UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant x | |

| Filed by a Party other than the Registrant ¨ | |

Check the appropriate box:

| | ¨ | Preliminary Proxy Statement |

| | ¨ | Confidential, For Use of the Commission Only (as Permitted by Rule 14a-6(e)(2)) |

| | ¨ | Definitive Proxy Statement |

| | x | Definitive Additional Materials |

| | ¨ | Soliciting Material Pursuant to §240.14a-12 |

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

On May 13, 2022, New York City REIT, Inc. (NYSE: NYC) (“we,” “NYC” or the “Company”) held a conference call in connection with the Company’s announcement of its earnings for the first quarter of its fiscal year 2022 and issued an investor presentation. Excerpts from the script for the conference call and slides from the investor presentation are set forth below:

“As I mentioned earlier, our independent board continues to provide great insight and guidance as we execute on our strategy to grow the businesses. Our board has been instrumental in helping us navigate the pandemic over the last two years and we believe that we have come through it as a stronger company. Not only are they fully engaged as board members, they’ve also acquired over 24,000 shares through a combination of individual stock purchases and electing to receive stock in lieu of fourth quarter board compensation. We believe that the board's stock purchases demonstrate the depth of the confidence they have in the Company's future. Naturally, I agree and I have continued to purchase shares, while NYC's advisor has received a portion of its advisory fee in stock in lieu of cash. As of May 1, the advisor owned over 1.5 million common shares.”

1 First Quarter 2022 Highlights 1) See appendix for a full description of capitalized terms and Non-GAAP reconciliations. 2) Refer to slide 11 – Top 10 Tenant Investment Grade Profile. 3) Refer to slide 15 – Capital Structure and Q1’22 Financial Results for further information regarding our capital structure and liquidity. 4) Refer to slide 25 – Forward Looking Statements for risks related to our financial performance. 5) Refer to slide 14 – Continued Cash Rent Collection Success for additional information. Total rent collected during the period includes both original Cash Rent due and payments made by tenants pursuant to rent deferral agreements. 6) Refer to slide 12 – Proactive Asset Management for additional information. 7) Refer to slide 3 – Case Study: Exceptional Investor Returns Since 2021. High-Quality Manhattan Focused Portfolio Increasing Financial Performance(3)(4) Continued Leasing Activity(6) Strong Investor Returns(7) ✓ Portfolio Occupancy(1) of 84% with a weighted average Remaining Lease Term(1) of 6.8 years ✓ Tenant base featuring Investment Grade and government agency tenants with core commercial business ✓ Top 10 tenants(2) are 71% Investment Grade rated and have a Remaining Lease Term of 9.5 years ✓ Well balanced and long-term lease maturity schedule with 36% of leases expiring after 2030 ✓ Year over year, total portfolio Cash Rent(1) collection improved from 87% to 98%(5) as Approved Agreements expired and tenants resumed paying original Cash Rent due ✓ Year over year, Adjusted EBITDA(1) and Cash NOI improved to $2.7 million from $1.8 million and $5.7 million from $5.6 million, respectively ✓ Weighted average debt maturity of 4.9 years and moderate Net Leverage(1) of 40% ✓ 100% of NYC’s debt is fixed rate debt and no maturities through 2023 ✓ Q1’22 Occupancy increase of 1.5%, including a nearly 3% Occupancy increase at 9 Times Square ✓ NYC’s Leasing Pipeline(1) is expected to increase Occupancy by 1.6% and straight-line rent by $0.9 million ❖ NYC’s Leasing Pipeline includes one Knotel replacement lease for 4,700 SF that would result in 76% of all of Knotel’s former space replaced ✓ Since Knotel’s lease termination in January 2021 and through Q1’22, NYC replaced 69% of the total space and 64% of the straight-line rent formerly derived from Knotel with creditworthy, rent-paying tenants(6) ✓ Since 2021, NYC investors have benefited from an exceptional Total Return(1) of 71.8% that compares favorably when compared to several peer and index benchmarks ✓ NYC overperformed the S&P 500 by over 47% and a group of New York City focused REIT peers by over 42% ✓ Management believes that there is significant upside for NYC as New York City continues to rebound and management leases available space to creditworthy tenants NYC is a real estate investment trust with a high-quality portfolio of real estate assets focused on the Manhattan market and is supported by a robust Advisor platform that has diligently navigated through the COVID-19 pandemic with portfolio Cash Rent collection at nearly 100%, maintained and enhanced a credit worthy tenant base and delivered exceptional investor returns since 2021 NYC’s independent board members and the Advisor and its affiliates have each separately demonstrated its depth of commitment to NYC’s long-term value by increasing ownership in NYC. As of May 1st 2022, NYC’s independent board members owned over 57,000 shares of NYC and separately, NYC’s Advisor and its affiliates owned over 1,500,000 shares of NYC

1 First Quarter 2022 Highlights 1) See appendix for a full description of capitalized terms and Non-GAAP reconciliations. 2) Refer to slide 11 – Top 10 Tenant Investment Grade Profile. 3) Refer to slide 15 – Capital Structure and Q1’22 Financial Results for further information regarding our capital structure and liquidity. 4) Refer to slide 25 – Forward Looking Statements for risks related to our financial performance. 5) Refer to slide 14 – Continued Cash Rent Collection Success for additional information. Total rent collected during the period includes both original Cash Rent due and payments made by tenants pursuant to rent deferral agreements. 6) Refer to slide 12 – Proactive Asset Management for additional information. 7) Refer to slide 3 – Case Study: Exceptional Investor Returns Since 2021. High-Quality Manhattan Focused Portfolio Increasing Financial Performance(3)(4) Continued Leasing Activity(6) Strong Investor Returns(7) ✓ Portfolio Occupancy(1) of 84% with a weighted average Remaining Lease Term(1) of 6.8 years ✓ Tenant base featuring Investment Grade and government agency tenants with core commercial business ✓ Top 10 tenants(2) are 71% Investment Grade rated and have a Remaining Lease Term of 9.5 years ✓ Well balanced and long-term lease maturity schedule with 36% of leases expiring after 2030 ✓ Year over year, total portfolio Cash Rent(1) collection improved from 87% to 98%(5) as Approved Agreements expired and tenants resumed paying original Cash Rent due ✓ Year over year, Adjusted EBITDA(1) and Cash NOI improved to $2.7 million from $1.8 million and $5.7 million from $5.6 million, respectively ✓ Weighted average debt maturity of 4.9 years and moderate Net Leverage(1) of 40% ✓ 100% of NYC’s debt is fixed rate debt and no maturities through 2023 ✓ Q1’22 Occupancy increase of 1.5%, including a nearly 3% Occupancy increase at 9 Times Square ✓ NYC’s Leasing Pipeline(1) is expected to increase Occupancy by 1.6% and straight-line rent by $0.9 million ❖ NYC’s Leasing Pipeline includes one Knotel replacement lease for 4,700 SF that would result in 76% of all of Knotel’s former space replaced ✓ Since Knotel’s lease termination in January 2021 and through Q1’22, NYC replaced 69% of the total space and 64% of the straight-line rent formerly derived from Knotel with creditworthy, rent-paying tenants(6) ✓ Since 2021, NYC investors have benefited from an exceptional Total Return(1) of 71.8% that compares favorably when compared to several peer and index benchmarks ✓ NYC overperformed the S&P 500 by over 47% and a group of New York City focused REIT peers by over 42% ✓ Management believes that there is significant upside for NYC as New York City continues to rebound and management leases available space to creditworthy tenants NYC is a real estate investment trust with a high-quality portfolio of real estate assets focused on the Manhattan market and is supported by a robust Advisor platform that has diligently navigated through the COVID-19 pandemic with portfolio Cash Rent collection at nearly 100%, maintained and enhanced a credit worthy tenant base and delivered exceptional investor returns since 2021 NYC’s independent board members and the Advisor and its affiliates have each separately demonstrated its depth of commitment to NYC’s long-term value by increasing ownership in NYC. As of May 1st 2022, NYC’s independent board members owned over 57,000 shares of NYC and separately, NYC’s Advisor and its affiliates owned over 1,500,000 shares of NYC

