ARTICLES OF INCORPORATION

OF

700 BONITA AVENUE CORPORATION

I.

The name of this corporation is:

700 BONITA AVENUE CORPORATION

II.

The purposes for which this corporation is formed, the specific business in which the corporation proposes primarily and initially to engage being set forth in Paragraph (a) below, are:

(a) To engage primarily in the specific business of recycling automobile bumpers.

(b) To engage generally in the business of repairing, electroplating and recycling automobile, truck and motorcycle parts; and to design, manufacture, buy, sell, import and export, supplies and accessories for automobiles, trucks and motorcycles.

(c) To purchase, acquire, own, hold, use, lease (either as lessor or lessee), grant, sell, exchange, subdivide, mortgage, convey in trust, manage, improve, construct, operate and generally deal in any and all real estate, improved or unimproved, stores, office buildings, dwelling houses, apartment houses, hotels, manufacturing plants and other buildings and any and all other property or every kind or description, real, personal and mixed, and wheresoever situated, either in California, other states of the United States, the District of Columbia, territories and colonies of the United States, or foreign countries.

(d) To acquire, by purchase or otherwise, the goodwill, business, property rights, franchises and assets of every kind, with or without undertaking, either wholly or in part, the liabilities of any person, firm, association or corporation; and to acquire any property or business as a going concern or otherwise (1) by purchase of the assets thereof wholly or in part, (ii) by acquisition of the shares or any part thereof, or (iii) in any other manner, and to pay for the same in cash or in shares or bonds or other evidences of indebtedness of this corporation, or otherwise; to hold, maintain and operate, or in any manner dispose of, the whole or any part of the goodwill, business, rights and property so acquired, and to conduct in any lawful manner the whole or any part of any business so acquired; and to exercise all the powers necessary or convenient in and about the management of such business.

(e) To take, purchase and otherwise acquire, own, hold, use, sell, assign, transfer, exchange, lease, mortgage, convey in trust, pledge, hypothecate, grant licenses in respect of and otherwise dispose of letters patent of the United States or any foreign country, patent rights, licenses and privileges, inventions, improvements and processes, copyrights, trade-marks and trade names, and governmental, state, territorial, county and municipal grants and concessions of every character which this corporation may deem

advantageous in the prosecution of its business or in the maintenance, operation, development or extension of its properties.

(f) To enter into, make, perform and carry out contracts of every kind for any lawful purpose without limit as to amount, with any person, firm, association or corporation, municipality, county, parish, state, territory, government or other municipal or governmental subdivision.

(g) To become a partner (either general or limited or both) and to enter into agreements of partnership, with one or more other persons or corporations, for the purpose of carrying on any business whatsoever which this corporation may deem proper or convenient in connection with any of the purposes herein set forth or otherwise, or which may be calculated, directly or indirectly, to promote the interests of this corporation or to enhance the value of its property or business.

(h) From time to time to apply for, purchase, acquire, by assignment, transfer or otherwise, exercise, carry out and enjoy any benefit, right, privilege, prerogative or power conferred by, acquired under or granted by any statute, ordinance, order, license, power, authority, franchise, commission, right or privilege which any government or authority or governmental agency or corporation or other public body may be empowered to enact, make or grant; to pay for, aid in, and contribute toward carrying the same into effect and to appropriate any of this corporation’s shares, bonds and/or assets to defray the costs, charges and expenses thereof.

(i) To subscribe or cause to be subscribed for, and to take, purchase and otherwise acquire, own, hold, use, sell, assign, transfer, exchange, distribute and otherwise dispose of, the whole or any part of the shares of the capital stock, bonds, coupons, mortgages, deeds of trust, debentures, securities, obligations, evidences of indebtedness, notes, goodwill, rights, assets and property of any and every kind, or any part thereof, of any other corporation or corporations, association or associations, firm or firms, or person or persons, together with shares, rights, units or interest in, or in respect of, any trust estate, now or hereafter existing, and whether created by the laws of the State of California or of any other state, territory or country; and to operate, manage and control such properties, or any of them, either in the name of such other corporation or corporations or in the name of this corporation, and while the owners of any of said shares of capital stock, to exercise all the rights, powers and privileges of ownership of every kind and description, including the right to vote thereon, with power to designate some person or persons for that purpose from time to time, and to the same extent as natural persons might or could do.

(j) To promote or to aid in any manner, financially or otherwise, any person, firm, corporation or association of which any shares of stock, bonds, notes, debentures or other securities or evidences of indebtedness are held directly or indirectly by this corporation; and for this purpose to guarantee the contracts, dividends, shares, bonds, debentures, notes and other obligations of such other persons, firms, corporations or associations; and to do any other acts or things designed to protect, preserve, improve or enhance the value of such shares, bonds, notes, debentures or other securities or evidences of indebtedness.

(k) To borrow and lend money, but nothing herein contained shall be construed as authorizing the business of banking, or as including the business purposes of a commercial bank, savings bank or trust company.

(1) To issue bonds, notes, debentures or other obligations of this corporation from time to time for any of the objects or purposes of this corporation, and to secure the same by mortgage, deed of trust, pledge or otherwise, or to issue the same unsecured; to purchase or otherwise acquire its own bonds, debentures or other evidences of its indebtedness or obligations; to purchase, hold, sell and transfer the shares of its own capital stock to the extent and in the manner provided by the laws of the State of California as the same are now in force or may be hereafter amended.

(m) To purchase, acquire, take, hold, own, use and enjoy, and to sell, lease, transfer, pledge, mortgage, convey, grant, assign or otherwise dispose of, and generally to invest, trade, deal in and with oil royalties, mineral rights of all kinds, mineral bearing lands and hydrocarbon products of all kinds, oil, gas and mineral leases, and all rights and interests therein, and in general products of the earth and deposits, both subsoil and surface, of every nature and description.

(n) To carry on any business whatsoever, either as principal or as agent or both or as a partnership or joint venture, which this corporation may deem proper or convenient in connection with any of the foregoing purposes or otherwise, or which may be calculated directly or indirectly to promote the interests of this corporation or to enhance the value of its property of business; to conduct its business in this state, in other states, in the District of Columbia, in the territories and colonies of the United States, and in foreign countries.

(o) To have and to exercise all the powers conferred by the laws of California upon corporations formed under the laws pursuant to and under which this corporation is formed, as such laws are now in effect or may at any time hereafter be amended.

The foregoing statement of purposes shall be construed as a statement of both purposes and powers, and the purposes and powers stated in each clause shall, except where otherwise expressed, be in nowise limited or restricted by reference to or inference from the terms or provisions of any other clause, but shall be regarded as independent purposes and powers.

III.

The county in the State of California where the principal office for the transaction of the business of this corporation is to be located is Los Angeles County.

IV.

No distinction shall exist between the shares of this corporation or the rights of the respective holders thereof with respect thereto.

V.

This corporation is authorized to issue only one class of shares of stock. The total number of shares of stock which this corporation shall have authority to issue is one hundred thousand (100,000); the aggregate par value of such shares shall be one hundred thousand dollars ($100,000); and the par value of each such share shall be one dollar ($1.00).

VI.

The number of directors of this corporation shall be three (3) and the names and addresses of the persons who are appointed to act as the first directors of this corporation are as follows:

| | | | | |

| Name | Address |

| |

| Gilbert E. Haakh | 1200 Wilshire Boulevard Los Angeles, California 90017 |

| |

| Robert B. Leck III | 1200 Wilshire Boulevard Los Angeles, California 90017 |

| |

| Joel Mark | 1200 Wilshire Boulevard Los Angeles, California 90017 |

| |

IN WITNESS WHEREOF, for the purposes of forming this corporation under the laws of the State of California, we, the undersigned, constituting the incorporators of this corporation and the persons named herein as the first directors of this corporation, have executed these Articles of Incorporation this 27th day of November, 1974.

/s/ Gilbert E. Haakh

Gilbert E. Haakh

/s/ Robert B. Leck III

Robert B. Leck III

/s/ Joel Mark

Joel Mark

County of Los Angeles )

) ss.

State of California )

On this 27th day of November, 1974, before me, a Notary Public in and for said State, personally appeared GILBERT E. HAAKH, ROBERT B. LECK III, and JOEL MARK, known to me to be the persons whose names are subscribed to the foregoing Articles of Incorporation and acknowledged to me that they executed the same.

WITNESS my hand and official seal.

/s/ Gloria Ann Barrack

Notary Public in and for said State

CERTIFICATE OF AMENDMENT

OF

ARTICLES OF INCORPORATION

JOHN G. JORDAN and VIRGIL K. BENTON certify:

1. That they are the president and the secretary, respectively, of 700 BONITA AVENUE CORPORATION, a California corporation.

