UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

_____________________

Filed by the Registrant x Filed by a Party other than the Registrant o

Check the appropriate box:

| | | | | |

| o | Preliminary Proxy Statement |

| |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| x | Definitive Proxy Statement |

| |

| o | Definitive Additional Materials |

| |

| o | Soliciting Material under §240.14a-12 |

ViewRay, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | | | | | |

| x | No fee required. |

| o | Fee paid previously with preliminary materials. |

| o | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

VIEWRAY, INC.

2 Thermo Fisher Way

Oakwood Village, OH 44146

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JUNE 10, 2022

To the Stockholders of ViewRay, Inc.:

NOTICE IS HEREBY GIVEN that the 2022 Annual Meeting of Stockholders (the “Annual Meeting”) of ViewRay, Inc., a Delaware corporation (referred to herein as the “Company,” “we” or “our”), will be held virtually via live audio webcast on June 10, 2022, at 8:30 a.m. Pacific Time, for the following purposes:

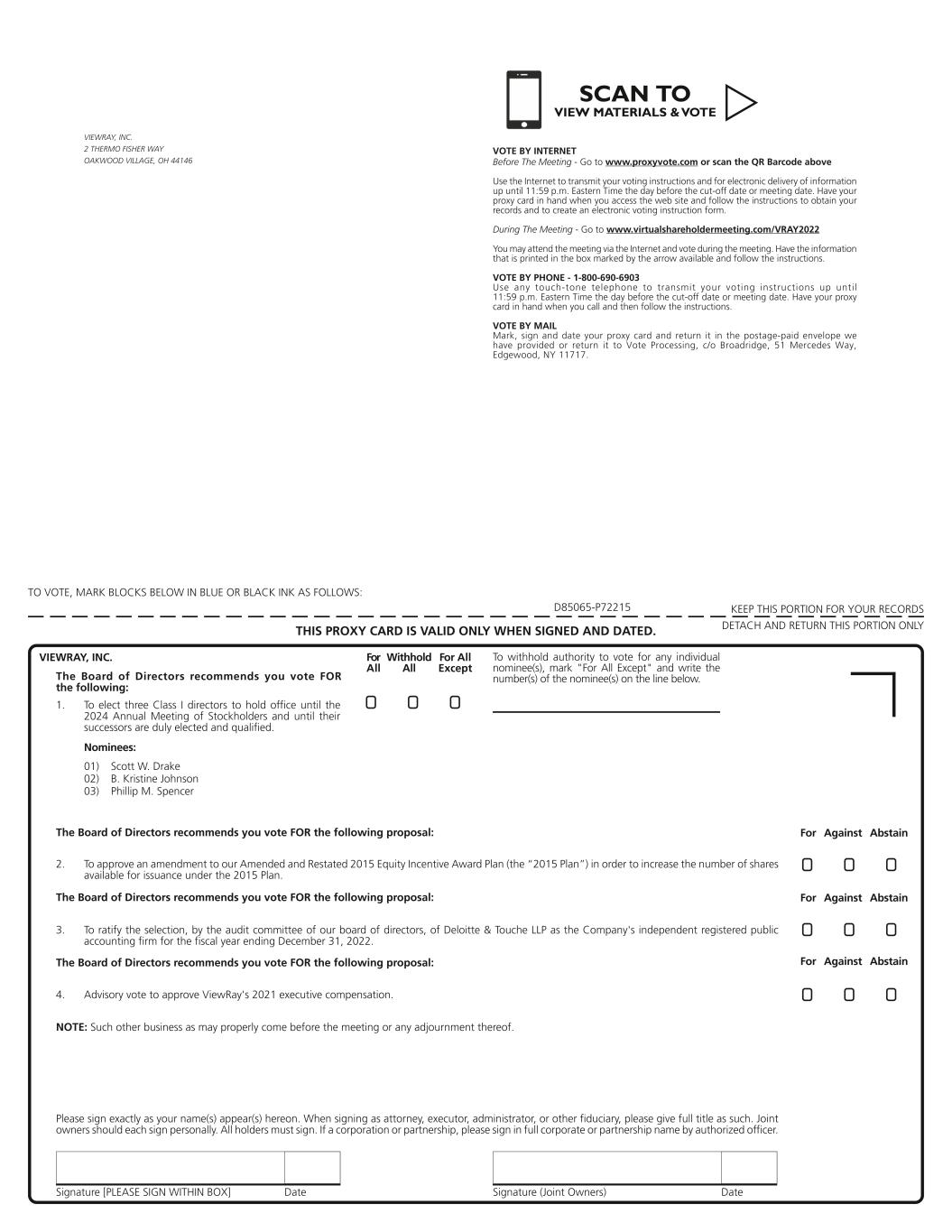

1.To elect the three Class I directors named in the Proxy Statement to hold office until the annual meeting of stockholders to be held in 2024 and until their successors are duly elected and qualified;

2.To approve an amendment to our Amended and Restated 2015 Equity Incentive Award Plan (the “2015 Plan”) in order to increase the number of shares available for issuance under the 2015 Plan;

3.To ratify the selection, by the audit committee (the “Audit Committee”) and our board of directors (the “Board”), of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2022;

4.To conduct an advisory vote to approve ViewRay’s 2021 executive compensation; and

5.To transact such other business as may properly come before the Annual Meeting or any adjournment thereof.

These proposals are more fully described in the Proxy Statement following this Notice. Only stockholders who owned our common stock at the close of business on April 18, 2022 (the “Record Date”) can vote at this meeting or any adjournments that take place.

We have elected to use the Internet as our primary means of providing our proxy materials to stockholders. Consequently, stockholders will not receive paper copies of our proxy materials unless they specifically request them. We will send a Notice of Internet Availability of Proxy Materials (the “Notice”) on or about April 29, 2022 to our stockholders of record as of the close of business on the Record Date. We are also providing access to our proxy materials over the Internet beginning on or about April 29, 2022. Electronic delivery of our proxy materials will significantly reduce our printing and mailing costs, and the environmental impact of the proxy materials.

The Annual Meeting can be accessed by visiting www.virtualshareholdermeeting.com/VRAY2022, where you will be able to listen to the meeting live, submit questions and vote online. To participate in the Annual Meeting, you will need the 16-digit control number included on the Notice or on the proxy card that you request and receive by mail or e-mail. The Notice contains instructions for accessing the proxy materials, including the Proxy Statement and our annual report, and provides information on how stockholders may obtain paper copies free of charge. The Notice also provides the date and time of the Annual Meeting; the matters to be acted upon at the meeting and the recommendation from our board of directors with regard to each matter; and information on how to attend the meeting and vote online.

It is important that your shares be represented and voted whether or not you plan to attend the virtual Annual Meeting. You may vote on the Internet, by telephone or by completing and mailing a proxy card or the form forwarded by your bank, broker or other holder of record. Voting over the Internet, by telephone or by written proxy will ensure your shares are represented at the Annual Meeting. Please review the instructions on the proxy card or the information forwarded by your bank, broker or other holder of record regarding each of these voting options.

The Board recommends that you vote (i) FOR the election of the Class I director nominees named in Proposal No. 1, (ii) FOR the amendment to the 2015 Plan in order to increase the number of shares available for issuance under the 2015 Plan as described in Proposal No. 2, (iii) FOR the ratification of the selection, by the Audit Committee and the Board, of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2022 as described in Proposal No. 3, and (iv) FOR the approval, on an advisory basis, of ViewRay’s 2021 executive compensation as described in Proposal No. 4.

| | | | | |

| By order of the Board of Directors, |

| |

| /s/ Scott W. Drake |

| Scott W. Drake President and Chief Executive Officer |

Oakwood Village, Ohio

April 29, 2022

YOUR VOTE IS IMPORTANT

PLEASE PROMPTLY AUTHORIZE A PROXY TO CAST YOUR VOTES THROUGH THE INTERNET FOLLOWING THE VOTING PROCEDURES DESCRIBED IN THE NOTICE OR, IF YOU HAVE REQUESTED AND RECEIVED PAPER COPIES OF THE PROXY MATERIALS, BY TELEPHONE OR BY SIGNING, DATING AND RETURNING THE PROXY CARD SENT TO YOU.

TABLE OF CONTENTS

VIEWRAY, INC.

