SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE TO

(Rule 13e-4)

TENDER OFFER STATEMENT PURSUANT TO SECTION 13(e)(1)

OF THE SECURITIES EXCHANGE ACT OF 1934

PMF TEI Fund, L.P.

(Name of Issuer)

PMF TEI Fund, L.P.

(Name of Person(s) Filing Statement)

Limited Partnership Shares

(Title of Class of Securities)

N/A

(CUSIP Number of class of securities)

| | |

John A. Blaisdell c/o Endowment Advisers, L.P. 4265 San Felipe, 8th Floor Houston, Texas 77027 (713) 993-4675 | | With a copy to: George J. Zornada K&L Gates LLP State Street Financial Center One Lincoln St. Boston, MA 02111-2950 (617) 261-3231 |

(Name, Address and Telephone No. of Person Authorized to Receive Notices and Communications on Behalf of the Person(s) Filing Statement

(February 20, 2014)

Calculation of Filing Fee

| | |

| Transaction Valuation | | Amount of Filing Fee |

| $1,124,503,355(a) | | $144,836.03(b) |

| |

| (a) | Calculated as the aggregate maximum purchase price for limited partnership interests. |

| (b) | Calculated at $128.80 per million of the Transaction Valuation. |

| ¨ | Check the box if any part of the fee is offset as provided by Rule 0-11(a)(2) and identify the filing with which the offsetting fee was previously paid. Identify the previous filing by registration statement number, or the Form of Schedule and the date of its filing. |

| | |

| Amount Previously Paid: | | Filing Parties: |

| Form or Registration No.: | | Date Filed: |

| ¨ | Check the box if the filing relates solely to preliminary communications made before commencement of a tender offer. |

Check the appropriate boxes below to designate any transactions to which the statement relates:

| | ¨ | third-party tender offer subject to Rule 14d-1. |

| | x | issuer tender offer subject to Rule 13e-4. |

| | ¨ | going-private transaction subject to Rule 13e-3. |

| | ¨ | amendment to Schedule 13D under Rule 13d-2. |

Check the following box if the filing is a final amendment reporting the results of the tender offer: ¨

Item 1. Summary Term Sheet.

The PMF TEI Fund, L.P. (the “Fund”) is offering to purchase its own shares of limited partnership interest (the “Shares”) from limited partners of the Fund (the “Partners”). This offer (the “Offer” or “Offer to Purchase”), which begins on February 20, 2014 will remain open until midnight, New York City Time, on March 19, 2014 (such date, as it may be extended, the “Expiration Date”). The Fund is a newly-formed, closed-end, non-diversified, registered investment company that invests substantially all of its assets in The Endowment PMF Master Fund, L.P. (“Master Fund”), which also is a newly-formed, closed-end, non-diversified, registered investment company. The estimated purchase price for each tendered Share will be calculated in accordance with the definition of the “Purchase Price” as set forth herein as of March 31, 2014 (or, solely in the event that it is necessary to extend such date in order to satisfy certain conditions of the Offer as set forth herein, June 30, 2014) (such date, as it may be extended, the “Effective Date”). Capitalized terms used herein, but not otherwise defined, have the meanings ascribed to them in the Fund’s Private Placement Memorandum dated as of February 20, 2014 (the “PPM”). This Offer is being made simultaneously with tender offers by the Legacy Funds (as defined below) (the “Legacy Fund Offers”), and is contingent upon the consummation of the Legacy Fund Offers and the satisfaction of certain other conditions set forth herein.

Following this summary is a formal notice of the Fund’s offer to purchase all or a portion of your Shares, which will remain open until the Expiration Date, unless extended.No Shareholder need participate. If you choose to participate, you may withdraw your tendered Shares until the Expiration Date, and, if tendered Shares have not yet been accepted, after the expiration of forty business days from the commencement of the Offer.

As stated in the PPM, the Fund’s investment objective is to manage a portfolio of Investment Funds and cash to preserve value while prioritizing liquidity to Partners over active management, until such time as the portfolio of The Endowment PMF Master Fund, L.P. (the “Master Fund”) has been liquidated. The Master Fund’s liquidation process is estimated to take up to ten years, after which time the Master Fund will enter a formal dissolution process. The Fund is making a cash repurchase offer to provide Partners with an early liquidation option by affording Partners the opportunity to liquidate their Shares (or a portion thereof) rather than hold Shares through the full liquidation of the Master Fund’s portfolio.The Purchase Price is less than the net asset value of the Shares and may be materially less than the amount Partners might otherwise receive by holding their Shares to liquidation, and Partners that tender Shares pursuant to the Offer may consequently be foregoing material value (on both a present value and an absolute dollar basis) that they would otherwise receive over time if they held their Shares through liquidation. The Master Fund’s other feeder funds (the “Feeder Funds”) are concurrently making similar repurchase offers to their respective investors.

Proceeds for Shares tendered and accepted will be paid in cash. As set forth in the PPM, the Fund’s portfolio is highly illiquid, cash will be distributed as underlying Investment Funds liquidate (subject to the Fund’s distribution policy), and, accordingly, the Fund will not conduct regular cash repurchase offers. The Fund is conducting the Offer on what is expected to be a one-time basis. The Fund, the Master Fund and other Feeder Funds have entered into an agreement (the “Purchase and Sale Agreement”) with HarbourVest - Origami Structured Solutions L.P., a third party feeder fund (the “Third Party Feeder”), whereby the Third Party Feeder will purchase Master Fund interests held by the Fund (and the other Feeder Funds) in an amount corresponding to the amount represented by the Shares tendered by Partners (and investors in such

ii

other Feeder Funds) in connection with the Offer. The Third Party Feeder will purchase Master Fund interests at a price that reflects a discount to the net asset value of such interests, as described herein, and the cash paid to the Fund by the Third Party Feeder to pay for such interests will in turn be used by the Fund to pay for Shares tendered in response to the Offer at the same discount to net asset value. The Fund, through the Offer, is offering to repurchase Shares at the same price to be paid by the Third Party Feeder in connection with its purchase of the Master Fund interests. The Purchase Price may be less than the amount Partners might otherwise receive by holding their Shares to liquidation, and Partners that tender Shares pursuant to the Offer may consequently be foregoing material value (on both a present value and an absolute dollar basis) that they would otherwise receive over time if they held their Shares through liquidation. The actual amount of distributions which Partners will receive for Shares held through liquidation is uncertain.

