UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________________

FORM 10-K

_____________________________

(Mark One)

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2024

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission file number: 001-36866

Summit Therapeutics Inc.

(Exact Name of Registrant as Specified in its Charter)

| | | | | | | | | | | |

| Delaware | | 37-1979717 |

| (State or Other Jurisdiction of Incorporation or Organization) | | (I.R.S. Employer Identification No.) |

| | | |

| 601 Brickell Key Drive, Suite 1000 | | |

| Miami | FL | | 33131 |

| (Address of Principal Executive Offices) | | (Zip Code) |

(305) 203-2034

(Registrant’s Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $0.01 per share | SMMT | The Nasdaq Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large accelerated filer | ☒ | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | Smaller reporting company | ☒ |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b).

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes No ☒

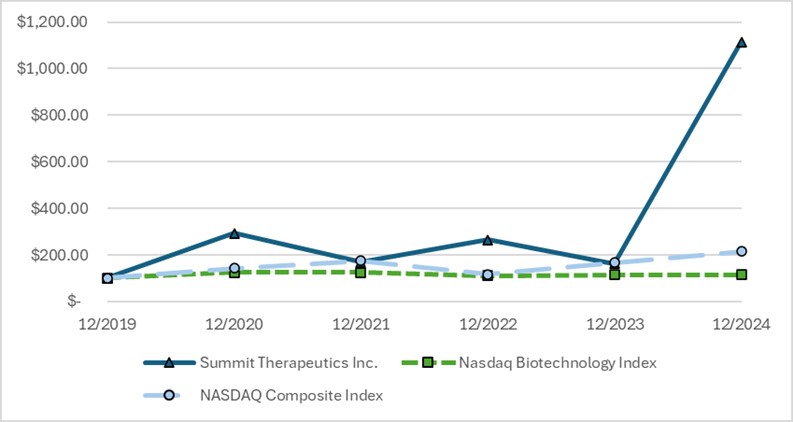

The aggregate market value of the voting common stock held by non-affiliates based on the closing stock price on June 30, 2024, was $827.3 million. For purposes of this computation only, all executive officers and directors have been deemed affiliates.

The number of outstanding shares of the registrant’s common stock, par value $0.01 per share, as of February 18, 2025 was 737,679,704.

Documents Incorporated by Reference

Portions of the registrant’s definitive proxy statement relating to the registrant’s 2025 annual meeting of stockholders to be filed hereafter are incorporated by reference into Part III of this Annual Report on Form 10-K. The registrant’s definitive proxy statement will be filed with the U.S. Securities and Exchange Commission within 120 days after the end of the fiscal year to which this report relates.

TABLE OF CONTENTS

| | | | | | | | |

| | | Page |

| Cautionary Note Regarding Forward-Looking Statements | |

| |

| Item 1. | | |

| Item 1A. | | |

| Item 1B. | | |

| Item 1C. | | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| |

| Item 5. | | |

| Item 6. | | |

| Item 7. | | |

| Item 7A. | | |

| Item 8. | | |

| Item 9. | | |

| Item 9A. | | |

| Item 9B. | | |

| Item 9C. | | |

| |

| Item 10. | | |

| Item 11. | | |

| Item 12. | | |

| Item 13. | | |

| Item 14. | | |

| |

| Item 15. | | |

| Item 16 | | |

| | |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), regarding the future financial performance, business prospects and growth of Summit Therapeutics Inc., that involve substantial risks and uncertainties. All statements contained in this Annual Report on Form 10-K, other than statements of historical fact, including statements regarding our strategy, future operations, future financial position, future revenues, projected costs, prospects, plans and objectives of management, are forward-looking statements. The words “anticipate,” “believe,” “estimate,” “expect,” “intend,” “may,” “plan,” “predict,” “project,” “target,” “potential,” “will,” “would,” “could,” “should,” “continue,” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. The forward-looking statements in this Annual Report on Form 10-K include, among other things, statements about:

•the ability to develop a successful product candidate under the License Agreement (as defined in Part I, Item I Business, Overview);

•our ability to raise sufficient additional funds to make payments under the License Agreement, and fund ongoing operations and capital needs;

•the timing of and the ability to effectively execute clinical development of ivonescimab;

•the timing, costs, conduct and outcomes of clinical trials for any product candidates, including ivonescimab;

•our plans with respect to possible future collaborations and partnering arrangements;

•the potential benefits of possible future acquisitions or investments in other businesses, products or technologies;

•our plans to pursue research and development of other future product candidates;

•our estimates regarding the potential market opportunity and patient population for commercializing our product candidates, if approved for commercial use;

•our sales, marketing and distribution capabilities and strategy;

•our ability to establish and maintain arrangements with third parties, such as contract research organizations, contract manufacturing organizations, suppliers and distributors;

•the costs and timing of preparing, filing and prosecuting patent applications, maintaining and protecting our intellectual property rights and defending against any intellectual property-related claims;

•our estimates regarding expenses, future revenues, capital requirements and needs for additional financing;

•the impact of government laws and regulations in the United States and in foreign countries;

•the timing and likelihood of regulatory filings and approvals for our product candidates;

•whether regulatory authorities determine that additional trials or data are necessary in order to accept a new drug application for review and approval;

•our competitive position;

•our planned use of our existing cash, cash equivalents and marketable securities;

•our ability to attract and retain key scientific or management personnel;

•the impact of public health epidemics, such as the novel coronavirus pandemic (“COVID-19”), natural disasters or geopolitical instability, the response to such events and the potential effects of such events on our business, financial results, supply chain and market; and

•general economic conditions, including economic slowdowns or other adverse economic conditions, such as periods of increased or prolonged inflation.

We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements, and you should not place undue reliance on our forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward-looking statements we make. We have included important factors in the cautionary statements included in this Annual Report on Form 10-K, particularly in the “Risk Factors” in Part 1, Item 1A of this Annual Report on Form 10-K, that we believe could cause actual results or events to differ materially from the forward-looking statements that we make. Our forward-looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, joint ventures or investments we may make.

You should read this Annual Report on Form 10-K and the documents that we have filed as exhibits to this Annual Report on Form 10-K completely and with the understanding that our actual future results may be materially different from what we expect. We do not assume any obligation to update any forward-looking statements.

SUMMARY OF RISK FACTORS

Below is a summary of the principal factors that make an investment in Summit speculative or risky. The following summary does not contain all of the information that may be important to you, and you should read the below summary in conjunction with the more detailed discussion of risks set forth under the heading “Risk Factors” in Part I, Item IA of this Annual Report on Form 10-K.

Risks Related to Our Financial Position and Need for Additional Capital

•We are a development-stage company and have incurred significant losses since our inception. We anticipate that we will continue to incur significant losses for at least the next several years and may never generate profits from operations or maintain profitability.

•We have not yet demonstrated an ability to successfully complete development of any product candidates.

•We will need substantial additional capital to fund our operations. Raising additional capital may cause dilution to our investors or restrict our operations.

•We depend heavily on the success of ivonescimab. If we are unable to successfully develop and commercialize ivonescimab, or experience significant delays in doing so, we may extend the period in which we will incur significant financial losses as an organization.

•Worldwide economic, social and geopolitical instability could adversely affect our business and ability to raise capital in the future.

Risks Related to the Development and Commercialization of our Product Candidates

•We can provide no assurance that our clinical product candidates, including our lead product candidate, ivonescimab, will obtain regulatory approval or that the results of clinical studies will be favorable.

•Clinical development involves a lengthy and expensive process with an uncertain outcome, and results of earlier studies and trials conducted by us or Akeso, as well as any interim results thereof, may not be predictive of future trial results and may negatively impact the size and scope of our ongoing or future Phase III clinical trials.

•Regulatory requirements and timelines may affect the scope and timeline of our trials and the potential market for our product candidates.

•If we experience unforeseen events, including unfavorable results, in connection with our clinical trials, potential marketing approval or commercialization of our product candidates could be delayed or prevented.

•Serious adverse events may limit our development of a product candidate.

•Even if a product candidate receives marketing approval, it may fail to achieve commercial success.

•We may expend our limited resources to pursue a particular product candidate and fail to capitalize on product candidates that may be more profitable or for which there is a greater likelihood of success.

•Others may discover, develop or commercialize products before us or more successfully than we do.

Risks Related to our Dependencies on Third Parties

•We depend on our relationship with, and the intellectual property licensed from, Akeso.

•We may be reliant on Akeso for knowledge transfer relating to any improvements in manufacturing of ivonescimab.

•We depend on collaborations with third parties for the development and commercialization of some of our product candidates.