2 Thermo Fisher Way

Oakwood Village, OH 44146

PROXY STATEMENT

FOR THE 2022 ANNUAL MEETING OF STOCKHOLDERS

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIAL FOR THE

STOCKHOLDER MEETING TO BE HELD ON JUNE 10, 2022

The Board of ViewRay, Inc. is soliciting your proxy to vote at our 2022 Annual Meeting of Stockholders to be held virtually via live audio webcast on June 10, 2022, at 8:30 a.m. Pacific Time, and any adjournment or postponement of that meeting (the “Annual Meeting”). The Annual Meeting can be accessed by visiting www.virtualshareholdermeeting.com/VRAY2022, where you will be able to listen to the meeting live, submit questions and vote online. To participate in the Annual Meeting, you will need the 16-digit control number included on the Notice of Internet Availability of Proxy Materials or on the proxy card that you request and receive by mail or e-mail.

This Proxy Statement is dated as of April 29, 2022. As used in this Proxy Statement henceforward, unless otherwise stated or the context clearly indicates otherwise, the terms the “Company,” the “Registrant,” “ViewRay,” “we,” “us” and “our” refer to ViewRay, Inc., a Delaware corporation.

In addition to solicitations by mail, our directors, officers and regular employees, without additional remuneration, may solicit proxies by telephone, e-mail and personal interviews. All costs of solicitation of proxies will be borne by us. Brokers, custodians and fiduciaries will be requested to forward proxy soliciting material to the owners of stock held in their names, and we will reimburse them for their reasonable out-of-pocket expenses incurred in connection with the distribution of proxy materials.

We have elected to provide access to our proxy materials on the Internet. Accordingly, we are sending a Notice of Internet Availability of Proxy Materials to our stockholders of record as of April 18, 2022 (the “Record Date”), while brokers and other nominees who hold shares on behalf of beneficial owners will be sending their own similar notice. All stockholders will have the ability to access the proxy materials on the website referred to in the Notice of Internet Availability of Proxy Materials, or to request a printed set of the proxy materials. Instructions on how to request a printed copy by mail or e-mail may be found in the Notice of Internet Availability of Proxy Materials and on the website referred to in the Notice of Internet Availability of Proxy Materials, including an option to request paper copies on an ongoing basis. We are making this Proxy Statement available on the Internet on or about April 29, 2022 and are mailing the Notice of Internet Availability of Proxy Materials to all stockholders entitled to vote at the Annual Meeting on or about April 29, 2022. We intend to mail or e-mail this Proxy Statement, together with a proxy card, to those stockholders entitled to vote at the Annual Meeting who have properly requested copies of such materials by mail or e-mail, within three business days of request.

The only voting securities of ViewRay are shares of common stock, $0.01 par value per share (the “common stock”), of which there were 180,455,595 shares outstanding as of the Record Date. We need the holders of a majority in voting power of the shares of common stock issued and outstanding and entitled to vote, present by remote communication or represented by proxy, to hold the Annual Meeting.

The Company’s Annual Report on Form 10-K, which contains financial statements for fiscal year December 31, 2021 (the “Annual Report”), accompanies this Proxy Statement if you have requested and received a copy of the proxy materials in the mail. Stockholders that receive the Notice of Internet Availability of Proxy Materials can access this Proxy Statement and the Annual Report at the website referred to in the Notice of Internet Availability of Proxy Materials. The Annual Report and this Proxy Statement are also available on the “SEC Filings” section of our investor relations website at http://investors.viewray.com and at the website of the Securities and Exchange Commission (the “SEC”) at www.sec.gov. Please note that the information on our website is not part of this Proxy Statement. You also may obtain a copy of ViewRay’s Annual Report, without charge, by writing to our Investor Relations department at the above address.

THE PROXY PROCESS AND STOCKHOLDER VOTING

QUESTIONS AND ANSWERS ABOUT THIS PROXY MATERIAL AND VOTING

Who can vote at the Annual Meeting?

Only stockholders of record at the close of business on the Record Date will be entitled to vote at the Annual Meeting. At the close of business on the Record Date, there were 180,455,595 shares of common stock issued and outstanding and entitled to vote. A list of stockholders entitled to vote at the Annual Meeting will be available during the Annual Meeting by visiting www.virtualshareholdermeeting.com/VRAY2022 and for ten days prior to the meeting during normal business hours at our offices at 2 Thermo Fisher Way, Oakwood Village, Ohio 44146. If you wish to examine the list, you may contact our Corporate Secretary, and arrangements will be made for you to review the list.

Stockholder of Record: Shares Registered in Your Name

If, on the Record Date, your shares were registered directly in your name with the transfer agent for our common stock, American Stock Transfer & Trust Company, LLC (“AST”), then you are a stockholder of record. As a stockholder of record, you may: vote electronically at the Annual Meeting; vote by proxy on the Internet or by telephone; or vote by returning a proxy card, if you request and receive one. Whether or not you plan to attend the Annual Meeting, to ensure your vote is counted, we urge you to vote by proxy on the Internet as instructed in the Notice of Internet Availability of Proxy Materials, by telephone as instructed on the website referred to on the Notice of Internet Availability of Proxy Materials, or (if you request and receive a proxy card by mail or e-mail) by signing, dating and returning the proxy card sent to you or by following the instructions on such proxy card to vote on the Internet or by telephone.

Beneficial Owner: Shares Registered in the Name of a Broker, Bank or Other Agent

If, on the Record Date, your shares were held in an account at a brokerage firm, bank, dealer or other similar organization, then you are the beneficial owner of shares held in “street name” and these proxy materials are being forwarded to you by that organization. The organization holding your account is considered the stockholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to direct your broker or other agent on how to vote the shares in your account. You are also invited to attend the virtual Annual Meeting. However, since you are not the stockholder of record, you may not vote your shares electronically at the Annual Meeting, unless you request and obtain a legal proxy from your broker or other agent who is the record holder of the shares, authorizing you to vote at the Annual Meeting.

What am I being asked to vote on?

You are being asked to vote on four proposals:

•Proposal No. 1: the election of three Class I directors to hold office until the annual meeting of stockholders to be held in 2024 and until their successors are duly elected and qualified;

•Proposal No. 2: a proposal to approve an amendment to the 2015 Plan in order to increase the number of shares available for issuance under the 2015 Plan;

•Proposal No. 3: the ratification of the selection, by the Audit Committee, of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2022; and

•Proposal No. 4: the advisory vote to approve ViewRay’s 2021 executive compensation.

In addition, you are entitled to vote on any other matters that are properly brought before the Annual Meeting.

How does the board of directors recommend I vote on the Proposals?

The Board recommends that you vote:

•FOR each of the Class I director nominees;

•FOR the amendment to the 2015 Plan in order to increase the number of shares available for issuance under the 2015 Plan;

•FOR ratification of the selection, by the Audit Committee, of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2022; and

•FOR the approval, on an advisory basis, of ViewRay’s 2021 executive compensation.

How do I vote?

•For Proposal No. 1, you may either vote “For,” or choose that your vote be “Withheld” from, any of the nominees to the Board.

•For Proposal No. 2, you may either vote “For” or “Against” the proposal, or “Abstain” from voting.

•For Proposal No. 3, you may either vote “For” or “Against” the proposal, or “Abstain” from voting.

•For Proposal No. 4, you may either vote “For” or “Against” the proposal, or “Abstain” from voting.

Please note that by casting your vote by proxy you are authorizing the individuals listed on the proxy to vote your shares in accordance with your instructions and in their discretion with respect to any other matter that properly comes before the Annual Meeting or any adjournments or postponements thereof. The procedures for voting, depending on whether you are a stockholder of record or a beneficial owner, are as follows:

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record, you may vote in any of the following manners:

•To vote over the Internet prior to the Annual Meeting, follow the instructions provided on the Notice of Internet Availability of Proxy Materials or on the proxy card that you request and receive by mail or e-mail. We provide Internet proxy voting to allow you to vote your shares online, with procedures designed to ensure the authenticity and correctness of your proxy vote instructions. However, please be aware that you must bear any costs associated with your Internet access, such as usage charges from Internet access providers and telephone companies.

•To vote by telephone, call the toll-free number found on the proxy card you request and receive by mail or e-mail, or the toll-free number that you can find on the website referred to on the Notice of Internet Availability of Proxy Materials.

•To vote by mail, complete, sign and date the proxy card you request and receive by mail or e-mail and return it promptly. As long as your signed proxy card is received before the Annual Meeting, we will vote your shares as you direct.

•To vote via the virtual meeting website, visit www.virtualshareholdermeeting.com/VRAY2022. You will need the 16-digit control number included on your Notice of Internet Availability of Proxy Materials or on the proxy card that you request and receive by mail or e-mail in order to participate in the virtual Annual Meeting. Instructions on how to attend and participate via the Internet, including how to demonstrate proof of stock ownership, are posted at www.virtualshareholdermeeting.com/VRAY2022.

