Exhibit 99.1 TerraForm Power (TERP) CORPORATE PROFILE JUNE 2018

Exhibit 99.1 Cautionary Statement Regarding Forward-Looking Statements This communication contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts. These statements involve estimates, expectations, projections, goals, assumptions, known and unknown risks, and uncertainties and typically include words or variations of words such as “expect,” “anticipate,” “believe,” “intend,” “plan,” “seek,” “estimate,” “predict,” “project,” “goal,” “guidance,” “outlook,” “objective,” “forecast,” “target,” “potential,” “continue,” “would,” “will,” “should,” “could,” or “may” or other comparable terms and phrases. All statements that address operating performance, events, or developments that TerraForm Power expects or anticipates will occur in the future are forward-looking statements. They may include estimates of cash available for distribution (“CAFD”), dividend growth, cost savings initiatives, earnings, Adjusted EBITDA, revenues, income, loss, capital expenditures, liquidity, capital structure, future growth, and other financial performance items (including future dividends per share), descriptions of management’s plans or objectives for future operations, products, or services, or descriptions of assumptions underlying any of the above. Forward-looking statements provide TerraForm Power’s current expectations or predictions of future conditions, events, or results and speak only as of the date they are made. Although TerraForm Power believes its expectations and assumptions are reasonable, it can give no assurance that these expectations and assumptions will prove to have been correct and actual results may vary materially. By their nature, forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those suggested by the forward-looking statements. Factors that might cause such differences include, but are not limited to, risks related to: the transition to Brookfield Asset Management Inc. sponsorship, including our ability to realize the expected benefits of the sponsorship; risks related to wind conditions at our wind assets or to weather conditions at our solar assets; risks related to the effectiveness of our internal controls over financial reporting; pending and future litigation; the willingness and ability of counterparties to fulfill their obligations under offtake agreements; our ability to successfully realize our cost savings targets and the anticipated benefits thereof; price fluctuations, termination provisions and buyout provisions in offtake agreements; our ability to enter into contracts to sell power on acceptable prices and terms, including as our offtake agreements expire; our ability to compete against traditional and renewable energy companies; government regulation, including compliance with regulatory and permit requirements and changes in tax laws, market rules, rates, tariffs, environmental laws and policies affecting renewable energy; the condition of the debt and equity capital markets and our ability to borrow additional funds and access capital markets, as well as our substantial indebtedness and the possibility that we may incur additional indebtedness going forward; operating and financial restrictions placed on us and our subsidiaries related to agreements governing indebtedness; our ability to successfully realize the anticipated benefits from the acquisition of Saeta Yield, S.A.; our ability to successfully execute and realize the anticipated benefits of our funding plan related to the acquisition of Saeta Yield, S.A.; our ability to successfully integrate the operations, technologies and personnel of Saeta Yield, S.A.; our ability to establish appropriate accounting controls, reporting procedures and regulatory compliance procedures in connection with the acquisition of Saeta Yield, S.A.; our ability to successfully identify, evaluate and consummate future acquisitions; and our ability to integrate future projects we acquire from third parties, or otherwise and realize the anticipated benefits from such acquisitions. The Company disclaims any obligation to publicly update or revise any forward-looking statement to reflect changes in underlying assumptions, factors, or expectations, new information, data, or methods, future events, or other changes, except as required by law. The foregoing list of factors that might cause results to differ materially from those contemplated in the forward-looking statements should be considered in connection with information regarding risks and uncertainties, which are described in our Annual Report on Form 10-K and any subsequent Quarterly Report on Form 10-Q, as well as additional factors we may describe from time to time in other filings with the SEC. We operate in a competitive and rapidly changing environment. New risks and uncertainties emerge from time to time, and you should understand that it is not possible to predict or identify all such factors and, consequently, you should not consider any such list to be a complete set of all potential risks or uncertainties. 2

Exhibit 99.1 Who We Are We are an integrated renewable power company that seeks to provide an attractive and sustainable total return to our investors 3

Exhibit 99.1 Overview of TerraForm Power ~$2.4 Billion1 TERP ~6.7% Yield2 Significant NOLs3 ~65% $0.76 TARGET MARKET TAX ADVANTAGED BROOKFIELD NASDAQ 2018 PER SHARE CAPITALIZATION STRUCTURE (C CORP) OWNERSHIP DIVIDEND $9 billion 3,600 64% / 36% POWER ASSETS MEGAWATTS OF CAPACITY 4 WIND / SOLAR 4 TERP’s mandate is to acquire, own and operate wind and solar assets in North America and Western Europe 1. Based on the closing price of TERP’s Class A common stock of $11.36 per share on June 12, 2018. 2. Based on 2018 target dividend of $0.76 per share and the closing price of TERP’s Class A common stock of $11.36 per share on June 12, 2018. 3. Net Operating Losses (“NOLs”). 4. Determined based on megawatts (“MWs”) owned by TERP net of proportional MWs owned by minority investors ("Net MWs") after giving pro forma effect to the acquisition of Saeta Yield, S.A. 4 (“Saeta”).

