Exhibit 3.1

(Requestor's Name) (Address) (Address) (City/State/Zip/Phone #) 1:1 PICK-UP El WAIT ? MAIL (Business Entity Name) (Document Number) Certified Copies Certificates of Status Special Instructions to Filing Officer: Office Use Only 11iiiiii 400254436784 12/26/13-01001-017 *443.75 Ds (ccithk Q.8tAkd -A- loa\)4 !DEC 2 6 2013 T. CARTER CAPITAL CONNECTION, INC. 417 E. Virginia Street, Suite I Tallahassee, Florida 32301 (850) 224-8870 1-800-342-8062 Fax (850) 222-1222 NORTH CAROLINA NATURAL ENERGY, INC. Art of inc. File LTD Partnership File Foreign Corp, File L.C. File Fictitious Name File Trade/Service Mark Merger File Art. of Amend. File RA Resignation Dissolution I Withdrawal Annual Report / Reinstatement g Cert. Copy Photo Copy Certificate of Good Standing Certificate of Status Certificate of Fictitious Name Corp Record Search Officer Search Fictitious Search Signature Requested by: Seth Name Walk-In 171 ecrAleCt Pro:ng ThorentAA QA BAN: 12/23/13 Date Time Will Pick Up Fictitious Owner Search Vehicle Search Driving Record UCC I or 3 File UCC I l Search UCC 11 Retrieval Courier 02/11/2009 01:06 9545274719 SPIEGELMAN INC PAGE r7 I (. TAL 01/07 'a);\ AMENDED ANI ARTICLES OF OF NORTH CAROLINA NA1 a Florida coi (Document num Clinton F. Walker, certifies that: 1. Clinton F. Walker is the duly elected and act Energy, Inc. (the "Corporation"). 2. The Articles of Incorporation of North Caro filed by the Secretary of State on February 26, read in fitll as follows: 3. Pursuant to the provisions of F.S. 607. 1002 following amendments and restates its Articles filings and amendments, which were duly adop and the board of directors of this Corporation o: RESOLVED, that the Articles of. Incorporation restated as follows: harIC The name of the Corporation is: APPALAC ARTIC :lc 13 DEC 23 Hi 2: 55 RESTATED ORPORATION IRAL ENERGY, INC. oration r L52786) ng President of North Carolina Natural na Natural Energy, Inc. were originally 990, shall be amended and restated to nd 607.1007, the Corporation adopts the if Incorporation superseding all prior d by the requisite vote of shareholders December 14, 2013, as follows: f this Corporation be amended and MOUNTAIN BREWERY, INC. This corporation is organized for the purpose of ARTICL The Corporation is authorized to issue 130,000, value per share and 70,000,001 shares of p divided, as described hereinafter. nsacting any and all lawful business. III 00 shares of common stock, $.001 par erred stock, $.001 par value per share, 02/11/2009 01:06 9545274719 SPIEGELMAN INC PAGE 02/07 3. DESIGNATION OF SERIES A PREFERRED STOCK. 3.1 DESIGNATION AND AMOUNT. 10,000,001 shares of the Corporation's authorized but undesignated preferred stock shall be designated as Series A Preferred Stock and having the conversion, voting and other rights and qualifications, limitations and restrictions set forth as follows: 3/ CONVERSION RIGHTS. (a) If at least one share of Series A Preferred Stock is issued and outstanding, then the total aggregate issued shares of Series A Preferred Stock at any given time, regardless of their number, shall be convertible into the number of shares of Common Stock which equals four times the sum of i) the total number of shares of Common Stock which are issued and outstanding at the time of conversion, plus ii) the total number of shares of Series B Preferred shares which are issued and outstanding at the time of conversion. (b) Each individual share of Series A Preferred Stock shall be convertible into the number of shares of Common Stock equal to: [four times the sum of: {all shares of Common Stock issued and outstanding at time of conversion + all shares of Series 13 Preferred Stock issued and outstanding at time of conversion}] divided by: [the number of shares of Series A Preferred Stock issued and outstanding at the time of conversion] (c) The holders of the Series A Preferred Stock may convert only by unanimous board consent of the Corporation, 3.3 VOTING RIGHTS. (a) If at least one share of Series A. Preferred Stock is issued and outstanding, then the total aggregate issued shares of Series A Preferred Stock at any given time, regardless of their number, shall have voting rights equal to four times the sum of: i) the total number of shares of Common Stock which are issued and outstanding at the time of voting, plus ii) the total number of shares of Series 13 Preferred Stock which arc issued and outstanding at the time of voting. (b) Each individual share of Series A Preferred Stock shall have the voting rights equal to: [four times the sum of: (all shares of Common. Stock issued and outstanding at time of voting + all shares of Series B Preferred Stock issued and outstanding at time of voting)] 02/11/2009 01:06 9545274719 SPIEGELMAN INC PAGE 03/07 Divided by: [the number of shares of Series A Preferred Stock issued and outstanding at the time of voting) (c) All decisions requiring the vote of the Series A Preferred Stock shall be by majority vote of the outstanding shares at any time called by meeting, by proxy or written action in lieu of a meeting. 4. DESIGNATION OF SERIES B PREFERRED STOCK. 4.1 DESIGNATION AND AMOUNT. 50,000,000 shares of the Corporation's authorized but undesignated preferred stock shall be designated as Series B Preferred Stock and having the conversion, voting and other rights and qualifications, limitations and restrictions set forth as follows: 4.2 DIVIDENDS. The holders of Series B Preferred Stock shall be entitled to receive dividends when, as and if declared by the Board of Directors, in its sole discretion, 4.3 LIQUIDATION RIGHTS. Upon any liquidation, dissolution or winding up of the Corporation, whether voluntary or involuntary, before any distribution or payment shall be made to the holders of any stock ranking junior to the Series B Preferred Stock (which stock shall be the common stock but not the Series A Preferred Stook), the holders of the Series B Preferred Stock shall be entitled to be paid out of the assets of the Corporation an amount equal to the initial issuance per share or, in the event of an aggregate subscription by a single subscriber for Series B Preferred Stock in excess of $100,000, 99.7% or the initial issuance price per share (as adjusted for any stock dividends, combinations, splits, recapitalizations and the like with respect to such shares) (the "Preference Value"), plus all declared but unpaid dividends, for each share of Series B Preferred Stock held by them. After the payment of the full applicable Preference Value of each share of the Series B Preferred Stock as set forth herein, the remaining assets of the Corporation legally available for distribution, if any, shall be distributed ratably to the holders of the Corporation's Common Stock and Series A Preferred Stock equally. 4.4 CONVERSION AND ANTI-DILUTION. (a) Each share of Series B Preferred Stock shall be convertible, with certain conditions being met including, but not limited to, board of directors approval, into the number of shares of the Corporation's common stock, par value $0.001 per share (the "Common Stock") equal to the price of the Series B Preferred Stock as stated in Section 4.6(a) of the Articles of Incorporation, divided by 2.50, equaling one (1) share of the Common Stock for each share of the preferred B stock, subject to adjustment as may be 02/1112009 01;06 9545274719 SPIEGELMAN INC determined by the Board of Directors from time to time (the "Conversion Rate"). For example, assuming a $2.50 price per share of Series B Preferred Stock, and a par value of $0.001 per share for Common Stock, each share of Series B Preferred Stook would be convertible into one (1) share of common stock. Such conversion shall be deemed to be effective on the business day (the "Conversion Date") following the receipt by the Corporation of written notice from the bolder of the Series B Preferred Stock of the holder's request to convert, and subsequent board of directors approval, the shares of Series 13 Stock, together with the bolder's stock certificate or certificates evidencing the Series B Preferred Stock to be converted. (b) Promptly after the Conversion Date, the Corporation shall issue and deliver to such holder a certificate or certificates for the number of shares of Common Stock issuable to the holder pursuant to the holder's conversion of Series B Preferred Shares in accordance with the provisions of this Section. The stock certificate(s) evidencing the Common Stock shall be issued with a restrictive legend indicating that it was issued in a transaction exempt from registration under the Securities Act of 1933, as amended (tbc "Securities Act"), and that it cannot be transferred unless it is so registered, or an exemption from registration is available, in the opinion of counsel to the Corporation. The Common Stock shall be issued in the same name as the person who is the holder of the Series B Preferred Stock unless, in the opinion of counsel to the Corporation, such transfer can be made in compliance with applicable securities laws. The person in whose name the certificatc(s) of Common Stock arc so registered shall be treated as a holder of shares of Common Stock of the Corporation on the date the Common Stock certificate(s) are so issued. All shares of common Stock delivered upon conversion of the Series B Preferred Shares as provided herein shall be duly and validly issued and fully paid and nonassessable. Effective as of the Conversion Date, such converted Series B Preferred Shares shall no longer be deemed to be outstanding and all rights of the holder with respect to such shares shall immediately terminate except the right to receive the shares of Common Stock issuable upon such conversion, (c) The Corporation covenants that, with unanimous board of directors approval, within 30 days of receipt of a conversion notice from any bolder of shares of Series B Preferred Stock wherein which such conversion would create more shares of Common Stock than are authorized, the Corporation will increase the authorized number of shares of Common Stock sufficient to satisfy such holder of shares of Series B submitted such conversion notice. (d) Shares of Series B Preferred Stock arc anti-dilutive to reverse splits, and therefore in the case of a reverse split, are convertible to the number of Common Shares after the reverse split as would be equal to the ratio established in Section 4.4(a) . PAGE 04/07 02/11/2009 5P1EGELMAN INC PAGE 05/07 01:06 9545274719 The conversion rate of shares of Series B Preferred Stock, however, would increase proportionately in the case of forward splits, and may not be diluted by a reverse split following a forward split. 