As filed with the Securities and Exchange Commission on September 1, 2023

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

LKQ CORPORATION*

(Exact Name of Registrant as Specified in its Charter)

| | | | | | | | | | | | | | |

| | | | |

| Delaware | | 5010 | | 36-4215970 |

(State or other jurisdiction of incorporation or organization) | | (Primary Standard Industrial Classification Code Number) | | (I.R.S. Employer Identification Number) |

500 West Madison Street, Suite 2800

Chicago, IL 60661

(312) 621-1950

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Matthew J. McKay

Senior Vice President, General Counsel and Corporate Secretary

LKQ Corporation

500 West Madison Street, Suite 2800

Chicago, Illinois 60661

(312) 621-1950

(Name, address, including zip code, and telephone number, including area code, of agent for service)

with copies to:

Kenneth A. Peterson, Jr., Esq.

Carrie C. McNally, Esq.

Jason R. Schendel, Esq.

Sheppard, Mullin, Richter & Hampton LLP

321 North Clark Street, 32nd Floor

Chicago, Illinois 60602

(312) 499-6300

| | | | | |

| * | The additional registrants listed on Schedule A on the next page are also included in this Form S-4 Registration Statement as additional registrants. |

Approximate date of commencement of proposed sale of the securities to the public: As soon as practicable after this registration statement becomes effective. If the securities being registered on this Form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box: ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| Large accelerated filer | | ☒ | | Accelerated filer | | ☐ |

| | | |

| Non-accelerated filer | | ☐ | | Smaller reporting company | | ☐ |

| | | |

| | | | Emerging growth company | | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

If applicable, place an X in the box to designate the appropriate rule provision relied upon in conducting this transaction:

| | | | | | |

| Exchange Act Rule 13e-4(i) (Cross Border Issuer Tender Offer) | ☐ |

| | | | | | |

| Exchange Act Rule 14d-1(d) (Cross Border Third-Party Tender Offer) | ☐ |

The registrants hereby amend this registration statement on such date or dates as may be necessary to delay its effective date until the registrants shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

SCHEDULE A

TABLE OF ADDITIONAL REGISTRANTS

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| Exact Name of Additional Registrant (1) | | State or Other Jurisdiction of Incorporation or

Organization | | Primary Standard Industrial

Classification Code Number | | I.R.S. Employer Identification No. |

| A&A Auto Parts Stores, Inc. | | Pennsylvania | | 5010 | | 23-3001870 |

| American Recycling International, Inc. | | California | | 5010 | | 95-3072886 |

| Assured Quality Testing Services, LLC | | Delaware | | 5010 | | 83-3543723 |

| Automotive Calibration & Technology Services, LLC | | Delaware | | 5010 | | N/A |

| DriverFx.com, Inc. | | Delaware | | 5010 | | 52-2204596 |

| Global Powertrain Systems, LLC | | Delaware | | 5010 | | 45-4796772 |

| KAIR IL, LLC | | Illinois | | 5010 | | 27-2172437 |

| KAO Logistics, Inc. | | Pennsylvania | | 5010 | | 46-1628386 |

| KAO Warehouse, Inc. | | Delaware | | 5010 | | 46-1799101 |

| Keystone Automotive Industries, Inc. | | California | | 5010 | | 95-2920557 |

| Keystone Automotive Operations, Inc. | | Pennsylvania | | 5010 | | 23-2950980 |

| Keystone Automotive Operations of Canada, Inc. | | Delaware | | 5010 | | 86-9884627 |

| KPGW Canadian Holdco, LLC | | Delaware | | 5010 | | 26-3412558 |

| LKQ Auto Parts of Central California, Inc. | | California | | 5010 | | 95-2907390 |

| LKQ Best Automotive Corp. | | Delaware | | 5010 | | 01-0550489 |

| LKQ Central, Inc. | | Delaware | | 5010 | | 48-1140432 |

| LKQ Foster Auto Parts, Inc. | | Oregon | | 5010 | | 93-0510648 |

| LKQ Investments, Inc. | | Delaware | | 5010 | | 82-1373924 |

| LKQ Lakenor Auto & Truck Salvage, Inc. | | California | | 5010 | | 36-4261867 |

| LKQ Midwest, Inc. | | Delaware | | 5010 | | 31-1692164 |

| LKQ Northeast, Inc. | | Delaware | | 5010 | | 32-0025173 |

| LKQ Pick Your Part Central, LLC | | Delaware | | 5010 | | 20-8081775 |

| LKQ Pick Your Part Midwest, LLC | | Delaware | | 5010 | | 31-1692164 |

| LKQ Pick Your Part Southeast, LLC | | Delaware | | 5010 | | 47-0916179 |

| LKQ Southeast, Inc. | | Delaware | | 5010 | | 59-2238605 |

| LKQ Taiwan Holding Company | | Illinois | | 5010 | | 80-0565845 |

| LKQ Trading Company | | Delaware | | 5010 | | 27-1915301 |

| North American ATK Corporation | | California | | 5010 | | 95-3719642 |

| Pick-Your-Part Auto Wrecking | | California | | 5010 | | 95-3406551 |

| Potomac German Auto, Inc. | | Maryland | | 5010 | | 52-1637030 |

| Redding Auto Center, Inc. | | California | | 5010 | | 36-4261871 |

| Warn Industries, Inc. | | Delaware | | 5010 | | 93-1292050 |

| | | | | |

| (1) | The address for the principal executive offices of each of the additional registrants is 500 West Madison Street, Suite 2800, Chicago, IL 60661, and the telephone number for each of the additional registrants is (312) 621-1950. |

The information in this prospectus is not complete and may be changed. We may not issue the exchange notes in the exchange offer until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state or jurisdiction where such offer or sale is not permitted.

Subject to Completion, dated September 1, 2023

PROSPECTUS

LKQ Corporation

Offers to Exchange the Registered Notes Set Forth Below that

Have Been Registered Under the Securities Act of 1933, as

Amended, for Any and All Outstanding

Restricted Notes Set Forth Opposite the Corresponding

Registered Notes

| | | | | | | | |

| | |

| Registered/Exchange Notes | | Restricted/Original Notes |

| $800,000,000 5.750% Senior Notes due 2028 | | $800,000,000 5.750% Senior Notes due 2028 |

| $600,000,000 6.250% Senior Notes due 2033 | | $600,000,000 6.250% Senior Notes due 2033 |

We are offering, upon the terms and subject to the conditions set forth in this prospectus and the accompanying letter of transmittal, to exchange up to $800.0 million aggregate principal amount of registered 5.750% Senior Notes due 2028 (the “2028 exchange notes”) for any and all of our $800.0 million aggregate principal amount of unregistered 5.750% Senior Notes due 2028 that were issued in a private placement on May 24, 2023 (the “2028 original notes”). We are also offering, upon the terms and subject to the conditions set forth in this prospectus and the accompanying letter of transmittal, to exchange up to $600.0 million aggregate principal amount of registered 6.250% Senior Notes due 2033 (the “2033 exchange notes” and, together with the 2028 exchange notes, the “exchange notes”) for any and all of our $600.0 million aggregate principal amount of unregistered 6.250% Senior Notes due 2033 that were issued in a private placement on May 24, 2023 (the “2033 original notes” and, together with the 2028 original notes, the “original notes”). Each series of the exchange notes are substantially identical to the original notes of such series, except the exchange notes are registered under the Securities Act of 1933, as amended (the “Securities Act”), and the transfer restrictions and registration rights, and related additional interest provisions, applicable to the original notes will not apply to the exchange notes. Each series of the exchange notes will represent the same debt as the original notes of such series, and we will issue the exchange notes under the same indenture under which the original notes were issued. As with the original notes, the exchange notes are fully and unconditionally guaranteed by the guarantors of the original notes.

We refer to the original notes and the exchange notes collectively in this prospectus as the “notes.” We refer to the exchange offer described in the immediately preceding paragraph as the “exchange offer.”