Exhibit 99.1 Renewables Portfolio of Scale in North America and Western Europe Owner and operator of an over 3,600 MW diversified portfolio of high-quality wind and solar assets, underpinned by long-term contracts Spain Portugal Uruguay U.K. Chile Wind Solar Total US 1,454 MW 894 MW 2,348 MW International 856 MW 430 MW 1,286 MW Total 1 2,310 MW 1,324 MW 3,634 MW 1. Determined based on total Net MW after giving pro forma effect to the acquisition of Saeta. 5

Exhibit 99.1 Our Value Proposition Our objective is to deliver an attractive and sustainable total return per annum to our shareholders 1 2 Attractive dividend Sustainable yield supported Target 5-8% total return by conservative annual DPS1 in the low teens target payout of increase 80-85% of CAFD 1. Dividend per share (“DPS”). 6

Exhibit 99.1 Simple Strategy to Enhance Shareholder Value Invest on a value basis in target markets of North America and Western Europe Build best-in-class operating platform to enhance margins and optimize the value of our portfolio Strengthen balance sheet over time to lower cost of capital and support capital market flexibility 7

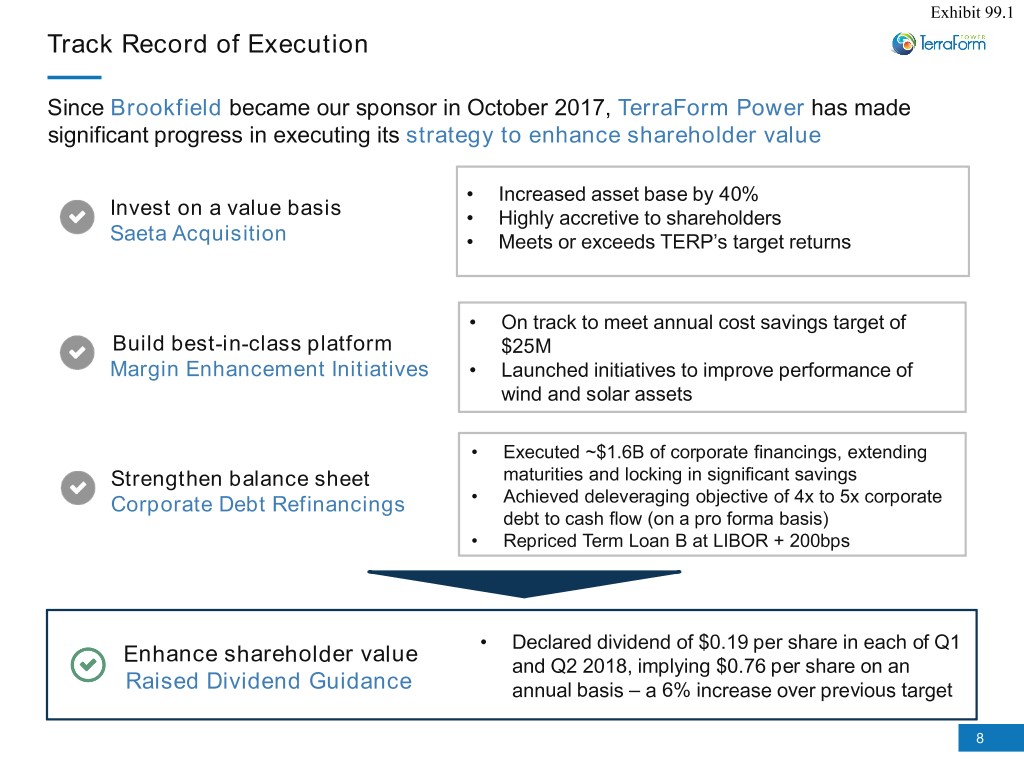

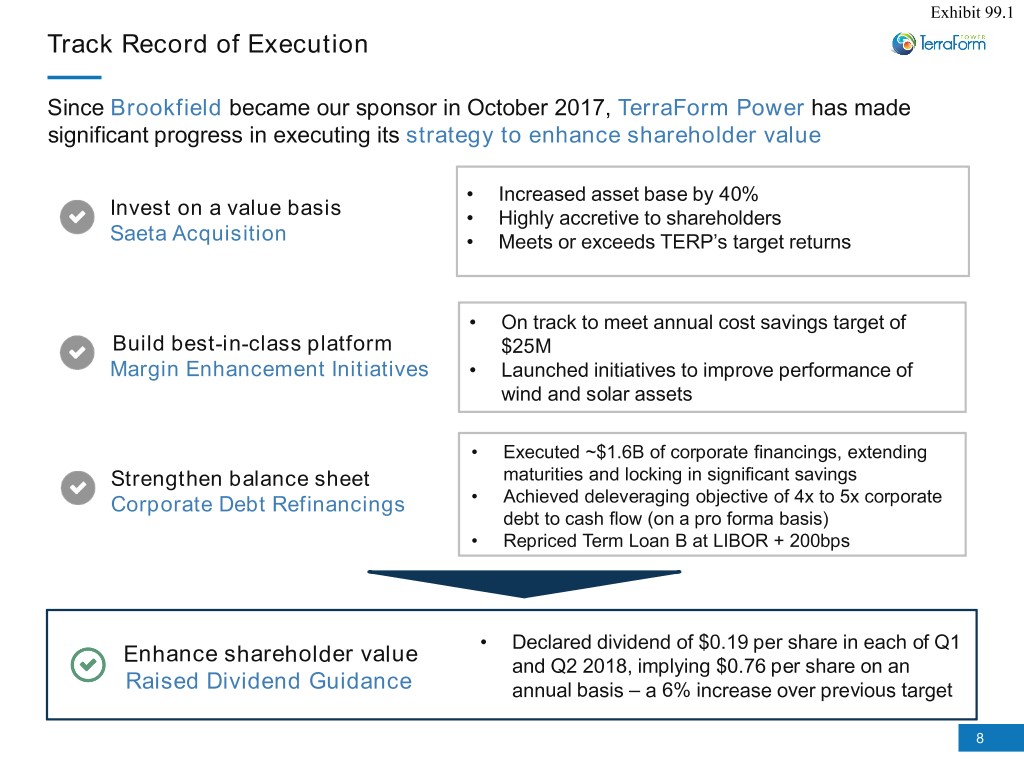

Exhibit 99.1 Track Record of Execution Since Brookfield became our sponsor in October 2017, TerraForm Power has made significant progress in executing its strategy to enhance shareholder value • Increased asset base by 40% Invest on a value basis • Highly accretive to shareholders Saeta Acquisition • Meets or exceeds TERP’s target returns • On track to meet annual cost savings target of Build best-in-class platform $25M Margin Enhancement