Exhibit 99.1

Safe Harbor

With the exception of historical information, certain matters disclosed in this presentation are forward-looking statements. Forward-looking statements involve known and unknown risks and uncertainties that could cause actual results to differ materially from those expressed or implied in the forward-looking statements. Potential risks and uncertainties are described in the filings of SunEdison, Inc. (“SunEdison”) and TerraForm Power, Inc. (“TerraForm” and, together with SunEdison, the “Companies”) with the Securities and Exchange Commission (SEC), including SunEdison Inc.’s most recent report on Form 10-K, TerraForm Power, Inc.’s registration statement for its recent public equity offering, and each Company’s reports on Forms 10-Q and 8-K, in addition to the risks and uncertainties described on page 3 of this presentation. These forward-looking statements represent the Companies’ judgment as of the date of this presentation and the Companies disclaim any intent or obligation to update these forward-looking statements, except as otherwise required by law.

This presentation also includes non-GAAP financial measures. You can find a reconciliation of the non-GAAP financial measures to the most directly comparable GAAP financial measures in the appendix to this presentation.

2

Forward-Looking Statements

This report contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Such forward-looking statements are subject to certain risks, uncertainties and assumptions, including the timing of the completion of the First Wind acquisition, and typically can be identified by the use of words such as “expect,” “estimate,” “anticipate,” “forecast,” “intend,” “project,” “target,” “plan,” “believe” and similar terms and expressions. Certain matters discussed in this presentation and conference call are forward-looking statements. The forward-looking statements contained in this presentation represent the SunEdison and TerraForm’s judgment as of the date of this presentation and are based on current expectations and assumptions. Although SunEdison and TerraForm believe that their expectations and assumptions are reasonable, they can give no assurance that these expectations and assumptions will prove to have been correct, and actual results may vary materially. Factors that could cause actual results to differ materially from those set forth in the forward-looking statements include, among others: the failure of counterparties to fulfill their obligations under off-take agreements; price fluctuations, termination provisions and buyout provisions in offtake agreements; TeraForm’s ability to enter into contracts to sell power on acceptable terms as offtake agreements expire; delays or unexpected costs during the completion of projects under construction; TerraForm’s ability to successfully identify, evaluate and consummate acquisitions from SunEdison, Inc. or third parties, including the acquisition of the First Wind wind generating projects from Sellers and to integrate such assets; government regulation; operating and financial restrictions under agreements governing indebtedness; SunEdison and TerraForm’s ability to borrow additional funds and access capital markets; SunEdison and TerraForm’s ability to compete against traditional and renewable energy companies; hazards customary to the power production industry and power generation operations, such as unusual weather conditions and outages, and TerraForm’s ability to operate its business efficiently and enter into new business segments or new geographies. Furthermore, any dividends are subject to available capital, market conditions and compliance with associated laws and regulations and other matters that our board of directors deem relevant. SunEdison and TerraForm undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as otherwise required by law. The foregoing review of factors that could cause SunEdison and TerraForm’s actual results to differ materially from those contemplated in the forward-looking statements included in this report should be considered in connection with information regarding risks and uncertainties that may affect SunEdison and TerraForm’s future results included in SunEdison and TerraForm’s filings with the Securities and Exchange Commission available at www.sec.gov.

3

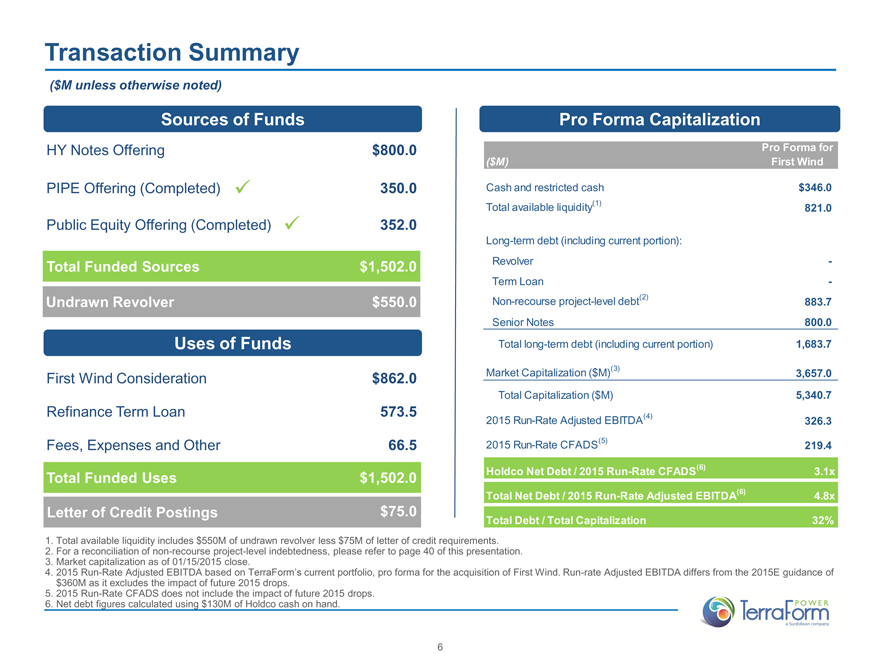

Transaction Summary

($M unless otherwise noted)

Sources of Funds

HY Notes Offering $800.0

PIPE Offering (Completed) 350.0

Public Equity Offering (Completed) 352.0

Total Funded Sources $1,502.0

Undrawn Revolver $550.0

Uses of Funds

First Wind Consideration $862.0

Refinance Term Loan 573.5

Fees, Expenses and Other 66.5

Total Funded Uses $1,502.0

Letter of Credit Postings $75.0

Pro Forma Capitalization

Pro Forma for

($M) First Wind

Cash and restricted cash $346.0

Total available liquidity(1) 821.0

Long-term debt (including current portion):

Revolver -

Term Loan -

Non-recourse project-level debt(2) 883.7

Senior Notes 800.0

Total long-term debt (including current portion) 1,683.7

Market Capitalization ($M)(3) 3,657.0

Total Capitalization ($M) 5,340.7

2015 Run-Rate Adjusted EBITDA(4) 326.3

2015 Run-Rate CFADS(5) 219.4

Holdco Net Debt / 2015 Run-Rate CFADS(6) 3.1x

Total Net Debt / 2015 Run-Rate Adjusted EBITDA(6) 4.8x

Total Debt / Total Capitalization 32%

1. Total available liquidity includes $550M of undrawn revolver less $75M of letter of credit requirements.

2. For a reconciliation of non-recourse project-level indebtedness, please refer to page 40 of this presentation.

3. Market capitalization as of 01/15/2015 close.

4. 2015 Run-Rate Adjusted EBITDA based on TerraForm’s current portfolio, pro forma for the acquisition of First Wind. Run-rate Adjusted EBITDA differs from the 2015E guidance of $360M as it excludes the impact of future 2015 drops.

5. 2015 Run-Rate CFADS does not include the impact of future 2015 drops.

6. Net debt figures calculated using $130M of Holdco cash on hand.

6

USA: Mt. Signal 266 MW

Section 1: Company Overview

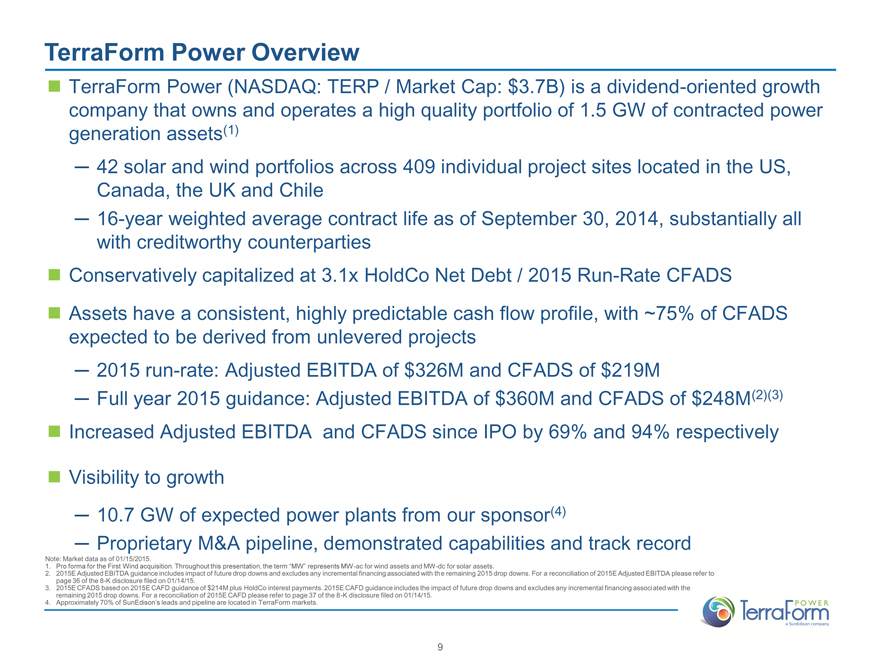

TerraForm Power Overview

TerraForm Power (NASDAQ: TERP / Market Cap: $3.7B) is a dividend-oriented growth

company that owns and operates a high quality portfolio of 1.5 GW of contracted power

generation assets(1)

42 solar and wind portfolios across 409 individual project sites located in the US,

Canada, the UK and Chile

16-year weighted average contract life as of September 30, 2014, substantially all

with creditworthy counterparties

Conservatively capitalized at 3.1x HoldCo Net Debt / 2015 Run-Rate CFADS

Assets have a consistent, highly predictable cash flow profile, with ~75% of CFADS

expected to be derived from unlevered projects

2015 run-rate: Adjusted EBITDA of $326M and CFADS of $219M

Full year 2015 guidance: Adjusted EBITDA of $360M and CFADS of $248M(2)(3)

Increased Adjusted EBITDA and CFADS since IPO by 69% and 94% respectively

Visibility to growth

10.7 GW of expected power plants from our sponsor(4)

Proprietary M&A pipeline, demonstrated capabilities and track record

Note: Market data as of 01/15/2015.

1. Pro forma for the First Wind acquisition. Throughout this presentation, the term “MW” represents MW -ac for wind assets and MW-dc for solar assets.

2. 2015E Adjusted EBITDA guidance includes impact of future drop downs and excludes any incremental financing associated with the remaining 2015 drop downs. For a reconciliation of 2015E Adjusted EBITDA please refer to page 36 of the 8-K disclosure filed on 01/14/15.

3. 2015E CFADS based on 2015E CAFD guidance of $214M plus HoldCo interest payments. 2015E CAFD guidance includes the impact of future drop downs and excludes any incremental financing associated with the remaining 2015 drop downs. For a reconciliation of 2015E CAFD please refer to page 37 of the 8-K disclosure filed on 01/14/15.