The 2028 original notes sold pursuant to Rule 144A under the Securities Act bear the CUSIP number 501889 AC3, and the 2028 original notes sold pursuant to Regulation S under the Securities Act bear the CUSIP number U5463T AB8. The 2033 original notes sold pursuant to Rule 144A under the Securities Act bear the CUSIP number 501889 AE9, and the 2033 original notes sold pursuant to Regulation S under the Securities Act bear the CUSIP number U5463T AC6.

Terms of the Exchange Offer

•The exchange offer expires at 5:00 p.m., New York City time, on , 2023, unless we extend it.

•The exchange offer is subject to customary conditions, which we may waive.

•We will exchange all original notes of a series that are validly tendered and not withdrawn prior to the expiration of the exchange offer for an equal principal amount of exchange notes of such series.

•You may withdraw your tender of original notes at any time prior to the expiration of the exchange offer.

•If you fail to tender your original notes, you will continue to hold unregistered, restricted securities, and it may be difficult to transfer them.

•We believe that the exchange of original notes for exchange notes will not be a taxable transaction for U.S. federal income tax purposes, but you should see the discussion under the caption “Certain Material United States Federal Income Tax Considerations” for more information.

•We will not receive any proceeds from the exchange offer.

The exchange offer involves risks. See “Risk Factors” beginning on page 10 for a discussion of certain factors that you should consider before deciding to tender the original notes in the exchange offer as well as the risk factors and other information contained herein or in the documents incorporated by reference in this prospectus.

Each broker-dealer that receives the exchange notes for its own account pursuant to this exchange offer must acknowledge by way of the letter of transmittal that it will deliver a prospectus in connection with any resale of the exchange notes. The letter of transmittal states that by so acknowledging and by delivering a prospectus, such broker-dealer will not be deemed to admit that it is an “underwriter” within the meaning of the Securities Act. This prospectus, as it may be amended or supplemented from time to time, may be used by a broker-dealer in connection with resales of the exchange notes received in exchange for original notes where such original notes were acquired by such broker-dealer as a result of market-making activities or other trading activities. We have agreed that, for a period of 180 days after the expiration date of the exchange offer, we will make this prospectus available to any broker-dealer for use in connection with any such resale. See “Plan of Distribution.”

There is no established trading market for the original notes or the exchange notes. We do not intend to list the exchange notes on any securities exchange or seek approval for quotation through any automated trading system and, therefore, no active public market is anticipated.

Neither LKQ Corporation nor any of its affiliates makes any recommendation as to whether or not holders of original notes should exchange their series of original notes for the corresponding series of exchange notes in response to the exchange offer.

Neither the Securities and Exchange Commission (“SEC”) nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2023.

TABLE OF CONTENTS

THIS PROSPECTUS INCORPORATES BUSINESS AND FINANCIAL INFORMATION ABOUT US THAT IS NOT INCLUDED IN OR DELIVERED WITH THIS PROSPECTUS. WE ARE RESPONSIBLE ONLY FOR THE INFORMATION CONTAINED IN OR INCORPORATED BY REFERENCE INTO THIS PROSPECTUS. WE HAVE NOT AUTHORIZED ANYONE TO PROVIDE ANY INFORMATION OR MAKE ANY REPRESENTATIONS OTHER THAN THE INFORMATION AND REPRESENTATIONS CONTAINED IN OR INCORPORATED BY REFERENCE INTO THIS PROSPECTUS. IF ANYONE PROVIDES YOU WITH DIFFERENT OR INCONSISTENT INFORMATION, WE TAKE NO RESPONSIBILITY FOR ANY SUCH INFORMATION. THIS PROSPECTUS MAY BE USED ONLY FOR THE PURPOSE FOR WHICH IT HAS BEEN PREPARED. YOU SHOULD NOT ASSUME THAT THE INFORMATION CONTAINED IN OR INCORPORATED BY REFERENCE INTO THIS PROSPECTUS IS ACCURATE AS OF ANY DATE OTHER THAN THE DATE OF THE APPLICABLE DOCUMENT. OUR BUSINESS, FINANCIAL CONDITION, RESULTS OF OPERATIONS AND PROSPECTS MAY HAVE CHANGED SINCE THAT DATE.

WE ARE NOT MAKING THIS EXCHANGE OFFER TO, NOR WILL WE ACCEPT SURRENDERS FOR EXCHANGE FROM, HOLDERS OF ORIGINAL NOTES IN ANY JURISDICTION IN WHICH THE EXCHANGE OFFER WOULD VIOLATE SECURITIES OR BLUE SKY LAWS OR WHERE IT IS OTHERWISE UNLAWFUL.

You can obtain documents incorporated by reference in this prospectus, other than some exhibits to those documents, by requesting them in writing or by telephone from us at the following:

LKQ Corporation

Attention: Corporate Secretary

500 West Madison Street, Suite 2800

Chicago, IL 60661

(312) 621-1950

You will not be charged for any of the documents that you request.

In order to ensure timely delivery of the requested documents, requests should be made no later than , 2023, which is five business days before the date this exchange offer expires. In the event that we extend the exchange offer, we urge you to submit your request at least five business days before the expiration date, as extended.

No person should construe anything in this prospectus as legal, business or tax advice. Each person should consult its own advisors as needed to make its investment decision and to determine whether it is legally permitted to participate in the exchange offer under applicable legal investment or similar laws or regulations.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

Statements and information contained in or incorporated by reference into this prospectus that are not historical are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and are made pursuant to the “safe harbor” provisions of such Act. Forward-looking statements include, but are not limited to, statements regarding our outlook, guidance, expectations, beliefs, hopes, intentions and strategies. Words such as “may,” “will,” “plan,” “should,” “expect,” “anticipate,” “believe,” “if,” “estimate,” “intend,” “project” and similar words or expressions are used to identify these forward-looking statements. These statements are subject to a number of risks, uncertainties, assumptions and other factors that may cause our actual results, performance or achievements to be materially different from those anticipated or implied in the forward-looking statements. All forward-looking statements are based on information available to us at the time the statements are made. We undertake no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

You should not place undue reliance on our forward-looking statements. Actual events or results may differ materially from those expressed or implied in the forward-looking statements. The risks, uncertainties, assumptions and other factors that could cause actual results to differ from the results predicted or implied by our forward-looking statements include those identified in this prospectus and in our Annual Report on Form 10-K for the year ended December 31, 2022, as may be amended or supplemented in other documents we file with the SEC from time to time, which are incorporated by reference herein (including under the sections hereof and thereof entitled “Risk

Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations”). These factors include the following (not necessarily in order of importance):

• our operating results and financial condition have been and will likely continue to be adversely affected by the COVID-19 pandemic and could be adversely affected by other public health emergencies;

• our operating results and financial condition have been and could continue to be adversely affected by the economic, political and social conditions in North America, Europe, Taiwan and elsewhere, as well as the economic health of vehicle owners and numbers and types of vehicles sold;

• we face competition from local, national, international, and internet-based vehicle products providers, and this competition could negatively affect our business;

• we rely upon our customers and insurance companies to promote the usage of alternative parts;

• intellectual property claims relating to aftermarket products could adversely affect our business;

• if the number of vehicles involved in accidents or being repaired declines, or the mix of the types of vehicles in the overall vehicle population changes, our business could suffer;

• fluctuations in the prices of metals and other commodities could adversely affect our financial results;

• an adverse change in our relationships with our suppliers, disruption to our supply of inventory, or the misconduct, performance failures or negligence of our third party vendors or service providers could increase our expenses, impede our ability to serve our customers, and/or expose us to liability;

• if we determine that our goodwill or other intangible assets have become impaired, we may incur significant charges to our pre-tax income;

• we could be subject to product liability claims and involved in product recalls;

