| 1) | Elect the Board’s three nominees for Class I directors for terms expiring in 2027 |

| 2) | Approve an amendment to the Company’s Amended and Restated Certificate of Incorporation to declassify the Board of Directors |

| 3) | Approve an amendment to the Company’s Amended and Restated Certificate of Incorporation to eliminate the supermajority voting provisions |

| 4) | Approve an amendment to the Company’s Amended and Restated Certificate of Incorporation to allow for exculpation of officers as permitted by Delaware law |

| 5) | Approve, in a non-binding vote, the compensation of our named executive officers as disclosed in the accompanying Proxy Statement |

| 6) | Ratify the appointment of Grant Thornton as our independent registered public accounting firm for 2024 |

| 7) | Act upon such other matters as may properly come before the meeting |

| | | By: | | |  | |

| | | | | R. Colby Slaughter Corporate Secretary |

| | Proxy Statement Summary | |

| | This summary highlights selected information that is provided in more detail throughout this Proxy Statement. This summary does not contain all of the information you should consider before voting, and you should read the entire Proxy Statement before casting your vote. | |

| | | Date & Time May 15, 2024 5:30 p.m. Eastern Time | | | Voting Stockholders of record holding our Common Stock as of the close of business on the record date, which is the close of business on March 15, 2024 (Record Date), are entitled to vote. Each share of Common Stock is entitled to one vote for each matter to be voted upon. |

| | | Location DoubleTree Hotel 1201 Riverplace Boulevard Jacksonville, Florida | | | Admission To attend the Annual Meeting, you will need to bring (1) proof of ownership of Common Stock as of the record date and (2) a valid government-issued photo identification. If you do not have proof of ownership together with a valid government-issued photo identification, you will not be admitted to the meeting. |

| | | Record Date Record holders of our Common Stock as of March 15, 2024 are entitled to notice of and to vote at, the Annual Meeting | | | Admission to the Annual Meeting is limited to stockholders holding our Common Stock as of the record date and one immediate family member; one individual properly designated as a stockholder’s authorized proxy holder; or one qualified representative authorized to present a stockholder proposal properly before the meeting. No cameras, recording equipment, large bags, briefcases, or packages will be permitted in the Annual Meeting. The Company may implement additional security procedures to ensure the safety of the meeting attendees. Questions and Answers about the Annual Meeting can be found in Appendix A. |

| | MATTER | | | | | BOARD VOTE RECOMMENDATION | | | PAGE REFERENCE (FOR MORE DETAIL) | | |

| | Proposal 1 | | | Elect the Board’s three nominees for Class I directors for terms expiring in 2027 | | | FOR each nominee | | | | |

| | Proposal 2 | | | Approve an amendment to the Company’s Amended and Restated Certificate of Incorporation to declassify the Board of Directors | | | FOR the proposal | | | | |

| | Proposal 3 | | | Approve an amendment to the Company’s Amended and Restated Certificate of Incorporation to eliminate the supermajority voting provisions | | | FOR the proposal | | | | |

| | Proposal 4 | | | Approve an amendment to the Company’s Amended and Restated Certificate of Incorporation to allow for exculpation of officers as permitted by Delaware law | | | FOR the proposal | | | | |

| | Proposal 5 | | | Approve, in a non-binding vote, the compensation of our named executive officers as disclosed in this Proxy Statement | | | FOR the proposal | | | | |

| | Proposal 6 | | | Ratify the appointment of Grant Thornton as our independent registered public accounting firm for 2024 | | | FOR the proposal | | | |

| | | 2024 RYAM PROXY STATEMENT | | | | | 1 |

COMMITMENT TO BEST PRACTICES IN CORPORATE GOVERNANCE |

| | STOCKHOLDER RIGHTS | | |||

| | Proposal to Declassify the Board of Directors | | | In our 2019, 2020, 2022 and 2023 proxy statements, management submitted a proposal to be voted on by stockholders at the 2019, 2020, 2022 and 2023 Annual Meetings to declassify the Company’s Board of Directors. This proposal did not receive the required stockholder approval. Again, at our 2024 Annual Meeting, management is proposing that the stockholders vote to declassify the Board. | |

| | Proposal to Eliminate Supermajority Voting Provisions | | | In our 2019, 2020, 2022 and 2023 proxy statements, management submitted a proposal to be voted on by stockholders at the 2019, 2020, 2022 and 2023 Annual Meetings to eliminate supermajority voting provisions from the Company’s Amended and Restated Certificate of Incorporation in favor of a majority voting standard. This proposal did not receive the required stockholder approval. Again, at our 2024 Annual Meeting, management is proposing that the stockholders vote to eliminate the supermajority voting provisions from the Company’s Amended and Restated Certificate of Incorporation. | |

| | Independent, Non-Executive Chair of the Board | | | Our Board of Directors is led by a Non-Executive Chair. | |

| | Single Voting Class | | | All holders of RYAM Common Stock have the same voting rights - one vote per share of stock. | |

| | Majority Voting Standard for Director Elections | | | Our Amended and Restated Bylaws mandate that directors be elected under a majority voting standard in uncontested elections. Each director must receive more votes “For” his or her election than votes “Against” in order to be elected. | |

| | Director Resignation | | | Any incumbent nominee for director who does not receive the affirmative vote of a majority of the votes cast in any uncontested election shall tender his or her resignation. The Nominating and Corporate Governance Committee (Nominating Committee) will consider the resignation and make a recommendation to the full Board. The full Board will then decide to accept or reject the tendered resignation and publicly disclose its decision and rationale. | |

2 | | | | |  | | |

COMMITMENT TO BEST PRACTICES IN CORPORATE GOVERNANCE |

| | BOARD COMPOSITION AND ACCOUNTABILITY | | |||

| | Independence | | | Our Corporate Governance Principles (CGPs) require that not less than 75% of our directors be independent. At all times during 2023, 89% (eight of nine) of our directors were independent. Additionally, each of our Audit, Compensation and Management Development, Nominating and Corporate Governance and Sustainability committees have consisted entirely of independent directors. See Director Independence section. | |

| | Diversity | | | The composition of the Board represents a diverse and broad mix of skills, experience, attributes, knowledge and perspectives relevant to our business. Three of our nine directors are women and one of the remaining six is racially/ethnically diverse. A summary of relevant director experience and qualifications can be found in the Director Qualifications section. | |

| | Continuous Board Refreshment | | | The average tenure of our directors is 6.2 years. Since 2018, the Board has appointed seven new directors, representing refreshment of 78% of the current nine-member Board in that time. Bryan D. Yokley is the Board’s most recent addition, having been appointed in October 2023. | |

| | Annual Management Succession Planning Review | | | The Board conducts an annual review of management development and succession planning for the CEO and Company senior leadership. See Succession Planning section. | |

| | Director Tenure | | | Our CGPs provide that a director is required to submit an offer of resignation for consideration by the Board upon any significant change in the director’s principal employment or personal circumstance that could adversely impact his or her reputation or the reputation of the Company. See Director Qualifications section. | |

| | Director Overboarding Limits | | | Our CGPs contain provisions to ensure that each of our directors is able to dedicate the meaningful amount of time and attention necessary to be a highly effective member of the Board. A director who is not serving as CEO of a public company may serve on no more than three public company boards (in addition to our Board), and a director serving as the CEO of a public company (including our CEO) may serve on no more than two other public company board (in addition to our Board). No director serving on the Company’s Audit Committee may also serve on the Audit Committee of more than two other public companies. | |

| | Mandatory Stock Ownership | | | Directors with five or more years of tenure on the Board are required to own Company stock having an aggregate equity value equal to or greater than the sum of their annual cash retainers over the previous five years. Prior to reaching this ownership requirement, directors are required to hold all Company stock comprising their annual equity retainer. | |

| | Annual Limit on Director Equity Awards and Cash Compensation | | | Our Incentive Stock Plan limits annual director awards. See Annual Limit on Director Equity Awards and Cash Compensation section. | |

| | | 2024 RYAM PROXY STATEMENT | | | | | 3 |

COMMITMENT TO BEST PRACTICES IN CORPORATE GOVERNANCE |

| Leading the Board’s oversight of the management of the Company |

| Approving materials and agendas for Board meetings in consultation with other directors and management |

| Presiding during stockholder meetings, Board meetings and executive sessions of the independent directors |

| Facilitating communication among directors and the regular flow of information between management and directors |

| Serving as principal liaison between independent directors and the CEO |

| Leading independent directors in periodic reviews of the performance of the CEO |

| If requested by major stockholders, ensuring he or she is available for consultation and direct communication |

| Recommending independent outside advisors who report directly to the Board on material issues |

| Assisting the Board and the Company’s officers in adhering to the CGPs |

| In collaboration with the Nominating Committee, leading the Board’s annual self-assessment, Committee assignment process and recruitment efforts |