2. That at a meeting of the board of directors of said corporation, duly held at La Jolla, California, on February 5, 1975, the following resolution was adopted:

“NOW, THEREFORE, BE IT RESOLVED, that Article I of the Articles of Incorporation of this Corporation be amended to read in its entirety as follows:

‘I

The name of this corporation is:

Keystone Automotive Plating Corporation.’”

3. That the shareholders have adopted said amendment by written consent. That the wording of the amended article, as set forth in the shareholders’ written consent, is the same as that set forth in the directors’ resolution in Paragraph 2 above.

4. That the number of shares represented by written consent is 10,000. That the total number of shares entitled to vote on or consent to the amendment is 10,000.

Dated: February 7, 1975.

/s/ John G. Jordan

John G. Jordan

President

/s/ Virgil K. Benton

Virgil K. Benton

Secretary

Each of the undersigned declares under penalty of perjury that the matters set forth in the foregoing certificate are true and correct.

Executed at Pomona, California, on February 7, 1975

/s/ John G. Jordan

John G. Jordan

/s/ Virgil K. Benton

Virgil K. Benton

CERTIFICATE OF AMENDMENT

OF

ARTICLES OF INCORPORATION

CHARLES T. BECKMANN and VIRGIL K. BENTON certify:

1. That they are the Vice-President and Secretary respectively, of KEYSTONE AUTOMOTIVE PLATING CORPORATION, a California corporation.

2. That at a meeting of the Board of Directors of said Corporation, duly held at Los Angeles, California on August 11, 1976, the following resolution was adopted:

“RESOLVED, that Article V of the Articles of Incorporation of this Corporation be amended to read in its entirety as follows:

‘V: This corporation is authorized to issue 3,000,000 shares without par value. Upon the amendment of this Article to read as hereinabove set forth, each outstanding share of a par value of $1.00 of the corporation is split up and converted into 100 shares without par value.’”

3. That the shareholders have adopted said amendment by resolution at a meeting held at Los Angeles, California, on August 11, 1976. That the wording of the amended article, as set forth in the shareholders’ resolution, is the same as that set forth in the directors’ resolution in Paragraph 2 above.

4. That the number of shares which voted affirmatively for the adoption of said resolution is 6,000, and that the total number of shares entitled to vote on or consent to said amendment is 10,000.

/s/ Charles T. Beckmann

Charles T. Beckmann, Vice-President

/s/ Virgil K. Benton

Virgil K. Benton, Secretary

Each of the undersigned declares under penalty of perjury that the matters set forth in the foregoing certificate are true and correct. Executed at Los Angeles, California, on August 11, 1976.

/s/ Charles T. Beckmann

Charles T. Beckmann

/s/ Virgil K. Benton

Virgil K. Benton

CERTIFICATE OF AMENDMENT

OF

ARTICLES OF INCORPORATION

John G. Jordan and Virgil K. Benton certify that:

1. They are the President and the Secretary of Keystone Automotive Plating Corporation, a California corporation.

2. Article I of the Articles of Incorporation of this corporation is amended to read in its entirety as follows:

“The name of this corporation is

Keystone Automotive Industries, Inc.”

3. The foregoing Amendment of Articles of Incorporation has been duly approved by the board of directors.

4. The foregoing Amendment of Articles of Incorporation has been duly approved by the required vote of shareholders in accordance with Section 902 of the Corporations Code. The total number of outstanding shares of the corporation is 1,232,295. The number of shares voting in favor of the amendment equaled or exceeded the vote required. The percentage vote required was more than 50%.

/s/ John G. Jordan

John G. Jordan

/s/ Virgil K. Benton

Virgil K. Benton

The undersigned declare under penalty of perjury that the matters set forth in the foregoing certificate are true of their own knowledge. Executed at Pomona, California on January 16, 1984.

/s/ John G. Jordan

John G. Jordan

/s/ Virgil K. Benton

Virgil K. Benton

RESTATED

ARTICLES OF INCORPORATION

OF

KEYSTONE AUTOMOTIVE INDUSTRIES, INC.,

a California corporation

The undersigned, Charles J. Hogarty and Al A. Ronco, hereby certify as follows:

One: They are, respectively, the duly elected and acting President and Secretary of Keystone Automotive Industries, Inc., a California corporation.

Two: The Articles of Incorporation of the corporation are amended and restated to read in full as set forth in Exhibit A attached hereto.

Three: The foregoing amendment and restatement of the Articles of Incorporation of the corporation has been approved by the Board of Directors of the corporation.

Four: The foregoing amendment and restatement of the Articles of Incorporation of the corporation has been approved by the required vote of the shareholders of the corporation in accordance with Section 902 of the California Corporations Code. The total number of outstanding shares of the corporation’s capital stock is 1,507,768, all of which are of one class. The number of shares voting in favor of the foregoing amendment and restatement exceeded the majority vote required for approval.

IN WITNESS WHEREOF, the undersigned have executed this Restated Articles of Incorporation the eighth day of April, 1996.

/s/ Charles J. Hogarty

CHARLES J. HOGARTY

/s/ Al A. Ronco

AL A. RONCO

The undersigned, Charles J. Hogarty and Al A. Ronco, the President and Secretary, respectively, of Keystone Automotive Industries, Inc., each certify under penalty of perjury that the matters set forth in the foregoing Restated Articles of Incorporation are true and correct.

Executed at Pomona, California April 8, 1996

/s/ Charles J. Hogarty

CHARLES J. HOGARTY

/s/ Al A. Ronco

AL A. RONCO

RESTATED

ARTICLES OF INCORPORATION

OF

KEYSTONE AUTOMOTIVE INDUSTRIES, INC.,

a California corporation

One.: The name of this corporation is Keystone Automotive Industries, Inc.

Two: The purpose of this corporation is to engage in any lawful act or activity for which a corporation may be organized under the General Corporation Law of California other than the banking business, the trust company business or the practice of a profession permitted to be incorporated by the California Corporations Code.

Three: This corporation is authorized to issue two classes of shares designated, respectively, “Common Stock” and “Preferred Stock.” The number of shares of Common Stock authorized to be issued is 20,000,000 and the number of shares of Preferred Stock authorized to be issued is 3,000,000, all of which shall be without par value. Upon the amendment of this Article Three to read as hereinabove set forth, each outstanding share of the capital stock of this corporation shall be split up and converted into 3.8467 shares of Common Stock.

Four: The Board of Directors of this corporation, without further action by the holders of the outstanding shares of Common Stock or Preferred Stock, if any, may issue the Preferred Stock from time to time in one or more series, may fix the number of shares and the designation of any wholly unissued series of Preferred Stock, may determine or alter the rights, preferences, privileges and restrictions granted to or imposed upon any such series and, within the limits and restrictions stated in any resolution or resolutions of the Board of Directors originally fixing the number of shares constituting any series of Preferred Stock, may increase or decrease (but not below the number of shares of such series then outstanding) the number of shares of such series subsequent to the issue of shares of that series.

Five: The liability of the directors of this corporation for monetary damages shall be eliminated to the fullest extent permissible under California law. This corporation is authorized to provide indemnification of agents (as defined in Section 317 of the California General Corporation Law) through bylaw provisions, agreements with agents, vote of shareholders or disinterested directors or otherwise, in excess of the indemnification otherwise permitted by Section 317 of the California General Corporation Law, subject only to the applicable limits set forth in Section 204 of thee California General Corporation Law with respect to actions for breach of duty to the corporation and its shareholders. This corporation is authorized

EXHIBIT A

to purchase and maintain insurance on behalf of its agents against any liability asserted against or incurred by the agent in such capacity or arising out of the agent’s status as such from a company, the shares of which are owned in whole or in part by this corporation, provided that any policy issued by such company is limited to the extent required by applicable law. Any repeal or modification of the foregoing provisions of this Article Five by the shareholders of this corporation shall not adversely affect any right or protection of an Agent of this corporation existing at the time of that repeal or modification.

Six: This corporation elects to be governed by all of e provisions of the General Corporation Law of 1977 not otherwise applicable to it under Chapter 23 thereof.

RESTATED ARTICLES OF INCORPORATION

OF

KEYSTONE AUTOMOTIVE INDUSTRIES, INC.

Virgil K. Benton II and Al A. Ronco certify that:

1. They are the Chairman of the Board and the Secretary, respectively, of Keystone Automotive Industries, Inc., a California corporation (the “Corporation”).