2 In 2021, NYC’s Board of Directors, led by Elizabeth Tuppeny, and in conjunction with the Advisor, continued to execute on the Company’s strategic initiatives and operational momentum by mitigating adverse impacts from COVID-19 by focusing on proactive asset management, increasing Cash Rent(1) collection and completing new and renewal leases. As a result, NYC shareholders benefited from a 72% Total Return(2) since 2021 NYC Generated Significant Value For Shareholders in 2021 2021 Highlights ▪ In Q1’21, Knotel, a former top 10 tenant, filed for bankruptcy and terminated all of their leased space with NYC ✓ Since termination, NYC executed new and expansion leases that replaced 69% of the square feet and 64% of the straight-line rent formerly from Knotel ▪ In Q4’21, NYC executed a termination agreement with Icon Parking and Quik Park, two non-compliant tenants, and immediately backfilled the space with a new operator, City Parking ✓ In Q2’22, City Parking extended its license agreements and will continue its operations through October 2022 ▪ In 2021, NYC completed 17 new leases totaling over 200,000 square feet and $7.4 million of straight-line rent ✓ NYC also executed four lease renewals in 2021, including a fiveyear lease extension in Q4’21 with an Aa2 credit rated tenant that increased the Annualized Straight-line Rent(3) from the tenant by $0.3 million as of December 31, 2021 ▪ Q2’22 forward Leasing Pipeline of 18,000 SF that includes three executed new leases and one executed LOI for former Knotel space ✓ The Leasing Pipeline is expected to increase portfolio Occupancy from 84% to 86%, once pipeline leases commence ▪ NYC outperformed the S&P 500 by over 47% and a group of New York City focused REIT peers over 42%(2) ✓ NYC 2021 Total Return of 72% ✓ New York City focused REIT peer performance of 29% ✓ Index Group Performance of 21% ▪ As of May 1st, 2022, NYC’s independent board members owned over 57,000 shares of NYC and separately, NYC’s Advisor and its affiliates owned over 1,500,000 shares of NYC, demonstrating their depth of commitment to NYC’s long-term value by increasing ownership in NYC Proactive Asset and Property Management Successful Navigation Throughout COVID-19 Impactful Leasing Activity Strong Shareholder Returns(2) ▪ Since Q4’20 and through Q4’21, NYC increased its Cash Rent collection rate by 15% to 97%(1) ✓ Q1’22 portfolio Cash Rent collection of 98% ▪ Diligently and proactively communicated with tenants to help them navigate the COVID-19 pandemic and mitigate adverse economic impacts ✓ In 2021, NYC executed two percentage rent deals with two key retail tenants. Since execution, both tenant’s operations have performed exceptionally well and returned to paying near full original Cash Rent due 1) Refer to slide 14 - Continued Cash Rent Collection Success for additional information. 2) Refer to slide 3 - Case Study: Exceptional Investor Returns Since 2021. 3) See appendix for a full description of capitalized terms.

2 In 2021, NYC’s Board of Directors, led by Elizabeth Tuppeny, and in conjunction with the Advisor, continued to execute on the Company’s strategic initiatives and operational momentum by mitigating adverse impacts from COVID-19 by focusing on proactive asset management, increasing Cash Rent(1) collection and completing new and renewal leases. As a result, NYC shareholders benefited from a 72% Total Return(2) since 2021 NYC Generated Significant Value For Shareholders in 2021 2021 Highlights ▪ In Q1’21, Knotel, a former top 10 tenant, filed for bankruptcy and terminated all of their leased space with NYC ✓ Since termination, NYC executed new and expansion leases that replaced 69% of the square feet and 64% of the straight-line rent formerly from Knotel ▪ In Q4’21, NYC executed a termination agreement with Icon Parking and Quik Park, two non-compliant tenants, and immediately backfilled the space with a new operator, City Parking ✓ In Q2’22, City Parking extended its license agreements and will continue its operations through October 2022 ▪ In 2021, NYC completed 17 new leases totaling over 200,000 square feet and $7.4 million of straight-line rent ✓ NYC also executed four lease renewals in 2021, including a fiveyear lease extension in Q4’21 with an Aa2 credit rated tenant that increased the Annualized Straight-line Rent(3) from the tenant by $0.3 million as of December 31, 2021 ▪ Q2’22 forward Leasing Pipeline of 18,000 SF that includes three executed new leases and one executed LOI for former Knotel space ✓ The Leasing Pipeline is expected to increase portfolio Occupancy from 84% to 86%, once pipeline leases commence ▪ NYC outperformed the S&P 500 by over 47% and a group of New York City focused REIT peers over 42%(2) ✓ NYC 2021 Total Return of 72% ✓ New York City focused REIT peer performance of 29% ✓ Index Group Performance of 21% ▪ As of May 1st, 2022, NYC’s independent board members owned over 57,000 shares of NYC and separately, NYC’s Advisor and its affiliates owned over 1,500,000 shares of NYC, demonstrating their depth of commitment to NYC’s long-term value by increasing ownership in NYC Proactive Asset and Property Management Successful Navigation Throughout COVID-19 Impactful Leasing Activity Strong Shareholder Returns(2) ▪ Since Q4’20 and through Q4’21, NYC increased its Cash Rent collection rate by 15% to 97%(1) ✓ Q1’22 portfolio Cash Rent collection of 98% ▪ Diligently and proactively communicated with tenants to help them navigate the COVID-19 pandemic and mitigate adverse economic impacts ✓ In 2021, NYC executed two percentage rent deals with two key retail tenants. Since execution, both tenant’s operations have performed exceptionally well and returned to paying near full original Cash Rent due 1) Refer to slide 14 - Continued Cash Rent Collection Success for additional information. 2) Refer to slide 3 - Case Study: Exceptional Investor Returns Since 2021. 3) See appendix for a full description of capitalized terms.

