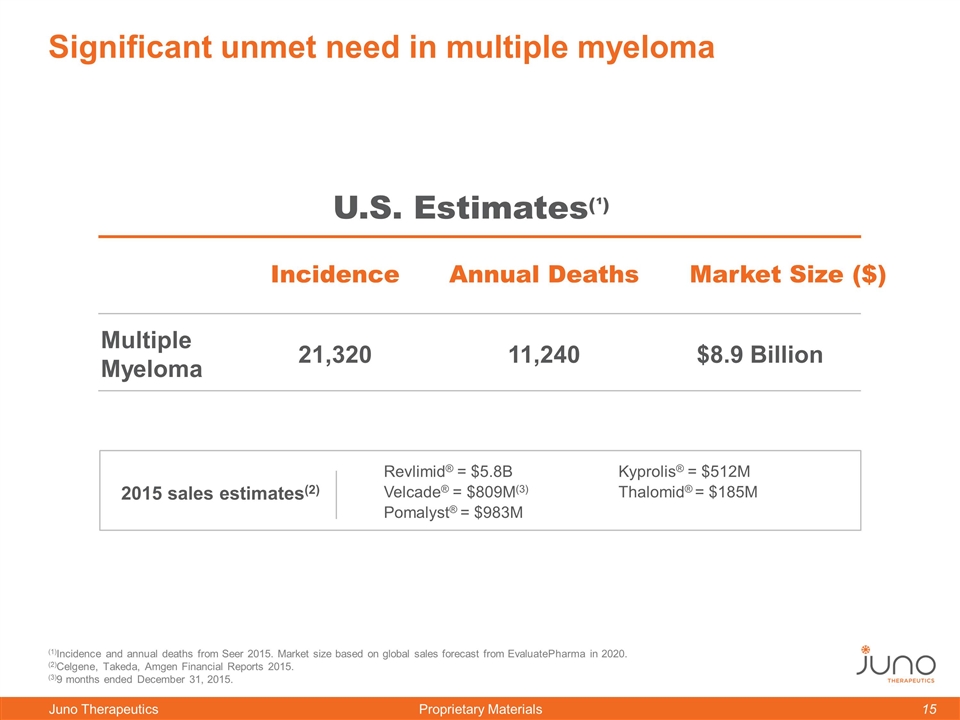

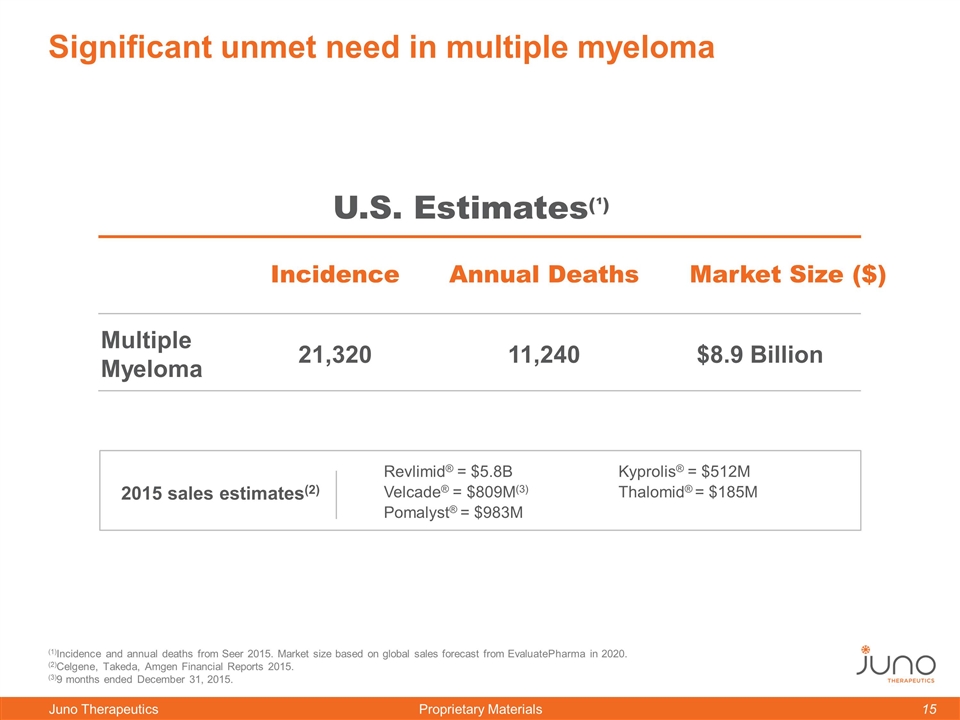

Significant unmet need in multiple myeloma Incidence Annual Deaths Multiple Myeloma 21,320 11,240 U.S. Estimates(¹) $8.9 Billion (1)Incidence and annual deaths from Seer 2015. Market size based on global sales forecast from EvaluatePharma in 2020. (2)Celgene, Takeda, Amgen Financial Reports 2015. (3)9 months ended December 31, 2015. Revlimid® = $5.8B Velcade® = $809M(3) Pomalyst® = $983M 2015 sales estimates(2) Kyprolis® = $512M Thalomid® = $185M Market Size ($)