2. The Articles of Incorporation of the Corporation are amended and restated to read as set forth on Exhibit “A” attached hereto.

3. The amendment and restatement of the Articles of Incorporation has been duly approved by the Board of Directors.

4. The amendment and restatement of the Articles of Incorporation has been duly approved by the required vote of shareholders in accordance with Section 902 of the California General Corporation Law (“California Law”). The total number of outstanding shares of the Corporation is 5,800,000. The number shares voting in favor of the amendment equaled or exceeded the vote required. The percentage vote required was more than 50%.

We further declare under penalty of perjury under the laws of the State of California that the matters set forth in this certificate are true and correct of our own knowledge.

Executed at Los Angeles, California this thirty-first day of May, 1996.

/s/ Virgil K. Benton II

Virgil K. Benton II, Chairman of the Board

/s/ Al A. Ronco

Al A. Ronco, Secretary

Exhibit “A”

RESTATED ARTICLES OF INCORPORATION

OF

KEYSTONE AUTOMOTIVE INDUSTRIES, INC.

ONE: The name of this corporation is Keystone Automotive Industries, Inc.

TWO: The purpose of this corporation is to engage in any lawful act or activity for which a corporation may be organized under the General Corporation Law of California other than the banking business, the trust company business or the practice of a profession permitted to be incorporated by the California Corporations Code.

THREE: This corporation is authorized to issue two classes of shares of stock designated “Common Stock” and “Preferred Stock,” respectively. The total number of shares of stock which this corporation shall have authority to issue is 23,000,000 shares, consisting of 20,000,000 shares of Common Stock and 3,000,000 shares of Preferred Stock.

A. Common Stock

1. Except where otherwise provided by law, by these Restated Articles of Incorporation, or by resolution of the Board of Directors pursuant to this Article THREE, the holders of the Common Stock issued and outstanding shall have and possess the exclusive right to notice of shareholders’ meetings and the exclusive voting rights and powers.

2. Subject to all of the rights of the Preferred Stock, dividends may be paid on the Common Stock, as and when declared by the Board of Directors, out of any funds of the corporation legally available for the payment of such dividends.

B. Preferred Stock

The Preferred Stock may be divided into such number of series as the Board of Directors may determine. The Board of Directors is authorized to determine and alter the rights, preferences, privileges and restrictions, or any of them, granted to or imposed upon any wholly unissued series of Preferred Stock and to fix the number of shares of any series of Preferred Stock and the designation of any such series of Preferred Stock. The Board of Directors, within the limits and restrictions stated in any resolution or resolutions of the Board of Directors originally fixing the number of shares constituting any series, may increase or decrease (but not below the number of shares of such series then outstanding) the number of shares of any series subsequent to the issue of shares of that series.

FOUR: A. This Article FOUR shall become effective only when this corporation becomes a listed corporation within the meaning of Section 301.5 of the California General Corporations Law (“California Law”), which section provides that a listed corporation means a corporation with outstanding shares listed on the New York Stock Exchange or the American Stock Exchange, or a corporation with outstanding securities designated as qualified for trading as a national market system security on the National Association of Securities Dealers Automatic Quotation System (or any successor national market system) if the corporation has at least 800 holders of its equity securities as of the record date of the corporation’s most recent annual meeting of shareholders.

B. Upon the effectiveness of this Article FOUR, the Board of Directors shall be classified into three classes, as nearly equal in numbers as the then total number of directors constituting the entire Board of Directors permits, the members of each class to serve for a term of three years. If the number of directors is not divisible by three, the first extra director shall be assigned to the first class of directors and any additional director shall be assigned to the second class of directors.

C. Upon the effectiveness of this Article FOUR, the election of directors by the shareholders shall not be by cumulative voting. At each election of directors, each shareholder entitled to vote may vote all the shares held by that shareholder for each of several nominees for director up to the number of directors to be elected. The shareholder may not cast more votes for any single nominee than the number of shares held by the shareholder.

D. At the first annual meeting of shareholders held after the effectiveness of this Article FOUR, directors of the first class shall be elected to hold office for a term expiring at the next succeeding annual meeting of shareholders, directors of the second class shall be elected to hold office for a term expiring at the second succeeding annual meeting of shareholders and directors of the third class shall be elected to hold office for a term expiring at the third succeeding annual meeting of shareholders. At each subsequent annual meeting of shareholders, the successors to the class of directors whose term shall then expire shall be elected to hold office for a term expiring at the third succeeding annual meeting of shareholders.

E. If at any time this corporation ceases to be a listed corporation as defined in Section 301.5 of the California Law, at each succeeding annual meeting of shareholders where the existing term of a class of directors is expiring, the directors of each such class shall then be elected for a term expiring in one year until all directors are elected for one year terms. The election of all directors at the annual meeting of shareholders for a term of one year shall continue until the corporation once again qualifies as a listed corporation within the meaning of Section 301.5 of the California Law, and the foregoing provisions of this Article FOUR shall be reinstated.

FIVE: The following provisions are inserted for the management of the business and for the conduct of the affairs of the corporation and for defining and regulating the powers of the corporation and its directors and shareholders and are in furtherance and not in limitation of the powers conferred upon the corporation by statute:

(a) Unless otherwise expressly provided in the California Law, approval by the holders of at least two-thirds of the outstanding shares of the capital stock of this corporation entitled to vote (including the affirmative vote of at least two-thirds of the outstanding shares of any class or series of the capital stock entitled to vote separately) shall be required with respect to each of the following actions:

A. Any amendment to or the elimination of Articles FOUR, FIVE, SIX or SEVEN of these Restated Articles of Incorporation.

B. Any amendment to or the elimination of any provision of the Bylaws of this corporation which requires approval by the shareholders to become effective.

(b) Unless otherwise expressly provided in the California Law, notwithstanding anything to the contrary in these Restated Articles of Incorporation or the Bylaws of this corporation, (A) vacancies and newly created directorships, whether resulting from an increase in the size of the Board of Directors, from the death, resignation, disqualification or removal of a director or otherwise, shall be filled solely by the affirmative vote of at least two-thirds of the remaining directors then in office, or by the sole remaining director, even though less than a

quorum of the Board of Directors, and (B) any director elected in accordance with clause (A) of this paragraph (b) shall hold office for the remainder of the full term of the class of directors in which the vacancy occurred or the new directorship was created and until such director’s successor shall have been elected and qualified.

SIX: Except as set forth in Section 603(d) of the California Law, no action required to be taken or which may be taken at any annual or special meeting of shareholders of the corporation may be taken by written consent of shareholders, unless a consent or consents in writing, setting forth the action so taken, is or are signed by the holders of at least two-thirds of the outstanding shares of the capital stock of the corporation entitled to vote thereon.

SEVEN: The liability of the directors of this corporation for monetary damages shall be eliminated to the fullest extent permissible under California law. This corporation is authorized to provide indemnification of agents (as defined in Section 317 of the California Law) through bylaw provisions, agreements with agents, vote of shareholders or disinterested directors or otherwise, in excess of the indemnification otherwise permitted by Section 317 of the California Law, subject only to the applicable limits set forth in Section 204 of the California Law with respect to actions for breach of duty to the corporation and its shareholders. This corporation is authorized to purchase and maintain insurance on behalf of its agents against any liability asserted against or incurred by the agent in such capacity or arising out of the agent’s status as such from a company, the shares of which are owned in whole or in part by this corporation, provided that any policy issued by such company is limited to the extent required by applicable law. Any repeal or modification of the foregoing provisions of this Article SEVEN by the shareholders of this corporation shall not adversely affect any right or protection of an agent of this corporation existing at the time of that repeal or modification.

EIGHT: This corporation elects to be governed by all of the provisions of the General Corporation Law of 1977 not otherwise applicable to it under Chapter 23 thereof.

CERTIFICATE OF AMENDMENT

OF

ARTICLES OF INCORPORATION

The undersigned certify that:

1. They are the President and Secretary, respectively, of Keystone Automotive Industries, Inc., a California corporation.

2. Article Three of the Articles of Incorporation of this corporation be amended to read as follows:

Three: This corporation is authorized to issue two classes of shares of stock designated “Common Stock” and “Preferred Stock,” respectively. The total number of shares of stock which this corporation shall have authority to issue is 53,000,000 shares, consisting of 50,000,000 shares of Common Stock and 3,000,000 shares of “Preferred Stock.”

3. The foregoing Amendment of Articles Incorporation has been duly approved by the Board of Directors.

4. The foregoing Amendment of Articles of Incorporation has been duly approved by the required vote of shareholders in accordance with Section 902, California Corporations Code, The total number of shares outstanding of the corporation is 12,638,052. The number of shares voting in favor of the amendment exceeded the vote required. The percentage vote required was more than 50%.

