Exhibit 99.2

Sunshine BANK COMMUNITY SOUTHERN BANK

SUNSHINE BANCORP, INC. STRATEGIC TRANSFORMATION CONTINUES

~~~

ACQUISITION OF

COMMUNITY SOUTHERN HOLDINGS, INC.

FEBRUARY 5, 2015

FORWARD LOOKING STATEMENTS

This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Congress passed the Private Securities Litigation Act of 1995 in an effort to encourage companies to provide information about their anticipated future financial performance. This act provides a safe harbor for such disclosure, which protects a company from unwarranted litigation if actual results are different from management expectations. This presentation reflects current views and estimates of the respective management of Sunshine Bancorp, Inc. (“SBCP”) and Community Southern Holdings, Inc. (“CMUY”) regarding future economic circumstances, industry conditions, company performance, and financial results. These forward-looking statements are subject to a number of factors and uncertainties which could cause SBCP, CMUY, or the combined company’s actual results and experience to differ from the anticipated results and expectations expressed in such forward-looking statements. Forward-looking statements speak only as of the date they are made and neither SBCP nor CMUY assumes any duty to update forward-looking statements. In addition to risks previously disclosed in SBCP’s and CMUY’s reports filed with regulators or other governmental agencies and those identified elsewhere in this presentation, these forward-looking statements include, but are not limited to, statements about (i) the expected benefits of the transaction between SBCP and CMUY, including future financial and operating results, cost savings, enhanced revenues and the expected market position of the combined company that may be realized for the transaction, and (ii) SBCP and CMUY’s plans, objectives, expectations and intentions and other statements contained in this presentation that are not historical facts. Other statements identified by words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “targets,” “projects” or words of similar meaning generally