Partners are not tendering Shares to the Third Party Feeder and have no claim or rights with respect to the Third Party Feeder. As discussed below, the Third Party Feeder is controlled by sophisticated investors who have made, in the course of analyzing the purchase price offered in the Purchase and Sale Agreement, professional determinations with respect to the Master Fund and its potential distributions. Additionally, the Third Party Feeder has had an opportunity to review the Master Fund’s portfolio holdings and may have access to information not generally available to Partners. To the extent any Partner participates in the Offer, such Partner will necessarily be foregoing any return from the Fund and the Master Fund with respect to Shares tendered in the Offer.

The Master Fund will be capitalized based on the division of The Endowment Master Fund, L.P. (the “Legacy Master Fund”) in conjunction with a set of concurrent repurchase offers being conducted by the feeder funds that invest their assets in the Legacy Master Fund (the “Legacy Feeder Funds” and together with the Legacy Master Fund, the “Legacy Funds”). All shareholders of the Fund previously were investors in one of the Legacy Feeder Funds. The Offer is conditioned upon the satisfaction of certain conditions set forth in the Purchase and Sale Agreement, which specifies, among other things, a minimum participation across all Feeder Fund repurchase offers of an amount of Feeder Fund interests (including Shares) representing at least 20% of the Legacy Master Fund’s net assets immediately prior to the commencement of the Offer (the “Minimum Participation Requirement”). If the Minimum Participation Requirement is not met, the Offer may be cancelled, in which case Shares will not be repurchased.

The Fund is unlikely to make another repurchase offer in the future, and transfers and sales of Shares are strictly limited under the Fund’s Amended and Restated Agreement of Limited Partnership dated as of February 18, 2014 (the “LP Agreement”). Partners who do not tender all of their Shares will remain invested in the Fund until the Master Fund’s portfolio has been fully liquidated, and will likely be unable otherwise to sell or transfer their Shares. The Fund will continue to pursue its investment objective utilizing a passive management style until the Master Fund’s portfolio is fully liquidated. Liquidity for Partners who do not tender their Shares will likely be limited to distributions paid by the Fund as the Master Fund’s portfolio is liquidated over time, which is expected to take up to ten years, after which time the Master Fund will enter a formal dissolution process. Any Partner considering participation in the Offer should be aware of certain risk factors, as described in the Offer to Purchase, which is an exhibit hereto.

If you do not wish to tender your Shares, you may ignore the Offer.

If an Partner would like to tender his or her Shares, the Partner generally should mail a Letter of Transmittal, which is attached to this document as Exhibit 99.3, to Endowment Advisers, L.P. (the “Investment Adviser”) at P.O. Box 182663, Columbus, Ohio 43218-2663, Attention: The Endowment Fund, or fax it to the Investment Adviser at (866) 624-0077, Attention: The Endowment Fund. Either method of delivery must result in the receipt of the properly executed form before the Expiration Date. If faxed, the original Tender Offer Form should be mailed promptly thereafter to the Investment Adviser. Investors whose broker of record is Merrill Lynch, Pierce, Fenner & Smith Incorporated (“Merrill”) or U.S. Trust Company, Bank of America Private Wealth Management (“U.S. Trust”) should mail or fax the Letter of Transmittal (the enclosed Tender Offer Form will suffice) to their Financial Advisor or Portfolio Manager, instead of to the Investment Adviser, by the Expiration Date.

iii

Please note that just as you have the opportunity to have your Shares repurchased in the Offer and the right to withdraw your tendered Shares until such time as they are accepted for purchase, the Fund reserves the right, subject to applicable law and the conditions described herein, to cancel, amend or postpone the Offer at any time prior to the later of the Expiration Date (as such may be extended) or when the tendered Shares have been accepted by the Fund. Following the acceptance of Shares for purchase in the Offer, you will not have the right to withdraw your tendered Shares.

Item 2. Issuer Information.

(a) The name of the issuer is PMF TEI Fund, L.P. The Fund is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as a closed-end, non-diversified, management investment company and is organized as a Delaware limited partnership. The principal executive office of the Fund is located at 4265 San Felipe, 8th Floor, Houston, Texas 77027 and the telephone number is (713) 993-4675.

(b) The title of the securities that are the subject of the Offer to Purchase is shares of limited partnership interest or portions thereof in the Fund. (As used herein, the term “Share” or “Shares,” as the context requires, shall refer to the shares of limited partnership interest in the Fund and portions thereof that constitute the class of security that is the subject of this tender offer or the limited partnership interests in the Fund or portions thereof that are tendered by Partners to the Fund pursuant to the Offer). The Fund is not yet capitalized and does not have any outstanding Shares, except that the Legacy Master Fund is the sole initial shareholder of the Fund. The Fund will issue Shares having an aggregate net asset value equal to the interests tendered by Partners in Legacy Fund Offers conducted by certain of the Legacy Feeder Funds, pursuant to which the proceeds of such Legacy Feeder Fund tenders will be paid in-kind in the form of Shares of the Fund. Subject to the conditions set forth in the Offer to Purchase, the Fund will purchase up to 100% of the Fund’s outstanding Shares (the “Offer Amount”).

(c) Shares are not traded in any market, and any transfer or sale thereof is strictly limited by the terms of the LP Agreement.

