Exhibit (c)(2)

| Wüest Dimensions - Business intelligence by Wüest Partner |  |

Valuation report

Commercial property

Riedmattstrasse 9

8153 Rümlang

Switzerland

| Market value | | CHF 25,070,000 |

| | | |

| Valuation date | | 01.04.2020 |

| Valuation purpose | | Update |

| Customer | | Optibase RE1, 45, boulevard Napoléon, 1120 Luxembourg, Luxembourg Yakir Ben Naim, +972-54-456-3894 |

| Project reference number (PRN) | | 118318 |

| Valuation Id | | 101-17096-100 |

| Project manager | | Moritz Menges, Wüest Partner, +41 44 289 91 76 |

| | | Bleicherweg 5, 8001 Zürich, Switzerland |

| Site visit date | | 17.12.2012 |

| Site visited by | | Wüest Partner / R. Paul |

Desktop Valuation as at 1 April 2020

DRAFT

Assumptions:

● The current valuation is based on the valuation report performed as at 1-1-2013.

● The rent roll provided by the client assumed to be valid as at the date of valuation.

● All lease contracts included in the valuation report are expected to be signed as at the date of valuation, although not all of them are signed until the preparation of the report (e.g. Gondrand prolongation currently not signed).

| 118318 | 101-17096-100 | Rümlang, Riedmattstrasse 9 | Created by Wüest Partner, 26.03.2020, DRAFT - Desktop Valuation as at 1 April 2020 | Page 1 of 31 |

| Wüest Dimensions - Business intelligence by Wüest Partner |  |

Summary

| Property condition |

| | | |

Commercial property Riedmattstrasse 9

8153 Rümlang

Switzerland WGS84: 47.460779 / 8.523837 | |  |

| Property unit | | |

| Reference number | | |

| Owner | | Optibase RE1 |

| Type of ownership | | Sole ownership |

| Construction year | | 1989 |

| Last renovated | | 2011 |

| Customer | | Optibase RE1 |

| Contact person | | Yakir Ben Naim |

| | | yakirb@optibase-holdings.com |

| Project manager | | Moritz Menges |

| | | moritz.menges@wuestpartner.com |

| Valuer | | Roger Blumenthal |

| | | roger.blumenthal@wuestpartner.com |

| Results | | | | |

| | | | | |

| Market values | | CHF | | CHF/m2 LA |

| Market value | | 25,070,000 | | 2,025 |

| Building insurance value | | 35,350,000 | | 2,855 |

| Repair cost years 1 to 10 | | 7,346,050 | | 593 |

| | | | | |

| Inflation | | | | 0.50% |

| Discount rate real/nominal | | 3.80% | | 4.32% |

| Net capitalisation rate (exit) | | | | 3.80% |

| Net/gross yield annuity | | 3.70% | | 7.45% |

| Gross yield (projected/effective) | | 7.22% | | 6.53% |

| IRR 5/IRR 10 | | 3.80% | | 3.80% |

| Net initial yield (P1) before/after capex | | 3.75% | | -2.38% |

| Annuity net yield (P1-10) before/after capex | | 5.57% | | 2.43% |

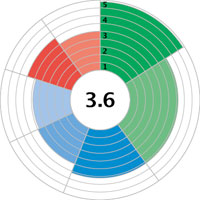

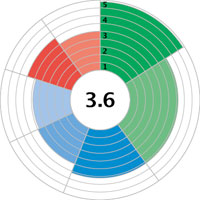

| Market matrix | Quality profile |

| Rents | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Use type | | Current rent | | Market rent | | |

| Type | | No. | | sqm | | Share | | Proj. p.a. [CHF] | | Vacant | | Eff. p.a. [CHF] | | Proj./sqm | | Quantile | | Proj. p.a. [CHF] | | Proj./sqm | | Quantile | | Vacant | | Dev. |

| Craft/Industry | | 11 | | 6,534 | | 45% | | 822,580 | | 0.0% | | 822,580 | | 126 | | 31% | | 914,760 | | 140 | | 39% | | 5.0% | | 11.2% |

| Office | | 11 | | 3,498 | | 29% | | 524,896 | | 26.0% | | 388,396 | | 150 | | 40% | | 521,400 | | 149 | | 39% | | 7.0% | | -0.7% |

| Indoor parking | | 138 | | | | 12% | | 213,577 | | 12.4% | | 187,057 | | | | | | 215,280 | | | | | | 8.0% | | 0.8% |

| Retail | | 3 | | 1,059 | | 7% | | 120,492 | | 8.2% | | 110,592 | | 114 | | 15% | | 116,490 | | 110 | | 13% | | 5.0% | | -3.3% |

| Warehousing | | 10 | | 1,271 | | 6% | | 113,652 | | 0.0% | | 113,652 | | 89 | | | | 101,680 | | 80 | | | | 5.0% | | -10.5% |

| Others | | 13 | | 18 | | 1% | | 14,852 | | 0.0% | | 14,852 | | 144 | | | | 12,260 | | 0 | | | | 5.0% | | -17.5% |

| Total | | 186 | | 12,380 | | 100% | | 1,810,048 | | 9.6% | | 1,637,128 | | 128 | | | | 1,881,870 | | 134 | | | | 5.9% | | 4.0% |

Yields

| | | Present value | | Annuity (P1-Exit) | | | Annuity (Exit) | | | | % project.

(P1-Exit) | | | | % project.

(Exit) | | | | % RPC

(P1-Exit) | | | | % RPC

(Exit) | | | | Yield |

| | | [CHF] | | [CHF] | | [CHF/m2] | | Q. | | [CHF/m2] | | Q. | | [%] | | Q. | | [%] | | Q. | | [%] | | Q. | | [%] | | Q. | | [%] |

| Gross target income | | 50,309,544 | | 1,868,323 | | 151 | | | | 152 | | | | 100.0% | | | | 100.0% | | | | 5.2% | | | | 5.2% | | | | 7.45% |

| Est. rental inc. | | 50,309,544 | | 1,868,323 | | 151 | | | | 152 | | | | 100.0% | | | | 100.0% | | | | 5.2% | | | | 5.2% | | | | 7.45% |

| Income reductions | | 3,687,491 | | 137,030 | | 11 | | | | 9 | | | | 7.3% | | | | 5.9% | | | | 0.4% | | | | 0.3% | | | | 0.55% |

| Actual gross inco… | | 46,622,054 | | 1,731,293 | | 140 | | | | 143 | | | | 92.7% | | | | 94.1% | | | | 4.8% | | | | 4.9% | | | | 6.91% |

| Operating costs | | 2,982,924 | | 111,078 | | 9 | | 10% | | 8 | | 5% | | 5.9% | | 44% | | 5.0% | | 30% | | 0.3% | | 26% | | 0.3% | | 19% | | 0.44% |

| Maintenance costs | | 3,055,326 | | 113,774 | | 9 | | 45% | | 10 | | 48% | | 6.1% | | 72% | | 6.4% | | 73% | | 0.3% | | 65% | | 0.3% | | 68% | | 0.45% |

| Refurbishment costs | | 15,511,923 | | 577,631 | | 47 | | 78% | | 39 | | 70% | | 30.9% | | 95% | | 25.6% | | 89% | | 1.6% | | | | 1.3% | | | | 2.30% |

| Total costs | | 21,550,173 | | 802,483 | | 65 | | | | 56 | | | | 43.0% | | | | 37.1% | | | | 2.2% | | | | 1.9% | | | | 3.20% |

| Total net income | | 25,071,881 | | 928,810 | | 75 | | | | 87 | | | | 49.7% | | | | 57.0% | | | | 2.6% | | | | 3.0% | | | | 3.70% |

| 118318 | 101-17096-100 | Rümlang, Riedmattstrasse 9 | Created by Wüest Partner, 26.03.2020, DRAFT - Desktop Valuation as at 1 April 2020 | Page 2 of 31 |

| Wüest Dimensions - Business intelligence by Wüest Partner |  |

Summary 2

Results

| | | | | Periods | real cashflows | | | | | | | | | | | | | | | | | | | | |

| | | | | 1 | | 2 | | 3 | | 4 | | 5 | | 6 | | 7 | | 8 | | 9 | | 10 | | Exit |

| Incomes | | Ann. | | 01.04.2020 | | 01.04.2021 | | 01.04.2022 | | 01.04.2023 | | 01.04.2024 | | 01.04.2025 | | 01.04.2026 | | 01.04.2027 | | 01.04.2028 | | 01.04.2029 | | 01.04.2030 |

| | | % | | - 31.03.2021 | | - 31.03.2022 | | - 31.03.2023 | | - 31.03.2024 | | - 31.03.2025 | | - 31.03.2026 | | - 31.03.2027 | | - 31.03.2028 | | - 31.03.2029 | | -31.03.2030 | | |

| | | project. | | | | | | | | | | | | | | | | | | | | | | |

| Gross target income | | 100.0% | | 1,812,047 | | 1,815,995 | | 1,822,711 | | 1,828,531 | | 1,834,849 | | 1,841,739 | | 1,849,105 | | 1,857,098 | | 1,865,727 | | 1,875,001 | | 1,881,966 |

| Est. rental inc. | | 100.0% | | 1,812,047 | | 1,815,995 | | 1,822,711 | | 1,828,531 | | 1,834,849 | | 1,841,739 | | 1,849,105 | | 1,857,098 | | 1,865,727 | | 1,875,001 | | 1,881,966 |

| Income reductions | | 7.3% | | 532,271 | | 327,124 | | 156,862 | | 132,627 | | 130,315 | | 118,340 | | 109,357 | | 109,776 | | 110,294 | | 110,771 | | 110,992 |

| Actual gross income | | 92.7% | | 1,279,776 | | 1,488,870 | | 1,665,849 | | 1,695,905 | | 1,704,534 | | 1,723,398 | | 1,739,748 | | 1,747,321 | | 1,755,433 | | 1,764,230 | | 1,770,974 |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Costs | | | | | | | | | | | | | | | | | | | | | | | | |

| Operating costs | | 5.9% | | 239,262 | | 193,466 | | 144,218 | | 131,813 | | 122,408 | | 121,733 | | 120,000 | | 120,000 | | 120,000 | | 120,000 | | 95,000 |

| Maintenance costs | | 6.1% | | 100,000 | | 100,000 | | 100,000 | | 100,000 | | 100,000 | | 100,000 | | 100,000 | | 100,000 | | 100,000 | | 100,000 | | 120,000 |

| Refurbishment costs | | 30.9% | | 1,536,900 | | 1,338,650 | | 293,250 | | 131,250 | | 4,026,750 | | 19,250 | | 0 | | 0 | | 0 | | 0 | | 482,544 |

| Total costs | | 43.0% | | 1,876,162 | | 1,632,116 | | 537,468 | | 363,063 | | 4,249,158 | | 240,983 | | 220,000 | | 220,000 | | 220,000 | | 220,000 | | 697,544 |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Total net income | | 49.7% | | -596,386 | | -143,245 | | 1,128,381 | | 1,332,842 | | -2,544,623 | | 1,482,416 | | 1,519,748 | | 1,527,321 | | 1,535,433 | | 1,544,230 | | 1,073,431 |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Market value as at start of period | | 25,071,881 | | 26,628,525 | | 27,781,762 | | 27,681,192 | | 27,368,157 | | 31,000,042 | | 30,660,467 | | 30,269,870 | | 29,856,677 | | 29,419,480 | | 28,956,665 |

| Gross yield p.a. | | 7.23% | | 6.82% | | 6.56% | | 6.61% | | 6.70% | | 5.94% | | 6.03% | | 6.14% | | 6.25% | | 6.37% | | 6.50% |

| Net yield after repair p.a. | | -2.38% | | -0.54% | | 4.06% | | 4.82% | | -9.30% | | 4.78% | | 4.96% | | 5.05% | | 5.14% | | 5.25% | | 3.71% |

| Capital growth return p.a. | | 6.21% | | 4.33% | | -0.36% | | -1.13% | | 13.27% | | -1.10% | | -1.27% | | -1.37% | | -1.46% | | -1.57% | | |

| Total return p.a. | | 3.83% | | 3.79% | | 3.70% | | 3.68% | | 3.97% | | 3.69% | | 3.68% | | 3.68% | | 3.68% | | 3.68% | | |

| Sensitivity analysis | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | Presentation in relative terms |

