UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant [X]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

| [X] | Preliminary Proxy Statement |

| [ ] | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| [ ] | Definitive Proxy Statement |

| [ ] | Definitive Additional Materials |

| [ ] | Soliciting Material under Rule 14a-12 |

Griffin Institutional Access Real Estate Fund

(Name of the Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11.

| | 1. | Title of each class of securities to which transaction applies: |

| | | |

| | 2. | Aggregate number of securities to which transaction applies: |

| | | |

| | 3. | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | |

| | 4. | Proposed maximum aggregate value of transaction: |

| | | |

| [ ] | Fee paid previously with preliminary materials. |

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | 1. | Amount Previously Paid: |

| | | |

| | 2. | Form, Schedule, or Registration Statement No.: |

| | | |

Griffin Institutional Access Real Estate Fund

Griffin Capital Plaza

1520 E. Grand Avenue

El Segundo, California 90245

Tel (310) 469-6100

[ ], 2022

Dear Shareholder:

Enclosed are a Notice and a Proxy Statement concerning a Special Meeting of Shareholders (the “Special Meeting”) of Griffin Institutional Access Real Estate Fund (the “Fund”). At the Special Meeting, shareholders of the Fund will be asked to approve: (i) a new Management Agreement (the “New Management Agreement”) between the Fund and the Fund’s investment adviser, Griffin Capital Advisor, LLC (the “Adviser”); (ii) a new Investment Sub-Advisory Agreement (the “New CenterSquare Agreement”) between the Adviser and CenterSquare Investment Management LLC (“CenterSquare”); and (iii) a new Investment Sub-Advisory Agreement (the “New Aon Agreement”, and, together with the New Management Agreement and the New CenterSquare Agreement, the “New Agreements”) between the Adviser and Aon Investments USA Inc. (“Aon”).

On December 2, 2021, Griffin Capital, LLC (“Griffin Capital”), the indirect parent of the Adviser, and Apollo Global Management, Inc. (“AGMI”) announced that they agreed that AGMI will acquire the US wealth distribution and asset management businesses of Griffin Capital in an all-stock transaction. AGMI and Griffin Capital intend to close the acquisition of the asset management businesses of Griffin Capital (the ���Transaction”) in the first half of 2022 (such closing time, the “Effective Date”). The Transaction will result in a change in control of the Adviser, which may be deemed an “assignment” under the Investment Company Act of 1940, as amended (the “1940 Act”), that results in an automatic termination of the Fund’s previous Management Agreement with the Adviser (the “Prior Management Agreement”) on the Effective Date. The prior investment sub-advisory agreement for the Fund between the Adviser and CenterSquare (the “Prior CenterSquare Agreement”) and the prior investment sub-advisory agreement for the Fund between the Adviser and Aon (the “Prior Aon Agreement” and, together with the Prior Management Agreement and the Prior CenterSquare Agreement, the “Prior Agreements”) will also terminate on the Effective Date as a result of the termination of the Prior Management Agreement.

Over the course of several meetings commencing on December 14, 2021, the Board of Trustees of the Fund (the “Board”) received and reviewed information from the Adviser, Griffin Capital, and AGMI regarding the Transaction. At a special meeting of the Board held on December 22, 2021, the Board reviewed and considered information provided by the Adviser and Griffin Capital and AGMI that it had requested regarding the proposed New Management Agreement with the Adviser as the investment adviser to the Fund. Subsequently, at a special meeting of the Board held on December 28, 2021, which was called for the purpose of considering the New Management Agreement, the Board, after meeting in executive session with counsel and further discussion with representatives of the Adviser and Griffin Capital, approved the New Management Agreement, subject to shareholder approval, in order for the Adviser to continue to provide services to the Fund without disruption. Also on December 22, 2021 and December 28, 2021, respectively, the Board considered and approved both the New Aon Agreement and the New CenterSquare Agreement, subject to shareholder approval, in order for Aon and CenterSquare to continue to provide services to the Fund without disruption. Under the 1940 Act, a new advisory agreement or sub-advisory agreement generally requires approval by a majority of such investment company’s outstanding voting securities, as defined in the 1940 Act, before it can go into effect. Therefore, the Board has called the Special Meeting to seek shareholder approval of the New Agreements in order to ensure that the Adviser, CenterSquare, and Aon can continue to provide uninterrupted service as the adviser and sub-advisers, respectively, to the Fund after the Effective Date.

There will be no increase in the advisory fee payable by the Fund to the Adviser and no increases in the sub-advisory fees payable by the Adviser to CenterSquare and Aon, respectively, as consequences of the Transaction, and the advisory fee and sub-advisory fees payable to the Adviser, CenterSquare and Aon under the New Agreements will be the same as that payable to the Adviser, CenterSquare and Aon under the Prior Agreements. The New Agreements are substantially similar in all material respects to the Prior Agreements, and the Fund’s investment strategy, management policies, and portfolio managers will not change in connection with the implementation of the New Agreements.

After careful review, the Board has unanimously approved the New Agreements, subject to shareholder approval, and recommends that you read the enclosed materials carefully and then vote to approve the New Agreements.

Your vote is extremely important, no matter how large or small your Fund holdings.

To vote, you may use any of the following methods:

| | · | By Mail. Please complete, date and sign the enclosed proxy card and mail it in the enclosed postage-paid envelope. |

| | · | By Internet. Have your proxy card available. Go to [WEBSITE]. Follow the instructions on the website. |

| | · | By Telephone. Have your proxy card available. Call [TELEPHONE]. Follow the recorded instructions. If you would like to speak to a live representative and cast your vote, please call [TELEPHONE]. |

| | · | By Attending the Virtual Meeting. Any shareholder who attends the Special Meeting virtually may vote by ballot at the Special Meeting. |

We encourage you to vote through the internet or by telephone using the number that appears on your proxy card. If you later decide to attend the Special Meeting, you may revoke your proxy and vote your shares virtually at the Special Meeting. Whichever voting method you choose, please take the time to read the full text of the Proxy Statement before you vote. If you have any questions before you vote, please call [PROXY FIRM], toll free at [TELEPHONE].

Thank you for your response and for your continued investment with the Fund.

| | Sincerely, | |

| | | |

| | /s/ Randy Anderson | |

| | Dr. Randy Anderson | |

| | Chairman and Secretary | |

| | Griffin Institutional Access Real Estate Fund | |

Griffin Institutional Access Real Estate Fund

Griffin Capital Plaza

1520 E. Grand Avenue

El Segundo, California 90245

Tel (310) 469-6100

NOTICE OF SPECIAL MEETING

[ ], 2022

Griffin Institutional Access Real Estate Fund (the “Fund”) will hold a Special Meeting of Shareholders of the Fund on March 15, 2022 at 10:00 a.m. Pacific time (the “Special Meeting”). The Special Meeting will be held virtually by means of a live webcast for the following purposes:

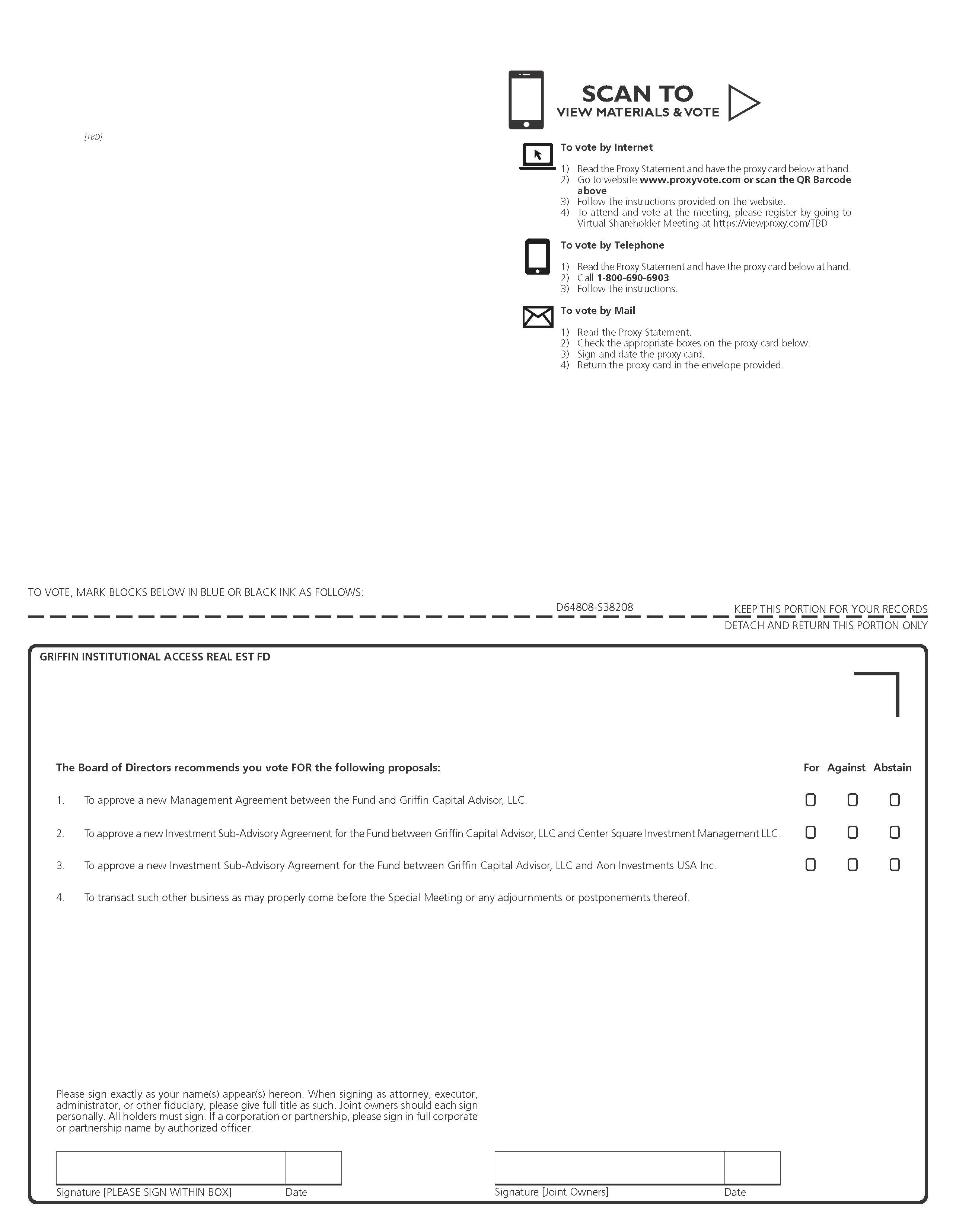

| 1. | To approve a new Management Agreement between the Fund and Griffin Capital Advisor, LLC; and |

| 2. | To approve a new Investment Sub-Advisory Agreement for the Fund between Griffin Capital Advisor, LLC and CenterSquare Investment Management LLC; and |

| 3. | To approve a new Investment Sub-Advisory Agreement for the Fund between Griffin Capital Advisor, LLC and Aon Investments USA Inc.; and |

| 4. | To transact such other business as may properly come before the Special Meeting or any adjournments or postponements thereof. |

Shareholders will be able to attend the Special Meeting online, submit questions during the Special Meeting, and vote their shares electronically. To participate in the Special Meeting, shareholders must register in advance by visiting [WEBSITE] and submitting the required information to Broadridge Financial Solutions, Inc. (“Broadridge”), the Fund’s proxy tabulator.

Shareholders whose shares are registered directly with the Fund in the shareholder’s name will be asked to submit their name and control number found on the shareholder’s proxy card in order to register to participate in and vote at the Special Meeting. Shareholders whose shares are held by a broker, bank or other nominee must first obtain a “legal proxy” from the applicable nominee/record holder, who will then provide the shareholder with a newly-issued control number. We note that obtaining a legal proxy may take several days. Requests for registration should be received no later than [TIME] Pacific time, on [DATE], but in any event must be received by the scheduled time for commencement of the Special Meeting. Once shareholders have obtained a new control number, they must visit [WEBSITE] and submit their name and newly issued control number in order to register to participate in and vote at the Special Meeting.

After shareholders have submitted their registration information, they will receive an email from Broadridge that confirms that their registration request has been received and is under review by Broadridge. Once a shareholder’s registration request has been accepted, the shareholder will receive (i) an email containing an event link and dial-in information to attend the Special Meeting, and (ii) an email with a password to enter at the event link in order to access the Special Meeting. Shareholders may vote before or during the Special Meeting at [WEBSITE]. Only shareholders of a Fund present virtually or by proxy will be able to vote, or otherwise exercise the powers of a shareholder, at the Special Meeting.

The Special Meeting webcast will begin promptly at 10:00 a.m. (Pacific time). We encourage shareholders to access the Special Meeting prior to the start time. For additional information on how you can attend and participate in the virtual Meeting, please see the instructions below. Because the Special Meeting will be a completely virtual meeting, there will be no physical location for shareholders to attend.

Shareholders of record at the close of business on January 14, 2022 are entitled to notice of and to vote at the Special Meeting or any adjournments or postponements thereof. Returning your proxy does not deprive you of your right to attend the Special Meeting and to vote your shares virtually.

| | By Order of the Board of Trustees, | |

| | | |

| | /s/ Randy Anderson | |

| | Randy Anderson | |

| | Chairman and Secretary | |

El Segundo, California

[ ], 2022

| Important Note: Voting your proxy is important. To vote your shares at the Special Meeting (other than virtually at the Special Meeting), a shareholder must return a proxy. The return envelope enclosed with the proxy requires no postage if mailed in the United States. By promptly returning the enclosed proxy, you can help us avoid the necessity and expense of sending follow-up letters to ensure a quorum. If you are unable to attend the Special Meeting, please mark, sign, date, and return the enclosed proxy so that the necessary quorum may be present at the Special Meeting. Proxies may also be submitted by internet and telephone. See “Voting Procedures” in the Proxy Statement for additional information. |

Griffin Institutional Access Real Estate Fund

Griffin Capital Plaza

1520 E. Grand Avenue

El Segundo, California 90245

Tel (310) 469-6100

PROXY STATEMENT

Special Meeting of Shareholders to be held on March 15, 2022

This Proxy Statement is furnished in connection with a solicitation of proxies by the Board of Trustees (the “Board” or the “Trustees”) of Griffin Institutional Access Real Estate Fund, a Delaware statutory trust (the “Fund” or the “Trust”), to be used at the Special Meeting of Shareholders (the “Special Meeting”) of the Fund to be held on March 15, 2022 at 10:00 a.m. Pacific time, for the purposes set forth in the accompanying notice. The Special Meeting will be held virtually by means of a live webcast.

The Special Meeting will be a virtual meeting conducted exclusively via live webcast starting at 10:00 a.m. (Pacific time). Shareholders will be able to attend the Special Meeting online, submit questions during the Special Meeting, and vote their shares electronically. To participate in the Special Meeting, shareholders must register in advance by visiting [WEBSITE] and submitting the required information to Broadridge Financial Solutions, Inc. (“Broadridge”), the Fund’s proxy tabulator.

Shareholders whose shares are registered directly with the Fund in the shareholder’s name will be asked to submit their name and control number found on the shareholder’s proxy card in order to register to participate in and vote at the Special Meeting. Shareholders whose shares are held by a broker, bank or other nominee must first obtain a “legal proxy” from the applicable nominee/record holder, who will then provide the shareholder with a newly-issued control number. We note that obtaining a legal proxy may take several days. Requests for registration should be received no later than [TIME] Pacific time, on [DATE], but in any event must be received by the scheduled time for commencement of the Special Meeting. Once shareholders have obtained a new control number, they must visit [WEBSITE] and submit their name and newly issued control number in order to register to participate in and vote at the Special Meeting.

After shareholders have submitted their registration information, they will receive an email from Broadridge that confirms that their registration request has been received and is under review by Broadridge. Once a shareholder’s registration request has been accepted, the shareholder will receive (i) an email containing an event link and dial-in information to attend the Special Meeting, and (ii) an email with a password to enter at the event link in order to access the Special Meeting. Shareholders may vote before or during the Special Meeting at [WEBSITE]. Only shareholders of a Fund present virtually or by proxy will be able to vote, or otherwise exercise the powers of a shareholder, at the Special Meeting.

In light of the rapidly changing developments related to coronavirus (COVID-19), we are pleased to offer our Shareholders a completely virtual Special Meeting, which provides worldwide access and communication, while protecting the health and safety of our shareholders, Trustees, and management. We are committed to ensuring that shareholders will be afforded the same rights and opportunities to participate as they would at an in-person meeting. We will try to answer as many shareholder-submitted questions as time permits that comply with the Special Meeting rules of conduct. However, we reserve the right to edit profanity or other inappropriate language, or to exclude questions that are not pertinent to meeting matters or that are otherwise inappropriate. If substantially similar questions are received, we will group such questions together and provide a single response to avoid repetition.

