UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☒ | Definitive Additional Materials |

| ☐ | Soliciting Material Under Rule 14a-12 |

New York City REIT, Inc.

(Name of Registrant as Specified in Its Charter)

Comrit Investments 1, LP

Comrit Investments Ltd.

I.B.I. Investment House Ltd

Ziv Sapir

Sharon Stern

(Name of Persons(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | |

| |

| ☒ | | No fee required. |

| |

| ☐ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | (5) | | Total fee paid: |

| |

| ☐ | | Fee paid previously with preliminary materials: |

| |

| ☐ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| | |

| | (1) | | Amount previously paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | (3) | | Filing Party: |

| | (4) | | Date Filed: |

Comrit Investments 1, LP, together with the other participants named herein (collectively, “Comrit”), has filed a definitive proxy statement and accompanying WHITE proxy card with the Securities and Exchange Commission (the “SEC”) to be used to solicit votes for the election of a highly qualified independent director nominee at the 2022 annual meeting of stockholders of New York City REIT, Inc., a Maryland corporation (the “Company”).

On May 4, 2022, Comrit issued the following press release and posted the slides that follow the press release below to the following website: www.RebuildNYCREIT.com.

Comrit Investments Releases Presentation Detailing the Urgent Need for Change in New York City REIT’s Boardroom

Highlights the Incumbent Board’s Anti-Stockholder Practices, Concerning Interconnectivity and Record of Presiding Over Negative Returns Across Every Relevant Time Horizon

Makes Clear That the Company Is at Risk if the Status Quo Persists, as NYC REIT’s Capital Position Shrinks, Executive Compensation Rises and Trading Price Discount to NAV Widens

Reminds Stockholders That Independent Nominee Sharon Stern Has the Public REIT Experience and Financial Expertise Required to Help Rebuild NYC REIT

Urges Stockholders to Vote on the WHITE Proxy Card to Restore Accountability and Credibility in the Boardroom

NEW YORK & TEL AVIV, Israel—(BUSINESS WIRE)—Comrit Investments 1, LP (together with its affiliates, “Comrit” or “we”), a long-term stockholder of New York City REIT, Inc. (NYSE: NYC) (“NYC REIT” or the “Company”), today issued a comprehensive presentation that details the urgent case for change in NYC REIT’s boardroom and summarizes the qualifications of its highly skilled and experienced nominee, Sharon Stern. As a reminder, Comrit is calling on stockholders to vote on the WHITE proxy card to elect Ms. Stern at the Company’s 2022 Annual Meeting of Stockholders (the “Annual Meeting”). Learn more at www.RebuildNYCREIT.com.

CLICK HERE TO DOWNLOAD AND VIEW THE INVESTOR PRESENTATION

Ziv Sapir, Comrit’s Managing Partner, commented:

“Following its public listing in August 2020, NYC REIT has continued to significantly underperform while the Board has initiated stockholder-unfriendly maneuvers, including the adoption of a defensive poison pill, serious conflicts of interest and the approval of an egregious advisory agreement that provides for excessive compensation and prioritizes management and the Company’s advisor’s interests over those of stockholders. In our view, leadership’s repeated failure to create value for stockholders stems from a lack of independence, financial acumen and governance expertise across the current Board and management team. We believe stockholders deserve a highly qualified, independent director who is unhindered by legacy biases and conflicts of interest and who is laser-focused on unlocking value for stockholders.

At this year’s Annual Meeting, stockholders have an opportunity to add a public company governance expert to the Board who can help objectively evaluate the Company’s performance, governance and go-forward strategy. If elected, Sharon Stern will bring fresh perspectives and much-needed skills to help the Board improve NYC REIT’s abysmal governance and create long-term value. We urge stockholders to vote to reverse the dismal status quo and begin rebuilding NYC REIT today.”

***

VISIT WWW.REBUILDNYCREIT.COM TO REVIEW OUR PRESENTATION.

VOTE THE WHITE PROXY CARD TO ELECT INDEPENDENT, HIGHLY QUALIFIED NOMINEE SHARON STERN.

CONTACT INFO@SARATOGAPROXY.COM WITH QUESTIONS ABOUT YOUR PROXY AND HOW TO VOTE.

***

About Comrit Investments

Comrit Investments 1, LP is an investment partnership that invests in income generating real estate through public non-traded real estate investment trusts. Founded in 2015 and based in Tel Aviv, Washington D.C. and New York City, Comrit is sponsored by I.B.I. Investment House Ltd. (TLV: IBI), an Israel-based market leader in alternative fund offerings. Comrit’s management team collectively has 30 years of experience investing across the U.S. real estate market.

Contacts

For Investors:

Saratoga Proxy Consulting LLC

John Ferguson / Joe Mills, 212-257-1311

jferguson@saratogaproxy.com / jmills@saratogaproxy.com

For Media:

Longacre Square Partners

Charlotte Kiaie / Bela Kirpalani, 646-386-0091

ckiaie@longacresquare.com / bkirpalani@longacresquare.com

Investor Presentation Comrit Investments 1, LP May 2022

The materials contained herein (the “Materials”) represent the opinions of Comrit Investments 1, LP and the other participants named in this proxy solicitation (collectively, “Comrit”) and are based on publicly available information with respect to New York City REIT, Inc. (the “Company”). Comrit recognizes that there may be confidential information in the possession of the Company that could lead it or others to disagree with the Comrit’s conclusions. Comrit reserves the right to change any of its opinions expressed herein at any time as it deems appropriate and disclaims any obligation to notify the market or any other party of any such changes. Comrit disclaims any obligation to update the information or opinions contained herein. Certain financial projections and statements made herein have been derived or obtained from filings made with the Securities and Exchange Commission (“SEC”) or other regulatory authorities and from other third party reports. The estimates, projections and potential impact of the opportunities identified by Comrit herein are based on assumptions that Comrit believes to be reasonable as of the date of the Materials, but there can be no assurance or guarantee that actual results or performance of the Company will not differ, and such differences may be material. The Materials are provided merely as information and are not intended to be, nor should they be construed as, an offer to sell or a solicitation of an offer to buy any security. Certain members of Comrit currently beneficially own, and/or have an economic interest in, securities of the Company. It is possible that there will be developments in the future (including changes in price of the Company’s securities) that cause one or more members of Comrit from time to time to sell all or a portion of their holdings of the Company in open market transactions or otherwise (including via short sales), buy additional securities (in open market or privately negotiated transactions or otherwise), or trade in options, puts, calls or other derivative instruments relating to some or all of such securities. To the extent that Comrit discloses information about its position or economic interest in the securities of the Company in the Materials, it is subject to change and Comrit expressly disclaims any obligation to update such information. The Materials contain forward-looking statements. All statements contained herein that are not clearly historical in nature or that necessarily depend on future events are forward-looking, and the words “anticipate,” “believe,” “expect,” “potential,” “opportunity,” “estimate,” “plan,” “may,” “will,” “projects,” “targets,” “forecasts,” “seeks,” “could,” and similar expressions are generally intended to identify forward-looking statements. The projected results and statements contained herein that are not historical facts are based on current expectations, speak only as of the date of the Materials and involve risks, uncertainties and other factors that may cause actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by such projected results and statements. Assumptions relating to the foregoing involve judgments with respect to, among other things, future economic, competitive and market conditions and future business decisions, all of which are difficult or impossible to predict accurately and many of which are beyond the control of Comrit. Although Comrit believes that the assumptions underlying the projected results or forward-looking statements are reasonable as of the date of the Materials, any of the assumptions could be inaccurate and therefore, there can be no assurance that the projected results or forward-looking statements included herein will prove to be accurate. Comrit will not undertake and specifically declines any obligation to disclose the results of any revisions that may be made to any projected results or forward-looking statements herein to reflect events or circumstances after the date of such projected results or statements or to reflect the occurrence of anticipated or unanticipated events. Unless otherwise indicated herein, Comrit has not sought or obtained consent from any third party to use any statements, photos or information indicated herein as having been obtained or derived from statements made or published by third parties. Any such statements or information should not be viewed as indicating the support of such third party for the views expressed herein. No warranty is made as to the accuracy of data or information obtained or derived from filings made with the SEC by the Company or from any third-party source. All trade names, trademarks, service marks, and logos herein are the property of their respective owners who retain all proprietary rights over their use. DISCLAIMER

Executive Summary The Case for Boardroom Change Our Solution: Comrit’s Highly Qualified, Independent Nominee TABLE OF CONTENTS

EXECUTIVE SUMMARY

Comrit has been a stockholder of NYC REIT since June 2015 Comrit has consistently engaged with NYC REIT’s management since its investment in 2015 Comrit possesses a deep knowledge of the Company’s assets, financials, governance and strategy Comrit Investments 1, LP (“Comrit” or “we”) is an investment partnership that invests in income-generating real estate through public non-traded real estate investment trusts (“REITs”) Founded in 2015 and based in Tel Aviv, Washington D.C. and New York City, Comrit is sponsored by I.B.I. Investment House Ltd. (TLV: IBI), an Israel-based market leader in alternative fund offerings Comrit’s management team collectively has 30 years of experience investing across the U.S. real estate market Firm Overview Long-Term Stockholder of New York City REIT, Inc. (NYSE: NYC) (“NYC REIT” or the “Company”) ABOUT COMRIT