4 | | | | |  | | |

COMMITMENT TO BEST PRACTICES IN CORPORATE GOVERNANCE |

| The Nominating Committee reviews the prior year’s process of self-evaluation and assessment for the Board and Board committees, as well as current trends and best practices. |

| Under the auspices of the Nominating Committee, the Corporate Secretary facilitates the process agreed upon by the Committee. In 2023, this process consisted of preparation of suggested topics of discussion (including key events that occurred during the prior year), which were disseminated to all directors, followed by confidential interviews of each Board member by the Corporate Secretary. |

| The feedback generated from the interviews is summarized by the Corporate Secretary and shared with the Non-Executive Chair of the Board. |

| These results are then communicated in executive session to the full Board and each committee, as well as to individual directors, as appropriate, which fosters robust discussion and consensus on actions to be undertaken. |

| Changes to policies and practices, as warranted, are implemented as directed by the Board. |

| | | 2024 RYAM PROXY STATEMENT | | | | | 5 |

COMMITMENT TO BEST PRACTICES IN CORPORATE GOVERNANCE |

6 | | | | |  | | |

COMMITMENT TO BEST PRACTICES IN CORPORATE GOVERNANCE |

| | | | | ||

| | INVESTMENT COMMUNITY OUTREACH Calls, meetings and other personal engagements | | | >300 | |

| | | | |

| | | | | ||

| | STOCKHOLDER ENGAGEMENT Percentage of Common Stock reached out to/spoken with, through calls, meetings and other personal engagements | | | ~58%/~30% | |

| | | | |

| | | | | ||

| | ANNUAL MEETING ENGAGEMENT Percentage of Common Stock represented by vote at the 2023 Annual Meeting | | | 85% | |

| | | | |

| | | 2024 RYAM PROXY STATEMENT | | | | | 7 |

COMMITMENT TO BEST PRACTICES IN CORPORATE GOVERNANCE |

8 | | | | |  | | |

COMMITMENT TO BEST PRACTICES IN CORPORATE GOVERNANCE |

| Annual cash retainer of $85,000, payable in equal quarterly installments |

| Additional annual cash retainers of $20,000 for the Audit Committee Chair, and $15,000 for each of the Compensation, Finance, Nominating and Sustainability Committee Chairs, payable in equal quarterly installments. No such additional retainer is payable to the Sustainability Committee Chair when such position is held by the then-current Non-Executive Chair of the Board; and |

| Additional annual cash retainer for the Non-Executive Chair of the Board of $100,000, payable in equal quarterly installments |

| | | 2024 RYAM PROXY STATEMENT | | | | | 9 |

COMMITMENT TO BEST PRACTICES IN CORPORATE GOVERNANCE |

| | NAME | | | FEES EARNED OR PAID IN CASH ($) | | | STOCK AWARDS ($)(1) | | | ALL OTHER COMPENSATION ($) | | | TOTAL ($) | |

| | Charles E. Adair | | | 105,000 | | | 115,000(2) | | | - | | | 220,000 | |

| | De Lyle W. Bloomquist(3) | | | - | | | - | | | - | | | - | |

| | Julie A. Dill | | | 100,000 | | | 115,000(2) | | | - | | | 215,000 | |

| | Charles R. Eggert | | | 85,000 | | | 115,000(2) | | | 11,858(4) | | | 211,858 | |

| | James F. Kirsch | | | 100,000 | | | 115,000(2) | | | - | | | 215,000 | |

| | David C. Mariano | | | 85,000 | | | 115,000(2) | | | - | | | 200,000 | |

| | Thomas I. Morgan(5) | | | 63,750 | | | 115,000(2)(6) | | | - | | | 178,750 | |

| | Lisa M. Palumbo | | | 185,000 | | | 115,000(2) | | | - | | | 300,000 | |

| | Ivona Smith | | | 100,000 | | | 115,000(2) | | | - | | | 215,000 | |

| | Bryan D. Yokley | | | 31,992 | | | 72,036(7) | | | - | | | 104,028 | |

| (1) | Represents the aggregate grant date fair value computed in accordance with Financial Accounting Standards Board’s (FASB) Accounting Standards Codification (ASC) Topic 718. A discussion of the assumptions used in calculating these values may be found in Note 16 Incentive Stock Plans included in the notes to consolidated financial statements in our 2023 Annual Report on Form 10-K. |

| (2) | On May 18, 2023, each non-management director (except Mr. Yokley) was granted a restricted stock unit award equivalent to $115,000 which, based on grant date value ($4.21), corresponded to 27,316 restricted stock units, for a total award of $115,000.36 after rounding (because the Company does not issue fractional shares for director equity awards). The aggregate number of restricted stock units outstanding on December 31, 2023 for each of Ms. Dill, Ms. Palumbo, Ms. Smith and Messrs. Adair, Eggert, Kirsch, Mariano and Morgan were 27,316. |

| (3) | Mr. Bloomquist, as an executive officer of the Company, was not compensated for his service as a director. See the Summary Compensation Table for compensation information relating to Mr. Bloomquist during 2023. |

| (4) | Reimbursement for spousal travel expenses. |

| (5) | Mr. Morgan retired from the Board effective September 30, 2023. |

| (6) | In accordance with the terms of the May 18, 2023 non-management director RSU grant, given the specific circumstances of Mr. Morgan’s resignation, the Nominating Committee approved allowing Mr. Morgan’s RSU grant to continue to vest on May 18, 2024, at which time Mr. Morgan will receive the underlying shares of RYAM Common Stock. |

| (7) | On October 1, 2023, Mr. Yokley was granted a restricted stock unit award equivalent to $72,036 which, based on grant date value ($3.51), corresponded to 20,523 restricted stock units, for a total award of $72,035.73 after rounding (because the Company does not issue fractional shares for director equity awards). The aggregate number of restricted stock units outstanding on December 31, 2023 for Mr. Yokley was 20,523. |

10 | | | | |  | | |

COMMITMENT TO BEST PRACTICES IN CORPORATE GOVERNANCE |

| Short sales |

| Trading in options |

| Hedging transactions of all types, including the use of financial instruments such as prepaid variable forwards, equity swaps, collars and exchange funds |

| Pledges of Company securities, such as collateral for margin loans or margin accounts |

| Standing or limit orders, unless under a Rule 10b5-1 plan that meets all requirements of the Company’s applicable policy and is approved by the Company’s Corporate Secretary |

| The Related Person’s relationship to the Company and interest in any transaction with the Company |

| The material terms of a transaction with the Company, including the type and amount |

| The benefits to the Company of any proposed or actual transaction |

| The availability of other sources of comparable products and services that are part of a transaction with the Company; and |

| If applicable, the impact on a director’s independence |

| | | 2024 RYAM PROXY STATEMENT | | | | | 11 |

COMMITMENT TO BEST PRACTICES IN CORPORATE GOVERNANCE |

12 | | | | |  | | |

PROPOSAL 1-ELECTION OF DIRECTORS |

| | | 2024 RYAM PROXY STATEMENT | | | | | 13 |

PROPOSAL 1-ELECTION OF DIRECTORS |

| | | | | |||

| | | The Board of Directors recommends that you vote “FOR” each of its three nominees named below for election to the Board of Directors for a term to expire at the 2027 Annual Meeting of Stockholders. | | | ||

| | |

14 | | | | |  | | |

PROPOSAL 1-ELECTION OF DIRECTORS |

| ||||||||

CHARLES E. ADAIR | | | AGE: 76 | | | DIRECTOR SINCE: 2015 | | |

Mr. Adair has been the President of Kowaliga Capital, Inc., an investment company, since 1993. Mr. Adair previously worked for Durr-Fillauer Medical, Inc. where he served in various capacities including President and Chief Operating Officer from 1973 to 1992. Mr. Adair served on the Board of Directors of Globe Life Inc. from 2003 until his retirement in April 2022. Mr. Adair also served on the Board of Directors of Tech Data Corporation (TECD) from 1995 through June 2020 when TECD was acquired by Apollo Global Management, Inc. and PSS World Medical, Inc. (PSS), from 2002 through February 2013 when PSS was acquired by McKesson Corp. Mr. Adair is a Certified Public Accountant (inactive) and holds a B.S. degree in Accounting from the University of Alabama and is a graduate of the Advanced Management Program from Harvard University. | | | EXPERIENCE: Mr. Adair brings significant experience in public company governance as a director, financial management and accounting, as well as extensive distribution and global supply chain expertise. As a result, we believe he is particularly well-suited to contribute to Board oversight of the Company’s governance and overall financial performance, auditing and its external auditors and controls over financial reporting. | | ||||

| | | 2024 RYAM PROXY STATEMENT | | | | | 15 |

PROPOSAL 1-ELECTION OF DIRECTORS |

| | ||||||||

| | ||||||||

| | ||||||||

| ||||||||

JULIE A. DILL | | | AGE: 64 | | | DIRECTOR SINCE: 2018 | | |

Ms. Dill most recently served as the Chief Communications Officer for Spectra Energy Corp. (Spectra) (which operated in three key areas of the natural gas industry: transmission and storage, distribution, and gathering and processing) from 2013 until Spectra’s merger with Enbridge, Inc. in February 2017. She previously served as the Group Vice President of Strategy for Spectra and the President and CEO of Spectra Energy Partners, LP (NYSE: SEP) from 2012 until 2013 and prior to that served as President of Union Gas Limited from 2007 until 2011. Previously, Ms. Dill served in various financial and operational roles with Duke Energy, Duke Energy International and Shell Oil Company. She serves on the Board of Directors of Sterling Infrastructure, Inc. and Southern Star Central Gas Pipeline. Ms. Dill serves on the Board of Directors of the Tri-Cities Chapter of the National Association of Corporate Directors, is a member of the Advisory Council for the College of Business and Economics at New Mexico State University and sits on the Community Relations Committee of the Health System Board of Memorial Hermann Hospital. Previously, she sat on the advisory board of Centuri Group, from 2018 to 2024; the Board of Directors of QEP Resources, Inc., from 2013 to March 2021; InterPipeline Ltd., from 2018 to August 2021; and Spectra Energy Partners, LP from 2012 to February 2017. Ms. Dill holds a B.B.A. from New Mexico State University, is a graduate of the Advanced Management Program from Harvard University, has received her NACD Directorship Certification and earned a CERT Certificate in Cybersecurity Oversight from Carnegie Mellon University. | | | EXPERIENCE: As a result of Ms. Dill’s experience as the President and CEO of a publicly-traded energy company, her strong financial background, investor relations and communications experience and her more than 35 years of experience in the energy industry, including in Canada, we believe she provides valuable insight and knowledge to our Board’s oversight of the Company’s internal operations, investor relations and communications strategies. | | ||||