4.5 VOTING RIGHTS. Each share of Series B Preferred Stock shall have one vote for any election or other vote placed before the shareholders of the Company but voting shall not be by class of stock but by majority vote of all outstanding shares of stock, including Common Stock and Series A Preferred Stock calculated in accordance with the voting rights set forth herein. 4.6 PRICE. (a) The initial issuance price of each share of Series B Preferred Stock shall be $2.50. (b) The initial issuance price of each share of Series 13 Preferred Stock may be changed either through a majority vote of the Board of Directors through a resolution at a meeting of the Board, or through a resolution passed at an Action Without Meeting of the unanimous Board. ARTtCLE V Regieter&affiesgudAgent 'The name of the corporation's registered agent is A. it S. and Associates Inc street address of the said registered agent where process may be saved is 20810 West Dixie Hwy., North Miami Beach, FL 33180. Bog(' ofThreetors The initial number of directors of the Corporation shall be up to 5 and may be increased or decreased from time to time in such manner as may be prescribed by the bylaws. The taine(s) and addresqcs) of the initial dircctor(s) of this corporation are: Sean Spiegelman 163 Boone Creek Drive, Boone, NC 28607. The Corporation shall indemnify and hold harmless each person who shall serve at any time hereafter as a director or officer of the Corporation, and any person who serve at the request of this Corporation as a director or officer of any other corporation from and against any and all claims and liabilities to which such person shall become subject by reason of his having theretofore or hereafter being a director of officer of the Corporation, or by reason of any action alleged to have been heretofore or hereafter 02/11/2009 01:06 9545274719 SPIEGELMAN INC taken or omitted by him as such director or officer, and shall reimburse each such person for all expenses (including attorney's fees) reasonably provided that no person shall be indemnified against, or be reimbursed for any expenses incurred in connection with any claim or liability as to which it shall be adjudged that such officer or director is liable for gross negligence or willful misconduct in the performance of his duties. The rights accruing to any person under the foregoing provisions shall not exclude any other right to which he may be lawfully entitled, nor shall anything herein contained restrict the right of the Corporation to indemnify or reimburse such person in any proper case even though not specifically herein provided for. No contract or other transaction between this Corporation and any other corporation or individual, and no act of this Corporation shall in any way be affected or invalidated by the fact that any of the owners or directors of the Corporation are pecuniarily or otherwise interested in or arc directors or officers, or owners of such other corporation. Any director individually, or any firm of which any director may be a member, may be a party to, or any be pecuniarily or otherwise interested in, any contract or transaction of the Corporation, provided that the fact that he or such firm so interested shall be disclosed or shall have been known to the Board of Directors or such members thereof as shall be present at any meeting of the Board at which action upon any such contract or transaction shall be taken; and any director of the Corporation who is also a director or officer of such other corporation or is so interested may be counted in determining the existence of a quorum at any meeting of the Board of Directors of the Corporation which shall authorize any such contract or transaction, and may vote there at to authorize any such contract or transaction with like force and effect as if he were not such director or officer of such other corporation or not so interested. a:MUM blasamalm The name and address of the person signing these Articles is: Clinton F. Walker 226 Walker Road Lawndalc, NC 28090 ARTICLE VIII )3vlaws The Board of Directors shall have the power and authority to make, alter, or amend the Bylaws; to fix the amount, in cash or otherwise, to be reserved as working capital; and to authorize and cease to be executed the mortgages and liens upon the property and franchises of Corporation. PAGE 06/07 02/11/2009 01:06 9545274719 SPIEGELMAN INC PAGE 07/07 0113,12CLEIX IN WITNESS WHEREOF, the undersigned has executed this Amended and Restated Articles of Incorporation this 14th day of December, 2013. Clinton F. Walker, President

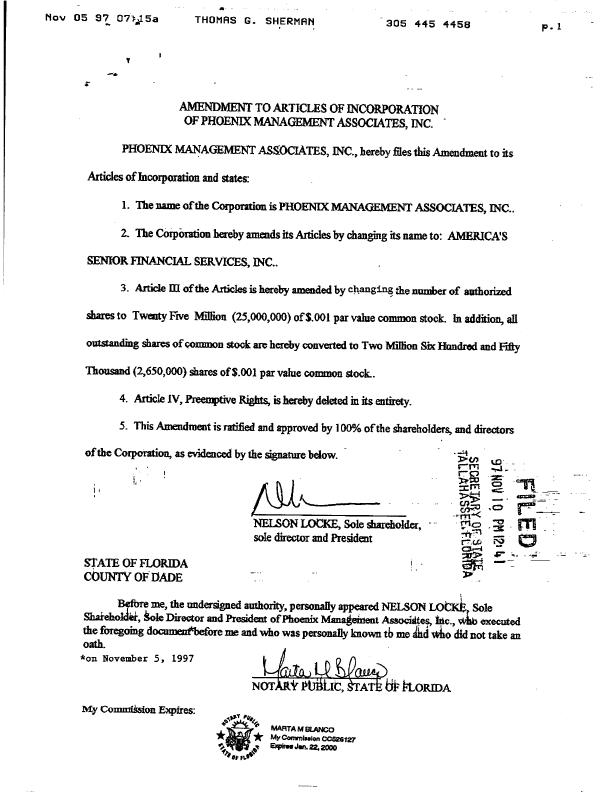

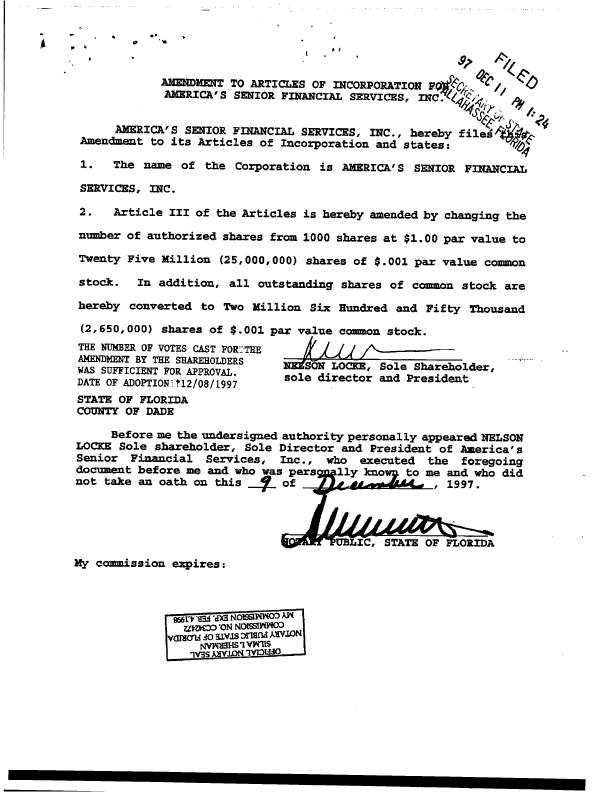

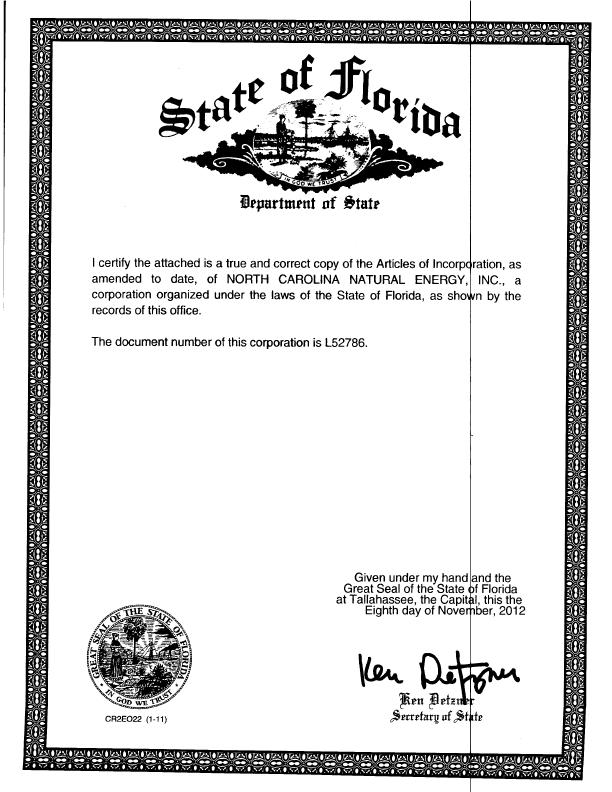

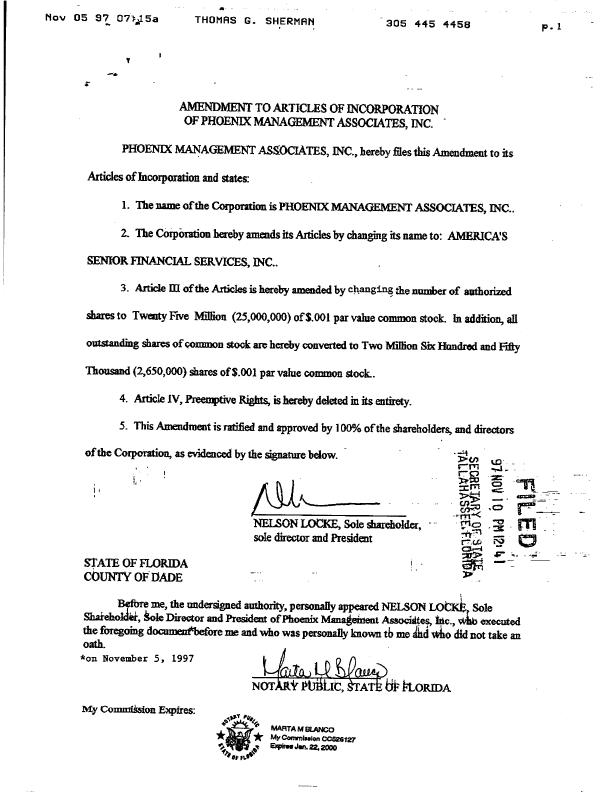

I certify the attached is a true and correct copy of the Articles of incorporation as amended to date, of NORTH CAROLINA NATURAL ENERGY, Inc., a corporation organized under the laws of the State of Florida, as shown by the records of this office. The document number of this corporation is L52786. ARTICLES OF INCORPORATION OF Phoenix Management Associates , Inc. :1 ARTICLE I Name The name of this corporation is: Phoenix Management Associates ARTICLE II Purpose This corporation is organized for the purpose of transacting any and all lawful business. ARTICLE III Capital Stock This corporation is authorized to issue Five Hundred (500) shares of One Dollar ($1.00) par Value common stock. ARTICLE IV Preemptive Rights Every shareholder, upon the issuance or sale of either new reasury stock for cash, property, services, in payment of corporate debts or otherwise, shall have the right to purchase his proportionate share thereof. ARTTCLE V Initial Registered Office and Agent The street address of the initial registered office t this corporation is: 218 Almeria Avenue, Coral Gables, Florida 33134 and the name of the initial registered agent of this corporation at that address is: THOMAS G. SHERMAN, ESQ. 218 Almeria Avenue, Coral Gables, Fl 33134 which agent, pursuant to 48.091, Florida Statutes, shall accept service of process within this state. ARTICLE VI Board of Directors This corporation shall have 2 director(s) initially. The number of directors may be increased or decreased from time to time in such manner as may be prescribed by the bylaws. The name(s) and address(es) of the initial director(s) of this corporation is (are): Nelson. Locke, Jr. 1205 B Wallace St. Coral Gables, Fl 33134 Cheryl D. Locke 1205 B Wallace St. Coral Gables, Fl 33134 The corporation shall indemnify and hold harmless each person who shall serve at any lime hereafter as a director or officer of the corporation, and any person who serves at the request of this corporation as a director or officer of any other - 2 - corporation from and against any and all claims and liabilities to which such person shall become subject by reason of his having heretofore or hereafter being a director or officer of the corporation, or by reason of any action alleged to have be: here- tofore or hereafter taken or Omitted by him as such directorr or officer, and shall reimburse each such person for all expenses (including attorney's fees) reasonably provided that no person shall be indemnified against, or be reimbursed for, any expenses incurred in connection with any claim or liability as to which it shall be .d that such officer or director is liable for negligence or wiLitu ..aiscoduct in the performance of his duties. The rights accruing to any person under the foregoing provisions shall not exclude any other right to which he may be law:ullv entitled, nor shall anything herein contained restrict the right of the corporation to indemnify or reimburse such person in any proper case even though not specifically herein pro provided for. No contract or oilier transaction between this corporation and any ocher corporation, and no act of this corporation shall in an" way be affected or invalidated by the fact that any o the directors of the corporation are pecuniarily or otherwise interested in or are directors or officers of such other corporpora- tion. any director individually, or any firm of which any director may :le a member, may be a party to, or any be pecuniarily or otherwise interested in, any contract or transaction of the torpor- at ion, provided that the fact that he or such firm so interested shall be disclosed or shall have been known to the Board of Directors o. such members thereof as shall be present at any meeting of the Board at which action upon any such contract. or transaction shall be taken; and any director of the corporation who is also A director or officer of such other corporation. or is so Interested may be counted in determining the existence of a a any meeting of the Board of Directors of the