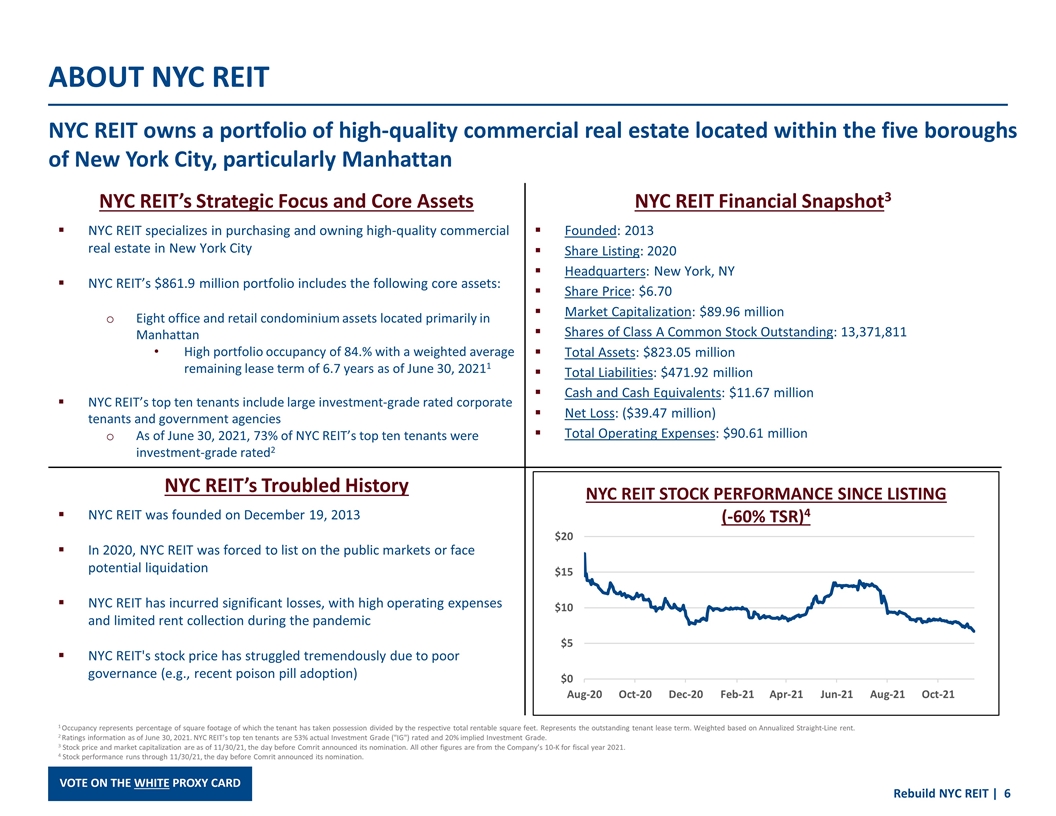

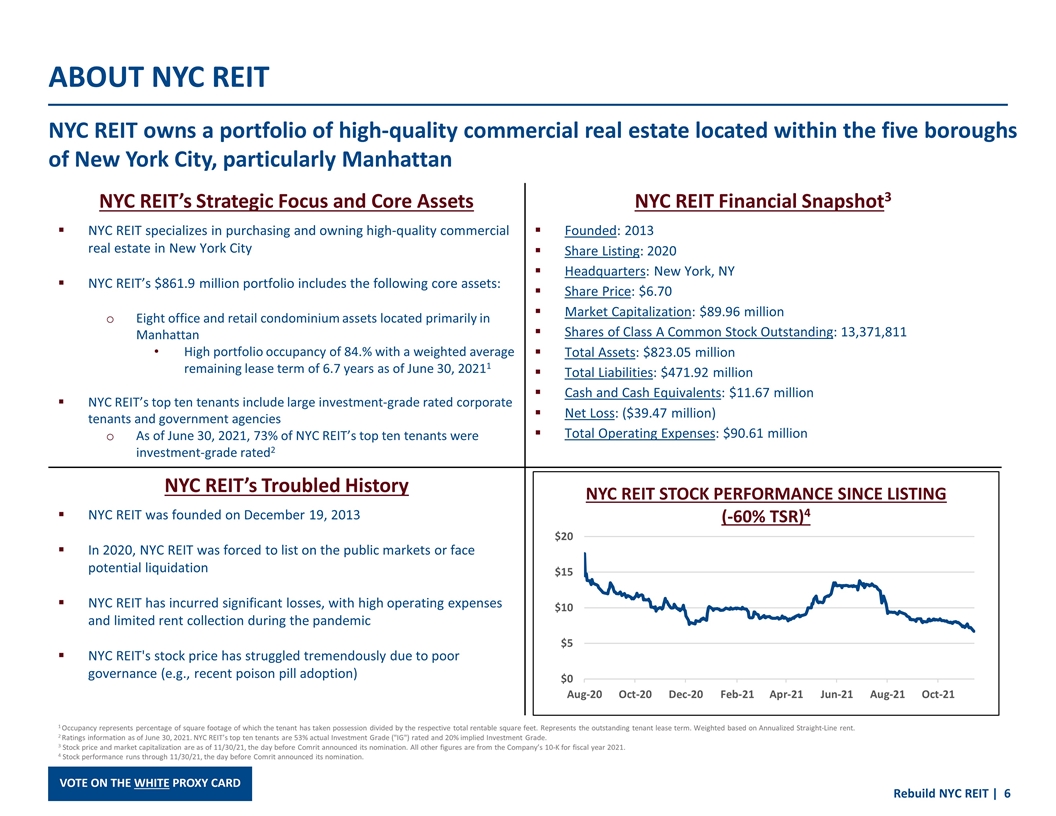

ABOUT NYC REIT NYC REIT owns a portfolio of high-quality commercial real estate located within the five boroughs of New York City, particularly Manhattan NYC REIT’s Strategic Focus and Core Assets NYC REIT specializes in purchasing and owning high-quality commercial real estate in New York City NYC REIT’s $861.9 million portfolio includes the following core assets: Eight office and retail condominium assets located primarily in Manhattan High portfolio occupancy of 84.% with a weighted average remaining lease term of 6.7 years as of June 30, 20211 NYC REIT’s top ten tenants include large investment-grade rated corporate tenants and government agencies As of June 30, 2021, 73% of NYC REIT’s top ten tenants were investment-grade rated2 NYC REIT Financial Snapshot3 Founded: 2013 Share Listing: 2020 Headquarters: New York, NY Share Price: $6.70 Market Capitalization: $89.96 million Shares of Class A Common Stock Outstanding: 13,371,811 Total Assets: $823.05 million Total Liabilities: $471.92 million Cash and Cash Equivalents: $11.67 million Net Loss: ($39.47 million) Total Operating Expenses: $90.61 million NYC REIT’s Troubled History NYC REIT was founded on December 19, 2013 In 2020, NYC REIT was forced to list on the public markets or face potential liquidation NYC REIT has incurred significant losses, with high operating expenses and limited rent collection during the pandemic NYC REIT's stock price has struggled tremendously due to poor governance (e.g., recent poison pill adoption) 1 Occupancy represents percentage of square footage of which the tenant has taken possession divided by the respective total rentable square feet. Represents the outstanding tenant lease term. Weighted based on Annualized Straight-Line rent. 2 Ratings information as of June 30, 2021. NYC REIT’s top ten tenants are 53% actual Investment Grade ("IG") rated and 20% implied Investment Grade. 3 Stock price and market capitalization are as of 11/30/21, the day before Comrit announced its nomination. All other figures are from the Company’s 10-K for fiscal year 2021. 4 Stock performance runs through 11/30/21, the day before Comrit announced its nomination.

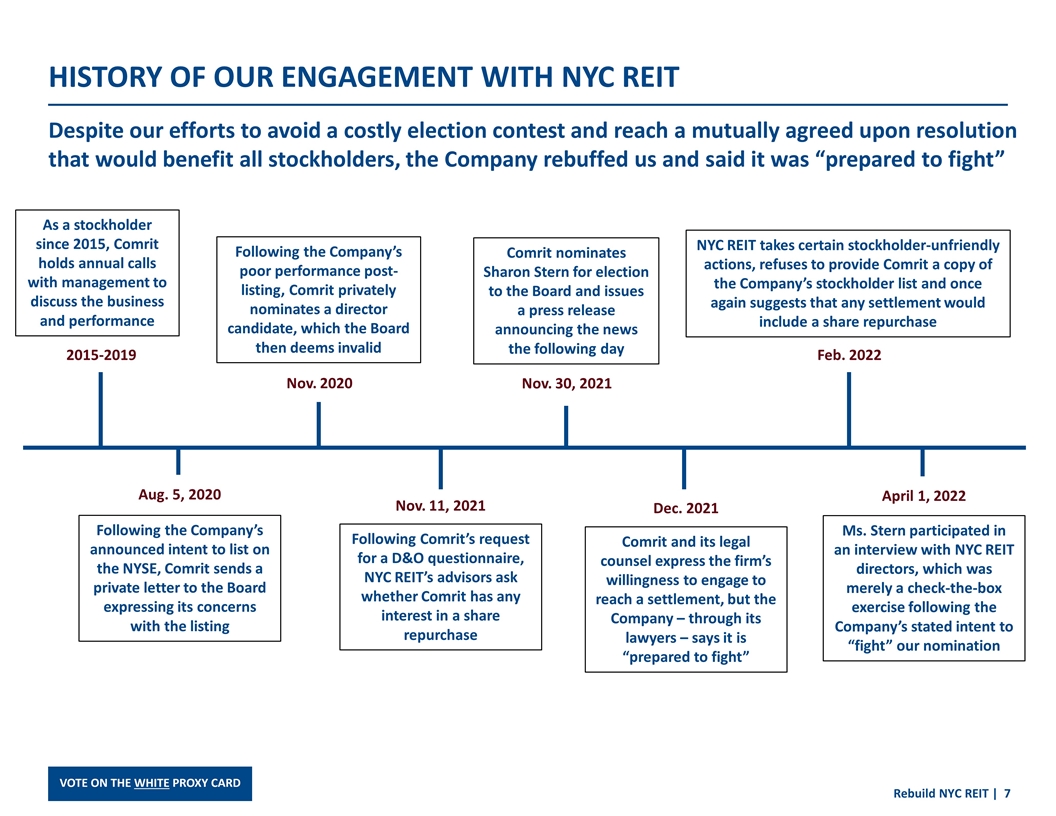

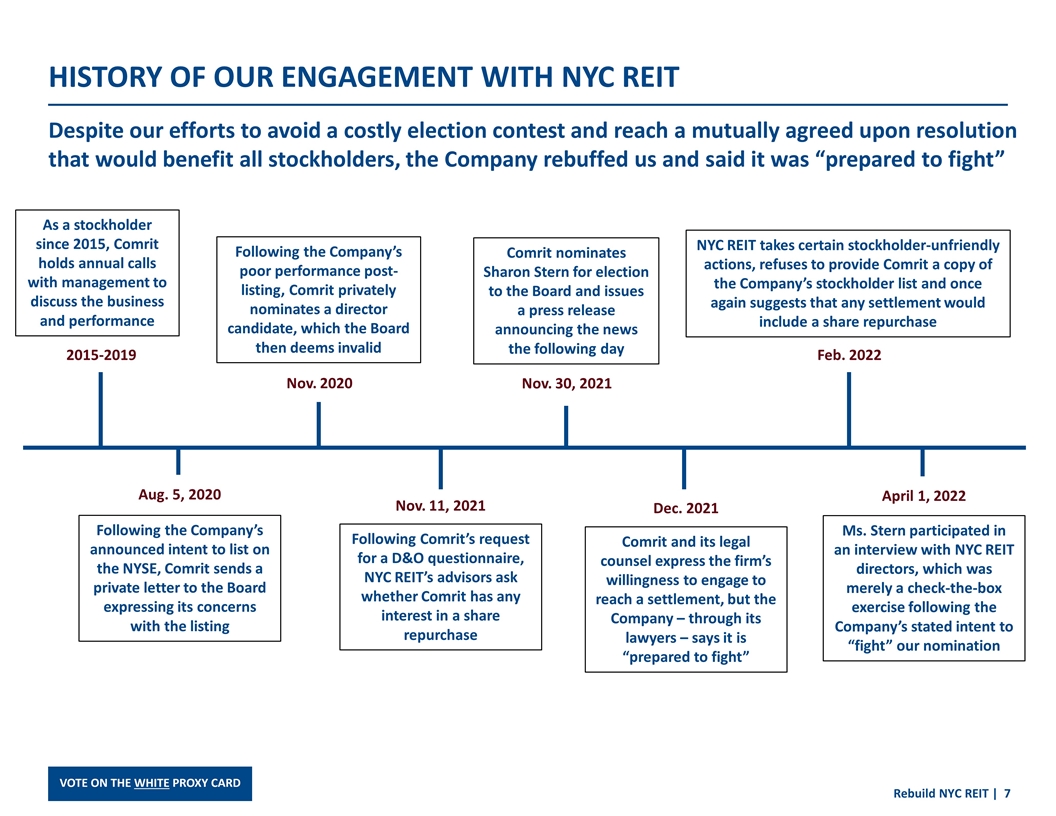

HISTORY OF OUR ENGAGEMENT WITH NYC REIT Despite our efforts to avoid a costly election contest and reach a mutually agreed upon resolution that would benefit all stockholders, the Company rebuffed us and said it was “prepared to fight” As a stockholder since 2015, Comrit holds annual calls with management to discuss the business and performance 2015-2019 Aug. 5, 2020 Following the Company’s announced intent to list on the NYSE, Comrit sends a private letter to the Board expressing its concerns with the listing Following the Company’s poor performance post-listing, Comrit privately nominates a director candidate, which the Board then deems invalid Nov. 2020 Nov. 11, 2021 Following Comrit’s request for a D&O questionnaire, NYC REIT’s advisors ask whether Comrit has any interest in a share repurchase Comrit nominates Sharon Stern for election to the Board and issues a press release announcing the news the following day Nov. 30, 2021 Dec. 2021 Comrit and its legal counsel express the firm’s willingness to engage to reach a settlement, but the Company – through its lawyers – says it is “prepared to fight” NYC REIT takes certain stockholder-unfriendly actions, refuses to provide Comrit a copy of the Company’s stockholder list and once again suggests that any settlement would include a share repurchase Feb. 2022 April 1, 2022 Ms. Stern participated in an interview with NYC REIT directors, which was merely a check-the-box exercise following the Company’s stated intent to “fight” our nomination

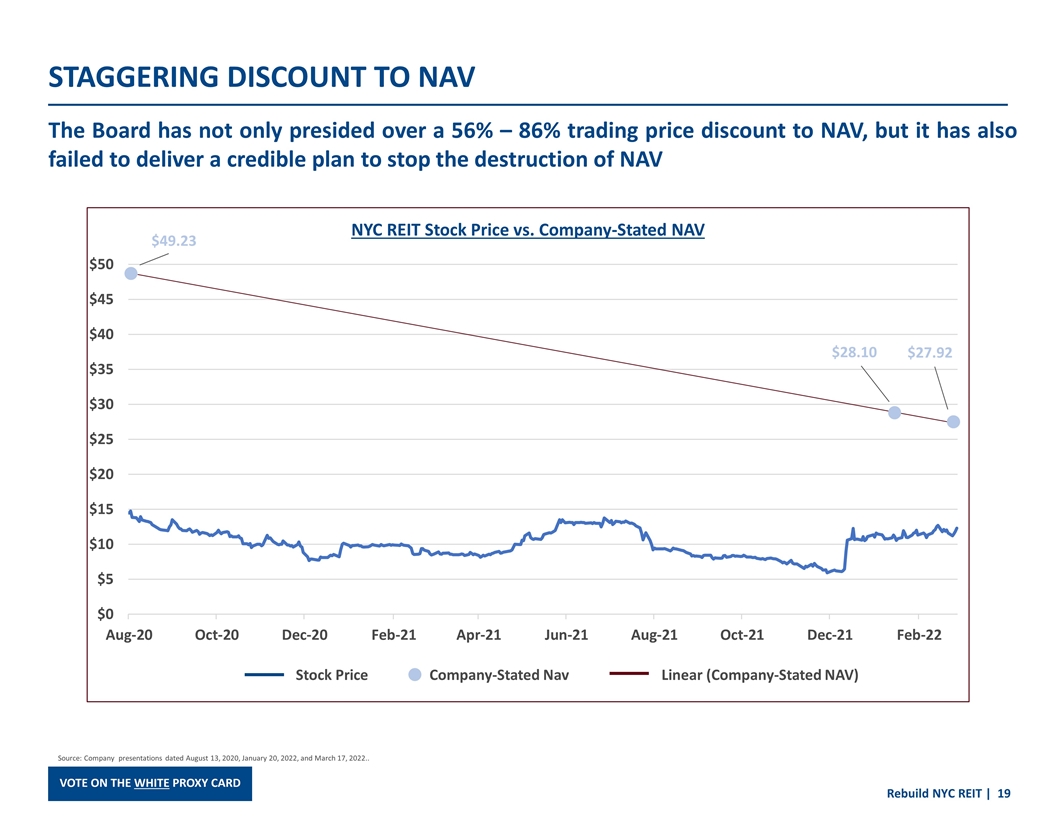

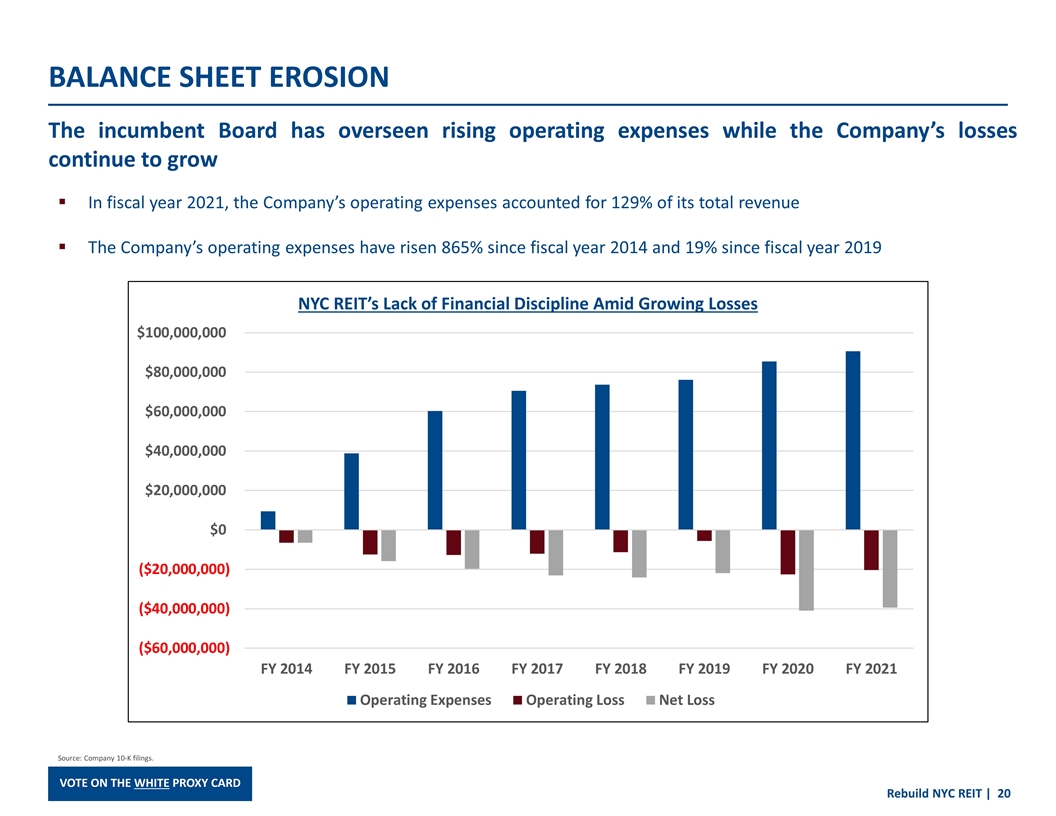

WHERE NYC REIT STANDS TODAY It is time to reverse NYC REIT’s trajectory of underperformance, strategic issues and poor governance under the incumbent Board The Company has lost 60% of its equity market value since publicly listing The Company trades at an 86% discount to its net asset value (“NAV”) The Company’s $11.7 million in cash on hand is declining Operating expenses are up 6% on a year-over-year basis The Company’s operating loss grew 265% from ($5.6) million in 2019 to ($20.4) million in 2021 Advisor and director compensation costs remain offensively high Source: Bloomberg; Company 10-K filings.