Item 3. Identity and Background of Filing Person.

(a) The name of the filing person is PMF TEI Fund, L.P. The Fund’s principal executive office is located at 4265 San Felipe, 8th Floor, Houston, Texas 77027 and the telephone number is (713) 993-4675. The investment adviser of the Fund is Endowment Advisers, L.P. The principal executive office of the Investment Adviser is located at 4265 San Felipe, 8th Floor, Houston, Texas 77027 and the telephone number is (713) 993-4675. The Investment Adviser’s investment committee (the “Investment Committee”) members are Messrs. Lee G. Partridge, Jeremy L. Radcliffe, William K. Enszer, William B. Hunt and William R. Guinn (herein defined as the “Managers”). Their address is c/o Endowment Advisers, L.P. at 4265 San Felipe, 8th Floor, Houston, Texas 77027.

Item 4. Terms of This Tender Offer.

(a) (1) (i) Subject to the conditions set forth in the Offer to Purchase, the Fund will purchase up to the Offer Amount of tendered Shares. The Fund will purchase all outstanding Shares that are properly tendered by and not withdrawn before the Expiration Date. The Fund is offering to purchase all outstanding Shares at the discount to net asset value as reflected in the Offer in an effort to provide Partners with an early liquidation option as an alternative to holding Shares to liquidation, which is expected to take up to ten years, after which time the Master Fund will enter a formal dissolution process. Partners of the Fund that do not tender their Shares will remain in the Fund, and the Fund does not anticipate making any future cash repurchase offers. By choosing to participate, Partners will be selling their Shares for less than net asset value and possibly less than the amount Partners might otherwise receive by holding their Shares to liquidation, and Partners that tender Shares pursuant to the Offer may consequently be foregoing material value (on both a present value and an absolute dollar basis) that they would otherwise receive over time if they held their Shares through liquidation.

(ii) All Partners will receive the same proceeds on a per Share basis. The purchase of Shares in the Offer shall be made at a price (the “Purchase Price”) determined by the pricing formula below.

iv

Purchase Price = Base Value * (Price - Asset Value Adjustment – Transaction Expense Adjustment)

The “Base Value” for each Partner will be determined based on the September 30, 2013 net asset value of the appropriate Legacy Fund attributable to such Partner, and contains the following components:

Base Value = 9/30 NAV – Adjusted Tender Amount

| | • | | 9/30 NAV: The aggregate net asset value of a Partner’s account as of September 30, 2013. |

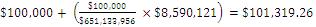

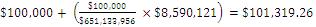

| | • | | Adjusted Tender Amount: The proceeds from fourth quarter Legacy Fund tender offers received by a Partner, plus (i) the percentage of the aggregate fourth quarter Legacy Fund tender value ($651,133,956) that was received by a Partner multiplied by (ii) $8,590,121. For example, the Adjusted Tender Amount for a Partner who received $100,000 in the fourth quarter tender offer would be calculated as: |

The “Price” is 87%.

The “Asset Value Adjustment” is designed to take into account, for purposes of determining the Purchase Price, certain limited changes in the value of the Legacy Master Fund (other than changes in the value of the Legacy Master Fund’s interests in Investment Funds) from September 30, 2013 through the Effective Date. The Asset Value Adjustment is subtracted from the Price on a percentage basis relative to the Base Value attributable to the Partner in question. As of the date of the Offer, it is estimated that the Asset Value Adjustment will be in the range of 1.10% to 1.45% of the Base Value.

The“Transaction Expense Adjustment” includes (i) the legal expenses incurred by the Third Party Feeder and its owners, including in relation to obtaining financing and (ii) advisory fees due to Park Hill Group, who sourced the transaction leading to the Purchase and Sale Agreement, each of which are subtracted from the Price on a percentage basis relative to the Base Value attributable to the tendering Partner. At the time of filing, it is estimated that the Transaction Expense Adjustment will be in the range of 1.20% to 2.20% of the Base Value.

Purchase Price (estimated range) = Base Value * (87% - [1.10% to 1.45%] – [1.20% to 2.20%])

Purchase Price (low end of estimated range) = Base Value * (83.3%)

Purchase Price (high end of estimated range) = Base Value * (84.7%)

Limitations on Estimated Purchase Price: Because the amounts of the Transaction Expense Adjustment and Asset Value Adjustment cannot be known until the Effective Date at the earliest, and because the individual holdings of investors in the Legacy Feeder Funds may have changed during the period from September 30, 2013 to the Effective Date, the Purchase Price is subject to adjustment. Estimates of these adjustments have been provided above in good faith, but there is no guarantee that these estimates will be accurate and actual adjustments may be significantly different, which could result in a materially lower Purchase Price. For example, if the Effective Date is June 30, 2014, the negative impact of the Transaction Expense Adjustment and Asset Value Adjustment on the Purchase Price will very likely be higher than if the Effective Date is March 31, 2014. Additionally, because one component of the Transaction Expense Adjustment is a dollar amount of legal expenses irrespective of the amount of Shares tendered, a lower participation in the Offer will mean a more significant negative impact of the Transaction Expense Adjustment on the Purchase Price, since such expenses will be borne across a fewer number of tendering Partners. Similarly, a higher participation in the Offer will lead to a less significant negative impact on the Purchase Price, since the expenses would be defrayed across a higher number of tendering Partners. There are many other variables outside of the control of the Fund and the Investment Adviser that may contribute to changes in the Asset Value and Transaction Expense Adjustments and, thus, the Purchase Price. Not all of such variables have been stated herein or fully considered in developing the estimates for the Asset Value and Transaction Expense Adjustments. If the Asset Value and/or Transaction Expense Adjustments are higher than those estimated and set

v

forth herein, the Purchase Price will be lower and Partners will receive a lesser amount than depicted in the above formula. Partners desiring absolute certainty as to the proceeds they will receive for tendered Shares should consider not participating in the Offer.