corporation s?;a: 1 Authorize any such contract or transaction, an may vote 1ere.4t to authorize any such contract or transaction with :ike And effect as if he were not such director or officer corporation or not so interested. ARTICLE VII Incorporator The name and address of the person signing these Articles is ARTICLE VIII By-Laws The power to adopt. alter, amend or repeal by-laws shall be vested in the shareholders_ [N WITNESS WHEREOF, the undersigned subscriber has executed these Articles of Incorporation this 6 day of February 1'4 40 Subscriber; THOMAS G. SHERMAN 4 STATE OF FLORIDA ) ) SS: COUNIY OF DADE ) I HEREBY CERTIFY that on this day before me, a notary public, duly authorized in the state and county above named acknowledgments, personally appeared THOMAS SHERMAN to me known to be the person who executed the foregoing Articles of Incorporation and who acknowledged before me that (s)he executed those Articles of Incorporation. WIFNE-:;S my hand and official seal in the county and state named above this 6 day of February 1990 / Notary Public.State of Florida My commission expires: The undersigned having been named to accept service of process for the above corporation at the place designated in Article VI hereof, hereby accepts such agency and agrees to comply with the provisions of the Florida Statutes relative to keeping open sii0 office. Resident Agent: THOMAS G. SHERMAN 5 I certify the attached is a true and correct copy of the Articles of Incorporation, as amended to date, of NORTH CAROLINA NATURAL ENERGY, INC., a corporation organized under the laws of the State of Florida, as Shown by the records of this office. The document number of this corporation is L52786. ' if I ARTICLES OF INCORPORATION OF Phoenix Management Associates , Inc. ARTICLE I Name The name of this corporation is: Phoenix Manaiement Associates , ARTICLE II Purpose This corporation is organized for any and all lawful business. ARTICLE III Capital Stock This corporation is authorized to shares of One Dollar ($l-00) par ialue common stock. ARTICLE IV Preemptive Rights Inc. the purpose of transacting issue Five Hundred (500) Every shareholder, upon the issuance or sale of either new reasury stock for cash, property, services, in payment of co orate debts or otherwise, shall have the right to purchase his proportionate share thereof. ARTICLE V Initial Registered Office and Agent The street address of the initial registered office f this co -'oration is: 218 Almeria Avenue, Coral Gables, Flor da 33134 and ih.t name of the initial registered agent of this corporation at that address is: THOMAS G. SHERMAN, ESQ. 218 Almeria Avenue, Coral Gables, Fl 33134 which agent, pursuant to 48.091, Florida Statutes, shall a cept service of process within this state. ARTICLE VI Board of Directors This corporation shall have 2 director(s) initially. The number of directors may be increased or decreased from time to time in such manner as may be prescribed by t-e bylaws. The name(s) and address(es) of the initial dire,cor(s) of this corporation is (are): Nelson Locke, Jr. 1205 B Wallace St. Coral Gables, Fl 33134 Cheryl D. Locke 1205 B Wallace St. Coral Gables, Fl 33134 The corporation shall indemnify and hold harmless each person who shall serve at any lime hereafter as a directoror officer of the corporation, and any person who serves at the request of this corporation as a direc tor or officer of a y other ri corporation from and against any and all claims and liabilities to which such person shall become subject by reason of his having heretofore or hereafter being a director or officer of the corporation, or by reason of any action alleged to have be n here- tofore or hereafter taken or cr7itted by him as such direct- r or officer, and shall reimburse each such person for all expe ses (including attorney's fees) reasonably provided that no pe son shall be indemnified against, or be reimbursed for, any expenses incurred in connection with any claim or liability as to which it shall be ,d that such officer or director is liable for negligence or wititu, 4iiscw:luct in the performance of his duties. The rights accruing to any person under the foregoing provisions shall not exclude any other right to which he may be law:ullv entitled, nor shall anything herein contained restrict the right of the corporation to indemnify or reimburse such person in any proper case even though not specifically herein pro idea for. No contract or other transaction between this corporation and any other corporation. and no act of this corporation shall in any way be affected or invalidated by the fact that any of the directors of the corporation are pecuniarily or otherwise interested in or are directors or officers of such other corpora- tion. any director individually, or any firm of which any director may !ye a member, may be a party to, or any be pecuniarily or otherwise interested in, any contract or transaction of the corpor- ation, provided that the fact that he or such firm so interested shall be disclosed or shall have been known to the Board Directors u. such members thereof as shall be present at a meeting of the Board at which action upon any such contrac or transaction sh,111 be taken; and any director of the corpor tion who is aim, A director or officer of such other corporatio or is so interested may be counted in determining the existence .f a ,:-_177.1 at any meeting of the Board of Directors of the corporation s All Authorize any such contract or transaction, an may vote Itere41 to authorize any such contract or transaction with :-orce And effect as if he were not such director or o ficer :rn )1";:er corporation or not'so interested. ARTICLE VII Incorporator The name and address of the person signing these Ar idles is : THOMAS G.SHERMAN, ESQ. 213 Almeria Ave. Coral Gables, Fl 33134 ARTICLE VIII By-Laws The power to adopt. alter, amend or repeal by-laws shall be vested in the shareholders_ IN WITNESS WHEREOF, the undersigned subscriber has executed these Articles of Incorporation this 6 day of Februar subscriber: THOMAS G. SliERMAN - 4 - STATE OF FLORIDA ) ) SS: COUNLY OF DADE ) I HEREBY CERTIFY that on this day before me, a notary public, duly authorized in the state and county above named acknowledgments, personally appeared THOMAS SHERMAN to me known to be the person who executed the foregoing Art Iles of Incorporation and who acknowledged before me that (s)he xecuted those Articles of Incorporation. WIFNESS my hand and official seal in the county and tate named above this 6 day of FEbruary , 1990 My commission expires: The undersigned having been named to accept service of process or the above corporation at the place designated in Article VI hereof, hereby accepts such agency and agrees to comply with the provisions of the Flordia Statutes relative to keeping open sii0 office. .J1 sz, Resident Agent: LOMAS G.I-SHERMAN n iTt rj - 5 - Nov 05 97 07-Q5a THOMAS G. SHERMAN 305 445 4458 p . 1 V AMENDMENT TO ARTICLES OF INCORPORATION OF PHOENIX MANAGEMENT ASSOCIATES, INC. PHOENIX MANAGEMENT ASSOCIATES, INC., hereby files this Amendment to its Articles of Incorporation and states: 1. The name of the Corporation is PHOENIX MANAGEMENT ASSOCIATES, INC.. 2. The Cotporation hereby amends its Articles by changing its name to: AMERICA'S SENIOR FINANCIAL SERVICES, INC.. 3. Article DI of the Articles is hereby amended by changing the number of authorized shares to Twenty Five Million (25,000,000) of $.001 par value common stock. In addition, all outstanding shares of common stock are hereby converted to Two Million Six Hundred and Fifty Thousand (2,650,000) shares of $.00l par value common stock.. 4. Article IV, Preemptive Rights, is hereby deleted in its entirety. 5. This Amendment is ratified and approved by 100% of the shareholders, and directors of the Corporation, as evidenced by the signature below. >v) rrn ;TIN argaz1=- NELSON LOCKE, Sole shareholder, - vic) 3 ni STATE OF FLORIDA COUNTY OF FADE sole director and President (3-4 Before me, the undersigned authority, personally appeared NELSON LOCKE? Sole Shafeholdel-, hole Director and President of Phoenix Management Associates, In c., *kb executed the foregoing documentbefore me and who was personally known tb me lid Who did not take an oath. *on November 5, 1997 My Commiksion Expires: ato ,J AtAPI NOT it' PUBLIC, ATE b FLORIDA SVN mon-Annum -*It Ay * mycomminionec626,27 Expire* Jam 22, 2000 d4A, OF 11.1, glit'"Z Itkle lft y,) 0' Y (fy 1.p1 ...po' S 121 VAS/ V,0: 42/.0. V(/3' V . akV.OT5T: 54 .)(5Te !. Vo.yoWok liefros Voyok V.,Aw v -.* ,--Le O > A (5 N,WaWC- (4)V.A.C4,(0) A70)V-0160 (4); 7/161 1(i) 47117-1 T(V7.117(4:74V0(0)717.11)07/70)'N'ir i)N. (41 % 41..C R Ori)% Ah ( A's. i4N /4)% /7( 43 -41 AD LOlf At iDl ? ?' VP 4 761 1 I k .4D1. . I, (41 k 411 111. +1 1. CIP 0 yv .111? ? 40 411 ' it II, cll. DCt.,, (... 0% % k )D1, . c...". / := '. NW NW NIklik. Wk. %W '-4 11 W(4W(1-1A?1V4."i'n"VW)(4-I.V4V14-:.:="474=1:0:41tW W7:41W4IP !4.4.4,74V.1:-M1,eVW,f)(4=4+5044n4ZVIZV./4: )) 5r 's. d'i 'C'Ori'C'/(0%-f.AN'Or Ts. 4NW4WO)'e7(0).tiAN'Ofi i)- 0).CWOVN:r;T(OW ($)" *Wie% di \ % /IC \ /it il\ `?72(0 \ % /IC% eti\ C-idel SO 'Cit.\ ''? 