We further declare under penalty of perjury under the laws of the State of California that the matters set forth in this Certificate are true and correct of our own knowledge.

Date: August 29, 1997

/s/ Charles J. Hogarty

Charles J. Hogarty, President

/s/ James C. Lockwood

James C. Lockwood, Secretary

CERTIFICATE OF AMENDMENT

OF

ARTICLES OF INCORPORATION

The undersigned certify that:

1. They are the President and Secretary, respectively, of Keystone Automotive Industries, Inc., a California corporation.

2. Article Four of the Articles of Incorporation of this corporation be amended to read as follows:

“FOUR: A. This Article FOUR shall become effective only when this corporation becomes a listed corporation within the meaning of Section 301.5 of the California General Corporations Law, which section provides that a listed corporation means a corporation with outstanding shares listed on the New York Stock Exchange or the American Stock Exchange, or a corporation with outstanding securities designated as qualified for trading as a national market system security on the National Association of Securities dealers Automatic Quotation System (or any successor national market system) if the corporation has at least 800 holders of its equity securities as of the record date of the corporation’s most recent annual meeting of shareholders.

B. Upon the effectiveness of this Article FOUR, the election of directors by the shareholders shall not be by cumulative voting. At each election of directors, each shareholder entitled to vote may vote all the shares held by that shareholder for each of several nominees for director up to the number of directors to be elected. The shareholder may not cast more votes for any single nominee than the number of shares held by the shareholder.”

3. The foregoing Amendment of Articles Incorporation has been duly approved by the Board of Directors.

4. The foregoing Amendment of Articles of Incorporation has been duly approved by the required vote of shareholders in accordance with Section 902, California Corporations Code. The total number of shares outstanding of the corporation is 14,657,352. The number of shares voting in favor of the amendment exceeded the vote required. The percentage vote required was more than 66 2/3%.

We further declare under penalty of perjury under the laws of the State of California that the matters set forth in this Certificate are true and correct of our own knowledge.

Date: June 25, 1998

/s/ Charles J. Hogarty

Charles J. Hogarty, President

/s/ James C. Lockwood

James C. Lockwood, Secretary

CERTIFICATE OF DETERMINATION

of

SERIES A JUNIOR PARTICIPATING PREFERRED STOCK

of

KEYSTONE AUTOMOTIVE INDUSTRIES, INC.

(Pursuant to Section 401 of the

California General Corporation Law)

The undersigned, Charles J. Hogarty and James C. Lockwood, hereby certify that:

One: They are the duly elected and acting President and Vice President and Secretary, respectively, of Keystone Automotive Industries, a California corporation (the “Corporation”).

Two: The number of authorized shares of Preferred Stock of the Corporation is 3,000,000 shares; none of which are issued and outstanding.

Three: The number of authorized shares constituting the Series A Junior Participating Preferred Stock is 153,650 shares, none of which have been issued.

Four: The Board of Directors has duly adopted the following recitals and resolutions as required by Section 401 of the California General Corporation Law at a meeting duly called and held on February 10, 2000. These recitals and resolutions set forth the rights, preferences, privileges and restrictions of the Series A Junior Participating Preferred Stock.

RESOLVED, that pursuant to the authority granted to and vested in the Board of Directors of this Corporation (hereinafter called the “Board of Directors” or the “Board”) in accordance with the provisions of the Certificate of incorporation of this Corporation, the Board of Directors hereby creates a series of Preferred Stock, no par value (the “Preferred Stock”), of the Corporation and hereby states the designation and number of shares, and fixes the relative rights, powers and preferences, and qualifications, limitations and restrictions thereof as follows:

Section 1. Designation and Amount. The shares of such series shall be designated as “Series A Junior Participating Preferred Stock” (the “Series A Preferred Stock’) and the number of shares constituting the Series A Preferred Stock shall be 153,650. Such number of shares may be increased or decreased by resolution of the Board of Directors; provided, that no decrease shall reduce the number of shares of Series A Preferred Stock to a number less than the number of shares then outstanding plus the number of shares reserved for issuance upon the exercise of outstanding options, rights or warrants or upon the conversion of any outstanding securities issued by the Corporation convertible into Series A Preferred Stock.

Section 2. Dividends and Distributions.

(A) Subject to the prior and superior rights of the holders of any shares of any class or series of stock of this Corporation ranking prior and superior to the Series A Preferred Stock with respect to dividends, the holders of shares of Series A Preferred Stock, in preference to the holders of Common Stock, no par value (the “Common Stock”), of the Corporation, and of any other stock ranking junior to the Series A Preferred Stock, shall be entitled to receive, when, as and if declared by the Board of Directors out of funds legally available for the purpose, quarterly dividends payable in cash on the first day of March, June, September and December in each year

(each such date being referred to herein as a “Quarterly Dividend Payment Date”), commencing on the first Quarterly Dividend Payment Date after the first issuance of a share or fraction of a share of Series A Preferred Stock, in an amount per share (rounded to the nearest cent) equal to the greater of (a) $1.00 or (b) subject to the provision for adjustment hereinafter set forth, 100 times the aggregate per share amount of all cash dividends, and 100 times the aggregate per share amount (payable in kind) of all non cash dividends or other distributions, other than a dividend payable in shares of Common Stock or a subdivision of the outstanding shares of Common Stock (by reclassification or otherwise), declared on the Common Stock since the immediately preceding Quarterly Dividend Payment Date or, with respect to the first Quarterly Dividend Payment Date, since the first issuance of any share or fraction of a share of Series A Preferred Stock. In the event the Corporation shall at any time declare or pay any dividend on the Common Stock payable in shares of Common Stock, or effect a subdivision, combination or consolidation of the outstanding shares of Common Stock (by reclassification or otherwise than by payment of a dividend in shares of Common Stock) into a greater or lesser number of shares of Common Stock, then in each such case the amount to which holders of shares of Series A Preferred Stock were entitled immediately prior to such event under clause (b) of the preceding sentence shall be adjusted by multiplying such amount by a fraction, the numerator of which is the number of shares of Common Stock outstanding immediately after such event and the denominator of which is the number of shares of Common Stock that were outstanding immediately prior to such event.

(B) The Corporation shall declare a dividend or distribution on the Series A Preferred Stock as provided in paragraph (A) of this Section 2 immediately after it declares a dividend or distribution on the Common Stock. (other than a dividend payable in shares of Common Stock); provided that, in the event no dividend or distribution shall have been declared on the Common Stock during the period between any Quarterly Dividend Payment Date and the next subsequent Quarterly Dividend Payment Date, a dividend of $1.00 per share on the Series A Preferred Stock shall nevertheless be payable on such subsequent Quarterly Dividend Payment Date.

(C) Dividends shall begin to accrue and be cumulative on outstanding shares of Series A Preferred Stock from the Quarterly Dividend Payment Date next preceding the date of issue of such shares, unless the date of issue of such shares is prior to the record date for the first Quarterly Dividend Payment Date, in which case dividends on such shares shall begin to accrue from the date of issue of such shares, or unless the date of issue is a Quarterly Dividend Payment Date or is a date after the record date for the determination of holders of shares of Series A Preferred Stock entitled to receive a quarterly dividend and before such Quarterly Dividend Payment Date, in either of which events such dividends shall begin to accrue and be cumulative from such Quarterly Dividend Payment Date. Accrued but unpaid dividends shall not bear interest. Dividends paid on the shares of Series A Preferred Stock in an amount less than the total amount of such dividends at the time accrued and payable on such shares shall be allocated pro rata on a share by share basis among all such shares at the time outstanding. The Board of Directors may fix a record date for the determination of holders of shares of Series A Preferred Stock entitled to receive payment of a dividend or distribution declared thereon, which record date shall be not more than 60 days prior to the date fixed for the payment thereof.

Section 3. Voting Rights. The holders of shares of Series A Preferred Stock shall have the following voting rights:

(A) Subject to the provision for adjustment hereinafter set forth, each share of Series A Preferred Stock shall entitle the holder thereof to 100 votes on all matters submitted to a vote of the stockholders of the Corporation. In the event the Corporation shall at any time declare or pay any dividend on the Common Stock payable in shares of Common Stock, or effect a subdivision, combination or consolidation of the outstanding shares of Common Stock (by reclassification or otherwise than by payment of a dividend in shares of Common Stock) into a

greater or lesser number of shares of Common Stock, then in each such case the number of votes per share to which holders of shares of Series A Preferred Stock were entitled immediately prior to such event shall be adjusted by multiplying such number by a fraction, the numerator of which is the number of shares of Common Stock outstanding immediately after such event and the denominator of which is the number of shares of Common Stock that were outstanding immediately prior to such event.