| | | | | | | | | | | | | |

| | | Δ | | +30 | | +10 | | +/- | | -10 | | -30 |

| | | | | 4.10% | | 3.90% | | 3.80% | | 3.70% | | 3.50% |

| Target rental income | | -10% | | -25% | | -22% | | -20% | | -17% | | -13% |

| | | +0% | | -7% | | -3% | | 0% | | 3% | | 9% |

| | | +10% | | 11% | | 17% | | 20% | | 23% | | 30% |

| Vacancy | | +100% | | -18% | | -14% | | -11% | | -9% | | -4% |

| | | +0% | | -7% | | -3% | | 0% | | 3% | | 9% |

| | | -100% | | 3% | | 9% | | 11% | | 15% | | 21% |

| Repair costs | | -10% | | -2% | | 3% | | 6% | | 9% | | 15% |

| | | +0% | | -7% | | -3% | | 0% | | 3% | | 9% |

| | | +10% | | -13% | | -8% | | -6% | | -4% | | 2% |

| Contract terms | | | | | | | | | | |

| Usage | | Expected | | WAULT | | WAULT | | WAULT | | Index |

| | | end ø [a] | | ø | | min | | max | | ø |

| Outdoor parking | | 4.1 | | | | | | | | 61% |

| Office | | 2.0 | | 1.7 | | 0.1 | | 3.7 | | 75% |

| Indoor parking | | 1.8 | | | | | | | | 52% |

| Retail | | 1.6 | | 1.6 | | 1.2 | | 2.7 | | 80% |

| Craft/Industry | | 0.7 | | 0.8 | | 0.2 | | 1.2 | | 60% |

| Special use without ar… | | 0.7 | | | | | | | | 80% |

| Warehousing | | 0.4 | | 0.5 | | 0.1 | | 3.0 | | 44% |

| Special use with area | | 0.1 | | | | | | | | 80% |

| Total | | 1.2 | | 1.1 | | 0.1 | | 3.7 | | 63% |

| 118318 | 101-17096-100 | Rümlang, Riedmattstrasse 9 | Created by Wüest Partner, 26.03.2020, DRAFT - Desktop Valuation as at 1 April 2020 | Page 3 of 31 |

| Wüest Dimensions - Business intelligence by Wüest Partner |  |

| Contents | |

| Title | 1 |

| Summary | 2 |

| Summary 2 | 3 |

| Contents | 4 |

| Description | 5 |

| Property data (plots, buildings) | 8 |

| Use-type overview | 10 |

| Area list | 12 |

| Tenant list outlook | 15 |

| Summary by tenant and use type | 17 |

| Projected accounts summary | 19 |

| Sensitivity analysis | 21 |

| Quality profile compact | 22 |

| Photo documentation | 23 |

| Maps (macro and micro location) | 25 |

| Context | 26 |

| Documentation index | 28 |

| Glossary | 29 |

| 118318 | 101-17096-100 | Rümlang, Riedmattstrasse 9 | Created by Wüest Partner, 26.03.2020, DRAFT - Desktop Valuation as at 1 April 2020 | Page 4 of 31 |

| Wüest Dimensions - Business intelligence by Wüest Partner |  |

Description

Commission

Wüest Partner was commissioned by Optibase RE1 to value the property in question as per the stipulated day of valuation for accounting reasons. The current valuation is set up as a desktop valuation without performing a site visit or detailed surveys in relation of the condition and standard of the building. Furthermore the effective letting situation has not been verified by a site visit and is therefore based on the rent roll provided by the client as well as the provided lease contracts.

Wüest Partner already prepared a valuation report dated to 1 January 2013, on which the present valuation is based. In the current valuation the following sections have been adopted from the previous valuation report: micro location, building/surrounding area, building fabric/condition, pictures.

The following main assumptions have to be considered:

● The current valuation is based on the valuation report performed as at 1-1-2013.

● The rent roll provided by the client assumed to be valid as at the date of valuation.

● All lease contracts included in the valuation report are expected to be signed as at the date of valuation, although not all of them are signed until the preparation of the report (e.g. Gondrand prolongation currently not signed).

In connection with the corona virus/COVID-19 and the fight against the pandemic, drastic measures have been put into effect in many countries, the consequences of which for the overall economy and the real estate market are not yet foreseeable. Above all, the consequences are difficult to quantify at the moment because no or not enough up-to-date comparative financial statements and transactions with these boundary conditions are available. Accordingly, the valuation uncertainty is currently increased.

Macro location

General locational factors

With a population of 8,172 (up by 8.2% between 2014 and 2018), the municipality of Rümlang (ZH) is located in the Zürich urban agglomeration. People with a higher income (executives and senior management) accounted for 12% of Rümlang’s population in 2017, compared to the Swiss average of 12%.

29,000 people live within a 10-minute and 243,000 within a 20-minute drive of Rümlang (the corresponding figures for the city of Zurich being around 415,000 and 695,000).

Within half an hour’s drive of Rümlang, 1,206,000 residents and 903,000 employees (full time equivalent) can be reached in Switzerland (equivalent figures for the city of Zurich: approx. 1,636,000 residents and 1,168,000 employees).

The number of people working in the industrial or service sector (full time equivalent) was 4,877 in 2017, 65.1% being employed in the service sector (Switzerland: 75.0%). Since 2015, the employment figure for Rümlang has decreased by 4.1%, with jobs shed in both the industrial and service sector. Between 2018 and

2019, the region of Glattal-Furttal, which Rümlang is part of, has shown a net inward corporate migration, i.e. fewer companies moved out of the area than arrived from other regions.

Office premises

The average asking rent (net) for office space in Rümlang is CHF 166 per sqm p.a. This value is below the Swiss average of CHF 206 per sqm p.a.

Overall, the urban agglomeration Zürich provides some 15,347,000 sqm of office space (including 84,000 sqm in Rümlang). The volume of new-build office development (in relation to the existing stock) over the last few years in the urban agglomeration Zürich has been par for Switzerland.

Retail premises

The average asking rent (net) for retail space in Rümlang is CHF 186 per sqm p.a. This value is below the Swiss average of CHF 263 per sqm p.a.

Overall, the urban agglomeration Zürich provides some 5,291,000 sqm of retail space (including 29,000 sqm in Rümlang). This is equivalent to some 3.8 sqm retail space per resident of urban agglomeration, a figure more or less in line with the Swiss average (4.1 sqm per resident). The volume of new-build retail development (in relation to the existing stock) over the last few years in the urban agglomeration Zürich has been above par for Switzerland.

Conclusion

According to Wüest Partner AG’s location and market rating, Rümlang ranks as a municipality with an excellent location quality for office premises (4.8 points) and an excellent location quality for retail premises (4.8 points on a scale from 1 [municipality with an extremely poor location quality] to 5 [municipality with an excellent location quality]).

Micro location

The property is located in the industrial area Riedmatt, which connects the north and out of the village Rümlang. The industrial quarter profits directly from the neighboring communities - the city of Zurich and Kloten intercontinental airport. Numerous industrial, commercial and service companies are located in the neighborhood. The property itself is located at the full front of the busy Riedmattstrasse and thus has good exposure to passing traffic. Within the local vicinity the general appearance of the local environment can be described as good. Local occupiers include Coop, Denner, Burger King and Top CC. The area will benefit from a new facility which is currently under construction. The situation of the property will be less influenced by passing pedestrians but rather than traffic. 100m from the property there is a bus stop providing services to the train station in a few minutes. The nearest highway exit is about five kilometers away providing good access to the A1 and A51 and the airport being just ten minutes. In summary, the micro-location with respect to the relevant uses are referred to as being between average and good.

| 118318 | 101-17096-100 | Rümlang, Riedmattstrasse 9 | Created by Wüest Partner, 26.03.2020, DRAFT – Desktop Valuation as at 1 April 2020 | Page 5 of 31 |

| Wüest Dimensions - Business intelligence by Wüest Partner |  |

Building/Surrounding area

The present review concerns: Plot No. 1688 with a plot area of 5,090 m2 and commercial building with underground car parking.

In the land register various easements are recorded. Noteworthy is the following:

● At best, the visitor parking maybe eliminated at its own cost and without compensation for an expansion of Riedmattstrasse. (Assumption: not relevant to assessment)

● The plot is no. is 4778. Compensation by way of assignment from the neighboring plot 4779 (assumption: not relevant to assessment)

● Continuity and shared the heating system: The 4779 heating system located on the property may be shared. All costs are allocated according to energy consumption.

The building is parallel to Riedmattstrasse which lies to the north. Both the main entrance and the access roads to the garage and the loading and unloading area are accessed from Riedmattstrasse. The property consists of five floors and two underground floors, the top two floors are in a H-shaped layout providing good natural light to all areas. The lower floors are made of reinforced concrete and masonry with the upper floors of reinforced concrete frame. The floors are connected by a central service core. This includes the two passenger lifts and sanitary facilities. Additionally, there are two service cores at the east and west at the front of the building each providing staircase access. Four goods lifts with up to 5000 kg open up next to the passenger elevators.

The building includes office, industrial, warehouse and showroom. The two upper floors are mainly for office use while the lower floors have a greater ceiling height and are mainly used for commercial purposes. The ground floor retail units are of a good size and make ideal show room accommodation. Covered ramps to the car parking are located at the front of the building with two ramps on either side to the rear for delivery (one to enter and one to exit). The basement provides sufficient car parking available over 3 split levels.

Building fabric/Condition

The property was constructed in 1989 and the façade consists of concrete with sections of the first floor façade having sheet metal panels coverings, one of which is missing from the south elevation at the exit of the loading bay. Both the entrance and exits to the covered loading bay has some minor damage to the ceiling caused by high vehicles. Some areas of the concrete façade are in need of repair and should be carried out within approximately the next five years. The windows frames are made of a wood-metal mix and the double glazing was replaced in 2002. The roof is flat and mainly gravel covered with one extensively planted terraced are above the second floor level. The roof is currently undergoing repair works. Overall, the property is in a good condition and is being regularly maintained. A new heating boiler was installed in 2010, the heat being distributed via radiators. A ventilation/air conditioning system was installed for the top floor office space in 2009. This is because of noise pollution from the air traffic. The ground floor showroom areas have their own individual tenant fit-out and the motor cycle showroom has a work shop area with all major installations usually available for auto repair work. Currently, the ventilation system is used only in the garage area.

Usage

The property contains the following use types:

- Office: 3,498 sqm

- Retail: 1,059 sqm

- Craft / Industry: 6,534 sqm

- Warehousing: 1,271 sqm

- Special use with area: 18 sqm

- Special use without area: 1 units

- Indoor parking: 138 units

- Outdoor parking: 11 units

Rental income

The actual target rental income as per valuation date amounts to CHF 1,810,048 p.a. The actual vacancy of the property is 9.6%. The property is leased as follows:

- Office: CHF 140 – 165/sqma

- Retail: CHF 112 – 119/sqma

- Craft / Industry: CHF 90 – 133/sqma

- Warehousing: CHF 27 – 144/sqma

- Indoor parking: CHF 13 - 240/mth

- Outdoor parking: CHF 60 - 80/mth

Wüest Partner estimates market rents at a total of CHF 1,881,870 p.a. and thus around 4.0% above the current target income of CHF 1,810,048 p.a. The following rent potential is assumed:

- Office: CHF 130 – 150/sqma

- Retail: CHF 110/sqma

- Craft / Industry: CHF 140/sqma

- Warehousing: CHF 80/sqma

- Indoor parking: CHF 130/mth

- Outdoor parking: CHF 60 - 80/mth

The structural vacancy rate is estimated at around 5.9%.

Running and maintenance costs

- Long term OPEX (excl. property taxes): CHF 111,000

- Long term maintenance from period 11: CHF 10/sqma

| 118318 | 101-17096-100 | Rümlang, Riedmattstrasse 9 | Created by Wüest Partner, 26.03.2020, DRAFT – Desktop Valuation as at 1 April 2020 | Page 6 of 31 |

| Wüest Dimensions - Business intelligence by Wüest Partner |  |

- Long term CAPEX from period 11: CHF 39/sqma

Refurbishment

Wüest Partner calculates – based on the information received by the client – the following CAPEX within the next 10 years:

● 2020: CHF 50,000 - Modernization remaining fire safety system

● 2020: CHF 50,000 - Water evacuation Parking (rough assumption by Wüest Partner)

● 2020: CHF 225,000 - Subdivision/Refurbishment of space

● 2021: CHF 575,000 - Renovation part of the roof

● 2025: CHF 4,000,000 - Windows/blinds and facade (estimate Wüest Partner)

Strengths/Weaknesses

● The property is typical for the general location

● Micro locational quality for industrial usage is good

● The property shows stable letting situation with some relevant contracts expiring in the first periods.