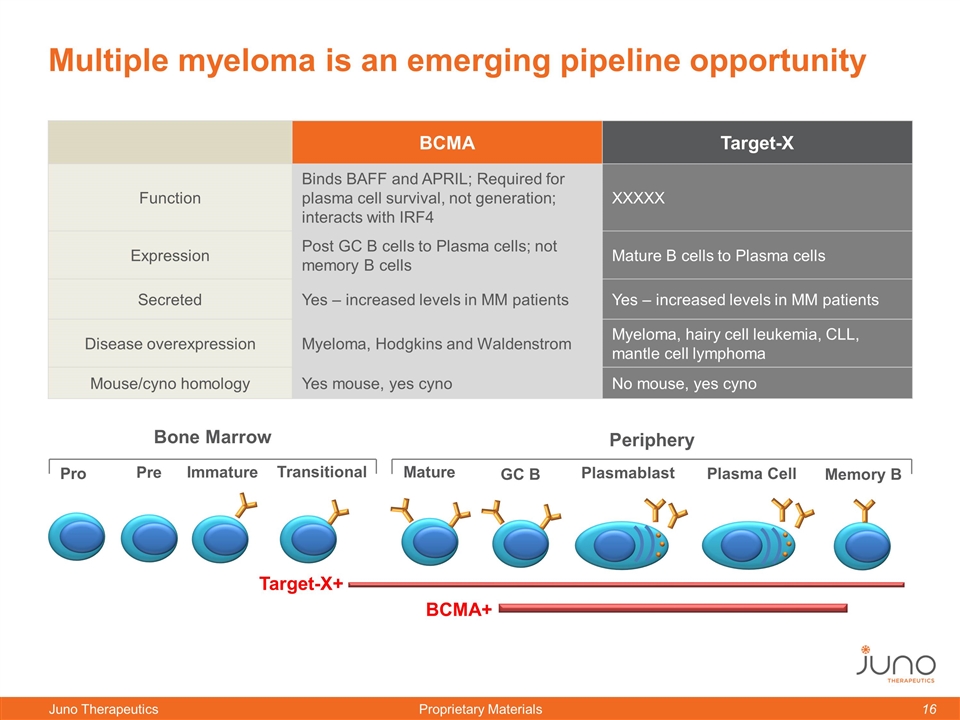

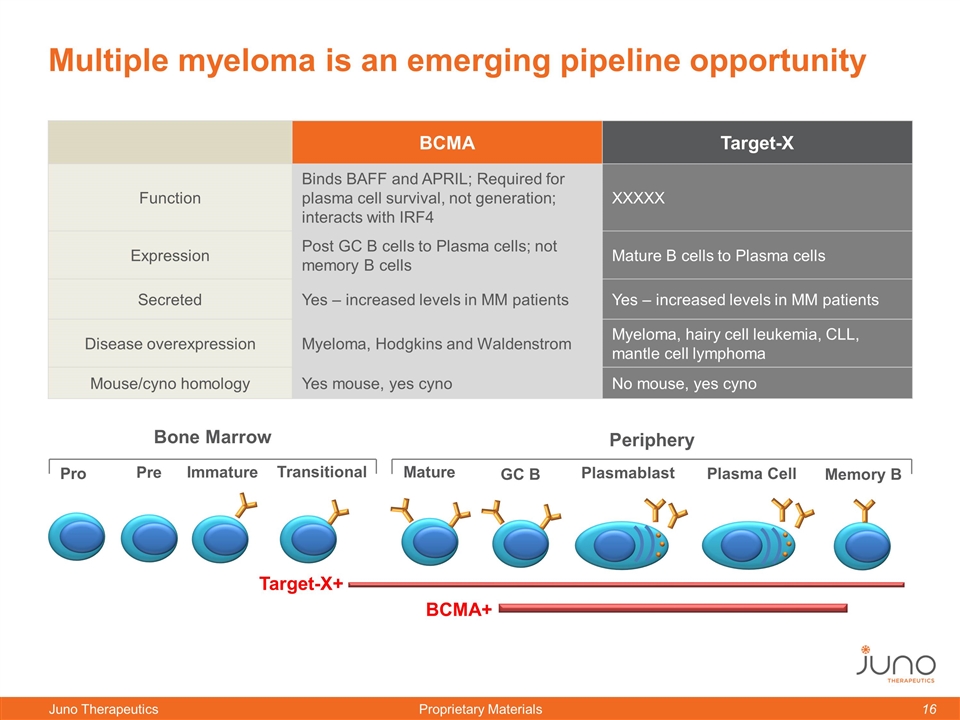

Multiple myeloma is an emerging pipeline opportunity BCMA Target-X Function Binds BAFF and APRIL; Required for plasma cell survival, not generation; interacts with IRF4 XXXXX Expression Post GC B cells to Plasma cells; not memory B cells Mature B cells to Plasma cells Secreted Yes – increased levels in MM patients Yes – increased levels in MM patients Disease overexpression Myeloma, Hodgkins and Waldenstrom Myeloma, hairy cell leukemia, CLL, mantle cell lymphoma Mouse/cyno homology Yes mouse, yes cyno No mouse, yes cyno Bone Marrow Periphery Pro Immature Pre Transitional Mature GC B Plasmablast Plasma Cell Memory B BCMA+ Target-X+