Even if you plan to participate in the Annual Meeting online, we recommend that you also vote by proxy as described above so that your vote will be counted if you later decide not to participate in the Annual Meeting. The Internet and telephone voting facilities for eligible stockholders of record will close at 11:59 p.m. Eastern Time on June 9, 2022. Even if you have submitted your vote before the Annual Meeting, you may still attend the virtual Annual Meeting and vote electronically. In such case, your previously submitted proxy will be disregarded.

Beneficial Owner: Shares Registered in the Name of Broker, Bank or Other Agent

If you are a beneficial owner of shares registered in the name of your broker, bank or other agent, you should have received a voting instruction card and voting instructions with these proxy materials from that organization, rather than from us. Simply complete and mail the voting instruction card to ensure that your vote is counted or follow the instructions to submit your vote by the Internet or telephone, if those instructions provide for Internet and telephone voting. To vote at the virtual Annual Meeting, you must obtain a valid proxy from your broker, bank or other agent. Follow the instructions from your broker, bank or other agent included with these proxy materials, or contact your broker, bank or other agent to request a proxy form.

Who counts the votes?

Broadridge Financial Solutions, Inc. (“Broadridge”) has been engaged as our independent agent to tabulate stockholder votes, or the Inspector of Election. If you are a stockholder of record, and you choose to vote over the Internet prior to the Annual Meeting or by telephone, Broadridge will access and tabulate your vote electronically, and if you have requested and received proxy materials via mail or e-mail and choose to sign and mail your proxy card, your executed proxy card is returned directly to Broadridge for tabulation. As noted above, if you hold your shares through a broker, your broker (or its agent for tabulating votes of shares held in “street name”) returns one proxy card to Broadridge on behalf of all its clients.

How are votes counted?

Votes will be counted by the Inspector of Election appointed for the Annual Meeting. For Proposal 1, the Inspector of Election will separately count “For” and “Withheld” votes and broker non-votes for each nominee. For Proposal 2, Proposal 3, and Proposal 4, the Inspector of Election will separately count “For” and “Against” votes, abstentions and broker non-votes, if any. If your shares are held by your broker as your nominee (that is, in “street name”), you will need to follow the instructions provided by your broker to instruct your broker how to vote your shares. If you do not give instructions to your broker, your broker can vote your shares with respect to “routine” items, but not with respect to “non-routine” items. See below for more information regarding: “What are “broker non-votes”?” and “Which ballot measures are considered “routine” and “non-routine”?”

What are “broker non-votes”?

Broker non-votes occur when a beneficial owner of shares held in “street name” does not give instructions to the broker or nominee holding the shares as to how to vote on matters deemed “non-routine.” Generally, if shares are held in street name, the beneficial owner of the shares is entitled to give voting instructions to the broker or nominee holding the shares. If the beneficial owner does not provide voting instructions, the broker or nominee can still vote the shares with respect to matters that are “routine,” but not with respect to “non-routine” matters. In the event that a broker, bank, custodian, nominee or other record holder of common stock indicates on a proxy that it does not have discretionary authority to vote certain shares on a particular proposal, then those shares will be treated as broker non-votes with respect to that proposal. Accordingly, if you own shares through a nominee, such as a broker or bank, please be sure to instruct your nominee how to vote to ensure that your vote is counted on each of the proposals.

Which ballot measures are considered “routine” or “non-routine”?

The ratification of the selection, by the Audit Committee, of Deloitte & Touche LLP as our independent registered public accounting firm for the year ending December 31, 2022 (Proposal 3) is considered routine under applicable rules. A broker or other nominee may generally vote on routine matters, and therefore no broker non-votes are expected to exist in connection with Proposal 3. The election of directors (Proposal 1), vote on the amendment to the 2015 Plan in order to increase the number of shares available for issuance under the 2015 Plan (Proposal 2), and advisory vote to approve ViewRay’s executive compensation (Proposal 4) are considered non-routine under applicable rules. A broker or other nominee cannot vote without instructions on non-routine matters, and therefore there may be broker non-votes on Proposal 1, Proposal 2, and Proposal 4.

How many votes are needed to approve the proposal?

With respect to Proposal 1, the election of directors, the three nominees receiving the highest number of “For” votes will be elected. “Withheld” votes and broker non-votes will have no effect on the outcome of this proposal.

With respect to Proposal 2, the affirmative vote of the majority of votes cast (excluding abstentions and broker non-votes) is required for approval. Abstentions and broker non-votes will have no effect on the outcome of this proposal.

With respect to Proposal 3, the affirmative vote of the majority of votes cast (excluding abstentions) is required for approval. Abstentions and broker non-votes will have no effect on the outcome of this proposal.

With respect to Proposal 4, the affirmative vote of the majority of votes cast (excluding abstentions and broker non-votes) is required for approval. Abstentions and broker non-votes will have no effect on the outcome of this proposal.

How many votes do I have?

On each matter to be voted upon, you have one vote for each share of common stock you own as of the Record Date.

What if I return a Proxy Card, but do not make specific choices?

If we receive a signed and dated Proxy Card and that Proxy Card does not specify how your shares are to be voted, your shares will be voted “For” the election of each of the three nominees for director, “For” the amendment to the 2015 Plan in order to increase the number of shares available for issuance thereunder, “For” the ratification of the selection, by the Audit Committee, of Deloitte & Touche LLP as our independent registered public accounting firm for the year ending December 31, 2022, and “For” the approval, on an advisory basis, of ViewRay’s 2021 executive compensation. If any other matter is properly presented at the Annual Meeting, your proxy (one of the individuals named on your Proxy Card) will vote your shares using his or her best judgment.

Who is paying for this proxy solicitation?

We will pay for the entire cost of soliciting proxies. In addition to those proxy materials received by mail or on the Internet, our directors, officers and employees may also solicit proxies in person, by telephone or by other means of communication. Directors, officers and employees will not be paid any additional compensation for soliciting proxies. We may also reimburse brokerage firms, banks and other agents for the cost of forwarding proxy materials to beneficial owners.

What does it mean if I receive more than one Notice of Internet Availability of Proxy Materials or more than one set of printed materials?

If you receive more than one Notice of Internet Availability of Proxy Materials or more than one set of printed materials, your shares are registered in more than one name or are registered in different accounts. In order to vote all the shares you own, you must follow the instructions for voting on each Notice of Internet Availability of Proxy Materials or proxy card you receive via mail or e-mail upon your request, which include voting over the Internet, telephone or by signing and returning any of the proxy cards you request and receive.

Can I change my vote after submitting my proxy vote?

Yes. You can revoke your proxy vote at any time before the final vote at the Annual Meeting. If you are the record holder of your shares, you may revoke your proxy vote in any one of three ways:

•You may submit a new vote on the Internet or by telephone or submit a properly completed proxy card with a later date.

•You may send a written notice that you are revoking your proxy to ViewRay’s Corporate Secretary at 2 Thermo Fisher Way, Oakwood Village, Ohio 44146.

•You may attend the virtual Annual Meeting and vote electronically at the Annual Meeting. Simply attending the virtual Annual Meeting will not, by itself, revoke your proxy.

If your shares are held by your broker, bank or other agent, you should follow the instructions provided by them.

How will voting on any business not described in this Proxy Statement be conducted?

We are not aware of any business to be considered at the Annual Meeting other than the items described in this Proxy Statement. If any other matter is properly presented at the Annual Meeting, your proxy will vote your shares using his or her best judgment.

When are stockholder proposals due for next year’s Annual Meeting?

To be considered for inclusion in next year’s proxy materials, your proposal must be submitted in writing by December 30, 2022, to ViewRay’s Secretary at 2 Thermo Fisher Way, Oakwood Village, Ohio 44146. If you wish to submit a proposal that is not to be included in our proxy materials for the next year’s annual meeting pursuant to the SEC’s shareholder proposal procedures or to nominate a director, you must do so between February 10, 2023 and March 12, 2023; provided that if the date of that annual meeting is more than 30 days before or more than 60 days after June 10, 2023, you must give notice not later than the 90th day prior to the annual meeting date or, if later, the 10th day following the day on which public disclosure of the annual meeting date is first made. You are also advised to review our Amended and Restated Bylaws (the “bylaws”), which contain additional requirements about advance notice of stockholder proposals and director nominations. In addition to satisfying the deadlines in the advance notice provisions of our bylaws, a stockholder who intends to solicit proxies in support of nominees under these advance notice provisions must provide the notice required under Rule 14a-19 to ViewRay’s Secretary no later than April 11, 2023.