ANTI-STOCKHOLDER CORPORATE GOVERNANCE The incumbent Board has fostered abysmal governance and failed to effectively oversee management and the Company’s performance Allowing Interlocking Director & Executive Connections Failing to Align Compensation to Financial Results Inking an Egregious Advisory Agreement Instituting a Defensive Poison Pill & Other Poor Governance Measures Repeatedly Attempting to Limit Stockholders’ Rights Neglecting to Align Itself with Stockholders The incumbent Board has a record of:

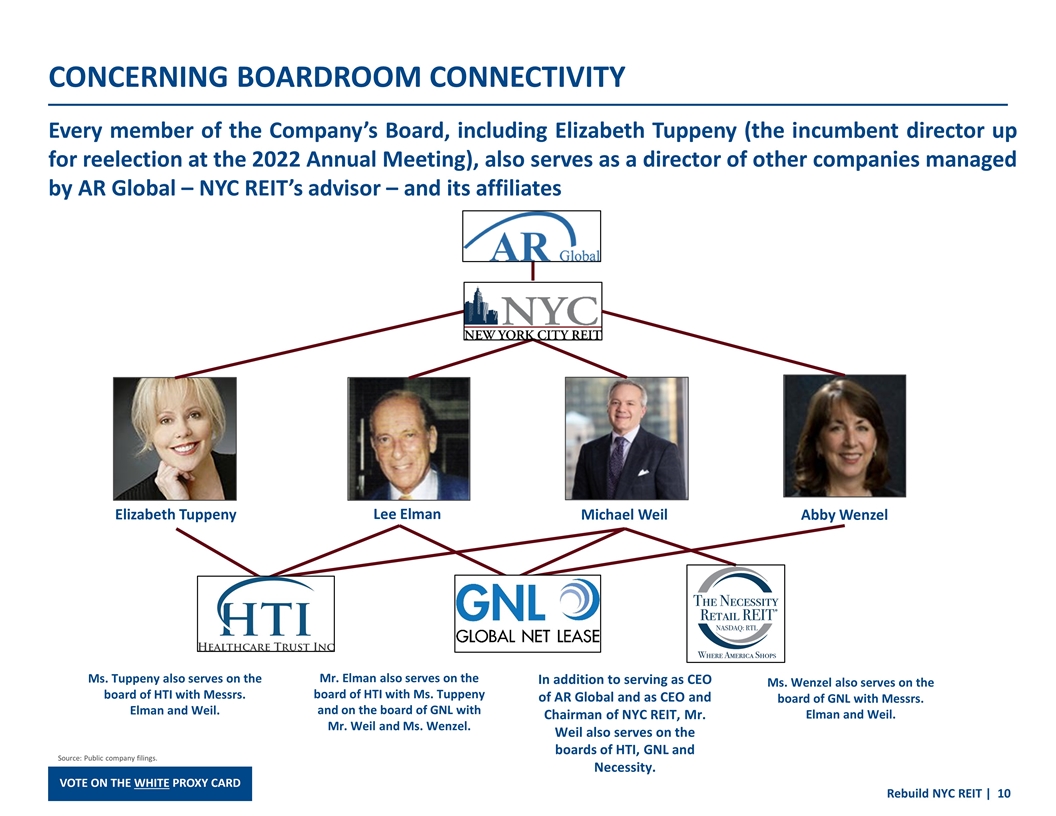

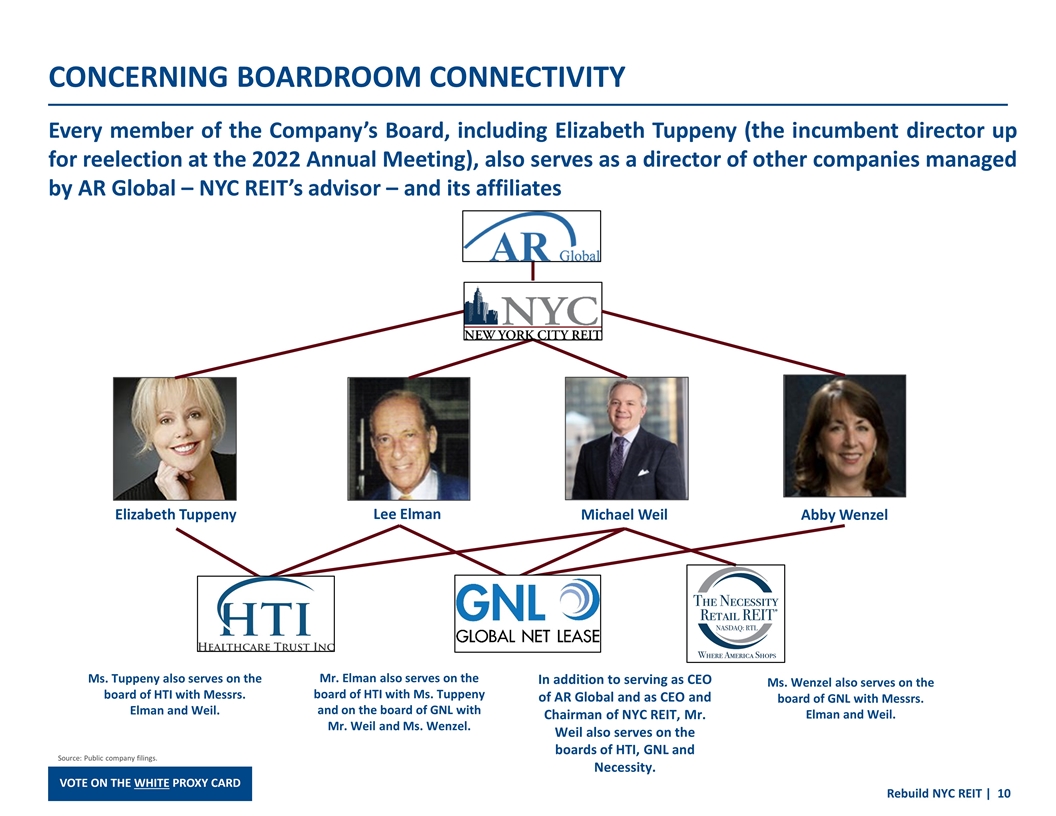

CONCERNING BOARDROOM CONNECTIVITY Every member of the Company’s Board, including Elizabeth Tuppeny (the incumbent director up for reelection at the 2022 Annual Meeting), also serves as a director of other companies managed by AR Global – NYC REIT’s advisor – and its affiliates Abby Wenzel Michael Weil Lee Elman Elizabeth Tuppeny Ms. Tuppeny also serves on the board of HTI with Messrs. Elman and Weil. Mr. Elman also serves on the board of HTI with Ms. Tuppeny and on the board of GNL with Mr. Weil and Ms. Wenzel. In addition to serving as CEO of AR Global and as CEO and Chairman of NYC REIT, Mr. Weil also serves on the boards of HTI, GNL and Necessity. Ms. Wenzel also serves on the board of GNL with Messrs. Elman and Weil. Source: Public company filings.

THE INCUMBENT BOARD APPEARS BEHOLDEN TO AR GLOBAL We believe the Board has prioritized the interests of AR Global over creating value for stockholders Mr. Weil is both Chairman and Chief Executive Officer of NYC REIT, a practice that is antithetical to good corporate governance Mr. Weil is also CEO of AR Global and CEO of the Company’s external advisor and property manager, which are subsidiaries of AR Global Mr. Weil’s multiple controlling roles deny the Company independent leadership that is not beholden to AR Global As previously noted, all the incumbent directors, including Ms. Tuppeny, also serve as directors of other companies managed by AR Global and its affiliates The incumbent Board has consistently prioritized the interests of AR Global and its affiliates over those of stockholders, including signing a conflict-ridden, expensive advisory agreement in favor of AR Global and waiving the application of the Company’s poison pill exclusively for AR Global, Mr. Weil and certain of his affiliates We question how a fully engaged and truly independent Board could allow the Company to enter into a generous advisory deal in favor of AR Global, an affiliate of certain Board members, which automatically renews for successive five-year terms and entitles the advisor to a $39 million minimum early termination fee At the 2022 Annual Meeting, stockholders have an opportunity to inject independence and fresh perspectives into the boardroom to provide better oversight of the Company.

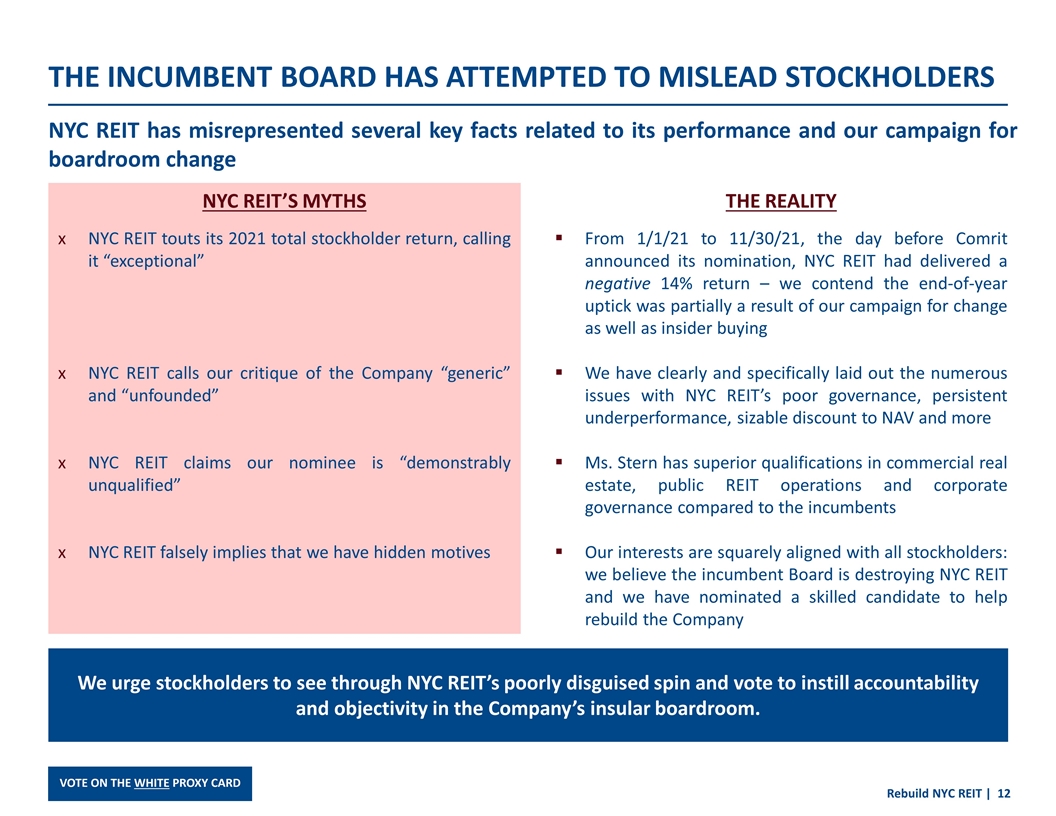

THE INCUMBENT BOARD HAS ATTEMPTED TO MISLEAD STOCKHOLDERS NYC REIT has misrepresented several key facts related to its performance and our campaign for boardroom change NYC REIT touts its 2021 total stockholder return, calling it “exceptional” NYC REIT calls our critique of the Company “generic” and “unfounded” NYC REIT claims our nominee is “demonstrably unqualified” NYC REIT falsely implies that we have hidden motives We urge stockholders to see through NYC REIT’s poorly disguised spin and vote to instill accountability and objectivity in the Company’s insular boardroom. From 1/1/21 to 11/30/21, the day before Comrit announced its nomination, NYC REIT had delivered a negative 14% return – we contend the end-of-year uptick was partially a result of our campaign for change as well as insider buying We have clearly and specifically laid out the numerous issues with NYC REIT’s poor governance, persistent underperformance, sizable discount to NAV and more Ms. Stern has superior qualifications in commercial real estate, public REIT operations and corporate governance compared to the incumbents Our interests are squarely aligned with all stockholders: we believe the incumbent Board is destroying NYC REIT and we have nominated a skilled candidate to help rebuild the Company NYC REIT’S MYTHS THE REALITY

OUR SOLUTION: A HIGHLY QUALIFIED, INDEPENDENT NOMINEE We are seeking to replace one current director with Sharon Stern, a highly qualified individual with real estate industry experience, relevant expertise and much-needed independence Currently serves as President of Eastmore Management and Metro Investments, two organizations focused on the acquisition, development and management of multi-residential and commercial properties in the downtown core of Montreal Significant experience in residential & commercial real estate, including acquisition, development, financing, litigation and property management Serves on the Board of Directors of Cedar Realty Trust, Inc. (NYSE: CDR), a publicly traded REIT, which recently announced an agreement for a sale that would represent a nearly 71% premium for shareholders following a robust review of strategic alternatives1 Following her appointment, she purchased stock in the company to align herself with shareholders Previously worked in Strategy and Corporate Development for the Business Development Bank of Canada Holds a Bachelor’s degree from McGill University and a Master’s degree from Brown University Sharon Stern If elected, Ms. Stern is committed to operating with integrity and transparency in the boardroom – all in the interest of delivering the best outcome for stockholders. MS. STERN IS A REIT EXPERT AND REAL ESTATE ENTREPRENEUR WITH RELEVANT PUBLIC COMPANY BOARD EXPERIENCE AND A STRONG RECORD OF VALUE CREATION. 1 Cedar Realty Trust press release dated March 2, 2022.

