1940 Act File No. 811-22926

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE SECURITIES

EXCHANGE ACT OF 1934 (AMENDMENT NO. __)

Filed by the registrant [X]

Filed by a party other than the registrant [ ]

Check the appropriate box:

| [X] | Preliminary proxy statement. |

[ ] | Confidential, for use of the Commission only (as permitted by Rule 14a-6(e)(2)). |

| [ ] | Definitive proxy statement. |

| [ ] | Definitive additional materials. |

| [ ] | Soliciting material pursuant to Section 240.14a-12 |

| INNOVATOR ETFS TRUST II |

| (Name of Registrant as Specified in Its Charter) |

| |

| |

| (Name of Person(s) Filing Proxy Statement if Other Than the Registrant) |

Payment of filing fee (check the appropriate box):

| [X] | No fee required. |

[ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | | |

| | | |

| | (2) | Aggregate number of securities to which transaction applies: |

| | | |

| | | |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | |

| | (4) | Proposed maximum aggregate value of transaction: |

| | | |

| | | |

| | (5) | Total fee paid: |

| | | |

[ ] Fee paid previously with preliminary materials.

[ ] Check box if any part of the fee is offset as provided by Exchange Act Rule-0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing.

| | (1) | Amount Previously Paid: |

| | | |

| | | |

| | (2) | Form, Schedule or Registration Statement No.: |

| | | |

| | | |

| | (3) | Filing Party: |

| | | |

| | | |

| | (4) | Date Filed: |

PROXY MATERIALS

Innovator Lunt Low Vol/High Beta Tactical ETF

(formerly, Elkhorn Lunt Low Vol/High Beta Tactical ETF)

Innovator S&P High Quality Preferred ETF

(formerly, Elkhorn S&P High Quality Preferred ETF)

Series of

Innovator ETFs Trust II

(formerly, Elkhorn ETF Trust)

Dear Shareholder:

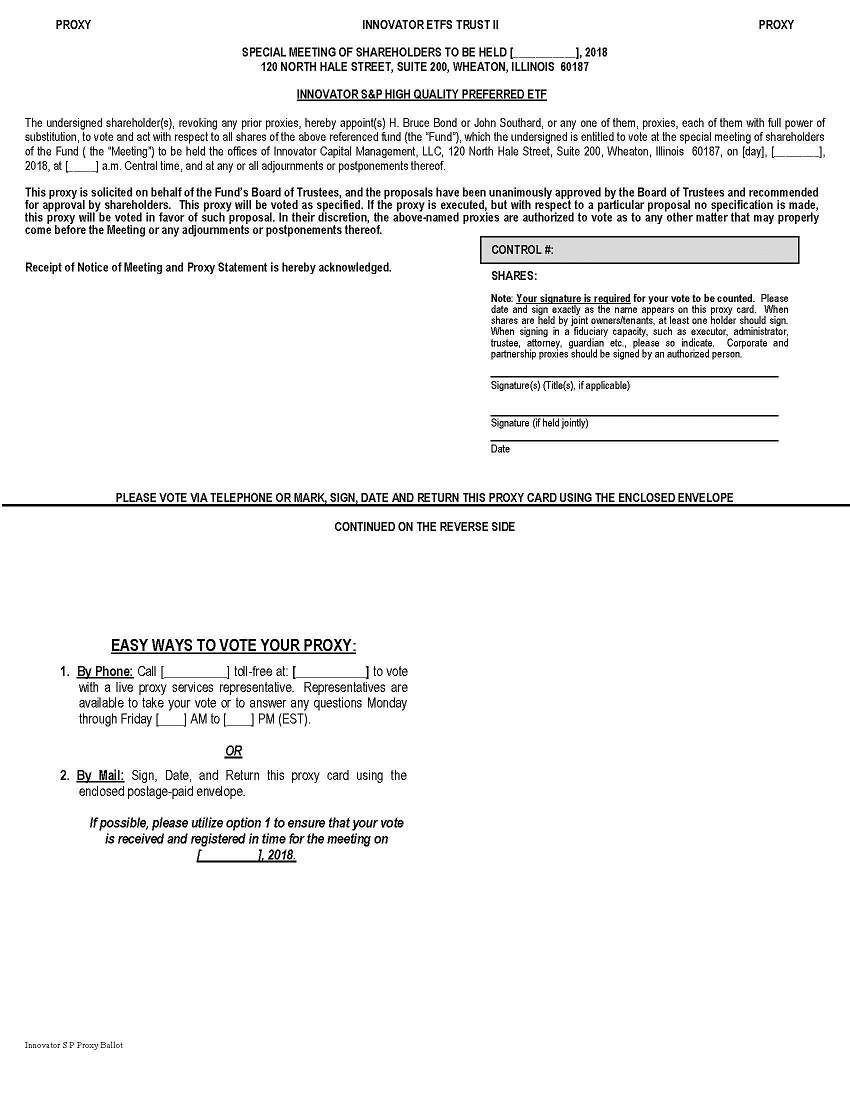

I am writing to let you know that a Joint Special Meeting of Shareholders (the “Meeting”) of the Innovator Lunt Low Vol/High Beta Tactical ETF (formerly, Elkhorn Lunt Low Vol/High Beta Tactical ETF) and the Innovator S&P High Quality Preferred ETF (formerly, Elkhorn S&P High Quality Preferred ETF) (each, a “Fund” and together, the “Funds”), series of Innovator ETFs Trust II (formerly, Elkhorn ETF Trust) (the “Trust”), will be held at the offices of [____________________], on [_________], 2018, at [__] a.m., Central time. The purpose of the Meeting is to vote on three proposals (each, a “Proposal” and together, the “Proposals”) that affect your Fund and your investment. As a shareholder, you have the opportunity to voice your opinion on the matters that affect your Fund. This package contains information about the Proposals and the materials to use when voting by mail, telephone, or through the Internet.