Initiatives • Launched initiatives to improve performance of wind and solar assets • Executed ~$1.6B of corporate financings, extending Strengthen balance sheet maturities and locking in significant savings Corporate Debt Refinancings • Achieved deleveraging objective of 4x to 5x corporate debt to cash flow (on a pro forma basis) • Repriced Term Loan B at LIBOR + 200bps • Declared dividend of $0.19 per share in each of Q1 Enhance shareholder value and Q2 2018, implying $0.76 per share on an Raised Dividend Guidance annual basis – a 6% increase over previous target 8

Exhibit 99.1 Profile of Operations 1 Utility Wind 2 Utility Solar 3 Distributed Solar 4 Regulated Wind and Solar 9

Exhibit 99.1 Utility Wind VT - 40 MW Summary Statistics1 Canada - 78 MW Net MW 1,771 MW Number of Sites 21 ME - 219 MW Portugal - 144 MW NY - 160 MW % of Total Net MW 49% IL - 386 MW NE - 181 MW HI - 81 MW Uruguay - 95 MW TX - 387 MW Remaining PPA Life1 Offtaker Credit Rating1 Turbine Supplier1 0-4 years 20+ years Suzlon Siemens Gamesa 16% 13% 5% 2% Clipper 5-9 years 13% 2% 15-19 years 13% 100% Primarily Average Investment 12 years Grade Top (IG) Vestas Tier GE 20% 60% 10-14 years 56% 1. After giving pro forma effect to the acquisition of Saeta. Net MW, Remaining PPA Life, Offtaker Credit Rating, and Turbine Supplier are MW-weighted. Offtaker Credit Rating indicates “IG” if rated as Investment Grade by either Moody’s or S&P, “NR” if not rated by either S&P and Moody’s, “< IG” if the former cases are not applicable and rated less than Investment Grade by either Moody’s or S&P. Remaining PPA Life and Offtaker Credit Rating are as of March 31, 2018. 10