• we may not be able to successfully acquire new businesses or integrate acquisitions, including our acquisition of Uni-Select (as defined herein) (the "Uni-Select Acquisition"), and we may not be able to successfully divest certain businesses (including Uni-Select's GSF Car Parts segment) on acceptable terms or at all;

• we have a substantial amount of indebtedness, which could have a material adverse effect on our financial condition and our ability to obtain financing in the future and to react to changes in our business;

• the Euro Notes (2024) (as defined herein), the Euro Notes (2028) (as defined herein), and the exchange notes offered hereby do not impose any limitations on our ability to incur additional debt or protect against certain other types of transactions, and we may incur additional indebtedness under our Senior Unsecured Credit Agreement (as defined herein) subject to certain limitations;

• our Senior Unsecured Credit Agreement imposes operating and financial restrictions on us and our subsidiaries, which may prevent us from capitalizing on business opportunities;

• we may not be able to generate sufficient cash to service all of our indebtedness, and may be forced to take other actions to satisfy our obligations under our indebtedness, which may not be successful;

• our future capital needs may require that we seek to refinance our debt or obtain additional debt or equity financing, events that could have a negative effect on our business;

• our variable rate indebtedness subjects us to interest rate risk, which could cause our indebtedness service obligations to increase significantly;

• repayment of our indebtedness is dependent on cash flow generated by our subsidiaries;

• a downgrade in our credit rating would impact our cost of capital;

• the amount and frequency of our share repurchases and dividend payments may fluctuate;

• existing or new laws and regulations, or changes to enforcement or interpretation of existing laws or regulations, may prohibit, restrict or burden the sale of aftermarket, recycled, refurbished or remanufactured products;

• we are subject to environmental regulations and incur costs relating to environmental matters;

• we may be adversely affected by legal, regulatory or market responses to global climate change;

• our Amended and Restated Bylaws provide that the courts in the State of Delaware are the exclusive forums for substantially all disputes between us and our stockholders, which could limit our stockholders’ ability to obtain a favorable judicial forum for disputes with us or our directors, officers or employees and may increase costs to our stockholders;

• our effective tax rate could materially increase as a consequence of various factors, including U.S. and/or international tax legislation, applicable interpretations and administrative guidance, our mix of earnings by jurisdiction, and U.S. and foreign jurisdictional audits;

• if significant tariffs or other restrictions are placed on products or materials we import or any related counter-measures are taken by countries to which we export products, our revenue and results of operations may be materially harmed;

• governmental agencies may refuse to grant or renew our operating licenses and permits;

• our employees are important to successfully manage our business and achieve our objectives and the loss of our key employees could impede the achievement of our business objectives;

• we operate in foreign jurisdictions which exposes us to foreign exchange and other risks;

• our business may be adversely affected by union activities and labor and employment laws;

• we rely on information technology and communication systems in critical areas of our operations and a disruption relating to such technology could harm our business;

• the costs of complying with the requirements of laws pertaining to the privacy and security of personal information and the potential liability associated with the failure to comply with such laws could materially adversely affect our business and results of operations;

• business interruptions in our distribution centers or other facilities may affect our operations, the function of our computer systems, and/or the availability and distribution of merchandise, which may affect our business;

• if we experience problems with our fleet of trucks and other vehicles, our business could be harmed;

• we may lose the right to operate at key locations which may materially adversely affect our business and results of operations;

• activist investors could cause us to incur substantial costs, divert management’s attention, and have an adverse effect on our business;

• inaccuracies in the data relating to our industry published by independent sources upon which we rely may cause our management to make decisions which have detrimental impacts on our business;

• currency fluctuations in the U.S. dollar, Canadian dollar, pound sterling and Euro versus other currencies may adversely affect our results of operations;

• volatility in the banking industry and any reaction to such volatility that may cause a change in how we conduct our operations;

• our ability to repurchase the exchange notes in the event of a change of control as required by the indenture; and

• other factors described in this prospectus and in the documents which are incorporated herein by reference.

It is not possible for us to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. In light of these risks, uncertainties and assumptions, the forward-looking events and circumstances discussed in this prospectus may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements.

You should not rely upon forward-looking statements as predictions of future events. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee that the future results, levels of activity, performance or events and circumstances reflected in the forward-looking statements will be achieved or occur.

You should read this prospectus, the documents incorporated by reference into this prospectus, and the documents we have filed with the SEC as exhibits to the registration statement of which this prospectus is a part with the understanding that our actual future results, levels of activity, performance and events and circumstances may be materially different from what we expect.

CURRENCY PRESENTATION

In this prospectus, all references to “U.S. dollars” and “$” are to the lawful currency of the United States, all references to “Canadian dollars” and “CAD” are to the lawful currency of Canada and all references to “Euro,” “EUR” or “€” are to the currency of the member states of the European Monetary Union that have adopted or that adopt the single currency in accordance with the treaty establishing the European Community, as amended by the Treaty on European Union. The exchange rate for Canadian dollars, as reported by Bloomberg, L.P., was approximately CAD 1.32 per $1.00 as of June 30, 2023. The exchange rate for Euros, as reported by Bloomberg, L.P., was approximately EUR 0.92 per $1.00 as of June 30, 2023. We make no representation that the Canadian dollar or Euro amount referred to above could have been or could, in the future, be converted into U.S. dollars at any particular rate, if at all.

TRADEMARKS, SERVICE MARKS AND COPYRIGHTS

We own or have rights to trademarks, service marks or trade names that we use in connection with the operation of our business. We also own or have the rights to copyrights that protect the content of our products. Solely for convenience, the trademarks, service marks, tradenames and copyrights referred to in this prospectus are listed without the ©, ® and TM symbols, but we will assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensors to these trademarks, service marks and tradenames.

SUMMARY

This summary highlights significant aspects of our business and the exchange offer, but it is not complete and may not contain all of the information that may be important to you. You should read this entire prospectus and the documents incorporated by reference herein carefully, including our historical financial statements and the related notes thereto, and especially the information presented under the headings “Risk Factors” and “Cautionary Statement Regarding Forward-Looking Statements.”

In this prospectus, unless otherwise indicated or the context otherwise requires, references to the terms “we,” “us,” “our,” “LKQ,” and the “Company” refer to LKQ Corporation and its subsidiaries and joint ventures.

Our Company

We are a global distributor of vehicle products, including replacement parts, components and systems used in the repair and maintenance of vehicles, and specialty vehicle aftermarket products and accessories to improve the performance, functionality and appearance of vehicles.

Buyers of vehicle replacement products have the option to purchase from primarily five sources: new products produced by original equipment manufacturers (“OEMs”); new products produced by companies other than the OEMs, which are referred to as aftermarket products; recycled products obtained from salvage and total loss vehicles; recycled products that have been refurbished; and recycled products that have been remanufactured. We distribute a variety of products to collision and mechanical repair shops, including aftermarket collision and mechanical products; recycled collision and mechanical products; refurbished collision products such as wheels, bumper covers and lights; and remanufactured engines and transmissions. Collectively, we refer to the four sources that are not new OEM products as alternative parts.

We are a leading provider of alternative vehicle collision replacement products and alternative vehicle mechanical replacement products, with our sales, processing, and distribution facilities reaching most major markets in the United States and Canada. We are also a leading provider of alternative vehicle replacement and maintenance products in Germany, the United Kingdom, the Benelux region (Belgium, Netherlands, and Luxembourg), Italy, Czech Republic, Austria, Slovakia, Poland, and various other European countries. In addition to our wholesale operations, we operate self service retail facilities across the United States that sell recycled automotive products from end-of-life vehicles. We are also a leading distributor of specialty vehicle aftermarket equipment and accessories reaching most major markets in the United States and Canada.