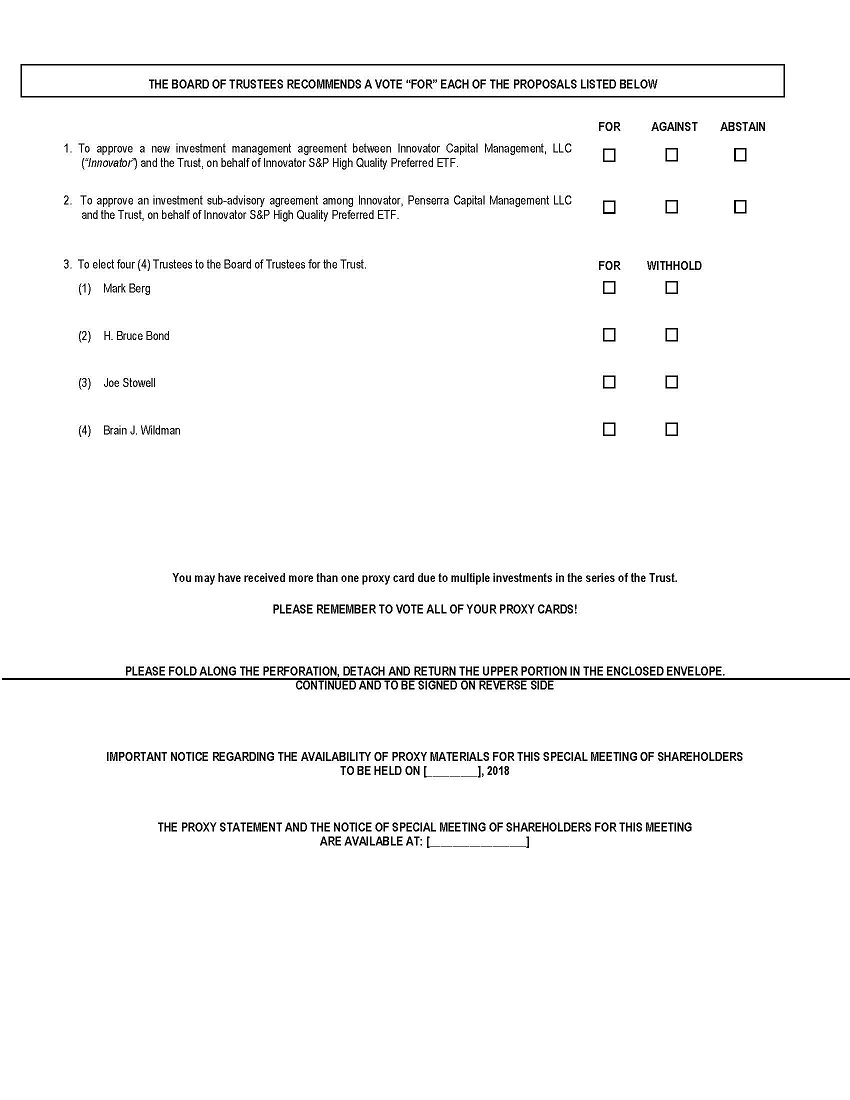

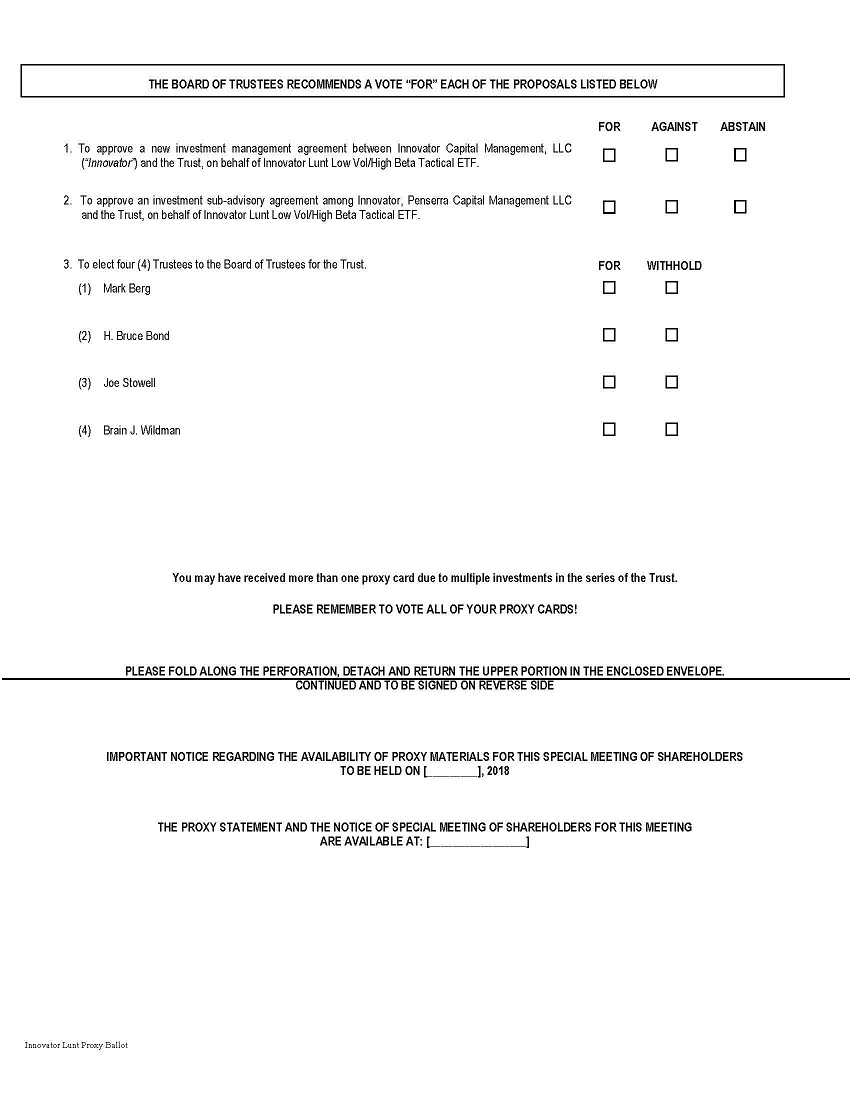

| | Proposal 1. | To approve a new investment management agreement between Innovator Capital Management, LLC (“Innovator”) and the Trust, on behalf of each Fund. |

| | Proposal 2. | To approve an investment sub-advisory agreement among Innovator, Penserra Capital Management LLC and the Trust, on behalf of each Fund. |

| | | |

| | Proposal 3. | To elect four (4) Trustees to the Board of Trustees for the Trust. |

The Proposals are described in greater detail in the enclosed Joint Proxy Statement.

The Board of Trustees unanimously recommends that you vote FOR each Proposal.

Voting is quick and easy. Everything you need is enclosed. Your vote is important no matter how many shares you own. Voting your shares early will avoid costly follow-up mail and telephone solicitation. After reviewing the enclosed materials, please complete, sign and date your proxy card(s) before mailing it (them) in the postage-paid envelope, or help save time and postage costs by calling the toll-free number and following the instructions. You may also vote via the Internet by logging on to the website indicated on your proxy card and following the instructions. If we do not hear from you, our proxy solicitor, [___________] (the “Proxy Solicitor”), may contact you. This will ensure that your vote is counted even if you cannot attend the Meeting in person. If you have any questions about the Proposals or the voting instructions, please call the Proxy Solicitor at [________]. Representatives are available to assist you Monday through Friday, [__] a.m. to [__] p.m. Eastern Time.

Very truly yours,

| /s/ Benjamin T. Fulton | |

Benjamin T. Fulton Chairman of the Board of Trustees Chief Executive Officer and President of the Trust _________, 2018 |

Innovator ETFs Trust II

(formerly, Elkhorn ETF Trust)

120 North Hale Street, Suite 200

Wheaton, Illinois 60187

Important Information for Fund Shareholders

___________, 2018

Innovator Lunt Low Vol/High Beta Tactical ETF (formerly, Elkhorn Lunt Low Vol/High Beta Tactical ETF)

Innovator S&P High Quality Preferred ETF (formerly, Elkhorn S&P High Quality Preferred ETF)

(each, a “Fund” and collectively, the “Funds”)

While we encourage you to read the full text of the enclosed Joint Proxy Statement, we are also providing you with a brief overview of the proposals in the Questions & Answers (“Q&A”) below. The Q&A contains limited information. It should be read in conjunction with, and is qualified by reference to, the more detailed information contained elsewhere in the Joint Proxy Statement.

Questions and Answers:

Q. | Why am I receiving this Joint Proxy Statement? |

A. | You are being asked to vote on the following important matters affecting your Fund: |

(1) Approval of a New Investment Management Agreement for your Fund.

Elkhorn Investments, LLC (“Elkhorn Investments”) served as your Fund’s investment adviser pursuant to an investment management agreement that expired by its terms on March 31, 2018. At an in-person meeting of the Board of the Trustees (the “Board”) of Innovator ETFs Trust II (formerly, Elkhorn ETF Trust) (the “Trust”) held on March 30, 2018, the Board, including the Trustees who are not “interested persons” (the “Independent Trustees”), as that term is defined in the Investment Company Act of 1940, as amended (the “1940 Act”), voted unanimously to approve an interim investment management agreement between Innovator Capital Management, LLC (“Innovator” or the “Adviser”) and the Trust, on behalf of your Fund, in reliance on Rule 15a-4 of the Investment Company Act of 1940, as amended (the “1940 Act”), pursuant to which Innovator replaced Elkhorn Investments as the investment adviser to your Fund, effective as of April 1, 2018. At an in-person meeting of the Board held on April 10, 2018, the Board unanimously approved a new investment management agreement between the Adviser and the Trust, on behalf of your Fund, subject to shareholder approval. The new investment management agreement will become effective as to your Fund only if it is approved by the shareholders of your Fund.

(2) Approval of an Investment Sub-Advisory Agreement for your Fund.

At an in-person meeting of the Board held on March 30, 2018, the Board unanimously approved an interim investment sub-advisory agreement among Penserra Capital Management LLC (“Penserra” or the “Sub-Adviser”), Innovator and the Trust in reliance on Rule 15a-4 of the 1940 Act, pursuant to which Penserra will manage your Fund’s assets under the supervision of the Adviser and the Board, effective as of April 1, 2018. At an in-person meeting of the Board held on April 10, 2018, the Board voted unanimously to approve an investment sub-advisory agreement among Penserra, Innovator and the Trust, on behalf of your Fund, subject to shareholder approval. The investment sub-advisory agreement will become effective as to your Fund only if it is approved by the shareholders of your Fund.

(3) Election of Trustees to the Board.

You are also being requested to vote on a proposal to elect four new Trustees: Mark Berg, H. Bruce Bond, Joe Stowell and Brian J. Wildman (each, a “Nominee” and collectively, the “Nominees”). The election of the new Board is contingent upon the new investment management agreement being approved by the shareholders of at least one of the Funds. The current Trustees are each expected to serve until the Nominees, who will serve as their successors, are elected, qualified and serving as Trustees. More information about these Board changes is provided in the Joint Proxy Statement under Proposal 3.

Your Fund’s Board unanimously recommends that you vote FOR each proposal.

Your vote is very important. We encourage you as a shareholder to participate in your Fund’s governance by returning your vote as soon as possible. If enough shareholders do not cast their votes, your Fund may not be able to hold its meeting or to obtain the vote on each issue. Your immediate response will prevent the inconvenience of further solicitations for a shareholder vote.

Q. | How will the new investment management agreement and the investment sub-advisory agreement affect my Fund investment? |

A. | Your Fund investment will not change as a result of the new investment management agreement and the investment sub-advisory agreement. You will still own the same Fund shares and the underlying value of those shares will not change. The Adviser and the Sub-Adviser will manage your Fund according to the same objectives and policies as before. |

Q. | Why am I being asked to approve a new investment management agreement with a new adviser? |

A. | The prior investment management agreement expired by its terms on March 31, 2018. In order to ensure the continued management of each Fund’s assets following the expiration of the prior investment management agreement, the Board approved an interim and a new investment management agreement with Innovator. The new investment management agreement is subject to your approval. |

Q. | Will there be any important differences between my Fund’s new investment management agreement and the prior agreement? |

A. | No. The terms of the new and prior investment management agreements are substantially identical for your Fund other than the identity of the Adviser, the effective date and the initial term. |

Q. | Will there be any changes in the services provided or fees paid by my Fund under the new investment management agreement and the investment sub-advisory agreement? |

A. | Under the new investment management agreement, the Adviser will provide investment advisory services to each Fund on substantially identical terms and for the same fees that were in effect pursuant to the prior investment management agreement. The Adviser will retain the Sub-Adviser under the investment sub-advisory agreement to manage the Funds under the supervision of the Adviser and the Board. The Funds will continue to be managed in accordance with their current investment objectives if the new investment management agreement and the investment sub-advisory agreement are approved by shareholders. The management fees payable by each Fund have not changed. Under the investment sub-advisory agreement, your Fund does not pay a sub-advisory fee directly to the Sub-Adviser. Rather, the Adviser pays the Sub-Adviser a sub-advisory fee out of the investment management fee it receives from the Fund. The investment management fee borne by your Fund will not change if the investment sub-advisory agreement is approved. |

