UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________________________

FORM 10-K

___________________________________________

(Mark One)

|

| |

| ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2014

Or

|

| |

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 001-36468

___________________________________________

ARISTA NETWORKS, INC.

(Exact name of registrant as specified in its charter)

___________________________________________

|

| | |

| Delaware | | 20-1751121 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification Number) |

5453 Great America Parkway

Santa Clara, California 95054

(Address of principal executive offices)

(408) 547-5500

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

___________________________________________

|

| | |

| Title of each class | | Name of each exchange on which registered |

| Common Stock, $0.0001 par value | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

| | |

Large accelerated filer o | | Accelerated filer o |

Non-accelerated filer x | (Do not check if a smaller reporting company) | Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ý

The aggregate market value of the registrant’s common stock held by non-affiliates of the registrant was $1,702,757,925 as of June 30, 2014 based on the closing sale price of the registrant’s common stock on the New York Stock Exchange on such date. Shares held by persons who may be deemed affiliates have been excluded. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

On March 6, 2015, 66,244,550 shares of the registrant’s common stock were outstanding. Portions of the registrant’s definitive Proxy Statement relating to its 2015 Annual Stockholders’ Meeting to be filed pursuant to Regulation 14A within 120 days after the registrant’s fiscal year end of December 31, 2014 are incorporated by reference into Part III of this Annual Report on Form 10-K.

ARISTA NETWORKS, INC.

TABLE OF CONTENTS

|

| | |

| | | Page |

| Item 1. | | |

| Item 1A. | | |

| Item 1B. | | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| | | |

| Item 5. | | |

| Item 6. | | |

| Item 7. | | |

| Item 7A. | | |

| Item 8. | | |

| Item 9. | | |

| Item 9A. | | |

| Item 9B. | | |

| | | |

| Item 10. | | |

| Item 11. | | |

| Item 12. | | |

| Item 13. | | |

| Item 14. | | |

| | | |

| Item 15. | | |

PART I

FORWARD-LOOKING INFORMATION

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K, including the sections entitled “Business,” “Risk Factors,” “Use of Proceeds,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, as Section 21E of the Securities Exchange Act of 1934, as amended, which statements involve substantial risks and uncertainties. The words “believe,” “may,” “will,” “potentially,” “estimate,” “continue,” “anticipate,” “intend,” “could,” “would,” “project,” “plan,” “predict,” “expect” and similar expressions that convey uncertainty of future events or outcomes are intended to identify forward-looking statements.

These forward-looking statements include, but are not limited to, statements concerning the following:

| |

| • | our ability to maintain an adequate rate of revenue growth and our future financial performance, including our expectations regarding our cost of revenue, gross profit or gross margin and operating expenses; |

| |

| • | our belief that the cloud networking market is still in the early stages of adoption and has a significant potential opportunity for growth; |

| |

| • | our business plan and our ability to effectively manage our growth, including the reporting requirements and compliance obligations of a public company; |

| |

| • | costs associated with defending intellectual property infringement and other claims and the potential outcomes of such disputes, such as those claims discussed in “Legal Proceedings;” |

| |

| • | our ability to satisfy the requirements for cloud networking solutions and to successfully anticipate technological shifts and market needs, innovate new products and bring them to market in a timely manner; |

| |

| • | the budgeting cycles and purchasing practices of end customers, including large end customers who may receive lower pricing terms due to volume discounts; |

| |

| • | the deferral or cancellation of orders by end customers, warranty returns or delays in acceptance of our products; |

| |

| • | our ability to attract and retain end customers; |

| |

| • | our ability to further penetrate our existing customer base and sell more complex and higher-performance configurations of our products; |

| |

| • | our ability to displace existing products in established markets; |

| |

| • | our belief that increasing channel leverage will extend and improve our engagement with a broad set of customers; |

| |

| • | our ability to expand our leadership position in the network switch industry, including the areas of mobility, virtualization, cloud computing and cloud networks; |

| |

| • | our ability to timely and effectively scale and adapt our existing technology; |

| |

| • | the benefits realized by our customers in their use of our products and services including lower total cost of ownership; |

| |

| • | our ability to expand our business domestically and internationally; |

| |

| • | the effects of increased competition in our market and our ability to compete effectively; |

| |

| • | the effects of seasonal and cyclical trends on our results of operations; |

| |

| • | our expectations concerning relationships with third parties; |

| |

| • | the attraction and retention of qualified employees and key personnel; |

| |

| • | our ability to maintain, protect and enhance our brand and intellectual property; |

| |

| • | economic and industry trends; |

| |

| • | estimates and estimate methodologies used in preparing our financial statements and determining option exercise prices; |

| |

| • | future trading prices of our common stock; |

| |

| • | our belief that we have adequately reserved for uncertain tax positions; |

| |

| • | our belief that our existing cash and cash equivalents together with cash flow from operations will be sufficient to meet our working capital requirements and our growth strategies for the foreseeable future; and |

| |

| • | future acquisitions of or investments in complementary companies, products, services or technologies; |

These forward-looking statements are subject to a number of risks, uncertainties and assumptions, including those described in the section titled “Risk Factors” and elsewhere in this Annual Report on Form 10-K. Moreover, we operate in a very competitive and rapidly changing environment, and new risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. In light of these risks, uncertainties and assumptions, the forward-looking events and circumstances discussed in this Annual Report on Form 10-K may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements. You should not rely upon forward-looking statements as predictions of future events.

The forward-looking statements made in this Annual Report on Form 10-K relate only to events as of the date on which the statements are made. We undertake no obligation to update any forward-looking statements made in this Annual Report on Form 10-K to reflect events or circumstances after the date of this Annual Report on Form 10-K or to reflect new information or the occurrence of unanticipated events, except as required by law. We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements and you should not place undue reliance on our forward-looking statements. Our forward-looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, joint ventures or investments we may make.

Item 1. Business

We are a leading supplier of cloud networking solutions that use software innovations to address the needs of large-scale Internet companies, cloud service providers and next-generation data centers for enterprises, based on market share. Our cloud networking solutions consist of our Extensible Operating System, or EOS, a set of network applications and our 10/40/100 Gigabit Ethernet switches. Our cloud networking solutions deliver industry-leading performance, scalability, availability, programmability, automation and visibility. Since we began shipping our products, we have grown rapidly, and, according to Crehan Research, we have achieved the second largest market share in data center 10/40/100 Gigabit Ethernet switch ports, excluding blade switching, sold in 2014.

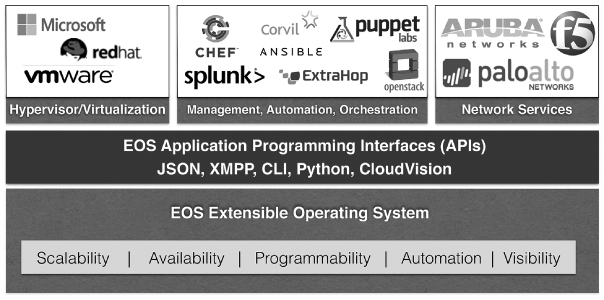

At the core of our cloud networking platform is EOS, which was purpose-built to be fully programmable and highly modular. The programmability of EOS has allowed us to create a set of software applications that address the requirements of cloud networking, including workflow automation, network visibility and analytics, and has also allowed us to rapidly integrate with a wide range of third-party applications for virtualization, management, automation, orchestration and network services.

