Saeta Acquisition TERRAFORM POWER FEBRUARY 2018 Exhibit 99.2

2 Cautionary Statement Regarding Forward-Looking Statements This communication contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts. These statements involve estimates, expectations, projections, goals, assumptions, known and unknown risks, and uncertainties and typically include words or variations of words such as “expect,” “anticipate,” “believe,” “intend,” “plan,” “seek,” “estimate,” “predict,” “project,” “goal,” “guidance,” “outlook,” “objective,” “forecast,” “target,” “potential,” “continue,” “would,” “will,” “should,” “could,” or “may” or other comparable terms and phrases. All statements that address operating performance, events, developments or financial performance that TerraForm Power expects or anticipates will occur in the future are forward-looking statements. They may include estimates or forecasts of expected net income (loss), revenues, earnings, adjusted EBITDA, adjusted revenue, cash available for distribution (CAFD), dividend growth, cost saving initiatives, capital expenditures, liquidity, capital structure, future growth, and other financial performance items (including future dividends per share), descriptions of management’s plans or objectives for future operations, products, or services, or descriptions of assumptions underlying any of the above. Forward-looking statements provide TerraForm Power’s current expectations or predictions of future conditions, events, or results and speak only as of the date they are made. Although TerraForm Power believes its expectations and assumptions are reasonable, it can give no assurance that these expectations and assumptions will prove to have been correct and actual results may vary materially. By their nature, forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those suggested by the forward-looking statements. Factors that might cause such differences include, but are not limited to, risks related to the expected timing and likelihood of completion of the tender offer for the shares of Saeta Yield, S.A. (“Saeta”), including the timing or receipt of any governmental approvals, risks related to our financing of the transaction, including our ability to issue equity on terms that are accretive to our shareholders and our ability to implement our permanent funding plan, risks related to the integration of Saeta and realization of the benefits of the transaction, risks related to the number of the shares of Saeta that are tendered, including the risk that we are unable to acquire all of the shares of Saeta and are subject to minority shareholder protection rights, the risk that any announcement of the transaction could have on an adverse impact on the market price of our common stock, risks related to entering new international jurisdictions, including related to our increased exposure to foreign currency fluctuation and risks and costs associated with the hedging of the Euro, risks related to Brookfield sponsorship, including our ability to realize the expected benefits of the transaction with Brookfield, risks related to wind conditions at our wind assets or to eather conditions at our solar assets, risks related to potential events of default at our project financings, risks related to delays in our filing of periodic reports with the SEC, risks related to the effectiveness of our internal controls over financial reporting, pending and future litigation, our ability to integrate the projects we acquire from third parties or otherwise and realize the anticipated benefits from such acquisitions, the willingness and ability of counterparties to fulfill their obligations under offtake agreements, price fluctuations, termination provisions and buyout provisions in offtake agreements, our ability to enter into contracts to sell power on acceptable prices and terms, including as our offtake agreements expire, our ability to successfully identify, evaluate and consummate acquisitions, government regulation, including compliance with regulatory and permit requirements and changes in market rules, rates, tariffs, tax rules, environmental laws and policies affecting renewable energy, operating and financial restrictions placed on us and our subsidiaries related to agreements governing indebtedness, the condition of the debt and equity capital markets and our ability to borrow additional funds and access capital markets, as well as our substantial indebtedness and the possibility that we may incur additional indebtedness going forward, cash trapped at the project level, including the risk that such project-level cash may not be released up to us in a timely manner, risks related to the proposed relocation of our headquarters, our ability to compete against traditional and renewable energy companies, and hazards customary to the power production industry and power generation operations, such as unusual weather conditions and outages. TerraForm Power disclaims any obligation to publicly update or revise any forward-looking statement to reflect changes in underlying assumptions, factors, or expectations, new information, data, or methods, future events, or other changes, except as required by law. The foregoing list of factors that might cause results to differ materially from those contemplated in the forward-looking statements should be considered in connection with information regarding risks and uncertainties which are described in TerraForm Power’s Form 10-K for the fiscal year ended December 31, 2016 including the risk factors identified therein, as well as additional factors it may describe from time to time in other filings with the Securities and Exchange Commission. You should understand that it is not possible to predict or identify all such factors and, consequently, you should not consider any such list to be a complete set of all potential risks or uncertainties. The information presented in this presentation does not represent a complete picture of the financial position, results of operation or cash flows of TerraForm Power, is not a replacement for full financial statements prepared in accordance with U.S. GAAP. In addition, this presentation contains projections of TerraForm Power’s CAFD and proforma CAFD figures giving effect to the Saeta transaction, which are not measures under generally accepted accounting principles in the United States. TerraForm Power believes these measures are useful to investors but the use of these measures is subject to inherent limitations and these measures should not be considered in isolation from or as a substitute for the applicable U.S. GAAP measure. Exhibit 99.2

