Exhibit 99.1

CYBERARK SOFTWARE LTD.

9 Hapsagot St., Park Ofer B, POB 3143, Petach-Tikva, 4951040, Israel

May 17, 2018

Dear CyberArk Software Ltd. Shareholders:

We cordially invite you to attend the 2018 Annual General Meeting of Shareholders, or the Meeting, of CyberArk Software Ltd., or the Company, to be held at 4:00 p.m. (Israel time) on June 21, 2018, at the Company’s offices at 9 Hapsagot St., Park Ofer B, Petach-Tikva, Israel.

The Meeting is being called for the following purposes:

| (1) | To re-elect each of Ehud (Udi) Mokady and David Schaeffer for a term of approximately three years as a Class I director of the Company, until the Company’s annual general meeting of shareholders to be held in 2021 and until his respective successor is duly elected and qualified. |

| (2) | To approve, in accordance with the requirements of the Israeli Companies Law, 5759-1999, or the Companies Law, a grant for 2018 of options to purchase ordinary shares of the Company, par value NIS 0.01 per share, or ordinary shares, restricted share units (RSUs) and performance share units (PSUs), to the Company’s Chairman and Chief Executive Officer, Ehud (Udi) Mokady. |

| (3) | To approve the re-appointment of Kost Forer Gabbay & Kasierer, registered public accounting firm, a member firm of Ernst & Young Global, as the Company’s independent registered public accounting firm for the year ending December 31, 2018 and until the Company’s 2019 annual general meeting of shareholders, and to authorize the Board to fix such accounting firm’s annual compensation. |

Members of the Company’s management will be available at the Meeting to discuss the consolidated financial statements of the Company for the fiscal year ended December 31, 2017.

The Board unanimously recommends that you vote in favor of each of the foregoing proposals, which are more fully described in the accompanying proxy statement.

We know of no other matters to be submitted at the Meeting other than as specified herein. If any other business is properly brought before the Meeting, the persons named as proxies may vote in respect thereof in accordance with the recommendation of the Board or, absent such recommendation, using their best judgment.

Shareholders of record at the close of business on May 15, 2018 are entitled to vote at the Meeting.

Whether or not you plan to attend the Meeting, it is important that your shares be represented and voted at the Meeting. Accordingly, after reading the accompanying proxy statement, please mark, date, sign and mail the enclosed proxy card as promptly as possible in the enclosed stamped envelope. If voting by mail, the proxy must be received by the Company’s transfer agent or at the Company’s registered office not later than 11:59 p.m. (EDT) on June 20, 2018 to be validly included in the tally of ordinary shares voted at the Meeting. If you are a shareholder who holds shares in “street name” (i.e., through a bank, broker or other nominee), an earlier deadline may apply to receipt of your proxy card. Detailed proxy voting instructions are provided both in the proxy statement and on the enclosed proxy card. An electronic copy of the enclosed proxy materials will also be available for viewing at http://investors.cyberark.com. The full text of the proposed resolutions, together with the form of proxy card for the Meeting, may also be viewed prior to the Meeting at the registered office of the Company, 9 Hapsagot St., Park Ofer B, Petach-Tikva, Israel, from Sunday to Thursday (excluding holidays), 10:00 a.m. to 5:00 p.m. (Israel time). The Company’s telephone number at its registered office is +972-3-918-0000.

| | Sincerely, Ehud (Udi) Mokady Chairman of the Board of Directors and Chief Executive Officer |

CYBERARK SOFTWARE LTD.

9 Hapsagot St., Park Ofer B, POB 3143, Petach-Tikva, 4951040, Israel

+972-3-918-0000

__________________________

PROXY STATEMENT

__________________________

2018 ANNUAL GENERAL MEETING OF SHAREHOLDERS

This proxy statement, or Proxy Statement, is being furnished in connection with the solicitation of proxies on behalf of the board of directors, or the Board, of CyberArk Software Ltd. (to which we refer as “we,” “us,” “CyberArk” or the “Company”) to be voted at the 2018 Annual General Meeting of Shareholders, or the Meeting, and at any postponement or adjournment thereof. The Meeting will be held at 4:00 p.m. (Israel time) on June 21, 2018, at our offices at 9 Hapsagot St., Park Ofer B, Petach-Tikva, Israel.

This Proxy Statement and the enclosed proxy card are being made available on or about May 17, 2018, to holders of the Company’s ordinary shares, nominal (par) value NIS 0.01 per share, or ordinary shares, as of the close of business on May 15, 2018, the record date for the Meeting, or the Record Date. You are entitled to vote at the Meeting, if you hold ordinary shares as of the close of business on the Record Date.

See “How You Can Vote” below for information on how you can vote your shares at the Meeting. Our Board urges you to vote your shares so that they will be counted at the Meeting or at any postponements or adjournments of the Meeting.

Agenda Items

The Meeting is being called for the following purposes:

| (1) | To re-elect each of Ehud (Udi) Mokady and David Schaeffer for a term of approximately three years as a Class I director of the Company, until the Company’s annual general meeting of shareholders to be held in 2021 and until his respective successor is duly elected and qualified. |

| (2) | To approve, in accordance with the requirements of the Israeli Companies Law, 5759-1999, or the Companies Law, a grant for 2018 of options to purchase ordinary shares of the Company, par value NIS 0.01 per share, or ordinary shares, restricted share units, or RSUs, and performance share units, or PSUs, to the Company’s Chairman and Chief Executive Officer, Ehud (Udi) Mokady. |

| (3) | To approve the re-appointment of Kost Forer Gabbay & Kasierer, registered public accounting firm, a member firm of Ernst & Young Global, as the Company’s independent registered public accounting firm for the year ending December 31, 2018 and until the Company’s 2019 annual general meeting of shareholders, and to authorize the Board to fix such accounting firm’s annual compensation. |

We are not aware of any other matters that will come before the Meeting. If any other matters are presented properly at the Meeting, the persons designated as proxies intend to vote upon such matters in accordance with the recommendation of the Board or, absent such recommendation, using their best judgment.

Board Recommendation

Our Board recommends that you vote “FOR” each of the above proposals.

Quorum

On May 15, 2018, we had 36,061,402 ordinary shares issued and outstanding. Each ordinary share outstanding as of the close of business on the Record Date is entitled to one vote on each of the proposals to be presented at the Meeting. Under our articles of association, the Meeting will be properly convened if at least two shareholders attend the Meeting in person or sign and return proxies, provided that they hold shares representing at least 25% of the voting power of our Company. If a quorum is not present within half an hour from the time scheduled for the Meeting, the Meeting will be adjourned for one week (to the same day of the week, time and place), or to a day, time and place determined by the Chairman of the Meeting (which may be earlier or later than said time). At such adjourned meeting the presence of any shareholder in person or by proxy (regardless of the voting power represented by his, her or its shares) will constitute a quorum.

Abstentions and broker non-votes are counted as present for purposes of determining a quorum. A “broker non-vote” occurs when a bank, broker or other nominee holding shares of record for a beneficial owner attends the Meeting, but does not vote on a particular proposal because that holder does not have discretionary voting power for that particular item and has not received instructions from the beneficial owner. It is important for a shareholder that holds ordinary shares through a bank, broker or other nominee to instruct its bank, broker or other nominee how to vote its shares, if the shareholder wants its shares to count for the proposal.

Vote Required for Approval of Each of the Proposals

The affirmative vote of the holders of a majority of the voting power represented at the Meeting in person or by proxy and voting thereon is necessary for the approval of each Proposal to be presented at the Meeting. Except for the purpose of determining a quorum, abstentions from voting and broker non-votes are not treated as votes cast and are not counted in determining the outcome of any of these Proposals.

How You Can Vote

You can vote your shares by attending the Meeting or, if you are a shareholder of record, by completing and signing a proxy card, and, if you are a “street name” holder, by submitting voting instructions to your broker, bank or other nominee as noted below. If you do not plan to attend the Meeting, the method of voting will differ for shares held as a record holder and shares held in “street name” (through a broker, trustee or other nominee). A record holder of shares will receive a proxy card. A holder of shares in “street name” will receive a voting instruction form directly from their bank, broker or nominee in order to instruct their banks, brokers or other nominees how to vote.