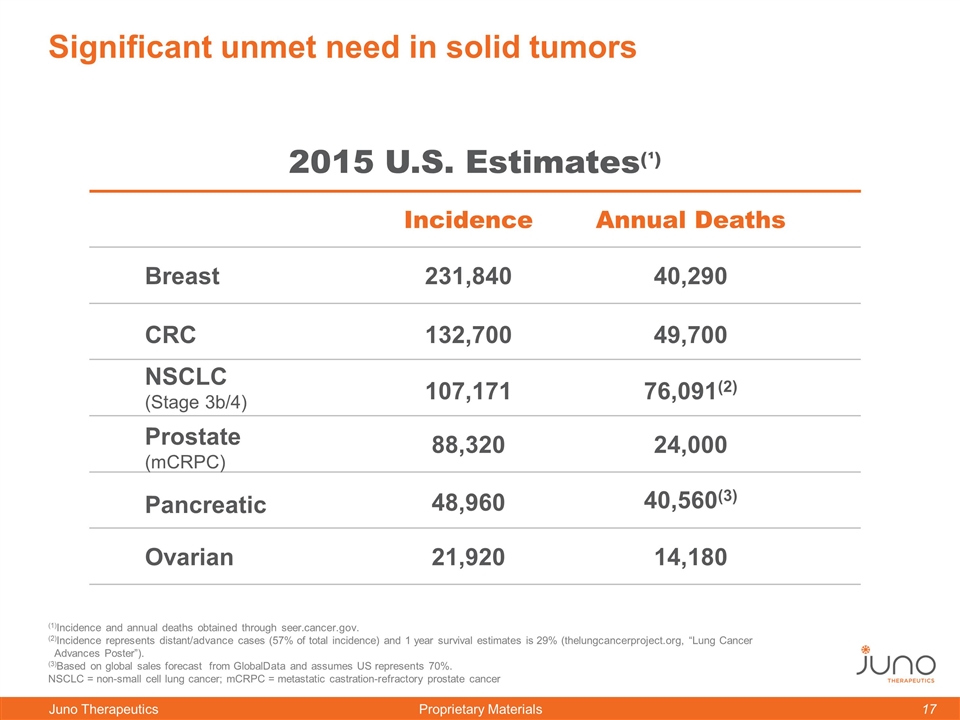

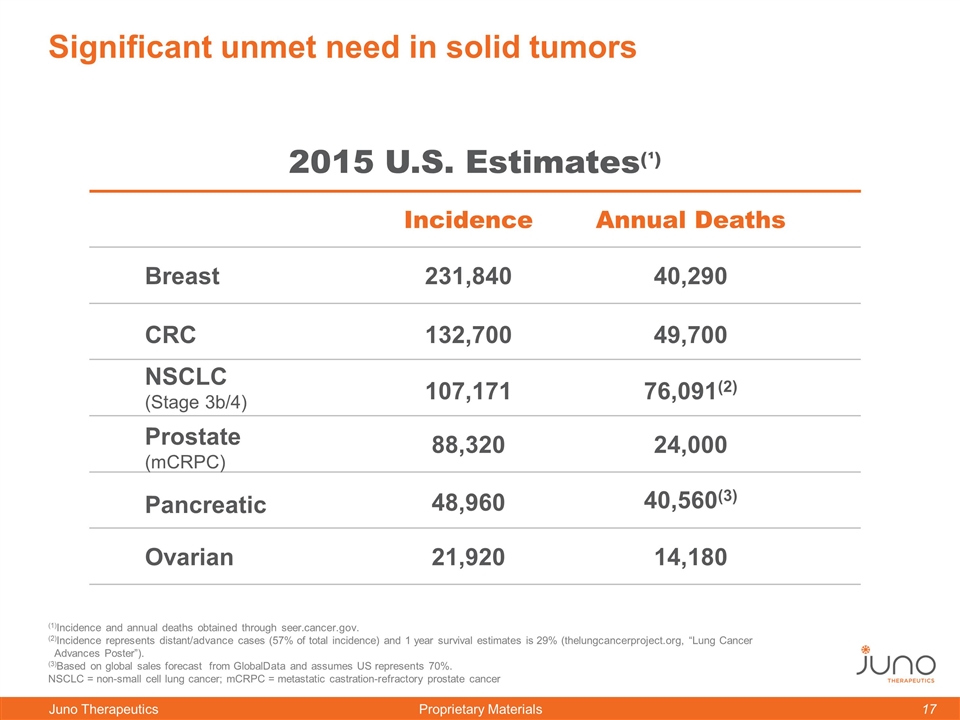

Significant unmet need in solid tumors Incidence Annual Deaths NSCLC (Stage 3b/4) 107,171 132,700 21,920 76,091(2) 49,700 14,180 2015 U.S. Estimates(¹) 88,320 24,000 (1)Incidence and annual deaths obtained through seer.cancer.gov. (2)Incidence represents distant/advance cases (57% of total incidence) and 1 year survival estimates is 29% (thelungcancerproject.org, “Lung Cancer Advances Poster”). (3)Based on global sales forecast from GlobalData and assumes US represents 70%. NSCLC = non-small cell lung cancer; mCRPC = metastatic castration-refractory prostate cancer Ovarian CRC Breast Prostate (mCRPC) Pancreatic 231,840 40,290 48,960 40,560(3)

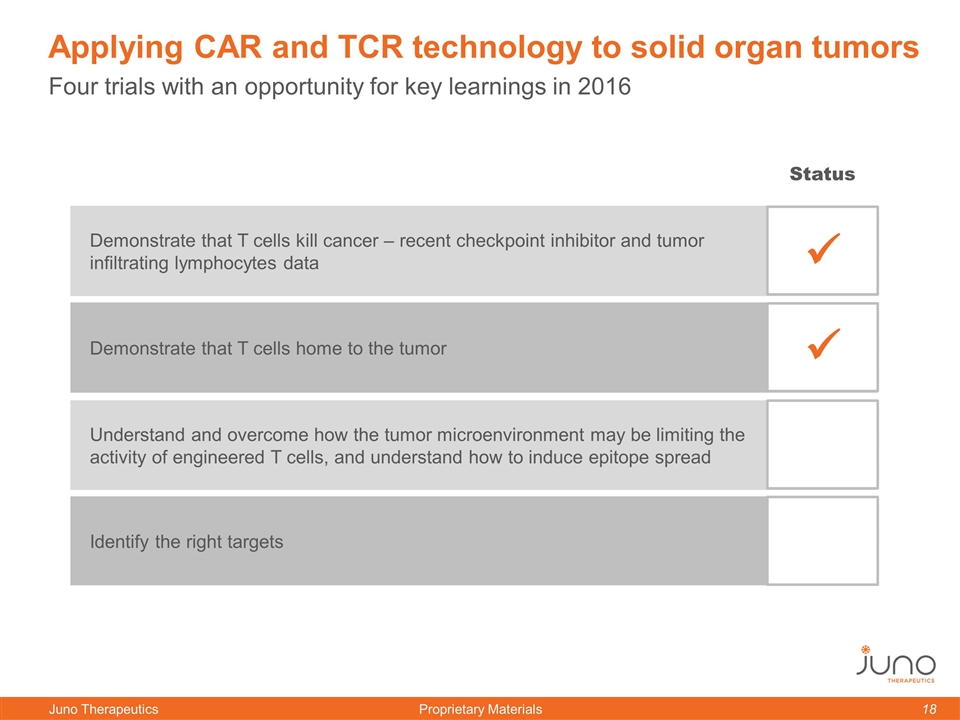

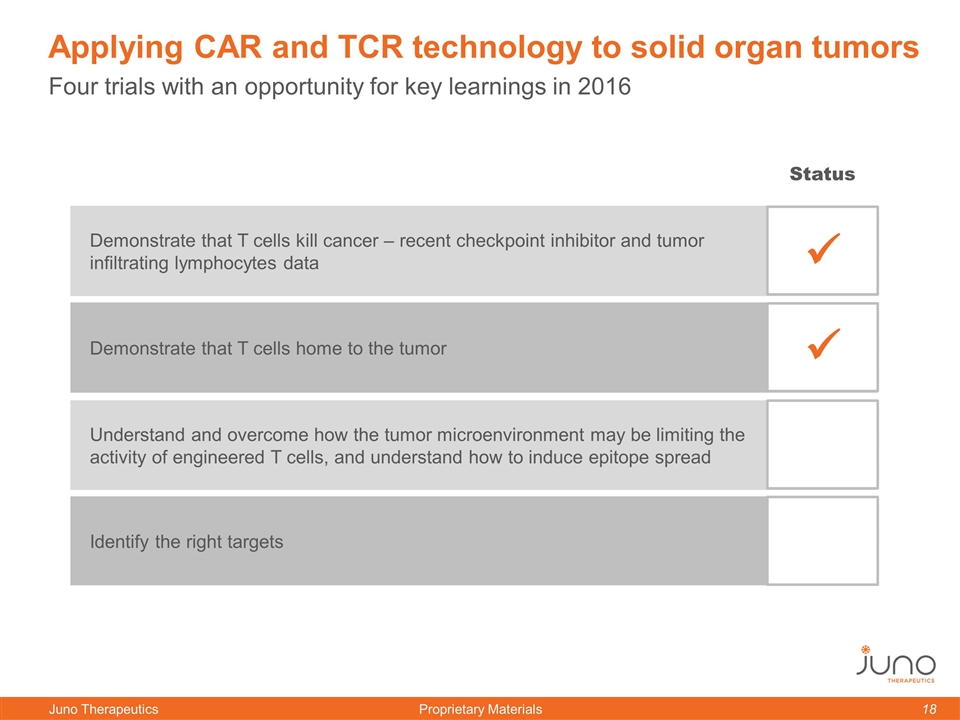

Four trials with an opportunity for key learnings in 2016 Applying CAR and TCR technology to solid organ tumors Demonstrate that T cells kill cancer – recent checkpoint inhibitor and tumor infiltrating lymphocytes data Demonstrate that T cells home to the tumor Understand and overcome how the tumor microenvironment may be limiting the activity of engineered T cells, and understand how to induce epitope spread Identify the right targets ü ü Status ü

