January 22, 2018 Juno All Company Meeting Exhibit A

The tender offer for the outstanding common stock of Juno Therapeutics, Inc. (“Juno”) referred to in this communication has not yet commenced. This communication is neither a recommendation, an offer to purchase nor a solicitation of an offer to sell any securities. The solicitation and the offer to buy shares of Juno’s common stock will be made pursuant to an offer to purchase and related materials that Celgene Corporation (“Celgene”) and Blue Magpie Corporation (“Purchaser”) intend to file with the Securities and Exchange Commission (the “SEC”). At the time the tender offer is commenced, Celgene and Purchaser will file a tender offer statement on Schedule TO with the SEC, and thereafter Juno will file a Solicitation/Recommendation Statement on Schedule 14D-9 with respect to the offer and a Transaction Statement on Schedule 13E-3 with respect to the transaction contemplated by the merger agreement. The Tender Offer Statement (including an offer to purchase, a related letter of transmittal and other offer documents), the Solicitation/Recommendation Statement and the Transaction Statement will contain important information that should be read carefully and considered before any decision is made with respect to the tender offer. Juno, Celgene and Purchaser will file other relevant materials in connection with the proposed acquisition of Juno by Celgene pursuant to the terms of the merger agreement. Juno, Celgene and Purchaser intend to mail these documents to the stockholders of Juno. All of the tender offer materials (and all other materials filed by Juno with the SEC) will also be available free of charge from the SEC through its website at www.sec.gov. INVESTORS AND STOCKHOLDERS OF JUNO ARE ADVISED TO READ THE SCHEDULE TO, THE SCHEDULE 14D-9 AND THE SCHEDULE 13E-3, INCLUDING THE SOLICITATION/RECOMMENDATION STATEMENT OF JUNO, AS EACH MAY BE AMENDED OR SUPPLEMENTED FROM TIME TO TIME, AS WELL AS ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC WHEN THEY BECOME AVAILABLE CAREFULLY AND IN THEIR ENTIRETY PRIOR TO MAKING ANY DECISIONS WITH RESPECT TO THE OFFER, MERGER OR WHETHER TO TENDER THEIR JUNO SHARES PURSUANT TO THE OFFER, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION (INCLUDING THE TERMS AND CONDITIONS OF THE OFFER) AND THE PARTIES THERETO. Important Information

Certain statements in this communication, other than historical facts, are forward-looking statements, including, without limitation, the statements made concerning the pending acquisition of Juno by Celgene and Purchaser. In some cases, you can identify forward-looking statements by the following words: “may,” “will,” “could,” “would,” “should,” “expect,” “intend,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “project,” “aim,” “potential,” “continue,” “ongoing,” “goal” or the negative of these terms or other similar expressions, although not all forward-looking statements contain these words. These statements reflect Juno’s current views concerning future events, including the planned completion of the tender offer and the merger, and are based on a number of assumptions that could ultimately prove inaccurate. As a general matter, forward-looking statements are those focused upon anticipated events or trends, expectations, and beliefs relating to matters that are not historical in nature. Such forward-looking statements are subject to uncertainties and factors relating to Juno’s operations and business environment, all of which are difficult to predict and many of which are beyond the control of Juno. Among others, the following factors could cause actual results to differ materially from those set forth in the forward-looking statements: (i) uncertainties as to the timing of the tender offer and the merger, (ii) uncertainties as to how many Juno stockholders will tender their Juno Shares in the tender offer, (iii) the possibility that competing offers will be made, (iv) the possibility that various closing conditions for the transaction may not be satisfied or waived, (v) the risk that the merger agreement may be terminated in circumstances requiring Juno to pay a termination fee, (vi) risks related to obtaining the requisite consents to the tender offer and the merger, including, without limitation, the risk that a regulatory approval that may be required for the proposed transaction, including under the Hart-Scott-Rodino Antitrust Improvements Act of 1976 (HSR Act) and from the Federal Trade Commission (FTC), is delayed, is not obtained, or is obtained subject to conditions that are not anticipated; (vii) the possibility that the transaction may not be timely completed, if at all, (viii) the risk that, prior to the completion of the transaction, if at all, Juno’s business and its relationships with employees, collaborators, vendors and other business partners may experience significant disruption due to transaction-related uncertainty, (ix) the risk that stockholder litigation in connection with the offer or the merger may result in significant costs of defense, indemnification and liability, and (x) the risks and uncertainties pertaining to Juno’s business, including those detailed under “Risk Factors” and elsewhere in Juno’s public periodic filings with the SEC, as well as the tender offer materials to be filed by Celgene and Purchaser and the Solicitation/Recommendation Statement to be filed by Juno in connection with the tender offer. Other factors that could cause actual results to differ materially include those set forth in Juno’s SEC reports, including, without limitation, the risks described in Juno’s Annual Report on Form 10-K for its fiscal year ended December 31, 2016 and Quarterly Report on Form 10-Q for the fiscal quarter ended September 30, 2017. The reader is cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. All forward-looking statements are qualified in their entirety by this cautionary statement and Juno undertakes no obligation to revise or update this report to reflect events or circumstances after the date hereof, except as required by law. Forward-Looking Statements