Shareholders of Record

If you are a shareholder of record, that is, your shares are registered directly in your name with our transfer agent, American Stock Transfer & Trust Company, LLC, these proxy materials are being sent directly to you by our transfer agent. As the shareholder of record, you have the right to provide your voting proxy directly to the Corporate Secretary of our Company or to vote in person at the Meeting. If you do not wish to attend the Meeting and wish to vote your ordinary shares, you should complete, sign and return the proxy card that was mailed to you via the enclosed envelope. If you have lost or misplaced the proxy card mailed to you, you may request another by calling our proxy solicitor, Innisfree M&A Incorporated toll-free at (888) 750-5834 (from the U.S. or Canada) or at +1 (412) 232-3651 (from other locations).

You may change your mind and cancel your proxy card by sending us written notice, by signing and returning a proxy card with a later date, or by voting in person or by proxy at the Meeting. We will not be able to count a proxy card unless we receive it at our principal executive offices at 9 Hapsagot St., Park Ofer B, POB 3143, Petach-Tikva, 4951040, Israel, or our registrar and transfer agent receives it in the enclosed envelope no later than 11:59 p.m. (EDT) on June 20, 2018.

Please follow the instructions on the proxy card. If you provide specific instructions (by marking a box) with regard to the Proposals, your shares will be voted as you instruct. If you sign and return your proxy card without giving specific instructions with respect to a particular Proposal, your shares will be voted by the persons named as proxies in accordance with the recommendation of the Board. The persons named as proxies in the enclosed proxy card will furthermore vote in accordance with the recommendation of the Board or, absent such recommendation, using their best judgment on any other matters that may properly come before the Meeting.

Shareholders Holding in “Street Name”

If your ordinary shares are held in a brokerage account or through a bank, trustee or other nominee, you are considered to be the beneficial owner of shares held in “street name.” Proxy materials are being furnished to you together with a voting instruction form by the broker, bank, trustee or other nominee or an agent hired by the broker, trustee or nominee. Please follow the instructions on that form to direct your broker, bank, trustee or other nominee how to vote your shares. Many nominees provide means to vote by telephone or by Internet. Alternatively, if you wish to attend the Meeting and vote in person, you must obtain a “legal proxy” from the broker, trustee or nominee that holds your shares, giving you the right to vote the shares at the Meeting.

Under the rules of The Nasdaq Stock Market LLC, or Nasdaq, brokers, trustees or other nominees that hold shares in “street name” for clients only have authority to vote on “routine” proposals where they have not received voting instructions from beneficial owners. The only item on the Meeting agenda that we believe may be considered “routine” is Proposal 3 relating to the reappointment of the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2018; however, we expect that this will not be treated as a routine matter since our proxy statement is prepared in compliance with the Companies Law, rather than the rules applicable to domestic U.S. reporting companies.

Thus, if you, as a beneficial owner of the shares, do not provide specific instructions to your broker, trustee or other nominee on a specific proposal, your broker, trustee or other nominee will not be allowed to exercise its voting discretion with respect to that proposal. In that case, while the shares held by you will count toward determining the presence of a “quorum” at the Meeting, they will not be counted as “present” for the vote itself on the proposal for which you do not provide voting instructions. This outcome is referred to as a “broker non-vote.” If your shares are held of record by a broker, trustee or other nominee, we urge you to give instructions to your broker, trustee or other nominee as to how your shares should be voted so that you thereby participate in the voting on these important matters.

Who Can Vote

You are entitled to receive notice of, and vote at, the Meeting if you are a shareholder of record at the close of business on May 15, 2018, the Record Date, in person or through a broker, trustee or other nominee that is one of our shareholders of record at such time, or which appear in the participant listing of a securities depository on that date.

Revocation of a Proxy

Shareholders may revoke the authority granted by their execution of proxies at any time before the effective exercise thereof by filing with us a written notice of revocation or duly executed proxy bearing a later date, or by voting in person at the Meeting. Unless otherwise indicated on the form of proxy, shares represented by any proxy in the enclosed form, if the proxy is properly executed and received by the Company not later than 11:59 p.m. (EDT) on June 20, 2018, will be voted in favor of the proposals and any other matters that may be presented to the Meeting, as described above.

Any shareholder of the Company who intends to present a proposal at the Meeting must satisfy the requirements of the Companies Law and our articles of association. Under the Companies Law, only shareholders who hold at least 1% of the Company’s outstanding voting rights are entitled to request that the board of directors include a proposal in a shareholders meeting, provided that such proposal is appropriate by the board of directors for consideration by shareholders at such meeting. Such shareholders may present proposals for consideration at the Meeting by submitting their proposals in writing to our General Counsel and Corporate Secretary at the following address: CyberArk Software Ltd., 9 Hapsagot St., POB 3143, Petach-Tikva, 4951040, Israel, Attn: Donna Rahav, General Counsel & Corporate Secretary, or by facsimile to +972-3-9180028. For a shareholder proposal to be considered for inclusion in the Meeting, our General Counsel & Corporate Secretary must receive the written proposal no later than May 24, 2018.

Solicitation of Proxies

Proxies are being made available to shareholders on or about May 17, 2018. We have retained Innisfree M&A Incorporated to assist with the solicitation of proxies in connection with the Meeting. Innisfree M&A Incorporated will receive customary fees plus out-of-pocket expenses in connection with the performance of its services. Certain officers, directors, employees, and agents of the Company, none of whom will receive additional compensation therefor, may also solicit proxies by telephone, email or other personal contact. We will bear the cost for the solicitation of the proxies, including postage, printing and handling, and will reimburse the reasonable expenses of brokerage firms and others for forwarding material to beneficial owners of shares.

Voting Results

The final voting results will be tallied by the Company’s Corporate Secretary based on the information provided by the Company’s transfer agent or otherwise, and the overall results of the Meeting will be published following the Meeting in a report of foreign private issuer on Form 6-K that will be furnished to the Securities and Exchange Commission, or the SEC.

Availability of Proxy Materials

Copies of the proxy card and this Proxy Statement were furnished to the SEC under cover of a Form 6-K and are also available at the “Investor Relations” section of our website at http://investors.cyberark.com. The contents of that website are not a part of this Proxy Statement and are not incorporated by reference herein.

SECURITY OWNERSHIP BY CERTAIN BENEFICIAL OWNERS

The following table sets forth the number of ordinary shares beneficially owned by all persons known by us to beneficially own more than 5% of our ordinary shares, as of the dates specified below, based on public filings or information provided to us by such shareholders.

| | | Shares Beneficially Owned | |

| Name of Beneficial Owner | | Number | | | Percentage (1) | |

| Principal Shareholders | | | | | | |

| Entities affiliated with Eminence Capital, LP (2) | | | 3,352,576 | | | | 9.3 | % |

| (1) | Based on 36,061,402 ordinary shares issued and outstanding as of May 15, 2018. |

| (2) | Based on a Schedule 13G/A filed on February 14, 2018, by Eminence Capital LP (“Eminence Capital”), Eminence GP, LLC (“Eminence GP”) and Ricky Sandler, shares beneficially owned as of December 31, 2017 consist of 3,352,576 ordinary shares held for the accounts of various funds affiliated with Eminence LP, namely, Eminence Partners, L.P. (“Eminence I”). Eminence Partners II, L.P. (“Eminence II”), Eminence Eaglewood Master, L.P. (“Eminence Eaglewood“), Eminence Partners Long, L.P. (together with Eminence I, Eminence II and Eminence Eaglewood, the “Partnerships”), Eminence Fund Master, Ltd. (“Eminence Offshore Master Fund”), Eminence Fund Leveraged Master, Ltd. (together with Eminence Offshore Master Fund, the “Master Funds”), and Eminence Fund Long, Ltd. (“Eminence Offshore Long,” and together with the Partnerships and Master Funds, the “Eminence Funds”) and a separately managed account (the “SMA”). Eminence Capital serves as the management company to the Eminence Funds with respect to the ordinary shares directly owned by the Eminence Funds and the investment adviser to the SMA with respect to the ordinary shares directly owned by the SMA. Eminence Capital may be deemed to have voting and dispositive power over the 3,352,576 shares held for the accounts of the Eminence Funds and the SMA. Eminence GP serves as general partner or manager with respect to the ordinary shares directly owned by the Partnerships and Master Funds and may be deemed to have voting and dispositive power over the 2,547,327 shares held for the accounts of the Partnerships and Master Funds. Mr. Sandler is the chief executive officer of Eminence Capital and the managing member of Eminence GP and may be deemed to have voting and dispositive power with respect to the 3,352,576 ordinary shares directly owned by the Eminence Funds and the SMA, as applicable. The address of the principal business and principal office of Eminence GP and Eminence Capital is 65 East 55th Street, 25th Floor, New York, NY 10022. The business address of Mr. Sandler is 65 East 55th Street, 25th Floor, New York, NY 10022. |