04)% WO\ 'Zi'te li\ 1 /(0'N. 01' W(i)W( Zt).7. ARTICLES OF INCORPORATION OF Phoenix Management Associates , Inc. ,T1 ARTICLE I Name The name of this corporation is: Phoenlx Management Associates , Inc. ARTICLE II Purpose This corporation is organized for the purpose of transacting any and alp lawful business. ARTICLE III Capital Stock This corporation is authorized to issue Five Hungred (500) shares of One Dollar ($1.00) par Jalue common stock. ARTICLE IV Preemptive Rights Every shareholder, upon the issuance or sale of either new -reasury stock for cash, property, services, in payment of cu.earate debts or otherwise, shall have the right to purchase his proportionate share thereof. ARTTCLE V Initial Registered Office and Agent The street address of the initial registered office 0 this co -,oration is: 218 Almeria Avenue, Coral Gables, Florida 33134 and th-! name of the initial registered agent of this corporation at that address is: THOMAS G. SHERMAN, ESQ. 218 Almeria Avenue, Coral Gables, Fl 33134 which agent, pursuant to 48.091, Florida Statutes, shall accept service of process within this state. ARTICLE VI Board of Directors This corporation shall have 2 director(s) initially. The number of directors may be increased or decreased from time to time in such manner as may be prescribed by t e bylaws. The name(s) and address(es) of the initial dire:tor(s) of this corporation is (are): Nelson Locke, Jr. 1205 B Wallace St. Coral Gables, Fl 33134 Cheryl D. Locke 1205 B Wallace St. Coral Gables, Fl 33134 rhe corporation shall indemnify and hold harmless each person who shall serve at any time hereafter as a director or officer of the corporation, and any person who serves at the request of this corporation as a director or officer of any other corporation from and against any and all claims and Liabil ties to which such person shall become subject by reason of his having heretofore or hereafter being a director or officer of the corporation, or by reason of any action alleged to have be n here- tofore or hereafter taken or o-7itted by him as such direct-r or officer. and shall reimburse each such person for all expe4ses (including attorney's fees) reasonably provided that no person shall be indemnified against, or be reimbursed for, any expenses incurred in connection with any claim or liability as to which it shall be that such officer or director is liable for negligence or wiLitu, .aisco!:_luct in the performance of his duties. The rights accruing to any person under the foregoing provisions shall not exclude any other right to which he may be entitled, nor shall anything herein contained restrict the right of the corporation to indemnify or reimburse such person in any proper case even though not specifically herein pro ided for. No contract or other transaction between this corporation and any other corporation, and no act of this corporation shall in any way be affected or invalidated by the fact that any of the directors of the corporation are pecuniarily or otherwise interested in or are directors or officers of such other corpora- tion. any director individually, or any firm of which any director may be a member, may be a party to, or any be pecuniarily or otherwise interested in, any contract or transaction of the corpor- ation, provided that the fact that he or such firm so interes ted - I - shall be disclosed or shall have been known to the Board Directors o. such members thereof as shall be present at a y meeting of the Board at which action upon any such contracor transaction shall be taken; and any director of the corporation who is alsc i director or officer of such other corporatio or is so in erected may be counted in determining the existence f a AL any meeting of the Board of Directors of the corporation authorize any such contract or transaction, and may -;ote :lere4'.. La authorize any such contract or transaction with rs:e ind effect as if he were not such director or officer g-icn )::er corporation or notso interested. ARTICLE VII Incorporator The name and address of the person signing these Articles is _ THOMAS G. SHERMAN, ESQ. 213 Almeria Ave. Coral Gables, Fl 33134 ARTICLE VIII By-Laws The power to adopt. alter, amend or repeal by-laws shall be vested in the shareholders_ IN WITNESS WHEREOF, the undersigned subscriber has executed these Articles of Incorporation th is 6 day of February Subscriber: THOMAS G. SHERMAN - 4 - STATE OF FLORIDA ) ) SS: COUNIY OF DADE ) I HEREBY CERTIFY that on this day before me, a notary public, duly authorized in the state and county above names acknowledgments, personally appeared THOMAS ;. SHERMAN to me known to be the person who executed the foregoing Art Iles of incorporation and who acknowledged before me that (s)he xecuted those Articles of Incorporation. wtrNE::s my hand and official seal in the county and State named above this 6 day of l99C. Notaty Public, State ofF16TI3a My commission expires: The undersigned having been named to accept service of process :-or the above corporation at the place designated in Article VI hereo:-. hereby accepts such agency and agrees to comply with the provisions of the Flordia Statutes relative to keeping open siiJ office_ .A,/ sz, Resident Agent: LOMAS G. SHERMAN - 5 - Nov 05 97 07V5a THOMAS G. SHERMAN 305 445 4458 P.1 AMENDMENT TO ARTICLES OF INCORPORATION OF PHOENIX MANAGEMENT ASSOCIATES, INC. - PHOENIX MANAGEMENT ASSOCIATES, INC., hereby files this Amendment to its Articles of Incorporation and states: 1. The name of the Corporation is PHOENIX MANAGEMENT ASSOCIATES, INC.. 2. The Corporation hereby amends its Articles by changing its name to: AMERICA'S SENIOR FINANCIAL SERVICES, INC.. 3. Article Hi of the Articles is hereby amended by changing the number of authorized shares to Twenty Five Million (25,000,000) of $.001 par value common stock. In addition, all outstanding shares of common stock are hereby converted to Two Million Six Hundred and Fifty Thousand (2,650,000) shares of $.00l par value common stock.. 4. Article IV, Preemptive Rights, is hereby deleted in its entirety. 5. This Amendment is ratified and approved by 100% of the shareholders, and directors of the Corporation, as evidenced by the signature below. STATE OF FLORIDA COUNTY OF DADE Before me, the undersigned authority, personally appeared NELSON LOtKE Sole Shareholciek, hole Director and President of Phoenix Manageinent Associates, hic., *he executed the foregoing documenfbefore me and who was personally known tb me itd who did not take an oath. *on November 5, 1997 Clitaj qTati NOT My Commilsion Expires: 414.1Z 1.Ztel. ir PUBLIC, ATI7.. PLORTDA MARIA M BLANCO * :; * My Commission CC626127 Expires Jam. 22, 2000 A r 4' S> AMENDMENT TO ARTICLES OF INCORPORATION FOye,q AMERICA'S SENIOR FINANCIAL SERVICES, INc.(e44, A> 4 44 / k o / 4s ' Z. et AMERICA'S SENIOR FINANCIAL SERVICES, INC., hereby filesii, :f* Amendment to its Articles of Incorporation and states: 1. The name of the Corporation is AMERICA'S SENIOR FINANCIAL SERVICES, INC. 2. Article III of the Articles is hereby amended by changing the number of authorized shares from 1000 shares at $1.00 par value to Twenty Five Million (25,000,000) shares of $.001 par value common stock. In addition, all outstanding shares of common stock are hereby converted to Two Million Six Hundred and Fifty Thousand (2,650,000) shares of $.001 par value common stock. THE NUMBER OF VOTES CAST FORTTHE AMENDMENT BY THE SHAREHOLDERS WAS SUFFICIENT FOR APPROVAL. DATE OF ADOPTIONT12/08/1997 STATE OF FLORIDA COUNTY OF DADE I /` SON LOCKE, Sole Shareholder, sole director and President Before me the undersigned authority personally appeared NELSON LOCKE Sole shareholder, Sole Director and President of America's Senior Financial Services, Inc., document before me and who was pers not take an oath on this 1F of My commission expires: 866 L'it dX3 K01900103 API who executed the foregoing ily kno to me and who did , 1997. UBLIC, STATE OF FLORIDA Larri,03 'ON IsIOISSIV0400 allio9.13O aLVIS prima AliVION WITS isIVNI1314S1 -IVES JapaorstiVrau.4.0 FAX At7DXT NO.: H99000007675 4 ARTICLES OF AMENDMENT TO ARTICLES OF INCORPORATION OF AMERICA'S MAWR FINANCIAL SERVICES, INC. Pursuant to Sections 607.1003 and 607.1006 of the Florida Business Corporation Act, the Articles of Incorporation of AMERICA'S SENIOR FINANCIAL SERVICES, INC. (the 'Corporation"), are hereby amended according to these Articles of Amendment: FIRST: The name of the Corporation is America's Senior Financial Services, Inc. SECOND: The Articles of Incorporation are hereby amended to add the following provision to Article Iii deal Stoic 'Ibe Corporation is also authorized to issue ten million (10,000,000) shares of Preferred Stock having a par value of 3.001 per share (the 'Preferred Stock'). Shares of Preferred Stock may be issued from time to time in one or more series. The Board of Directors is authorized to fix the number of shares in each series, the designation thereof and the relative rights, preferences and limitations of each series, and specifically, the Board of Directors is authorized to fix with respect to each series (a) the dividend rate; (h) redeemable features, if any; (C) rights upon liquidation; (d) whether or not the shares of such series shall be subject to a purchase, retirement or sinking fund provision; (e) whether or not the shares of such series shall be convertible into or exchangeable for shares of any other class and, if so, the rate of conversion or =change; (f) restrictions, if any, upon the payment of dividends on common stock (g) reshictions, if any, upon the creation of indebtedness; (h) voting powers, if any, of the shares of each scrim and (I) such other rights, preferences and limitathms as shall not be inconsistent with the laws of the State of Florida. THIRD: The foregoing amendment was adopted effective March 24,1999 by written consent of the directors of the Corporation, in accordance with Sections 607.0V1 of the Florida Statutes. The foregoing amendment was adopted effective Much 25, 1999 by written consent of the shareholders of the Corporation, in accordance with Sections 607.0704 of the Florida Stales, constituting a sufficient number of votes for the amendment to be approve& This instrument was prepared by; Teresita H. Garcia, Beg. Florida Bar No. 0836753 Holland & might LLP 701 Brickell Ave.. Suite 3000 Nigel, Florida 33131 Tel. (305) 374-8500 Fax (305) 789-7700 PBX Am= NO.: H99000007675 4 ZO,E0'd EZEZEMZEZEISOSLL 01 662.2. EaL SOE J.HDINN aNU110H eld EIS:ZT 6661 TR didW ** 20'30tId 1111.01 ** rim ADMIT NO.! 109000007675 4 AMERICA'S SENIOR FINANCIAL SERVICES ,INC. BY; Nelson A, Locke, President 1 44-7021 42.2 4 FAX AUDIT NO.: H99000007675 2 0,10'd ZEZEZtien22#061./.,Di 6611 6eL SO2 IHSINA a4d110H NA SS:al 6661 TE bdW ARTICLES OF AMENDMENT y TO ARTICLES OF INCORPORATION OF AMERICA'S SENIOR FINANCIAL SERVICES, INC. The undersigned corporation adopts the following amendments to its Articles of Incorporation. The amendments herein were duly adopted by the Board of Directors of the Corporation on October 24, 2000. 