- RYAM Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

PRE 14A Filing

Rayonier Advanced Materials (RYAM) PRE 14APreliminary proxy

Filed: 20 Mar 20, 3:05pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☒ | Preliminary Proxy Statement |

| ☐ | CONFIDENTIAL, FOR USE OF THE COMMISSION ONLY (AS PERMITTED BY RULE14A-6(E)(2)) |

| ☐ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to§240.14a-12 |

RAYONIER ADVANCED MATERIALS INC.

Incorporated in the State of Delaware

I.R.S. Employer Identification No. 46-4559529

1301 RIVERPLACE BOULEVARD, SUITE 2300

JACKSONVILLE, FL 32207

(Principal Executive Office)

Telephone Number: (904) 357-4600

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. |

| ☐ | Fee computed on table below per Exchange Act Rules14a-6(i)(4) and0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

PAUL G. BOYNTON Chairman, President and Chief Executive Officer | Dear Stockholder:

We are pleased to invite you to attend our Annual Meeting of Stockholders on May 18, 2020, at the DoubleTree Hotel, 1201 Riverplace Boulevard, Jacksonville, Florida, at 5:00 p.m. local time. In the following Notice of 2020 Annual Meeting and Proxy Statement, we describe the matters upon which you will be asked to vote at the meeting.

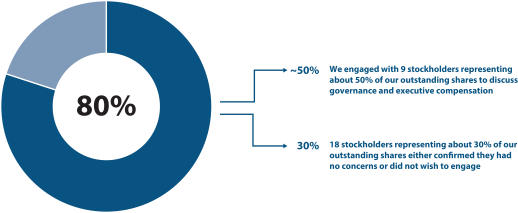

2019 was a challenging and difficult year, but we did not shy away from soliciting the frank feedback of our stockholders. In fact, in 2019 we enhanced our stockholder outreach to even greater levels than in prior years. We reached out to stockholders holding almost 80% of our outstanding shares. I, other members of senior management and our Board of Directors personally met with, in person or telephonically, stockholders owning about half of our shares. We heard your concerns about our May 2019 failedsay-on-pay vote and your views about our business strategy and corporate governance. And, as described in our Proxy Statement, we are incorporating your advice into our business, compensation and governance changes as we move forward in 2020.

Please review the proxy/notice card for instructions on how to vote over the Internet, by telephone or by mail in order to be certain that your shares of stock are represented at the meeting, even if you plan to attend. It is important that all Rayonier Advanced Materials stockholders vote and participate in the affairs and governance of our Company.

The Company is monitoring the COVID-19 situation and we are planning for the possibility that it may become inadvisable or impossible to hold the 2020 Annual Meeting as planned. If we determine that we need to make changes to the 2020 Annual Meeting, we will announce the alternative arrangements as soon as possible.

Thank you for your continued trust, confidence and investment in Rayonier Advanced Materials.

PAUL G. BOYNTON Chairman, President and Chief Executive Officer

April 3, 2020 |

Corporate Headquarters

April 3, 2020

Notice of 2020 Annual Meeting

TO OUR STOCKHOLDERS:

Notice is hereby given that the 2020 Annual Meeting of Stockholders of Rayonier Advanced Materials Inc., a Delaware corporation, will be held at the DoubleTree Hotel, 1201 Riverplace Boulevard, Jacksonville, Florida on Monday, May 18, 2020 at 5:00 p.m. local time, for purposes of:

| 1) | Electing three Class III directors to terms expiring in 2023 |

| 2) | Approving an amendment to the Company’s Amended and Restated Certificate of Incorporation to declassify the board of directors |

| 3) | Approving an amendment to the Company’s Amended and Restated Certificate of Incorporation to eliminate the supermajority voting provisions |

| 4) | Approving, in anon-binding vote, the compensation of our named executive officers as disclosed in the accompanying Proxy Statement |

| 5) | Ratifying the appointment of Grant Thornton as our independent registered public accounting firm for 2020; and |

| 6) | Acting upon such other matters as may properly come before the meeting |

All stockholders holding Rayonier Advanced Materials common stock of record at the close of business on March 20, 2020 are entitled to vote at the meeting.

WHETHER OR NOT YOU EXPECT TO ATTEND THE ANNUAL MEETING IN PERSON, PLEASE PROMPTLY SUBMIT YOUR PROXY OR VOTING INSTRUCTION. Most stockholders have a choice of voting over the Internet, by telephone or by using a traditional proxy card. Please refer to the enclosed proxy materials or the information forwarded by your bank, broker or other holder of record to determine which voting methods are available to you. We urge you to complete and submit your proxy electronically or by telephone (if those options are available to you) as a means of reducing the Company’s expenses related to the meeting.

Please be aware that, if you own shares in a brokerage account, you must instruct your broker on how to vote your shares. New York Stock Exchange rules do not allow your broker to vote your shares without your instructions on any of the proposals except the ratification of the appointment of the Company’s independent registered public accounting firm. Please exercise your right as a stockholder to vote on all proposals, including the election of directors, by instructing your broker by proxy.

We urge you to vote your stock, by any of the available methods, at your earliest convenience.

| By: |

| |

R. Colby Slaughter Assistant Corporate Secretary |

NOTE ABOUT FORWARD-LOOKING STATEMENTS

Certain statements in this Proxy Statement, including statements in the Compensation Discussion and Analysis, (also referred to as CD&A) regarding anticipated financial, business, legal or other outcomes, including business and market conditions, outlook and other similar statements relating to Rayonier Advanced Materials’ future events, developments, or financial or operational performance or results, are forward-looking statements made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 and other federal securities laws. These forward-looking statements are identified by the use of words such as “may,” “will,” “should,” “expect,” “estimate,” “believe,” “intend,” “forecast,” “anticipate,” “guidance” and other similar language. However, the absence of these or similar words or expressions does not mean a statement is not forward-looking. While we believe these forward-looking statements are reasonable when made, forward-looking statements are not guarantees of future performance or events and undue reliance should not be placed on these statements. Although we believe the expectations reflected in any forward-looking statements are based on reasonable assumptions, we can give no assurance these expectations will be attained and it is possible actual results may differ materially from those indicated by these forward-looking statements due to a variety of risks and uncertainties. A detailed discussion of risks and uncertainties that could cause actual results and events to differ materially from such forward-looking statements is included in Item 1A-Risk Factorsin our Annual Report on Form10-K for the year ended 2019.

General Information about this Proxy Statement and the Annual Meeting

2020 ANNUAL MEETING OF STOCKHOLDERS OF RAYONIER ADVANCED MATERIALS INC.

MONDAY, MAY 18, 2020

The 2020 Annual Meeting of Stockholders of Rayonier Advanced Materials Inc. (the Annual Meeting) will be held on May 18, 2020, for the purposes set forth in the accompanying Notice of 2020 Annual Meeting. This Proxy Statement and the accompanying proxy card are furnished in connection with the solicitation by the Board of Directors of proxies to be used at the meeting and at any adjournment of the meeting. We may refer to Rayonier Advanced Materials Inc. in this Proxy Statement as “we,” “us,” “our,” the “Company” or “Rayonier Advanced Materials.”

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting

We are utilizing Securities and Exchange Commission (the SEC) rules that allow companies to furnish proxy materials to stockholders via the Internet. If you received an Important Notice Regarding the Availability of Proxy Materials (the Internet Notice) by mail, you will not receive a printed copy of the proxy materials unless you specifically request one. The Internet Notice tells you how to access and review the Proxy Statement, form of proxy card and our 2020 Annual Report to Stockholders (the Annual Report), which includes our 2019 Annual Report on Form10-K, as well as instructions for how to submit your proxy over the Internet. If you received the Internet Notice and would still like to receive a printed copy of our proxy materials, simply follow the instructions for requesting printed materials included in the Internet Notice.

The Internet Notice, these proxy solicitation materials and our Annual Report were first made available on the Internet and mailed to certain stockholders on or about April 3, 2020.

The Notice of 2020 Annual Meeting, this Proxy Statement and our Annual Report are available atwww.proxyvote.com.

Annual Report

A copy of our Annual Report, which includes the 2019 Annual Report on Form10-K, is available on the Internet atwww.proxyvote.com as set forth in the Internet Notice. However, we will send a copy of our 2019 Annual Report on Form10-K (with financial statements but without exhibits) to any stockholder without charge upon written request addressed to:

Rayonier Advanced Materials Inc.