STOCKHOLDERS STAND WITH COMRIT Stockholders agree that fresh perspectives are urgently needed in NYC REIT’s insular and seemingly self-serving boardroom In our view, the management and oversight of NYC REIT is another travesty foisted upon stockholders by Nick Schorsch and his management lackeys. We are unaware of a REIT with worse governance and operating results and in need of fresh perspectives and greater accountability. “ Michael L. Ashner (NYC REIT Stockholder), January 2022 I, agree, I am sickened by the decisions of this board. I have lost approximately 60 % of my investment. These current board members have no concern at all for the shareholders who invested our hard earned money. “ “ NYC REIT Stockholder, March 2022 I invested $50,000 and it's worth less than $10,000 which happened when this company went public, which achieved nothing but putting money into the pockets of the BODs. […] and you don't have to convince me anyone can do better than the current officers. “ “ NYC REIT Stockholder, January 2022 I have been ripped off for over $40,000 by their shenanigans'. I had faith in these clowns and bought over $200,000 worth of NYC REIT in private trades and public aftermarket combined. These people are disgraceful and are plundering the company with no regard to stockholders. “ “ NYC REIT Stockholder, March 2022 “

THE CASE FOR BOARDROOM CHANGE

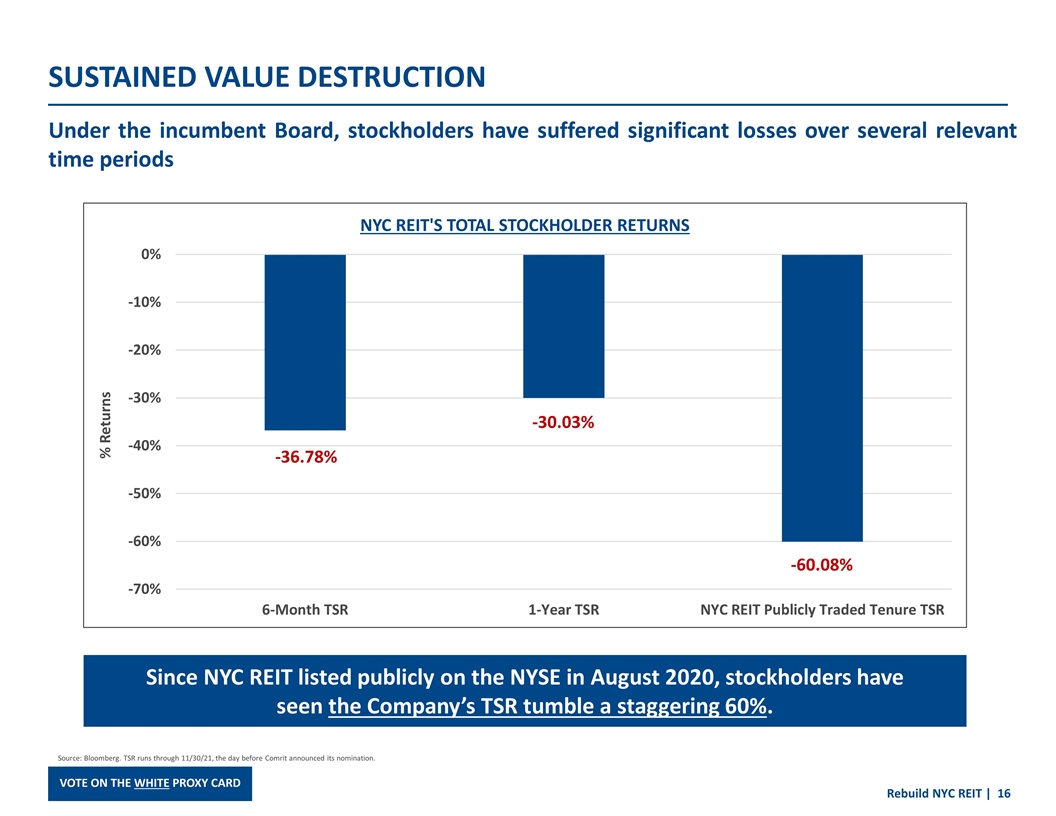

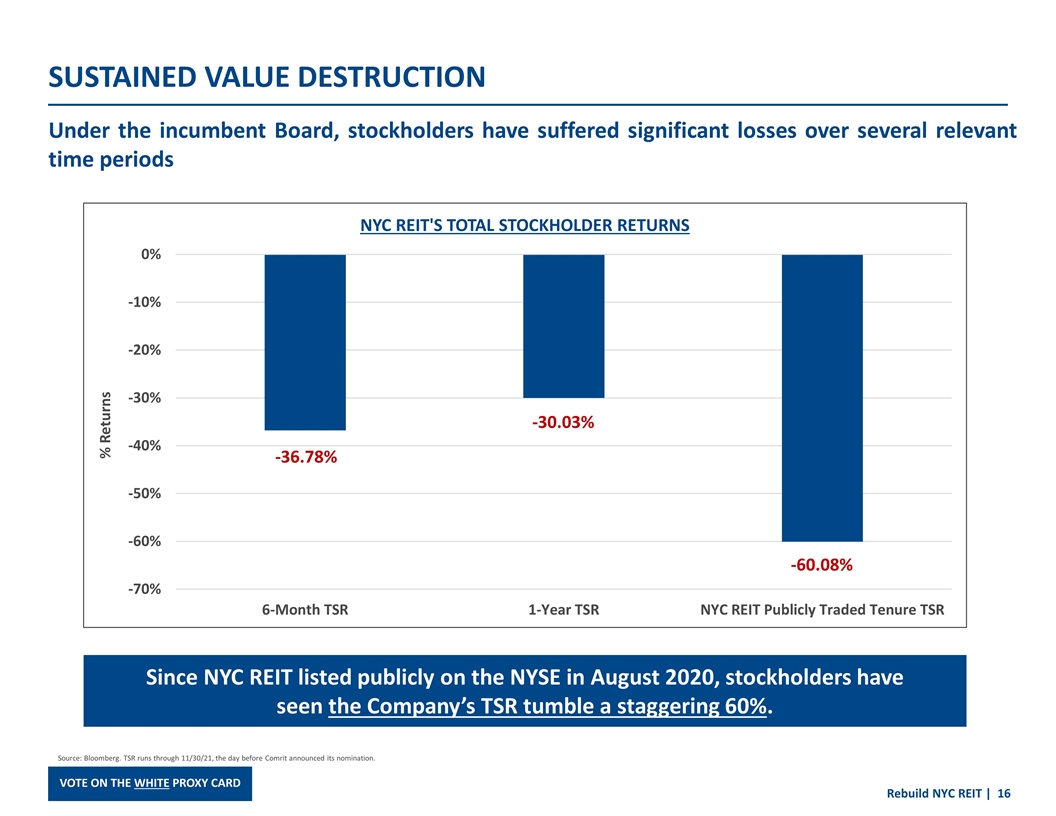

SUSTAINED VALUE DESTRUCTION Under the incumbent Board, stockholders have suffered significant losses over several relevant time periods Source: Bloomberg. TSR runs through 11/30/21, the day before Comrit announced its nomination. % Returns Since NYC REIT listed publicly on the NYSE in August 2020, stockholders have seen the Company’s TSR tumble a staggering 60%. -36.78% -30.03% -60.08%

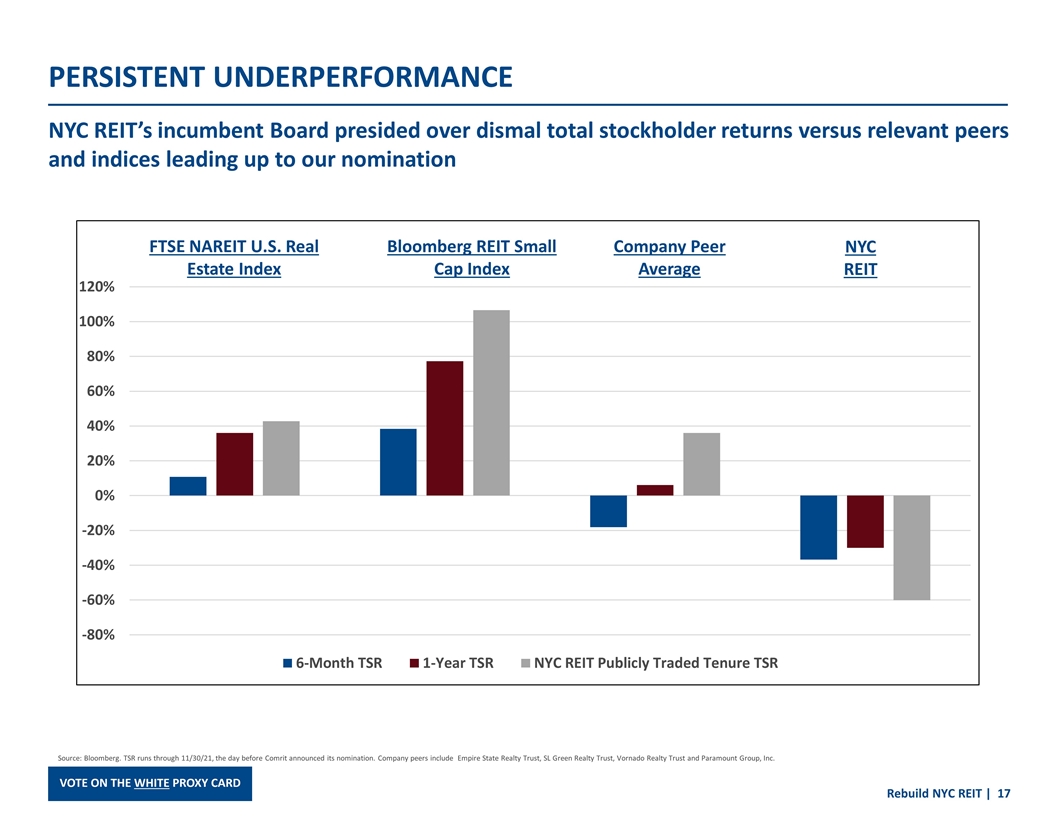

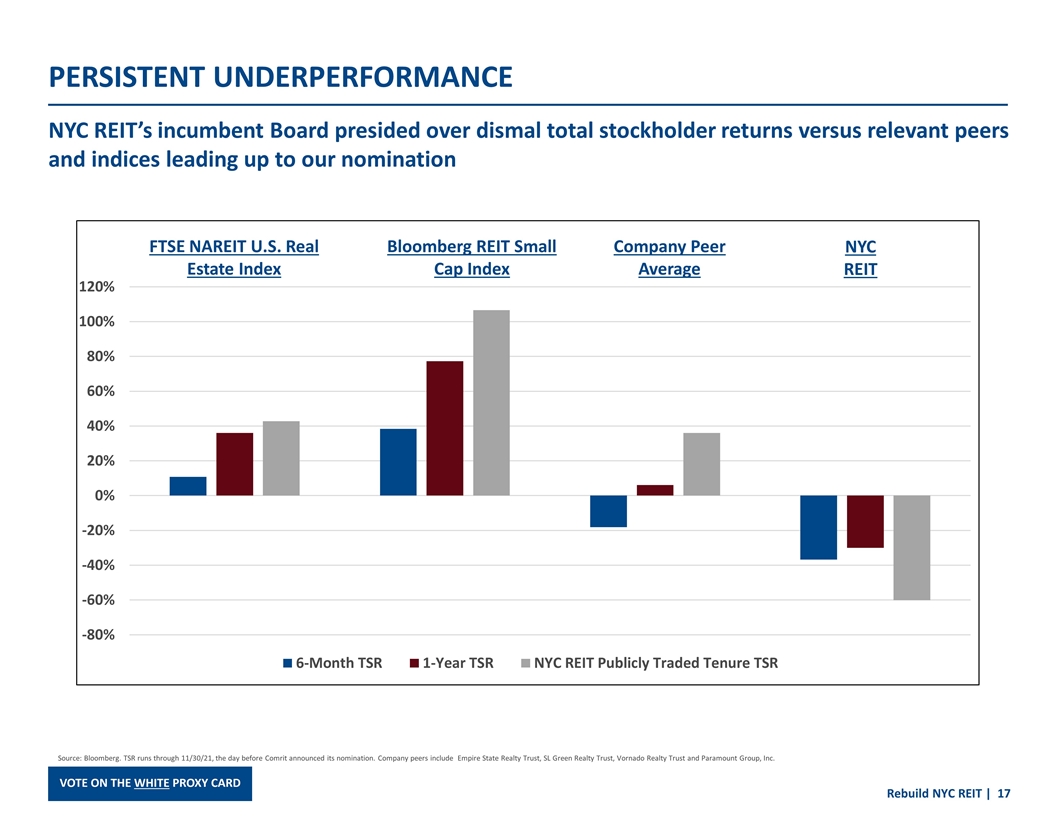

PERSISTENT UNDERPERFORMANCE NYC REIT’s incumbent Board presided over dismal total stockholder returns versus relevant peers and indices leading up to our nomination FTSE NAREIT U.S. Real Estate Index Bloomberg REIT Small Cap Index Company Peer Average NYC REIT Source: Bloomberg. TSR runs through 11/30/21, the day before Comrit announced its nomination. Company peers include Empire State Realty Trust, SL Green Realty Trust, Vornado Realty Trust and Paramount Group, Inc.