4. Approximately 70% of SunEdison’s leads and pipeline are located in TerraForm markets.

9

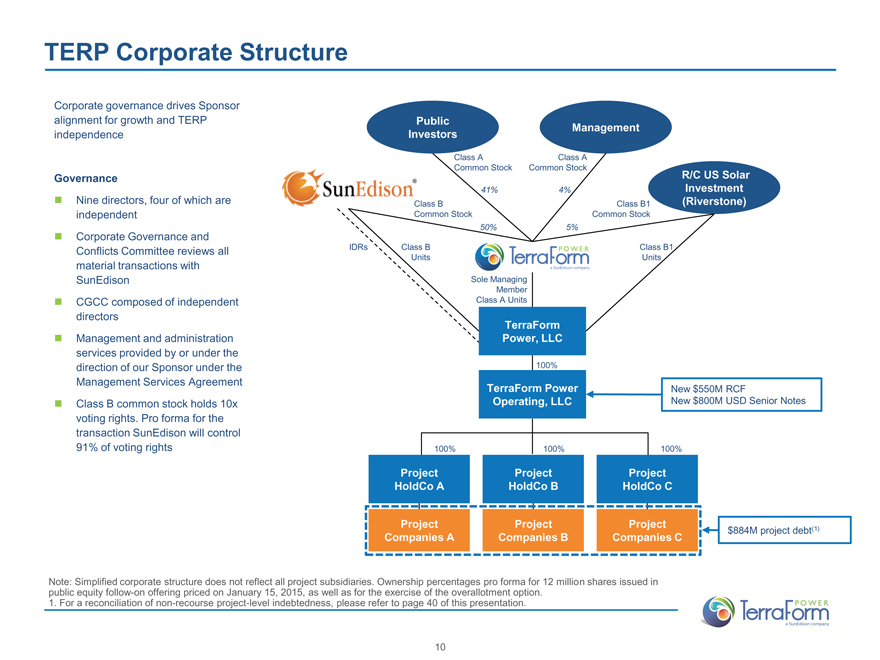

TERP Corporate Structure

Corporate governance drives Sponsor

alignment for growth and TERP

independence

Governance

Nine directors, four of which are

independent

Corporate Governance and

Conflicts Committee reviews all

material transactions with

SunEdison

CGCC composed of independent

directors

Management and administration

services provided by or under the

direction of our Sponsor under the

Management Services Agreement

Class B common stock holds 10x

voting rights. Pro forma for the

transaction SunEdison will control

91% of voting rights

Public Management

Investors

Class A Class A

Common Stock Common Stock

R/C US Solar

41% 4% Investment

Class B Class B1 (Riverstone)

Common Stock Common Stock

50% 5%

IDRs Class B Class B1

Units Units

Sole Managing

Member

Class A Units

TerraForm

Power, LLC

100%

TerraForm Power New $550M RCF

Operating, LLC New $800M USD Senior Notes

100% 100% 100%

Project Project Project

HoldCo A HoldCo B HoldCo C

Project Project Project $884M project debt(1)

Companies A Companies B Companies C

Note: Simplified corporate structure does not reflect all project subsidiaries. Ownership percentages pro forma for 12 million shares issued in public equity follow-on offering priced on January 15, 2015, as well as for the exercise of the overallotment option. el indebtedness, please refer to page 40 of this presentation.

10

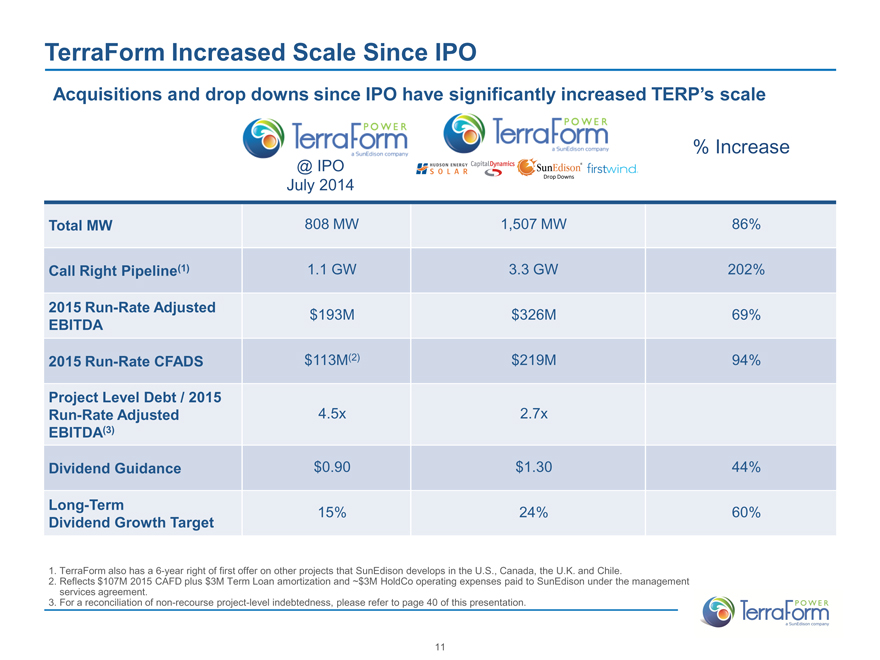

TerraForm Increased Scale Since IPO

Acquisitions and drop downs since IPO have significantly increased TERP’s scale

% Increase

@ IPO

Drop Downs

July 2014

Total MW 808 MW 1,507 MW 86%

Call Right Pipeline(1) 1.1 GW 3.3 GW 202%

2015 Run-Rate Adjusted $193M $326M 69%

EBITDA

2015 Run-Rate CFADS $113M(2) $219M 94%

Project Level Debt / 2015

Run-Rate Adjusted 4.5x 2.7x

EBITDA(3)

Dividend Guidance $0.90 $1.30 44%

Long-Term 15% 24% 60%

Dividend Growth Target

1. TerraForm also has a 6-year right of first offer on other projects that SunEdison develops in the U.S., Canada, the U.K. and Chile.

2. Reflects $107M 2015 CAFD plus $3M Term Loan amortization and ~$3M HoldCo operating expenses paid to SunEdison under the management services agreement. el indebtedness, please refer to page 40 of this presentation.

11

Strong Track Record of Execution

Since IPO Execution

Install

189 MW 32 157 MW MW expected reached to COD achieve since COD IPO by 2Q 2015

Closed the following drop downs ahead of schedule:

Drop Downs

Two U.K. utility scale solar assets (50 MW combined)

76 MW

US DG solar assets (26 MW)

Acquired portfolio of US DG assets from Capital Dynamics and Hudson

Third Party M&A Energy Solar (103 MW combined)

Announced agreement to acquire First Wind (521 MW)

624 MW

Expected to close 1Q 2015, all regulatory approvals received

New Global Platform First Wind portfolio includes 500 MW of wind assets

Wind Doubled addressable renewable market by diversifying into wind

12

Chile: CAP 101 MW

Section 2: Our Portfolio

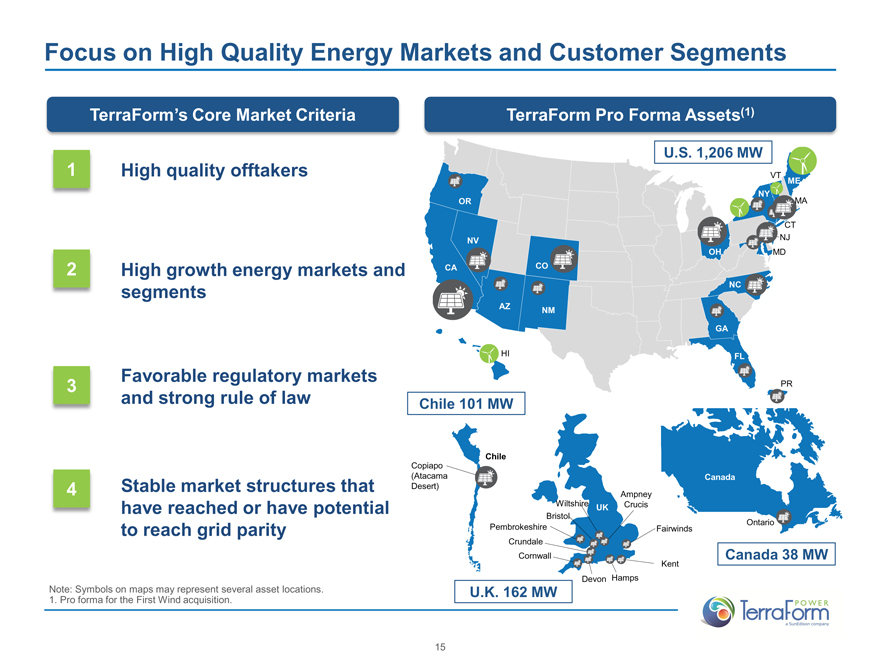

Focus on High Quality Energy Markets and Customer Segments

TerraForm’s Core Market Criteria

1 High quality offtakers

2 High growth energy markets and

segments

3 Favorable regulatory markets

and strong rule of law

4 Stable market structures that

have reached or have potential

to reach grid parity

TerraForm Pro Forma Assets(1)

U.S. 1,206 MW

VT ME

NY

OR MA

CT

NV NJ

OH MD

CA CO

NC

AZ NM

GA

HI FL

PR

Chile 101 MW

Chile

Copiapo

(Atacama Canada

Desert)

Ampney

Wiltshire UK Crucis

Bristol

Pembrokeshire Fairwinds Ontario

Crundale

Cornwall Canada 38 MW

Kent

Devon Hamps

U.K. 162 MW

Note: Symbols on maps may represent several asset locations.