3 1. If requested by TERP, Brookfield has agreed to provide a backstop for up to $400 million of the equity offering if the offering price equals the five-day volume weighted average price (VWAP) as of close of market on February 6, 2018, of $10.66 per share 2. Weighted on Net MW, as of January 31, 2018 Saeta Acquisition | Executive Summary • TerraForm Power has announced that it will commence a voluntary tender offer to acquire 100% of the outstanding shares of Saeta Yield, S.A. (“Saeta”) ‒ TERP’s offer will be €12.20 in cash per share of Saeta ‒ Tender offer is irrevocably supported by Saeta shareholders who together own more than a 50% interest and have committed to sell into the offer ‒ Purchase price of the ~50% interest will be approximately $600 million ‒ If TERP successfully acquires 100% of Saeta in tender offer, total purchase price will be ~ $1.2 billion ‒ TERP intends to finance the transaction with a $400 million equity offering, fully backstopped by Brookfield1, with the balance funded from available liquidity • Saeta is a leading European owner and operator of wind and solar assets, located primarily in Spain with 778 MW of wind and 250 MW of solar • 100% of Saeta’s revenues are generated under very stable regulatory or contractual frameworks with investment grade counterparties • Transaction highlights ‒ Increases size of TERP’s portfolio by ~40%2 and establishes a scale presence in Western Europe ‒ Expected to be highly accretive to TERP’s CAFD ‒ Accelerates deleveraging of TERP’s balance sheet • TERP has increased its dividend to $0.76 per share (on an annual basis), a 6% increase over its previous target of $0.72 per share, and reconfirms its dividend growth target of 5-8% per annum • The tender offer is expected to close in the second quarter of 2018, subject to certain conditions, including obtaining regulatory approvals Exhibit 99.2

4 Highly accretive • Pro forma FY 2017 adjusted CAFD per share accretion of 24% • Levered IRR in excess of TERP’s target return High quality asset base in attractive target market • 100% owned, recently constructed assets in Western Europe • 778 MW onshore wind and 250 MW concentrated solar • Average age of six years and remaining useful life in excess of 25 years Stable and predictable cash flows • 100% of revenues generated under stable frameworks with investment grade counterparties • 80% of revenues are regulated with limited resource and market price risk; remaining 20% are under long term power purchase or concession agreements • Average remaining regulatory/contractual term of 15 years Multiple value levers • Opportunity to enhance value by reducing G&A and operating and maintenance costs • Ability to increase cashflow by extending maturities of Saeta’s project debt, which fully amortizes with ~5 years of remaining regulatory/contract life Accelerate achievement of deleveraging objective • Accelerates deleveraging of its corporate debt to cash flow ratio towards its 4.0x and 5.0x target • Furthers TERP’s long term plan to establish an investment grade balance sheet Saeta Acquisition | Transaction Highlights This transformative transaction demonstrates TERP’s ability to grow accretively, expand its geographic footprint, and accelerate the deleveraging of its balance sheet with transactions originated through Brookfield’s sponsorship Exhibit 99.2