● Larger investments to be considered in the first decade.

| 118318 | 101-17096-100 | Rümlang, Riedmattstrasse 9 | Created by Wüest Partner, 26.03.2020, DRAFT – Desktop Valuation as at 1 April 2020 | Page 7 of 31 |

Wüest Dimensions - Business intelligence by Wüest Partner |  |

Property data (plots, buildings)

| Property unit | | |

| | | |

| Property ID | | |

| PU Id | | 259251 |

| PU reference number (PURN) | | |

| PU name | | |

| Owner | | Optibase RE1 |

| Ownership | | Sole ownership |

| Type | | Commercial property |

| Address | | Riedmattstrasse 9

8153 Rümlang |

| | | |

| Country | | Switzerland |

| Coord. [Lat./Long. WGS 84] | | 47.460779 / 8.523837 |

| Land plots | | | | |

| | | Buildings | | sqm |

| Riedmattstrasse 9, Rümlang | | 1 | | 5,090 |

| Total | | 1 | | 5,090 |

| Buildings | | | | |

| | | Land plots | | BF sqm |

| Riedmattstrasse 9, Rümlang | | 1 | | |

| Total | | 1 | | |

| Details for land plot Riedmattstrasse 9, Rümlang |

| | | |

| Reference number | | |

| Name | | Riedmattstrasse 9, Rümlang |

| Ownership | | Sole ownership |

| Comments | | |

| Owner | | Optibase RE1 |

| EGRID | | |

| Parcel area [sqm] | | 5,090 |

| Coord. [Lat./Long. WGS 84] | | 47.460779 / 8.523837 |

| | | |

| | | |

| Land registry | | |

| Local court | | Niederglatt |

| Municipality of land registry | | Rumlang |

| Name of the corridor | | |

| Land registry sheet number | | 1688 |

| Serial registration number | | |

| Plan number | | |

| Cadastral no. | | 4778 |

| Land registry entry | | |

| Land registry extract date | | 21.12.2017 |

| | | |

| | | |

| Planning law | | |

| Planning zone | | Industrial Zone IIIA |

| Design plan | | |

| Utilisation potential | | Ratio of building per parcel area 8.00 |

| Contaminated sites | | no information |

| Listed building | | no information |

| Details for building Riedmattstrasse 9, Rümlang |

| | | |

| Reference number | | |

| Name | | Riedmattstrasse 9, Rumlang |

| EGID | | |

| Building category | | |

| Address | | Riedmattstrasse 9

8153 Rumlang |

| Country | | Switzerland |

| Coord. [Lat./Long. WGS 84] | | 47.460779 / 8.523837 |

| Volume (V) | | 72,348 |

| Gross floor area (GFA) | | |

| Usable area | | |

| Building footprint (BF) | | |

| Energy certificate | | Without certificate |

| Building construction activities | | |

| Construction year | | Comments |

| 1989 | | |

| | | |

| Building renovation | | |

| Renovation year | | Comments |

| 2011 | | |

| Associated land plot | | |

| Land plot | | Share of building area |

| Riedmattstrasse 9, Rümlang | | 100.0% |

| | | |

| 118318 | 101-17096-100 | Rümlang, Riedmattstrasse 9 | Created by Wüest Partner, 26.03.2020, DRAFT – Desktop Valuation as at 1 April 2020 | Page 8 of 31 |

Wüest Dimensions - Business intelligence by Wüest Partner |  |

| Total [CHF] | | | | |

| Type | | Date | | Value Comments |

| Building insurance value | | 02.12.2019 | | 35,350,000 | | gem. iSure |

| Details [CHF] | | | | | | | | |

Transaction

price/construction costs | | Reconstruction/renovation

costs | | Parking | | Hobby room | | Other |

| | | | | | | | | |

| 118318 | 101-17096-100 | Rümlang, Riedmattstrasse 9 | Created by Wüest Partner, 26.03.2020, DRAFT – Desktop Valuation as at 1 April 2020 | Page 9 of 31 |

Wüest Dimensions - Business intelligence by Wüest Partner |  |

Use-type overview

| Use type | | Current rent | | Market rent | | | |

| |  | |  | | |  |

| | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | No. | | Area | | CHF p.a. | | Share CHF/sqm | | | | | | CHF p.a. | | Share CHF/sqm | | | | | | Dev. | | |

| | | | | | | | | | | Min | | Max | | Ø | | | | | | Min | | Max | | Ø | | | | CHF/sqm p.a. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Craft/Industry | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Target income | | 11 | | 6,534 | | 822,580 | | 45.4% | | 90 | | 133 | | 126 | | 914,760 | | 48.6% | | 140 | | 140 | | 140 | | 11% | |  |

| Vacancy | | | | | | 0.0% | | | | | | | | | | 5.0% | | | | | | | | | | 100% | |

| Actual rental income | | 11 | | 6,534 | | 822,580 | | | | 90 | | 133 | | 126 | | 869,022 | | | | | | | | | | 6% | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Office | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Target income | | 11 | | 3,498 | | 524,896 | | 29.0% | | 140 | | 165 | | 150 | | 521,400 | | 27.7% | | 130 | | 150 | | 149 | | -1% | |  |

| Vacancy | | 2 | | 910 | | 26.0% | | | | 150 | | 150 | | 150 | | 7.0% | | | | | | | | | | -73% | |

| Actual rental income | | 9 | | 2,588 | | 388,396 | | | | 140 | | 165 | | 150 | | 484,902 | | | | | | | | | | 25% | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Indoor parking | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Target income | | 138 | | | | 213,577 | | 11.8% | | | | | | | | 215,280 | | 11.4% | | | | | | | | 1% | | |

| Vacancy | | 17 | | | | 12.4% | | | | | | | | | | 8.0% | | | | | | | | | | -36% | | |

| Actual rental income | | 121 | | | | 187,057 | | | | | | | | | | 198,058 | | | | | | | | | | 6% | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Retail | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Target income | | 3 | | 1,059 | | 120,492 | | 6.7% | | 110 | | 119 | | 114 | | 116,490 | | 6.2% | | 110 | | 110 | | 110 | | -3% | |  |

| Vacancy | | 1 | | 90 | | 8.2% | | | | 110 | | 110 | | 110 | | 5.0% | | | | | | | | | | -39% | |

| Actual rental income | | 2 | | 969 | | 110,592 | | | | 112 | | 119 | | 114 | | 110,666 | | | | | | | | | | 0% | |

| 118318 | 101-17096-100 | Rümlang, Riedmattstrasse 9 | Created by Wüest Partner, 26.03.2020, DRAFT – Desktop Valuation as at 1 April 2020 | Page 10 of 31 |

Wüest Dimensions - Business intelligence by Wüest Partner |  |

| Use type | | Current rent | | Market rent | | | | |

| | | | | | | | | |

| | | No. | | Area | | CHF p.a. | | Share CHF/sqm | | | | | | CHF p.a. | | Share CHF/sqm | | | | | | Dev. | | |

| | | | | | | | | | | Min | | Max | | Ø | | | | | | Min | | Max | | Ø | | | | CHF/sqm p.a. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Warehousing | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Target income | | 10 | | 1,271 | | 113,652 | | 6.3% | | 27 | | 144 | | 89 | | 101,680 | | 5.4% | | 80 | | 80 | | 80 | | -11% | | |

| Vacancy | | | | | | 0.0% | | | | | | | | | | 5.0% | | | | | | | | | | 100% | | |

| Actual rental income | | 10 | | 1,271 | | 113,652 | | | | 27 | | 144 | | 89 | | 96,596 | | | | | | | | | | -15% | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Outdoor parking | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Target income | | 11 | | | | 8,760 | | 0.5% | | | | | | | | 8,760 | | 0.5% | | | | | | | | 0% | | |

| Vacancy | | | | | | 0.0% | | | | | | | | | | 5.0% | | | | | | | | | | 100% | | |

| Actual rental income | | 11 | | | | 8,760 | | | | | | | | | | 8,322 | | | | | | | | | | -5% | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Special use without area | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Target income | | 1 | | | | 3,500 | | 0.2% | | | | | | | | 3,500 | | 0.2% | | | | | | | | 0% | | |

| Vacancy | | | | | | 0.0% | | | | | | | | | | 5.0% | | | | | | | | | | 100% | | |

| Actual rental income | | 1 | | | | 3,500 | | | | | | | | | | 3,325 | | | | | | | | | | -5% | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Special use with area | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Target income | | 1 | | 18 | | 2,592 | | 0.1% | | 144 | | 144 | | 144 | | 0 | | 0.0% | | 0 | | 0 | | 0 | | -100% | | |

| Vacancy | | | | | | 0.0% | | | | | | | | | | | | | | | | | | | | 100% | | |

| Actual rental income | | 1 | | 18 | | 2,592 | | | | 144 | | 144 | | 144 | | 0 | | | | | | | | | | -100% | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Target income | | 186 | | 12,380 | | 1,810,048 | | 100.0% | | 27 | | 165 | | 128 | | 1,881,870 | | 100.0% | | 0 | | 150 | | 134 | | 4% | | Legend: |

| Vacancy | | 20 | | 1,000 | | 172,920 | | 9.6% | | 110 | | 150 | | 146 | | 110,980 | | 5.9% | | | | | | | | -36% | | Red marking = Min, Ø, Max Market rent |

| Actual rental income | | 166 | | 11,380 | | 1,637,128 | | 90.4% | | 27 | | 165 | | 126 | | 1,770,890 | | 94.1% | | | | | | | | 8% | | Green marking = Min, Ø, Max Current rent |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | Blue = Quantiles municipality/city quarter |

| 118318 | 101-17096-100 | Rümlang, Riedmattstrasse 9 | Created by Wüest Partner, 26.03.2020, DRAFT – Desktop Valuation as at 1 April 2020 | Page 11 of 31 |

Wüest Dimensions - Business intelligence by Wüest Partner |  |

Area list

| Rental unit | | Current rent | | Market rent | | Δ | | Current lease agreement |

| Ref. No. | | Tenant name | | Floor | | UT | | No. | | Ro | | Area [sqm] | | CHF p.a. | | Unit/month [CHF] | | per sqm [CHF] | | CHF p.a. | | Unit/month [CHF] | | Q. | | per sqm [CHF] | | Q. | | Vacant | | Trans. [a] | | Dev. | | Start | | End | | Early break/1st notice | | Options real/false | | Index |

| 809-10-02 | | Butti Mario | | -1 | | W | | 1 | | | | 82 | | 3,840 | | 320 | | 47 | | 6,560 | | 547 | | | | 80 | | | | 5.0% | | 10 | | | +71% | | 01.04.18 | | | | | | | | 40% |

| 809-01-02 | | Polymed Medical Center (Lager) | | -1 | | W | | 1 | | | | 198 | | 17,820 | | 1,485 | | 90 | | 15,840 | | 1,320 | | | | 80 | | | | 5.0% | | 10 | | | -11% | | 01.04.16 | | | | | | | | 40% |

| 809-01-04 | | Polymed Medical Center (Lager) | | -1 | | W | | 1 | | | | 287 | | 25,830 | | 2,153 | | 90 | | 22,960 | | 1,913 | | | | 80 | | | | 5.0% | | 10 | | | -11% | | 01.12.15 | | | | | | | | 40% |

| 809-08-01 | | Theodor Riccardo AG | | -1 | | W | | 1 | | | | 18 | | 480 | | 40 | | 27 | | 1,440 | | 120 | | | | 80 | | | | 5.0% | | 10 | | | +200% | | 01.01.15 | | 30.06.20 | | | | | | 40% |

| 809-08-01 | | Theodor Riccardo AG | | -1 | | W | | 1 | | | | 46 | | 2,400 | | 200 | | 52 | | 3,680 | | 307 | | | | 80 | | | | 5.0% | | 10 | | | +53% | | 01.01.15 | | 30.06.20 | | | | | | 40% |

| 809-08-02 | | Theodor Riccardo AG | | -1 | | W | | 1 | | | | 48 | | 3,840 | | 320 | | 80 | | 3,840 | | 320 | | | | 80 | | | | 5.0% | | 10 | | | +0% | | 01.04.18 | | 31.03.23 | | | | | | 80% |

| 809-12-01 | | Clear Channel Schweiz AG | | 0 | | SU… | | 1 | | | | | | 3,500 | | 292 | | | | 3,500 | | 292 | | | | | | | | 5.0% | | 10 | | +0% | | 01.12.00 | | 30.11.20 | | | | 1x5 | | 80% |

| 809-06-01/4 | | Novabau AG | | 0 | | Ret | | 1 | | | | 689 | | 77,232 | | 6,436 | | 112 | | 75,790 | | 6,316 | | | | 110 | | 13% | | 5.0% | | 10 | | -2% | | 01.12.03 | | 31.05.23 | | 31.05.21 | | | | 80% |

| 809-01-01/4 | | Polymed Medical Center | | 0 | | W | | 1 | | | | 480 | | 44,232 | | 3,686 | | 92 | | 38,400 | | 3,200 | | | | 80 | | | | 5.0% | | 10 | | -13% | | 01.09.00 | | | | | | | | 40% |

| 809-17-02 | | Resin Floor GmbH | | 0 | | O | | 1 | | | | 165 | | 24,900 | | 2,075 | | 151 | | 21,450 | | 1,788 | | | | 130 | | 27% | | 7.0% | | 10 | | -14% | | 01.02.18 | | 31.01.23 | | | | 1x5 | | 80% |

| 809-08-01 | | Theodor Riccardo AG | | 0 | | Ind. | | 1 | | | | 90 | | 11,340 | | 945 | | 126 | | 12,600 | | 1,050 | | | | 140 | | 39% | | 5.0% | | 10 | | +11% | | 01.01.15 | | 30.06.20 | | | | | | 40% |

| 809-08-01 | | Theodor Riccardo AG | | 0 | | W | | 1 | | | | 25 | | 3,240 | | 270 | | 130 | | 2,000 | | 167 | | | | 80 | | | | 5.0% | | 10 | | -38% | | 01.01.15 | | 30.06.20 | | | | | | 40% |

| 809-08-01 | | Theodor Riccardo AG | | 0 | | W | | 1 | | | | 31 | | 3,906 | | 326 | | 126 | | 2,480 | | 207 | | | | 80 | | | | 5.0% | | 10 | | -37% | | 01.01.15 | | 30.06.20 | | | | | | 40% |