Investor Relations

1301 Riverplace Boulevard

Suite 2300

Jacksonville, Florida 32207, USA

Delivery of Materials to Stockholders Sharing an Address

In addition to furnishing proxy materials over the Internet, the Company takes advantage of the SEC’s householding rules to reduce the delivery cost of materials. Under such rules, only one Internet Notice or, if paper copies are requested, only one Proxy Statement and Annual Report, will be delivered to multiple stockholders sharing an address unless the Company has received contrary instructions from one or more of the stockholders. If you are a stockholder who resides in the same household with another stockholder and you wish to receive a separate Proxy Statement and Annual Report or Notice of Internet Availability of Proxy Materials for each account, please contact Broadridge, toll freeat 1-866-540-7095. You may also write to Broadridge, Householding Department, 51 Mercedes Way, Edgewood, New York 11717. Any stockholder making such request will promptly receive a separate copy of the proxy materials, and separate copies of all future proxy materials. Any stockholder currently sharing an address with another stockholder, but nonetheless receiving separate copies of the materials, may request delivery of a single copy in the future by contacting Broadridge Householding Department by telephone or mail as indicated above.

This summary highlights selected information that is provided in more detail throughout this Proxy Statement. This summary does not contain all of the information you should consider before voting, and you should read the entire Proxy Statement before casting your vote.

|

2020 ANNUAL MEETING INFORMATION

| Date & Time May 18, 2020 5:00 p.m. local time | Voting Stockholders holding our Common Stock as of the close of business on the record date, which is the close of business on March 20, 2020 (Record Date), are entitled to vote. Each share of Common Stock is entitled to one vote for each matter to be voted upon. | ||

| Location DoubleTree Hotel 1201 Riverplace Boulevard Jacksonville, Florida | Admission To attend the Annual Meeting, you will need to bring (1) proof of ownership of Common Stock as of the record date and (2) a valid government-issued photo identification. If you do not have proof of ownership together with a valid picture identification, you will not be admitted to the meeting. | ||

| Record Date Record holders of our Common Stock as of March 20, 2020 are entitled to notice of, and to vote at, the Annual Meeting | Admission to the Annual Meeting is limited to stockholders holding our Common Stock as of the record date and one immediate family member; one individual properly designated as a stockholder’s authorized proxy holder; or one qualified representative authorized to present a stockholder proposal properly before the meeting. | ||

No cameras, recording equipment, large bags, briefcases, or packages will be permitted in the Annual Meeting.The Company may implement additional security procedures to ensure the safety of the meeting attendees.

Questions and Answers about the Annual Meeting can be found in Appendix D. | ||||

PROPOSALS

MATTER | BOARD VOTE RECOMMENDATION | PAGE REFERENCE (FOR MORE DETAIL) | ||||

|

Election of three Class III directors to terms expiring in 2023 | FOR each nominee |

15 | |||

| Approving an amendment to the Company’s Amended and Restated Certificate of Incorporation to declassify the Board of Directors |

FOR |

26 | |||

| Approving an amendment to the Company’s Amended and Restated Certificate of Incorporation to eliminate the supermajority voting provisions |

FOR |

27 | |||

| Approving, in anon-binding vote, the compensation of our named executive officers as disclosed in this Proxy Statement |

FOR |

29 | |||

| Ratification of the appointment of Grant Thornton as our independent registered public accounting firm for 2020 |

FOR |

64 | |||

| 2020 RYAM PROXY STATEMENT | 1 | |||||||

COMMITMENT TO BEST PRACTICES IN CORPORATE GOVERNANCE

|

Commitment to Best Practices in Corporate Governance

CORPORATE GOVERNANCE HIGHLIGHTS

Our Board of Directors (the Board) has implemented an effective corporate governance structure that allows our Board and management to focus primarily on the creation of long-term value for our stockholders while also considering the interests of our employees and the communities in which we do business. Supporting that philosophy, we have adopted many leading corporate governance practices, including:

| STOCKHOLDER RIGHTS | ||

Management Proposal to Declassify the Board of Directors | In our 2019 proxy statement, management submitted a proposal to be voted on by stockholders at the 2019 Annual Meeting to declassify the Company’s Board of Directors. It did not receive the required stockholder approval. Again, at our 2020 Annual Meeting, management is proposing that the stockholders vote to declassify the Board. | |

Management Proposal to Eliminate Supermajority Voting Provisions | In our 2019 proxy statement, management submitted a proposal to be voted on by stockholders at the 2019 Annual Meeting to eliminate supermajority voting provisions from the Company’s Amended and Restated Certificate of Incorporation in favor of a majority voting standard. It did not receive the required stockholder approval. Again, at our 2020 Annual Meeting, management is proposing that the stockholders vote to eliminate the supermajority voting provisions from the Company’s Amended and Restated Certificate of Incorporation. | |

Independent,Non-Executive Chairman of the Board | Since the creation of the Company in 2014, our Corporate Governance Principles (CGPs) have required an Independent Lead Director to ensure independent oversight whenever our CEO is also the Chair of the Board (as he has been since 2014). However, on March 6, 2020, we announced that our Board has decided to split the roles of Chairman and CEO, effective as of the day following our 2020 Annual Meeting, with Paul Boynton to continue in his role as CEO. See IndependentNon-Executive Chairman section. | |

Single Voting Class | All holders of Rayonier Advanced Materials Common Stock have the same voting rights - one vote per share of stock. | |

Majority Voting Standard for Director Elections | Our Amended and Restated Bylaws mandate that directors be elected under a majority voting standard in uncontested elections. Each director must receive more votes “For” his or her election than votes “Against” in order to be elected. | |

| 2 |  | |||||||

COMMITMENT TO BEST PRACTICES IN CORPORATE GOVERNANCE

|

| STOCKHOLDER RIGHTS | ||

Director Resignation | Any incumbent nominee for director who does not receive the affirmative vote of a majority of the votes cast in any uncontested election must promptly offer to resign. The Nominating and Corporate Governance Committee (Nominating Committee) will make a recommendation on the offer and the Board must accept or reject the offer and publicly disclose its decision and rationale. | |

No Poison Pill | We do not have a stockholder rights plan, also known as a poison pill, in place. | |

| BOARD COMPOSITION AND ACCOUNTABILITY | ||

Independence | Our CGPs require that not less than 75% of our directors must be independent. During 2019, 90%(nine of ten)of our directors were independent(1), and each of our Board committees consisted entirely of independent directors. See Director Independence section. | |

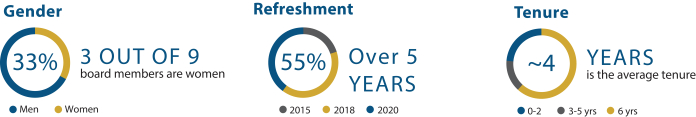

Diversity | The composition of our Board represents a diverse and broad mix of skills, experience, knowledge and perspectives relevant to our business. During 2019, we had two female directors on our Board and, commencing in May 2020, we will have three female directors. A summary of relevant director experience and qualifications can be found in the Director Qualifications section. | |

Continuous Board Refreshment | On March 6, 2020, the Board announced the appointment of two new directors, Ivona Smith and David C. Mariano, and the retirement of C. David Brown, II and Mark E. Gaumond from the Board after the 2020 Annual Stockholders Meeting. Therefore, since 2015, the Board has appointed five new directors, representing refreshment of 55% of the current nine-member Board. | |

Annual Management Succession Planning Review | Our Board conducts an annual review of management development and succession planning for the CEO and Company senior leadership. See Management Succession Planning section. | |

Director Tenure | Our CGPs provide that no director may be nominated for election following the director’s 74th birthday. In addition, a director is required to submit an offer of resignation for consideration by the Board upon any significant change in the director’s principal employment or personal circumstance that could adversely impact his or her reputation or the reputation of the Company. See Director Qualifications section. | |

Director Overboarding Limits | Our CGPs contain provisions to ensure that each of our directors is able to dedicate the meaningful amount of time and attention necessary to be a highly effective member of the Board. A director who is not serving as CEO of a public company may serve on no more than three public company boards (in addition to our Board) and a director serving as the CEO of a public company (including our CEO) may serve on no more than one other public company board (in addition to our Board). No director serving on the Company’s Audit Committee may also serve on the Audit Committee of more than two other public companies. | |

| 2020 RYAM PROXY STATEMENT | 3 | |||||||

COMMITMENT TO BEST PRACTICES IN CORPORATE GOVERNANCE

|

| BOARD COMPOSITION AND ACCOUNTABILITY | ||

Mandatory Stock Ownership | Each of our directors is required to own Company stock totaling not less than the number of shares constituting the cash portion of his or her annual retainer for the previous five years. See Mandatory Stock Ownership section. | |

Limit on Equity Awards | Our Incentive Stock Plan limits annual director equity awards. See Limit on Annual Equity Awards section. | |

| (1) | Following Matthew P. Hepler’s resignation from the Board on May 23, 2019, eight of nine of our directors were independent. |

| 4 |  | |||||||

COMMITMENT TO BEST PRACTICES IN CORPORATE GOVERNANCE

|

CORPORATE GOVERNANCE PRINCIPLES

Our Board of Directors has adopted a set of Corporate Governance Principles (CGPs), which includes guidelines for determining director independence and consideration of potential director nominees. Our CGPs are found on the Company’s website atwww.rayonieram.com. The Board, through its Nominating Committee, regularly reviews developments in corporate governance and best practices and modifies the CGPs, committee charters and key practices as necessary or desirable.