COMPENSATION OF CERTAIN EXECUTIVE OFFICERS AND DIRECTORS

For information about the compensation, on an individual basis, of our five most highly compensated office holders during or with respect to the year ended December 31, 2017, as required by regulations promulgated under the Companies Law, see “Item 6.B. Compensation” of our annual report on Form 20-F filed with the SEC on March 15, 2018, and available on the “Investor Relations” section of our website at http://investors.cyberark.com or through the SEC’s website at www.sec.gov.

CORPORATE GOVERNANCE AND DIRECTOR COMPENSATION

Overview

Our articles of association (the “Articles”) provide that we may have no fewer than four and no more than 9 directors, as may be fixed from time to time by the Board. Our Board currently consists of six directors. Our directors are divided into three classes with staggered three-year terms. Each class of directors consists, as nearly as possible, of one-third of the total number of directors constituting the entire Board. At each annual general meeting of our shareholders, the election or re-election of directors following the expiration of the term of office of the directors of that class of directors is for a term of office that expires as of the date of the third annual general meeting following such election or re-election. Therefore, at each annual general meeting, the term of office of only one class of directors expires. Each director holds office until the annual general meeting of our shareholders in which his or her term expires, unless he or she is removed by a vote of 65% of the total voting power of our shareholders at a general meeting of our shareholders or upon the occurrence of certain events, in accordance with the Companies Law and our Articles.

A majority of our directors must meet the independence requirements specified under Nasdaq corporate governance rules. Each of the current five non-employee directors is independent under those rules.

Board Leadership Structure and Lead Independent Director

Mr. Mokady has been our CEO since 2005, and following approval by our shareholders at the June 2016 annual meeting, has held that post in addition to serving as Chairman since that year, for the maximum period permitted under the Companies Law. As approved by our shareholders at the June 2016 annual meeting, for so long as the positions of the chief executive officer and chairman of the Board are combined, our Board will appoint the chairman and a lead independent director. Mr. Tirosh currently serves as our lead independent director. Our lead independent director is selected by our non-executive Board members from among the independent directors of the Board, and is required to have served minimum of one year as a director. Additionally, if at any meeting of the Board the lead independent director is not present, a majority of the independent members of the Board present will select an independent member of the Board to act as lead independent director for such meeting.

The authorities and responsibilities of the lead independent director include, but are not limited to, the following:

| • | providing leadership to the Board if circumstances arise in which the role of the Chairman may be, or may be perceived to be, in conflict, and responding to any reported conflicts of interest, or potential conflicts of interest, arising for any director; |

| • | presiding as chairman of the meeting at all meetings of the Board at which the Chairman of the Board is not present, including executive sessions of the independent members of the Board; |

| • | serving as liaison between the Chairman of the Board and the independent members of the Board; |

| • | approving meeting agendas for the Board; |

| • | approving information sent to the Board; |

| • | approving meeting schedules to assure that there is sufficient time for discussion of all agenda items; |

| • | having the authority to call meetings of the independent members of the Board; |

| • | if requested by a major shareholder, ensuring that he or she is available for consultation and direct communication; and |

| • | performing such other duties as the board may from time to time delegate to assist the Board in the fulfillment of its duties. |

Board Committees and Meetings

During 2017, our Board met 11 times, our audit committee met seven times, our compensation committee met ten times and our nominating and governance committee met one time. Certain of these meetings included actions through written consent. Each of the incumbent directors, including the nominees for re-election, attended more than 75% of our Board meetings and more than 75% of the meetings of each of the committees of the Board on which he or she served in the 2017 fiscal year.

Compensation of Non-Executive Directors

Our non-executive directors are entitled to the following compensation:

(1) an annual cash fee with respect to each 12 months of service in an amount of:

| • | $24,000 for all directors, except for the lead independent director and the chairpersons of the audit committee and compensation committee, |

| • | $39,000 for the lead independent director, or |

| • | $30,000 to each of the chairman of the audit committee and chairman of the compensation committee; and |

(2) a per-meeting cash fee, payable at the same time as the annual fee, in the amount of:

| • | $1,000 for each meeting of the Board or any committee thereof in which a director participated in person, |

| • | $600 for each meeting of the Board or any committee thereof in which such director has participated through means of telecommunications, or |

| • | $500 for each written consent of the Board or any committee thereof that was adopted in writing in lieu of a meeting. |

Directors are also entitled to be reimbursed with reasonable travel, accommodation and other expenses incurred by them in connection with attending Board and committee meetings and performing their functions as directors of the company.

Each of our non-executive directors, serving at the time of each annual meeting of shareholders whose tenure does not terminate at such time, is entitled to receive, effective as of the date of each such annual meeting of shareholders, (1) options to purchase 5,000 ordinary shares, and (2) RSUs covering 2,000 ordinary shares. We may also grant options and/or RSUs in an aggregate value that shall not exceed the value of options to purchase up to 32,000 ordinary shares under our 2014 Share Incentive Plan (the “2014 Plan”) to each newly appointed non-executive director, upon his or her appointment in the future.

For more information on director compensation, see “Part I, Item 6.C. Board Practices—Compensation of Directors” of our annual report on Form 20-F filed with the SEC on March 15, 2018. Any director elected at the Meeting would be remunerated in the manner described above and in that section.

PROPOSAL 1

RE-ELECTION OF OUR CLASS I DIRECTORS

Background

Our shareholders are being asked to re-elect each of Ehud (Udi) Mokady and David Schaeffer as a Class I director.

Our current directors are divided among the three classes as follows:

(1) our Class I directors are Ehud (Udi) Mokady and David Schaeffer, whose current terms expire at the Meeting and upon the election and qualification of their respective successors;

(2) our Class II directors are Gadi Tirosh and Amnon Shoshani, whose current terms expire at our 2019 annual general meeting of shareholders and upon the election and qualification of their respective successors; and

(3) our Class III directors are Ron Gutler and Kim Perdikou, whose current terms expire at our 2020 annual general meeting of shareholders and upon the election and qualification of their respective successors.

Re-Election of Class I Directors (Proposal 1)

The nominating and corporate governance committee recommended that we nominate each of our current Class I directors—Mr. Mokady and Mr. Schaeffer—for re-election as a Class I director at the Meeting.

Under the Companies Law, the affirmative vote of the holders of a majority of the ordinary shares present or represented at the Meeting, in person or by proxy, entitled to vote and voting on the matter, is required to reelect, as a Class I director, each of the nominees listed above.

It is intended that proxies (other than those directing the proxy holders not to vote for the listed nominees or for one of them) will be voted for the election of each of the two nominees listed below as a Class I director.

Nominees Qualifications and Independence

Each of the nominees has consented to being named in this Proxy Statement and has advised the Company that he is willing, able and ready to serve as a Class I director if elected. Additionally, in accordance with the Companies Law, each of the nominees has certified to us that he meets all the requirements of the Companies Law for election as a director of a public company, and possesses the necessary qualifications and has sufficient time to fulfill his duties as a director of the Company, taking into account the size and needs of our Company. We do not have any arrangements, understandings or agreements with respect to the election of any of the nominees at the Meeting. Mr. Schaeffer is independent under Nasdaq corporate governance rules.