Q. | What will happen if shareholders of my Fund do not approve the new investment management agreement and the investment sub-advisory agreement? |

A. | If shareholders of a Fund do not approve the new investment management agreement and the investment sub-advisory agreement, then the interim investment management agreement and the interim investment sub-advisory agreement with respect to that Fund will terminate 150 days following termination of the prior investment management agreement. The terms of the interim investment management agreement are the same as those of the prior investment management agreement and the terms of the new investment management agreement, except for the identity of the Adviser and the effective date and the duration of the agreement. The interim investment sub-advisory agreement contains similar required provisions with respect to the payment of compensation to the Sub-Adviser. If shareholders of a Fund do not approve the new investment management agreement and the investment sub-advisory agreement within the term of the interim investment management agreement and the interim investment sub-advisory agreement, respectively, the Board will consider other alternatives and will make such arrangements for the management of the Fund’s investments as it deems appropriate and in the best interests of the Fund, including, without limitation, the liquidation of that Fund. |

Q. | Is the approval of one proposal contingent on the approval of any other proposals? |

A. | The approval of Proposal 2 (relating to an investment sub-advisory agreement) for a Fund is contingent on the approval of Proposal 1 (relating to a new investment management agreement) for that Fund. The approval of Proposal 3 (relating to the election of new Trustees) is contingent on the approval of Proposal 1 with respect to at least one of the Funds. The approval of Proposal 1 is not contingent on the approval of the other Proposals. |

Q. | How does the Board recommend that I vote on the proposals? |

A. | After careful consideration, the Board unanimously recommends that shareholders vote FOR each proposal. |

Q. | Whom do I call if I have questions? |

A. | If you need any assistance or have any questions regarding the proposals or how to vote your shares, please call [_____________], your Fund’s proxy solicitor, at [(___) _______]. |

Q. | Will my Fund pay for this proxy solicitation? |

A. | No. The Adviser will bear all costs and expenses associated with the preparation, printing and mailing of the Joint Proxy Statement, the solicitation of proxy votes and holding the meetings. |

Q. | How do I vote my shares? |

A. | You can vote your shares by completing and signing the enclosed proxy card and mailing it in the enclosed postage-paid envelope. Alternatively, you may vote by telephone by calling the toll-free number found on your proxy card or by going to the Internet site found on your proxy card. |

Q. | Will anyone contact me? |

A. | You may receive a call from [_____________], the proxy solicitor, to verify that you received your proxy materials, to answer any questions you may have about the proposals and to encourage you to vote your proxy. |

120 North Hale Street, Suite 200

Wheaton, Illinois 60187

Notice of Joint Special Meeting

of Shareholders

to Be Held on ___________, 2018

| Innovator ETFs Trust II | (FORMERLY, ELKHORN ETF TRUST) |

Innovator Lunt Low Vol/High Beta Tactical ETF (formerly, Elkhorn Lunt Low Vol/High Beta Tactical ETF)

Innovator S&P High Quality Preferred ETF (formerly, Elkhorn S&P High Quality Preferred ETF)

___________, 2018

To the Shareholders of the above Funds:

Notice is hereby given that a Joint Special Meeting of Shareholders (the “Meeting”) of Innovator ETFs Trust II (formerly, Elkhorn ETF Trust), a Massachusetts business trust (the “Trust”), on behalf of each series of the Trust (as identified above and on Appendix A to the enclosed Joint Proxy Statement, each a “Fund,” and collectively, the “Funds”), will be held in the offices of [____________________], on [_________], 2018, at [__] a.m., Central time, for the following purposes:

• Proposal 1: | To approve a new investment management agreement between the Trust and Innovator Capital Management, LLC (“Innovator”), as each Fund’s investment adviser, applicable to each series of the Trust. |

• Proposal 2: | To approve an investment sub-advisory agreement among the Trust, Innovator and Penserra Capital Management LLC, as each Fund’s investment sub-adviser, applicable to each series of the Trust. |

• Proposal 3: | To elect four (4) Trustees to the Board. |

| | |

| | To transact such other business as may properly come before the Meeting. |

Shareholders of record at the close of business on [_________], 2018, are entitled to notice of and to vote at the Meeting.

The Board of Trustees unanimously recommends that shareholders vote FOR each proposal above.

All shareholders are cordially invited to attend the Meeting with respect to their Fund. In order to avoid delay and additional expense and to assure that your shares are represented, please vote as promptly as possible, regardless of whether or not you plan to attend the Meeting. You may vote by mail, by telephone or over the Internet. To vote by mail, please mark, sign, date and mail the enclosed proxy card. No postage is required if mailed in the United States. To vote by telephone, please call the number found on your proxy card and follow the recorded instructions, using your proxy card as a guide. To vote over the Internet, please go to the website found on your proxy card and follow the instructions, using your proxy card as a guide.

By Order of the Board of Trustees,

| /s/ Benjamin T. Fulton | |

Benjamin T. Fulton Chairman of the Board of Trustees Chief Executive Officer and President of the Trust |

Table of Contents

PROPOSAL 1: APPROVAL OF A NEW INVESTMENT MANAGEMENT AGREEMENT | 3 |

Background and Reason for Vote | 3 |

Information Concerning Innovator | 4 |

Comparison of Original Investment Management Agreement and New Investment Management Agreement | 4 |

Affiliated Brokerage and Other Fees | 5 |

Shareholder Approval | 5 |

PROPOSAL 2: APPROVAL OF THE INVESTMENT SUB-ADVISORY AGREEMENT | 6 |

Background and Reason for Vote | 6 |

Information Concerning Penserra | 6 |

Proposed Sub-Advisory Agreement | 6 |

Affiliated Brokerage and Other Fees | 7 |

Shareholder Approval | 7 |

PROPOSAL 3: ELECTION OF TRUSTEES | 10 |

Background and Reason for Vote | 10 |

Share Ownership | 13 |

Compensation | 13 |

Board Leadership and Risk Oversight | 13 |

Board Diversification and Trustee Qualifications | 15 |

Attendance of Trustees at Annual Meetings | 16 |

Independent Registered Public Accounting Firm | 17 |

Audit and Related Fees | 17 |

Audit Committee Pre-Approval Policies and Procedures | 17 |

Shareholder Approval | 17 |

ADDITIONAL INFORMATION | 18 |

Principal Shareholders | 18 |

Shareholder Proposals | 18 |

Shareholder Communications | 18 |

Expenses of Proxy Solicitation | 18 |

Fiscal Year | 18 |

Service Providers | 18 |

Shareholder Report Delivery | 18 |

General | 19 |

| APPENDIX A: | SHAREHOLDER INFORMATION | A-1 |

| APPENDIX B: | DATES RELATING TO ORIGINAL INVESTMENT MANAGEMENT AGREEMENT | B-1 |

| APPENDIX C: | INVESTMENT MANAGEMENT FEE INFORMATION | C-1 |

| APPENDIX D: | INFORMATION REGARDING PRINCIPAL EXECUTIVE OFFICERS OF THE ADVISER | D-1 |

| APPENDIX E: | SHARE OWNERSHIP | E-1 |

| APPENDIX F: | TRUSTEE COMPENSATION | F-1 |

| APPENDIX G: | AUDITOR INFORMATION | G-1 |

| APPENDIX H: | PRINCIPAL HOLDERS INFORMATION | H-1 |

| APPENDIX I: | FORM OF NEW INVESTMENT MANAGEMENT AGREEMENT | I-1 |

| APPENDIX J: | FORM OF INVESTMENT SUB-ADVISORY AGREEMENT | J-1 |

| APPENDIX K: | INFORMATION REGARDING PRINCIPAL EXECUTIVE OFFICERS OF THE SUB-ADVISER | K-1 |

| APPENDIX L: | SUB-ADVISORY FEE INFORMATION | L-1 |

Innovator ETFs Trust II

(formerly, Elkhorn ETF Trust)

120 North Hale Street, Suite 200

Wheaton, Illinois 60187

Joint Proxy Statement

___________, 2018

This Joint Proxy Statement is first being mailed to shareholders on or about ___________, 2018.

Innovator Lunt Low Vol/High Beta Tactical ETF (formerly, Elkhorn Lunt Low Vol/High Beta Tactical ETF)

Innovator S&P High Quality Preferred ETF (formerly, Elkhorn S&P High Quality Preferred ETF)

This Joint Proxy Statement is furnished in connection with the solicitation by the board of trustees (the “Board” and each trustee, a “Trustee” and collectively, the “Trustees”) of Innovator ETFs Trust II (formerly, Elkhorn ETF Trust) (the “Trust”), on behalf of each series of the Trust (as identified above and on Appendix A, each a “Fund,” and collectively, the “Funds”), of proxies to be voted at the Special Meeting of Shareholders of each Fund to be held in the offices of [____________________], on [_________], 2018, at [__] a.m., Central time (for each Fund, a “Meeting”), and at any and all adjournments, postponements or delays thereof.