For additional information regarding the determination of the Purchase Price, please see Exhibit 99.4 attached hereto.

The repurchase of Shares is subject to regulatory requirements imposed by the Securities and Exchange Commission (“SEC”). The Fund’s repurchase procedures are intended to comply with such requirements. However, in the event that the Board determines that modification of the repurchase procedures described above is required or appropriate, the Board will adopt revised repurchase procedures as necessary to ensure the Fund’s compliance with applicable regulations or as the Board in its sole discretion deems appropriate. The Offer is subject to certain conditions, as set forth in Item 7(b).

The Fund does not presently intend to impose any charges (except for direct costs and expenses, such as wiring fees) on the repurchase of Shares; however, the Purchase Price will incorporate certain adjustments for fees and expenses as described in more detail herein.

In the event that the Investment Adviser or any of its affiliates holds Shares in its capacity as a Partner, such Shares (or portion thereof) may be tendered for repurchase in connection with any repurchase offer made by the Fund, without notice to the other Partners.

A copy of: (i) the Cover Letters to Offer to Purchase and Letter of Transmittal; (ii) the Offers to Purchase; and (iii) the Forms of Letter of Transmittal are attached hereto as exhibits.

(iii) The initial scheduled expiration date is midnight, New York City Time, March 19, 2014.

(iv) Not applicable.

(v) The Fund reserves the right, subject to applicable law, to extend the period of time during which the Offer is open by notifying Partners of such extension. If the Fund extends the period during which the Offer is open, the Effective Date may, in the discretion of the Board, be extended to June 30, 2014. The Fund may elect to extend the period during which the Offer is open in order to satisfy the conditions to the Offer as described herein. During any such extension, all Shares previously tendered and not withdrawn will remain subject to the Offer (so that you might not be able to withdraw your tendered Shares). Any such ability would increase the potential that the value of the Shares will change between the time you elect to tender and the Valuation Date. Following the acceptance of Shares tendered in the Offer, Shareholders will not have the right to withdraw such Shares.

(vi) You may withdraw your tendered Shares until the Expiration Date and, if Shares have not yet been accepted by the Fund, after the expiration of 40 business days from the commencement of the Offer. Following the acceptance of Shares for purchase in the Offer, you will not have the right to withdraw your tendered Shares.

(vii) Investors wishing to tender Shares pursuant to the Offer generally should send or deliver a completed and executed Letter of Transmittal (the enclosed Tender Offer Form will suffice) to the Investment Adviser, to the attention of The Endowment Fund, at P.O. Box 182663, Columbus, Ohio 43218-2663, or fax a completed and executed Letter of Transmittal (the enclosed Tender Offer Form will suffice) to the Investment Adviser, also to the attention of The Endowment Fund, at (866) 624-0077. Investors whose broker of record is Merrill or U.S. Trust should send or deliver, or fax, the completed and executed Letter of Transmittal to their Financial Advisor or Portfolio Manager instead of to the Investment Adviser. The completed and executed Letter of Transmittal must be received, either by mail or by fax, prior to the Expiration Date. The Fund recommends that all documents be submitted by certified mail, return receipt requested, or by facsimile transmission. A Partner choosing to fax a Letter of Transmittal must also send or deliver the original completed and executed Letter of Transmittal promptly thereafter to the Investment Adviser or to their Financial Advisor or Portfolio Manager.

vi

Any Partner tendering a Share pursuant to the Offer may withdraw its tendered Shares until the Expiration Date and, if Shares have not yet been accepted by the Fund, after the expiration of 40 business days from the commencement of the Offer. To be effective, any notice of withdrawal must be timely received by the Investment Adviser by mail or fax, or in the case of clients of Merrill or U.S. Trust, by their Financial Advisor or Portfolio Manager. A form to use to give notice of withdrawal is available by calling, in the case of clients of Merrill or U.S. Trust, their Financial Advisor or Portfolio Manager or, for all other Partners, the Investment Adviser at (800) 725-9456. Shares properly withdrawn will not thereafter be deemed to be tendered for purposes of the Offer. However, withdrawn Shares may be re-tendered prior to the Expiration Date by following the procedures described above.

(viii) For purposes of the Offer, the Fund will be deemed to have accepted Shares that are tendered when the Fund gives written notice to the tendering Partner of the Fund’s election to purchase such Shares. Payment for Shares will be made as promptly as practicable, although settlement of the Offer and payment of the Purchase Price are not expected to occur until after the Effective Date.

In light of the necessity for Investment Fund transfers to be duly authorized and effected to divide the Legacy Master Fund’s portfolio as of the Effective Date, settlement of the Offer may only occur following the execution of the required transfer agreements, which may not occur after the date on which Shares are accepted for purchase in the Offer. Due to, among other things, the large number of Investment Funds held and the varying degrees of cooperation needed from the Investment Managers, the date as of which transfer agreements will be executed is uncertain. To the extent that the Master Fund is delayed in entering into sufficient agreements to acquire an approximately pro-rata portion of the Legacy Master Fund’s portfolio or the Fund’s Board of Directors determines that the other conditions to the Offer cannot be met by March 31, 2014, the Fund will be required to delay the Effective Date to June 30, 2014, in which case the settlement of the Offer and payment of the Purchase Price to tendering Partners will also be delayed. Such a change in the Effective Date would not necessarily be accompanied by an extension of the Offer (so that you might not be able to withdraw your tendered Shares) and would increase the potential that the value of the tendered Shares may change between the time you elect to tender and the Valuation Date. Following the acceptance of Shares for purchase in the Offer, you will not have the right to withdraw your tendered Shares.

(ix) Not applicable.