| 809-05-01 | | Vale Moto GmbH | | 0 | | Ret | | 1 | | | | 280 | | 33,360 | | 2,780 | | 119 | | 30,800 | | 2,567 | | | | 110 | | 13% | | 5.0% | | 10 | | -8% | | 01.01.13 | | 31.12.22 | | | | | | 80% |

| 809-99-99 | | ■ | | 0 | | Ret | | 1 | | | | 90 | | 9,900 | | 825 | | 110 | | 9,900 | | 825 | | | | 110 | | 13% | | 5.0% | | | | +0% | | | | | | | | | | |

| 809-02-03 | | Fastlog AG | | 1 | | Ind. | | 1 | | | | 1,800 | | 223,116 | | 18,593 | | 124 | | 252,000 | | 21,000 | | | | 140 | | 39% | | 5.0% | | 10 | | +13% | | 01.07.15 | | 30.06.21 | | | | | | 80% |

| 809-02-03 | | Fastlog AG | | 1 | | Ind. | | 1 | | | | 571 | | 70,776 | | 5,898 | | 124 | | 79,940 | | 6,662 | | | | 140 | | 39% | | 5.0% | | 10 | | +13% | | 01.07.15 | | 30.06.21 | | | | | | 80% |

| 809-02-03 | | Fastlog AG | | 1 | | Ind. | | 1 | | | | 105 | | 13,020 | | 1,085 | | 124 | | 14,700 | | 1,225 | | | | 140 | | 39% | | 5.0% | | 10 | | +13% | | 01.07.15 | | 30.06.21 | | | | | | 80% |

| 809-02-03 | | Fastlog AG | | 1 | | Ind. | | 1 | | | | 146 | | 18,096 | | 1,508 | | 124 | | 20,440 | | 1,703 | | | | 140 | | 39% | | 5.0% | | 10 | | +13% | | 01.07.15 | | 30.06.21 | | | | | | 80% |

| 809-02-03 | | Fastlog AG | | 1 | | Ind. | | 1 | | | | 155 | | 19,212 | | 1,601 | | 124 | | 21,700 | | 1,808 | | | | 140 | | 39% | | 5.0% | | 10 | | +13% | | 01.07.15 | | 30.06.21 | | | | | | 80% |

| 809-02-03 | | Fastlog AG | | 1 | | Ind. | | 1 | | | | 180 | | 22,320 | | 1,860 | | 124 | | 25,200 | | 2,100 | | | | 140 | | 39% | | 5.0% | | 10 | | +13% | | 01.07.15 | | 30.06.21 | | | | | | 80% |

| 809-01-01/4 | | Polymed Medical Center | | 2 | | Ind. | | 1 | | | | 1,298 | | 172,764 | | 14,397 | | 133 | | 181,720 | | 15,143 | | | | 140 | | 39% | | 5.0% | | 10 | | +5% | | 01.09.00 | | | | | | | | 40% |

| 809-01-01/4 | | Polymed Medical Center | | 2 | | Ind. | | 1 | | | | 864 | | 115,000 | | 9,583 | | 133 | | 120,960 | | 10,080 | | | | 140 | | 39% | | 5.0% | | 10 | | +5% | | 01.09.00 | | | | | | | | 40% |

| 809-01-01/4 | | Polymed Medical Center | | 2 | | Ind. | | 1 | | | | 913 | | 119,856 | | 9,988 | | 131 | | 127,820 | | 10,652 | | | | 140 | | 39% | | 5.0% | | 10 | | +7% | | 01.09.01 | | | | | | | | 40% |

| 809-19-02 | | Gondrand International AG | | 3 | | O | | 1 | | | | 431 | | 71,115 | | 5,926 | | 165 | | 64,650 | | 5,388 | | | | 150 | | 40% | | 7.0% | | 10 | | -9% | | 01.06.15 | | 31.05.25 | | 31.05.22 | | | | 80% |

| 809-25-01 | | CesaroSana GmbH | | 3 | | O | | 1 | | | | 36 | | 5,040 | | 420 | | 140 | | 5,400 | | 450 | | | | 150 | | 40% | | 7.0% | | 10 | | +7% | | 01.01.20 | | 31.01.25 | | 31.01.22 | | 1x5 | | 80% |

| 809-99-99 | | ■ | | 3 | | O | | 1 | | | | 388 | | 58,200 | | 4,850 | | 150 | | 58,200 | | 4,850 | | | | 150 | | 40% | | 7.0% | | | | +0% | | | | | | | | | | |

| 809-07-01/2 | | Polygene AG | | 3 | | O | | 1 | | | | 525 | | 77,364 | | 6,447 | | 147 | | 78,750 | | 6,563 | | | | 150 | | 40% | | 7.0% | | 10 | | +2% | | 01.01.08 | | 31.12.23 | | | | | | 80% |

| 809-01-05 | | Polymed Medical Center | | 3 | | O | | 1 | | | | 297 | | 47,520 | | 3,960 | | 160 | | 44,550 | | 3,713 | | | | 150 | | 40% | | 7.0% | | 10 | | -6% | | 01.09.17 | | 30.06.22 | | | | 1x5 | | 40% |

| 809-23-01 | | Wenger Krenar | | 3 | | O | | 1 | | | | 62 | | 8,680 | | 723 | | 140 | | 9,300 | | 775 | | | | 150 | | 40% | | 7.0% | | 10 | | +7% | | 01.09.19 | | | | | | | | 40% |

| 809-27-01 | | Fehr Real Estate GmbH | | 3 | | O | | 1 | | | | 77 | | 10,780 | | 898 | | 140 | | 11,550 | | 963 | | | | 150 | | 40% | | 7.0% | | 10 | | +7% | | 01.04.20 | | 31.03.25 | | 30.09.21 | | 1x5 | | 100% |

| 809-24-01 | | S&C Sportcars Rumlang | | 3 | | O | | 1 | | | | 71 | | 9,940 | | 828 | | 140 | | 10,650 | | 888 | | | | 150 | | 40% | | 7.0% | | 10 | | +7% | | 01.12.19 | | 30.11.24 | | 31.05.21 | | 1x5 | | 80% |

| 809-03-06 | | Arrow Central Europe GmbH | | 4 | | W | | 1 | | | | 56 | | 8,064 | | 672 | | 144 | | 4,480 | | 373 | | | | 80 | | | | 5.0% | | 10 | | -44% | | 01.05.14 | | 30.04.20 | | | | | | 80% |

| 809-03-06 | | Arrow Central Europe GmbH | | 4 | | O | | 1 | | | | 924 | | 133,056 | | 11,088 | | 144 | | 138,600 | | 11,550 | | | | 150 | | 40% | | 7.0% | | 10 | | +4% | | 01.05.14 | | 30.04.20 | | | | | | 80% |

| 809-03-06 | | Arrow Central Europe GmbH | | 4 | | SU… | | 1 | | | | 18 | | 2,592 | | 216 | | 144 | | 0 | | 0 | | | | 0 | | | | 5.0% | | 10 | | -100% | | 01.05.14 | | 30.04.20 | | | | | | 80% |

| 809-02-04 | | Fastlog AG | | 4 | | Ind. | | 1 | | | | 412 | | 37,080 | | 3,090 | | 90 | | 57,680 | | 4,807 | | | | 140 | | 39% | | 5.0% | | 10 | | +56% | | 01.07.15 | | 30.06.20 | | | | | | 80% |

| 809-99-99 | | ■ | | 4 | | O | | 1 | | | | 522 | | 78,300 | | 6,525 | | 150 | | 78,300 | | 6,525 | | | | 150 | | 40% | | 7.0% | | | | +0% | | | | | | | | | | |

| 809-03-06 | | Arrow Central Europe GmbH | | -3 | | IP | | 7 | | | | | | 7,920 | | 94 | | | | 10,920 | | 130 | | | | | | | | 8.0% | | 10 | | +38% | | 01.03.19 | | 30.04.20 | | | | | | 40% |

| 809-03-06 | | Arrow Central Europe GmbH | | -3 | | IP | | 9 | | | | | | 12,960 | | 120 | | | | 14,040 | | 130 | | | | | | | | 8.0% | | 10 | | +8% | | 01.10.15 | | 30.04.20 | | | | | | 40% |

| 809-03-06 | | Arrow Central Europe GmbH | | -3 | | IP | | 6 | | | | | | 960 | | 13 | | | | 9,360 | | 130 | | | | | | | | 8.0% | | 10 | | +875% | | 01.03.19 | | 30.04.20 | | | | | | 40% |

| 118318 | 101-17096-100 | Rümlang, Riedmattstrasse 9 | Created by Wüest Partner, 26.03.2020, DRAFT – Desktop Valuation as at 1 April 2020 | Page 12 of 31 |

Wüest Dimensions - Business intelligence by Wüest Partner |  |

| Rental unit | | Current rent | | Market rent | | Δ | | Current lease agreement |

| Ref. No. | | Tenant name | | Floor | | UT | | No. | | Ro | | Area [sqm] | | CHF p.a. | | Unit/month [CHF] | | per sqm [CHF] | | CHF p.a. | | Unit/month [CHF] | | Q. | | Per sqm [CHF] | | Q. | | Vacant | | Trans. [a] | | Dev. | | Start | | End | | Early break/1st notice | | Options real/false | | Index |

| 809-03-06 | | Arrow Central Europe GmbH | | -3 | | IP | | 7 | | | | | | 6,720 | | 80 | | | | 10,920 | | 130 | | | | | | | | 8.0% | | 10 | | | +63% | | 01.03.19 | | 30.04.20 | | | | | | 40% |

| 809-02-05 | | Fastlog AG | | -2 | | IP | | 8 | | | | | | 11,520 | | 120 | | | | 12,480 | | 130 | | | | | | | | 8.0% | | 10 | | | +8% | | 01.07.10 | | | | | | | | 40% |

| 809-19-03 | | Gondrand International AG | | -2 | | IP | | 3 | | | | | | 8,640 | | 240 | | | | 4,680 | | 130 | | | | | | | | 8.0% | | 10 | | | -46% | | 01.10.15 | | 31.05.25 | | 31.05.22 | | 1x5 | | 40% |

| 809-19-03 | | Gondrand International AG | | -2 | | IP | | 2 | | | | | | 5,760 | | 240 | | | | 3,120 | | 130 | | | | | | | | 8.0% | | 10 | | | -46% | | 01.10.15 | | 31.05.25 | | 31.05.22 | | 1x5 | | 40% |

| 809-19-03 | | Gondrand International AG | | -2 | | IP | | 1 | | | | | | 2,880 | | 240 | | | | 1,560 | | 130 | | | | | | | | 8.0% | | 10 | | | -46% | | 01.10.15 | | 31.05.25 | | 31.05.22 | | 1x5 | | 40% |

| 809-19-03 | | Gondrand International AG | | -2 | | IP | | 2 | | | | | | 3,840 | | 160 | | | | 3,120 | | 130 | | | | | | | | 8.0% | | 10 | | | -19% | | 01.10.15 | | 31.05.25 | | 31.05.22 | | 1x5 | | 40% |

| 809-19-03 | | Gondrand International AG | | -2 | | IP | | 1 | | | | | | 1,920 | | 160 | | | | 1,560 | | 130 | | | | | | | | 8.0% | | 10 | | | -19% | | 01.10.15 | | 31.05.25 | | 31.05.22 | | 1x5 | | 40% |

| 809-13-01 | | Implenia Bau AG | | -2 | | IP | | 1 | | | | | | 2,880 | | 240 | | | | 1,560 | | 130 | | | | | | | | 8.0% | | 10 | | | -46% | | 01.11.05 | | | | | | | | 40% |

| 809-13-01 | | Implenia Bau AG | | -2 | | IP | | 1 | | | | | | 1,560 | | 130 | | | | 1,560 | | 130 | | | | | | | | 8.0% | | 10 | | | +0% | | 01.11.05 | | | | | | | | 40% |

| 809-99-99 | | ■ | | -2 | | IP | | 2 | | | | | | 3,120 | | 130 | | | | 3,120 | | 130 | | | | | | | | 8.0% | | | | | +0% | | | | | | | | | | |

| 809-08-03 | | Theodor Riccardo AG | | -2 | | IP | | 1 | | | | | | 2,400 | | 200 | | | | 1,560 | | 130 | | | | | | | | 8.0% | | 10 | | -35% | | 01.10.17 | | | | | | | | 40% |

| 809-05-02 | | Vale Moto GmbH | | -2 | | IP | | 1 | | | | | | 2,880 | | 240 | | | | 1,560 | | 130 | | | | | | | | 8.0% | | 10 | | -46% | | 01.10.15 | | | | | | | | 40% |

| 809-27-01 | | Fehr Real Estate GmbH | | -2 | | IP | | 5 | | | | | | 12,000 | | 200 | | | | 7,800 | | 130 | | | | | | | | 8.0% | | 10 | | -35% | | 01.04.20 | | 31.03.25 | | 30.09.21 | | 1x5 | | 100% |

| 809-99-99 | | ■ | | -1 | | IP | | 2 | | | | | | 3,120 | | 130 | | | | 3,120 | | 130 | | | | | | | | 8.0% | | | | +0% | | | | | | | | | | |