•We rely on the use of third parties, including Akeso, to manufacture our product candidate.

•We rely on third parties to conduct our clinical trials and those third parties may not perform satisfactorily.

Legal, Tax, Regulatory and Compliance Risks

•Any approved product candidate may become subject to unfavorable pricing regulations, third-party reimbursement practices or other healthcare reform initiatives.

•Our business is subject to the risks associated with doing business in China.

•Product liability lawsuits against us could materially harm our business.

•If we fail to comply with applicable laws and regulations, we could face material adverse consequences.

•Changes to tax laws or the interpretation thereof could increase our future tax liabilities and adversely affect our business.

•Our future tax liabilities may be greater than expected if our net operating loss carryforwards and other tax attributes are limited, we do not generate expected deductions, or tax authorities challenge our tax positions.

•If we are unsuccessful or delayed in obtaining required regulatory approvals, we may not be able to commercialize our product candidates, and our ability to generate revenue will be materially impaired.

•Our ability to obtain and maintain conditional marketing authorizations in the E.U. and other countries in our Licensed Territory may be more limited in number as well as scope of the relevant authorizations and subject to several conditions and obligations that could prevent us from continuing to market our products.

•The terms of any received marketing approvals, including post-marketing requirements, and regulations may limit how we manufacture, market and price our products.

Risks Related to Our Intellectual Property, Cybersecurity and Data Privacy

•Insufficient patent protection could materially negatively impact our competitive position.

•Any litigation relating to our intellectual property may have a material adverse effect on our business.

•We may be subject to claims by third parties asserting misappropriation of their intellectual property.

•If we are unable to protect the confidentiality of our trade secrets, our business could be harmed.

•Any interruption, malfunction, or lapse related to information technology, including any cybersecurity incidents, could harm our business.

•Failure to comply with data privacy and security obligations could harm our business.

Risks Related to Operations

•We depend on our ability to retain our Co-Chief Executive Officers, Chief Operating Officer and other key executives and personnel.

•We or the third parties we rely on may be adversely affected by social unrest, terrorism or natural disasters.

•Widespread health concerns or pandemics or epidemics could harm our business.

•Any non-compliance with regulations or other misconduct by employees could harm our business.

Risks Related to Owning Our Common Stock

•Our principal stockholder and Co-Chief Executive Officer maintains the ability to control or significantly influence all matters submitted to stockholders for approval.

•We are a “controlled company” under the listing requirements of the Nasdaq Stock Market, which could adversely affect our stockholders.

•The price of our shares of common stock have been, and may continue to be, volatile.

•Substantial future sales of our shares of common stock in the public market, or the perception that these sales could occur, could cause the price of the shares to decline significantly, even if our business is doing well.

•Any failure to maintain an effective system of internal control over financial reporting could decrease confidence in our financial and other public reporting, which would harm our business.

•Our stockholders’ ability to obtain a favorable judicial forum for disputes with us or our directors, officers and employees is limited by our Certificate of Incorporation.

•Because we do not anticipate paying any cash dividends on our shares of common stock in the foreseeable future, capital appreciation, if any, will be the sole source of gain for our stockholders.

•We are exposed to risks related to currency exchange rates.

PART I

Item 1. Business

Overview

Summit Therapeutics Inc. (“we”, “Summit” or the “Company”) is a biopharmaceutical company focused on the discovery, development, and commercialization of patient-, physician-, caregiver- and societal-friendly medicinal therapies intended to improve quality of life, increase potential duration of life, and resolve serious unmet medical needs. The Company’s pipeline of product candidates is designed with the goal to become the patient-friendly, new-era standard-of-care medicines, in the therapeutic area of oncology.