Exhibit 99.1 Utility Solar CO - 8 MW Summary Statistics1 UT - 23 MW Canada - 59 MW Net MW 671 MW NV - 32 MW Number of Sites 26 U.K. - 11 MW CA - 402 MW % of Total Net MW 18% NC - 26 MW Chile - 102 MW FL - 8 MW Remaining PPA Life1 Offtaker Credit Rating1 Module Supplier1 NR Celestica All others 10-14 years 4% Trina Solar 3% (<3%) 9% < IG 3% 3% 15% Sharp 4% SunEdison SunTech / MEMC 20+ years 6% High 42% Average 81% 48% 18 years IG Quality Modules 15-19 years 43% First Solar 39% 1. After giving pro forma effect to the acquisition of Saeta. Net MW, Remaining PPA Life, Offtaker Credit Rating, and Module Supplier are MW-weighted. Offtaker Credit Rating indicates “IG” if rated as Investment Grade by either Moody’s or S&P, “NR” if not rated by either S&P and Moody’s, “< IG” if the former cases are not applicable and rated less than Investment Grade by either Moody’s or S&P. Remaining PPA Life and Offtaker Credit Rating are as of March 31, 2018. 11

Exhibit 99.1 Distributed Solar Canada - 8 MW 1 Summary Statistics OH - 10 MW MN - 2 MW OR - 1 MW VT - 8 MW Net MW 404 MW NH - 1 MW MA - 123 MW CT - 1 MW Number of Sites 489 NY - 16 MW NJ - 63 MW % of Total Net MW 11% PA - 8 MW MD - 19 MW CA - 99 MW NC - 10 MW UT - 19 MW AZ - 12 MW GA - 5 MW CO - 4 MW FL - 1 MW NM - 1 MW TX - 1 MW HI - 1 MW PR - 5 MW Remaining PPA Life1 Offtaker Credit Rating1 Module Supplier1 0-4 years Solar All others (≤1%) 5-9 years 20+ years 1% World 10% 9% 10% NR Canadian 23% Solar 2% 4% SunEdison / MEMC SunPower 35% 4% 10-14 years < IG High Average 75% 25% 2% Quality 15 years IG SunTech 7% Modules Trina Solar 11% 15-19 Yingli Chint years 55% Solar Solar 11% 16% 1. After giving pro forma effect to the acquisition of Saeta. Net MW, Remaining PPA Life, Offtaker Credit Rating, and Module Supplier are MW-weighted. Offtaker Credit Rating indicates “IG” if rated as Investment Grade by either Moody’s or S&P, “NR” if not rated by either S&P and Moody’s, “< IG” if the former cases are not applicable and rated less than Investment Grade by either Moody’s or S&P. Remaining PPA Life and Offtaker Credit Rating are as of March 31, 2018. 12

Exhibit 99.1 Regulated Solar and Wind1 Summary Statistics2 Spain Net MW 788 MW Number of Sites 21 Regulated Solar - 250 MW % of Total Net MW 22% Regulated Wind - 539 MW Remaining PPA Life2 Offtaker Credit Rating2 Equipment Supplier2 20+ years Gamesa 13% 8% Siemens ACS 10-14 years 14% 32% 41% High Average 100% Quality 15 years IG Equipment GE 15-19 years 23% 46% Vestas 23% 1. Assets remunerated through the Spanish guaranteed return on deemed investment (RAB) regime (see Slide 19). 2. After giving pro forma effect to the acquisition of Saeta.Net MW, Remaining PPA Life, Offtaker Credit Rating, and Equipment Supplier are MW-weighted. Offtaker Credit Rating indicates “IG” if rated as Investment Grade by either Moody’s or S&P, “NR” if not rated by either S&P and Moody’s, “< IG” if the former cases are not applicable and rated less than Investment Grade by either Moody’s or S&P. Remaining PPA Life and Offtaker Credit Rating are as of March 31, 2018. 13

Exhibit 99.1 Investment Highlights A Brookfield as Sponsor B Closed Saeta Acquisition C High Quality Assets that Produce Stable Cash Flow D Potential CAFD per Share Growth Supports 5-8% Dividend Growth E Prudent Financing Strategy 14

Exhibit 99.1 A Brookfield as Sponsor Significant deal sourcing capabilities and deep expertise in owning, operating and developing renewable power assets Acquired and developed ~13 gigawatts (GW) of capacity since 2012 One of the largest public pure-play renewable power businesses globally with 100 years of experience Extensive development, operating, and power marketing capabilities with >2,000 experienced operators and over 140 power marketing experts $43 billion 17,3001 7,9001 TOTAL POWER ASSETS MEGAWATTS OF CAPACITY MEGAWATTS OF WIND & SOLAR (OPERATING AND DEVELOPMENT) Z 857 power generating facilities 25 markets in 15 countries North America and Western Europe 1. Reflects assets owned by Brookfield Renewable Partners including TERP assets. 15