1. Pro forma for the First Wind acquisition.

15

First Wind Transaction Snapshot

Attractive Transaction Economics, Combined with Conservative Financing

Operating Assets Acquired 500 MW wind / 21 MW solar

# of Assets(1) 16

Enterprise Value $862M

Adjusted EBITDA 2015E $91M

CFADS 2015E $72.5M

Asset Locations ME, NY, HI, VT and MA

Pro forma for the acquisition, the operating assets will have no project-level debt

1. MA Solar Project is composed of four separate locations.

2. Annual run rate guidance.

16

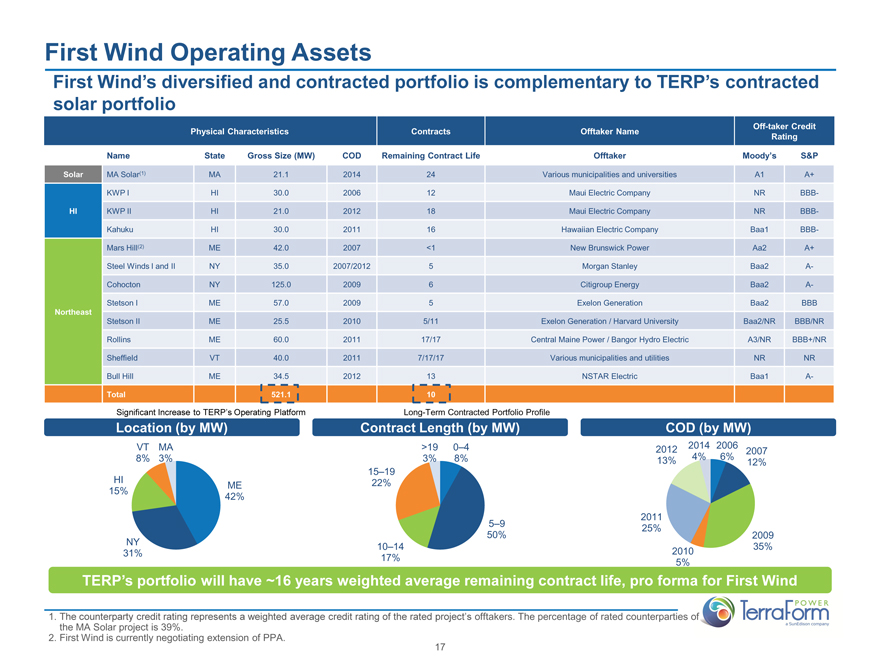

First Wind Operating Assets

First Wind’s diversified and contracted portfolio is complementary to TERP’s contracted solar portfolio

Physical Characteristics Contracts Offtaker Name Off-taker Credit

Rating

Name State Gross Size (MW) COD Remaining Contract Life Offtaker Moody’s S&P

Solar MA Solar(1) MA 21.1 2014 24 Various municipalities and universities A1 A+

KWP I HI 30.0 2006 12 Maui Electric Company NR BBB-

HI KWP II HI 21.0 2012 18 Maui Electric Company NR BBB-

Kahuku HI 30.0 2011 16 Hawaiian Electric Company Baa1 BBB-

Mars Hill(2) ME 42.0 2007 <1 New Brunswick Power Aa2 A+

Steel Winds I and II NY 35.0 2007/2012 5 Morgan Stanley Baa2 A-

Cohocton NY 125.0 2009 6 Citigroup Energy Baa2 A-

Stetson I ME 57.0 2009 5 Exelon Generation Baa2 BBB

Northeast

Stetson II ME 25.5 2010 5/11 Exelon Generation / Harvard University Baa2/NR BBB/NR

Rollins ME 60.0 2011 17/17 Central Maine Power / Bangor Hydro Electric A3/NR BBB+/NR

Sheffield VT 40.0 2011 7/17/17 Various municipalities and utilities NR NR

Bull Hill ME 34.5 2012 13 NSTAR Electric Baa1 A-

Total 521.1 10

Significant Increase to TERP’s Operating Platform

Location (by MW)

VT MA

8% 3%

HI ME

15% 42%

NY

31%

Long-Term Contracted Portfolio Profile

Contract Length (by MW)

>19 0–4

3% 8%

15–19

22%

5–9

50%

10–14

17%

COD (by MW)

2012 2014 2006 2007

13% 4% 6% 12%

2011

25%

2009

2010 35%

5%

TERP’s portfolio will have ~16 years weighted average remaining contract life, pro forma for First Wind

1. The counterparty credit rating represents a weighted average credit rating of the rated project’s offtakers. The percentage of rated counterparties of the MA Solar project is 39%.

2. First Wind is currently negotiating extension of PPA.

17

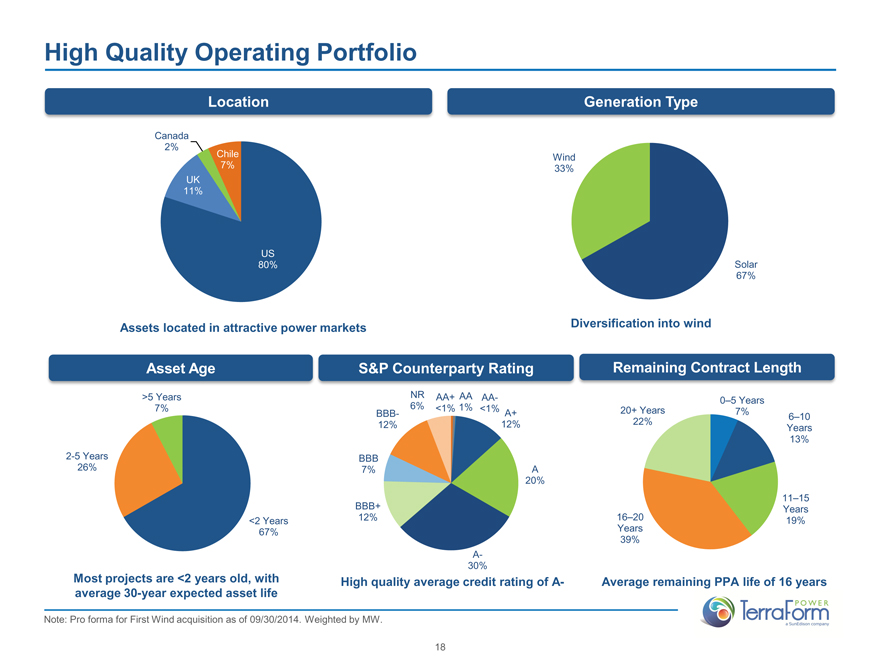

High Quality Operating Portfolio

Location

Canada

2%

Chile

7%

UK

11%

US

80%

Assets located in attractive power markets

Generation Type

Wind

33%

Solar

67%

Diversification into wind

Asset Age S&P Counterparty Rating Remaining Contract Length

>5 Years NR AA+ AA AA- 0–5 Years

7% BBB- 6% <1% 1% <1% A+ 20+ Years 7%

12% 12% 22% Years 6–10

13%

2-5 Years BBB

26% 7% A

20%

11–15

BBB+ Years

<2 Years 12% 16–20 19%

67% Years

39%

A-

30%

Most projects are <2 years old, with average 30-year expected asset life

High quality average credit rating of A-

Average remaining PPA life of 16 years

Note: Pro forma for First Wind acquisition as of 09/30/2014. Weighted by MW.

18

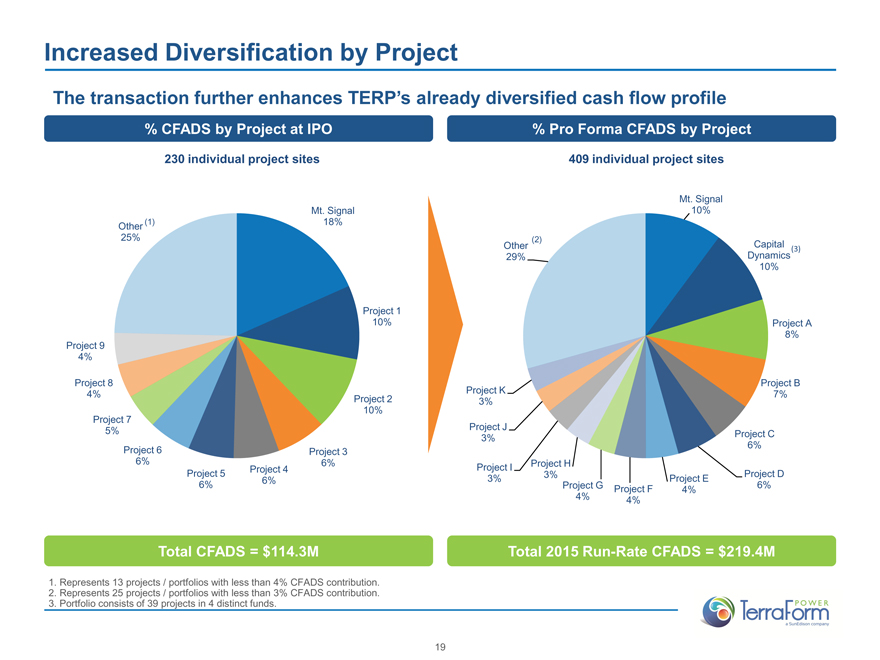

Increased Diversification by Project

The transaction further enhances TERP’s already diversified cash flow profile

% CFADS by Project at IPO

230 individual project sites

Mt. Signal

Other (1) 18%

25%

Project 1

10%

Project 9

4%

Project 8

4% Project 2

10%

Project 7

5%

Project 6 Project 3

6% 6%

Project 5 Project 4

6% 6%

% Pro Forma CFADS by Project

409 individual project sites

Mt. Signal

10%

Other (2) Capital

29% Dynamics(3)

10%

Project A

8%

Project B

Project K 7%

3%

Project J

3% Project C

6%

Project I Project H

3% 3% Project E Project D

Project G Project F 4% 6%

4% 4%

Total CFADS = $114.3M

1. Represents 13 projects / portfolios with less than 4% CFADS contribution.

2. Represents 25 projects / portfolios with less than 3% CFADS contribution.

3. Portfolio consists of 39 projects in 4 distinct funds.

Total 2015 Run-Rate CFADS = $219.4M

19

USA: KWP I 30 MW

Section 3: Key Growth Drivers

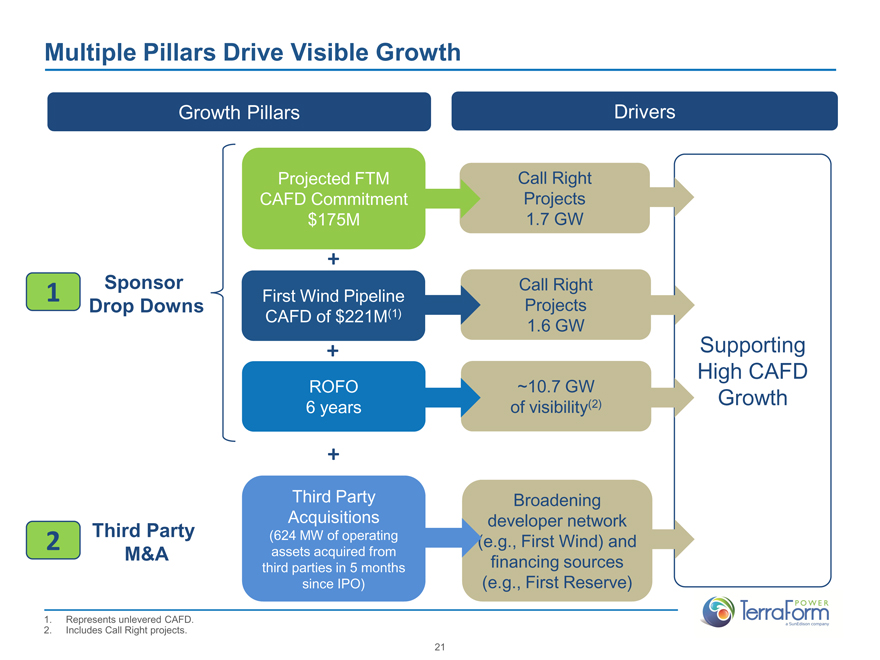

Multiple Pillars Drive Visible Growth

Growth Pillars Drivers

Projected FTM Call Right

CAFD Commitment Projects

$175M 1.7 GW

+

1 Sponsor First Wind Pipeline Call Right

Drop Downs Projects

CAFD of $221M(1) 1.6 GW

+ Supporting

High CAFD

ROFO ~10.7 GW

6 years of visibility(2) Growth

+

Third Party Broadening

Acquisitions developer network

2 Third Party (624 MW of operating (e.g., First Wind) and

M&A assets acquired from financing sources

third parties in 5 months

since IPO) (e.g., First Reserve)