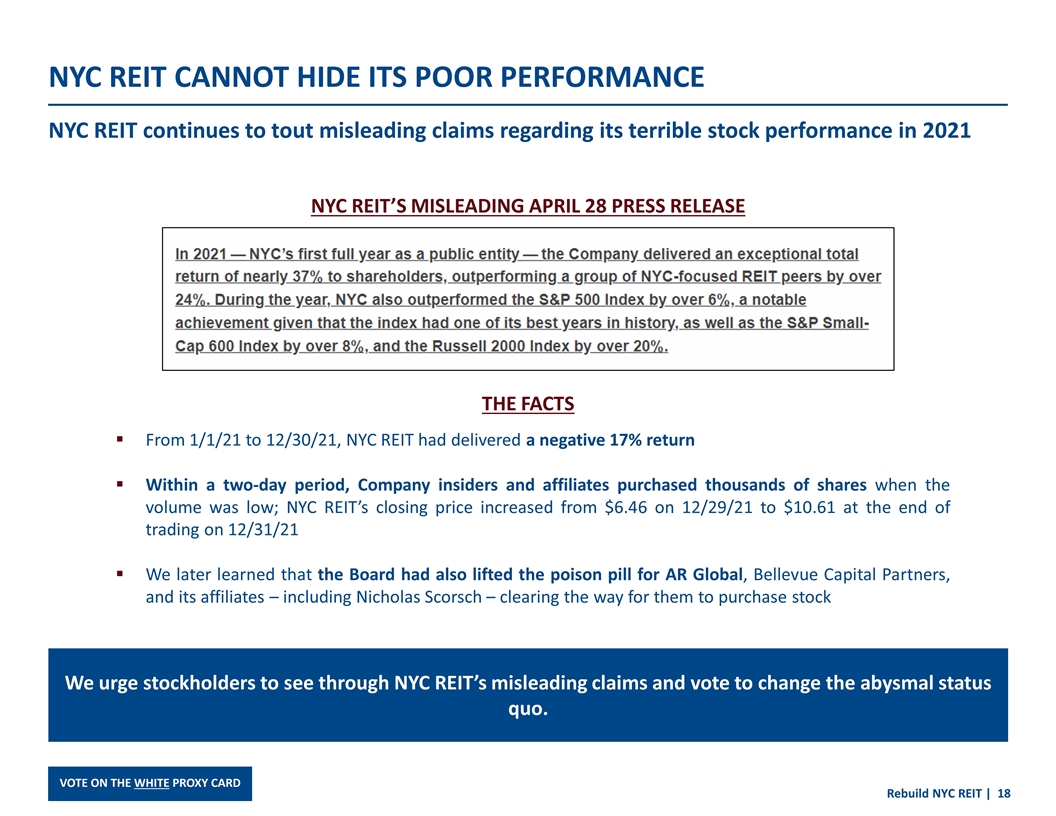

NYC REIT CANNOT HIDE ITS POOR PERFORMANCE NYC REIT continues to tout misleading claims regarding its terrible stock performance in 2021 From 1/1/21 to 12/30/21, NYC REIT had delivered a negative 17% return Within a two-day period, Company insiders and affiliates purchased thousands of shares when the volume was low; NYC REIT’s closing price increased from $6.46 on 12/29/21 to $10.61 at the end of trading on 12/31/21 We later learned that the Board had also lifted the poison pill for AR Global, Bellevue Capital Partners, and its affiliates – including Nicholas Scorsch – clearing the way for them to purchase stock We urge stockholders to see through NYC REIT’s misleading claims and vote to change the abysmal status quo. THE FACTS NYC REIT’S MISLEADING APRIL 28 PRESS RELEASE

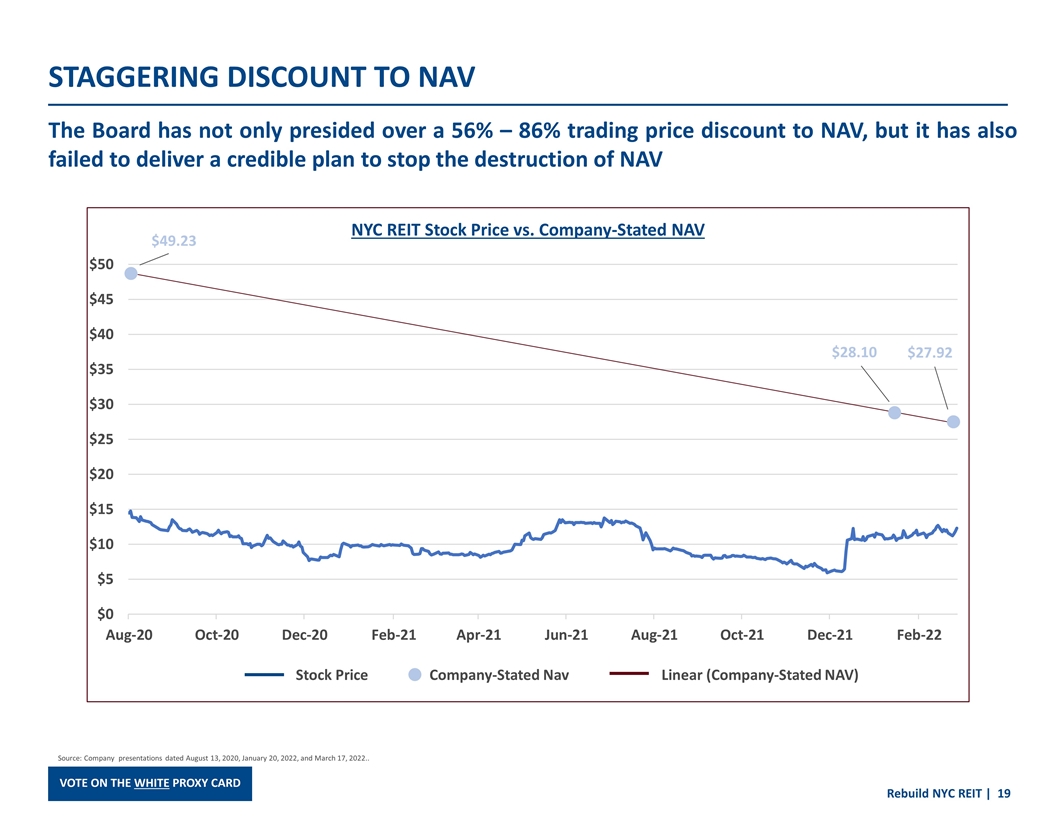

STAGGERING DISCOUNT TO NAV The Board has not only presided over a 56% – 86% trading price discount to NAV, but it has also failed to deliver a credible plan to stop the destruction of NAV Stock Price Company-Stated Nav Linear (Company-Stated NAV) $49.23 $27.92 $28.10 Source: Company presentations dated August 13, 2020, January 20, 2022, and March 17, 2022..

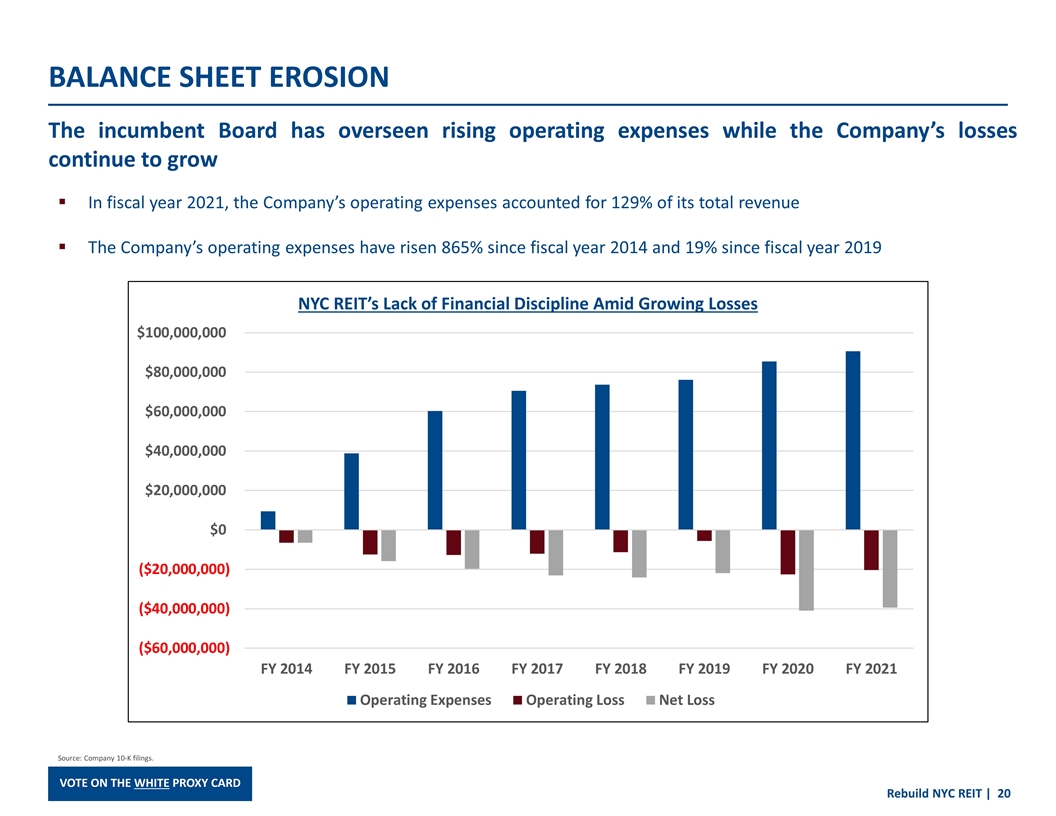

BALANCE SHEET EROSION The incumbent Board has overseen rising operating expenses while the Company’s losses continue to grow In fiscal year 2021, the Company’s operating expenses accounted for 129% of its total revenue The Company’s operating expenses have risen 865% since fiscal year 2014 and 19% since fiscal year 2019 Source: Company 10-K filings.

NYC REIT’S SCANDAL-RIDDEN HISTORY NYC REIT has a concerning history of financial issues and stockholder-unfriendly behavior Founded and initially led by Mr. Scorsch, NYC REIT – then called American Realty Capital (“ARC”) – delivered 60% losses to certain investors in the secondary market In 2019, ARC was rocked by an accounting scandal that saw its CFO resign and a $14 million fine incurred by the Company ARC was then renamed NYC REIT in a branding maneuver apparently crafted to disassociate the Company from the fraud and accounting issues Prior to the 2020 public listing, the Board approved a reverse stock split of 2.43:1, which caused 50%+ losses for principal investors When NYC REIT listed on the NYSE in 2020, shares plummeted 41% the first day of trading Shareholders who had purchased the Company’s stock when it was a non-traded REIT suffered particularly large losses and later sued the Company Source: U.S. Attorney’s Office Southern District of New York Press Release; The DI Wire Article; Fitzapelli Kurta Press Release.

NUMEROUS BOARDROOM ISSUES The incumbent Board is plagued by serious governance issues, which we believe prevent stockholders from realizing the true value of their investment CONCERNING DIRECTOR CONNECTIVITY WE BELIEVE THE FOLLOWING BOARDROOM ISSUES PLAGUE NYC REIT TO THE DETRIMENT OF STOCKHOLDERS: NON-INDEPENDENT, INEFFECTIVE CHAIRMAN EGREGIOUS EXTERNAL ADVISORY AGREEMENT RESTRICTIVE POISON PILL CLASSIFIED BOARD STRUCTURE UNJUSTIFIABLE COMPENSATION INSUFFICIENT OWNERSHIP PERSPECTIVES MULTIPLE ATTEMPTS TO DIMINISH STOCKHOLDER RIGHTS

BOARDOOM ISSUE #1: CONCERNING DIRECTOR CONNECTIVITY Among NYC REIT’s current directors, there is a troubling amount of interconnectedness and overlap in board service at other AR Global-affiliated companies; we believe this threatens Board independence and effective oversight Abby Wenzel Michael Weil Lee Elman Elizabeth Tuppeny Ms. Tuppeny also serves on the board of HTI with Messrs. Elman and Weil. Mr. Elman also serves on the board of HTI with Ms. Tuppeny and on the board of GNL with Mr. Weil and Ms. Wenzel. In addition to serving as CEO of AR Global and as CEO and Chairman of NYC REIT, Mr. Weil also serves on the boards of HTI, GNL and Necessity. Ms. Wenzel also serves on the board of GNL with Messrs. Elman and Weil. Source: Public company filings.

BOARDROOM ISSUE #2: NON-INDEPENDENT, INEFFECTIVE CHAIRMAN Given Mr. Weil’s dual CEO-Chairman role and ties to NYC REIT’s advisor’s parent company, AR Global, it is no wonder why the Board has failed to hold management accountable for underperformance Mr. Weil is both Executive Chairman and Chief Executive Officer of NYC REIT, a practice that is antithetical to good corporate governance Mr. Weil is also CEO of AR Global and CEO of the Company’s external advisor and property manager, both of which are subsidiaries of AR Global Mr. Weil’s multiple controlling roles deny the Company independent leadership that is not beholden to AR Global We contend NYC REIT’s Board has consistently prioritized AR Global’s interests over the best interests of the Company’s stockholders, to whom it owes fiduciary obligations Michael Weil

BOARDROOM ISSUE #3: ONEROUS ADVISORY AGREEMENT The Board has wasted stockholder capital on costly advisory agreements and operating expenses related to its external advisors while investors have been forced to endure negative returns For 2019 through 2021, NYC REIT has paid approximately $33.4 million in management fees and reimbursements to its external advisor and property manager, both owned by AR Global In 2020, NYC REIT's Board awarded the Company's advisor long-term incentive plan ("LTIP") units valued at $25.8 million If the “high” performance target – which we believe is actually incredibly low – is achieved, the Company's advisor could receive an award valued at more than $52 million, representing more than 30% of NYC REIT's outstanding common stock This generous advisory deal also entitles the advisor to receive a termination fee of at least $39 million – equivalent to 23% of NYC REIT’s current total market capitalization – if the advisory agreement is terminated following a change of control of NYC REIT, which the advisor can do unilaterally In addition, regardless of when or how the advisory deal is terminated, the advisor will receive a one-time payment equal to the then-present fair market value of its shares of NYC REIT's common stock plus its interest in the Company's operating partnership This would include some or all of the excessive equity award, which had a grant date value of ~$25.8 million and could be worth much more Source: NYC REIT’s 2022 Proxy Statement. The egregious terms of this advisory agreement, which clearly benefit Mr. Weil, his boardroom allies and affiliates at AR Global, should only reinforce the need for a highly qualified and impartial voice in the boardroom.