The Company’s Common Stock is listed on the New York Stock Exchange (NYSE). In accordance with NYSE listing standards, the Board makes affirmative determinations annually as to the independence of each director and nominee for election as a director. To assist in making such determinations, the Board has adopted a set of Director Independence Standards which conform to or, in some cases, are more exacting than, the independence requirements set forth in the NYSE listing standards. Our Director Independence Standards are appended to the Company’s CGPs and are available atwww.rayonieram.com. Based on our Director Independence Standards, the Board has affirmatively determined in its business judgment that all persons who have served as directors of our Company at any time since January 1, 2019, other than Mr. Boynton, are independent (i.e., nine of ten directors in 2019).

NON-EXECUTIVE CHAIRMAN OF THE BOARD

Until March of 2020, our Board had been led by an independent lead director, who was nominated and elected to atwo-year term by the other independent Board members. The Board believes this leadership structure has been effective in providing independent oversight of management.

As publicly announced on March 6, 2020, the Board has decided to elect an independent director to serve asNon-Executive Chairman of the Board, thus necessitating the separation of the roles of CEO and Chairman. This change will be effective as of the day after our 2020 Annual Meeting. We believe that the separation of these roles is appropriate and in the best interest of our Company and its stockholders at this time. This change recognizes the time and effort our CEO is required to devote to strategy andday-to-day management of our business, and allows our Chairman to focus on sound governance and oversight practices that benefit the long-term interests of our stockholders.

The duties of ourNon-Executive Chairman will include:

| Leading the Board’s oversight of the management of the Company |

| Approving materials and agendas for Board meetings in consultation with other directors and management |

| Presiding during stockholder meetings, Board meetings and executive sessions of the independent directors |

| Facilitating communication among directors and the regular flow of information between management and directors |

| Serving as liaison between independent directors and the CEO |

| Leading independent directors in periodic reviews of the performance of the CEO |

| If requested by major stockholders, ensuring he or she is available for consultation and direct communication |

| Recommending independent outside advisors who report directly to the Board on material issues |

TheNon-Executive Chairman of the Board will be elected by the Board prior to the 2020 Annual Meeting, with his or her term to commence on the day after such meeting. Until then, Paul G. Boynton will continue as Chairman, President and Chief Executive Officer. After election of the newNon-Executive Chairman, Mr. Boynton will continue in his role as President and Chief Executive Officer. Mr. Boynton will also continue to serve as a director on the Board.

| 2020 RYAM PROXY STATEMENT | 5 | |||||||

COMMITMENT TO BEST PRACTICES IN CORPORATE GOVERNANCE

|

INDEPENDENTNON-MANAGEMENT DIRECTOR MEETINGS

Our independentnon-management directors met separately (without the Chairman and CEO or any members of management) during five regularly scheduled meetings in 2019; these meetings were chaired by our Independent Lead Director. Independentnon-management directors on our Board committees also have the opportunity to meet without management present at Board committee meetings.

Our Nominating Committee evaluates the specific personal and professional attributes of each director candidate versus those of the existing Board members to ensure diversity of competencies, experience, personal history and background, thought, skills and expertise across the full Board. While our Nominating Committee has not adopted a formal diversity policy in connection with the evaluation of director candidates or the selection of nominees, consideration is also given to diversity in terms of gender, ethnic background, age and other similar attributes that could contribute to Board perspective and effectiveness. The Nominating Committee also assesses diversity through its annual assessment of Board structure and composition and review of the annual Board and committee performance evaluations. The Nominating Committee and the Board believe that considering diversity is consistent with the goal of creating a Board that best serves the needs of the Company and the interests of its stockholders, and it is one of the many factors that they consider when identifying individuals for Board membership.

In addition, we believe that diversity with respect to refreshment and tenure is important to provide both fresh perspectives and deep experience and knowledge of the Company. Therefore, we aim to maintain an appropriate balance of tenure across our directors. In furtherance of the Board’s active role in succession planning, taking into account the new appointments announced on March 6, 2020, the Board has appointed five new directors since 2015, representing Board refreshment of 55% in six years. Our Board currently has two experienced, highly skilled female directors and, as of the day after our 2020 Annual Meeting, will have three (representing 33% of the Board).

BOARD EVALUATION AND ASSESSMENT

Annual self-evaluation and assessment of Board performance helps ensure that the Board and its committees function effectively and in the best interest of our stockholders. This process also promotes good governance and helps set expectations about the relationship and interaction of the Board and management. The Board’s annual self-evaluation and assessment process, which has been overseen by our Independent Lead Director and in the future will be overseen by ourNon-Executive Chairman, is currently structured and carried out as follows:

| The Nominating Committee reviews the prior year’s process of self-evaluation and assessment for the Board and Board committees, as well as current trends and best practices. |

| Under the auspices of the Nominating Committee, the Corporate Secretary facilitates the process agreed upon by the Committee. In 2019, this process consisted of preparation of suggested general topics of discussion, which were disseminated to all directors, followed by confidential interviews of each Board member by the Corporate Secretary. |

| The feedback generated from the interviews is summarized by the Corporate Secretary and shared with the Lead Director and Chairman. |

| 6 |  | |||||||

COMMITMENT TO BEST PRACTICES IN CORPORATE GOVERNANCE

|

| These results are then communicated in executive session to the full Board and each committee, as well as to individual directors, as appropriate, which fosters good discussion and consensus on actions to be undertaken. |

| Changes to policies and practices, as warranted, are implemented as directed by the Board. |

The structure of this process is reviewed annually by the Company’s Nominating Committee and changes made as it deems appropriate in accordance with good governance practices.

One of the primary responsibilities of our Board is to ensure that the Company has a high-performing management team in place. Our full Board has responsibility for management succession planning. The Board manages the succession planning process and, on an annual basis, reviews and approves succession plans for the CEO and other senior executives. This detailed process is designed to maximize the pool of qualified internal candidates who can assume top management positions. To assist the Board, the CEO annually provides our Board with an assessment of senior managers and the potential of each manager to succeed to the CEO position. The CEO also provides the Board with an assessment of persons considered potential successors to senior management positions.

We have a robust risk assessment and mitigation process, overseen by our Board of Directors, which includes extensive interaction among our Board, CEO and members of senior management.