What is the quorum requirement?

A quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if the holders of a majority in voting power of the shares of common stock issued and outstanding and entitled to vote are present by remote communication or represented by proxy at the Annual Meeting. On the Record Date, there were 180,455,595 shares of common stock outstanding and entitled to vote.

If you are a stockholder of record, your shares will be counted towards the quorum only if you submit a valid proxy vote or vote at the Annual Meeting. If you are a beneficial owner of shares held in “street name,” your shares will be counted towards the quorum if your broker or nominee submits a proxy for your shares at the Annual Meeting, even if the

proxy results in a broker non-vote due to the absence of voting instructions from you. Abstentions and broker non-votes will be counted towards the quorum requirement. If there is no quorum, either the Chair of the Annual Meeting or a majority in voting power of the stockholders entitled to vote at the Annual Meeting, present by remote communication or represented by proxy, may adjourn the Annual Meeting to another time or place.

How can I find out the results of the voting at the Annual Meeting?

Voting results will be announced by the filing of a Current Report on Form 8-K within four business days after the Annual Meeting. If final voting results are unavailable at that time, we will file an amended Current Report on Form 8-K within four business days of the day the final results are available.

Attending the Annual Meeting

The Annual Meeting can be accessed by visiting www.virtualshareholdermeeting.com/VRAY2022, where you will be able to listen to the meeting live, submit questions and vote online. To participate in the Annual Meeting, you will need the 16-digit control number included on the Notice or on the proxy card that you request and receive by mail or e-mail.

PROPOSAL NO. 1

ELECTION OF DIRECTORS

Until the election of directors at the 2024 annual meeting of stockholders, the Board is divided into three classes. Each class consists, as nearly as possible, of one-third of the total number of directors, and each class has a three-year term. Unless the Board determines that vacancies (including vacancies created by increases in the number of directors) shall be filled by the stockholders, and except as otherwise provided by law, vacancies on the Board may be filled only by the affirmative vote of a majority of the remaining directors.

The Board currently consists of nine seated directors, divided into the three following classes:

•Class I directors: Scott W. Drake, B. Kristine Johnson and Phillip M. Spencer, whose current terms will expire at the Annual Meeting;

•Class II directors: Daniel Moore, Gail Wilensky, Ph.D., and Susan Schnabel, whose current terms will expire at the annual meeting of stockholders to be held in 2023; and

•Class III directors: Caley Castelein, M.D., Brian K. Roberts and Karen Prange, whose current terms will expire at the annual meeting of stockholders to be held in 2024.

Each director elected at the Annual Meeting shall be elected for a two-year term expiring at the annual meeting of stockholders to be held in 2024. Each director elected at the 2023 annual meeting of stockholders shall be elected for a one-year term expiring at the annual meeting of stockholders to be held in 2024. At the 2024 annual meeting of stockholders and each annual meeting of stockholders thereafter, all directors shall be elected for a one-year term expiring at the next annual meeting of stockholders held after such director’s election.

Each director to be elected at the Annual Meeting will hold office from the date of his or her election by the stockholders until the annual meeting of stockholders to be held in 2024 and until that director’s successor is duly elected and has been qualified, or until that director’s earlier death, resignation or removal.

Shares represented by executed proxies will be voted, if authority to do so is not withheld, for the election of the three nominees named below. In the event that any nominee should be unavailable for election as a result of an unexpected occurrence, those shares will be voted for the election of those substitute nominees as the Board may propose. Each person nominated for election has agreed to serve if elected, and management has no reason to believe that any nominee will be unable to serve.

Directors are elected by a plurality of the votes cast at the meeting. However, under our corporate governance guidelines, any nominee for director in an uncontested election (i.e., an election where the only nominees are those recommended by the Board) who receives a greater number of votes “withheld” from his or her election than votes “for” such election (a “Majority Withheld Vote”) will, within five business days of the certification of the shareholder vote by the inspector of elections, tender a written offer to resign from the Board. The nominating and corporate governance committee of the Board (“Nominating and Corporate Governance Committee”) will promptly consider the resignation offer and recommend to the Board whether to accept it. The Nominating and Corporate Governance Committee will consider all factors its members deem relevant in considering whether to recommend acceptance or rejection of the resignation offer. The Board will act on the Nominating and Corporate Governance Committee’s recommendation within 90 days following the certification of the shareholder vote by the inspector of elections. In considering whether to accept the resignation offer, the Board will consider the factors considered by the Nominating and Corporate Governance Committee and any additional information and factors that the Board believes to be relevant. Any director who tenders his or her offer to resign from the Board pursuant to this provision shall not participate in the Nominating and Corporate Governance Committee or Board deliberations regarding whether to accept the offer of resignation.

The following table sets forth, for the Class I directors and for our other current directors, information with respect to their position/office held with the Company and their ages as of April 18, 2022:

| | | | | | | | | | | | | | | | | | | | |

| Name | | Age | | Position with Company | | Position

Since |

| Class I Directors whose terms expire at the Annual Meeting and who are standing for election at the Annual Meeting | | |

| Scott W. Drake | | 54 | | President, Chief Executive Officer and Director | | 2018 |

| B. Kristine Johnson (2) | | 70 | | Director | | 2020 |

| Phillip M. Spencer (2) | | 59 | | Director | | 2021 |

| Class II Directors whose terms expire at the annual meeting of stockholders to be held in 2023 | | |

| Daniel Moore (1)(3) | | 61 | | Board Chair | | 2018 |

| Gail Wilensky, PhD. (3) | | 78 | | Director | | 2019 |

| Susan C. Schnabel | | 60 | | Director | | 2022 |

| Class III Directors whose terms expire at the annual meeting of stockholders to be held in 2024 | | |

| Caley Castelein, M.D. (1)(3) | | 51 | | Director | | 2008 |

| Brian K. Roberts (1)(2) | | 51 | | Director | | 2015 |

| Karen N. Prange (3) | | 58 | | Director | | 2021 |

(1)Member of the Audit Committee.

(2)Member of the Compensation Committee.

(3)Member of the Nominating and Corporate Governance Committee.

Set forth below is biographical information for the nominees and each person whose term of office as a director will continue after the Annual Meeting. The following includes certain information regarding our directors’ individual experience, qualifications, attributes and skills that led the Board to conclude that they should serve as directors.

Nominees for Election to a Two-Year Term Expiring at the Annual Meeting of Stockholders to be Held in 2024

Scott W. Drake has served as our President and Chief Executive Officer and as a member of the Board since July 2018. Mr. Drake has over 30 years of experience in the medical device field. From August 2011 to August 2017, he served as President and Chief Executive Officer, and as a member of the board of directors of The Spectranetics Corporation (NASDAQ: SPNC), a medical device company. From November 2009 to July 2011, he was a Senior Vice President of DaVita Corporation (NYSE: DVA), a provider of kidney care and dialysis. Mr. Drake has served on the board of directors of Paragon 28, Inc. (NYSE: FNA) a medical device manufacturer, since August 2021. Mr. Drake served as the Board Chair of AtriCure, Inc. (NASDAQ: ATRC) from 2013 to April 2021, as well as a member of the board of directors of Zayo Group Holdings, Inc. (NYSE: ZAYO) from November 2018 to March 2020. He has served on the board of directors of Cordis, a privately held medical device manufacturer, since August 2021. He serves as the Chair of the AdvaMed Radiation Therapy Sector as well as a board member for the Medical Device Manufacturers Association. Mr. Drake holds a B.S. in Business Administration from Miami University of Ohio. We believe that Mr. Drake is qualified to serve on our board of directors based on his experience in leading innovative medical technology companies, delivering value to patients and customers, as well as growth for stockholders.

B. Kristine Johnson has served as a member of the Board since April 2020. Since 2000, Ms. Johnson has been President and General Partner of Affinity Capital Management, a venture capital firm. In April 2021, she was appointed Board Chair of AtriCure, Inc. (NASDAQ: ATRC), a medical device company, where she has also served as a member of the board of directors since March 2017. In December 2021, she was appointed to the board of directors of Paragon 28, Inc. (NASDAQ: FNA), a medical device company. Ms. Johnson has served as a member of the board of directors of ClearPoint Neuro (NASDAQ: CLPT), a medical device company, since August 2019. She served as a member of the board of directors of Piper Sandler, an investment banking firm, from 2003 to 2019. Ms. Johnson served as a member of the board of directors of The Spectranetics Corporation (NASDAQ: SPNC), a medical device company, from 2012 to 2017. She held various executive leadership positions at Medtronic (NYSE: MDT) from 1982 to 1999. Ms. Johnson serves as a member of the board of directors of the University of Minnesota Foundation Investment Advisors. She holds a B.A. from St. Olaf College. We believe Ms. Johnson is qualified to serve on our board based on her extensive experience in the medical device industry as well as her depth of knowledge in the investment banking and capital management arenas.