5 Saeta Acquisition | Saeta Portfolio Overview1 Net MW 1,028 MW Wind 778 MW Concentrated Solar 250 MW Number of Sites 24 % IG Counterparties 100% 18+ years, 29% 14-18 years, 26% 11-14 years, 45% Average 15 years Spain Wind 53% Spain CSP 24% Portugal Wind 14% Uruguay Wind 9% 9-10 years, 14% 6-9 years, 35% 3-6 years, 42% 1-3 years, 9% Average 6 years 76% wind 24% solar Remaining Contract LifeAsset AgeCapacity (MW) Summary Statistics Spain 789 MW Portugal 144 MW Uruguay 95 MW 1. Derived from Saeta’s publicly available disclosures Exhibit 99.2

6 <10 years 12% 10-15 years 45% 15-20 years 25% 20+ years 18% Saeta Acquisition | TERP Portfolio Overview (Post-Acquisition) Significant resource diversity2 Recently constructed2 Long-Term Offtake Contracts1 Solar 27% Solar (Regulated) 6% Wind 54% Wind (Regulated) 13% 3.6 GW Fleet <2 years 15% 2-5 years 52% >5 years 33% 1. Average remaining offtake contract length is net MW-weighted, as of 12/31/2017 2. Weighted on Net MW. As of January 25, 2018 Average age of 5 years Solar: US 25% Solar: Canada 2% Solar: Europe 7% Solar: Chile 3% Wind: US Midwest 16% Wind: US Northeast 11% Wind: US Texas 11% Wind: US Hawaii 2% Wind: Canada 2% Wind: Spain 15% Wind: Portugal 4% Wind: Uruguay 3% Meaningful Portfolio Effect Large-scale, diversified portfolio2 ~14 years1 of contracted cash flow with significant resource diversity Average ~14 years Remaining Exhibit 99.2