BOARD OF DIRECTORS

| ENTERPRISE RISK MANAGEMENT COMMITTEE

| AUDIT COMMITTEE

| COMPENSATION AND MANAGEMENT DEVELOPMENT COMMITTEE

| |||||||||

The Board oversees risk management through amanagement-led assessment process that involves direct Board committee oversight. The Board annually appoints the members of the Enterprise Risk Management (ERM) Committee, which is chaired by the CEO, who also serves as the Company’s Chief Risk Officer. Senior executives of the Company are members of the ERM Committee.

|

| The ERM Committee appoints the members of business unit and staff function-level Risk Assessment and Mitigation teams, which continually identify and assess the risks facing their respective business or function and submit semi-annual reports to the ERM Committee. These reports form the basis of the ERM Committee’s annual risk assessment. This assessment is used to develop a list of enterprise-level material risks which are reported to the Audit Committee for review and evaluation of mitigation strategies.

|

| The Audit Committee then assigns ongoing Board-level oversight responsibility for each material risk identified by the ERM Committee to either the full Board or the appropriate Board committee. Presentations and other communications regarding each risk are made periodically during the year. |

| The ERM Committee’s annual risk assessment of the Company’s overall compensation policies and practices is presented to the Compensation and Management Development Committee. | ||||||

| 2020 RYAM PROXY STATEMENT | 7 | |||||||

COMMITMENT TO BEST PRACTICES IN CORPORATE GOVERNANCE

|

ENGAGEMENT BY MANAGEMENT AND OUR BOARD WITH OUR STOCKHOLDERS

>325 | INVESTMENT COMMUNITY OUTREACH Calls, meetings and other personal engagements

| |

~80%/~50% | STOCKHOLDER ENGAGEMENT Percentage of common stock reached out to/spoken with, through calls, meetings and other personal engagements

| |

>90% | ANNUAL MEETING ENGAGEMENT Percentage of common stock represented by vote at the 2019 Annual Meeting

| |

Stockholder Engagement Overview

Our Board and management value and rely upon our stockholders’ perspectives. To help ensure we understand and focus on the priorities that matter most to our stockholders, our directors and senior management proactively conduct thorough and extensive investor outreach throughout the year. In addition to discussing business results and initiatives, strategy and capital structure, we engage with investors on various other matters integral to our business and the Company, such as governance practices, executive compensation and sustainability.

Specific Ways We Engaged with Stockholders in 2019

In 2019 we requested meetings with stockholders representing almost 80% of our issued and outstanding shares, and we were able to meet and engage directly, in person or telephonically, with approximately half of these stockholders. We also met with analysts who cover our Company and leading proxy advisors who serve our investors. We presented at three industry conferences, held two road shows, and in March of 2019 held an Investor Day at the New York Stock Exchange, where investors and analysts heard presentations from our senior management about all aspects of our business (Investor Day presentation materials are available on our website atwww.rayonieram.com). Our Board and management carefully consider and evaluate feedback received during these meetings. The feedback we received in 2019 and early 2020 is reflected in the governance changes we announced on March 6, 2020.

Additionally, our Independent Lead Director and other independent directors continued to be closely and directly involved in our investor engagement efforts. Specifically, in 2019 three of our directors held outreach discussions with stockholders representing approximately 50% of our outstanding shares.

A key focus of our investor outreach was our failedSay-on-Pay vote at the 2019 Annual Meeting. This is discussed in more detail below and in the CD&A section.

Stockholders and other interested parties who would like to communicate with one or more members of the Board, a Board committee, the Independent Lead Director (until May 18, 2020), theNon-Executive Chairman (after May 18, 2020) or the independentnon-management directors as a group may do so by writing to any such party at Rayonier Advanced Materials Inc., c/o Corporate Secretary, 1301 Riverplace Boulevard, Suite 2300, Jacksonville, Florida 32207. All communications received will be forwarded to the intended recipient(s).

| 8 |  | |||||||

COMMITMENT TO BEST PRACTICES IN CORPORATE GOVERNANCE

|

How We’ve Incorporated Stockholder Feedback Received Over the Past Year

In 2019, investors provided feedback on several governance, strategic and capital structure issues, which the Board and management have carefully evaluated. The feedback we received over the past year has helped guide the Company and influence our thinking and decision-making in several areas, including:

| At our 2019 Annual Meeting of Stockholders, our Board and management asked stockholders, in separate proposals, to vote to declassify our Board of Directors and eliminate supermajority voting provisions from our Articles of Incorporation and Bylaws, respectively. These proposals were not approved and, after feedback from our investor outreach, we are again asking our stockholders to approve similar proposals at the 2020 Annual Meeting. |

| On March 6, 2020, we announced the appointment of two new directors, Ivona Smith and David C. Mariano, and the retirement from the Board of C. David Brown, II1 and Mark E. Gaumond1. These changes will be effective as of the day after the 2020 Annual Meeting (and, in the case of Mr. Mariano, assuming his election by the stockholders). Since 2015, 55% of the Board has been refreshed. |

| Also on March 6, 2020, the Board announced the split of the Chairman and CEO roles, effective as of the day after our 2020 Annual Meeting, thus creating an independentnon-executive Chairman. This is consistent with the Board’s commitment to best governance practices, as well as allowing our CEO to focus even more of his time and attention on the strategy andday-to-day operations of the Company. |

| Our renegotiation of our credit agreement covenants, in September 2019, to provide the Company with flexibility to manage through the current trade and economic headwinds we face. |

| Our previously-announced initiatives to continue to drastically reduce our costs and focus on cash generation in response to our current business challenges. |

| Our ESG and sustainability programs, including publication of our 2019 Sustainability report, and discussion of the standards and metrics some of our investors believe we should consider using in the future. |

| OurGo-To-Market strategy for our High Purity Cellulose business, which we announced at our Investor Day in March of 2019. |

| Positive support for our announced portfolio review, including our November 2019 sale of our Matane high yield pulp facility for $175 million. |

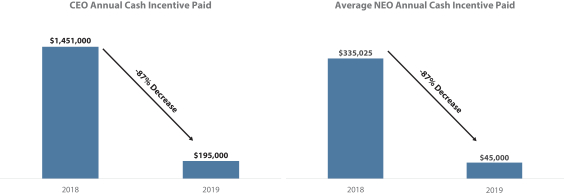

2019Say-On-Pay Vote

At our 2019 Annual Meeting, only approximately 40% of stockholders expressed support for the compensation of our named executives. As a result of this outcome, we conducted extensive outreach, as described in our CD&A section, with our investors and proxy advisory firms to review our compensation actions and listen to their feedback. As part of its annual assessment of the Company’s executive compensation programs, the Compensation Committee evaluated this investor feedback and decided to take various actions to strengthen the alignment between these programs and the interests of the Company’s stockholders. These actions are summarized in detail in the CD&A section.

STANDARD OF ETHICS AND CODE OF CORPORATE CONDUCT

The Company’s Standard of Ethics and Code of Corporate Conduct (code of conduct) is available on the Company’s website atwww.rayonieram.com. Any waivers or amendments to the Code of Conduct will also be available on the Company’s website.

| 1 | Messrs. Brown and Gaumond will retire from the Board following the Annual Meeting. |

| 2020 RYAM PROXY STATEMENT | 9 | |||||||

COMMITMENT TO BEST PRACTICES IN CORPORATE GOVERNANCE

|

SUSTAINABILITY OF OUR BUSINESS, COMMUNITY AND ENVIRONMENT

Overview

Sustainability is an integral part of our strategy to maximize long-term stockholder value. Our global sustainability platform is derived directly from our Company values and cultural cornerstones. We are focused on doing what’s right in conducting our business to ensure that we preserve resources for future generations and provide a safe and healthy working environment for our colleagues, while at the same time promoting the continued financial success of the Company and its businesses.

Stewardship

Stewardship is at the heart of our sustainability practices. It means forming partnerships with the people who live, work and raise families in the communities near the forests from which we source our wood and our manufacturing plants, including indigenous communities. It means making quality products from renewable resources so our customers can create their remarkable products we use every day. It means creating a workplace where our employees can have a rewarding career. It means operating our manufacturing plants in an environmentally responsible way and in compliance with laws. It means partnering with suppliers who share our values and commitment to stewardship and sustainability principles.

Sustainability Report

Our 2019 Sustainability Report, which can be found on our Company website athttps://rayonieram.com/sustainability-overview/2019-sustainability-report/, provides significant disclosure and transparency regarding our Company-wide sustainability efforts. The Report highlights in detail various specific actions our Company has taken to demonstrating its commitment to sustainability, including in the following areas:

| Managing forests and procuring fiber responsibly, and subscribing to internationally recognized forestry standards. |

| Partnering collaboratively with First Nations in Canada through business relationships, employment opportunities and community and conservation projects. |

| Investing in scientific research to keep forests healthy. |

| Continuously looking for ways to conserve energy and water, increase efficiency, reduce the quantities of chemicals we use and recycle/reuse manufacturing byproducts. |

| Producing innovative products from renewable materials, in many cases offering our customers a substitute for petroleum-based chemicals. |

| Engaging with and investing in our communities through charitable initiatives, local scholarship programs, open houses and participation on Community Advisory Councils. |

| Establishing a safety leadership culture focused on everyone working incident free. |

Sustainability Council

Our Sustainability Council is comprised of members of senior management representing a broad cross-section of our business. Working under the close oversight of our Board of Directors, the Council identifies the sustainability issues most critical to our business and our stakeholders, recommends programs to advance the Company’s sustainability objectives and identifies the data we need to collect to measure and report progress.

