UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANY

Investment Company Act file number 811-22942

PMF TEI Fund, L.P.

(Exact name of registrant as specified in charter)

712 W. 34TH STREET, SUITE 201, AUSTIN, TX 78705

(Address of principal executive offices) (Zip code)

| | | With a copy to: |

| William P. Prather III | | George J. Zornada |

| PMF TEI Fund, L.P. | | K & L Gates LLP |

| 712 W. 34th Street, Suite 201 | | 1 Congress Street, Suite 2900 |

| Austin, TX 78705 | | Boston, MA 02114 |

| (Name and address of agent for service) | | (617) 261-3231 |

Registrant’s telephone number, including area code: (512) 660-5146

Date of fiscal year end: 3/31/24

Date of reporting period: 3/31/24

Item 1. Reports to Stockholders.

(a)

TABLE OF CONTENTS

| | |

PMF TEI Fund, L.P. | |

Management Discussion of Fund Performance (Unaudited) | 1 |

Report of Independent Registered Public Accounting Firm | 11 |

Statement of Assets, Liabilities and Partners’ Capital | 12 |

Statement of Operations | 13 |

Statements of Changes in Partners’ Capital | 14 |

Statement of Cash Flows | 15 |

Notes to Financial Statements | 16 |

Supplemental Information (Unaudited) | 27 |

Privacy Policy (Unaudited) | 33 |

PMF Offshore TEI Fund, Ltd. | |

Independent Auditor’s Report | 38 |

Statement of Assets and Liabilities | 40 |

Statement of Operations | 41 |

Statement of Changes in Net Assets | 42 |

Statement of Cash Flows | 43 |

Notes to Financial Statements | 44 |

The Endowment PMF Master Fund, L.P. | |

Management Discussion of Fund Performance (Unaudited) | 51 |

Report of Independent Registered Public Accounting Firm | 60 |

Statement of Assets, Liabilities and Partners’ Capital | 62 |

Schedule of Investments | 63 |

Statement of Operations | 67 |

Statements of Changes in Partners’ Capital | 68 |

Statement of Cash Flows | 69 |

Notes to Financial Statements | 70 |

Supplemental Information (Unaudited) | 88 |

Privacy Policy (Unaudited) | 94 |

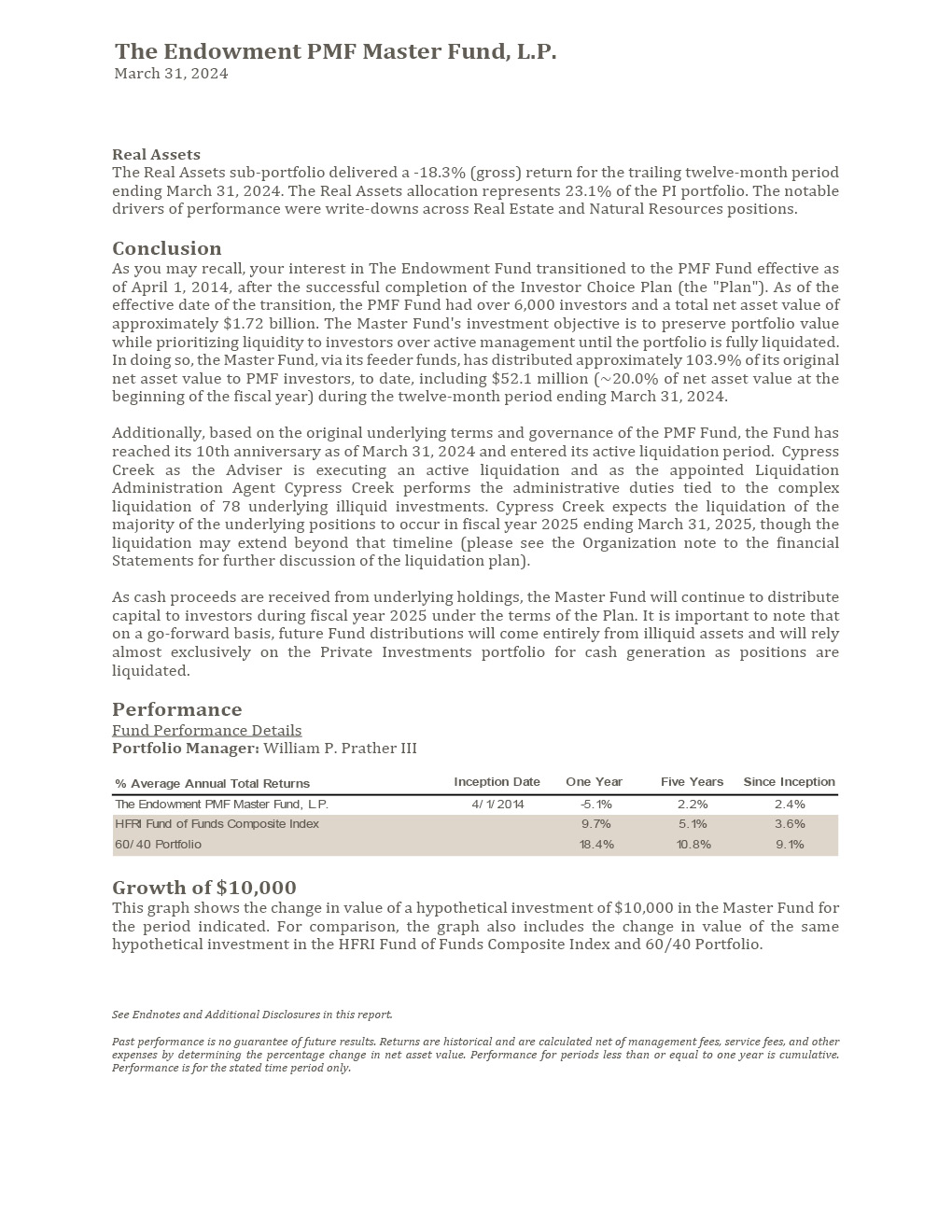

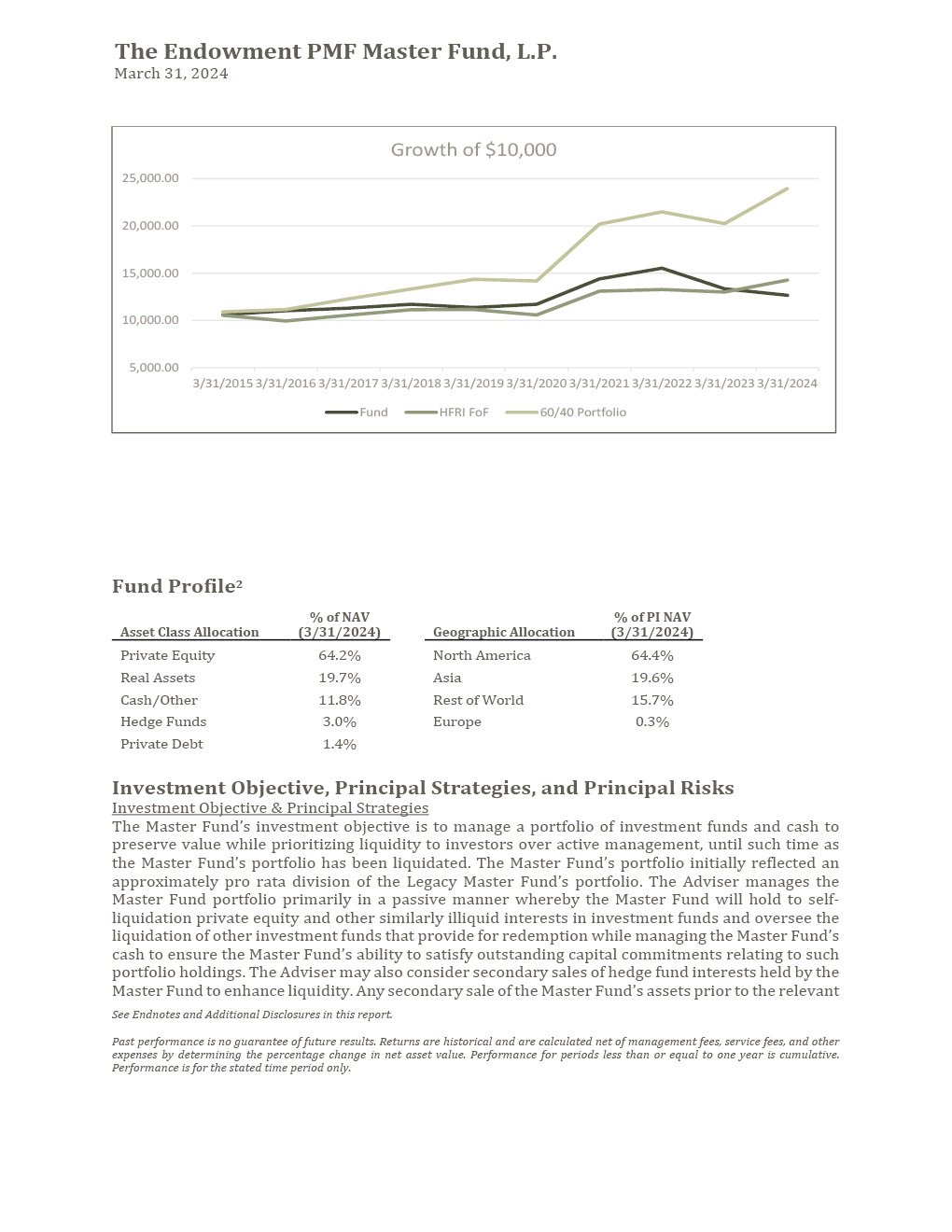

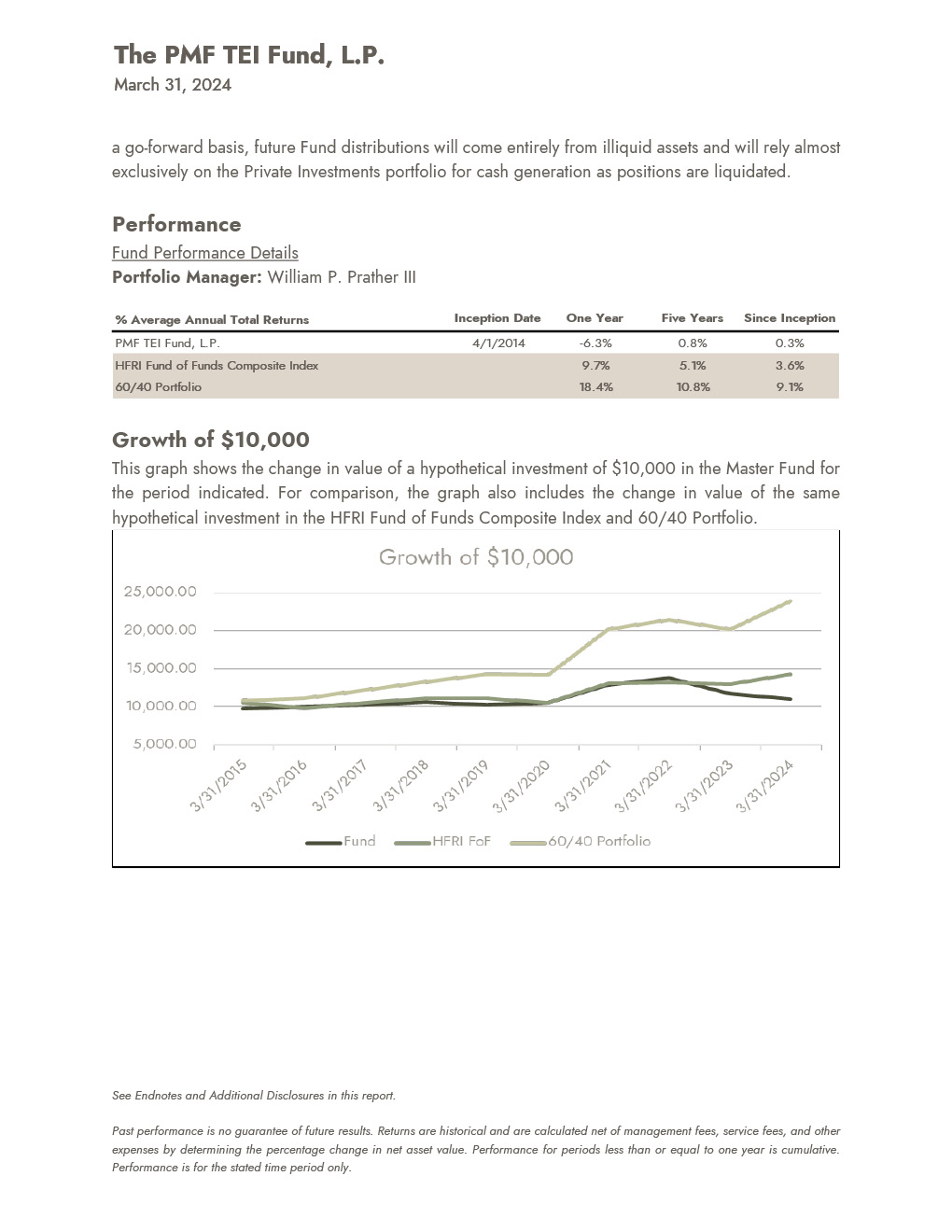

1

2

3

4

5

6

7

8

9

10

Report of Independent Registered Public Accounting Firm

To the Partners and the Board of Directors of

PMF TEI Fund, L.P.

Opinion on the Financial Statements

We have audited the accompanying statement of assets, liabilities and partners’ capital of PMF TEI Fund, L.P. (the Fund), as of March 31, 2024, the related statements of operations and cash flows for the year then ended, the statements of changes in partners’ capital for each of the two years in the period then ended, and the related notes to the financial statements (collectively, the financial statements), and the financial highlights for the years ended March 31, 2024 and March 31, 2023, the period from January 1, 2022 to March 31, 2022, and for the year ended December 31, 2021. In our opinion, the financial statements and financial highlights present fairly, in all material respects, the financial position of the Fund as of March 31, 2024, the results of its operations and its cash flows for the year then ended, the changes in partners’ capital for each of the two years in the period then ended, and the financial highlights for the years ended March 31, 2024 and March 31, 2023, the period from January 1, 2022 to March 31, 2022, and for the year ended December 31, 2021, in conformity with accounting principles generally accepted in the United States of America.

The financial highlights for the years ended December 31, 2020 and December 31, 2019, for the Fund were audited by other auditors. Those auditors expressed an unqualified opinion on those financial statements and financial highlights in their report dated February 26, 2021.