(x) Following the Offer, so long as the conditions to the Purchase and Sale Agreement are satisfied (or, in the discretion of the Third Party Feeder, waived), the Third Party Feeder will acquire Master Fund interests. The Third Party Feeder’s acquisition of Master Fund interests may result in the Third Party Feeder (and its investors) being deemed a control person of the Master Fund, and will in any case result in the Third Party Feeder having the ability effectively to veto certain actions requiring a vote or unilaterally determine the outcome of a Master Fund vote, including changes to certain governance standards and any vote required under the 1940 Act, which could adversely affect the interests of the Fund and Partners. Additionally, the Third Party Feeder has had an opportunity to review the Master Fund’s portfolio holdings and may have access to information not generally available to Partners. Investors are not tendering Shares to the Third Party Feeder and have no claim or rights with respect to the Third Party Feeder. The Third Party Feeder is controlled by certain institutional investors managed by two separate and unaffiliated investment advisory organizations, HarbourVest Partners L.P. and Origami Capital Partners, LLC (each is also unaffiliated with the Fund and the Investment Adviser).

Additionally, in consideration of the Third Party Feeder’s agreement to purchase Master Fund interests and assuming that the conditions to such purchase are met, following the Offer the Master Fund Board has agreed to appoint as directors of the Master Fund two individuals to be submitted by the Third Party Feeder prior to the closing of the Third Party Feeder investment. The Third Party Feeder anticipates appointing as directors an individual to be identified, who is expected to be affiliated with HarbourVest Partners L.P., and Jeffrey Young, a principal of Origami Capital Partners, LLC. Mr. Young was born in 1967 and is responsible for all aspects of Origami’s operations, collaborating on firm leadership, investing, and working with clients. His primary experience is in completing complex transactions and building businesses. Mr. Young graduated from the University of California, Berkeley (A.B., 1989) and the Santa Clara University School of Law (J.D., 1993). He is admitted to the bar in California and Nevada. The addition of two new directors would increase the size of the Master Fund’s board

vii

from five to seven members, with four members serving as persons who are not “interested” as defined in the 1940 Act. The two new Master Fund directors would be “interested” directors, and would have the ability effectively to veto certain actions requiring a unanimous vote of fund directors but would not constitute a majority and would not themselves be able to determine the outcome of any Master Fund board vote, other than matters that require a unanimous vote. Such nominees will not become directors of the Fund. Investors are not tendering Shares to the Third Party Feeder and have no claim or rights with respect to the Third Party Feeder.

The investors in the Third Party Feeder have entered into a voting agreement with the Investment Adviser (the “Voting Agreement”) pursuant to which the investors in the Third Party Feeder agree that they will not vote to terminate the Master Fund’s investment management agreement (the “Investment Management Agreement”) with the Investment Adviser unless (i) a majority of the Master Fund’s independent directors has voted to so terminate the Investment Management Agreement, (ii) it has been finally determined by a court or an arbitrator that the Investment Adviser (or any officer, director, member, partner, principal or employee thereof) has engaged in willful misfeasance, bad faith, gross negligence, or reckless disregard of the duties involved in the conduct of the Investment Adviser’s office or has materially breached its obligations under the LP Agreement or (iii) such vote is in the same proportion as the other investors in the Master Fund’s feeder funds (for example, if 40% of the investors in the other Master Fund’s feeder funds vote to terminate the Investment Management Agreement, the investors in the Third Party Feeder may cause the Third Party Feeder to vote 40% of its interest to terminate the Investment Management Agreement). In addition, the investors in the Third Party Feeder have agreed that they will vote in favor of any nominee to serve as an independent director on the Master Fund board of directors who has been nominated by a majority of the Master Fund’s independent directors unless (i) they have received written advice of reputable outside counsel that voting for such nominee would be a breach of such investors’ fiduciary duties (such investors have pre-approved two existing directors of the Legacy Funds as suitable independent directors for the Master Fund) or (ii) such vote is in the same proportion as the other investors in the Master Fund’s feeder funds (for example, if 40% of the investors in the other Master Fund’s feeder funds vote against a nominee of the independent directors of the Master Fund, the investors in the Third Party Feeder may cause the Third Party Feeder to vote 40% of its interest against such nominee). The investors in the Third Party Feeder have also agreed that they will not cause the Third Party Feeder to call a meeting of the holders of the Master Fund’s voting interests for the purpose of terminating the Investment Management Agreement, or to solicit proxies (including, without limitation, hiring a proxy solicitor) or the written consent of the holders of the Master Fund’s voting interests in connection with a vote of such holders to terminate the Investment Management Agreement.

(xi) Not applicable.

(xii) A Partner who tenders all of its Shares to the Fund for repurchase generally will recognize capital gain or loss to the extent of the difference between the proceeds received by such Partner and such Partner’s adjusted tax basis in its Shares. The amount realized will include the investor’s allocable share of the Fund’s nonrecourse borrowings (as defined for Federal income tax purposes), if any. Gain, if any, will be recognized by a tendering Partner only as and after the total proceeds received by such Partner exceed the investor’s adjusted tax basis in its Shares. A Partner’s tax basis in its Shares generally will be adjusted for Fund income, gain, deduction or loss allocated, for tax purposes, to the Partner for periods prior to the purchase of the Shares by the Fund. A tax loss, if any, will be recognized by the Partner only after the tendering Partner has received full payment from the Fund. This capital gain or loss will be short-term or long-term depending upon the Partner’s holding period for its Shares at the time the gain or loss is recognized. United States Treasury Regulations provide that a Partner may have a fragmented holding period for its Shares if the Partner has made contributions to the Fund at different times. However, a tendering Partner will recognize ordinary income to the extent such Partner’s allocable share of the Fund’s “unrealized receivables” or items of Fund inventory exceeds the Partner’s basis in such unrealized receivables or items of Fund inventory, as determined pursuant to the United States Treasury Regulations. For these purposes, accrued but untaxed market discount if any, on securities held by the Fund will be treated as an unrealized receivable with respect to the tendering Partner. A Partner who tenders less than all of its Shares to the Fund for repurchase will recognize gain (but not loss) in a similar manner only to the extent that the amount of the proceeds received exceeds such Partner’s adjusted tax basis in its Shares.