Exhibit 99.1 A Proven Track Record as Cornerstone Investor Brookfield has a proven track record as cornerstone investor aligned with other stakeholders' interests Brookfield Renewable (BEP) Brookfield Infrastructure (BIP) Total Return (annualized)1 Total Return (annualized)2 April 2001 – April 2018 April 2008 – April 2018 25% 25% 20% 20% 18% 15% 15% 15% 10% 10% 9% 7% 5% 5% 0% 0% Brookfield Renewable S&P 500 ETF Brookfield S&P 500 ETF (BEP) Infrastructure (BIP) Source: Bloomberg. Annualized total return includes dividend reinvestment. 1. Reflects annualized total return of BEP (NYSE) from April 30, 2001 – April 30, 2018. 2. Reflects annualized total return of BIP (NYSE) from April 30, 2008 – April 30, 2018. 16

Exhibit 99.1 A Strong Alignment of Interests Drives Significant Support Strong Alignment of Interests Significant Support • Brookfield has a 65% interest in TERP • Brookfield provides significant support to TERP through the MSA, including: • Brookfield is an investor focused on creating value over the long-term ‒ Executive management (CEO, CFO and GC) • Variable management fee equal to 1.25% of the ‒ Business development resources increase in TERP’s market capitalization1 ‒ Capital markets support • Brookfield has extended a $500 million subordinated acquisition facility to TERP to support growth initiatives • By purchasing $650 million of TERP equity in a private placement, Brookfield supported the successful execution of the Saeta acquisition • TERP has the right of first offer (“ROFO”) on 3,500 MW portfolio of wind and solar assets 1. In addition to this variable component, the base management fee that TERP pays Brookfield also includes a fixed component, which is currently equal to $2.5 million per quarter. 17

Exhibit 99.1 B Saeta Acquisition | Transaction Highlights Transaction demonstrates TERP’s ability to grow accretively, expand its geographic footprint and accelerate the deleveraging of its balance sheet with transactions originated through Brookfield’s sponsorship Expected to be • Saeta acquisition expected to be immediately accretive to CAFD and DPS immediately accretive • Levered Internal Rate of Return (“IRR”) expected to meet or exceed TERP’s target return • Provides a platform for growth in Western Europe High quality asset • 100% owned, recently constructed assets in Western Europe base in attractive • 778 MW onshore wind and 250 MW concentrated solar target market • Average age of six years and remaining useful life of approximately 25 years Stable and • 100% of revenues generated under predictable frameworks with investment grade counterparties predictable cash • 77% of revenues are under the Spanish regulatory regime with limited resource and market price flows risk; remaining 23% are under long term power purchase or concession agreements • Average remaining regulatory/contractual term of 14 years Multiple value levers • Opportunity to enhance value by optimizing existing resources and benefiting from synergies • Ability to increase cash flow by extending maturities of Saeta’s project debt Accelerate • Pro forma for the transaction, TERP’s corporate debt to cash flow ratio is expected to be within its achievement of target of 4.0x to 5.0x deleveraging • Expected to further TERP’s long term plan to establish an investment grade balance sheet objective 18