Proposals

1. | To approve a new investment management agreement between the Trust and Innovator Capital Management, LLC (“Innovator” or the “Adviser”), as each Fund’s investment adviser, applicable to each series of the Trust. |

2. | To approve an investment sub-advisory agreement among the Trust, Innovator and Penserra Capital Management LLC, as each Fund’s investment sub-adviser, applicable to each series of the Trust. |

3. | To elect four (4) Trustees to the Board. |

Voting Information

On the Proposals coming before the Meeting as to which a choice has been specified by shareholders on the proxy, the shares will be voted accordingly. If a properly executed proxy is returned and no choice is specified, the shares will be voted:

| | • | FOR the approval of the Funds’ new investment management agreement, |

| | • | FOR the approval of the Funds’ investment sub-advisory agreement, and |

| | • | FOR the election of four (4) Trustees to the Board of Trustees as described in this Joint Proxy Statement. |

Shareholders of a Fund who execute proxies may revoke them at any time before they are voted by filing a written notice of revocation, by delivering a duly executed proxy bearing a later date or by attending the Meeting and voting in person. A prior proxy can also be revoked by submitting a new proxy through the toll-free number or the Internet address listed in the proxy card. Merely attending the Meeting, however, will not revoke any previously submitted proxy.

A quorum of shareholders is required to take action at a Meeting. Thirty percent of the shares of a Fund entitled to vote at that Fund’s Meeting or, in the case of the election of a Trustee, thirty percent of the shares of the Trust, represented in person or by proxy, will constitute a quorum of shareholders at that Meeting. Votes cast by proxy or in person at a Meeting will be tabulated by the inspectors of election appointed for that Meeting. The inspectors of election will determine whether or not a quorum is present at the Meeting. The inspectors of election will treat abstentions and “broker non-votes” (i.e., shares held by brokers or nominees, typically in “street name,” as to which (i) instructions have not been received from the beneficial owners or persons entitled to vote and (ii) the broker or nominee does not have discretionary voting power on a particular matter) as present for purposes of determining a quorum.

Broker-dealer firms holding shares of a Fund in “street name” for the benefit of their customers and clients may request the instructions of such customers and clients on how to vote their shares before the Meeting. We urge you to provide instructions to your broker or nominee so that your votes may be counted.

The details of the Proposals to be voted on by the shareholders of each Fund and the vote required for approval of the Proposals are set forth under the description of the Proposals below.

Shareholders of each Fund will vote separately on Proposals 1 and 2 relating to their Fund. Shareholders of the Funds will vote together on Proposal 3.

Note that the approval of Proposal 2 (relating to an investment sub-advisory agreement) for a Fund is contingent on the approval of Proposal 1 (relating to a new investment management agreement) for that Fund. The approval of Proposal 3 (relating to the election of new Trustees) is contingent on the approval of Proposal 1 with respect to at least one of the Funds. The approval of Proposal 1 is not contingent on the approval of the other Proposals.

Shares Outstanding

Those persons who were shareholders of record at the close of business on [_________], 2018 (the “Record Date”), will be entitled to one vote for each share held and a proportionate fractional vote for each fractional share held. Appendix A lists the shares of each Fund that were issued and outstanding as of the Record Date.

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to Be Held on [_________], 2018. This Joint Proxy Statement is available on the Internet at www. [_________]. The Funds’ most recent annual and semiannual reports are also available on the Internet at http://www.innovatoretfs.com. In addition, the Funds will furnish, without charge, copies of their most recent annual and semiannual reports to any shareholder upon request. To request a copy, please write to Innovator ETFs Trust II, 120 North Hale Street, Suite 200, Wheaton, Illinois 60187, or call (___) _____.

You may call [(___) _______] for information on how to obtain directions to be able to attend the Meeting and vote in person.

PROPOSAL 1: APPROVAL OF A NEW INVESTMENT MANAGEMENT AGREEMENT

Background and Reason for Vote

Elkhorn Investments, LLC (“Elkhorn Investments”) served as each Fund’s investment adviser pursuant to an investment management agreement (the “Original Investment Management Agreement”) between Elkhorn Investments and the Trust that expired by its terms on March 31, 2018. The Board of Trustees (the “Board”) of Innovator ETFs Trust II (formerly, Elkhorn ETF Trust) (the “Trust”), including the Trustees who are not “interested persons” (the “Independent Trustees”), as that term is defined in the Investment Company Act of 1940, as amended (the “1940 Act”), unanimously approved an interim and proposed new investment management agreement (the “New Investment Management Agreement”) with Innovator to ensure the continued management of each Fund’s assets following the expiration the Original Investment Management Agreement.

In 2017, the Board initiated discussions with Elkhorn Investments regarding the amount and level of resources available to Elkhorn Investments for purposes of managing the Funds. In response, Elkhorn Investments advised the Board that it planned to enter into a strategic transaction, which would bring additional resources, and that it was in discussions with multiple parties. Subsequently, Elkhorn Investments advised the Board that it intended to enter into a transaction with Veracen L.P. (formerly, Turner Investment Holdings L.P.) (“Veracen”) pursuant to which Veracen would acquire a controlling interest of Elkhorn Investments, and Elkhorn Investments and Veracen presented the proposed transaction to the Board. On August 30, 2017, the parties announced the proposed transaction with an expected closing to occur in the fall of 2017. However, the closing of the transaction was delayed and, ultimately, it was determined that the closing was not expected to occur by March 31, 2018, the date the Original Investment Management Agreement expired by its terms. To avoid disruption of the Funds’ investment management program, the Board unanimously approved at the March 30, 2018 Board meeting an interim investment management agreement, effective as of April 1, 2018, between the Trust and Innovator Capital Management, LLC (“Innovator” or the “Adviser”) with respect to each Fund. The interim investment management agreement was approved pursuant to Rule 15a-4 under the 1940 Act, which allows an adviser to provide investment management services pursuant to an interim investment management agreement for up to 150 days while a fund seeks shareholder approval of a new investment management agreement, subject to certain conditions.

Many of the terms of the interim investment management agreement are the same as those of the Original Investment Management Agreement; however, there are, among other differences, differences in provisions relating to the effective date, the identity of the Adviser and, consistent with the requirements of Rule 15a-4, the duration of the interim investment management agreement. The interim investment management agreement went into effect with respect to each Fund as of April 1, 2018. If shareholder approval is not obtained for a Fund with respect to the New Investment Management Agreement, the interim investment management agreement will remain in effect (unless sooner terminated) until the earlier of shareholder approval or disapproval of the New Investment Management Agreement or 150 days following the expiration of the Original Investment Management Agreement, or August 28, 2018.

The form of the New Investment Management Agreement is attached hereto in Appendix I. The terms of the New Investment Management Agreement are substantially identical to the terms of the Original Investment Management Agreement with respect to services provided, and to be provided, by the Adviser. In addition, the advisory fees payable to the Adviser by each Fund under the New Investment Management Agreement are identical to the advisory fees payable under the Original Investment Management Agreement and the interim investment management agreement.

The 1940 Act requires that the New Investment Management Agreement be approved by the Fund’s shareholders in order for it to become effective. At an April 10, 2018 in-person meeting, and for the reasons discussed below (see “Board Considerations” after Proposal 2 below), the Board unanimously approved a New Investment Management Agreement between Innovator and the Trust, on behalf of each Fund, and unanimously recommended its approval by shareholders.

In addition, as described below, there are no material differences between the Original Investment Management Agreement and the New Investment Management Agreement other than the identity of the Adviser. In this regard, the Original Investment Management Agreement and the New Investment Management Agreement contain the same terms, conditions and fee rates, and provide for the same management services.

Information Concerning Innovator

Innovator is a Delaware limited liability company located at 120 N. Hale Street, Suite 200, Wheaton, Illinois 60187. The Adviser is registered as an investment advisor with the Securities and Exchange Commission (the “SEC”) under the Investment Advisers Act of 1940, as amended (the “Advisers Act”). As of March 31, 2018, the Adviser directly managed $393 million across two exchange-traded funds that do not have similar investment objectives to the Funds. Messrs. H. Bruce Bond (President and Principal Executive Officer of the Trust, effective June 1, 2018) and John Southard (Vice President, Treasurer and Principal Financial Accounting Officer of the Trust, effective June 1, 2018) may be deemed to control the Adviser due to their ownership interests in and/or positions with the Adviser.

Additional Information. Certain information regarding the principal executive officers of the Adviser is set forth in Appendix D.

Comparison of Original Investment Management Agreement and New Investment Management Agreement

The terms of the New Investment Management Agreement, including fees payable to the Adviser by the Fund thereunder, are identical to those of the Original Investment Management Agreement, except for the date of effectiveness and the identity of the Adviser. There is no change in the fee rate payable by each Fund to the Adviser. If approved by shareholders of a Fund, the New Investment Management Agreement for such Fund will expire on or about [__________], 2020, unless continued. The New Investment Management Agreement will continue in effect from year to year thereafter if such continuance is approved for the Fund at least annually in the manner required by the 1940 Act and the rules and regulations thereunder. Below is a comparison of certain terms of the Original Investment Management Agreement to the terms of the New Investment Management Agreement. For purposes of the below comparison, the “Adviser” under the Original Investment Management Agreement is Elkhorn Investments and the “Adviser” under the New Investment Management Agreement is Innovator. For a more complete understanding of the New Investment Management Agreement, please refer to the form of the New Investment Management Agreement provided in Appendix I. The summary below is qualified in all respects by the terms and conditions of the form of New Investment Management Agreement.