are intended to identify forward-looking statements. These statements are based upon the current beliefs and expectations of SBCP’s and CMUY’s management and are inherently subject to significant business, economic and competitive risks and uncertainties, many of which are beyond their respective control. In addition, these forward-looking statements are subject to assumptions with respect to future business strategies and decisions that are subject to change. Actual results may differ materially from those indicated or implied in the forward-looking statements.

- 1 -

Sunshine BANK

TRANSFORMATIONAL EVENTS

November 1954 Sunshine Federal Savings and Loan Association is formed in Plant City, FL

July 2014 Sunshine converts from mutual to stock ownership adding over $42 million

in new capital; Sunshine Bancorp, Inc. is formed as holding company and

common shares are listed on NASDAQ under the ticker SBCP

October 2014 New management team is assembled led by Andrew S. Samuel

December 2014 Sunshine is rebranded Sunshine Bank to better reflect a planned transition

from a traditional thrift institution to a commercial bank

4Q14/1Q15 Highly experienced business and financial services leaders added to the

Sunshine board of directors

February 2015 Sunshine announces agreement to acquire Community Southern Holdings,

Inc. and its wholly-owned subsidiary Community Southern Bank, a $246

million bank headquartered in Lakeland, FL

- 2 -

Sunshine Bank

Transaction Details and Overview

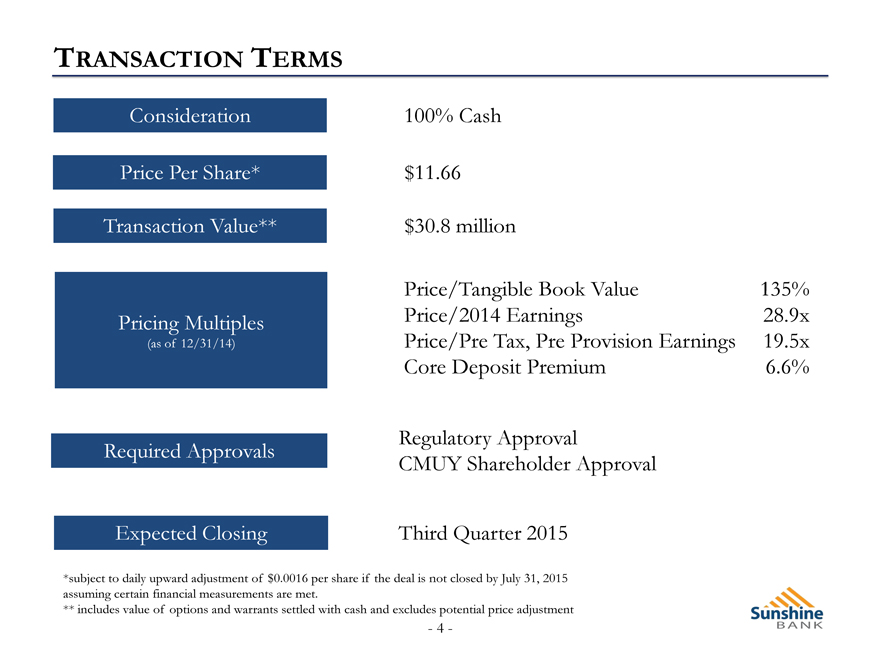

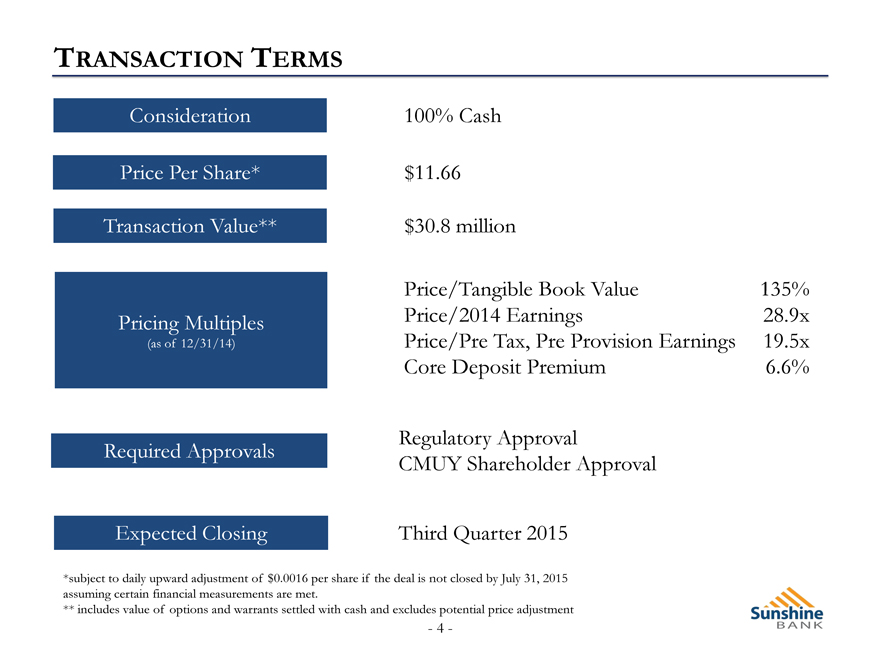

TRANSACTION TERMS

Consideration 100% Cash

Price Per Share* $11.66

Transaction Value** $30.8 million

Price/Tangible Book Value 135%

Pricing Multiples Price/2014 Earnings 28.9x

(as of 12/31/14) Price/Pre Tax, Pre Provision Earnings 19.5x

Core Deposit Premium 6.6%

Regulatory Approval

Required Approvals CMUY Shareholder Approval

Expected Closing Third Quarter 2015

*subject to daily upward adjustment of $0.0016 per share if the deal is not closed by July 31, 2015 assuming certain financial measurements are met.