1. The name of the corporation is. AMERICA'S SENIOR FINANCIAL SERVICES, INC. 2. Amendment adopted: Series B Convertible Preferred Stock: Pars= to the authority vested in the Board of Directors of the Corporation by Article /II of the Corporation's Articles of Incorporation, as amended, a series of Preferred Stock of the Corporation be, and it hereby is, created out of the authorized but unissued shares of the capital stock of the Corporation, such series to be designated Series B Convertible Preferred. Stock (the "Preferred Stock"), to consist of 1,000,000 shares, par value $.001 per share, of which the preferences and relative and other rights, and the qualifications, limitations or restrictions thereof, shall be (in addition to those set forth in the Corporation's Articles of Incorporation, as amended) as follows: 4401 0000 7z e ZZ:ST TOW-TT-411 H o ( 0000 VD- winding up of the Corporation, whether voluntary or involuntary (all such distributions being referred to collectively as "Distributions"). Section 3. Dividends. The Series B Convertible Preferred Stock shall not be entitled to receive any dividend. Section 4. Liquidation Preference. (a) In the event of any liquidation, dissolution or winding up of the Corporation ("Liquidation Events), either voluntary or involuntary, the Holders of shares of Series B Convertible Preferred Stock shall be entitled to receive, immediately after any distributions to Senior Securities required by the Corporation's Articles of Incorporation or any Articles of desigation, and prior in preference to any distribution to Junior Securities but in parity with any distribution to Parity Securities, an amount per share equal to the sum of .3281 and no more. If upon the occurrence of such event, and after payment in full of the preferential amounts with respect to the Senior Securities, the assets and funds available to be distributed among the Holders of the Series B Convertible Preferred Stock and Parity Securities shall be insufficient to permit the payment to such Holders of the full preferential amounts due to the Holders of the Series B Convertible Preferred Stock and the Parity Securities, respectively, then the entire assets and funds of the Corporation legally available far distribution shall be distributed among the Holders of the Series B Convertible Preferred Stock and the Parity Securities, pro rata, based on the respective liquidation amounts to which the Holders of each such series are entitled by the Corporation's Articles of Incorporation and any certificate(s) of designation relating thereto. In the event of an adjustment in the conversion price of the Series B Convertible Preferred Stock, the liquidation preference shall be appropriately adjusted. (b) Upon the completion of the distribution required by subsection 4(a), if assets remain in this Corporation, they shall be distributed to holders of Junior Securities. (a) Holders Right to Convert. Each record Holder of Series B Convertible Preferred Stock shall be entitled to convert (in multiples of one preferred share) any or all of the shares of Series B Convertible Preferred Stock held by such Holder at any time into one (1) fully paid and nonassessable share of Common Stock of the Corporation (the Conversion Price") subject to adjustment as set forth below. Sales of these underlying shares of Common Stock shall be completed in accordance with a leakage plan for orderly distribution, in the best interest of all shareholders. (b) Mechanics of Conversion. Before any holder of Series B Convertible Preferred Stock shall be entitled to convert the same into shares of Common Stock, he shall surrender the 2 44 0 I 0000-rDeE5.a. 912/13'd 22:ST TOW-TT-WE __ Rol zcoVA?-- certificate or certificates therefor, duly endorsed, at the office of the Corporation or of any transfer agent for the Common Stock, and shall give written notice to the Corporation (the "Notice of Conversion") at such office that he elects to convert the same and shall state therein the number of shares of Series B Convertible Preferred Stock being converted. Thereupon the Corporation shall promptly issue and deliver at such office to such holder of Series B Convertible Preferred Stock a certificate or certificates for the number of shares of Common Stock to which he shall be entitled, or as otherwise agreed between the holder and the Corporation. Such conversion shall be deemed to have been made immediately prior to the close of business on the date of such surrender of the shares of Series B Convertible Preferred Stock to be converted, and the person or persons entitled to receive the shares of Common Stock issuable upon such conversion shall be treated for all purposes as the record bolder or holders of such shares of Common Stock on such date. However, for purposes of Rule 144 , the record date on the underlying shares of Common Stock shall be the date of the issuance of the Series B Convertible Preferred Stock. (i) Lost. or Stolen Certificates. Upon receipt by the Corporation of evidence of the loss, theft, destruction or mutilation of any Series B Convertible Preferred Stock Certificates, and (m the case of loss, theft or destruction) of indemnity or security reasonably satisfactory to the Corporation and its Transfer Agent, and upon surrender and cancellation of the Series A Convertible Preferred Stock Certificate(s), if mutilated, the Corporation shall execute and deliver new Series B Convertible Preferred Stock Certificate(s) of like tenor and date. However, Corporation shall not be obligated to re-issue such lost or stolen Series B Convertible Preferred Stock Certificates if Holder contemporaneously requests Corporation to convert such Series B Convertible Preferred Stock into Common Stock. (ii) No Fractional Shares. If any conversion of the Series B Convertible Preferred Stock would create a fractional share of Common Stock to a holder or a right to acquire a fractional share of Common Stock, such fractional share shall be disregarded and the number of shares of Common Stock issuable upon conversion, shall be the next higher number of shares, or the Corporation may at its option pay cash equal to fair value of the fractional share based on the fair market value of one share of the Corporation's Common Stock on the date of conversion, as determined to good faith by the Board of Directors. (c) Reservation of Stock Issuable Upon Conversion. The Corporation shall at all times reserve and keep available out of its authorized but unissued shares of Common Stock, solely for the purpose of effecting the conversion of the Series B Convertible Preferred Stock, such number 91,1F13 ' of its shares of Common Stock as shall from time to time be sufficient to effect the conversion of all then outstanding Series B Convertible Preferred Stock; and if at any time the number of authorized but unissued shares of Common Stock shall not be sufficient to effect the conversion of all then outstanding shares of Series B Convertible Preferred Stock, the Corporation. will. 3 4-1-01 00001 a-8 BA ZZ:ST TO0a-TTNnr Ooo0198(6)- immediately take such corporate action as may be necessary to increase its authorized but unissued shares of Common Stock to such number of shares as shall be sufficient for such purpose. (d) Adjustment to Conversion Price. (i) Adjustment Dtie to Stock Split, Stock Dividend, Etc. If, prior to the conversion of all of the Series B Convertible Preferred Stock, the number of outstanding shares of Common Stock is increased by a stock split, stock dividend, or other similar event, the number of shares of Common Stock issuable on conversion shall be proportionately increased, or if the number of outmoding shares of Common Stock is decreased by a combination or reclassification of shares, or other similar event, the number of shares issuable ou conversion shall be proportionately decreased. The intention is to keep the ownership percentage the same. (ii) Adjustment Due to Merger, Consolidation, etc. If, prior to the conversion of all Series B Convertible Preferred Stock, there shall be any merger, consolidation, exchange of shares, recapitalization, reorganization, or other similar event, as a result of which shares of Common Stock of the Corporation shall be changed into the same or a different number of shares of the same or another class or classes of stock or securities of the Corporation or another entity (each aBusiness Combination Event"), then the Holders of Series B Convertible Preferred Stock shall thereafter have the right to receive upon conversion of Series B Convertible Preferred Stock, upon the basis and upon the terms and conditions specified herein and in lieu of the shares of Common Stock immediately theretofore issuable upon conversion, such stock, securities and/or other assets which the Holder would have been entitled to receive in such transaction had the Series B Convertible Preferred Stock been converted immediately prior to such