UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | |

| x | | Preliminary Proxy Statement |

| |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| ¨ | | Definitive Proxy Statement |

| |

| ¨ | | Definitive Additional Materials |

| |

| ¨ | | Soliciting Material under § 240.14a-12 |

JUNO THERAPEUTICS, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | |

| |

| x | | No fee required. |

| |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | (5) | | Total fee paid: |

| |

| ¨ | | Fee paid previously with preliminary materials. |

| |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | (3) | | Filing Party: |

| | (4) | | Date Filed: |

PRELIMINARY PROXY STATEMENT—SUBJECT TO COMPLETION

JUNO THERAPEUTICS, INC.

307 Westlake Avenue North, Suite 300

Seattle, Washington 98109

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JUNE 16, 2016

To the Stockholders of Juno Therapeutics, Inc.:

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders (“Annual Meeting”) of Juno Therapeutics, Inc., a Delaware corporation (referred to herein as “Juno,” the “Company,” “we” or “our”), will be held on June 16, 2016, at 10:00 a.m. local time, at the Residence Inn by Marriott at Lake Union, 800 Fairview Ave N., Seattle, Washington 98109, for the following purposes:

| | 1. | To elect three directors to hold office until the 2019 annual meeting of stockholders or until their successors are duly elected and qualified; |

| | 2. | To approve under NASDAQ Marketplace Rule 5635(b) and NASDAQ Marketplace Rule 5635(d) the issuance by Juno, pursuant to the Share Purchase Agreement dated as of June 29, 2015, among Juno, Celgene Corporation, and a subsidiary of Celgene Corporation, of more than 19.99% of the Company’s outstanding Common Stock (measured as of June 28, 2015) to Celgene Corporation or its subsidiaries; |

| | 3. | To consider an advisory vote on whether an advisory vote on executive compensation should be held every one, two, or three years; |

| | 4. | To approve and ratify a compensation policy for non-employee directors, including annual limits on the amount of cash and equity compensation that may be paid to non-employee directors; |

| | 5. | To ratify the appointment, by the Audit Committee of our Board of Directors, of Ernst & Young LLP as the independent registered public accounting firm of the Company for the Company’s fiscal year ending December 31, 2016; and |

| | 6. | To transact such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof. |

The foregoing items of business are more fully described in the Proxy Statement. Only stockholders who owned our common stock at the close of business on April 18, 2016 (the “Record Date”) can vote at this meeting or any adjournments that take place.

We have elected to use the Internet as our primary means of providing our proxy materials to stockholders. Consequently, stockholders will not receive paper copies of our proxy materials unless they specifically request them. We will send a notice regarding the Internet availability of proxy materials (the “Notice of Internet Availability”) on or about April , 2016 to our stockholders of record as of the close of business on the Record Date. We are also providing access to our proxy materials over the Internet beginning on or about April , 2016. Electronic delivery of our proxy materials will significantly reduce our printing and mailing costs, and the environmental impact of the proxy materials.

The Notice of Internet Availability contains instructions for accessing the proxy materials, including the Proxy Statement and our annual report, and provides information on how stockholders may obtain paper copies free of charge. The Notice of Internet Availability also provides the date, time and location of the Annual Meeting; the matters to be acted upon at the meeting and the recommendation from our Board of Directors with regard to each matter; and information on how to attend the meeting.

It is important that your shares be represented and voted whether or not you plan to attend the Annual Meeting in person. You may vote on the Internet, by telephone, or by completing and mailing a proxy card or the

form forwarded by your bank, broker or other holder of record. Voting over the Internet, by telephone, or by written proxy will ensure your shares are represented at the Annual Meeting. Please review the instructions on the proxy card or the information forwarded by your bank, broker or other holder of record regarding each of these voting options.

Our Board of Directors recommends that you voteFOR the election of the director nominees named in Proposal No. 1,FOR Proposal No. 2, Proposal No. 4, and Proposal No. 5, and every ONE YEAR on Proposal No. 3.

|

By Order of the Board of Directors Hans E. Bishop President, Chief Executive Officer, and Director |

Seattle, Washington

April , 2015

TABLE OF CONTENTS

PRELIMINARY PROXY STATEMENT—SUBJECT TO COMPLETION

JUNO THERAPEUTICS, INC.

307 Westlake Avenue North, Suite 300

Seattle, Washington 98109

PROXY STATEMENT

FOR THE 2016 ANNUAL MEETING OF STOCKHOLDERS

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE

STOCKHOLDER MEETING TO BE HELD ON JUNE 16, 2016

The Board of Directors (the “Board”) of Juno Therapeutics, Inc. (referred to herein as “Juno,” the “Company,” “we,” “us,” or “our”) is soliciting your proxy to vote at our 2016 Annual Meeting of Stockholders to be held on Thursday, June 16, 2016, at 10:00 a.m. local time, at the Residence Inn by Marriott at Lake Union, 800 Fairview Ave N., Seattle, Washington 98109, and any adjournment or postponement of that meeting (the “Annual Meeting”). This Proxy Statement is dated as of April , 2016.

In addition to solicitations by mail, our directors, officers, and regular employees, without additional remuneration, may solicit proxies by telephone, e-mail, and personal interviews. All costs of solicitation of proxies will be borne by us. Brokers, custodians, and fiduciaries will be requested to forward proxy soliciting material to the owners of stock held in their names, and we will reimburse them for their reasonable out-of-pocket expenses incurred in connection with the distribution of proxy materials.

We have elected to provide access to our proxy materials on the Internet. Accordingly, we are sending a notice regarding the Internet available of proxy materials (the “Notice of Internet Availability”) to our stockholders of record as of April 18, 2016 (the “Record Date”), while brokers and other nominees who hold shares on behalf of beneficial owners will be sending their own similar notice. All stockholders will have the ability to access the proxy materials on the website referred to in the Notice of Internet Availability, or to request a printed set of the proxy materials. Instructions on how to request a printed copy by mail or e-mail may be found in the Notice of Internet Availability and on the website referred to in the Notice of Internet Availability, including an option to request paper copies on an ongoing basis. On or about April , 2016, we are mailing the Notice of Internet Availability to all stockholders entitled to vote at the Annual Meeting. We are also providing access to our proxy materials over the Internet beginning on or about April , 2016. We intend to mail or e-mail this Proxy Statement, together with a proxy card, to those stockholders entitled to vote at the Annual Meeting who have properly requested copies of such materials by mail or e-mail, within three business days of request.

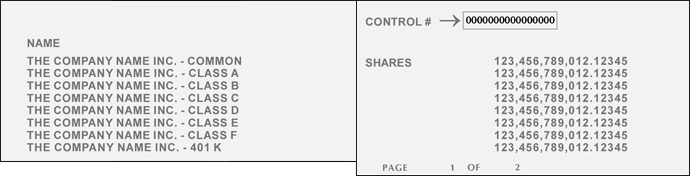

The only voting securities of Juno are shares of common stock, $0.0001 par value per share (the “Common Stock”), of which there were shares outstanding as of the Record Date. We need the holders of a majority in voting power of the shares of Common Stock issued and outstanding and entitled to vote, present in person or represented by proxy, to hold the Annual Meeting.

The Company’s Annual Report, which contains financial statements for fiscal year 2015 (the “Annual Report”), accompanies this Proxy Statement if you have requested and received a copy of the proxy materials in the mail. Stockholders that receive the Notice of Internet Availability can access this Proxy Statement and the Annual Report at the website referred to in the Notice of Internet Availability. The Annual Report and this Proxy Statement are also available on our investor relations website athttp://ir.junotherapeutics.com/ and at the website of the Securities and Exchange Commission (the “SEC”) atwww.sec.gov. You also may obtain a copy of Juno’s Annual Report, without charge, by writing to our Investor Relations department at the above address.

1

THE PROXY PROCESS AND STOCKHOLDER VOTING

QUESTIONS AND ANSWERS ABOUT THIS PROXY MATERIAL AND VOTING

Who can vote at the Annual Meeting?