In 2019, members of the Sustainability Council engaged with our customers, investors and other stakeholders and received valuable feedback that helped inform the Company’s sustainability strategy, priorities and initiatives. The Council also published a new human rights and diversity policy and a supplier code of conduct, which are

| 10 |  | |||||||

COMMITMENT TO BEST PRACTICES IN CORPORATE GOVERNANCE

|

available on our Company website, to help ensure we partner with suppliers who share our values and commitment. Additionally, the Council quantified Scope 1 and Scope 2 greenhouse gas emissions following the internationally-recognized Greenhouse Gas Protocol.

Consistent with the plan previously communicated, the Sustainability Council’s focus for 2020 will be to identify key sustainability metrics important to the Company and its investors and other stakeholders and then establish the processes necessary to measure and collect data and track and report progress.

| 2020 RYAM PROXY STATEMENT | 11 | |||||||

COMMITMENT TO BEST PRACTICES IN CORPORATE GOVERNANCE

|

The Company uses a combination of cash and stock-based incentive compensation to attract and retain qualified candidates to serve on the Board. In setting director compensation, the Board considers the significant time commitment and the skills and experience level necessary for directors to fulfill their duties.

The Nominating Committee’s annual compensation review includes a periodic analysis of data, comparing the Company’s director compensation levels against a peer group of publicly held companies. F.W. Cook, the Board’s independent compensation consultant, provides the Nominating Committee with advice and recommendations on the composition of the peer group and competitive data used for benchmarking our director compensation program. The Nominating Committee uses the information provided by F. W. Cook, as well as other data, to reach its recommendation regarding compensation to be paid to our directors. The Nominating Committee’s recommendation is then provided to the full Board for review and final approval.

Our directors are subject to minimum stock ownership and time-based stock retention requirements, as discussed in the Mandatory Stock Ownership section below.

2019/2020 Cash Compensation

Non-management director compensation is set by the Board after considering the recommendation of the Nominating Committee. For the twelve-month 2019-2020 director compensation period, which ends with the May 18, 2020 Annual Stockholders Meeting, eachnon-management director receives the following cash compensation (which is prorated for partial year service):

| Annual cash retainer of $85,000, payable in equal quarterly installments |

| Additional annual cash retainers for the chairs of the Audit, Compensation and Nominating Committees of $20,000, $15,000 and $10,000, respectively, payable in equal quarterly installments; and |

| Additional annual cash retainer for the Independent Lead Director of $25,000, payable in equal quarterly installments |

Annual Equity Awards

For the 2019-2020 period, on or about May 21, 2019, eachnon-management director received a restricted stock unit award equivalent to $105,000 based on grant date value (which is prorated for partial year service), to vest on May 21, 2020 if the director has not voluntarily left the Board prior to such date (other than due to the director’s death or disability or in the event of other extraordinary circumstances as determined by the Nominating Committee).

Dividends on the restricted stock unit award accrue in a separate account and are paid upon vesting, together with interest thereon at a rate equal to the Prime Rate as reported inThe Wall Street Journal, adjusted and compounded annually as of each December 31 (the Prime Rate).

Limit on Annual Equity Awards

Our Equity Incentive Plan caps annual equity awards to each director at not more than $300,000 per year. As described above, each Director’s annual equity award in the 2019-2020 period was valued at $105,003.

Cash Fees Deferral Plan

Directors may defer up to 100% of their cash compensation. Any deferred amounts are paid to the director in a single lump sum on the later of the date the director turns 74, the conclusion of the director’s term, or upon termination as a director, if prior to age 74. Any deferred amounts earn interest at a rate equal to the Prime Rate.

| 12 |  | |||||||

COMMITMENT TO BEST PRACTICES IN CORPORATE GOVERNANCE

|

Mandatory Stock Ownership

Each of our directors is required to own Company stock valued at not less than the cash portion of his or her annual retainer for the previous five years. Information on stock ownership by our directors is provided in the CD&A.

2019 Director Compensation Table

The following table provides compensation information for theone-year period ended December 31, 2019 for all individuals serving on our Board of Directors at any time from January 1, 2019 until December 31, 2019.

NAME | FEES EARNED OR PAID IN CASH ($) | STOCK AWARDS ($)(1) | ALL OTHER COMPENSATION ($)(2) | TOTAL ($) | ||||||||||||||||

Charles E. Adair |

| 105,000 |

| 105,003 |

| 1,655 |

| 211,658 | ||||||||||||

De Lyle W. Bloomquist |

| 85,000 |

| 105,003 |

| 1,655 |

| 191,658 | ||||||||||||

Paul G. Boynton(3) |

| - |

| - |

| - |

| - | ||||||||||||

C. David Brown, II(4) |

| 110,000 |

| 105,003 |

| 1,655 |

| 216,658 | ||||||||||||

Julie A. Dill |

| 85,000 |

| 105,003 |

| 1,655 |

| 191,658 | ||||||||||||

Mark E. Gaumond(5) |

| 100,000 |

| 105,003 |

| 1,655 |

| 206,658 | ||||||||||||

Matthew P. Hepler(6) |

| 21,250 |

| - |

| 1,655 |

| 22,905 | ||||||||||||

James F. Kirsch |

| 85,000 |

| 105,003 |

| 1,655 |

| 191,658 | ||||||||||||

Thomas I. Morgan |

| 85,000 |

| 105,003 |

| 1,655 |

| 191,658 | ||||||||||||

Lisa M. Palumbo |

| 95,000 |

| 105,003 |

| 1,655 |

| 201,658 | ||||||||||||

| (1) | Represents the aggregate grant date fair value computed in accordance with FASB ASC Topic 718. A discussion of the assumptions used in calculating these values may be found in Note 15 Incentive Stock Plans included in the notes to financial statements in our 2019 Annual Report on Form10-K. On May 21, 2019, eachnon-management director was granted a restricted stock unit award equivalent to $105,000 which, based on grant date value ($7.92), corresponded to 13,258 restricted stock units, for a total award of $105,003 after rounding (because the Company does not issue fractional shares for director equity awards). These awards will vest on May 21, 2020. |

| (2) | Represents accrued dividends and interest on restricted stock awards which vested on May 22, 2019. |

| (3) | Mr. Boynton, as an executive officer of the Company, was not compensated for service as a director. See the Summary Compensation Table for compensation information relating to Mr. Boynton during 2019. |

| (4) | Mr. Brown will retire from the Board following the Annual Meeting. |

| (5) | Mr. Gaumond will retire from the Board following the Annual Meeting. |

| (6) | Mr. Hepler resigned from the Board on May 23, 2019. |

ANTI-HEDGING/ANTI-PLEDGING POLICY

We have adopted a stringent anti-hedging and anti-pledging policy that applies to all (1) employees of the Company who are officers, (2) directors, and (3) immediate family members of employees who are officers and directors and other members of their households, as well as entities controlled by any of them. Under our policy, the Company may also designate, from time to time, in our discretion, other key employees to be subject to our anti-hedging policy.

The policy precludes all hedging or other offsetting of any potential decrease in the market value of the Company’s equity securities as well as pledging of Company securities. Although not limited to these specific types of transactions, under the Company’s policy the following are specifically prohibited:

| Short sales |

| Trading in options |

| 2020 RYAM PROXY STATEMENT | 13 | |||||||

COMMITMENT TO BEST PRACTICES IN CORPORATE GOVERNANCE

|

| Hedging transactions of all types, including the use of financial instruments such as prepaid variable forwards, equity swaps, collars and exchange funds |

| Pledges of Company securities, such as collateral for margin loans or margin accounts |

| Standing or limit orders, unless under a Rule10b5-1 plan that meets all requirements of the Company’s applicable policy and is approved by the Company’s Corporate Secretary |

Our Board has adopted a written policy designed to minimize potential conflicts of interest in connection with Company transactions with related persons. Our policy defines a Related Person to include any director, executive officer or person owning more than five percent of the Company’s stock, any of their immediate family members and any entity with which any of the foregoing persons are employed or affiliated. A Related Person Transaction is defined as a transaction, arrangement or relationship in which the Company is a participant, the amount involved exceeds $120,000 and a Related Person has or will have a direct or indirect material interest.