EOS supports leading cloud and virtualization solutions, including VMware NSX, Microsoft System Center, OpenStack and other cloud management frameworks. We have worked with industry leaders to define new open protocols for the virtualized data center. We co-authored the VXLAN protocol specification with VMware and were the first to demonstrate VXLAN integration. We also co-authored the NVGRE protocol specification with Microsoft and support integration with Microsoft’s System Center.

We use standard Linux as our underlying operating system, providing customers with access to all Linux operating system facilities. This allows customers to extend our EOS software with off-the-shelf Linux applications and a growing number of open source management tools.

EOS has a highly modular architecture, which allows us to prevent network outages in deployments of our cloud networking solutions. This architecture also allows us to rapidly develop new features and protocols without compromising the quality of the existing code base. Because all of our switching products are powered by the same binary image of EOS, we are able to deliver these new innovations to our entire installed base with minimal disruption.

In 2014, we introduced EOS+, a software platform for network programmability and automation, provides an advanced level of programmability, allowing customers to take advantage of pre-built and custom EOS applications as well as integration with a wide range of technology partner solutions.

During the second half of fiscal 2014, the 25 Gigabit Ethernet Consortium was formed by leading cloud networking technology providers for the purpose of supporting an industry-standard and interoperable Ethernet specifications that increase the performance and reduce the interconnect cost per Gbps between the server Network Interface Controller (NIC) and Top-of-Rack (ToR) switch. This new specification will enable the cost-efficient scaling of network bandwidth to 25 or 50 Gbps delivered to server and storage endpoints in next-generation cloud infrastructure, where workloads are expected to surpass the capacity of 10 or 40 Gbps Ethernet links deployed today. The new specification is being made available royalty-free by the Consortium members to any data center ecosystem vendor or consumer who joins the Consortium.

We sell our products through both our direct sales force and our channel partners. Since shipping our first products in 2008, our cumulative end-customer base has grown rapidly. Between December 31, 2010 and December 31, 2014, our cumulative end-customer base grew from approximately 570 to approximately 3,000. Our end customers span a range of industries and include large Internet companies, service providers, financial services organizations, government agencies, media and entertainment companies and others. Our customers include six of the largest cloud services providers based on annual revenue.

We have experienced rapid revenue growth over the last several years, increasing our revenue at a compound annual growth rate of 68.9% from 2010 to 2014. For 2010, 2011, 2012, 2013 and 2014, our revenue was $71.7 million, $139.8 million, $193.4 million,

$361.2 million and $584.1 million, respectively. Our 2014 revenue grew 61.7% when compared to 2013. For 2010, 2011, 2012, 2013 and 2014, our net income was $2.4 million, $34.0 million, $21.3 million, $42.5 million and $86.9 million, respectively.

We were incorporated in the State of California as Arastra, Inc. in October 2004. We reincorporated in the State of Nevada in March 2008, and we changed our name to Arista Networks, Inc. in October 2008. We reincorporated in the State of Delaware in March 2014. Our principal executive offices are located at 5453 Great America Parkway, Santa Clara, California 95054. Our main telephone number is (408) 547-5500. Our website address is www.arista.com. Information contained on, or that can be accessed through, our website is not incorporated by reference into this report, and you should not consider information on our website to be part of this report.

Industry Background

Cloud computing is fundamentally changing the way IT infrastructure is built and how applications are delivered. In cloud computing, applications are distributed across thousands of servers. These servers are connected with high-speed network switches that, together, form a pool of resources that allows applications to be rapidly deployed and cost-effectively updated. Cloud computing enables ubiquitous and on-demand network access to these applications from Internet-connected devices including personal computers, tablets and smartphones.

Nearly all consumer applications today are delivered as cloud services. Enterprise applications are rapidly moving to the cloud as well, since cloud services are easier and more cost effective to deploy, scale and operate than traditional applications. Internet leaders like Amazon, eBay, Facebook, Google, Microsoft and Yahoo! pioneered the development of large-scale cloud data centers in order to meet the growing demands of their users, including business customers. Enterprises and service providers around the world are adopting cloud computing technologies in order to achieve similar performance improvements and cost reductions.

The aggregate network bandwidth in the cloud can be orders of magnitude higher than typical legacy data center networks. Therefore, the networks in such cloud environments must be architected and built in a new way. We refer to these next-generation data center networks as cloud networks. Cloud networks must deliver high capacity, high availability and predictable performance and must be programmable to allow integration with third-party applications for network, management, automation, orchestration and network services.

Limitations of Traditional Data Center Networks

In our view, cloud networks and legacy networks are fundamentally different. In a traditional data center, specific applications are installed on a small number of servers, and most network traffic is server-to-client, or “north-south” traffic, which results in perhaps a few terabits/second of aggregate network bandwidth. In the cloud, most network traffic is server-to-server, or “east-west” traffic. The aggregate network bandwidth in the cloud can exceed 1 petabit/second, orders of magnitude higher than that of typical legacy data center networks.

The much larger scale of cloud networks requires much higher network availability since network outages in the cloud are very expensive in terms of customer impact. Traditional network switches have evolved, and the features and capabilities of their operating system have expanded over many years without addressing the structural deficiencies of their underlying software architectures, making it difficult to achieve high network switch reliability.

Some networking vendors have built products that use proprietary protocols to address the scaling needs of next-generation data centers. However, proprietary protocols are generally not acceptable to Internet companies or cloud service providers because they create vendor lock-in.

Legacy networks are not programmable and, as a result, are extremely difficult to integrate with third-party applications for network management, automation, orchestration and network services. This lack of integration forces customers to continue to rely on time consuming, error-prone manual processes that may be cost-prohibitive.

Requirements for Cloud Networking

Cloud networks differ in many aspects from legacy networks, including capacity, performance, scale, availability, programmability, automation, visibility and cost performance. The requirements for cloud networking include the following:

| |

| • | Capacity, Performance and Scalability. Cloud networks must have sufficient capacity to interconnect large numbers of servers, up to hundreds of thousands, with predictable network bandwidth. |

| |

| • | High Availability. Cloud networks must overcome hardware and software failures for customers in order to avoid network outages that can result in lost revenue, dissatisfied customers and increased operational cost. |

| |

| • | Open and Programmable. Cloud networks must be based on open protocols and be programmable to enable integration with leading network applications and management and data analysis tools. |

| |

| • | Workflow Automation. Cloud networks must offer automated provisioning and configuration to enable fast service delivery and to minimize operational costs, avoiding time-consuming and error-prone manual processes for configuring, provisioning, monitoring and managing the network. |

| |

| • | Network Visibility. Cloud networks must provide IT administrators with real-time in-depth visibility of network status to proactively monitor, detect and notify when issues arise. |

| |

| • | Cost Performance. Cloud networks must deliver high performance while lowering overall cost of ownership, including capital and operational costs. |

Our Cloud Networking Solutions

We are a leading supplier of cloud networking solutions that use software innovations to address the needs of large-scale Internet companies, cloud service providers and next-generation enterprise data centers. Our cloud networking platform was purpose-built to address the functional and performance requirements for cloud networks. We deliver our solutions via our industry-leading 10/40/100 Gigabit Ethernet switches optimized for next-generation data center networks.