Recent Developments

On August 1, 2023, we completed the previously announced acquisition of Uni-Select Inc., a corporation existing under the Business Corporations Act (Québec) (“Uni-Select”), pursuant to the Arrangement Agreement, dated as of February 26, 2023 (the “Uni-Select Agreement”), by and among LKQ, 9485-4692 Québec Inc., a corporation existing under the Business Corporations Act (Québec) and a wholly owned subsidiary of LKQ (the “Purchaser”), and Uni-Select. Pursuant to the terms and conditions of the Uni-Select Agreement, Purchaser acquired all of the issued and outstanding common shares of Uni-Select for CAD $48.00 per share in cash.

Corporate Information

LKQ Corporation was incorporated in Delaware in 1998. Our principal executive offices are located at 500 West Madison Street, Suite 2800, Chicago, Illinois 60661, and our telephone number at that address is (312) 621-1950.

Corporate Structure and Financing Arrangements

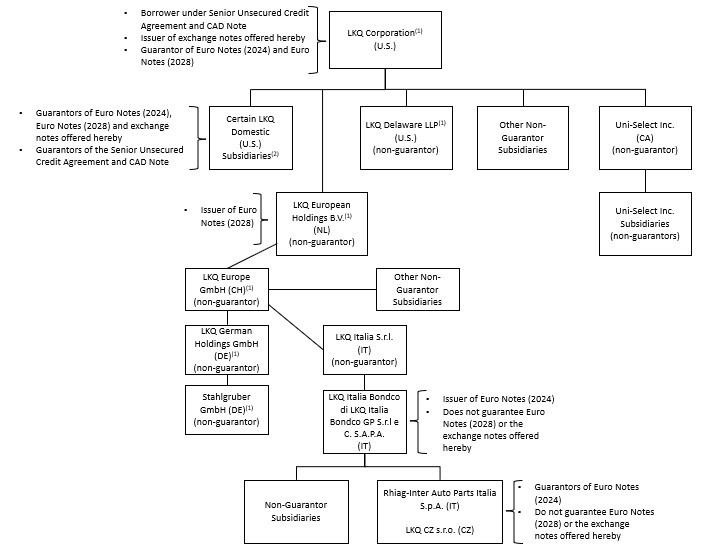

The following diagram summarizes our corporate structure and principal outstanding financing arrangements, after giving effect to the consummation of the Uni-Select Acquisition. The diagram does not include all of our subsidiaries, nor all the debt obligations thereof. For a summary of the debt obligations identified in this diagram, please refer to the sections of this prospectus entitled “Description of Certain Indebtedness,” “Description of the Exchange Notes” and “Capitalization” for further information. See also the section of this prospectus entitled “Supplemental Guarantor Financial Information.”

(1) Borrowers under the Senior Unsecured Credit Agreement consist of LKQ Corporation (U.S.), LKQ Delaware LLP (U.S.), Euro Car Parts Limited (GB), LKQ North-West Europe B.V. (f/k/a LKQ Netherlands B.V.) (NL), LKQ European Holdings B.V. (NL), LKQ German Holdings GmbH (DE), Stahlgruber GmbH (DE), Atracco Group AB (SE), Elit Group GmbH (CH), and LKQ Europe GmbH (CH). Other than LKQ Corporation, none of these borrowers will guarantee or otherwise be an obligor of the exchange notes offered hereby.

(2) Certain other direct and indirect domestic (U.S.) subsidiaries of LKQ Corporation are anticipated to become guarantors of the Senior Unsecured Credit Agreement, the CAD Note, the original notes, and the exchange notes offered hereby in the first calendar quarter of 2024.

Note: CA means Canada. CH means Switzerland. CZ means the Czech Republic. DE means Germany. GB means England and Wales. IT means Italy. NL means The Netherlands. SE means Sweden.

SUMMARY HISTORICAL CONSOLIDATED FINANCIAL INFORMATION

The summary historical consolidated financial information set forth below is not necessarily indicative of our future results of operations or financial condition. The following summary historical consolidated statements of income and statements of cash flows data for the years ended December 31, 2022, 2021 and 2020, and the summary historical consolidated balance sheet data as of December 31, 2022 and 2021, are derived from our audited consolidated financial statements included in our Annual Report on Form 10-K for the year ended December 31, 2022, which is incorporated by reference herein. The following summary historical consolidated statements of income and statements of cash flows data for the six months ended June 30, 2023 and 2022, and the summary historical consolidated balance sheet data as of June 30, 2023, are derived from our unaudited interim consolidated financial statements included in our Quarterly Report on Form 10-Q for the six months ended June 30, 2023, which is incorporated by reference herein. You should read this summary historical consolidated financial data together with the section entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our Annual Report on Form 10-K for the year ended December 31, 2022 and our Quarterly Report on Form 10-Q for the six months ended June 30, 2023, and our audited and unaudited consolidated financial statements

Consolidated Statement of Income Data

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | |

| Six months ended June 30, | | Year ended December 31, |

| 2023 | | 2022 | | 2022 | | 2021 | | 2020 |

| (unaudited) | | | | | | |

| (in millions) |

| Revenue | $ | 6,797 | | | $ | 6,689 | | | $ | 12,794 | | | $ | 13,089 | | | $ | 11,629 | |

| Cost of goods sold | 4,011 | | | 3,965 | | | 7,571 | | | 7,767 | | | 7,036 | |

| Gross margin | 2,786 | | | 2,724 | | | 5,223 | | | 5,322 | | | 4,593 | |

| Selling, general and administrative expenses | 1,869 | | | 1,822 | | | 3,544 | | | 3,568 | | | 3,266 | |

| Restructuring and transaction related expenses | 26 | | | 7 | | | 20 | | | 20 | | | 66 | |

| (Gain) on disposal of businesses and impairment of net assets held for sale | — | | | (155) | | | (159) | | | — | | | 3 | |

| Depreciation and amortization | 119 | | | 120 | | | 237 | | | 260 | | | 272 | |

| Operating income | 772 | | | 930 | | | 1,581 | | | 1,474 | | | 986 | |

| Total other expense, net | 22 | | | 31 | | | 63 | | | 75 | | | 101 | |

| Income from continuing operations before provision for income taxes | 750 | | | 899 | | | 1,518 | | | 1,399 | | | 885 | |

| Provision for income taxes | 203 | | | 216 | | | 385 | | | 331 | | | 250 | |

| Equity in earnings of unconsolidated subsidiaries | 5 | | | 6 | | | 11 | | | 23 | | | 5 | |

| Income from continuing operations | 552 | | | 689 | | | 1,144 | | | 1,091 | | | 640 | |

| Net income from discontinued operations | — | | | 4 | | | 6 | | | 1 | | | — | |

| Net income | 552 | | | 693 | | | 1,150 | | | 1,092 | | | 640 | |

| Less: net income attributable to continuing noncontrolling interest | 1 | | | — | | | 1 | | | 1 | | | 2 | |

| Net income attributable to LKQ stockholders | $ | 551 | | | $ | 693 | | | $ | 1,149 | | | $ | 1,091 | | | $ | 638 | |

Consolidated Balance Sheet Data

| | | | | | | | | | | | | | | | | |

| As of June 30, | | As of December 31, |

| 2023 | | 2022 | | 2021 |

| (unaudited) | | | | |

| (in millions) |

| Cash and cash equivalents | $ | 1,904 | | | $ | 278 | | | $ | 274 | |

| Current assets | 6,156 | | | 4,258 | | | 4,254 | |

| Total assets | 14,155 | | | 12,038 | | | 12,606 | |

| Current liabilities | 3,028 | | | 2,271 | | | 2,165 | |

| Long-term operating lease liabilities, excluding current portion | 1,131 | | | 1,091 | | | 1,209 | |

| Long-term obligations, excluding current portion | 3,421 | | | 2,622 | | | 2,777 | |

| Total stockholders' equity | 5,968 | | | 5,467 | | | 5,787 | |

| Total liabilities and stockholders' equity | 14,155 | | | 12,038 | | | 12,606 | |

