UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | |

| ¨ | | Preliminary Proxy Statement |

| |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| x | | Definitive Proxy Statement |

| |

| ¨ | | Definitive Additional Materials |

| |

| ¨ | | Soliciting Material under §240.14a-12 |

SUNSHINE BANCORP, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | |

| |

| x | | No fee required. |

| |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | (5) | | Total fee paid: |

| |

| ¨ | | Fee paid previously with preliminary materials. |

| |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | (3) | | Filing Party: |

| | (4) | | Date Filed: |

Sunshine Bancorp, Inc.

102 West Baker Street

Plant City, Florida 33563

(813) 752-6193

March 24, 2016

Dear Stockholder:

We cordially invite you to attend the Annual Meeting of Stockholders of Sunshine Bancorp, Inc. The Annual Meeting will be held at Sunshine Bank, 102 West Baker Street, Plant City, Florida at 8:30 a.m., local time, on April 27, 2016.

The enclosed Notice of Annual Meeting and Proxy Statement describe the formal business to be transacted. During the Annual Meeting we will also report on our operations. Certain of our directors and officers will be present to respond to any questions that stockholders may have. Also enclosed for your review is our Annual Report to Stockholders, which contains detailed information concerning our activities and operating performance.

The Annual Meeting is being held so that stockholders may be given the opportunity to elect directors and ratify the appointment of Hacker, Johnson & Smith PA, as the independent registered public accounting firm for the year ending December 31, 2016. For the reasons set forth in the Proxy Statement, the Board of Directors has determined that the matters to be considered at the Annual Meeting are in the best interests of our stockholders, and the Board of Directors unanimously recommends a vote “FOR” each matter to be considered.

It is important that your shares be represented at the Annual Meeting, whether or not you plan to attend personally. Please take a moment now to cast your vote via the Internet or by telephone as described on the enclosed proxy card, or alternatively, complete, sign, date and return the proxy card in the postage-paid envelope provided so that your shares will be represented at the Annual Meeting. You may revoke your proxy at any time prior to its exercise, and you may attend the Annual Meeting and vote in person, even if you have previously voted. However, if you are a stockholder whose shares are not registered in your own name, you will need additional documentation from your record holder in order to vote personally at the Annual Meeting.

We thank you for your prompt attention to this matter and appreciate your support.

|

Sincerely, |

|

Andrew S. Samuel |

President and Chief Executive Officer |

Sunshine Bancorp, Inc.

102 West Baker Street

Plant City, Florida 33563

(813) 752-6193

NOTICE OF

ANNUAL MEETING OF STOCKHOLDERS

To Be Held On April 27, 2016

Notice is hereby given that the Annual Meeting of Stockholders of Sunshine Bancorp, Inc. will be held at Sunshine Bank, 102 West Baker Street, Plant City, Florida 33563 on April 27, 2016, at 8:30 a.m., local time.

A Proxy Statement for the Annual Meeting is enclosed. The Annual Meeting is for the purpose of considering and acting upon:

| | 1. | the election of five directors; |

| | 2. | the ratification of the appointment of Hacker, Johnson & Smith PA as our independent registered public accounting firm for the year ending December 31, 2016; and |

such other matters as mayproperly come before the Annual Meeting, or any adjournments thereof. The Board of Directors is not aware of any other business to come before the Annual Meeting.

Any action may be taken on the foregoing proposals at the Annual Meeting on the date specified above, or on the date or dates to which the Annual Meeting may be adjourned. Stockholders of record at the close of business on March 15, 2016 are the stockholders entitled to vote at the Annual Meeting, and any adjournments thereof.

EACH STOCKHOLDER, WHETHER HE OR SHE PLANS TO ATTEND THE ANNUAL MEETING, IS REQUESTED TO VOTE THEIR PROXY WITHOUT DELAY. ANY PROXY GIVEN BY THE STOCKHOLDER MAY BE REVOKED AT ANY TIME BEFORE IT IS VOTED. A PROXY MAY BE REVOKED BY FILING WITH THE SECRETARY OF SUNSHINE BANCORP, INC. A WRITTEN REVOCATION OR VOTING BY PROXY BEARING A LATER DATE. ANY STOCKHOLDER PRESENT AT THE ANNUAL MEETING MAY REVOKE HIS OR HER PROXY AND VOTE PERSONALLY ON EACH MATTER BROUGHT BEFORE THE ANNUAL MEETING. HOWEVER, IF YOU ARE A STOCKHOLDER WHOSE SHARES ARE NOT REGISTERED IN YOUR OWN NAME, YOU WILL NEED ADDITIONAL DOCUMENTATION FROM YOUR RECORD HOLDER IN ORDER TO VOTE IN PERSON AT THE ANNUAL MEETING.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING

The Notice, Proxy Statement and Annual Report on Form 10-K are available at www.envisionreports.com/SBCP for the Annual Meeting.

|

| By Order of the Board of Directors |

|

| Falene Ellis |

| Secretary |

Plant City, Florida

March 24, 2016

PROXY STATEMENT

Sunshine Bancorp, Inc.

102 West Baker Street

Plant City, Florida 33563

(813) 752-6193

ANNUAL MEETING OF STOCKHOLDERS

April 27, 2016

This Proxy Statement is furnished in connection with the solicitation of proxies on behalf of the Board of Directors of Sunshine Bancorp, Inc. to be used at the Annual Meeting of Stockholders, which will be held at Sunshine Bank, located at 102 West Baker Street, Plant City, Florida 33563 on April 27, 2016, at 8:30 a.m., local time, and all adjournments of the Annual Meeting.The accompanying Notice of Annual Meeting of Stockholders and this Proxy Statement are first being mailed to stockholders on or about March 24, 2016.

REVOCATION OF PROXIES

Stockholders who execute proxies in the form solicited hereby retain the right to revoke them in the manner described below. Unless so revoked, the shares represented by such proxies will be voted at the Annual Meeting and all adjournments thereof. Proxies solicited on behalf of the Board of Directors of Sunshine Bancorp, Inc. will be voted in accordance with the directions given thereon.Where no instructions are indicated, validly executed proxies will be voted “FOR” the proposals set forth in this Proxy Statement for consideration at the Annual Meeting.

Proxies may be revoked by sending written notice of revocation to the Secretary of Sunshine Bancorp, Inc. at 102 West Baker Street, Plant City, Florida, 33563, delivering alater-dated proxy or by attending the Annual Meeting and voting in person. The presence at the Annual Meeting of any stockholder who had returned a proxy shall not revoke such proxy unless the stockholder delivers his or her ballot in person at the Annual Meeting or delivers a written revocation to the Secretary of Sunshine Bancorp, Inc. prior to the voting of such proxy. If you are a stockholder whose shares are not registered in your name, you will need appropriate documentation from your record holder to vote in person at the Annual Meeting.

VOTING SECURITIES AND PRINCIPAL HOLDERS

Except as otherwise noted below, holders of record of Sunshine Bancorp, Inc.’s shares of common stock, par value $0.01 per share, as of the close of business on March 15, 2016 are entitled to one vote for each share then held. As of March 15, 2016, there were 5,265,950 shares of common stock issued and outstanding.