Shareholders of record of the Fund at the close of business on January 14, 2022 (the “Record Date”) are entitled to receive notice of and to vote at the Special Meeting. Shareholders are entitled to one vote for each Fund share held and fractional votes for each fractional Fund share held. Shareholders of the Fund will vote as a single class on each Proposal.

Proxies in the accompanying form that are signed, returned, and not revoked will be voted at the Special Meeting and at any adjournments or postponements thereof. Where you make a specification by means of a signed proxy, your proxy will be voted in accordance with your specification. If you make no specification on a signed proxy, your proxy will be voted in favor of approving each of the following: (i) the new Management Agreement between the Fund and Griffin Capital Advisor, LLC (the “New Management Agreement”); (ii) the new Investment Sub-Advisory Agreement for the Fund between Griffin Capital Advisor, LLC and CenterSquare Investment Management, LLC (the “New CenterSquare Agreement”); and (iii) the new Investment Sub-Advisory Agreement for the Fund between Griffin Capital Advisor, LLC and Aon Investments USA Inc. (the “New Aon Agreement” and, together with the New Management Agreement and the New CenterSquare Agreement, the “New Agreements”), as summarized below in the Proposals. Unsigned proxies will not be counted as present at the Special Meeting. If the enclosed proxy card is executed and returned, or if you have voted by telephone or through the internet, your vote nevertheless may be revoked after it is received by giving another proxy by mail, by calling the toll-free telephone number, or through the Internet. To be effective, such revocation must be received before the Special Meeting. In addition, any shareholder who attends the Special Meeting virtually may vote at the Special Meeting, thereby canceling any proxy previously given.

The approximate mailing date of this Proxy Statement and the accompanying proxy card is [ ], 2022. Proxies may be submitted by mail, telephone or internet. Please follow the instructions on the enclosed proxy card.

Important Notice Regarding the Availability of Proxy Materials For

The Shareholder Meeting to Be Held on March 15, 2022:

This Proxy Statement is available at [WEBSITE]. |

GENERAL OVERVIEW

This Proxy Statement presents three Proposals for the Fund, each of which are described in further detail below. The Board recommends that you vote in favor of each Proposal.

Background Information

On December 2, 2021, Griffin Capital, LLC (“Griffin Capital”), the indirect parent of Griffin Capital Advisor, LLC (the “Adviser”), and Apollo Global Management, Inc. (“AGMI”) announced that they agreed that AGMI will acquire the US wealth distribution and asset management businesses of Griffin Capital in an all-stock transaction and had entered into a definitive agreement with respect to the Transaction (the “Transaction Agreement”). AGMI and Griffin Capital intend to close the acquisition of the asset management businesses of Griffin Capital (the “Transaction”) in the first half of 2022 (such closing time, the “Effective Date”).

The Transaction will result in a change in control of the Adviser, which may be deemed an “assignment” under the Investment Company Act of 1940, as amended (the “1940 Act”), that results in an automatic termination of the Fund’s previous Management Agreement with the Adviser (the “Prior Management Agreement”) on the Effective Date. The prior investment sub-advisory agreement for the Fund between the Adviser and CenterSquare Investment Management LLC (“CenterSquare” or a “Sub-Adviser”) (the “Prior CenterSquare Agreement”) and the prior investment sub-advisory agreement for the Fund between the Adviser and Aon Investments USA Inc. (“Aon” or a “Sub-Adviser”) (the “Prior Aon Agreement” and, together with the Prior Management Agreement and the Prior CenterSquare Agreement, the “Prior Agreements”) will also terminate on the Effective Date as a result of the termination of the Prior Management Agreement.

The Fund is not a party to the Transaction Agreement. However, the closing of the Transaction (the “Closing”) is subject to certain conditions, including shareholder approval of each Proposal, as described in this proxy statement. Therefore, if shareholders do not approve the New Agreements, or, if the other conditions in the Transaction Agreement are not satisfied or waived, then the Transaction will not close, and the Prior Agreements will not terminate. If the Transaction does not close, the Adviser, Aon and CenterSquare will continue to manage the Fund under the Prior Agreements. If the Proposals are approved, the New Agreements will be effective on or about the Effective Date.

Summary of Proposals

At the Special Meeting, shareholders of the Fund will be asked:

| 1. | To approve the New Management Agreement; and |

| 2. | To approve the New CenterSquare Agreement; and |

| 3. | To approve the New Aon Agreement; and |

| 4. | To transact such other business as may properly come before the Special Meeting or any adjournments or postponements thereof. |

PROPOSAL 1: APPROVAL OF NEW MANAGEMENT AGREEMENT BETWEEN THE FUND AND GRIFFIN CAPITAL ADVISOR, LLC

Introduction

The Board is recommending the approval of the New Management Agreement between the Fund and Griffin Capital Advisor, LLC.

Over the course of several meetings commencing on December 14, 2021, the Board, including the Independent Trustees, received and reviewed information from the Adviser, Griffin Capital, and AGMI regarding the Transaction. At a special meeting of the Board held on December 22, 2021, the Board reviewed and considered information provided by the Adviser, Griffin Capital, and AGMI that it had requested regarding the proposed New Management Agreement with the Adviser as the investment adviser to the Fund. Subsequently, at a special meeting of the Board held on December 28, 2021, which was called for the purpose of considering the New Management Agreement, the Board, after meeting in executive session with counsel and further discussion with representatives of the Adviser and Griffin Capital, approved the New Management Agreement, subject to shareholder approval, in order for the Adviser to continue to provide services to the Fund without disruption. See “Evaluation by the Fund’s Board” below for a discussion of this approval.

Under the 1940 Act, a new advisory agreement generally requires approval by a majority of such investment company’s outstanding voting securities, as defined in the 1940 Act, before it can go into effect. Therefore, the Board has called the Special Meeting to seek shareholder approval of the New Management Agreement in order to ensure that the Adviser can continue to provide uninterrupted service as the adviser to the Fund. If shareholders approve the Proposals, the New Management Agreement is expected to take effect on the Effective Date.

There will be no increase in the advisory fee payable by the Fund to the Adviser as a consequence of the Transaction, and the advisory fee payable to the Adviser under the New Management Agreement will be the same as that payable to the Adviser under the Prior Management Agreement. The New Management Agreement is substantially similar in all material respects to the Prior Management Agreement, and the Fund’s investment strategy, management policies, and portfolio managers will not change in connection with the implementation of the New Management Agreement.

If sufficient shareholder votes to approve the New Management Agreement are not received in advance of the Effective Date, the Adviser is expected to manage the Fund under an Interim Investment Management Agreement (the “Interim Management Agreement”) for the Fund between the Adviser and the Fund until the earlier of 150 days from the effective date of the Interim Management Agreement or the date on which the New Management Agreement is approved by the shareholders of the Fund. See “The Interim Management Agreement” below.

Information about the Adviser

The Adviser, headquartered at Griffin Capital Plaza, 1520 E. Grand Avenue, El Segundo, California 90245, is an investment advisory firm registered with the U.S. Securities and Exchange Commission (the “SEC”). The Adviser is a Delaware limited liability company formed in August 2013 for the purpose of advising the Fund. Until the Closing, the Adviser is indirectly controlled by Griffin Capital Company, LLC, a Delaware limited liability company, which is controlled by Kevin Shields because he controls more than 25% of the voting interests of Griffin Capital Company, LLC. Upon the Closing, the Adviser will be indirectly wholly owned by AGMI. Under the general supervision of the Fund’s Board, the Adviser carries out the investment and reinvestment of the net assets of the Fund, will furnish continuously an investment program with respect to the Fund, and determines which securities should be purchased, sold or exchanged, subject to the delegation of certain advisory functions to the Sub-Advisers. In addition, the Adviser supervises and provides oversight of the Fund’s service providers.

AGMI is a longstanding and leading global alternative asset manager with approximately $472 billion of assets under management as of June 30, 2021. AGMI operates its three primary business segments, private equity, credit, and real assets, in a fully integrated manner, which AGMI believes is distinct from other comparable alternative investment managers. By collaborating across disciplines, with each business unit contributing to, and drawing from, AGMI’s shared information and experience, AGMI believes the Fund is well-positioned to invest across the asset classes in which the Fund invests pursuant to its investment strategy. The Adviser draws upon AGMI’s more than 30-year history and benefits from the broader firm’s significant capital markets, trading, and research expertise developed through investments in many core sectors in over 200 companies since AGMI’s inception.