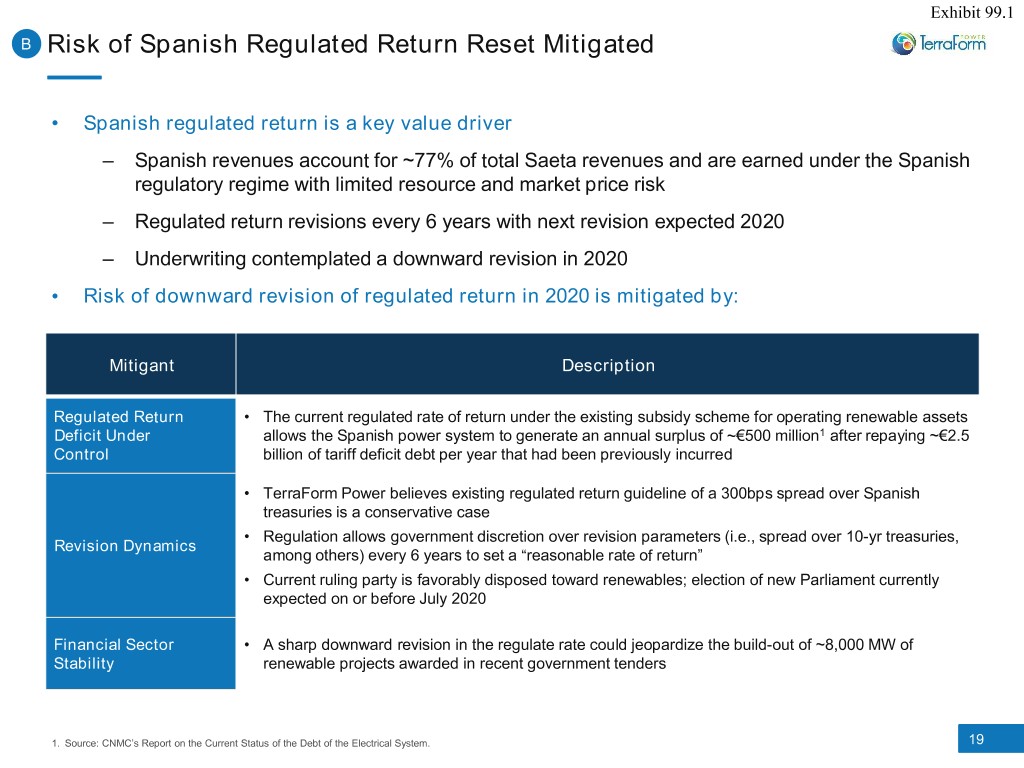

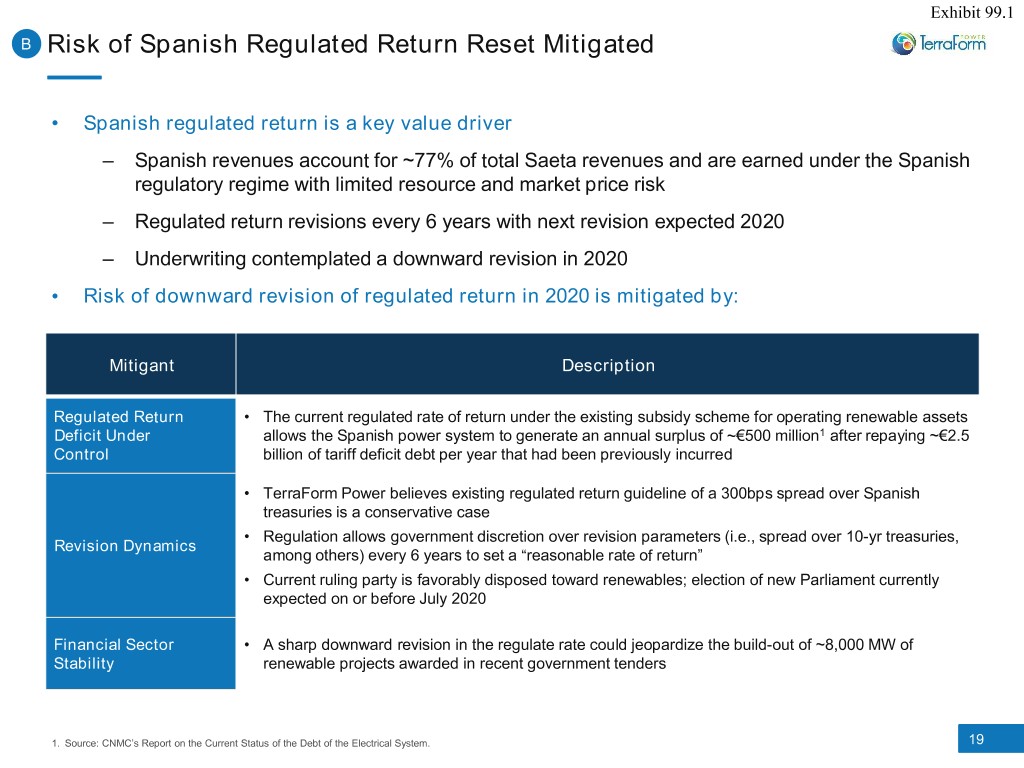

Exhibit 99.1 B Risk of Spanish Regulated Return Reset Mitigated • Spanish regulated return is a key value driver ‒ Spanish revenues account for ~77% of total Saeta revenues and are earned under the Spanish regulatory regime with limited resource and market price risk ‒ Regulated return revisions every 6 years with next revision expected 2020 ‒ Underwriting contemplated a downward revision in 2020 • Risk of downward revision of regulated return in 2020 is mitigated by: Mitigant Description Regulated Return • The current regulated rate of return under the existing subsidy scheme for operating renewable assets Deficit Under allows the Spanish power system to generate an annual surplus of ~€500 million1 after repaying ~€2.5 Control billion of tariff deficit debt per year that had been previously incurred • TerraForm Power believes existing regulated return guideline of a 300bps spread over Spanish treasuries is a conservative case • Regulation allows government discretion over revision parameters (i.e., spread over 10-yr treasuries, Revision Dynamics among others) every 6 years to set a “reasonable rate of return” • Current ruling party is favorably disposed toward renewables; election of new Parliament currently expected on or before July 2020 Financial Sector • A sharp downward revision in the regulate rate could jeopardize the build-out of ~8,000 MW of Stability renewable projects awarded in recent government tenders 1. Source: CNMC’s Report on the Current Status of the Debt of the Electrical System. 19