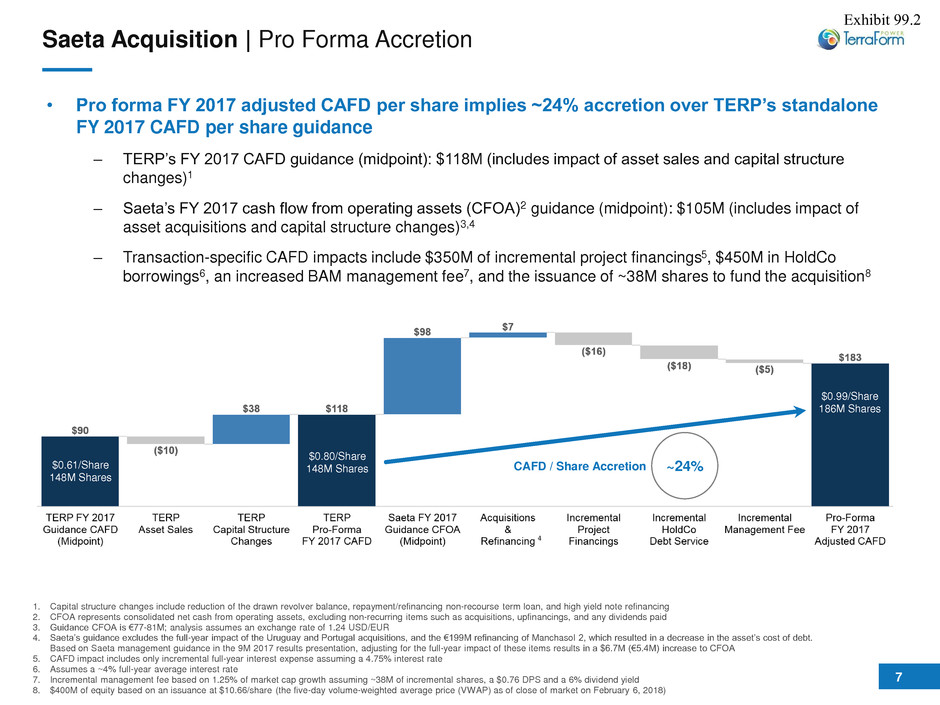

7 1. Capital structure changes include reduction of the drawn revolver balance, repayment/refinancing non-recourse term loan, and high yield note refinancing 2. CFOA represents consolidated net cash from operating assets, excluding non-recurring items such as acquisitions, upfinancings, and any dividends paid 3. Guidance CFOA is €77-81M; analysis assumes an exchange rate of 1.24 USD/EUR 4. Saeta’s guidance excludes the full-year impact of the Uruguay and Portugal acquisitions, and the €199M refinancing of Manchasol 2, which resulted in a decrease in the asset’s cost of debt. Based on Saeta management guidance in the 9M 2017 results presentation, adjusting for the full-year impact of these items results in a $6.7M (€5.4M) increase to CFOA 5. CAFD impact includes only incremental full-year interest expense assuming a 4.75% interest rate 6. Assumes a ~4% full-year average interest rate 7. Incremental management fee based on 1.25% of market cap growth assuming ~38M of incremental shares, a $0.76 DPS and a 6% dividend yield 8. $400M of equity based on an issuance at $10.66/share (the five-day volume-weighted average price (VWAP) as of close of market on February 6, 2018) • Pro forma FY 2017 adjusted CAFD per share implies ~24% accretion over TERP’s standalone FY 2017 CAFD per share guidance ‒ TERP’s FY 2017 CAFD guidance (midpoint): $118M (includes impact of asset sales and capital structure changes)1 ‒ Saeta’s FY 2017 cash flow from operating assets (CFOA)2 guidance (midpoint): $105M (includes impact of asset acquisitions and capital structure changes)3,4 ‒ Transaction-specific CAFD impacts include $350M of incremental project financings5, $450M in HoldCo borrowings6, an increased BAM management fee7, and the issuance of ~38M shares to fund the acquisition8 Saeta Acquisition | Pro Forma Accretion $0.80/Share 148M Shares$0.61/Share 148M Shares $0.99/Share 186M Shares CAFD / Share Accretion ~24% 4 Exhibit 99.2