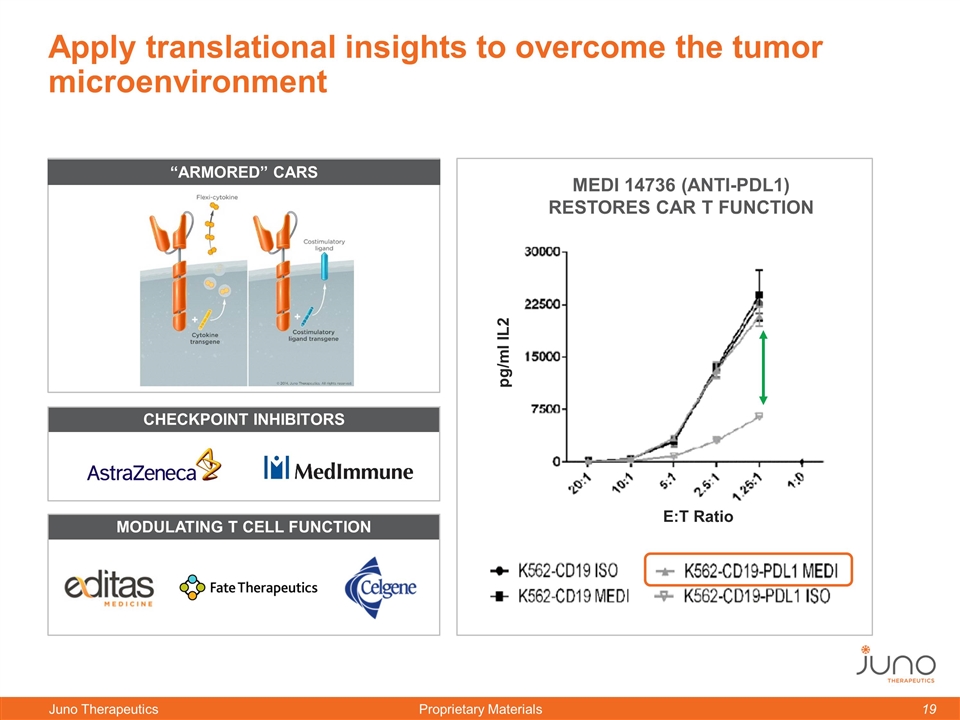

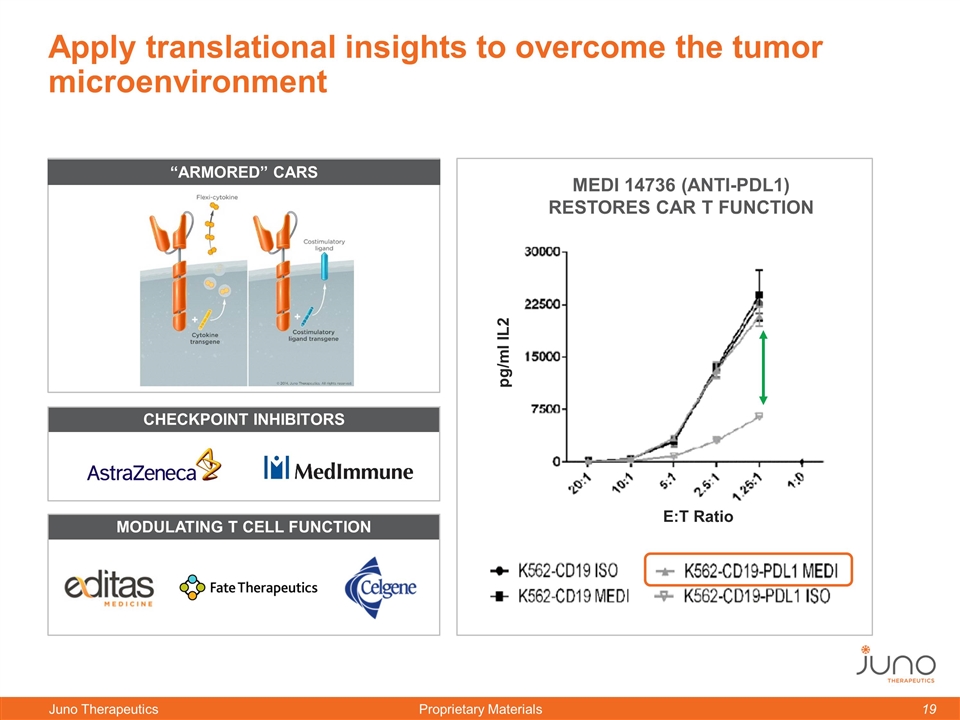

Apply translational insights to overcome the tumor microenvironment Checkpoint Inhibitors Modulating T Cell Function pg/ml IL2 Medi 14736 (anti-PDL1) restores CAR T Function “Armored” CARs E:T Ratio