Emphasis of a Matter

As described in Notes 1 and 8 to the financial statements, in accordance with its limited partnership agreement, the Fund entered into active liquidation effective April 1, 2024. Our opinion is not modified with respect to this matter.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements and financial highlights based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Fund in accordance with U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Fund is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits, we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

We have served as the auditor of one or more Cypress Creek Partners investment companies since 2021.

/s/ RSM US LLP

Chicago, Illinois

May 30, 2024

11

PMF TEI FUND, L.P.

(A Limited Partnership)

Statement of Assets, Liabilities and Partners’ Capital

March 31, 2024

Assets | | | | |

Investment in the Offshore TEI Fund, at fair value | | $ | 56,610,877 | |

Receivable from the Offshore TEI Fund | | | 3,591,868 | |

Total assets | | | 60,202,745 | |

Liabilities and Partners’ Capital | | | | |

Withdrawals payable | | | 3,591,868 | |

Accounts payable and accrued expenses | | | 162,135 | |

Servicing Fees payable | | | 42,075 | |

Total liabilities | | | 3,796,078 | |

Partners’ capital | | | 56,406,667 | |

Total liabilities and partners’ capital | | $ | 60,202,745 | |

See accompanying notes to financial statements.

12

PMF TEI FUND, L.P.

(A Limited Partnership)

Statement of Operations

Year Ended March 31, 2024

Net investment loss allocated from the Offshore TEI Fund: | | | | |

Interest income | | $ | 334,130 | |

Foreign tax withholding (net of dividend income) | | | (248,645 | ) |

Expenses | | | (1,251,891 | ) |

Net investment loss allocated from the Offshore TEI Fund | | | (1,166,406 | ) |

Expenses of the TEI Fund: | | | | |

Servicing Fees | | | 266,956 | |

Professional fees | | | 120,684 | |

Other expenses | | | 146,760 | |

Total expenses of the TEI Fund | | | 534,400 | |

Net investment loss of the TEI Fund | | | (1,700,806 | ) |

Net realized and unrealized gain (loss) from investments allocated from the Offshore TEI Fund: | | | | |

Net realized gain (loss) from investments | | | (5,341,689 | ) |

Change in unrealized appreciation/depreciation from investments | | | 2,972,849 | |

Net realized and unrealized gain (loss) from investments allocated from the Offshore TEI Fund | | | (2,368,840 | ) |

Net decrease in partners’ capital resulting from operations | | $ | (4,069,646 | ) |

See accompanying notes to financial statements.

13

PMF TEI FUND, L.P.

(A Limited Partnership)

Statements of Changes in Partners’ Capital

Years Ended March 31, 2023, and March 31, 2024

Partners’ capital at March 31, 2022 | | $ | 115,232,827 | |

Withdrawals | | | (24,946,561 | ) |

Net decrease in partners’ capital resulting from operations: | | | | |

Net investment loss | | | (1,311,388 | ) |

Net realized gain from investments | | | 9,553,884 | |

Change in unrealized appreciation/depreciation from investments | | | (22,914,074 | ) |

Net decrease in partners’ capital resulting from operations | | | (14,671,578 | ) |

Partners’ capital at March 31, 2023 | | $ | 75,614,688 | |

Withdrawals | | | (15,138,375 | ) |

Net decrease in partners’ capital resulting from operations: | | | | |

Net investment loss | | | (1,700,806 | ) |

Net realized loss from investments | | | (5,341,689 | ) |

Change in unrealized appreciation/depreciation from investments | | | 2,972,849 | |

Net decrease in partners’ capital resulting from operations | | | (4,069,646 | ) |

Partners’ capital at March 31, 2024 | | $ | 56,406,667 | |

See accompanying notes to financial statements.

14

PMF TEI FUND, L.P.