Pursuant to the authority granted to it under the LP Agreement, the Investment Adviser may specially allocate items of Fund capital gain, including short-term capital gain, to a withdrawing Partner to the extent its

viii

proceeds would otherwise exceed its adjusted tax basis in its Shares. Such a special allocation may result in the withdrawing Partner recognizing capital gain, which may include short-term gain, in the Partner’s last taxable year in the Fund, thereby reducing the amount of any long-term capital gain recognized during the tax year in which it receives its proceeds upon withdrawal.

Such gain, if recognized by a Partner that is a tax-exempt entity, should not constitute unrelated business taxable income, unless such Partner has incurred acquisition indebtedness with respect to its Shares in the Fund.

The Third Party Feeder’s purchase of Master Fund interests held by the PMF TEI (Offshore) Fund, Ltd. (through which the Fund invests in the Master Fund) (the “Offshore Fund”) will result in the recognition of certain gain taxable to the Offshore Fund as income “effectively connected” with any U.S. trade or business conducted, or United States real property interests held, by certain Investment Funds in which the Master Fund invests. Any such gain will be taxable to the Offshore Fund at U.S. corporate income tax rates of 35%, together with a branch profits tax of 30% on the “dividend equivalent amount” remaining after the corporate income tax is applied. Estimated taxes will be withheld from the portion of purchase price expected to constitute such effectively connected income. The identification of assets that might result in such effectively connected income and the calculation of gain attributable to such assets are both difficult, and in making such determinations the Master Fund and the Offshore Fund must rely in large part on estimates based upon information provided by the Investment Funds in which the Master Fund invests, which information may be limited. Taxes resulting from the recognition of such gain will reduce the value of the Offshore Fund and the amount received by tendering Partners.

(2) Not applicable.

(b) At the present time, certain Managers, members of the Board and officers of the Fund or of a Fund affiliate have indicated their intentions to have their Shares acquired in this tender offer (or to have their interests of other feeder funds of the Master Fund acquired in parallel tender offers being made simultaneously with this tender offer by such other feeder funds of the Master Fund).

Item 5. Past Contracts, Transactions, Negotiations and Agreements With Respect to the Issuer’s Securities.

Other than as described herein, the Fund is not aware of any contract, arrangement, understanding or relationship relating, directly or indirectly, to the Offer (whether or not legally enforceable) between: (i) the Fund and the Investment Adviser or the Fund’s Board, or any person controlling the Fund or controlling the Investment Adviser or the Fund’s Board; and (ii) any person, with respect to Shares.

The Master Fund and the Feeder Funds (including the Fund) have negotiated and entered into the Purchase and Sale Agreement with the Third Party Feeder. Under the Purchase and Sale Agreement, the Third Party Feeder has agreed to purchase Master Fund interests from the Fund (and other Feeder Funds) at a purchase price that reflects a discount to the net asset value of such Master Fund interests corresponding to the Purchase Price payable in the Offer. See section 2 for details on the Purchase Price for Shares, which will be less than the net asset value of the Shares and may be materially less, on both a present value and an absolute dollar basis, than the value that Partners tendering Shares would otherwise receive over time if they held their Shares through liquidation. The purchase of Master Fund interests pursuant to the Purchase and Sale Agreement is contingent upon, among other requirements, a minimum participation of Feeder Fund investors tendering interests, in the aggregate, equal to the Minimum Participation Requirement. If the Minimum Participation Requirement or other conditions are not met, or are not waived by the Third Party Feeder, the purchase contemplated by the Purchase and Sale Agreement will not close, and as a result, the Offer will be cancelled, Shares will not be accepted for repurchase and Partners will remain invested in the Fund. The Offer may be extended for the purpose of meeting the Minimum Participation Percentage or other conditions to the completion of the Third Party Feeder’s purchase. If the Minimum Participation Requirement and other conditions are met, the Third Party Feeder will purchase Master Fund interests from the Fund at the agreed upon purchase price. The agreed upon purchase price is reflected in the Purchase Price of the Offer such that the purchase price which the Third Party Feeder pays for the Fund’s Master Fund interests will equal the Purchase Price which the Fund pays Partners for tendered Shares.

ix

In light of the necessity for Investment Fund transfers to be duly authorized and effected to divide the Legacy Master Fund’s portfolio as of the Effective Date, settlement of the Offer may only occur following the execution of such transfer agreements, which will occur after the date on which Shares are accepted for purchase in the Offer. Due to, among other things, the large number of Investment Funds held and the varying degrees of cooperation needed from the Investment Managers, the date as of which transfer agreements will be executed is uncertain. To the extent that the Master Fund is delayed in entering into sufficient agreements to acquire an approximately pro-rata portion of the Legacy Master Fund’s portfolio or the Fund’s Board of Directors determines that the other conditions to the Offer cannot be met by March 31, 2014, the Fund will be required to delay the Effective Date to June 30, 2014, in which case the settlement of the Offer and payment of the Purchase Price to tendering Partners will also be delayed. Such a change in the Effective Date would not necessarily be accompanied by an extension of the Offer (so that you might not be able to withdraw your tendered Shares). Following the acceptance of Shares for purchase in the Offer, you will not have the right to withdraw your tendered Shares.