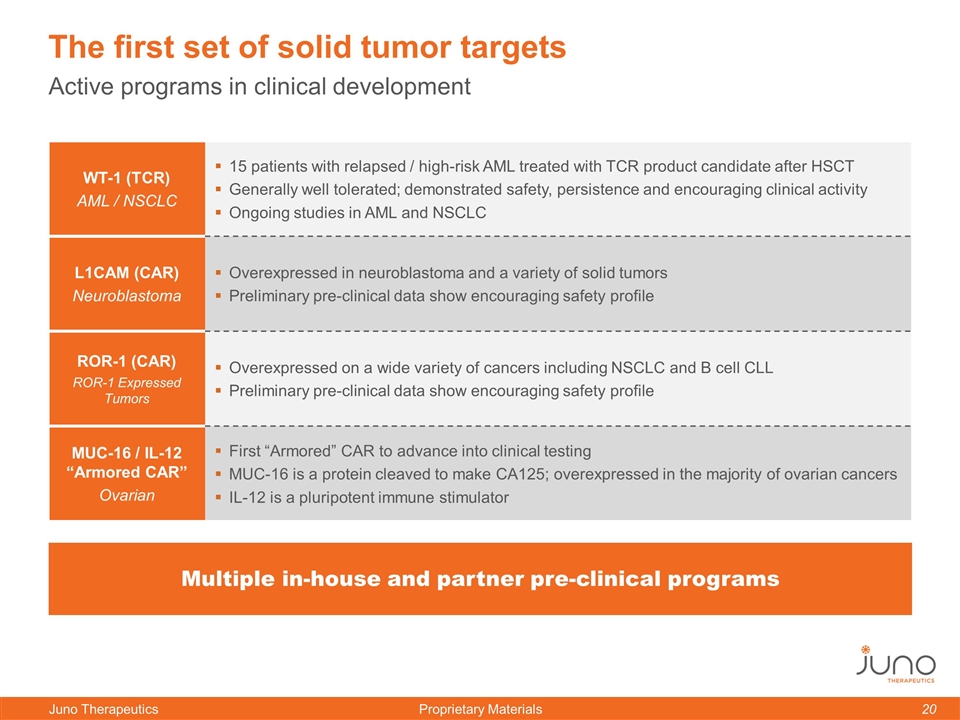

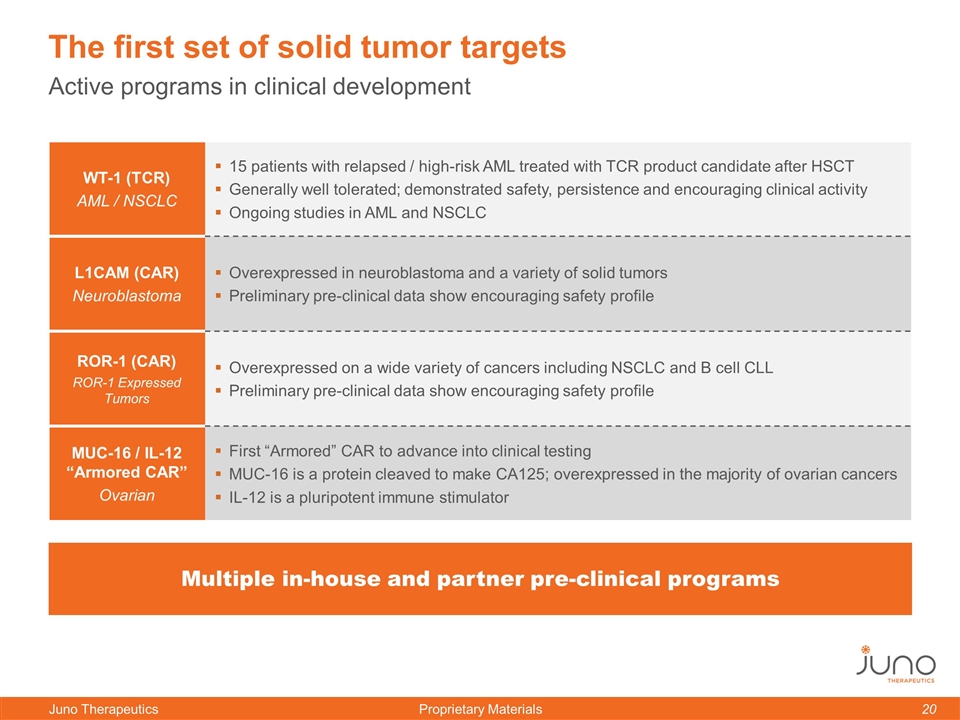

Active programs in clinical development The first set of solid tumor targets WT-1 (TCR) AML / NSCLC 15 patients with relapsed / high-risk AML treated with TCR product candidate after HSCT Generally well tolerated; demonstrated safety, persistence and encouraging clinical activity Ongoing studies in AML and NSCLC L1CAM (CAR) Neuroblastoma Overexpressed in neuroblastoma and a variety of solid tumors Preliminary pre-clinical data show encouraging safety profile ROR-1 (CAR) ROR-1 Expressed Tumors Overexpressed on a wide variety of cancers including NSCLC and B cell CLL Preliminary pre-clinical data show encouraging safety profile MUC-16 / IL-12 “Armored CAR” Ovarian First “Armored” CAR to advance into clinical testing MUC-16 is a protein cleaved to make CA125; overexpressed in the majority of ovarian cancers IL-12 is a pluripotent immune stimulator Multiple in-house and partner pre-clinical programs

Building a category leader Manufacturing capabilities JuMP facility online Defined cell product Global reach Celgene collaboration Research capabilities Internal and BD opportunities Strong balance sheet $1.22 billion at year end 2015

Manufacturing infrastructure to support patient supply Facility online to supply clinical material for ongoing Phase II ROCKET trial Capacity for thousands of patients with a scalable and modular design Flexible capacity and able to process multiple products Functionally closed process with extensive use of automation Processes predictably produce CAR T cells without patient pre-selection to date Defined cell process positions Juno to exploit biologic insights today and in the future Medium term goal to implement two day manufacturing process