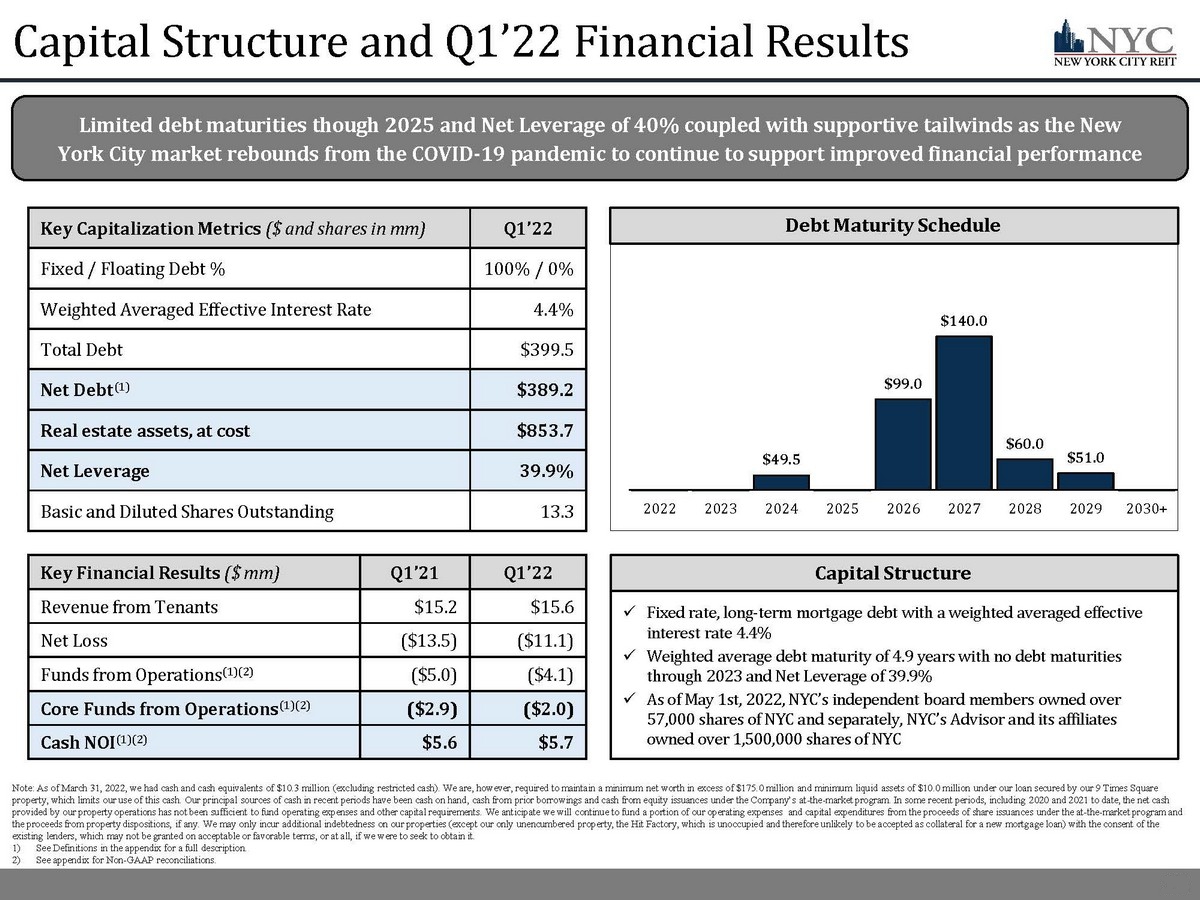

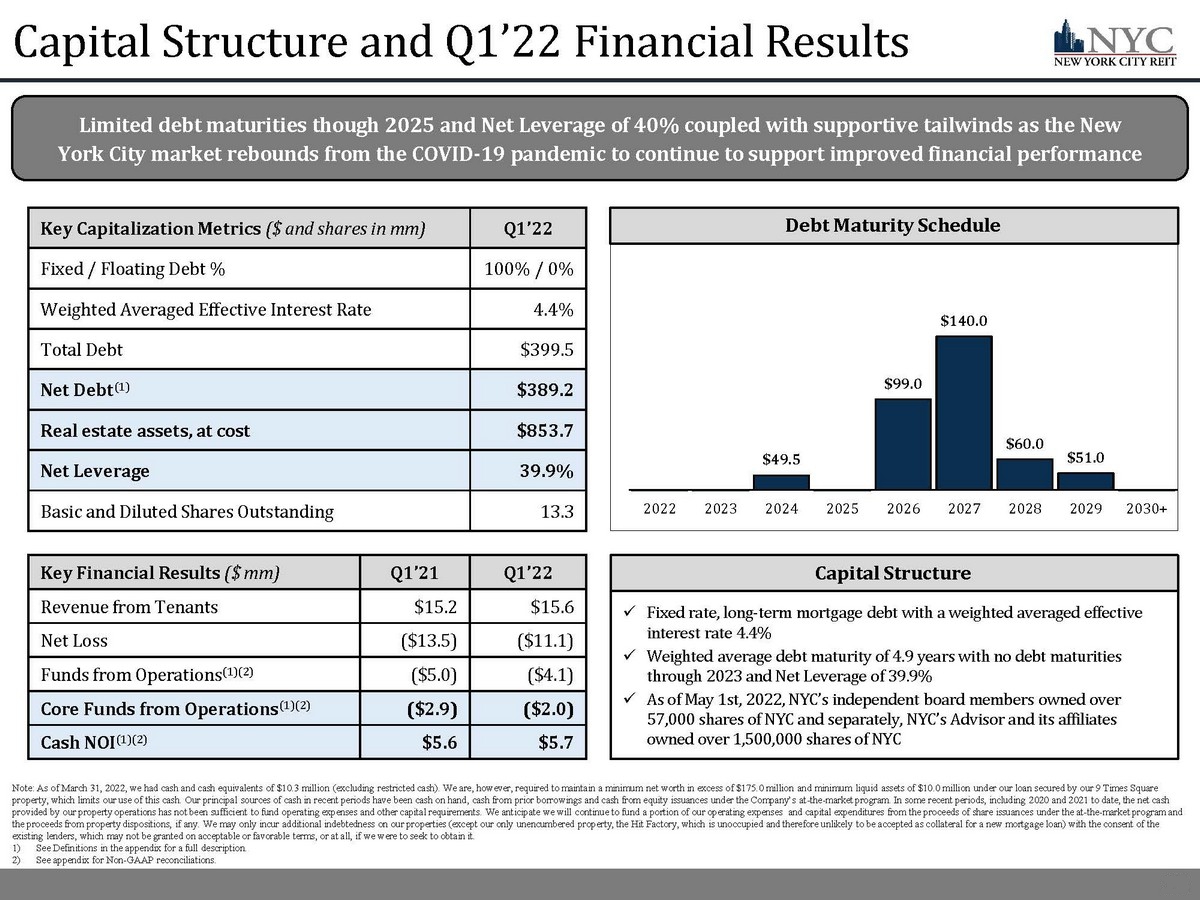

15 Capital Structure and Q1’22 Financial Results Note: As of March 31, 2022, we had cash and cash equivalents of $10.3 million (excluding restricted cash). We are, however, required to maintain a minimum net worth in excess of $175.0 million and minimum liquid assets of $10.0 million under our loan secured by our 9 Times Square property, which limits our use of this cash. Our principal sources of cash in recent periods have been cash on hand, cash from prior borrowings and cash from equity issuances under the Company’s at-the-market program. In some recent periods, including 2020 and 2021 to date, the net cash provided by our property operations has not been sufficient to fund operating expenses and other capital requirements. We anticipate we will continue to fund a portion of our operating expenses and capital expenditures from the proceeds of share issuances under the at-the-market program and the proceeds from property dispositions, if any. We may only incur additional indebtedness on our properties (except our only unencumbered property, the Hit Factory, which is unoccupied and therefore unlikely to be accepted as collateral for a new mortgage loan) with the consent of the existing lenders, which may not be granted on acceptable or favorable terms, or at all, if we were to seek to obtain it. 1) See Definitions in the appendix for a full description. 2) See appendix for Non-GAAP reconciliations. Limited debt maturities though 2025 and Net Leverage of 40% coupled with supportive tailwinds as the New York City market rebounds from the COVID-19 pandemic to continue to support improved financial performance Key Capitalization Metrics ($ and shares in mm) Q1’22 Fixed / Floating Debt % 100% / 0% Weighted Averaged Effective Interest Rate 4.4% Total Debt $399.5 Net Debt(1) $389.2 Real estate assets, at cost $853.7 Net Leverage 39.9% Basic and Diluted Shares Outstanding 13.3 Debt Maturity Schedule $49.5 $99.0 $140.0 $60.0 $51.0 $40.0 $60.0 $80.0 $100.0 $120.0 $140.0 $160.0 $180.0 2022 2023 2024 2025 2026 2027 2028 2029 2030+ Key Financial Results ($ mm) Q1’21 Q1’22 Revenue from Tenants $15.2 $15.6 Net Loss ($13.5) ($11.1) Funds from Operations(1)(2) ($5.0) ($4.1) Core Funds from Operations(1)(2) ($2.9) ($2.0) Cash NOI(1)(2) $5.6 $5.7 Capital Structure ✓ Fixed rate, long-term mortgage debt with a weighted averaged effective interest rate 4.4% ✓ Weighted average debt maturity of 4.9 years with no debt maturities through 2023 and Net Leverage of 39.9% ✓ As of May 1st, 2022, NYC’s independent board members owned over 57,000 shares of NYC and separately, NYC’s Advisor and its affiliates owned over 1,500,000 shares of NYC