16 | | | | |  | | |

PROPOSAL 1-ELECTION OF DIRECTORS |

| | ||||||||

| | ||||||||

| | ||||||||

| ||||||||

JAMES F. KIRSCH | | | AGE: 66 | | | DIRECTOR SINCE: 2014 | | |

Mr. Kirsch served as the Chairman, President and CEO of Ferro Corporation (a leading producer of specialty materials and chemicals) from 2006 to 2012. He joined Ferro in October 2004 as its President and Chief Operating Officer, was appointed CEO and Director in November 2005 and was elected Chairman in December 2006. Prior to that, from 2002 through 2004, he served as President of Quantum Composites, Inc. (a manufacturer of thermoset molding compounds, parts and sub-assemblies for the automotive, aerospace, electrical and HVAC industries). From 1999 through 2002, he served as President and a director of Ballard Generation Systems, Inc. and Vice President for Ballard Power Systems Inc. in Burnaby, British Columbia, Canada. Mr. Kirsch began his career with The Dow Chemical Company, where he spent 19 years and held various positions of increasing responsibility, including global business director of Propylene Oxide and Derivatives and Global Vice President of Electrochemicals. Mr. Kirsch formerly served as a director of GCP Applied Technologies Inc. from 2018 to 2020, as a director of Cleveland-Cliffs, Inc., formerly known as Cliffs Natural Resources, Inc. from March 2010 to August 2014 and as the Executive Chairman from January 2014 to August 2014. He is a graduate of The Ohio State University. | | | EXPERIENCE: Mr. Kirsch brings a wealth of senior management experience with major organizations with international operations and has substantial experience in the areas of specialty materials and chemicals. As a former chairman, president and CEO of a NYSE-listed company, he brings considerable senior leadership experience to our Board and the committees thereof on which he serves. | | ||||

| | | 2024 RYAM PROXY STATEMENT | | | | | 17 |

PROPOSAL 1-ELECTION OF DIRECTORS |

| | ||||||||

| | ||||||||

| | ||||||||

| ||||||||

LISA M. PALUMBO | | | AGE: 66 | | | DIRECTOR SINCE: 2014 | | |

Ms. Palumbo served as the Senior Vice President, General Counsel and Secretary of Parsons Brinckerhoff Group Inc. (a global consulting firm providing planning, design, construction and program management services for critical infrastructure projects) from 2008 until her retirement in January 2015. Prior to that, Ms. Palumbo served as Senior Vice President, General Counsel and Secretary of EDO Corporation (a defense technology company) from 2002 to 2008. In 2001, Ms. Palumbo served as Senior Vice President, General Counsel and Secretary of Moore Corporation; from 1997 to 2001 she served as Vice President, General Counsel and Secretary of Rayonier Inc. and from 1987 to 1997 she served in positions of increasing responsibility, including Assistant General Counsel and Assistant Secretary for Avnet, Inc. (a global distributor of technology products). Ms. Palumbo holds bachelor’s and juris doctorate degrees from Rutgers University. | | | EXPERIENCE: With over 28 years of legal experience with international, public and private companies, Ms. Palumbo brings substantial expertise in the areas of law, corporate governance, mergers and acquisitions, enterprise risk management, health and safety and compliance. We believe this experience and expertise, together with her prior experience as the General Counsel of Rayonier Inc., uniquely qualify her to contribute to our Board regarding the Company’s business and to assist with our Board’s oversight of the Company’s risk management, legal and compliance responsibilities. | | ||||

18 | | | | |  | | |

PROPOSAL 1-ELECTION OF DIRECTORS |

| | ||||||||

| | ||||||||

| | ||||||||

| ||||||||

IVONA SMITH | | | AGE: 54 | | | DIRECTOR SINCE: 2020 | | |

Ms. Smith is an advisor with Drivetrain LLC, an independent fiduciary services firm, a position she has held since 2016. Prior to joining Drivetrain LLC, she was Managing Director at Fair Oaks Capital LP, an investment advisory firm, from 2014 to 2016, Co-Founder of Restoration Capital Management LLC, an investment advisory firm from 2001-2012 and Co-Portfolio Manager at Tribeca Investments, LLC, the broker/dealer division of Citigroup/Traveler’s from 1999 to 2000. Ms. Smith was also an auditor, analyst and financial consultant at various accounting and investment banking firms, including Kidder Peabody and Ernst & Young. Ms. Smith formerly served on the Boards of ITN Networks LLC (2017 to 2018) and The Weinstein Company (2018 to 2021 during its sale and wind-down), among others. Ms. Smith holds a bachelor’s degree in finance from Fordham University and an MBA from NYU Stern School of Business. | | | EXPERIENCE: Ms. Smith brings significant financial, capital markets, restructuring and accounting experience, working extensively with senior management teams and as a fiduciary to the investment community, including serving as an outside independent director for companies. Additionally, she has over 25 years of experience investing in or advising companies undergoing operational or financial challenges. Ms. Smith is particularly well-suited to contribute to the Board’s oversight of the Company’s capital structure, financial performance, auditing and its external auditors and controls over financial reporting. | | ||||

| ||||||||

BRYAN D. YOKLEY | | | AGE: 62 | | | DIRECTOR SINCE: 2023 | | |

Mr. Yokley served as an Audit Partner of Ernst & Young Global Limited (a global leader in assurance, tax, information technology services, consulting, and advisory services to its clients) from 2001 until his retirement in June 2022. Prior to that, Mr. Yokley served as Chief Financial Officer of World Access, Inc. and from 1997 to 1999 was an Audit Partner at Ernst Young. Mr. Yokley served a fellowship with the Financial Accounting Standards Board in Connecticut from 1995 to 1997 and from 1984 to 1995 was an auditor for Arthur Young (Ernst Young merged with Arthur Young in 1989). Mr. Yokley is a Certified Public Accountant (inactive) and holds a bachelor’s degree in business administration from the University of Alabama. | | | EXPERIENCE: Mr. Yokley has 40 years of managerial, financial and accounting experience working extensively with senior management, audit committees and boards of directors of public companies. We believe Mr. Yokley’s experience and financial expertise allow him to significantly contribute to our Board’s oversight of the Company’s overall financial performance, auditing and its external auditors, and controls over financial reporting. | | ||||

| | | 2024 RYAM PROXY STATEMENT | | | | | 19 |

PROPOSAL 1-ELECTION OF DIRECTORS |

| | ||||||||

| | ||||||||

| | ||||||||

| ||||||||

DE LYLE W. BLOOMQUIST | | | AGE: 65 | | | DIRECTOR SINCE: 2014 | | |

Mr. Bloomquist is President and Chief Executive Officer of the Company, a position he has held since May 28, 2022. He is also a partner for Windrunner Management Advisors LLC (a management advisory services business). He retired in March 2015 as President, Global Chemical Business of Tata Chemicals Limited (an international inorganic chemical and fertilizer manufacturing company), a position he held since 2009. Previously, he served as President and Chief Executive Officer (CEO) of General Chemical Industrial Products Inc. (which was acquired by Tata Chemicals Limited in 2008) from 2004 to 2009. Prior to that, Mr. Bloomquist served at General Chemical Group Inc. in positions of increasing responsibility from 1991 to 2004, including Division Vice President and General Manager, Industrial Chemicals and Vice President and Chief Operating Officer. Mr. Bloomquist serves on the Board of Directors of Sisecam Wyoming LLC (f/k/a Ciner Wyoming LLC) and Evoq Nano, Inc. He is currently a partner for Ranch Estates LLC (a real estate developer) and WC Tucson I LLC (a real estate developer). Mr. Bloomquist also served as a director of Crystal Peak Minerals (f/k/a EPM Mining Ventures Inc. from October 2011 to November 2021, PDS Biotechnology Corporation (f/k/a Edge Therapeutics Inc.) from December 2006 to March 2019, Scientia Vascular LLC from October 2017 to May 2021, Huber Engineered Materials from July 2010 to November 2020, Vivos Therapeautics Inc., from April 2018 to March 2019, and Costa Farms, Inc. from July 2016 to July 2017. He also serves on the Board of Business Advisors for the Tepper School of Business at Carnegie Mellon University and on the Board of Advisors for Sonoran Capital. Mr. Bloomquist is a graduate of Brigham Young University and holds an MBA from Carnegie Mellon University. | | | EXPERIENCE: As a result of Mr. Bloomquist’s service as the Company’s President and CEO and his over 25 years of domestic and international experience in the chemicals, minerals and materials industries, including in the areas of finance, sales, logistics, operations, IT, strategy and business development, as well as CEO and other senior leadership experience, he has developed valuable business, management and leadership experience. We believe Mr. Bloomquist’s depth and breadth of experience and expertise in these industries makes him particularly well-suited to help lead the Board’s consideration of operational and strategic decisions and manage the Company’s business. | | ||||

20 | | | | |  | | |

PROPOSAL 1-ELECTION OF DIRECTORS |

| | ||||||||

| | ||||||||

| | ||||||||

| ||||||||

CHARLES R. EGGERT | | | AGE: 70 | | | DIRECTOR SINCE: 2022 | | |

Mr. Eggert has been an Operating Partner at iSelect Fund Management, a venture capital firm focused on early-stage agriculture, food, nutrition, and wellness growth companies, since 2019. Prior to this, Mr. Eggert served as an Operating Partner for Arsenal Capital Partners, a lower middle market private equity firm specializing in building value for specialty chemical and healthcare service companies from 2016 to 2019. He also served as a Board member at Arsenal portfolio companies Spartech LLC, Chroma Color Corporation, and Meridian Adhesives Group. Mr. Eggert served as President and CEO of Solvaira Specialties, one of Arsenal’s portfolio companies. He also served six years as CEO and a member of the Board of Directors of the renewable chemicals company OPX Biotechnologies, Inc. From 1999 to 2008, Mr. Eggert held several positions at the National Starch and Chemical business of ICI PLC including Group Vice President, Specialty Polymers. From 1997 to 1999, he was Vice President Marketing and Sales at Engelhard and from 1977 to 1997, he held roles with increasing responsibility at Monsanto Company in R&D, manufacturing, business development, and marketing. He is currently a member of the Board of Directors of CP Kelco. Mr. Eggert graduated from Washington University in St. Louis with an MBA in Marketing and Finance. He holds a master’s degree in Biochemical Engineering from the University of Minnesota and a bachelor’s degree in Chemical Engineering from Washington University. | | | EXPERIENCE: With his impressive track record of driving growth through strategic leadership and operational transformation in the global specialty chemicals and food ingredients industries, including in a venture capital role of identifying investments and developing value creation strategies for early-stage companies, we believe Mr. Eggert’s is uniquely qualified to contribute to the Board’s oversight of the Company’s innovation, new products and business development efforts as the Company looks to execute its Biofuture strategy. | | ||||