Principal Holders

Persons and groups who beneficially own in excess of 5% of the shares of our common stock are required to file certain reports with the Securities and Exchange Commission regarding such ownership. The following table sets forth, as of March 15, 2016, the shares of common stock beneficially owned by our directors and executive officers, individually and as a group, and by each person who was known to us as the beneficial owner of more than 5% of the outstanding shares of common stock. No director, nominee for director or executive officer has pledged shares of our common stock as collateral for a loan. The mailing address for each of our directors and executive officers and the Sunshine Bank Employee Stock Ownership Plan is 102 West Baker Street, Plant City, Florida 33563.

| | | | | | | | |

Name and Address of Beneficial Owners | | Amount of Shares

Owned and Nature

of Beneficial

Ownership(1) | | | Percent of

Shares

of Common

Stock

Outstanding | |

| | |

Five Percent Stockholders | | | | | | | | |

| | |

EJF Capital LLC Emanuel J. Friedman EJF Sidecar Fund, Series LLC – Series E 2107 Wilson Boulevard, Suite 410, Arlington, VA 22201 | | | 360,489 | (2) | | | 6.9 | % |

| | |

Sunshine Bank Employee Stock Ownership Plan Trust | | | 338,548 | (3) | | | 6.4 | % |

| | |

Directors, Executive Officers and Named Executive Officers | | | | | | | | |

| | |

Ray H. Rollyson, Chairman of the Board | | | 25,860 | (4) | | | | * |

Andrew S. Samuel, President and Chief Executive Officer | | | 71,796 | (5) | | | 1.4 | % |

Kenneth H. Compton, Director | | | 13,360 | (6) | | | | * |

James Coleman Davis, Director | | | 8,860 | (7) | | | | * |

J. Floyd Hall, Director | | | 26,811 | (8) | | | | * |

Winfred M. Harrell, Director | | | 20,860 | (9) | | | | * |

W.D. McGinnes, Jr., Director | | | 35,860 | (10) | | | | * |

D. William Morrow, Director | | | 35,860 | (11) | | | | * |

Joe E. Newsome, Director | | | 9,860 | (12) | | | | * |

George Parmer, Director | | | 49,650 | (13) | | | | * |

William E. Pommerening, Director | | | 25,860 | (14) | | | | * |

Marion M. Smith, Director | | | 25,860 | (15) | | | | * |

Will Weatherford, Director | | | 8,870 | (16) | | | | * |

Brent S. Smith, SVP-Corporate Development | | | 14,092 | (17) | | | | * |

Jane Tompkins, Executive Vice President and Chief Risk Officer | | | 11,072 | (18) | | | | * |

John D. Finley, Executive Vice President and Chief Financial Officer | | | 3,841 | (19) | | | | * |

Janak M. Amin, Executive Vice President of Sales and Marketing | | | 46,629 | (20) | | | | * |

All directors and current executive officers as a group (16 persons) | | | 420,909 | (21) | | | 7.9 | % |

| (1) | In accordance with Rule 13d-3 under the Securities Exchange Act of 1934, a person is deemed to be the beneficial owner for purposes of this table, of any shares of common stock if he or she has shared voting or investment power with respect to such security, or has a right to acquire beneficial ownership at any time within 60 days from the date as of which beneficial ownership is being determined. As used herein, “voting power” is the power to vote or direct the voting of shares and “investment power” is the power to dispose or direct the disposition of shares, and includes all shares held directly as well as by spouses and minor children, in trust and other indirect ownership, over which shares the named individuals effectively exercise sole or shared voting or investment power. |

| (2) | On a Schedule 13G filed with the Securities and Exchange Commission on February 19, 2016, EJF Capital LLC, Emanuel J. Friedman and EJF Sidecar Fund, Series LLC – Series E reported shared dispositive and voting power with respect to 360,489 shares of our common stock. |

| (3) | On a Schedule 13G/A filed with the Securities and Exchange Commission on February 8, 2016, Pentegra Services, Inc. reported sole voting power with respect to 315,990 shares, shared voting power with respect to 22,558 shares and sole dispositive power with respect to 338,548 shares of our common stock. |

| (4) | Includes 3,124 unvested shares of restricted stock and 1,953 shares that can be acquired pursuant to stock options within 60 days of March 15, 2016. |

| (5) | Includes 631 shares held in the ESOP, 33,856 unvested shares of restricted stock and 21,160 shares that can be acquired pursuant to stock options within 60 days of March 15, 2016. |

| (6) | Includes 3,124 unvested shares of restricted stock and 1,953 shares that can be acquired pursuant to stock options within 60 days of March 15, 2016. |

| (7) | Includes 3,124 unvested shares of restricted stock and 1,953 shares that can be acquired pursuant to stock options within 60 days of March 15, 2016. |

2

| (8) | Includes 20,000 shares held in the Sunshine State Federal Savings Employees Savings Plan for the benefit of Mr. Hall, 951 shares held in the ESOP, 3,124 unvested shares of restricted stock and 1,953 shares that can be acquired pursuant to stock options within 60 days of March 15, 2016. |

| (9) | Includes 3,124 unvested shares of restricted stock and 1,953 shares that can be acquired pursuant to stock options within 60 days of March 15, 2016. |

| (10) | Includes 20,000 shares held in a trust for the benefit of Mr. McGinnes, 10,000 shares held in a trust for the benefit of Mr. McGinnes’ spouse, 3,124 unvested shares of restricted stock and 1,953 shares that can be acquired pursuant to stock options within 60 days of March 15, 2016. |

| (11) | Includes 10,000 shares held by Mr. Morrow’s spouse, 3,124 unvested shares of restricted stock and 1,953 shares that can be acquired pursuant to stock options within 60 days of March 15, 2016. |

| (12) | Includes 3,124 unvested shares of restricted stock and 1,953 shares that can be acquired pursuant to stock options within 60 days of March 15, 2016. |

| (13) | Includes 2,200 shares held by an affiliated company, 3,124 unvested shares of restricted stock and 1,953 shares that can be acquired pursuant to stock options within 60 days of March 15, 2016. |

| (14) | Includes 7,500 shares held in Mr. Pommerening’s SEP-IRA account, 3,124 unvested shares of restricted stock and 1,953 shares that can be acquired pursuant to stock options within 60 days of March 15, 2016. |

| (15) | Includes 20,000 shares held in a trust for the benefit of Ms. Smith, 3,124 unvested shares of restricted stock and 1,953 shares that can be acquired pursuant to stock options within 60 days of March 15, 2016. |

| (16) | Includes 1,260 shares held in Mr. Weatherford’s IRA account, 1,750 shares held in a retirement account, 3,124 unvested shares of restricted stock and 1,953 shares that can be acquired pursuant to stock options within 60 days of March 15, 2016. |

| (17) | Includes 393 shares held in the ESOP, 8,000 unvested shares of restricted stock and 12,000 shares that can be acquired pursuant to stock options within 60 days of March 15, 2016. |

| (18) | Includes 443 shares held in the ESOP, 2,000 shares held in Ms. Tompkins’ IRA account, 5,600 unvested shares of restricted stock and 2,000 shares that can be acquired pursuant to stock options within 60 days of March 15, 2016. |

| (19) | Includes 2,400 unvested shares of restricted stock and 1,000 shares that can be acquired pursuant to stock options within 60 days of March 15, 2016. |

| (20) | 5,600 unvested shares of restricted stock and 2,000 shares that can be acquired pursuant to stock options within 60 days of March 15, 2016. |

| (21) | Reflects ownership of Executive Officers as of January 1, 2016, which includes Andrew S. Samuel, John D. Finley, Jane Tompkins and Janak M. Amin. |

Quorum

The presence in person or by proxy of a majority of the outstanding shares of common stock entitled to vote is necessary to constitute a quorum at the Annual Meeting. Abstentions and broker non-votes will be counted for purposes of determining that a quorum is present.

Limitations on Voting

In accordance with the provisions of our Articles of Incorporation, record holders of common stock who beneficially own in excess of 10% of the outstanding shares of our common stock (the “Limit”) are not entitled to any vote with respect to the shares held in excess of the Limit. Our Articles of Incorporation authorize the Board of Directors (i) to make all determinations necessary to implement and apply the Limit, including determining whether persons or entities are acting in concert, and (ii) to demand that any person who is reasonably believed to beneficially own stock in excess of the Limit supply information to us to enable the Board of Directors to implement and apply the Limit.

Method of Counting Votes

As to the election of directors, a stockholder may vote FOR each nominee proposed by the Board or WITHHOLD authority to vote for each nominee being proposed. Directors are elected by a plurality of votes cast, without regard to either broker non-votes or proxies as to which the authority to vote for the nominees being proposed is withheld. Plurality means that individuals who receive the highest number of votes cast are elected, up to the maximum number of directors to be elected at the Annual Meeting.

As to the ratification of the appointment of Hacker, Johnson & Smith PA as our independent registered public accounting firm, a stockholder may: (i) vote FOR the ratification; (ii) vote AGAINST the ratification; or (iii) ABSTAIN from voting on such ratification. The affirmative vote of a majority of the votes cast on the matter at the Annual Meeting is required for the ratification of Hacker, Johnson & Smith PA as the independent registered public accounting firm for the year ending December 31, 2016. Shares as to which “ABSTAIN” has been selected will have no effect on the outcome of the vote.