Phillip M. Spencer has served as a member of the Board since February 2021. He has served as President and Chief Executive Officer and as a member of the board of directors of MBI (Mega-Broadband Investments), a private cable and communications company, since 2017. Mr. Spencer served as Chief Executive Officer of Rural Broadband Investments from 2011 to 2017. He has served as a member of the board of directors of Halftime Institute, a leadership organization, since October 2020. From August 2015 to August 2018, Mr. Spencer served as a member of the board of directors of the Truman Medical Foundation, a non-profit medical provider that serves as the public health system for residents of Jackson County and Kansas City, Missouri. He holds a B.S. from Marquette University. We believe Mr. Spencer is qualified to serve on our board of directors based on his extensive technical experience and operational leadership expertise.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR”

THE ELECTION OF EACH CLASS I NOMINEE NAMED ABOVE

Directors Continuing in Office Until the Annual Meeting of Stockholders to be Held in 2023

Daniel Moore has served as a member of the Board and our Board Chair since February 2018. Mr. Moore has served as Board Chair for medical device company LivaNova, PLC (NASDAQ: LIVN) since September 2015. He served as a member of the board of directors for GI Dynamics, Inc. (ASX: GID), a medical device company from 2014 to 2020. From 2012 to 2019, Mr. Moore served as a member of the board of directors of medical device company, BrainScope. He served as a member of the board of directors of TriVascular (NASDAQ: TRIV), a medical device company, from 2010 to 2016. From 2007 to 2015, Mr. Moore served as Chief Executive Officer as well as a member of the board of directors of Cyberonics, Inc. (NASDAQ: CYBX), a medical device company. From 1989 to 2007, Mr. Moore held various positions in sales, marketing and senior management for Boston Scientific Corporation (NYSE: BSX). From 2009 to 2016, Mr. Moore was a member of the board of directors of the Medical Device Manufacturers Association, serving as Board Chair from 2012 to 2014. He was a member of the board of directors of the Medical Device Innovation Consortium from 2012 to 2014. Mr. Moore has served on the board of the Epilepsy Foundation of America since 2014. He holds a B.A. from Harvard University, and an M.B.A. from Boston University. We believe Mr. Moore is qualified to serve on our board of directors based on his diverse domestic and global business experience in the medical device industry.

Gail Wilensky, Ph.D. has served as a member of the Board since July 2019. She has served as a member of the board of directors of UnitedHealth Group, Inc. (NYSE: UNH), a health and well-being services company, since 1993. Dr. Wilensky has served as a member of the board of directors of Quest Diagnostics, Inc. (NYSE: DGX), a diagnostic testing and information company, since 1997. She has served as a Senior Fellow at Project HOPE, an international non-profit health foundation, since 1993. Dr. Wilensky has served in the U.S. Department of Defense as President and Chair, Health Care Advisory Subcommittee from 2008 to 2009, and from 2006 to 2008 as Co-Chair, Task Force on the Future of Military Health. She served as Co-Chair and Presidential Appointee of the Task Force to Improve Healthcare Delivery for the Nation’s Veterans from 2001 to 2003. From 1997 to 2001, Dr. Wilensky served as Chair of the Medicare Payment Advisory Committee. She served as Chair of the Physician Payment Review Commission from 1995 to 1997. From March 1992 to January 1993, Dr. Wilensky served as Deputy Assistant to the President for Policy Development. She served as Administrator of the Health Care Financing Administration (now known as the Centers for Medicare and Medicaid Services) directing the Medicaid and Medicare programs for the United States from 1990 to 1992. Dr. Wilensky serves on the Board of Regents of the Uniformed Services University of the Health Sciences (USUHS) and the Geisinger Health System Foundation and is an elected member of the National Academy of Medicine. She holds a B.A., M.A. and Ph.D. from the University of Michigan. We believe Dr. Wilensky is qualified to serve on the Board based on her extensive experience as an economist, as well as her advisory and policy making work in the medical technology and healthcare fields.

Susan C. Schnabel has served as a member of the Board since March 2022. Ms. Schnabel is a founder and has served as the Co-Managing Partner of aPriori Capital Partners, a private equity investment firm, since April 2014. She has served on the board of directors of Altice USA (NYSE: ATUS), a broadband communication and video service provider, since July 2021. Ms. Schnabel has served on the board of directors of Kayne Anderson BDC, a private management investment company, since September 2020. Ms. Schnabel served on the board of directors of Versum Materials, Inc. (NYSE: VSM), a technology driven semiconductor materials supplier, from October 2016 to October 2019. Ms. Schnabel has served on numerous other private company boards for the past twenty years. Ms. Schnabel has served on the Cornell University Board of Trustees since July 2019. She has served on the California Institute of Technology Investment Committee since May 2017. Ms. Schnabel has served on the Board of Directors of the US Olympic & Paralympic Foundation since January 2016. She served on the Harvard Business School Alumni Advisory Board from September 2014 to June 2019. Ms. Schnabel holds a B.S. from Cornell University and a M.B.A. from Harvard Business School. Ms. Schnabel was appointed to the board pursuant to a Cooperation Agreement entered into between the Company and Hudson Executive Capital LP and certain of its affiliates (“Hudson”) on March 8, 2022. We believe Ms. Schnabel is qualified to

serve on the Board based on her extensive capital markets and investment banking experience, as well as her deep executive and board leadership experience.

Directors Continuing in Office Until the Annual Meeting of Stockholders to be Held in 2024

Caley Castelein, M.D. has served as a member of our Board since January 2008. Since March 2006, he has served as a Managing Director and founder of Kearny Venture Partners, L.P., a healthcare venture capital fund. Additionally, he founded KVP Capital, L.P. in 2013 and manages the fund, which invests in small and mid-cap healthcare companies. Since February 2017, Dr. Castelein has served as a member of the board of directors of Aerpio Therapeutics, Inc. (NASDAQ: ARPO), a biopharmaceutical company, which merged with Aadi Bioscience, Inc. (NASDAQ: AADI) in August 2021, where he now serves as Chair. He served as a member of the board of directors for Boreal Genomics, Inc., a diagnostics company, from October 2010 until its successful sale in September 2021. He has served as a director at NewBridge Pharmaceuticals FZ, LLC, a specialty therapeutics company, since March 2015. Dr. Castelein served as a member of the board of directors for Waterstone Pharmaceuticals, Inc., a pharmaceutical company from March 2015 to March 2018; AliveCor, Inc., a medical device company from April 2015 to March 2020; Wellpartner, Inc., a pharmaceutical distribution solutions company, from March 2015 to November 2017; and Neos Therapeutics, Inc. (NASDAQ: NEOS), a pharmaceutical company from March 2015 to July 2015. He holds an A.B. from Harvard College and an M.D. from the University of California, San Francisco. We believe Dr. Castelein is qualified to serve on our Board based on his extensive investment experience in the healthcare industry.

Brian K. Roberts has served as a member of the Board since December 2015. Since September 2020, Mr. Roberts has served as President and Chief Executive Officer of Tarveda Therapeutics, Inc., a biopharmaceutical company, where he also served as Chief Financial Officer from January 2018 to September 2020. From July 2016 to April 2020, he served as a member of the board of directors for Valeritas Holdings, Inc. (NASDAQ: VLRX), a medical technology company. Mr. Roberts served as Chief Operating and Financial Officer at Avedro, Inc., a pharmaceutical and medical device company, from January 2015 to October 2016. He served as Chief Financial Officer at Insulet Corporation (NASDAQ: PODD), also a medical device company, from 2009 to 2014. Mr. Roberts served as Chief Financial Officer at Jingle Networks, Inc., an advertising and technology solutions company, from September 2007 to December 2008. From 2001 to 2007, he held various leadership roles, including serving as Chief Financial Officer of Digitas, Inc. (NASDAQ: DTAS), (a/k/a DigitasLBi, Inc.), a marketing and technology agency. Mr. Roberts served as Vice President of Finance at Idiom Technologies, Inc., a provider of globalization management, from 2000 to 2001. From 1997 to 1999, he served as U.S. Controller of The Monitor Group, a consulting firm. Mr. Roberts served as an Auditor with Ernst & Young LLP from 1993 to 1997. He holds a B.S. from Boston College. We believe Mr. Roberts is qualified to serve on the Board because of his over 25 years of financial, operational and strategic experience in private and public companies.