The Adviser does not expect any changes to the portfolio managers responsible for the Fund as a result of the Transaction. However, certain members of the Adviser’s Investment Committee may be replaced, as a well as certain officers of the Fund. However, the Adviser does not anticipate that these changes will have any significant impact on the Adviser’s services to the Fund. In addition, the Adviser has no current plans to change the manner in which investments are selected for the Fund’s portfolio. The Adviser does not currently serve as investment adviser or sub-adviser to any registered investment companies that have a similar investment objective or similar investment management policies as the Fund.

The names, titles, and principal occupations of the officers of the Adviser are set forth below. The business address for each person listed below is Griffin Capital Plaza, 1520 E. Grand Avenue, El Segundo, California 90245.

| Name | Title | Principal Occupation |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

No Independent Trustee has, or has had, any material interest in a material transaction or proposed transaction with the Adviser or AGMI since the beginning of the Fund’s most recently completed fiscal year.

The New Management Agreement

The following discussion is a description of the material terms of the New Management Agreement. The form of the New Management Agreement is attached as Attachment A to this Proxy Statement.

On December 22, 2021 and December 28, 2021, the Board, including the Independent Trustees, considered and approved the New Management Agreement with the Adviser as the investment adviser to the Fund, When evaluating the reasonableness of the New Management Agreement, the Board considered multiple factors related to the reasonableness of the New Management Agreement, as further described below, including the nature of the services provided by the Adviser, as well as the costs of such services and the profits to be realized by the Adviser in providing such services. If the New Management Agreement is approved by shareholders, it is expected to take effect on the Effective Date. Under the New Management Agreement, the Adviser will continue to pursue the investment strategies of the Fund by employing the methodologies described in the Fund’s Prospectus. The services to be provided by the Adviser under the New Management Agreement are the same as the services provided by the Adviser under the Prior Management Agreement.

The New Management Agreement, if approved by shareholders as proposed, will provide that it is effective for an initial two-year period and will be renewed thereafter only so long as such renewal and continuance is specifically approved at least annually by the Board, including a majority of the Independent Trustees. The New Management Agreement may be terminated at any time on at least 60 days’ prior written notice to the Adviser, without the payment of any penalty, (i) by vote of the Trustees or (ii) by vote of a majority of the outstanding voting securities (as defined in the 1940 Act) of the Fund. The Adviser may terminate the New Management Agreement at any time, without the payment of any penalty, on at least 60 days’ prior written notice to the Fund. In addition, the New Management Agreement provides that it will terminate automatically in the event of its “assignment,” as defined in the 1940 Act.

Pursuant to the New Management Agreement and as under the Prior Management Agreement, the Adviser will receive a monthly management fee computed at the annual rate of 1.50% of the Fund’s daily net assets. During the fiscal year ended September 30, 2021, the Adviser received $59,307,497 in advisory fees from the Fund.

Like the Prior Management Agreement, the New Management Agreement, if approved by shareholders as proposed, will continue to provide that the Adviser is not liable for any error of judgment or for any loss suffered by the Fund in connection with the performance of the New Management Agreement, except a loss resulting from a breach of fiduciary duty with respect to receipt of compensation for services (in which case any award of damages shall be limited to the period and the amount set forth in Section 36(b)(3) of the 1940 Act) or a loss resulting from willful misfeasance, bad faith or gross negligence on the Adviser’s part in the performance of, or from reckless disregard by the Adviser of its obligations and duties under, the New Management Agreement.

The form of the New Management Agreement is attached to this Proxy Statement as Attachment A. Please take the time to read the New Management Agreement. The description of the New Management Agreement in this Proxy Statement is only a summary. If the New Management Agreement with the Adviser is not approved by shareholders, the Board will consider other options, including a new or modified request for shareholder approval of a new investment management agreement.

Evaluation by the Fund’s Board

At meetings of the Board on December 22, 2021 and December 28, 2021, the Board, including the Independent Trustees, discussed and approved the New Management Agreement between the Fund and the Adviser. The Board, including the Independent Trustees, also discussed and approved the Interim Management Agreement for the Fund in order for the Adviser to continue to provide services to the Fund without disruption. The Board, including the Independent Trustees, concluded that approval of the New Management Agreement is in the best interests of the Fund and its shareholders.

In connection with the Board meetings and in accordance with Section 15(c) of the 1940 Act, the Board requested, and the Adviser and AGMI provided, materials relating to the Transaction, the Adviser, and AGMI in connection with the Board’s consideration of whether to approve the New Management Agreement. This included a description of the Transaction and its anticipated effects on the Adviser, as well as information regarding AGMI. The Board noted that the services provided under the New Management Agreement will be identical to those provided under the Prior Management Agreement. In addition, the advisory fee under the New Management Agreement will remain the same as the advisory fee under the Prior Management Agreement. The Adviser confirmed that it anticipated that, under the New Management Agreement, there would be no diminution in services provided by the Adviser to the Fund or changes in the fee payable by the Fund to the Adviser as a result of the Transaction. It was noted that the Board and the Adviser intended to use reasonable best efforts to operate the Fund in compliance with the conditions of the safe harbor in Section 15(f) of the 1940 Act so that 75% or more of the Board was not comprised of “interested persons” (as defined in the 1940 Act) of the Adviser and would remain so for three years following the Effective Date, and that no “unfair burden” (as defined in the 1940 Act) would be imposed on the Fund by the Adviser during the two-year period following the Effective Date.

In considering whether to approve the New Management Agreement, the Trustees reviewed and considered the information they deemed reasonably necessary, including the following material factors discussed in further detail below: (1) the nature, extent, and quality of the services to be provided by the Adviser; (2) the investment performance of the Fund and the Adviser; (3) the costs of the services to be provided and profits to be realized by the Adviser and its affiliates from the relationship with the Fund; (4) the extent to which economies of scale would be realized as the Fund grows and whether advisory fee levels reflect those economies of scale for the benefit of the Fund’s investors; (5) the Adviser’s practices regarding brokerage and portfolio transactions; and (6) the Adviser’s practices regarding possible conflicts of interest.

The Trustees also reviewed a memorandum from the Fund’s legal counsel that summarized the fiduciary duties and responsibilities of the Board in reviewing and approving the New Management Agreement, including the types of information and factors that should be considered in order to make an informed decision.

| (1) | The nature, extent, and quality of the services to be provided by the Adviser. The Board received and considered information regarding the fact that the nature, extent, and quality of services to be provided to the Fund by the Adviser under the New Management are the same as under the Prior Management Agreement and are not expected to change as a result of the Transaction. The Trustees considered the responsibilities of the Adviser under the New Management Agreement and reviewed the services provided to the Fund including, without limitation, the Adviser’s procedures for formulating investment recommendations and assuring compliance with the Fund’s investment objectives and limitations, coordination of services for the Fund among the Fund’s service providers, expertise and experience in the field, and efforts to promote the Fund, grow the Fund’s assets, and assist in the distribution of Fund shares. The Trustees noted that the Adviser seeks to achieve the Fund’s investment objective to generate a return comprised of both current income and capital appreciation with moderate volatility and low correlation to the broader markets, through pursuing strategic investing across private institutional real estate investment funds as well as a diversified set of public real estate securities. The Trustees also noted that the Adviser continues its process of allocating between public and private real estate securities and allows the Fund to invest across a diversified set of investment managers and strategies as well as to provide investment exposure across property types and geographies. The Board noted the Adviser’s robust investment process, which has benefited the Fund through negotiation of fee reductions and other benefits for the Fund. The Board concluded that the Fund would continue to benefit from the quality and experience of the Adviser’s investment professionals who will continue to provide services to the Fund after the Transaction as employees of the Adviser. After reviewing the foregoing information and other information in the Adviser’s Memorandum (e.g., the Adviser’s Form ADV and descriptions of the Adviser’s business and compliance program), the Board concluded that the nature, extent, and quality of the services provided by the Adviser to the Fund were satisfactory. |

| (2) | The investment performance of the Fund and the Adviser. The Trustees noted the Fund’s strong positive performance since its inception. After reviewing the Fund’s performance and other factors, the Board concluded that it was satisfied with the performance of the Fund. |

| (3) | The costs of the services to be provided by the Adviser. The Trustees evaluated the current and projected asset levels of the Fund; and the overall expenses of the Fund, including the nature and frequency of advisory fee payments. |

The Trustees then compared the fees and expenses of the Fund (including the management fee) to other peer funds comparable in terms of the type of fund, the nature of its investment strategy, and its style of investment management, among other factors. The Trustees determined that the base management fee was higher than other funds but noted that other funds had externalized certain services that the Adviser provided (such as research) as part of its management fees and agreed that it was important to consider the entire expense ratio in the comparison. In that regard, they noted that the net expense ratio was below the average of the peer group. The Board considered that other peer funds also utilized less laborious strategies.