1. Represents unlevered CAFD.

2. Includes Call Right projects.

21

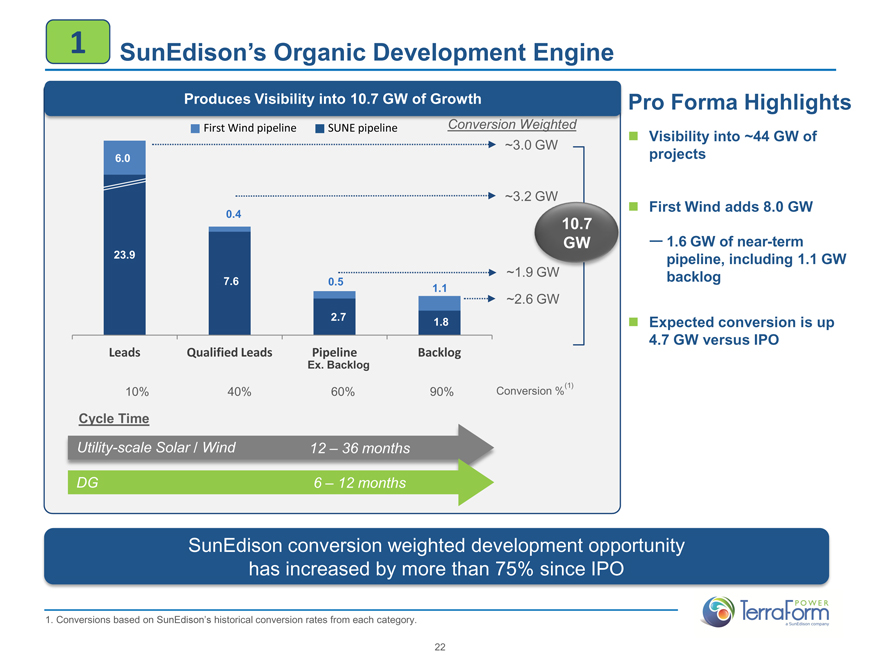

1 SunEdison’s Organic Development Engine

Produces Visibility into 10.7 GW of Growth

First Wind pipeline SUNE pipeline Conversion Weighted

First Wind pipeline SUNE pipeline

~3.0 GW

6.0

~3.2 GW

0.4

10.7 GW

23.9

~1.9 GW

7.6 0.5

1.1 ~2.6 GW

2.7

1.8

Leads Qualified Leads Pipeline Backlog

Ex. Backlog

(1)

10% 40% 60% 90% Conversion %

Cycle Time

Utility-scale Solar / Wind 12 – 36 months

DG 6 – 12 months

Pro Forma Highlights

Visibility into ~44 GW of projects

First Wind adds 8.0 GW

1.6 GW of near-term pipeline, including 1.1 GW backlog

Expected conversion is up 4.7 GW versus IPO

SunEdison conversion weighted development opportunity has increased by more than 75% since IPO

1. Conversions based on SunEdison’s historical conversion rates from each category.

22

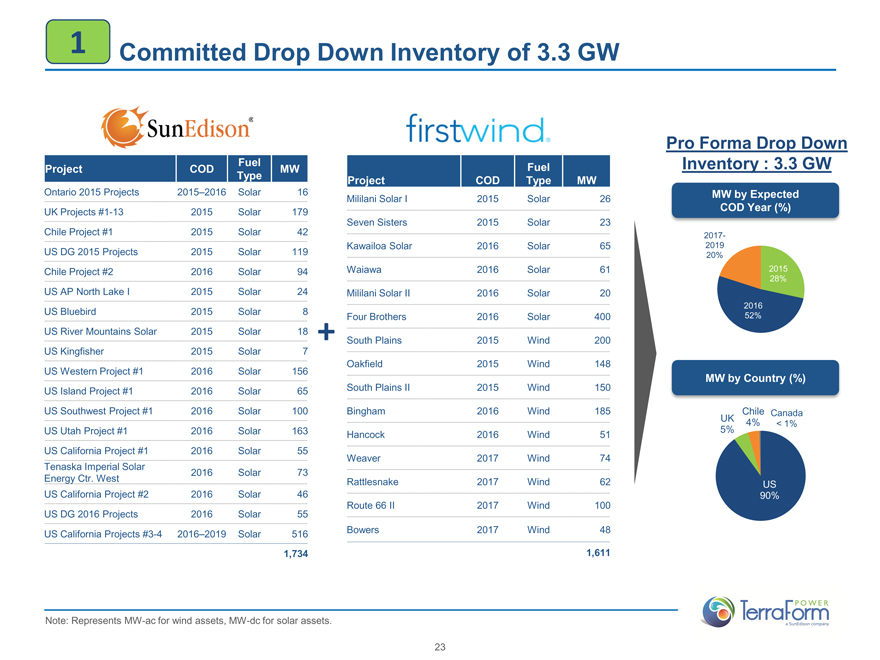

1 | | Committed Drop Down Inventory of 3.3 GW |

Fuel

Project COD MW

Type

Ontario 2015 Projects 2015–2016 Solar 16

UK Projects #1-13 2015 Solar 179

Chile Project #1 2015 Solar 42

US DG 2015 Projects 2015 Solar 119

Chile Project #2 2016 Solar 94

US AP North Lake I 2015 Solar 24

US Bluebird 2015 Solar 8

US River Mountains Solar 2015 Solar 18 +

US Kingfisher 2015 Solar 7

US Western Project #1 2016 Solar 156

US Island Project #1 2016 Solar 65

US Southwest Project #1 2016 Solar 100

US Utah Project #1 2016 Solar 163

US California Project #1 2016 Solar 55

Tenaska Imperial Solar 2016 Solar 73

Energy Ctr. West

US California Project #2 2016 Solar 46

US DG 2016 Projects 2016 Solar 55

US California Projects #3-4 2016–2019 Solar 516

1,734

Fuel

Project COD Type MW

Mililani Solar I 2015 Solar 26

Seven Sisters 2015 Solar 23

Kawailoa Solar 2016 Solar 65

Waiawa 2016 Solar 61

Mililani Solar II 2016 Solar 20

Four Brothers 2016 Solar 400

South Plains 2015 Wind 200

Oakfield 2015 Wind 148

South Plains II 2015 Wind 150

Bingham 2016 Wind 185

Hancock 2016 Wind 51

Weaver 2017 Wind 74

Rattlesnake 2017 Wind 62

Route 66 II 2017 Wind 100

Bowers 2017 Wind 48

1,611

Pro Forma Drop Down Inventory : 3.3 GW

MW by Expected COD Year (%)

2017-2019 20%

2015 28%

2016 52%

MW by Country (%)

Chile Canada

UK 4%

< 1%

5%

US 90%

Note: Represents MW-ac for wind assets, MW-dc for solar assets.

23

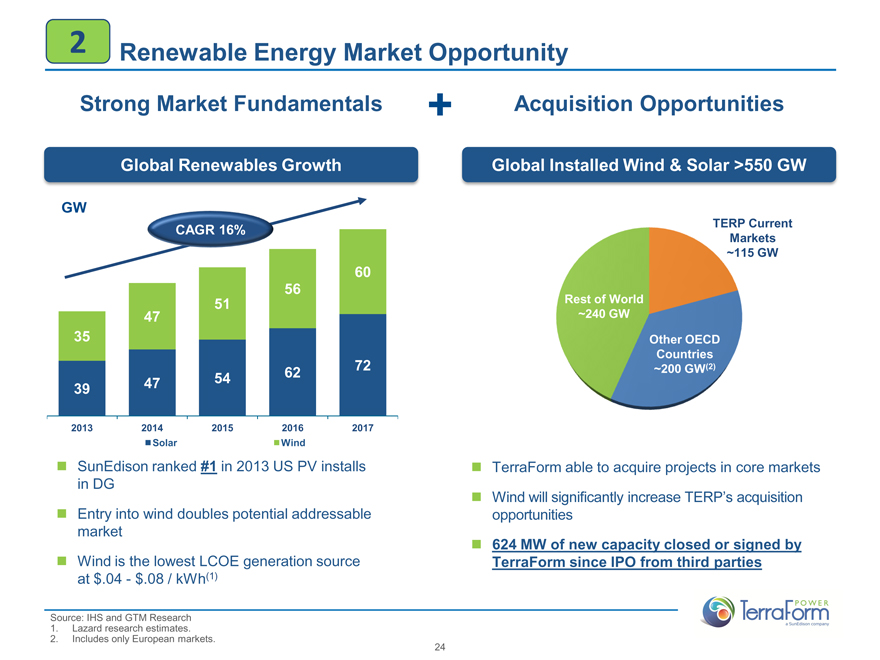

2 | | Renewable Energy Market Opportunity |

Strong Market Fundamentals + Acquisition Opportunities

Global Renewables Growth

GW

CAGR 16%

60 56

47 51 35

72

54 62

39 47

2013 2014 2015 2016 2017 Solar Wind

SunEdison ranked #1 in 2013 US PV installs in DG

Entry into wind doubles potential addressable market

Wind is the lowest LCOE generation source at $.04—$.08 / kWh(1)

Global Installed Wind & Solar >550 GW

TERP Current

Markets

~115 GW

Rest of World

~240 GW

Other OECD Countries ~200 GW(2)