Only stockholders of record at the close of business on April 18, 2016 (the “Record Date”), will be entitled to vote at the Annual Meeting. At the close of business on the Record Date, there were shares of common stock issued and outstanding and entitled to vote.

Stockholder of Record: Shares Registered in Your Name

If, on the Record Date, your shares were registered directly in your name with the transfer agent for our common stock, Wells Fargo Bank, N.A., then you are a stockholder of record. As a stockholder of record, you may vote in person at the Annual Meeting or vote by proxy on the Internet or by telephone or by returning a proxy card if you request and receive one. Whether or not you plan to attend the Annual Meeting, to ensure your vote is counted we urge you to vote by proxy on the Internet as instructed in the Notice of Internet Availability, by telephone as instructed on the website referred to on the Notice of Internet Availability, or (if you request and receive a proxy card by mail or e-mail) by signing, dating, and returning the proxy card sent to you or by following the instructions on such proxy card to vote on the Internet or by telephone.

Beneficial Owner: Shares Registered in the Name of a Broker, Bank or Other Agent

If, on the Record Date, your shares were held in an account at a brokerage firm, bank, dealer, or other similar organization, then you are the beneficial owner of shares held in “street name” and these proxy materials are being forwarded to you by that organization. The organization holding your account is considered the stockholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to direct your broker or other agent on how to vote the shares in your account. You are also invited to attend the Annual Meeting. However, because you are not the stockholder of record, you may not vote your shares in person at the Annual Meeting unless you request and obtain a legal proxy from your broker or other agent who is the record holder of the shares, authorizing you to vote at the Annual Meeting.

What am I being asked to vote on?

You are being asked to vote on five proposals:

| | • | | Proposal No. 1: the election of three Class II directors to hold office until our 2019 annual meeting of stockholders or until their successors are duly elected and qualified; |

| | • | | Proposal No. 2: the approval under NASDAQ Marketplace Rule 5635(b) and NASDAQ Marketplace Rule 5635(d) of the issuance by Juno, pursuant to the Share Purchase Agreement dated as of June 29, 2015, among Juno, Celgene Corporation, and a subsidiary of Celgene Corporation, of more than 19.99% of Juno’s outstanding Common Stock (measured as of June 28, 2015) to Celgene Corporation or its subsidiaries; |

| | • | | Proposal No. 3: an advisory vote on whether an advisory vote on executive compensation should be held every one, two, or three years; |

| | • | | Proposal No. 4: the approval and ratification of a compensation policy for non-employee directors, including annual limits on the amount of cash and equity compensation that may be paid to non-employee directors; and |

| | • | | Proposal No. 5: the ratification of the appointment, by the audit committee of our Board, of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2016. |

In addition, you are entitled to vote on any other matters that are properly brought before the Annual Meeting.

2

How does the Board recommend I vote on the Proposals?

The Board recommends that you vote:

| | • | | “FOR” each of the Class II director nominees listed in Proposal No. 1; |

| | • | | “FOR” each of Proposal No. 2, Proposal No. 4, and Proposal No. 5; and |

| | • | | Every “ONE YEAR” on Proposal No. 3. |

How do I vote?

| | • | | For Proposal No. 1, you may either vote “For,” or “Withhold” your vote from, any of the nominees to the Board. |

| | • | | For Proposal No. 2, Proposal No. 4, and Proposal No. 5, you may vote “For” or “Against” the proposal, or “Abstain” from voting. |

| | • | | For Proposal No. 3, you may vote “1 Year,” “2 Years,” “3 Years,” or “Abstain” from voting. |

Please note that by casting your vote by proxy you are authorizing the individuals listed on the proxy to vote your shares in accordance with your instructions and in their discretion with respect to any other matter that properly comes before the Annual Meeting or any adjournments or postponements thereof.

The procedures for voting, depending on whether you are a stockholder of record or a beneficial owner, are as follows:

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record, you may vote in any of the following manners:

| | • | | To vote in person, come to the Annual Meeting and we will give you a ballot when you arrive. |

| | • | | To vote over the Internet prior to the Annual Meeting, follow the instructions provided on the Notice of Internet Availability or on the proxy card that you request and receive by mail or e-mail to vote atwww.proxyvote.com using the control number contained on the Notice of Internet Availability or proxy card that you received. We provide Internet proxy voting to allow you to vote your shares online, with procedures designed to ensure the authenticity and correctness of your proxy vote instructions. However, please be aware that you must bear any costs associated with your Internet access, such as usage charges from Internet access providers and telephone companies. |

| | • | | To vote by telephone, call 1-800-690-6903 (toll free). You will need to have your Notice of Internet Availability or proxy card available when you call. |

| | • | | To vote by mail, complete, sign and date the proxy card you request and receive by mail or e-mail, and return it promptly to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717. As long as your signed proxy card is received before the Annual Meeting, we will vote your shares as you direct. |

Whether or not you plan to attend the Annual Meeting, we urge you to vote by proxy by mail, Internet, or telephone to ensure your vote is counted. The Internet and telephone voting facilities for eligible stockholders of record will close at 11:59 p.m. Eastern Time on June 15, 2016. Even if you have submitted your vote before the Annual Meeting, you may still attend the Annual Meeting and vote in person. In such case, your previously submitted proxy will be disregarded.

3

Beneficial Owner: Shares Registered in the Name of Broker, Bank or Other Agent

If you are a beneficial owner of shares registered in the name of your broker, bank, or other agent, you should have received a voting instruction card and voting instructions with these proxy materials from that organization rather than from us. Simply complete and mail the voting instruction card to ensure that your vote is counted, or follow such instructions to submit your vote by the Internet or telephone, if the instructions provide for Internet and telephone voting. To vote in person at the Annual Meeting, you must obtain a valid proxy from your broker, bank, or other agent. Follow the instructions from your broker, bank, or other agent included with these proxy materials, or contact your broker, bank, or other agent to request a proxy form.

Can I change my vote after submitting my proxy vote?

Yes. You can revoke your proxy vote at any time before the final vote at the Annual Meeting. If you are the record holder of your shares, you may revoke your proxy vote in any one of three ways:

| | • | | You may submit a new vote on the Internet or by telephone or submit a properly completed proxy card with a later date, by following the instructions set forth in answer to the preceding question. |

| | • | | You may send a written notice that you are revoking your proxy to Juno’s General Counsel at 307 Westlake Avenue North, Suite 300, Seattle, Washington 98109. |

| | • | | You may attend the Annual Meeting and vote in person. Simply attending the Annual Meeting will not, by itself, revoke your proxy. |

If your shares are held by your broker, bank or other agent, you should follow the instructions provided by them.

Who counts the votes?

Broadridge Financial Solutions, Inc. (“Broadridge”) has been engaged as our independent agent to tabulate stockholder votes, or Inspector of Election. If you are a stockholder of record, and you choose to vote over the Internet prior to the Annual Meeting or by telephone, Broadridge will access and tabulate your vote electronically, and if you have requested and received proxy materials via mail or e-mail and choose to sign and mail your proxy card, your executed proxy card is returned directly to Broadridge for tabulation. As noted above, if you hold your shares through a broker, your broker (or its agent for tabulating votes of shares held in “street name”) returns one proxy card to Broadridge on behalf of all its clients.

How are votes counted?

Votes will be counted by the Inspector of Election appointed for the Annual Meeting. For Proposal No. 1, the Inspector of Election will separately count “For” and “Withheld” votes and broker non-votes for each nominee. For each of Proposal No. 2, Proposal No. 4, and Proposal No. 5, the Inspector of Election will separately count “For” and “Against” votes, abstentions and broker non-votes. For Proposal No. 3, the Inspector of Elections will separately count votes for “One Year,” “Two Years,” and “Three Years,” abstentions and broker non-votes. If your shares are held by your broker as your nominee (that is, in “street name”), you will need to follow the instructions provided by your broker to instruct your broker how to vote your shares. If you do not give instructions to your broker, your broker can vote your shares with respect to “routine” items, but not with respect to “non-routine” items. See below for more information regarding: “What are “broker non-votes”?” and “Which ballot measures are considered “routine” and “non-routine”?”