** includes value of options and warrants settled with cash and excludes potential price adjustment

- 4 -

Sunshine BANK

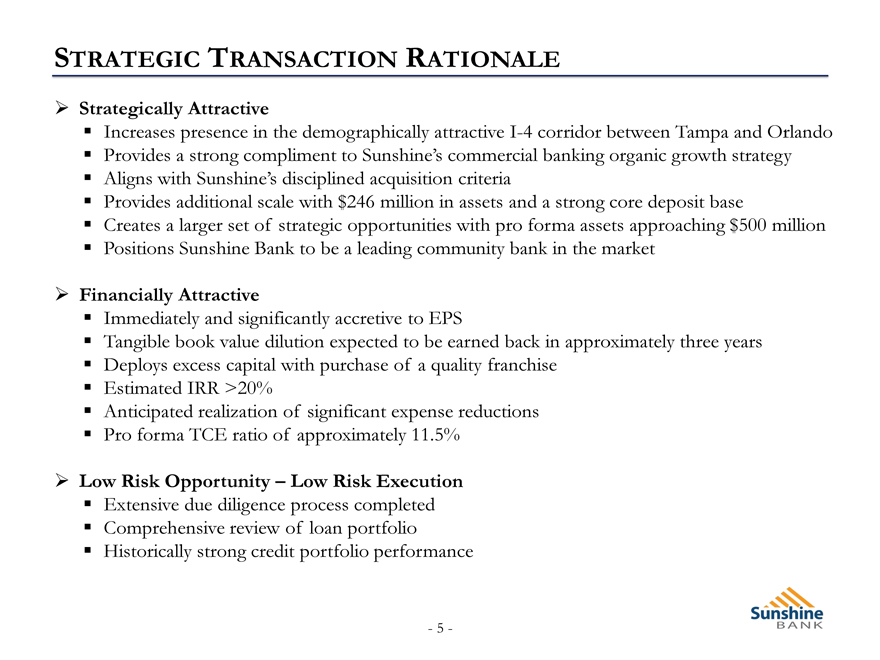

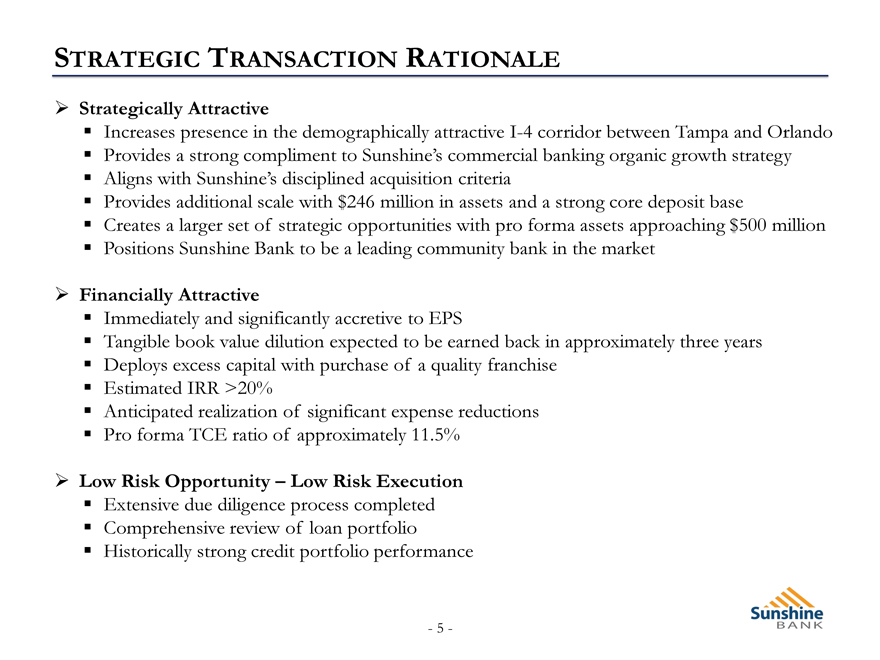

STRATEGIC TRANSACTION RATIONALE

Strategically Attractive

Increases presence in the demographically attractive I-4 corridor between Tampa and Orlando

Provides a strong compliment to Sunshine’s commercial banking organic growth strategy

Aligns with Sunshine’s disciplined acquisition criteria

Provides additional scale with $246 million in assets and a strong core deposit base

Creates a larger set of strategic opportunities with pro forma assets approaching $500 million

Positions Sunshine Bank to be a leading community bank in the market

Financially Attractive

Immediately and significantly accretive to EPS

Tangible book value dilution expected to be earned back in approximately three years

Deploys excess capital with purchase of a quality franchise

Estimated IRR >20%