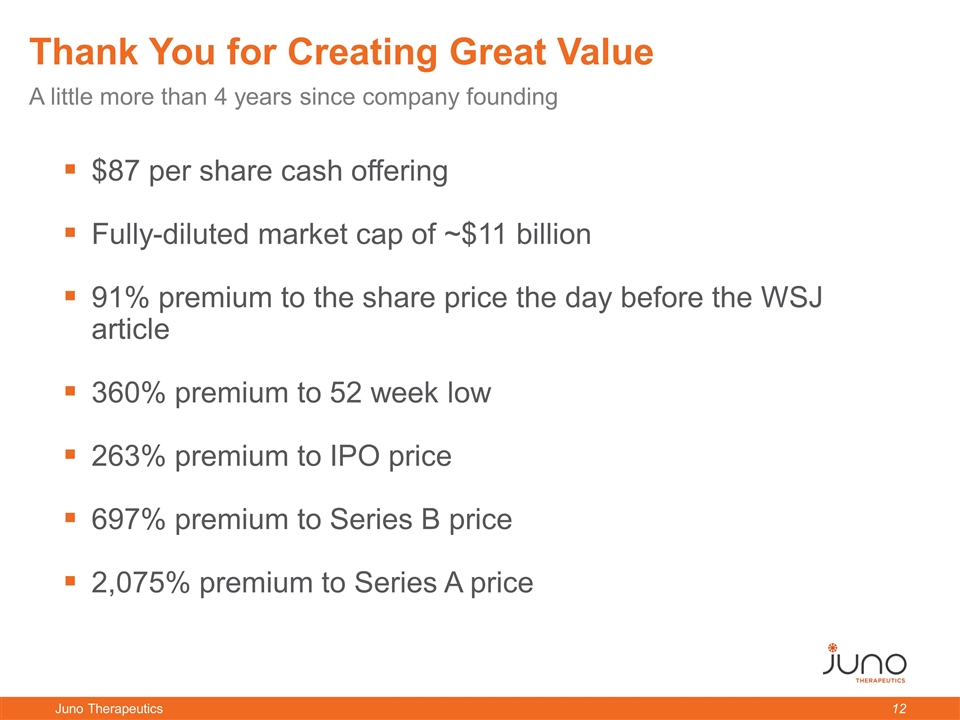

$87 per share cash offering Fully-diluted market cap of ~$11 billion 91% premium to the share price the day before the WSJ article The acquisition is subject to regulatory approval before it goes into effect (referred to as the “closing”) The closing could occur before the end of March Terms of Agreement

Current compensation will not change and we will proceed with our annual compensation review process, which kicks off on February 5, as planned. Some highlights about this year’s process: Base Pay. Eligible employees in good standing will receive a base pay increase of 3.25% Bonus. As in previous years, Juno’s bonus pool will be approved by the Board on January 31. Given the exceptional year we had in 2017, we anticipate the Board to approve the bonus pool above 100% of target based on performance results. Awards will be made consistent with past practices. Annual Equity Grant. Annual grants will be made to all eligible employees in good standing, consistent with past practices except that employees will receive the grant in the form of RSUs (and not stock options). Promotion process. This process also remains the same and the treatment of compensation for approved promotions will be consistent with past practices. Compensation

A special one-time bonus pool of $20MM has been created to incentivize all active regular employees to stay focused on driving hard on our goals on behalf of our patients between now and the Closing. These bonuses will be awarded shortly before the Closing. “Focus” Bonus Pool

Celgene intends to transition Juno employees into their benefit plans in the future. Until then, you will continue to receive the same benefits from Juno during the transition period. Details about the transition, including exact timing, will be developed and communicated by Celgene after completion of this transaction. Benefits