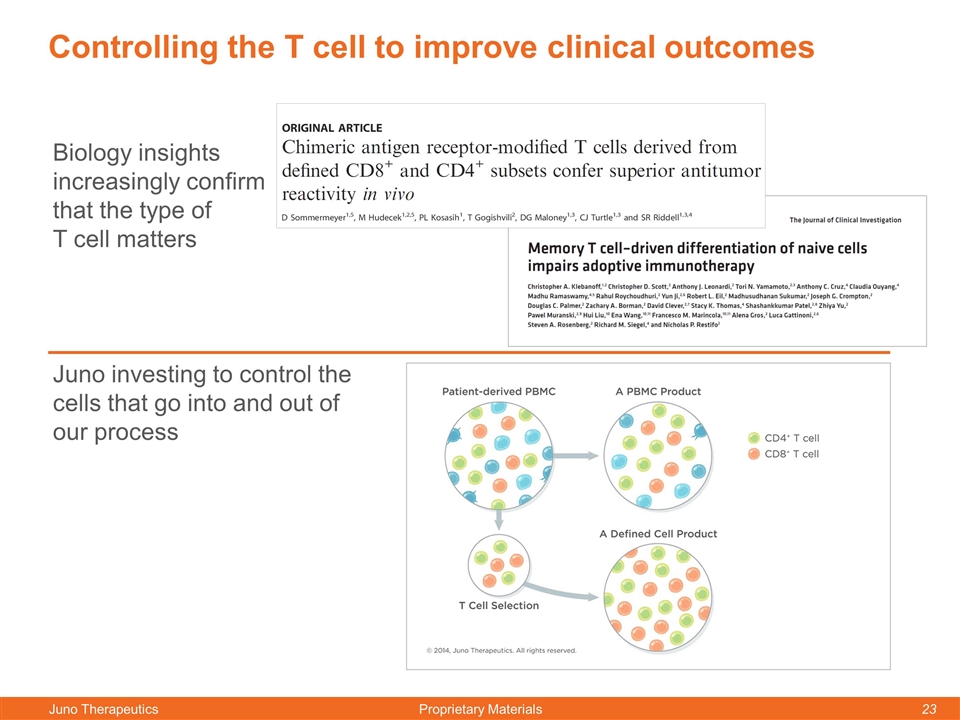

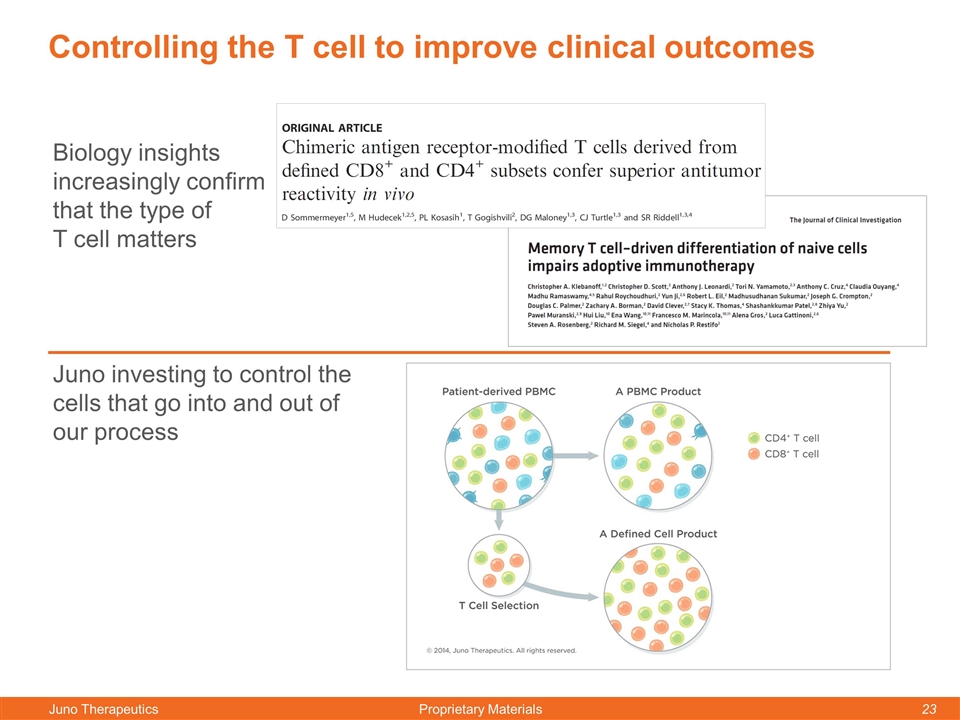

Controlling the T cell to improve clinical outcomes Juno investing to control the cells that go into and out of our process Biology insights increasingly confirm that the type of T cell matters