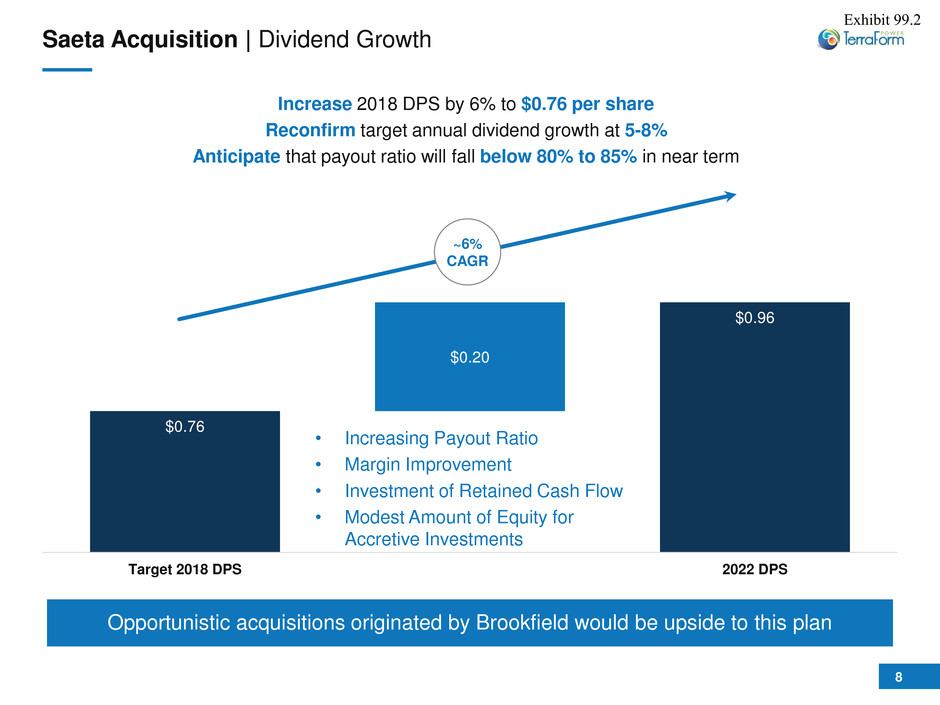

8 $0.76 $0.96 $0.20 Target 2018 DPS 2022 DPS Saeta Acquisition | Dividend Growth Increase 2018 DPS by 6% to $0.76 per share Reconfirm target annual dividend growth at 5-8% Anticipate that payout ratio will fall below 80% to 85% in near term ~6% CAGR Opportunistic acquisitions originated by Brookfield would be upside to this plan • Increasing Payout Ratio • Margin Improvement • Investment of Retained Cash Flow • Modest Amount of Equity for Accretive Investments Exhibit 99.2

9 • Prior to funding the transaction, TerraForm Power has over $1 billion of liquidity under committed facilities, including $500 million under its corporate credit facility, which has been upsized to $600 million, and $500 million under the sponsor line with Brookfield • Assuming a $1.2 billion acquisition price, TERP intends to execute a funding plan comprised of the following sources: ‒ A $400 million equity offering, which Brookfield has agreed to backstop in order to provide a minimum issuance price equal to TerraForm Power’s 5-day VWAP immediately prior to announcement of the transaction1; ‒ The remaining $800 million will be financed with available liquidity, which Terraform Power intends to refinance with a combination of project financings of its unencumbered assets and cash to be released from Saeta’s assets Saeta Acquisition | Funding Plan HoldCo 42% Non- recourse 58% TERP Standalone Leverage Breakdown (9/30/2017) HoldCo 36% Non- recourse 64% Post-Acquisition Leverage Breakdown Pro Forma2 1. If requested by TERP, Brookfield has agreed to provide a backstop for up to $400 million of the equity offering if the offering price equals the five-day volume weighted average price (VWAP) as of close of market on February 6, 2018, of $10.66 per share 2. Non-recourse includes $350 million of non-recourse project-level debt utilized in funding the Saeta acquisition Exhibit 99.2

10 Appendix Exhibit 99.2

11 Saeta Acquisition | Spanish Tariff Summary Mitigant Description Tariff Deficit Under Control • Historical deficit debt being repaid (€2.5 billion/year) with current power system annual surplus of ~€500 million1 Revision Dynamics • Regulation allows government discretion over revision parameters (i.e., spread over 10-yr bond) every 6-years to set a “reasonable rate of return” European Renewables Targets • Reduction in regulated returns would compromise 8 GW2 of new greenfield projects awarded at 2017 auctions Lawsuits from 2014 Reform • Government has already created reserves to address future settlements stemming from lawsuits from 2014 subsidy reform • Spanish regulated return is a key value driver, but existing risks have been effectively mitigated ‒ Spanish revenues account for ~80% of total Saeta revenues and are 100% regulated ‒ Regulated return revisions every 6-years with next revision in 2020 ‒ Underwriting assumes a downward revision by 2020 • Risk of downward revision in 2020 of regulated return is mitigated by: 1. Source: CNMC’s Report on the Current Status of the Debt of the Electrical System 2. Source: European Commission (http://europa.eu/rapid/press-release_IP-17-4542_en.htm) Exhibit 99.2

12 • Regulatory regime remunerates renewables through a guaranteed return on deemed investment (RAB model) to be revised every 6 years based on Spanish bond plus a spread ‒ Regulated return takes into account the economic cycle, electricity demand, and Spanish treasury bond outlook, providing a “reasonable return” for these activities ‒ Revised every 6 years, with the next review due in 2020 • Remuneration comprises a capacity payment (€/MW) on top of merchant revenues and is determined by applying the regulated return to the Net Asset Value (NAV) of a theoretical reference plant ‒ NAV is based on standard cost and generation parameters of an average plant differentiated by region and COD ‒ Capacity top-up value is the difference between merchant revenues forecasted by the regulator and the total revenues required to reach regulated returns • Determined ex-ante and valid for a 6-year period with minor look-back adjustments in year 3 to account for difference between power price and peaking discount outturn versus government forecasts Saeta Acquisition | Spanish Tariff Mechanics Market Payment Component Regulated Payment Component Electricity Sold @ Pool Remuneration to Investment (Rinv) top-up payment over electricity sales, to reach guaranteed RoR Regulated Revenues • Paid in hourly market • Renewable facilities sell electricity to the market • Received on a monthly basis: Fixed amount per installed capacity (€/MW) • Intended to cover investment costs that cannot be recovered through the sale of electricity to the market in order to reach the guaranteed regulated return Exhibit 99.2