Karen N. Prange has served as a member of the Board since June 2021. She has served as a member of the board of directors of Cantel Medical (NYSE: CMD), a medical equipment company, since October 2019 until its sale to Steris Corp in June 2021. Ms. Prange has served as a member of the board of directors of Atricure (NASDAQ: ATRC), a medical device company, since December 2019. She has served as a member of the board of directors of Nevro (NASDAQ: NVRO), a medical device company, since December 2019. Ms. Prange has served as a member of the board of directors of WS Audiology, a hearing aid manufacturer, since March 2020. Ms. Prange has served on the board of Embecta (NASDAQ: EMBC since April 2022. She has served as Strategic Advisor to Nuvo Group, LLC, a medical device company, since September of 2019 and Industrial Advisor to EQT Group, a global investment organization, since March 2020. From May 2016 to April 2018, Ms. Prange was Executive Vice President and Chief Executive Officer for the Global Animal Health, Medical and Dental Surgical Group at Henry Schein as well as a member of the Executive Committee. She served as Senior Vice President of Boston Scientific and President of its Urology and Pelvic Health business from 2012 to 2016. From 1995 to 2012, Ms. Prange held various roles of increasing leadership at Johnson & Johnson Company (NYSE: JNJ), most recently as General Manager of the Micrus Endovascular and Codman Neurovascular businesses. She holds a B.S. in Business Administration from the University of Florida. We believe Ms. Prange is qualified to serve on the Board based on her other public medical device board service and her extensive experience in commercial, operational and strategic leadership roles in healthcare companies.

Director Compensation

There were no changes to the amounts payable to non-employee directors in 2021 as compared to 2020. Pursuant to the Company’s Director Compensation Policy for 2021, each non-employee director received the following cash amounts for their service:

| | | | | | | | |

| Compensation element | | |

| Director annual retainer | | $ | 45,000 | |

| Board of Directors chair | | $ | 35,000 | |

| Audit Committee chair | | $ | 20,000 | |

| Audit Committee member | | $ | 10,000 | |

| Compensation Committee chair | | $ | 15,000 | |

| Compensation Committee member | | $ | 7,000 | |

| Nominating and Corporate Governance Committee chair | | $ | 10,000 | |

| Nominating and Corporate Governance Committee member | | $ | 5,000 | |

Under the Director Compensation Policy, each non-employee director may elect to receive the Annual Retainer in cash or Deferred Stock Units (“DSUs”). If the non-employee director elects to receive the Annual Retainer in the form of cash, the Annual Retainer will be paid in equal quarterly installments in arrears following the close of each calendar quarter, subject to pro-ration (rounded down to the nearest month) if a non-employee director serves less than a full calendar quarter. If the non-employee director elects to receive the Annual Retainer in the form of DSUs, the underlying shares of our common stock subject to such DSUs will not be issued to the non-employee director until the earlier of the date the non-employee director separates from service with us or upon a change of control of our Company (as defined in the 2015 Plan).

In addition to the cash fees outlined above, each non-employee director receives an annual grant of RSUs valued at $115,000 (“Annual Grant”). This Annual Grant is made on the date of the annual meeting of stockholders or, if later, the date of the non-employee director’s appointment to the Board. Non-employee directors appointed after the annual meeting receive a pro-rated grant to reflect their partial year of service. The Annual Grants vest on the one-year anniversary of the annual meeting, subject to the director’s continued service through such vesting date.

Upon the director’s initial appointment or election to the Board, each non-employee director received an initial equity grant with an aggregate grant date fair value equal to $175,000, either (i) 100% in the form of Restricted Stock Units (“RSUs”), or (ii) at the director’s written election, 50% in the form of RSUs and 50% in the form of stock options (an “Initial Grant”). Unless a different vesting schedule is specified, an Initial Grant will vest as to 1/36th of the shares subject to the award on each monthly anniversary of the applicable grant date, subject to continued service through each applicable vesting date.

Pursuant to the terms of the 2021 Director Compensation Policy, all equity awards outstanding and held by a non-employee director will vest in full immediately prior to the occurrence of a change in control (as defined in the applicable equity plan under which such awards were granted).

In approving the Director Compensation Policy, the Board considered, among other factors, market data provided by our compensation consultant regarding the compensation paid to directors at peer companies, as described below in the “Executive Compensation – Overview of Executive Compensation Program – Use of Market Data for Comparison Against Peer Companies” section, regarding compensation paid to directors of similarly situated companies in our industry and determined that the levels of cash for director compensation, are appropriate. While the Board considers director compensation annually, market data is currently compiled and assessed every other year.

In connection with his appointment to the Board, in March 2021, we granted Mr. Spencer an Initial Grant of 37,553 RSUs that vest in equal installments of 1/36th of the shares subject to the grant on each monthly anniversary beginning on April 1, 2021, subject to Mr. Spencer’s continued service through each applicable vesting date. In addition, in March 2021 Mr. Spencer received a prorated Annual Grant of 7,166 RSUs that vested on June 15, 2021, subject to the Mr. Spencer’s continued service through such vesting date.

In connection with her appointment to the Board, in June 2021, we granted Ms. Prange an Initial Grant of 26,395 RSUs that vest in equal installments of 1/36th of the shares subject to the grant on each monthly anniversary beginning on August 1, 2021, subject to Ms. Prange’s continued service through each applicable vesting date. In addition, in June 2021

Ms. Prange received an Annual Grant of 19,759 RSUs that vest on June 15, 2022, subject to the Ms. Prange’s continued service through such vesting date.

2021 Director Compensation Table

The following table sets forth information for the year ended December 31, 2021 regarding the compensation awarded to, earned by, or paid to our non-employee directors.

| | | | | | | | | | | | | | | | | | | | |

| Name of Director | | Fees Earned

or Paid in Cash

($)(1) | | Stock

Awards

($)(2) | | Total ($) |

| Caley Castelein, M.D. | | $ | 60,833 | | | $ | 114,997 | | | $ | 175,830 | |

| Keith Grossman (3) | | 8,333 | | | — | | | 8,333 | |

| Scott Huennekens (3) | | 35,000 | | | — | | | 35,000 | |

| B. Kristine Johnson | | 56,667 | | | 114,997 | | | 171,664 | |

| Daniel Moore | | 95,000 | | | 114,997 | | | 209,997 | |

| Karen N. Prange (4) | | 29,167 | | | 289,996 | | | 319,163 | |

| Brian K. Roberts | | 72,000 | | | 114,997 | | | 186,997 | |

| Phillip M. Spencer (5) | | 47,667 | | | 323,388 | | | 371,055 | |

| Gail Wilensky, Ph.D. | | 50,000 | | | 114,997 | | | 164,997 | |

| Kevin Xie, Ph.D. | | 45,000 | | | 114,997 | | | 159,997 | |

(1)Includes the following fees earned in 2021 that were satisfied through the grant of DSUs for which the underlying common stock will be issued upon the earlier of a change in control or the director’s separation from service.

| | | | | | | | |

| Name of Director | | Fees Satisfied in DSUs ($) |

| Caley Castelein, M.D. | | 60,833 | |

| Keith Grossman | | 8,333 | |

| Scott Huennekens | | — | |

| B. Kristine Johnson | | — | |

| Daniel Moore | | 95,000 | |

| Karen N. Prange | | — | |

| Brian K. Roberts | | — | |

| Phillip M. Spencer | | 47,667 | |

| Gail Wilensky, Ph.D. | | 50,000 | |

| Kevin Xie, Ph.D. | | — | |

(2)Amounts shown represent the aggregate grant date fair value of RSUs granted, as calculated in accordance with FASB ASC Topic 718 excluding the impact of estimated forfeitures related to service-based vesting provisions. See Footnote 13 of the financial statements included in our Annual Report on Form 10-K filed February 25, 2022 for the assumptions used in calculating this amount.

(3)Mr. Grossman and Mr. Huennekens ceased serving on the Board in February 2021 and June 2021, respectively.

(4)Amounts shown for Ms. Prange under “Fees Earned or Paid in Cash” reflect prorated retainer fees (rounded down to the nearest month) since she served less than a full calendar year following her appointment to the Board in June 2021. Amounts shown for Ms. Prange under “Stock Awards” include the Initial Grant that she received in connection with her appointment to the Board as well as her prorated Annual Grant.