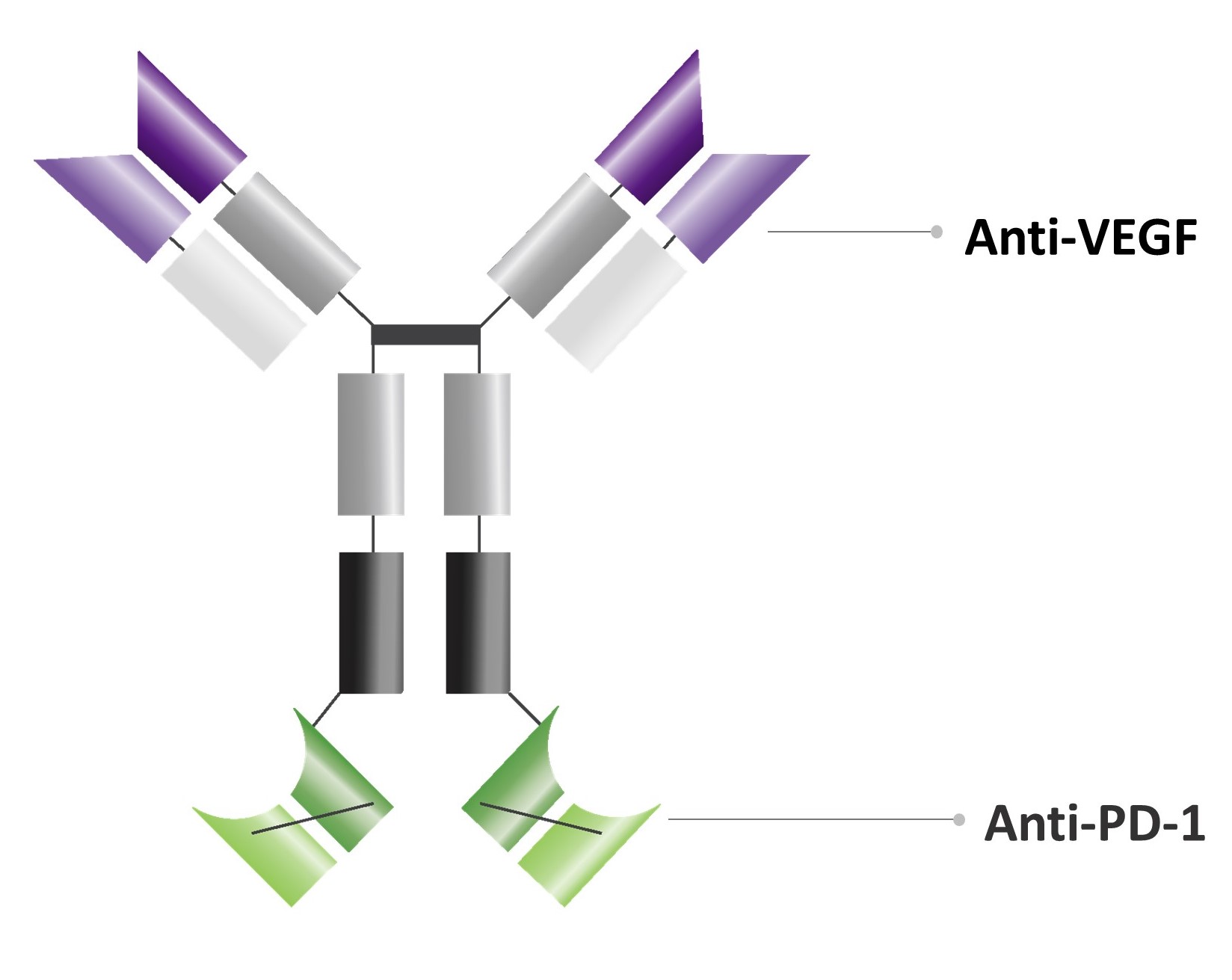

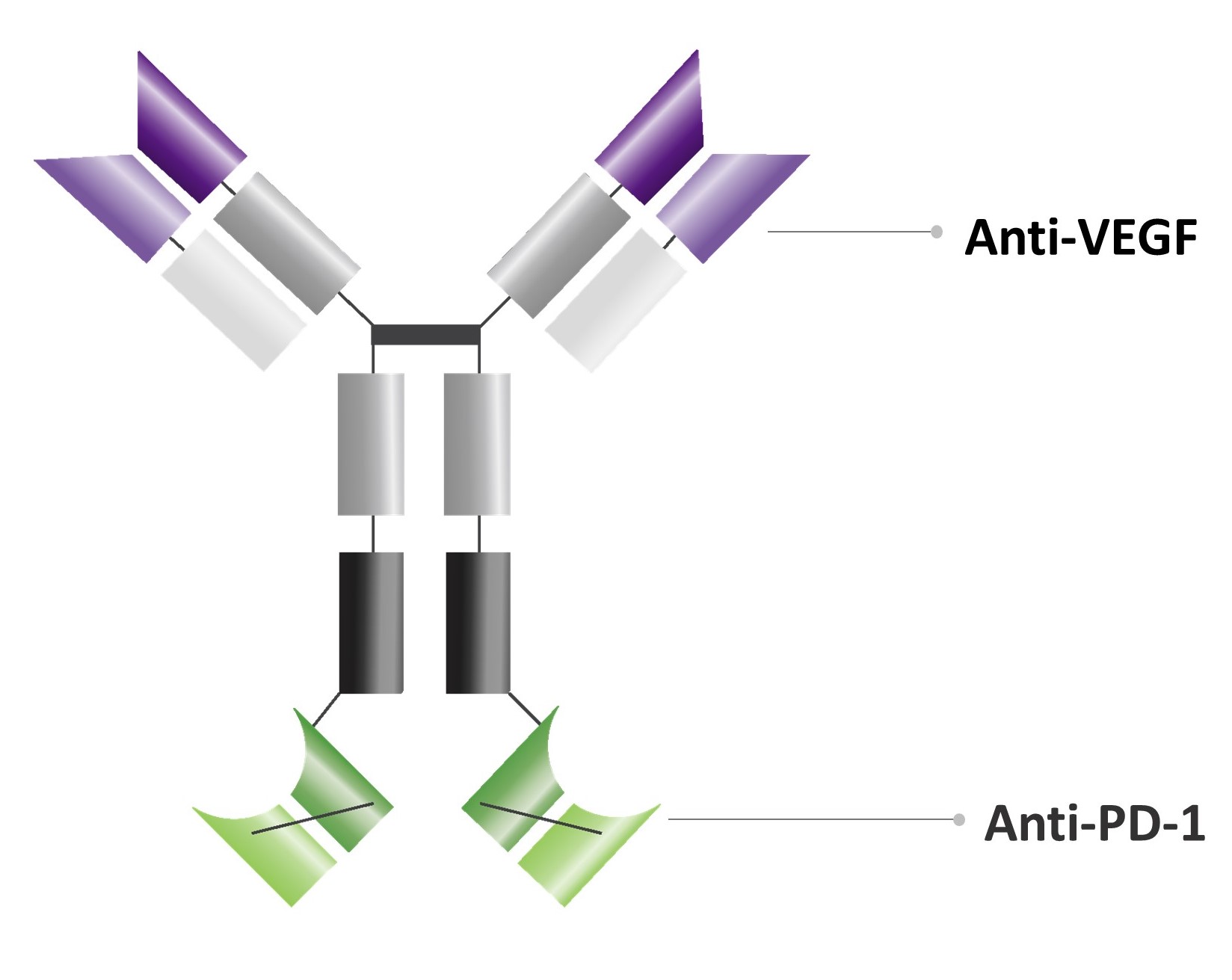

The Company’s current lead development candidate is ivonescimab, a novel, potential first-in-class bispecific antibody intending to combine the effects of immunotherapy via a blockade of PD-1 with the anti-angiogenesis effects of an anti-VEGF compound into a single molecule. On December 5, 2022, the Company entered into a Collaboration and License Agreement (the “License Agreement”) with Akeso, Inc. and its affiliates (collectively, “Akeso”) pursuant to which the Company has in-licensed intellectual property related to ivonescimab. Through the License Agreement, the Company obtained the rights to develop and commercialize ivonescimab in the United States, Canada, Europe, and Japan. The License Agreement and transaction closed in January 2023 following customary waiting periods. On June 3, 2024, the Company entered into an amendment to the License Agreement with Akeso to expand its territories covered under the License Agreement to also include the Latin America, Middle East and Africa regions (collectively, and as expanded, the "Licensed Territory"). The Company’s operations are focused on the development of ivonescimab and other future activities, as the Company determines.

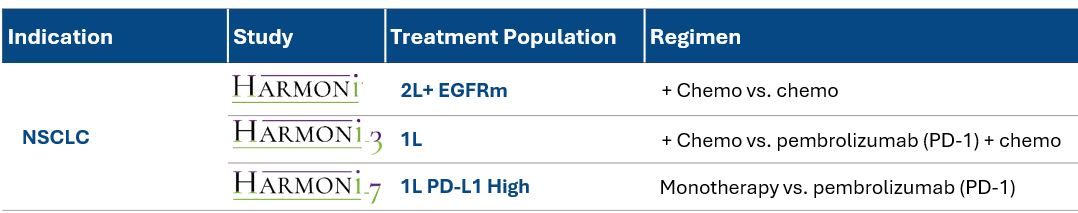

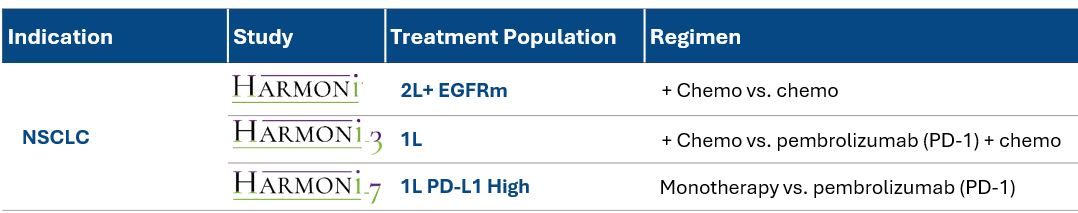

The Company has begun its development for ivonescimab in non-small cell lung cancer (“NSCLC”), specifically launching Phase III clinical trials in the following proposed indications:

(a) ivonescimab combined with chemotherapy in patients with epidermal growth factor receptor (“EGFR”)-mutated, locally advanced or metastatic non-squamous NSCLC who have progressed after treatment with a third-generation EGFR tyrosine kinase inhibitor (“TKI”) (“HARMONi”); and

(b) ivonescimab combined with chemotherapy in first-line metastatic NSCLC patients (“HARMONi-3”).

In addition, the Company has begun to activate clinical trial sites in the United States for a Phase III clinical study in the following proposed indication:

(c) ivonescimab monotherapy in first-line metastatic NSCLC patients with high PD-L1 expression (“HARMONi-7”).

In October 2024, the Company completed enrollment in its HARMONi clinical trial. The Company expects to disclose topline results from HARMONi in mid-2025, depending upon maturation of the data per the protocol.

Akeso Collaboration and License Agreement

Pursuant to the License Agreement with Akeso, the Company received the rights to develop and commercialize ivonescimab in the Licensed Territory. Akeso will retain development and commercialization rights for the rest of the world excluding the Licensed Territory. In exchange for these rights, Summit made an upfront payment during the first quarter of 2023 comprised of $474.9 million cash and the issuance of 10 million shares of Company common stock in lieu of $25.1 million cash pursuant to a share transfer agreement. Furthermore, on June 3, 2024, the Company entered into an amendment to the License Agreement with Akeso to expand its territories covered under the License Agreement to also include the Latin America, Middle East and Africa regions for which Summit paid an upfront payment of $15.0 million cash in the third quarter of 2024. In addition, the Company may also pay Akeso (a) milestone payments tied to achievement of regulatory approval of ivonescimab with various regulatory authorities in the Licensed Territory, (b) milestone payments tied to achievement of annual revenue from ivonescimab in the Licensed Territory and (c) royalty payments equal to low-double-digit percentage of annual revenues from ivonescimab in the Licensed Territory. In connection with the License Agreement, the Company agreed to purchase a certain portion of drug substance and/or drug product for clinical and commercial supply and to enter into a supply agreement with Akeso.

Pursuant to the terms of the License Agreement, Summit has final decision-making authority with respect to commercial strategy, pricing and reimbursement and other commercialization matters in the Licensed Territory. Summit has not assumed any liabilities (including contingent liabilities), nor acquired any physical assets or trade names, or hired or acquired any employees from Akeso in connection with the License Agreement.

Ivonescimab

Ivonescimab is a novel potential first-in-class PD-1 / VEGF bispecific antibody, believed to be the most advanced in clinical development in the Licensed Territory. Engineered with Akeso’s unique Tetrabody technology, ivonescimab, as a single molecule, blocks programmed cell death protein 1 (“PD-1”) from binding to PD-L1 and PD-L2, and blocks vascular endothelial growth factor (“VEGF”) from binding to VEGF receptors. Ivonescimab is designed to potentially allow cooperative binding of the intended targets, such that the binding of PD-1 increases the binding affinity of VEGF. In view of the co-expression of VEGF and PD-1 in the tumor micro-environment (“TME”), ivonescimab may block these two pathways more effectively and enhance the antitumor activity, as compared to combination therapy through what is believed to be a unique cooperative binding mechanism.