| | | 2024 RYAM PROXY STATEMENT | | | | | 21 |

PROPOSAL 1-ELECTION OF DIRECTORS |

| | ||||||||

| | ||||||||

| | ||||||||

| ||||||||

DAVID C. MARIANO | | | AGE: 61 | | | DIRECTOR SINCE: 2020 | | |

Mr. Mariano is currently the Managing Director of DCM Capital, a private investment firm with holdings in the equity and debt of public and private companies, a position he has held since founding DCM in 2011. From 1998 to 2011, Mr. Mariano was Managing Partner of Wellspring Capital Management, a registered investment advisor focusing on turnaround and restructuring opportunities in a range of industries and served as Executive Chairman of the Board of Neucel Specialty Cellulose, a manufacturer and seller of dissolving wood pulp products, including high purity specialty cellulose and viscose pulps, from 2006 to 2011. Mr. Mariano was also a Managing Director at the Blackstone Group and a Senior Manager at Ernst & Young. He holds a bachelor’s degree in economics from Gustavus Adolphus College and an MBA from Duke University. | | | EXPERIENCE: Mr. Mariano has 35 years of experience investing in, managing and advising global businesses, with a focus over the past 17 years in the dissolving wood pulp industry, as well as significant experience in capital markets, restructurings and value-creating transactions. He is also a significant stockholder of the Company, currently holding approximately 1.35% of the Company’s Common Stock. | | ||||

22 | | | | |  | | |

PROPOSAL 1-ELECTION OF DIRECTORS |

24 | | | | |  | | |

PROPOSAL 1-ELECTION OF DIRECTORS |

| | AUDIT | | | NUMBER OF MEETINGS IN 2023: 8 | | |||

| | This committee advises the Board and oversees our accounting and financial reporting policies, processes and systems, as well as our systems for internal control, including: | | | CURRENT MEMBERS: Charles E. Adair, Chair Charles R. Eggert David C. Mariano Bryan D. Yokley | | |||

| |  | | | overseeing financial reporting, controls and audit performance | | |||

| |  | | | monitoring and oversight of the independence and performance of our independent registered public accounting firm, with responsibility for such firm’s selection, evaluation, compensation and, if applicable, discharge | | |||

| |  | | | approving, in advance, all of the audit and non-audit services provided to the Company by the independent registered public accounting firm | | |||

| |  | | | facilitating open communication among the Board, senior management, internal audit and the independent registered public accounting firm | | |||

| |  | | | overseeing our enterprise risk management, cybersecurity and legal compliance and ethics programs, including our Standard of Ethics and Code of Corporate Conduct | | |||

| | COMPENSATION AND MANAGEMENT DEVELOPMENT | | | NUMBER OF MEETINGS IN 2023: 6 | | |||

| | This committee oversees the compensation and benefits of senior-level employees, including: | | | CURRENT MEMBERS: Julie A. Dill, Chair Charles E. Adair Lisa M. Palumbo Bryan D. Yokley | | |||

| |  | | | evaluating senior executive performance, succession planning and development matters | | |||

| |  | | | establishing executive compensation | | |||

| |  | | | reviewing and approving the Compensation Discussion and Analysis included in the annual Proxy Statement | | |||

| |  | | | recommending compensation actions regarding our CEO for approval by non-management directors of the Board | | |||

| |  | | | approving individual compensation actions for all senior executives other than our CEO | | |||

| | FINANCE AND STRATEGIC PLANNING | | | NUMBER OF MEETINGS IN 2023: 12 | | |||

| | This committee advises the Board with regard to capital strategy, financial matters and strategic planning, including: | | | CURRENT MEMBERS: James F. Kirsch, Chair De Lyle W. Bloomquist David C. Mariano Ivona Smith | | |||

| |  | | | reviewing the Company’s capital structure and capital allocation priorities, policies and guidelines | | |||

| |  | | | advising management with respect to development of the Company’s strategic planning process | | |||

| |  | | | providing review and oversight with respect to significant financings and banking relationships | | |||

| |  | | | reviewing and recommending the registration, issuance and redemption of Company equity securities and evaluating the Company’s dividend policy | | |||

| |  | | | overseeing the financial performance of the assets invested in our pension and savings plans and reviewing employee benefits | | |||

| |  | | | ensuring robust focus on growth through innovation and new products | | |||

| |  | | | providing oversight with respect to the Company’s tax strategy, hedging policies and financial aspects of insurance program | | |||

| | | 2024 RYAM PROXY STATEMENT | | | | | 25 |

PROPOSAL 1-ELECTION OF DIRECTORS |

| | NOMINATING AND CORPORATE GOVERNANCE | | | NUMBER OF MEETINGS IN 2023: 3 | | |||

| | This committee advises the Board with regard to Board structure, composition and governance, including: | | | CURRENT MEMBERS: Ivona Smith, Chair Julie A. Dill James F. Kirsch | | |||

| |  | | | establishing criteria for Board nominees and identifying qualified individuals for nomination to become Board members, including engaging advisors to assist in the search process where appropriate and considering potential nominees recommended by stockholders | | |||

| |  | | | recommending the structure and composition of Board committees | | |||

| |  | | | overseeing evaluation of Board and committee effectiveness | | |||

| |  | | | recommending director compensation and benefits programs to the Board | | |||

| |  | | | overseeing our corporate governance structure and practices, including our CGPs | | |||

| |  | | | reviewing and approving changes to the charters of the other Board committees | | |||

| | SUSTAINABILITY | | | NUMBER OF MEETINGS IN 2023: 2 | | |||

| | This committee advises the Board with regard to Environmental, Social and Governance (ESG) matters, including: | | | CURRENT MEMBERS: Lisa M. Palumbo, Chair Charles R. Eggert David C. Mariano | | |||

| |  | | | overseeing the Company’s environmental sustainability initiatives, performance and targets | | |||

| |  | | | overseeing the Company’s strategy and performance with respect to social matters including health and safety, and diversity and inclusion | | |||

| |  | | | providing input to management on and overseeing the Company’s identification, assessment and management of risks associated with the environmental and social matters | | |||

| |  | | | reviewing the Company’s Sustainability Report and other ESG-related disclosures such as climate-related metrics and targets | | |||

| |  | | | engaging with and monitoring feedback and expectations of key investors, advisors and other stakeholders with respect to ESG topics | | |||

26 | | | | |  | | |

PROPOSAL 2 – APPROVAL OF AMENDMENT TO AMENDED AND RESTATED CERTIFICATE OF INCORPORATION TO DECLASSIFY THE BOARD OF DIRECTORS |

| | | | | |||

| | | The Board of Directors recommends that you vote “FOR” the proposal to amend the Certificate of Incorporation to declassify the Board of Directors and allow for annual elections of directors. | | | ||

| | |

| | | 2024 RYAM PROXY STATEMENT | | | | | 27 |

PROPOSAL 3 – APPROVAL OF AMENDMENT TO AMENDED AND RESTATED CERTIFICATE OF INCORPORATION TO ELIMINATE THE SUPERMAJORITY VOTING PROVISIONS |

| Issuance of preferred stock (Section 3 of Article IV of the Certificate of Incorporation); |

| Size, tenure, classes of directors, vacancies and director removal relating to the Board of Directors (Article VI); |

| Stockholder action, including written consents and special meetings (Article VII); |

| Indemnification of officers and directors (Article X); and |

| Amendments to the Certificate of Incorporation to change the Supermajority Voting Requirements (Article XIII). |

| Special meetings of stockholders and written consents by stockholders (Article II, Sections 2.2 and 2.13, respectively) |

| Board size and tenure, classes of directors, board vacancies, and director removal (Article III, Sections 3.2, 3.10 and 3.12, respectively) |

| Indemnification of directors and officers (Article VI); and |

| Amendments to the Bylaws (Article IX) |

28 | | | | |  | | |

PROPOSAL 3 – APPROVAL OF AMENDMENT TO AMENDED AND RESTATED CERTIFICATE OF INCORPORATION TO ELIMINATE THE SUPERMAJORITY VOTING PROVISIONS |

| | | | | |||

| | | The Board of Directors recommends that you vote “FOR” the proposal to amend the Certificate of Incorporation to eliminate Supermajority Voting Provisions. | | | ||

| | |

| | | 2024 RYAM PROXY STATEMENT | | | | | 29 |

Proposal 4 – Approval of Amendment to Amended and Restated Certificate of Incorporation to Allow for Exculpation of Officers as Permitted by Delaware Law |

30 | | | | |  | | |

Proposal 4 – Approval of Amendment to Amended and Restated Certificate of Incorporation to Allow for Exculpation of Officers as Permitted by Delaware Law |

| | | | | |||

| | | The Board of Directors recommends that you vote “FOR” approval of this proposal to amend the Certificate of Incorporation to allow for exculpation of officers as permitted by Delaware law. | | | ||

| | |

| | | 2024 RYAM PROXY STATEMENT | | | | | 31 |

PROPOSAL 5 – ADVISORY VOTE ON EXECUTIVE COMPENSATION |

| We eliminated the collars associated with changes in commodity prices and changed the weighting of the EBITDA metric to 50% of the bonus opportunity. |

| We replaced Days Working Capital with Operating Cash Flow. |

| We changed the weighting of our strategic objectives to 15%. |

| We added individual objectives for each member of our executive team that focused on the most important actions in their area of responsibility to drive improved performance and increased shareholder value weighted at 15%. |

32 | | | | |  | | |

PROPOSAL 5 – ADVISORY VOTE ON EXECUTIVE COMPENSATION |

| | | 2024 RYAM PROXY STATEMENT | | | | | 33 |

PROPOSAL 5 – ADVISORY VOTE ON EXECUTIVE COMPENSATION |

| | | | | |||

| | | The Board of Directors recommends that you vote “FOR” this advisory resolution to approve the compensation of our Named Executive Officers as disclosed in this Proxy Statement. | | | ||

| | |

34 | | | | |  | | |

COMPENSATION DISCUSSION AND ANALYSIS |

De Lyle W. Bloomquist | | | Marcus J. Moeltner | | | Joshua C. Hicks | | | R. Colby Slaughter | | | Michael D. Osborne(1) |