TerraForm able to acquire projects in core markets

Wind will significantly increase TERP’s acquisition opportunities

624 MW of new capacity closed or signed by TerraForm since IPO from third parties

Source: IHS and GTM Research

1. Lazard research estimates.

2. Includes only European markets.

24

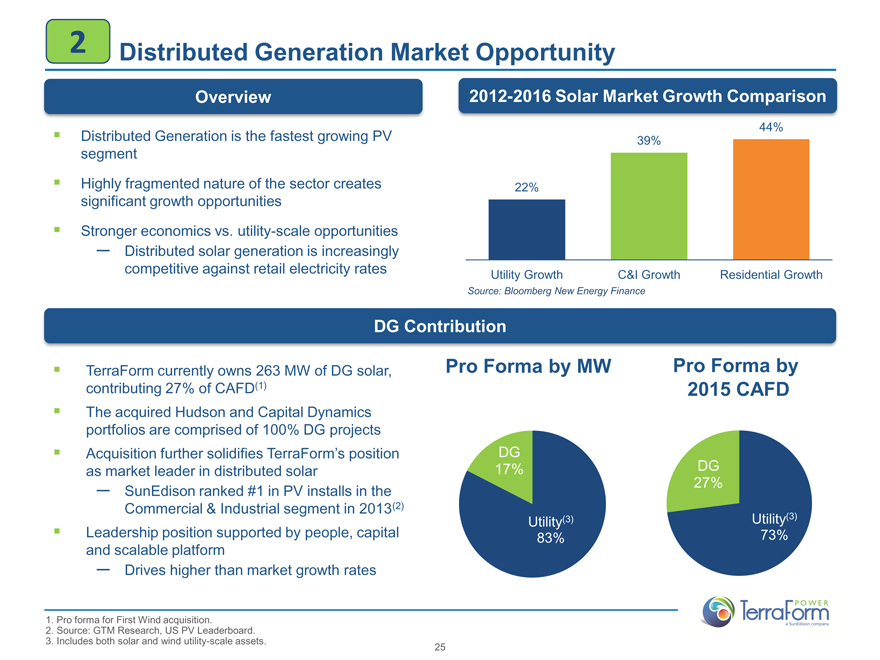

2 | | Distributed Generation Market Opportunity |

Overview 2012-2016 Solar Market Growth Comparison

Distributed Generation is the fastest growing PV segment

Highly fragmented nature of the sector creates significant growth opportunities

Stronger economics vs. utility-scale opportunities

Distributed solar generation is increasingly competitive against retail electricity rates

44% 39%

22%

Utility Growth C&I Growth Residential Growth

Source: Bloomberg New Energy Finance

DG Contribution

TerraForm currently owns 263 MW of DG solar, contributing 27% of CAFD(1)

The acquired Hudson and Capital Dynamics portfolios are comprised of 100% DG projects

Acquisition further solidifies TerraForm’s position as market leader in distributed solar

SunEdison ranked #1 in PV installs in the Commercial & Industrial segment in 2013(2)

Leadership position supported by people, capital and scalable platform

Drives higher than market growth rates

Pro Forma by MW Pro Forma by 2015 CAFD

DG

17% DG 27%

Utility(3) Utility(3) 83% 73%

Pro forma for First Wind acquisition.

Source: GTM Research, US PV Leaderboard.

Includes both solar and wind utility-scale assets.

25

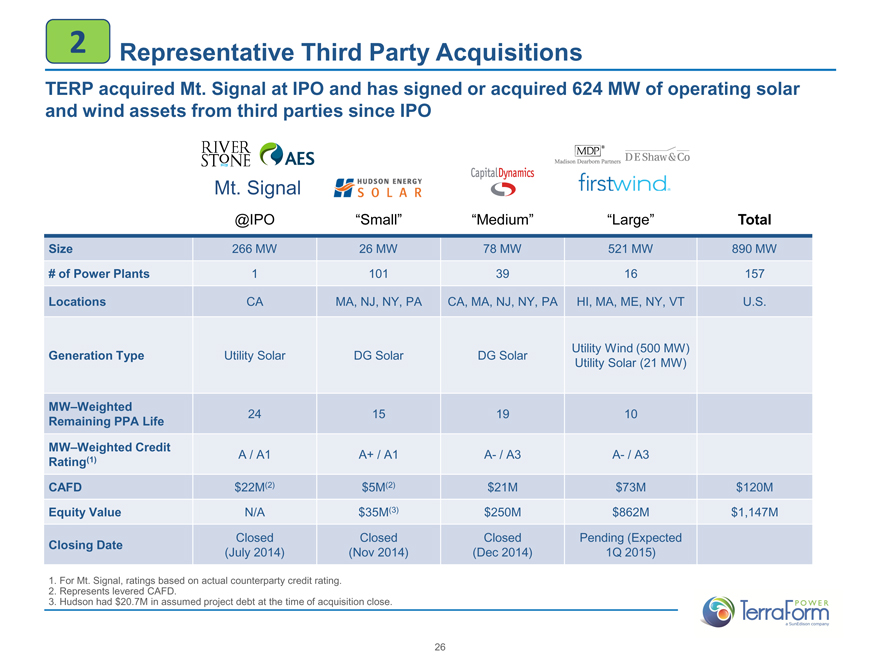

2 | | Representative Third Party Acquisitions |

TERP acquired Mt. Signal at IPO and has signed or acquired 624 MW of operating solar and wind assets from third parties since IPO

Mt. Signal

@IPO “Small” “Medium” “Large” Total

@IPO “Small” “Medium” “Large” Total

Size 266 MW 26 MW 78 MW 521 MW 890 MW

# of Power Plants 1 101 39 16 157

Locations CA MA, NJ, NY, PA CA, MA, NJ, NY, PA HI, MA, ME, NY, VT U.S.

Generation Type Utility Solar DG Solar DG Solar Utility Wind (500 MW)

Utility Solar (21 MW)

MW–Weighted 24 15 19 10

Remaining PPA Life

MW–Weighted Credit

Rating(1) A / A1 A+ / A1 A- / A3 A- / A3

CAFD $22M(2) $5M(2) $21M $73M $120M

Equity Value N/A $35M(3) $250M $862M $1,147M

Closing Date Closed Closed Closed Pending (Expected

(July 2014) (Nov 2014) (Dec 2014) 1Q 2015)

For Mt. Signal, ratings based on actual counterparty credit rating.

Represents levered CAFD.

Hudson had $20.7M in assumed project debt at the time of acquisition close.

26

USA: DG 2009-2013 Portfolio of 15.2 MW

Section 4: Key Investment Highlights

Key Investment Highlights

High Quality Cash Flows From Long-Term Contracts

With Creditworthy Offtakers

Increased Scale & Diversity

Improved Financial Profile

Reduced Structural Subordination

Enhanced Liquidity

28

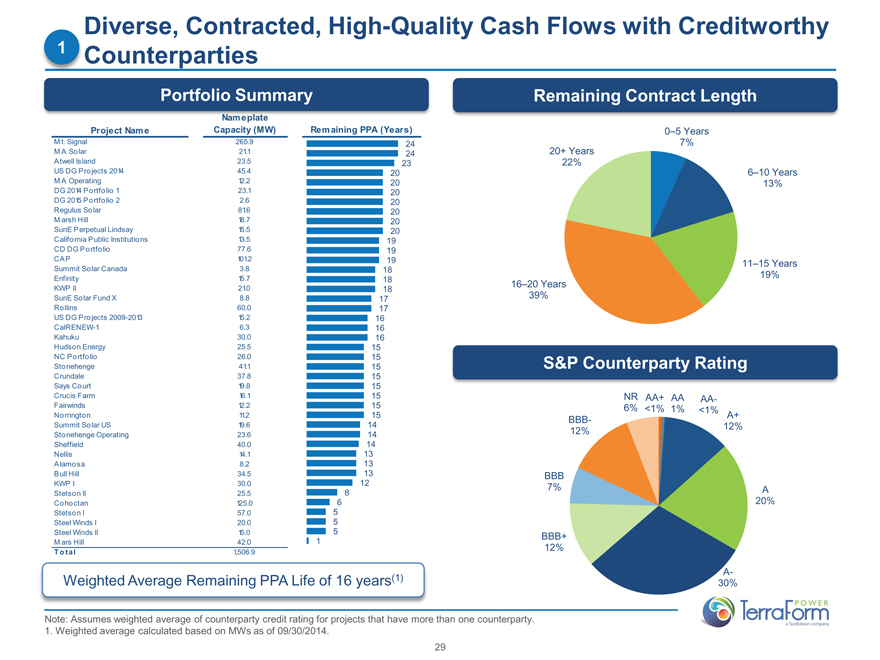

Diverse, Contracted, High-Quality Cash Flows with Creditworthy

Portfolio Summary

Project Name Capacity (MW) Remaining PPA (Years)

M t. Signal 265.9 24

M A Solar 21.1 24

Atwell Island 23.5 23

US DG Projects 2014 45.4 20

M A Operating 12.2 20

DG 2014 Portfolio 1 23.1 20

DG 2015 Portfolio 2 2.6 20

Regulus Solar 81.6 20

M arsh Hill 18.7 20

SunE Perpetual Lindsay 15.5 20

California Public Institutions 13.5 19

CD DG Portfolio 77.6 19

CAP 101.2 19

Summit Solar Canada 3.8 18

Enfinity 15.7 18

KWP II 21.0 18

SunE Solar Fund X 8.8 17

Rollins 60.0 17

US DG Projects 2009-2013 15.2 16

CalRENEW-1 6.3 16

Kahuku 30.0 16

Hudson Energy 25.5 15

NC Portfolio 26.0 15

Stonehenge 41.1 15

Crundale 37.8 15

Says Court 19.8 15

Crucis Farm 16.1 15

Fairwinds 12.2 15

Norrington 11.2 15

Summit Solar US 19.6 14

Stonehenge Operating 23.6 14

Sheffield 40.0 14

Nellis 14.1 13

Alamosa 8.2 13

Bull Hill 34.5 13

KWP I 30.0 12

Stetson II 25.5 8

Cohoctan 125.0 6

Stetson I 57.0 5

Steel Winds I 20.0 5

Steel Winds II 15.0 5

M ars Hill 42.0 1

T o tal 1,506.9

Weighted Average Remaining PPA Life of 16 years(1)

Note: Assumes weighted average of counterparty credit rating for projects that have more than one counterparty.