(5)Amounts shown for Mr. Spencer under “Fees Earned or Paid in Cash” reflect prorated retainer fees (rounded down to the nearest month) since he served less than a full calendar year following her appointment to the Board in February 2021. Amounts shown for Mr. Spencer under “Stock Awards” include the Initial Grant that he received in connection with his appointment to the Board as well as his prorated Annual Grant.

As of December 31, 2021, each of our non-employee directors held the following outstanding DSUs, RSUs and options to purchase shares of our common stock:

| | | | | | | | | | | | | | | | | | | | |

| Name of Director | | Deferred

Stock Units (#) | | Restricted

Stock Units (#) | | Shares Subject to

Outstanding Options(#) |

| Caley Castelein, M.D. | | 70,937 | | | 19,759 | | | 84,305 | |

| Keith Grossman* | | — | | | — | | | — | |

| Scott Huennekens** | | — | | | — | | | — | |

| B. Kristine Johnson | | — | | | 63,253 | | | — | |

| Daniel Moore | | 52,857 | | | 19,759 | | | 71,169 | |

| Karen N. Prange | | — | | | 42,489 | | | — | |

| Brian K. Roberts | | 27,875 | | | 19,759 | | | 84,305 | |

| Phillip M. Spencer | | 9,708 | | | 47,924 | | | — | |

| Gail Wilensky, Ph.D. | | 21,972 | | | 19,759 | | | — | |

| Kevin Xie, Ph.D. | | 11,097 | | | 19,759 | | | — | |

* Mr. Grossman ceased serving on the Board in February 2021.

**Mr. Huennekens ceased serving on the Board in June 2021.

PROPOSAL NO. 2

APPROVAL OF AMENDMENT TO THE 2015 PLAN IN ORDER TO INCREASE THE NUMBER OF SHARES AVAILABLE FOR ISSUANCE UNDER THE 2015 PLAN

On April 19, 2022, the Board approved an amendment to the ViewRay, Inc. Amended and Restated 2015 Equity Incentive Award Plan (the “2015 Plan”) that increases the shares authorized for issuance thereunder by an additional 6,300,000 shares of our common stock, subject to approval by our stockholders. The 2015 Plan is a critical tool for attracting, retaining, and incentivizing our key employees and directors and provides for the grant of stock options, restricted stock, restricted stock units, performance awards, dividend equivalents, deferred stock, deferred stock units, stock payments, and stock appreciation rights.

If the amendment to the 2015 Plan is not approved, we currently expect that we will not be able to continue to grant equity-based compensation awards beyond December 31, 2022. We are asking our stockholders to consider and vote to approve the amendment to the 2015 Plan.

The following table sets forth certain information about the Company and the 2015 Plan:

| | | | | | | | |

| | As of March 31, 2022 |

| Common shares outstanding | | 180,442,026 |

| Number of additional shares reserved for issuance under the 2015 Plan by the amendment | | 6,300,000 |

| Number of shares available for future awards under the 2015 Plan (1) | | 1,133,564 |

| Number of shares subject to outstanding stock options | | 3,592,187 |

| Number of shares subject to awards of restricted stock and restricted stock units (including performance awards) (1) | | 8,080,625 |

| Maximum option term | | 10 years |

| Minimum exercise price (relative to the market value on date of grant) | | 100% |

| Weighted average remaining term of outstanding options | | 5.69 years |

| Weighted average exercise price of outstanding options | | $ | 6.71 |

| Approximate number of shares available for awards under the 2015 Plan if this proposal is approved | | 7,433,564 |

(1) Balance assumes 150% and Target achievement of the performance-based awards granted in 2021 and 2022, respectively.

In addition to the above, as of March 31, 2022, the Company had a total of 113,845 outstanding restricted stock units and 2,942,998 outstanding stock options with a weighted average remaining term of 6.7 years and a weighted average exercise price of $8.19 that had been granted as inducement awards under its 2018 Inducement Program, a total of 468,304 outstanding stock options with a weighted average remaining term of 2.1 years and a weighted average exercise price of $1.19 that had been granted under its 2008 Plan, and an additional 3.2 million shares remaining available for issuance under its 2015 Employee Stock Purchase Plan.

If this proposal is approved, the Company’s total potential dilution from the shares available for issuance under its equity incentive plans would increase from 9.9% as of March 31, 2022 to 12.7%. The compensation committee of the Board (“Compensation Committee”) has considered this potential dilution level in the context of competitive data from its peer group, and believes that the resulting dilution levels would be within normal competitive ranges. If the amendment to the 2015 Plan is approved, the Company’s potential dilution will increase by approximately 2.9%, and then would be expected to decline as awards are exercised and/or become vested.

The Company manages its long-term dilution goal by monitoring the number of shares subject to equity awards that it grants annually, commonly referred to as burn rate. Burn rate shows how rapidly a company is depleting its shares reserved for equity compensation plans, and is defined as the number of shares granted under the Company’s equity incentive plans divided by the weighted average number of common shares outstanding at the end of the year. The Company has calculated the burn rate under the 2015 Plan and the 2018 Inducement Program for the past three years, as set forth in the following table:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Options Granted | | Full-Value Shares Granted (1) | | Weighted Average Number of Common Shares Outstanding | | Burn Rate |

| Fiscal 2019 | | 2,652,505 | | 3,356,820 | | | 102,001,954 | | 5.89 | % |

| Fiscal 2020 | | 736,579 | | | 6,079,659 | | | 147,895,561 | | | 4.61 | % |

| Fiscal 2021 | | — | | | 3,802,798 | | | 164,521,064 | | | 2.31 | % |

(1) Assumed 150% achievement of the performance-based awards granted in 2021.The Company’s three-year average burn rate is 4.27%, which the Company believes is in line with peer group practices.

When considering the size of the share reserve under the amended 2015 Plan, the Compensation Committee also reviewed, among other things, projected future share usage and projected future forfeitures. The projected future usage of shares for long-term incentive awards under the 2015 Plan was reviewed under scenarios based on a variety of assumptions. Depending on assumptions, the Compensation Committee currently anticipates that the additional 6,300,000 shares under the amended 2015 Plan, in combination with the shares remaining available under the 2015 Plan and the shares added back to the 2015 Plan from forfeitures or cash settlement of awards previously granted, are expected to satisfy the Company’s equity compensation needs for approximately one year of similar levels of awards.

In order to minimize shareholder dilution, the 2015 Plan provides that, if the exercise price or withholding obligation of any award granted under the 2015 Plan is satisfied by tendering shares to the Company or by withholding shares, such tendered or withheld shares will not again be made available for issuance under the 2015 Plan.

The closing price of a share of our common stock on the NASDAQ Stock Market on April 18, 2022 was $3.36.

Why You Should Vote to Approve the Amendment to the 2015 Plan

The Board recommends that our shareholders approve the amendment to the 2015 Plan because it believes that the 2015 Plan promotes the success and enhances the value of the Company by linking the individual interests of employees, consultants and non-employee directors of the Company and its affiliates to those of the Company’s stockholders and provides such individuals with an incentive for outstanding performance to generate superior returns to the Company’s stockholders. The 2015 Plan is further intended to provide flexibility to the Company in its ability to motivate, attract, and retain the services of such individuals upon whose judgment, interest, and special effort the successful conduct of the Company’s operation is largely dependent. The approval of the amendment to the 2015 Plan will enable us to continue to provide such incentives.

Highlights of the 2015 Plan (as amended). Specific features of the 2015 Plan that are consistent with good corporate governance practices include, but are not limited to:

•There can be no repricing of options or stock appreciation rights without stockholder approval, either by canceling the award in exchange for a replacement award at a lower price or by reducing the exercise price of the award (other than in connection with a change in our capitalization).

•Dividend, distribution and dividend equivalent rights may not be paid on any unvested restricted stock or restricted stock units or unearned performance-based awards. No dividend, distribution and dividend equivalent rights may be granted on stock options or SARs.

•The 2015 Plan includes a $500,000 cap on the aggregate dollar value of equity-based (based on grant date fair value) and cash compensation granted under the plan or otherwise during any calendar year to any non-employee director, which limit is increased by 200% in the calendar year in which the non-employee director first joins the Board or is designated as Chairman of the Board.

•Awards are subject to a minimum vesting period of one year after the grant date with respect to 95% of the shares reserved for issuance under the 2015 Plan. This minimum vesting requirement does not apply to the other 5% of the share pool. Exceptions to this minimum vesting provision apply in the case of awards that accelerate and vest on a change of control, death or disability or awards made to non-employee directors that vest at the next annual shareholder meeting, provided that annual meetings are at least 50 weeks apart. Such awards do not count against the 5% share pool reserve or be subject to the minimum vesting requirement.