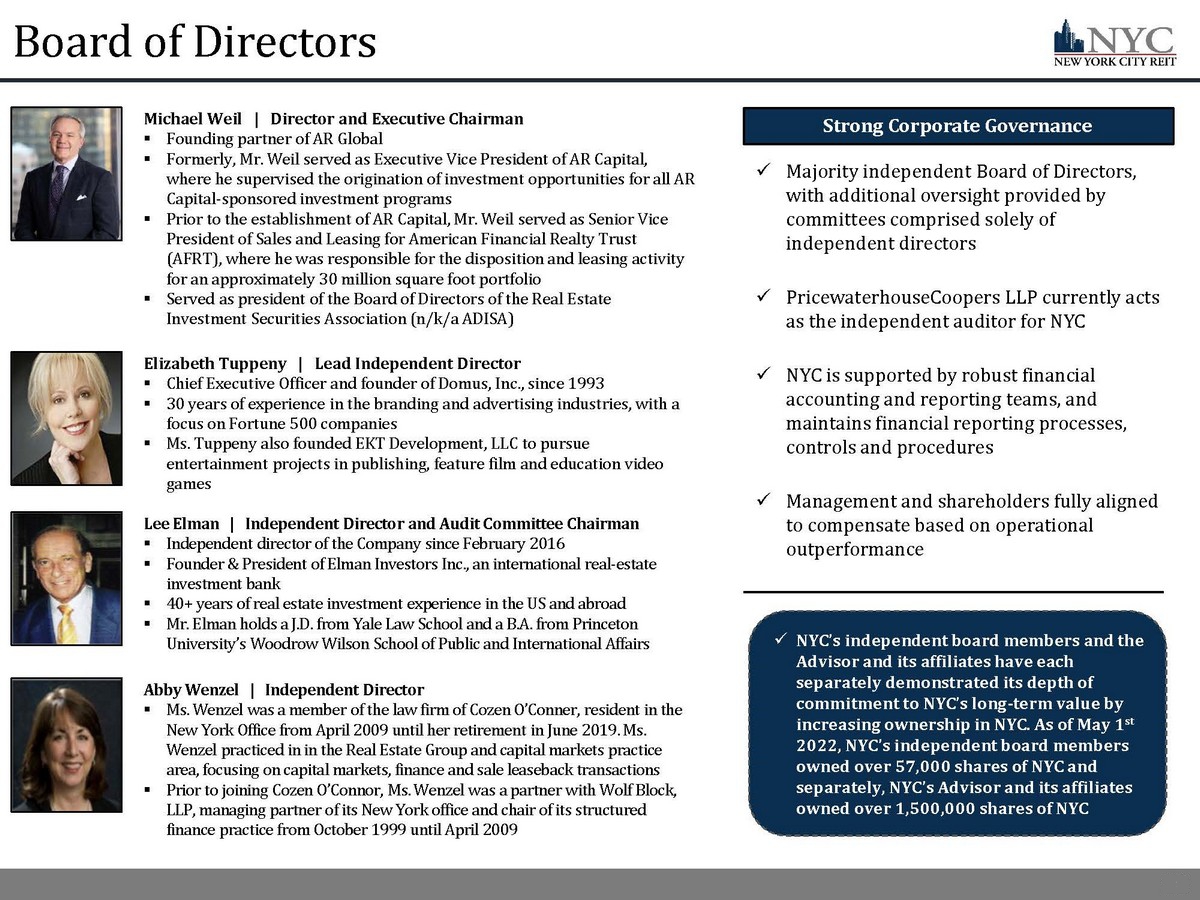

18 Board of Directors Michael Weil | Director and Executive Chairman ▪ Founding partner of AR Global ▪ Formerly, Mr. Weil served as Executive Vice President of AR Capital, where he supervised the origination of investment opportunities for all AR Capital-sponsored investment programs ▪ Prior to the establishment of AR Capital, Mr. Weil served as Senior Vice President of Sales and Leasing for American Financial Realty Trust (AFRT), where he was responsible for the disposition and leasing activity for an approximately 30 million square foot portfolio ▪ Served as president of the Board of Directors of the Real Estate Investment Securities Association (n/k/a ADISA) Lee Elman | Independent Director and Audit Committee Chairman ▪ Independent director of the Company since February 2016 ▪ Founder & President of Elman Investors Inc., an international real-estate investment bank ▪ 40+ years of real estate investment experience in the US and abroad ▪ Mr. Elman holds a J.D. from Yale Law School and a B.A. from Princeton University’s Woodrow Wilson School of Public and International Affairs Abby Wenzel | Independent Director ▪ Ms. Wenzel was a member of the law firm of Cozen O’Conner, resident in the New York Office from April 2009 until her retirement in June 2019. Ms. Wenzel practiced in in the Real Estate Group and capital markets practice area, focusing on capital markets, finance and sale leaseback transactions ▪ Prior to joining Cozen O’Connor, Ms. Wenzel was a partner with Wolf Block, LLP, managing partner of its New York office and chair of its structured finance practice from October 1999 until April 2009 Elizabeth Tuppeny | Lead Independent Director ▪ Chief Executive Officer and founder of Domus, Inc., since 1993 ▪ 30 years of experience in the branding and advertising industries, with a focus on Fortune 500 companies ▪ Ms. Tuppeny also founded EKT Development, LLC to pursue entertainment projects in publishing, feature film and education video games Strong Corporate Governance ✓ Majority independent Board of Directors, with additional oversight provided by committees comprised solely of independent directors ✓ PricewaterhouseCoopers LLP currently acts as the independent auditor for NYC ✓ NYC is supported by robust financial accounting and reporting teams, and maintains financial reporting processes, controls and procedures ✓ Management and shareholders fully aligned to compensate based on operational outperformance ✓ NYC’s independent board members and the Advisor and its affiliates have each separately demonstrated its depth of commitment to NYC’s long-term value by increasing ownership in NYC. As of May 1st 2022, NYC’s independent board members owned over 57,000 shares of NYC and separately, NYC’s Advisor and its affiliates owned over 1,500,000 shares of NYC

18 Board of Directors Michael Weil | Director and Executive Chairman ▪ Founding partner of AR Global ▪ Formerly, Mr. Weil served as Executive Vice President of AR Capital, where he supervised the origination of investment opportunities for all AR Capital-sponsored investment programs ▪ Prior to the establishment of AR Capital, Mr. Weil served as Senior Vice President of Sales and Leasing for American Financial Realty Trust (AFRT), where he was responsible for the disposition and leasing activity for an approximately 30 million square foot portfolio ▪ Served as president of the Board of Directors of the Real Estate Investment Securities Association (n/k/a ADISA) Lee Elman | Independent Director and Audit Committee Chairman ▪ Independent director of the Company since February 2016 ▪ Founder & President of Elman Investors Inc., an international real-estate investment bank ▪ 40+ years of real estate investment experience in the US and abroad ▪ Mr. Elman holds a J.D. from Yale Law School and a