(A Limited Partnership)

Statement of Cash Flows

Year Ended March 31, 2024

Cash flows from operating activities: | | | | |

Net decrease in partners’ capital resulting from operations | | $ | (4,069,646 | ) |

Adjustments to reconcile net decrease in partners’ capital resulting from operations to net cash provided by operating activities: | | | | |

Net realized and unrealized (gain) loss from investments allocated from the Offshore TEI Fund | | | 2,368,840 | |

Net investment (income) loss allocated from the Offshore TEI Fund | | | 1,166,406 | |

Withdrawals from the Offshore TEI Fund | | | 15,655,244 | |

Change in operating assets and liabilities: | | | | |

Receivable from the Offshore TEI Fund | | | (3,591,868 | ) |

Servicing Fees payable | | | 16,862 | |

Accounts payable and accrued expenses | | | 669 | |

Net cash provided by operating activities | | | 11,546,507 | |

Cash flows from financing activities: | | | | |

Withdrawals, net of change in withdrawals payable | | | (11,546,507 | ) |

Net cash used in financing activities | | | (11,546,507 | ) |

Net change in cash and cash equivalents | | | — | |

Cash and cash equivalents at beginning of year | | | — | |

Cash and cash equivalents at end of year | | $ | — | |

See accompanying notes to financial statements.

15

PMF TEI FUND, L.P.

(A Limited Partnership)

Notes to Financial Statements

March 31, 2024

PMF TEI Fund, L.P. (the “TEI Fund”), a Delaware limited partnership registered under the Investment Company Act of 1940, as amended (the “1940 Act”), which commenced operations on March 31, 2014, is a non-diversified, closed-end management investment company. The TEI Fund was created to serve as a feeder fund for PMF TEI Offshore Fund, Ltd. (the “Offshore Fund”), which in turn is a feeder fund for The Endowment PMF Master Fund, L.P. (the “Master Fund”). There are currently three feeder funds (the “Feeder Funds”). For convenience, reference to the TEI Fund may include the Offshore Fund and Master Fund, as the context requires.

The TEI Fund’s investment objective is to manage a portfolio of investments in a wide range of investment vehicles (“Investment Funds”) and cash to preserve value while prioritizing liquidity to investors over active management, until such time as the Master Fund’s portfolio has been liquidated. The Master Fund holds a portfolio of Investment Funds, reflecting an approximate pro rata division of the portfolio of the Legacy Master Fund, managed in a broad range of investment strategies and asset categories. The Adviser, as hereinafter defined, manages the Master Fund portfolio primarily in a passive manner whereby the Master Fund holds to self-liquidating private equity and other similar illiquid interests in Investment Funds and oversees the liquidation of other Investment Funds that provide for redemption while managing the Master Fund’s cash to ensure the Master Fund has the ability to satisfy outstanding capital commitments relating to such portfolio holdings. The Master Fund’s financial statements, Schedule of Investments and notes to financial statements included elsewhere in this report, should be read in conjunction with this report. The Offshore Fund serves solely as an intermediary for the TEI Fund’s investment in the Master Fund. The percentage of the Master Fund’s partnership interests indirectly owned by each of the TEI Fund and the Offshore Fund on March 31, 2024, was 29.11%.

The Endowment Fund GP, L.P., a Delaware limited partnership, serves as the general partner of the TEI Fund, the Master Fund and the Legacy Master Fund (the “General Partner”). To the fullest extent permitted by applicable law, the General Partner has irrevocably delegated to a board of directors (the “Board” and each member a “Director”) its rights and powers to monitor and oversee the business affairs of the TEI Fund, including the complete and exclusive authority to oversee and establish policies regarding the management, conduct, and operation of the TEI Fund’s business. A majority of the Directors are independent of the General Partner and its management. To the extent permitted by applicable law, the Board may delegate any of its rights, powers and authority to, among others, the officers of the TEI Fund, the Adviser, or any committee of the Board.

The Board is authorized to engage an investment adviser and it has selected Endowment Advisers, L.P. d/b/a Cypress Creek Partners (the “Adviser”), to manage the TEI Fund’s portfolio and operations, pursuant to an investment management agreement (the “Investment Management Agreement”). The Adviser is a Delaware limited partnership that is registered as an investment adviser under the Investment Advisers Act of 1940, as amended (the “Advisers Act”). Under the Investment Management Agreement, the Adviser is responsible for the establishment of an investment committee, which is responsible for developing, implementing, and supervising the TEI Fund’s investment program subject to the ultimate supervision of the Board. In addition to investment advisory services, the Adviser also functions as the servicing agent of the TEI Fund (the “Servicing Agent”) and as such provides or procures investor services and administrative assistance for the TEI Fund. The Adviser can delegate all or a portion of its duties as Servicing Agent to other parties, who would in turn act as sub-servicing agents.

Under the TEI Fund’s organizational documents, the TEI Fund’s officers and Directors are indemnified against certain liabilities arising out of the performance of their duties to the TEI Fund. In the normal course of business, the TEI Fund enters into contracts with service providers, which also provide for indemnifications by the TEI Fund. The TEI

16

PMF TEI FUND, L.P.

(A Limited Partnership)

Notes to Financial Statements, continued

March 31, 2024

Fund’s maximum exposure under these arrangements is unknown, as this would involve any future potential claims that may be made against the TEI Fund. However, based on experience, the General Partner expects that risk of loss to be remote.

The Fund’s limited partnership agreement requires that the Master Fund be dissolved promptly upon the occurrence of the ten year anniversary of its creation. Accordingly, following the occurrence of this anniversary, the Master Fund entered into active liquidation on April 1, 2024. Such liquidation of Investment Funds may require the sale of most such assets in the secondary market. Any such secondary sales of assets would likely be at a discount to the net asset value reported by the respective Investment Fund, used to determine the fair value as of March 31, 2024, and would therefore reduce the amounts realized by the Master Fund and distributed to investors.

(2) | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES AND PRACTICES |

The accounting and reporting policies of the TEI Fund conform with U.S. generally accepted accounting principles (“U.S. GAAP”). The accompanying financial statements reflect the financial position of the TEI Fund and the results of its operations. The TEI Fund is an investment company and follows the investment company accounting and reporting guidance under Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 946, “Financial Services—Investment Companies.”

The TEI Fund considers all unpledged temporary cash investments with a maturity date at the time of purchase of three months or less to be cash equivalents.

(c) | INVESTMENT SECURITIES TRANSACTIONS |

The TEI Fund records monthly its pro-rata share of income, expenses, changes in unrealized appreciation and depreciation, and realized gains and losses derived from the Offshore Fund.

The TEI Fund records investment transactions on a trade-date basis.

Investments that are held by the TEI Fund are marked to fair value at the date of the financial statements, and the corresponding change in unrealized appreciation/depreciation is included in the Statement of Operations.

The valuation of the TEI Fund’s investments is determined as of the close of business at the end of each reporting period, generally monthly. The valuation of the TEI Fund’s investments is calculated by UMB Fund Services, Inc., the TEI Fund’s independent administrator (the “Administrator”).

The Board responsible for overseeing the TEI Fund’s valuation policies, making recommendations to the Adviser on valuation-related matters, and overseeing implementation by the Adviser of such valuation policies.

Pursuant to Rule 2a-5 under the 1940 Act, the Board has delegated day-to-day management of the valuation process to the Adviser as the appointed Valuation Designee, which has established a valuation committee (the “Adviser Valuation Committee”) to carry out this function. The Valuation Designee is subject to the oversight of the Board. The Valuation Designee is responsible for assessing and managing key valuation risk, and is generally to review valuation methodologies, valuation determinations, and any information provided by the Adviser or the Administrator.

17

PMF TEI FUND, L.P.

(A Limited Partnership)

Notes to Financial Statements, continued

March 31, 2024

The TEI Fund invests substantially all of its assets in the Offshore Fund, which in turn invests substantially all of its assets in the Master Fund. Investments in the Offshore Fund are recorded at fair value based on the TEI Fund’s proportional share of the Offshore Fund’s net assets. The Offshore Fund’s Investments in the Master Fund are recorded at fair value based on the Offshore Fund’s proportional share of the Master Fund’s partners’ capital.

Investments in the Master Fund are recorded at fair value based on the TEI Fund’s proportional share of the Master Fund’s partners’ capital, through the Offshore Fund. Valuation of the investments held by the Offshore Fund and the Master Fund is discussed in the Offshore Fund and Master Fund’s notes to financial statements, respectively, both included elsewhere in this report.

For investments in securities, dividend income is recorded on the ex-dividend date, net of withholding taxes. Interest income is recorded as earned on the accrual basis and includes amortization of premiums or accretion of discounts.

Unless otherwise voluntarily or contractually assumed by the Adviser or another party, the TEI Fund bears all expenses incurred in its business, directly or indirectly through its investment in the Master Fund (through the Offshore Fund), including but not limited to, the following: all costs and expenses related to investment transactions and positions for the TEI Fund’s account; legal fees; compliance fees; accounting, auditing and tax preparation fees; recordkeeping and custodial fees; costs of computing the TEI Fund’s net asset value; fees for data and software providers; research expenses; costs of insurance; registration expenses; expenses of meetings of the partners; directors fees; all costs with respect to communications to partners; offshore withholding taxes; and other types of expenses as may be approved from time to time by the Board.