transaction, and in any such case appropriate provisions shall be made with respect to the rights and interests of the Holders of the Series B Convertible Preferred Stock to the end that the provisions hereof (including, without limitation, provisions for the adjustment of the number of shares issuable upon conversion of the Series B Convertible Preferred Stock) shall thereafter be applicable, as nearly as may be practicable in relation to any securities thereafter deliverable upon the exercise hereof. (iii) No Fractional Shares. If any adjustment under this Section 5(d) would require the issuance of a fractional share of Common Stock to a holder, such fractional share shall be disregarded and the rairaber of shares of Common Stock issuable upon conversion shall be the next higher full number of shares. Section 6. Voting Rights. This special series has no voting rights as preferred stock. Upon conversion into common stock, the holders shall be entitled to vote as provided by law. 4 WY wool (2)4,3D--- E :ST 10121E- T-Nnr 90'd HOI 000 0 idtb(?);_, To the extent that under Florida Law the vote of the Holders of the Series B Convertible Preferred Stock, voting separately as a class, is required to authorize a given action of the Corporation, the affirmative vote or consent of the Holders of at least a majority of the shares of the Series A Convertible Preferred Stock represented at a duly held meeting at which a quorum is present or by written consent of a majority of the shares of Series B Convertible Preferred Stock (except as otherwise may be required under Florida Law) shall constitute the approval of such action by the class. Holders of the Series B Convertible Preferred Stock shall be entitled to notice of all shareholder meetings or written consents with respect to which they would be entitled to vote, which notice would be provided pursuant to the Corporation's by-laws and applicable statutes. Section 7. Status of Redeemed or Converted Stock. Any shares of Series B Convertible Preferred Stock which have not been issued within one year following the filing of these Articles or which have been converted shall return to the status of authorized but unissued- Preferred Stock of no designated series. AMERICA'S SENIOR FINANCIAL SERVICES, INC_ By: October 24, 2000 CACLIENTSvatur-soioACORNAntomAas-1014 5 90,-90'd ?????????? , NI Nelson A. Locke, President 1--t0 I 0000 -7 )43,52_, VZ:ST T00ZTT Nu The undersigned corporation adopts the following amendments to its Articles of Incorporation. The amendments herein were duly adopted by the Board of Directors of the Corporation on October 24, 2000. I. The name of the corporation is: AMERICA'S SENIOR FINANCIAL SERVICES, 2_ Amendment adopted: Series A Convertible Preferred Stock: Pursuant to the authority vested in the Board of Directors of the Corporation by Article III of the Corporation's Articles of Incorporation, as amended, a series of Preferred Stocic of the Corporation be, and it hereby is, created out of the authorized but unissued shares of the capital stock of the Corporation, such series to be designated Series A Convertible Preferred Stock (the Preferred Stock"), to consist of 5,000,000 shares, par value $.001 per share, of which the preferences and relative and other rights, and the qualifications, limitations or restrictions thereof, shall be (in addition to those set forth in the Corporation's Articles of incorporation, as amended) as follows: it0 I 00007OSBO SZ :9T TEtee-TT-NRf Flo (30001 z2g o whether voluntary or involuntary (all such distributions being referred to collectively as "Distributionsw). Section 3, Dividends. The Series A Convertible Preferred Stock shall not be entitled to receive any dividend. Section 4. Liquidation Preference. Section 5. Conversion. The record Holders of the Series A Convertible Preferred Stock shall have conversion rights as follows (the 'Conversion Rights"): (a) Holders Right to Convert. Each record Holder of Series A Convertible Preferred Stock shall be entitled to convert (in multiples of one preferred share) any or all of the shares of Series A Convertible Preferred Stock held by such Holder at any time into one (1) fully-paid and non-assessable share of Common Stock of the Corporation (the "Conversion Price") subject to adjustment as set forth below. Sales of these underlying shares of Common Stock shol be completed in accordance with a leakage plan for orderly distribution, in the best interest of all shareholders. (b) Mechanics of Conversion_ Before any holder of Series A Convertible Preferred Stock shall be entitled to convert the same into shares of Common Stock, he shall surrender the 2 Hot oco072Y VAD 1E1/E3Z1-cl SZ:ST TOW-TT -Nns 4+0 0000 izx certificate or certificates therefor, duly endorsed, at the office of the Corporation or of any transfer agent for the Common Stock, and shall give written notice to the Corporation (the Notice of Conversion") at such office that he elects to convert the same and shall state therein the number of shares of Series A Convertible Preferred Stock being converted. Thereupon the Corporation shall promptly issue and deliver at such office to such holder of Series A Convertible Preferred Stock a certificate or certificates for the number of shares of Common Stock to which he shall be entitled, or as otherwise agreed between the holder and the Corporation, (ii) No Fractional Shares. If any conversion of the Series A Convertible Preferred Stock would create a fractional share of Common Stock to a holder or a right to acquire a. fractional share of Common Stock, such fractional share shall be disregarded and the number of shares of Common Stock issuable upon conversion, shall be the next higher number of shares, or the Corporation may at its option pay cull equal to fair value of the fractional share based on the fair market value of one share of the Corporation's Common Stock on the dace of conversion, as determined in good faith by the Board of Directors. (e) Reservation of Stock 'salable Upon Conversion The Corporation shall at all times reserve and keep available out of its authorized but unissued shares of Common Stock, solely for the purpose of effecting the conversion of the Series A Convertible Preferred Stock, such number of its shares of Common Stock as shall from time to time be sufficient to effect the conversion of all then outstanding Series A Convertible Preferred Stock; and if at any time the number of authorized but unissued shares of Common Stock shall not be sufficient CO effect the conversion of all then outstanding shares of Series A Convertible Preferred Stock, the Corporation will 3 HO i 0000-Pee 5EVVZI-cl SZ:ST woe TT -NV 4-10 I es QA3 42rze80 immediately take such corporate action as may be necessary to increase its authorized but unissued shares of Common Stock to such number of shares as shall be sufficient for such purpose. Section 6. Voting Rights. Each holder of Series A Convertible Preferred Stock shall be entitled to the utzmber of votes equal to three times the number of shares of common stock into which such shares of Series A Convertible Preferred Stock could be converted and shall vote together with the common stock as a single class, except as otherwise expressly provided herein or as required by law. 4 00 007;115 0 5,1.,SEt 9d :ST TOW-TT-Nflf 93'd 111101 HO 1 4300o72 e Holders of the Series A Convertible Preferred Stock shall be entitled to notice of all shareholder meetings or written consents with respect to which they would be entitled to vote, which notice would be provided pursuant to the Corporation's by-laws and applicable statutes. Section 7. Status of Redeemed or Converted Stock. Any shares of Series A Convertible Preferred Stock which have not been issued within one year following the filing of these Articles or which have been =averted shall return to the status of authorized but unissued- Preferred Stock of no designated series. October 24, 2000 VGLZENTSWmer-SeWOMPIVutAaWW1-102 90-913 a AMERICA'S SENIOR FINANCIAL SERVICES, rNc. Nelson A. Locke, President 5 no l000074)880 9Z:SI TOOZ-VI

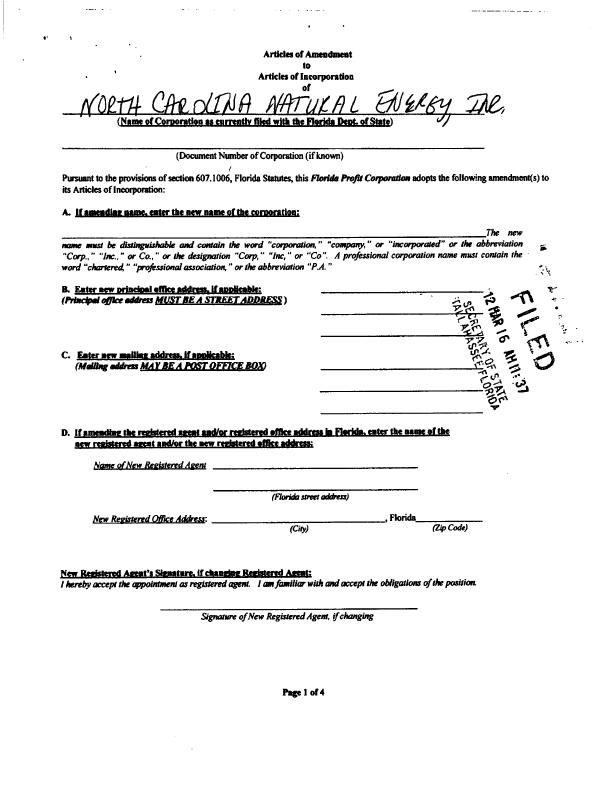

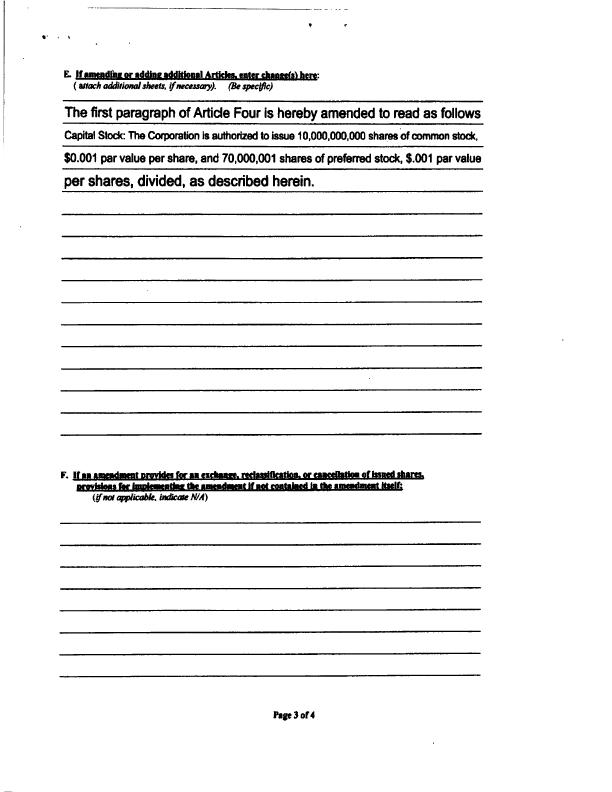

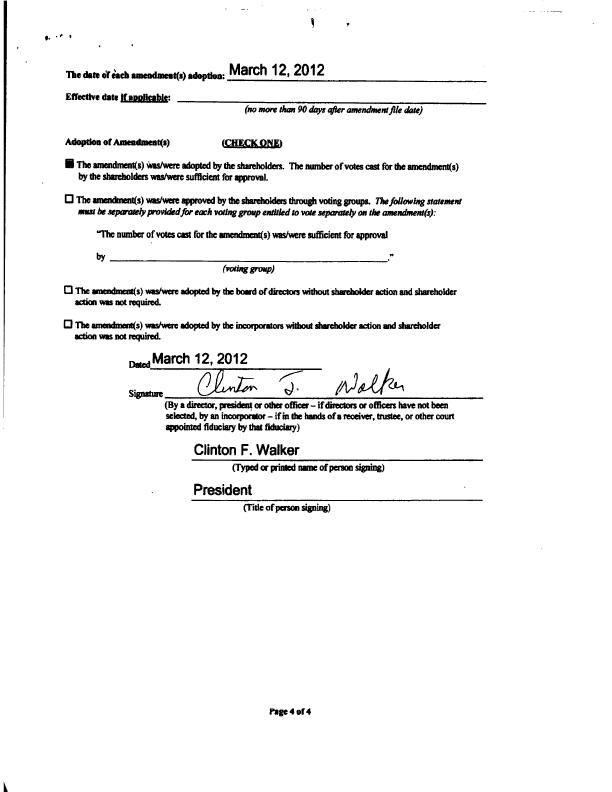

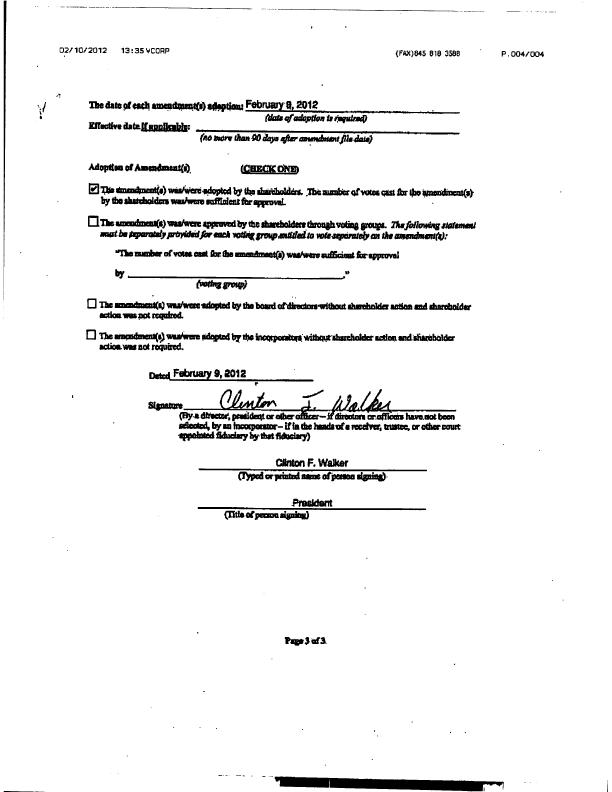

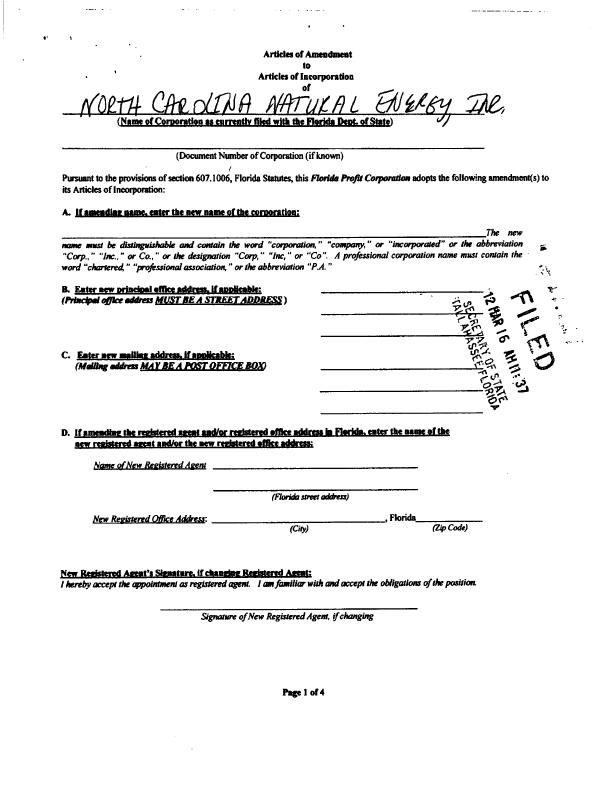

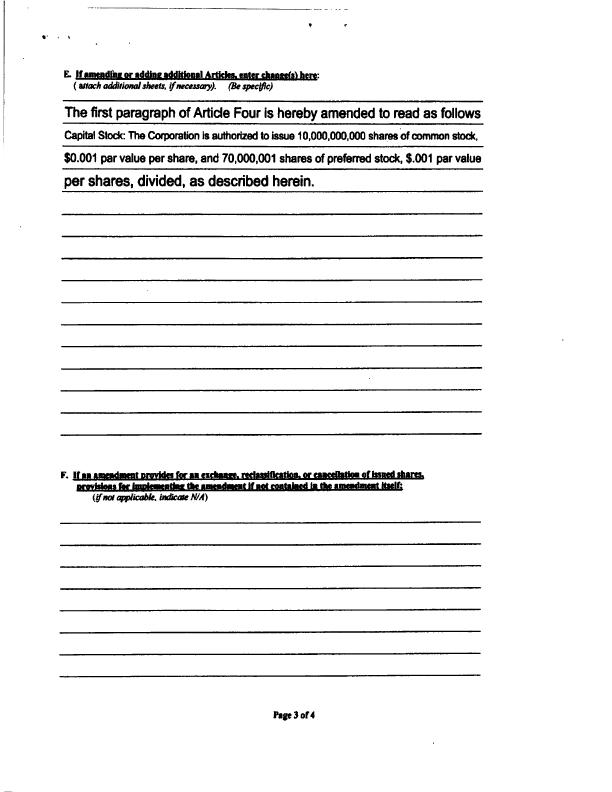