B.A. from Princeton University’s Woodrow Wilson School of Public and International Affairs Abby Wenzel | Independent Director ▪ Ms. Wenzel was a member of the law firm of Cozen O’Conner, resident in the New York Office from April 2009 until her retirement in June 2019. Ms. Wenzel practiced in in the Real Estate Group and capital markets practice area, focusing on capital markets, finance and sale leaseback transactions ▪ Prior to joining Cozen O’Connor, Ms. Wenzel was a partner with Wolf Block, LLP, managing partner of its New York office and chair of its structured finance practice from October 1999 until April 2009 Elizabeth Tuppeny | Lead Independent Director ▪ Chief Executive Officer and founder of Domus, Inc., since 1993 ▪ 30 years of experience in the branding and advertising industries, with a focus on Fortune 500 companies ▪ Ms. Tuppeny also founded EKT Development, LLC to pursue entertainment projects in publishing, feature film and education video games Strong Corporate Governance ✓ Majority independent Board of Directors, with additional oversight provided by committees comprised solely of independent directors ✓ PricewaterhouseCoopers LLP currently acts as the independent auditor for NYC ✓ NYC is supported by robust financial accounting and reporting teams, and maintains financial reporting processes, controls and procedures ✓ Management and shareholders fully aligned to compensate based on operational outperformance ✓ NYC’s independent board members and the Advisor and its affiliates have each separately demonstrated its depth of commitment to NYC’s long-term value by increasing ownership in NYC. As of May 1st 2022, NYC’s independent board members owned over 57,000 shares of NYC and separately, NYC’s Advisor and its affiliates owned over 1,500,000 shares of NYC

Forward-Looking Statements

The statements in this communication that are not historical facts may be forward-looking statements. These forward-looking statements involve risks and uncertainties that could cause actual results or events to be materially different. The words “may,” “will,” “seeks,” “anticipates,” “believes,” “estimates,” “expects,” “projects,” “plans,” “intends,” “should” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. These forward-looking statements are subject to a number of risks, uncertainties and other factors, many of which are outside of the Company’s control, which could cause actual results to differ materially from the results contemplated by the forward-looking statements. These risks and uncertainties include (a) the potential adverse effects of (i) the ongoing global COVID-19 pandemic, including actions taken to contain or treat COVID-19, and (ii) the geopolitical instability due to the ongoing military conflict between Russia and Ukraine, including related sanctions and other penalties imposed by the U.S. and European Union, and other countries, as well as other public and private actors and companies, on the Company, the Company’s tenants and the global economy and financial markets, and (b) that any potential future acquisition is subject to market conditions and capital availability and may not be identified or completed on favorable terms, or at all, as well as those risks and uncertainties set forth in the Risk Factors section of the Company’s Annual Report on Form 10-K for the year ended December 31, 2021 filed on March 18, 2022 and all other filings with the SEC after that date, as such risks, uncertainties and other important factors may be updated from time to time in the Company's subsequent reports. Further, forward-looking statements speak only as of the date they are made, and the Company undertakes no obligation to update or revise any forward-looking statement to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating results over time, unless required to do so by law.