This could differentiate ivonescimab as there is potentially higher expression (presence) of both PD-1 and VEGF in tumor tissue and the TME as compared to normal tissue in the body. As shown in Akeso’s in-vitro studies, ivonescimab’s tetravalent structure (four binding sites) enables higher avidity (accumulated strength of multiple binding interactions) in the TME with over 10 fold increased binding affinity to PD-1 in the presence of VEGF in vitro. This tetravalent structure, the intentional novel design of the molecule, and bringing these two targets into a single bispecific antibody with cooperative binding qualities has the potential to direct ivonescimab to the tumor tissue versus healthy tissue. The intent of this design is to improve upon previously established efficacy thresholds, in addition to side effects and safety profiles associated with these targets.

Ivonescimab is currently being developed by both Akeso and the Company in multiple Phase III clinical trials. There are also multiple early-phase trials being conducted in multiple solid tumors. Ivonescimab has been dosed in more than 2,300 patients globally.

Akeso-Sponsored Ivonescimab Trials

Akeso is currently developing ivonescimab in non-small cell lung cancer and other solid tumor settings. Ivonescimab is currently approved in China in combination with chemotherapy for patients with EGFR-mutated non-small cell lung cancer whose tumors have progressed following an EGFR-TKI based on the results of the HARMONi-A clinical trial that was first announced and presented in 2024. In addition, a supplemental application has been submitted in China by Akeso for ivonescimab as monotherapy based on the results of the HARMONi-2 study in first-line, PD-L1 positive non-small cell lung cancer. Further details related to these two trials, in addition to other Phase II clinical data presented during 2024, are described further below. In addition, Akeso is currently conducting Phase III clinical trials in combination with chemotherapy in first-line advanced squamous NSCLC (HARMONi-6) and first-line biliary tract cancer (HARMONi-GI1), as well as in combination with ligufalimab, a proprietary Akeso-owned investigational CD-47 monoclonal antibody, in first-line recurrent / metastatic PD-L1

positive head-and-neck cancer (HARMONi-HN1). Further, Akeso has announced its intention to conduct Phase III clinical trials in combination with chemotherapy in first-line advanced PD-L1 low or negative triple-negative breast cancer (HARMONi-BC1) and first-line advanced pancreatic cancer (HARMONi-GI2).

HARMONi-A

Based on data published by Akeso at the American Society of Clinical Oncology (ASCO 2024) and in a recent publication in the Journal of the American Medical Association (JAMA) in the HARMONi-A study, in a single-region (China), randomized, double-blinded Phase III study in patients with NSCLC who have progressed following an EGFR-TKI, ivonescimab achieved its primary endpoint of PFS when combined with doublet chemotherapy (pemetrexed and carboplatin). Patients experienced a 54% reduction in disease progression or death as compared to placebo plus doublet-chemotherapy (HR: 0.46, 95% CI: 0.34 - 0.62; p<0.001). In a pre-specified subgroup analysis of patients who received a previous third-generation TKI, a hazard ratio of 0.48 was observed. A median Overall Survival (mOS) in this study of 17.1 months was observed, reflecting a 20% reduction in death as compared to placebo plus chemotherapy in the study (HR: 0.80, 95% CI: 0.59 - 1.08). The Phase III study was considered to have demonstrated a tolerable safety profile and a low discontinuation rate for adverse events.

HARMONi-2

After announcing positive qualitative results for the HARMONi-2 trial, also referred to as AK112-303, a randomized, single-region (China) Phase III study sponsored by Akeso, on May 30, 2024, the Company announced, on September 8, 2024, quantitative data from the primary analysis of the Phase III HARMONi-2 trial featuring ivonescimab that was presented as part of the Presidential Symposium at the International Association for the Study of Lung Cancer’s (IASLC) 2024 World Conference on Lung Cancer (WCLC 2024). The HARMONi-2 presentation evaluated monotherapy ivonescimab compared to monotherapy pembrolizumab in patients with locally advanced or metastatic NSCLC whose tumors have positive PD-L1 expression. HARMONi-2 is a single region, multi-center, double-blinded Phase III study conducted in China sponsored by Akeso, with data generated and analyzed by Akeso.

In the HARMONi-2 primary analysis, ivonescimab monotherapy demonstrated a statistically significant improvement in the trial’s primary endpoint, PFS by Independent Radiologic Review Committee (IRRC), when compared to monotherapy pembrolizumab, achieving a hazard ratio of 0.51 (95% CI: 0.38, 0.69; p<0.0001). A clinically meaningful benefit was demonstrated across clinical subgroups, including patients with tumors with high PD-L1 expression. Overall survival data was not yet mature at the time of the data cutoff and will be evaluated in the future.

Ivonescimab demonstrated an acceptable and manageable safety profile, which was consistent with previous studies. There were three patients (1.5%) who discontinued ivonescimab due to treatment-related adverse events ("TRAEs") compared to six patients (3.0%) who discontinued pembrolizumab due to TRAEs. There was one patient in the ivonescimab arm and two patients in the pembrolizumab arm who died as a result of TRAEs in this Phase III study.

Additional Phase II Data Sets

In addition to the HARMONi-2 data announced at WCLC 2024, Akeso also announced Phase II trial results from AK112-205, for patients with Stage II or III resectable NSCLC. Further, the Company announced data for ivonescimab was presented as a part of the 2024 European Society for Medical Oncology Annual Meeting (ESMO 2024) featuring updated Phase II ivonescimab data in advanced triple-negative breast cancer (TNBC), recurrent / metastatic head and neck squamous cell carcinoma (HNSCC), and metastatic microsatellite-stable (MSS) colorectal cancer (CRC). At ASCO 2024, Akeso presented ivonescimab Phase II data in biliary-tract cancer (BTC). Earlier, at the 2024 European Lung Cancer Conference (ELCC 2024), Akeso announced updated data from AK112-201 (Cohort 1), a Phase II study for patients with first-line advanced NSCLC. Each trial from which the data was generated was a multi-center Phase II study conducted in China sponsored by Akeso, with data generated and analyzed by Akeso.

Product Pipeline

Summit Sponsored Ivonescimab Trials

Ivonescimab is currently being investigated in global Phase III clinical trials. Phase I and II trials were completed by or are ongoing with our partner Akeso. This pipeline reflects Phase III clinical trials that have been or are planned to be initiated by Summit in its Licensed Territory.

HARMONi study (NCT05184712) is a Phase III, multi-regional, potentially registration-enabling clinical trial, which enrolled patients in North America, Europe, and China. Patients enrolled in China were also enrolled as a part of the HARMONi-A study. We completed enrollment of patients in North America and Europe in October 2024. The two primary endpoints for this study are progression-free survival ("PFS") and overall survival ("OS"), and the study compares ivonescimab plus platinum-based doublet chemotherapy versus placebo plus platinum-based doublet chemotherapy in patients with advanced or metastatic EGFR-mutated NSCLC whose tumors have progressed following treatment with a third generation EGFR-TKI. We expect to disclose top-line results from HARMONi in mid-2025, depending upon maturation of the data per the protocol.

The U.S. Food and Drug Administration ("FDA") has granted Fast Track designation for the proposed use of ivonescimab in combination with platinum-based chemotherapy for the treatment of adult patients with locally advanced or metastatic NSCLC with EGFR mutation, who have experienced disease progression following EGFR-TKI therapy.

HARMONi-3 study (NCT05899608) is a Phase III, multi-regional, potentially registration-enabling clinical trial for which we initiated activating sites in North America and China during the fourth quarter of 2023 and later in Europe in 2024. The two primary endpoints for this study are PFS and OS, and the study compares ivonescimab plus platinum-based doublet chemotherapy versus pembrolizumab plus platinum-based doublet chemotherapy in first-line patients with metastatic squamous NSCLC and, based on changes made to the protocol in the fourth quarter of 2024, non-squamous NSCLC. Enrollment is ongoing in all regions for patients with squamous tumors; the protocol amendment is effective and enrollment has begun in United States in the fourth quarter of 2024 for patients with non-squamous tumors. The Company plans to enroll an estimated 1,080 patients.

Based on the results of HARMONi-2, the Company has begun to activate clinical trial sites in the United States for HARMONi-7. HARMONi-7 is a multi-regional Phase III clinical trial that will compare ivonescimab monotherapy to pembrolizumab monotherapy in patients with metastatic squamous and non-squamous NSCLC whose tumors have high PD-L1 expression. The sample size for this study is currently planned to have an estimated 780 patients with two primary endpoints, PFS and OS.

