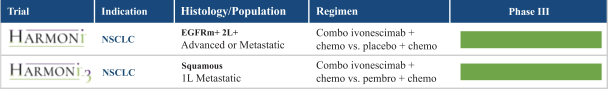

approval for any of our product candidates in the United States or other jurisdictions where we retain commercial rights, and if we choose to retain those rights, we would expect to incur significant sales, marketing, distribution and outsourced manufacturing expenses, as well as ongoing research and development expenses. We believe that our financial resources as of December 31, 2023, together with the extension of the note payable entered into on February 17, 2024 to extend the maturity date and all interest that is payable until April 1, 2025, will fund our operating costs and working capital needs for our planned clinical trials for ivonescimab into the first quarter of 2025, which raises substantial doubt of our ability to continue as a going concern.

As a result, we will need to seek additional funding in the future to fund operations. Until such time, if ever, as we can generate substantial revenue and achieve profitability, we will need to raise additional capital to fund ongoing operations and capital needs, including the payment of the milestone payments due to Akeso subject to the terms and conditions of the License Agreement. We continue to evaluate options to further finance our operating cash needs for our product candidates through a combination of some, or all, of the following: equity and debt offerings, collaborations, strategic alliances, grants and clinical trial support from government entities, philanthropic, non-government and not-for-profit organizations, and marketing, distribution or licensing arrangements. While we believe that funds would be available in this manner, there is no assurance, however, that additional financing will be available when needed or that we will be able to obtain financing on acceptable terms. If we are unable to raise additional funds through equity or debt financings or other arrangements when needed, we may be required to delay, limit, reduce, or terminate our product development, product portfolio expansion, future commercialization efforts, or grant rights to develop and market product candidates that we would otherwise prefer to develop and market ourselves, which could adversely affect our business prospects.

Corporate Information

Summit Therapeutics Inc. was incorporated in Delaware on July 17, 2020. Our principal executive office is located at 601 Brickell Key Drive, Suite 1000, Miami, FL 33131 and our phone number is (650) 460-8308. Our website is https://www.smmttx.com. Information contained on or accessible through our website is not incorporated by reference into this prospectus and should not be considered a part of this prospectus.

The Securities That May Be Offered

We may offer or sell common stock, preferred stock, debt securities, depositary shares, warrants, subscription rights, purchase contracts and units in one or more offerings and in any combination. The aggregate offering price of the securities we sell pursuant to this prospectus will not exceed $450,000,000. Each time securities are offered by the Company with this prospectus, we will provide a prospectus supplement that will describe the specific amounts, prices and terms of the securities being offered and the net proceeds we expect to receive from that sale.

The securities may be sold from time to time pursuant to underwritten public offerings, negotiated transactions, block trades, “at the market” offerings into an existing trading market, subscription rights offering, or a combination of these methods, to or through underwriters, dealers or agents or directly to purchasers, or, in the case of the selling stockholder, in ordinary brokerage transactions, or as otherwise set forth in the section of this prospectus captioned “Plan of Distribution” or in any applicable prospectus supplement. Each prospectus supplement relating to the sale of securities by the Company will set forth the names of any underwriters, dealers, agents or other entities involved in the sale of securities described in that prospectus supplement and any applicable fee, commission or discount arrangements with them.

Up to 2,976,190 shares of Common Stock may be sold pursuant to this prospectus by the selling stockholder. In connection with and as consideration for an investment of $5,000,000 in the Company in a private placement, the selling stockholder received shares of Common Stock pursuant to that certain Securities Purchase Agreement dated as of October 13, 2023. The selling stockholder, Manmeet S. Soni, is our Chief Operating Officer and a member of our Board of Directors. Mr. Soni and his permitted transferees, pledgees or other successors may from time to time offer the shares of our common stock offered by this prospectus.

5