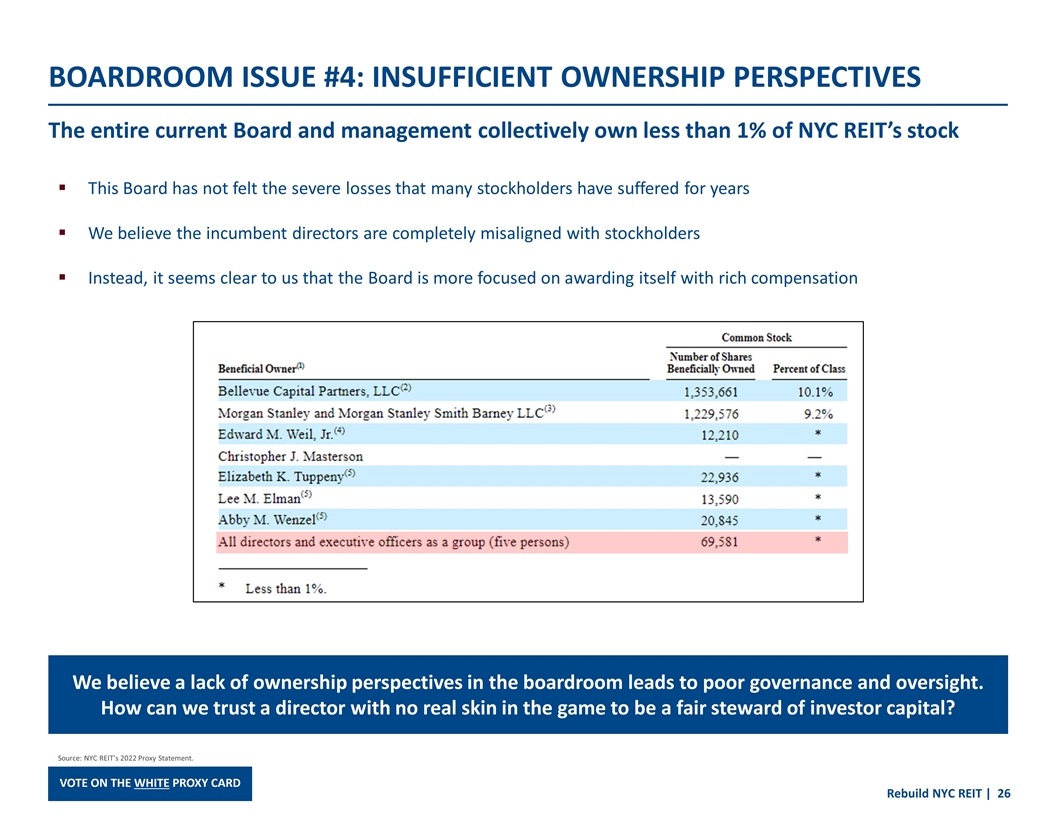

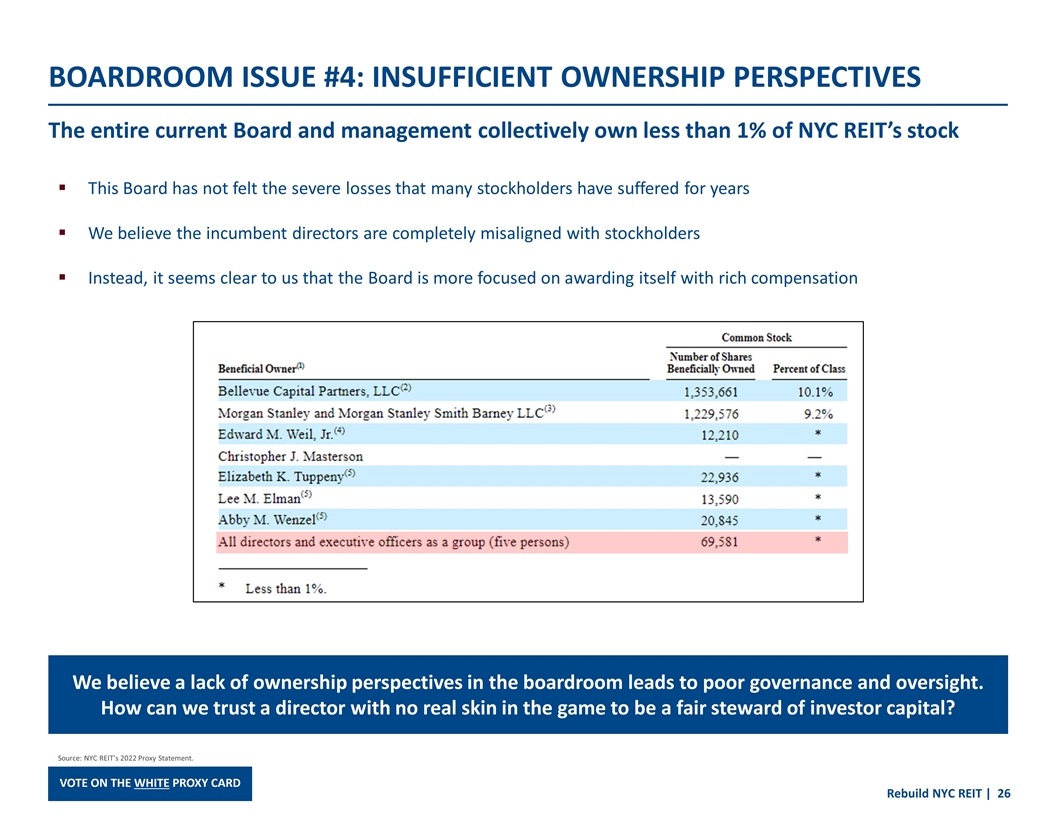

BOARDROOM ISSUE #4: INSUFFICIENT OWNERSHIP PERSPECTIVES The entire current Board and management collectively own less than 1% of NYC REIT’s stock This Board has not felt the severe losses that many stockholders have suffered for years We believe the incumbent directors are completely misaligned with stockholders Instead, it seems clear to us that the Board is more focused on awarding itself with rich compensation We believe a lack of ownership perspectives in the boardroom leads to poor governance and oversight. How can we trust a director with no real skin in the game to be a fair steward of investor capital? Source: NYC REIT’s 2022 Proxy Statement.

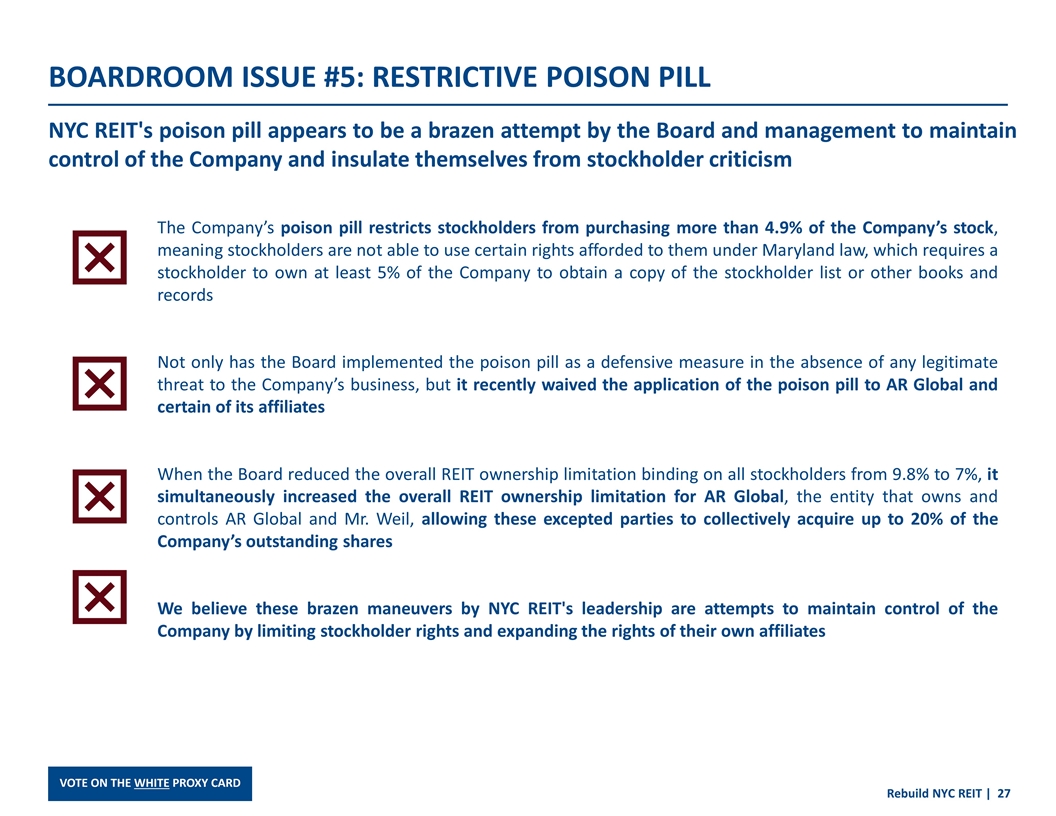

BOARDROOM ISSUE #5: RESTRICTIVE POISON PILL NYC REIT's poison pill appears to be a brazen attempt by the Board and management to maintain control of the Company and insulate themselves from stockholder criticism The Company’s poison pill restricts stockholders from purchasing more than 4.9% of the Company’s stock, meaning stockholders are not able to use certain rights afforded to them under Maryland law, which requires a stockholder to own at least 5% of the Company to obtain a copy of the stockholder list or other books and records Not only has the Board implemented the poison pill as a defensive measure in the absence of any legitimate threat to the Company’s business, but it recently waived the application of the poison pill to AR Global and certain of its affiliates When the Board reduced the overall REIT ownership limitation binding on all stockholders from 9.8% to 7%, it simultaneously increased the overall REIT ownership limitation for AR Global, the entity that owns and controls AR Global and Mr. Weil, allowing these excepted parties to collectively acquire up to 20% of the Company’s outstanding shares We believe these brazen maneuvers by NYC REIT's leadership are attempts to maintain control of the Company by limiting stockholder rights and expanding the rights of their own affiliates

BOARDROOM ISSUE #6: CLASSIFIED BOARD STRUCTURE We believe NYC REIT's troubling corporate governance demonstrates that the Board is more focused on protecting itself than unlocking value for investors The Company has a classified or “staggered” Board, meaning each director is only up for election every three years as opposed to every year This protects incumbent directors from annual scrutiny and makes it more difficult for stockholders to enact change The Board also has the exclusive power to de-classify itself, meaning stockholders cannot make that change NYC REIT's Board also failed to establish a nominating and corporate governance committee or compensation committee until the Company decided to publicly list in August 2020 (rather than liquidate and return capital to stockholders), leading us to question the Board's commitment to fulfilling its obligations to its true owners