Investment Management Services. The terms of the investment management services to be provided by the Adviser to each Fund under the New Investment Management Agreement will be identical to those services provided by the Adviser to each Fund under the Original Investment Management Agreement. Both the Original Investment Management Agreement and New Investment Management Agreement provide that the Adviser shall manage the investment and reinvestment of the Fund’s assets in accordance with the Fund’s investment objectives and policies and limitations and administer the Fund’s affairs to the extent requested by, and subject to the supervision of, the Fund’s Board.

Sub-Advisers. Both the Original Investment Management Agreement and the New Investment Management Agreement authorize the Adviser to retain one or more sub-advisers at the Adviser’s own cost and expense for the purpose of providing investment management services to the Funds. As discussed below in Proposal 2, the Adviser and the Trust are seeking shareholder approval for the retention of Penserra Capital Management LLC, as the sub-adviser to each Fund.

Brokerage. Both the Original Investment Management Agreement and New Investment Management Agreement authorize the Adviser to select the brokers or dealers that will execute the purchases and sales of portfolio securities for the Funds, subject to its obligation to obtain best execution under the circumstances, which may take account of the overall quality of brokerage and research services provided to the Adviser.

Fees. Under both the Original Investment Management Agreement and New Investment Management Agreement, each Fund pays to the Adviser an investment management fee equal to the annual rate of the Fund’s average daily net assets as set forth on Appendix C. The investment management fee rate payable by each Fund to Innovator under the New Investment Management Agreement will be the same investment management fee rate payable to Elkhorn Investments under the Original Investment Management Agreement.

Limitation on Liability. The Original Investment Management Agreement and New Investment Management Agreement provide that the Adviser shall not be liable for any loss sustained by reason of the purchase, sale or retention of any security, whether or not such purchase, sale or retention shall have been based upon the investigation and research made by any other individual, firm or corporation, if such recommendation shall have been selected with due care and in good faith, except loss resulting from willful misfeasance, bad faith or gross negligence on the part of the Adviser in the performance of its obligations and duties, or by reason of its reckless disregard of its obligations and duties thereunder.

Continuance. The Original Investment Management Agreement of each Fund originally was in effect for an initial term and could be continued thereafter for successive one-year periods if such continuance was specifically approved at least annually in the manner required by the 1940 Act. If the shareholders of a Fund approve the New Investment Management Agreement for that Fund, the New Investment Management Agreement will expire on or about [_________], 2020, unless continued. The New Investment Management Agreement may be continued for successive one-year periods if approved at least annually in the manner required by the 1940 Act.

Termination. The Original Investment Management Agreement and New Investment Management Agreement for each Fund provide that the agreement shall automatically terminate in the event of its assignment, and may be terminated at any time with respect to a Fund without the payment of any penalty by the Fund or Adviser on sixty (60) days’ written notice to the other party. A Fund may effect termination by action of the Board or by vote of a majority of the outstanding voting securities of the Fund, accompanied by appropriate notice.

Affiliated Brokerage and Other Fees

No Fund paid brokerage commissions within the last fiscal year to (i) any broker that is an affiliated person of such Fund or an affiliated person of such person, or (ii) any broker an affiliated person of which is an affiliated person of such Fund, the Adviser or any sub-adviser of such Fund.

Shareholder Approval

To become effective with respect to a particular Fund, the New Investment Management Agreement must be approved by a vote of a majority of the outstanding voting securities of the Fund, with all shares voting together as a single class. The “vote of a majority of the outstanding voting securities” is defined in the 1940 Act as the lesser of the vote of (i) 67% or more of the shares of the Fund entitled to vote thereon present at the meeting if the holders of more than 50% of such outstanding shares are present in person or represented by proxy; or (ii) more than 50% of such outstanding shares of the Fund entitled to vote thereon. For purposes of determining the approval of the New Investment Management Agreement, abstentions and broker non-votes will have the same effect as shares voted against the proposal.

The New Investment Management Agreement was approved by the Board with respect to each Fund after consideration of all factors that it determined to be relevant to its deliberations, including those discussed in “Board Considerations” after Proposal 2 below. The Board also determined with respect to each Fund to submit the Fund’s New Investment Management Agreement for consideration by the shareholders of such Fund.

Note that the approval of Proposal 1 for a Fund is not contingent on the approval of the other Proposals.

The Board unanimously recommends that shareholders of each Fund vote FOR approval of the Fund’s New Investment Management Agreement.

PROPOSAL 2: APPROVAL OF THE INVESTMENT SUB-ADVISORY AGREEMENT

Background and Reason for Vote

In connection with the retention of Innovator, the Board is proposing that shareholders of each Fund approve an investment sub-advisory agreement (the “Sub-Advisory Agreement”), a copy of which is attached hereto as Appendix J, to be entered into among the Trust, on behalf of each Fund, Innovator and Penserra Capital Management LLC (“Penserra” or the “Sub-Adviser”). The Trust and Innovator wish to retain the services of Penserra as sub-adviser to manage each Fund’s assets under the supervision of the Adviser and the Board. The description of the Sub-Advisory Agreement that follows is qualified in its entirety by reference to Appendix J.

Penserra currently serves as sub-adviser to each Fund pursuant to an interim investment sub-advisory agreement (“Interim Sub-Advisory Agreement”) unanimously approved by the Board, on March 30, 2018, in reliance on Rule 15a-4 under the 1940 Act. With respect to services provided by Penserra to each Fund, the terms of the Interim Sub-Advisory Agreement are substantially identical to the terms of the proposed Sub-Advisory Agreement. Pursuant to Rule 15a-4 under the 1940 Act, the Interim Sub-Advisory Agreement has a duration no greater than 150 days. The compensation arrangement under the Interim Sub-Advisory Agreement is the same as under the proposed Sub-Advisory Agreement with respect to each Fund.

The 1940 Act requires that the proposed Sub-Advisory Agreement be approved by that Fund’s shareholders in order for it to become effective. At the April 10, 2018 Board meeting, and for the reasons discussed below (see “Board Considerations” after Proposal 2), the Board unanimously approved, with respect to each Fund, the Sub-Advisory Agreement on behalf of such Fund and unanimously recommended its approval by shareholders of such Fund.

Information Concerning Penserra

Penserra is a New York limited liability company located at 140 Broadway, 26th Floor, New York, NY 10005. The Sub-Adviser is registered as an investment advisor with the SEC under the Advisers Act. As of March 31, 2018, the Sub-Adviser directly managed approximately $1.37 billion across [14] exchange-traded funds that do not have similar investment objectives to the Funds. Messrs. George Madrigal, Dustin Lewellyn and Anthony Castelli may be deemed to control the Sub-Adviser due to their ownership interests in and/or positions with the Sub-Adviser. Ernesto Tong, Penserra Financial Ventures and Penserra Securities LLC each own a minority interest in the Sub-Adviser.

Additional Information. Certain information regarding the principal executive officers of the Sub-Adviser is set forth in Appendix K.

Proposed Sub-Advisory Agreement

Sub-Advisory Services. Under the Sub-Advisory Agreement, the Sub-Adviser will furnish an investment program in respect of, make investment decisions for and place all orders for the purchase and sale of securities for each Fund’s investment portfolio, all on behalf of each Fund and subject to the supervision of the Board and the Adviser. In performing its duties under the Sub-Advisory Agreement, the Sub-Adviser will, among other things, monitor each Fund’s investments and will comply with the provisions of the Trust’s Declaration of Trust and By-laws and the stated investment objectives, policies and restrictions of each Fund.

Brokerage. The Sub-Advisory Agreement authorizes the Sub-Adviser to select the brokers or dealers that will execute the purchases and sales of securities for each Fund, unless otherwise provided by the Adviser.

Fees. Under the Sub-Advisory Agreement, the Adviser pays the Sub-Adviser a sub-advisory fee out of the investment management fee it receives from each Fund. The rate of the sub-advisory fee payable by the Adviser to the Sub-Adviser under the Sub-Advisory Agreement is equal to the annual rate of the Fund’s average daily net assets as set forth on Appendix L.

Payment of Expenses. Under the Sub-Advisory Agreement, the Sub-Adviser agrees to pay all expenses incurred by it in connection with providing sub-advisory services under the agreement, other than the cost of securities and other assets (including brokerage commissions, if any) purchased for the Funds.

Limitation on Liability. The Sub-Advisory Agreement provides that the Sub-Adviser will not be liable for, and the Trust and the Adviser will not take any action against the Sub-Adviser to hold the Sub-Adviser liable for any error of judgment or mistake of law or for any loss suffered by a Fund or the Adviser in connection with the performance of the Sub-Adviser’s duties under the agreement, except for a loss resulting from willful misfeasance, bad faith or gross negligence on the part of the Sub-Adviser in the performance of its duties under the agreement, or by reason of its reckless disregard of its obligations and duties under the agreement.

Continuance. If the shareholders of a Fund approve the Sub-Advisory Agreement for that Fund, the Sub-Advisory Agreement will expire on or about [_______], 2020, unless continued. Thereafter, the Sub-Advisory Agreement may be continued for successive one-year periods if approved at least annually in the manner required by the 1940 Act.

Termination. The Sub-Advisory Agreement provides that it shall automatically terminate in the event of its assignment and may be terminated at any time without the payment of any penalty by either party on sixty (60) days’ written notice. The Sub-Advisory Agreement may also be terminated by action of the Board or by a vote of a majority of the outstanding voting securities of that Fund in the event that it shall have been established by a court of competent jurisdiction that the Sub-Adviser or any officer or director of the Sub-Adviser has taken any action which results in a breach of the material covenants of the Sub-Adviser under the agreement.