Anticipated realization of significant expense reductions

Pro forma TCE ratio of approximately 11.5%

Low Risk Opportunity – Low Risk Execution

Extensive due diligence process completed

Comprehensive review of loan portfolio

Historically strong credit portfolio performance

- 5 -

Sunshine BANK

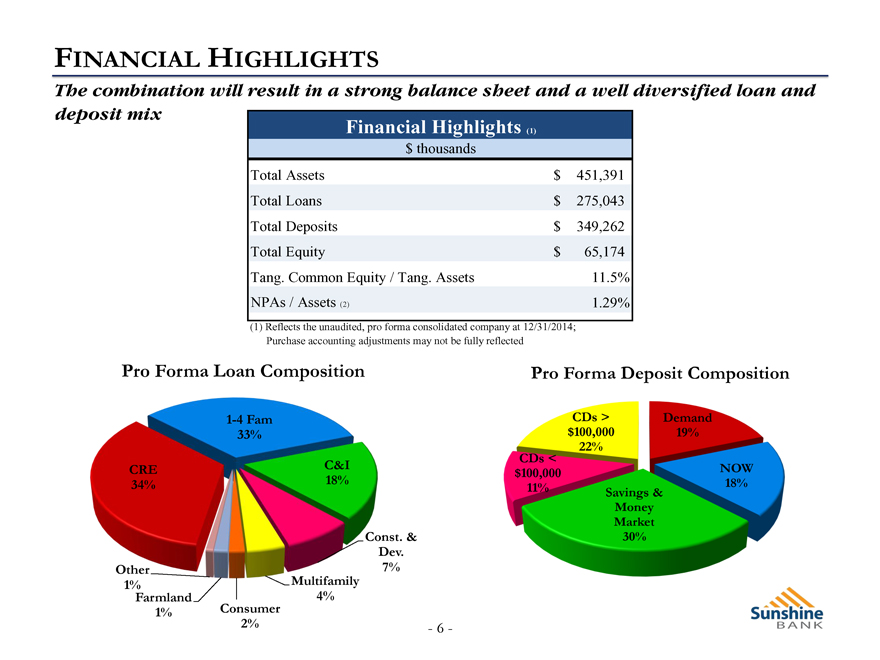

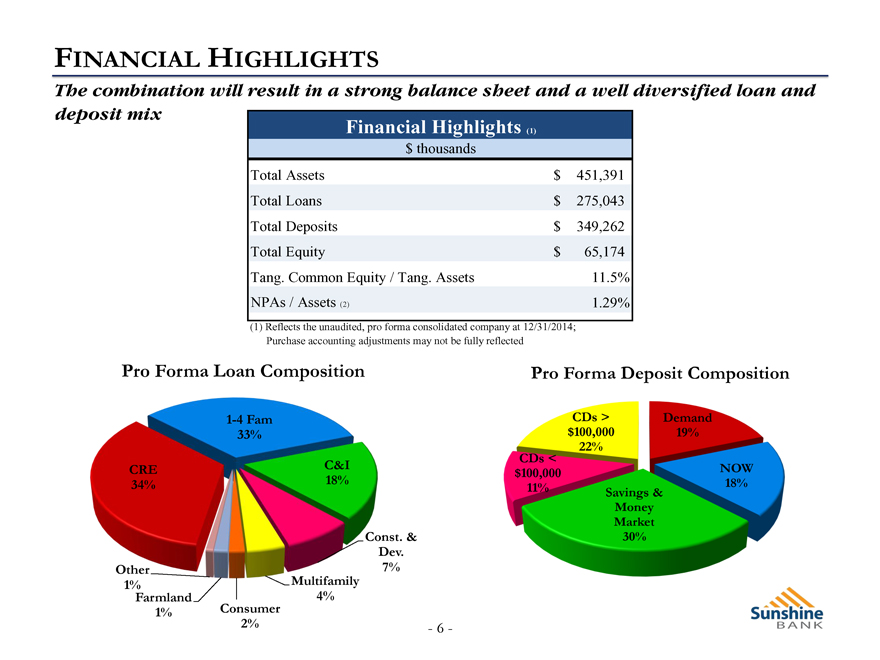

FINANCIAL HIGHLIGHTS

The combination will result in a strong balance sheet and a well diversified loan and

deposit mix

Financial Highlights (1)

$ thousands

Total Assets $ 451,391

Total Loans $ 275,043

Total Deposits $ 349,262

Total Equity $ 65,174

Tang. Common Equity / Tang. Assets 11.5%

NPAs / Assets (2) 1.29%

(1) Reflects the unaudited, pro forma consolidated company at 12/31/2014; Purchase accounting adjustments may not be fully reflected

Pro Forma Loan Composition Pro Forma Deposit Composition

1-4 Fam CDs > Demand

33% $100,000 19%

22%

C&I CDs <

CRE $100,000 NOW

34% 18% 11% 18%

Savings &

Money

Market

Const. & 30%

Dev.