The Master Fund’s portfolio will represent an approximately pro-rata division of the Legacy Master Fund’s portfolio. An approximately pro-rata division of the Legacy Master Fund’s portfolio, and thus the consummation of the Legacy Fund Offers, is dependent upon obtaining sufficient Investment Manager consents to transfer otherwise non-transferable Investment Fund interests that represent a proportional cross-section of the Legacy Master Fund’s portfolio as of the Effective Date. The Offer is contingent upon the completion of the Legacy Fund Offers. If the Legacy Master Fund’s Board of Directors determines that the Master Fund is ultimately unable to make an approximately pro-rata division of its portfolio or of certain Investment Fund interests held in the portfolio for any reason, including the failure to obtain the consent of Investment Funds representing at least 98% of the Legacy Master Fund portfolio to the division of the Legacy Master Fund portfolio (the “Consent Threshold”), the Legacy Fund Offers would not be consummated, the Master Fund would not be capitalized, and the Fund will not have investors.

As stated above, the Legacy Master Fund will transfer to the Master Fund an approximately pro-rata portion of the Legacy Master Fund’s investment portfolio. However, to the extent that the Consent Threshold is met but one or more Investment Managers do not consent to the division of the Legacy Master Fund’s interest in the Investment Fund as of the Effective Date, the Legacy Master Fund will be unable to transfer to the Master Fund a pro-rata portion of its interest in the Investment Fund. Instead, the Legacy Master Fund will be required to pay to the Master Fund an amount of cash equal to the net asset value as of the Effective Date of the relevant portion of the Legacy Master Fund’s interest proposed but unable to be transferred. The Purchase Price will not be adjusted to reflect such amounts of cash. Accordingly, there may be differences in the allocations and/or holdings of the portfolios of the Legacy Master Fund and the Master Fund if consents are not received from all Investment Funds. Furthermore, there can be no assurance that the net asset value of such a non-transferring Investment Fund paid in cash would ultimately represent the full value of a continuing interest in such Investment Fund.

The Third Party Feeder is controlled by certain institutional investors managed by two separate and unaffiliated investment advisory organizations, HarbourVest Partners, L.P. and Origami Capital Partners, LLC (each is also unaffiliated with the Fund and the Investment Adviser). If the Minimum Participation Requirement and other conditions to the Purchase and Sale Agreement are met (or, in the discretion of the Third Party Feeder, waived) and the purchase of Shares by the Third Party Feeder is completed, the Offer will result in the Third Party Feeder acquiring a controlling interest in the Master Fund such that the Third Party Feeder investors will have the ability effectively to veto certain actions requiring a vote or unilaterally determine the outcome of a Master Fund vote, including votes with respect to changes to certain governance standards and any vote required under the 1940 Act, which could adversely affect the interests of the Fund and Partners. Additionally, the Third Party Feeder has had an opportunity to review the Master Fund’s portfolio holdings and may have access to information not generally available to Fund Partners. To the extent that the interests of investors in the Third Party Feeder hereto conflict with those of the Fund or Partners, the Third Party Feeder investors’ ability to determine the outcome of certain Master Fund votes may adversely affect the Fund and the Partners.

x

Item 6. Purposes of This Tender Offer and Plans or Proposals of the Issuer or Affiliate.

(a) The purpose of the Offer is to provide Partners with an early liquidation option as an alternative to holding Shares to liquidation, which is expected to occur over an extended period of time, with formal dissolution commencing after ten years.

(b) Shares that are tendered to the Fund in connection with the Offer to Purchase, if accepted for repurchase, will be repurchased and cancelled by the Fund, resulting in a potential increase in the expenses borne by remaining Partners in the Fund.

(c) None of the Fund, the Investment Adviser nor any of the Managers or Directors of the Fund have any plans or proposals that relate to or would result in: (1) other than as described herein, the acquisition by any of the above of additional Shares in the Fund, or the disposition of Shares in the Fund; (2) an extraordinary transaction, such as a merger, reorganization or liquidation, involving the Fund; (3) other than as described herein, any material change in the present distribution policy or indebtedness or capitalization of the Fund; (4) other than as described herein, any change in the identity of the Investment Adviser or the Managers or Directors of the Fund, or in the management of the Fund including, but not limited to, any plans or proposals to change the number or the term of the Directors of the Fund, to fill any existing vacancy for a Director or to change any material term of the investment advisory arrangements with the Investment Adviser; (5) other than the sale of Master Fund interests pursuant to the Purchase and Sale Agreement as described herein, a sale or transfer of a material amount of assets of the Fund; (6) any other material change in the Fund’s structure or business, including any plans or proposals to make any changes in its fundamental investment policies, as amended, for which a vote would be required by Section 13 of the 1940 Act; or (7) any changes in the LP Agreement or other actions that might impede the acquisition of control of the Fund by any person. Because Shares are not traded in any market, Items (6), (7) and (8) of Item 1006(c) of Regulation M-A are not applicable to the Fund.

To obtain consents, the Master Fund and the PMF Master Fund may be required to agree to indemnify Investment Funds and Investment Managers in connection with the division of the Master Fund’s portfolio or any related transfers of Investment Fund interests to the PMF Master Fund, which could expose the Master Fund and PMF Master Fund, and thus the Fund and the PMF Fund, to additional liabilities. The Master Fund may also bear the expenses imposed on transfers by Investment Funds, including fees and expenses of counsel to the Investment Funds, as well as accounting fees and expenses that the Investment Funds may incur in the future in connection with the Investment Fund’s compliance with any U.S. federal tax requirements or elections as a result of the transfers.

Item 7. Source and Amount of Funds or Other Consideration.

(a) The Purchase Price will be paid by the Fund in cash with the cash proceeds it receives from the Third Party Feeder as consideration for the purchase of Master Fund interests held by the Fund pursuant to the Purchase and Sale Agreement. Certain proceeds may also be paid in the form of a cash distribution from the Fund of cash the Master Fund receives as part of the division of the Legacy Master Fund’s portfolio. Such a distribution would be made to all Partners, whether or not they participate in the Offer. If the conditions set forth in the Purchase and Sale Agreement are met, the Fund will sell Master Fund interests to the Third Party Feeder in an amount corresponding to the amount represented by Shares tendered by Partners pursuant to the Offer.