What are “broker non-votes”?

Broker non-votes occur when a beneficial owner of shares held in “street name” does not give instructions to the broker or nominee holding the shares as to how to vote on matters deemed “non-routine.” Generally, if

4

shares are held in street name, the beneficial owner of the shares is entitled to give voting instructions to the broker or nominee holding the shares. If the beneficial owner does not provide voting instructions, the broker or nominee can still vote the shares with respect to matters that are considered to be “routine,” but not with respect to “non-routine” matters. In the event that a broker, bank, custodian, nominee or other record holder of common stock indicates on a proxy that it does not have discretionary authority to vote certain shares on a particular proposal, then those shares will be treated as broker non-votes with respect to that proposal. Accordingly, if you own shares through a nominee, such as a broker or bank, please be sure to instruct your nominee how to vote to ensure that your vote is counted on each of the proposals.

Which ballot measures are considered “routine” or “non-routine”?

The ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, 2016 (Proposal No. 5) is considered routine under applicable rules. A broker or other nominee may generally vote on routine matters, and therefore no broker non-votes are expected to exist in connection with Proposal No. 5. Proposal No. 1, Proposal No. 2, Proposal No. 3, and Proposal No. 4 are considered non-routine under applicable rules. A broker or other nominee cannot vote without instructions on non-routine matters, and therefore there may be broker non-votes on Proposal No. 1, Proposal No. 2, Proposal No. 3, and Proposal No. 4.

How many votes are needed to approve the proposal?

With respect to Proposal No. 1, the election of directors, the three nominees receiving the highest number of “For” votes will be elected. Only votes “For” or “Withheld” will affect the outcome of this proposal. Broker non-votes will have no effect on the outcome of this proposal.

With respect to Proposal No. 2, Proposal No. 4, and Proposal No. 5, the affirmative vote of the majority of votes cast affirmatively or negatively (excluding abstentions and broker non-votes) is required for approval. Abstentions and broker non-votes will have no effect on the outcome of these proposals. Shares of common stock held by Celgene shall not be entitled to vote on Proposal No. 2.

With respect to Proposal No. 3, the option of one year, two years, or three years that receives the highest number of votes cast by stockholders will be the frequency for the advisory vote on executive compensation that has been selected by stockholders. However, because this vote is advisory and not binding on the Company, the compensation committee, or our Board in any way, we may decide that it is in the best interests of our stockholders and the Company to hold an advisory vote on executive compensation more or less frequently than the vote frequency approved by our stockholders.

How many votes do I have?

On each matter to be voted upon, you have one vote for each share of common stock you own as of the Record Date.

What if I return a Proxy Card but do not make specific choices?

If we receive a signed and dated Proxy Card and the Proxy Card does not specify how your shares are to be voted, your shares will be voted “For” the election of each of the three nominees for director in Proposal No. 1 of this Proxy Statement, “For” Proposal No. 2, Proposal No. 4, and Proposal No. 5, and “1 Year” on Proposal No. 3. If any other matter is properly presented at the Annual Meeting, your proxy (one of the individuals named on your Proxy Card) will vote your shares using his or her best judgment.

Who is paying for this proxy solicitation?

Juno will pay for the entire cost of soliciting proxies. In addition to these mailed proxy materials, our directors, officers and employees may also solicit proxies in person, by telephone or by other means of

5

communication. Directors, officers and employees will not be paid any additional compensation for soliciting proxies. We may also reimburse brokerage firms, banks and other agents for the cost of forwarding proxy materials to beneficial owners.

What does it mean if I receive more than one Notice of Internet Availability or more than one set of printed materials?

If you receive more than one Notice of Internet Availability or more than one set of printed materials, your shares are registered in more than one name or are registered in different accounts. In order to vote all the shares you own, you must follow the instructions for voting on each Notice of Internet Availability or proxy card you receive via mail or e-mail upon your request, which include voting over the Internet, telephone or by signing and returning any of the proxy cards you request and receive.

How will voting on any business not described in this Proxy Statement be conducted?

We are not aware of any business to be considered at the Annual Meeting other than the items described in this Proxy Statement. If any other matter is properly presented at the Annual Meeting, your proxy will vote your shares using his or her best judgment.

When are stockholder proposals due for next year’s Annual Meeting?

To be considered for inclusion in next year’s proxy materials, your proposal must be submitted in writing by December , 2016, to Juno’s Corporate Secretary at 307 Westlake Avenue North, Suite 300, Seattle, Washington 98109. If you wish to submit a proposal that is not to be included in our proxy materials for the next year’s annual meeting pursuant to the SEC’s shareholder proposal procedures or to nominate a director, you must do so between February , 2017 and March , 2017; provided that if the date of that annual meeting is more than 30 days before or more than 60 days after June 16, 2017, you must give notice not later than the 90th day prior to the annual meeting date or, if later, the 10th day following the day on which public disclosure of the annual meeting date is first made. You are also advised to review our bylaws, which contain additional requirements about advance notice of stockholder proposals and director nominations. A copy of our bylaws may be obtained by accessing our filings on the SEC’s website atwww.sec.gov. You may also request a copy of our bylaws, without charge, from our Corporate Secretary, at 307 Westlake Avenue North, Suite 300, Seattle, Washington 98109.

What is the quorum requirement?

A quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if the holders of a majority in voting power of the shares of common stock issued and outstanding and entitled to vote are present in person or represented by proxy at the Annual Meeting. On the Record Date, there were shares outstanding and entitled to vote. Accordingly, shares must be represented by stockholders present at the Annual Meeting or by proxy to have a quorum.

If you are a stockholder of record, your shares will be counted towards the quorum only if you submit a valid proxy vote or vote at the Annual Meeting. If you are a beneficial owner of shares held in “street name,” your shares will be counted towards the quorum if your broker or nominee submits a proxy for your shares at the Annual Meeting, even if such proxy results in a broker non-vote due to the absence of voting instructions from you. Abstentions and broker non-votes will be counted towards the quorum requirement. If there is no quorum, either the chairperson of the Annual Meeting or a majority in voting power of the stockholders entitled to vote at the Annual Meeting, present in person or represented by proxy, may adjourn the Annual Meeting to another time or place.

6

How can I find out the results of the voting at the Annual Meeting?

Voting results will be announced by the filing of a Current Report on Form 8-K within four business days after the Annual Meeting. If final voting results are unavailable at that time, we will file an amended Current Report on Form 8-K within four business days of the day the final results are available.

Directions to Annual Meeting

To obtain directions to our Annual Meeting, which is to be held at the Residence Inn by Marriott at Lake Union, 800 Fairview Ave N., Seattle, Washington 98109, please visit the following website:http://www.marriott.com/hotels/maps/travel/sealu-residence-inn-seattle-downtown-lake-union/. Parking is complimentary at the Residence Inn during the hours of the Annual Meeting. Visit the registration desk upon arrival to secure your parking pass for the event.

7

NOTE ABOUT FORWARD-LOOKING STATEMENTS

This Proxy Statement contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, including statements regarding our business plans, corporate goals, and objectives, the potential of our collaboration with Celgene, clinical development and regulatory approval timelines, the potential of acquired technologies, and the design of compensation programs and their intended effect. In some cases, you can identify forward-looking statements by the following words: “may,” “will,” “could,” “would,” “should,” “expect,” “intend,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “project,” “aim,” “potential,” “continue,” “ongoing,” “goal,” or the negative of these terms or other similar expressions, although not all forward-looking statements contain these words. These statements involve risks, uncertainties, and other factors that may cause actual results, levels of activity, performance, achievements, or future compensation policies or programs to be materially different from the information expressed or implied by these forward-looking statements. Given these uncertainties, you should not place undue reliance on these forward-looking statements. Factors that may cause actual results to differ materially from current expectations include, among other things, those listed under “Risk Factors” in our Annual Report on Form 10-K and subsequently filed Quarterly Reports on Form 10-Q. These forward-looking statements speak only as of the date hereof. Except as required by law, we assume no obligation to update or revise these forward-looking statements for any reason, even if new information becomes available in the future.