Our cloud networking solutions consist of EOS, our Extensible Operating System, a set of networking applications and our 10/40/100 Gigabit Ethernet switches. At the core of our cloud networking platform is EOS. EOS was architected to be fully programmable and highly modular.

As illustrated below, the programmability of EOS has allowed us to create a set of software applications and application programming interfaces, or APIs, that address the requirements of cloud networking, including workflow automation, network visibility and analytics, and has further allowed us to integrate rapidly with a wide range of third-party applications for virtualization, management, automation, orchestration and network services.

The key benefits of our cloud networking solutions are as follows:

Capacity, Performance and Scalability

Our cloud networking platform enables data center networks to scale to hundreds of thousands of physical servers and millions of virtual machines with the least number of switching tiers. We achieve this by leveraging standard protocols to meet the scale requirements of cloud computing. We have used active-active Layer 2 and Layer 3 network topologies to enable customers to build extremely large and resilient networks.

High Availability

Our highly modular EOS software architecture was designed to be fault-isolating and self-healing in order to deliver higher stability compared to legacy network operating systems. In addition, our customers can non-disruptively upgrade our switches running in the network using our Smart System Upgrade, or SSU, application.

Open and Programmable

Our EOS software was purpose-built to offer programmable interfaces throughout all levels of our software. This has allowed us to integrate our cloud networking platform with a wide range of leading third-party applications. For example, we support VMware NSX, OpenStack and Microsoft System Center for orchestration and fast provisioning, enabling true workload mobility and automatic provisioning of physical switches. We enable customers, through application programming interfaces, to write their own scripts to customize and optimize their networks. In addition, we support a wide range of software-defined network controllers via our OpenFlow and DirectFlow interfaces.

Workflow Automation

Our EOS software enables enterprises to provision networking resources in minutes with no manual intervention through our Zero Touch Provisioning. We also natively support Ansible, CFEngine, Chef, Puppet, virtual network orchestration applications and third-party management tools. Finally, EOS embraces the DevOps model, which is a software development method that combines development and operations, to provision and monitor servers, storage and network resources in a unified fashion.

Network Visibility

Our EOS software provides a set of tools and applications that proactively monitor, detect and notify network managers when network issues arise, delivering real-time data to third-party management applications including Corvil, ExtraHop, Riverbed and Splunk to provide detailed application visibility. Our telemetry applications include VM Tracer, which provides visibility down to the virtual machine level, Path Tracer, which detects errors in provisioned network paths, MapReduce Tracer, which monitors and optimizes the performance of Hadoop workloads, and Health Tracer, which monitors infrastructure resiliency. Our network visibility applications provide real-time insight into the status of the network. They include LANZ, which monitors latency, and DANZ, which provides advanced traffic monitoring with flow analysis and timestamps, plus the ability to perform tap aggregation for reporting and analysis.

Lower Total Cost of Ownership

Our cloud networking platform offers architectural and system advantages that provide our customers with cost-effective and highly available cloud networking solutions. Our programmable, scalable leaf-spine architectures, combined with industry-leading applications, significantly reduce networking costs when compared to legacy network designs, enabling faster time to service and improved availability. Our automation tools reduce the operational costs of provisioning, managing and monitoring a data center network and speed up service delivery. Our visibility tools provide high levels of visibility into complex network environments without the need for additional data collection equipment. As a result, fewer network engineers are needed to operate large networks.

Our Market Opportunity

We compete primarily in the data center switching market for 10 Gigabit Ethernet and above, excluding blade switches.

We believe that cloud computing represents a fundamental shift from traditional legacy data centers and that cloud networking is the fastest growing segment within the data center switching market. As organizations of all sizes are adopting cloud architectures, spending on cloud and next-generation data centers has increased rapidly over the last several years, while traditional legacy IT spending has been growing more slowly.

Our Customers

As of December 31, 2014, we had delivered our cloud networking solutions to approximately 3,000 end customers worldwide in over 70 countries. Our end customers span a range of industries and include large Internet companies, service providers, financial services organizations, government agencies, media and entertainment companies and others. Our customers include six of the largest cloud service providers based on annual revenue, including eBay, Facebook, Microsoft and Yahoo!, financial services organizations such as Barclays, Citigroup, and Morgan Stanley, and a number of media and service providers, including AOL, Comcast, Equinix, ESPN, Netflix, and Rackspace. For each of the years ended December 31, 2014, 2013 and 2012, Microsoft purchases, through our channel partner World Wide Technology, Inc., accounted for more than 10% of our total revenue.

Our Competitive Strengths

We believe the following strengths will allow us to maintain and extend our technology leadership position in cloud networking and next-generation data center Ethernet switching:

| |

| • | Purpose-Built Cloud Networking Platform. We have developed a highly scalable cloud networking platform that uses software to address the needs of large-scale Internet companies, cloud service providers, financial services organizations, government agencies and media and entertainment companies, including virtualization, big data and low-latency applications. As a result, our cloud networking platform does not have the inherent limitations of legacy network architectures. |

| |

| • | Broad and Differentiated Switch Portfolio. Using multiple silicon architectures, we deliver switches with industry-leading capacity, low latency, port density and power efficiency and have innovated in areas such as deep packet buffers, embedded optics and reversible cooling. Our broad switching portfolio has allowed us to offer customers products that best match their specific requirements. |

| |

| • | Single Binary Image Software. The single binary image of EOS software allows us to maintain feature consistency across our entire product portfolio and enables us to introduce new software innovations into the market that become available to our entire installed base without a “forklift upgrade” (i.e., a broad upgrade of the data center infrastructure). |

| |

| • | Rapid Development of New Features and Applications. Our highly modular EOS software has allowed us to rapidly deliver new features and applications while preserving the structural integrity and quality of our network operating system. We believe our ability to deliver new features and capabilities more quickly than possible with legacy switch operating systems provides us with a strategic advantage given that the requirements in cloud and next-generation data center networking continue to evolve rapidly. |

| |

| • | Deep Understanding of Customer Requirements. We have developed close working relationships with many of our largest customers that provide us with insights about their needs and future requirements. This has allowed us develop and deliver products to market that meet customer demands and expectations as well as to rapidly grow sales to existing customers. |

| |

| • | Strong Management and Engineering Team with Significant Data Center Networking Expertise. Our management and engineering team consists of networking veterans with extensive data center networking expertise. Our President and Chief Executive Officer, Jayshree Ullal, previously served as SVP and general manager of Cisco’s Data Center Business. Andy Bechtolsheim, our founder and Chief Development Officer, was previously a founder and chief system architect at Sun |