3

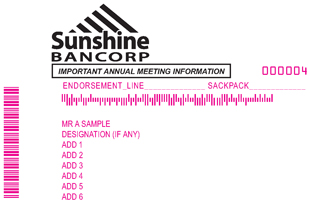

Participants in the ESOP and 401(k) Plan

Participants in the Sunshine Bank Employee Stock Ownership Plan (the “ESOP”) will each receive a Vote Instruction Form that reflects all of the shares that the participant may direct the trustees to vote on his or her behalf under the plan. Under the terms of the ESOP, the ESOP trustee votes all shares held by the ESOP, but each ESOP participant may direct the trustee how to vote the shares of Sunshine Bancorp, Inc. common stock allocated to his or her account. The ESOP trustee will vote all unallocated shares of Sunshine Bancorp, Inc. common stock held by the ESOP and allocated shares for which no voting instructions are received in the same proportion as shares for which it has received timely voting instructions. In addition, participants in the Sunshine Bank Employees Savings Plan (“401(k) Plan”) with an interest in the Sunshine Bancorp, Inc. Stock Fund (“Stock Fund”) will receive a Vote Instruction Form that allows them to direct the 401(k) Plan trustee to vote their interest in the Stock Fund. If a participant does not direct the 401(k) Plan trustee as to how to vote his or her interest in the Stock Fund, the trustee will vote such interest in the same proportion as it has received voting instructions from other 401(k) Plan participants.The deadline for returning your ESOP Vote Instruction Form and/or 401(k) Vote Instruction Form is Friday, April 22, 2016 at 5:00 p.m. local time.

PROPOSAL I—ELECTION OF DIRECTORS

Our Board of Directors is comprised of thirteen members. Our Bylaws provide that directors are divided into three classes, with one class of directors elected annually. Our directors are generally elected to serve for a three-year period and until their respective successors shall have been elected and shall qualify. Five directors will be elected at the Annual Meeting to serve for a three-year period and until their respective successors shall have been elected and shall qualify. The Nominating and Corporate Governance Committee of the Board of Directors has nominated the following persons to serve as directors for three-year terms: Kenneth H. Compton, J. Floyd Hall, William E. Pommerening, Ray H. Rollyson, Jr. and Marion M. Smith. All five nominees are currently directors of Sunshine Bancorp, Inc. and Sunshine Bank. The Board of Directors recommends a vote “FOR” the election of the nominees.

4

The table below sets forth certain information regarding the nominees, the other current members of our Board of Directors, and executive officers who are not directors, including the terms of office of board members. It is intended that the proxies solicited on behalf of the Board of Directors (other than proxies in which the vote is withheld as to any nominee) will be voted at the Annual Meeting for the election of the proposed nominees. If a nominee is unable to serve, the shares represented by all such proxies will be voted for the election of such substitute as the Board of Directors may determine. At this time, the Board of Directors knows of no reason why any of the nominees might be unable to serve, if elected.

| | | | | | | | |

Name | | Position(s) Held With

Sunshine Bancorp, Inc. | | Age(1) | | Director

Since(2) | | Current

Term

Expires |

| NOMINEES |

| | | | |

Kenneth H. Compton | | Director | | 47 | | 2015 | | 2016 |

J. Floyd Hall | | Director | | 68 | | 1984 | | 2016 |

William E. Pommerening | | Director | | 57 | | 2014 | | 2016 |

Ray H. Rollyson, Jr. | | Chairman of the Board | | 71 | | 1992 | | 2016 |

Marion M. Smith | | Director | | 58 | | 1995 | | 2016 |

|

| CONTINUING DIRECTORS |

| | | | |

J. Coleman Davis | | Director | | 73 | | 2010 | | 2017 |

W.D. McGinnes, Jr. | | Director | | 68 | | 1999 | | 2017 |

George Parmer | | Director | | 76 | | 2014 | | 2017 |

Andrew S. Samuel | | President, CEO and Director | | 53 | | 2014 | | 2017 |

Winfred M. Harrell | | Director | | 75 | | 2009 | | 2018 |

D. William Morrow | | Director | | 62 | | 2012 | | 2018 |

Joe E. Newsome | | Director | | 74 | | 1993 | | 2018 |

Will Weatherford | | Director | | 36 | | 2015 | | 2018 |

|

| EXECUTIVE OFFICERS WHO ARE NOT DIRECTORS |

| | | | |

Janak M. Amin | | Executive Vice President of Sales and Marketing | | 51 | | N/A | | N/A |

John D. Finley | | Executive Vice President and Chief Financial Officer | | 56 | | N/A | | N/A |

Jane Tompkins | | Executive Vice President and Chief Risk Officer | | 63 | | N/A | | N/A |

Brent Smith(3) | | Senior Vice President, Corporate Development | | 33 | | N/A | | N/A |

| (1) | As of December 31, 2015. |

| (2) | Includes service with Sunshine Bank and Sunshine Bancorp, Inc. |

| (3) | Mr. Smith was an executive officer only in 2015. |

The biographies of each of the nominees, continuing board members and executive officers are set forth below. With respect to directors and nominees, the biographies also contain information regarding the person’s business experience and the experiences, qualifications, attributes or skills that caused the Nominating and Corporate Governance Committee to determine that the person should serve as a director. Each director of Sunshine Bancorp, Inc. is also a director of Sunshine Bank, and if elected each nominee will be appointed as a director of Sunshine Bank.

Nominees and Continuing Directors

Kenneth H. Comptonis the founder and managing partner of Compton & Associates, a private wealth consulting firm since 1998. On June 30, 2015, in connection with the completion of the acquisition of Community Southern Holdings, Inc. by Sunshine Bancorp, Inc., Mr. Compton began his service as a director. His appointment to the Board of Directors was made pursuant to the Agreement and Plan of Merger. Mr. Compton was a director of Community Southern Holdings, Inc. and Community Southern Bank since 2013. Mr. Compton’s financial experience led to his selection as the financial expert on the Audit Committee.

J. Floyd Hall is retired. He was the President and Chief Executive Officer of Sunshine Bank from 1986 until October 2014. Mr. Hall also serves as Treasurer and Director of the Florida Strawberry Festival and Trustee of the South Florida Baptist Hospital. Mr. Hall holds a degree in accounting from the University of Central Florida. Mr. Hall provides the board of directors with 35 years of banking experience in the Florida market.

William E. Pommerening is the chief executive officer and managing director of RP Financial, LC. He has provided consulting, valuation, merger and acquisition advisory and planning services to the financial services industry since 1993. In addition to his banking work, Mr. Pommerening is engaged with several smaller technology oriented companies as investor and director. Mr. Pommerening’s vast experience with the financial services industry led to his nomination to the board.

5

Ray H. Rollyson, Jr.is an advisor and insurance agent with V&R Insurance, Inc. Mr. Rollyson’s experience in the insurance industry provides the board of directors with knowledge of the local business community. Mr. Rollyson is also actively involved in the Sunshine Bank community and has been associated with the Florida Strawberry Festival for many years. Mr. Rollyson became Chairman of the Board in 2007.

Marion M. Smith has been President of the Greater Plant City Chamber of Commerce since 2001. Previously, Ms. Smith was a partner and managed an automotive sales company in Sunshine Bank’s market area for approximately19 years. Ms. Smith’s experience working with the Chamber of Commerce provides the board of directors with insights into issues facing local businesses.

J. Coleman Davisis retired. For more than 40 years, Mr. Davis operated several retail furniture, appliance and electronics stores that financed the majority of customer purchases in-house. In the last 18 years before his retirement, he owned and operated up to four stores. As a result, Mr. Davis has extensive experience in lending, credit approval, and collections, which provides a valuable resource to the board of directors. Mr. Davis is a Trustee of the South Florida Baptist Hospital, a member of the board of the South Florida Baptist Hospital Foundation, a member of the Plant City Lions Club, and a member of the Plant City Chamber of Commerce.

W.D. McGinnes, Jr. is retired. For more than 35 years, Mr. McGinnes worked in the building material supply industry, serving as President of his family-owned corporation which he sold in 2000. Mr. McGinnes’ business background brings financial and local market knowledge to the board of directors. Mr. McGinnes serves as a Deacon of the First Baptist Church of Plant City, Chairman of the Board of Trustees of the South Florida Baptist Hospital, member of the board of directors of the South Florida Baptist Hospital Foundation and member of the board of directors of the Florida Strawberry Festival.