The TEI Fund is organized and operates as a limited partnership and is not subject to income taxes as a separate entity. Such taxes are the responsibility of the individual partners. Accordingly, no provision for income taxes has been made in the TEI Fund’s financial statements. Investments in foreign securities may result in foreign taxes being withheld by the issuer of such securities.

For the current open tax years, and for all major jurisdictions, management of the TEI Fund has evaluated the tax positions taken or expected to be taken in the course of preparing the TEI Fund’s tax returns to determine whether the tax positions will “more-likely-than-not” be sustained by the TEI Fund upon challenge by the applicable tax authority. Tax positions not deemed to meet the more-likely-than-not threshold and that would result in a tax benefit or expense to the TEI Fund would be recorded as a tax benefit or expense in the current period. For the year ended March 31, 2024, the TEI Fund did not recognize any amounts for unrecognized tax benefit/expense. A reconciliation of unrecognized tax benefit/expense is not provided herein, as the beginning and ending amounts of unrecognized tax benefit/expense are zero, with no interim additions, reductions or settlements. Tax positions taken in tax years which remain open under the statute of limitations (generally three years for federal income tax purposes and four years for state income tax purposes) are subject to examination by federal and state tax jurisdictions.

18

PMF TEI FUND, L.P.

(A Limited Partnership)

Notes to Financial Statements, continued

March 31, 2024

The financial statements have been prepared in conformity with U.S. GAAP, which requires management to make estimates and assumptions relating to the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses during the reporting period. Actual results may differ from those estimates and such differences may be significant.

(3) | FAIR VALUE MEASUREMENTS |

The TEI Fund records its investment in the Offshore Fund, which in turn invests substantially all of its assets in the Master Fund, at fair value. Investments of the Master Fund are recorded at fair value as more fully discussed in the Master Fund’s notes to financial statements, included elsewhere in this report.

(4) | PARTNERS’ CAPITAL ACCOUNTS |

Interests of the TEI Fund are generally available only to those investors who received Interests as in-kind repurchase proceeds for their tendered interests in one of the feeder funds to the Legacy Master Fund. Interests of the TEI Fund will generally not otherwise be offered or sold.

(b) | ALLOCATION OF PROFITS AND LOSSES |

For each fiscal period net profits or net losses of the TEI Fund, including allocations from the Master Fund, are allocated among and credited to or debited against the capital accounts of all partners as of the last day of each fiscal period in accordance with the partners’ respective capital account ownership percentage for the fiscal period. Net profits or net losses are measured as the net change in the value of the partners’ capital of the TEI Fund, including any change in unrealized appreciation or depreciation of investments and income, net of expenses, and realized gains or losses during a fiscal period.

(c) | REPURCHASE OF INTERESTS |

A partner will not have the right to require the TEI Fund to repurchase all or any portion of an Interest at the partner’s discretion at any time. Partners may not be able to liquidate their investment other than as a result of repurchases of Interests as described below. Interests are not redeemable nor are they exchangeable for Interests or shares of any other fund.

The Master Fund anticipates making quarterly distributions pro rata to all investors in an amount equal to the Master Fund’s excess cash (“Excess Cash”). Excess Cash is defined as the amount of cash on hand over and above the amount necessary or prudent for operational and regulatory purposes (“Required Cash”). The amount of Required Cash is determined by the Adviser with oversight by the Board. Excess Cash is generally distributed in the subsequent quarter or quarters where the aggregate of Excess Cash from such subsequent quarter(s) and prior quarters exceeds a threshold of $10 million. Intra-quarter distributions may also be made if Excess Cash exceeds a threshold of $25 million as of the forty fifth day after the end of any quarter. The Master Fund may make in-kind distributions of portfolio securities as deemed necessary. Total distributions during the year ended March 31, 2023, were $24,946,561 and total distributions of $15,138,962 were made during the year ended March 31, 2024, of which $3,591,868 was outstanding as a payable at March 31, 2024.

19

PMF TEI FUND, L.P.

(A Limited Partnership)

Notes to Financial Statements, continued

March 31, 2024

(5) | INVESTMENTS IN PORTFOLIO SECURITIES |

As of March 31, 2024, all of the investments made by the TEI Fund were in the Master Fund (through the Offshore Fund).

(6) | FINANCIAL INSTRUMENTS WITH OFF-BALANCE SHEET RISK |

In the normal course of business, the Investment Funds in which the TEI Fund may invest either directly or through the Offshore Fund and Master Fund may trade various derivative securities and other financial instruments, and enter into various investment activities with off-balance sheet risk both as an investor and as a principal. The TEI Fund’s risk of loss in these Investment Funds is limited to the TEI Fund’s pro rata share of the value of its investment in or commitment to such Investment Funds as held directly or through the Offshore Fund and Master Fund.

(7) | ADMINISTRATION AGREEMENT |

In consideration for administrative, accounting, and recordkeeping services, the Master Fund pays the Administrator a monthly administration fee based on the month-end partners’ capital of the Master Fund. The Administrator also provides the TEI Fund, the Offshore Fund and the Master Fund with compliance, transfer agency, and other investor related services at an additional cost.

The fees for TEI Fund administration are paid out of the Master Fund’s assets, which decreases the net profits or increases the net losses of the partners in the TEI Fund.

(8) | RELATED PARTY TRANSACTIONS |

(a) | INVESTMENT MANAGEMENT FEE |

In consideration of the advisory and other services provided by the Adviser to the Master Fund and the TEI Fund, the Master Fund pays the Adviser an investment management fee (the “Investment Management Fee”) equal to 0.40% on an annualized basis of the Master Fund’s partners’ capital at the end of each month, payable monthly in arrears, until the period ending March 31, 2024, when the Adviser will no longer receive the Investment Management Fee.

In addition, effective April 1, 2019, the Investment Management Fee will not be charged to the Master Fund on any Investment Fund classified as a “Hedge Fund” (as defined in the Master Fund’s Limited Partnership Agreement and disclosed on the Schedule of Investments of the Master Fund included elsewhere in this report), with any such Hedge Fund remaining in the Master Fund’s portfolio being excluded from the calculation.

The TEI Fund’s partners bear an indirect portion of the Investment Management Fee paid by the Master Fund. The Investment Management Fee decreases the net profits or increases the net losses of the Master Fund and indirectly the TEI Fund as the fees reduce the capital accounts of the Master Fund’s partners.

In consideration for providing or procuring investor services and administrative assistance to the TEI Fund, the Adviser receives a servicing fee (the “Servicing Fee”) equal to 0.40% (on an annualized basis) of each partner’s capital account balance, calculated at the end of each month, payable quarterly in arrears, until the period ending March 31, 2024, when the Adviser will no longer receive a Servicing Fee.

20

PMF TEI FUND, L.P.

(A Limited Partnership)

Notes to Financial Statements, continued

March 31, 2024

The Adviser may engage one or more sub-servicing agents to provide some or all of the services. Compensation to any sub-servicing agent is paid by the Adviser. The Adviser or its affiliates also may pay a fee out of their own resources to sub-servicing agents.

For the year ended March 31, 2024, $266,956 was incurred for Servicing Fees, of which $42,075 was outstanding as a payable at March 31, 2024.

(c) | LIQUIDATION ADMINISTRATION AGREEMENT |

Effective July 17, 2023, the Adviser was appointed by the Board to serve as Liquidation Administration Agent (the “Agent), to foster the prompt liquidation of the business and administrative affairs of the Master Fund. In consideration for these services, the Master Fund will pay the Adviser a liquidating agent service fee (the “Liquidating Agent Service Fee”) that will be paid in four equal installments over the course of the liquidation process. The Liquidating Agent Service Fee will be reviewed and potentially adjusted based on the NAV of the Master Fund as of March 31, 2024.

The TEI Fund’s partners bear an indirect portion of the Liquidating Agent Service Fee paid by the Master Fund. The Liquidating Agent Service Fee decreases the net profits or increases the net losses of the Master Fund and indirectly the TEI Fund as the fee reduces the capital accounts of the Master Fund’s partners.

| | | Year Ended

March 31,

2024 | | | Year Ended

March 31,

2023 | | | Period Ended

March 31,

2022* | | | Year Ended

December 31,

2021 | | | Year Ended

December 31,

2020 | | | Year Ended

December 31,

2019 | |

Net investment loss to average partners’

capital (1) | | | (2.60 | )% | | | (1.45 | )% | | | (1.83 | )% | | | (0.94 | )% | | | (2.62 | )% | | | (1.60 | )% |

Expenses to average partners’ capital (1) | | | 2.73 | % | | | 2.27 | % | | | 1.83 | % | | | 1.33 | % | | | 2.98 | % | | | 2.41 | % |

Portfolio turnover (2) | | | 0.65 | % | | | 1.06 | % | | | 0.96 | % | | | 18.69 | % | | | 3.04 | % | | | 2.00 | % |

Internal rate of return since inception (3) | | | (0.58 | )% | | | (0.24 | )% | | | 0.44 | % | | | 0.40 | % | | | (0.43 | )% | | | (1.77 | )% |

Total return (4) | | | (6.25 | )% | | | (15.38 | )% | | | (3.37 | )% | | | 11.56 | % | | | 16.29 | % | | | 4.30 | % |

Partners’ capital, end of period (000’s) | | $ | 56,407 | | | $ | 75,615 | | | $ | 115,233 | | | $ | 119,250 | | | $ | 153,300 | | | $ | 146,406 | |

An investor’s return (and operating ratios) may vary from those reflected based on the timing of capital transactions.