Consolidated Statement of Cash Flows Data

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Six months ended June 30, | | Year ended December 31, |

| 2023 | | 2022 | | 2022 | | 2021 | | 2020 |

| (unaudited) | | | | | | |

| (in millions) |

| Net cash provided by operating activities | $ | 703 | | | $ | 737 | | | $ | 1,250 | | | $ | 1,367 | | | $ | 1,444 | |

| Net cash (used in) provided by investing activities | (185) | | | 265 | | | 172 | | | (419) | | | (166) | |

Net cash provided by (used in) financing activities(1) | 1,099 | | | (985) | | | (1,394) | | | (985) | | | (1,513) | |

| Depreciation and amortization | 135 | | | 133 | | | 264 | | | 284 | | | 299 | |

| Purchases of property, plant and equipment | (136) | | | (99) | | | (222) | | | (293) | | | (173) | |

(1) Includes proceeds (net of unamortized bond discount) of $1,394 million from the issuance of the original notes for the six months ended June 30, 2023. Includes dividends paid to LKQ stockholders of $148 million and $142 million for the six months ended June 30, 2023 and June 30, 2022, respectively. Includes purchase of treasury stock of $8 million and $528 million for the six months ended June 30, 2023 and June 30, 2022, respectively. Includes dividends paid to LKQ stockholders of $284 million, $73 million, and nil for the years ended December 31, 2022, 2021 and 2020, respectively. Includes purchase of treasury stock of $1,040 million, $877 million, and $117 million for the years ended December 31, 2022, 2021 and 2020, respectively.

The Exchange Offer

The following summary contains basic information about the exchange offer and the exchange notes. This summary is not intended to be complete. You should read the full text and more specific details contained elsewhere in this prospectus. For a more detailed description of the exchange notes, see “Description of the Exchange Notes.” With respect to the discussion of the terms of the exchange notes on the cover page, in this summary of the exchange offer and under the caption “Description of the Exchange Notes,” the terms “LKQ,” “we,” “us,” “our,” or the “Company” refer only to LKQ Corporation, and not to any of its subsidiaries.

On May 24, 2023, we issued the 2028 original notes and the 2033 original notes in a private offering to BofA Securities, Inc., Wells Fargo Securities, LLC, Capital One Securities, Inc., MUFG Securities Americas Inc., PNC Capital Markets LLC, Truist Securities, Inc., HSBC Securities (USA) Inc., UniCredit Capital Markets LLC, BNP Paribas Securities Corp., and U.S. Bancorp Investments, Inc., whom we refer to as the “initial purchasers,” in reliance on exemptions from, or in transactions not subject to, the registration requirements of the Securities Act and applicable state securities laws. We entered into a registration rights agreement with the initial purchasers in the private offering in which we agreed, among other things, to file the registration statement of which this prospectus forms a part and to complete an exchange offer for the original notes. The following is a summary of the exchange offer.

| | | | | |

| 2028 Original Notes | $800.0 million of our 5.750% Senior Notes due 2028, which we refer to as the “2028 original notes.” |

| 2033 Original Notes | $600.0 million of our 6.250% Senior Notes due 2033, which we refer to as the “2033 original notes.” We refer to the 2028 original notes and the 2033 original notes collectively as the “original notes.” |

| 2028 Exchange Notes | $800.0 million of our 5.750% Senior Notes due 2028, which we refer to as the “2028 exchange notes.” |

| 2033 Exchange Notes | $600.0 million of our 6.250% Senior Notes due 2033, which we refer to as the “2033 exchange notes.” We refer to the exchange 2028 notes and the exchange 2033 notes collectively as the “exchange notes.” We refer to the original notes and the exchange notes collectively as the “notes.” The terms of the exchange notes are substantially identical to the terms of the original notes, except that the exchange notes will not contain terms with respect to additional interest, registration rights or transfer restrictions. |

| The Exchange Offer | We are offering exchange notes of each series in exchange for a like principal amount of our original notes of such series. You may tender your original notes of a series for exchange notes of such series by following the procedures described under the heading “The Exchange Offer.” |

| Expiration Date; Withdrawal | The exchange offer will expire at 5:00 p.m., New York City time, on , 2023, unless we extend it. You may withdraw any original notes that you tender for exchange at any time prior to the expiration of this exchange offer. See “The Exchange Offer—Terms of the Exchange Offer” for a more complete description of the tender and withdrawal period. |

| Conditions to the Exchange Offer | The exchange offer is subject to the condition that the exchange offer does not violate any applicable law or any interpretations of the staff of the SEC. However, the exchange offer is not conditioned upon any minimum aggregate principal amount of original notes being tendered in the exchange offer. |

| | | | | |

| Procedures for Tendering Original Notes | To participate in the exchange offer, you must properly complete and duly execute a letter of transmittal, which accompanies this prospectus, and transmit it, along with all other documents required by such letter of transmittal, to the exchange agent on or before the expiration date at the address provided on the cover page of the letter of transmittal. In the alternative, you can tender your original notes by book-entry delivery following the procedures described in this prospectus, whereby you will agree to be bound by the letter of transmittal and we may enforce the letter of transmittal against you. If a holder of original notes desires to tender such original notes and the holder’s original notes are not immediately available, or time will not permit the holder’s original notes or other required documents to reach the exchange agent before the expiration date, or the procedure for book-entry transfer cannot be completed on a timely basis, a tender may be effected pursuant to the guaranteed delivery procedures described in this prospectus. See “The Exchange Offer—How to Tender Original Notes for Exchange.” |

| United States Federal Income Tax Consequences | Your exchange of original notes for exchange notes to be issued in the exchange offer is not expected to result in any gain or loss to you for U.S. federal income tax purposes. See “Certain Material United States Federal Income Tax Considerations.” |

| Use of Proceeds | We will not receive any cash proceeds from the exchange offer. |

| Consequences of Failure to Exchange Your Original Notes | Original notes not exchanged in the exchange offer will continue to be subject to the restrictions on transfer that are described in the legend on the original notes. In general, you may offer or sell your original notes only if they are registered under, or offered or sold under an exemption from, the Securities Act and applicable state securities laws. Except as required by the registration rights agreement, we do not currently intend to register the original notes under the Securities Act. |

| Resales of the Exchange Notes | Based on interpretations of the staff of the SEC set forth in no-action letters issued to third parties, we believe that you may offer for sale, resell or otherwise transfer the exchange notes that we issue in the exchange offer without complying with the registration and prospectus delivery requirements of the Securities Act if: • you are not a broker-dealer tendering notes acquired directly from us; • you acquire the exchange notes issued in the exchange offer in the ordinary course of your business; • you are not participating, do not intend to participate, and have no arrangement or undertaking with anyone to participate, in the distribution of the exchange notes issued to you in the exchange offer; and • you are not an “affiliate”, as that term is defined in Rule 405 of the Securities Act, of ours. If any of these conditions are not satisfied and you transfer any exchange notes issued to you in the exchange offer without delivering a compliant prospectus or without qualifying for an exemption from registration, you may incur liability under the Securities Act. We will not be responsible for, or indemnify you against, any liability you incur. Any broker-dealer that acquires exchange notes in the exchange offer for its own account in exchange for original notes which it acquired through market-making or other trading activities must acknowledge that it will deliver this prospectus when it resells or transfers any exchange notes issued in the exchange offer. See “Plan of Distribution” for a description of the prospectus delivery obligations of broker-dealers. |

| | | | | |

| Acceptance of Original Notes and Delivery of Exchange Notes | Subject to the satisfaction or waiver of the conditions to the exchange offer, we will accept for exchange any and all original notes properly tendered prior to the expiration of the exchange offer. We will complete the exchange offer and issue the exchange notes promptly after the expiration of the exchange offer. |

| Exchange Agent | U.S. Bank Trust Company, National Association, the trustee under the indenture governing the notes, is serving as exchange agent in connection with the exchange offer. The address and telephone number of the exchange agent are set forth under the heading “The Exchange Offer—The Exchange Agent.” |

The Exchange Notes

The exchange offer applies to the 2028 original notes outstanding as of the date hereof and the 2033 original notes outstanding as of the date hereof. The form and terms of the exchange notes of each series will be identical in all respects to the form and the terms of the original notes of such series except that the exchange notes:

•will have been registered under the Securities Act;

•will not be subject to restrictions on transfer under the Securities Act;

•will not be entitled to the registration rights that apply to the original notes; and

•will not be subject to any increase in annual interest rate as described below under “The Exchange Offer—Purpose of the Exchange Offer.”