To implement the policy, each year a Related Person list is compiled based on information obtained from our annual Director and Officer Questionnaires and, after review and consolidation by our Corporate Secretary, is provided to business unit, accounts payable, accounts receivable, financial, legal and communications managers and other persons responsible for purchasing or selling goods or services for the Company. Prior to entering into any transaction with a Related Person, the manager responsible for the potential transaction, or the Related Person, must provide notice to the Corporate Secretary setting out the facts and circumstances of the proposed transaction. If the Corporate Secretary determines the transaction would constitute a Related Person Transaction, it is then submitted for consideration by the Audit Committee, which will approve only those transactions determined to be in, or not inconsistent with, the best interests of the Company and its stockholders. In reviewing Related Person Transactions, the Audit Committee considers:

| The Related Person’s relationship to the Company and interest in any transaction with the Company |

| The material terms of a transaction with the Company, including the type and amount |

| The benefits to the Company of any proposed or actual transaction |

| The availability of other sources of comparable products and services that are part of a transaction with the Company; and |

| If applicable, the impact on a director’s independence |

In the event we become aware of a completed or ongoing Related Person Transaction that has not been previously approved, it is promptly submitted to the Audit Committee for evaluation and, if deemed appropriate, ratification.

In addition, each year the persons and entities identified as Related Persons are matched against the Company’s accounts payable and accounts receivable records to determine whether any Related Person participated in a transaction with the Company, regardless of the amount involved. A report of all such transactions is prepared by the Corporate Secretary and reviewed with the Audit Committee to determine if any would constitute a Related Person Transaction under our policy or would require Proxy Statement disclosure under applicable SEC rules and regulations. After conclusion of this process, the Audit Committee did not identify any Related Person Transactions occurring in 2019 that would require Proxy Statement disclosure.

| 14 |  | |||||||

PROPOSAL1-ELECTION OF DIRECTORS

|

Proposal1-Election of Directors

Our Board of Directors is responsible for establishing overall corporate policy and for overseeing management and the ultimate performance of the Company. Our Board reviews strategy and significant developments affecting the Company and acts on matters requiring Board approval. Our Board held 17 meetings during 2019 and each director attended at least 75% of the combined total of all (i) Board meetings and (ii) meetings of committees of the Board of which the director was a member during his or her tenure as a Board member.

Our Board currently consists of nine directors divided as evenly as possible into three classes (I, II and III) serving staggered three-year terms. Directors for each class will be voted on at the annual meeting of stockholders held in the year in which the term for that class expires, and after election, will serve for a term of three years. The terms of the Class III directors will expire at the 2020 Annual Meeting of Stockholders and such directors are nominees for election. The terms of the Class I directors will expire at the 2021 Annual Meeting of Stockholders, and the terms of the Class II directors are set to expire at the 2022 Annual Meeting of Stockholders.

Accordingly, stockholders are being asked to vote on the election of the three Class III directors, each to serve until the 2023 Annual Meeting of Stockholders (and their successors are duly elected and qualified). Each of the nominees has consented to stand for election. Our Board has no reason to believe any nominee will be unable to serve as a director. If, however, a nominee should be unable to serve at the time of the 2020 Annual Meeting of Stockholders, Common Stock properly represented by valid proxies will be voted for a substitute nominee nominated by the Board. Alternatively, our Board may either allow the vacancy to remain unfilled until an appropriate candidate is located or may reduce the authorized number of directors to eliminate the unfilled seat.

If any incumbent nominee for director should fail to receive the required affirmative vote of a majority of the votes cast with regard to his or her election, then under Delaware law (the Company’s state of incorporation) the director would remain in office as a holdover director until a successor is elected or the director resigns, retires or is otherwise removed. In such a situation, our CGPs require the director to tender his or her resignation to our Board. The Nominating Committee would then consider such resignation and make a recommendation to our Board as to whether to accept or decline the resignation. Our Board would then make a determination and publicly disclose its decision and rationale within 90 days after receipt of the tendered resignation.

We believe the members of our Board of Directors have an optimal mix of relevant and diverse experience, qualifications, attributes, and skills given the Company’s business, together with demonstrated integrity, judgment, leadership and collegiality, to effectively advise and oversee management in executing our strategy. There are no specific minimum qualifications for director nominees other than, as required by our CGPs, no director nominee may stand for election after he or she has reached the age of 74. In identifying and evaluating potential nominees, our Nominating Committee seeks individuals who have the experience, skills, knowledge, expertise and personal and professional integrity to be effective, in conjunction with our other Board members, in collectively serving the long-term interests of our stockholders. Criteria for Board membership are periodically evaluated by the Nominating Committee taking into account the Company’s strategy, objectives, markets, operations, regulatory environment and other relevant factors, as well as changes, if any, in applicable laws and NYSE listing standards.

The Nominating Committee believes that each of our directors has an established record of accomplishment in areas relevant to our business and objectives and possesses the characteristics identified in our CGPs as essential to a well-functioning and deliberative governing body, including integrity, independence and commitment.

Each of the directors listed below, including the three nominees for election, has experience as a senior executive and also is serving or has served as a director of one or more private or public companies and on a variety of board committees. As such, each has executive experience, as either or both a director or senior executive, in most, if not all, of the following areas, which are critical to the conduct of the Company’s business: strategy development and implementation; global operations; risk assessment and management; accounting and financial reporting; internal controls; capital markets and corporate finance; the evaluation, compensation, motivation and retention of senior

| 2020 RYAM PROXY STATEMENT | 15 | |||||||

PROPOSAL1-ELECTION OF DIRECTORS

|

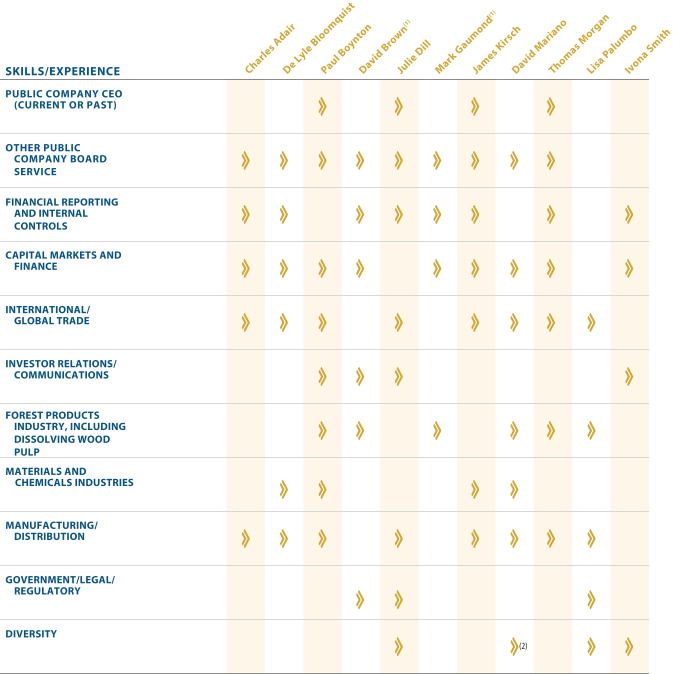

executive talent; public policy as it impacts global industrial companies; compliance program oversight; and corporate governance. Many of the directors also bring insights into specificend-markets and geographic markets that are important to the Company. Our directors collectively provide a range of perspectives, experiences and competencies well-suited to providing advice and counsel to management and to overseeing the Company’s business and operations. See Director Skills and Experience Matrix.

A biography of each member of the Company’s Board of Directors, including the three nominees for election, is set forth below, along with a statement of each director’s qualifications to serve on the Board.