8

PROPOSAL NO. 1

ELECTION OF DIRECTORS

Our Board is divided into three classes. Each class consists of one-third of the total number of directors, and each class has a three-year term. Unless the Board determines that vacancies (including vacancies created by increases in the number of directors) shall be filled by the stockholders, and except as otherwise provided by law, vacancies on the Board may be filled only by the affirmative vote of a majority of the remaining directors. A director elected by the Board to fill a vacancy (including a vacancy created by an increase in the number of directors) shall serve for the remainder of the term of the class of directors in which the vacancy occurred and until such director’s successor is elected and qualified.

The Board currently consists of nine seated directors, divided into the three following classes:

| | • | | Class I directors: Hans E. Bishop, Howard H. Pien, and Anthony Evnin, Ph.D., whose current terms will expire at the annual meeting of stockholders to be held in 2018; |

| | • | | Class II directors: Hal V. Barron, M.D., Richard D. Klausner, M.D., and Robert T. Nelsen, whose current terms will expire at the Annual Meeting; and |

| | • | | Class III directors: Thomas O. Daniel, M.D., Marc Tessier-Lavigne, Ph.D., and Mary Agnes (“Maggie”) Wilderotter, whose current terms will expire at the annual meeting of stockholders to be held in 2017. |

At each annual meeting of stockholders, the successors to directors whose terms will then expire will be elected to serve from the time of election and qualification until the third subsequent annual meeting of stockholders.

Each director to be elected will hold office from the date of their election by the stockholders until the third subsequent annual meeting of stockholders or until his successor is elected and has been qualified, or until such director’s earlier death, resignation, or removal.

Shares represented by executed proxies will be voted, if authority to do so is not withheld, for the election of the three nominees named below. In the event that any nominee should be unavailable for election as a result of an unexpected occurrence, such shares will be voted for the election of such substitute nominee as the Board may propose. Each person nominated for election has agreed to serve if elected, and management has no reason to believe that any nominee will be unable to serve. Directors are elected by a plurality of the votes cast at the meeting.

Our Board has determined that each of our directors, other than Mr. Bishop, Dr. Daniel, and Dr. Klausner, is independent according to applicable rules of the SEC and The Nasdaq Stock Market, LLC (“NASDAQ”).

Celgene Designation Rights

As described in Proposal No. 2, Juno has agreed to give Celgene certain Board designation rights until at least June 29, 2020, and thereafter for as long as Celgene and its affiliates beneficially own at least 7.5% of the voting power of Juno’s outstanding shares. Juno agreed to initially appoint Dr. Thomas O. Daniel, president of Celgene Research and Early Development, as a Class III director on the Board, and to nominate Dr. Daniel for election and reelection to such position, provided in each case that Dr. Daniel is reasonably acceptable to the nominating and governance committee of the Board. Celgene may designate another nominee to replace Dr. Daniel upon Dr. Daniel’s departure from the Board or as a replacement nominee for election at a meeting of stockholders at which such position is up for election. Except for the first such subsequent designee, any such subsequent designee may not be an employee or officer of Celgene, must be independent under NASDAQ rules,

9

and must be reasonably acceptable to the nominating and governance committee of the Board. The first subsequent designee may be an “officer” of Celgene Corporation for purposes of Section 16 of the Securities Exchange Act of 1934, as amended (“Exchange Act”), within the meaning of Rule 16a-1(f) thereunder, provided that such designee is reasonably acceptable to the nominating and governance committee of the Board.

Director Information

The following table sets forth, for the Class II directors who are standing for election and for our other current directors who will continue in office after the Annual Meeting, information with respect to their position/office held with the Company and their ages as of March 31, 2016:

| | | | | | | | | | |

Name | | Age | | | Position/Office Held With the Company | | Director

Since | |

Class II Directors whose terms expire at the Annual Meeting and who are standing for election at the Annual Meeting | |

Hal V. Barron, M.D. (3)(4) | | | 53 | | | Director | | | 2014 | |

| | | |

Richard D. Klausner, M.D. (4) | | | 64 | | | Director | | | 2013 | |

| | | |

Robert T. Nelsen (1)(2) | | | 52 | | | Director | | | 2013 | |

|

Class III Directors whose terms expire at the 2017 annual meeting of stockholders | |

Thomas O. Daniel, M.D. (4) | | | 62 | | | Director | | | 2015 | |

| | | |

Marc Tessier-Lavigne, Ph.D. (2)(4) | | | 56 | | | Director | | | 2014 | |

| | | |

Mary Agnes Wilderotter (1)(3) | | | 61 | | | Director | | | 2014 | |

|

Class I Directors whose terms expire at the 2018 annual meeting of stockholders | |

Hans E. Bishop | | | 51 | | | President, Chief Executive Officer and Director | | | 2013 | |

| | | |

Howard H. Pien (2) | | | 58 | | | Chairman of the Board | | | 2014 | |

| | | |

Anthony B. Evnin, Ph.D. (1)(3) | | | 75 | | | Director | | | 2014 | |

| (1) | Member of the audit committee. |

| (2) | Member of the compensation committee. |

| (3) | Member of the nominating and governance committee. |

| (4) | Member of the scientific committee. |

Set forth below is biographical information for the nominees and each person whose term of office as a director will continue after the Annual Meeting.

Nominees for Election to a Three-Year Term Expiring at the 2019 Annual Meeting of Stockholders

Hal V. Barron, M.D. has served as a member of our Board since September 2014. Dr. Barron is currently the president of research and development at Calico Life Sciences LLC, a private biotechnology company, where he has been employed since November 2013. Previously, he served as executive vice president, head of global product development, and chief medical officer at Hoffmann-La Roche, or Roche, a global health care company, from January 2010 to November 2013. Dr. Barron was executive vice president at Genentech, which became a subsidiary of Roche in March 2009, from June 2009 to November 2013. While at Genentech, Dr. Barron also served as chief medical officer from June 2004 to November 2013, as senior vice president of development from June 2004 to June 2010, and as vice president of medical affairs from June 2002 to June 2004. Dr. Barron previously served as a member of the board of directors of Alexza Pharmaceuticals Inc., a public pharmaceutical company, from December 2007 to May 2013. He received a B.S. in engineering physics from Washington University in 1985 and an M.D. from Yale University in 1989. The Board believes that Dr. Barron’s scientific and medical expertise, particularly in drug research and drug development, as well as his leadership in the biotechnology industry make him an appropriate member of our Board.

10

Richard D. Klausner, M.D. has served as a member of our Board since inception in August 2013. From September 2013 to February 2016, Dr. Klausner served first as senior vice president and chief medical officer and later as chief opportunity officer at Illumina Corporation, a publicly-traded biotechnology company. He served as the chairman of the board of directors of Audax Health until February 2014. Previously, he has served as managing partner of the venture capital firm, The Column Group from May 2005 to February 2011. Dr. Klausner was the executive director for global health of the Bill and Melinda Gates Foundation from 2002 to 2005 and was the eleventh director of the National Cancer Institute between 1995 and 2001. Dr. Klausner also served as chief of the cell biology and metabolism branch of the National Institute of Child Health and Human Development as well as a past president of the American Society of Clinical Investigation. Dr. Klausner is the chief strategy advisor for USAID and has served in senior advisory roles to the U.S., Norwegian, Qatari and Indian governments. He previously chaired the International Advisory Board for Samsung and previously chaired the Strategic Oversight Council of Sanofi. Dr. Klausner received a B.S. in Molecular Biophysics and Biochemistry from Yale University in 1973 and an M.D. from Duke Medical School in 1976. The Board believes that Dr. Klausner’s scientific and medical expertise, particularly in cell biology, molecular biology, and cancer, as well as his industry, academic, and public service leadership roles make him an appropriate member of our Board.