•Awards under the 2015 Plan, including any shares subject to an award, may be subject to any recovery, recoupment, clawback and/or other forfeiture policy maintained by the Company now or in the future.

2015 Plan Summary

The following is qualified in its entirety by the full text of the 2015 Plan as amended, which is attached to this Proxy Statement as Appendix A and is incorporated by reference into this proposal.

Purpose and Eligibility

The purpose of the 2015 Plan is to promote the success and enhance the value of the Company by linking the individual interests of the members of the board, employees, and consultants of the Company and its affiliates to those of the Company’s stockholders and provide such individuals with an incentive for outstanding performance to generate superior returns to the Company’s stockholders. The 2015 Plan is further intended to provide flexibility to the Company in its ability to motivate, attract, and retain the services of members of the board, employees, and consultants of the Company and its affiliates upon whose judgment, interest, and special effort the successful conduct of the Company’s operation is largely dependent.

Awards may be granted under the 2015 Plan to employees, non-employee directors, advisors and consultants of the Company and its affiliates, as selected by the Administrator. As of April 18, 2022, there were approximately 280 individuals who would be eligible to receive awards under the 2015 Plan. Further, only our employees or employees of our subsidiaries are eligible to receive incentive stock options.

Effective Date and Term; Amendment and Termination

The 2015 Plan was adopted by the Board on April 14, 2020, and became effective upon approval by the Company’s stockholders on June 12, 2020 (the “Effective Date”). The 2015 Plan will remain available for the grant of awards until the tenth (10th) anniversary of the Effective Date. However, incentive stock options may not be granted under the 2015 Plan after April 14, 2030. The 2015 Plan may be terminated at such earlier time as the Board may determine (subject to certain limitations described in the following paragraph).

The 2015 Plan may be wholly or partially amended or otherwise modified, suspended or terminated at any time or from time to time by the Board or the Compensation Committee. However, without approval of the Company’s stockholders given within 12 months before or after the action by the Administrator, no action of the Administrator may (other than in connection with changes in the Company’s capital stock) increase the limits on the maximum number of shares which may be issued under the 2015 Plan. Except for changes intended to comply with the requirements of Section 409A of the Internal Revenue Code, no amendment, suspension or termination of the 2015 Plan will, without the consent of the award holder, materially and adversely affect any rights or obligations under any award theretofore granted or awarded, unless the award itself otherwise expressly so provides. No awards may be granted or awarded during any period of suspension or after termination of the 2015 Plan.

Administration

The Compensation Committee (or another committee or a subcommittee of the Board or the Compensation Committee assuming the functions of the Committee under the 2015 Plan) will administer the 2015 Plan (except as otherwise permitted under the 2015 Plan). However, the full Board, acting by a majority of its members in office, will conduct the general administration of the 2015 Plan with respect to awards granted to non-employee directors. The Board or Compensation Committee may delegate its authority to the extent permitted by the 2015 Plan.

The Administrator will conduct the general administration of the 2015 Plan in accordance with its provisions. The Administrator will have the power to interpret the 2015 Plan, any program adopted pursuant to the 2015 Plan and the applicable award agreement, and to adopt such rules for the administration, interpretation and application of the 2015 Plan as are not inconsistent therewith, to interpret, amend or revoke any such rules and to amend any such program or applicable award agreement. However, the rights or obligations of the holder of an award that is the subject of any such program or award agreement cannot be affected materially and adversely by such amendment, unless the consent of the holder is obtained or such amendment is otherwise intended to comply with the requirements of Section 409A of the Internal Revenue Code. In its sole discretion, the Board may at any time and from time to time exercise any and all rights and duties of the Committee under the 2015 Plan (except with respect to matters which under Rule 16b-3 under the Exchange Act or any successor rule or the rules of any securities exchange or automated quotation system on which the Shares are listed, quoted or traded are required to be determined in the sole discretion of the Committee).

Subject to the by-laws of the Company, the charter of the Compensation Committee and any specific designation in the 2015 Plan, the Administrator has the exclusive power, authority and sole discretion to:

•designate eligible individuals to receive awards;

•determine the type or types of awards to be granted to each eligible individual;

•determine the number of awards to be granted and the number of shares to which an award will relate subject to the limitations set forth in the 2015 Plan;

•subject to limitations set forth in the 2015 Plan, determine the terms and conditions of any award granted pursuant to the 2015 Plan;

•determine whether, to what extent, and pursuant to what circumstances an award may be settled in, or the exercise price of an award may be paid in cash, shares, other Awards, or other property, or an award may be canceled, forfeited, or surrendered;

•prescribe the form of each award agreement;

•decide all other matters that must be determined in connection with an award;

•establish, adopt, or revise any rules and regulations as it may deem necessary or advisable to administer the 2015 Plan;

•interpret the terms of, and any matter arising pursuant to, the 2015 Plan, any program adopted pursuant to the 2015 Plan or any award agreement;

•make all other decisions and determinations that may be required pursuant to the 2015 Plan or as the Administrator deems necessary or advisable to administer the 2015 Plan; and

•accelerate wholly or partially the vesting or lapse of restrictions of any award or portion thereof at any time after the grant of an Award (subject to certain limitations set forth in the 2015 Plan).

Shares Subject to 2015 Plan (As Amended)

Subject to certain limitations set forth in the 2015 Plan, the number of shares which may be issued or transferred pursuant to awards under the 2015 Plan, as amended, on or after the Effective Date will be equal to (i) 9,550,000 Shares, plus (ii) the 1,133,564 shares that remained available for issuance under the prior restatement of the 2015 Plan as of June 12, 2020, plus (iii) any shares subject to outstanding awards under the 2015 Plan that are forfeited, expire or are settled in cash (the “Share Limit”). The maximum number of Shares with respect to incentive stock options which may be granted under the 2015 Plan on or after the Effective Date will be 9,550,000 Shares.

If any shares subject to an award are forfeited or expire or such award is settled for cash (in whole or in part), the shares subject to such award will, to the extent of such forfeiture, expiration or cash settlement, again be available for future grants of awards under the 2015 Plan and will be added back to the Share Limit. In addition, the following shares will not be available for future grants of awards under the 2015 Plan and will not be added back to the Share Limit: (i) shares tendered by a holder of an award or withheld by the Company in payment of the exercise price of an stock option or a stock appreciation right; (ii) shares tendered by the holder of an award or withheld by the Company to satisfy any tax withholding obligation with respect to an award; and (iii) shares purchased on the open market with the proceeds from the exercise of awards.

Substitute awards granted under the plan upon the assumption of, or in substitution for, outstanding equity awards previously granted by a company or other entity in connection with a corporate transaction will not reduce the shares authorized for grant under the 2015 Plan. Additionally, in the event that a company acquired by the Company or any affiliate or with which the Company or any affiliate combines has shares available under a pre-existing plan approved by its stockholders and not adopted in contemplation of such acquisition or combination, the shares available for grant pursuant to the terms of such pre-existing plan (as adjusted, to the extent appropriate, using the exchange ratio or other adjustment or valuation ratio or formula used in such acquisition or combination to determine the consideration payable to the holders of common stock of the entities party to such acquisition or combination) may be used for awards under the 2015 Plan and will not reduce the shares authorized for grant under the 2015 Plan.

Non-Employee Director Limitations

Subject to adjustment provisions in the 2015 Plan, the aggregate grant date fair market value of share subject to awards granted under the 2015 Plan, together with any cash compensation paid or payable, during any calendar year to any one non-employee director will not exceed $500,000. However, with respect to the calendar year in which a non-employee director first joins the Board or is designated as Chairman of the Board or Lead Director, such maximum dollar value may be up to two hundred percent (200%) of the dollar value set forth in the foregoing limit.

Minimum Vesting

Awards granted under the 2015 Plan may not become exercisable, vest or settle, in whole or in part, prior to the one-year anniversary of the date of grant. The following are exceptions: (1) the Compensation Committee may provide that awards become exercisable, vest or settle prior to such date in the event of the participant’s death or disability or in connection with a change in control, (2) awards to non-employee directors may vest on the Company’s next annual

meeting of shareholders (provided that such annual meetings are at least fifty (50) weeks apart), and (3) up to 5% of the aggregate number of shares authorized for issuance under the 2015 Plan may be issued without regard to the restrictions of the sentence.

Awards

Awards under the 2015 Plan may be made in the form of stock options, restricted stock, restricted stock units, performance awards, dividend equivalents, deferred stock, deferred stock units, stock payments, and stock appreciation rights.