Biographies of Nominees

Set forth below is certain biographical information regarding the background and experience of Mr. Mokady and Mr. Schaeffer.

Ehud (Udi) Mokady is one of our founders and serves as our Chief Executive Officer since 2005 and as chairman of the board since June 2016. He previously served as our President from 2005 to 2016 and as our Chief Operating Officer from 1999 to 2005. Mr. Mokady has also served as a member of our board since November 2004. Mr. Mokady serves as a member of the Board of Directors of Demisto, Inc. commencing in January 2018. From 1997 to 1999, Mr. Mokady served as general counsel at Tadiran Spectralink Ltd., a producer of secure wireless communication systems. From 1986 to 1989, Mr. Mokady served in a military intelligence unit in the Israel Defense Forces. Mr. Mokady was honored by a panel of independent judges with the New England EY Entrepreneur Of The Year™ 2014 Award in the Technology Security category. Mr. Mokady holds a Bachelor of Laws (LL.B.) from Hebrew University in Jerusalem, Israel and a Master of Science Management (MSM) from Boston University in Massachusetts.

David Schaeffer has served as a member of our board of directors since May 2014. Mr. Schaeffer has served as the Chairman, Chief Executive Officer and President of Cogent Communications, Inc. (NASDAQ: CCOI), an internet service provider based in the United States that is listed on NASDAQ, since he founded the company in August 1999. Mr. Schaeffer was the founder of Pathnet, Inc., a broadband telecommunications provider, where he served as Chief Executive Officer from 1995 until 1997 and as Chairman from 1997 until 1999. Mr. Schaeffer holds a Bachelor of Science in physics from the University of Maryland, the United States.

Proposed Resolutions: Proposal 1

We are proposing that our shareholders adopt the following resolutions at the Meeting:

| | (a) | “RESOLVED, that the re-election of Ehud (Udi) Mokady as a Class I director of the Company, for a term of approximately three years that expires at the third annual general meeting of shareholders to be held following his re-election, and until the due election and qualification of his successor, be, and hereby is, approved in all respects.” |

| | (b) | “RESOLVED, that the re-election of David Schaeffer as a Class I director of the Company, for a term of approximately three years that expires at the third annual general meeting of shareholders to be held following his re-election, and until the due election and qualification of his successor, be, and hereby is, approved in all respects.” |

Required Vote: Proposal 1

The vote required for the re-election of each of the of the above-referenced director nominees is the affirmative vote of the holders of a majority of the voting power present or represented at the Meeting in person or by proxy and voting on such re-election.

Board Recommendation

The Board recommends that you vote “FOR” the re-election of each of Mr. Mokady and Mr. Schaeffer as a Class I director.

PROPOSAL 2

APPROVAL OF AN EQUITY GRANT

TO OUR CHAIRMAN AND CEO, EHUD (UDI) MOKADY, WITH RESPECT TO 2018

Background

Our shareholders are being asked to approve a grant of RSUs, PSUs and options to purchase ordinary shares to our Chairman of the Board and CEO, Mr. Mokady, with respect to 2018 (the “2018 CEO Grant”).

Under the Companies Law, any arrangement between a company and a director, including a CEO who also serves as the chairman of the board, relating to his or her compensation, must be consistent with the company’s compensation policy, and requires the approval of that company’s compensation committee, board, and shareholders by a simple majority, in that order.

The shareholder vote on this matter is binding under Israeli law and not merely advisory, unlike the “say-on-pay” votes found in some proxy statements for U.S. domestic companies. If this Proposal 2 is not approved by the affirmative vote of our shareholders, the Company will NOT be authorized to award any equity grant to our CEO for 2018.

Overview of our Executive Compensation Methodology

Our compensation committee and Board have carefully structured our executive compensation program to attract, motivate and retain the key executive officers who drive our success, including our Chairman and CEO. Our design and decisions regarding executive compensation stem from the central tenets of paying for performance and aligning the interests of our executive officers and shareholders. Our executive management team remains focused on executing the Company’s strategic plan to create long-term value for our shareholders. We believe that our executive compensation program is effective in achieving the Company’s objectives of:

| · | hiring, motivating and retaining top-notch executive officers to lead us as we expand our business |

| · | designing compensation packages that reflect both the outperformance and underperformance of our Company and individual executives |

| · | reflecting our long-term strategy of disciplined investing for our future growth |

| · | aligning the interests of our executive officers with those of our shareholders |

| · | providing compensation packages that are competitive, reasonable and fair relative to peers and the overall market. |

Performance as Key Consideration in Annual Compensation Review

Our compensation committee regularly reviews our compensation practices and policies, and, along with our Board, periodically modifies our compensation programs, as our Company matures, in light of evolving trends and competitive positions.

The personal compensation packages of our executives are determined by the compensation committee and the Board based on a performance review process that is conducted by the compensation committee on an annual basis. The results of such review are used to determine the extent to which an executive has earned his or her variable compensation for the previous financial year, and serve as a key factor in considering potential future updates of an executive’s compensation package. The compensation committee reviews the personal performance of our executives, considering the actual achievement of the specific performance goals that were set for them at the beginning of the previous year as well as our CEO’s assessment of the personal performance of the executives.

Each year, the committee determines and recommends to the Board the financial and strategic goals that are applied to the executives’ performance-oriented, variable compensation based on the Company’s annual operating plan for that year and its strategic plan for the upcoming years. These quantitative and qualitative goals are assigned to each executive as part of his or her annual bonus plan, and certain key performance indicators for the Company are designated as performance criteria for the purposes of earning performance stock units (“PSUs”) granted by the Company. These goals are designed to align executive pay with Company performance, promote successful achievement of critical milestones in the Company’s growth, and mitigate material risks, thereby creating long-term Company and shareholder value.

The compensation committee has engaged Radford Surveys and Consulting as an independent, outside consultant, to provide advice to the compensation committee related to our executive and non-employee director compensation programs and assist in the design, formulation, analysis and implementation of our compensation program. The information provided by Radford relating to the compensation practices of peer companies aids the decision-making process of the compensation committee and Board and supports our ability to inform our shareholders of the Company’s relative positioning on compensation. Although they consult this data from Radford from time to time, the compensation committee and the Board do not rely on peer data every year and instead make their final decisions relating to annual executive compensation in reliance on various considerations, with a focus on the individual performance of our executives.

Based on Radford’s report and recommendations, the Company’s compensation committee approved the following list of companies as our 2018 peer group (the “Peer Group”) for the purpose of supporting the process of determining our Chairman and CEO’s pay for 2018 and providing analysis of it as part of this Proxy Statement:

| Barracuda Networks | Ellie Mae | LogMeIn | Rapid7 |

| Benefitfocus | FireEye | New Relic | RingCentral |

| Box | Gigamon | Proofpoint | Varonis Systems |

| BroadSoft | HubSpot | Q2 Holdings | VASCO Data Security International |

| Cornerstone OnDemand | Imperva | Qualys | Wix.com |

The Peer Group was constructed with careful consideration and represents an appropriate comparison pool based on the peer companies’ industry, size, revenues and maturity stage. The Peer Group used in 2017 has not changed, except that the compensation committee removed Nimble Storage following its acquisition by Hewlett Packard Enterprise.

Equity Plan Management

In its independent survey, Radford advised that CyberArk’s 2017 burn rate of less than 4% of total outstanding ordinary shares and issued equity overhang of approximately 10% of total outstanding ordinary shares and outstanding equity awards were at the 25th percentile of our Peer Group. CyberArk’s total equity overhang of approximately 12% of total outstanding ordinary shares, outstanding equity awards and shares available for future grant was at less than the 25th percentile of our Peer Group. Further, one of the measures that we have undertaken in avoiding excessive dilution is gradually changing our executive equity program to favor grants of PSUs over stock options, as detailed below.