* | The PMF TEI Fund has changed its fiscal year end from December 31 to March 31. This period represents the 3-month period from January 1, 2022, to March 31, 2022. |

(1) | Ratios are calculated by dividing the indicated amount by average partners’ capital measured at the end of each month during the period. Ratios include allocations of net investment loss and expenses from the Offshore Fund and the Master Fund. Ratios are annualized for periods less than 12 months. |

(2) | The TEI Fund is invested exclusively in the Offshore Fund which in turn is invested solely in the Master Fund, therefore this ratio reflects the portfolio turnover of the Master Fund, which is for the period indicated. |

(3) | The internal rate of return since inception (“IRR”) of the limited partners is net of all fees and profit allocations to the Adviser. The IRR was computed based on the actual dates of the cash inflows (capital contributions), cash outflows (cash distributions), and the ending partners’ capital as of March 31, 2024 (the residual value). The IRR reported is for the PMF TEI Fund as a whole, which includes the early liquidity discount that was |

21

PMF TEI FUND, L.P.

(A Limited Partnership)

Notes to Financial Statements, continued

March 31, 2024

specifically allocated only to those investors that did not elect the PMF TEI Fund option but instead elected to be fully redeemed for cash pursuant to the March 31, 2014, tender offer. The IRR for investors who remained invested in the PMF TEI Fund is 2.94%. The IRR reported for the Master Fund is 4.03%.

(4) | The total return of the TEI Fund is calculated as geometrically linked monthly returns for each month in the period, not annualized for periods less than 12 months. |

(10) | INVESTMENT-RELATED RISKS |

All securities investing and trading activities risk the loss of capital. No assurance can be given that the Master Fund’s or any Investment Fund’s investment activities will be successful or that the Partners will not suffer losses.

In general, these principal risks exist whether the investment is made by an Investment Fund or held by the Master Fund directly and therefore for convenience purposes, the description of such risks in terms of an Investment Fund is intended to include the same risks for investments made directly by the Master Fund. It is possible that an Investment Fund (or the Master Fund) will make (or hold) an investment that is not described below, and any such investment will be subject to its own particular risks. For purposes of this discussion, references to the activities of the Investment Funds should generally be interpreted to include the activities of an Investment Manager. The risks and considerations described below are intended to reflect the Master Fund’s anticipated holdings.

(a) | HIGHLY VOLATILE MARKETS RISK |

The prices of an Investment Fund’s investments, and therefore the net asset value (the “NAV”) of the Master Fund’s Interests, can be highly volatile. Price movements of forward contracts, futures contracts and other derivative contracts in which an Investment Fund may invest are influenced by, among other things, interest rates, changing supply and demand relationships, trade, fiscal, monetary and exchange control programs and policies of governments, and national and international political and economic events and policies. In addition, governments from time to time intervene, directly and by regulation, in certain markets, particularly those in currencies, financial instruments and interest rate-related futures and options. Such intervention often is intended directly to influence prices and may, together with other factors, cause all of such markets to move rapidly in the same direction because of, among other things, interest rate fluctuations. Moreover, since internationally there may be less government supervision and regulation of worldwide stock exchanges and clearinghouses than in the U.S., Investment Funds also are subject to the risk of the failure of the exchanges on which their positions trade or of their clearinghouses, and there may be a higher risk of financial irregularities and/or lack of appropriate risk monitoring and controls.

The market value of fixed income investments changes in response to interest rate changes and other factors. During periods of rising interest rates, the values of outstanding fixed income securities generally decrease. Moreover, while securities with longer maturities tend to produce higher yields, the prices of longer maturity securities are also subject to greater market value fluctuations as a result of changes in interest rates. During periods of falling interest rates, certain debt obligations with high interest rates may be prepaid (or “called”) by the issuer prior to maturity. This may cause the weighted average weighted maturity of investments to fluctuate and may require investments to invest the resulting proceeds at lower interest rates. Income from the investment’s debt securities portfolio will decline if and when the investment invests the proceeds from matured, traded or called securities in securities with market interest rates that are below the current earnings rate of the investment’s portfolio. A rise in interest rates may also increase volatility and reduce liquidity in the fixed income markets, and result in a decline in the value of the fixed income investments held by Investments. Reductions in dealer market-making capacity as a result of structural or regulatory changes could further decrease liquidity and/or increase volatility in the fixed income markets.

22

PMF TEI FUND, L.P.

(A Limited Partnership)

Notes to Financial Statements, continued

March 31, 2024

In addition, the impact of any epidemic, pandemic or natural disaster, or widespread fear that such events may occur, could negatively affect the global economy, as well as the economies of individual countries, the financial performance of individual companies and sectors, and the markets in general in significant and unforeseen ways. Any such impact could adversely affect the prices and liquidity of the securities and other instruments in which the Master Fund invests, which in turn could negatively impact the Master Fund’s performance and cause losses on your investment in the Master Fund. Recent examples include pandemic risks related to COVID-19 and aggressive measures taken worldwide in response by governments, including closing borders, restricting international and domestic travel, and the imposition of prolonged quarantines of large populations, and by businesses, including changes to operations and reducing staff. As a result of these market conditions, the Master Fund’s NAV may fluctuate. Fixed income securities may also be subject to credit risk, which is the possibility that an issuer will be unable or unwilling to make timely payments of either principal or interest. Changes in the actual or perceived creditworthiness of an issuer, factors affecting an issuer directly (such as management changes, labor relations, collapse of key suppliers or customers, or material changes in overhead), factors affecting the industry in which a particular issuer operates (such as competition or technological advances) and changes in general social, economic or political conditions can increase the risk of default by an issuer, which can affect a security’s credit quality or value. Since the Master Fund and investments may purchase securities backed by credit enhancements from banks and other financial institutions, changes in the credit ratings of these institutions could cause the Master Fund to lose money and may affect the Fund’s NAV. Moreover, in order to enforce its rights in the event of a default, bankruptcy or similar situation, the Master Fund may be required to retain legal or similar counsel, which may increase the Master Fund’s operating expenses and adversely affect the Master Fund’s NAV.

(c) | NON-U.S. INVESTMENT RISK |

Investment Funds may invest in securities of non-U.S. issuers and the governments of non-U.S. countries. These investments involve special risks not usually associated with investing in securities of U.S. companies or the U.S. government, including political and economic considerations, such as greater risks of expropriation and nationalization, confiscatory taxation, the potential difficulty of repatriating funds, general social, political and economic instability and adverse diplomatic developments; the possibility of the imposition of withholding or other taxes on dividends, interest, capital gain or other income; the small size of the securities markets in such countries and the low volume of trading, resulting in potential lack of liquidity and in price volatility; fluctuations in the rate of exchange between currencies and costs associated with currency conversion; and certain government policies that may restrict the Investment Funds’ investment opportunities. In addition, because non-U.S. entities are not subject to uniform accounting, auditing, and financial reporting standards, practices and requirements comparable with those applicable to U.S. companies, there may be different types of, and lower quality, information available about a non-U.S. company than a U.S. company. There is also less regulation, generally, of the securities markets in many foreign countries than there is in the U.S., and such markets may not provide the same protections available in the U.S. With respect to certain countries there may be the possibility of political, economic or social instability, the imposition of trading controls, import duties or other protectionist measures, various laws enacted for the protection of creditors, greater risks of nationalization or diplomatic developments which could materially adversely affect the Investment Funds’ investments in those countries. Furthermore, individual economies may differ favorably or unfavorably from the U.S. economy in such respects as growth of gross national product, rate of inflation, capital reinvestment, resource self-sufficiency, and balance of payments position. An Investment Fund’s investment in non-U.S. countries may also be subject to withholding or other taxes, which may be significant and may reduce the Investment Fund’s returns. Brokerage commissions, custodial services and other costs relating to investment in international securities markets generally are more expensive than in the U.S. In addition, clearance and settlement procedures may be different in foreign countries and, in certain markets, such procedures have been unable to keep pace with the volume of securities transactions, thus making it difficult to conduct such transactions.

23

PMF TEI FUND, L.P.

(A Limited Partnership)

Notes to Financial Statements, continued

March 31, 2024

Investment in sovereign debt obligations of non-U.S. governments involves additional risks not present in debt obligations of corporate issuers and the U.S. government. The issuer of the debt or the governmental authorities that control the repayment of the debt may be unable or unwilling to repay principal or pay interest when due in accordance with the terms of such debt, and an Investment Fund may have limited recourse to compel payment in the event of a default. A sovereign debtor’s willingness or ability to repay principal and to pay interest in a timely manner may be affected by, among other factors, its cash flow situation, the extent of its foreign currency reserves, the availability of sufficient foreign exchange on the date a payment is due, the relative size of the debt service burden to the economy as a whole, the sovereign debtor’s policy toward international lenders, and the political constraints to which the sovereign debtor may be subject. Periods of economic uncertainty may result in the volatility of market prices of sovereign debt to a greater extent than the volatility inherent in debt obligations of other types of issues.