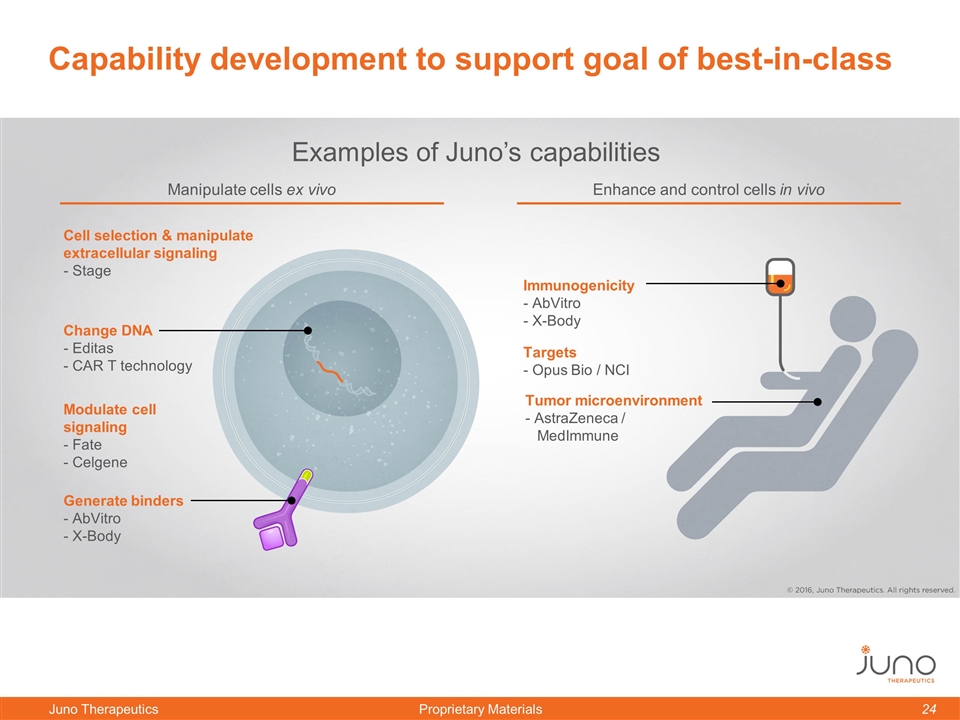

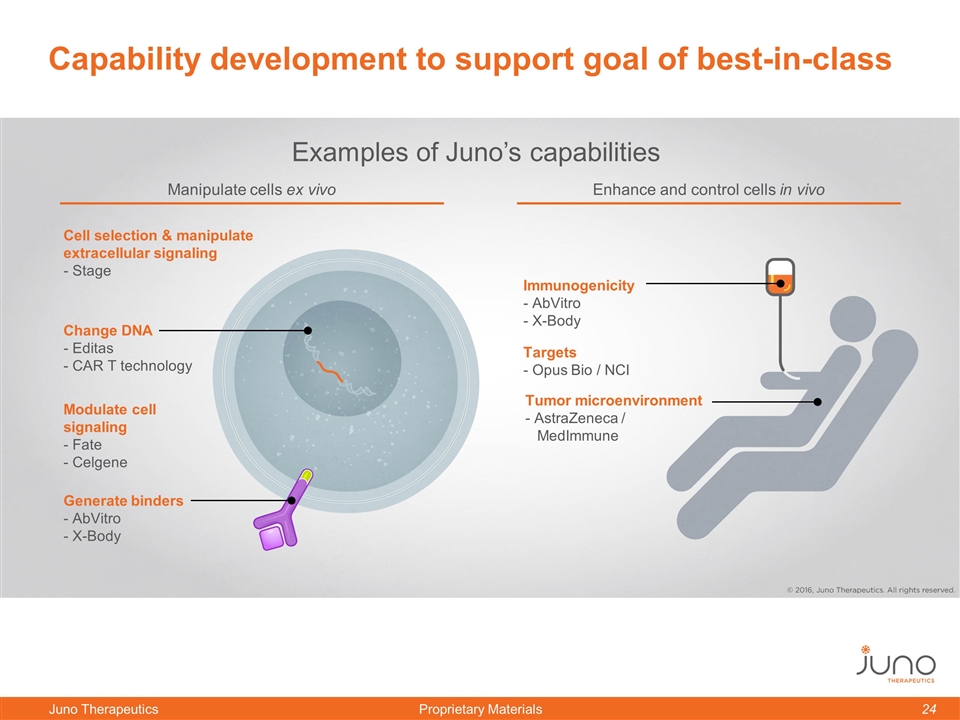

Cell selection & manipulate extracellular signaling - Stage Targets - Opus Bio / NCI Tumor microenvironment - AstraZeneca / MedImmune Generate binders - AbVitro - X-Body Examples of Juno’s capabilities Capability development to support goal of best-in-class Change DNA - Editas - CAR T technology Modulate cell signaling - Fate - Celgene Immunogenicity - AbVitro - X-Body Manipulate cells ex vivo Enhance and control cells in vivo

Solidifying leadership in the development of transformative immunotherapies BUSINESS DEVELOPMENT COOPERATION EXPANDED CAPABILITIES ACCELERATED PIPELINE PIPELINE ENHANCEMENT Cell therapies, small molecules, and proteins Immuno-oncology combinations Deep translational capabilities Global commercialization A partner of choice for cellular immunotherapies Enhanced capabilities to identify and add value to immuno-oncology assets more broadly Access to an array of Celgene pipeline assets over time Potential to exploit T cell biology more broadly

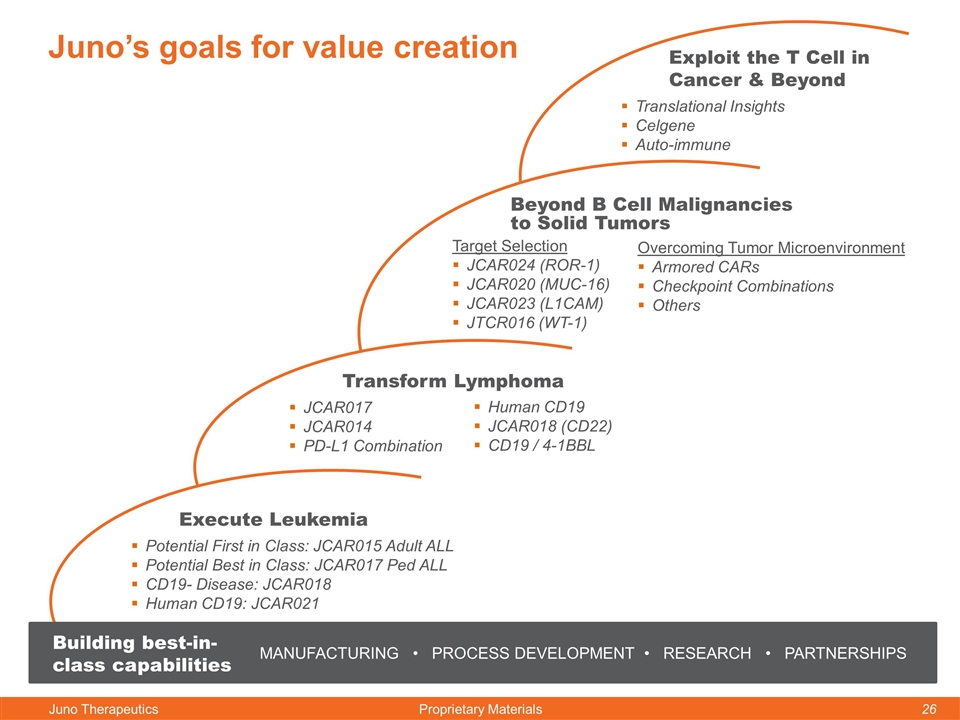

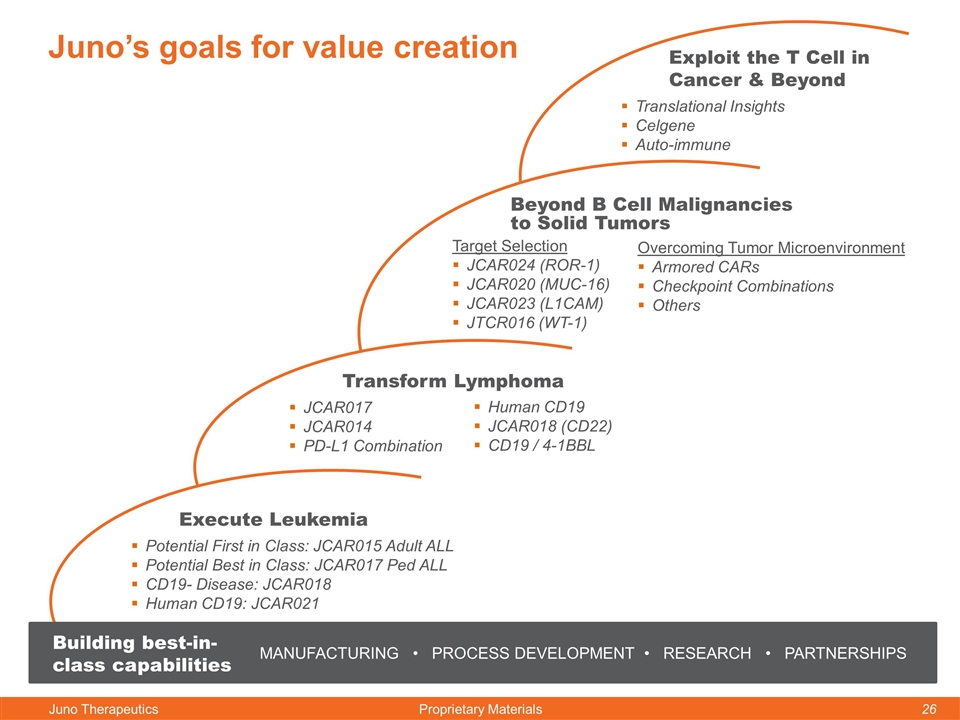

Juno’s goals for value creation Execute Leukemia Potential First in Class: JCAR015 Adult ALL Potential Best in Class: JCAR017 Ped ALL CD19- Disease: JCAR018 Human CD19: JCAR021 Transform Lymphoma JCAR017 JCAR014 PD-L1 Combination Beyond B Cell Malignancies to Solid Tumors Target Selection JCAR024 (ROR-1) JCAR020 (MUC-16) JCAR023 (L1CAM) JTCR016 (WT-1) Exploit the T Cell in Cancer & Beyond Translational Insights Celgene Auto-immune MANUFACTURING • PROCESS DEVELOPMENT • RESEARCH • PARTNERSHIPS Building best-in-class capabilities Human CD19 JCAR018 (CD22) CD19 / 4-1BBL Overcoming Tumor Microenvironment Armored CARs Checkpoint Combinations Others