Microsystems and from 1996 to 2003 served as VP/GM of the Gigabit Systems Business Unit at Cisco. Kenneth Duda, our founder, Chief Technology Officer and SVP Software Engineering, led the software development effort of the Gigabit Systems Business Unit at Cisco from 1996 to 2000.

| |

| • | Significant Technology Lead. We believe that our networking technology represents a fundamental advance in networking software. Our EOS software is the result of more than 1,000 man-years of research and development investment over a ten-year period. |

Our Growth Strategy

We intend to grow our revenue and market share in cloud and next-generation data center Ethernet switching. Key elements of our growth strategy include:

| |

| • | Continue to Innovate and Extend our Technology Leadership. We plan to increase our investment in research and development to expand and enhance the features and capabilities of our cloud networking solutions, including our EOS software and our switching products. We believe that continued software and hardware innovation is critical to addressing the complex and changing requirements of cloud networks and that our approach will enable us to continue to innovate rapidly and bring new offerings to market. |

| |

| • | Expand our Sales Organization and our Channel Partners. We intend to continue to invest in our sales organization around the globe as we pursue relationships with new large enterprise, service provider and government customers that are deploying data centers. We believe our channel partner network serves a critical role in growing our sales, and we intend to continue to expand our channel partner network and enhance our sales efficiency through sales and support training. We designed our Arista Partner Program, targeted at resellers and systems integrators, to engage partners who provide value-added services and extend our reach into the marketplace. As of December 31, 2014, we had over 800 channel partners worldwide. |

| |

| • | Increase Penetration with our Existing Customer Base. Our customers often deploy our products initially for a specific application, which may account for only a portion of their networking needs. As we successfully demonstrate the benefits of our solutions, we see a significant opportunity to sell additional products and services to our existing customers to migrate additional workloads and applications onto our cloud networking platform. For example, the information technology department of a global financial services institution, which is associated with one of our underwriters, initially purchased our products for a trading application, then for an IP storage application and is now using our products in the core of its data center. |

| |

| • | Expand Strategic Relationships. We have developed strategic relationships with a number of technology ecosystem participants including A10 Networks, Ansible, Aruba Networks, Cloudera, F5 Networks, Microsoft, Nuage, Palo Alto Networks, Puppet Labs, Pure Storage, RedHat, Riverbed, Splunk, VMTurbo, VMware and Zscaler, to allow integration of our cloud networking solutions with their offerings and enable an integrated experience for our customers. This is a key differentiating point of our solutions as it allows customers to improve performance by integrating with leading solutions. We intend to continue building upon these relationships to provide our customers with the ability to more easily integrate our networking products with their existing and planned IT infrastructures. |

Our Products and Technology

We offer one of the broadest product lines of data center 10/40/100 Gigabit Ethernet switches in the industry, comprising our 7050 Series and 7150 Series top-of-rack switches, our 72XX/7300 X Series SPLINE switches and our 7280 and 7500 E Series spine switches.

We deliver switches with industry-leading capacity, low latency, port density and power efficiency. We have also innovated in areas such as deep packet buffers, embedded optics and reversible cooling. Our products have been recognized with a number of awards, including the Best of Interop Grand Prize that was given to our industry-leading spine switch, the Arista 7500 Series, in 2010 and again, to the Arista 7500E Series, in 2013. An overview of our switching portfolio is shown in the figure below.

We use multiple silicon architectures across our products, which allows us to build a broader range of switching products optimized for different functions in the network than competitors that utilize fewer silicon architectures. While we use multiple silicon architectures, all of our switches are powered with the same binary EOS image, which significantly simplifies deployment and ensures the same rich feature set and consistent operation across all our products.

Our Extensible Operating System

The core of our cloud networking platform is our Extensible Operating System, or EOS, which runs on top of standard Linux and offers programmability at all layers of the stack. All of our 10/40/100 Gigabit Ethernet switches run our EOS software.

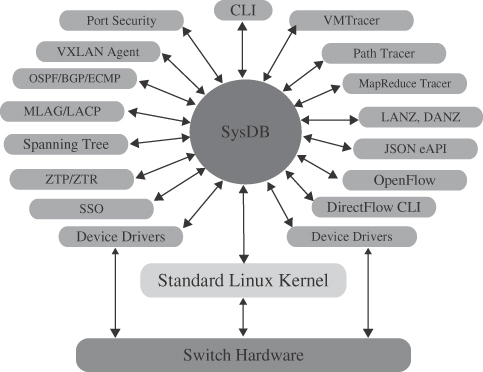

EOS is based on a new and innovative architecture that cleanly separates protocol processing from system state. Our EOS software is highly modular and consists of more than 100 separate processes that we call agents, each one handling specific protocol processing, device driver or system management functions. Each agent runs in user space as a separate Linux process and is completely protected and isolated from all other agents. Communication between agents only occurs through a central in-memory database called SysDB, which provides a central repository for all system state. Any update posted by an agent to SysDB is automatically forwarded to

all other processes that need to be notified of such an update to perform the appropriate processing. The exchange of state through a central state repository is far more reliable than the conventional approach of direct inter-process communication between a large number of processes.

As illustrated below, all agents are isolated from each other and interact directly through SysDB, thereby ensuring fault containment and availability.

EOS Attributes

The modular and programmable architecture of EOS enables us to offer a set of attributes, capabilities and features that are essential for cloud networking and next-generation data centers.

High Availability

EOS is self-healing in the sense that individual processes can be restarted without impacting application traffic. The same attribute allows in-service software upgrades of individual EOS processes. The capability to recover from software faults and upgrade processes in a running system is not available in legacy network operating systems.

Programmable at All Layers

EOS is programmable at all layers from the Linux kernel to switch configuration, provisioning, automation and detailed monitoring of the network. We support the following application programming interfaces, or APIs:

| |

| • | JSON (JavaScript Object Notation) application programming interfaces to our EOS software enable us, customers and third parties to integrate our cloud networking solutions with existing orchestration and automation systems; |

| |

| • | OpenFlow and DirectFlow interfaces enable programming of the forwarding state of the system for traffic engineering in conjunction with external controllers; and |

| |

| • | vCenter APIs enable integration with VMware ESX and VMware NSX. |

In addition, we support full access to Linux and support standard Linux tools such as Ping, TCPdump, Ganglia and Nagios, as well as customized Shell, Python and Perl scripts and native C++ programs.