1. Weighted average calculated based on MWs as of 09/30/2014.

Remaining Contract Length

0–5 Years 20+ Years 7% 22%

6–10 Years 13%

11–15 Years 19%

16–20 Years 39%

S&P Counterparty Rating

NR AA+ AA AA-

6% <1% 1% <1% A+ BBB- 12% 12%

BBB

7% A

20%

BBB+ 12%

A- 30%

29

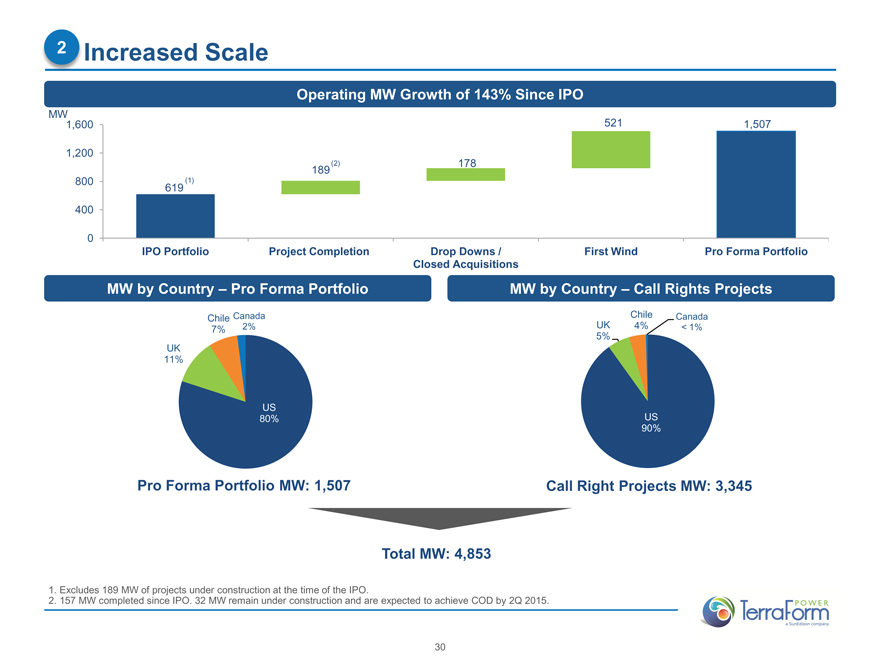

Operating MW Growth of 143% Since IPO

MW

1,600 521 1,507

1,200

189 800 (1) 619

400

0

IPO Portfolio Project Completion Drop Downs / First Wind Pro Forma Portfolio Closed Acquisitions

MW by Country – Pro Forma Portfolio MW by Country – Call Rights Projects

Chile Canada Chile Canada

2% UK 4% < 1%

7%

5% UK

11%

US

80% US 90%

Pro Forma Portfolio MW: 1,507 Call Right Projects MW: 3,345

Total MW: 4,853

Excludes 189 MW of projects under construction at the time of the IPO.

157 MW completed since IPO. 32 MW remain under construction and are expected to achieve COD by 2Q 2015.

30

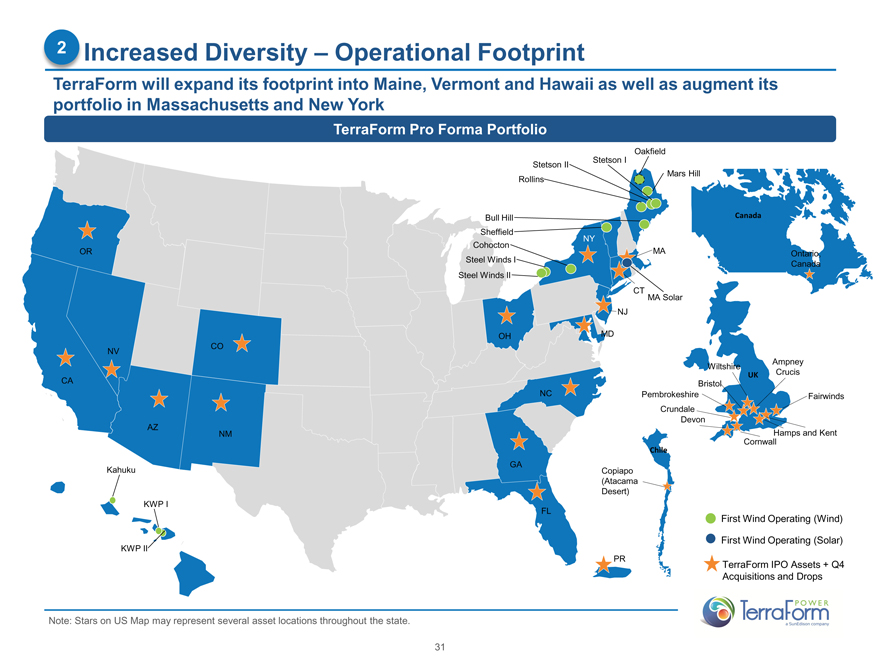

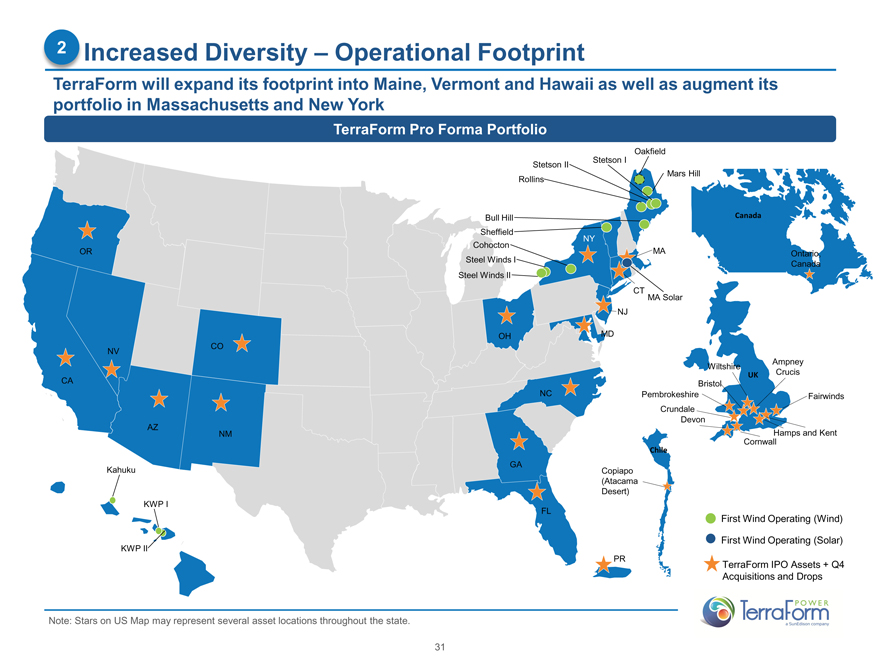

2 | | Increased Diversity – Operational Footprint |

TerraForm will expand its footprint into Maine, Vermont and Hawaii as well as augment its portfolio in Massachusetts and New York

TerraForm Pro Forma Portfolio

Oakfield Stetson I

Stetson II

Mars Hill Rollins

Bull Hill Canada Sheffield NY

Cohocton

OR MA Ontario, Steel Winds I

Canada Steel Winds II

CT

MA Solar NJ

OH MD CO

NV

Ampney Wiltshire UK Crucis CA Bristol

NC Pembrokeshire Fairwinds Crundale AZ Devon Hamps and Kent NM Cornwall

Chile

GA

Kahuku Copiapo (Atacama Desert) KWP I FL

First Wind Operating (Wind)

KWP II First Wind Operating (Solar)

PR

TerraForm IPO Assets + Q4 Acquisitions and Drops

Note: Stars on US Map may represent several asset locations throughout the state.

31

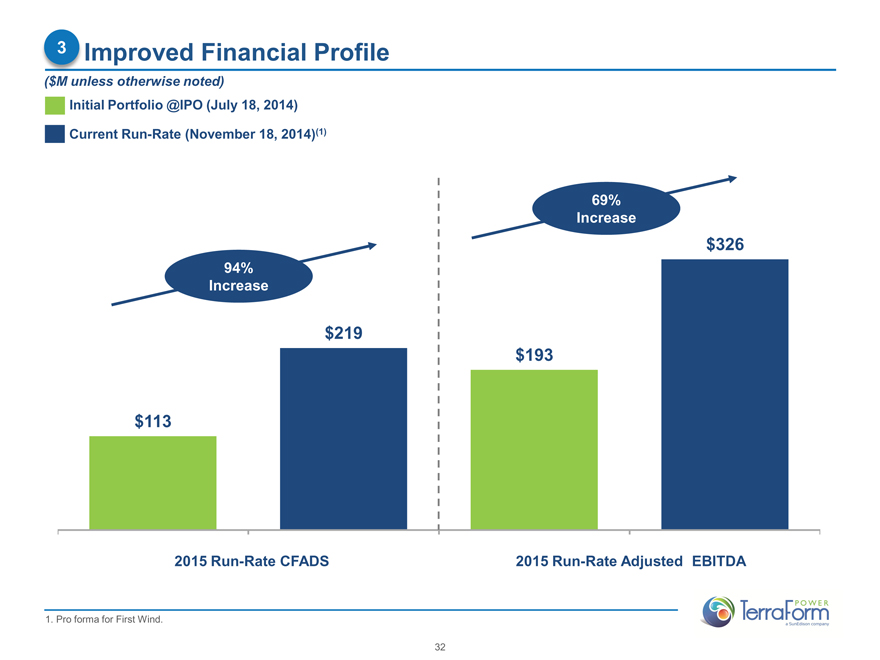

3 | | Improved Financial Profile |

($M unless otherwise noted)

Initial Portfolio @IPO (July 18, 2014)

Current Run-Rate (November 18, 2014)(1)