President and Chief Executive Officer | | | Chief Financial Officer and Senior Vice President, Finance | | | Senior Vice President, High Purity Cellulose | | | Senior Vice President, General Counsel and Corporate Secretary | | | Vice President, Manufacturing |

| (1) | Mr. Osborne was hired on April 10, 2023 |

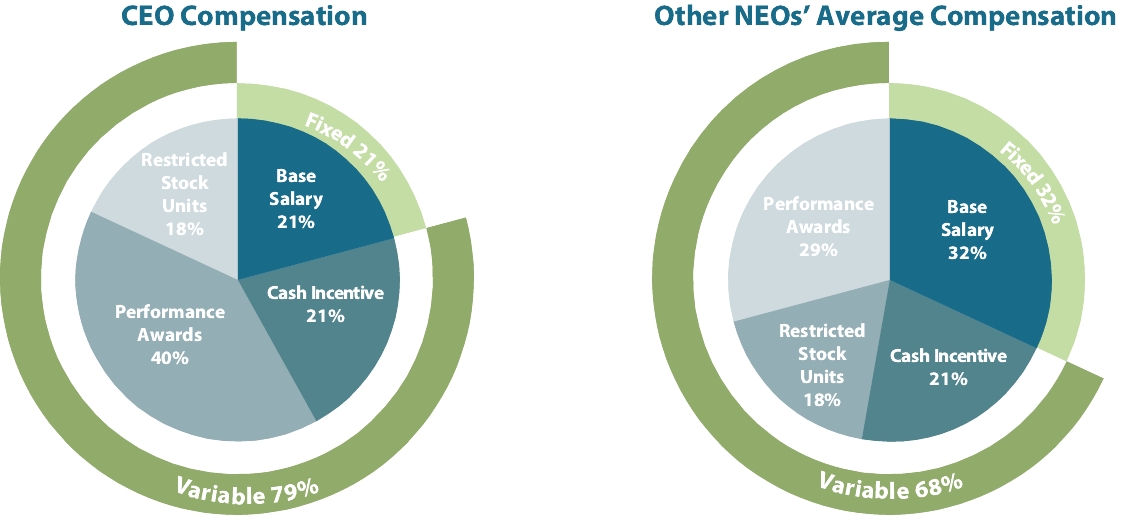

| Align executive compensation with our stockholders’ interests |

| Attract, engage and retain key executive talent especially in a dynamic business environment |

| Reward strong business and individual performance |

| Maintain a balanced mix of pay elements which focuses participants on creating sustainable long-term value for stockholders |

| Eliminated the collars for input cost and commodity selling prices on Adjusted EBITDA, and changed the overall weighting to 50% |

| Replaced the cash flow metric of Days Working Capital with an Adjusted Operating Cash Flow metric weighted 20%. |

| Reduced the corporate strategic metric weighting associated with key safety indicators, sustainability, and diversity to 15% |

| Introduced individual objectives weighted at 15% |

| | | 2024 RYAM PROXY STATEMENT | | | | | 35 |

COMPENSATION DISCUSSION AND ANALYSIS |

| Mr. Moeltner received an increase in his base salary |

| Mr. Hicks received an increase in his base salary, his target bonus opportunity, as well as his long-term equity grant |

| Mr. Slaughter received an increase in his target bonus opportunity as well as his long-term equity grant |

| Mr. Bloomquist received an increase in his long-term equity grant |

36 | | | | |  | | |

COMPENSATION DISCUSSION AND ANALYSIS |

| | Pay Element | | | Component | | | Metrics | | | What the Pay Element Rewards |

| | Base Salary | | | • Cash | | | • Fixed amount based on responsibilities, experience, and market data | | | • Scope of core responsibilities, years of experience and potential to affect the Company’s overall performance | |

| | Annual Cash Incentive | | | • Cash | | | • 50% Adjusted EBITDA • 20% Adjusted Operating Cash Flow • 15% Strategic Objectives • 15% Individual Objectives | | | • Focus executives on achieving annual financial and strategic objectives that drive stockholder value | |

| | Long Term Incentive Program | | | • PSUs (35% of total) | | | • 50% based on relative TSR objectives • 50% Cumulative Adjusted EBITDA goal of fiscal years 2023, 2024, and 2025 | | | • Drive execution of financial goals that generate long-term stockholder value and support executive retention | |

| | • Performance Cash (35% of total) | | |||||||||

| | • RSUs (30% of total) | | | • Time based RSUs that cliff vest over three years | | | • Support retention of the executive and growth of stock price | |

| | | 2024 RYAM PROXY STATEMENT | | | | | 37 |

COMPENSATION DISCUSSION AND ANALYSIS |

| | What We Do | | | What We Don’t Do | |

| |  Vast majority of pay is at-risk or variable, i.e., performance-based or equity-based or both Vast majority of pay is at-risk or variable, i.e., performance-based or equity-based or both | | |  No single trigger change in control (CIC) cash payments or equity acceleration No single trigger change in control (CIC) cash payments or equity acceleration | |

| |  Stringent stock ownership guidelines (6x base salary for CEO) Stringent stock ownership guidelines (6x base salary for CEO) | | |  No excise tax reimbursement for payments made in connection with a change in control No excise tax reimbursement for payments made in connection with a change in control | |

| |  Clawback provisions covering both cash and equity Clawback provisions covering both cash and equity | | |  No option or other equity award repricing No option or other equity award repricing | |

| |  Independent compensation consultant reporting to the Compensation Committee of the Board Independent compensation consultant reporting to the Compensation Committee of the Board | | |  No hedging or pledging of Company securities by executives No hedging or pledging of Company securities by executives | |

| |  Risk assessment performed annually Risk assessment performed annually | | |  No NEO employment agreements No NEO employment agreements | |

| |  Engage with institutional investors regarding our executive compensation program Engage with institutional investors regarding our executive compensation program | | |  No significant perquisites No significant perquisites | |

| • | Budgeted levels for annual salary based on benchmarking of the competitive compensation positioning of our CEO and other executive officers (see discussion below in this CD&A for further information regarding the Committee’s use of benchmarking) |

| • | The executive’s level of responsibility |

| • | The executive’s experience and breadth of knowledge |

| • | The executive’s annual performance review |

| • | The executive’s role in management continuity and development plans |

| | | | BASE SALARY ($) 2022 | | | BASE SALARY ($) 2023 | | |

| | De Lyle W. Bloomquist | | | 1,000,000 | | | 1,000,000 | |

| | Marcus J. Moeltner | | | 475,000 | | | 495,000 | |

| | Joshua C. Hicks | | | 445,000 | | | 475,000 | |

| | Michael D. Osborne (hired April 10, 2023) | | | - | | | 375,000 | |

| | R. Colby Slaughter | | | 400,000 | | | 400,000 | |

38 | | | | |  | | |

COMPENSATION DISCUSSION AND ANALYSIS |

| • | 50%: Adjusted EBITDA |

| • | 20%: Adjusted Operating Cash Flow |

| • | 15%: Strategic Initiatives |

| • | 15%: Individual Objectives |

| • | Safety Key Performance Indicators (KPIs) |

| • | Diversity and Inclusion goals |

| • | Key Sustainability Initiatives |

| • | Financial |

| • | Strategy development and execution |

| • | Sales |

| • | ESG planning and reporting |

| | | 2024 RYAM PROXY STATEMENT | | | | | 39 |

COMPENSATION DISCUSSION AND ANALYSIS |

| | Metric | | | 2023 TARGET | | | 2023 ACTUAL | | | 2023 CALCULATED RESULTS | | | WEIGHTING | | | 2023 PLAN PAYOUT(1) | |

| | Adjusted EBITDA | | | $200.0 | | | $141.4 | | | 0% | | | 50% | | | 0.0% | |

| | Adjusted Operating Cash Flow(2) | | | $58.5 | | | $99.6 | | | 200% | | | 20% | | | 40.0% | |

| | Non-Financial Strategic Objectives | | | Various | | | Partially achieved | | | 87.5% | | | 15% | | | 13.1% | |

| | Individual Objectives | | | Various | | | Varies | | | 50-200% | | | 15% | | | 7.5%-30% | |

| | Total Payout | | | | | | | | | | | 60.6%-83.1% | |

| (1) | Adjusted EBITDA and Adjusted Operating Cash Flow thresholds are established at 80% of target and maximum is established at 120% of target. Actual performance and results are interpolated. |

| (2) | Adjusted Operating Cash Flow includes adjustments for working capital, interest expense, custodial capital expenditures, and non-EBITDA charges for discontinued operations, pension, income tax, and LTIP charges. |

| | | | CALCULATED RESULTS ($) | | | COMMITTEE ADJUSTMENT ($) | | | TOTAL BONUS PAID ($)(1) | | | BONUS PAID AS % OF TARGET | | |

| | De Lyle W. Bloomquist | | | 606,000 | | | 0 | | | 606,000 | | | 60.6% | |

| | Marcus J. Moeltner | | | 235,967 | | | 0 | | | 236,000 | | | 68.1% | |

| | Joshua C. Hicks | | | 276,308 | | | 0 | | | 276,000 | | | 83.1% | |

| | Michael D. Osborne | | | 111,727 | | | 0 | | | 112,000 | | | 68.1% | |

| | R. Colby Slaughter | | | 199,440 | | | 0 | | | 199,000 | | | 83.1% | |

| (1) | Rounded to nearest $1,000. |

| • | PSUs weighted at 35% of the overall award value measuring performance against three-year relative TSR and Cumulative Adjusted EBITDA for fiscal years 2023, 2024, and 2025 |

| • | Performance-based cash weighted at 35% of the overall award value using the same three-year goals as the PSUs |