Complete Network Visibility

Through EOS, we have developed a wide range of applications available to our customers for purchase as additional licenses that enable enhanced network monitoring and visibility without requiring additional external monitoring devices, including the following:

| |

| • | Latency Analyzer, or LANZ, an application that allows network operators to manage congestion actively in real-time and trigger packet data capture based on queue depth analysis, enabling proactive congestion management; |

| |

| • | Data Analyzer, or DANZ, an application that integrates an advanced suite of Tap and SPAN Switch Port aggregation management with our switches; |

| |

| • | VMTracer, an application that enables auto-provisioning of the network segmentation model on a per-VM basis and provides complete visibility of the locations of virtual machines on a given physical network port; |

| |

| • | PathTracer, an application that detects issues with all paths in active-active Layer 2 or Layer 3 networks; |

| |

| • | MapReduce Tracer, an application that provides faster rebalancing and recovery in case of node failures in Hadoop networks; and |

| |

| • | Health Tracer, an application that monitors the health of the network switch. |

Network Automation

EOS supports Puppet, Chef and Ansible, which enables automatic network configuration in the same manner as servers and storage. In addition, EOS provides two tools that greatly reduce network operational costs:

| |

| • | Zero Touch Provisioning, a tool that automates the provisioning of network infrastructure and speeds time to production for new services while eliminating the risk of human error; and |

| |

| • | Zero Touch Replacement, a tool that provides automated provisioning of replacement switches, significantly reducing mean-time-to-replacement of a failed switch. |

Leaf-Spine Network Designs

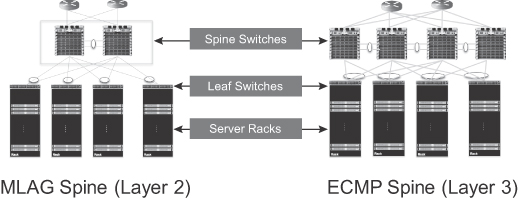

Our customers typically deploy leaf-spine network topologies consisting of leaf switches or top-of-rack switches, located in the server rack connected with uplinks to multiple load-sharing spine switches that provide the backbone. Our leaf-spine network designs scale up to more than 300,000 physical servers and millions of virtual machines using Equal Cost Multiple Pathing, or ECMP, to load balance Layer 3 network traffic across multiple spine switches. With Multi-Chassis Link Aggregation, or MLAG, we can build an active-active Layer 2 network that can connect more than 25,000 physical servers. Examples of our leaf-spine MLAG and ECMP architectures are illustrated below.

Our leaf-spine network designs have been widely deployed and provide predictable network bandwidth and latency. A key advantage of predictable network performance is that it eliminates the need to optimize the network for specific applications, which means a single network design works equally well for all applications.

Customer Support and Services

We have designed our customer support offerings to provide our customers with high levels of support. Our global team of support engineers engages directly with client IT teams and is available at all times over e-mail, by phone or through our website.

We offer multiple service options that allow our customers to select the product replacement service level that best meets their needs. We stock spare parts in over 95 locations around the world through our third-party logistics suppliers. All of our service options include unlimited access to bug-fixes, new feature-releases, online case management and our community forums.

Sales and Marketing

We market and sell our products through our direct sales force and in partnership with our channel partners, including distributors, value-added resellers, systems integrators and OEM partners. We also sell in conjunction with various technology partners. To facilitate channel coordination and increase productivity, we have created a partner program, the Arista Partner Program, to engage partners who provide value-added services and extend our reach into the marketplace. Authorized training partners perform technical training of our channel partners and end customers. Our partners commonly receive an order from an end customer prior to placing an order with us, and we confirm the identification of the end customer prior to accepting such orders. Our partners generally do not stock inventory received from us.

Our sales organization is supported by systems engineers with deep technical expertise and responsibility for pre-sales technical support and solutions engineering for our end customers, systems integrators, original equipment manufacturers, or OEMs, and channel partners. A pool of shared channel sales and marketing representatives also supports these teams. Each sales team is responsible for a

geographical territory, has responsibility for a number of major direct end-customer accounts or has assigned accounts in a specific vertical market. We have field sales teams operating in 24 countries. During 2014 and 2013, 79.7% and 82.9% of our revenue was generated from the Americas, substantially all from the U.S., 12.8% and 11.2% from Europe, the Middle East and Africa and 7.5% and 5.9% from the Asia-Pacific region, respectively.

Our marketing activities consist primarily of technology conferences, web marketing, trade shows, product demonstrations, seminars and events, public relations, analyst relations, demand generation and direct marketing to build our brand, increase end-customer awareness, communicate our product advantages and generate qualified leads for our field sales force and channel partners.

Research and Development

We believe our future success depends on our ability to develop new products and features that address the needs of our end customers. Our in-house engineering personnel are responsible for the development, quality, documentation, support and release of our products. We plan to continue to invest significantly in resources to conduct our research and development efforts.

Manufacturing

We subcontract the manufacturing of all of our products to various contract manufacturers. Our primary manufacturing partners are Jabil Circuit and Foxconn. We also work with Flextronics International Ltd. to provide logistics and final configuration services in North America. This approach allows us to reduce our costs, manufacturing overhead and inventory position and allows us to adjust more quickly to changing end-customer demand. We require all of our manufacturing locations to be ISO-9001 certified. Our EOS software is installed on our products at one of three direct fulfillment facilities.

Our contract manufacturing partners procure the majority of the components needed to build our products and assemble our products according to our design specifications. This allows us to leverage the purchasing power of our contract manufacturing partners. We retain complete control over the bill of material, test procedures and quality assurance programs. Our on-site personnel work closely with our partners and review on an ongoing basis forecasts, inventory levels, processes, capacity, yields and overall quality. Our contract manufacturing partners procure components and assemble our products based on our demand forecasts. These forecasts represent our estimates of future demand for our products based upon historical trends and analyses from our sales and product management functions as adjusted for overall market conditions. We update these forecasts monthly.

Our products rely on key components, including merchant silicon, integrated circuit components and power supplies purchased from a limited number of suppliers, including certain sole source providers. Generally, neither our contract manufacturers nor we have a written agreement with any of these component providers to guarantee the supply of the key components used in our products nor do we have exclusive rights to such key components. Our product development efforts also depend upon continued collaboration with our key suppliers, including our merchant silicon vendors such as Broadcom and Intel. As we develop our product roadmap and continue to expand our relationships with these and other merchant silicon vendors, it is critical that we work in tandem with our key merchant silicon vendors to ensure that their silicon includes improved features and that our products take advantage of such improved features. This enables us to focus our research and development resources on software core competencies and to leverage the investments made by merchant silicon vendors to achieve cost-effective solutions.

Once the completed products are manufactured and tested, our contract manufacturing partners ship them to various theatre direct fulfillment facilities in California, the Netherlands and Singapore for final configuration, quality control inspection and shipment to our distribution partners and end customers. After the products are shipped to our end customers, our products are installed by the end customers or by third-party service providers such as system integrators or value added resellers on their behalf.

Backlog

We do not have any long-term purchase commitments from customers. Customers generally order products on an as-needed basis with short lead and delivery times on a per-purchase-order basis. We maintain substantial finished goods inventory to ensure that products can generally be shipped shortly after receipt of an order. A significant portion of our customer shipments in any fiscal year relate to orders received and shipped in that fiscal year, resulting in low product backlog relative to total shipments. Because our customers utilize purchase orders containing non-binding purchase commitments and we allow customers to cancel, change or reschedule orders without penalty at any time prior to shipment, we also do not believe backlog is firm. As a result of the foregoing factors, backlog is not material and not a meaningful indicator in any given period of our ability to achieve any particular level of overall revenue or financial performance.