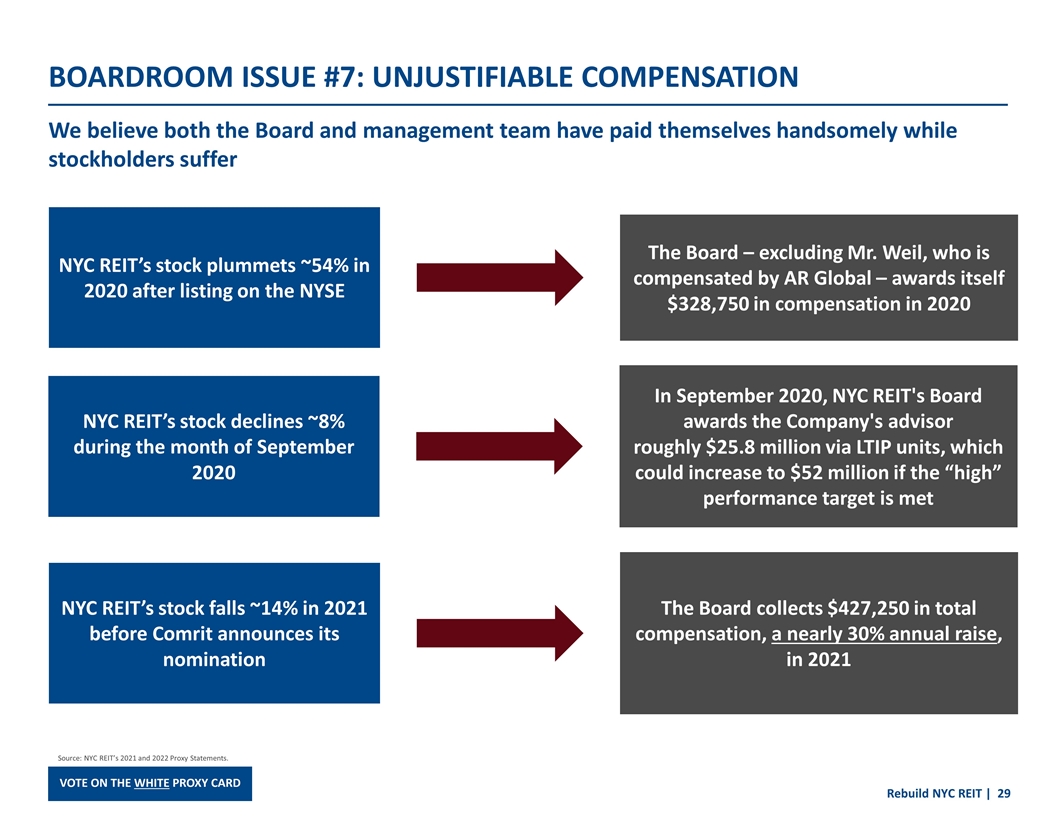

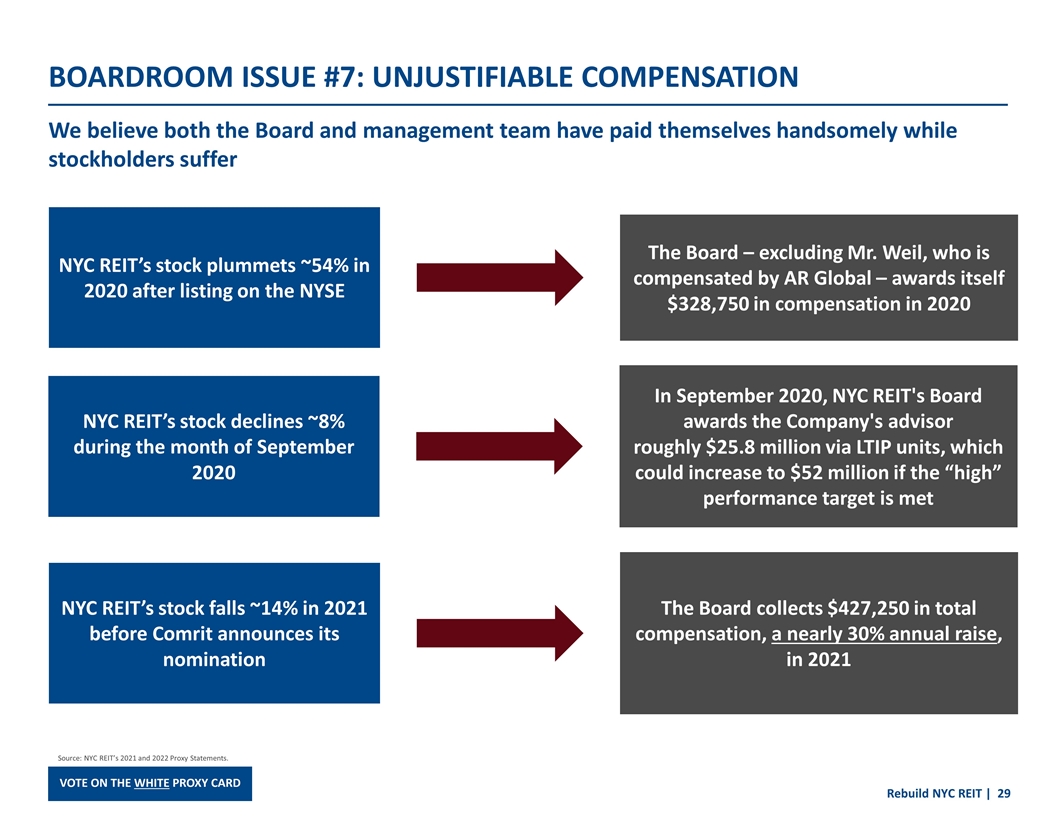

BOARDROOM ISSUE #7: UNJUSTIFIABLE COMPENSATION We believe both the Board and management team have paid themselves handsomely while stockholders suffer NYC REIT’s stock plummets ~54% in 2020 after listing on the NYSE The Board – excluding Mr. Weil, who is compensated by AR Global – awards itself $328,750 in compensation in 2020 NYC REIT’s stock declines ~8% during the month of September 2020 In September 2020, NYC REIT's Board awards the Company's advisor roughly $25.8 million via LTIP units, which could increase to $52 million if the “high” performance target is met NYC REIT’s stock falls ~14% in 2021 before Comrit announces its nomination The Board collects $427,250 in total compensation, a nearly 30% annual raise, in 2021 Source: NYC REIT’s 2021 and 2022 Proxy Statements.

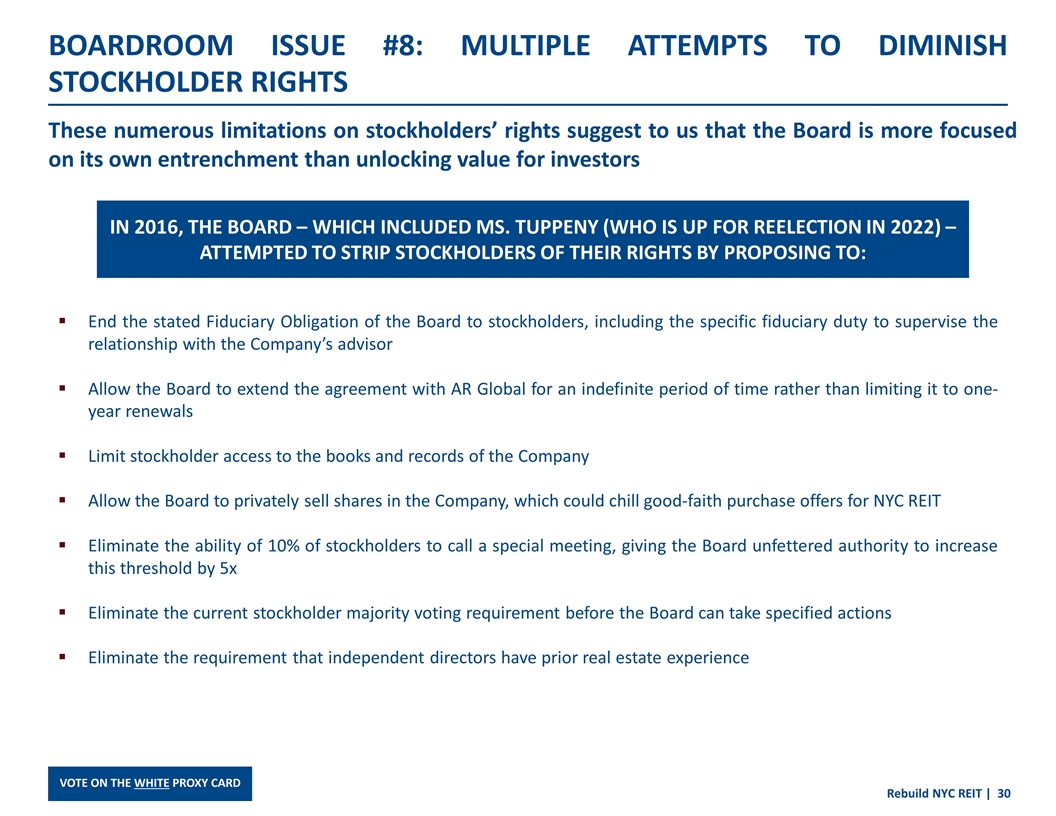

BOARDROOM ISSUE #8: MULTIPLE ATTEMPTS TO DIMINISH STOCKHOLDER RIGHTS These numerous limitations on stockholders’ rights suggest to us that the Board is more focused on its own entrenchment than unlocking value for investors End the stated Fiduciary Obligation of the Board to stockholders, including the specific fiduciary duty to supervise the relationship with the Company’s advisor Allow the Board to extend the agreement with AR Global for an indefinite period of time rather than limiting it to one-year renewals Limit stockholder access to the books and records of the Company Allow the Board to privately sell shares in the Company, which could chill good-faith purchase offers for NYC REIT Eliminate the ability of 10% of stockholders to call a special meeting, giving the Board unfettered authority to increase this threshold by 5x Eliminate the current stockholder majority voting requirement before the Board can take specified actions Eliminate the requirement that independent directors have prior real estate experience IN 2016, THE BOARD – WHICH INCLUDED MS. TUPPENY (WHO IS UP FOR REELECTION IN 2022) – ATTEMPTED TO STRIP STOCKHOLDERS OF THEIR RIGHTS BY PROPOSING TO:

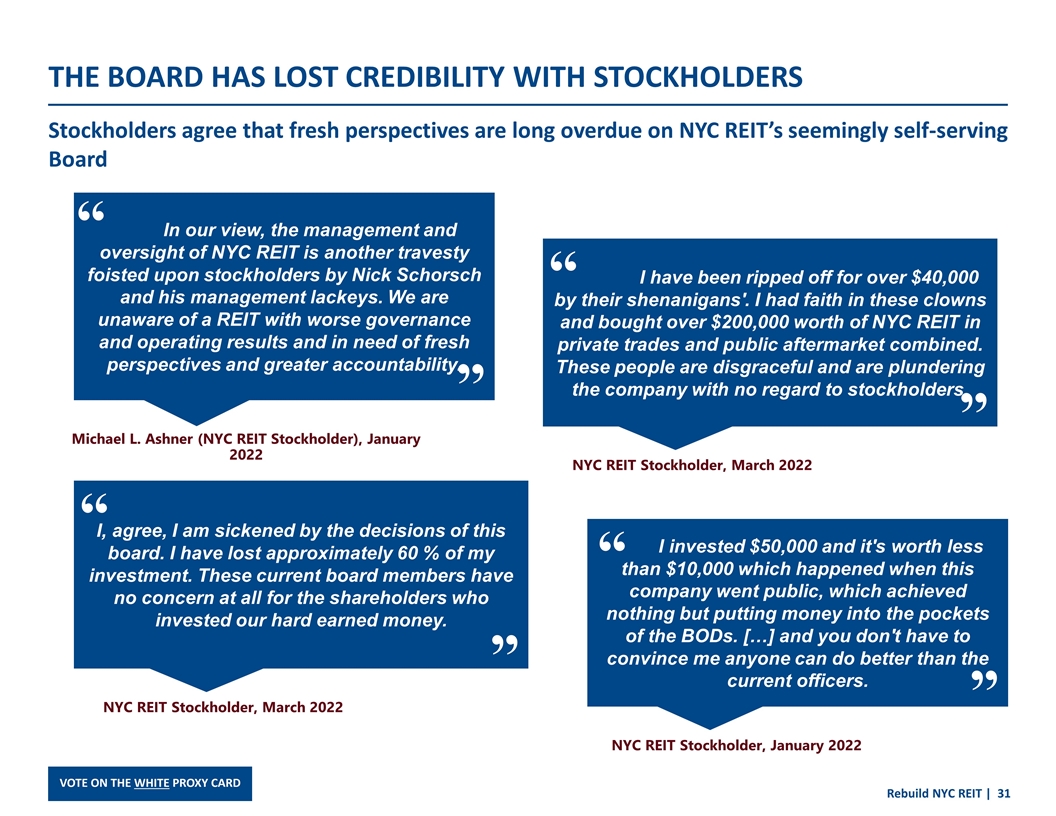

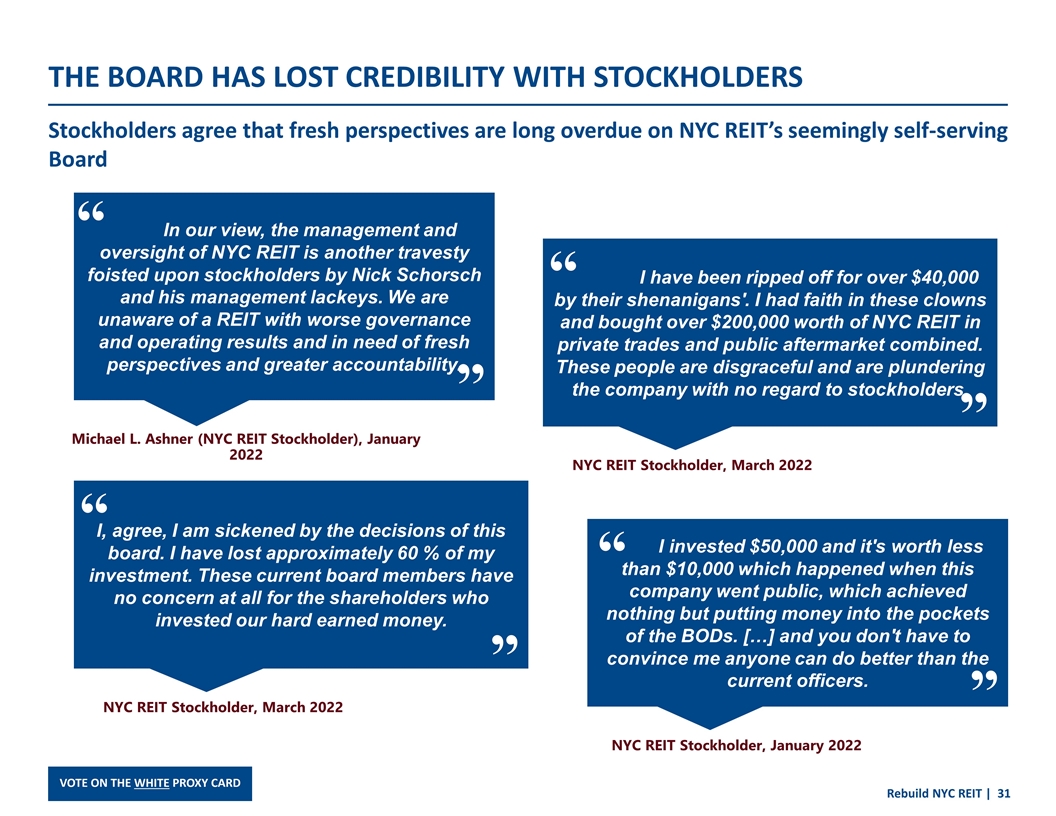

THE BOARD HAS LOST CREDIBILITY WITH STOCKHOLDERS Stockholders agree that fresh perspectives are long overdue on NYC REIT’s seemingly self-serving Board In our view, the management and oversight of NYC REIT is another travesty foisted upon stockholders by Nick Schorsch and his management lackeys. We are unaware of a REIT with worse governance and operating results and in need of fresh perspectives and greater accountability. “ “ Michael L. Ashner (NYC REIT Stockholder), January 2022 I, agree, I am sickened by the decisions of this board. I have lost approximately 60 % of my investment. These current board members have no concern at all for the shareholders who invested our hard earned money. “ “ NYC REIT Stockholder, March 2022 I invested $50,000 and it's worth less than $10,000 which happened when this company went public, which achieved nothing but putting money into the pockets of the BODs. […] and you don't have to convince me anyone can do better than the current officers. “ “ NYC REIT Stockholder, January 2022 I have been ripped off for over $40,000 by their shenanigans'. I had faith in these clowns and bought over $200,000 worth of NYC REIT in private trades and public aftermarket combined. These people are disgraceful and are plundering the company with no regard to stockholders. “ “ NYC REIT Stockholder, March 2022

OUR SOLUTION: COMRIT’S HIGHLY QUALIFIED, INDEPENDENT NOMINEE

MEET OUR NOMINEE – SHARON STERN Comrit’s highly qualified and independent director candidate is the right solution at the right time for NYC REIT Currently serves as President of Eastmore Management and Metro Investments, two organizations focused on the acquisition, development and management of multi-residential and commercial properties in the downtown core of Montreal Significant experience in residential & commercial real estate, including acquisition, development, financing, litigation and property management Serves on the Board of Directors of Cedar Realty Trust, Inc. (NYSE: CDR), a publicly traded REIT, which recently announced an agreement for a sale that would represent a nearly 71% premium for shareholders following a robust review of strategic alternatives1 Following her appointment, she purchased stock in the company to align herself with shareholders Previously worked in Strategy and Corporate Development for the Business Development Bank of Canada Holds a Bachelor’s degree from McGill University and a Master’s degree from Brown University Sharon Stern MS. STERN IS A REIT EXPERT AND REAL ESTATE ENTREPRENEUR WITH RELEVANT PUBLIC COMPANY BOARD EXPERIENCE AND A STRONG RECORD OF VALUE CREATION. 1 Cedar Realty Trust press release dated March 2, 2022.