George Parmer is the founder, president and CEO of Fine Line Homes, a family-owned company that started building homes in 1972. He is also the president and CEO of Residential Warranty Corporation, a leading provider of insured new home warranties to the building industry. In addition to his business venues, Mr. Parmer was a licensed public accountant, a member of the National Association of Accountants, and is currently a member of the National Association of Home Builders. Mr. Parmer provides the board of directors with an in depth knowledge of real estate and finance.

Andrew S. Samuel has been the President and Chief Executive Officer of Sunshine Bancorp, Inc. and Sunshine Bank since October 2014. He served as a Director and President of Susquehanna Bancshares, Inc. and President and Chief Executive Officer and Chairman of the Board of Susquehanna Bank, from February 2012 to October 2014. Prior to joining Susquehanna and, beginning in 2005, Mr. Samuel served as Chairman, Chief Executive Officer and President of Tower Bancorp, Inc. and Graystone Financial Corp. Mr. Samuel has served in various executive and other positions at other financial institutions dating back to 1984, including Waypoint Financial Corp., Sovereign Bank, Fulton Bank, and Commonwealth National Banks/Mellon. Mr. Samuel’s leadership experience and vast knowledge of the banking industry led to his appointment to the board.

Winfred Harrell is the owner and president of Harrell’s Nursery, Inc. and Harrell’s Liner Farm, Inc. and has operated these companies for more than 50 years. Mr. Harrell’s experience managing a local business provides the board of directors with insight into economic and business trends in Sunshine Bank’s market area and led to his nomination to the board. Mr. Harrell also serves as a Trustee of South Florida Baptist Hospital.

D. William Morrow is President and Chief Executive Officer of Morrow Steel, a position he has held since 1995. Mr. Morrow has more than 40 years of experience in the construction industry and currently serves as a Trustee for Tampa Iron Workers Pension and Annuity Fund. Mr. Morrow also serves both as a Regional and National Trustee for IMPACT, an iron worker international labor and management organization. Mr. Morrow’s experience in the steel industry provides the board of directors with business and financial expertise that led to his nomination to the board. Mr. Morrow also serves as a Deacon of the First Baptist Church of Plant City and is a member of the board of directors of the South Florida Baptist Hospital Foundation.

Joe E. Newsome is retired. Mr. Newsome was a local pharmacist and store owner. He served on the Hillsborough County School Board for 25 years. He currently serves as a Trustee of the South Florida Baptist Hospital, a Director of the Florida Strawberry Festival, and a Deacon of the First Baptist Church of Plant City. Mr. Newsome’s long standing ties to the local community provide the board of directors with valuable insight on Sunshine Bank’s local market area which led to his selection to the board.

6

Will Weatherford was the Speaker of the Florida House of Representatives, serving from 2012-2014. In addition to his public service, he is the Managing Partner of Weatherford Partners, a firm with deep roots in Florida and a strong global network that partners with owners and management teams to build businesses through the provision of capital and strategic business advisory services. Mr. Weatherford spent six years as a board director at Florida Traditions Bank, prior to its sale to Home BancShares in July 2014. He is also Managing Partner of Red Eagle Group, a boutique investment and business consulting firm. Mr. Weatherford’s extensive experience in finance, politics and his previous experience as a bank director led to his selection to the board.

Executive Officers Who Are Not Directors

Janak M. Aminhas been the Executive Vice President of Sales and Marketing since January 2016 after serving as a consultant to Sunshine Bank in 2015. Mr. Amin previously held the position of Market CEO for the Pennsylvania region for Susquehanna Bank from 2012 to 2014. Mr. Amin has also served in various executive positions at other financial institutions since 1997 including Tower Bancorp, Graystone Tower Bank, Graystone Financial, Sovereign Bank and Waypoint Bank. Mr. Amin is a graduate of Liverpool University (U.K.) and obtained his MBA from Penn State. He has held board positions in community organizations such as Holy Spirit Hospital, Leukemia Society and been an active member of YPO.

John D. Finley has been the Executive Vice President and Chief Financial Officer since October 5, 2015. Beginning in 2013 and until he joined Sunshine Bancorp, Inc. and Sunshine Bank, Mr. Finley served as Director of Treasury Strategies at Susquehanna Bancshares, Inc. (recently acquired by The BB&T Corporation), where he was responsible for leading the interest rate and liquidity risk management processes as well as ALCO management for the company. From 2007 to 2012, Mr. Finley was with Graystone Tower Bank and served in the positions of Senior Vice President and Chief Financial Officer and Senior Vice President, Director of Finance. From 2012 to 2013, he was President of Margin Advisors, Inc., which provided consulting services to community banks.

Brent Smithhas been the Senior Vice President, Corporate Development since 2014. He has over 10 years of experience in the financial services industry. Prior to joining Sunshine Bank, he was vice president and director of brokerage services at Susquehanna Bank from 2012 to 2014. He joined Susquehanna after the acquisition of Tower Bancorp, Inc. where he had served as Vice President and Director of Investor Relations from 2009 to 2012.

Jane Tompkins has been the Executive Vice President and Chief Risk Officer since 2014 and has over 40 years of experience in the banking industry. Prior to joining Sunshine Bancorp, Inc., she most recently served as the Risk Management Officer at F&M Trust Company from 2013 to 2014 where she managed all aspects of Enterprise Risk as well as served as the Chairman of the Loan Committee and liaison with internal audit and bank examiners. She was Chief Credit Officer with Graystone Tower Bank from 2007 until 2012 and then Senior Credit Officer with Susquehanna Bank until 2013.

Board Independence

The board of directors has determined that each of our directors, with the exception of President and Chief Executive Officer Andrew Samuel and former President and Chief Executive Officer J. Floyd Hall, is “independent” as defined in the listing standards of the Nasdaq Stock Market. Messrs. Samuel and Hall are not independent because they are or have been an executive officer during the past three years. In determining the independence of the other directors, the board of directors considered loans made to Directors Davis and Smith.

Board Leadership Structure and Risk Oversight

Our Board of Directors is chaired byRay H. Rollyson, Jr., who is a non-executive director. Andrew S. Samuel, our President and Chief Executive Officer, is a member of our Board of Directors. We intend to continue to separate the Chairman and Chief Executive Officer positions. This structure ensures a greater role for the independent directors in the oversight of Sunshine Bancorp, Inc. and Sunshine Bank and active participation of the independent directors in setting agendas and establishing priorities and procedures for the work of the Board.

7

The Board of Directors is actively involved in oversight of risks that could affect Sunshine Bancorp, Inc. This oversight is conducted in part through committees of the Board of Directors, but the full Board of Directors has retained responsibility for general oversight of risks. The Board of Directors satisfies this responsibility through full reports by each committee regarding its considerations and actions, regular reports directly from officers responsible for oversight of particular risks within Sunshine Bancorp, Inc. as well as through internal and external audits. Risks relating to the direct operations of Sunshine Bank are further overseen by the Board of Directors of Sunshine Bank, who are the same individuals who serve on the Board of Directors of Sunshine Bancorp, Inc. The Board of Directors of Sunshine Bank also has additional committees that conduct risk oversight separate from Sunshine Bancorp, Inc. Further, the Board of Directors oversees risks through the establishment of policies and procedures that are designed to guide daily operations in a manner consistent with applicable laws, regulations and risks acceptable to the organization.

A risk management committee of Sunshine Bancorp, Inc. was formed in 2015 comprised of members of the board of directors. As defined by its charter, the risk management committee’s purpose is to, on an enterprise level, identify, monitor, assess, measure, and mitigate risk of Sunshine Bancorp, Inc. The risk committee reviews all business units to ensure policies, procedures, and systems are in place to provide reasonable assurance that Sunshine Bank’s risks are being properly evaluated and mitigated where possible.

References to our Website Address

References to our website address throughout this proxy statement and the accompanying materials are for informational purposes only, or to fulfill specific disclosure requirements of the Securities and Exchange Commission’s rules. These references are not intended to, and do not, incorporate the contents of our website by reference into this proxy statement or the accompanying materials.