Robert T. Nelsen is one of our co-founders and has served as a member of our Board since inception in August 2013. Since 1994, Mr. Nelsen has served as a co-founder and managing director of ARCH Venture Partners, a venture capital firm focused on early-stage technology companies. Mr. Nelsen has played a significant role in the early sourcing, financing and development of more than 30 companies. Mr. Nelsen is a director of Sapphire Energy, Inc., Agios Pharmaceuticals Inc., Arivale, Inc., Denali Therapeutics, Inc., Sage Therapeutics, Inc., Ensemble Therapeutics Corporation, and Syros Pharmaceuticals, among other companies, and previously served as a director of Illumina, Inc., Fate Therapeutics, Inc., deCODE Genetics, Ltd., NeurogesX, Inc., KYTHERA Biopharmaceuticals, Inc., Bellerophon Therapeutics, Inc., and Caliper Life Sciences, Inc. Mr. Nelsen also previously served as a trustee of Fred Hutchinson Cancer Research Center. Mr. Nelsen received a B.S. in Economics and Biology from the University of Puget Sound in 1985 and an M.B.A. from the University of Chicago in 1987. The Board believes that Mr. Nelsen’s experience as a venture capitalist building and serving on the boards of many public and private emerging companies, including multiple life sciences, biotechnology, and pharmaceutical companies makes him an appropriate member of our Board.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR”

THE ELECTION OF EACH CLASS II NOMINEE NAMED ABOVE

Directors Continuing in Office Until the 2017 Annual Meeting of Stockholders

Marc Tessier-Lavigne, Ph.D. has served as a member of our Board since January 2014. Dr. Tessier-Lavigne has served as president of the Rockefeller University, as well as professor and head of the Laboratory of Brain Development and Repair, since March 2011. Stanford University has announced that Dr. Tessier-Lavigne will become president of Stanford University in September 2016. Previously, he was employed at Genentech, Inc., a biotechnology company, from September 2003 to March 2011, where he became executive vice president for research and chief scientific officer. He is a member of the board of directors of Agios Pharmaceuticals, Inc., Regeneron Pharmaceuticals Inc., and Denali Therapeutics Inc., and was previously a member of the board of directors of Pfizer, Inc. Dr. Tessier-Lavigne earned a B.Sc. in Physics from McGill University in 1980 and a B.A. in Philosophy and Physiology from Oxford University in 1983. He received his Ph.D. in neurophysiology from University College London in 1987, and conducted postdoctoral work at the MRC Developmental Neurobiology Unit in London and at Columbia University. The Board believes that Dr. Tessier-Lavigne’s pioneering research, his scientific knowledge, his service on boards of public companies in the life sciences industry, and his leadership in the biotechnology industry makes him an appropriate member of our Board.

Mary Agnes “Maggie” Wilderotter has served as a member of our Board since November 2014. From April 2015 to April 2016, Ms. Wilderotter was executive chairman of the board of directors of Frontier

11

Communications Corporation, a public telecommunications company formerly known as Citizens Communications Company. From November 2004 until April 2015, Mrs. Wilderotter was chief executive officer of Frontier and served as chairman of its board of directors since December 2005. Prior to joining Frontier, Mrs. Wilderotter was the senior vice president of the world wide public sector of Microsoft Corp. from February 2004 to November 2004 and the senior vice president of worldwide business strategy of Microsoft from 2002 to February 2004. From 1997 to 2002, Mrs. Wilderotter served as the president and chief executive officer of Wink Communications, an interactive telecommunications and media company. Mrs. Wilderotter is a member of the board of directors of Costco Wholesale Corporation, Dreamworks Animation SKG, Inc, and Hewlett Packard Enterprise Co. Mrs. Wilderotter previously served as a member of the board of directors of Procter & Gamble, Xerox Corporation, and Yahoo! Inc. Mrs. Wilderotter received a B.A. in Economics from the College of the Holy Cross in 1977 and an Honorary Doctor of Engineering from the Stevens Institute of Technology in 2014. The Board believes that Mrs. Wilderotter’s significant public company leadership experience as both a board member and an officer, her extensive business and financial acumen, and her deep expertise in marketing and technology make her an appropriate member of our Board.

Thomas O. Daniel, M.D. has served as a member of our Board since August 2015. Dr. Daniel has been Celgene’s chairman of Celgene research since January 2016. Dr. Daniel was previously Celgene’s president, research and early development from December 2006 to January 2016 and executive vice president and president, research and early development from February 2012 until July 2014. He served as the chief scientific officer and a member of the board of directors at Ambrx Inc., a biotechnology company focused on discovering and developing protein-based therapeutics, from 2003 to 2006. Dr. Daniel previously served as vice president, research at Amgen Inc., where he was research site head of Amgen Washington and therapeutic area head of inflammation. Prior to Amgen’s acquisition of Immunex, Dr. Daniel served as senior vice president of discovery research at Immunex. Dr. Daniel has been a member of the therapeutic advisory board of aTyr Pharma, Inc., was previously a director for Epizyme Corporation, and is currently a director of Ferrumax and PharmAkea, privately-held biotechnology companies. Dr. Daniel serves as a member of the biomedical science advisory board of Vanderbilt University Medical Center and the biomedical advisory council of PhRMA. A nephrologist and former academic investigator, Dr. Daniel was previously the K.M. Hakim Professor of Medicine and Cell Biology at Vanderbilt University, and Director of the Vanderbilt Center for Vascular Biology. Dr. Daniel received a B.A. from the Southern Methodist University in Texas in 1974 and an M.D. from the University of Texas, Southwestern, in 1978, and completed medical residency at Massachusetts General Hospital.

Directors Continuing in Office Until the 2018 Annual Meeting of Stockholders

Hans E. Bishop is one of our co-founders and has served as our president and chief executive officer and a member of our Board since September 2013. Bishop previously served as chairman of the board of Genesis Biopharma, Inc., a biotechnology company, from January 2012 until November 2012, and as a member of the board of directors of Avanir Pharmaceutics, Inc., a publicly-traded biopharmaceutical company, from May 2012 to January 2015, when Avanir was sold to Otsuka Pharmaceuticals Co., Ltd. From February 2012 until October 2012, Mr. Bishop was the chief operating officer of Photothera Inc., a late-stage medical device company owned by Warburg Pincus, and he continued working with Warburg Pincus as an Executive in Residence until October 2013. Prior to joining Photothera Inc., Mr. Bishop served as executive vice president and chief operating officer at Dendreon Corporation, a publicly-traded biopharmaceutical company, from January 2010 to September 2011. Mr. Bishop has also served as the president of the specialty medicine business at Bayer Healthcare Pharmaceuticals Inc. from December 2006 to January 2010, where he was responsible for a diverse portfolio of neurology, oncology and hematology products. Mr. Bishop was employed by Chiron Corporation, a global biotechnology company, from January 2004 to August 2006, with commercial responsibilities that included service as its senior vice president of global commercial operations until its sale to Novartis Corporation. Mr. Bishop received a B.Sc. in Chemistry from Brunel University in London in 1987. Based on Mr. Bishop’s broad experience as an operating officer within the pharmaceutical industry and his executive experience in the biotechnology industry, our Board believes Mr. Bishop has the appropriate set of skills to serve as our chief executive officer and a member of our Board.

12

Howard H. Pien has served as a member of our Board since January 2014 and as its chairman since September 2014. Mr. Pien is also the chairman of Indivior PLC, which was a division of the United Kingdom-based consumer goods conglomerate Reckitt Benckiser Group plc that was spun off as a public company in December 2014. He also currently serves as a member of the boards of directors of Immunogen, Inc., Sage Therapeutics, Inc., and Vanda Pharmaceuticals, Inc. Mr. Pien previously served as president and chief executive officer and chairman of the board of directors of Medarex, Inc., a biopharmaceutical company, from June 2007 until its acquisition by Bristol-Myers Squibb in September 2009. Mr. Pien served as the chief executive officer and president of Chiron Corporation, a biotechnology company, from April 2003 until its acquisition by Novartis Corporation in 2006. Mr. Pien has been a director of several other boards, including at ViroPharma, Inc., where he served as its lead independent director from December 2008 to January 2014, Chiron Corporation, where he served as chairman of the board of directors, and Ikaria, Inc. Mr. Pien also previously served as a director of the Biotechnology Industry Association and the Pharmaceutical Research and Manufacturers of America. Mr. Pien received a B.S. from the Massachusetts Institute of Technology in 1979 and an M.B.A. from Carnegie-Mellon University in 1981. The Board believes that Mr. Pien’s extensive experience as a chief executive officer in the pharmaceutical industry, including an immuno-oncology company, and his expertise in corporate governance matters makes him an appropriate member of our Board.