Important Additional Information and Where to Find It

NYC filed a definitive proxy statement on Schedule 14A on April 15, 2022 and will file other relevant documents with the SEC in connection with the solicitation of proxies from NYC stockholders for NYC's 2022 annual meeting of stockholders. NYC STOCKHOLDERS ARE STRONGLY ENCOURAGED TO READ NYC'S DEFINITIVE PROXY STATEMENT (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) AND ALL OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN IMPORTANT INFORMATION. Investors and stockholders may obtain a copy of the definitive proxy statement, an accompanying proxy card, any amendments or supplements to the definitive proxy statement and other documents filed by NYC with the SEC at no charge at the SEC's website at www.sec.gov. Copies are also available at no charge in the “SEC Filings” subsection of the “Financial Information” section of NYC's Investor Relations website at investors.newyorkcityreit.com or by contacting NYC's Investor Relations department at info@ar-global.com.

Participants in the Solicitation

NYC, its directors, and certain of its executive officers may be deemed to be participants in the solicitation of proxies from NYC stockholders in connection with matters to be considered at NYC's 2022 annual meeting of stockholders. Information regarding the direct and indirect interests, by security holdings or otherwise, of NYC's directors and executive officers, in NYC is included in NYC's Proxy Statement on Schedule 14A for the 2022 annual meeting of stockholders, filed with the SEC on April 15, 2022. Changes to the direct or indirect interests of NYC's directors and executive officers are set forth in SEC filings on Initial Statements of Beneficial Ownership on Form 3, Statements of Change in Ownership on Form 4 and Annual Statements of Changes in Beneficial Ownership on Form 5. These documents are available free of charge as described above. Updated information regarding the identities of potential participants and their direct or indirect interests, by security holdings or otherwise, in NYC will be set forth in relevant documents to be filed with the SEC, if and when they become available.

1 First Quarter 2022 Highlights 1) See appendix for a full description of capitalized terms and Non-GAAP reconciliations. 2) Refer to slide 11 – Top 10 Tenant Investment Grade Profile. 3) Refer to slide 15 – Capital Structure and Q1’22 Financial Results for further information regarding our capital structure and liquidity. 4) Refer to slide 25 – Forward Looking Statements for risks related to our financial performance. 5) Refer to slide 14 – Continued Cash Rent Collection Success for additional information. Total rent collected during the period includes both original Cash Rent due and payments made by tenants pursuant to rent deferral agreements. 6) Refer to slide 12 – Proactive Asset Management for additional information. 7) Refer to slide 3 – Case Study: Exceptional Investor Returns Since 2021. High-Quality Manhattan Focused Portfolio Increasing Financial Performance(3)(4) Continued Leasing Activity(6) Strong Investor Returns(7) ✓ Portfolio Occupancy(1) of 84% with a weighted average Remaining Lease Term(1) of 6.8 years ✓ Tenant base featuring Investment Grade and government agency tenants with core commercial business ✓ Top 10 tenants(2) are 71% Investment Grade rated and have a Remaining Lease Term of 9.5 years ✓ Well balanced and long-term lease maturity schedule with 36% of leases expiring after 2030 ✓ Year over year, total portfolio Cash Rent(1) collection improved from 87% to 98%(5) as Approved Agreements expired and tenants resumed paying original Cash Rent due ✓ Year over year, Adjusted EBITDA(1) and Cash NOI improved to $2.7 million from $1.8 million and $5.7 million from $5.6 million, respectively ✓ Weighted average debt maturity of 4.9 years and moderate Net Leverage(1) of 40% ✓ 100% of NYC’s debt is fixed rate debt and no maturities through 2023 ✓ Q1’22 Occupancy increase of 1.5%, including a nearly 3% Occupancy increase at 9 Times Square ✓ NYC’s Leasing Pipeline(1) is expected to increase Occupancy by 1.6% and straight-line rent by $0.9 million ❖ NYC’s Leasing Pipeline includes one Knotel replacement lease for 4,700 SF that would result in 76% of all of Knotel’s former space replaced ✓ Since Knotel’s lease termination in January 2021 and through Q1’22, NYC replaced 69% of the total space and 64% of the straight-line rent formerly derived from Knotel with creditworthy, rent-paying tenants(6) ✓ Since 2021, NYC investors have benefited from an exceptional Total Return(1) of 71.8% that compares favorably when compared to several peer and index benchmarks ✓ NYC overperformed the S&P 500 by over 47% and a group of New York City focused REIT peers by over 42% ✓ Management believes that there is significant upside for NYC as New York City continues to rebound and management leases available space to creditworthy tenants NYC is a real estate investment trust with a high-quality portfolio of real estate assets focused on the Manhattan market and is supported by a robust Advisor platform that has diligently navigated through the COVID-19 pandemic with portfolio Cash Rent collection at nearly 100%, maintained and enhanced a credit worthy tenant base and delivered exceptional investor returns since 2021 NYC’s independent board members and the Advisor and its affiliates have each separately demonstrated its depth of commitment to NYC’s long-term value by increasing ownership in NYC. As of May 1st 2022, NYC’s independent board members owned over 57,000 shares of NYC and separately, NYC’s Advisor and its affiliates owned over 1,500,000 shares of NYC