(B) Except as otherwise provided herein, in any other Certificate of Designations creating a series of Preferred Stock or any similar stock, or by law, the holders of shares of Series A Preferred Stock and the holders of shares of Common Stock and any other capital stock of the Corporation having general voting rights shall vote together as one class on all matters submitted to a vote of stockholders of the Corporation.

(C) Except as set forth herein, or as otherwise provided by law, holders of Series A Preferred Stock shall have no special voting rights and their consent shall not be required (except to the extent they are entitled to vote with holders of Common Stock as set forth herein) for taking any corporate action.

Section 4. Certain Restrictions.

(A) Whenever quarterly dividends or other dividends or distributions payable on the Series A Preferred Stock as provided in Section 2 are in arrears, thereafter and until all accrued and unpaid dividends and distributions, whether or not declared, on shares of Series A Preferred Stock outstanding shall have been paid in full, the Corporation shall not:

(i) declare or pay dividends, or make any other distributions, on any shares of stock ranking junior (either as to dividends or upon liquidation, dissolution or winding up) to the Series A Preferred Stock;

(ii) declare or pay dividends, or make any other distributions, on any shares of stock ranking on a parity (either as to dividends or upon liquidation, dissolution or winding up) with the Series A Preferred Stock, except dividends paid ratably on the Series A Preferred Stock and all such parity stock on which dividends are payable or in arrears in proportion to the total amounts to which the holders of all such shares are then entitled;

(iii) redeem or purchase or otherwise acquire for consideration shares of any stock ranking junior (either as to dividends or upon liquidation, dissolution or winding up) to the Series A Preferred Stock, provided that the Corporation may at any time redeem, purchase or otherwise acquire shares of any such junior stock in exchange for shares of any stock of the Corporation ranking junior (both as to-dividends and upon dissolution, liquidation or winding up) to the Series A Preferred Stock; or

(iv) redeem or purchase or otherwise acquire for consideration any shares of Series A Preferred Stock, or any shares of stock ranking on a parity with the Series A Preferred Stock, except in accordance with a purchase offer made in writing or by publication (as determined by the Board of Directors) to all holders of such shares upon such terms as the Board of Directors, after consideration of the respective annual dividend rates and other relative rights and preferences of the respective series and classes, shall determine in good faith will result in fair and equitable treatment among the respective series or classes.

(B) The Corporation shall not permit any subsidiary of the Corporation to purchase or otherwise acquire for consideration any shares of stock of the Corporation unless the Corporation could, under paragraph (A) of this Section 4, purchase or otherwise acquire such shares at such time and in such manner.

Section 5. Reacquired Shares. Any shares of Series A Preferred Stock purchased or otherwise acquired by the Corporation in any manner whatsoever shall be retired and canceled promptly after the acquisition thereof. All such shares shall upon their cancellation become authorized but unissued shares of Preferred Stock and may be reissued as part of a new series of Preferred Stock subject to the conditions and restrictions on issuance set forth herein, in the Certificate of Incorporation, or in any other Certificate of Designations creating a series of Preferred Stock or any similar stock or as otherwise required by law.

Section 6. Liquidation, Dissolution or Winding Up. (A) Upon any liquidation, dissolution or winding up of the Corporation, voluntary or otherwise no distribution shall be made (1) to the holders of shares of stock ranking junior (either as to dividends or upon liquidation, dissolution or winding up) to the Series A Preferred Stock unless, prior thereto, the holders of shares of Series A Preferred Stock shall have received an amount per share (the “Series A Liquidation Preference”) equal to $100 per share, plus an amount equal to accrued and unpaid dividends and distributions thereon, whether or not declared, to the date of such payment, provided that the holders of shares of Series A Preferred Stock shall be entitled to receive an aggregate amount per share, subject to the provision for adjustment hereinafter set forth, equal to 100 times the aggregate amount to be distributed per share to holders of shares of Common Stock, or (2) to the holders of shares of stock ranking on a parity (either as to dividends or upon liquidation, dissolution or winding up) with the Series A Preferred Stock, except distributions made ratably on the Series A Preferred Stock and all such parity stock in proportion to the total amounts to which the holders of all such shares are entitled upon such liquidation, dissolution or winding up. In the event the Corporation shall at any time declare or pay any dividend on the Common Stock payable in shares of Common Stock, or effect a subdivision, combination or consolidation of the outstanding shares of Common Stock (by reclassification or otherwise than by payment of a dividend in shares of Common Stock) into a greater or lesser number of shares of Common Stock, then in each such case the aggregate amount to which holders of shares of Series A Preferred Stock were entitled immediately prior to such event under the proviso in clause (1) of the preceding sentence shall be adjusted by multiplying such amount by a fraction the numerator of which is the number of shares of Common Stock outstanding immediately after such event and the denominator of which is the number of shares of Common Stock that are outstanding immediately prior to such event.

(B) In the event, however, that there are not sufficient assets available to permit payment in full of the Series A Liquidation Preference and the liquidation preferences of all other classes and series of stock of the Corporation, if any, that rank on a parity with the Series A Preferred Stock in respect thereof, then the assets available for such distribution shall be distributed ratably to the holders of the Series A Preferred Stock and the holders of such parity shares in proportion to their respective liquidation preferences.

(C) Neither the merger or consolidation of the Corporation into or with another corporation nor the merger or consolidation of any other corporation into or with the Corporation shall be deemed to be a liquidation, dissolution or winding up of the Corporation within the meaning of this Section 6.

Section 7. Consolidation, Merger, etc. In case the Corporation shall enter into any consolidation, merger, combination or other transaction in which the shares of Common Stock are exchanged for or changed into other stock or securities, cash and/or any other property, then in any such case each share of Series A Preferred Stock shall at the same time be similarly exchanged or changed into an amount per share, subject to the provision for adjustment hereinafter set forth, equal to 100 times the aggregate amount of stock, securities, cash and/or any other property (payable in kind), as the case may be, into which or for which each share of Common Stock is changed or exchanged. In the event the Corporation shall at any time declare or pay any dividend on the Common Stock payable in shares of Common Stock, or effect a

subdivision, combination or consolidation of the outstanding shares of Common Stock (by reclassification or otherwise than by payment of a dividend in shares of Common Stock) into a greater or lesser number of shares of Common Stock, then in each such case the amount set forth in the preceding sentence with respect to the exchange or change of shares of Series A Preferred Stock shall be adjusted by multiplying such amount by a fraction, the numerator of which is the number of shares of Common Stock outstanding immediately after such event and the denominator of which is the number of shares of Common Stock that were outstanding immediately prior to such event.

Section 8. No Redemption. The shares of Series A Preferred Stock shall not be redeemable by the Company.

Section 9. Rank. The Series A Preferred Stock shall rank, with respect to the payment of dividends and the distribution of assets upon liquidation, dissolution or winding up, junior to all series of any other class of the Corporation’s Preferred Stock, except to the extent that any such other series specifically provides that it shall rank on a parity with or junior to the Series A Preferred Stock.

Section 10. Amendment. At any time any Shares of Series A Preferred Stock are outstanding, the Certificate of Incorporation of the Corporation shall not be amended in any manner which would materially alter or change the powers, preferences or special rights of the Series A Preferred Stock so as to affect them adversely without the affirmative vote of the holders of at least two thirds of the outstanding shares of Series A Preferred Stock, voting separately as a single class.

Section 11, Fractional Shares. Series A Preferred Stock may be issued in fractions of a share that shall entitle the holder, in proportion to such holder’s fractional shares, to exercise voting rights, receive dividends, participate in distributions and to have the benefit of all other rights of holders of Series A Preferred Stock.

IN WITNESS WHEREOF, the undersigned have executed this certificate on March 10, 2000.

/s/ Charles J. Hogarty

Charles J. Hogarty, President

/s/ James C. Lockwood

James C. Lockwood, Secretary

The undersigned, Charles J. Hogarty, President of Keystone Automotive Industries, Inc., and James C. Lockwood, Vice President and Secretary of Keystone Automotive Industries, Inc., declare under penalty of perjury that the matters set forth in the foregoing Certificate are true and of their own knowledge.

Executed at Pomona, California on March 10, 2000.

/s/ Charles J. Hogarty

Charles J. Hogarty

/s/ James C. Lockwood

James C. Lockwood

AGREEMENT OF MERGER

OF

KEYSTONE AUTOMOTIVE INDUSTRIES, INC.