The Trustees noted that the Adviser had agreed to an Expense Limitation Agreement, which limits the Fund’s annual operating expenses, that was still in effect and that a new Expense Limitation Agreement with the same terms would be in place along with the New Management Agreement. The Trustees also considered potential benefits for the Adviser in managing the Fund, including promotion of the Adviser’s name.

Following further consideration and discussion of the foregoing, the Board concluded that the fee paid to the Adviser by the Fund was fair and reasonable in relation to the nature and quality of the services provided by the Adviser and that they reflected charges that were within a range of what could have been negotiated at arm’s length.

| (4) | The profits to be realized by the Adviser and its affiliates from the relationship with the Fund. The Trustees reviewed the Adviser’s profitability analysis in connection with its management of the Fund and noted that the Adviser earned what the Board considered to be a reasonable profit from its relationship with the Fund and would continue to do so after the Closing. The Board concluded that the Adviser’s profitability was not excessive. |

| (5) | The extent to which economies of scale would be realized as the Fund grows and whether advisory fee levels reflect those economies of scale for the benefit of the Fund’s investors. The Trustees considered that the Fund’s fee arrangements with the Adviser involved both the management fee and an Expense Limitation Agreement. The Trustees noted that, while the management fee remains the same at all asset levels, the Fund’s shareholders have benefitted from the Fund’s expense limitation arrangement over time, although the Fund’s assets had grown to a level where the Fund’s expenses fell below the cap set by the arrangement, and as a result the Adviser has been receiving its full fee. The Trustees further noted that prior fee waivers and expense reimbursements borne by the Adviser have aided the Fund’s growth since its inception. The Trustees also noted that the Fund’s shareholders would benefit from economies of scale under the Fund’s agreements with service providers other than the Adviser. Further, the size of the Fund has allowed the Adviser to lead additional negotiations to reduce the Fund’s fees when making investments, which, while time intensive for the Adviser, reflected significant benefits to the Fund. Following further discussion of the Fund’s current and projected asset levels, expectations for growth, and fee levels, the Board determined that the Fund’s fee arrangements were fair and reasonable in relation to the nature and quality of the services provided by the Adviser and that the Expense Limitation Agreement has provided savings for the benefit of the Fund’s investors. |

| (6) | The Adviser’s practices regarding brokerage and portfolio transactions. The Trustees reviewed the Adviser’s standards, and performance in utilizing those standards, for seeking best execution for Fund portfolio transactions. The Trustees also considered the portfolio turnover rate for the Fund; the process by which evaluations are made of the overall reasonableness of commissions paid; the method and basis for selecting and evaluating the broker-dealers used; any anticipated allocation of portfolio business to persons affiliated with the Adviser; and the extent to which the Fund allocates portfolio business to broker-dealers who provide research, statistical, or other services (“soft dollars”). After further review and discussion, the Board determined that the Adviser’s practices regarding brokerage and portfolio transactions were satisfactory. |

| (7) | The Adviser’s practices regarding conflicts of interest. The Trustees evaluated the potential for conflicts of interest and considered such matters as the experience and ability of the advisory personnel assigned to the Fund; the basis of decisions to buy or sell securities for the Fund and the Adviser’s other accounts; the method for bunching of portfolio securities transactions; and the substance and administration of the Adviser’s code of ethics. Following further consideration and discussion, the Board indicated that the Adviser’s standards and practices relating to the identification and mitigation of potential conflicts of interests were satisfactory. |

Having requested and received such information from the Adviser as the Trustees believed to be reasonably necessary to evaluate the terms of the New Management Agreement, the Board, including the Independent Trustees, approved the New Management Agreement and voted to recommend it to the shareholders of the Fund for approval.

Section 15(f) of the 1940 Act

With respect to the Fund, the Transaction was structured in reliance upon Section 15(f) of the 1940 Act. Section 15(f) of the 1940 Act provides that when a sale of an interest in an investment adviser of a registered investment company occurs that results in an assignment of an investment advisory agreement, the adviser or any of its affiliated persons may receive any amount or benefit in connection with the sale so long as two conditions are satisfied. The first condition of Section 15(f) is that during the three-year period following the completion of the transaction, at least 75% of the investment company’s board of trustees must not be “interested persons” (as defined in the 1940 Act) of the Adviser. Following the contemplated resignation of Mr. Kevin A. Shields from the Fund’s Board, at least 75% of the Board will not “interested persons”, and the Board has no current intention to change the Board’s composition during the three-year period after the Effective Date in a manner that would cause the Board to fail this requirement. Second, an “unfair burden” (as defined in the 1940 Act) must be not be imposed on the investment company as a result of the transaction relating to the sale of such interest, or any express or implied terms, conditions or understandings applicable thereto. The term “unfair burden” includes any arrangement during the two-year period after the transaction whereby the adviser (or predecessor or successor adviser), or any “interested person” (as defined in the 1940 Act) of such adviser, receives or is entitled to receive any compensation, directly or indirectly, from the investment company or its security holders (other than fees for bona fide investment advisory or other services) or from any person in connection with the purchase or sale of securities or other property to, from or on behalf of the investment company (other than bona fide ordinary compensation as principal underwriter for the investment company). The advisory fee under the New Management Agreement will remain the same as the advisory fee under the Prior Management Agreement, and there is no intention to increase the management fee payable to the Adviser during the two-year period after the Effective Date.

Interim Management Agreement

If shareholders have not yet approved the New Management Agreement by the Effective Date, the Adviser and the Fund plan to enter into the Interim Management Agreement. The Interim Management Agreement was considered and approved by the Board, including the Independent Trustees, at Board meetings held on December 22, 2021 and December 28, 2021.

The terms of the Prior Management Agreement, the Interim Management Agreement, and the New Management Agreement are substantially similar. There has not been, and there will not be, an increase in the advisory fee payable by the Fund to the Adviser as a consequence of the Transaction. The services provided by the Adviser under the Interim Management Agreement are identical to the services provided by the Adviser under the Prior Management Agreement.

There are no material differences between the Prior Management Agreement and the Interim Management Agreement, except for the term and termination provisions. In addition, the Interim Management Agreement contains provisions that state that the fee payable by the Fund to the Adviser will be paid into an interest-bearing escrow account with the Fund’s custodian or a bank for the period during which the Interim Management Agreement is in effect. Under the terms of the Interim Management Agreement and in accordance with Rule 15a-4 under the 1940 Act: (i) the term of the Interim Management Agreement is the earlier of 150 days from the effective date of the Interim Management Agreement or the date on which the New Management Agreement is approved by the shareholders of the Fund; and (ii) the Interim Management Agreement may be terminated by the Board on 10 days’ written notice to the Adviser If shareholders of the Fund do not approve the New Management Agreement within 150 days from the date of the Interim Management Agreement, the Adviser will be paid the total amount in the escrow account, including interest earned.

Pursuant to the Interim Management Agreement and as under the Prior Management Agreement, the Adviser will receive a monthly management fee computed at the annual rate of 1.50% of the Fund’s daily net assets.

Conclusion

The Board believes approval of the New Management Agreement will benefit the Fund and its shareholders. The Board recommends voting FOR the Proposal. In the event that the Proposal is not approved by the Fund’s shareholders, the Board will then consider what action, if any, should be taken with respect to the Fund.

* * *

REQUIRED VOTE AND THE BOARD’S RECOMMENDATION

The approval of the Proposal requires the affirmative vote of a majority of the Fund’s outstanding voting securities as defined in the 1940 Act. Such a majority means the affirmative vote of the holders of (a) 67% or more of the shares of the Fund present, attending the Special Meeting virtually or presented by proxy, at the Special Meeting, if the holders of more than 50% of the outstanding shares of the Fund are so present, or (b) more than 50% of the outstanding shares of the Fund, whichever is less.