Anthony B. Evnin, Ph.D. has served as a member of our Board since January 2014. Dr. Evnin is currently a member of the board of directors of AVEO Pharmaceuticals, Inc. and Infinity Pharmaceuticals, Inc. as well as Constellation Pharmaceuticals, Inc., a private company. Since 1975, Dr. Evnin has served as partner of Venrock, a venture capital firm, and has been employed by Venrock since 1974. Dr. Evnin was formerly a director of many other biotechnology companies, including Acceleron Pharma Inc., Celladon Corporation, Coley Pharmaceutical Group, Inc., Icagen, Inc., Pharmos Corp., and Sunesis Pharmaceuticals Incorporated. He serves as a trustee of The Rockefeller University, as a trustee of The Jackson Laboratory, as a member of the boards of overseers and managers of Memorial Sloan Kettering Cancer Center, as a member of the board of directors of the New York Genome Center, as a member of the board of directors of the Albert and Mary Lasker Foundation, and as a trustee emeritus of Princeton University. Dr. Evnin received an A.B. from Princeton University in 1962 and a Ph.D. in Chemistry from the Massachusetts Institute of Technology in 1966. The Board believes that Dr. Evnin’s financial and investment expertise, scientific knowledge, and extensive service on public and private company boards, especially in life sciences, biotechnology and pharmaceutical industries, makes him an appropriate member of our Board.

13

PROPOSAL NO. 2

APPROVAL UNDER NASDAQ MARKETPLACE RULE 5635(B) AND NASDAQ MARKETPLACE RULE 5635(D) OF THE ISSUANCE BY JUNO, PURSUANT TO THE SHARE PURCHASE AGREEMENT DATED AS OF JUNE 29, 2015 AMONG JUNO, CELGENE CORPORATION, AND A SUBSIDIARY OF CELGENE CORPORATION, OF MORE THAN 19.99% OF JUNO’S OUTSTANDING COMMON STOCK (MEASURED AS OF JUNE 28, 2015) TO CELGENE CORPORATION OR ITS SUBSIDIARIES

Terms of the Celgene Transaction

Initial Closing

On June 29, 2015, Juno entered into a Share Purchase Agreement (the “Share Purchase Agreement”) with Celgene Corporation and one of its subsidiaries (collectively, “Celgene”), pursuant to which Celgene agreed to purchase from Juno, and we agreed to issue and sell to Celgene, an aggregate of 9,137,672 shares of Juno common stock at a price of $93.00 per share of common stock, representing 10% of the outstanding shares of Juno common stock as of June 28, 2015. The closing of this share issuance took place on August 4, 2015. The Share Purchase Agreement was entered into concurrently with the Master Research and Collaboration Agreement, dated June 29, 2015, by and between Juno and Celgene, as amended (the “Celgene Collaboration Agreement”) pursuant to which Juno and Celgene will research, develop and commercialize novel cellular therapy product candidates and other immuno-oncology and immunology therapeutics, including, in particular, chimeric antigen receptor (“CAR”) and T cell receptor product candidates.

We have already added over a billion dollars to our balance sheet as a result of the Celgene Collaboration Agreement and the Share Purchase Agreement. In addition to this significant amount of capital, which strengthens our ability to pursue our goal of re-engaging the body’s immune system to revolutionize the treatment of cancer, our collaboration with Celgene:

| | • | | provides us access to a broader set of capabilities that we believe will allow us to more fully exploit the therapeutic potential of T cells; |

| | • | | provides us with resources that we believe will accelerate and expand the advancement of Juno’s pipeline; |

| | • | | encourages further collaboration between Juno and Celgene in business development; and |

| | • | | provides Juno with the opportunity to opt-in to a number Celgene’s programs directed at T cells. |

First Period Top-Up Rights

From August 4, 2015 until June 29, 2020, Celgene has the annual right, following the filing of each annual report on Form 10-K filed by Juno or the equivalent thereof (a “Triggering Report”), to purchase additional shares from Juno at an average market price, allowing it to “top up” to an ownership interest equal to 10% of the then-outstanding shares (after giving effect to such purchase), less the number of shares, if any, previously sold, transferred or otherwise disposed of by Celgene to a person other than certain permitted transferees, with such number of shares to be adjusted for any stock split, stock dividend, share exchange, merger, consolidation or similar recapitalization. If Celgene does not exercise its top-up right in full in any given year, then the percentage of ownership targeted for a top-up stock purchase for the next year will be reduced to Celgene’s percentage ownership at the time of such non-exercise or partial exercise (after giving effect to the issuance of shares in any partial exercise). In March 2016, Celgene purchased 1,137,593 shares of Juno common stock in partial exercise of its top-up right that was triggered by the filing of the Annual Report on Form 10-K for the fiscal year ended December 31, 2015. As a result of such partial exercise, the target percentage of Juno’s outstanding shares up to which Celgene may exercise its top-up right in future years has been reduced from 10% to approximately 9.7556%.

14

First Acquisition Right

During the period beginning on June 29, 2019 and ending on June 28, 2020, subject to Celgene opting in to a certain number and type of Juno programs under the Celgene Collaboration Agreement, Celgene will have the right (the “First Acquisition Right”) to purchase up to a maximum of 19.99% of the then-outstanding shares of Juno’s common stock (after giving effect to such purchase) (the “FAR Acquisition Percentage”) at the closing price of the common stock on the principal trading market (currently The NASDAQ Global Select Market) on the date of exercise (the “FAR Base Price”), plus a premium on all shares in excess of the number of shares that Celgene would then be able to purchase if it then had a top-up right as described in the preceding paragraph. The maximum number of shares Celgene may acquire pursuant to this purchase right, and the maximum aggregate consideration paid by Celgene, are limited by the maximum FAR Acquisition Percentage but otherwise depend solely on the outstanding number of shares of Juno’s common stock and its trading price at the time of exercise. The amount of the premium varies depending on the trading price of Juno’s common stock at the time the purchase right is exercised, and may be reduced if certain conditions under the collaboration agreement are met. In all cases, the premium in percentage terms is less than the premium paid at the initial closing. Additionally, although the per share purchase price for all shares acquired pursuant to this purchase right will either be equal to, or exceed, the market price of Juno’s common stock determined at the time of exercise as described above, these shares may be acquired at a discount to the market value of Juno’s common stock on the last trading day prior to the date of the Share Purchase Agreement, with no limitation provided on the maximum size of such discount.

Second Period Top-Up Rights

After the closing of the purchase of shares upon the exercise of the First Acquisition Right until the SAR Termination Date (as defined below) (the “Second Top-Up Period”), in the event that Celgene has been diluted after exercising the First Acquisition Right, Juno may elect annually, upon the filing of a Triggering Report by Juno, to offer Celgene the right to purchase additional shares from Juno at 105% of an average market price, allowing Celgene to “top up” to an ownership interest (after giving effect to such purchase) equal to the percentage ownership of shares that Celgene obtained upon exercise of the First Acquisition Right, less the number of shares, if any, previously sold, transferred or otherwise disposed of by Celgene to a person other than certain permitted transferees, with such number of shares to be adjusted for any stock split, stock dividend, share exchange, merger, consolidation or similar recapitalization. If Celgene does not exercise its top-up right in full in any year in which it is offered such right by Juno, then the percentage of ownership targeted for a top-up stock purchase for the next year it is offered such top-up right will be reduced to Celgene’s percentage ownership at the time of such non-exercise or partial exercise (after giving effect to the issuance of shares in any partial exercise).