69% Increase

$326

94% Increase

$219 $193

$113

2015 Run-Rate CFADS 2015 Run-Rate Adjusted EBITDA

1. Pro forma for First Wind.

32

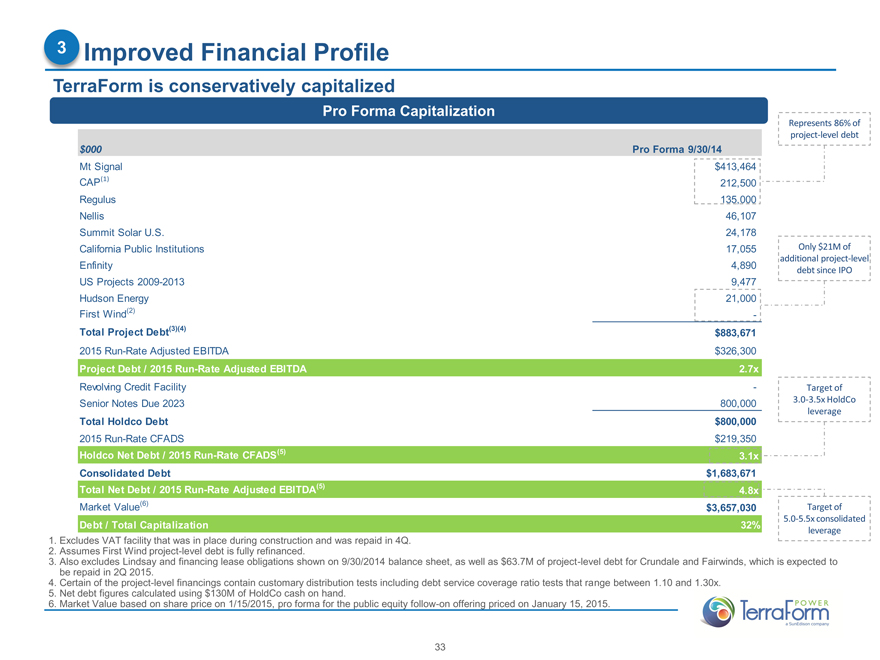

3 | | Improved Financial Profile |

TerraForm is conservatively capitalized

Pro Forma Capitalization

Represents 86% of

project-level debt

$000 Pro Forma 9/30/14

Mt Signal $413,464

CAP(1) 212,500

Regulus 135,000

Nellis 46,107

Summit Solar U.S. 24,178

California Public Institutions 17,055 Only $21M of

additional project-level

Enfinity 4,890 debt since IPO

US Projects 2009-2013 9,477

Hudson Energy 21,000

First Wind(2) —

Total Project Debt(3)(4) $883,671

2015 Run-Rate Adjusted EBITDA $326,300

Project Debt / 2015 Run-Rate Adjusted EBITDA 2.7x

Revolving Credit Facility — Target of

Senior Notes Due 2023 800,000 3.0-3.5x HoldCo

leverage

Total Holdco Debt $800,000

2015 Run-Rate CFADS $219,350

Holdco Net Debt / 2015 Run-Rate CFADS(5) 3.1x

Consolidated Debt $1,683,671

Total Net Debt / 2015 Run-Rate Adjusted EBITDA(5) 4.8x

Market Value(6) $3,657,030 Target of

5.0-5.5x consolidated

Debt / Total Capitalization 32% leverage

Excludes VAT facility that was in place during construction and was repaid in 4Q.

Assumes First Wind project-level debt is fully refinanced.

Also excludes Lindsay and financing lease obligations shown on 9/30/2014 balance sheet, as well as $63.7M of project-level debt for Crundale and Fairwinds, which is expected to be repaid in 2Q 2015.

Certain of the project-level financings contain customary distribution tests including debt service coverage ratio tests that range between 1.10 and 1.30x.

Net debt figures calculated using $130M of HoldCo cash on hand.

Market Value based on share price on 1/15/2015, pro forma for the public equity follow-on offering priced on January 15, 2015.

33

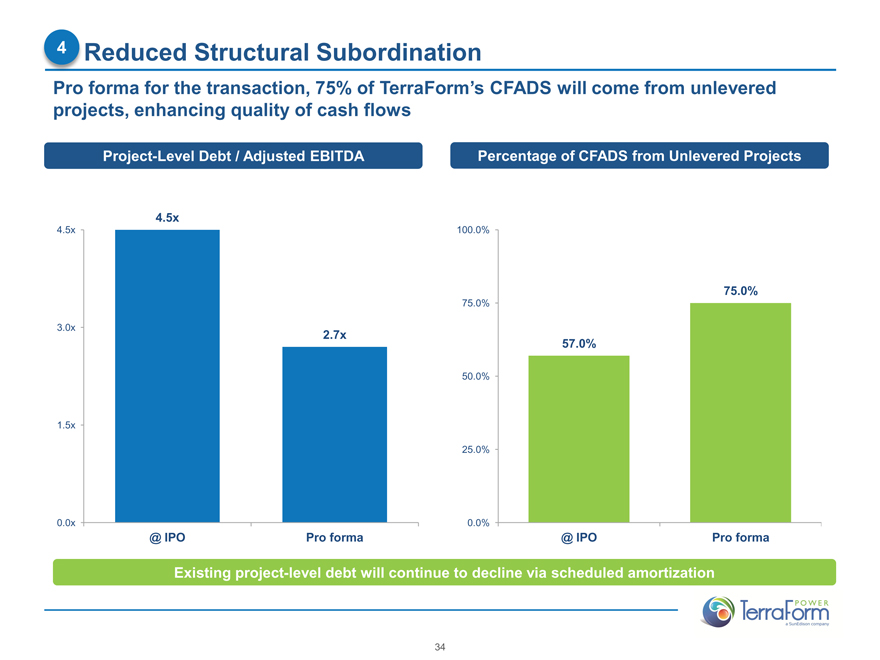

4 | | Reduced Structural Subordination |

Pro forma for the transaction, 75% of TerraForm’s CFADS will come from unlevered projects, enhancing quality of cash flows

Project-Level Debt / Adjusted EBITDA

4.5x

4.5x

3.0x

2.7x

1.5x

0.0x

@ IPO Pro forma

Percentage of CFADS from Unlevered Projects

100.0%

75.0%

75.0%

57.0%

50.0%

25.0%

0.0%

@ IPO Pro forma

Existing project-level debt will continue to decline via scheduled amortization

34

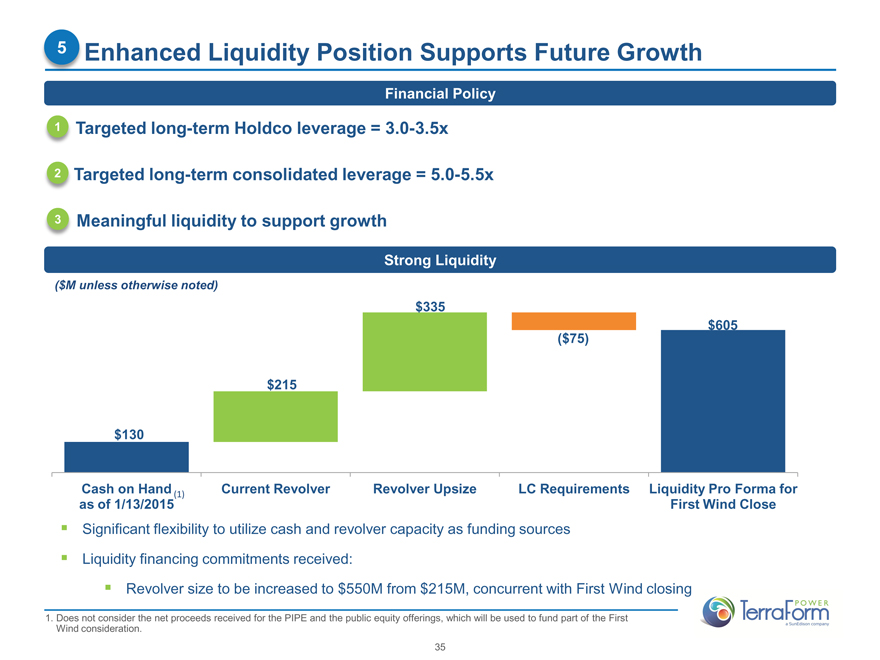

5 | | Enhanced Liquidity Position Supports Future Growth |

Financial Policy

1 | | Targeted long-term Holdco leverage = 3.0-3.5x |

2 | | Targeted long-term consolidated leverage = 5.0-5.5x |

3 | | Meaningful liquidity to support growth |

Strong Liquidity

($M unless otherwise noted) $335 $605

($75) $215 $130

Cash on Hand Current Revolver Revolver Upsize LC Requirements Liquidity Pro Forma for as of 1/13/2015(1) First Wind Close

Significant flexibility to utilize cash and revolver capacity as funding sources Liquidity financing commitments received:

Revolver size to be increased to $550M from $215M, concurrent with First Wind closing

Does not consider the net proceeds received for the PIPE and the public equity offerings, which will be used to fund part of the First Wind consideration.

35

USA: Nellis Air Force Base 14 MW

Section 5: Summary

Key Takeaways

1 | | High Quality Cash Flows From Long-Term Contracts |

With Creditworthy Offtakers

2 | | Increased Scale & Diversity |

3 | | Improved Financial Profile |

4 | | Reduced Structural Subordination |

37

USA: Stetson Wind I 57 MW

Appendix

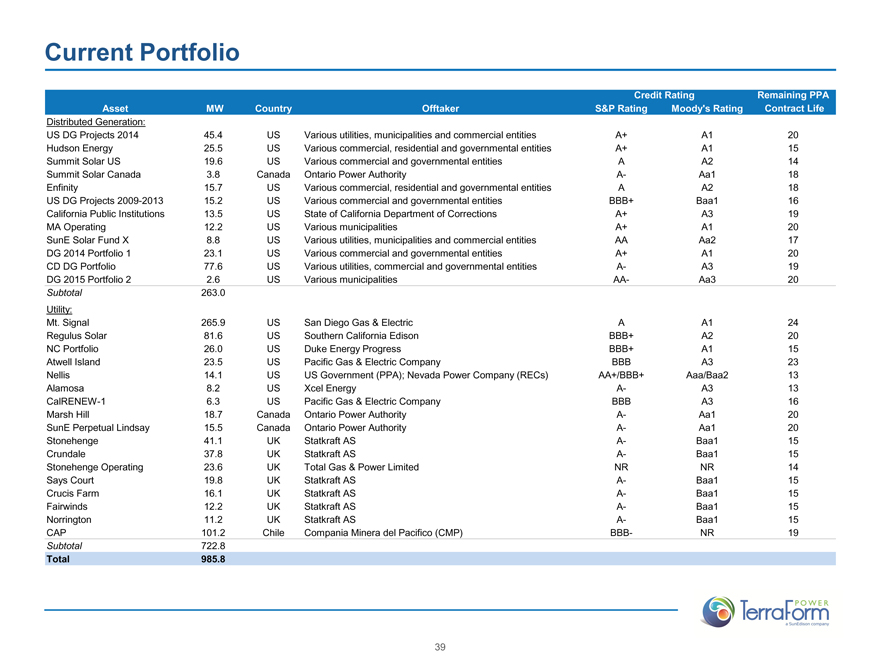

Current Portfolio

Credit Rating Remaining PPA

Asset MW Country Offtaker S&P Rating Moody’s Rating Contract Life

Distributed Generation:

US DG Projects 2014 45.4 US Various utilities, municipalities and commercial entities A+ A1 20