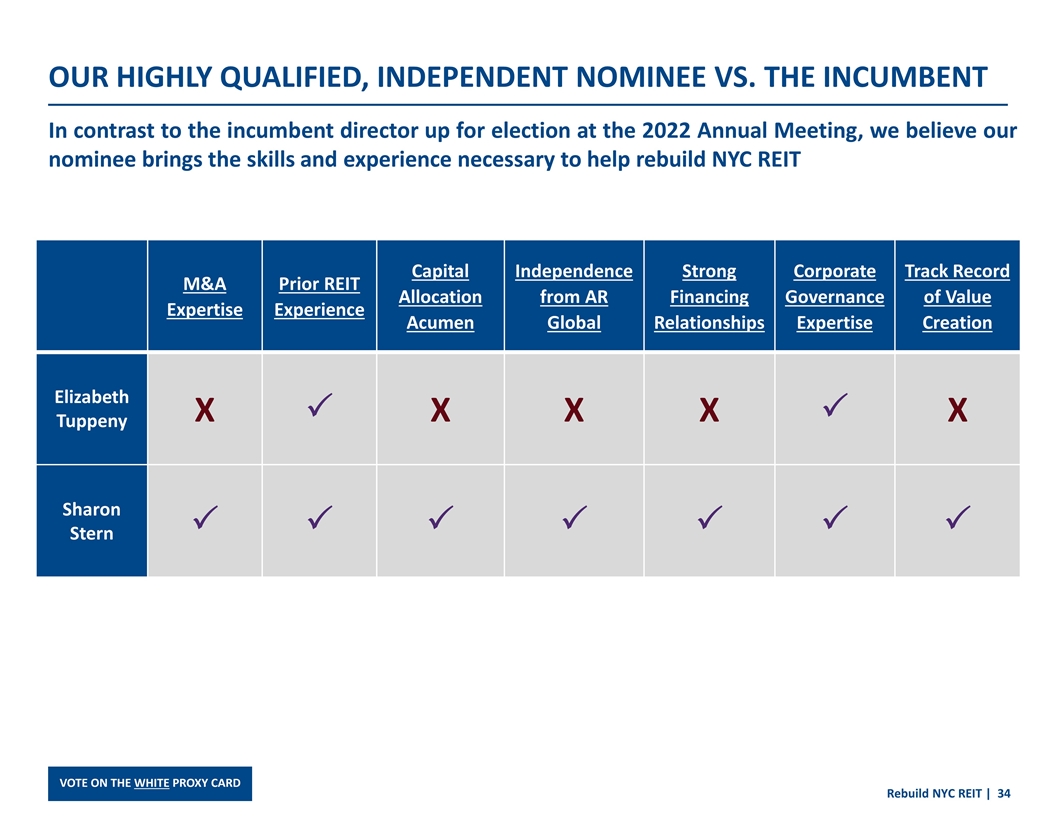

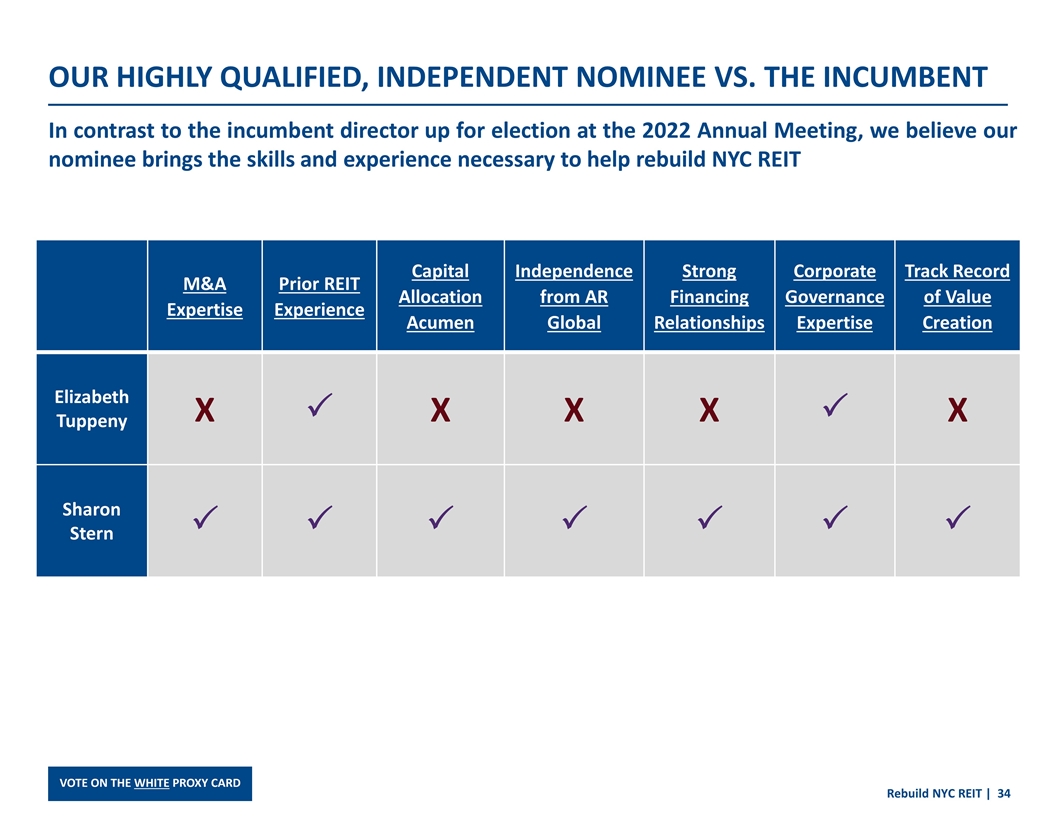

OUR HIGHLY QUALIFIED, INDEPENDENT NOMINEE VS. THE INCUMBENT In contrast to the incumbent director up for election at the 2022 Annual Meeting, we believe our nominee brings the skills and experience necessary to help rebuild NYC REIT M&A Expertise Prior REIT Experience Capital Allocation Acumen Independence from AR Global Strong Financing Relationships Corporate Governance Expertise Track Record of Value Creation Elizabeth Tuppeny X P X X X P X Sharon Stern P P P P P P P

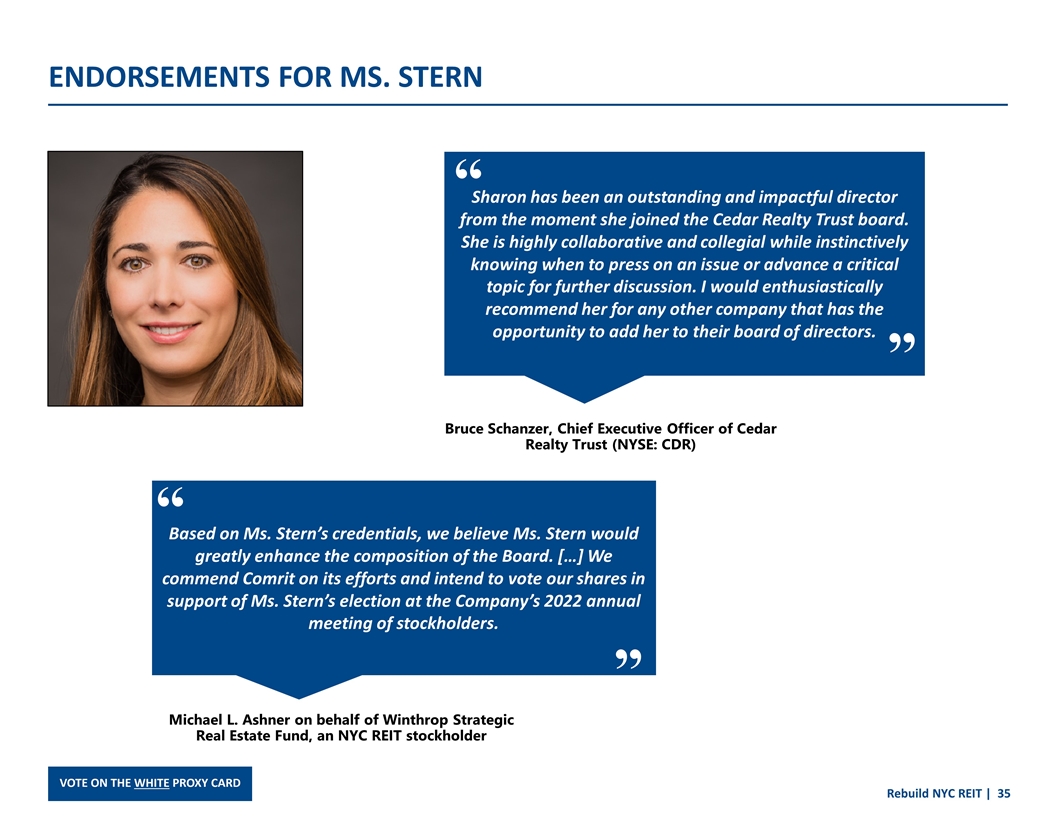

ENDORSEMENTS FOR MS. STERN Sharon has been an outstanding and impactful director from the moment she joined the Cedar Realty Trust board. She is highly collaborative and collegial while instinctively knowing when to press on an issue or advance a critical topic for further discussion. I would enthusiastically recommend her for any other company that has the opportunity to add her to their board of directors. “ “ Bruce Schanzer, Chief Executive Officer of Cedar Realty Trust (NYSE: CDR) Based on Ms. Stern’s credentials, we believe Ms. Stern would greatly enhance the composition of the Board. […] We commend Comrit on its efforts and intend to vote our shares in support of Ms. Stern’s election at the Company’s 2022 annual meeting of stockholders. “ “ Michael L. Ashner on behalf of Winthrop Strategic Real Estate Fund, an NYC REIT stockholder

COMMITMENT TO STOCKHOLDERS If elected to the boardroom, we believe shareholders can count on our director candidate – Ms. Stern – to improve NYC REIT’s abysmal corporate governance and focus on the right initiatives, including: Ensuring Transparent Investor Communication Reprioritizing Stockholder Rights Exploring All Paths to Value Creation Immediately Slowing the Operating Expense Burn Reducing Director Compensation Realigning Management’s Incentives to Value Creation

VOTE THE WHITE PROXY CARD FOR CHANGE Stockholders can help inject fresh perspectives into the boardroom and rebuild NYC REIT by voting on the WHITE proxy card to elect Ms. Stern at the 2022 Annual Meeting VOTE ON THE WHITE PROXY CARD WWW.REBUILDNYCREIT.COM

***

About Comrit Investments

Comrit Investments 1, LP is an investment partnership that invests in income generating real estate through public non-traded real estate investment trusts. Founded in 2015 and based in Tel Aviv, Washington D.C. and New York City, Comrit is sponsored by I.B.I. Investment House Ltd. (TLV: IBI), an Israel-based market leader in alternative fund offerings. Comrit’s management team collectively has 30 years of experience investing across the U.S. real estate market.

CERTAIN INFORMATION CONCERNING THE PARTICIPANTS

Comrit, together with the other participants named below, has filed a definitive proxy statement and accompanying WHITE proxy card with the Securities and Exchange Commission (“SEC”) to be used to solicit votes for the election of a highly qualified director nominee at the 2022 annual meeting of stockholders of New York City REIT, Inc. (the “Company”).

COMRIT STRONGLY ADVISES ALL STOCKHOLDERS OF THE COMPANY TO READ THE PROXY STATEMENT, AND OTHER PROXY MATERIALS AS THEY BECOME AVAILABLE, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. SUCH PROXY MATERIALS ARE AND WILL BE AVAILABLE AT NO CHARGE ON THE SEC’S WEB SITE AT HTTP://WWW.SEC.GOV. IN ADDITION, THE PARTICIPANTS IN THIS PROXY SOLICITATION WILL PROVIDE COPIES OF THE PROXY STATEMENT WITHOUT CHARGE, WHEN AVAILABLE, UPON REQUEST. REQUESTS FOR COPIES SHOULD BE DIRECTED TO THE PARTICIPANTS’ PROXY SOLICITOR.

The participants in the proxy solicitation are Comrit, Comrit Investments Ltd., I.B.I. Investment House Ltd., Ziv Sapir and Sharon Stern.

As of the date hereof, Comrit beneficially owns 267,520 shares of Class A Common Stock, par value $0.01 per share, of the Company (the “Class A Common Stock”). Comrit Investments Ltd., as the general partner of Comrit, may be deemed the beneficial owner of the 267,520 shares of Class A Common Stock owned by Comrit. I.B.I. Investment House Ltd, as the majority owner of Comrit Investments Ltd., may be deemed the beneficial owner of the 267,520 shares of Class A Common Stock owned by Comrit. Ziv Sapir, as the Managing Partner and CEO of Comrit, and as the CEO and minority owner of Comrit Investments Ltd., may be deemed the beneficial owner of the 267,520 shares of Class A Common Stock owned by Comrit. As of the date hereof, Ms. Stern does not own any securities of the Company.

Contacts

For Investors:

Saratoga Proxy Consulting LLC

John Ferguson / Joe Mills, 212-257-1311

jferguson@saratogaproxy.com / jmills@saratogaproxy.com

For Media:

Longacre Square Partners

Charlotte Kiaie / Bela Kirpalani, 646-386-0091

ckiaie@longacresquare.com / bkirpalani@longacresquare.com