Affiliated Brokerage and Other Fees

No Fund paid brokerage commissions within the last fiscal year to (i) any broker that is an affiliated person of such Fund or an affiliated person of such person, or (ii) any broker an affiliated person of which is an affiliated person of such Fund, the Adviser or any sub-adviser of such Fund.

Shareholder Approval

To become effective with respect to a particular Fund, the Sub-Advisory Agreement must be approved by a vote of a majority of the outstanding voting securities of such Fund, with all classes of shares voting together as a single class. The “vote of a majority of the outstanding voting securities” is defined in the 1940 Act as the lesser of the vote of (i) 67% or more of the shares of the Fund entitled to vote thereon present at the meeting if the holders of more than 50% of such outstanding shares are present in person or represented by proxy; or (ii) more than 50% of such outstanding shares of the Fund entitled to vote thereon. For purposes of determining the approval of the Sub-Advisory Agreement, abstentions and broker non-votes will have the same effect as shares voted against the proposal.

The Sub-Advisory Agreement was approved by the Board with respect to each Fund after consideration of all factors that it determined to be relevant to its deliberations, including those discussed below under “Board Considerations” immediately following this Proposal 2. The Board also determined to submit the Sub-Advisory Agreement for consideration by the shareholders of each Fund.

Note that the approval of Proposal 2 for a Fund is contingent on the approval of Proposal 1 for that Fund.

The Board unanimously recommends that shareholders of each Fund vote FOR approval

of the Sub-Advisory Agreement.

BOARD CONSIDERATIONS IN APPROVING THE NEW INVESTMENT MANAGEMENT AGREEMENT AND THE SUB-ADVISORY AGREEMENT

At the meeting held on April 10, 2018, the Board and the Independent Trustees, voting separately, approved the New Investment Management Agreement and the Sub-Advisory Agreement with respect to each Fund.

To reach this determination, the Board considered its duties under the 1940 Act as well as under the general principles of state law in reviewing and approving advisory contracts; the requirements of the 1940 Act in such matters; the fiduciary duty of investment advisers with respect to advisory agreements and compensation; the standards used by courts in determining whether investment company boards have fulfilled their duties; and the factors to be considered by the Board in voting on such agreements. To assist the Board in its evaluation of the New Investment Management Agreement and the Sub-Advisory Agreement, the Independent Trustees received materials in advance of Board meetings from Innovator and Penserra. The Independent Trustees also met with senior executives of Innovator and Penserra. The Independent Trustees also met separately with their independent legal counsel to discuss the information provided by Innovator and Penserra. The Board applied its business judgment to determine whether the arrangements between the Trust and Innovator and Penserra are reasonable business arrangements from the applicable Fund’s perspective as well as from the perspective of shareholders.

The Board considered, among other things, the following information:

| | ● | The Original Investment Management Agreement was scheduled to expire by its terms on March 31, 2018, and an interim and proposed New Investment Management Agreement with Innovator would ensure the continued management of each Fund’s assets following the expiration of the Original Investment Management Agreement. |

| | ● | The Adviser agreed to make payment on certain outstanding liabilities to Fund service providers, and the Adviser has agreed to pay all expenses of the Funds in connection with the Board’s consideration of the New Investment Management Agreement, the Sub-Advisory Agreement and related agreements and all costs of this proxy solicitation. As a result, the Funds will bear no costs in obtaining shareholder approval of the New Investment Management Agreement and the Sub-Advisory Agreement. |

| | ● | The capabilities, reputation, resources, experience and personnel of the Adviser and the sub-adviser to provide the services pursuant to the terms of the New Investment Management Agreement and the Sub-Advisory Agreement. |

| | ● | The significant financial resources of the principals of the Adviser that the Adviser indicated would benefit the Funds by providing a more robust operational infrastructure and a dedicated team designed to grow the assets of each Fund. |

| | ● | The terms and conditions of the New Investment Management Agreement, including that each Fund’s contractual fee rate under the New Investment Management Agreement would remain the same, and that the Adviser would compensate the Sub-Adviser out of its fee. |

Certain of these considerations are discussed below in more detail.

Nature, Extent and Quality of Services Provided to the Funds.

The Board considered the capabilities, reputation, experience, and resources of the Adviser, including its Principals. The Adviser’s founder also founded PowerShares in early 2003. As founder and Chief Executive Officer of PowerShares, Mr. Bond pioneered many firsts in the ETF industry. In 2006, PowerShares was acquired by Invesco, a global asset manager. Mr. Bond remained the President and Chief Executive Officer of PowerShares and Chairman of the Board of the PowerShares Funds until September of 2011. During his time at PowerShares, Mr. Bond helped develop, list and distribute over 130 fund products on various exchanges located in the United States and throughout Europe, with assets under management in excess of $80 billion. The Board also considered the capabilities, reputation, experience, and resources of Penserra, including in particular its trading capabilities.

In connection with the investment advisory services to be provided under the New Investment Management Agreement and the Sub-Advisory Agreement, the Board took into account discussions with representatives of Innovator and Penserra regarding the management of each Fund. The Board also considered the allocation of responsibilities between the Adviser and Penserra.

Investment Performance of the Funds.

The Board considered Innovator’s and Penserra’s investment philosophy and experience and their history in managing other ETFs, as they had only assumed management of the Funds on April 1, 2018. The Board also considered Fund performance information, which it had reviewed at regular quarterly meetings.

Costs of Services Provided and Profits Realized by the Adviser.

In evaluating the costs of the services to be provided by the Adviser under the New Investment Management Agreement, the Board considered, among other things, whether advisory fee rates or other expenses would change from the Original Investment Management Agreement. The Board noted that the New Investment Management Agreement is substantially identical to the Original Investment Management Agreement, including the fact that the fee rates under the agreements are identical. The Board also reviewed information comparing each Fund’s total expense ratio to the average and median expense ratios of Morningstar and Bloomberg categories. The Board noted that the unitary fee for the Innovator S&P High Quality Preferred ETF was lower than both the Morningstar and Bloomberg category averages and medians, and the unitary fee for the Innovator Lunt Low Vol/High Beta Tactical ETF was higher than the Morningstar category average and median, as well as the Bloomberg category median, but lower than the Bloomberg category average. The Board considered the Adviser’s explanation regarding the proprietary, alpha-seeking strategy of the Fund, developed by Lunt Capital Management LLC, and the higher than typical licensing fee.

With respect to the Adviser’s estimated profitability for managing the Funds, the Board noted that the Adviser will likely have little to no profitability in the first year or more, given the current asset levels of the Funds and as a result of satisfying certain outstanding liabilities of the Funds. With respect to the sub-advisory fees and Penserra’s profitability, the Board considered that the sub-advisory fee was negotiated between the Adviser and Penserra, an unaffiliated third party, and that the Adviser would compensate Penserra from its fees.

Economies of Scale and Fee Levels Reflecting Those Economies.

The Board considered any potential economies of scale that may result from Innovator acting as the investment adviser to the Funds and Penserra serving as sub-adviser. The Board noted that any change in economies of scale would be speculative at present.

Other Benefits to the Adviser.

The Board considered the sub-adviser’s representation that it generally would not use its affiliated broker to effect transactions for the Funds, and that the Adviser would monitor the trading activity and any use of the affiliated broker by the sub-adviser. Based on their review, the Independent Trustees concluded that any indirect benefits to be received by the Adviser or Penserra as a result of its relationship with each Fund were reasonable and within acceptable parameters.

Board Determination. After discussion, the Board and the Independent Trustees, voting separately, concluded that, based upon such information as they considered necessary to the exercise of their reasonable business judgment, it approved the New Investment Management Agreement and the Sub-Advisory Agreement each for an initial two-year term. No single factor was identified as determinative in the Board’s analysis or any Independent Trustee’s analysis.

PROPOSAL 3: ELECTION OF TRUSTEES

Background and Reason for Vote

The Board of Trustees oversees the management of the Funds, including general supervision of each Fund’s investment activities. Among other things, the Board generally oversees the portfolio management of each Fund and reviews and approves each Fund’s advisory and sub-advisory contracts and other principal contracts.

To facilitate the transfer to Innovator, the Board considered a proposal to elect a new Board, composed of the same members as the Innovator ETFs Trust board of trustees: Mark Berg, H. Bruce Bond, Joe Stowell and Brian J. Wildman (together, the “Nominees”). The three “Independent Nominees” are Mark Berg, Joe Stowell and Brian J. Wildman. The “Interested Nominee” is H. Bruce Bond. Mr. Bond is deemed to be an “interested person” of the Trust, as that term is defined in the 1940 Act, because he is an executive officer, principal and controlling owner of the Adviser, the Funds’ current investment adviser under the interim investment management agreement, and an officer of the Trust. The Nominees currently serve as independent trustees, and with respect to Mr. Bond, interested trustee, for the Innovator ETFs Trust, which together with the Trust comprises the Innovator Fund Complex (as defined below). Certain biographical and other information relating to the Nominees, including each of the Nominee’s name and age, their principal occupations during the past five years and certain of their other affiliations are set forth below.

The current Trustees will be succeeded by the Nominees if Proposal 3 is approved. Because each of the Funds is advised by the same investment adviser as another trust in the Innovator Fund Complex, the current Trustees believe it is more efficient and cost effective to have each trust board composed of the same trustees. If Proposal 3 is not approved by shareholders, then the current Trustees would continue to serve as Trustees and determine what action, if any, to take.