FILED 2011 JUN-1 AM 9:30 SECRETARY OF STATE TALLAHASSE, FLORIDA Articles of Amendment to Articles of Incorporation of AMERICAN HERITAGE FAMILY PARKS, INC. (Name of Corporation as currently filed with the Florida Dept. of State) L52786 (Document Number of Corporation (if known) Pursuant to the provisions of section 607.1006, Florida Statutes, this Florida Profit Corporation adopts the following amendment(s) to its Articles of Incorporation: A. If amending name, enter the new name of the corporation: REMODEL AUCTION, INC. The new name must be distinguishable and contain the word "corporation," "company," or "incorporated" or the abbreviation "Corp.," "Inc.," or Co.," or the designation "Corp," "Inc," or "Co". A professional corporation name must contain the word "chartered," "professional association," or the abbreviation "P.A." B. Enter new prindpal office address, if applicable: - (Principal office address MUST BE A STREET ADDRESS ) C. Enter new mailing address, if applicable: (Mailing address MAY BE A POST OFFICE BOX) : - D. If amending the registered agent and/or registered office address in Florida. enter the name of the new registered agent and/or the new registered office address: Name of New Registered Agent: New Registered Office Address: (Florida street address) , Florida (Cit)y (Zip Code) New Registered Agent's Signature, if changiqg Registered Agent: I hereby accept the appointment as registered agent. I am familiar with and accept the obligations of the position. Signature of New Registered Agent, if changing Page 1 of 3 If amending the Officers and/or Directors, enter the title and name of each officer/director being removed and title, name. and address of each Officer and/or Director being added: (Attach additional sheets, if necessary) Title Name Address Type of Action ? Add ? Remove ? Add ? Remove ? Add ? Remove E. If amending or adding additional Articles. enter change(a) here: (attach additional sheets. if necessary). (Be specific) F. Jf an amendment provides for an exchange. reclassification, or cancellation of issued shares, provisions for imnlementine the amendment if not contained in the amendment itself: (if not applicable, indicate N/A) Page 2 of 3 The date of each amendments) adoption: 5/26/2011 (date of adoption is required) Effective date Jiamslicable: (no more than 90 days after amendment .file date) Adoption of Amend men t(s) (CHECK ONE) ? The amendment(s) was/were adopted by the shareholders. The number of votes cost for the amendment(s) by the slum:holden was/were suilicient for approval. ? The amendment(s) was/were approved by the shareholders through voting groups. The following statement must be separately provided for each voting group entitled to vote separately on the amendment(s): 'The number of votes cast for the amendments) was/ Were sufficient for approval by , (voting group) ? The amendment(s) was/were adopted by the board of directors without shareholder action and shareholder action was not required. ? The amcnchneut(s) was/were adopted by the incorporators without shareholder action and shareholder action was not required Dated May 26 /. Signature {Illegibel} (By a director, president or other officer if directors or officers have not been selected by an incorporator if in the hands of a receiver, trustee, or other court appointed fiduciary by that fiduciary) -Roy Stephen Shiver (Typed or printed name of person signing) President (Title of person signing) Page 3 of 3 Articles of Amendment to Ankles of Incorporation of Remodel Auction, Inc. (Name of Corporation as currently filed with the Florida Dept. Of State) L52716 (Document Number of Corporation (if known) Pursuant to do provisions of section 607.1006, Florida Statutes, this Florida Prefit Corporation adopts the following amendments) to its Article of Incorporation: A. If amending name, enter the new name of the corporation ---...North Carolina Natural Energy, Inc. The new name must be distinguishable and contain the word corporation; company" or "incorporated" or the Abbreviation: Corp, "Inc.,"or co, or the designation "Corp' "Inc" orca". A professional corporation name must contain the word "chartered" "professional association, or the abbreviation P.A." B Enter new principal office address if applicable:.- 126 Walker Road (Principal office address MUST BE A STREET ADDRESS) Lawndale, NC 28090 C iml' es Wan affray efaiiii4MIECNIE/MHPD 126 %Weaned LovhitbdA,14(1 21000 Mg roisteredmostuiter thameseeletered o whims: ifalluakiaffigEtkiltiRt: SeIrptirroiftt TLe -WILSC4"112=7s.t2releg1 j oa4k1en) --- tietiklitiladalattAdditg Arlie , Plothio 23334 M 1 Page 1 ot4 12/07/2011 15:20 YCORP .1111,11. ! 1). ss :of Minn P. Walker (FAX)845 818 3588 r - ,t Atka 126 Walker Rood Laval:11e. NC 25090 P.003/005 4(.11 34ti5PC W28I 090 Clinton P...Welker 126 Ws&unclad hmstgo. NC 22090 4)SEQ., Clinton f. Walker 126 %kilo* Lannulde. NC 211090 51?11,.= .1 Zia= Thus) Ray Slerben Shiver. Jr. diamatiladcm 5) braes W..11nroer 6) Page 2 of 4 L.tl 1 Mims W. Reeder Clam 12/0712011 15:20 VCOPP (FAX)845 818 3588 P.004/005 .:- g ixesai g atimisdatitskujouns (artach adatotsal shaft y memory). ale apscpr) 12/07/2011 15:20 MCORP 11' EILIMEMESZIMINglikausphipishutined (FAX)845 818 3588 P.005/005 nekko Dr-m*110114 n nand spiral Met applicab4 bebeate NIA) 0.?1 ?IIIIMMINIM?11??????11.7, ?.- Medal* of sash siteedseet(u) adoption: December 7.20 1 Mass data apithabbt December2i. 21t1 1 (RP MOM fl on PO stays Oar comakistantAte dam) Adopdsa of Muodascnt(s) TearaKOM) M The mixecirma($) wuhreze adopted by the ibuchokkri. Tbc uuniber ()NOW west for the inntadatcal(s) by the abereheiders wishvere sufficient far approval. D ammiment(s) vseshvere.appreved by the shapisticlera Waugh voting groups. Miaowing steams* most b. nparogeO provided/or rack voting romp artiattdo vets moms* on the areas ment(1): l be number of vows east fist do anteedmengs) waewere unclog for apron) yb kale VW* D The snlastheenga) wawa adopted by Ifte bond of directors without stereholder acticc and abarbbiddca led= ass riot required. o The arnendment(s) wee/were edopted by the Wormed= vtitbeut diartheider action tied shareholder action wits net ecquired. Ditca Decsimbe 7, 2G11. cl) (By a Omar, pieddcator ober after Irdlecetors or officers have not been ackcycd, by in Inompondor if In the bonds eta maim, trustec..er Othar court appointed fiduciary by that fiduciary) Orton F Walker (1)pcd et printed name of.persou sisnias) President (Tide at poison signing) Pais 4 efe 02/08/2012 17:25 %I/CORP (FAX )1345 811, ssgs P 002/ 008 F I LE D First: The nrime br iction of the puryking corporation:' Lie 1iitisdicti Moment Number Orkzamkt, tetilltablo) North Carolina Natural Energy, Inc. Florida L52786 Second: The name and jurisdiction of each mergingociporation: Name 3ntidkakni JDoeument Number aricrotwil Bpplhal10 X-Pnise Arnoriba, Inc, Florida P12000009573 Third: The flan of Merger adliched Fourth: The-Jae:get shall-become effective on the date the' Aylidell onriergerare flied with the Florida Departnasntof 'State.. ft& I I (Enter &specific( dabs. NOTE: .An efActiva dim dubsorlia:Prior to the dew dTalbor Mre dm Ways after mfr file data.) Fifth: Adoption of Merger by Agatagg corporation - (CaStPLETIS ONLY ONE STATEMENT) The Plan cifiVerga was adoptisd bythe shareholders of the mirviving corporation On The Plan OfMerger wai adeptett by the boixdofclirectora of the durviving.dotpurtiima on 1/30/2012 andAmiihoIder approval was not iequred. Sixth: Adoption of Meter:by merging Corpopitiop(s) (tbiitPLiera am.,V ONE sTATiumrr) The Plan of Merger was:adopted hythe shareholders of the Merging. ecirporatlon(s)on The Plan of Merges'Was adopted hy the hoard of directots of the Mergiageorporadon(s) on 1 30/2012 and ahsreholder ;pp:Iva' was 4141rwired. (Attriekadditkeel sheets (1'mb:es:miry) Q2108/2012 17:25 VCCIRP Seventh' ariNalaartingruiraraMiAnga ;game of Couxuation Signature otati Ottleerpr 'Direetcir North Caroline Naturel..En ti X-Press. America, irtc- (FAX)845 818 3588 P.003/DOS ,Viped orpriiited Name.otIndiillAyttil klitts Inton Walker,. President Bruce E. Thomsen, President 02/08/2012 17125 4C0RP (FA )845 818 3588 = "LAN Q2' /AMP"' or X.,PRISSAMEVICAtints (4.1107.011 teiParat4n) INTO WIRTH CAR01414014.1131PA ENEIGIG Floside *pored* 'TICS PLAN OF:N(14MM b taland kdo this 30th dayof blowy, 2032, by and hempen X-P Am** .Flarlda coxpatatigo, sod North CandirralattualSance, bare Florida corpora**, and is being antleporstint .10 Stigetoo 6071101, Florida 811Intert. Figs X.Piress Moeda; /nc. abitida.rnrporralos, is iltalotraged Corporation" and Ninth. CarollnaNituralEacia, leo,. a Florida corpetariot. is tho iSuLtivkag CogPouth11". P2222d: Maged.Corsonalne strbahrtsry, of Surviving Corpersdag, 'with theignMeieg Corporation wring Nitte17,pettent (9096) of -the inuedand. outstanding:shoo; of capital dock of ha Merged Colponaion. 33da Ito therglir sball-bsoneetextiremoct 211% Oftgdolesaf Mown with die Fbitida SeeretsiyotStatt of florida (the liffecifivegree''). WuOr Tbspriarip81 office of the Merged Cotponteen islocated *12063 Stastaga Woods latte, Humble, TX 77346..The prIndpstornt of Seri/Meg Coiparatien is Wand* 126 Walker aged. Inveniste, NC 22090. REP The Merged COTPOCCIOrt OW= 110 iliteiteit 11217rOpUSY Lk die State periceitia. (a) The total number of:prima ataxic Nom the Merged Qusionntea lentahdrized 153ue 14.30.000.900 gums ofelesalloti stock sod en shins ptektled mak. As orthe 4ate haw& the Mecied Cospotadazibm 111,231;000 Awes cifectranon stock issued and nutstanding of *bleb 0,420,542 slum Me owsied, of rand and benegols.11)by the SurrIving Corporation. P.004/006 02/08/2012 17:26KORP (FAX)845 818 3588 P,005/006 (b) The Mel stoteter cif slums. of *oh:whir& the %whin Ccispotation la authorized to ism 10,070,000;000 Oberst tif Welt 10.000.009,000 tuna of Comas stiArcesil 70400,000 shaties Ow:fared stock otistish 1039cAPOO shwa** datiitsgsd es We:gat preferred stoct ;PO 50.000.00Ctlawes en &satiated 10:Seslektisaftsieditoak. ite *Medea 4stoot the Sunken Corporation las 31i ,141;340 tans afoottmon stook:SO.502 AM-of Salsa A ins/arca stock and 6.,355.691 Sham of Sado, piefitsted stock ors issued sudoutstanding. &MA: At the fiffeetite 77ale. the Merged Capastion Eon berierged vrith and htto the Suzviving Gaya:Won; the lepistmelemispreotroftbaterged Corporation shall uthae and the SacoosseiCorporadon shall oedipus In mdkeDee and shill iitemesapd and all purposes sad pesters prthe Waged .Cotporation; and ail assets, :Ott , inmettla and privileges as weans debts. obligitions en4 dudes ofiheMerged Cotpoialion shall bad w, vested. in and dovalimcl dison the *passer coquille= Without fulthernet or deed. giSkS (a) Paultahatu ofwatmon Stork of the Merged Calkaalloa that la Dastattling Inumedistely. Worm the Eltbetivelfroc shall beronvated Iota Onenandtedllluity-One and 251100 (19125) axes of thucetnutonmarchof the Cosporedoe.