Other 7%

1% Multifamily

Farmland 4%

1% Consumer

2% - 6 -

Sunshine Bank

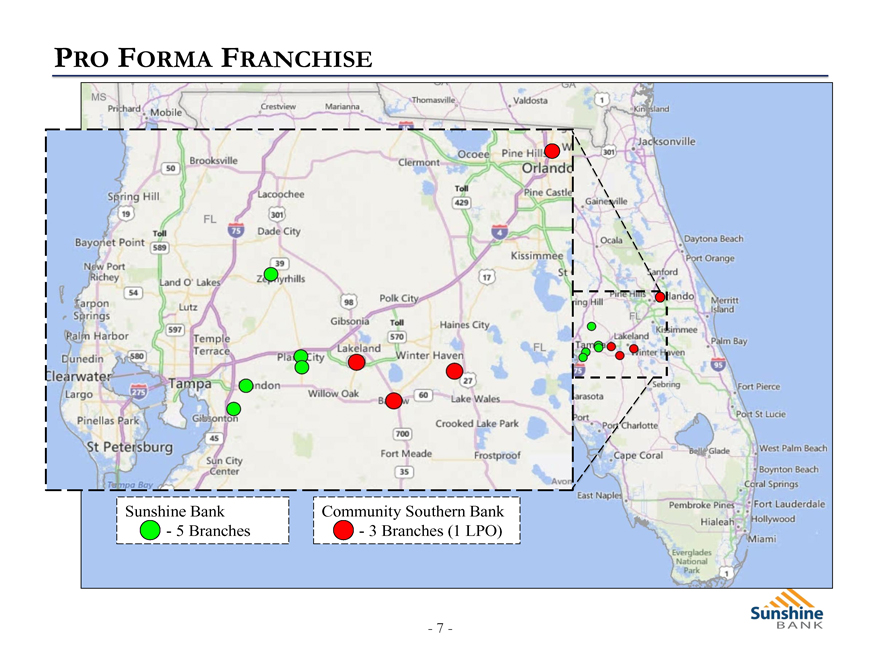

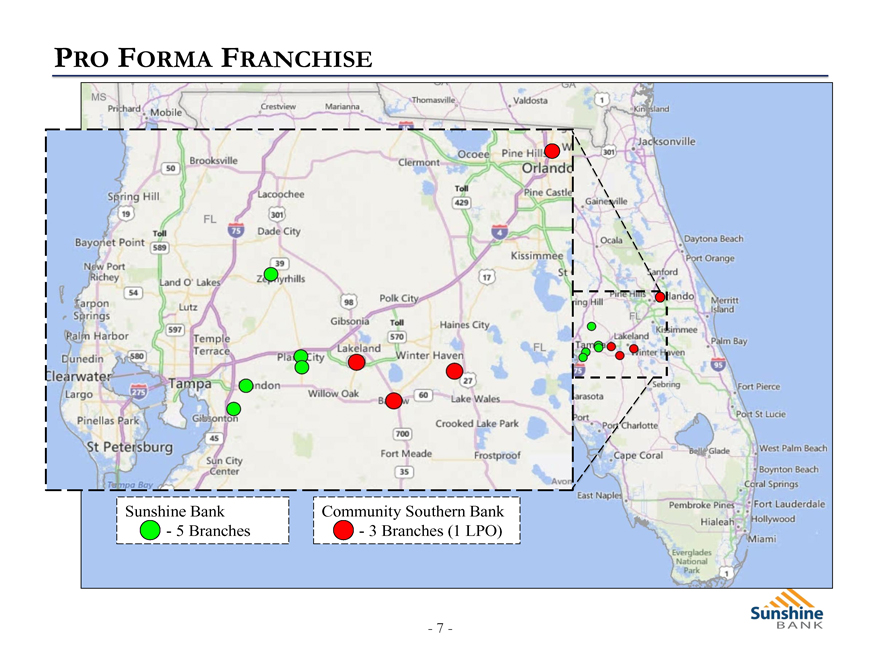

PRO FORMA FRANCHISE

Sunshine Bank Community Southern Bank

- 5 Branches - 3 Branches (1 LPO)

Sunshine Bank

- 7 -

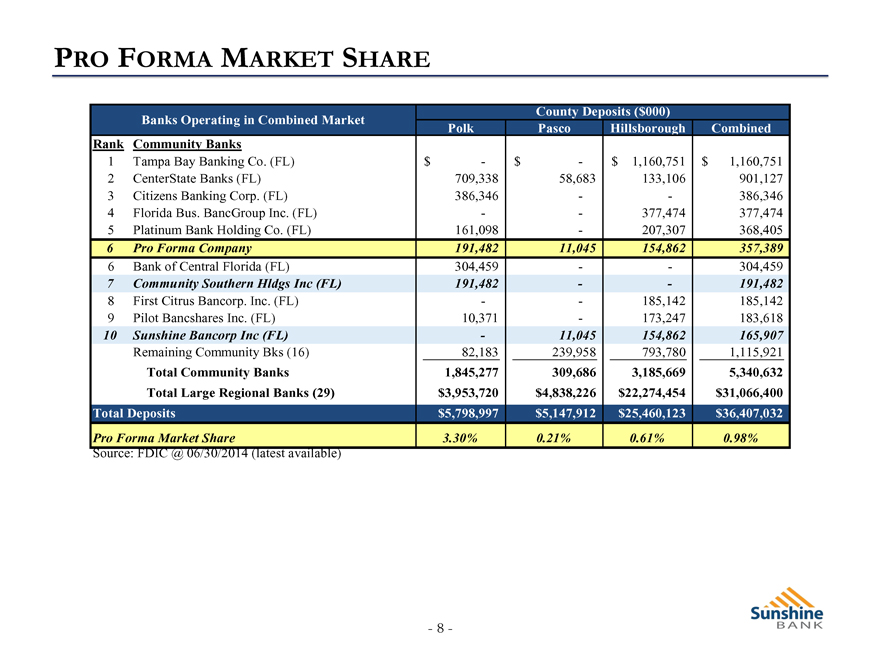

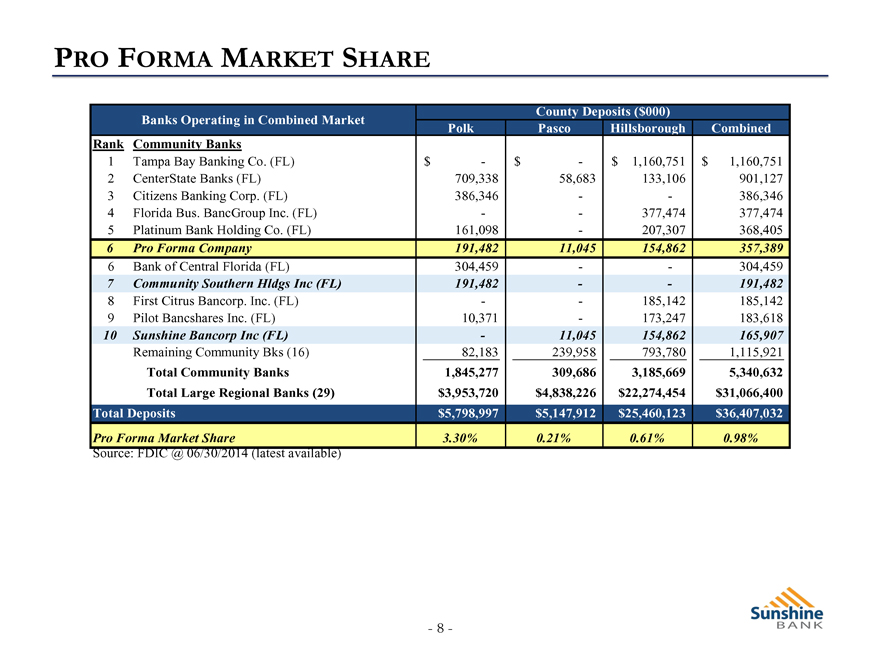

PRO FORMA MARKET SHARE

County Deposits ($000)

Banks Operating in Combined Market Polk Pasco Hillsborough Combined

Rank Community Banks

1 Tampa Bay Banking Co. (FL) $- $- $1,160,751 $1,160,751

2 CenterState Banks (FL) 709,338 58,683 133,106 901,127

3 Citizens Banking Corp. (FL) 386,346 - - 386,346

4 Florida Bus. BancGroup Inc. (FL) - - 377,474 377,474