Our compensation committee and Board have consistently taken a disciplined approach to managing the long-term dilutive effects of equity incentive grants, and are committed to continue balancing the incentive-based goals of our equity compensation program with their effect on earnings per share. Accordingly, the compensation committee and Board regularly review the program to ensure that it supports the achievement of our financial and strategic objectives while remaining in line with market practices, thereby maintaining share-based compensation proportional to our overall revenue and preventing excessive shareholder dilution.

For 2018 equity compensation, our compensation committee and Board determined that the Company must not exceed an overall dilution rate of 15% of total ordinary shares, taking into account all shares reserved for future grant and shares underlying outstanding awards. As a result, in December 2017, the Board approved adding only 1,200,000 ordinary shares to the reserve, which was lower than what was permissible under the 2014 Plan (i.e., over 1,400,000, or 4% of ordinary shares as of December 31, 2017). As of May 15, 2018, 3,295,599 ordinary shares underlying share-based awards were outstanding under the Company’s equity incentive plans and 2,051,332 ordinary shares were reserved for future grant under such plans, reflecting a dilution rate of 12.9%.

Our compensation committee considers from time to time whether implementing a holding period or share ownership guidelines with respect to our executive officers would be appropriate, as it believes that maintaining a meaningful level of share ownership in the Company aligns their interests with those of the Company’s shareholders and deters from taking excessive risks to promote short term gains. As our CEO, executive officers and directors have maintained significant personal shareholdings in the Company, the compensation committee believes that such provisions are not currently necessary. The Board and the compensation committee are striving to continue ensuring a strong alignment of our executives’ interests with long-term shareholder value, and will continue reviewing this matter periodically.

Components of our Executive Equity Compensation in 2018

We strive to provide a mix of compensation that supports a pay-for-performance culture and emphasizes long-term incentives. Our executive compensation packages have historically consisted of a mix of options and RSUs. In 2017, we introduced PSUs as part of our Chairman and CEO’s compensation package. As we have found PSUs to be an effective tool in aligning performance with compensation, our compensation committee and Board decided to introduce them into the compensation packages of other executive officers and senior managers in 2018, using key financial and operational criteria that indicate and drive the overall success of our business and management’s performance. We believe that our progressive use of PSUs distinguishes our overall approach to compensation from that of other companies in our peer group and nearly all other Israeli technology companies, making our pay methodology more performance-oriented and cutting-edge.

Each of our Board and compensation committee discussed at length the various considerations in determining the balance among stock options, RSUs and PSUs in our executive compensation, in order to ensure that equity awards meet our compensation objectives and promote our long-term success. Accordingly, it was decided to increase significantly the portion of PSUs and decrease the portion of stock options in management compensation packages for 2018, compared to the equity mix granted to Mr. Mokady in 2017. We believe that the resulting compensation, which was implemented for all our executive officers and senior managers other than our CEO and will be applied for our CEO if this Proposal 2 is approved by our shareholders, enables us to promote the long-term retention of key contributors to our success by offering competitive long-term incentives, and promotes Company performance and alignment with shareholder interests.

Process for Determining CEO 2018 Compensation

As in past years, we have designed Mr. Mokady’s compensation package, including the proposed 2018 CEO Grant, with the objective of aligning a significant portion of his compensation with shareholder interests and Company value. Our long-term success depends, in part, on our ability to continue to retain our CEO, who has been, and is expected to continue to be, vital to our Company’s short- and long-term success. Accordingly, a majority of Mr. Mokady’s pay package consists of long-term equity incentive compensation, and a progressively larger portion of his equity awards is subject to performance conditions. Our compensation committee and Board have structured Mr. Mokady’s equity compensation, whether in the form of RSUs, PSUs or options, to vest over extended, four-year-long periods, thus emphasizing long-term growth and vision rather than short-term gains, and motivating retention of a talented executive.

The proposed 2018 CEO Grant is intended to keep our Chairman and CEO’s total annual compensation package competitive and appropriate for the role of CEO in a technology company, while continuing to align his interests closely with those of our shareholders. The following considerations were taken into account in designing the proposed 2018 CEO Grant.

Performance Assessment

We grant equity awards to our Chairman and CEO annually, in connection with a yearly performance assessment carried out by our compensation committee and Board. Subject to applicable shareholder approval requirements under Israeli law, and as with our other executive officers, our compensation committee and Board use this assessment to re-evaluate Mr. Mokady’s compensation. The annual performance assessment takes into account the following factors:

| · | Mr. Mokady’s responsibilities as CEO and Chairman of the Board |

| · | the degree of achievement of Company financial performance targets and strategic goals during previous fiscal years |

| · | the nature of such goals in the upcoming fiscal year, and an assessment of the degree of difficulty of those goals and their expected contribution to promoting the long-term success of the Company |

| · | the performance of our executive team, on an individual basis and as a whole, as a result of Mr. Mokady’s impact |

| · | the existing compensation arrangements with Mr. Mokady, including outstanding equity compensation awarded in previous fiscal years |

| · | the proportion of cash to equity compensation, and of different types of equity compensation, and their related impact on performance |

| · | data from an independent analysis of equity compensation awarded to CEOs of peer companies within our industry conducted by Radford |

| · | the difficulty and cost of replacing a high-performing leader with in-demand skills and its potential ramifications for the Company’s long-term success. |

In approving the proposed 2018 CEO Grant and recommending it for shareholder approval, our compensation committee and Board specifically considered Mr. Mokady’s role in the Company’s success both in the short and long terms, his capacities and skillsets, and his past and future ability to execute on a vision for the Company’s expansion. During his tenure as President, CEO and director since before our IPO, and more recently as Chairman of the Board, Mr. Mokady has demonstrated strong leadership in numerous ways, including, but not limited to the following:

| · | Under his oversight, the Company has achieved sustainable multi-year high revenue growth across multiple geographies, with customers spread over 70 countries. Our 2017 revenues hit $261.7 million, and our five-year CAGR between 2012 and 2017 was 41%. Our revenue growth, business model and strategy contributed to our ability to generate significant profitability and cash flow growth during the last four years. |

| · | Between 2014 and 2017, our customer base has rapidly expanded, more than doubling from 1,800 customers in 2014 to approximately 3,700 customers in 2017. Such growth was not only in numbers but also in quality and across all verticals, as our products are deployed in over 50% of the Fortune 100 and approximately 30% of the Global 2000. Customer satisfaction rates are high, demonstrated by maintenance renewal rates exceeding 90% and sales expansion among more than a third of our customers each year. |

| · | Between 2014 and 2017, our headcount increased from approximately 321 employees to over 1,000 employees in more than 35 countries. |

| · | Mr. Mokady acted as a driving force in the Company’s successful efforts to broaden its products and services in cyber threat detection, least privilege management, control and operation, DevOps security software and cloud security, both organically and through our acquisitions. Our acquisitions enable us to accelerate our product diversification, with our integrated products generating over 10% of our 2017 business. |

| · | Our robust balance sheet allowed us to continue making ongoing investments in our business, leading to our competitive differentiation. Based on our continued innovation, today we are a leader in privileged access security, a critical layer of IT security to protect data, infrastructure and assets across the enterprise, in the cloud and throughout the DevOps pipeline. |

As part of Mr. Mokady’s annual performance review, the compensation committee and the Board also recognized the Company’s shortcomings in financial performance in the second quarter of 2017, when guidance was not met and the Company accordingly reduced its full-year guidance for revenue and income, as well as Mr. Mokady’s matching, proactive response in re-aligning the global workforce in order to meet our Company’s ambitious revenue projections. At the end of fiscal year 2017, the Company reported 21% revenue growth with 20% operating margin, which was lower than the Company’s original full-year guidance of approximately 24% revenue growth and approximately 21% operating margin. As part of their rigorous analysis of Mr. Mokady’s compensation package for 2018, the compensation committee and Board balanced such underperformance against Mr. Mokady’s rapid and decisive response to it. Mr. Mokady took initiatives to change our leadership team in EMEA, globalize further our sales organization and improve our visibility into our future financial results. Mr. Mokady’s crucial role in managing and quickly responding to such challenges was evidenced by our ability to outperform our guidance in subsequent quarters, which included generating strong revenues, cash flow from operations, and operating margins for fiscal year 2017 as well as delivering more consistent performance in the EMEA region.