| 809-99-99 | | ■ | | -1 | | IP | | 4 | | | | | | 6,240 | | 130 | | | | 6,240 | | 130 | | | | | | | | 8.0% | | | | +0% | | | | | | | | | | |

| 809-99-99 | | ■ | | -1 | | IP | | 9 | | | | | | 14,040 | | 130 | | | | 14,040 | | 130 | | | | | | | | 8.0% | | | | +0% | | | | | | | | | | |

| 809-07-02 | | Polygene AG | | -1 | | IP | | 1 | | | | | | 1,440 | | 120 | | | | 1,560 | | 130 | | | | | | | | 8.0% | | 10 | | +8% | | 01.01.14 | | | | | | | | 40% |

| 809-01-01 | | Polymed Medical Center | | -1 | | IP | | 2 | | | | | | 2,647 | | 110 | | | | 3,120 | | 130 | | | | | | | | 8.0% | | 10 | | +18% | | 01.01.19 | | | | | | | | 40% |

| 809-01-01/5 | | Polymed Medical Center | | -1 | | IP | | 11 | | | | | | 18,256 | | 138 | | | | 17,160 | | 130 | | | | | | | | 8.0% | | 10 | | -6% | | 01.09.00 | | | | | | | | 40% |

| 809-01-01/5 | | Polymed Medical Center | | -1 | | IP | | 1 | | | | | | 1,740 | | 145 | | | | 1,560 | | 130 | | | | | | | | 8.0% | | 10 | | -10% | | 01.09.00 | | | | | | | | 40% |

| 809-08-01 | | Theodor Riccardo AG | | -1 | | IP | | 1 | | | | | | 1,440 | | 120 | | | | 1,560 | | 130 | | | | | | | | 8.0% | | 10 | | +8% | | 01.01.12 | | 30.06.20 | | | | | | 40% |

| 809-22-01 | | ZS Carpoint AG | | -1 | | IP | | 1 | | | | | | 1,560 | | 130 | | | | 1,560 | | 130 | | | | | | | | 8.0% | | 10 | | +0% | | 01.03.19 | | 28.02.24 | | | | | | 40% |

| 809-22-01 | | ZS Carpoint AG | | -1 | | IP | | 10 | | | | | | 15,600 | | 130 | | | | 15,600 | | 130 | | | | | | | | 8.0% | | 10 | | +0% | | 01.03.19 | | 28.02.24 | | | | | | 80% |

| 809-22-01 | | ZS Carpoint AG | | -1 | | IP | | 6 | | | | | | 9,360 | | 130 | | | | 9,360 | | 130 | | | | | | | | 8.0% | | 10 | | +0% | | 01.03.19 | | 28.02.24 | | | | | | 40% |

| 809-22-01 | | ZS Carpoint AG | | -1 | | IP | | 13 | | | | | | 20,280 | | 130 | | | | 20,280 | | 130 | | | | | | | | 8.0% | | 10 | | +0% | | 01.03.19 | | 28.02.24 | | | | | | 80% |

| 809-25-01 | | CesaroSana GmbH | | -1 | | IP | | 1 | | | | | | 2,880 | | 240 | | | | 1,560 | | 130 | | | | | | | | 8.0% | | 10 | | -46% | | 01.01.20 | | 31.01.25 | | 31.01.22 | | 1x5 | | 40% |

| 809-01-01 | | Polymed Medical Center | | 0 | | IP | | 7 | | | | | | 13,754 | | 164 | | | | 10,920 | | 130 | | | | | | | | 8.0% | | 10 | | -21% | | 01.03.19 | | | | | | | | 40% |

| 809-05-03 | | Vale Moto GmbH | | 0 | | IP | | 6 | | | | | | 1,080 | | 15 | | | | 9,360 | | 130 | | | | | | | | 8.0% | | 10 | | +767% | | 01.07.18 | | | | | | | | 40% |

| 809-05-03 | | Vale Moto GmbH | | 0 | | IP | | 1 | | | | | | 180 | | 15 | | | | 1,560 | | 130 | | | | | | | | 8.0% | | 10 | | +767% | | 01.07.18 | | | | | | | | 40% |

| 809-24-01 | | S&C Sportcars Rümlang | | 0 | | IP | | 5 | | | | | | 12,000 | | 200 | | | | 7,800 | | 130 | | | | | | | | 8.0% | | 10 | | -35% | | 01.12.19 | | 30.11.24 | | 31.05.21 | | 1x5 | | 40% |

| 809-06-01/4 | | Novabau AG | | 0 | | OP | | 6 | | | | | | 4,680 | | 65 | | | | 4,680 | | 65 | | | | | | | | 5.0% | | 10 | | +0% | | 01.12.03 | | 31.05.23 | | 31.05.21 | | | | 80% |

| 809-17-02 | | Resin Floor GmbH | | 0 | | OP | | 2 | | | | | | 1,920 | | 80 | | | | 1,920 | | 80 | | | | | | | | 5.0% | | 10 | | +0% | | 01.02.18 | | 31.01.23 | | | | 1x5 | | 40% |

| 809-05-01 | | Vale Moto GmbH | | 0 | | OP | | 3 | | | | | | 2,160 | | 60 | | | | 2,160 | | 60 | | | | | | | | 5.0% | | 10 | | +0% | | 01.01.13 | | 31.12.22 | | | | | | 40% |

| 118318 | 101-17096-100 | Rümlang, Riedmattstrasse 9 | Created by Wüest Partner, 26.03.2020, DRAFT – Desktop Valuation as at 1 April 2020 | Page 13 of 31 |

| Wüest Dimensions - Business intelligence by Wüest Partner |  |

| Rental unit | | Current rent | | Market rent | | Δ | | Current lease agreement | |

| Ref. No. | Tenant name | | Floo UT | | No. | | Ro | | Area | | CHF p.a. | | Unit/month | | per sqm | | CHF p.a. | | Unit/month | | Q. | | per | | Q. | | Vacant | | Trans. | | Dev. | | Start | | End | | Early | | Options | | Index | |

| | | r | | | | | | [sqm] | | | | [CHF] | | [CHF] | | | | [CHF] | | | | sqm | | | | | | [a] | | | | | | | | break/1st | | real/false | | | |

| | | | | | | | | | | | | | | | | | | | | | | [CHF] | | | | | | | | | | | | | | notice | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | % project. | | | | | | | | | | | | % proj… | | | | | | | | | | | | | | | | | |

| Total budgeted rental income | | | | 186 | | | | 12,380 | | 1,810,048 | | 100.0% | | 128 | | 1,881,870 | | 843 | | | | 134 | | 100.0% | | | | | | +4% | | | | | | | | | | | |

| Total vacancy | | | | 20 | | | | 1,000 | | 172,920 | | 9.6% | | | | 110,980 | | | | | | | | 5.9% | | | | | | -36% | | | | | | | | | | | |

| Total tenants | | | | 166 | | | | 11,380 | | 1,637,128 | | 90.4% | | | | 1,770,890 | | | | | | | | 94.1% | | | | | | +8% | | | | | | | | | | | |

| ■ | | Vacancy |

| ■ Tenant name | | Vacant, but the future tenant is already known. |

Comments:

| • | Arrow Central Europe GmbH: Lease contract terminated per 30.04.2020 |

| • | ZS Carpoint AG: Vacancy from 01.03.2020 |

| • | Gondrand International AG: Lease prolongation until 2025 assumed although no lease contract has been signed. |

| • | Fehr Real Estate GmbH: No early break options (would include a penalty payment) or any prolongation option has been applied in the valuation. |

| 118318 | 101-17096-100 | Rümlang, Riedmattstrasse 9 | Created by Wüest Partner, 26.03.2020, DRAFT - Desktop Valuation as at 1 April 2020 | Page 14 of 31 |

| Wüest Dimensions - Business intelligence by Wüest Partner |  |

Tenant list outlook

| Rental unit | | | | | | | | | | | | | | Rents | | | | Periods | real cashflows | | | | | | | |

| | | | | | | | | | | | | | | Actual | | Market | | 1 | | 2 | | 3 | | 4 | | 5 | | 6 | | 7 | | 8 | | 9 | | 10 |

| Ref. No. | | Tenant | | Floor UT | | No. | | Ro | | sqm | | end [a] | | CHF p.a. | | CHF p.a. | | 01.04.2020 | | 01.04.2021 | | 01.04.2022 | | 01.04.2023 | | 01.04.2024 | | 01.04.2025 | | 01.04.2026 | | 01.04.2027 | | 01.04.2028 | | 01.04.2029 |

| | | | | | | | | | | | | | | | | | | - 31.03.2021 | | - 31.03.2022 | | - 31.03.2023 | | - 31.03.2024 | | - 31.03.2025 | | - 31.03.2026 | | - 31.03.2027 | | - 31.03.2028 | | - 31.03.2029 | | - 31.03.2030 |

| 809-10-02 | | Butti Mario | | -1 | | W | | 1 | | | | 82 | | 0.2 | | 3,840 | | 6,560 | | 3,917 | | 4,169 | | 4,431 | | 4,696 | | 4,962 | | 5,231 | | 5,503 | | 5,779 | | 6,059 | | 6,343 |

| 809-01-02 | | Polymed Medical Center (Lager) | | -1 | | W | | 1 | | | | 198 | | 0.2 | | 17,820 | | 15,840 | | 17,764 | | 17,527 | | 17,294 | | 17,073 | | 16,862 | | 16,662 | | 16,471 | | 16,291 | | 16,119 | | 15,956 |

| 809-01-04 | | Polymed Medical Center (Lager) | | -1 | | W | | 1 | | | | 287 | | 0.5 | | 25,830 | | 22,960 | | 25,794 | | 25,474 | | 25,136 | | 24,813 | | 24,506 | | 24,213 | | 23,936 | | 23,672 | | 23,422 | | 23,185 |

| 809-08-01 | | Theodor Riccardo AG | | -1 | | W | | 1 | | | | 18 | | 0.2 | | 480 | | 1,440 | | 507 | | 598 | | 693 | | 787 | | 882 | | 977 | | 1,073 | | 1,169 | | 1,267 | | 1,365 |

| 809-08-01 | | Theodor Riccardo AG | | -1 | | W | | 1 | | | | 46 | | 0.2 | | 2,400 | | 3,680 | | 2,436 | | 2,553 | | 2,676 | | 2,799 | | 2,924 | | 3,050 | | 3,179 | | 3,309 | | 3,442 | | 3,577 |

| 809-08-02 | | Theodor Riccardo AG | | -1 | | W | | 1 | | | | 48 | | 3.0 | | 3,840 | | 3,840 | | 3,840 | | 3,836 | | 3,832 | | 3,829 | | 3,827 | | 3,826 | | 3,825 | | 3,825 | | 3,826 | | 3,828 |

| 809-12-01 | | Clear Channel Schweiz AG | | 0 | | SU… | | 1 | | | | | | 0.7 | | 3,500 | | 3,500 | | 3,500 | | 3,497 | | 3,494 | | 3,492 | | 3,491 | | 3,491 | | 3,491 | | 3,492 | | 3,494 | | 3,496 |

| 809-06-01/4 | | Novabau AG | | 0 | | Ret | | 1 | | | | 689 | | 1.2 | | 77,232 | | 75,790 | | 77,232 | | 77,108 | | 76,907 | | 76,720 | | 76,548 | | 76,391 | | 76,250 | | 76,124 | | 76,013 | | 75,917 |

| 809-01-01/4 | | Polymed Medical Center | | 0 | | W | | 1 | | | | 480 | | 0.2 | | 44,232 | | 38,400 | | 44,068 | | 43,389 | | 42,721 | | 42,081 | | 41,467 | | 40,879 | | 40,315 | | 39,774 | | 39,256 | | 38,759 |

| 809-17-02 | | Resin Floor GmbH | | 0 | | O | | 1 | | | | 165 | | 2.8 | | 24,900 | | 21,450 | | 24,900 | | 24,875 | | 24,846 | | 24,601 | | 24,244 | | 23,893 | | 23,546 | | 23,204 | | 22,866 | | 22,533 |

| 809-08-01 | | Theodor Riccardo AG | | 0 | | Ind. | | 1 | | | | 90 | | 0.2 | | 11,340 | | 12,600 | | 11,375 | | 11,467 | | 11,570 | | 11,679 | | 11,794 | | 11,917 | | 12,046 | | 12,183 | | 12,328 | | 12,480 |

| 809-08-01 | | Theodor Riccardo AG | | 0 | | W | | 1 | | | | 25 | | 0.2 | | 3,240 | | 2,000 | | 3,205 | | 3,077 | | 2,947 | | 2,820 | | 2,694 | | 2,571 | | 2,448 | | 2,328 | | 2,208 | | 2,089 |

| 809-08-01 | | Theodor Riccardo AG | | 0 | | W | | 1 | | | | 31 | | 0.2 | | 3,906 | | 2,480 | | 3,866 | | 3,718 | | 3,569 | | 3,422 | | 3,277 | | 3,135 | | 2,995 | | 2,856 | | 2,718 | | 2,582 |

| 809-05-01 | | Vale Moto GmbH | | 0 | | Ret | | 1 | | | | 280 | | 2.7 | | 33,360 | | 30,800 | | 33,360 | | 33,327 | | 33,286 | | 33,077 | | 32,804 | | 32,538 | | 32,279 | | 32,027 | | 31,780 | | 31,540 |