(d) | INVESTMENT IN EMERGING MARKETS RISK |

The Master Fund may hold investments in Investment Funds that focus on “emerging markets” (defined below), and the Adviser anticipates that this will continue. Investment Funds may invest in securities of companies based in emerging markets or issued by the governments of such countries. Securities traded in certain emerging markets may be subject to risks due to the inexperience of financial intermediaries, the lack of modern technology, the lack of a sufficient capital base to expand business operations, and the possibility of temporary or permanent termination of trading. Political and economic structures in many emerging markets may be undergoing significant evolution and rapid development, and emerging markets may lack the social, political and economic stability characteristics of more developed countries. As a result, the risks relating to investments in foreign securities described above, including the possibility of nationalization or expropriation, may be heightened. In addition, certain countries may restrict or prohibit investment opportunities in issuers or industries deemed important to national interests. Such restrictions may affect the market price, liquidity and rights of securities that may be purchased by Investment Funds. Settlement mechanisms in emerging securities markets may be less efficient and less reliable than in more developed markets and placing securities with a custodian or broker-dealer in an emerging country also may present considerable risks. The small size of securities markets in such countries and the low volume of trading may result in a lack of liquidity and in substantially greater price volatility. Many emerging market countries have experienced substantial, and in some periods extremely high rates of inflation for many years. Inflation and rapid fluctuations in inflation rates and corresponding currency devaluations and fluctuations in the rate of exchange between currencies and costs associated with currency conversion have had and may continue to have negative effects on the economies and securities markets of certain emerging market countries. In addition, accounting and financial reporting standards that prevail in certain of such countries are not equivalent to standards in more developed countries and, consequently, less information is available to investors in companies located in such countries.

(e) | FOREIGN CURRENCY TRANSACTIONS AND EXCHANGE RATE RISK |

Investment Funds may invest in equity and equity-related securities denominated in non-U.S. currencies and in other financial instruments, the price of which is determined with reference to such currencies. Investment Funds may engage in foreign currency transactions for a variety of purposes, including to “lock in” the U.S. dollar price of the security, between the trade and the settlement dates, the value of a security an Investment Fund has agreed to buy or sell, or to hedge the U.S. dollar value of securities the Investment Fund already owns. The Investment Funds also may engage in foreign currency transactions for non-hedging purposes to generate returns. The Master Fund will, however, value its investments and other assets in U.S. dollars. To the extent unhedged, the value of the Master Fund’s net assets will fluctuate with U.S. dollar exchange rates as well as with price changes of an Investment Fund’s investments in the various local markets and currencies. Forward currency contracts and options may be utilized by Investment Funds to hedge against currency fluctuations, but the Investment Funds are not required to utilize such techniques, and there can be no assurance that such hedging transactions will be available or, even if undertaken, effective.

24

PMF TEI FUND, L.P.

(A Limited Partnership)

Notes to Financial Statements, continued

March 31, 2024

The Master Fund will hold Investment Funds whose Investment Managers take long positions in securities believed to be undervalued and short positions in securities believed to be overvalued. In the event that the perceived mispricings underlying one or more Investment Managers’ trading positions were to fail to converge toward, or were to diverge further from, relationships expected by such Investment Managers, the Master Fund may incur significant losses.

Substantial transaction failure risks are involved in companies that are the subject of publicly disclosed mergers, takeover bids, exchange offers, tender offers, spin-offs, liquidations, corporate restructuring, and other similar transactions. Similarly, substantial risks are involved in investments in companies facing negative publicity or uncertain litigation. Thus, there can be no assurance that any expected transaction will take place, that negative publicity will not continue to affect a company or that litigation will be resolved in a company’s favor. Certain transactions are dependent on one or more factors to become effective, such as market conditions which may lead to unexpected positive or negative changes in a company profile, shareholder approval, regulatory and various other third party constraints, changes in earnings or business lines or shareholder activism as well as many other factors. No assurance can be given that the transactions entered into will result in a profitable investment for the Investment Funds or that the Investment Funds will not incur substantial losses.

The issuers of securities acquired by Investment Funds sometimes involve a high degree of business and financial risk. These companies may be in an early stage of development, may not have a proven operating history, may be operating at a loss or have significant variations in operating results, may be engaged in a rapidly changing business with products subject to a substantial risk of obsolescence, may require substantial additional capital to support their operations, to finance expansion or to maintain their competitive position, or may otherwise have a weak financial condition.

Issuers of securities acquired by Investment Funds may be highly leveraged. Leverage may have important adverse consequences to these companies and an Investment Fund as an investor. These companies may be subject to restrictive financial and operating covenants. The leverage may impair these companies’ ability to finance their future operations and capital needs. As a result, these companies’ flexibility to respond to changing business and economic conditions and to business opportunities may be limited. A leveraged company’s income and net assets will tend to increase or decrease at a greater rate than if borrowed money were not used.

In addition, such companies may face intense competition, including competition from companies with greater financial resources, more extensive development, manufacturing, marketing, and other capabilities, and a larger number of qualified managerial and technical personnel.

Management of the TEI Fund has evaluated the need for additional disclosures and/or adjustments resulting from subsequent events through the date the financial statements were issued. Based on this evaluation, no adjustments were required to the financial statements, and there were no subsequent events that needed to be disclosed other than those events that have been disclosed elsewhere in these financial statements.

25

PMF TEI FUND, L.P.

(A Limited Partnership)

Notes to Financial Statements, continued

March 31, 2024

As of April 1, 2024, the end of the 10-year passive liquidation period, Cypress Creek Partners, acting as Adviser and Liquidation Administration Agent of the Fund, has been granted additional authority by the Fund’s governing documents to actively liquidate any remaining investments. A broker was hired by the Fund to run a secondary market evaluation for the remaining portfolio. On May 10, 2024, the Master Fund executed a Purchase and Sales Agreement (“PSA”) to sell approximately one-third of the portfolio (as a percent of NAV) to a qualified buyer. The transaction is scheduled to close on or around June 30, 2024. Management of the Master Fund evaluated this subsequent event and in accordance with the Fund’s valuation policy, adjusted the fair values of the Investment Funds subject to the agreement to reflect the values assigned to those investments in the agreement by ($12,515,857) in the aggregate as of March 31, 2024. Management of the Master Fund has assessed the need for additional disclosures and/or adjustments resulting from subsequent events through the date the financial statements were issued and concluded that no further adjustments were required to the financial statements as of March 31, 2024.

26

PMF TEI FUND, L.P.

(A Limited Partnership)

Supplemental Information

March 31, 2024

(Unaudited)

Directors and Officers

The TEI Fund’s operations are managed under the direction and oversight of the Board. Each Director serves for an indefinite term or until he or she reaches mandatory retirement, if any, as established by the Board. The Board appoints the officers of the TEI Fund who are responsible for the TEI Fund’s day-to-day business decisions based on policies set by the Board. The officers serve at the pleasure of the Board.

Compensation for Directors

The Endowment PMF Master Fund, L.P., PMF Fund, L.P., and PMF TEI Fund, L.P., together pay each of the Directors who is not an “interested person” of the Adviser, as defined in the 1940 Act (the “Independent Directors”), an annual retainer of $35,000 paid quarterly. There are currently four Independent Directors. In the interest of retaining Independent Directors of the highest quality, the Board intends to periodically review such compensation and may modify it as the Board deems appropriate.

The table below shows, for each Director and executive officer, their full name, address and age, the position held with the Fund, the length of time served in that position, their principal occupation during the last five years, and other directorships held by such Director. The address of each Director and officer is c/o Endowment PMF Fund, 712 W. 34th Street, Suite 201, Austin, TX 78705. The Fund’s Statement of Additional Information includes additional information about the Directors and is available free of charge, upon request, by calling toll-free 1-800-725-9456.

Interested Director

Name and Year of Birth | Position(s)

Held | Principal

Occupation(s) During

the Past 5 Years | Number of

Portfolios

in Fund

Complex

Overseen

by Director(1) | Other

Directorships

Held by

Director During the

Past 5 Years |

William P. Prather, III

Year of birth: 1982 | Director, Principal Executive Officer (Since 2021) | Cypress Creek Partners (Investment Management) – Chief Investment Officer and Founding Partner (2019-Current); University of Texas / Texas A&M Investment Management Company (Endowment – Investment Management) – Head of Infrastructure and Natural Resources (2014-2019). | 7 | MTi Group Ltd (Director) from 2019 to January 2023. |

(1) | The ‘Fund Complex’ for the purpose of this table consists of The Endowment PMF Funds (three funds) and Cypress Creek Private Strategies Funds (four funds) with all funds in the Fund Complex being advised by the Adviser. |

27

PMF TEI FUND, L.P.