Section 16(a) Beneficial Ownership Reporting Compliance

Our executive officers and directors and beneficial owners of greater than 10% of the outstanding shares of common stock are required to file reports with the Securities and Exchange Commission disclosing beneficial ownership and changes in beneficial ownership of our common stock. Securities and Exchange Commission rules require disclosure if an executive officer, director or 10% beneficial owner fails to file these reports on a timely basis. Based on our review of such ownership reports, (i) director Parmer had one late Form 4 reporting four late transactions over two days, (ii) director Weatherford had one late Form 4 reporting two late transactions over one day, (iii) director Carr had one late Form 4 reporting seven late transactions over one day, and (iv) director Compton had one late Form 4 reporting three late transactions over one day. No other executive officer, director or 10% beneficial owner of our shares of common stock failed to file ownership reports for 2015 on a timely basis.

Code of Ethics

Sunshine Bancorp, Inc. has adopted a Code of Ethics that is applicable to its senior financial officers, including the principal executive officer, principal financial officer, principal accounting officer and all officers performing similar functions. We have posted this Code of Ethics on our Internet website at www.mysunshinebank.com. Amendments to and waivers from the Code of Ethics will also be disclosed on Sunshine Bancorp, Inc.’s website.

Attendance at Annual Meetings of Stockholders

Sunshine Bancorp, Inc. does not have a written policy regarding director attendance at Annual Meetings of Stockholders, although directors are expected to attend these meetings absent unavoidable scheduling conflicts. 13 directors attended our 2015 Annual Meeting.

Communications with the Board of Directors

Any stockholder who wishes to contact our Board of Directors or an individual director may do so by writing to: Sunshine Bancorp, Inc., 102 West Baker Street, Plant City, Florida 33563, Attention: Secretary. The letter should indicate that the sender is a stockholder and if shares are not held of record, should include appropriate

8

evidence of stock ownership. Communications are reviewed by the Secretary and are then distributed to the Board of Directors or the individual director, as appropriate, depending on the facts and circumstances outlined in the communications received. The Secretary may attempt to handle an inquiry directly or forward a communication for response by the director or directors to whom it is addressed. The Secretary has the authority not to forward a communication if it is primarily commercial in nature, relates to an improper or irrelevant topic, or is unduly hostile, threatening, illegal or otherwise inappropriate.

Meetings and Committees of the Board of Directors

The business of Sunshine Bancorp, Inc. is conducted at regular and special meetings of the Board of Directors and its committees. In addition, the “independent” members of the Board of Directors (as defined in the listing standards of the NASDAQ Stock Market) meet in executive sessions. The standing committees of the Board of Directors of Sunshine Bancorp, Inc. are the Audit, Risk, Compensation and Nominating and Corporate Governance Committees.

The Board of Directors of Sunshine Bancorp, Inc. had 12 meetings during the year ended December 31, 2015. No member of the Board of Directors of Sunshine Bancorp, Inc. or any committee thereof attended fewer than 75% of the aggregate of: (i) the total number of meetings of the Board of Directors (held during the period for which he or she has been a director); and (ii) the total number of meetings held by all committees on which he or she served (during the periods that he or she served).

Audit Committee. The Audit Committee is comprised of Directors Kenneth H. Compton, W.D. McGinnes, Jr. (Chair), D. William Morrow, Ray H. Rollyson, Jr. and Marion M. Smith, each of whom is “independent” in accordance with applicable SEC rules and Nasdaq listing standards. The Audit Committee also serves as the audit committee of the board of directors of Sunshine Bank. The Board of Directors has determined that Kenneth H. Compton qualifies as an “audit committee financial expert” as defined under applicable SEC rules. In addition, each Audit Committee member has the ability to analyze and evaluate our financial statements as well as an understanding of the Audit Committee’s functions.

Our Board of Directors has adopted a written charter for the Audit Committee, which is available on our Internet website at www.mysunshinebank.com. As more fully described in the Audit Committee Charter, the Audit Committee reviews the financial records and affairs of Sunshine Bancorp, Inc. and monitors adherence in accounting and financial reporting to accounting principles generally accepted in the United States of America. The Audit Committee of Sunshine Bancorp, Inc. met eight times during the year ended December 31, 2015.

Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee is comprised of Directors D. William Morrow (Chair), J. Floyd Hall and George Parmer. Messrs. Morrow and Parmer are each independent in accordance with Nasdaq listing standards. Even though he is no longer employed by us, due to his prior service as our President and Chief Executive Officer until October 2014, Mr. Hall is not considered independent under Nasdaq rules. However, as permitted by Nasdaq Rule 5605(e)(3), the Board of Directors determined that it is in the best interests of Sunshine Bancorp, Inc. and its stockholders for him to serve as a member of the Nominating and Corporate Governance Committee, given his familiarity with the Board and the local community. The Nominating and Corporate Governance Committee also serves as the nominating committee of the board of directors of Sunshine Bank. The Nominating and Corporate Governance Committee operates under a written charter which is available on our Internet website at www.mysunshinebank.com. The Nominating and Corporate Governance Committee of Sunshine Bancorp, Inc. met two times during the year ended December 31, 2015.

The Nominating and Corporate Governance Committee does not have a formal policy or specific guidelines regarding diversity among board members. However, the Nominating and Corporate Governance Committee seeks members who represent a mix of backgrounds that will reflect the diversity of our stockholders, employees, and customers, and experiences that will enhance the quality of the Board of Directors’ deliberations and decisions. As the holding company for a community bank, the Nominating and Corporate Governance Committee also seeks directors who can continue to strengthen Sunshine Bank’s position in its community and can assist Sunshine Bank with business development through business and other community contacts. The Nominating and Corporate Governance Committee considers the following criteria in evaluating and selecting candidates for nomination:

| | • | | eligibility criteria in Sunshine Bancorp, Inc.’s bylaws; |

9

| | • | | the extent to which the candidate would contribute to the range of talent, skill and expertise appropriate for the Board of Directors; |

| | • | | the candidate’s relevant financial, regulatory and business experience and skills, including knowledge of the banking and financial services industries, familiarity with the operations of public companies and the ability to read and understand financial statements; |

| | • | | the candidate’s familiarity with the Sunshine Bancorp, Inc.’s market areas, participation in local business, civic, or charitable organizations, and ties to local businesses; |

| | • | | the candidate’s personal and professional integrity, honesty and reputation; |

| | • | | the candidate’s ability to represent the best interests of Sunshine Bancorp, Inc. and its stockholders, including potential for conflicts of interest with the candidate’s other endeavors; |

| | • | | the candidate’s ability to devote sufficient time and energy to perform his or her duties, including the ability to attend meetings; |

| | • | | whether or not the candidate would be independent under applicable SEC rules and Nasdaq listing standards for purposes of service on the Board of Directors or on any particular committee; and |

| | • | | any other factors that the Nominating Committee deems relevant to a candidate’s nomination, including the extent to which the candidate helps the Board of Directors reflect the diversity of Sunshine Bancorp, Inc.’s stockholders, employees, customers and communities, the current composition and size of the Board of Directors, the balance of management and independent directors. |

The Nominating and Corporate Governance Committee identifies nominees by first evaluating the current members of the Board of Directors willing to continue in service, including the current members’ board and committee attendance and performance, length of board service, experience and contributions, and independence. Current members of the Board of Directors with skills and experience that are relevant to Sunshine Bancorp, Inc.’s business and who are willing to continue in service are considered for re-nomination, balancing the value of continuity of service by existing members of the board with that of obtaining a new perspective. If there is a vacancy on the Board of Directors because any member of the Board of Directors does not wish to continue in service or if the Nominating and Corporate Governance Committee decides not to re-nominate a member for re-election, the Nominating and Corporate Governance Committee would determine the desired skills and experience of a new nominee (including a review of the skills set forth above), may solicit suggestions for director candidates from all board members and may engage in other search activities.

During the year ended December 31, 2015 we did not pay a fee to any third party to identify or evaluate or assist in identifying or evaluating potential nominees for director.