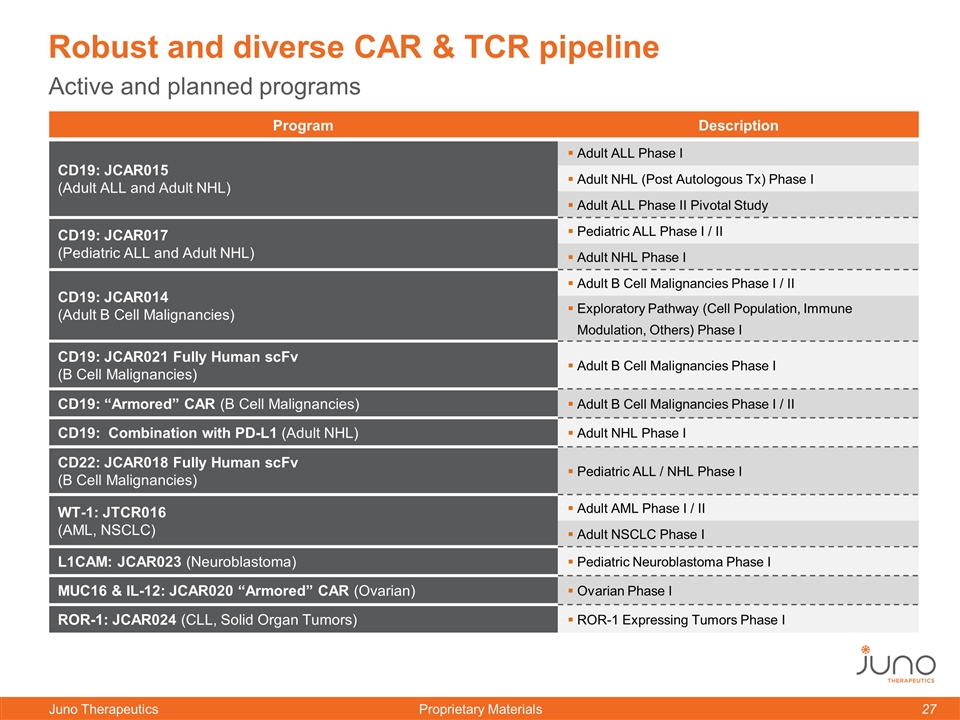

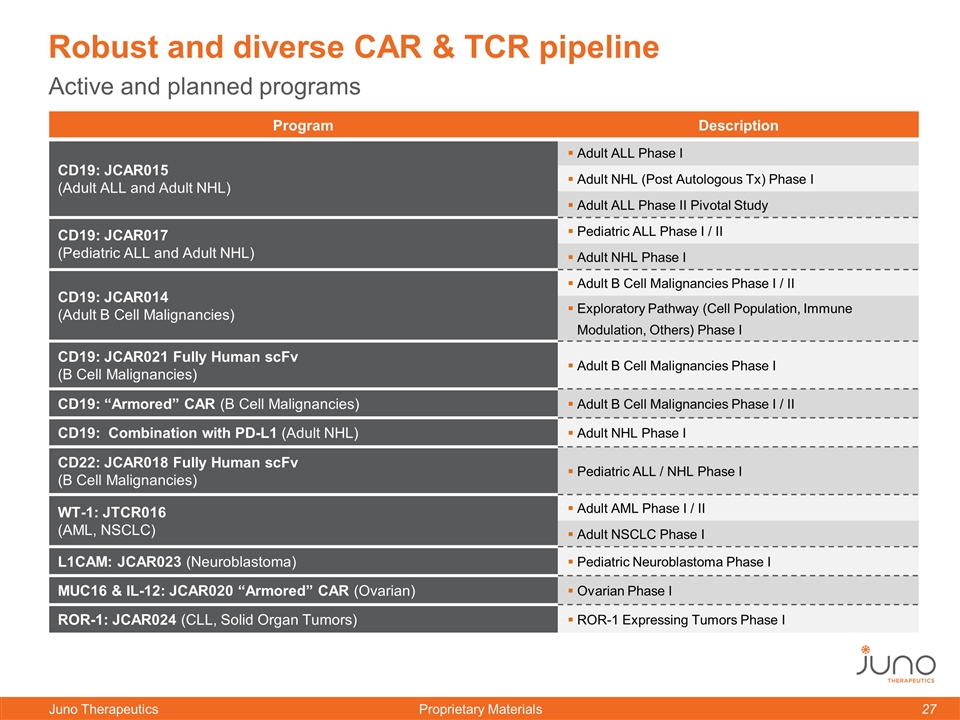

Program Description CD19: JCAR015 (Adult ALL and Adult NHL) Adult ALL Phase I Adult NHL (Post Autologous Tx) Phase I Adult ALL Phase II Pivotal Study CD19: JCAR017 (Pediatric ALL and Adult NHL) Pediatric ALL Phase I / II Adult NHL Phase I CD19: JCAR014 (Adult B Cell Malignancies) Adult B Cell Malignancies Phase I / II Exploratory Pathway (Cell Population, Immune Modulation, Others) Phase I CD19: JCAR021 Fully Human scFv (B Cell Malignancies) Adult B Cell Malignancies Phase I CD19: “Armored” CAR (B Cell Malignancies) Adult B Cell Malignancies Phase I / II CD19: Combination with PD-L1 (Adult NHL) Adult NHL Phase I CD22: JCAR018 Fully Human scFv (B Cell Malignancies) Pediatric ALL / NHL Phase I WT-1: JTCR016 (AML, NSCLC) Adult AML Phase I / II Adult NSCLC Phase I L1CAM: JCAR023 (Neuroblastoma) Pediatric Neuroblastoma Phase I MUC16 & IL-12: JCAR020 “Armored” CAR (Ovarian) Ovarian Phase I ROR-1: JCAR024 (CLL, Solid Organ Tumors) ROR-1 Expressing Tumors Phase I Active and planned programs Robust and diverse CAR & TCR pipeline