AND

LKQ ACQUISITION COMPANY

This Agreement of Merger is entered into between Keystone Automotive Industries, Inc., a California corporation (herein “Surviving Corporation”), and LKQ Acquisition Company, a California corporation (herein “Merging Corporation”).

1. Merging Corporation shall be merged with and into Surviving Corporation (the “Merger”).

2. Upon effectiveness of the Merger, all shares of capital stock of Surviving Corporation outstanding immediately prior to the effectiveness of the Merger shall be converted into the right to receive $48.00 in cash, without interest, and shall be canceled and extinguished.

3. Upon effectiveness of the Merger, all shares of Merging Corporation outstanding immediately prior to the effectiveness of the Merger shall be converted into 100 shares of common stock of Surviving Corporation.

4. Merging Corporation shall from time to time, as and when requested by Surviving Corporation, execute and deliver all such documents and instruments and take all such action necessary or desirable to evidence or carry out this merger.

5. The effect of the merger and the effective date of the merger are as prescribed by law.

IN WITNESS WHEREOF, the parties have executed this Agreement.

KEYSTONE AUTOMOTIVE INDUSTRIES, INC.

By: /s/ Richard L. Keister

Name: Richard L. Keister

Title: President and Chief Executive Officer

By: /s/ John G. Arena

Name: John G. Arena

Title: General Counsel and Secretary

LKQ ACQUISITION COMPANY

By: /s/ Joseph M. Holston

Name: Joseph M. Holston

Title: President and Chief Executive Officer

By: /s/ Victor M. Casini

Name: Victor M. Casini

Title: Vice President and Secretary

CERTIFICATE OF APPROVAL

OF

AGREEMENT OF MERGER

OF

KEYSTONE AUTOMOTIVE INDUSTRIES, INC.

Richard L. Keister and John G. Arena certify that:

I. They are the President and Chief Executive Officer and the General Counsel and Secretary, respectively, of Keystone Automotive Industries, Inc., a California corporation.

2. The Agreement of Merger in the form attached was duly approved by the Board of Directors and by the vote of the shareholders of the corporation which equaled or exceeded the vote required.

3. The approval of the holders of a majority of the outstanding shares of the corporation entitled to vote was required to approve the Agreement of Merger. The shareholder approval was by the holders of 11,766,016 of the outstanding shares of the corporation.

4. There are 16,574,252 shares outstanding entitled to vote on the merger, all of which are Common Stock.

We further declare under penalty of perjury under the laws of the State of California that the matters set forth in this certificate are true and correct of our own knowledge.

Date: October 12, 2007

/s/ Richard L. Keister

Name: Richard L. Keister

Title: President and Chief Executive Officer

/s/ John G. Arena

Name: John G. Arena

Title: General Counsel and Secretary

CERTIFICATE OF APPROVAL

OF

AGREEMENT OF MERGER

OF

LKQ ACQUISITION COMPANY

Joseph M. Holsten and Victor M. Casini certify that:

1. They are the President and Chief Executive Officer and the Vice President and Secretary, respectively, of LKQ Acquisition Company, a California corporation.

2. The Agreement of Merger in the form attached was duly approved by the Board of Directors and by the vote of the sole shareholder of the corporation which equaled or exceeded the vote required.

3. The shareholder approval was by the holder of 100% of the outstanding shares of the corporation.

4. There is only one class of shares and the number of shares outstanding entitled to vote on the merger is 100.

We further declare under penalty of perjury under the laws of the State of California that the matters set forth in this certificate are true and correct of our own knowledge.

Dated: October 12, 2007

/s/ Joseph M. Holston

Name: Joseph M. Holston

Title: President and Chief Executive Officer

/s/ Victor M. Casini

Name: Victor M. Casini

Title: Vice President and Secretary

AGREEMENT OF MERGER

OF

KEYSTONE AUTOMOTIVE INDUSTRIES, INC.;

KWIK AUTO BODY SUPPLIES, INC.

AND

P.B.F. SPECIALTIES, INC.

AGREEMENT Of MERGER, pursuant to the provisions of the California Corporations Code, dated this 20th day of August, 2015, among Keystone Automotive Industries, Inc., a California corporation (herein “Surviving Corporation”), KWIK Auto Body Supplies, Inc., a Massachusetts corporation, and P.B.E. Specialities, Inc., a Massachusetts corporation (each, a “Merging Corporation” and collectively, the “Merging Corporations).

WITNESSETH that:

WHEREAS, all of the constituent corporations desire to merge into a single corporation; and

NOW THEREFORE, the corporations, parties to the Agreement, in consideration of the mutual covenants, agreements and provisions hereinafter contained do hereby prescribe the terms and conditions of said merger and mode of carrying the same into effect as follows:

1.The Merging Corporations shall be merged with and into Surviving Corporation (the “Merger”).

2.The Certificate of Incorporation of Surviving Corporation, as in effect on the date of the merger provided for in this Agreement, shall continue in full force and effect as the Certificate of Incorporation of the corporation surviving this merger.

3.Upon effectiveness of the Merger, all shares of the Merging Corporations immediately prior to the effectiveness of the Merger shall be cancelled without consideration and converted into no shares of the Surviving Corporation. All the shares of the Surviving Corporation shall not be converted in any manner, but each such share which is issued as of the effective date of the merger shall continue to represent one issued share of the Surviving Corporation.

4.The Surviving Corporation shall assume the assets and liabilities of the Merging Corporations.

5.The by-laws of the Surviving Corporation as they exist of the effective date of this merger shall be and remain the by-laws of the Surviving Corporation until the same shall be altered, amended and repealed as therein provided.

6.This merger shall become effective as of August 31, 2015.

[SIGNATURE PAGE FOLLOWS]

IN WITNESS WHEREOF, the parties to this Agreement, pursuant to the approval and authority duly given by resolutions adopted by their respective Boards of Directors have caused these presents to be executed by an officer of each party hereto as the respective act, deed, and agreement of each said corporation on this 20th day of August, 2015.

KEYSTONE AUTOMOTIVE INDUSTRIES, INC.

By: /s/ Victor M. Casini

Victor M. Casini, Vice President

By: /s/ Matthew J. McKay

Matthew J. McKay, Secretary

KWIK AUTO BODY SUPPLIES, INC.

By: /s/ Victor M. Casini

Victor M. Casini, Vice President

By: /s/ Matthew J. McKay

Matthew J. McKay, Secretary

P.B.E. SPECIALTIES, INC.

By: /s/ Victor M. Casini

Victor M. Casini, Vice President

By: /s/ Matthew J. McKay

Matthew J. McKay, Secretary

OFFICERS’ CERTIFICATE

KEYSTONE AUTOMOTIVE INDUSTRIES, INC.

CERTIFICATE OF APPROVAL OF AGREEMENT OF MERGER

Victor M. Casini and Matthew J. McKay certify that:

1. They are the vice president and secretary, respectively, of Keystone Automotive Industries, Inc., a California corporation.

2. The principal terms of the Agreement of Merger in the form attached were duly approved by the board of directors and by the shareholders of the corporation by a vote that equaled or exceeded the vote required.

3. The shareholder approval was by the holders of 100% of the outstanding shares of the corporation.

4. There is only one class of shares (common). There are 100 shares outstanding and all of the outstanding shares were entitled to vote on the merger.

We further declare under penalty of perjury under the laws of the State of California that the matters set forth in this certificate are true and correct to our own knowledge.

Date: August 20, 2015

/s/ Victor M. Casini

Victor M. Casini, Vice President

/s/ Matthew J. McKay

Matthew J. McKay, Secretary

OFFICERS’ CERTIFICATE

KWIK AUTO BODY SUPPLIES, INC.

CERTIFICATE OF APPROVAL OF AGREEMENT OF MERGER

Victor M. Casini and Matthew J. McKay certify that:

1. They are the vice president and secretary, respectively, of Kwik Auto Body Supplies, Inc., a Massachusetts corporation.

2. The principal terms of the Agreement of Merger in the form attached were duly approved by the board of directors and by the shareholders of the corporation by a vote that equaled or exceeded the vote required.

3. The shareholder approval was by the holders of 100% of the outstanding shares of the corporation.

4. There is only one class of shares (common). There are 50 shares outstanding and all of the outstanding shares were entitled to vote on the merger.

We further declare under penalty of perjury under the laws of the State of California that the matters set forth in this certificate are true and correct to our own knowledge.

Date: August 20, 2015

/s/ Victor M. Casini

Victor M. Casini, Vice President

/s/ Matthew J. McKay

Matthew J. McKay, Secretary

OFFICERS’ CERTIFICATE

P.B.E. SPECIALTIES, INC.