Competition

The markets in which we compete are highly competitive and characterized by rapidly changing technology, changing end-customer needs, evolving industry standards and frequent introductions of new products and services. We expect competition to intensify in the future as the market for cloud networking expands and existing competitors and new market entrants introduce new products or enhance existing products.

The data center networking market has been historically dominated by Cisco Systems, with competition also coming from other large network equipment and system vendors including Brocade Communications Systems, Dell, Hewlett-Packard and Juniper Networks.

We also face competition from other companies and new market entrants, including “whitebox” switch vendors as well as current technology partners and end customers who may develop network switches and cloud service solutions for internal use and/or to broaden their portfolio of products.

The principle competitive factors applicable to our products include:

| |

| • | breadth of product offerings and features; |

| |

| • | reliability and product quality; |

| |

| • | total cost of ownership, including automation, monitoring and integration costs; |

| |

| • | programmability and extensibility; |

| |

| • | interoperability with other products; |

| |

| • | ability to be bundled with other vendor offerings; and |

| |

| • | quality of service, support and fulfillment. |

We believe our products compete favorably with respect to these factors. Our EOS software offers high reliability, integrates with existing network protocols and is open and programmable. We believe the combination of EOS, a set of network applications and our 10/40/100 Gigabit Ethernet Switch makes our offering highly competitive for both cloud and enterprise data centers. However, many of our competitors have greater name recognition, longer operating histories, larger sales and marketing budgets and resources, broader distribution and established relationships with channel partners and end customers, greater access to larger end-customer bases, greater end-customer support resources, greater manufacturing resources, the ability to leverage their sales efforts across a broader portfolio of products, the ability to leverage purchasing power when purchasing subcomponents, the ability to bundle competitive offerings with other products and services, the ability to develop their own silicon chips, the ability to set more aggressive pricing policies, lower labor and development costs, greater resources to make acquisitions, larger intellectual property portfolios and substantially greater financial, technical, research and development or other resources.

Intellectual Property

Our success and ability to compete depend substantially upon our core technology and intellectual property. We rely on patent, trademark and copyright laws, trade secret protection and confidentiality agreements with our employees, end customers, resellers, systems integrators and others to protect our intellectual property rights. As of December 31, 2014, we had 39 patent applications pending in the U.S. and two patents granted in the U.S., which expire in 2025 and 2028.

We cannot assure you that any of our patent applications will result in the issuance of a patent or whether the examination process will result in patents of valuable breadth or applicability. In addition, any patents that may be issued may be contested, circumvented, found unenforceable or invalidated, and we may not be able to prevent third parties from infringing them. We also license software from third parties for integration into our products, including open source software and other software available on commercially reasonable terms. We also own a number of trademarks in the U.S. and other jurisdictions, including Arista (which mark is not registered in the U.S.), EOS, CloudVision, Health Tracer, MapReduce Tracer, Path Tracer, MXP, RAIL and SPLINE.

We control access to and use of our software, technology and other proprietary information through internal and external controls, including contractual protections with employees, contractors, end customers and partners. Our software is protected by U.S. and international copyright, patent and trade secret laws. Despite our efforts to protect our software, technology and other proprietary information, unauthorized parties may still copy or otherwise obtain and use our software, technology and other proprietary information. In addition, we intend to expand our international operations, and effective patent, copyright, trademark and trade secret protection may not be available or may be limited in foreign countries.

Our industry is characterized by the existence of a large number of patents and frequent claims and related litigation regarding patent and other intellectual property rights. If we become more successful, we believe that competitors will be more likely to try to develop products that are similar to ours and that may infringe our proprietary rights. It may also be more likely that competitors or other third parties will claim that our products infringe their proprietary rights. In particular, large and established companies in our industry have extensive patent portfolios and are regularly involved in both offensive and defensive litigation. From time to time, third parties, including certain of these large companies and non-practicing entities, may assert patent, copyright, trademark and other intellectual property rights against us, our channel partners or our end customers, whom our standard license and other agreements obligate us to indemnify against such claims. For example, in December 2014, Cisco Systems filed two lawsuits against us in the Northern District of California for alleged patent and copyright infringement. Additionally, Cisco Systems filed to complaints against us in the International Trade Commission (ITC) for patent infringement, and the ITC has initiated an investigation. Please see "Legal Proceedings" included in Part I, Item 3 of this Annual Report on Form 10-K, for a description of this litigation. Successful claims of infringement by a third party, if any, could prevent us from distributing certain products or performing certain services, require us to expend time and money to develop non-infringing solutions or force us to pay substantial damages, royalties or other fees. We cannot assure you that we do not currently infringe, or that we will not in the future infringe, upon any third-party patents or other proprietary rights.

Employees

As of December 31, 2014 we employed over 1,000 full-time employees. None of our employees are represented by unions. We consider our relationship with our employees to be good and have not experienced significant interruptions of operations due to labor disagreements.

Available Information

Our website is located at www.arista.com and our investor relations website is located at www. investors.arista.com. Our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to reports filed or furnished pursuant to Sections 13(a) and 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), are available free of charge on the Investors portion of our web site as soon as reasonably practicable after we electronically file such material with, or furnish it to, the Securities and Exchange Commission (SEC). Further, a copy of this Annual Report on Form 10-K is located at the SEC's Public Reference Room at 100 F Street, NE, Washington, D.C. 20549. Information on the operation of the Public Reference Room can be obtained by calling the SEC at 1-800-SEC-0330.

Webcasts of our earnings calls and certain events we participate in or host with members of the investment community are on our investor relations website. Additionally, we announce investor information, including news and commentary about our business and financial performance, SEC filings, notices of investor events, and our press and earnings releases, on our investor relations website. Investors and others can receive notifications of new information posted on our investor relations website in real time by signing up for email alerts and RSS feeds. Further corporate governance information, including our corporate governance guidelines, board committee charters, and code of conduct, is also available on our investor relations website under the heading “Corporate Governance.” The contents of our websites are not incorporated by reference into this Annual Report on Form 10-K or in any other report or document we file with the SEC, and any references to our websites are intended to be inactive textual references only.

Item 1A. Risk Factors

You should consider carefully the risks and uncertainties described below, together with all of the other information in this Annual Report on Form 10-K, which could materially affect our business, financial condition, results of operations and prospects. The risks described below are not the only risks facing us. Risks and uncertainties not currently known to us or that we currently deem to be immaterial also may materially affect our business, financial condition, results of operations and prospects.

Risks Related to Our Business and Our Industry

Our limited operating history makes it difficult to evaluate our current business and future prospects and may increase the risk associated with your investment.

We were founded in 2004 and shipped our first products in 2008. The majority of our revenue growth has occurred since the beginning of 2010. Our limited operating history makes it difficult to evaluate our current business and our future prospects, including our ability to plan for and model future growth. We have encountered and will continue to encounter risks and difficulties frequently experienced by rapidly growing companies in constantly evolving industries, including the risks described elsewhere in this Annual Report on Form 10-K. If we do not address these risks successfully, our business, financial condition, results of operations and prospects will be adversely affected, and the market price of our common stock could decline. Further, we have limited historical financial data, and we operate in a rapidly evolving market. As such, any predictions about our future revenue and expenses may not be as accurate as they would be if we had a longer operating history or operated in a more predictable market.