1 First Quarter 2022 Highlights 1) See appendix for a full description of capitalized terms and Non-GAAP reconciliations. 2) Refer to slide 11 – Top 10 Tenant Investment Grade Profile. 3) Refer to slide 15 – Capital Structure and Q1’22 Financial Results for further information regarding our capital structure and liquidity. 4) Refer to slide 25 – Forward Looking Statements for risks related to our financial performance. 5) Refer to slide 14 – Continued Cash Rent Collection Success for additional information. Total rent collected during the period includes both original Cash Rent due and payments made by tenants pursuant to rent deferral agreements. 6) Refer to slide 12 – Proactive Asset Management for additional information. 7) Refer to slide 3 – Case Study: Exceptional Investor Returns Since 2021. High-Quality Manhattan Focused Portfolio Increasing Financial Performance(3)(4) Continued Leasing Activity(6) Strong Investor Returns(7) ✓ Portfolio Occupancy(1) of 84% with a weighted average Remaining Lease Term(1) of 6.8 years ✓ Tenant base featuring Investment Grade and government agency tenants with core commercial business ✓ Top 10 tenants(2) are 71% Investment Grade rated and have a Remaining Lease Term of 9.5 years ✓ Well balanced and long-term lease maturity schedule with 36% of leases expiring after 2030 ✓ Year over year, total portfolio Cash Rent(1) collection improved from 87% to 98%(5) as Approved Agreements expired and tenants resumed paying original Cash Rent due ✓ Year over year, Adjusted EBITDA(1) and Cash NOI improved to $2.7 million from $1.8 million and $5.7 million from $5.6 million, respectively ✓ Weighted average debt maturity of 4.9 years and moderate Net Leverage(1) of 40% ✓ 100% of NYC’s debt is fixed rate debt and no maturities through 2023 ✓ Q1’22 Occupancy increase of 1.5%, including a nearly 3% Occupancy increase at 9 Times Square ✓ NYC’s Leasing Pipeline(1) is expected to increase Occupancy by 1.6% and straight-line rent by $0.9 million ❖ NYC’s Leasing Pipeline includes one Knotel replacement lease for 4,700 SF that would result in 76% of all of Knotel’s former space replaced ✓ Since Knotel’s lease termination in January 2021 and through Q1’22, NYC replaced 69% of the total space and 64% of the straight-line rent formerly derived from Knotel with creditworthy, rent-paying tenants(6) ✓ Since 2021, NYC investors have benefited from an exceptional Total Return(1) of 71.8% that compares favorably when compared to several peer and index benchmarks ✓ NYC overperformed the S&P 500 by over 47% and a group of New York City focused REIT peers by over 42% ✓ Management believes that there is significant upside for NYC as New York City continues to rebound and management leases available space to creditworthy tenants NYC is a real estate investment trust with a high-quality portfolio of real estate assets focused on the Manhattan market and is supported by a robust Advisor platform that has diligently navigated through the COVID-19 pandemic with portfolio Cash Rent collection at nearly 100%, maintained and enhanced a credit worthy tenant base and delivered exceptional investor returns since 2021 NYC’s independent board members and the Advisor and its affiliates have each separately demonstrated its depth of commitment to NYC’s long-term value by increasing ownership in NYC. As of May 1st 2022, NYC’s independent board members owned over 57,000 shares of NYC and separately, NYC’s Advisor and its affiliates owned over 1,500,000 shares of NYC  2 In 2021, NYC’s Board of Directors, led by Elizabeth Tuppeny, and in conjunction with the Advisor, continued to execute on the Company’s strategic initiatives and operational momentum by mitigating adverse impacts from COVID-19 by focusing on proactive asset management, increasing Cash Rent(1) collection and completing new and renewal leases. As a result, NYC shareholders benefited from a 72% Total Return(2) since 2021 NYC Generated Significant Value For Shareholders in 2021 2021 Highlights ▪ In Q1’21, Knotel, a former top 10 tenant, filed for bankruptcy and terminated all of their leased space with NYC ✓ Since termination, NYC executed new and expansion leases that replaced 69% of the square feet and 64% of the straight-line rent formerly from Knotel ▪ In Q4’21, NYC executed a termination agreement with Icon Parking and Quik Park, two non-compliant tenants, and immediately backfilled the space with a new operator, City Parking ✓ In Q2’22, City Parking extended its license agreements and will continue its operations through October 2022 ▪ In 2021, NYC completed 17 new leases totaling over 200,000 square feet and $7.4 million of straight-line rent ✓ NYC also executed four lease renewals in 2021, including a fiveyear lease extension in Q4’21 with an Aa2 credit rated tenant that increased the Annualized Straight-line Rent(3) from the tenant by $0.3 million as of December 31, 2021 ▪ Q2’22 forward Leasing Pipeline of 18,000 SF that includes three executed new leases and one executed LOI for former Knotel space ✓ The Leasing Pipeline is expected to increase portfolio Occupancy from 84% to 86%, once pipeline leases commence ▪ NYC outperformed the S&P 500 by over 47% and a group of New York City focused REIT peers over 42%(2) ✓ NYC 2021 Total Return of 72% ✓ New York City focused REIT peer performance of 29% ✓ Index Group Performance of 21% ▪ As of May 1st, 2022, NYC’s independent board members owned over 57,000 shares of NYC and separately, NYC’s Advisor and its affiliates owned over 1,500,000 shares of NYC, demonstrating their depth of commitment to NYC’s long-term value by increasing ownership in NYC Proactive Asset and Property Management Successful Navigation Throughout COVID-19 Impactful Leasing Activity Strong Shareholder Returns(2) ▪ Since Q4’20 and through Q4’21, NYC increased its Cash Rent collection rate by 15% to 97%(1) ✓ Q1’22 portfolio Cash Rent collection of 98% ▪ Diligently and proactively communicated with tenants to help them navigate the COVID-19 pandemic and mitigate adverse economic impacts ✓ In 2021, NYC executed two percentage rent deals with two key retail tenants. Since execution, both tenant’s operations have performed exceptionally well and returned to paying near full original Cash Rent due 1) Refer to slide 14 - Continued Cash Rent Collection Success for additional information. 2) Refer to slide 3 - Case Study: Exceptional Investor Returns Since 2021. 3) See appendix for a full description of capitalized terms.