(A Limited Partnership)

Supplemental Information, continued

March 31, 2024

(Unaudited)

Independent Directors

Name and Year of Birth | Position(s)

Held | Principal

Occupation(s) During

the Past 5 Years | Number of

Portfolios

in Fund

Complex

Overseen

by Director(1) | Other

Directorships

Held by

Director During the

Past 5 Years |

Graeme Gunn

Year of birth: 1967 | Director (Since 2021) | SL Capital Partners LLP; Partner.

| 7 | 3 Bridges Capital; Director;

Sport Maison Limited; Director. |

Victor L. Maruri

Year of birth: 1952 | Director (Since 2021) | Managing Partner, HCP Management Co., LLC (investment company). | 7 | HCP ED Holdings (holding company) (since 2010); HPE II (investment company) (since 2008); MIAT College, Inc. (2014-2021) (trade school); Taylor College Inc. (trade school) (2013-2021);

Career Training Academy (trade school) (2011-2020). |

David Munoz

Year of birth: 1974 | Director (Since 2021) | President and CEO of financial services company. Advisor to multiple financial services companies. | 7 | Deltec International Group; Deltec Bank & Trust Limited; International Financial Services Group Limited; International Financial Services Group SA/CV; Deltec Investment Advisers Limited; Deltec Fund Services; Deltec U.S. Holdings Inc.; Deltec Wealth Management LLC; Deltec Securities Ltd.; Deltec Capital Limited; Long Cay Captive Insurance Management; Halcyon Life Insurance Limited.; Access Personal Finance LLC; Global Clearing & Settlement Assurance LLC. |

28

PMF TEI FUND, L.P.

(A Limited Partnership)

Supplemental Information, continued

March 31, 2024

(Unaudited)

Name and Year of Birth | Position(s)

Held | Principal

Occupation(s) During

the Past 5 Years | Number of

Portfolios

in Fund

Complex

Overseen

by Director(1) | Other

Directorships

Held by

Director During the

Past 5 Years |

Carl Weatherley-White

Year of birth: 1962 | Director (Since 2021) | Managing Director, Greenbacker Capital (investment company) (since 2024); Managing Director, Advantage Capital (investment company) (since 2019-2024); Chief Executive, Hoosier Solar Holdings, LLC (solar development company) (Since 2020); Chief Executive, VivoPower Holdings (solar development company) (from 2016 to 2019). | 7 | |

(1) | The ‘Fund Complex’ for the purpose of this table consists of The Endowment PMF Funds (three funds) and Salient Private Access Funds (four funds) with all funds in the Fund Complex being advised by the Adviser. |

Officers of the Fund Who Are Not Directors*

Name and Year of Birth | Position(s) Held with the Fund | Principal Occupation(s) During the

Past 5 Years |

Frederick C. Teufel, Jr.

Year of birth: 1959 | Principal Financial Officer, Chief Compliance Officer and Treasurer (Since 2024). | Director – Vigilant Compliance, LLP since 2020; Visiting Professor of Accounting, Saint Joseph’s University, Philadelphia, PA (2015 – 2021). |

J. Henry Glenn

Year of birth: 1988 | Secretary (Since 2023). | Managing Director – Cypress Creek Partners (2021-present); Associate Director – University of Texas/Texas A&M Investment Management Company (2016-2021). |

29

PMF TEI FUND, L.P.

(A Limited Partnership)

Supplemental Information, continued

March 31, 2024

(Unaudited)

Allocation of Investments

The following chart indicates the allocation of investments among the asset classes in the Master Fund as of March 31, 2024.

Asset Class (1) | | Fair Value | | | % | |

Energy | | $ | 24,765,029 | | | | 13.50 | |

Event-Driven | | | 3,594,924 | | | | 1.96 | |

Private Equity | | | 139,200,908 | | | | 75.90 | |

Real Estate | | | 15,309,560 | | | | 8.35 | |

Relative Value | | | 532,336 | | | | 0.29 | |

Total Investments | | $ | 183,402,757 | | | | 100.00 | |

(1) | The complete list of investments included in the following asset class categories is included in the Schedule of Investments of the Master Fund. |

Board Consideration of the Investment Management Agreements

At an in-person meeting held on February 1, 2024 (“Meeting”), the Fund’s Board of Directors (“Board”), including all the Fund’s directors who are not “interested persons” as defined under the 1940 Act (“Independent Directors”), considered and unanimously approved the continuation of the Investment Management Agreement between the Fund and the Adviser (the “Advisory Agreement”). In preparation for review of the Advisory Agreement, the Board requested the Adviser to provide detailed information which the Board determined to be reasonably necessary to evaluate the agreement. The Independent Directors met on January 23, 2024 (“Pre-Meeting”), to discuss the responses with the Adviser, and also met in executive session prior to the Meeting to review and discuss aspects of the materials. At both the Pre-Meeting and the Meeting, at the request of the Independent Directors, the Adviser made presentations regarding the materials and responded to questions from the Independent Directors relating to, among other things, portfolio management and planning, the Master Fund’s investment program and impending active liquidation phase, the Master Fund’s and Adviser’s compliance programs, Adviser staffing and management changes, Master Fund performance including benchmarks and comparisons to other funds, Master Fund fee levels, other portfolios (including fees) managed by the Adviser and the Adviser’s profitability (including revenue of the Adviser from its service relationships and across all of its funds). The Board, including the Independent Directors, also took into consideration information furnished for the Board’s review and consideration throughout the year at regular Board meetings. The Independent Directors were assisted at all times by independent counsel.

Following the Board’s review, the Independent Directors at the Meeting reported that they had concluded that the Advisory Agreement enables the Fund’s partners to obtain high quality services, noting the continuation of such services at no fee following March 31, 2024. As of that date, the Master Fund enters its mandated active liquidation phase, and the Advisory Agreement provides that the advisory fee ceases. The Independent Directors noted that because the fee, by the terms of the Advisory Agreement, ceases, it is appropriate, reasonable, and in the interests of investors. The Board considered that the services to be provided under the Advisory Agreement will continue during active liquidation following cessation of the fee. They stated that prudent exercise of judgment warranted renewal of the Advisory Agreement. It also was noted that the Board’s decision to renew the Advisory Agreement was not based on any single factor, but rather was based on a comprehensive consideration of all the information provided to the Board at its meetings. Upon consideration of these and other factors, the Board also determined:

30

PMF TEI FUND, L.P.

(A Limited Partnership)

Supplemental Information, continued

March 31, 2024

(Unaudited)

The nature, extent and quality of the advisory services provided. With respect to the Investment Advisory Agreement, the Board considered: the unique characteristics and special purposes of the Fund’s operations and the specific services provided in overseeing the Fund; the background and experience of key personnel; the Adviser’s successful implementation of the passive liquidation program and the considerable distributions made by the Fund; that the Master Fund following March 31, 2024 is entering a new phase of active liquidation; the conduct and oversight of the Fund’s operations; that the Adviser’s existing non-investment advisory services provided as liquidation agent will continue during the Master Fund’s active liquidation phase; the Adviser’s significant compliance and tax reporting functions; and the Adviser’s oversight of and interaction with service providers.

The Board concluded that the nature, extent and quality of the management and advisory service provided were appropriate and thus supported a decision to renew the Investment Advisory Agreement. The Board also concluded that the Adviser would be able to provide during the coming year quality investment management and related services, and that these services are appropriate in scope and extent in light of the Fund’s operations and investor needs.

The investment performance. The Board evaluated the comparative information provided by the Adviser regarding the Fund’s investment performance, noting the largely irrelevant nature of any other funds in comparison due to the Fund’s purpose and objective of successful and efficient liquidation of its existing portfolio. The Board also considered that the primary focus of the Fund was orderly passive liquidation and noted the distribution of assets by the Fund over time. The Board took into account the Fund’s overall performance and the commencement as of March 31, 2024 of the active liquidation phase for the remaining Master Fund portfolio assets. The Board concluded that the Adviser continued to be successful in seeking the Fund’s objective. Based on the Directors’ assessment, the Directors concluded that the Adviser was capable of undertaking the Fund’s management as appropriate in light of the Fund’s investment objective and strategies.

The cost of advisory service provided and the level of profitability. In analyzing the cost of services and profitability of the Adviser during the period when the Fund pays the advisory fee, the Board considered the revenues earned and expenses incurred by the Adviser. The Board noted that the fee under the Advisory Agreement, by the agreement’s terms, would cease as of March 31, 2024 when the Master Fund’s partnership agreement required active liquidation of the portfolio and no further advisory fee. The Board also noted that the non-advisory liquidation services provided to the Master Fund by the Adviser, as authorized by the Master Fund’s limited partnership agreement, would continue under the existing separate liquidation agent agreement with the Adviser, and the Board would continue to review such services routinely. On the basis of the Board’s review, the Board concluded that the zero fee in the Advisory Agreement is reasonable.

The extent to which economies of scale would be realized as the Fund grows and whether fee levels reflect these economies of scale for the benefit of Fund investors. The Board noted that because the Master Fund’s size will certainly decline as it enters active liquidation on March 31, 2024, that economies of scale are not present or likely to be present. The Board concluded that the advisory fee will cease, and took into account continuing services by the Adviser under the Advisory Agreement during liquidation.

Benefits (such as soft dollars) to the Adviser from its relationship with the Fund. The Board concluded that other benefits derived by the Adviser from its relationship with the Fund are necessary and appropriate in that fees from the continuing liquidation agent services agreement with the Adviser reflect the Master Fund’s complicated liquidation support. The Board noted that liquidation would be unlikely to result in the Master Fund trading securities and thus unlikely to incur brokerage.

31

PMF TEI FUND, L.P.