Exhibit 99.1 C Portfolio of High Quality Assets with Significant Diversity Contracted and regulated assets with significant resource diversity Large-Scale, Diversified Portfolio1 Recently Constructed1 Solar 36% Average 0-5 years, 3.6 GW > 5 years, age of 48% Fleet 52% 5 years Wind 64% Significant Resource Diversity1 Contracted and Regulated Revenue2 Wind: Uruguay 3% 3 Wind: Portugal 4% Regulated 35% Wind: Spain 15% Solar: US 25% Wind: Canada 2% Meaningful Stable Wind: US Hawaii 2% Portfolio Solar: Canada 2% Revenue Merchant Effect 4% Solar: Europe 7% Wind: US Texas 11% Solar: Chile 3% Wind: US Contracted Northeast 12% Wind: US Midwest 16% 61% 1. Determined based on Total Net MW after giving pro forma effect to the acquisition of Saeta. 20 2. Determined based on TERP projected 2018 revenue pro forma for Saeta acquisition. 3. Assets remunerated through the Spanish guaranteed return on deemed investment (RAB) regime (see Slide 19).

Exhibit 99.1 C Long Term Stable Cash Flows ~14 years1 of contracted cash flow with creditworthy offtakers ~96% of cash flows2 are under long-term contract or regulatory framework3 Tenor of Offtake Contracts1 Creditworthy Investment Grade Offtakers1 < IG, NR 0-4 years, 8% 3% 3% 5-9 years, 2% 20+ years, 19% Average 94% 14 years IG Remaining 10-14 years, 40% 15-19 years, 31% 1. Tenor of Offtake Contracts and Offtaker Credit Ratings are calculated based on Total Net MW after giving pro forma effect to the acquisition of Saeta, as of March 31, 2018. Offtaker Credit Rating indicates “IG” if rated as Investment Grade by either Moody’s or S&P, “NR” if not rated by either S&P and Moody’s, “< IG” if the former cases are not applicable and rated less than Investment Grade by either Moody’s or S&P. 2. Determined based on TERP projected 2018 revenue pro forma for Saeta. 3. Assets remunerated through the Spanish guaranteed return on deemed investment (RAB) regime (see Slide 19). 21

Exhibit 99.1 D Multiple Drivers of Growth With Brookfield relationship, TerraForm Power has multiple avenues for growth Acquisitions Originated Organic Growth ROFO Opportunity by Brookfield • Enhance cash flows through • Opportunistically pursue value- • Access to 3,500 MW through margin improvements oriented acquisitions originated Brookfield ROFO pipeline by Brookfield • Invest in our existing fleet on an • Access to ~500 MW with accretive basis ‒ Brookfield has acquired multiple third parties ‒ Asset repowerings ~13 GW since 2012 ‒ Site expansions ‒ Track record of executing complex transactions to ‒ Energy storage buy assets for value • Develop add-on acquisition • Saeta Yield will provide a scale pipeline across our scope of platform for growth in Western operations Europe ‒ Tax equity buyouts • Target market wind and solar ‒ Originate preferred installations are estimated to relationships with exceed 39 GW in 20201 developers • Industry is highly fragmented 1. Source: BMI Research Q1 2018 Global Solar and Wind Reports. 22