2 In 2021, NYC’s Board of Directors, led by Elizabeth Tuppeny, and in conjunction with the Advisor, continued to execute on the Company’s strategic initiatives and operational momentum by mitigating adverse impacts from COVID-19 by focusing on proactive asset management, increasing Cash Rent(1) collection and completing new and renewal leases. As a result, NYC shareholders benefited from a 72% Total Return(2) since 2021 NYC Generated Significant Value For Shareholders in 2021 2021 Highlights ▪ In Q1’21, Knotel, a former top 10 tenant, filed for bankruptcy and terminated all of their leased space with NYC ✓ Since termination, NYC executed new and expansion leases that replaced 69% of the square feet and 64% of the straight-line rent formerly from Knotel ▪ In Q4’21, NYC executed a termination agreement with Icon Parking and Quik Park, two non-compliant tenants, and immediately backfilled the space with a new operator, City Parking ✓ In Q2’22, City Parking extended its license agreements and will continue its operations through October 2022 ▪ In 2021, NYC completed 17 new leases totaling over 200,000 square feet and $7.4 million of straight-line rent ✓ NYC also executed four lease renewals in 2021, including a fiveyear lease extension in Q4’21 with an Aa2 credit rated tenant that increased the Annualized Straight-line Rent(3) from the tenant by $0.3 million as of December 31, 2021 ▪ Q2’22 forward Leasing Pipeline of 18,000 SF that includes three executed new leases and one executed LOI for former Knotel space ✓ The Leasing Pipeline is expected to increase portfolio Occupancy from 84% to 86%, once pipeline leases commence ▪ NYC outperformed the S&P 500 by over 47% and a group of New York City focused REIT peers over 42%(2) ✓ NYC 2021 Total Return of 72% ✓ New York City focused REIT peer performance of 29% ✓ Index Group Performance of 21% ▪ As of May 1st, 2022, NYC’s independent board members owned over 57,000 shares of NYC and separately, NYC’s Advisor and its affiliates owned over 1,500,000 shares of NYC, demonstrating their depth of commitment to NYC’s long-term value by increasing ownership in NYC Proactive Asset and Property Management Successful Navigation Throughout COVID-19 Impactful Leasing Activity Strong Shareholder Returns(2) ▪ Since Q4’20 and through Q4’21, NYC increased its Cash Rent collection rate by 15% to 97%(1) ✓ Q1’22 portfolio Cash Rent collection of 98% ▪ Diligently and proactively communicated with tenants to help them navigate the COVID-19 pandemic and mitigate adverse economic impacts ✓ In 2021, NYC executed two percentage rent deals with two key retail tenants. Since execution, both tenant’s operations have performed exceptionally well and returned to paying near full original Cash Rent due 1) Refer to slide 14 - Continued Cash Rent Collection Success for additional information. 2) Refer to slide 3 - Case Study: Exceptional Investor Returns Since 2021. 3) See appendix for a full description of capitalized terms.

18 Board of Directors Michael Weil | Director and Executive Chairman ▪ Founding partner of AR Global ▪ Formerly, Mr. Weil served as Executive Vice President of AR Capital, where he supervised the origination of investment opportunities for all AR Capital-sponsored investment programs ▪ Prior to the establishment of AR Capital, Mr. Weil served as Senior Vice President of Sales and Leasing for American Financial Realty Trust (AFRT), where he was responsible for the disposition and leasing activity for an approximately 30 million square foot portfolio ▪ Served as president of the Board of Directors of the Real Estate Investment Securities Association (n/k/a ADISA) Lee Elman | Independent Director and Audit Committee Chairman ▪ Independent director of the Company since February 2016 ▪ Founder & President of Elman Investors Inc., an international real-estate investment bank ▪ 40+ years of real estate investment experience in the US and abroad ▪ Mr. Elman holds a J.D. from Yale Law School and a B.A. from Princeton University’s Woodrow Wilson School of Public and International Affairs Abby Wenzel | Independent Director ▪ Ms. Wenzel was a member of the law firm of Cozen O’Conner, resident in the New York Office from April 2009 until her retirement in June 2019. Ms. Wenzel practiced in in the Real Estate Group and capital markets practice area, focusing on capital markets, finance and sale leaseback transactions ▪ Prior to joining Cozen O’Connor, Ms. Wenzel was a partner with Wolf Block, LLP, managing partner of its New York office and chair of its structured finance practice from October 1999 until April 2009 Elizabeth Tuppeny | Lead Independent Director ▪ Chief Executive Officer and founder of Domus, Inc., since 1993 ▪ 30 years of experience in the branding and advertising industries, with a focus on Fortune 500 companies ▪ Ms. Tuppeny also founded EKT Development, LLC to pursue entertainment projects in publishing, feature film and education video games Strong Corporate Governance ✓ Majority independent Board of Directors, with additional oversight provided by committees comprised solely of independent directors ✓ PricewaterhouseCoopers LLP currently acts as the independent auditor for NYC ✓ NYC is supported by robust financial accounting and reporting teams, and maintains financial reporting processes, controls and procedures ✓ Management and shareholders fully aligned to compensate based on operational outperformance ✓ NYC’s independent board members and the Advisor and its affiliates have each separately demonstrated its depth of commitment to NYC’s long-term value by increasing ownership in NYC. As of May 1st 2022, NYC’s independent board members owned over 57,000 shares of NYC and separately, NYC’s Advisor and its affiliates owned over 1,500,000 shares of NYC

18 Board of Directors Michael Weil | Director and Executive Chairman ▪ Founding partner of AR Global ▪ Formerly, Mr. Weil served as Executive Vice President of AR Capital, where he supervised the origination of investment opportunities for all AR Capital-sponsored investment programs ▪ Prior to the establishment of AR Capital, Mr. Weil served as Senior Vice President of Sales and Leasing for American Financial Realty Trust (AFRT), where he was responsible for the disposition and leasing activity for an approximately 30 million square foot portfolio ▪ Served as president of the Board of Directors of the Real Estate Investment Securities Association (n/k/a ADISA) Lee Elman | Independent Director and Audit Committee Chairman ▪ Independent director of the Company since February 2016 ▪ Founder & President of Elman Investors Inc., an international real-estate investment bank ▪ 40+ years of real estate investment experience in the US and abroad ▪ Mr. Elman holds a J.D. from Yale Law School and a B.A. from Princeton University’s Woodrow Wilson School of Public and International Affairs Abby Wenzel | Independent Director ▪ Ms. Wenzel was a member of the law firm of Cozen O’Conner, resident in the New York Office from April 2009 until her retirement in June 2019. Ms. Wenzel practiced in in the Real Estate Group and capital markets practice area, focusing on capital markets, finance and sale leaseback transactions ▪ Prior to joining Cozen O’Connor, Ms. Wenzel was a partner with Wolf Block, LLP, managing partner of its New York office and chair of its structured finance practice from October 1999 until April 2009 Elizabeth Tuppeny | Lead Independent Director ▪ Chief Executive Officer and founder of Domus, Inc., since 1993 ▪ 30 years of experience in the branding and advertising industries, with a focus on Fortune 500 companies ▪ Ms. Tuppeny also founded EKT Development, LLC to pursue entertainment projects in publishing, feature film and education video games Strong Corporate Governance ✓ Majority independent Board of Directors, with additional oversight provided by committees comprised solely of independent directors ✓ PricewaterhouseCoopers LLP currently acts as the independent auditor for NYC ✓ NYC is supported by robust financial accounting and reporting teams, and maintains financial reporting processes, controls and procedures ✓ Management and shareholders fully aligned to compensate based on operational outperformance ✓ NYC’s independent board members and the Advisor and its affiliates have each separately demonstrated its depth of commitment to NYC’s long-term value by increasing ownership in NYC. As of May 1st 2022, NYC’s independent board members owned over 57,000 shares of NYC and separately, NYC’s Advisor and its affiliates owned over 1,500,000 shares of NYC