The Board of Directors recommends that you vote “for” each of the three nominees named below for election to the Board of Directors for a term to expire at the 2023 Annual Meeting of Stockholders.

| ||||

BIOGRAPHICAL AND QUALIFICATIONS INFORMATION OF THE THREE NOMINEES FOR ELECTION TO THE BOARD OF DIRECTORS

Class III, Terms to Expire in 2023, ifRe-elected

| DE LYLE W. BLOOMQUIST | AGE: 61 | DIRECTOR SINCE: 2014 | |||

| Mr. Bloomquist is currently a partner for Windrunner Management Advisors LLC (a management advisory services business). He retired in March 2015 as President, Global Chemical Business of Tata Chemicals Limited (an international inorganic chemical and fertilizer manufacturing company), a position he held since 2009. Previously, he served as President and Chief Executive Officer (CEO) of General Chemical Industrial Products Inc. (which was acquired by Tata Chemicals Limited in 2008) from 2004 to 2009. Prior to that, Mr. Bloomquist served at General Chemical Group Inc. in positions of increasing responsibility from 1991 to 2004, including Division Vice President and General Manager, Industrial Chemicals and Vice President and Chief Operating Officer. Mr. Bloomquist serves on the Board of Directors of Crystal Peak Minerals Inc. (f/k/a EPM Mining Ventures Inc.), Gran Colombia Gold Inc., Huber Engineered Materials, PDS Biotechnology Corporation (f/k/a Edge Therapeutics Inc.), Ciner Wyoming LLC and Scientia Vascular LLC. He is currently a partner for Ranch Estates LLC (a real estate developer). Mr. Bloomquist also served as a director of Vivos Therapeautics Inc., from April 2018 to March 2019, Costa Farms, Inc. from July 2016 to July 2017, a director of PDS Biotechnology Corporation from December 2014 to March 2019 and ANSAC from January 1998 to July 2009. He also serves on the Board of Business Advisors for the Tepper School of Business at Carnegie Mellon University, and on the Board of Advisors for Sonoran Capital. Mr. Bloomquist is a graduate of Brigham Young University and holds an MBA from Carnegie Mellon University. | EXPERIENCE: Mr. Bloomquist has over 25 years of domestic and international experience in the chemicals, minerals and materials industries, including in the areas of finance, sales, logistics, operations, IT, strategy and business development, as well as CEO and other senior leadership experience. We believe Mr. Bloomquist’s depth and breadth of experience and expertise in industry makes him particularly well-suited to assist our Board with operational and strategic decisions about the Company’s business. | |||||

| 16 |  | |||||||

PROPOSAL1-ELECTION OF DIRECTORS

|

| PAUL G. BOYNTON | AGE: 55 | DIRECTOR SINCE: 2014 | |||

| Mr. Boynton is Chairman, President and CEO of the Company, a position he has held since June 2014. (As noted earlier, Mr. Boynton will step down as Chairman, and will continue as CEO, President and Director, following the 2020 Annual Meeting.) He previously held a number of positions of increasing responsibility with Rayonier Inc., including Senior Vice President, Performance Fibers from 2002 to 2008, Senior Vice President, Performance Fibers and Wood Products from 2008 to 2009, Executive Vice President, Forest Resources and Real Estate from 2009 to 2010, President and Chief Operating Officer from 2010 to 2011, President and CEO from January 2012 to May 2012 and Chairman, President and CEO from May 2012 to June 2014. Mr. Boynton joined Rayonier Inc. as Director, Specialty Pulp Marketing and Sales in 1999. Prior to joining Rayonier Inc., he held positions with 3M Corporation from 1990 to 1999, including as Global Brand Manager, 3M Home Care Division. Mr. Boynton has served on the Board of Directors of The Brink’s Company since 2010, and is a member of the Board of Governors and Executive Committee of the National Council for Air and Stream Improvement, a member of the Board of Directors of the National Association of Manufacturers and a member of the Board of Directors of the Federal Reserve Bank of Atlanta’s Jacksonville Branch. From 2012 until 2014 Mr. Boynton also served as a director of Rayonier Inc. He holds a bachelor’s degree in Mechanical Engineering from Iowa State University, an MBA from the University of Iowa and graduated from the Harvard University Graduate School of Business Advanced Management Program. | EXPERIENCE: As a result of Mr. Boynton’s service as the Company’s President and CEO, and his prior service as an officer and director of Rayonier Inc., he has developed valuable business, management and leadership experience, as well as extensive knowledge of the Company and long-standing relationships with its major customers. We believe this experience, together with his marketing and engineering background, make Mr. Boynton uniquely well-suited to help lead our Board’s considerations of strategic and operational decisions and manage the Company’s business. | |||||

| 2020 RYAM PROXY STATEMENT | 17 | |||||||

PROPOSAL1-ELECTION OF DIRECTORS

|

| DAVID C. MARIANO | AGE: 57 | DIRECTOR SINCE: 2020 | |||

| Mr. Mariano is currently the Managing Director of DCM Capital, a private investment firm with holdings in the equity and debt of public and private companies, a position he has held since founding DCM in 2011. From 1998 to 2011, Mr. Mariano was Managing Partner of Wellspring Capital Management, a registered investment advisor focusing on turnaround and restructuring opportunities in a range of industries, and served as Executive Chairman of the Board of Neucel Specialty Cellulose, a manufacturer and seller of dissolving wood pulp products, including high purity specialty cellulose and viscose pulps, from 2006 to 2011. Mr. Mariano was also a Managing Director at the Blackstone Group and a Senior Manager at Ernst & Young. He holds a bachelor’s degree in economics from Gustavus Adolphus College and an MBA from Duke University. | EXPERIENCE: Mr. Mariano has33 years of experience investing in, managing and advising global businesses, with a focus over the past 15 years in the dissolving wood pulp business, as well as significant experience in capital markets, restructurings and value-creating transactions. He is also a significant stockholder of the Company, currently holding approximately 1.3% of the Company’s common stock. | |||||

BIOGRAPHICAL AND QUALIFICATIONS INFORMATION OF OTHER DIRECTORS

Class I, Terms to Expire in 2021

| CHARLES E. ADAIR | AGE: 72 | DIRECTOR SINCE: 2015 | |||

| Mr. Adair is the President of Kowaliga Capital, Inc., an investment company, since 1993. Mr. Adair previously worked for Durr-Fillauer Medical, Inc. where he served in various capacities including President and Chief Operating Officer from 1973 to 1992. Mr. Adair has served on the Board of Directors of Tech Data Corporation since 1995 and Globe Life Inc. (f/k/a Torchmark Corporation) since 2003. Mr. Adair also served on the Board of Directors of PSS World Medical, Inc. (PSS), from 2002 through February 2013, when PSS was acquired by McKesson Corp. Mr. Adair is a Certified Public Accountant (inactive) and holds a B.S. degree in Accounting from the University of Alabama. | EXPERIENCE: Mr. Adair brings significant experience in public company governance as a director, financial management and accounting, as well as extensive distribution and global supply chain expertise. As a result, we believe he is particularly well-suited to contribute to Board oversight of the Company’s governance and overall financial performance, auditing and its external auditors, and controls over financial reporting. | |||||

| 18 |  | |||||||

PROPOSAL1-ELECTION OF DIRECTORS

|

| JULIE A. DILL | AGE: 60 | DIRECTOR SINCE: 2018 | |||

| Ms. Dill most recently served as the Chief Communications Officer for Spectra Energy Corp. (Spectra) (which operated in three key areas of the natural gas industry: transmission and storage, distribution, and gathering and processing) from 2013 until Spectra’s merger with Enbridge, Inc. in February 2017. She previously served as the Group Vice President of Strategy for Spectra and the President and CEO of Spectra Energy Partners, LP (NYSE: SEP) from 2012 until 2013, and prior to that served as President of Union Gas Limited from 2007 until 2011. Previously, Ms. Dill served in various financial and operational roles with Duke Energy, Duke Energy International and Shell Oil Company. She serves on the Board of Directors of QEP Resources, Inc., InterPipeline Ltd. and Southern Star, and is on the advisory board of Centuri Construction Group. Ms. Dill is a member of the Advisory Council for the College of Business and Economics at New Mexico State University and sits on the Community Relations Committee of the Health System Board of Memorial Hermann Hospital. Previously, she sat on the board of directors of Spectra Energy Partners, LP from 2012 to February 2017. Ms. Dill holds a B.B.A. from New Mexico State University and graduated from the Harvard University Graduate School of Business Advanced Management Program. | EXPERIENCE: As a result of Ms. Dill’s experience as the President and CEO of a publicly-traded energy company, her strong financial background, investor relations and communications experience and her more than 35 years of experience in the energy industry, including in Canada, we believe she provides valuable insight and knowledge to our Board’s oversight of the Company’s internal operations, investor relations and communications strategies. | |||||