-teandsdnp to the nod 143olt gather of salb et. at thalffeetivellammittend tae wily *taw action on the Pe of thte as Plovidodur is *Wag (h) Oft* Anicla Edit. 0) AR? sham of eitammeassteek oftbahtoged COVOIralialt did 12 owned by the. Surviving Comonitionbsunedatelyiniut Who:Medea That shall:lie camels& and shall not not be foc eouvetslottinto comma nocir. oldie Suntivbrg Cosponitlau. (c) Bach alum efeommon steak alba Staviving Comeration that is owned by MragsdCarpotalonimuiedlaely prier to iha Meths grunt shaln eanceletend Worm setherized, but mideatted tharmat (d) .F.ffeetiveas of the Motive tiatikeatit bolder ofe andfielts Weft prior to.fisactio mausolea shwa proms= not& of tha Wir,d C0000438 CatutPt-thoursteltsisd Polors4 toparegtapb.(b)inbOve. theo,, upon suoutideratibe satio,ba. crags! to readvoinexeliaage therefore e 6ertifieste-tePtsinuttiagtheasabor ors*" of macaw stoaltaftha Stsvivhilg corporeal= into vdtklt thershatio thcateautepresented by.theantiftenzact surandeted *ball lave been convened as widths' in paregrapt (a); Tcovided.that m porthd.sbares of the oarsmen no* of the Stmvivts&Cocparatitamball be Wok PARR' lottlailiggia *Oa "ilea lag to Ovum tad* *Dm thitfisP Atercoderedomoh such outtesedioneertithata that Worth the Efactivettrue repealented sluirMtuf stock of the Magid Carnation shall bes deemed for 41 =Mame PerPoseso to Ph** awnrsajdio cd thentatber Onions of common matt otthe Surviving Camps rdion snob sham shall*** been Mr convened. 02/08/2012 17 :26 WCORP trah: 1.11e tonato.tood cooditkass PUN tratishction eat forth n,th P (FA()845 818 3588 P.006/006 1 *ofMeiser we .arivised,.alsho.dzcd sod; wprovisity thilMarged,CcUpoixiion scathe puccessor cotpqrsiiott ht. the null= sod hythe yOttrequirod by the Istsve of thellocts of flOchla tiolallowe ' (1) Pisa of Moues ens littr miticsizzd by Bosolif DIA:dors article:Ned Corpooition. by Written Coi3Sest deterUhausgy 30; 2012. . Ronda to 607.1104,11oridaStatittos; swim*. of*, Plon.ofttiergarby the slasochokkls of tho Morgai Ozepotatiou is not ;squired os Ake fhsrfivbts.comosagots moss Mow pet000t (9p.0'5) iho3isoed and. Ooteten#0, 1csottst stock oft* Metpd Corponickus.. Rawqranthesbattelioldera die 11,.11cagetCcapoilitien *taw comet eartla:swiliabillty. 607.1104,-71,632 &abate* wocall.be aPtifie4 to votenad who dim= frora thikrbtir .Of MOW roissat to 607:1321, Thii .S tutie maybi agts)od, Ifthay.eoraPlYwIrk doe prOtrisktos Of lowitbt Statuses ma:dist lipprolial rights, to by paid AO* value "Obeli shwas. 0). The PT of moger vas thilysoithociaxt by the poorti of:Direct= ottho Surviving Cotisotatkut by WrillatIConsted dated Jeassaty-30, 2012. Puzstlent W.6071104, Hoax Mouths; rgixovel of the Marx 61:Merger by the obsciabolders of tho SoMviog CorponCida :oar rtqizired as the Surviving Corporation thaw tamely paitent (90%).opbe issued anitOtaftsading capital stock of the Mergociromosation. zinungs WIEEREGF. this Plan otMergeris beteby executed by tally atubodzed officerof each of the Merv! Corpoosioti atoll the Ogvistog.Colpotartan on tildes:1.11mm; ID& hissisahove. KPRESSAMICRICMLIC, Flosida cotprealion 13roe E ThotsseoPreshieni NORTH CAROLlNANATUFtAL ENERGYAN7C. a Florida etgorstion 02/10/2012 13:3410M0RP AT&lea of Amendment to Articles of Incorporation or North Carolina Natural Energy, Inc. Nog of Cooperation as earrentlyilled with the Florida Dept. of State) L52786 (DosomeniNurthar ofCaporation (ifloovers) Ammo to the poviskos emotion d071 006. Florida Statutes, Ibis Moral Projit Corporation osiolito the following, inwedeleol(s) to its Midas ofIncotporsiim A.HiasultagineastaibuislimualagEN2mant (FtfMocipiomlviklaidalsigdthreislsliidm alslradadnla.4WAakDiDlawg) OaDisW aims MAMAIPSIBMM ROV Xempdhijktinglaggiaggpi and/or reatstovidlicanddreertn ROW- odor dtdisame of the wig isidstered spent and/or dte new reoietered dike addrug kidallatiectdadimiddroxy (Mo?i& Meet whine's) Florida Codt# 4 - hereby socgot dtaappointonost Go 41M tonfinosillor with and amp: the obligations elf* platoon. Sigma:mm.411m RggintraiAlannt rchaniing Pip 1 013 02/10/2012 13:351000RP (FAX)845 818 3588 P.003/004 Xgmesdinuthe OftlettumWar Directors. enter the title gag name steed officer/director bebig -1 1 I A ? - - ' P.. I (Attach addition:dolt:sty, 'mammy) llds Night Maas. Tisteir Atolls; P. Add t) Remove ands ReON7/0 ? Add 0 Itemolie U1. 111WaddialLION AlikalldIfESANIgga : (attack additional shoe*, (nscrsrory). Osspadir4 The lire paragraph of MOW FoUrth is hereby amended to read as follows: Capita) Mode The Cotporation is authorized to Issue SOUK= sharee of common stook,. $(1001 par value per share, and 70,000,001 shares preferred stook, $0.001 par value, per shake, divided, as described hetet& If an Inlentheretwa tdatituut ea:Uwe. recludilendee. or eiuseettetion ciliated Janet, Dravideithr taipleatestinn tbasiDesdnient not costelsed In the amendment Itadit Weet **able. baficats WAY 02/10/2012 13:35VCORP (FAX)845 818 3588 P.004/004 The date tif esti! smandateatis) soptigiu February-2, 2012 (dots gradation *piked)! Effective detaffiumilsidthp Oto two than-00 dap after aardntantjila data) Adoption of Manama:0(4 (C c . a ONE) Elms tecedineet(s) vniarifest 05ioptui 1130 t e elnizthuldars. .The numbs aVeCei cast ibr tpa =dim* by tbo gum :holders washvere sufficient for aprovid. One arnendinest(e) washout approved by the duirelioldectdirough voting weeps. ihifollowing.rierestot sant be stivernagp preykaidfor dud nib* groupdadittatI to voiesepisrate& an the aletentintsnteek "The number &votes an Gar~ the sennedreeet(s) melon= aufficitait fee-approval 0 by iiiptinsroupi ? The scoenchnent(s) mew= adopted by the board ordiroctresivithout shareholder action and shareholder actin 11115 pot required. ? The sensidnoti(s) wasiwure 'cloyed by the Inenrporaton(witbrturshsreholdre action andelianthoider *dimwits not required. olec4 February 9, 2012 Signature (Flys &woe. pniidan ore directors oraffiteirs tuwo.not been Waded, by en incorparater if in the hendsvfa receiver, trustee, or Oboe court -appointed fiduciary bythat fulaelory) Mien F. Walker (TYped Imprinted name epergne signing) President (atisercEgmaisaibb) Per oft Articles of Amendment to Articles of Incorporation of L &1Jg (Name of Corporation as currently filed with the Florida Dent. of State) (Document Number of Corporation (if known) Pursuant to the provisions of section 607.1006, Florida Statutes, this Florida Profit Corporation adopts the following amendment(s) to its Articles of Incorporation: A. If &sadist name, enter the new name of the corporation: The new name must be distinguishable and contain the word "corporatior4" "company," or "incorporated" or the abbreviation "Corp.," "inc.," or Co.," or the designation "Corp," "Inc," or "Co". A professional corporation name must contain the word "chartered " "professional association," or the abbreviation "P.A." B. E.IVEmitn tMlugigmesligglinkh (Priadpal office address MUST BE A STREET AMU= ) C. Eater new mailint address. if anolicable: (Mail* address MAY EE A POST OFFICE BOX) D. If aatendint the r egistered atent and/or resister ed a1ECe address io Fl rids. enter the Dame of the arrimiftatagelimiavriktmagierstalliudgm Name ofNew Registered Agent (Florida street adebvss) New Actj andafigadgkar , Florida (City) (Zip Code) 1 hereby accept the appointment as registered agent. I am familiar with and accept the obligations of the position. Signature of New Registered Agent, ifchanging Page 1 of 4 If amending the Officers and/or Directors, enter the title and name of each officer/director being removed and title, name, and address of each Officer and/or Director being added: (Attach additional sheets, if necessary) Please note the officer/director title by the first letter of the office title: P = President; V= Vice President; T= Treasurer; S= Secretary; D= Director; TR= Trustee; C = Chairman or Clerk; CEO = Chief Executive Officer; CFO = Chief Financial Officer. If an o(ficer/director holds more than one tide, list the first letter of each office held President, Treasurer, Director would be PTD. Changes should be noted in the following manner. Currently John Doe is listed as the PST and Mike Jones is listed as the V. There is a change, Alike Jones leaves the corporation, Sally Smith is named the V and S. Mese should be noted as John Doe, PT as a Change, Mike Jones, Vas Remove, and Sally Smith, SY as an Add Example: 2Lchange El Maks X Remove V Iles, Joy X Add II SalkId1h hTrailkii211 Title NMI tatas (Check One) I) Add Remove 2) Change Add Remove 3 ) Change Add Remove 4) Change Add Remove 5) Change Add Remove 6) alange Add Remove Page 2 of 4 E. nejsuakigludbuidatuldarkadaskaastgajw: (attach additional sheets, ifnecessary). (Be specific) The first paragraph of Article Four is hereby amended to read as follows Capital Stock: The Corporation is authorized to issue 10,000,000,000 shares of common stock, $0.001 par value per share, and 70,000,001 shares of preferred stock, $.001 par value per shares, divided, as described herein. (f not applicable. intricate N/A) Page 3 of 4 0. The date of each amendments) adoption: March 12, 2012 Effective date if applicable: (no more than 90 days after amendment file date) Adoption of Amendment(s) (CHECK QNE) ii The amendment(s) was/were adopted by the shareholders. The number of votes cast for the amendment(s) by the shareholders was/were sufficient for approval. ? The amendrnent(s) was/were adopted by the board of directors without shareholder action and shareholder action was not required. The amendment(s) was/were adopted by the incorporators without shareholder action and shareholder action was not required. March 12, 2012 Signature /1) (By a director, president or other officer if directors or officers have not been selected, by an incorporator if in the hands of a receiver, trustee, or other court appointed fiduciary by that fiduciary) Clinton F. Walker (Typed or printed name of person signing) President (Tide of person signing) Page 4 of 4