Existing Cash Compensation

Although the shareholder vote solicited in this Proposal 2 does not cover Mr. Mokady’s salary and variable cash compensation, we believe that these components of compensation are an important consideration in the discussion of the proposed 2018 CEO Grant.

Over the past three fiscal years, we have made only modest increases to Mr. Mokady’s base salary. In particular, a salary increase of $25,000 in 2016 was designed to adjust his compensation in line with market practice, based on an analysis that his 2015 cash compensation was at the 25th percentile compared to the CEOs of our peers according to a survey of our Peer Group completed by Radford. Since 2016, Mr. Mokady’s annual salary has not increased from $375,000 (as well as certain additional customary benefits and perquisites generally provided to other executives of the Company).

Mr. Mokady continues to be entitled to variable cash compensation equal to his base salary based on the achievement of certain pre-established quantitative and, to a lesser extent, qualitative performance goals and objectives, and subject to certain payout terms. The overachievement of such goals may entitle Mr. Mokady to up to twice his base salary (in the aggregate). Mr. Mokady is not entitled to any other compensation as a director and Chairman of the Board. For more information, see “Part I, Item 6. Directors, Senior Management and Employees” of our annual report on Form 20-F for the fiscal year ended December 31, 2017.

According to Radford’s recent survey, Mr. Mokady’s total cash compensation at target falls between the 25th and 50th percentiles compared to the CEOs of our Peer Group. Further, we believe that the variability of Mr. Mokady’s bonuses over the past three fiscal years illustrates that the performance goals and objectives set for him have functioned effectively and closely calibrated to our actual financial and operational performance.

For 2018, our compensation committee and Board concluded that it would be in the best interests of the Company and its shareholders to make no change to Mr. Mokady’s cash compensation or to change the breakdown of cash to equity compensation, instead continuing to offer competitive variable performance-based equity compensation which offsets the relatively low-cash compensation, thereby ensuring that the vast majority of his compensation is directly tied to building long-term shareholder value. This is consistent with our past practice—which we believe has worked effectively over the past three years—focused on providing fixed and predictable, yet competitive, compensation with cash, with the goal of aligning, through equity, our management’s interests in financial performance with those of our shareholders.

Outstanding Equity Awards

As of May 15, 2018, Mr. Mokady holds options to purchase 532,705 of our ordinary shares, with a weighted average exercise price of $32.74 per share. Approximately 77% of his outstanding stock options (options to purchase 407,645 ordinary shares) are already vested and currently exercisable. Out of his unvested equity grants, including RSUs, previously earned PSUs and stock options, the following numbers of ordinary shares are expected to vest in coming years, subject to his continued employment and the terms of his grants:

| Year of Vesting | | RSUs | | | Earned PSUs | | | Stock Options (1) | |

| 2018 | | | 21,018 | | | | 1,475 | | | | 45,983 | |

| 2019 | | | 26,381 | | | | 2,950 | | | | 52,827 | |

| 2020 | | | 14,250 | | | | 2,950 | | | | 22,500 | |

| 2021 | | | 2,813 | | | | 738 | | | | 3,750 | |

| (1) | 25% of the unvested options are underwater based on our share price as of May 15, 2018. |

In determining the size of the 2018 CEO Grant, our compensation committee and Board found that the unvested portion of Mr. Mokady’s equity awards (approximately 0.55% of our total outstanding ordinary shares as of May 15, 2018), which would continue to diminish if this Proposal 2 is not approved at the Meeting, could harm our ability to retain a highly-qualified CEO and to encourage him to deliver value to our shareholders, thereby introducing potential risk, and potentially jeopardizing the Company’s long-term success.

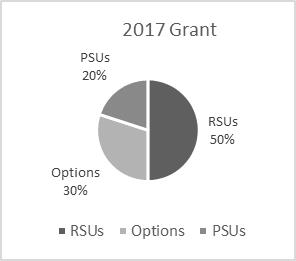

In 2017, we added a performance-based element to Mr. Mokady’s equity compensation package which was approved in June 2017 by our shareholders. Mr. Mokady was granted PSUs in respect of 18,000 ordinary shares to be earned based on a one-year performance period, subject to further time-based vesting. In February 2018, the compensation committee certified the performance of the PSUs that were granted in 2017. The Company’s revenue and non-GAAP profitability over 2017 exceeded the threshold level yet fell slightly short of targets, with an overall performance rate of over 90%. As a result, Mr. Mokady earned 11,800 PSUs out of 18,000 ordinary shares at target, representing an earning rate of approximately 66%. We believe this result reflects our overall methodology that actual compensation related to long-term incentives should vary above or below target levels commensurate with the Company’s financial performance, and demonstrates that the PSU performance criteria for 2017 were appropriate and effective.

Terms of Proposed 2018 CEO Grant

In February 2018, each of our compensation committee and Board approved, consistent with the compensation policy, a grant with respect to 2018 of additional equity-based awards to Mr. Mokady under our 2014 Plan, subject to shareholder approval of this Proposal 2, execution of applicable award agreements and pursuant to the terms of his employment agreement, consisting of 52,700 RSUs, 36,900 PSUs (at target) and options to purchase 35,200 of our ordinary shares, on the date of the Meeting (the “Date of Grant”).

Value of Proposed Grant

In determining the aggregate compensation package to be offered to Mr. Mokady for 2018, the Board and the compensation committee reviewed the independent compensation analysis prepared by Radford to ensure that Mr. Mokady’s total compensation is competitive relative to market practices. In its review, Radford advised that companies which offer their executives below median cash compensation typically offset it by providing above median equity awards, in order to ensure that the total compensation they offer, as a whole, is competitive with market. In February 2018, the compensation committee and the Board determined that the appropriate value of the 2018 CEO Grant would be $4,500,000, assuming future payout with respect to the PSUs based on achievement of the full year performance goals at target level.

Similar to the process followed in 2017, the value and scope of all our executive equity awards, including Mr. Mokady’s, were determined in February 2018 based on our average closing stock price in January 2018 ($42.72). We believe that the appropriate timing for determining the value of the 2018 CEO Grant and corresponding number of the underlying grants of RSUs, PSUs and stock options should be the same as that of the grants to all our other executive officers, based on our then-existing stock price (rather than the date of this Meeting). The timing is also aligned with the PSU performance period of fiscal year 2018, thereby appropriately rewarding our CEO for the Company’s performance during such period. Given that the gap between the time at which the scope of grant was determined and the time at which the grant would actually be made, the stock price may fluctuate up or down. As a result, the compensation committee and the Board believe that it is appropriate to fix the scope of grant based on its estimated value at the time of their consideration and approval. The value of the proposed 2018 CEO Grant is substantially similar to the value of the equity awards that had been approved by our Board in 2016 and 2017, except that a greater extent is subject to the achievement of performance criteria. The value of such grant, and the value of Mr. Mokady’s on target compensation package as a whole (meaning, total cash compensation combined with the proposed 2018 CEO grant, on target), fall between the 50th and 75th percentile compared to the CEOs of our peers pursuant to Radford’s independent analysis.

Equity Mix

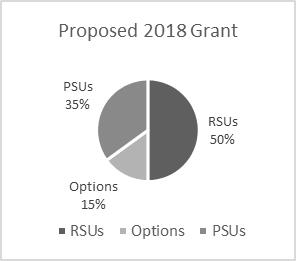

Based on the effectiveness of our PSUs in both encouraging and responding to Mr. Mokady’s performance in 2017, our shareholder feedback and our focus on long-term performance-based compensation, the proposed 2018 PSU program structure is similar to our inaugural 2017 PSU program, but with an increase in the percentage of PSUs granted.