| 809-99-99 | | ■ | | 0 | | Ret | | 1 | | | | 90 | | | | 9,900 | | 9,900 | | 9,900 | | 9,900 | | 9,900 | | 9,900 | | 9,900 | | 9,900 | | 9,900 | | 9,900 | | 9,900 | | 9,900 |

| 809-02-03 | | Fastlog AG | | 1 | | Ind. | | 1 | | | | 1800 | | 1.2 | | 223,116 | | 252,000 | | 223,116 | | 223,712 | | 226,332 | | 229,084 | | 231,879 | | 234,719 | | 237,605 | | 240,539 | | 243,523 | | 246,559 |

| 809-02-03 | | Fastlog AG | | 1 | | Ind. | | 1 | | | | 571 | | 1.2 | | 70,776 | | 79,940 | | 70,776 | | 70,965 | | 71,796 | | 72,670 | | 73,556 | | 74,457 | | 75,373 | | 76,304 | | 77,251 | | 78,214 |

| 809-02-03 | | Fastlog AG | | 1 | | Ind. | | 1 | | | | 105 | | 1.2 | | 13,020 | | 14,700 | | 13,020 | | 13,055 | | 13,207 | | 13,367 | | 13,530 | | 13,695 | | 13,863 | | 14,033 | | 14,207 | | 14,383 |

| 809-02-03 | | Fastlog AG | | 1 | | Ind. | | 1 | | | | 146 | | 1.2 | | 18,096 | | 20,440 | | 18,096 | | 18,144 | | 18,357 | | 18,580 | | 18,807 | | 19,038 | | 19,272 | | 19,510 | | 19,752 | | 19,998 |

| 809-02-03 | | Fastlog AG | | 1 | | Ind. | | 1 | | | | 155 | | 1.2 | | 19,212 | | 21,700 | | 19,212 | | 19,263 | | 19,489 | | 19,726 | | 19,967 | | 20,211 | | 20,460 | | 20,713 | | 20,970 | | 21,231 |

| 809-02-03 | | Fastlog AG | | 1 | | Ind. | | 1 | | | | 180 | | 1.2 | | 22,320 | | 25,200 | | 22,320 | | 22,379 | | 22,641 | | 22,915 | | 23,194 | | 23,477 | | 23,764 | | 24,057 | | 24,355 | | 24,657 |

| 809-01-01/4 | | Polymed Medical Center | | 2 | | Ind. | | 1 | | | | 1298 | | 0.2 | | 172,764 | | 181,720 | | 173,016 | | 173,429 | | 173,971 | | 174,615 | | 175,361 | | 176,211 | | 177,167 | | 178,230 | | 179,401 | | 180,684 |

| 809-01-01/4 | | Polymed Medical Center | | 2 | | Ind. | | 1 | | | | 864 | | 0.2 | | 115,000 | | 120,960 | | 115,168 | | 115,443 | | 115,803 | | 116,232 | | 116,728 | | 117,294 | | 117,930 | | 118,637 | | 119,417 | | 120,270 |

| 809-01-01/4 | | Polymed Medical Center | | 2 | | Ind. | | 1 | | | | 913 | | 0.2 | | 119,856 | | 127,820 | | 120,080 | | 120,536 | | 121,086 | | 121,706 | | 122,397 | | 123,160 | | 123,997 | | 124,910 | | 125,899 | | 126,967 |

| 809-19-02 | | Gondrand International AG | | 3 | | O | | 1 | | | | 431 | | 2.2 | | 71,115 | | 64,650 | | 71,115 | | 71,044 | | 70,754 | | 70,071 | | 69,394 | | 68,732 | | 68,083 | | 67,447 | | 66,825 | | 66,216 |

| 809-25-01 | | CesaroSana GmbH | | 3 | | O | | 1 | | | | 36 | | 4.8 | | 5,040 | | 5,400 | | 5,040 | | 5,035 | | 5,030 | | 5,025 | | 5,020 | | 5,041 | | 5,075 | | 5,110 | | 5,146 | | 5,183 |

| 809-99-99 | | ■ | | 3 | | O | | 1 | | | | 388 | | | | 58,200 | | 58,200 | | 58,200 | | 58,200 | | 58,200 | | 58,200 | | 58,200 | | 58,200 | | 58,200 | | 58,200 | | 58,200 | | 58,200 |

| 809-07-01/2 | | Polygene AG | | 3 | | O | | 1 | | | | 525 | | 3.7 | | 77,364 | | 78,750 | | 77,364 | | 77,287 | | 77,210 | | 77,138 | | 77,183 | | 77,289 | | 77,409 | | 77,545 | | 77,697 | | 77,864 |

| 809-01-05 | | Polymed Medical Center | | 3 | | O | | 1 | | | | 297 | | 2.2 | | 47,520 | | 44,550 | | 47,520 | | 47,378 | | 47,162 | | 46,780 | | 46,420 | | 46,088 | | 45,783 | | 45,507 | | 45,256 | | 45,033 |

| 809-23-01 | | Wenger Krenar | | 3 | | O | | 1 | | | | 62 | | 0.2 | | 8,680 | | 9,300 | | 8,698 | | 8,735 | | 8,779 | | 8,828 | | 8,882 | | 8,942 | | 9,007 | | 9,077 | | 9,153 | | 9,235 |

| 809-27-01 | | Fehr Real Estate GmbH | | 3 | | O | | 1 | | | | 77 | | 5.0 | | 10,780 | | 11,550 | | 10,780 | | 10,780 | | 10,780 | | 10,780 | | 10,780 | | 10,819 | | 10,896 | | 10,973 | | 11,050 | | 11,127 |

| 809-24-01 | | S&C Sportcars Rümlang | | 3 | | O | | 1 | | | | 71 | | 4.7 | | 9,940 | | 10,650 | | 9,940 | | 9,930 | | 9,920 | | 9,911 | | 9,905 | | 9,954 | | 10,021 | | 10,091 | | 10,162 | | 10,236 |

| 809-03-06 | | Arrow Central Europe GmbH | | 4 | | W | | 1 | | | | 56 | | 0.1 | | 8,064 | | 4,480 | | 7,913 | | 7,550 | | 7,187 | | 6,826 | | 6,467 | | 6,109 | | 5,752 | | 5,396 | | 5,041 | | 4,687 |

| 809-03-06 | | Arrow Central Europe GmbH | | 4 | | O | | 1 | | | | 924 | | 0.1 | | 133,056 | | 138,600 | | 133,289 | | 133,727 | | 134,193 | | 134,685 | | 135,204 | | 135,749 | | 136,321 | | 136,921 | | 137,549 | | 138,204 |

| 809-03-06 | | Arrow Central Europe GmbH | | 4 | | SU… | | 1 | | | | 18 | | 0.1 | | 2,592 | | 0 | | 2,483 | | 2,223 | | 1,963 | | 1,703 | | 1,444 | | 1,185 | | 927 | | 668 | | 410 | | 151 |

| 809-02-04 | | Fastlog AG | | 4 | | Ind. | | 1 | | | | 412 | | 0.2 | | 37,080 | | 57,680 | | 37,659 | | 39,620 | | 41,651 | | 43,687 | | 45,730 | | 47,782 | | 49,843 | | 51,915 | | 54,000 | | 56,097 |

| 809-99-99 | | ■ | | 4 | | O | | 1 | | | | 522 | | | | 78,300 | | 78,300 | | 78,300 | | 78,300 | | 78,300 | | 78,300 | | 78,300 | | 78,300 | | 78,300 | | 78,300 | | 78,300 | | 78,300 |

| 809-03-06 | | Arrow Central Europe GmbH | | -3 | | IP | | 7 | | | | | | 0.1 | | 7,920 | | 10,920 | | 8,046 | | 8,324 | | 8,606 | | 8,892 | | 9,184 | | 9,480 | | 9,782 | | 10,090 | | 10,406 | | 10,728 |

| 809-03-06 | | Arrow Central Europe GmbH | | -3 | | IP | | 9 | | | | | | 0.1 | | 12,960 | | 14,040 | | 13,005 | | 13,079 | | 13,161 | | 13,251 | | 13,348 | | 13,453 | | 13,566 | | 13,687 | | 13,817 | | 13,955 |

| 809-03-06 | | Arrow Central Europe GmbH | | -3 | | IP | | 6 | | | | | | 0.1 | | 960 | | 9,360 | | 1,313 | | 2,144 | | 2,976 | | 3,807 | | 4,639 | | 5,472 | | 6,309 | | 7,151 | | 8,000 | | 8,856 |

| 118318 | 101-17096-100 | Rümlang, Riedmattstrasse 9 | Created by Wüest Partner, 26.03.2020, DRAFT - Desktop Valuation as at 1 April 2020 | Page 15 of 31 |

| Wüest Dimensions - Business intelligence by Wüest Partner |  |

| Rental unit | | | | | | | | | | | | | | | | Rents | | | | Periods | real cashflows | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | Actual | | Market | | 1 | | 2 | | 3 | | 4 | | 5 | | 6 | | 7 | | 8 | | 9 | | 10 |

| Ref. No. | | Tenant | | Floor | | UT | | No. | | Ro | | sqm | | end [a] | | CHF p.a. | | CHF p.a. | | 01.04.2020 | | 01.04.2021 | | 01.04.2022 | | 01.04.2023 | | 01.04.2024 | | 01.04.2025 | | 01.04.2026 | | 01.04.2027 | | 01.04.2028 | | 01.04.2029 |

| | | | | | | | | | | | | | | | | | | | | - 31.03.2021 | | - 31.03.2022 | | - 31.03.2023 | | - 31.03.2024 | | - 31.03.2025 | | - 31.03.2026 | | - 31.03.2027 | | - 31.03.2028 | | - 31.03.2029 | | - 31.03.2030 |

| 809-03-06 | | Arrow Central Europe GmbH | | -3 | | IP | | 7 | | | | | | 0.1 | | 6,720 | | 10,920 | | 6,896 | | 7,296 | | 7,700 | | 8,107 | | 8,518 | | 8,934 | | 9,355 | | 9,782 | | 10,216 | | 10,658 |

| 809-02-05 | | Fastlog AG | | -2 | | IP | | 8 | | | | | | 0.2 | | 11,520 | | 12,480 | | 11,547 | | 11,610 | | 11,682 | | 11,761 | | 11,846 | | 11,939 | | 12,039 | | 12,146 | | 12,261 | | 12,383 |

| 809-19-03 | | Gondrand International AG | | -2 | | IP | | 3 | | | | | | 2.2 | | 8,640 | | 4,680 | | 8,640 | | 8,614 | | 8,454 | | 8,049 | | 7,646 | | 7,247 | | 6,854 | | 6,465 | | 6,079 | | 5,695 |

| 809-19-03 | | Gondrand International AG | | -2 | | IP | | 2 | | | | | | 2.2 | | 5,760 | | 3,120 | | 5,760 | | 5,743 | | 5,636 | | 5,366 | | 5,097 | | 4,832 | | 4,569 | | 4,310 | | 4,052 | | 3,797 |

| 809-19-03 | | Gondrand International AG | | -2 | | IP | | 1 | | | | | | 2.2 | | 2,880 | | 1,560 | | 2,880 | | 2,871 | | 2,818 | | 2,683 | | 2,549 | | 2,416 | | 2,285 | | 2,155 | | 2,026 | | 1,898 |

| 809-19-03 | | Gondrand International AG | | -2 | | IP | | 2 | | | | | | 2.2 | | 3,840 | | 3,120 | | 3,840 | | 3,829 | | 3,793 | | 3,715 | | 3,639 | | 3,564 | | 3,492 | | 3,422 | | 3,354 | | 3,288 |

| 809-19-03 | | Gondrand International AG | | -2 | | IP | | 1 | | | | | | 2.2 | | 1,920 | | 1,560 | | 1,920 | | 1,914 | | 1,897 | | 1,858 | | 1,819 | | 1,782 | | 1,746 | | 1,711 | | 1,677 | | 1,644 |

| 809-13-01 | | Implenia Bau AG | | -2 | | IP | | 1 | | | | | | 0.2 | | 2,880 | | 1,560 | | 2,843 | | 2,708 | | 2,571 | | 2,436 | | 2,303 | | 2,172 | | 2,041 | | 1,912 | | 1,784 | | 1,656 |

| 809-13-01 | | Implenia Bau AG | | -2 | | IP | | 1 | | | | | | 0.2 | | 1,560 | | 1,560 | | 1,560 | | 1,556 | | 1,553 | | 1,551 | | 1,549 | | 1,549 | | 1,550 | | 1,551 | | 1,553 | | 1,557 |

| 809-99-99 | | ■ | | -2 | | IP | | 2 | | | | | | | | 3,120 | | 3,120 | | 3,120 | | 3,120 | | 3,120 | | 3,120 | | 3,120 | | 3,120 | | 3,120 | | 3,120 | | 3,120 | | 3,120 |