Summit is conducting its current clinical trials, and plans to design and conduct additional clinical trial activities for ivonescimab within its Licensed Territory, to support and submit relevant regulatory filings. We intend to explore further clinical development of ivonescimab in solid tumor settings outside of metastatic non-small cell lung cancer, our current area of focus in its Phase III clinical trials.

In the fourth quarter of 2023, we began collaborating with multiple institutions globally and opened our investigator-sponsored trials program across several disease areas. We continued to expand this program in 2024 in order to discover additional opportunities for ivonescimab, including in several tumors outside of our current development plan.

We plan to review the data generated from these clinical trials as a part of our consideration for advancing our clinical development pipeline for ivonescimab in the Licensed Territory.

Competition

The markets for oncology pharmaceuticals, in which we compete, are characterized by significant scientific innovation, regulatory oversight and intense competition. The key competitive factors affecting the success of our product candidates are likely to be their efficacy, safety, convenience, price and availability of coverage and reimbursement from government and other third-party payors.

Many of our competitors may have significantly greater financial resources and expertise in research and development, manufacturing, preclinical testing, conducting clinical trials, obtaining regulatory approvals, and marketing approved products than we do. Smaller or early-stage companies may also prove to be significant competitors, particularly through collaborative arrangements with large and established companies. These competitors also compete with us in recruiting and retaining qualified scientific and management personnel and establishing clinical trial sites and patient registration for clinical trials, as well as in acquiring technologies complementary to, or necessary for, our programs.

Our commercial opportunity could be reduced or eliminated if our competitors develop and commercialize products that are safer, more effective, have fewer or less severe side effects, are more convenient, or are less expensive than any products that we may develop. Our competitors also may obtain marketing approvals for their products more rapidly than we obtain approval for ours. This may have the effect of making branded products less attractive from a cost perspective to buyers. Our commercial opportunity could also be reduced or eliminated if the results of our clinical trials, both safety and efficacy, combined with other factors, do not lead to significant adoption of our product.

Competition for ivonescimab

Ivonescimab is currently being investigated in global Phase III clinical trials in Summit’s Licensed Territory in two metastatic NSCLC indications:

(a) ivonescimab combined with chemotherapy in patients with epidermal growth factor receptor (“EGFR”)-mutated, locally advanced or metastatic non-squamous NSCLC who have progressed after treatment with a third-generation EGFR tyrosine kinase inhibitor (“TKI”) (“HARMONi”); and

(b) ivonescimab combined with chemotherapy in first-line metastatic squamous NSCLC patients (“HARMONi-3”)

In addition, the Company has begun to activate clinical trial sites in the United States for a Phase III clinical study in the following proposed indication:

(c) ivonescimab monotherapy in first-line metastatic NSCLC patients with high PD-L1 expression (“HARMONi-7”).

Ivonescimab is also being investigated in multiple Phase II and Phase III clinical trials in China. We plan to review the data generated from these clinical trials as a part of our consideration for advancing our clinical development pipeline for ivonescimab in the Licensed Territory.

There are no known PD-1-based bispecific antibodies currently approved by the FDA, the European Medicines Agency (“EMA”), or Japan’s Pharmaceuticals and Medical Devices Agency (“PMDA”). There are currently no known approved PD-1/VEGF bispecific antibodies that are further advanced in clinical trial development or approved in the territories in which we have licensed ivonescimab. However, there are several PD-(L)1/VEGF(R2) bispecific antibodies in development around the world, including multiple that are currently in development or with planned development globally. These include, but are not limited to BNT327, which is owned by BioNTech SE, which has begun conducting Phase III clinical studies globally, and LM-299, which was licensed globally by Merck & Co., Inc. in November 2024.

Our current clinical development plan in the Licensed Territory is focused on NSCLC. Several pharmaceutical and biotechnology companies have established themselves in the market for the treatment of NSCLC, and several additional companies are developing products for the treatment of NSCLC. Currently, the most commonly used treatments for first-line NSCLC without genomic alterations are several immuno-oncology drugs and chemotherapies, administered either individually as monotherapy, in combination with each other, or in combination with other approved therapeutics. In addition to various chemotherapies, several immunotherapies have been approved by the FDA for these treatments, including, but not limited to pembrolizumab, atezolizumab, nivolumab, durvalumab, cemiplimab and ipilimumab. There are anti-angiogenic therapies which are approved for the treatment of certain lung cancers, including bevacizumab in front-line non-squamous NSCLC as well as ramucirumab for patients who have progressed after platinum-based chemotherapy. The proposed indications for ivonescimab in the HARMONi-3 and HARMONi-7 clinical trial settings in first-line NSCLC may face competition from clinical candidates

such as novel immunotherapy targets including various clinical candidates targeting T-cell immunoreceptors with Ig and ITIM domains (TIGIT) and lymphocyte activation gene 3 (LAG-3) each of which have various developers for different candidates as either monoclonal antibodies or multispecific antibodies, a bispecific antibody, volrustomig (AstraZeneca), and antibody drug conjugates (ADCs) with novel targets such as datopotamab deruxetecan (AstraZeneca and Daiichi Sankyo), sacituzumab tirumotecan (Merck), and sigvotatug vedotin (Pfizer), each having announced, are currently enrolling in, or having completed enrollment in Phase III clinical trials.

For those patients EGFR mutations, there are several targeted therapies that have also been approved in the front-line setting, including, but not limited to, osimertinib (AstraZeneca) with or without chemotherapy and amivantamab and lazertinib (both from Johnson & Johnson). The proposed indication for ivonescimab in the HARMONi clinical trial setting, post third-generation EGFR-TKIs such as osimertinib or lazertinib, may face competition from amivantamab plus chemotherapy, as well as clinical candidates such as as datopotamab deruxetecan (AstraZeneca and Daiichi Sankyo) and patritumab deruxtecan (Merck and Daiichi Sankyo).

Should ivonescimab ultimately receive marketing authorization in certain jurisdictions within the Licensed Territory, the marketing authorization holder for some of the approved agents may lose exclusive rights to these agents, increasing competition from biosimilar agents or generic compounds.

As we intend to explore further clinical development of ivonescimab in solid tumor settings outside of metastatic non-small cell lung cancer, our current area of focus in our Phase III clinical trials, we will encounter significant competition in the development of ivonescimab in each of these potential settings.

Manufacturing

We do not own or operate, and currently have no plans to establish, manufacturing facilities for the production of clinical or commercial quantities of ivonescimab. We currently rely, and expect to continue to rely, on third parties for the manufacture of our product candidates and any products that we may develop.

Ivonescimab

In connection with the License Agreement, we agreed to purchase a certain portion of drug substance and/or drug product for clinical and commercial use and to enter into a supply agreement with Akeso. Until such time that we are able to establish second source suppliers or are able to manufacture the drug substance independently, Akeso shall be solely responsible for the manufacture of the drug substance for use in the Licensed Territory. We continue to make progress in transferring relevant know-how to third parties to establish additional supply sources. We are using a different third-party supplier for clinical packaging, labeling and distribution of the clinical drug product.

Intellectual Property

We have obtained and maintain proprietary protection for our antibiotic product candidates, technology and know-how. We strive to protect the proprietary technology by, among other methods, seeking and maintaining patents, where available, that are intended to cover our product candidates, compositions and formulations, their methods of use and processes for their manufacture and any other inventions that are commercially important to the development of our business. We also rely on trade secrets, know-how, continuing technological innovation and in-licensing opportunities to develop and maintain our proprietary and competitive position.

Ivonescimab Program. Following the completion of the License Agreement with Akeso, we have in-licensed the rights to various Akeso patents and patent applications covering ivonescimab and related compositions of matter and methods of manufacture/use in the Licensed Territory and have rights to control prosecution of such in-licensed intellectual property in the Licensed Territory in collaboration with Akeso. We continue to develop, identify, and strive to protect other technologies that are commercially relevant to our ivonescimab position.

| | | | | | | | | | | |

| Patent Number | Country/Region* | Patent Type | Not Due to Expire Before** |

| 12195527 | United States | Compositions of Matter | August 30, 2039 |

| 3882275 | Europe | Compositions of Matter & Methods of Manufacture/Use | August 30, 2039 |

| 7374995 | Japan | Compositions of Matter & Methods of Manufacture/Use | August 30, 2039 |

| 7589314 | Japan | Methods of Use | August 30, 2039 |

*Additional granted patents and/or pending patent applications in the U.S., Europe, Japan, and other countries/regions, not due to expire before 2039 to 2042, may be available.

**Dates do not account for any available patent term adjustment/extensions/supplemental protection certificates and assume that all maintenance/annuity fees are timely paid.