Our business and operations have experienced rapid growth, and if we do not appropriately manage any future growth or are unable to improve our systems and processes, our business, financial condition, results of operations and prospects will be adversely affected.

We have experienced rapid growth and increased demand for our products over the last several years, which has placed a strain on our management, administrative, operational and financial infrastructure. Our employee headcount and number of end customers have increased significantly. To handle the increase in end customers, we expect to continue to grow our headcount significantly over the next 12 months. For example, as of December 31, 2010 and December 31, 2014, our cumulative number of end customers increased from approximately 570 to over 3,000. As we have grown, we have had to manage an increasingly larger and more complex array of internal systems and processes to scale with all aspects of our business, including our hardware and software development, contract manufacturing and purchasing, logistics and fulfillment and maintenance and support. Our success will depend in part upon our ability to manage our growth effectively. To do so, we must continue to increase the productivity of our existing employees and continue to hire, train and manage new employees as needed. To manage domestic and international growth of our operations and personnel, we will need to continue to improve our operational, financial and management controls and our reporting processes and procedures and implement more extensive and integrated financial and business information systems. We may not be able to successfully implement these or other improvements to our systems and processes in an efficient or timely manner, and we may discover deficiencies in their capabilities or effectiveness. We may experience difficulties in managing improvements to our systems and processes or in connection with third-party technology. In addition, our systems and processes may not prevent or detect all errors, omissions or fraud. Our failure to improve our systems and processes, or their failure to operate effectively and in the intended manner, may result in disruption of our current operations and end-customer relationships, our inability to manage the growth of our business and our inability to accurately forecast our revenue, expenses and earnings and prevent certain losses.

Our results of operations are likely to vary significantly from period to period and be unpredictable and if we fail to meet the expectations of analysts or investors or our previously issued financial guidance, or if any forward-looking financial guidance does not meet the expectation of analysts or investors, the market price of our common stock could decline substantially

Our results of operations have historically varied from period to period, and we expect that this trend will continue. As a result, you should not rely upon our past financial results for any period as indicators of future performance. Our results of operations in any given period can be influenced by a number of factors, many of which are outside of our control and may be difficult to predict, including:

| |

| • | our ability to retain and increase sales to existing customer and attract new end customers, including large end customers; |

| |

| • | the budgeting cycles and purchasing practices of end customers, including large end customers who may receive lower pricing terms due to volume discounts; |

| |

| • | the buying patterns of our large end customers in which large bulk purchases may or may not occur in certain quarters; |

| |

| • | the cost and potential outcomes of existing and future litigation; |

| |

| • | the rate of expansion and productivity of our sales force; |

| |

| • | changes in our pricing policies, whether initiated by us or as a result of competition; |

| |

| • | the amount and timing of operating costs and capital expenditures related ot the operation and expansion of our business; |

| |

| • | changes in end-customer, distributor or reseller requirements or market needs; |

| |

| • | deferral or cancellation of orders from end customers, including in anticipation of new products or product enhancements announced by us or our competitors, or warranty returns; |

| |

| • | the inclusion of any acceptance provisions in our customer contracts or any delays in acceptance of those products; |

| |

| • | changes in the growth rate of the networking market; |

| |

| • | the actual or rumored timing and success of new product and service introductions by us or our competitors or any other change in the competitive landscape of our industry, including consolidation among our competitors or end customers; |

| |

| • | our ability to successfully expand our business domestically and internationally; |

| |

| • | our ability to increase the size of our distribution channel; |

| |

| • | decisions by potential end customers to purchase cloud networking solutions from larger, more established vendors, white box vendors or their primary network equipment vendors; |

| |

| • | insolvency or credit difficulties confronting our end customers, which could adversely affect their ability to purchase or pay for our products and services, or confronting our key suppliers, including our sole source suppliers, which could disrupt our supply chain; |

| |

| • | any disruption in our sales channel or termination of our relationship with important channel partners; |

| |

| • | our inability to fulfill our end customers’ orders due to supply chain delays, access to key commodities or technologies or events that impact our manufacturers or their suppliers; |

| |

| • | seasonality or cyclical fluctuations in our markets; |

| |

| • | future accounting pronouncements or changes in our accounting policies; |

| |

| • | stock-based compensation expense; |

| |

| • | our overall effective tax rate, including impacts caused by any reorganization in our corporate structure, any changes in our valuation allowance for domestic deferred tax assets and any new legislation or regulatory developments; |

| |

| • | increases or decreases in our expenses caused by fluctuations in foreign currency exchange rates, as an increasing portion of our expenses are incurred and paid in currencies other than the U.S. dollar; |

| |

| • | general economic conditions, both domestically and in foreign markets; and |

| |

| • | other risk factors described in this Annual Report on Form 10-K. |

Any one of the factors above or the cumulative effect of several of the factors described above may result in significant fluctuations in our financial and other results of operations. This variability and unpredictability could result in our failure to meet our revenue, gross margins, results of operations or other expectations contained in any forward looking financial guidance we have issued or the expectations of securities analysts or investors for a particular period. If we fail to meet or exceed such guidance or expectations for these or any other reasons, the market price of our common stock could decline substantially, and we could face costly lawsuits, including securities class action suits.

We expect large purchases by a limited number of end customers to continue to represent a substantial portion of our revenue, and any loss or delay of expected purchases could result in material quarter-to-quarter fluctuations of our revenue or otherwise adversely affect our results of operations.

Historically, large purchases by a relatively limited number of end customers have accounted for significant portion of our revenue. Many of these end customers make large purchases to complete or upgrade specific data center installations and are typically made on a purchase-order basis rather than pursuant to long-term contracts. Revenue from sales to Microsoft, through our channel partner, World Wide Technology, Inc., accounted for 14.9% of our revenue for the year ended December 31, 2014, 21.9% of our revenue for the year ended December 31, 2013 and 15.3% of our revenue for the year ended December 31, 2012.

As a consequence of the concentrated nature of our customer base and their purchasing behavior, our quarterly revenue and results of operations may fluctuate from quarter to quarter and are difficult to estimate. For example, any cancellation of orders or any acceleration or delay in anticipated product purchases or the acceptance of shipped products by our larger end customers could materially affect our revenue and results of operations in any quarterly period. We may be unable to sustain or increase our revenue from our large end customers or offset the discontinuation of concentrated purchases by our larger end customers with purchases by new or existing end customers. We expect that such concentrated purchases will continue to contribute materially to our revenue for the foreseeable future and that our results of operations may fluctuate materially as a result of such larger end customers’ buying patterns. In addition, we may see consolidation of our customer base, such as among Internet companies and cloud service providers, which could result in loss of end customers. The loss of such end customers, or a significant delay or reduction in their purchases, could materially harm our business, financial condition, results of operations and prospects.

Our revenue growth rate in recent periods may not be indicative of our future performance.