(A Limited Partnership)

Supplemental Information, continued

March 31, 2024

(Unaudited)

Other considerations. The Board determined that the Adviser has made a continuing and substantial commitment both to the recruitment of high quality personnel, monitoring and investment decision-making and provision of investor service, has planned appropriately for the commencing active liquidation of the Master Fund, and has the financial, compliance and operational resources reasonably necessary to manage the Fund in a professional manner that is consistent with the best interests of the Fund and its partners.

Form N-PORT Filings

The TEI Fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. The TEI Fund’s Form N-PORTs are available on the SEC’s website at http://www.sec.gov.

Proxy Voting Policies

A description of the policies and procedures that the TEI Fund uses to determine how to vote proxies relating to portfolio securities is available (i) without charge, upon request, by calling 1-800-725-9456; and (ii) on the Securities and Exchange Commission website at http://www.sec.gov.

Information regarding how the TEI Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 is available (i) without charge, upon request, by calling 1-800-725-9456; and (ii) on the Securities and Exchange Commission website at http://www.sec.gov.

Additional Information

The TEI Fund’s private placement memorandum (the “PPM”) includes additional information about Directors of the TEI Fund. The PPM is available, without charge, upon request by calling 1-800-725-9456.

32

PMF TEI FUND, L.P.

(A Limited Partnership)

Privacy Policy

(Unaudited)

FACTS | WHAT DOES CYPRESS CREEK PARTNERS (“CCP”) DO WITH YOUR PERSONAL INFORMATION? |

| | | | |

WHY? | Financial companies choose how they share your personal information. Federal law gives consumers the right to limit some but not all sharing. Federal law also requires us to tell you how we collect, share, and protect your personal information. Please read this notice carefully to understand what we do. |

| | | | |

WHAT? | The types of personal information we collect and share depend on the product or service you have with us. This information can include: ● Social security number ● Income ● Assets ● Account balances ● Wire transfer instructions ● Transaction history When you are no longer our customer, we continue to share information about you as described in this notice. |

| | | | |

HOW? | All financial companies need to share customers’ personal information to run their everyday business. In the section below, we list the reasons financial companies can share their customers’ personal information; the reasons CCP chooses to share; and whether you can limit this sharing. |

| | | | |

Reasons we can share your personal information | Does CCP Share? | Can you limit this sharing? |

For our everyday business purposes -

such as to process your transactions, maintain your accounts(s) or respond to court orders and legal investigations. | Yes | No |

For our marketing purposes -

to offer our products and services to you | Yes | No |

For joint marketing with other financial companies | No | We do not share |

For our affiliates’ everyday business purposes -

information about your transactions and experiences | No | We do not share |

For our affiliates’ everyday business purposes –

information about your creditworthiness | No | We do not share |

For non-affiliates to market to you | No | We do not share |

| | |

Questions? | Call CCP at (512) 660-5146 |

33

PMF TEI FUND, L.P.

(A Limited Partnership)

Privacy Policy, continued

(Unaudited)

Page 2 | |

Who we are |

Who is providing this notice? | This notice pertains to CCP, the registered and private funds it manages (as follows), and each funds’ general partner. ● The Endowment PMF Master Fund, L.P. ● The PMF Fund, L.P. ● PMF TEI Fund, L.P. ● PMF Offshore TEI Fund, Ltd. ● Cypress Creek Private Strategies Master Fund, L.P. ● Cypress Creek Private Strategies Registered Fund, L.P. ● Cypress Creek Private Strategies TEI Fund, L.P. ● Cypress Creek Private Strategies Institutional Fund, L.P. ● Cypress Creek Private Strategies Domestic Fund, L.P. ● Cypress Creek Private Strategies Domestic QP Fund, L.P. ● Cypress Creek Private Strategies International Fund, Ltd. ● Cypress Creek Private Strategies Offshore TEI Fund, Ltd. ● Cypress Creek Private Strategies Onshore Fund, L.P. ● Cypress Creek Private Strategies Offshore Fund, L.P. ● Cypress Creek Private Strategies Offshore Blocker Fund, LLC ● CCP Coastal Redwood Fund, L.P. ● CCP Sierra Redwood Fund, L.P. ● Marinas I SPV LLC ● CCP GP Fund LLC ● CCP Trinity Aquifer, LLC ● CCP Dawn Redwood Fund, L.P. |

What we do |

How does CCP protect my personal information? | To protect your personal information from unauthorized access and use, we use security measures that comply with federal law. These measures include computer safeguards and secured files and buildings. |

How does CCP collect my personal information? | We collect your personal information, for example, when you ● Open an account ● Enter into an investment advisory contract ● Seek financial advice ● Make deposits or withdrawals from your account ● Provide account information |

Why can’t I limit all sharing? | Federal law gives you the right to limit only ● sharing for affiliates’ everyday business purposes—information about your creditworthiness ● affiliates from using your information to market to you ● sharing for nonaffiliates to market to you State laws and individual companies may give you additional rights to limit sharing. |

34

PMF TEI FUND, L.P.

(A Limited Partnership)

Privacy Policy, continued

(Unaudited)

Page 3 | |

Definitions |

Affiliates | Companies related by common ownership or control. They can be financial and nonfinancial companies. ● CCP does not share with our affiliates. |

Non-affiliates | Companies not related by common ownership or control. They can be financial and non-financial companies. ● CCP does not share with non-affiliates so they can market to you. |

Joint Marketing | A formal agreement between non-affiliated financial companies that together market financial products or services to you. ● CCP does not jointly market. |

Other important information |

n/a |

35

PMF OFFSHORE TEI FUND, LTD.

(A Company Limited By Shares)

Financial Statements

March 31, 2024

(With Independent Auditor’s Report Thereon)

Also Including

THE ENDOWMENT PMF MASTER FUND, L.P.

(A Limited Partnership)

Financial Statements

March 31, 2024

(With Report of Independent Registered Public Accounting Firm)

This page intentionally left blank.

Independent Auditor’s Report

The Managing Member PMF

Offshore TEI Fund, Ltd.

Opinion

We have audited the financial statements of PMF Offshore TEI Fund, Ltd. (the Fund), which comprise the statement of assets and liabilities as of March 31, 2024, the related statements of operations, changes in net assets and cash flows for the year then ended, and the related notes to the financial statements.

In our opinion, the accompanying financial statements present fairly, in all material respects, the financial position of the Fund as of March 31, 2024, and the results of its operations, changes in net assets and its cash flows for the year then ended, in accordance with accounting principles generally accepted in the United States of America.

Emphasis of a Matter

As described in Notes 1 and 8 to the financial statements, in accordance with its limited partnership agreement, the Fund entered into active liquidation effective April 1, 2024. Our opinion is not modified with respect to this matter.

Basis for Opinion

We conducted our audit in accordance with auditing standards generally accepted in the United States of America (GAAS). Our responsibilities under those standards are further described in the Auditor’s Responsibilities for the Audit of the Financial Statements section of our report. We are required to be independent of the Fund and to meet our other ethical responsibilities, in accordance with the relevant ethical requirements relating to our audit. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion.

Responsibilities of Management for the Financial Statements

Management is responsible for the preparation and fair presentation of the financial statements in accordance with accounting principles generally accepted in the United States of America, and for the design, implementation and maintenance of internal control relevant to the preparation and fair presentation of financial statements that are free from material misstatement, whether due to fraud or error.

In preparing the financial statements, management is required to evaluate whether there are conditions or events, considered in the aggregate, that raise substantial doubt about the Fund’s ability to continue as a going concern within one year after the date that the financial statements are issued or available to be issued.

Auditor’s Responsibilities for the Audit of the Financial Statements

Our objectives are to obtain reasonable assurance about whether the financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditor’s report that includes our opinion. Reasonable assurance is a high level of assurance but is not absolute assurance and therefore is not a guarantee that an audit conducted in accordance with GAAS will always detect a material misstatement when it exists. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control. Misstatements are considered material if there is a substantial likelihood that, individually or in the aggregate, they would influence the judgment made by a reasonable user based on the financial statements.

38

Independent Auditor’s Report

In performing an audit in accordance with GAAS, we:

| | ● | Exercise professional judgment and maintain professional skepticism throughout the audit. |

| | ● | Identify and assess the risks of material misstatement of the financial statements, whether due to fraud or error, and design and perform audit procedures responsive to those risks. Such procedures include examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. |

| | ● | Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control. Accordingly, no such opinion is expressed. |

| | ● | Evaluate the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluate the overall presentation of the financial statements. |

| | ● | Conclude whether, in our judgment, there are conditions or events, considered in the aggregate, that raise substantial doubt about the Fund’s ability to continue as a going concern for a reasonable period of time. |

We are required to communicate with those charged with governance regarding, among other matters, the planned scope and timing of the audit, significant audit findings, and certain internal control-related matters that we identified during the audit.

/s/ RSM US LLP

Chicago, Illinois

May 30, 2024

39

PMF OFFSHORE TEI FUND, LTD.

(A Company Limited By Shares)

Statement of Assets and Liabilities

March 31, 2024

Assets | | | | |

Investment in the Master Fund, at fair value | | $ | 56,891,295 | |

Receivable from the Master Fund | | | 3,591,868 | |