Hudson Energy 25.5 US Various commercial, residential and governmental entities A+ A1 15

Summit Solar US 19.6 US Various commercial and governmental entities A A2 14

Summit Solar Canada 3.8 Canada Ontario Power Authority A- Aa1 18

Enfinity 15.7 US Various commercial, residential and governmental entities A A2 18

US DG Projects 2009-2013 15.2 US Various commercial and governmental entities BBB+ Baa1 16

California Public Institutions 13.5 US State of California Department of Corrections A+ A3 19

MA Operating 12.2 US Various municipalities A+ A1 20

SunE Solar Fund X 8.8 US Various utilities, municipalities and commercial entities AA Aa2 17

DG 2014 Portfolio 1 23.1 US Various commercial and governmental entities A+ A1 20

CD DG Portfolio 77.6 US Various utilities, commercial and governmental entities A- A3 19

DG 2015 Portfolio 2 2.6 US Various municipalities AA- Aa3 20

Subtotal 263.0

Utility:

Mt. Signal 265.9 US San Diego Gas & Electric A A1 24

Regulus Solar 81.6 US Southern California Edison BBB+ A2 20

NC Portfolio 26.0 US Duke Energy Progress BBB+ A1 15

Atwell Island 23.5 US Pacific Gas & Electric Company BBB A3 23

Nellis 14.1 US US Government (PPA); Nevada Power Company (RECs) AA+/BBB+ Aaa/Baa2 13

Alamosa 8.2 US Xcel Energy A- A3 13

CalRENEW-1 6.3 US Pacific Gas & Electric Company BBB A3 16

Marsh Hill 18.7 Canada Ontario Power Authority A- Aa1 20

SunE Perpetual Lindsay 15.5 Canada Ontario Power Authority A- Aa1 20

Stonehenge 41.1 UK Statkraft AS A- Baa1 15

Crundale 37.8 UK Statkraft AS A- Baa1 15

Stonehenge Operating 23.6 UK Total Gas & Power Limited NR NR 14

Says Court 19.8 UK Statkraft AS A- Baa1 15

Crucis Farm 16.1 UK Statkraft AS A- Baa1 15

Fairwinds 12.2 UK Statkraft AS A- Baa1 15

Norrington 11.2 UK Statkraft AS A- Baa1 15

CAP 101.2 Chile Compania Minera del Pacifico (CMP) BBB- NR 19

Subtotal 722.8

Total 985.8

39

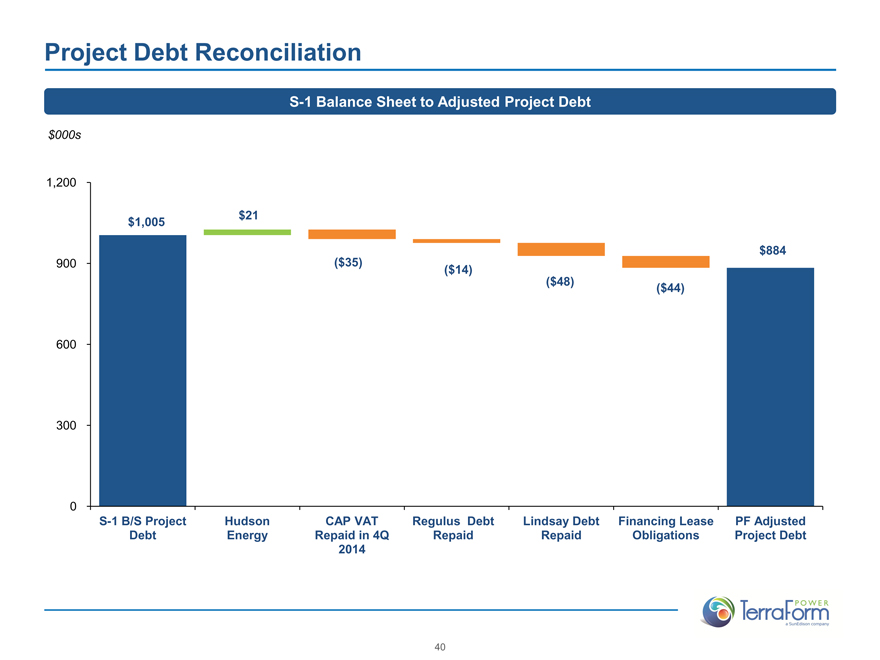

Project Debt Reconciliation

S-1 Balance Sheet to Adjusted Project Debt

$000s

1,200

$1,005 $21

$884

900 ($35) ($14)

($48) ($44)

600

300

0

S-1 B/S Project Hudson CAP VAT Regulus Debt Lindsay Debt Financing Lease PF Adjusted

Debt Energy Repaid in 4Q Repaid Repaid Obligations Project Debt

2014

40

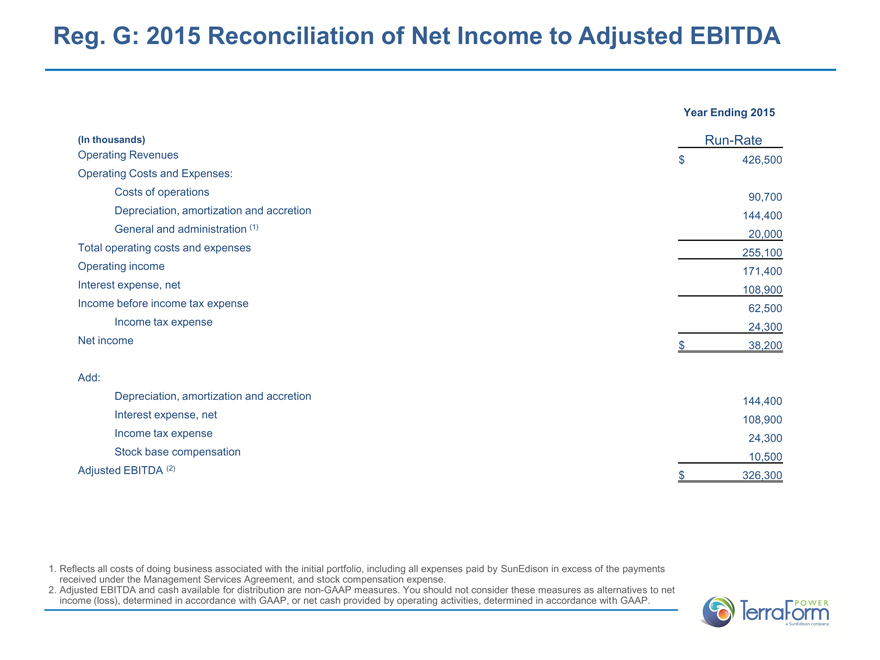

Reg. G: 2015 Reconciliation of Net Income to Adjusted EBITDA

Year Ending 2015

(In thousands) Run-Rate

Operating Revenues $ 426,500

Operating Costs and Expenses:

Costs of operations 90,700

Depreciation, amortization and accretion 144,400

General and administration (1) 20,000

Total operating costs and expenses 255,100

Operating income 171,400

Interest expense, net 108,900

Income before income tax expense 62,500

Income tax expense 24,300

Net income $ 38,200

Add:

Depreciation, amortization and accretion 144,400

Interest expense, net 108,900

Income tax expense 24,300

Stock base compensation 10,500

Adjusted EBITDA (2) $ 326,300

Reflects all costs of doing business associated with the initial portfolio, including all expenses paid by SunEdison in excess of the payments received under the Management Services Agreement, and stock compensation expense.

Adjusted EBITDA and cash available for distribution are non-GAAP measures. You should not consider these measures as alternatives to net income (loss), determined in accordance with GAAP, or net cash provided by operating activities, determined in accordance with GAAP.

41

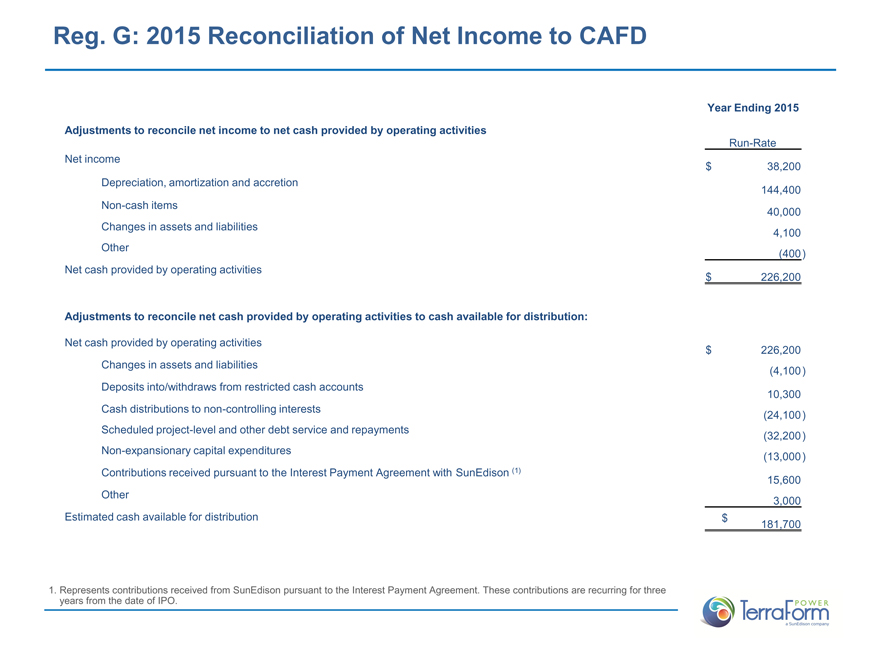

Reg. G: 2015 Reconciliation of Net Income to CAFD

Year Ending 2015

Adjustments to reconcile net income to net cash provided by operating activities

Run-Rate

Net income

$ 38,200

Depreciation, amortization and accretion

144,400

Non-cash items 40,000

Changes in assets and liabilities 4,100

Other (400 )

Net cash provided by operating activities

$ 226,200

Adjustments to reconcile net cash provided by operating activities to cash available for distribution:

Net cash provided by operating activities

$ 226,200

Changes in assets and liabilities (4,100 )

Deposits into/withdraws from restricted cash accounts

10,300

Cash distributions to non-controlling interests (24,100 )

Scheduled project-level and other debt service and repayments (32,200 )

Non-expansionary capital expenditures (13,000 )

Contributions received pursuant to the Interest Payment Agreement with SunEdison (1)

15,600

Other 3,000

Estimated cash available for distribution $ 181,700

Represents contributions received from SunEdison pursuant to the Interest Payment Agreement. These contributions are recurring for three years from the date of IPO.