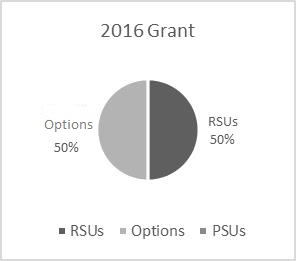

In assessing the structure and terms of the proposed 2018 CEO Grant, our compensation committee and Board also reviewed, in consultation with Radford, the mix of equity award types granted to Mr. Mokady in the past, as well as in comparison to other CEOs in our Peer Group. Based on such analysis and discussion, they have found that it would be beneficial to the Company and its shareholders if Mr. Mokady were allocated a greater percentage of aggregate equity value as PSUs (35% instead of 20% in 2017) and a smaller percentage in stock options (15% instead of 30% in 2017), as follows:

Our compensation committee and Board considered that approximately half of the companies in our 2018 Peer Group utilized PSUs in their equity mix. Further, companies in our Peer Group structured their CEO long term incentive compensation, on average, to consist of approximately 50% RSUs, 30% PSUs and 20% stock options. Thus, we believe that the breakdown proposed in the 2018 CEO Grant is in line with best practices in our Peer Group with respect to performance-conditioned equity awards. This decision reflected the Company’s increased size and sophistication as a public company actively engaged with shareholders and the compensation committee and Board’s objective to structure a more progressive, cutting-edge package, which directly aligns compensation with performance and encourages outperformance of key financial goals.

The proposed 2018 CEO Grant based on the fair value of the overall equity grant set at $4,500,000 in February 2018 and reflecting the recommended equity mix as detailed above is as follows:

| | | RSUs | | | PSUs, on Target | | | Stock Options | |

| Percentage | | | 50% | | | | 35% | | | | 15% | |

| Amount | | | 52,700 | | | | 36,900 | | | | 35,200 | |

| Estimated Value | | $ | 2,251,419 | | | $ | 1,576,421 | | | $ | 676,707 | |

The RSU and PSU amount and values were calculated using the foregoing average closing stock price in January 2018, and the option value and amount was calculated using the Black-Scholes model for the same period. Consistent with our equity grant policy, the exercise price of the options shall be equal to the closing price on Nasdaq Global Select Market on the Date of Grant. No consideration would be paid with respect to the RSUs and PSUs.

Vesting Schedule and Performance Period

As in past fiscal years and consistent with the terms of Mr. Mokady’s employment agreement, our compensation committee and Board have structured his equity compensation, whether in the form of RSUs, PSUs or options, to vest over an extended period, thus emphasizing long-term growth and vision rather than short-term gains and motivating retention of a talented executive.

Subject to Mr. Mokady’s continued employment and the acceleration provisions referred to below, the proposed grants will vest on a quarterly basis over a period of four years, and the vesting commencement date will be February 15, 2018 as originally determined by our compensation committee and Board. Accordingly, if the 2018 CEO Grant is approved at the Meeting, equity awards which would have vested on May 15, 2018 will become vested at the Meeting (totaling 3,294 RSUs and options to purchase 2,200 ordinary shares).

The PSUs will be earned based on a one-year performance period, beginning on January 1, 2018 and ending on December 31, 2018, and be further subject to time-based vesting. 25% of the number of the PSUs to which Mr. Mokady will actually be entitled, or the earned PSUs, would vest on February 15, 2019 (or, if the achievement of the performance metrics had not been determined at such time, on the day such determination is made), with the remainder vesting on a quarterly basis over a three-year period starting February 15, 2019, subject to Mr. Mokady’s continued employment with the Company and the acceleration provisions referred to below.

In determining the one-year performance period, our compensation committee and Board considered whether to apply a longer performance period. Given the relative maturity and growth rate of the Company, our ongoing acquisition strategy as well as the dynamic, continually changing industry in which we operate, the compensation committee and the Board believe that at this time a performance period for financial metrics that extends longer than one year may result in setting inappropriate targets could put the alignment with our shareholders’ interests at risk.

Notably, according to Radford’s independent analysis of similarly-situated companies in our Peer Group which have elected to award PSUs, the median performance period among such companies was 1.5 years, the median additional vesting period thereafter was one year, and the median overall vesting period was three years. Only one company applied an overall vesting period longer than ours. The compensation committee and the Board therefore believe that setting a performance period of one year, an additional vesting period of three years and a total vesting period of 4 years is in line with market practice, if not relatively progressive given our growth stage.

Performance Criteria

Our compensation committee and Board align the interests of our executives, including Mr. Mokady, with those of our shareholders by setting PSU performance targets that correlate with the trajectory of our growth and operating performance based on growth expectations at the beginning of fiscal 2018 for fiscal 2018.

As with the PSUs granted in 2017, the performance metrics for the proposed 2018 CEO Grant would consist of revenue and non-GAAP profitability. Additionally, based on our analysis of our 2017 financial results, our 2018 operating plan and the feedback we received from our investors, we determined to include a third performance metric of license-derived revenues, which is viewed as a key factor in our long term success. The three metrics that were set for purposes of the performance criteria are consistent with the financial objectives set in our 2018 operating plan, which was approved by our Board in December 2017.

The number of earned PSUs will be determined based on the attainment of three performance criteria—revenue, non-GAAP profitability and licensed-derived revenues—as certified by the compensation committee after the end of fiscal year 2018. Entitlement based on performance will be determined linearly based on a straight-line interpolation between the applicable performance levels. The threshold performance level has been set at no less than 80% of each target. Meeting all respective threshold levels will entitle Mr. Mokady to 50% of the PSUs awarded (18,450 ordinary shares). Target performance will entitle him to 100% of the PSUs awarded (36,900 ordinary shares) and performance of 120% and higher will entitle Mr. Mokady to 200% of the target number of PSUs awarded (73,800 ordinary shares).

We believe that the performance criteria selected and their associated metrics, including the threshold and overachievement performance levels, would motivate and incentivize our CEO to drive long- term growth in our business with a strong mix of license-derived revenue while maintaining fiscal discipline to generate positive cash flow to sustain and grow our Company. Further, the proposed structure of the PSUs is tied to key financial drivers that we use for financial and operational decision-making and for evaluating our own financial results over different periods of time in the following ways:

| · | Increased non-GAAP operating income and non-GAAP net income enable us to assess the effectiveness of our sales and marketing efforts. |

| · | License-derived revenues, whether by new customers or due to expansion by existing customers, deliver near-term revenues and are viewed as a leading indicator for the long-term market opportunity. |

| · | License-derived revenues further contribute significantly to our revenues in the long term, as the size of our maintenance and support contracts is directly linked to our licenses revenues. |

The compensation committee specifically considered, in consultation with Radford, whether it would be appropriate to include total shareholder return (“TSR”) in our performance criteria. While the use of TSR, or relative TSR, as a performance criterion has gradually increased in the United States over the past decade, Radford advised us that the vast majority of technology companies of similar size and maturity stage as ours do not use such metric. In fact, among the companies in our Peer Group that have incorporated performance-based equity into their executive equity programs, revenue, operating income and other earnings measures were more common performance metrics, with only one peer using total shareholder return as a performance metric. Given our relative maturity, our growth rate, the dynamic industry in which we operate, as well as compensation trends within similar sized technology companies, the compensation committee and Board determined not to include TSR as a performance metric at this time, and will continue evaluating whether such criteria should be incorporated in our compensation packages.

Limited Ability to Adjust Performance Criteria

Throughout the performance period, the compensation committee and the Board acting jointly have the discretion to reasonably adjust (increase or decrease) the PSU performance metrics and their relative weights, to the extent they reasonably determine that such adjustment is necessary to preserve the intended incentives and benefits of the PSUs, if any of the following events has a material impact on the performance metrics:

| · | unusual or non-recurring events, such as acquisitions |

| · | changes in our accounting principles or tax laws |

| · | events related to currency fluctuations. |

As of the date hereof, our compensation committee and Board have never adjusted any PSU performance metrics. The compensation committee and the Board have taken and will continue to apply a disciplined approach in considering changes in the PSU performance metrics and their weights with respect to future grants. For example, while the Company’s 2017 financial results were negatively impacted by its acquisition of Conjur, Inc. as well as by certain external events such as changes to tax laws and currency fluctuations, the compensation committee and the Board did not make any changes to the PSU performance criteria at the time. Any potential adjustment will be carefully considered and may only be applied in order to preserve the original purpose of the grant and the executive performance it was intended to promote.