The Nominating and Corporate Governance Committee may consider qualified candidates for director suggested by our stockholders. Stockholders can suggest qualified candidates for director by writing to our Secretary at 102 West Baker Street, Plant City, Florida 33563. In order for the Nominating and Corporate Governance Committee to consider a candidate suggested by a stockholder, the Secretary must receive a submission not less than 180 days prior to the anniversary date of the proxy statement relating to the prior year’s Annual Meeting. The submission must include the following:

| | • | | the name, address and contact information of the candidate, and the number of shares of Sunshine Bancorp, Inc.’s common stock that are owned by the candidate (and appropriate evidence if the candidate is not a holder of record); |

10

| | • | | a statement of the candidate’s business and educational experience; |

| | • | | such other information regarding the candidate as would be required to be included in Sunshine Bancorp, Inc.’s proxy statement pursuant to Securities and Exchange Commission Regulation 14A; |

| | • | | the candidate’s written consent to serve as a director; |

| | • | | a statement that the writer is a stockholder and is proposing a candidate for consideration by the Nominating and Corporate Governance Committee; |

| | • | | a statement detailing any relationship between the candidate and any customer, supplier or competitor of Sunshine Bancorp, Inc.; |

| | • | | the name and address of the stockholder, and the number of shares of Sunshine Bancorp, Inc.’s common stock that are owned by such stockholder (and appropriate evidence if the stockholder is not a holder of record); and |

| | • | | detailed information about any relationship or understanding between the proposing stockholder and the candidate. |

Submissions that are received and that satisfy the above requirements are forwarded to the Nominating and Corporate Governance Committee for further review and consideration, using the same criteria to evaluate the candidate as it uses for evaluating other candidates that it considers.

Compensation Committee. The Compensation Committee is comprised of Directors Joe E. Newsome (Chair), J. Coleman Davis and Winfred M. Harrell, each of whom is independent in accordance with applicable Nasdaq listing standards. No member of the Compensation Committee is a current or former officer or employee of Sunshine Bancorp, Inc. or Sunshine Bank. The Compensation Committee also serves as the compensation committee of the board of directors of Sunshine Bank. The Compensation Committee of Sunshine Bancorp, Inc. met eight times during the year ended December 31, 2015.

The Compensation Committee is responsible for establishing the compensation philosophy, developing compensation guidelines, establishing (or recommending to the entire Board of Directors) the compensation of the Chief Executive Officer and the other senior executive officers. No executive officer who is also a director participates with respect to decisions on his compensation. The Compensation Committee also administers our stock-based incentive plan that was adopted in 2015.

The Compensation Committee operates under a written charter which is available on our Internet website at www.mysunshinebank.com. This charter sets forth the responsibilities of the Compensation Committee and reflects the Compensation Committee’s commitment to create a compensation structure that not only compensates senior management but also aligns the interests of senior management with those of our stockholders.

Our goal is to determine appropriate compensation levels that will enable us to meet the following objectives:

| | • | | to attract, retain and motivate an experienced, competent executive management team; |

| | • | | to reward the executive management team for the enhancement of stockholder value based on our annual performance and the market price of our stock; |

| | • | | to provide compensation rewards that are adequately balanced between short-term and long-term performance goals; |

| | • | | to encourage ownership of our common stock throughstock-based compensation to all levels of management; and |

| | • | | to maintain compensation levels that are competitive with other financial institutions, particularly those in our peer group based on asset size and market area. |

11

The Compensation Committee considers a number of factors in their decisions regarding executive compensation, including, but not limited to, the level of responsibility and performance of the individual executive officers and the overall performance of Sunshine Bancorp, Inc. The Compensation Committee also considers the recommendations of the Chief Executive Officer with respect to the compensation of executive officers other than the Chief Executive Officer.

The base salary levels for our executive officers are set to reflect the duties and levels of responsibilities inherent in the position and to reflect competitive conditions in the banking business in Sunshine Bancorp, Inc.’s market area. Comparative salaries paid by other financial institutions are considered in establishing the salary for our executive officers. In setting the base salaries, the Compensation Committee also considers a number of factors relating to the executive officers, including individual performance, job responsibilities, experience level, ability and the knowledge of the position. These factors are considered subjectively and none of the factors are accorded a specific weight.

The Compensation Committee has sole authority and responsibility under its charter to approve the engagement of any compensation consultant it uses and the fees for those services. However, the Compensation Committee did not engage a compensation consultant to assist in determining the amount or form of executive and director compensation paid during the year ended December 31, 2015.

Audit Committee Report

The Audit Committee has issued a report that states as follows:

| | • | | We have reviewed and discussed with management our audited consolidated financial statements for the year ended December 31, 2015; |

| | • | | We have discussed with the independent registered public accounting firm the matters required to be discussed by Statement on Auditing Standards No. 16, Communications with Audit Committees, as amended, adopted by the Public Company Accounting Oversight Board in Rule 3200T; and |

| | • | | We received the written disclosures and the letter from the independent registered public accounting firm required by applicable requirements of the Public Company Accounting Oversight Board regarding the independent registered public accounting firm’s communications with the audit committee concerning independence, and have discussed with the independent registered public accounting firm their independence from us. |

Based on the review and discussions referred to above, the Audit Committee recommended to the Board of Directors that the audited consolidated financial statements be included in our Annual Report on Form 10-K for the year ended December 31, 2015 for filing with the Securities and Exchange Commission.

This report shall not be deemed incorporated by reference by any general statement incorporating by reference this proxy statement into any filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except to the extent that Sunshine Bancorp, Inc. specifically incorporates this information by reference, and shall not otherwise be deemed filed under such Acts.

This report has been provided by the Audit Committee:

| | |

| | W.D. McGinnes, Jr. (Chair) Kenneth H. Compton D. William Morrow Ray H. Rollyson, Jr. Marion M. Smith |

12

Executive Officer Compensation

Summary Compensation Table. The following table sets forth the total compensation paid to Andrew S. Samuel who served as principal executive officer of Sunshine Bancorp, Inc. during 2015 and the total compensation paid to our two other most highly compensated executive officers who earned total compensation in excess of $100,000 for 2015. Each individual listed in the table below is referred to as a “named executive officer.”

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Name and principal position | | Year | | Salary

($) | | | Bonus

($) | | | Stock

Awards (1)

($) | | | Option

Awards (1)

($) | | | Non-equity

Incentive Plan

Compensation

($) | | | All other

compensation

($)(2) | | | Total

($) | |

Andrew S. Samuel

President and Chief Executive Officer | | 2015

2014 | |

| 366,923

69,231 |

| |

| 3,600

108,000 |

| |

| 590,787

— |

| |

| 321,632

— |

| |

| 180,000

— |

| |

| 223,278

403 |

| |

| 1,686,220

177,634 |

|

| | | | | | | | |

Brent S. Smith

Senior Vice President, Corporate Development | | 2015 | | | 136,791 | | | | — | | | | 139,600 | | | | 45,600 | | | | 44,800 | | | | 8,716 | | | | 375,507 | |

| | | | | | | | |

Jane Tompkins

Executive Vice President and Chief Risk Officer | | 2015 | | | 178,365 | | | | — | | | | 97,720 | | | | 30,400 | | | | 52,500 | | | | 8,546 | | | | 367,531 | |

| (1) | The amounts for the year ended December 31, 2015 represent the grant date fair value of the stock and option awards granted to the named executive officers under the 2015 Equity Incentive Plan. The grant date fair value of the stock and option awards have been computed in accordance with the stock-based compensation accounting rules (FASB ASC Topic 718). Assumptions used in the calculations of these amounts are included in note 20 to our financial statements in our Annual Report on Form 10-K filed with the SEC on March 18, 2016. |

| (2) | The amounts in this column reflect what Sunshine Bank paid for, or reimbursed, the applicable named executive officer for the various benefits and perquisites received in 2015. A breakdown of the various elements of compensation in this column is set forth in the following table: |

| | | | | | | | | | | | | | | | | | | | | | | | |

Name | | Country

Club Dues

($) | | | SERP

Contribution ($) | | | Employer

Contributions to

401(k) Plan

($) | | | ESOP(1)

($) | | | Personal

Use

Company

Car

($) | | | All Other

Compensation

($) | |

| | | | | | |

Andrew S. Samuel | | | 1,200 | | | | 207,403 | | | | 3,808 | | | | 9,592 | | | | 1,275 | | | | 223,278 | |

Brent S. Smith | | | — | | | | — | | | | 2,746 | | | | 5,970 | | | | — | | | | 8,716 | |

Jane Tompkins | | | — | | | | — | | | | 1,817 | | | | 6,729 | | | | — | | | | 8,546 | |

| (1) | Based on Sunshine Bancorp, Inc.’s closing stock price of $15.20 per share on December 31, 2015. |

Amounts included in the “Stock Awards” and “Option Awards” columns of the Summary Compensation Table for the year ended December 31, 2015 represent grants under our 2015 Equity Incentive Plan. Notwithstanding that (1) 80% of these awards vest ratably over a four-year period following the grant date; and (2) the annual financial statement expense that we are required to recognize for these grants will be expensed ratably over the vesting period and will be significantly less than the amounts included in the “Stock Awards” and “Option Awards” columns for the year ended December 31, 2015, the Securities and Exchange Commission rules require that we report the full grant date fair value of restricted stock and stock option awards in the year in which the grants are made. In addition, with respect to the stock options, the actual value, if any, realized by any named executive officers from any stock options will depend on the extent to which the market value of the Sunshine Bancorp, Inc. common stock exceeds the exercise price of the stock option on the date of exercise. Accordingly, there is no assurance that the value realized by a named executive officer will be at or near the value estimated above in the “Option Awards” column.