| 809-08-03 | | Theodor Riccardo AG | | -2 | | IP | | 1 | | | | | | 0.2 | | 2,400 | | 1,560 | | 2,376 | | 2,289 | | 2,201 | | 2,114 | | 2,029 | | 1,945 | | 1,862 | | 1,781 | | 1,700 | | 1,620 |

| 809-05-02 | | Vale Moto GmbH | | -2 | | IP | | 1 | | | | | | 0.2 | | 2,880 | | 1,560 | | 2,843 | | 2,708 | | 2,571 | | 2,436 | | 2,303 | | 2,172 | | 2,041 | | 1,912 | | 1,784 | | 1,656 |

| 809-27-01 | | Fehr Real Estate GmbH | | -2 | | IP | | 5 | | | | | | 5.0 | | 12,000 | | 7,800 | | 12,000 | | 12,000 | | 12,000 | | 12,000 | | 12,000 | | 11,790 | | 11,370 | | 10,950 | | 10,530 | | 10,110 |

| 809-99-99 | | ■ | | -1 | | IP | | 2 | | | | | | | | 3,120 | | 3,120 | | 3,120 | | 3,120 | | 3,120 | | 3,120 | | 3,120 | | 3,120 | | 3,120 | | 3,120 | | 3,120 | | 3,120 |

| 809-99-99 | | ■ | | -1 | | IP | | 4 | | | | | | | | 6,240 | | 6,240 | | 6,240 | | 6,240 | | 6,240 | | 6,240 | | 6,240 | | 6,240 | | 6,240 | | 6,240 | | 6,240 | | 6,240 |

| 809-99-99 | | ■ | | -1 | | IP | | 9 | | | | | | | | 14,040 | | 14,040 | | 14,040 | | 14,040 | | 14,040 | | 14,040 | | 14,040 | | 14,040 | | 14,040 | | 14,040 | | 14,040 | | 14,040 |

| 809-07-02 | | Polygene AG | | -1 | | IP | | 1 | | | | | | 0.2 | | 1,440 | | 1,560 | | 1,443 | | 1,451 | | 1,460 | | 1,470 | | 1,481 | | 1,492 | | 1,505 | | 1,518 | | 1,533 | | 1,548 |

| 809-01-01 | | Polymed Medical Center | | -1 | | IP | | 2 | | | | | | 0.2 | | 2,647 | | 3,120 | | 2,660 | | 2,699 | | 2,741 | | 2,784 | | 2,828 | | 2,875 | | 2,923 | | 2,973 | | 3,025 | | 3,078 |

| 809-01-01/5 | | Polymed Medical Center | | -1 | | IP | | 11 | | | | | | 0.2 | | 18,256 | | 17,160 | | 18,225 | | 18,071 | | 17,926 | | 17,792 | | 17,668 | | 17,555 | | 17,453 | | 17,361 | | 17,279 | | 17,207 |

| 809-01-01/5 | | Polymed Medical Center | | -1 | | IP | | 1 | | | | | | 0.2 | | 1,740 | | 1,560 | | 1,735 | | 1,713 | | 1,692 | | 1,671 | | 1,652 | | 1,634 | | 1,617 | | 1,600 | | 1,585 | | 1,570 |

| 809-08-01 | | Theodor Riccardo AG | | -1 | | IP | | 1 | | | | | | 0.2 | | 1,440 | | 1,560 | | 1,443 | | 1,451 | | 1,460 | | 1,470 | | 1,481 | | 1,492 | | 1,505 | | 1,518 | | 1,533 | | 1,548 |

| 809-22-01 | | ZS Carpoint AG | | -1 | | IP | | 1 | | | | | | 3.9 | | 1,560 | | 1,560 | | 1,560 | | 1,555 | | 1,551 | | 1,546 | | 1,543 | | 1,541 | | 1,539 | | 1,539 | | 1,540 | | 1,542 |

| 809-22-01 | | ZS Carpoint AG | | -1 | | IP | | 10 | | | | | | 3.9 | | 15,600 | | 15,600 | | 15,600 | | 15,584 | | 15,569 | | 15,553 | | 15,542 | | 15,535 | | 15,531 | | 15,530 | | 15,533 | | 15,539 |

| 809-22-01 | | ZS Carpoint AG | | -1 | | IP | | 6 | | | | | | 3.9 | | 9,360 | | 9,360 | | 9,360 | | 9,332 | | 9,304 | | 9,276 | | 9,255 | | 9,243 | | 9,236 | | 9,235 | | 9,240 | | 9,250 |

| 809-22-01 | | ZS Carpoint AG | | -1 | | IP | | 13 | | | | | | 3.9 | | 20,280 | | 20,280 | | 20,280 | | 20,260 | | 20,240 | | 20,220 | | 20,204 | | 20,195 | | 20,190 | | 20,190 | | 20,193 | | 20,200 |

| 809-25-01 | | CesaroSana GmbH | | -1 | | IP | | 1 | | | | | | 1.8 | | 2,880 | | 1,560 | | 2,880 | | 2,870 | | 2,776 | | 2,640 | | 2,506 | | 2,373 | | 2,242 | | 2,113 | | 1,984 | | 1,856 |

| 809-01-01 | | Polymed Medical Center | | 0 | | IP | | 7 | | | | | | 0.2 | | 13,754 | | 10,920 | | 13,674 | | 13,365 | | 13,056 | | 12,756 | | 12,464 | | 12,180 | | 11,903 | | 11,632 | | 11,368 | | 11,110 |

| 809-05-03 | | Vale Moto GmbH | | 0 | | IP | | 6 | | | | | | 0.1 | | 1,080 | | 9,360 | | 1,428 | | 2,247 | | 3,067 | | 3,886 | | 4,705 | | 5,527 | | 6,352 | | 7,182 | | 8,019 | | 8,863 |

| 809-05-03 | | Vale Moto GmbH | | 0 | | IP | | 1 | | | | | | 0.1 | | 180 | | 1,560 | | 238 | | 375 | | 511 | | 648 | | 784 | | 921 | | 1,059 | | 1,197 | | 1,336 | | 1,477 |

| 809-24-01 | | S&C Sportcars Rümlang | | 0 | | IP | | 5 | | | | | | 1.2 | | 12,000 | | 7,800 | | 12,000 | | 11,820 | | 11,381 | | 10,945 | | 10,516 | | 10,094 | | 9,679 | | 9,269 | | 8,863 | | 8,462 |

| 809-06-01/4 | | Novabau AG | | 0 | | OP | | 6 | | | | | | 3.2 | | 4,680 | | 4,680 | | 4,680 | | 4,675 | | 4,671 | | 4,667 | | 4,664 | | 4,662 | | 4,661 | | 4,662 | | 4,663 | | 4,665 |

| 809-17-02 | | Resin Floor GmbH | | 0 | | OP | | 2 | | | | | | 7.8 | | 1,920 | | 1,920 | | 1,920 | | 1,914 | | 1,909 | | 1,903 | | 1,897 | | 1,892 | | 1,886 | | 1,880 | | 1,878 | | 1,877 |

| 809-05-01 | | Vale Moto GmbH | | 0 | | OP | | 3 | | | | | | 2.7 | | 2,160 | | 2,160 | | 2,160 | | 2,154 | | 2,147 | | 2,142 | | 2,139 | | 2,137 | | 2,136 | | 2,136 | | 2,138 | | 2,141 |

| Total | | | | | | | | | | | | | | | | 1,810,048 | | 1,881,870 | | 1,812,047 | | 1,815,995 | | 1,822,711 | | 1,828,531 | | 1,834,849 | | 1,841,739 | | 1,849,105 | | 1,857,098 | | 1,865,727 | | 1,875,001 |

| Share of rental income from rental contracts | | | | | | 46% | | 21% | | 13% | | 9% | | 2% | | 0% | | 0% | | 0% | | 0% | | 0% |

| Legend: | | |

| ■ | | Vacancy |

| ■ Tenant name | | Vacant, but the future tenant is already known. |

| 118318 | 101-17096-100 | Rümlang, Riedmattstrasse 9 | Created by Wüest Partner, 26.03.2020, DRAFT – Desktop Valuation as at 1 April 2020 | Page 16 of 31 |

| Wüest Dimensions - Business intelligence by Wüest Partner |  |

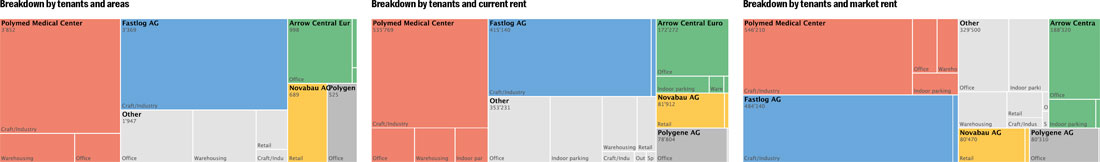

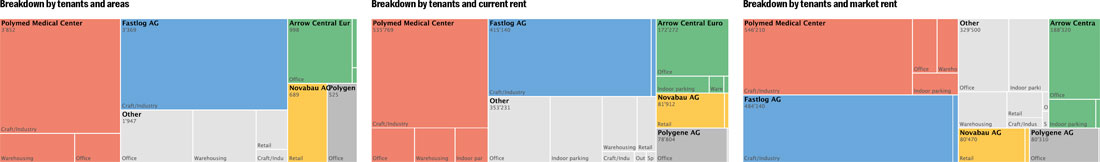

Summary by tenant and use type

| Rental property | | | | | | | | Current rent | | | | | | | | | | Market rent | | | | | | | | | | | | Δ | | Current lease agreement | | | | |

| Tenant | | UT | | No. | | sqm | | Share | | CHF p.a. CHF/sqm | | | | | | Q. | | Share | | CHF p.a. CHF/sqm | | | | | | Q. | | Vac. | | Dev. | | Start | | End | | Early break | | End | | Index |

| | | | | | | | | | | | | Min | | Max | | Ø | | | | | | | | Min | | Max | | Ø | | | | | | | | Min | | Max | | earliest termin. | | [a] | | Ø |

| Polymed Medical Center | | | | 26 | | 3,852 | | 33% | | 535,769 | | 92 | | 160 | | 130 | | 38% | | 32% | | 546,210 | | 80 | | 150 | | 133 | | 39% | | 5.3% | | 2% | | 01.09.00 | | 30.06.22 | | | | 0.4 | | 40% |

| | | Ind. | | 3 | | 3,075 | | 76% | | 407,620 | | 131 | | 133 | | 133 | | 35% | | 79% | | 430,500 | | 140 | | 140 | | 140 | | 39% | | 5.0% | | 6% | | 01.09.00 | | | | | | 0.2 | | 40% |

| | | O | | 1 | | 297 | | 9% | | 47,520 | | 160 | | 160 | | 160 | | 46% | | 8% | | 44,550 | | 150 | | 150 | | 150 | | 40% | | 7.0% | | -6% | | 01.09.17 | | 30.06.22 | | | | 2.2 | | 40% |

| | | W | | 1 | | 480 | | 8% | | 44,232 | | 92 | | 92 | | 92 | | | | 7% | | 38,400 | | 80 | | 80 | | 80 | | | | 5.0% | | -13% | | 01.09.00 | | | | | | 0.2 | | 40% |

| | | IP | | 21 | | | | 7% | | 36,397 | | | | | | | | | | 6% | | 32,760 | | | | | | | | | | 8.0% | | -10% | | 01.09.00 | | | | | | 0.2 | | 40% |

| Fastlog AG | | | | 15 | | 3,369 | | 25% | | 415,140 | | 90 | | 124 | | 120 | | 28% | | 28% | | 484,140 | | 140 | | 140 | | 140 | | 39% | | 5.1% | | 17% | | 01.07.10 | | 30.06.21 | | | | 1.1 | | 79% |

| | | Ind. | | 7 | | 3,369 | | 97% | | 403,620 | | 90 | | 124 | | 120 | | 28% | | 97% | | 471,660 | | 140 | | 140 | | 140 | | 39% | | 5.0% | | 17% | | 01.07.15 | | 30.06.21 | | | | 1.2 | | 80% |

| | | IP | | 8 | | | | 3% | | 11,520 | | | | | | | | | | 3% | | 12,480 | | | | | | | | | | 8.0% | | 8% | | 01.07.10 | | | | | | 0.2 | | 40% |

| Arrow Central Europe GmbH | | | | 32 | | 998 | | 11% | | 172,272 | | 144 | | 144 | | 144 | | 36% | | 11% | | 188,320 | | 0 | | 150 | | 143 | | 40% | | 7.2% | | 9% | | 01.05.14 | | 30.04.20 | | | | 0.1 | | 73% |

| | | O | | 1 | | 924 | | 77% | | 133,056 | | 144 | | 144 | | 144 | | 36% | | 74% | | 138,600 | | 150 | | 150 | | 150 | | 40% | | 7.0% | | 4% | | 01.05.14 | | 30.04.20 | | | | 0.1 | | 80% |

| | | IP | | 29 | | | | 17% | | 28,560 | | | | | | | | | | 24% | | 45,240 | | | | | | | | | | 8.0% | | 58% | | 01.10.15 | | 30.04.20 | | | | 0.1 | | 40% |