Our revenue growth rate in recent periods may not be indicative of our future performance. We experienced annual revenue growth rates of 61.7%, 86.8% and 38.3% in 2014, 2013 and 2012, respectively. We may not achieve similar revenue growth rates in future periods, especially as we enter and expand into the cloud services and application services provider markets. You should not rely on our revenue for any prior quarterly or annual period as any indication of our future revenue or revenue growth. If we are unable to maintain consistent revenue or revenue growth, our business, financial condition, results of operations and prospects could be materially adversely affected.

We face intense competition, especially from larger, well-established companies, and we may lack sufficient financial or other resources to maintain or improve our competitive position.

The market for data center networking, including the market for cloud networking, is intensely competitive, and we expect competition to increase in the future from established competitors and new market entrants. This competition could result in increased pricing pressure, reduced profit margins, increased sales and marketing expenses and our failure to increase, or the loss of, market share, any of which would likely seriously harm our business, financial condition, results of operations and prospects.

The data center networking market has been historically dominated by Cisco Systems, with competition also coming from other large network equipment and system vendors, including Juniper Networks, Brocade Communications Systems, Hewlett-Packard and Dell. We also face competition from other companies and new market entrants, including “whitebox” switch vendors as well as current technology partners and end customers. Many of our existing and potential competitors enjoy substantial competitive advantages, such as:

| |

| • | greater name recognition and longer operating histories; |

| |

| • | larger sales and marketing budgets and resources; |

| |

| • | broader distribution and established relationships with channel partners and end customers; |

| |

| • | greater access to larger end-customer bases; |

| |

| • | greater end-customer support resources; |

| |

| • | greater manufacturing resources; |

| |

| • | the ability to leverage their sales efforts across a broader portfolio of products; |

| |

| • | the ability to leverage purchasing power with vendor subcomponents; |

| |

| • | the ability to bundle competitive offerings with other products and services; |

| |

| • | the ability to develop their own silicon chips; |

| |

| • | the ability to set more aggressive pricing policies; |

| |

| • | lower labor and development costs; |

| |

| • | greater resources to make acquisitions; |

| |

| • | larger intellectual property portfolios; and |

| |

| • | substantially greater financial, technical, research and development or other resources. |

Our competitors also may be able to provide end customers with capabilities or benefits different from or greater than those we can provide in areas such as technical qualifications or geographic presence or may be able to provide end customers a broader range of products, services and prices. In addition, large competitors may have more extensive relationships with and within existing and potential end customers that provide them with an advantage in competing for business with those end customers. For example, certain large competitors encourage end customers of their other products and services to adopt their data networking solutions through discounted bundled product packages. Our ability to compete will depend upon our ability to provide a better solution than our competitors at a more competitive price. We may be required to make substantial additional investments in research, development, marketing and sales in order to respond to competition, and we cannot assure you that these investments will achieve any returns for us or that we will be able to compete successfully in the future.

We also expect increased competition if our market continues to expand. Conditions in our market could change rapidly and significantly as a result of technological advancements or other factors. Current or potential competitors may be acquired by third parties that have greater resources available than we do. Our current or potential competitors might take advantage of the greater resources of the larger organization resulting from these acquisitions to compete more vigorously or broadly with us. In addition, continued industry consolidation might adversely affect end customers’ perceptions of the viability of smaller and even medium-sized networking companies and, consequently, end customers’ willingness to purchase from those companies. Further, certain large end customers may develop network switches and cloud service solutions for internal use and/or to broaden their portfolio of products, which could allow these end customers to become new competitors in the market.

If we do not successfully anticipate technological shifts, market needs and opportunities, and develop products and product enhancements that meet those technological shifts, needs and opportunities, or if those products are not made available in a timely manner or do not gain market acceptance, we may not be able to compete effectively, and our ability to generate revenue will suffer.

The cloud networking market can be characterized by rapid technological shifts and increasingly complex end-customer requirements to achieve scalable and more programmable networks that facilitate virtualization, big data, public/private cloud and web scale computing. We must continue to develop new technologies and products that address emerging technological trends and changing end-customer needs. The process of developing new technology is complex and uncertain, and new offerings requires significant upfront investment that may not result in material design improvements to existing products or result in marketable new products or costs savings or revenue for an extended period of time, if at all. The success of new products depends on several factors, including appropriate new product definition, component costs, timely completion and introduction of these products, differentiation of new products from those of our competitors and market acceptance of these products.

In addition, new technologies could render our existing products obsolete or less attractive to end customers, and our business, financial condition, results of operations and prospects could be materially adversely affected if such technologies are widely adopted. For example, end customers may prefer to address their network switch requirements by licensing software operating systems separately

and placing them on industry-standard servers or develop their own networking products rather than purchasing integrated hardware products as has occurred in the server industry.

We may not be able to successfully anticipate or adapt to changing technology or end-customer requirements on a timely basis, or at all. If we fail to keep up with technology changes or to convince our end customers and potential end customers of the value of our solutions even in light of new technologies, our business, financial condition, results of operations and prospects could be materially adversely affected.

We are currently involved in litigation with Cisco Systems, Inc.

On December 5, 2014, Cisco filed two complaints against us in District Court for the Northern District of California, which are proceeding as Case No. 4-14-cv-0543 (“’043 Case”) and Case No. 4-14-cv-0544 (“’044 Case”). In the ’043 Case, Cisco alleges that we infringe U.S. Patent Nos. 6,377,577; 6,741,592; 7,023,853; 7,061,875; 7,162,537; 7,200,145; 7,224,668; 7,290,164; 7,340,597; 7,460,492; 8,051,211; and 8,356,296 (respectively, “the ’577 patent,” “the ’592 patent,” “the ’853 patent,” “the 875 patent,” “the ’537 patent,” “the ’145 patent,” “the ’668 patent,” “the ’164 patent,” “the ’597 patent,” “the ’492 patent,” “the ’211 patent,” and “the ’296 patent”). Cisco seeks, as relief for our alleged infringement in the ’043 Case, lost profits and/or reasonable royalty damages in an unspecified amount, including treble damages, attorney’s fees, and associated costs. Cisco also seeks injunctive relief in the ’043 Case. On February 10, 2015, the court granted our unopposed motion to stay the ’043 Case until the proceedings before the United States International Trade Commission (“USITC”) pertaining to the same patents (as discussed below) become final. In the ’044 Case, Cisco’s complaint alleges that we infringe U.S. Patent Nos. 7,047,526 and 7,953,886 and further alleges that we infringe numerous copyrights pertaining to Cisco’s “Command Line Interface” or “CLI.” As relief for our alleged patent infringement in the ’044 Case, Cisco seeks lost profits and/or reasonable royalty damages in an unspecified amount including treble damages, attorney’s fees, and associated costs as well as injunctive relief. As relief from our alleged copyright infringement, Cisco seeks damages in an unspecified amount in the form of alleged lost profits, profits from our alleged infringement, statutory damages, attorney’s fees and associated costs. Cisco also seeks injunctive relief against our alleged copyright infringement. On February 13, 2015, we answered the complaint in the ’044 Case, denying the patent and copyright infringement allegations and also raising numerous affirmative defenses. Trial has not been scheduled in either the ’043 or ’044 Cases.