Short Term Cash Incentive Plan

On January 28, 2015, Sunshine Bank adopted the Sunshine Bank Executive Incentive Plan (the “Incentive Plan”). Each named executive officer was eligible to participate in the plan in 2015. The Incentive Plan is based on overall performance against pre-defined performance factors. These factors may change from year to year and may

13

be based on measures such as return on assets, return on equity, earnings per share or net income and additional strategic objectives appropriate for the plan year. The performance factors and weighing of the factors are determined at the beginning of each plan year. Each factor has quantifiable objectives consisting of threshold, target, and maximum goals. The award opportunities are calculated as a percentage of the participant’s base salary.

Annual goals are determined at the beginning of each plan year and may change from year to year. The goals are established each year by the Compensation Committee, with input from the Chief Executive Officer. The Incentive Plan provides that if a performance factor is satisfied as a result of inappropriate risk, that performance factor will be deemed to not have been met for purposes of quantifying payments under the Incentive Plan. Sunshine Bank’s board of directors also has discretion to reduce incentive payments, on an individual or group basis, by as much as 100% if it is determined that excessive risk has been taken.

For the 2015 plan year, the board of directors established the following performance factors for determining annual incentive awards payable to the named executive officers: (1) core earnings per share; (2) non-performing assets to average assets; and (3) the achievement of pre-established strategic objectives related to the named executive officer’s executive position. The target payout level range (as a percentage of base salary) for the Chief Executive Officer and other named executive officers was 20% to 60% and 10% to 40%, respectively.

Based on the satisfaction of the performance factors noted above, the Compensation Committee authorized the payments to the named executive officers under the Incentive Plan for 2015 plan year as set forth in the “Non-Equity Incentive Plan Compensation” column of the Summary Compensation Table above.

Employment and Change in Control Agreements

Employment Agreement with Andrew S. Samuel. Sunshine Bancorp, Inc. and Sunshine Bank are parties to an employment agreement with Mr. Samuel. Pursuant to the terms and conditions of the agreement, Mr. Samuel is retained for a period of three years to serve as President and Chief Executive Officer of Sunshine Bancorp, Inc. and Sunshine Bank, subject to extension for an additional year on each annual anniversary of the agreement. The agreement provides for Mr. Samuel to receive a base salary and participate in Sunshine Bancorp, Inc.’s benefit plans. He also is entitled to an annual bonus which, in the first year of employment, will be equal to 20% of his annual rate of base salary.

If Mr. Samuel’s employment is terminated by Sunshine Bancorp, Inc. or Sunshine Bank without cause (as defined in the agreement) or by Mr. Samuel for good reason (as defined in the agreement) or by Mr. Samuel within 30 days after a change in control (as defined in the agreement), then Sunshine Bank is required to pay to him a lump sum cash payment equal to three times the sum of: (i) his highest annual base salary during the immediately preceding three calendar years; (ii) the highest cash bonus and other cash incentive compensation earned by him with respect to one of the three calendar years immediately preceding the year of termination; and (iii) the highest value of stock options and other stock based incentives awarded to him with respect to one of the three calendar years immediately preceding the year of termination. In addition, for a period of three years after the date of termination of employment he is permitted to continue participation in Sunshine Bank’s benefit plans. Also, upon termination of employment following a change in control, all stock grants received by Mr. Samuel will immediately become vested in full. If any payments received by Mr. Samuel, together with any other payments to which he is entitled to receive from Sunshine Bancorp, Inc. and Sunshine Bank, result in the imposition of an excise tax under the Sections 280G and 4999 of the Internal Revenue Code, he will be entitled to an additional “excise tax” adjustment payment. In the event of his termination due to disability, the agreement also provides for certain post-termination payments to be made to Mr. Samuel. If his employment is terminated for cause, all rights of Mr. Samuel under the agreement will cease.

The agreement includes confidentiality, non-competition and non-solicitation provisions for any period of time during which Mr. Samuel is receiving salary, benefits or any other compensation under the agreement and for 12 months after the effective date of the termination of his employment. The agreement also indemnifies Mr. Samuel to the fullest extent permitted by Florida Law, with respect to any threatened, pending or contemplated action, suit or proceeding brought against him by reason of the fact that he is or was a director, officer, employee or agent of Sunshine Bancorp, Inc. and Sunshine Bank or is or was serving at the written request of Sunshine Bancorp as a director, officer, employee or agent of another person or entity.

14

Employment Agreement with John D. Finley. On January 27, 2016, Sunshine Bancorp, Inc. and Sunshine Bank entered into an employment agreement with John D. Finley, Chief Financial Officer of Sunshine Bancorp, Inc. and Executive Vice President of Sunshine Bank. The term of the agreement is for two years and renews daily such that the remaining term will be two years, unless otherwise terminated. Mr. Finley is entitled to a base salary of $200,000 and incentive bonuses payable at the discretion of the board. In addition, Mr. Finley is eligible to participate in the employee benefit plans offered by Sunshine Bank, and will be reimbursed for reasonable business expenses incurred.

If Mr. Finley’s employment is terminated by Sunshine Bancorp, Inc. or Sunshine Bank without cause or he voluntarily resigns for “good reason,” he will receive a payment equal to the sum of his annual base salary and most recent bonus received from Sunshine Bank, payable for a period of 12 months following his date of termination. In addition, Sunshine Bank will reimburse Mr. Finley for the cost of continued coverage under Sunshine Bank’s medical insurance plan during his applicable COBRA period, less the amount that he would be required to contribute for such coverage if he was an active employee with Sunshine Bank.

In the event of a change in control of Sunshine Bancorp, Inc. or Sunshine Bank, followed by either Mr. Finley’s: (i) voluntary resignation within 30 days thereafter; or (ii) involuntary termination without cause within two years thereafter, Mr. Finley will receive a lump sum payment equal to two times the sum of his annual base salary and last annual cash bonus earned. In addition, Mr. Finley will receive a lump sum payment equal to the estimated cost of obtaining medical insurance substantially similar to the coverage under Sunshine Bank’s medical insurance plan for a period of 24 months, less the aggregate amount he would be required to contribute for coverage under Sunshine Bank’s medical insurance plan if he was an active employee with Sunshine Bank for 24 months following his date of termination.

Mr. Finley agrees that while employed and for period of 12 months following his termination of employment for any reason, he will be subject to non-competition and non-solicitation covenants.

Change in Control Agreements for Jane Tompkins and Brent Smith.On January 27, 2016, Sunshine Bank entered into change in control agreements with Ms. Tompkins and Mr. Smith. The change in control agreement provides that in the event of a change in control of Sunshine Bancorp, Inc. or Sunshine Bank, followed by either the executive’s: (i) voluntary resignation within 30 days thereafter; or (ii) involuntary termination without cause, the executive will receive a lump sum payment equal to two times the sum of the executive’s annual base salary and last annual cash bonus earned by the executive.