(b) The Offer is contingent upon participation by investors across all Feeder Funds (including the Fund) in an aggregate amount equal to at least the Minimum Participation Requirement, which is a condition to the Purchase and Sale Agreement. The Offer may be extended to meet the Minimum Participation Percentage. In light of the necessity for Investment Fund transfers to be duly authorized and effected to divide the Legacy Master Fund’s portfolio as of the Effective Date, settlement of the Offer may only occur following the execution of such transfer agreements, which will occur after the date on which Shares are accepted for purchase in the Offer. Due to, among other things, the large number of Investment Funds held and the varying degrees of cooperation needed from the Investment Managers, the date as of which transfer agreements will be executed is uncertain. To the extent that the Master Fund is delayed in entering into sufficient transfer agreements to acquire an approximately pro-rata portion of the Legacy Master Fund’s portfolio or the Fund’s Board of Directors determines that the other conditions to the

xi

Offer cannot be met by March 31, 2014, the Fund will be required to delay the Effective Date to June 30, 2014, in which case the settlement of the Offer and payment of repurchase proceeds to tendering Partners will also be delayed. Such a change in the Effective Date would not necessarily be accompanied by an extension of the Offer (so that you might not be able to withdraw your tendered Shares), and would increase the potential that the value of the tendered Shares may change between the time you terminate and the Valuation Date. Following the acceptance of Shares for purchase in the Offer, you will not have the right to withdraw your tendered Shares.

The Master Fund’s portfolio will represent an approximately pro-rata division of the Legacy Master Fund’s portfolio. An approximately pro-rata division of the Legacy Master Fund’s portfolio, and thus the consummation of the Legacy Fund Offers, is dependent upon obtaining sufficient Investment Manager consents to transfer otherwise non-transferable Investment Fund interests that represent a proportional cross-section of the Legacy Master Fund’s portfolio as of the Effective Date. The Offer is contingent upon the completion of the Legacy Fund Offers. If the Legacy Master Fund’s Board of Directors determines that the Master Fund is ultimately unable to make an approximately pro-rata division of its portfolio or of certain Investment Fund interests held in the portfolio for any reason, including the failure to meet the Consent Threshold, the Legacy Fund Offers would not be consummated, the Master Fund would not be capitalized, and the Fund will not have investors.

(d) The Fund is not required, and does not expect, to borrow funds, directly or indirectly, for the purpose of the Offer.

Item 8. Interests in Securities of the Issuer.

(a) Based on December 31, 2013 estimated values, Mr. John A. Blaisdell, Manager, Director and Co-Principal Executive Officer of the Fund, does not have any beneficial ownership in the Fund, but beneficially owns an aggregate of $1,503,159 of the interests in the fund complex, which includes the Feeder Funds, the Master Fund, the Legacy Feeder Funds and the Legacy Master Fund (the “Fund Complex”).

Based on December 31, 2013 estimated values, Mr. John E. Price, Principal Financial Officer of the Fund, does not have any beneficial ownership in the Fund, but beneficially owns an aggregate of $121,947 of the interests in the Fund Complex.

Based on December 31, 2013 estimated values, Mr. Lee G. Partridge, Manager and Chief Investment Officer of the Investment Adviser, does not have any beneficial ownership in the Fund or the Fund Complex.

Based on December 31, 2013 estimated values, Mr. Jeremy L. Radcliffe, Secretary of the Fund, does not have any beneficial ownership in the Fund, but beneficially owns an aggregate of $516,490 of the interests in the Fund Complex.

Based on December 31, 2013 estimated values, Mr. Scott E. Schwinger, Independent Director of the Fund, does not have any beneficial ownership in the Fund, but beneficially owns an aggregate of $223,345 of the interests in the Fund Complex.

Based on December 31, 2013 estimated values, Mr. William K. Enszer, portfolio manager of the Fund, does not have any beneficial ownership in the Fund or the Fund Complex.

None of the other directors of the Fund have any beneficial ownership in the Fund Complex.

(b) The Fund is a newly-created fund which has not yet commenced operations. The Fund has been established for the purpose of providing Partners with an opportunity to transfer their investments in the Legacy Feeder Funds into feeder funds with the investment objective of preserving value while prioritizing liquidity to Partners over active management as well as having an opportunity to participate in the Offer. The Legacy Feeder Funds are conducting concurrent repurchase offers, and all investors participating in certain of such offers will receive Shares as in-kind repurchase proceeds for tendered interests.

xii

Item 9. Persons/Assets Retained, Employed, Compensated or Used.

No persons have been employed, retained or are to be compensated by the Fund to make solicitations or recommendations in connection with the Offer to Purchase.

Item 10. Financial Statements.

The Fund has not yet commenced operations and, accordingly, financial statements are not available. The Fund will issue and file financial statements with the SEC on Form N-CSR, as required under the 1940 Act.

Item 11. Additional Information.

Item 12. Exhibits.

| 99.1 | Cover Letter to Offers to Purchase and Letter of Transmittal. |

| 99.3 | Forms of Letter of Transmittal. |

| 99.4 | Additional Detail on Purchase Price Calculation. |

xiii

SIGNATURE

After due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

| | | | |

| Dated: February 20, 2014 |

|

| PMF TEI FUND, L.P. |

| | |

| | By: | | /s/ John A. Blaisdell |

| | Name: | | John A. Blaisdell |

| | Title: | | Principal Executive Officer |

xiv

EXHIBIT INDEX

| | |

Exhibit | | |

| |

| 99.1 | | Cover Letter to Offer to Purchase and Letter of Transmittal. |

| |

| 99.2 | | Offers to Purchase. |

| |

| 99.3 | | Forms of Letter of Transmittal. |

| |

| 99.4 | | Additional Detail on Purchase Price Calculation. |

xv