| • | The 2023 PSU component of the Equity Incentive Program measures relative TSR and Cumulative Adjusted EBITDA for three years. Further, if RYAM’s three-year TSR is negative, payouts for the TSR component will be capped at 100% unless RYAM’s relative TSR is above the 75th percentile of the peer group at which time the cap would become 150%; however, payouts under the Cumulative Adjusted EBITDA metric will be measured and scored separately. |

| | | | THRESHOLD | | | TARGET | | | MAXIMUM | | |

| | Relative Performance (Percentile Ranking) | | | 25th Percentile | | | 50th Percentile | | | 75th Percentile | |

| | Payout (% of Target) | | | 30% | | | 100% | | | 200% | |

40 | | | | |  | | |

COMPENSATION DISCUSSION AND ANALYSIS |

| | | | Threshold | | | Target | | | Maximum | | |

| | Cumulative Adjusted EBITDA Payout Range | | | 30% | | | 100% | | | 200% | |

| (1) | Cumulative Adjusted EBITDA goals and results will be disclosed in 2026 when the Program ends. |

| | | | 2023 | | |

| | | | TARGET GRANT VALUE ($) | | |

| | De Lyle W. Bloomquist | | | 2,700,000 | |

| | Marcus J. Moeltner | | | 700,000 | |

| | Joshua C. Hicks | | | 700,000 | |

| | Michael D. Osborne | | | 350,000 | |

| | R. Colby Slaughter | | | 450,000 | |

| | | | THRESHOLD | | | TARGET | | | MAXIMUM | | |

| | Relative Performance (Percentile Ranking) | | | 25th Percentile | | | 50th Percentile | | | 75th Percentile | |

| | Payout (% of Target) | | | 30% | | | 100% | | | 200% | |

| | | | 2021 Program | | |

| | Threshold | | | 13.0% | |

| | Target | | | 15.0% | |

| | Maximum | | | 17.0% | |

| | | | Results | | |

| | Actual Adjusted HPC Segment EBITDA Margin(1) Achieved | | | 11% | |

| (1) | Adjusted HPC Segment EBITDA margin is calculated based on Adjusted HPC Segment EBITDA (see Appendix F). |

| | | 2024 RYAM PROXY STATEMENT | | | | | 41 |

COMPENSATION DISCUSSION AND ANALYSIS |

| | | | Results | | | Weighting | | | Plan Payout | | |

| | TSR Matrix | | | 0.0% | | | 50% | | | 0.0% | |

| | Adjusted HPC Segment EBITDA Margin | | | 0.0% | | | 50% | | | 0.0% | |

| | Total Payout | | | | | | | 0.0% | |

42 | | | | |  | | |

COMPENSATION DISCUSSION AND ANALYSIS |

| • | 50%: Adjusted EBITDA |

| • | 20%: Adjusted Operating Cash Flow |

| • | 15%: Strategic Initiatives |

| • | 15%: Individual Goals |

| • | PSUs weighted at 65% of the overall award value measuring performance against three-year relative TSR compared against the S&P SmallCap 600 Capped Materials Index (weighted at 50%) and Cumulative Adjusted EBITDA goals (weighted at 50%) |

| • | Performance Cash Units weighted at 35% of the overall award value using the same three-year goals as the PSUs |

| • | PSUs weighted at 35% of the overall award value measuring performance against three-year relative TSR compared against the S&P SmallCap 600 Capped Materials Index (weighted at 50%) and Cumulative Adjusted EBITDA goals (weighted at 50%) |

| • | Performance Cash Units weighted at 35% of the overall award value using the same three-year goals as the PSUs |

| • | RSUs at 30% of the overall award which vest three years following the date of the award |

| | | 2024 RYAM PROXY STATEMENT | | | | | 43 |

COMPENSATION DISCUSSION AND ANALYSIS |

COMPENSATION COMMITTEE RESPONSIBILITIES | | | TIMING |

Review and approve compensation levels for all our executive officers | | | Annually in January |

Review and approve all compensation-related programs for executive officers | | | February – Determine Annual Cash Incentive Program payouts in respect of prior fiscal year performance. Set performance measures, weightings and targets, for Equity Incentive Program awards for new fiscal year, with grants to be made in March |

Establish annual performance objectives for the CEO | | | Annually in January |

Evaluate CEO accomplishments and performance | | | Regular meetings throughout the year and in February when evaluating the company’s prior fiscal year performance. |

Ensure all major considerations relating to compensation, including metrics used to set compensation targets and awards, are appropriately evaluated and that compensation and benefit programs are properly designed, implemented and monitored | | | Regular meetings throughout the year, with special meetings held as needed to address matters outside the normal compensation cycle |

Confer with external compensation advisor and outside counsel for compensation-related advice and benchmarking | | | Routinely |

44 | | | | |  | | |

COMPENSATION DISCUSSION AND ANALYSIS |

AdvanSix Ecovyst Glatfelter Corporation H.B. Fuller Company Hawkins Ingevity Innospec Inc. | | | Koppers Holdings Inc. Minerals Technologies Inc. Quaker Chemical Corporation Sensient Technologies Corporation Stepan Company Tredegar Venator Materials |

| | Title | | | Multiple of BASE SALARY |

| | President & CEO | | | 6x |

| | Executive Vice President | | | 3x |

| | Chief Financial Officer | | | 3x |

| | Chief Administrative Officer | | | 3x |

| | Senior Vice President | | | 2x |

| | Vice President | | | 1x |

| | | 2024 RYAM PROXY STATEMENT | | | | | 45 |

COMPENSATION DISCUSSION AND ANALYSIS |

46 | | | | |  | | |

COMPENSATION DISCUSSION AND ANALYSIS |

| The Rayonier Advanced Materials Inc. Investment and Savings Plan for Salaried Employees (401(k) Plan) |

| The Rayonier Advanced Materials Inc. Excess Savings and Deferred Compensation Plan (Excess Savings and Deferred Compensation Plan) |

| | | 2024 RYAM PROXY STATEMENT | | | | | 47 |

COMPENSATION DISCUSSION AND ANALYSIS |

| Executive Physical Program: Each executive-level employee is encouraged to have a physical examination every other year until age 50 and every year after 50. |

| Senior Executive Tax and Financial Planning Program: This program provides reimbursement to senior executives, including our NEOs, for expenses incurred for financial and estate planning and for preparation of annual income tax returns. Reimbursements are taxable to the recipient and are not grossed-up for tax purposes. The annual reimbursement limit remained unchanged for 2023 and was $25,000 for Mr. Bloomquist and $10,000 for all other participants. |

48 | | | | |  | | |

COMPENSATION DISCUSSION AND ANALYSIS |

| | | 2024 RYAM PROXY STATEMENT | | | | | 49 |

Executive compensation tables and related information |

| | Name and Principal Position | | | Year | | | Salary ($) | | | Bonus ($)(1) | | | Stock Awards ($)(2) | | | Option Awards ($) | | | Non-Equity Incentive Plan Compensation ($)(3) | | | Change in Pension Value and Non-Qualified Deferred Compensation Earnings ($)(4) | | | All Other Compensation ($)(5) | | | Total ($) | |

| | De Lyle W. Bloomquist President and Chief Executive Officer | | | 2023 | | | 1,000,000 | | | - | | | 2,071,527 | | | - | | | 606,000 | | | - | | | 54,611 | | | 3,732,138 | |

| | 2022 | | | 590,278 | | | - | | | 1,681,313 | | | - | | | 695,000 | | | - | | | 198,140 | | | 3,164,731 | | |||

| | - | | | - | | | - | | | - | | | - | | | - | | | - | | | - | | | - | | |||

| | Marcus J. Moeltner Chief Financial Officer and Senior Vice President, Finance | | | 2023 | | | 495,000 | | | - | | | 537,064 | | | - | | | 236,000 | | | - | | | 26,650 | | | 1,294,714 | |

| | 2022 | | | 475,000 | | | - | | | 894,407 | | | - | | | 390,000 | | | - | | | 49,511 | | | 1,808,918 | | |||

| | 2021 | | | 460,000 | | | - | | | 605,915 | | | - | | | 360,000 | | | - | | | 43,633 | | | 1,469,548 | | |||

| | Joshua C. Hicks Senior Vice President, High Purity Cellulose | | | 2023 | | | 475,000 | | | - | | | 537,064 | | | - | | | 276,000 | | | - | | | 24,375 | | | 1,312,439 | |

| | 2022 | | | 445,000 | | | - | | | 926,375 | | | - | | | 340,000 | | | - | | | 203,944 | | | 1,915,319 | | |||

| | 2021 | | | 32,027 | | | 505,000 | | | 1,019,892 | | | - | | | - | | | - | | | 34,500 | | | 1,591,419 | | |||

| | Michael D. Osborne Vice President, Manufacturing Operations | | | 2023 | | | 273,438 | | | - | | | 424,815 | | | - | | | 112,000 | | | - | | | 131,263 | | | 941,516 | |

| | - | | | - | | | - | | | - | | | - | | | - | | | - | | | - | | | | ||||

| | - | | | - | | | - | | | - | | | - | | | - | | | - | | | - | | | | ||||

| | R. Colby Slaughter Senior Vice President, General Counsel and Corporate Secretary | | | 2023 | | | 400,000 | | | - | | | 345,272 | | | - | | | 199,000 | | | - | | | 15,524 | | | 959,796 | |

| | - | | | - | | | - | | | - | | | - | | | - | | | - | | | - | | | | ||||

| | - | | | - | | | - | | | - | | | - | | | - | | | - | | | - | | | |

| (1) | The amount for 2021 for Mr. Hicks reflects a $475,000 cash inducement award and a pro-rata 2021 incentive payment in connection with his December 6, 2021 hire. |