The exchange notes evidence the same debt as the original notes exchanged for the exchange notes and will be entitled to the benefits of the same indenture under which the original notes were issued, which is governed by New York law.

The following is a brief summary of the principal terms of the exchange notes. For a more complete description of the terms of the exchange notes and the terms and provisions of the indenture that govern the original notes and will govern the exchange notes, see “Description of the Exchange Notes.”

| | | | | | | | |

| | |

| |

| Issuer | | LKQ Corporation |

| |

| Notes Offered | | $800,000,000 aggregate principal amount of 5.750% Senior Notes due 2028, which we refer to as the “2028 exchange notes;” and

$600,000,000 aggregate principal amount of 6.250% Senior Notes due 2033, which we refer to as the “2033 exchange notes.” We refer to the 2028 exchange notes and the 2033 exchange notes collectively as the “exchange notes.” |

| |

| Maturity | | The 2028 exchange notes will mature on June 15, 2028.

The 2033 exchange notes will mature on June 15, 2033. |

| |

| Interest | | Interest on the 2028 exchange notes will accrue at a rate of 5.750% per annum. Interest on the 2033 exchange notes will accrue at a rate of 6.250% per annum. We will pay interest on the exchange notes semi-annually in arrears on June 15 and December 15 of each year, commencing December 15, 2023. |

| |

| | | | | | | | |

| Guarantees | | The exchange notes will be fully and unconditionally guaranteed, jointly and severally, on a senior unsecured basis by each of our wholly owned domestic subsidiaries that guarantee the obligations under the Senior Unsecured Credit Agreement and the CAD Note (each, as defined below). See “Description of the Exchange Notes—Ranking” and “Description of Certain Indebtedness.”

The guarantor subsidiaries, without giving effect to the Uni-Select Acquisition, represented approximately 50% and 61% of our revenue and income from continuing operations, respectively, for the six months ended June 30, 2023, and represented approximately 51% and 52% of our total assets and total liabilities, respectively, as of June 30, 2023 (excluding, in each case, intercompany amounts). The guarantor subsidiaries, without giving effect to the Uni-Select Acquisition, represented approximately 52% and 71% of our revenue and income from continuing operations, respectively, for the year ended December 31, 2022, and represented approximately 47% and 42% of our total assets and total liabilities, respectively, as of December 31, 2022 (excluding, in each case, intercompany amounts). |

| |

| Ranking | | The exchange notes offered hereby and the guarantees thereof will be our and the subsidiary guarantors’ senior unsecured obligations, and will:

• rank equally in right of payment with all of our and each subsidiary guarantor’s existing and future senior unsecured indebtedness;

• rank senior in right of payment to all of our and each subsidiary guarantor’s existing and future subordinated indebtedness;

• be effectively subordinated to all of our and the subsidiary guarantors’ existing and future secured indebtedness to the extent of the lesser of the obligations secured by such assets and the value of the assets securing such indebtedness; and

• be structurally subordinated to all liabilities (including trade payables) of our and the subsidiary guarantors’ existing and future subsidiaries that do not guarantee the notes.

As of June 30, 2023, our total long-term debt was approximately $4.0 billion (approximately $72 million of which was secured debt), and we had approximately $700 million of availability under the Senior Unsecured Credit Agreement (after giving effect to approximately $74 million of letters of credit outstanding). In addition, as of June 30, 2023, our subsidiaries that will not guarantee the original notes or the exchange notes had approximately $1.6 billion of outstanding indebtedness (which includes $742 million of borrowings under the Senior Unsecured Credit Agreement by our subsidiaries that are borrowers under the Senior Unsecured Credit Agreement).

In connection with the closing of the Uni-Select Acquisition, we borrowed approximately $531 million under the CAD Note on July 31, 2023. The remaining approximately $1.6 billion required to fund the purchase price for the Uni-Select Acquisition (amount is exclusive of any proceeds to be received in connection with the anticipated divestiture of Uni-Select’s GSF Car Parts segment) was funded with a combination of proceeds from the original notes (which were held in an escrow account pending closing of the Uni-Select Acquisition on August 1, 2023), borrowings on the revolving credit facilities under our Senior Unsecured Credit Agreement, and cash-on-hand. |

| | | | | | | | |

| Optional Redemption | | We may redeem some or all of the exchange notes of either series at any time and from time to time at the applicable redemption prices described under the heading “Description of the Exchange Notes—Optional Redemption.” |

| Special Mandatory Redemption | | The 2033 original notes were subject to a special mandatory redemption provision which would have applied to the 2033 exchange notes if the Uni-Select Acquisition was not consummated, or the Uni-Select Agreement was terminated, on or prior to November 27, 2023 (subject to potential extension). The Uni-Select Acquisition was consummated on August 1, 2023 and, therefore, the 2033 exchange notes will not be subject to the special mandatory redemption provision that applied to the 2033 original notes. |

| Change of Control Repurchase Event | | In the event of a change of control triggering event as described herein, we will be required to offer to repurchase the exchange notes of each series at a price equal to 101% of the principal amount thereof, plus accrued and unpaid interest to, but not including, the date of repurchase. See “Description of the Exchange Notes—Change of Control.” |

| Further Issues of Notes | | We may, from time to time, without notice to or the consent of the holders of the exchange notes, issue additional notes of either series and create and issue additional series of debt securities having the same terms as and ranking equally and ratably with the exchange notes of such series in all respects, as described under “Description of the Exchange Notes—Further Issuances of Notes.” |

| No Listing | | No series of the exchange notes will be listed on any national securities exchange. |

| Form and Denominations | | Each series of the exchange notes will be issued in minimum denominations of $2,000 and integral multiples of $1,000 in excess thereof. The exchange notes will be book-entry only and registered in the name of a nominee of The Depository Trust Company (“DTC”). |

| Governing Law | | The exchange notes, the guarantees, and the indenture are governed by, and construed in accordance with, the laws of the State of New York. |

| Trustee | | U.S. Bank Trust Company, National Association |

| Risk Factors | | Investing in the exchange notes involves substantial risks. You should carefully consider the risk factors set forth under the caption “Risk Factors,” as well as other information included and incorporated by reference into this prospectus prior to making an investment in the exchange notes. See “Risk Factors” beginning on page 10. |

RISK FACTORS

You should carefully consider the risk factors and uncertainties described below and other information included and incorporated by reference in this prospectus in evaluating us, our business and your participation in the exchange offer. If any of the events described below occur, our business, financial condition, operating results and prospects could be materially adversely affected, which, in turn, could adversely affect the trading price of the exchange notes and our ability to repay the exchange notes.

Risks Relating to Our Business

For a discussion of risks related to our business and operations, please see “Item 1A. Risk Factors” and “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our Annual Report on Form 10-K for our fiscal year ended December 31, 2022, which is incorporated by reference in this prospectus, as well as disclosures contained in our other filings with the SEC.

Risks Relating to the Exchange Offer

The exchange offer may not be consummated.

The exchange offer is subject to the condition that the exchange offer does not violate any applicable law or any interpretations of the staff of the SEC. Even if the exchange offer is completed, it may not be completed on the time schedule described in this prospectus. Accordingly, holders of original notes participating in the exchange offer may have to wait longer than expected to receive the exchange notes, during which time those holders will not be able to effect transfers of their original notes tendered in the exchange offer.