15

Outstanding Equity Awards at Year End. The following table sets forth information with respect to outstanding equity awards as of December 31, 2015 for the named executive officers. All equity awards reflected in this table were granted pursuant to our 2015 Equity Incentive Plan, described below.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Name | | Option awards | | Stock awards | |

| | Number of

securities

underlying

unexercised

options (#)

exercisable(1) | | | Number of

securities

underlying

unexercised options

(#) unexercisable(1) | | | Equity incentive plan

awards: number of

securities underlying

unexercised unearned

options (#) | | | Option

exercise

price

($) | | | Option

expiration

date | | Number of shares

or units of stock

that have not

vested (#)(2) | | | Market value of

shares or units of

stock that have

not vested ($)(3) | |

Andrew S. Samuel | | | 21,160 | | | | 84,640 | | | | — | | | $ | 13.96 | | | 10/29/25 | | | 33,856 | | | $ | 514,611 | |

Brent S. Smith | | | 3,000 | | | | 12,000 | | | | — | | | $ | 13.96 | | | 10/29/25 | | | 8,000 | | | $ | 121,600 | |

Jane Tompkins | | | 2,000 | | | | 8,000 | | | | — | | | $ | 13.96 | | | 10/29/25 | | | 5,600 | | | $ | 85,120 | |

| (1) | Options vest in five equal annual installments commencing on October 29, 2015. |

| (2) | Stock awards vest in five equal annual installments commencing on October 29, 2015. |

| (3) | Based on the $15.20 per share trading price of our common stock on December 31, 2015. |

16

Benefit Plans

2015 Equity Incentive Plan. At a special meeting held in 2015, Sunshine Bancorp, Inc.’s stockholders approved the Sunshine Bancorp, Inc. 2015 Equity Incentive Plan (the “2015 Equity Incentive Plan”) to provide officers, employees and directors of Sunshine Bancorp, Inc. and Sunshine Bank with additional incentives to promote the growth and performance of Sunshine Bancorp, Inc. Subject to permitted adjustments for certain corporate transactions, the 2015 Equity Incentive Plan authorizes the issuance or delivery to participants of up to 592,480 shares of Sunshine Bancorp, Inc. common stock pursuant to grants of incentive and non-statutory stock options, restricted stock awards and restricted stock units, provided that the maximum number of shares that may be delivered pursuant to the exercise of stock options (all of which may be granted as incentive stock options) is 423,200 shares and the maximum number of shares of Sunshine Bancorp, Inc. stock that may be issued as restricted stock awards or restricted stock units is 169,280 shares. Employees and directors of Sunshine Bancorp, Inc. and its subsidiaries are eligible to receive awards under the 2015 Equity Incentive Plan, except non-employee directors may not be granted incentive stock options. The 2015 Equity Incentive Plan will be administered by the members of Sunshine Bancorp, Inc.’s Compensation Committee. The Compensation Committee may grant any of these types of awards subject to performance based vesting conditions. Such awards shall be referred to herein as “performance awards.” As of December 31, 2015, 58,254 stock options and 10,556 shares of restricted stock remain available for award from the 2015 Equity Incentive Plan.

Unless otherwise specified in an award agreement, the vesting of awards will accelerate upon death, disability, or involuntary termination of employment (or, with respect to a director, termination of service) following a change in control. Awards will not vest upon retirement. For a participant who is a director, termination of service as a director will not be deemed to have occurred if he or she continues as a director emeritus or advisory director. For a participant who is both an employee and a director, termination of employment as an employee will not be considered a termination event so long as the participant continues to provide service as a director, director emeritus or advisory director. The Compensation Committee may in its discretion elect to use a different vesting schedule or different performance measures than those set forth in the 2015 Equity Incentive Plan, provided that such feature is provided in the participant’s award agreement.

Supplemental Executive Retirement Plan for Andrew S. Samuel. On January 28, 2015, Sunshine Bank adopted the Supplemental Executive Retirement Plan (the “SERP”) for Andrew Samuel. Upon separation from service after normal retirement age (age 63), Mr. Samuel will be entitled to an annual benefit in the amount of 40% of his “final pay,” defined as the highest annualized base salary and bonus from the three years prior to Mr. Samuel’s separation from service, disability or death, including the year such separation occurs. The benefit percentage could increase to 50% or 60%, provided certain core earnings thresholds are met by Sunshine Bank in any calendar year before his separation from service. The normal retirement benefit under the SERP is payable in monthly installments over a period of 15 years, commencing the month following separation from service. In the event of voluntary separation from service before normal retirement age, no benefit is due under the SERP. In the event of involuntary separation from service before normal retirement age, Mr. Samuel will receive his accrued benefit under the SERP, payable in a lump sum. In the event Mr. Samuel suffers a disability prior to normal retirement age and prior to a separation from service, Sunshine Bank will pay Mr. Samuel the accrued benefit under the SERP in monthly installments over 15 years, commencing the month following disability. If a change in control occurs prior to a separation from service and prior to normal retirement age, Sunshine Bank will pay a lump sum benefit payable to Mr. Samuel equal to the present value of an annual benefit equal to 70% of his “projected final pay” (as defined in the SERP) payable over 15 years, discounted from normal retirement age to the date of the change in control. If the change in control occurs before separation from service but after normal retirement age, the benefit will be equal to the present value of an annual benefit equal to 70% of final pay payable for 15 years. The change in control benefit will be paid in a lump sum within 90 days following the change in control. In the event Mr. Samuel dies prior to a separation from service, disability or change in control, Sunshine Bank will pay Mr. Samuel’s beneficiary a benefit equal to the greater of the accrued benefit under the SERP or $5.0 million, in a lump sum within 90 days following death. In the event Mr. Samuel dies while receiving payments but prior to receiving all payments due under the SERP, Sunshine Bank will pay his beneficiary the same amounts at the same times as Sunshine Bank would have paid Mr. Samuel had Mr. Samuel survived. In the event Mr. Samuel is terminated by Sunshine Bank for cause, no benefit will be paid under the SERP.

17

401(k) Plan. In connection with the mutual-to-stock conversion, Sunshine Bank adopted the Sunshine Bank 401(k) Plan (“401(k) Plan”), effective May 1, 2014. The 401(k) Plan superseded and replaced a prior plan that was originally adopted effective as of May 28, 2002. Generally, all employees of Sunshine Bank, including the named executive officers, are eligible to participate in the 401(k) Plan.

Employees who are age 18 or older and who have completed six months of service are eligible to participate in the 401(k) Plan.Under the 401(k) Plan a participant may elect to defer, on a pre-tax basis, up to 100% of his or her salary in any plan year, subject to limits imposed by the Internal Revenue Code. For 2015, the salary deferral contribution limit is $18,000, provided, however, that a participant over age 50 may contribute an additional $6,000, for a total contribution of $24,000. In addition to salary deferral contributions, Sunshine Bank makes a safe harbor matching contribution equal to 50% of the participant’s salary deferral contributions on the first six percent of the participant’s compensation. A participant is always 100% vested in his or her salary deferral contributions and the employer safe harbor matching contributions over the course of six years (20% per year after the first year). Generally, unless the participant elects otherwise, the participant’s account balance will be distributed upon request following his or her termination of employment with Sunshine Bank. During the year ended December 31, 2015, Sunshine Bank recognized $5,321 as a 401(k) Plan expense.

Each participant has an individual account under the 401(k) Plan and may direct the investment of his or her account among a variety of investment options. Each participant is allowed to invest up to 100% of his or her account balance in the common stock of Sunshine Bancorp through the Sunshine Bancorp Stock Fund.

Employee Stock Ownership Plan.In connection with the completion of the mutual to stock conversion, Sunshine Bank adopted a tax-qualified retirement employee stock ownership plan (“ESOP”) for eligible employees. Eligible employees will begin participation in the ESOP on the later of January 1, 2014 or upon the first entry date commencing on or after the eligible employee’s completion of age 21 and 1,000 hours of service during a continuous 12-month period.

On behalf of the ESOP, the ESOP trustee purchased 338,560 shares of Sunshine Bancorp, Inc. common stock issued in the conversion. The ESOP funded its stock purchase with a loan from Sunshine Bancorp, Inc. equal to the aggregate purchase price of the common stock. The loan will be repaid principally through Sunshine Bank’s contribution to the ESOP and dividends payable on common stock held by the ESOP over a 30-year loan term of the loan. The interest rate for the ESOP loan is an adjustable rate equal to the prime rate, as published inThe Wall Street Journal. The interest rate adjusts annually and will be the prime rate on the first business day of the calendar year, retroactive to January 1 of such year.