Second Acquisition Right

During the period beginning on June 29, 2024 and ending on the date that is the later of (a) June 29, 2025 and (b) the earlier of (x) the date that is 6 months following the date that the Second Acquisition Right Conditions (as defined below) are satisfied and (y) December 29, 2025 (the “SAR Termination Date”), subject to each of Celgene and Juno opting into a certain number and type of programs under the Celgene Collaboration Agreement, and provided that Celgene exercised the First Acquisition Right so as to obtain a percentage ownership of 17% of Juno (the “Second Acquisition Right Conditions”), Celgene will have the right (the “Second Acquisition Right”) to purchase up to a maximum of 30% of the then-outstanding shares of Juno’s common stock (after giving effect to such purchase) (the “SAR Acquisition Percentage”) at the closing price of the common stock on the principal trading market on the date of exercise (the “SAR Base Price”), plus a premium on all shares in excess of the number of shares for which Celgene would then be able to purchase if it then had a top-up right as described in the preceding paragraph. The maximum number of shares Celgene may acquire pursuant to this purchase right, and the maximum aggregate consideration paid by Celgene, are limited by the maximum SAR Acquisition Percentage but otherwise depend solely on the outstanding number of shares of Juno’s common stock and its trading price at the time of exercise. The amount of the premium varies

15

depending on the trading price of Juno’s common stock at the time the purchase right is exercised. In all cases, the premium in percentage terms is less than the premium paid at the initial closing. Additionally, although the per share purchase price for all shares acquired pursuant to this purchase right will exceed the market price of Juno’s common stock determined at the time of exercise as described above, these shares may be acquired at a discount to the market value of Juno’s common stock on the last trading day prior to the date of the Share Purchase Agreement, with no limitation provided on the maximum size of such discount.

Final Top-Up Rights

Following the closing of the purchase of shares upon the exercise of the Second Acquisition Right and until the Celgene Collaboration Agreement expires or is terminated, Celgene would have the annual right, in the event that Celgene has been diluted after exercising the Second Acquisition Right, following the filing of a Triggering Report by Juno, to purchase additional shares from Juno at a price equal to 105% of an average market price, allowing it to “top up” to the percentage ownership it had attained upon exercising the Second Acquisition Right, less 250 basis points, less the number of shares, if any, previously sold, transferred or otherwise disposed of by Celgene to a person other than certain permitted transferees, with such number of shares to be adjusted for any stock split, stock dividend, share exchange, merger, consolidation or similar recapitalization. If Celgene does not exercise its top-up right in full in any given year, then the percentage of ownership targeted for a top-up stock purchase for the next year will be reduced to Celgene’s percentage ownership at the time of such non-exercise or partial exercise (after giving effect to the issuance of shares in any partial exercise).

Conditions to Closing; Termination

Future closings of the First Acquisition Right, Second Acquisition Right and the top-up rights are subject to customary closing conditions, including termination or expiration of the waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended, if applicable. Juno has the ability to terminate Celgene’s future purchase rights under the Share Purchase Agreement in the event that (i) Celgene disposes of any of its shares, breaches certain of its obligations under the Voting and Standstill Agreement (described below), or undergoes a change in control, or (ii) the Celgene Collaboration Agreement terminates or expires.

Limit on Issuance

The Share Purchase Agreement limits the aggregate number of shares that may be issued thereunder to 19.99% of Juno common stock outstanding immediately prior to the entry into the agreement, unless stockholder approval is obtained for additional issuances of shares. Juno agreed to seek such stockholder approval, including at the Annual Meeting, until such approval is obtained.

Voting and Standstill Agreement

In connection with the Share Purchase Agreement, on June 29, 2015, Juno entered into a Voting and Standstill Agreement (the “Voting and Standstill Agreement”) with Celgene. Pursuant to the Voting and Standstill Agreement, until the later of June 29, 2020 and the expiration or earlier termination of the Celgene Collaboration Agreement, Celgene will be bound by certain “standstill” provisions which generally will prevent it from purchasing outstanding shares of Juno common stock or common stock equivalents, making a tender offer or encouraging or supporting a third party tender offer, calling a meeting of Juno’s stockholders, nominating a director whose nomination has not been approved by Juno’s Board, soliciting proxies in opposition to the recommendation of the Board, depositing shares of common stock in a voting trust, assisting a third party in taking such actions, entering into discussions with a third party as to such actions, or requesting or proposing in writing to the Board or any member thereof that Juno amend or waive any of these limitations.

Celgene has also agreed not to dispose of any shares of common stock beneficially owned by it during certain specified lock-up periods, other than (i) with the prior approval of the majority of Juno’s Board, (ii) as

16

part of a tender offer, (iii) to certain permitted transferees, (iv) subject to certain sale limitations, selling shares to reduce its beneficial ownership to the percentage reached following the exercise of the First Acquisition Right, or (iv) selling shares to reduce its beneficial ownership to 16% during the Second Top-Up Period. The lock-up periods include (a) the 364-day period following August 4, 2015, (ii) the 364-day period following the date of any other closing of purchase of shares of Juno common stock under the Share Purchase Agreement, (iii) if Celgene is eligible to deliver a notice exercising the First Acquisition Right and fails to do so prior to June 29, 2020, the 364 day period following June 29, 2020, and (iv) if Celgene is eligible to deliver a notice exercising the Second Acquisition Right and fails to do so prior to the SAR Termination Date, the 364 day period following the SAR Termination Date. Following the expiration of such lock-up periods, Celgene may sell shares subject to certain manner of sale and volume limitations, as well as restrictions on sales to persons defined as “competitors.” Celgene has agreed generally to vote its shares in accordance with the recommendations of the majority of Juno’s Board.

Juno has agreed to give Celgene certain Board designation rights until at least June 29, 2020, and thereafter for as long as Celgene and its affiliates beneficially own at least 7.5% of the voting power of Juno’s outstanding shares. Juno agreed to initially appoint Dr. Thomas O. Daniel, President of Celgene Research and Early Development, as a Class III director on the Board, and to nominate Dr. Daniel for election and reelection to such position, provided in each case that Dr. Daniel is reasonably acceptable to the nominating and governance committee of the Board. Celgene may designate another nominee to replace Dr. Daniel upon Dr. Daniel’s departure from the Board or as a replacement nominee for election at a meeting of stockholders at which such position is up for election. Except for the first such subsequent designee, any such subsequent designee may not be an employee or officer of Celgene, must be independent under NASDAQ rules, and must be reasonably acceptable to the nominating and governance committee of the Board. The first subsequent designee may be an “officer” of Celgene Corporation for purposes of Section 16 of the Exchange Act, within the meaning of Rule 16a-1(f) thereunder, provided that such designee is reasonably acceptable to the nominating and governance committee of the Board.

The rights and restrictions applicable to Celgene under the Voting and Standstill Agreement are subject to termination upon the occurrence of certain events, including certain events involving a change of control, or potential change of control, of Juno.

Registration Rights Agreement

In connection with the Share Purchase Agreement, on June 29, 2015, Juno also entered into a Registration Rights Agreement (the “Registration Rights Agreement”) with Celgene. Pursuant to the Registration Rights Agreement, if and as Celgene is permitted to sell shares under the Voting and Standstill Agreement, Juno has agreed to, upon the written request of Celgene, prepare and file with the SEC a registration statement onForm S-3 for purposes of registering the resale of the shares specified in Celgene’s written request or, if Juno is not at such time eligible for the use of Form S-3, use its commercially reasonable efforts to prepare and file a registration statement on a Form S-1 or alternative form that permits the resale of the shares. Juno has also agreed, among other things, to indemnify Celgene under the registration statement from certain liabilities and to pay all fees and expenses (excluding any legal fees of the selling holder(s) above $10,000 per registration statement, and any underwriting discounts and selling commissions) incident to Juno’s obligations under the Registration Rights Agreement.

Why Juno Needs Stockholder Approval

Our common stock is listed on The NASDAQ Global Select Market and, as such, we are subject to the NASDAQ Marketplace Rules.

NASDAQ Marketplace Rule 5635(b) requires an issuer to obtain stockholder approval prior to share issuances which could result in a change of control. Generally, NASDAQ interpretations provide that a change of control would occur when, as a result of an issuance, an investor or group of affiliated investors would own 20%

17

or more of the outstanding shares or voting power, constituting the largest ownership position. The issuance of common stock to Celgene under future share purchase rights contained in the Share Purchase Agreement, as described above, could result in such a change of control of Juno within the meaning of these NASDAQ interpretations.