You must comply with the exchange offer procedures in order to receive exchange notes.

We will not accept your original notes for exchange if you do not follow the exchange offer procedures. We will issue exchange notes as part of the exchange offer only after timely receipt of your original notes, a properly completed and duly executed letter of transmittal and all other required documents or if you comply with the guaranteed delivery procedures for tendering your original notes. Therefore, if you want to tender your original notes, please allow sufficient time to ensure timely delivery. If we do not receive your original notes, letter of transmittal, and all other required documents by the expiration date of the exchange offer, or you do not otherwise comply with the guaranteed delivery procedures for tendering your original notes, we will not accept your original notes for exchange. Neither we nor the exchange agent is required to notify you of defects or irregularities with respect to the tenders of original notes for exchange. If there are defects or irregularities with respect to your tender of original notes, we will not accept your original notes for exchange unless we decide in our sole discretion to waive such defects or irregularities.

You may have difficulty selling the original notes that you do not exchange.

If you do not exchange your original notes for exchange notes in the exchange offer, you will continue to be subject to the restrictions on transfer of your original notes described in the legend on your original notes. The restrictions on transfer of your original notes arise because we issued the original notes under exemptions from, or in transactions not subject to, the registration requirements of the Securities Act and applicable state securities laws. In general, you may only offer or sell the original notes if they are registered under the Securities Act and applicable state securities laws, or offered and sold under an exemption from these requirements. Except as required by the registration rights agreement, we do not intend to register the original notes under the Securities Act. The tender of original notes under the exchange offer will reduce the principal amount of the original notes. Due to the corresponding reduction in liquidity, this may have an adverse effect upon, and increase the volatility of, the market price of any original notes that you continue to hold following completion of the exchange offer. Additionally, if a large number of original notes are exchanged for exchange notes issued in the exchange offer, it may be more difficult for you to sell your unexchanged original notes because there will be fewer original notes outstanding. See “The Exchange Offer—Consequences of Failure to Exchange Original Notes.”

Some persons who participate in the exchange offer must deliver a prospectus in connection with resales of the exchange notes.

Based on interpretations of the staff of the SEC contained in Exxon Capital Holdings Corp., SEC No-Action Letter available on May 13, 1988, Morgan Stanley & Co., Incorporated, SEC No-Action Letter available June 5, 1991 and Shearman & Sterling, SEC No-Action Letter available July 2, 1993, we believe that you may offer for resale, resell or otherwise transfer the exchange notes without compliance with the registration and prospectus delivery

requirements of the Securities Act. However, in some instances described in this prospectus under "Plan of Distribution," you will remain obligated to comply with the registration and prospectus delivery requirements of the Securities Act to transfer your exchange notes. In these cases, if you transfer any exchange note without delivering a prospectus meeting the requirements of the Securities Act or without an exemption from registration of your exchange notes under the Securities Act, you may incur liability under the Securities Act. We do not and will not assume, or indemnify you against, this liability.

Risks Relating to our Indebtedness, our Financial Structure and the Exchange Notes

We have a substantial amount of indebtedness, which could have a material adverse effect on our financial condition and our ability to obtain financing in the future and to react to changes in our business.

As of June 30, 2023, we had (a) approximately $4.0 billion of total long-term debt outstanding ($72 million of which was secured), including $1.4 billion aggregate principal amount of the original notes, €500 million ($545 million) aggregate principal amount of 3.875% senior notes due April 1, 2024 (the “Euro Notes (2024)”), €250 million ($273 million) of 4.125% senior notes due 2028 (the “Euro Notes (2028)”), $500 million drawn of term loans under the Senior Unsecured Credit Agreement, and $1,226 million drawn of the revolving credit facilities under the Senior Unsecured Credit Agreement, and (b) $700 million of availability under the Senior Unsecured Credit Agreement (after giving effect to approximately $74 million of letters of credit outstanding). In connection with the closing of the Uni-Select Acquisition, we borrowed approximately $531 million under the CAD Note on July 31, 2023. The remaining approximately $1.6 billion required to fund the purchase price for the Uni-Select Acquisition (amount is exclusive of any proceeds to be received in connection with the anticipated divestiture of Uni-Select’s GSF Car Parts segment) was funded with a combination of proceeds from the original notes (which were held in an escrow account pending closing of the Uni-Select Acquisition on August 1, 2023), borrowings on the revolving credit facility under our Senior Unsecured Credit Agreement, and cash-on-hand. Under the Senior Unsecured Credit Agreement, the Credit Agreement Revolving Loans have a maturity date of January 5, 2028, and the Credit Agreement Term Loan has a maturity date of January 5, 2026. The maturity date of the Credit Agreement Revolving Loans can be extended for up to two years in one-year increments. The maturity date of the Credit Agreement Term Loan can be extended for one year. The CAD Note matures three years after the date of funding. Our significant amount of debt and our debt service obligations could limit our ability to satisfy our obligations, limit our ability to operate our business and impair our competitive position.

For example, our debt and our debt service obligations could:

• increase our vulnerability to adverse economic and general industry conditions, including interest rate fluctuations, because a portion of our borrowings are and will continue to be at variable rates of interest;

• require us to dedicate a substantial portion of our cash flow from operations to payments on our debt, which would reduce the availability of our cash flow from operations to fund working capital, capital expenditures or other general corporate purposes;

• limit our flexibility in planning for, or reacting to, changes in our business and industry;

• place us at a disadvantage compared to competitors that may have proportionately less debt;

• limit our ability to obtain additional debt or equity financing due to applicable financial and restrictive covenants in our debt agreements; and

• increase our cost of borrowing.

In addition, if we or our subsidiaries incur additional debt, the risks associated with our substantial leverage and the ability to service such debt would increase.

The indentures governing our notes do not impose any limitations on our ability to incur additional debt or protect against certain other types of transactions, and we may incur additional indebtedness under our credit agreements.

The indentures governing the Euro Notes (2024) and the Euro Notes (2028) and the indenture that governs the original notes and the exchange notes offered hereby do not restrict the future incurrence of unsecured indebtedness, guarantees or other obligations. The indentures governing our Euro Notes (2024) and Euro Notes (2028) and the indenture that governs the original notes and the exchange notes offered hereby contain certain limitations on our ability to incur liens on assets, and the indentures governing our Euro Notes (2024) and Euro Notes (2028) and the indenture that governs the original notes and the exchange notes offered hereby contain certain limitations on our ability to engage in sale and leaseback transactions. However, these limitations are subject to important exceptions. In addition, the indentures do not contain many other restrictions, including certain restrictions contained in the Senior Unsecured Credit Agreement and the CAD Note, including, without limitation, making investments, prepaying subordinated indebtedness or engaging in transactions with our affiliates.

The Senior Unsecured Credit Agreement and the CAD Note permit, subject to specified conditions and limitations, the incurrence of a significant amount of additional indebtedness. If we or our subsidiaries incur additional debt, the risks associated with our substantial leverage and the need to service such debt would increase.

The Senior Unsecured Credit Agreement and the CAD Note impose operating and financial restrictions on us and our subsidiaries, which may prevent us from capitalizing on business opportunities.

Our Senior Unsecured Credit Agreement and CAD Note impose operating and financial restrictions on us. These restrictions may limit our ability, among other things, to:

• incur, assume or permit to exist additional indebtedness (including guarantees thereof) outside of the Senior Unsecured Credit Agreement and the CAD Note;

• incur liens on assets;

• engage in transactions with affiliates;

• sell certain assets or merge or consolidate with or into other companies;

• guarantee indebtedness; and

• alter the business we conduct.