CERTIFICATE OF APPROVAL OF AGREEMENT OF MERGER

Victor M. Casini and Matthew J. McKay certify that:

1. They are the vice president and secretary, respectively, of P.B.E. Specialties., a Massachusetts corporation.

2. The principal terms of the Agreement of Merger in the form attached were duly approved by the board of directors and by the shareholders of the corporation by a vote that equaled or exceeded the vote required.

3. The shareholder approval was by the holders of 100% of the outstanding shares of the corporation.

4. There is only one class of shares (common). There are 200 shares outstanding and all of the outstanding shares were entitled to vote on the merger.

We further declare under penalty of perjury under the laws of the State of California that the matters set forth in this certificate are true and correct to our own knowledge.

Date: August 20, 2015

/s/ Victor M. Casini

Victor M. Casini, Vice President

/s/ Matthew J. McKay

Matthew J. McKay, Secretary

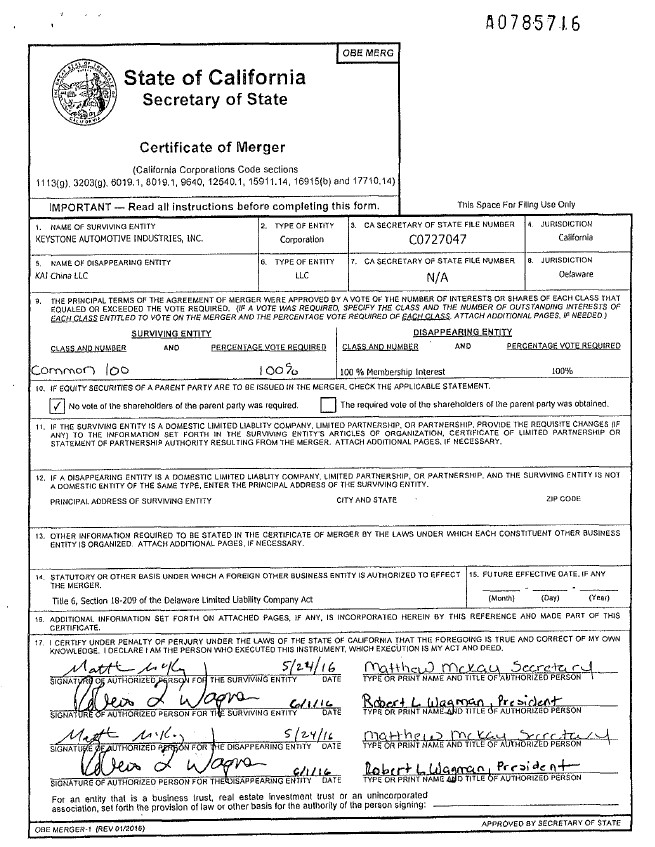

AGREEMENT AND PLAN OF MERGER

THIS AGREEMENT AND PLAN OF MERGER is made as of June 1, 2016 and adopted by KAI China, LLC, a Delaware limited liability company (“KAI”), by resolution of its Board of Managers on May 23, 2016 and by resolution of its sole member on May 23,2016, and Keystone Automotive Industries, Inc., a California corporation (“Keystone”), by resolution of its Board of Directors on May 23, 2016 and by resolution of its sole shareholder on May 23, 2016.

1. KAI shall, pursuant to the provisions of the Limited Liability Company Act of the State of Delaware, be merged with and into Keystone, with Keystone being the surviving company at the effective time and date of the merger (sometimes hereinafter referred to as the “surviving company”). Keystone shall continue to exist, as of the effective time and date of the merger, under the name Keystone Automotive Industries, Inc. Inc. pursuant to the provisions of the California Corporations Code. The separate existence of KAI (which is sometimes hereinafter referred to as the “non-surviving company”) shall cease at the effective time and date of the merger in accordance with the provisions of the Limited Liability Company Act of the State of Delaware.

2. The Articles of Incorporation of Keystone at the effective time and date or the merger shall be the Articles of Incorporation of the surviving company, and said Articles or Incorporation shall continue in full force and effect until amended and changed in the manner prescribed by the provisions of the California Corporations Code.

3. The Bylaws of Keystone at the effective time and date of the merger shall be the Bylaws of the surviving company, and said Bylaws shall continue in full force and effect until changed, altered, or amended as therein provided and in the manner prescribed by the provisions of the California Corporations Code.

4. The members of the Board of Directors and the officers in office of Keystone at the effective time and date of the merger shall be the members of the Board of Directors and the officers of the surviving company, all of whom shall hold their respective directorship and offices until their successors are elected and qualified or until their tenure is otherwise terminated in accordance with the Bylaws of the surviving company.

5. KAI has 100 authorized and issued membership units. The membership units of KAI are 100% of the issued and outstanding membership units of KAI. The membership units of KAI shall not be converted in any manner, but each said share that is issued immediately prior to the effective time and date of the merger shall be surrendered and extinguished, and cancelled without consideration. The issued and outstanding shares of capital stock of Minim shall not be converted or exchanged in any manner, but each said share that is issued and outstanding immediately prior to the effective time and date of the merger shall continue to represent the issued and outstanding membership units of Keystone.

6. The Merger will be effective (“Effective Time”) as prescribed by law.

7. This Agreement and Plan of Merger may be executed in any number of counterparts, each of which shall be deemed to be an original and all of which together shall constitute one and the same instrument. Signatures to this Agreement and Plan of Merger delivered by facsimile or in .pdf or other electronic format shall be acceptable and binding and treated in all respects as having the same effect as an original signature.

[Signature Page Follows]

IN WITNESS WHEREOF, the parties to this Agreement and Plan of Merger have caused this document to be signed by an authorized person of each party as the date first written above.

KAI China, LLC

/s/ Robert L. Wagman

Name: Robert L. Wagman

Title: President

KAI China, LLC

/s/ Matthew McKay

Name: Matthew McKay

Title: Secretary

Keystone Automotive Industries, Inc.

/s/ Robert L. Wagman

Name: Robert L. Wagman

Title: President

Keystone Automotive Industries, Inc.

/s/ Matthew McKay

Name: Matthew McKay

Title: Secretary

Certificate of Approval

of

Agreement and Plan of Merger

Robert L. Wagman and Matthew McKay certify that:

1. They are the president and the secretary, respectively, of Keystone Automotive Industries, Inc. a California corporation.

2. The principal terms of the Agreement and Plan of Merger in the form attached were duly approved by the board of directors and by the shareholders of the corporation by a vote that equaled or exceeded the vote required.

3. The shareholder approval was by the holders of 100% of the outstanding shares of the corporation.

4. There is only one class of shares and the number of shares outstanding entitled to vote on the merger is 100.

5. The shareholders approve the agreement and plan of merger dated June 1, 2016.

We further declare under penalty of perjury under the laws of the State of California that the matters set forth in this certificate are true and correct of our own knowledge.

Date: June 22, 2016

/s/ Robert L. Wagman

Robert L. Wagman, President

/s/ Matthew McKay

Matthew McKay, Secretary

AGREEMENT AND PLAN OF MERGER

THIS AGREEMENT AND PLAN OF MERGER is made as of December 20, 2016 and adopted by Taylor’s Executive Radiator Service, Inc., a Maryland corporation (“TAYLOR’S”), by resolution of its Board of Managers on December 16, 2016 and by resolution of its sole member on December 16, 2016, and Keystone Automotive Industries, Inc. a California corporation (“Keystone”), by resolution of its Board of Directors on December 16, 2016 and by resolution of its sole shareholder on December 16, 2016.

1. TAYLOR’S shall, pursuant to Sections 3-102, 3-107, 3-109, 4A-701, 8-501.1 and 10-208 of the Maryland Corporations and Associations Article of the Amended Code of Maryland be merged with and into Keystone, with Keystone being the surviving company at the effective time and date of the merger (sometimes hereinafter referred to as the “surviving company”). Keystone shall continue to exist, as of the effective time and date of the merger, under the name Keystone Automotive Industries, Inc. Inc. pursuant to the provisions of the California Corporations Code. The separate existence of TAYLOR’S (which is sometimes hereinafter referred to as the “non-surviving company”) shall cease at the effective time and date of the merger in accordance with the provisions of the Corporation Act of the State of Maryland.

2. The Articles of Incorporation of Keystone at the effective time and date of the merger shall be the Articles of Incorporation of the surviving company, and said Articles of Incorporation shall continue in full force and effect until amended and changed in the manner prescribed by the provisions of the California Corporations Code.