Trade Secrets. In addition to patents, we rely on trade secrets and know-how to develop and maintain our competitive position. Trade secrets and know-how can be difficult to protect. We seek to protect our proprietary technology and processes, in part, by confidentiality agreements and invention assignment agreements with our employees, consultants, scientific advisors, contractors, manufacturers, and commercial partners. These agreements are designed to protect our proprietary information and, in the case of the invention assignment agreements, to grant us ownership of technologies that are developed through a relationship with a third party. We also seek to preserve the integrity and confidentiality of our data, trade secrets and know-how by maintaining physical security of our premises and physical and electronic security of our information technology systems.

Trademarks. We are in the process of selecting a name for ivonescimab, which we will pursue protection for as a trademark in the Licensed Territory. In connection with the development of our product pipeline, we will seek protection for marks we currently use and future marks when appropriate.

We may not be able to obtain, maintain or protect the intellectual property rights necessary to conduct our business, and we may be subject to claims, whether or not meritorious, that we infringe or otherwise violate the intellectual property rights of third parties. For more information, please see the section on “Risk Factors – Risks Related to Intellectual Property”.

Government Regulation

As a biopharmaceutical company focused on the discovery, development, and commercialization of novel therapeutics for serious diseases, we are subject to extensive and ongoing regulation by government authorities, including regulation by the United States Food and Drug Administration (“FDA”) under the Federal Food, Drug, and Cosmetic Act (“FDCA”) and its implementing regulations, as well as by other regulatory bodies in the United States, Europe and other countries in which we operate. Government authorities in the United States, at the federal, state and local level, and in other countries and jurisdictions, including the European Union, extensively regulate, among other things, the research, development, testing, manufacture, quality control, approval, packaging, storage, record keeping, labeling, pricing, reimbursement, advertising, promotion, distribution, marketing, post-approval monitoring and reporting, and import and export of pharmaceutical products. The processes for obtaining regulatory approvals in the United States and in foreign countries and jurisdictions, along with compliance with applicable statutes and regulations and other regulatory authorities, require the expenditure of substantial time and financial resources.

Review and Approval of Drugs in the United States

In the United States, the FDA regulates drugs under the FDCA and implementing regulations. An entity that takes responsibility for the initiation and management of a clinical development program for such products, and for their regulatory approval, is typically referred to as a “sponsor” or “applicant.” The failure of a sponsor to comply with the FDCA and applicable U.S. requirements at any time during the product development process, approval process or after approval may subject an applicant or sponsor to a variety of administrative or judicial sanctions, including imposition of a clinical hold or other delays in the conduct of a study, refusal by the FDA to approve pending applications, withdrawal of an approval, issuance of warning letters and other types of letters, product recalls, product seizures, total or partial suspension of production, importation or distribution, injunctions, fines, refusals of government contracts, restitution, disgorgement of profits, or civil or criminal investigations and penalties brought by the FDA and the Department of Justice (“DOJ”), or other federal and state governmental entities.

An applicant seeking approval to market and distribute a new drug product in the United States must typically undertake the following:

•completion of preclinical laboratory tests, animal studies and formulation studies in compliance with the FDA’s good laboratory practice (“GLP”) regulations;

•submission to the FDA of an Investigational New Drug (“IND”) Application, which must take effect before human clinical trials may begin;

•approval by an independent institutional review board, or IRB, approving each clinical study at each research site before a clinical trial may be initiated at the site;

•performance of adequate and well-controlled human clinical trials in accordance with current good clinical practice (“GCP”) standards, to establish the safety and efficacy of the proposed drug product for each indication;

•preparation and submission to the FDA of a new drug application (“NDA”) or Biologic Licensing Application (“BLA”);

•review of the product candidate by an FDA advisory committee, where appropriate or if applicable;

•satisfactory completion of one or more FDA inspections of the manufacturing facility or facilities at which the product, or components thereof, are produced to assess compliance with current Good Manufacturing Practices (“cGMP”), requirements and to assure that the facilities, methods and controls are adequate to preserve the product’s identity, strength, quality and purity;

•satisfactory completion of FDA audits of clinical trial sites to assure compliance with GCPs and the integrity of the clinical data submitted in support of the NDA/BLA;

•payment of user fees and securing FDA approval of the NDA/BLA for the marketing of the drug product; and

•compliance with any post-approval requirements, including Risk Evaluation and Mitigation Strategies (“REMS”), where applicable, and any post-approval studies required by the FDA.

Preclinical Studies

Before an applicant begins testing a compound with potential therapeutic value in humans, the product candidate must undergo rigorous preclinical testing. Preclinical studies include laboratory evaluation of the purity and stability of the API and the formulated drug product, as well as in vitro and animal studies to assess the safety and activity of the drug for initial testing in humans and to establish a rationale for therapeutic use. The conduct of preclinical studies is subject to federal regulations and requirements, including GLP regulations and the United States Department of Agriculture's Animal Welfare Act, if applicable. The results of the preclinical tests, together with manufacturing information, analytical data, any available clinical data or literature and plans for clinical trials, among other things, are submitted to the FDA as part of an IND. Some long-term preclinical testing, such as animal tests of reproductive adverse events and carcinogenicity, may continue after the IND is submitted.

Companies usually must complete some long-term preclinical testing, such as animal tests of reproductive adverse events and carcinogenicity, and must also develop additional information about the synthesis and physical characteristics of the investigational product. Prior to submission of an NDA or BLA, a manufacturer must finalize a process for manufacturing the product in commercial quantities in accordance with cGMP requirements. The manufacturing process must be capable of consistently producing quality batches of the candidate product and, among other things, the manufacturer must develop methods for testing the identity, strength, quality and purity of the final product. Additionally, appropriate packaging must be selected and tested. Stability studies must be conducted to demonstrate that the candidate product does not undergo unacceptable deterioration over its shelf-life.

The IND and Institutional Review Board (“IRB”) Processes

An IND is an exemption from the FDCA that allows an unapproved drug to be shipped in interstate commerce for use in a clinical investigational clinical trial and serves as a request for FDA authorization to administer an investigational drug to humans. Such authorization must be secured prior to interstate shipment and administration of any new drug that is not the subject of an approved NDA/BLA. In support of a request for an IND, applicants must submit a protocol for each clinical trial and any subsequent protocol amendments must be submitted to the FDA as part of the IND. In addition, the results of the preclinical tests, together with manufacturing information, analytical data, any available clinical data or literature and plans for clinical trials, among other things, are submitted to the FDA as part of an IND. The FDA requires a 30-day waiting period after the filing of each new IND before clinical trials may begin. This waiting period is designed to allow the FDA to review the IND to determine whether human research subjects will be exposed to unreasonable health risks. At any time during this 30-day

period, the FDA may raise concerns or questions about the conduct of the trials as outlined in the IND and impose a clinical hold. In this case, the IND sponsor and the FDA must resolve any outstanding concerns before clinical trials can begin.

Following commencement of a clinical trial under an IND, the FDA may also place a clinical hold or partial clinical hold on that trial. Clinical holds are imposed by the FDA when there is concern for patient safety and may be a result of new data, findings, or developments in clinical, nonclinical, and/or chemistry, manufacturing, and controls, or CMC. A clinical hold is an order issued by the FDA to the sponsor to delay a proposed clinical investigation or to suspend an ongoing investigation, and FDA must provide a basis for its imposition within 30 days after imposition of a clinical hold. A partial clinical hold is a delay or suspension of fewer than all of the clinical investigations subject to the IND.

Following issuance of a clinical hold or partial clinical hold, an investigation may only resume after the FDA has notified the sponsor that the investigation may proceed. The FDA will base that determination on information provided by the sponsor correcting the deficiencies previously cited or otherwise satisfying the FDA that the investigation can proceed.

A sponsor may choose, but is not required, to conduct a foreign clinical study under an IND. When a foreign clinical study is conducted under an IND, all FDA IND requirements must be met unless waived. When the foreign clinical study is not conducted under an IND, the sponsor must ensure that the study complies with certain regulatory requirements of the FDA in order to use the study as support for an IND or application for marketing approval. Specifically, on April 28, 2008, the FDA amended its regulations governing the acceptance of foreign clinical studies not conducted under an IND as support for an IND or an NDA or BLA. The final rule provides that such studies must be conducted in accordance with GCP, including review, approval, and continuing review by an independent ethics committee, or IEC, and freely given informed consent from subjects. The GCP requirements in the final rule encompass both ethical and data integrity standards for clinical studies. The FDA’s regulations are intended to help ensure the protection of human subjects enrolled in non-IND foreign clinical studies, as well as the quality and integrity of the resulting data. They further help ensure that non-IND foreign studies are conducted in a manner comparable to that required for IND studies.