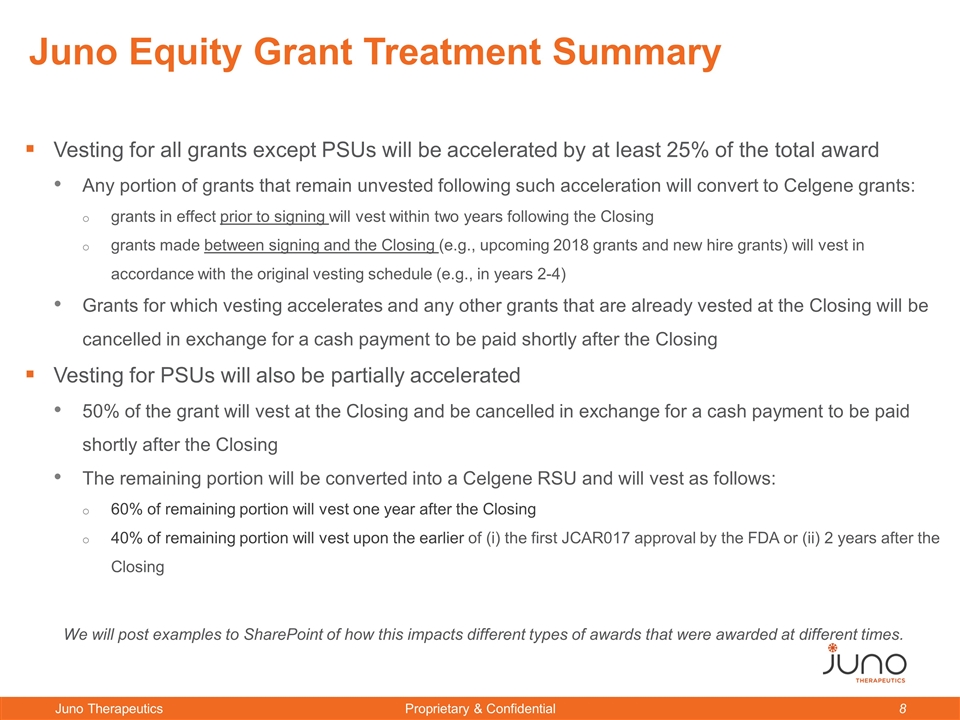

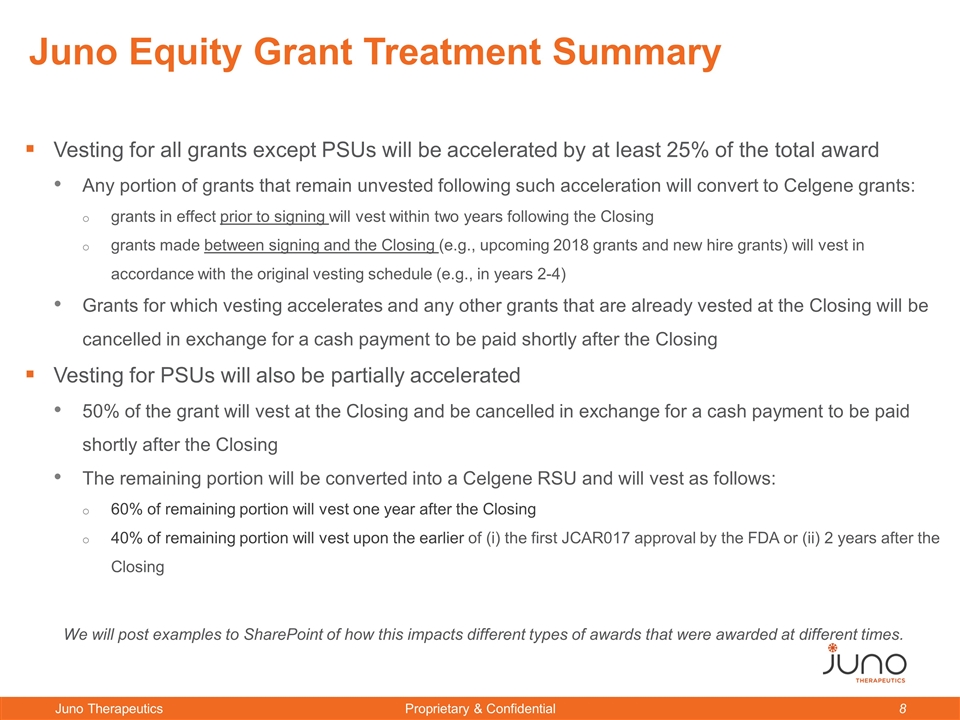

Vesting for all grants except PSUs will be accelerated by at least 25% of the total award Any portion of grants that remain unvested following such acceleration will convert to Celgene grants: grants in effect prior to signing will vest within two years following the Closing grants made between signing and the Closing (e.g., upcoming 2018 grants and new hire grants) will vest in accordance with the original vesting schedule (e.g., in years 2-4) Grants for which vesting accelerates and any other grants that are already vested at the Closing will be cancelled in exchange for a cash payment to be paid shortly after the Closing Vesting for PSUs will also be partially accelerated 50% of the grant will vest at the Closing and be cancelled in exchange for a cash payment to be paid shortly after the Closing The remaining portion will be converted into a Celgene RSU and will vest as follows: 60% of remaining portion will vest one year after the Closing 40% of remaining portion will vest upon the earlier of (i) the first JCAR017 approval by the FDA or (ii) 2 years after the Closing We will post examples to SharePoint of how this impacts different types of awards that were awarded at different times. Juno Equity Grant Treatment Summary

We know you have many questions about what happens between now and the Closing. Zach Hale and Robin Andrulevich will hold regular office hours to address questions, particularly around compensation, over the next two weeks, and then as needed in order to support you through this time. Robin will send out an email with more details following this meeting. We ask you to please utilize these times to ask your questions and to learn more rather than reaching out individually. Office Hours

Thank you.

Appendix

$87 per share cash offering Fully-diluted market cap of ~$11 billion 91% premium to the share price the day before the WSJ article 360% premium to 52 week low 263% premium to IPO price 697% premium to Series B price 2,075% premium to Series A price Thank You for Creating Great Value A little more than 4 years since company founding