| Item 7.01. | Regulation FD Disclosure. |

On March 3, 2022, Sabre Corporation (“Sabre,” “we,” “us,” or “our”) provided the following key volume metrics update:

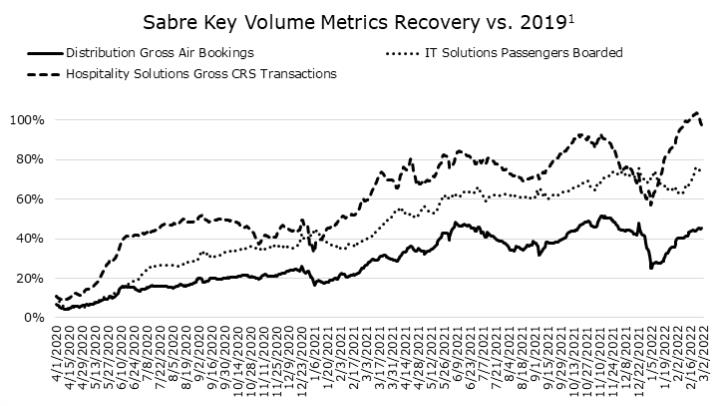

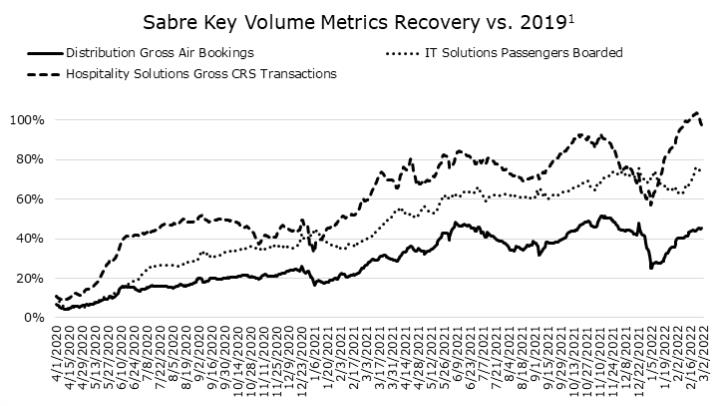

Our gross air bookings recovered to approximately 43%, and net air bookings were approximately 45%, in February 2022 versus February 2019. Passengers boarded were approximately 70% in February 2022 versus February 2019. Gross hotel central reservation system transactions were approximately 99% in February 2022 versus February 2019.

The recovery in our key volume metrics versus 2019 levels is summarized in the chart below.

| 1 | 7-Day moving average; calendar shifted; CRS transactions are community model only; data through February 28, 2022. |

Forward-looking statements

Certain statements herein are forward-looking statements about trends, future events, uncertainties and our plans and expectations of what may happen in the future. Any statements that are not historical or current facts are forward-looking statements. In many cases, you can identify forward-looking statements by terms such as “expect,” “trend,” “recovery,” “outlook,” “target,” “milestone,” “future,” “believe,” “plan,” “guidance “anticipate,” “will,” “forecast,” “continue,” “strategy,” “estimate,” “project,” “may,” “should,” “would,” “intend,” “potential” or the negative of these terms or other comparable terminology. Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause Sabre’s actual results, performance or achievements to be materially different from any future results, performances or achievements expressed or implied by the forward-looking statements. The potential risks and uncertainties include, among others, the severity, extent and duration of the global COVID-19 pandemic and its impact on our business and results of operations, financial condition and credit ratings, as well as on the travel industry and consumer spending more broadly, the actions taken to contain the disease or treat its impact, the effect of remote working arrangements on our operations and the speed and extent of the recovery across the broader travel ecosystem, our ability to recruit, train and retain employees, including our key executive officers and technical employees, competition in the travel distribution market and solutions markets, exposure to pricing pressure in the Travel Solutions business, dependency on transaction volumes in the global travel industry, particularly air travel transaction volumes, including from airlines’ insolvency, suspension of service or aircraft groundings, failure to adapt to technological advancements, the timing, implementation and effects of the technology investment and other strategic initiatives, the completion and effects of travel platforms, changes affecting travel supplier customers, dependence on establishing, maintaining and renewing contracts with customers and other counterparties and collecting amounts due to us under these agreements, implementation of software solutions, implementation and effects of new, amended or renewed agreements and strategic partnerships, including anticipated savings, dependence on relationships with travel buyers, our collection, processing, storage, use and transmission of personal data and risks associated with PCI compliance, the effects of any litigation and regulatory reviews and investigations, failure to comply with regulations, use of third-party distributor partners, the financial and business results