| | | W | | 1 | | 56 | | 5% | | 8,064 | | 144 | | 144 | | 144 | | | | 2% | | 4,480 | | 80 | | 80 | | 80 | | | | 5.0% | | -44% | | 01.05.14 | | 30.04.20 | | | | 0.1 | | 80% |

| | | SUw | | 1 | | 18 | | 2% | | 2,592 | | 144 | | 144 | | 144 | | | | 0% | | 0 | | 0 | | 0 | | 0 | | | | | | -100% | | 01.05.14 | | 30.04.20 | | | | 0.1 | | 80% |

| | | A | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Gondrand International AG | | | | 10 | | 431 | | 6% | | 94,155 | | 165 | | 165 | | 165 | | 50% | | 5% | | 78,690 | | 150 | | 150 | | 150 | | 40% | | 7.2% | | -16% | | 01.06.15 | | 31.05.25 | | 31.05.22 | | 2.2 | | 70% |

| | | O | | 1 | | 431 | | 76% | | 71,115 | | 165 | | 165 | | 165 | | 50% | | 82% | | 64,650 | | 150 | | 150 | | 150 | | 40% | | 7.0% | | -9% | | 01.06.15 | | 31.05.25 | | 31.05.22 | | 2.2 | | 80% |

| | | IP | | 9 | | | | 24% | | 23,040 | | | | | | | | | | 18% | | 14,040 | | | | | | | | | | 8.0% | | -39% | | 01.10.15 | | 31.05.25 | | 31.05.22 | | 2.2 | | 40% |

| Novabau AG | | | | 7 | | 689 | | 5% | | 81,912 | | 112 | | 112 | | 112 | | 14% | | 5% | | 80,470 | | 110 | | 110 | | 110 | | 13% | | 5.0% | | -2% | | 01.12.03 | | 31.05.23 | | 31.05.21 | | 1.3 | | 80% |

| | | Ret | | 1 | | 689 | | 94% | | 77,232 | | 112 | | 112 | | 112 | | 14% | | 94% | | 75,790 | | 110 | | 110 | | 110 | | 13% | | 5.0% | | -2% | | 01.12.03 | | 31.05.23 | | 31.05.21 | | 1.2 | | 80% |

| | | OP | | 6 | | | | 6% | | 4,680 | | | | | | | | | | 6% | | 4,680 | | | | | | | | | | 5.0% | | 0% | | 01.12.03 | | 31.05.23 | | 31.05.21 | | 3.2 | | 80% |

| Polygene AG | | | | 2 | | 525 | | 5% | | 78,804 | | 147 | | 147 | | 147 | | 38% | | 5% | | 80,310 | | 150 | | 150 | | 150 | | 40% | | 7.0% | | 2% | | 01.01.08 | | 31.12.23 | | | | 3.7 | | 79% |

| | | O | | 1 | | 525 | | 98% | | 77,364 | | 147 | | 147 | | 147 | | 38% | | 98% | | 78,750 | | 150 | | 150 | | 150 | | 40% | | 7.0% | | 2% | | 01.01.08 | | 31.12.23 | | | | 3.7 | | 80% |

| | | IP | | 1 | | | | 2% | | 1,440 | | | | | | | | | | 2% | | 1,560 | | | | | | | | | | 8.0% | | 8% | | 01.01.14 | | | | | | 0.2 | | 40% |

| ZS Carpoint AG | | | | 30 | | | | 3% | | 46,800 | | | | | | | | | | 3% | | 46,800 | | | | | | | | | | 8.0% | | 0% | | 01.03.19 | | 28.02.24 | | | | 3.9 | | 71% |

| | | IP | | 30 | | | | 100% | | 46,800 | | | | | | | | | | 100% | | 46,800 | | | | | | | | | | 8.0% | | 0% | | 01.03.19 | | 28.02.24 | | | | 3.9 | | 71% |

| Polymed Medical Center (La… | | | | 2 | | 485 | | 3% | | 43,650 | | 90 | | 90 | | 90 | | | | 2% | | 38,800 | | 80 | | 80 | | 80 | | | | 5.0% | | -11% | | 01.12.15 | | | | | | 0.4 | | 40% |

| 118318 | 101-17096-100 | Rümlang, Riedmattstrasse 9 | Created by Wüest Partner, 26.03.2020, DRAFT – Desktop Valuation as at 1 April 2020 | Page 17 of 31 |

Wüest Dimensions - Business intelligence by Wüest Partner |  |

| Rental property | | Current rent | | Market rent | | Δ | | Current lease agreement |

| Tenant | | UT | | No. | | sqm | | Share | | CHF p.a. | | CHF/sqm | | | | | | Q. | | Share | | CHF p.a. | | CHF/sqm | | | | | | Q. | | Vac. | | Dev. | | Start | | End | | Early break | | End | | Index |

| | | | | | | | | | | | | Min | | Max | | Ø | | | | | | | | Min | | Max | | Ø | | | | | | | | Min | | Max | | earliest termin. | | [a] | | Ø |

| | | W | | 2 | | 485 | | 100% | | 43,650 | | 90 | | 90 | | 90 | | | | 100% | | 38,800 | | 80 | | 80 | | 80 | | | | 5.0% | | -11% | | 01.12.15 | | | | | | 0.4 | | 40% |

| Vale Moto GmbH | | | | 12 | | 280 | | 2% | | 39,660 | | 119 | | 119 | | 119 | | 18% | | 3% | | 45,440 | | 110 | | 110 | | 110 | | 13% | | 5.8% | | 15% | | 01.01.13 | | 31.12.22 | | | | 2.5 | | 74% |

| | | Ret | | 1 | | 280 | | 84% | | 33,360 | | 119 | | 119 | | 119 | | 18% | | 68% | | 30,800 | | 110 | | 110 | | 110 | | 13% | | 5.0% | | -8% | | 01.01.13 | | 31.12.22 | | | | 2.7 | | 80% |

| | | IP | | 8 | | | | 10% | | 4,140 | | | | | | | | | | 27% | | 12,480 | | | | | | | | | | 8.0% | | 201% | | 01.10.15 | | | | | | 0.2 | | 40% |

| | | OP | | 3 | | | | 5% | | 2,160 | | | | | | | | | | 5% | | 2,160 | | | | | | | | | | 5.0% | | 0% | | 01.01.13 | | 31.12.22 | | | | 2.7 | | 40% |

| Theodor Riccardo AG | | | | 8 | | 258 | | 2% | | 29,046 | | 27 | | 130 | | 98 | | 31% | | 2% | | 29,160 | | 80 | | 140 | | 101 | | 39% | | 5.3% | | 0% | | 01.01.12 | | 31.03.23 | | | | 0.6 | | 45% |

| | | W | | 5 | | 168 | | 48% | | 13,866 | | 27 | | 130 | | 83 | | | | 46% | | 13,440 | | 80 | | 80 | | 80 | | | | 5.0% | | -3% | | 01.01.15 | | 31.03.23 | | | | 1.0 | | 51% |

| | | Ind. | | 1 | | 90 | | 39% | | 11,340 | | 126 | | 126 | | 126 | | 31% | | 43% | | 12,600 | | 140 | | 140 | | 140 | | 39% | | 5.0% | | 11% | | 01.01.15 | | 30.06.20 | | | | 0.2 | | 40% |

| | | IP | | 2 | | | | 13% | | 3,840 | | | | | | | | | | 11% | | 3,120 | | | | | | | | | | 8.0% | | -19% | | 01.01.12 | | 30.06.20 | | | | 0.2 | | 40% |

| Resin Floor GmbH | | | | 3 | | 165 | | 2% | | 26,820 | | 151 | | 151 | | 151 | | 40% | | 1% | | 23,370 | | 130 | | 130 | | 130 | | 27% | | 6.8% | | -13% | | 01.02.18 | | 31.01.23 | | | | 3.2 | | 77% |

| | | O | | 1 | | 165 | | 93% | | 24,900 | | 151 | | 151 | | 151 | | 40% | | 92% | | 21,450 | | 130 | | 130 | | 130 | | 27% | | 7.0% | | -14% | | 01.02.18 | | 31.01.23 | | | | 2.8 | | 80% |

| | | OP | | 2 | | | | 7% | | 1,920 | | | | | | | | | | 8% | | 1,920 | | | | | | | | | | 5.0% | | 0% | | 01.02.18 | | 31.01.23 | | | | 7.8 | | 40% |

| Fehr Real Estate GmbH | | | | 6 | | 77 | | 1% | | 22,780 | | 140 | | 140 | | 140 | | 33% | | 1% | | 19,350 | | 150 | | 150 | | 150 | | 40% | | 7.4% | | -15% | | 01.04.20 | | 31.03.25 | | 30.09.21 | | 5.0 | | 100% |

| | | IP | | 5 | | | | 53% | | 12,000 | | | | | | | | | | 40% | | 7,800 | | | | | | | | | | 8.0% | | -35% | | 01.04.20 | | 31.03.25 | | 30.09.21 | | 5.0 | | 100% |

| | | O | | 1 | | 77 | | 47% | | 10,780 | | 140 | | 140 | | 140 | | 33% | | 60% | | 11,550 | | 150 | | 150 | | 150 | | 40% | | 7.0% | | 7% | | 01.04.20 | | 31.03.25 | | 30.09.21 | | 5.0 | | 100% |

| S&C Sportcars Rümlang | | | | 6 | | 71 | | 1% | | 21,940 | | 140 | | 140 | | 140 | | 33% | | 1% | | 18,450 | | 150 | | 150 | | 150 | | 40% | | 7.4% | | -16% | | 01.12.19 | | 30.11.24 | | 31.05.21 | | 2.7 | | 58% |

| | | IP | | 5 | | | | 55% | | 12,000 | | | | | | | | | | 42% | | 7,800 | | | | | | | | | | 8.0% | | -35% | | 01.12.19 | | 30.11.24 | | 31.05.21 | | 1.2 | | 40% |

| | | O | | 1 | | 71 | | 45% | | 9,940 | | 140 | | 140 | | 140 | | 33% | | 58% | | 10,650 | | 150 | | 150 | | 150 | | 40% | | 7.0% | | 7% | | 01.12.19 | | 30.11.24 | | 31.05.21 | | 4.7 | | 80% |

| Wenger Krenar | | | | 1 | | 62 | | 1% | | 8,680 | | 140 | | 140 | | 140 | | 33% | | 1% | | 9,300 | | 150 | | 150 | | 150 | | 40% | | 7.0% | | 7% | | 01.09.19 | | | | | | 0.2 | | 40% |

| | | O | | 1 | | 62 | | 100% | | 8,680 | | 140 | | 140 | | 140 | | 33% | | 100% | | 9,300 | | 150 | | 150 | | 150 | | 40% | | 7.0% | | 7% | | 01.09.19 | | | | | | 0.2 | | 40% |

| CesaroSana GmbH | | | | 2 | | 36 | | 0% | | 7,920 | | 140 | | 140 | | 140 | | 33% | | 0% | | 6,960 | | 150 | | 150 | | 150 | | 40% | | 7.2% | | -12% | | 01.01.20 | | 31.01.25 | | 31.01.22 | | 3.7 | | 65% |

| | | O | | 1 | | 36 | | 64% | | 5,040 | | 140 | | 140 | | 140 | | 33% | | 78% | | 5,400 | | 150 | | 150 | | 150 | | 40% | | 7.0% | | 7% | | 01.01.20 | | 31.01.25 | | 31.01.22 | | 4.8 | | 80% |

| | | IP | | 1 | | | | 36% | | 2,880 | | | | | | | | | | 22% | | 1,560 | | | | | | | | | | 8.0% | | -46% | | 01.01.20 | | 31.01.25 | | 31.01.22 | | 1.8 | | 40% |

| Implenia Bau AG | | | | 2 | | | | 0% | | 4,440 | | | | | | | | | | 0% | | 3,120 | | | | | | | | | | 8.0% | | -30% | | 01.11.05 | | | | | | 0.2 | | 40% |

| | | IP | | 2 | | | | 100% | | 4,440 | | | | | | | | | | 100% | | 3,120 | | | | | | | | | | 8.0% | | -30% | | 01.11.05 | | | | | | 0.2 | | 40% |

| Butti Mario | | | | 1 | | 82 | | 0% | | 3,840 | | 47 | | 47 | | 47 | | | | 0% | | 6,560 | | 80 | | 80 | | 80 | | | | 5.0% | | 71% | | 01.04.18 | | | | | | 0.2 | | 40% |

| | | W | | 1 | | 82 | | 100% | | 3,840 | | 47 | | 47 | | 47 | | | | 100% | | 6,560 | | 80 | | 80 | | 80 | | | | 5.0% | | 71% | | 01.04.18 | | | | | | 0.2 | | 40% |

| Clear Channel Schweiz AG | | | | 1 | | | | 0% | | 3,500 | | | | | | | | | | 0% | | 3,500 | | | | | | | | | | 5.0% | | 0% | | 01.12.00 | | 30.11.20 | | | | 0.7 | | 80% |

| | | SUwo A | | 1 | | | | 100% | | 3,500 | | | | | | | | | | 100% | | 3,500 | | | | | | | | | | 5.0% | | 0% | | 01.12.00 | | 30.11.20 | | | | 0.7 | | 80% |