Equity Clawback

The 2018 CEO Grant will be further subject to the Board’s discretion to reduce variable components to the extent permitted by the 2014 Plan, the Company’s Compensation Policy and applicable law. The PSUs granted as part of the 2018 CEO Grant will be subject to recoupment, to the extent amounts payable thereunder are based on incorrect figures that are subsequently restated, in the same manner as set forth in the Compensation Policy with respect to other amounts paid to directors and officers.

Acceleration and Change of Control

Similar to previous equity-based awards granted to Mr. Mokady, and in accordance with his employment agreement, the 2018 CEO Grant would be made pursuant and subject to the terms and conditions of our 2014 Plan and the relevant RSU, PSU or option award agreement, as applicable, in the form generally used by the Company. Pursuant to Mr. Mokady’s employment agreement and previous resolutions of our shareholders, equity awards granted to Mr. Mokady are subject to acceleration of vesting upon events occurring in connection with a change in control (as defined in the 2014 Plan) and following his resignation for good reason (as defined in his employment agreement). If prior to the end of the performance period, Mr. Mokady’s equity grants become subject to acceleration, then immediately prior to (and contingent on) the occurrence of an event resulting in equity acceleration, the number of PSUs at target performance would be earned and will vest on an accelerated basis.

Conclusion

Our compensation committee and Board believe that it is in the best interest of our shareholders and the Company to grant Mr. Mokady the proposed 2018 CEO Grant providing a competitive, industry-conscious and performance-based equity compensation package. If this Proposal 2 is not approved at the Meeting, it could ultimately impede our ability to retain a highly-qualified CEO and to incentivize him to continue delivering value to our shareholders, thereby potentially posing a material risk to the Company’s medium- and long-term success. The proposed 2018 CEO Grant appropriately links Mr. Mokady’s compensation to creating shareholder value and demonstrates a progressive approach to executive compensation.

The compensation committee and the Board are committed to responsible management of earnings-per-share dilution as the Company must balance the requirements associated with its equity compensation program during its growth stage with the effect on dilution. Therefore, the compensation committee and the Board continue to review the Company’s equity compensation practices to ensure that they remain in line with evolving regulatory conditions and changes in best practices. The Company remains focused on open and ongoing dialogue with its shareholders and welcomes regular feedback regarding its compensation policies.

This Proposal 2 relates to a binding vote on CEO compensation, unlike an advisory “say-on-pay” vote found in some U.S. domestic proxy statements. Accordingly, the Company will NOT be authorized to award any equity grant to our CEO for 2018 unless approved by the affirmative vote of our shareholders by a simple majority.

Proposed Resolution

We are proposing that our shareholders adopt the following resolution at the Meeting:

“RESOLVED to grant the Chairman and CEO of the Company an equity award with respect to 2018, as set forth in Proposal 2 of the Company’s Proxy Statement for its 2018 Annual General Meeting of Shareholders.”

Required Vote

The affirmative vote of the holders of a majority of the voting power present or represented at the Meeting in person or by proxy and voting on this Proposal 2 is required to approve the 2018 CEO Grant to Mr. Mokady.

Board Recommendation

The Board recommends that you vote “FOR” the approval of the 2018 CEO Grant.

PROPOSAL 3

RE-APPOINTMENT OF INDEPENDENT AUDITORS AND AUTHORIZATION OF THE BOARD

TO FIX ANNUAL REMUNERATION OF THE INDEPENDENT AUDITORS

Background

Our shareholders are asked to approve the re-appointment of our independent auditors and to authorize our Board to approve their annual remuneration for the fiscal year ending December 31, 2018.

In June 2017, Kost Forer Gabbay & Kasierer, a member of Ernst & Young Global, or Kost Forer, was appointed by the Company’s shareholders as the Company’s independent auditors for the fiscal year ended December 31, 2017, and for such additional period until the Meeting. Each of the audit committee and the Board has approved the re-appointment of Kost Forer as the Company’s independent auditors, subject to approval by the Company’s shareholders, for the fiscal year ending December 31, 2018, and for such additional period until the next annual general meeting of shareholders. The Company, based upon the recommendation of the audit committee and the Board, is submitting for approval the re-appointment of Kost Forer as its independent auditors for the year ending December 31, 2018until the annual general meeting to be held in 2019, and the authorization of the Board, following approval of the audit committee, to determine the compensation of the auditors in accordance with the volume and nature of their services pursuant to their engagement.

The following table sets forth the total fees paid by the Company and its subsidiaries to the Company’s independent auditors, Kost Forer, in each of the previous two fiscal years:

| | | 2016 | | | 2017 | |

| | | (in thousands) | |

| Audit Fees(1) | | $ | 504 | | | $ | 559 | |

| Audit-Related Fees(2) | | | 110 | | | | 130 | |

| Tax Fees(3) | | | 133 | | | | 179 | |

| All Other Fees(4) | | | - | | | | 7 | |

| | | | | | | | | |

| Total | | $ | 747 | | | $ | 875 | |

| | (1) | “Audit fees” are the aggregate fees billed for the audit of our annual financial statements. This category also includes services that generally the independent accountant provides, such as consents and assistance with and review of documents filed with the SEC. |

| | (2) | “Audit-related fees” are the aggregate fees billed for assurance and related services that are reasonably related to the performance of the audit and are not reported under audit fees. These fees primarily include accounting consultations regarding the accounting treatment of matters that occur in the regular course of business, implications of new accounting pronouncements and other accounting issues that occur from time to time. |

| | (3) | “Tax fees” include fees for professional services rendered by our independent registered public accounting firm for tax compliance and tax advice on actual or contemplated transactions. |

| | (4) | “All other fees” include fees for services rendered by our independent registered public accounting firm with respect to government incentives and other matters. |

Our audit committee has adopted a pre-approval policy for the engagement of our independent accountant to perform certain audit and non-audit services. Pursuant to this policy, which is designed to assure that such engagements do not impair the independence of our auditors, the audit committee pre-approves each type of audit, audit-related, tax and other permitted service. The audit committee has delegated the pre-approval authority with respect to audit, audit-related, tax and permitted non-audit services up to a maximum of $25,000 to its chairman and may in the future delegate such authority to one or more additional members of the audit committee, provided that all decisions by that member to pre-approve any such services must be subsequently reported, for informational purposes only, to the full audit committee. All audit and non-audit services provided by our auditors in 2017 were approved in accordance with our policy.

Proposed Resolutions

We are proposing that our shareholders adopt the following resolutions at the Meeting:

“RESOLVED, that the Company’s independent auditors, Kost Forer Gabbay & Kasierer, a member of Ernst & Young Global, be, and hereby are, re-appointed as the independent auditors of the Company for the fiscal year ending December 31, 2018, and for such additional period until the next annual general meeting of shareholders.”

“RESOLVED, that the Company’s Board be, and hereby is, authorized to fix the remuneration of the independent auditors in accordance with the volume and nature of their services, such remuneration and the volume and nature of such services to be approved first by the audit committee.”

Required Vote

The approval of this Proposal 3 requires the affirmative vote of the holders of a majority of the ordinary shares present, in person or by proxy, and voting on the proposal.

Board Recommendation

The Board recommends that you vote “FOR” the re-appointment of Kost Forer Gabbay & Kasierer, a member of Ernst & Young Global, as the independent auditors of the Company for the fiscal year ending December 31, 2018 and for such additional period until the next annual general meeting of shareholders, and the authorization of the Board to fix the remuneration of the independent auditors in accordance with the volume and nature of their services.

PRESENTATION AND DISCUSSION OF AUDITED ANNUAL FINANCIAL STATEMENTS