5 Platinum Bank Holding Co. (FL) 161,098 - 207,307 368,405

6 Pro Forma Company 191,482 11,045 154,862 357,389

6 Bank of Central Florida (FL) 304,459 - - 304,459

7 Community Southern Hldgs Inc (FL) 191,482 - - 191,482

8 First Citrus Bancorp. Inc. (FL) - - 185,142 185,142

9 Pilot Bancshares Inc. (FL) 10,371 - 173,247 183,618

10 Sunshine Bancorp Inc (FL) - 11,045 154,862 165,907

Remaining Community Bks (16) 82,183 239,958 793,780 1,115,921

Total Community Banks 1,845,277 309,686 3,185,669 5,340,632

Total Large Regional Banks (29) $3,953,720 $4,838,226 $22,274,454 $31,066,400

Total Deposits $5,798,997 $5,147,912 $25,460,123 $36,407,032

Pro Forma Market Share 3.30% 0.21% 0.61% 0.98%

Source: FDIC @ 06/30/2014 (latest available)

- 8 -

Sunshine Bank

Additional Information

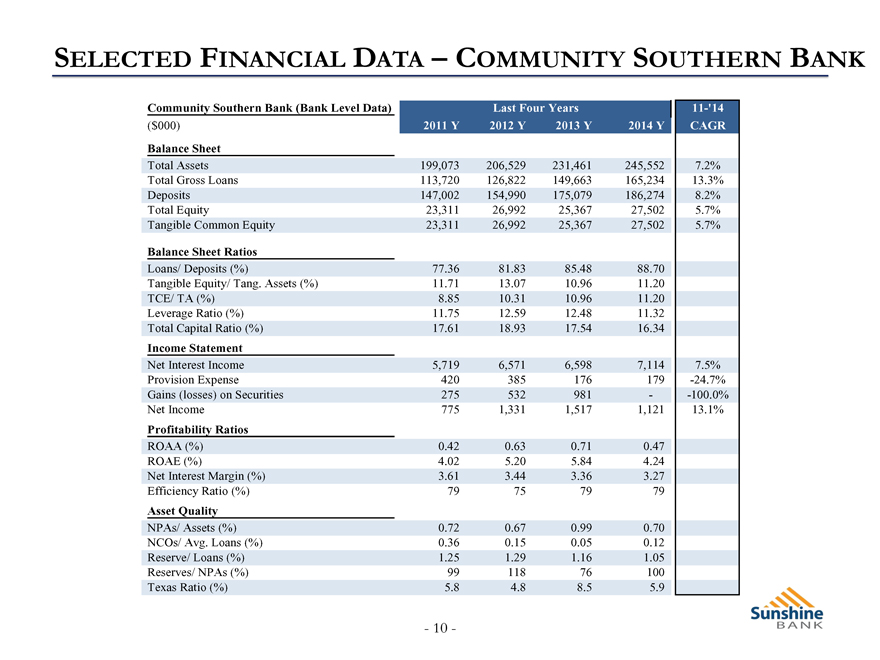

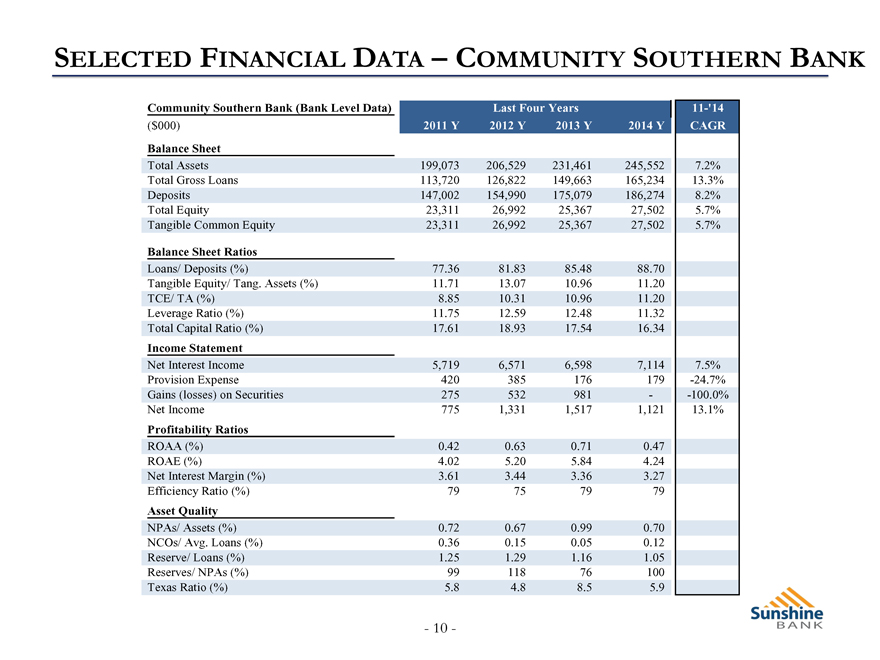

SELECTED FINANCIAL DATA – COMMUNITY SOUTHERN BANK

Community Southern Bank (Bank Level Data) Last Four Years 11-‘14

($000) 2011 Y 2012 Y 2013 Y 2014 Y CAGR

Balance Sheet

Total Assets 199,073 206,529 231,461 245,552 7.2%

Total Gross Loans 113,720 126,822 149,663 165,234 13.3%

Deposits 147,002 154,990 175,079 186,274 8.2%

Total Equity 23,311 26,992 25,367 27,502 5.7%

Tangible Common Equity 23,311 26,992 25,367 27,502 5.7%

Balance Sheet Ratios

Loans/ Deposits (%) 77.36 81.83 85.48 88.70

Tangible Equity/ Tang. Assets (%) 11.71 13.07 10.96 11.20

TCE/ TA (%) 8.85 10.31 10.96 11.20

Leverage Ratio (%) 11.75 12.59 12.48 11.32

Total Capital Ratio (%) 17.61 18.93 17.54 16.34

Income Statement

Net Interest Income 5,719 6,571 6,598 7,114 7.5%

Provision Expense 420 385 176 179 -24.7%

Gains (losses) on Securities 275 532 981 - -100.0%

Net Income 775 1,331 1,517 1,121 13.1%

Profitability Ratios

ROAA (%) 0.42 0.63 0.71 0.47

ROAE (%) 4.02 5.20 5.84 4.24

Net Interest Margin (%) 3.61 3.44 3.36 3.27

Efficiency Ratio (%) 79 75 79 79

Asset Quality

NPAs/ Assets (%) 0.72 0.67 0.99 0.70

NCOs/ Avg. Loans (%) 0.36 0.15 0.05 0.12

Reserve/ Loans (%) 1.25 1.29 1.16 1.05

Reserves/ NPAs (%) 99 118 76 100

Texas Ratio (%) 5.8 4.8 8.5 5.9

- 10 -

Sunshine Bank