In addition to the foregoing IND requirements, an IRB/Ethics Committee (“EC”) representing each institution participating in any clinical trial for which data is intended to be submitted to FDA must review and approve the plan for any clinical trial before it commences at that institution, and the IRB must conduct continuing review and reapprove the study at least annually. The IRB/EC must review and approve, among other things, the study protocol and informed consent information to be provided to study subjects. An IRB/EC must operate in compliance with FDA/HA (“Health Authority”) regulations. An IRB/EC can suspend or terminate approval of a clinical trial at its institution, or an institution it represents, if the clinical trial is not being conducted in accordance with the IRB’s/EC’s requirements or if the product candidate has been associated with unexpected serious harm to patients.

Additionally, some trials are overseen by an independent group of qualified experts with relevant expertise that organized by the trial sponsor, but should be independent of the sponsor, and is known as a data safety monitoring board or data safety monitoring committee (“DSMB”). A DSMB recommends to the sponsor whether to continue, modify, or stop a trial or trials based on its periodic review of accumulating data from one or more clinical trials. Suspension or termination of a clinical trial or a clinical development program during any phase of clinical trials can occur if it is determined that the participants or patients are being exposed to an unacceptable health risk. Other reasons for suspension or termination may be made by us based on evolving business objectives and/or competitive climate.

Information about clinical trials must be submitted within specific timeframes to the National Library of Medicine (“NLM”), for public dissemination on its ClinicalTrials.gov website. The failure to submit clinical trial information to clinicaltrials.gov, as required, is a prohibited act under the FDCA with violations subject to potential civil monetary penalties. Similar requirements for posting clinical trial information are present in the European Union (EudraCT) website: https://eudract.ema.europa.eu/ and other countries, as well.

Expanded Access to an Investigational Drug for Treatment Use

Expanded access, sometimes called “compassionate use,” is the use of investigational new drug products outside of clinical trials to treat patients with serious or immediately life-threatening diseases or conditions when there are no comparable or satisfactory alternative treatment options. The rules and regulations related to expanded access are intended to improve access to investigational drugs for patients who may benefit from investigational therapies. FDA regulations allow access to investigational drugs under an IND by the company upon request by the treating physician for treatment purposes on a case-by-case basis for: individual patients (single-patient IND applications for treatment in emergency settings and non-emergency

settings); intermediate-size patient populations; and larger populations for use of the drug under a treatment protocol or Treatment IND Application.

When considering an IND application for expanded access to an investigational product with the purpose of treating a patient or a group of patients, the sponsor and treating physicians or investigators will determine suitability when all of the following criteria apply: patient(s) have a serious or immediately life-threatening disease or condition, and there is no comparable or satisfactory alternative therapy to diagnose, monitor, or treat the disease or condition; the potential patient benefit justifies the potential risks of the treatment and the potential risks are not unreasonable in the context or condition to be treated; and the expanded use of the investigational drug for the requested treatment will not interfere with initiation, conduct, or completion of clinical investigations that could support marketing approval of the product or otherwise compromise the potential development of the product.

On December 13, 2016, the 21st Century Cures Act established (and the 2017 Food and Drug Administration Reauthorization Act later amended) a requirement that sponsors of one or more investigational drugs for the treatment of a serious disease(s) or condition(s) make publicly available their policy for evaluating and responding to requests for expanded access for individual patients. Although these requirements were rolled out over time, they have now come into full effect. This provision requires drug and biologic companies to make publicly available their policies for expanded access for individual patient access to products intended for serious diseases. Sponsors are required to make such policies publicly available upon the earlier of initiation of a Phase II or Phase III study; or 15 days after the drug or biologic receives designation as a breakthrough therapy, fast track product, or regenerative medicine advanced therapy. Sponsors are not required to provide access to investigational products via expanded access, but the manufacturer must develop an internal policy and respond to patient requests according to that policy.

In addition, on May 30, 2018, the Right to Try Act was signed into law. The law, among other things, provides a federal framework for certain patients to access certain investigational new drug products that have completed a Phase I clinical trial and that are undergoing investigation for FDA approval. Under certain circumstances, eligible patients can seek access to an investigational drug product without enrolling in clinical trials and without obtaining FDA permission under the FDA expanded access program. There is no obligation for a drug manufacturer to make its drug products available to eligible patients as a result of the Right to Try Act.

Human Clinical Trials in Support of an NDA/BLA

Clinical trials involve the administration of the investigational product to human subjects under the supervision of qualified investigators in accordance with GCP requirements, which include, among other things, the requirement that all research subjects provide their freely given informed consent in accordance with FDA regulations and applicable local laws before their participation in any clinical trial. Clinical trials are conducted under written study protocols detailing, among other things, the inclusion and exclusion criteria, the objectives of the study, the parameters to be used in monitoring the study and the safety and effectiveness criteria to be evaluated.

Human clinical trials are typically conducted in three sequential phases, which may overlap or be combined:

Phase I. The investigational drug is initially introduced into healthy human subjects or, in certain indications such as cancer, patients with the target disease or condition, and tested for safety, dosage tolerance, absorption, metabolism, distribution, excretion and, if possible, to gain an early indication of its effectiveness and to determine optimal dosage.

Phase II. The investigational drug is administered to a limited patient population to identify possible adverse effects and safety risks, to preliminarily evaluate the efficacy of the product for specific targeted diseases and to determine dosage tolerance and optimal dosage.

Phase III. The investigational drug is administered to an expanded patient population, generally at geographically dispersed clinical trial sites, in well-controlled clinical trials to generate sufficient data to statistically evaluate the efficacy and safety of the product for approval, to establish the overall risk-benefit profile of the product, and to provide adequate information for the labeling of the product. These clinical trials are commonly referred to as “pivotal” studies, which denotes a study that is intended to generate data that will be relied upon by the FDA or another relevant regulatory agency as the primary basis for approval of a product candidate.

Progress reports of the clinical trials must be submitted at least annually to the FDA, and more frequently in some circumstances, such as if serious adverse events occur. In addition, IND safety reports must be submitted to the FDA for any of

the following: serious and unexpected suspected adverse reactions; findings from other studies or animal or in vitro testing that suggest a significant risk in humans exposed to the drug; and any clinically important increase in the case of a serious suspected adverse reaction over that listed in the protocol or investigator brochure. Phase I, Phase II and Phase III clinical trials may not be completed successfully within any specified period, or at all. Furthermore, the FDA or other regulatory authority or the sponsor may suspend or terminate a clinical trial at any time on various grounds, including a finding that the research subjects are being exposed to an unacceptable health risk. Similarly, a reviewing IRB/EC can suspend or terminate approval of a clinical trial at a clinical trial site if the clinical trial is not being conducted in accordance with the IRB’s/EC’s requirements or if the drug has been associated with unexpected serious harm to patients. The FDA or other regulatory authority will typically inspect one or more clinical trial sites prior to approval of an NDA or BLA to assure compliance with GCP and assess the integrity of the clinical data submitted in support of the NDA or BLA.

Under the Pediatric Research Equity Act (“PREA”) of 2003, an application or supplement to an NDA or BLA for a new active ingredient, new indication, new dosage form, new dosing regimen, or new route of administration must contain a pediatric assessment unless the applicant has obtained a waiver or deferral. The pediatric assessment includes data to assess the safety and effectiveness of the drug product for the claimed indications in all relevant pediatric subpopulations, and to support dosing and administration for each pediatric subpopulation for which the product is safe and effective or reasons why dosing in pediatric patients is not recommended. The FDA also may require holders of approved NDAs and BLAs for marketed drugs and biological products to conduct pediatric studies under certain circumstances. With enactment of the Food and Drug Administration Safety and Innovation Act (“FDASIA”), in 2012, sponsors of drug product applications subject to PREA must also submit pediatric study plans prior to the assessment data during the development program. Those plans must contain an outline of the proposed pediatric study or studies the applicant plans to conduct any deferral or waiver requests and other information required or applicable by regulation. The applicant, the FDA, and the FDA’s internal review committee must then review the information submitted, consult with each other, and agree upon a final plan. The FDA or the applicant may request an amendment to the pediatric plan at any time.

A sponsor must submit an initial pediatric study plan, if required under PREA, no later than either 60 calendar days after the date of the end-of-phase II meeting or such other time as agreed upon between FDA and the sponsor. The FDA may, on its own initiative or at the request of the applicant, grant deferrals for submission of some or all pediatric data until after approval of the product for use in adults, or full or partial waivers from the pediatric data requirements. Additional requirements and procedures relating to deferral requests and requests for extension of deferrals are contained in FDASIA.