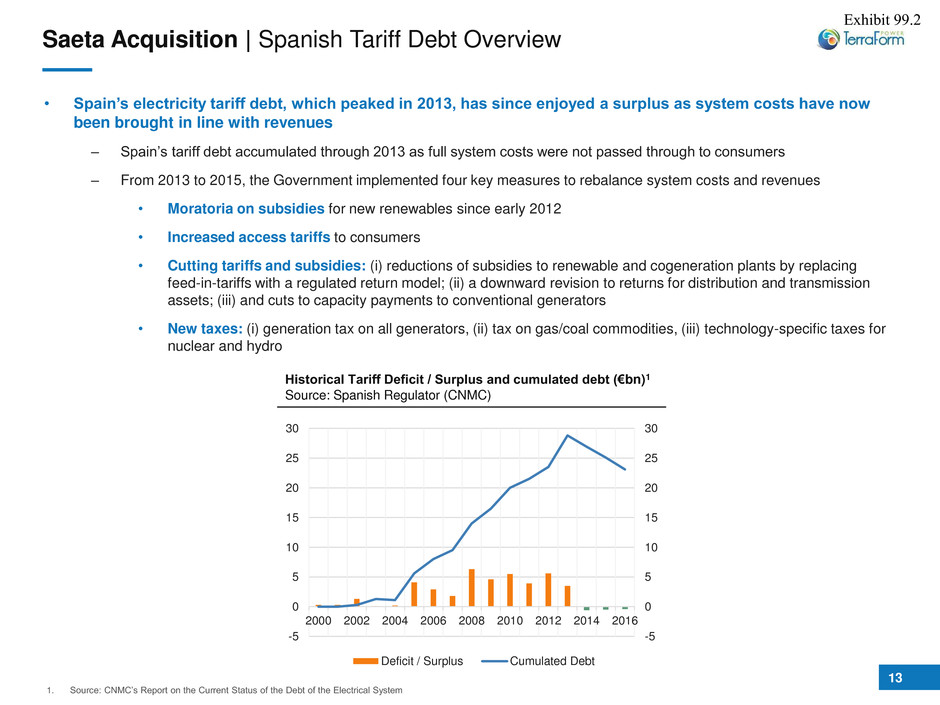

13 Saeta Acquisition | Spanish Tariff Debt Overview Historical Tariff Deficit / Surplus and cumulated debt (€bn)1 Source: Spanish Regulator (CNMC) • Spain’s electricity tariff debt, which peaked in 2013, has since enjoyed a surplus as system costs have now been brought in line with revenues ‒ Spain’s tariff debt accumulated through 2013 as full system costs were not passed through to consumers ‒ From 2013 to 2015, the Government implemented four key measures to rebalance system costs and revenues • Moratoria on subsidies for new renewables since early 2012 • Increased access tariffs to consumers • Cutting tariffs and subsidies: (i) reductions of subsidies to renewable and cogeneration plants by replacing feed-in-tariffs with a regulated return model; (ii) a downward revision to returns for distribution and transmission assets; (iii) and cuts to capacity payments to conventional generators • New taxes: (i) generation tax on all generators, (ii) tax on gas/coal commodities, (iii) technology-specific taxes for nuclear and hydro 1. Source: CNMC’s Report on the Current Status of the Debt of the Electrical System -5 0 5 10 15 20 25 30 -5 0 5 10 15 20 25 30 2000 2002 2004 2006 2008 2010 2012 2014 2016 Deficit / Surplus Cumulated Debt Exhibit 99.2