As a result of these covenants and restrictions, we may be limited in how we conduct our business and we may be unable to raise additional debt or equity financing to compete effectively or to take advantage of new business opportunities. The terms of any future indebtedness we may incur or changes we make to existing indebtedness could include more restrictive covenants. We cannot assure you that we will be able to maintain compliance with these covenants in the future and, if we fail to do so, that we will be able to obtain waivers from the lenders and/or amend the covenants. The failure to comply with any of these covenants would cause a default under the applicable credit agreement. A default, if not waived, could result in acceleration of our debt, in which case the debt would become immediately due and payable. If this occurs, we may not be able to repay our debt or borrow sufficient funds to refinance it. Even if new financing were available, it may be on terms that are less attractive to us than our existing credit facilities or it may be on terms that are not acceptable to us.

We may not be able to generate sufficient cash to service all of our indebtedness, and may be forced to take other actions to satisfy our obligations under our indebtedness, which may not be successful.

Our ability to make scheduled payments on or to refinance our debt obligations depends on our financial condition and operating performance, which are subject to prevailing economic and competitive conditions and to certain financial, business and other factors beyond our control. We cannot assure you that we will maintain a level of cash flows from operating activities sufficient to permit us to pay the principal, premium, if any, and interest on our indebtedness. If our cash flows and capital resources are insufficient to fund our debt service obligations, we may be forced to reduce or delay investments and capital expenditures, or to sell assets, seek additional capital or restructure or refinance our indebtedness. These alternative measures may not be successful and may not permit us to meet our scheduled debt service obligations. If our operating results and available cash are insufficient to meet our debt service obligations, we could face substantial liquidity problems and might be required to dispose of material assets or operations to meet our debt service and other obligations. We may not be able to consummate those dispositions or to obtain the proceeds that we hope to realize from them, and these proceeds may not be adequate to meet any debt service obligations then due. Any future refinancing of our indebtedness could be at higher interest rates and may require us to comply with more onerous covenants which could further restrict our business operations. Additionally, our credit agreements and the indentures that govern the Euro Notes (2024) and the Euro Notes (2028) limit the use of the proceeds from certain dispositions of our assets. As a result, our credit agreements and the indentures that govern the Euro Notes (2024) and the Euro Notes (2028) may prevent us from using the proceeds from such dispositions to satisfy all of our debt service obligations.

Our future capital needs may require that we seek to refinance our debt or obtain additional debt or equity financing, events that could have a negative effect on our business.

We may need to raise additional funds in the future to, among other things, refinance existing debt, fund our existing operations, improve or expand our operations, respond to competitive pressures, or make acquisitions. From time to time, we may raise additional funds through public or private financing, strategic alliances, or other arrangements. Funds may not be available or available on terms acceptable to us as a result of different factors, including but not limited to, turmoil in the credit markets that results in the tightening of credit conditions and current or future regulations applicable to the financial institutions from which we seek financing. If adequate funds are not available on acceptable terms, we may be unable to meet our business or strategic objectives or compete effectively. If we raise additional funds by issuing equity securities, stockholders may experience dilution of their ownership interests, and the newly issued securities may have rights superior to those of our common stock. If we raise additional funds by issuing debt, we may be subject to higher borrowing costs and further limitations on our operations. If we refinance or restructure our debt, we may incur charges to write off the unamortized portion of deferred debt issuance costs from a previous financing, or we may incur charges related to hedge ineffectiveness from our interest

rate swap obligations. There are restrictions in the indentures that govern the Euro Notes (2024), the Euro Notes (2028), the 2028 exchange notes offered hereby, and the 2033 exchange notes offered hereby on our ability to refinance such notes prior to January 1, 2024, April 1, 2023, May 15, 2028 and March 15, 2033, respectively. We could refinance the Euro Notes (2024), the Euro Notes (2028), and the exchange notes offered hereby through open market purchases, subject to a limitation in our credit agreement on the amount of such purchases. If we fail to raise capital when needed, our business may be negatively affected.

Our variable rate indebtedness subjects us to interest rate risk, which could cause our indebtedness service obligations to increase significantly.

Borrowings under our credit agreements are at variable rates of interest and expose us to interest rate risk. If interest rates increase, our debt service obligations on the variable rate indebtedness would increase even though the amount borrowed remained the same, and our net income and cash flows, including cash available for servicing our indebtedness, would correspondingly decrease. Moreover, changes in market interest rates could affect the trading value of the Euro Notes (2024), the Euro Notes (2028), and the exchange notes offered hereby. To hedge the risk of changes in interest rates related to forecasted debt issuance to finance a portion of the Uni-Select Acquisition, in March 2023, we entered into forward-starting interest rate swaps to lock interest rates for the exchange notes offered hereby. These swaps were settled in May 2023 after issuance of the original notes, resulting in total payments of $13 million. As of June 30, 2023, on an as adjusted basis to give effect to the Uni-Select Acquisition and the borrowings under our Senior Unsecured Credit Agreement and CAD Note in connection therewith as well as the offering of the original notes and the application of the proceeds therefrom, we had an aggregate principal amount of $1.7 billion of outstanding variable rate indebtedness that was not covered by interest rate hedges.

Repayment of our indebtedness is dependent on cash flows generated by our subsidiaries.

We are a holding company and repayment of our indebtedness will be dependent upon cash flows generated by our subsidiaries and their ability to make such cash available to us, by dividend, debt repayment or otherwise. Unless they are borrowers or guarantors of the indebtedness, our subsidiaries do not have any obligation to pay amounts due on our indebtedness or to make funds available for that purpose. Our subsidiaries may not be able to, or be permitted to, make distributions to enable us to make payments in respect of our indebtedness, including the Euro Notes (2024), Euro Notes (2028), the original notes, and the exchange notes offered hereby. Each of our subsidiaries is a distinct legal entity and, under certain circumstances, legal and contractual restrictions may limit our ability to obtain cash from our subsidiaries and, under certain circumstances, distributions from our subsidiaries may be subject to taxes that reduce the amount of such distributions available to us. In the event that we do not receive sufficient distributions from our subsidiaries, we may be unable to make required principal and interest payments on our indebtedness, including the Euro Notes (2024), the Euro Notes (2028), the original notes, and the exchange notes offered hereby.

A downgrade in our credit rating would impact our cost of capital.

Credit ratings have an important effect on our cost of capital. Credit rating agencies rate our debt securities on factors that include, among other items, our results of operations, business decisions that we make, their view of the general outlook for our industry, and their view of the general outlook for the economy. Actions taken by the rating agencies can include maintaining, upgrading, or downgrading the current rating or placing us on a watch list for possible future downgrading. We believe our current credit ratings enhance our ability to borrow funds at favorable rates. A downgrade in our current credit rating from a rating agency could adversely affect our cost of capital by causing us to pay a higher interest rate on borrowed funds under our credit facilities. A downgrade could also adversely affect our ability to issue debt securities in the future or incur other indebtedness upon favorable terms. If the Euro Notes (2024) or the Euro Notes (2028) are downgraded to a rating that is below investment grade by S&P or Moody’s, we may also become subject to additional covenants under the indentures governing the Euro Notes (2024) or the Euro Notes (2028), as the case may be.

The amount and frequency of our share repurchases and dividend payments may fluctuate.

The amount, timing and execution of our share repurchase program may fluctuate based on our priorities for the use of cash for other purposes such as operational spending, capital spending, acquisitions or repayment of debt. Changes in cash flows, tax laws and our share price could also impact our share repurchase program and other capital activities. Additionally, decisions to return capital to stockholders, including through our repurchase program or the issuance of dividends on our common stock, remain subject to determination of our Board of Directors that any such activity is in the best interests of our stockholders and is in compliance with all applicable laws and contractual obligations.

The right to receive payments on the notes is effectively junior to those lenders who have a security interest in our assets.

Our obligations under the exchange notes and our guarantors’ obligations under their guarantees of the exchange notes are unsecured. If we are declared bankrupt or insolvent, or if we default under any future secured indebtedness, the lenders could declare all of the funds borrowed thereunder, together with accrued interest,