The 1940 Act requires that certain percentages of trustees on boards of registered investment companies must have been elected by shareholders under various circumstances. For example, in general, at least a majority of the trustees must have been elected to such office by shareholders. In addition, new trustees cannot be appointed by existing trustees to fill vacancies created by retirements, resignations or an expansion of a board unless, after those appointments, at least two thirds of the trustees have been elected by shareholders.

It is intended that the enclosed proxy will be voted FOR the election of each Nominee, unless such authority has been withheld in the proxy.

Each Nominee will be elected for an indefinite term. Each Nominee has indicated a willingness to serve as a Trustee of the Board if elected. If any Nominee should not be available for election, the persons named as proxies may vote for other persons in their discretion. However, there is no reason to believe that any Nominee will be unavailable for election.

The following table includes certain important information regarding the Nominees, as well as the current officers and Trustees of the Trust.

| Name, Business Address and Birth Year | | Position(s) to Be Held with the Trust | | Term of Office and

Length of Time Served | | Principal Occupation(s) During Past Five Years | | Number of Portfolios in Fund Complex to Be Overseen by Trustee | | Other Directorships Held by Trustee During Last Five Years |

| | | | | | | | | | | |

| Nominees: | | | | | | | | | | |

| | | | | | | | | | | |

| Independent Nominees | | | | | | | | | | |

| | | | | | | | | | | |

Mark Berg

c/o Innovator ETFs Trust II

120 N. Hale Street

Suite 200

Wheaton, Illinois 60187

Y.O.B. 1971 | | Trustee | | N/A | | President and Founding Principal of Timothy Financial Counsel Inc. (2001 – present) | | [4] | | Trustee of Innovator ETFs Trust (2017 – present) |

| | | | | | | | | | | |

Joe Stowell

c/o Innovator ETFs Trust II

120 N. Hale Street

Suite 200

Wheaton, Illinois 60187

Y.O.B. 1968 | | Trustee | | N/A | | Chief Operating Officer, Woodmen Valley Chapel (September 2015 – present); Executive Vice President and Chief Operating Officer, English Language Institute/China (2007 – 2015) | | [4] | | Board of Advisors, Westmont College; Trustee of Innovator ETFs Trust (2017 – present) |

| | | | | | | | | | | |

Brian J. Wildman

c/o Innovator ETFs Trust II

120 N. Hale Street

Suite 200

Wheaton, Illinois 60187

Y.O.B. 1968 | | Trustee | | N/A | | Executive Vice President, Consumer Banking (March 2016 – present), Chief Risk Officer (April 2013 – March 2016), Head of Wealth Management (2003 – 2013) and Head of Commercial Services (2010 – 2013), MB Financial Bank | | [4] | | MB Financial Bank (2003 – present); Missionary Furlough Homes, Inc. (2008 – present); Trustee of Innovator ETFs Trust (2017 – present) |

| | | | | | | | | | | |

Interested Nominee | | | | | | | | | | |

| | | | | | | | | | | |

H. Bruce Bond(1)

c/o Innovator ETFs Trust II

120 N. Hale Street

Suite 200

Wheaton, Illinois 60187

Y.O.B. 1963 | | Interested Trustee; President and Principal Executive Officer (effective June 1, 2018) | | | | Chief Executive Officer of Innovator Capital Management, LLC (May 2017 – present); formerly Chairman (2010 – 2013) and President and CEO (2006 – 2010), Invesco PowerShares Capital Management LLC; formerly Co-Founder, President and CEO, PowerShares Capital Management (2002 – 2006); formerly Chairman; PowerShares Fund Board (2002 – 2013) | | [4] | | Interested Trustee of Innovator ETFs Trust (2017 – present) |

| | | | | | | | | | | |

| Current Trustees: | | | | | | | | | | |

| | | | | | | | | | | |

Independent Trustee | | | | | | | | | | |

| | | | | | | | | | | |

Bruce Howard(2)

120 N. Hale Street

Suite 200

Wheaton, Illinois 60187

Y.O.B.: 1952 | | Trustee | | • Indefinite term • Since inception | | Advisory Board Member, Performance Trust Capital Partners LLC (2009 – present); Director/Tax Consultant, Tyndale House Publishers Inc. (1980 – present); Professor of Business & Economics, Wheaton College (1980 – present) | | N/A | | None |

| Name, Business Address and Birth Year | | Position(s) to Be Held with the Trust | | Term of Office and

Length of Time Served | | Principal Occupation(s) During Past Five Years | | Number of Portfolios in Fund Complex to Be Overseen by Trustee | | Other Directorships Held by Trustee During Last Five Years |

| | | | | | | | | | | |

Gregory D. Bunch(2)

120 N. Hale Street

Suite 200

Wheaton, Illinois 60187

Y.O.B.: 1958 | | Trustee | | • Indefinite term • Since inception | | Adjunct Professor of Entrepreneurship, University of Chicago (2009 – present); President, Masterplan International Corporation (1998 – present); Co-Founder, Oration (2012 – 2013) | | N/A | | None |

| | | | | | | | | | | |

Jeffrey P. Helton(2)

120 N. Hale Street

Suite 200

Wheaton, Illinois 60187

Y.O.B.: 1959 | | Trustee | | • Indefinite term • Since inception | | Pastor, The People’s Church (2012 – present); Executive/Life Coach, WellSpring Coaching (2010 – present) | | N/A | | None |

| | | | | | | | | | | |

| Interested Trustee | | | | | | | | | | |

| | | | | | | | | | | |

Benjamin T. Fulton(2)(3)

120 N. Hale Street

Suite 200

Wheaton, Illinois 60187

Y.O.B.: 1961 | | Chairman of the Board of Trustees; Chief Executive Officer and President | | • Indefinite term • Since inception | | Chief Executive Officer and President, Elkhorn Investments, LLC (2013 – present); Managing Director, Invesco PowerShares Capital Management LLC, (2005 – 2013) | | N/A | | None |

(1) | Mr. Bond is deemed to be an “interested person” of the Trust (as defined in the 1940 Act) because of his affiliation with the Adviser and the Trust. |

| (2) | Messrs. Howard, Bunch, Helton and Fulton will be succeeded by the Nominees. |

(3) | Mr. Fulton has been deemed to be an “interested person” of the Trust (as defined in the 1940 Act) because of his position as Chief Executive Officer and President of Elkhorn Investments, LLC (the Fund’s previous investment adviser) and the Trust. |

Name, Business Address and Birth Year | | Position(s) Held

with the Trust | | Term of Office and

Length of

Time Served

with Trust | | Principal Occupation(s)

During Past Five Years |

| | | | | | | |

| | | | | | | |

Officers: | | | | | | |

| | | | | | | |

Benjamin T. Fulton(1)

c/o Innovator ETFs Trust II

120 North Hale Street

Suite 200

Wheaton, IL 60187

Y.O.B.: 1961 | | Chief Executive Officer and President; Chairman of the Board of Trustees | | • To serve until May 31, 2018 • Since inception | | Chief Executive Officer and President, Elkhorn Investments, LLC (2013 – present); Managing Director, Invesco PowerShares Capital Management LLC (2005 – 2013) |

| | | | | | | |

Philip L. Ziesemer(1)

c/o Innovator ETFs Trust II

120 North Hale Street

Suite 200

Wheaton, IL 60187

Y.O.B.: 1963 | | Chief Financial Officer and Secretary | | • To serve until May 31, 2018 • Since inception | | Chief Financial Officer, Elkhorn Investments, LLC (2013 – present); Chief Financial Officer, Renegade Holdings (2009 – 2013) |

| | | | | | | |

James Nash(2)

c/o Foreside Financial Group, LLC

10 High Street, Suite 302

Boston, MA 02110

Y.O.B.: 1976 | | Chief Compliance Officer and Anti-Money Laundering Officer | | • Indefinite term • Since 2017 | | Foreside Fund Officer Services, LLC, (2016 – present); Fund Chief Compliance Officer; JPMorgan Chase & Co. (2014 – 2016); Senior Associate, Regulatory Administration Advisor; Linedata Services (2011 – 2014), Product Analyst |

Name, Business Address and Birth Year | | Position(s) Held

with the Trust | | Term of Office and

Length of

Time Served

with Trust | | Principal Occupation(s)

During Past Five Years |

| | | | | | | |

| | | | | | | |

H. Bruce Bond(3)

c/o Innovator ETFs Trust II

120 N. Hale Street

Suite 200

Wheaton, Illinois 60187

Y.O.B. 1963 | | President and Principal Executive Officer | | • Indefinite term to commence on June 1, 2018 | | Chief Executive Officer of Innovator Capital Management, LLC (2017 to present); formerly Chairman (2010 – 2013) and President and CEO (2006 – 2010), Invesco PowerShares Capital Management LLC; formerly Co-Founder, President and CEO, PowerShares Capital Management (2002 – 2006); formerly Chairman; PowerShares Fund Board (2002 – 2013) |

| | | | | | | |

John W. Southard, Jr. (3)

c/o Innovator ETFs Trust II

120 N. Hale Street

Suite 200

Wheaton, IL 60187

Y.O.B.: 1969 | | Vice President, Treasurer and Principal Financial Accounting Officer | | • Indefinite term to commence on June 1, 2018 | | Chief Investment Officer, Innovator Capital Management, LLC (2017 – present); Director and Co-Founder, T2 Capital Management, LLC (2010 – 2017); formerly Managing Director, Portfolio Manager and Manager, Invesco PowerShares Capital Management LLC, Managing Director, Principal Financial Officer, Vice President and Treasurer, PowerShares Funds (2002-2009) |

| (1) | Messrs. Fulton and Ziesemer will serve in their respective capacities as officers of the Trust through May 31, 2018. |

| (2) | Mr. Nash is an employee of Foreside Fund Officer Services, LLC, a wholly owned subsidiary of the Fund’s principal underwriter. |

| (3) | Messrs. Bond and Southard will commence serving in their respective capacities as officers of the Trust on June 1, 2018. |

Share Ownership

As of the Record Date, the Trustees, Nominees and officers of the Funds as a group owned an aggregate of less than 1% of the outstanding shares of each Fund. As of the Record Date, none of the Nominees or their immediate family members owned beneficially or of record any securities of the Adviser or its affiliates.