| (2) | Reflects the grant date fair value computed in accordance with FASB ASC Topic 718 for PSU awards grated in 2021, 2022 and 2023 using a Monte Carlo simulation model. A discussion of the assumptions used in calculating these values may be found in Note 16 Incentive Stock Plans includes in the notes to the consolidated financial statements in our 2023 Annual Report on Form 10-K. Amounts reflect our accounting for these awards and do not necessarily correspond to the actual values that may be realized by our NEOs. The PSU awards vest following completion of the 36-month performance period upon the determination of the amount earned, if any, based upon performance achievement and actual award value can range from zero to 200% of the target. The LPU awards vest following completion of the 36-month performance period upon the determination of the amount earned, if any, based upon performance achievement and actual award value can range from zero to 250% of the target. See the Equity Incentive Program section of the CD&A for additional information. |

| | The grant date fair value of PSU awards were computed based on the probable outcome of the performance conditions as of the grant date of such awards, which was at target. The respective grant date fair values of the PSUs granted in 2021, 2022 and 2023, as applicable, assuming at such grant date the maximum payment (200% of target in the case of 2021, 2022 and 2023 PSUs and 250% of target in the case of 2022 LPUs), would have been as follows: Mr. Bloomquist, $2,567,808 and $2,523,046; Mr. Moeltner, $546,077, $1,458,781, and $654,125; Mr. Hicks, $563,385, $1,175,484, and $654,125; Mr. Osborne, $143,246; and Mr. Slaughter $233,015, $514,888, and $420,538. |

| (3) | Amounts under the Non-Equity Incentive Plan Compensation column represent annual cash incentive awards under our 2023, 2022 and 2021 Annual Cash Incentive Programs. |

| (4) | Reflects the annual aggregate change in actuarial present value of the participant’s pension benefit under the Company’s retirement plans in 2023. None of our NEOs participate in the closed pension plan. There were no above-market earnings on non-qualified deferred compensation. |

| (5) | The All Other Compensation column in the 2023 Summary Compensation Table above includes the following for 2023: financial planning and tax services, 401(k) retirement contributions, Excess Savings Plans, and other miscellaneous items. |

50 | | | | |  | | |

Executive compensation tables and related information |

| | | | de lyle W. bloomquist ($) | | | Marcus J. Moeltner ($) | | | Joshua C. Hicks ($) | | | MICHAEL D. OSBORNE ($) | | | R. Colby slaughter ($) | | |

| | Tax and Financial Planning services | | | - | | | - | | | 5,560 | | | 209 | | | - | |

| | 401(k) Plan Company contributions | | | 13,200 | | | 13,200 | | | 11,250 | | | 5,078 | | | 11,250 | |

| | Excess Savings Plan Company contributions | | | 26,800 | | | 6,600 | | | 5,800 | | | - | | | 2,800 | |

| | Hiring Bonus | | | - | | | - | | | - | | | 125,000 | | | - | |

| | Spousal Travel | | | 10,062 | | | - | | | - | | | - | | | - | |

| | Miscellaneous | | | 4,549 | | | 6,850 | | | 1,765 | | | 976 | | | 1,474 | |

| | Total | | | 54,611 | | | 26,650 | | | 24,375 | | | 131,263 | | | 15,524 | |

| | NAME | | | SALARY AND BONUS AS PROPORTION OF TOTAL COMPENSATION | |

| | De Lyle W. Bloomquist | | | 27% | |

| | Marcus J. Moeltner | | | 38% | |

| | Joshua C. Hicks | | | 36% | |

| | Michael D. Osborne | | | 29% | |

| | R. Colby Slaughter | | | 42% | |

| | | 2024 RYAM PROXY STATEMENT | | | | | 51 |

Executive compensation tables and related information |

| | | | | | | | Estimated Future Payouts Under Non-Equity Incentive Plan Awards(2)(3) | | | Estimated Future Payouts Under Equity Incentive Plan Awards(4) | | | All Other Stock Awards: Number of Shares of Stock or Units (#)(5) | | | Grant Date Fair Value of Stock and OPTION Awards ($)(6) | | |||||||||||||||

| | Name | | | Grant Date | | | Approval Date(1) | | | Threshold ($) | | | Target ($) | | | Maximum ($) | | | Threshold (#) | | | Target (#) | | | Maximum (#) | | ||||||

| | De Lyle W. Bloomquist | | | | | | | | | | | | | | | | | | | | | | ||||||||||

| | Annual Incentive Plan | | | 1/1/2023 | | | 1/20/2023 | | | 45,000 | | | 1,000,000 | | | 2,000,000 | | | | | | | | | | | | |||||

| | Performance Cash Units | | | 3/1/2023 | | | 2/15/2023 | | | 283,500 | | | 945,000 | | | 1,890,000 | | | | | | | | | | | | | ||||

| | Performance Share Units | | | 3/1/2023 | | | 2/15/2023 | | | | | | | | | 33,790 | | | 112,636 | | | 225,272 | | | | | 1,261,523 | | ||||

| | Restricted Stock Units | | | 3/1/2023 | | | 2/15/2023 | | | | | | | | | | | | | | | 96,544 | | | 810,004 | | ||||||

| | Marcus J. Moeltner | | | | | | | | | | | | | | | | | | | | | | ||||||||||

| | Annual Incentive Plan | | | 1/1/2023 | | | 1/20/2023 | | | 15,593 | | | 346,500 | | | 693,000 | | | | | | | | | | | | | ||||

| | Performance Cash Units | | | 3/1/2023 | | | 2/15/2023 | | | 73,500 | | | 245,000 | | | 490,000 | | | | | | | | | | | | |||||

| | Performance Share Units | | | 3/1/2023 | | | 2/15/2023 | | | | | | | | | 8,760 | | | 29,202 | | | 58,404 | | | | | 327,062 | | ||||

| | Restricted Stock Units | | | 3/1/2023 | | | 2/15/2023 | | | | | | | | | | | | | | | 25,030 | | | 210,002 | | ||||||

| | Joshua C. Hicks | | | | | | | | | | | | | | | | | | | | | | ||||||||||

| | Annual Incentive Plan | | | 1/1/2023 | | | 1/20/2023 | | | 14,963 | | | 332,500 | | | 665,000 | | | | | | | | | | | | |||||

| | Performance Cash Units | | | 3/1/2023 | | | 2/15/2023 | | | 73,500 | | | 245,000 | | | 490,000 | | | | | | | | | | | | | ||||

| | Performance Share Units | | | 3/1/2023 | | | 2/15/2023 | | | | | | | | | 8,760 | | | 29,202 | | | 58,404 | | | | | 327,062 | | ||||

| | Restricted Stock Units | | | 3/1/2023 | | | 2/15/2023 | | | | | | | | | | | | | | | 25,030 | | | 210,002 | | ||||||

| | Michael D. Osborne | | | | | | | | | | | | | | | | | | | | | | ||||||||||

| | Annual Incentive Plan | | | 4/10/2023 | | | 1/27/2023 | | | 7,379 | | | 163,973 | | | 327,946 | | | | | | | | | | | | |||||

| | Performance Cash Units | | | 5/17/2023 | | | 2/15/2023 | | | 36,750 | | | 122,500 | | | 245,000 | | | | | | | | | | | | | ||||

| | Performance Share Units | | | 5/17/2023 | | | 2/15/2023 | | | | | | | | | | 4,380 | | | 14,602 | | | 29,204 | | | | | 71,623 | | |||

| | Restricted Stock Units | | | 4/10/2023 | | | 1/27/2023 | | | | | | | | | | | | | | | 52,540 | | | 300,003 | | ||||||

| | Restricted Stock Units | | | 5/17/2023 | | | 2/15/2023 | | | | | | | | | | | | | | | 12,515 | | | 53,189 | | ||||||

| | R. Colby Slaughter | | | | | | | | | | | | | | | | | | | | | | ||||||||||

| | Annual Incentive Plan | | | 1/1/2023 | | | 1/20/2023 | | | 10,800 | | | 240,000 | | | 480,000 | | | | | | | | | | | | |||||

| | Performance Cash Units | | | 3/1/2023 | | | 2/15/2023 | | | 47,250 | | | 157,500 | | | 315,000 | | | | | | | | | | | | | ||||

| | Performance Share Units | | | 3/1/2023 | | | 2/15/2023 | | | | | | | | | 5,632 | | | 18,774 | | | 37,548 | | | | | 210,269 | | ||||

| | Restricted Stock Units | | | 3/1/2023 | | | 2/15/2023 | | | | | | | | | | | | | | | 16,091 | | | 135,003 | | ||||||

| (1) | 2023 Equity Incentive Program grants were approved February 15, 2023 and the grant date reflects the date on which the Compensation Committee approved the applicable performance measures. Our Equity Incentive Program RSU and PSU awards granted March 1 are set in dollars and converted to shares using the closing price of RYAM stock on the March 1, 2023 award date, which was $8.39 per share. The closing price used to calculate the number of shares was $5.71 for Mr. Osborne’s April 10, 2023 RSUs and Mr. Osborne’s May 17, 2023 RSU & PSU awards used the March 1, 2023 stock price of $8.39 per share. |

| (2) | Reflects range of potential cash incentive awards under the 2023 Annual Cash Incentive Program. Awards can range from zero to 200% of the target cash incentive award. See the 2023 Annual Cash Incentive Program section of the CD&A for more information. The actual amount earned by each NEO for 2023 is reflected in the 2023 Summary Compensation Table under the Non-Equity Incentive Plan Compensation column. |

| (3) | Reflects performance cash unit awards approved February 15, 2023 as a part of 2023 long-term incentives; the grant date reflects the date on which the Compensation Committee approved the applicable performance measures. Each performance cash unit represents the right to receive a cash payment equal to $1 on the vesting date which is three years from the grant date. Awards can range from zero to 200% of the target units/value. See the 2023 Equity Incentive Program section of the CD&A for additional information. The actual amount earned if any will be reflected in the 2026 Proxy Statement in the Summary Compensation Table under the Non-Equity Incentive Plan Compensation column. |

| (4) | Reflects potential payouts, in numbers of shares, that were possible to earn under the 2023 Equity Incentive Program PSU awards. Payouts can range from zero to 200% of the target units/value for PSUs. See the Equity Incentive Program Awards in 2023 section of the CD&A for additional information. |