3. The Bylaws of Keystone at the effective time and date of the merger shall be the Bylaws of the surviving company, and said Bylaws shall continue in full force and effect until changed, altered, or amended as therein provided and in the manner prescribed by the provisions of the California Corporations Code.

4. The members of the Board of Directors and the officers in office of Keystone at the effective time and date of the merger shall be the members of the Board of Directors and the officers of the surviving company, all of whom shall hold their respective directorship and offices until their successors are elected and qualified or until their tenure is otherwise terminated in accordance with the Bylaws of the surviving company.

5. TAYLOR’S has 2 shares of common stock, The common stock of TAYLOR’S are 100% of the issued and outstanding stock of TAYLOR’S. The stock of TAYLOR’S shall not be converted in any manner, but each said share that is issued immediately prior to the effective time and date of the merger shall be surrendered and extinguished, and cancelled without consideration.

6. The Merger will be effective (“Effective Time”) as prescribed by law.

7. This Agreement and Plan of Merger may be executed in any number of counterparts, each of which shall be deemed to be an original and all of which together shall constitute one and the same instrument. Signatures to this Agreement and Plan of Merger delivered by facsimile or in .pdf or other electronic format shall be acceptable and binding and treated in all respects as having the same effect as an original signature.

[Signature Page Follows]

IN WITNESS WHEREOF, the parties to this Agreement and Plan of Merger have caused this document to be signed by an authorized person of each party as the date first written above.

Taylor’s Executive Radiator Service, Inc.

/s/ Walter Hanley

Name: Walter Hanley

Title: Vice President

Taylor’s Executive Radiator Service, Inc.

/s/ Matthew McKay

Name: Matthew McKay

Title: Secretary

Keystone Automotive Industries, Inc.

/s/ Walter Hanley

Name: Walter Hanley

Title: Vice President

Keystone Automotive Industries, Inc.

/s/ Matthew McKay

Name: Matthew McKay

Title: Secretary

Certificate of Approval

Of

Agreement and Plan of Merger

Robert Wagman and Matthew McKay certify that:

1. They are the president and the secretary, respectively, of Keystone Automotive Industries, Inc., a California corporation.

2. The principal terms of the Agreement and Plan of Merger in the form attached were duly approved by the board of directors and by the shareholders of the corporation by a vote that equaled or exceeded the vote required.

3. The shareholder approval was by the holders of 100% of the outstanding shares of the corporation.

4. There are two classes of shares and the number of shares outstanding entitled to vote on the merger is no preferred shares and 100 common shares.

We further declare under penalty of perjury under the laws of the State of California that the matters set forth in this certificate are true and correct of our own knowledge.

Date: January 5, 2017

/s/ Robert Wagman

Robert Wagman, President

/s/ Matthew McKay

Matthew McKay, Secretary

Certificate of Approval

Of

Agreement and Plan of Merger

Robert Wagman and Matthew McKay certify that:

1. They are the president and the secretary, respectively, of Taylor’s Executive Radiator Service, Inc., a Maryland corporation.

2. The principal terms of the Agreement and Plan of Merger in the form attached were duly approved by the board of directors and by the shareholders of the corporation by a vote that equaled or exceeded the vote required.

3. The shareholder approval was by the holders of 100% of the outstanding shares of the corporation.

4. There is only one class of shares and number of shares outstanding entitled to vote on the

merger is 2.

We further declare under penalty of perjury under the laws of the State of Maryland that the matters set forth in this certificate are true and correct of our own knowledge.

Date: January 5, 2017

/s/ Robert Wagman

Robert Wagman, President

/s/ Matthew McKay

Matthew McKay, Secretary

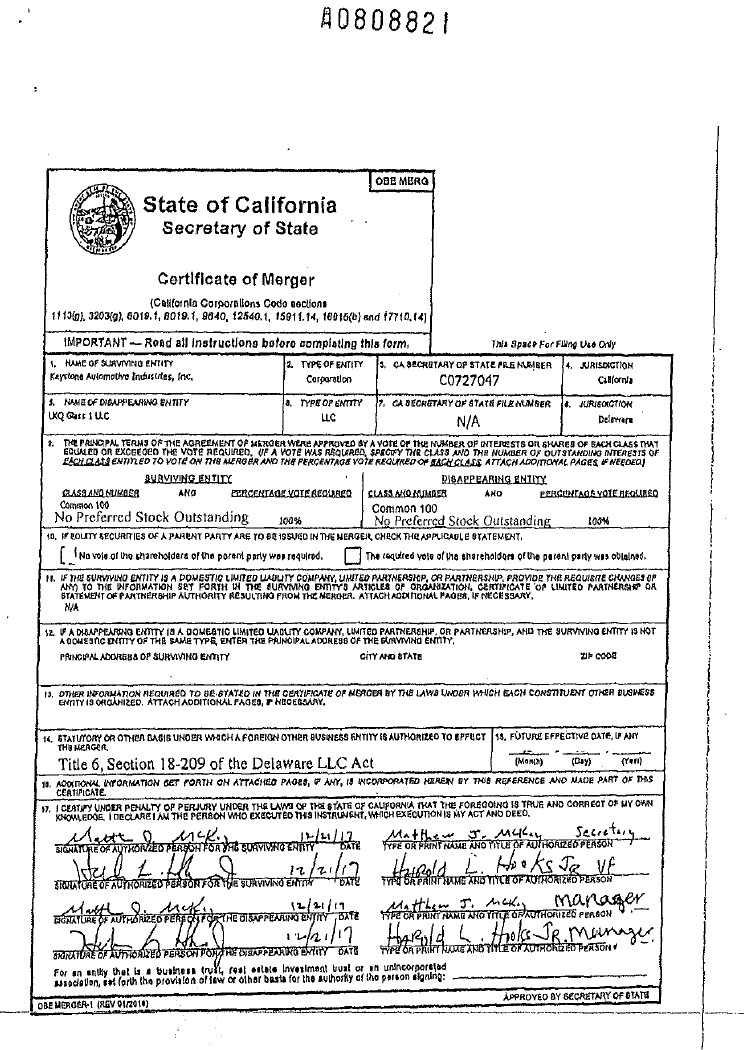

AGREEMENT AND PLAN OF MERGER

THIS AGREEMENT AND PLAN OF MERGER is made as of December 20, 2017 and adopted by LKQ Glass 1, LLC, a Delaware limited liability company (“LKQ”), by resolution of its Board of Managers on December 16, 2017 and by resolution of its sole member on December 16, 2017, and Keystone Automotive Industries, Inc., a California corporation (“Keystone”), by resolution of its Board of Directors on December 16, 2017 and by resolution of its sole shareholder on December 16, 2017.

1. LKQ shall, pursuant to the provisions of the Limited Liability Company Act of the State of Delaware, be merged with and into Keystone, with Keystone being the surviving company at the effective time and date of the merger (sometimes hereinafter referred to as the “surviving company”), Keystone shall continue to exist, as of the effective time and date of the merger, under the name Keystone Automotive Industries, Inc. Inc. pursuant to the provisions of the California Corporations Code. The separate existence of LKQ (which is sometimes hereinafter referred to as the “non-surviving company”) shall cease at the effective time and date of the merger in accordance with the provisions of the Limited Liability Company Act of the State of Delaware.

2. The Articles of Incorporation of Keystone at the effective time and date of the merger shall be the Articles of Incorporation of the surviving company, and said Articles of Incorporation shall continue in full force and effect until amended and changed in the manner prescribed by the provisions of the California Corporations Code.

3. The Bylaws of Keystone at the effective time and date of the merger shall be the Bylaws of the surviving company, and said Bylaws shall continue in full force and effect until changed, altered, or amended as therein provided and in the manner prescribed by the provisions of the California Corporations Code.

4. The members of the Board of Directors and the officers in office of Keystone at the effective time and date of the merger shall be the members of the Board of Directors and the officers of the surviving company, all of whom shall hold their respective directorship and offices until their successors are elected and qualified or until their tenure is otherwise terminated in accordance with the Bylaws of the surviving company.

5. LKQ has 100 authorized and issued membership units, The membership units of LKQ are 100% of the issued and outstanding membership units of LKQ. The membership units of LKQ shall not be converted in any manner, but each said share that is issued immediately prior to the effective time and date of the merger shall be surrendered and extinguished, and cancelled without consideration. The issued and outstanding shares of capital stock or Keystone shall not be converted or exchanged in any manner, but each said share that is issued and outstanding immediately prior to the effective time and date of the merger shall continue to represent the issued and outstanding membership units of Keystone.

6. The Merger will be effective December 31st, 2017, for accounting purposes only.