The FDA Reauthorization Act of 2017 established new requirements to govern certain molecularly targeted cancer indications. Any company that submits an NDA/BLA three years after the date of enactment of that statute must submit pediatric assessments with the NDA/BLA if the drug is intended for the treatment of an adult cancer and is directed at a molecular target that the FDA determines to be substantially relevant to the growth or progression of a pediatric cancer. The investigation must be designed to yield clinically meaningful pediatric study data regarding the dosing, safety and preliminary efficacy to inform pediatric labeling for the product.

Submission of an NDA/BLA to the FDA

Assuming successful completion of required clinical investigations and other requirements, the results of the preclinical studies and clinical trials, together with detailed information relating to the product’s chemistry, manufacture, controls and proposed labeling, among other things, are submitted to the FDA as part of an NDA or BLA requesting approval to market the drug product for one or more indications. Under federal law, the submission of most NDAs and BLAs is subject, under the Prescription Drug User Fee Reauthorization Act of 2022 (“PDUFA VII”), to an application user fee, which for federal fiscal year 2025 is $4,310,002 for an application requiring clinical data. The sponsor of the approved NDA/BLA is also subject to an annual program fee, which for the fiscal year 2025 is $403,889. Certain exceptions and waivers are available for some of these fees, such as an exception from the application fee for products with orphan designation and a waiver for certain small businesses.

Following submission of an application, the FDA conducts a filing review of an NDA or BLA within 60 calendar days of its receipt and strives to inform the sponsor by the 74th day after the FDA’s receipt of the submission whether the application is sufficiently complete to permit substantive review. The FDA may request additional information rather than accept an NDA or BLA for filing. In this event, the application must be resubmitted with the additional information. The resubmitted application is also subject to review before the FDA accepts it for filing. Once the submission is accepted for filing, the FDA begins an in-depth substantive review.

The FDA has agreed to certain performance goals in the review process of NDAs and BLAs. Under the agency's PDUFA VII commitments, 90% of applications seeking approval of new molecular entities (“NMEs”), are meant to be reviewed within ten months from the date on which FDA accepts the NDA for filing, and 90% of applications for NMEs that have been designated for “priority review” are meant to be reviewed within six months of the acceptance date. The review process may be extended by the FDA for three additional months to consider new information or clarification provided by the applicant to address an outstanding deficiency identified by the FDA following the original submission.

Before approving an NDA or BLA, the FDA typically will inspect the facility or facilities where the product is or will be manufactured. These pre-approval inspections cover all or selected facilities associated with an NDA/BLA submission, including drug component manufacturing (such as API), finished drug product manufacturing, and control testing laboratories. The FDA will not approve an application unless it determines that the manufacturing processes and facilities are in compliance with cGMP requirements and adequate to assure consistent production of the product within required specifications. Additionally, before approving an NDA or BLA, the FDA will typically inspect one or more clinical sites to assure compliance with GCP.

In addition, as a condition of approval, the FDA may require an applicant to develop a REMS. REMS use risk minimization strategies beyond the professional labeling to ensure that the benefits of the product outweigh the potential risks. To determine whether a REMS is needed, the FDA will consider the size of the population likely to use the product, seriousness of the disease, expected benefit of the product, expected duration of treatment, seriousness of known or potential adverse events, and whether the product is a new molecular entity. REMS can include medication guides, physician communication plans for healthcare professionals, and elements to assure safe use (“ETASU”). ETASU may include, but are not limited to, special training or certification for prescribing or dispensing, dispensing only under certain circumstances, special monitoring, and the use of patient registries. The FDA may require a REMS before approval or post-approval if it becomes aware of a serious risk associated with use of the product. The requirement for a REMS can materially affect the potential market and profitability of a product.

The FDA may refer an application for a drug to an advisory committee or explain why such referral was not made. Typically, an advisory committee is a panel of independent experts, including clinicians and other scientific experts, that reviews, evaluates and provides a recommendation as to whether the application should be approved and under what conditions. The FDA is not bound by the recommendations of an advisory committee, but it considers such recommendations carefully when making decisions.

Fast Track, Breakthrough Therapy and Priority Review

The FDA is authorized to designate certain products for expedited review if they are intended to address an unmet medical need in the treatment of a serious or life-threatening disease or condition. These programs are referred to as fast-track designation, breakthrough therapy designation, priority review designation and regenerative medicine advanced therapy designation.

Specifically, the FDA may designate a product for fast-track review if it is intended, whether alone or in combination with one or more other products, for the treatment of a serious or life-threatening disease or condition, and it demonstrates the potential to address unmet medical needs for such a disease or condition. For fast-track products, sponsors may have greater interactions with the FDA, and the FDA may initiate review of sections of a fast-track product’s application before the NDA or BLA is complete. This rolling review may be available if the FDA determines, after preliminary evaluation of clinical data submitted by the sponsor, that a fast-track product may be effective. The sponsor must also provide, and the FDA must approve, a schedule for the submission of the remaining information and the sponsor must pay applicable user fees. However, the FDA’s time period goal for reviewing a fast-track application does not begin until the last section of the NDA or BLA is submitted. In addition, the fast-track designation may be withdrawn by the FDA if the FDA believes that the designation is no longer supported by data emerging from the clinical development program.

Second, a product may be designated as a breakthrough therapy if it is intended, either alone or in combination with one or more other products, to treat a serious or life-threatening disease or condition and preliminary clinical evidence indicates that the product may demonstrate substantial improvement over existing therapies on one or more clinically significant endpoints, such as substantial treatment effects observed early in clinical development. The FDA may take certain actions with respect to breakthrough therapies, including holding meetings with the sponsor throughout the development process; providing timely advice to the product sponsor regarding development and approval; involving more senior staff in the review process; assigning a cross-disciplinary project lead for the review team; and taking other steps to design the clinical trials in an efficient manner.

Third, the FDA may designate a product for priority review if it is a product that treats a serious condition and, if approved, would provide a significant improvement in safety or effectiveness. The FDA determines, on a case-by-case basis, whether the proposed product represents a significant improvement when compared with other available therapies. Significant improvement may be illustrated by evidence of increased effectiveness in the treatment of a condition, elimination or substantial reduction of a treatment-limiting product reaction, documented enhancement of patient compliance that may lead to improvement in serious outcomes, and evidence of safety and effectiveness in a new subpopulation. A priority designation is intended to direct overall attention and resources to the evaluation of such applications, and to shorten the FDA’s goal for taking action on a marketing application from ten months to six months.

Accelerated Approval Pathway

The FDA may grant accelerated approval to a drug for a serious or life-threatening condition that provides meaningful therapeutic advantage to patients over existing treatments based upon a determination that the drug has an effect on a surrogate endpoint that is reasonably likely to predict clinical benefit. The FDA may also grant accelerated approval for such a drug when the product has an effect on an intermediate clinical endpoint that can be measured earlier than an effect on irreversible morbidity or mortality (“IMM”), and that is reasonably likely to predict an effect on IMM or other clinical benefit, taking into account the severity, rarity, or prevalence of the condition and the availability or lack of alternative treatments. Drugs granted accelerated approval must meet the same statutory standards for safety and effectiveness as those granted traditional approval.

For the purposes of accelerated approval, a surrogate endpoint is a marker, such as a laboratory measurement, radiographic image, physical sign, or other measure that is thought to predict clinical benefit, but is not itself a measure of clinical benefit. Surrogate endpoints can often be measured more easily or more rapidly than clinical endpoints. An intermediate clinical endpoint is a measurement of a therapeutic effect that is considered reasonably likely to predict the clinical benefit of a drug, such as an effect on IMM. The FDA has limited experience with accelerated approvals based on intermediate clinical endpoints, but has indicated that such endpoints generally may support accelerated approval where the therapeutic effect measured by the endpoint is not itself a clinical benefit and basis for traditional approval, if there is a basis for concluding that the therapeutic effect is reasonably likely to predict the ultimate clinical benefit of a drug.

The accelerated approval pathway is most often used in settings in which the course of a disease is long and an extended period of time is required to measure the intended clinical benefit of a drug, even if the effect on the surrogate or intermediate clinical endpoint occurs rapidly. For example, accelerated approval has been used extensively in the development and approval of drugs for treatment of a variety of cancers in which the goal of therapy is generally to improve survival or decrease morbidity and the duration of the typical disease course requires lengthy and sometimes large clinical trials to demonstrate a clinical or survival benefit.