THE BOARD, INCLUDING THE INDEPENDENT TRUSTEES, UNANIMOUSLY RECOMMENDS THAT SHAREHOLDERS VOTE “FOR” PROPOSAL 1.

* * *

PROPOSAL 2: APPROVAL OF NEW INVESTMENT SUB-ADVISORY AGREEMENT BETWEEN GRIFFIN CAPITAL ADVISOR, LLC AND CENTERSQUARE INVESTMENT MANAGEMENT LLC

Introduction

The Board is recommending the approval of the New CenterSquare Agreement for the Fund between Griffin Capital Advisor, LLC and CenterSquare. CenterSquare is a limited liability company owned by (i) members of CenterSquare’s management; (ii) private funds sponsored by Lovell Minnick Partners LLC, a private equity firm (“Lovell Minnick”); and (iii) certain co-investors. CenterSquare is not affiliated with the Adviser or AGMI.

Over the course of several meetings commencing on December 14, 2021, the Board, including the Independent Trustees received and reviewed information from the Adviser, Griffin Capital, and AGMI regarding the Transaction. At a special meeting of the Board held on December 22, 2021, the Board reviewed and considered information provided by CenterSquare that it had requested regarding the proposed New CenterSquare Agreement between the Adviser and CenterSquare. Subsequently, at a special meeting of the Board held on December 28, 2021, which was called for the purpose of considering the New CenterSquare Agreement, the Board, after meeting in executive session with counsel, approved the New CenterSquare Agreement, subject to shareholder approval, in order for CenterSquare to continue to provide services to the Fund without disruption. Also on December 22, 2021 and December 28, 2021, respectively, the Board considered and approved both the New Aon Agreement and the New CenterSquare Agreement, subject to shareholder approval, in order for Aon and CenterSquare to continue to provide services to the Fund without disruption.

Under the 1940 Act, a new sub-advisory agreement generally requires approval by a majority of such investment company’s outstanding voting securities, as defined in the 1940 Act, before it can go into effect. Therefore, the Board has called the Special Meeting to seek shareholder approval of the New CenterSquare Agreement in order to ensure that CenterSquare can continue to provide uninterrupted service as sub-adviser to the Fund. If shareholders approve this Proposal, the New CenterSquare Agreement is expected to take effect on the Effective Date.

There will be no increase in the advisory fee payable by the Fund to the Adviser as a consequence of the Transaction, and the sub-advisory fee payable by the Adviser to CenterSquare under the New CenterSquare Agreement will be the same as that payable by the Adviser to CenterSquare under the Prior CenterSquare Agreement. The New CenterSquare Agreement is substantially similar in all material respects to the Prior CenterSquare Agreement, and the Fund’s investment strategy, management policies, and portfolio managers will not change in connection with the implementation of the New CenterSquare Agreement. CenterSquare confirmed to the Board that it anticipated that there will be no diminution in the nature, extent or quality of the services provided to the Fund in connection with the implementation of the New CenterSquare Agreement.

If sufficient shareholder votes to approve the New CenterSquare Agreement are not received in advance of the Effective Date, CenterSquare is expected to manage the Fund under an Interim Investment Sub-Advisory Agreement (the “Interim CenterSquare Agreement”) for the Fund between the Adviser and CenterSquare until the earlier of 150 days from the effective date of the Interim CenterSquare Agreement or the date on which the New CenterSquare Agreement is approved by the shareholders of the Fund. See “The Interim CenterSquare Agreement” below.

Information about CenterSquare

CenterSquare, headquartered at 630 West Germantown Pike, Suite 300, Plymouth Meeting, Pennsylvania 19462, is an investment advisory firm registered with the U.S. Securities and Exchange Commission (the “SEC”) specializing in actively managed real estate and infrastructure strategies. CenterSquare is a limited liability company formed under the laws of the State of Delaware. Lovell Minnick-sponsored private funds and certain co-investors own approximately 80% of the equity interests of CenterSquare, and certain members of CenterSquare’s management team own approximately 20% of the equity interests of CenterSquare. The investors in the private funds sponsored by Lovell Minnick include endowments, insurance companies and pension funds, and Lovell Minnick is the general partner of the funds. No single member of CenterSquare’s management team, nor any co-investor, own more than 25% of CenterSquare’s voting securities as of the date of the Proxy Statement.

The Transaction will have no impact on CenterSquare, its personnel or its services to the Fund. CenterSquare or its predecessor, CenterSquare Investment Management, Inc., has served as the Fund’s sub-adviser since the Fund commenced operations on June 30, 2014. The Prior CenterSquare Agreement was approved by the Fund’s shareholders on June 27, 2018. CenterSquare has assets under management of approximately $14 billion as of September 30, 2021.

CenterSquare has no current plans to change the manner in which investments are selected for the Fund’s portfolio. CenterSquare assists the Adviser by managing the portion of the Fund’s investment portfolio that is allocated to publicly traded securities, such as common and preferred stocks, and debt securities of issuers that are principally engaged in, or related to, the real estate industry, including those that own significant real estate assets.

CenterSquare does not currently serve as investment adviser or sub-adviser to any registered investment companies that have a similar investment objective or similar investment management policies as the Fund.

The names, titles, and principal occupations of the officers of CenterSquare are set forth below. The business address for each person listed below is 630 West Germantown Pike, Suite 300, Plymouth Meeting, PA 19462.

| Name | Title | Principal Occupation |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

No Trustee has, or has had, any material interest in a material transaction or proposed transaction with CenterSquare since the beginning of the Fund’s most recently completed fiscal year.

The New CenterSquare Agreement

The following discussion is a description of the material terms of the New CenterSquare Agreement. The form of the New CenterSquare Agreement is attached as Attachment B to this Proxy Statement.

On December 22, 2021 and December 28, 2021, the Board considered and approved the New CenterSquare Agreement. When evaluating the reasonableness of the New CenterSquare Agreement, the Board considered multiple factors related to the reasonableness of the New CenterSquare Agreement, as further described below, including the nature of the services provided by CenterSquare, as well as the costs of such services and the profits to be realized by CenterSquare in providing such services. If the New CenterSquare Agreement is approved by shareholders, it is expected to take effect at the Closing. Under the New CenterSquare Agreement, CenterSquare will continue to pursue the investment strategies of the Fund by employing the methodologies described in the Fund’s Prospectus. The services to be provided by CenterSquare under the New CenterSquare Agreement are the same as the services provided by CenterSquare under the Prior CenterSquare Agreement.

The New CenterSquare Agreement, if approved by shareholders as proposed, will provide that the agreement is effective for an initial two-year period and will be renewed thereafter only so long as such renewal and continuance is specifically approved at least annually by the Board, including a majority of the Independent Trustees. The New CenterSquare Agreement may be terminated at any time on at least 60 days’ prior written notice to CenterSquare, without the payment of any penalty, (i) by vote of the Trustees or (ii) by vote of a majority of the outstanding voting securities (as defined in the 1940 Act) of the Fund; and further, it may be terminated at any time by the Adviser, on at least 60 days’ prior written notice to CenterSquare, and subject to certain termination conditions as agreed to between the Adviser and CenterSquare. CenterSquare may terminate the New CenterSquare Agreement at any time, without the payment of any penalty, on at least 60 days' prior written notice to the Adviser and the Fund. In addition, the New CenterSquare Agreement provides that it will terminate automatically in the event of its “assignment,” as defined in the 1940 Act.

Pursuant to the New CenterSquare Agreement and as under the Prior CenterSquare Agreement, CenterSquare will receive fees as follows: (i) 0.65% for up to $50 million in assets under advisement, 0.50% for $50 million to $100 million in assets under advisement, and 0.45% for $100 million or more in assets under advisement until assets under advisement by CenterSquare exceed $25 million; and (ii) 0.50% for up to $50 million in assets under advisement, 0.45% for $50 million to $100 million in assets under advisement, 0.40% for $100 million to $150 million in assets under advisement, and 0.35% for $150 million or more in assets under advisement once assets under advisement by CenterSquare exceed $25 million. During the fiscal year ended September 30, 2021, CenterSquare received $3,214,907 in sub-advisory fees from the Adviser.