| 2020 RYAM PROXY STATEMENT | 19 | |||||||

PROPOSAL1-ELECTION OF DIRECTORS

|

| JAMES F. KIRSCH | AGE: 62 | DIRECTOR SINCE: 2014 | |||

| Mr. Kirsch served as the Chairman, President and CEO of Ferro Corporation (a leading producer of specialty materials and chemicals) from 2006 to 2012. He joined Ferro in October 2004 as its President and Chief Operating Officer, was appointed CEO and Director in November 2005 and was elected Chairman in December 2006. Prior to that, from 2002 through 2004, he served as President of Quantum Composites, Inc. (a manufacturer of thermoset molding compounds, parts andsub-assemblies for the automotive, aerospace, electrical and HVAC industries). From 2000 through 2002, he served as President and director of Ballard Generation Systems, Inc. and Vice President for Ballard Power Systems Inc. in Burnaby, British Columbia, Canada. Mr. Kirsch began his career with The Dow Chemical Company, where he spent 19 years and held various positions of increasing responsibility, including global business director of Propylene Oxide and Derivatives and Global Vice President of Electrochemicals. Since October of 2018, he has served as a director of GCP Applied Technologies Inc. Mr. Kirsch formerly served as a director of Cleveland-Cliffs, Inc., formerly known as Cliffs Natural Resources, Inc. from March 2010 to August 2014 and as the Executive Chairman from January 2014 to August 2014. He is a graduate of The Ohio State University. | EXPERIENCE: Mr. Kirsch brings a wealth of senior management experience with major organizations with international operations, and has substantial experience in the areas of specialty materials and chemicals. As a former chairman, president and CEO of a NYSE-listed company, he brings considerable senior leadership experience to our Board and the committees thereof on which he serves. | |||||

| 20 |  | |||||||

PROPOSAL1-ELECTION OF DIRECTORS

|

Class II, Terms to Expire in 2022

| THOMAS I. MORGAN | AGE: 66 | DIRECTOR SINCE: 2014 | |||

| Mr. Morgan is a Senior Advisor to AEA Investors LP (a New York private equity firm). He was formerly a partner and Lead Director of the Advisory Board of BPV Capital Management LLC (an investment manager of mutual funds) from April 2013 to May 2016. Mr. Morgan also served as the Chairman of Baker & Taylor, Inc. (a leading distributor of books, videos and music products to libraries, institutions and retailers) from July 2008 to January 2014, and served as the CEO from 2008 to 2012. Mr. Morgan also served as the CEO of Hughes Supply Inc. (a diversified wholesale distributor of construction, repair and maintenance-related products) from 2003 to 2006, as President from 2001 to 2006, and as Chief Operating Officer from 2001 to 2003. Previously, he served as CEO of Enfotrust Networks, LLC, Value America, Inc. and US Office Products Co. He also served for 22 years at Genuine Parts Company in positions of increasing responsibility from 1975 to 1997. Mr. Morgan has been a director of Tech Data Corporation since 2007. He formerly served as a director of ITT Educational Services, Inc. (January 2013 to September 2016), Rayonier Inc. (January 2012 to June 2014), Baker & Taylor, Inc. and Waste Management, Inc. Mr. Morgan holds a bachelor’s degree in Business Administration from the University of Tennessee. | EXPERIENCE: Mr. Morgan brings both public and private company leadership and public company CEO experience and a deep understanding of distribution and global supply chain management. As a result, we believe he is particularly well-suited to contribute to Board oversight of overall management and governance issues and our global high-purity cellulose business. | |||||

| LISA M. PALUMBO | AGE: 62 | DIRECTOR SINCE: 2014 | |||

| Ms. Palumbo served as the Senior Vice President, General Counsel and Secretary of Parsons Brinckerhoff Group Inc. (a global consulting firm providing planning, design, construction and program management services for critical infrastructure projects) from 2008 until her retirement in January 2015. Prior to that, Ms. Palumbo served as Senior Vice President, General Counsel and Secretary of EDO Corporation (a defense technology company) from 2002 to 2008. In 2001, Ms. Palumbo served as Senior Vice President, General Counsel and Secretary of Moore Corporation; from 1997 to 2001 she served as Vice President, General Counsel and Secretary of Rayonier Inc., and from 1987 to 1997 she served in positions of increasing responsibility, including Assistant General Counsel and Assistant Secretary for Avnet, Inc. (a global distributor of technology products). Ms. Palumbo holds bachelor’s and juris doctorate degrees from Rutgers University. | EXPERIENCE: With over 28 years of legal experience with international, public and private companies, Ms. Palumbo brings substantial expertise in the areas of law, corporate governance, enterprise risk management, health and safety and compliance. We believe this experience and expertise, together with her prior experience as the General Counsel of Rayonier Inc., uniquely qualify her to contribute to our Board regarding the Company’s business and to assist with our Board’s oversight of the Company’s risk management, legal and compliance responsibilities. | |||||

| 2020 RYAM PROXY STATEMENT | 21 | |||||||

PROPOSAL1-ELECTION OF DIRECTORS

|

| IVONA SMITH | AGE: 50 | DIRECTOR SINCE: 2020 | |||

| Ms. Smith is an advisor with Drivetrain LLC, an independent fiduciary services firm, a position she has held since 2016. Prior to joining Drivetrain LLC, she was Managing Director at Fair Oaks Capital LP, an investment advisory firm, from 2014 to 2016,Co-Founder of Restoration Capital Management LLC, an investment advisory firm from 2001-2012, and Co-Portfolio Manager at Tribeca Investments, LLC, the broker/dealer division of Citigroup/Traveler’s from 1999 to 2000. Ms. Smith was also an auditor, analyst and financial consultant at various accounting and investment banking firms, including Kidder Peabody and Ernst & Young. Ms. Smith previously served on the Boards of ITN Networks LLC from 2017 to 2018 and The Weinstein Company from 2018 to present. Ms. Smith holds a bachelor’s degree in finance from Fordham University and an MBA from NYU Stern School of Business. | EXPERIENCE: Ms. Smith brings significant financial, capital markets, restructuring and accounting experience, working extensively with senior management teams and as a fiduciary to the investment community, including serving as an outside independent director for companies. Additionally, she has over 25 years of experience investing in or advising companies undergoing operational or financial challenges. Ms. Smith is particularly well-suited to contribute to the Board of Directors oversight of the Company’s capital structure, financial performance, auditing and its external auditors, and controls over financial reporting. | |||||

| 22 |  | |||||||

PROPOSAL1-ELECTION OF DIRECTORS

|

DIRECTOR SKILLS AND EXPERIENCE MATRIX

The table below shows the skills and experience each director brings to our Board.

| (1) | Messrs. Brown and Gaumond will retire from the Board following the Annual Meeting. |

| (2) | Mr. Mariano was born and raised in the City of Manila, in the Philippines. |

| 2020 RYAM PROXY STATEMENT | 23 | |||||||

PROPOSAL1-ELECTION OF DIRECTORS

|

Potential director candidates may come to the attention of the Nominating Committee through current directors, management, business leaders, stockholders and others. The Nominating Committee also has, from time to time, utilized independent third-party search firms to identify potential director candidates and may do so in the future. Our Nominating Committee will consider director nominees submitted by stockholders based on the same criteria used in evaluating candidates for Board membership identified from any other source. The directions for stockholders to submit director nominations for the 2021 Annual Meeting of Stockholders are set forth in Appendix D under When Are Stockholder Proposals for the 2021 Annual Meeting of Stockholders Due?

Mr. Mariano, who has been nominated for election to the Board as a Class III Director, and Ms. Smith, who was appointed as a Class II Director to the Board effective as of the conclusion of the Annual Meeting on May 18, 2020, were both named to the Board in accordance with an agreement entered into between the Company, Pangaea Ventures, L.P. and Ortelius Advisors L.P. (who collectively are significant stockholders of the Company), dated March 6, 2020. Information about this agreement was disclosed in the Company’s Form8-K filed on March 9, 2020.

FORMAL DIRECTOR ONBOARDING PROCESS

Upon joining our Board, new directors receive a comprehensive orientation and formal onboarding process to facilitate their transition onto our Board. Our onboarding process familiarizes new directors with the Company’s businesses, strategic plans, governance program, Board policies, and the director’s responsibilities on assigned Board committees. New directors hold meetings with the Company’s senior leadership and key management team members to learn about the Company and its opportunities, challenges and risks, and participate in site visits to learn about our manufacturing, quality and supply chain operations. Based on feedback received, we believe this onboarding program, coupled with participation in regular Board and Board committee meetings, provides new directors with a strong foundation in our Company’s business and accelerates their ability to fully engage in Board discussions.

DIRECTOR ATTENDANCE AT ANNUAL MEETING OF STOCKHOLDERS

Directors are encouraged to attend each Annual Meeting of Stockholders. At the 2019 Annual Meeting of Stockholders, all directors were in attendance.

| 24 |  | |||||||