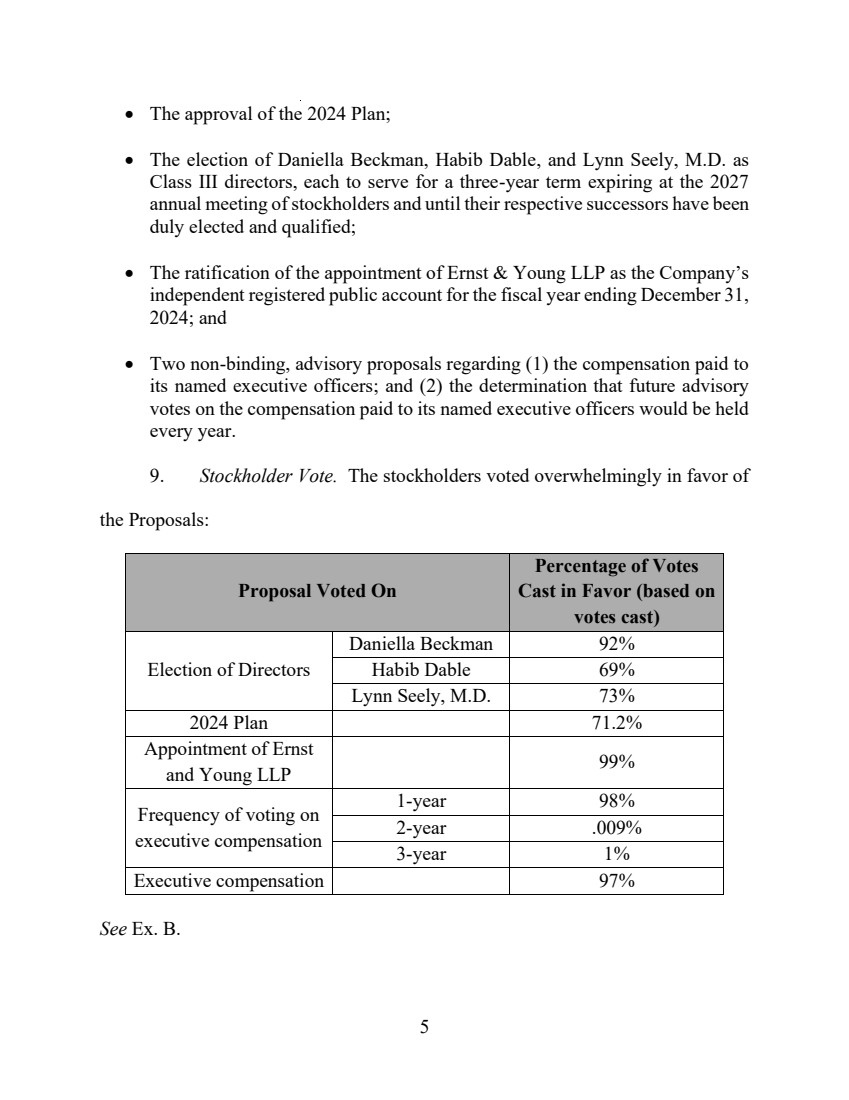

| 6 10. Stockholder Base. Blueprint has a stable stockholder base with relatively few shares of stock traded each day. Its average daily trading volume between January 1, 2024 and June 30, 2024 was just 716,527, representing approximately 1% of the common stock outstanding.2 Based on publicly available information, the trading volume for April 15 (i.e., the next trading day after April 12 and within 60 days of the Annual Meeting date) was 506,386 shares. This is approximately 0.8% of the stock outstanding as of April 15. If an additional 506,386 shares were changed from “for” votes to “against” votes, the Proposals still would have been adopted. 3 The defect in setting the Record Date for Friday, April 12 instead of Saturday, April 13 (or immediately prior to the opening of the market on Monday, April 15) did not affect the stockholder vote at the Annual Meeting. 11. The Taylor Action. On November 22, 2024, a purported stockholder of Blueprint filed the action captioned Taylor v. Haviland, et al., C.A. No. 2024-1203- JTL (the “Taylor Action”) and asked the Court to invalidate the actions taken at the 2https://finance.yahoo.com/quote/BPMC/history/?period1=1704067200&period2= 1719705600. 3 For the 2024 Plan, the difference between the 41,494,784 “for” votes actually cast and 506,386 is 40,988,398. Dividing that amount by the 60,341,342 shares deemed present and entitled to vote on the 2024 Plan means that 67.9% would still have approved the 2024 Plan. For the director election, 88.6% would still have voted “for” Daniella Beckman, 66.7% would still have voted “for” Habib Dable, and 69.9% would still have voted “for” Lynn Seely, M.D. |