In addition, NASDAQ Marketplace Rule 5635(d) requires an issuer to obtain stockholder approval prior to certain non-public issuances of shares at a price less than the greater of market value or book value of such shares, if the number of shares issued equals 20% or more of the common stock or voting power of the issuer outstanding before the transaction. Our common stock had a market value of $46.61 at the close of trading on June 26, 2015, the last trading day prior to the date of the Share Purchase Agreement. The book value of our common stock was $3.64 as of March 31, 2015, the end of the last fiscal quarter prior to the date of the Share Purchase Agreement. Even though the market price premiums included in the prices of the First Acquisition Right, Second Acquisition Right and certain of the future top-up rights reduce the likelihood that Celgene would exercise its First Acquisition Right, Second Acquisition Right, or future top-up rights, at a price and for an aggregate share amount that do not satisfy these price and quantity limitations, it is possible that Celgene would do so depending on the trading price of our common stock around the time of exercise.

We did not seek advance stockholder approval of the initial share issuance, or of all potential future share issuances, under the Share Purchase Agreement, because the agreement restricts the number of shares that can be issued without stockholder approval to 19.99% of the outstanding shares of common stock or the voting power of Juno as of immediately prior to June 29, 2015. Therefore, advance stockholder approval of the initial issuance, or of future issuances up to such limit, was not required by the NASDAQ Marketplace Rules.

However, to enable future share issuances under the Share Purchase Agreement in compliance with the NASDAQ Marketplace Rules, and to comply with our covenants under the Share Purchase Agreement, we are seeking stockholder approval for the potential issuance of our shares under the Share Purchase Agreement, to the extent that any such issuance exceeds 18,266,206 shares, which equals 19.99% of our common stock outstanding as of June 28, 2015.

If stockholders do not approve Proposal No. 2 at the Annual Meeting, our future issuances, if any, under the Share Purchase Agreement will remain limited to an aggregate of 18,266,206 shares. However, we will be obligated under the Share Purchase Agreement to continue to seek stockholder approval of issuances in excess of that limit at our future stockholder meetings, until stockholder approval is obtained. This ongoing obligation will necessitate continuing effort and expense by Juno if Proposal No. 2 is not approved at the upcoming Annual Meeting.

No Dissenters’ Rights

Under applicable Delaware law, our stockholders are not entitled to dissenters’ or appraisal rights with respect to the approval of the issuance of shares related to the Share Purchase Agreement.

Effect of Proposal No. 2 on Current Stockholders

If Proposal No. 2 is adopted, we would be able to issue shares of common stock in excess of 19.99% of our outstanding shares of common stock as of June 28, 2015. The issuance of such shares could result in significant dilution to our stockholders, and afford them a smaller percentage interest in the voting power, liquidation value and aggregate book value of Juno. Additionally, the sale or any resale into the public markets of the common stock could cause the market price of our common stock to decline.

Required Vote

Under the NASDAQ Marketplace Rules and our bylaws, approval of the issuance of more than 19.99% of the Juno’s outstanding common stock pursuant to the Share Purchase Agreement requires the affirmative vote of

18

a majority of the votes cast affirmatively or negatively (excluding abstentions and broker non-votes) on Proposal No. 2 at the Annual Meeting. Shares of common stock held by Celgene shall not be entitled to vote on Proposal No. 2.

Further Information

The terms of the Share Purchase Agreement, the Voting and Standstill Agreement and the Registration Rights Agreement are complex and only briefly summarized above. For further information, please refer to the transaction documents included as exhibits to the Company’s Current Report on Form 8-K filed with the SEC on June 29, 2015. The discussion herein is qualified in its entirety by reference to such filed transaction documents.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” APPROVAL UNDER NASDAQ MARKETPLACE RULE 5635(B) AND NASDAQ MARKETPLACE RULE 5635(D) OF THE ISSUANCE OF MORE THAN 19.99% OF THE COMPANY’S OUTSTANDING COMMON STOCK (MEASURED AS OF JUNE 28, 2015) TO CELGENE CORPORATION OR ITS SUBSIDIARIES IN ACCORDANCE WITH THE SHARE PURCHASE AGREEMENT DATED AS OF JUNE 29, 2015.

19

PROPOSAL NO. 3

ADVISORY VOTE ON THE FREQUENCY OF

FUTURE VOTES ON EXECUTIVE COMPENSATION

The Dodd-Frank Act enables our stockholders to indicate, at least once every six years, how frequently we should seek a non-binding vote on the compensation of our named executive officers, as disclosed pursuant to the SEC’s compensation disclosure rules. By voting on this Proposal No. 3, stockholders may indicate whether they would prefer a non-binding vote on named executive officer compensation once every one, two, or three years.

Our Board believes that it is appropriate to give our stockholders the opportunity to provide regular input on our executive compensation program though an advisory vote. Accordingly, our Board recommends that you vote to hold an advisory vote on executive compensation every year.

We understand that our stockholders may have different views as to what is the best approach for the Company, and we look forward to hearing from our stockholders on this Proposal.

You may cast your vote on your preferred voting frequency by choosing the option of one year, two years, three years, or abstain from voting when you vote in response to the resolution set forth below:

“RESOLVED, that the option of once every one year, two years, or three years that receives the highest number of votes cast for this resolution will be determined to be the preferred frequency with which the Company is to hold a stockholder vote to approve the compensation of the named executive officers, as disclosed pursuant to the compensation disclosure rules of the Securities and Exchange Commission, including the Compensation Discussion and Analysis, the compensation tables, and the other related disclosure.”

The option of one year, two years, or three years that receives the highest number of votes cast by stockholders will be the frequency for the advisory vote on executive compensation that has been selected by stockholders. However, because this vote is advisory and not binding on the Company, the compensation committee, or our Board in any way, we may decide that it is in the best interests of our stockholders and the Company to hold an advisory vote on executive compensation more or less frequently than the vote frequency approved by our stockholders.

THE BOARD OF DIRECTORS RECOMMENDSAN ANNUAL VOTE AS THE FREQUENCY WITH WHICH STOCKHOLDERS ARE PROVIDED AN ADVISORY VOTE ON EXECUTIVE COMPENSATION (AS OPPOSED TO EVERY TWO OR THREE YEARS) ON THIS PROPOSAL NO. 3.

20

PROPOSAL NO. 4

APPROVAL AND RATIFICATION OF NON-EMPLOYEE DIRECTOR COMPENSATION POLICY

In December 2015, the compensation committee recommended, and the Board approved, a director compensation policy (the “Non-Employee Director Compensation Policy”) for directors who are not employed by us as employees or executive officers (“non-employee directors”), effective as of January 1, 2016. The stockholders are being asked to approve and ratify the Non-Employee Director Compensation Policy.

Although the Board is not required to seek or receive stockholder approval of the Non-Employee Director Compensation Policy, the Board is submitting the policy to the Company’s stockholders for approval and ratification in the interests of good corporate governance. If the Non-Employee Director Compensation Policy is not ratified by our stockholders, the Board will consider whether to adopt a different compensation structure to attract, retain and reward the service of our non-employee directors.

The Board believes the Non-Employee Director Compensation Policy is necessary to attract the best available personnel for service as non-employee directors, to provide additional incentive to the non-employee directors to encourage their continued service on the Board, and to reward them for their service members of the Board.

Description of the Non-Employee Director Compensation Policy

The following is a summary of the principal features of the Non-Employee Director Compensation Policy and its operation and is qualified in its entirety by reference to the policy set forth inAppendix A. The compensation committee originally worked with its outside compensation consultant, Willis Towers Watson, in formulating the Non-Employee Director Compensation Policy, who then recommended its adoption and approval by the Board. The type and amount of compensation was compared against that of other new publicly-traded companies to ensure the Non-Employee Director Compensation Policy would allow us to be competitive against those companies with whom we compete for talent.

Equity Compensation