Mr. Berg does, however, have a $120,000 passive limited partner equity interest in a real estate fund managed by an adviser controlled by Jeffrey Brown (a minority owner of the Adviser) and in which John Southard (a control person of the Adviser) holds a passive ownership interest. The current Independent Trustees concluded that based on the information provided to them at their April meeting, these business relationships were not significant to the respective overall business activities of Messrs. Berg, Southard, and Brown, and would not be likely to have a material impact on their net worth. Moreover, the Board was informed that Mr. Berg’s investments are treated on the same terms as other investors in the real estate fund or the limited liability company. Accordingly, the current Independent Trustees concluded that, based on the information available to them, Mr. Berg could serve as an Independent Trustee if elected by shareholders. None of the Nominees beneficially owned shares of the Funds as of March 31, 2018.

Compensation

Each Independent Trustee is paid a fixed annual retainer of $10,000 per year. Through March 31, 2018, the fixed annual retainer was allocated pro rata among each fund advised by Elkhorn Investments based on net assets and from April 1, 2018, will be allocated pro rata among each fund advised by Innovator (collectively, the “Innovator Fund Complex”) based on net assets. Independent Trustees are also reimbursed by the investment companies in the Innovator Fund Complex for travel and out of pocket expenses incurred in connection with all meetings. The Trust does not have a retirement or pension plan.

Information relating to the amount of compensation paid by the Funds to the current Trustees is available in each Fund’s statement of additional information and is provided in Appendix F. The Nominees do not currently serve as a Trustee of the Trust and therefore have not yet received any compensation from the Trust.

Board Leadership and Risk Oversight

The Board oversees the operations and management of the Funds, including the duties performed for the Funds by the Adviser. None of the Trustees who are not “interested persons” of the Trust or the Nominees, nor any of their immediate family members, has ever been a director, officer or employee of, or consultant to, the Adviser or its affiliates (other than the service of each Nominee as a Trustee of the Innovator ETFs Trust).

The Board oversees the services performed for the Funds under the interim investment management agreement between the Trust, on behalf of each Fund, and the Adviser. The Trustees approve policies for the Funds, choose the Trust’s officers and hire the Funds’ investment advisers, sub-advisers and other service providers. The officers of the Trust manage the day-to-day operations and are responsible to the Board. The applicable provisions regarding the management of the Funds, as outlined above, in the New Investment Management Agreement are identical to those in the Original Investment Management Agreement.

The Board is currently comprised of three Independent Trustees, Bruce Howard, Gregory Bunch and Jeffrey Helton, and one Interested Trustee, Mr. Fulton.

Annually, the Board reviews its governance structure and the committee structures, its performance and functions and any processes that would enhance board governance. The Board has determined that its leadership structure, including the unitary board and committee structure, is appropriate based on the characteristics of the funds it serves and the characteristics of the fund complex as a whole.

The Board has established two standing committees (as described below) and has delegated certain of its responsibilities to those committees. The Board and its committees meet frequently throughout the year to oversee the activities of the Funds, review contractual arrangements with and the performance of service providers, oversee compliance with regulatory requirements and review Fund performance. The Independent Trustees are represented by independent legal counsel at all Board and committee meetings. Generally, the Board acts by majority vote of the Trustees present at a meeting, assuming a quorum is present, unless otherwise required by applicable law.

The two standing committees of the Board are the Nominating and Governance Committee and the Audit Committee.

The Nominating and Governance Committee is responsible for appointing and nominating non-interested persons to the Board. Messrs. Bunch, Helton and Howard are members of the Nominating and Governance Committee. If there is no vacancy on the Board, the Board will not actively seek recommendations from other parties, including shareholders. When a vacancy on the Board occurs and nominations are sought to fill such vacancy, the Nominating and Governance Committee may seek nominations from those sources it deems appropriate in its discretion, including shareholders of the Fund. To submit a recommendation for nomination as a candidate for a position on the Board, shareholders of the Fund should mail such recommendation to Trust Secretary, at the Trust’s address, 120 North Hale Street, Suite 200, Wheaton, Illinois 60187. Such recommendation shall include the following information: (i) a statement in writing setting forth (A) the name, age, date of birth, business address, residence address and nationality of the person or persons to be nominated; (B) the class or series and number of all shares of the Fund owned of record or beneficially by each such person or persons, as reported to such shareholder by such nominee(s); (C) any other information regarding each such person required by paragraphs (a), (d), (e) and (f) of Item 401 of Regulation S-K or paragraph (b) of Item 22 of Rule 14a-101 (Schedule 14A) under the 1934 Act (as defined below); (D) any other information regarding the person or persons to be nominated that would be required to be disclosed in a proxy statement or other filings required to be made in connection with solicitation of proxies for election of trustees or directors pursuant to Section 14 of the 1934 Act and the rules and regulations promulgated thereunder; and (E) whether such shareholder believes any nominee is or will be an “interested person” of the Fund (as defined in the 1940 Act) and, if not an “interested person,” information regarding each nominee that will be sufficient for the Fund to make such determination; and (ii) the written and signed consent of any person to be nominated to be named as a nominee and to serve as a trustee if elected. In addition, the Trustees may require any proposed nominee to furnish such other information as they may reasonably require or deem necessary to determine the eligibility of such proposed nominee to serve as a Trustee. During the last fiscal year, the Nominating and Governance Committee met _______.

The Audit Committee is responsible for overseeing the Fund’s accounting and financial reporting process, the system of internal controls and audit process and for evaluating and appointing independent auditors (subject also to approval of the Board). Messrs. Bunch, Helton and Howard serve on the Audit Committee. During the last fiscal year, the Audit Committee met _____ times.

As part of the general oversight of the Fund, the Board is involved in the risk oversight of each Fund. The Board has adopted and periodically reviews policies and procedures designed to address each Fund’s risks. Oversight of investment and compliance risk, including, if applicable, oversight of any sub-adviser, is performed primarily at the Board level in conjunction with the Adviser’s investment oversight group and the Trust’s Chief Compliance Officer (“CCO”).

James Nash of Foreside Fund Officer Services, LLC (“Foreside Officer Services”) serves as CCO of the Trust. In a joint effort between the Trust and Foreside Officer Services to ensure the Trust complies with Rule 38a-1 under the 1940 Act, Foreside Officer Services has agreed to render services to the Trust by entering into a Chief Compliance Officer Services Agreement (the “CCO Services Agreement”) with the Trust. Pursuant to the CCO Services Agreement, Foreside Officer Services designates, subject to the Trust’s approval, one of its own employees to serve as CCO of the Trust within the meaning of Rule 38a-1. Mr. Nash currently serves in such capacity under the terms of the CCO Services Agreement.

Oversight of other risks also occurs at the committee level. The Adviser’s investment oversight group reports to the Board at quarterly meetings regarding, among other things, Fund performance and the various drivers of such performance, as well as information related to the Adviser and its operations and processes. The Board reviews reports on each Fund’s and the service providers’ compliance policies and procedures at each quarterly Board meeting and receives an annual report from the CCO regarding the operations of the Funds and the service providers’ compliance programs. In addition, the Independent Trustees meet privately with the CCO at least annually and as circumstances warrant (typically at least quarterly). The Audit Committee reviews with the Adviser the Funds’ major financial risk exposures and the steps the Adviser has taken to monitor and control these exposures, including the Funds’ risk assessment and risk management policies and guidelines. The Audit Committee also, as appropriate, reviews in a general manner the processes other Board committees have in place with respect to risk assessment and risk management. The Nominating and Governance Committee monitors all matters related to the corporate governance of the Trust.

Not all risks that may affect the Funds can be identified nor can controls be developed to eliminate or mitigate their occurrence or effects. It may not be practical or cost effective to eliminate or mitigate certain risks, the processes and controls employed to address certain risks may be limited in their effectiveness, and some risks are simply beyond the reasonable control of the Funds or the Adviser or other service providers. For instance, as the use of Internet technology has become more prevalent, the Funds and their service providers have become more susceptible to potential operational risks through breaches in cyber security (generally, intentional and unintentional events that may cause a Fund or a service provider to lose proprietary information, suffer data corruption or lose operational capacity). There can be no guarantee that any risk management systems established by a Fund, its service providers, or issuers of the securities in which a Fund invests to reduce cyber security risks will succeed, and a Fund cannot control such systems put in place by service providers, issuers or other third parties whose operations may affect a Fund and/or its shareholders. Moreover, it is necessary to bear certain risks (such as investment-related risks) to achieve a Fund’s goals. As a result of the foregoing and other factors, a Fund’s ability to manage risk is subject to substantial limitations.

The composition of the Trust’s committees and overall governance structure of the Trust is determined by the Board.

Board Diversification and Trustee Qualifications