Like the Prior CenterSquare Agreement, the New CenterSquare Agreement, if approved by shareholders as proposed, will continue to provide that CenterSquare is not liable for any error of judgment or for any loss suffered by the Adviser or the Fund in connection with the performance of the New CenterSquare Agreement, except a loss resulting from a breach of fiduciary duty with respect to receipt of compensation for services (in which case any award of damages shall be limited to the period and the amount set forth in Section 36(b)(3) of the 1940 Act) or a loss resulting from willful misfeasance, bad faith or gross negligence on CenterSquare’s part in the performance of, or from reckless disregard by CenterSquare of its obligations and duties under, the New CenterSquare Agreement.

The form of the New CenterSquare Agreement is attached to this Proxy Statement as Attachment B. Please take the time to read the New CenterSquare Agreement. The description of the New CenterSquare Agreement in this Proxy Statement is only a summary. If the New Sub-Advisory Agreement with CenterSquare is not approved by shareholders, the Board will consider other options, including a new or modified request for shareholder approval of a new investment sub-advisory agreement.

Evaluation by the Fund’s Board

At meetings of the Board on December 22, 2021 and December 28, 2021, the Board, including the Independent Trustees, discussed and approved the New CenterSquare Agreement between the Adviser and CenterSquare. The Board, including the Independent Trustees, also discussed and approved the Interim CenterSquare Agreement for the Fund in order for CenterSquare to continue to provide services to the Fund without disruption. The Board, including the Independent Trustees, concluded that approval of these agreements was in the best interests of the Fund and its shareholders.

In connection with the December 22, 2021 and December 28, 2021 Board meetings and in accordance with Section 15(c) of the 1940 Act, the Board requested, and the Adviser and CenterSquare provided, materials relating to the Board’s consideration of whether to approve the New Sub-Advisory Agreement. This included a description of the Transaction and its anticipated effects on CenterSquare. The Board noted that the services provided under the New CenterSquare Agreement will be identical to those provided under the Prior CenterSquare Agreement. In addition, the sub-advisory fee under the New CenterSquare Agreement will remain the same as the sub-advisory fee under the Prior CenterSquare Agreement. CenterSquare confirmed that under the New CenterSquare Agreement that it anticipated that there would be no diminution in services provided by CenterSquare to the Fund or changes in the fee payable by the Adviser to CenterSquare as a result of the Transaction.

In considering whether to approve the New CenterSquare Agreement, the Trustees reviewed and considered the information they deemed reasonably necessary, including the following material factors discussed in further detail below: (1) the nature, extent, and quality of the services to be provided by CenterSquare; (2) the investment performance of the Fund and CenterSquare; (3) the costs of the services to be provided and profits to be realized by CenterSquare and its affiliates from the relationship with the Fund; (4) the extent to which economies of scale would be realized as the Fund grows and whether sub-advisory fee levels reflect those economies of scale for the benefit of the Fund’s investors; (5) CenterSquare’s practices regarding brokerage and portfolio transactions; and (6) CenterSquare’s practices regarding possible conflicts of interest.

The Trustees also reviewed a memorandum from the Fund’s legal counsel that summarized the fiduciary duties and responsibilities of the Board in reviewing and approving the New CenterSquare Agreement, including the types of information and factors that should be considered in order to make an informed decision.

| (1) | The nature, extent, and quality of the services to be provided by CenterSquare. The Board received and considered information regarding the fact that the nature, extent and quality of services to be provided to the Fund by CenterSquare under the New CenterSquare Agreement are the same as under the Prior CenterSquare Agreement and are not expected to change as a result of the Transaction. The Trustees considered the responsibilities of CenterSquare under the New CenterSquare Agreement and reviewed the services provided to the Fund including, without limitation, CenterSquare’s procedures for formulating investment recommendations and assuring compliance with the Fund’s investment objectives and limitations, coordination of services for the Fund among the Fund’s service providers, and efforts to promote the Fund, grow the Fund’s assets, and assist in the distribution of Fund shares. The Trustees noted that CenterSquare assists the Adviser in seeking to achieve the Fund’s investment objective to generate a return comprised of both current income and capital appreciation with moderate volatility and low correlation to the broader markets, through pursuing strategic investing across private institutional real estate investment funds as well as a diversified set of public real estate securities. The Trustees also noted that CenterSquare seeks to invest the Fund’s assets across a diversified set of public real estate securities. The Board concluded that the Fund would continue to benefit from the quality and experience of CenterSquare’s investment professionals that will continue to provide services to the Fund after the Transaction as employees of CenterSquare. After reviewing the foregoing information and further information in the memorandum from CenterSquare (e.g., CenterSquare’s Form ADV and descriptions of the firm’s business and compliance program), the Board concluded that the nature, extent, and quality of the services provided by CenterSquare were satisfactory and appropriate for the Fund. |

| (2) | The investment performance of the Fund and CenterSquare. The Trustees discussed the performance of the public real estate related securities portion of the Fund. The Trustees noted the Fund’s continued strong performance in the period since inception and recalled their deliberations relating to the Adviser. The Board agreed that they should consider the performance of the Fund as a whole in reviewing this factor and noted that Adviser continued to be satisfied with CenterSquare’s performance. After reviewing these considerations, the Board concluded that the investment performance of CenterSquare was satisfactory. |

| (3) | The costs of the services to be provided by CenterSquare. The Trustees evaluated the overall expenses of the Fund, including the nature and frequency of advisory and sub-advisory fee payments. The Trustees also considered potential benefits for CenterSquare in providing services to the Fund. The Trustees noted that the Adviser paid the fee to CenterSquare out of its management fee, agreeing that, accordingly, the Fund’s overall management fee and expenses was the appropriate vehicle to compare to other funds. The Board also noted that CenterSquare represented that the sub-advisory fee being charged to the Fund was a material discount from its standard fee schedule. The Board recalled their deliberations relating to the Adviser’s cost of services. Following further consideration and discussion of the foregoing, the Board concluded that the fees to be paid to CenterSquare by the Fund were fair and reasonable in relation to the nature and quality of the services provided by CenterSquare and that they reflected charges that were within a range of what could have been negotiated at arm’s length. |

| (4) | The profits to be realized by CenterSquare and its affiliates from the relationship with the Fund. The Trustees reviewed CenterSquare’s profitability analysis in connection with its management of the Fund and noted that CenterSquare earned what the Board considered to be a reasonable profit from its relationship with the Fund. The Board concluded that CenterSquare’s profitability was not excessive. |

| (5) | The extent to which economies of scale would be realized as the Fund grows and whether the advisory fee levels reflect these economies of scale for benefit of the Fund’s investors. The Trustees considered that the Fund’s fee arrangements with CenterSquare and noted that the sub-advisory fee contained break points, which caused the Adviser to pay lower fees to CenterSquare based on higher asset levels. Following further discussion of the Fund’s current and projected asset levels, expectations for growth, and levels of fees, the Board determined that the Fund’s fee arrangements were fair and reasonable in relation to the nature and quality of the services provided by CenterSquare. |

| (6) | CenterSquare’s practices regarding brokerage and portfolio transactions. The Trustees reviewed CenterSquare standards, and performance in utilizing those standards, for seeking best execution for Fund portfolio transactions. The Trustees also considered the portfolio turnover rate for the Fund; the process by which evaluations are made of the overall reasonableness of commissions paid; the method and basis for selecting and evaluating the broker-dealers used; any anticipated allocation of portfolio business to persons affiliated with CenterSquare; and the extent to which the Fund allocates portfolio business to broker-dealers who provide research, statistical, or other services (“soft dollars”). After further review and discussion, the Board determined that CenterSquare’s practices regarding brokerage and portfolio transactions were satisfactory. |

| (7) | CenterSquare’s practices regarding conflicts of interest. The Trustees evaluated the potential for conflicts of interest and considered such matters as the experience and ability of the advisory personnel assigned to the Fund; the basis of decisions to buy or sell securities for the Fund and CenterSquare’s other accounts; the method for bunching of portfolio securities transactions; and the substance and administration of CenterSquare’s code of ethics. Following further consideration and discussion, the Board indicated that CenterSquare’s standards and practices relating to the identification and mitigation of potential conflicts of interests were satisfactory. |

Having requested and received such information from CenterSquare as the Trustees believed to be reasonably necessary to evaluate the terms of the New CenterSquare Agreement, the Board, including the Independent Trustees, approved the New CenterSquare Agreement and voted to recommend it to the shareholders of the Fund for approval.