52 | | | | |  | | |

Executive compensation tables and related information |

| (5) | Reflects RSUs awarded March 1, 2023 under the 2023 Equity Award Program. Mr. Osborne's April RSUs were awarded in connection with his April 10, 2023 hire. Mr. Osborne's RSUs under the 2023 Equity Award Program were awarded May 17, 2023. |

| (6) | Reflects the grant date fair value of each equity award computed in accordance with FASB Topic 718. For PSUs the grant date fair value is computed based on the probable outcome of the performance conditions as of the grant date of the award, using the Monte Carlo simulation model which utilizes multiple input variables that determine the probability of satisfying the performance conditions stipulated in the award to determine the fair market value. A discussion of the assumptions used in calculating these values may be found in the Incentive Stock Plans note to our financial statements included in our Annual Report on Form 10-K for 2023. No options were granted to the NEOs in 2023. |

| | | 2024 RYAM PROXY STATEMENT | | | | | 53 |

Executive compensation tables and related information |

| | | | Option Awards(4) | | | Stock Awards(4) | | ||||||||||||||||||||||||||||

| | | | | | | | | | | | Equity Incentive plan awards | | | | | | | | | | | Equity Incentive Plan Awards | | ||||||||||||

| | Name | | | Number of Securities Underlying Unexercised Options (#) Exercisable | | | Number of Securities Underlying Unexercised Options (#) Un-exercisable(1) | | | Option Exercise Price ($) | | | Option Grant Date | | | Number of securities underlying un-exercised unearned options | | | Option Expiration Date | | | stock award grant date | | | Number of Shares or Units of Stock That Have Not Vested (#)(1) | | | Market Value of Shares or Units of Stock that Have Not Vested ($)(3) | | | Number of Unearned Shares, Units or Other Rights That Have Not Vested (#)(2) | | | Market or Payout Value of Unearned Shares, Units or Other Rights That Have Not Vested ($)(3) | |

| | De Lyle W. Bloomquist | | | 0 | | | 0 | | | 0 | | | - | | | 0 | | | - | | | | | | | | | | | | |||||

| | | | | | | | | | | | | | 5/28/2022 | | | 130,209 | | | $527,346 | | | | | | |||||||||||

| | | | | | | | | | | | | | 3/1/2023 | | | 96,544 | | | $391,003 | | | | | | |||||||||||

| | | | | | | | | | | | | | 5/28/2022 | | | | | | | 16,277 | | | $65,922 | | |||||||||||

| | | | | | | | | | | | | | 6/13/2022 | | | | | | | 41,877 | | | $169,602 | | |||||||||||

| | | | | | | | | | | | | | 7/13/2022 | | | | | | | 117,925 | | | $477,596 | | |||||||||||

| | | | | | | | | | | | | | 3/1/2023 | | | | | | | 16,896 | | | $68,429 | | |||||||||||

| | | | | | | | | | | | | | 3/1/2023 | | | | | | | 56,318 | | | $228,088 | | |||||||||||

| | Marcus J. Moeltner | | | 0 | | | 0 | | | 0 | | | - | | | 0 | | | - | | | | | | | | | | | | |||||

| | | | | | | | | | | | | | 3/1/2021 | | | 24,194 | | | $97,986 | | | | | | |||||||||||

| | | | | | | | | | | | | | 3/1/2022 | | | 44,271 | | | $179,298 | | | | | | |||||||||||

| | | | | | | | | | | | | | 3/1/2023 | | | 25,030 | | | $101,372 | | | | | | |||||||||||

| | | | | | | | | | | | | | 3/1/2021 | | | | | | | 4,234 | | | $17,148 | | |||||||||||

| | | | | | | | | | | | | | 7/14/2021 | | | | | | | 4,234 | | | $17,148 | | |||||||||||

| | | | | | | | | | | | | | 3/1/2022 | | | | | | | 5,535 | | | $22,417 | | |||||||||||

| | | | | | | | | | | | | | 3/29/2022 | | | | | | | 14,238 | | | $57,664 | | |||||||||||

| | | | | | | | | | | | | | 7/13/2022 | | | | | | | 40,095 | | | $162,385 | | |||||||||||

| | | | | | | | | | | | | | 3/1/2023 | | | | | | | 4,381 | | | $17,743 | | |||||||||||

| | | | | | | | | | | | | | 3/1/2023 | | | | | | | 14,601 | | | $59,134 | | |||||||||||

| | Joshua C. Hicks | | | 0 | | | 0 | | | 0 | | | - | | | 0 | | | - | | | | | | | | | | | | |||||

| | | | | | | | | | | | | | 3/1/2022 | | | 31,250 | | | $126,563 | | | | | | |||||||||||

| | | | | | | | | | | | | | 3/1/2023 | | | 25,030 | | | $101,372 | | | | | | |||||||||||

| | | | | | | | | | | | | | 12/6/2021 | | | | | | | 6,557 | | | $26,556 | | |||||||||||

| | | | | | | | | | | | | | 12/6/2021 | | | | | | | 6,556 | | | $26,552 | | |||||||||||

| | | | | | | | | | | | | | 1/21/2022 | | | | | | | 21,295 | | | $86,245 | | |||||||||||

| | | | | | | | | | | | | | 3/1/2022 | | | | | | | 5,469 | | | $22,149 | | |||||||||||

| | | | | | | | | | | | | | 7/13/2022 | | | | | | | 39,623 | | | $160,473 | | |||||||||||

| | | | | | | | | | | | | | 3/1/2023 | | | | | | | 4,381 | | | $17,743 | | |||||||||||

| | | | | | | | | | | | | | 3/1/2023 | | | | | | | 14,601 | | | $59,134 | | |||||||||||

| | Michael D. Osborne | | | 0 | | | 0 | | | 0 | | | 0 | | | | | | | | | | | | | | | | |||||||

| | | | | | | | | | | | | | 4/10/2023 | | | 52,540 | | | $212,787 | | | | | | |||||||||||

| | | | | | | | | | | | | | 5/17/2023 | | | 12,515 | | | $50,686 | | | | | | |||||||||||

| | | | | | | | | | | | | | 5/17/2023 | | | | | | | 2,191 | | | $8,874 | | |||||||||||

| | | | | | | | | | | | | | 5/17/2023 | | | | | | | 7,301 | | | $29,569 | | |||||||||||

| | R. Colby Slaughter | | | 231 | | | 0 | | | 36.5528 | | | 1/2/2014 | | | 0 | | | 1/2/2024 | | | | | | | | | | | | |||||

| | | | | | | | | | | | | | 3/1/2021 | | | 8,123 | | | $32,898 | | | | | | |||||||||||

| | | | | | | | | | | | | | 3/1/2022 | | | 15,625 | | | $63,281 | | | | | | |||||||||||

| | | | | | | | | | | | | | 3/1/2023 | | | 16,091 | | | $65,169 | | | | | | |||||||||||

| | | | | | | | | | | | | | 3/1/2021 | | | | | | | 1,422 | | | $5,759 | | |||||||||||

| | | | | | | | | | | | | | 7/14/2021 | | | | | | | 1,422 | | | $5,759 | | |||||||||||

| | | | | | | | | | | | | | 3/1/2022 | | | | | | | 1,954 | | | $7,914 | | |||||||||||

| | | | | | | | | | | | | | 3/29/2022 | | | | | | | 5,026 | | | $20,355 | | |||||||||||

| | | | | | | | | | | | | | 7/13/2022 | | | | | | | 14,151 | | | $57,312 | | |||||||||||

| | | | | | | | | | | | | | 3/1/2023 | | | | | | | 9,387 | | | $38,017 | | |||||||||||

| | | | | | | | | | | | | | 3/1/2023 | | | | | | | 2,817 | | | $11,409 | | |||||||||||

| (1) | Option awards vested and became exercisable in one-third increments on the first, second and third anniversaries of the grant date. RSU awards vest on the third anniversary of the grant date. |

| (2) | Represents PSU awards granted in 2021, 2022 and 2023, with a 36-month performance period. These awards are immediately vested following the completion of the performance period upon the determination of the amount earned, if any, based upon performance achievement. Under the terms of |

54 | | | | |  | | |

Executive compensation tables and related information |

| (3) | Value based on the December 31, 2023 closing price of Rayonier Advanced Materials stock of $4.05. |

| (4) | Share amounts and option exercise prices shown have been adjusted to reflect a June 2014 valuation adjustment due to our spinoff from our former parent company. |

| | | | Option Awards | | | Stock Awards | | |||||||

| | Name | | | NUMBER OF SHARES ACQUIRED ON EXERCISE (#) | | | VALUE REALIZED ON EXERCISE ($) | | | NUMBER OF SHARES ACQUIRED ON VESTING (#)(1) | | | VALUE REALIZED ON VESTING ($)(1) | |

| | De Lyle Bloomquist | | | - | | | - | | | 0 | | | $0 | |

| | Marcus J. Moeltner | | | - | | | - | | | 102,072 | | | $857,405 | |

| | Joshua C. Hicks | | | - | | | - | | | 65,560 | | | $228,149 | |

| | Michael D. Osborne | | | - | | | - | | | 0 | | | $0 | |

| | R. Colby Slaughter | | | - | | | - | | | 34,865 | | | $292,866 | |

| (1) | Represents vesting of RSUs and the 144.1% payout of the 2020 PSU awards which were a part of the overall 2020 Equity Incentive Plan, with value realized on vesting determined by multiplying the number of shares acquired on vesting by the $8.40 closing market price of our Common Stock on March 1, 2023. The number of shares acquired for Mr. Hicks represents the partial vesting of his 2021 RSUs granted upon hire, with the value realized was determined by multiplying the number of shares acquired on vesting by the $3.48 closing price of our Common Stock on December 6, 2023. |

| | Name | | | Executive Contributions in Last FY ($)(1) | | | Registrant Contributions in Last FY ($)(1) | | | Aggregate Earnings in Last FY ($) | | | Aggregate Withdrawals/ Distributions in Last FY ($) | | | Aggregate Balance at Last FYE ($)(2) | |