The Interim CenterSquare Agreement

If shareholders have not yet approved the New CenterSquare Agreement by the Effective Date, the Adviser and CenterSquare plan to enter into the Interim CenterSquare Agreement. The Interim CenterSquare Agreement was considered and approved by the Board, including the Independent Trustees, at Board meetings held on December 22, 2021 and December 28, 2021. The Board discussed the Transaction, and the Adviser recommended the approval of the Interim CenterSquare Agreement and the New CenterSquare Agreement in connection with the automatic termination of the Prior CenterSquare Agreement. Prior to the approval of the Interim CenterSquare Agreement, CenterSquare served as a sub-adviser to the Fund pursuant to the Prior CenterSquare Agreement.

The terms of the Prior CenterSquare Agreement, the Interim CenterSquare Agreement, and the New CenterSquare Agreement are substantially similar. There has not been, and there will not be, an increase in the advisory fee payable by the Fund to the Adviser as a consequence of the Transaction, and the sub-advisory fee payable by the Adviser to CenterSquare under the Interim CenterSquare Agreement and the New CenterSquare Agreement will be the same as that payable by the Adviser to CenterSquare under the Prior CenterSquare Agreement. During the Board meetings, CenterSquare confirmed to the Board that it anticipated that there will be no diminution in the nature, extent or quality of the services provided to the Fund as a result of the Transaction. The services provided by CenterSquare under the Interim CenterSquare Agreement are identical to the services provided by CenterSquare under the Prior CenterSquare Agreement.

There are no material differences between the Prior CenterSquare Agreement and the Interim CenterSquare Agreement, except for the term and termination provisions. In addition, the Interim CenterSquare Agreement contains provisions that state that the fee payable by the Adviser to CenterSquare will be paid into an interest-bearing escrow account with the Fund’s custodian or a bank for the period during which the Interim CenterSquare Agreement is in effect. Under the terms of the Interim CenterSquare Agreement and in accordance with Rule 15a-4 under the 1940 Act: (i) the term of the Interim CenterSquare Agreement is the earlier of 150 days from the effective date of the Interim CenterSquare Agreement or the date on which the New CenterSquare Agreement is approved by the shareholders of the Fund; and (ii) the Interim CenterSquare Agreement may be terminated by the Board on 10 days’ written notice to CenterSquare. If shareholders of the Fund do not approve the New CenterSquare Agreement within 150 days from the date of the Interim CenterSquare Agreement, CenterSquare will be paid the total amount in the escrow account, including interest earned.

Pursuant to the Interim CenterSquare Agreement and as under the Prior CenterSquare Agreement, CenterSquare will receive fees as follows: (i) 0.65% for up to $50 million in assets under advisement, 0.50% for $50 million to $100 million in assets under advisement, and 0.45% for $100 million or more in assets under advisement until assets under advisement by CenterSquare exceed $25 million; and (ii) 0.50% for up to $50 million in assets under advisement, 0.45% for $50 million to $100 million in assets under advisement, 0.40% for $100 million to $150 million in assets under advisement, and 0.35% for $150 million or more in assets under advisement once assets under advisement by CenterSquare exceed $25 million.

Conclusion

The Board believes approval of the New CenterSquare Agreement will benefit the Fund and its shareholders. The Board recommends voting FOR the Proposal. In the event that the Proposal is not approved by the Fund’s shareholders, the Board will then consider what action, if any, should be taken with respect to the Fund.

* * *

REQUIRED VOTE AND THE BOARD’S RECOMMENDATION

The approval of the Proposal requires the affirmative vote of a majority of the Fund’s outstanding voting securities as defined in the 1940 Act. Such a majority means the affirmative vote of the holders of (a) 67% or more of the shares of the Fund present, attending the Special Meeting virtually or presented by proxy, at the Special Meeting, if the holders of more than 50% of the outstanding shares of the Fund are so present, or (b) more than 50% of the outstanding shares of the Fund, whichever is less.

THE BOARD, INCLUDING THE INDEPENDENT TRUSTEES, UNANIMOUSLY RECOMMENDS THAT SHAREHOLDERS VOTE “FOR” PROPOSAL 2.

* * *

PROPOSAL 3: APPROVAL OF NEW INVESTMENT SUB-ADVISORY AGREEMENT BETWEEN GRIFFIN CAPITAL ADVISOR, LLC AND AON INVESTMENTS USA INC.

Introduction

The Board is recommending the approval of the New Aon Agreement for the Fund between Griffin Capital Advisor, LLC and Aon. Aon is the U.S. Investment Consulting Division of Aon Consulting, Inc. and an indirect wholly-owned subsidiary of Aon plc, a publicly held company. Aon is not affiliated with the Adviser or AGMI.

Over the course of several meetings commencing on December 14, 2021, the Board of Trustees of the Fund (the “Board”) received and reviewed information from the Adviser, Griffin Capital, and AGMI regarding the Transaction. At a special meeting of the Board held on December 22, 2021, the Board reviewed and considered information provided by Aon that it had requested regarding the proposed New Aon Agreement between the Adviser and Aon. Subsequently, at a special meeting of the Board held on December 28, 2021, which was called for the purpose of considering the New Aon Agreement, the Board, after meeting in executive session with counsel, approved the New Aon Agreement, subject to shareholder approval, in order for Aon to continue to provide services to the Fund without disruption.

Under the 1940 Act, a new sub-advisory agreement generally requires approval by a majority of such investment company’s outstanding voting securities, as defined in the 1940 Act, before it can go into effect. Therefore, the Board has called the Special Meeting to seek shareholder approval of the New Aon Agreement in order to ensure that Aon can continue to provide uninterrupted service as sub-adviser to the Fund. If shareholders approve this Proposal, the New Aon Agreement is expected to take effect on the Effective Date.

There will be no increase in the advisory fee payable by the Fund to the Adviser as a consequence of the Transaction, and the sub-advisory fee payable by the Adviser to Aon under the New Aon Agreement will be the same as that payable by the Adviser to Aon under the Prior Aon Agreement. The New Aon Agreement is substantially similar in all material respects to the Prior Aon Agreement, and the Fund’s investment strategy, management policies, and portfolio managers will not change in connection with the implementation of the New Aon Agreement. Aon confirmed to the Board that it anticipated that there will be no diminution in the nature, extent or quality of the services provided to the Fund in connection with the implementation of the New Aon Agreement.

If sufficient shareholder votes to approve the New Aon Agreement are not received in advance of the Effective Date, Aon is expected to manage the Fund under an Interim Investment Sub-Advisory Agreement (the “Interim Aon Agreement”) for the Fund between the Adviser and Aon until the earlier of 150 days from the effective date of the Interim Aon Agreement or the date on which the New Aon Agreement is approved by the shareholders of the Fund. See “The Interim Aon Agreement” below.

Information about Aon

Aon, headquartered at 200 East Randolph Street, Suite 700, Chicago, Illinois 60601, is an investment advisory firm registered with the U.S. Securities and Exchange Commission (the “SEC”). Aon and its affiliates have provided global leadership in investment consulting and have been leading advisers to corporate and public pension plans, defined contribution plans, union associations, health systems, financial intermediaries, endowments and foundations. Aon had $3.03 trillion in assets under advisement as of March 31, 2021.

Aon is a corporation formed under the laws of the State of Illinois. Aon is the U.S. Investment Consulting Division of Aon Consulting, Inc. and an indirect wholly owned subsidiary of Aon plc, a publicly held company (NYSE: Aon). Aon employs over 800 professionals in 10 countries serving more than 1,900 clients worldwide.

The Transaction will have no impact on Aon, its personnel or its services to the Fund. Aon has served as the Fund’s sub-adviser since the Fund commenced operations on June 30, 2014. The Prior Aon Agreement was approved by the Fund’s initial shareholder on May 12, 2014.

Aon has no current plans to change the manner in which investments are recommended for the Fund’s portfolio. Aon Investments assists the Adviser by providing ongoing research, opinions and recommendations to the portion of the Fund’s investment portfolio that is allocated to private real estate investment funds.

Aon does not currently serve as investment adviser or sub-adviser to any registered investment companies that have a similar investment objective or similar investment management policies as the Fund.

The names, titles, and principal occupations of the officers of Aon are set forth below. The business address for each person listed below is 200 East Randolph Street, Suite 700, Chicago, Illinois 60601.

| Name | Title | Principal Occupation |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

No Trustee has, or has had, any material interest in a material transaction or proposed transaction with Aon since the beginning of the Fund’s most recently completed fiscal year.

The New Aon Agreement