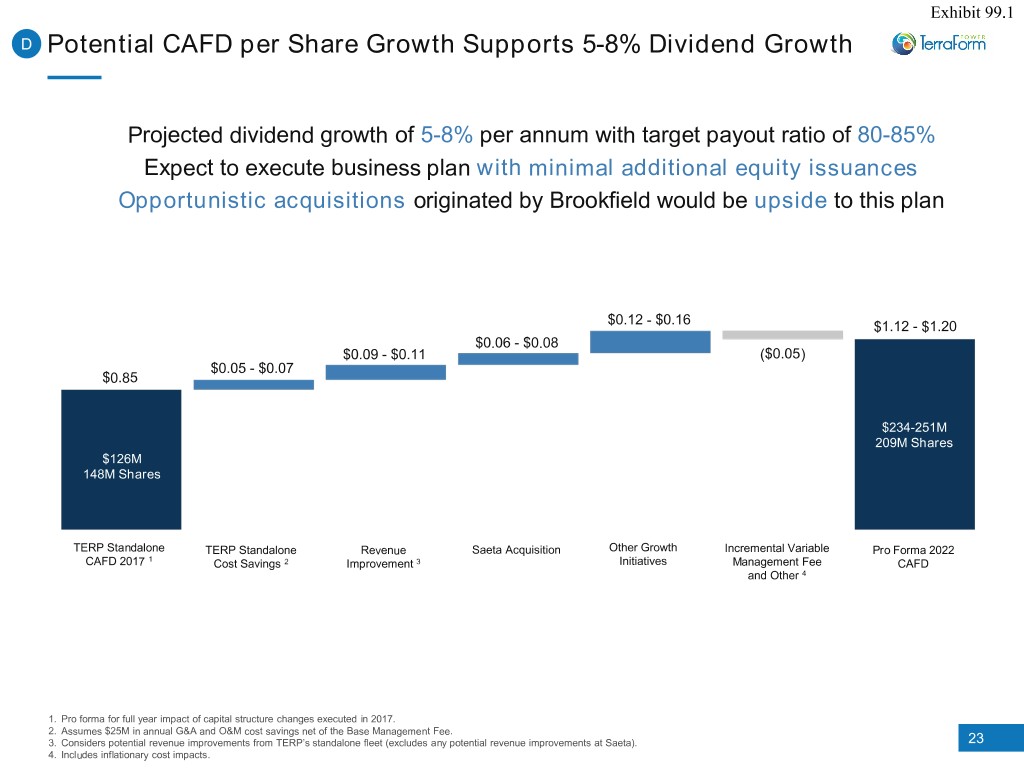

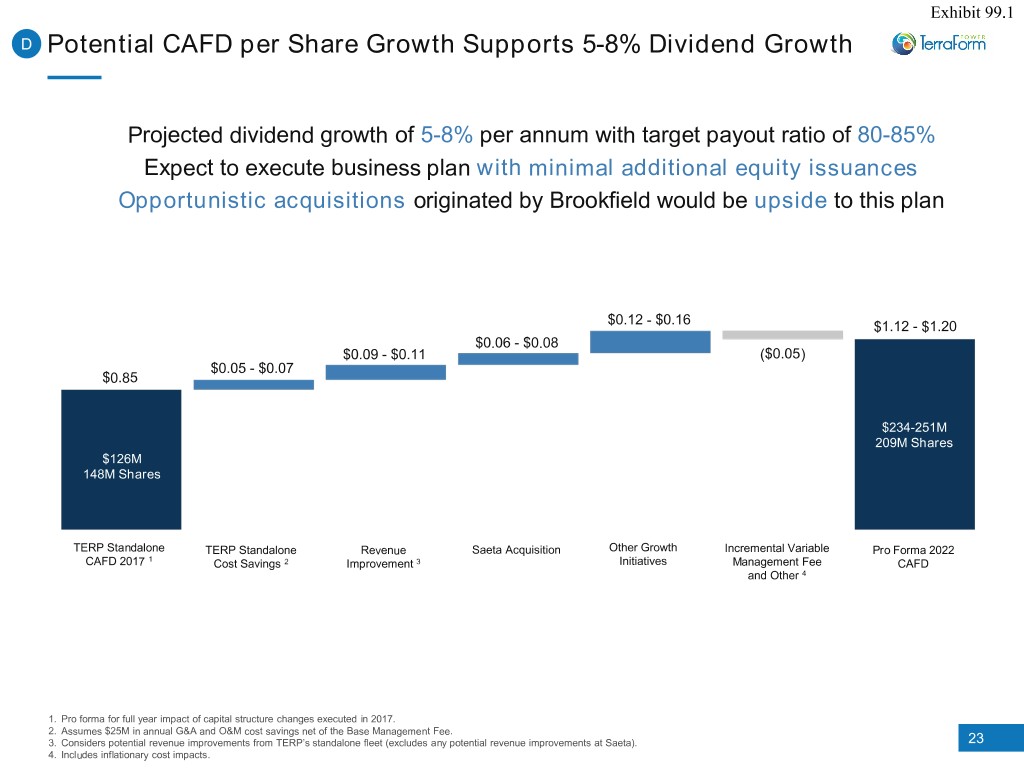

Exhibit 99.1 D Potential CAFD per Share Growth Supports 5-8% Dividend Growth Projected dividend growth of 5-8% per annum with target payout ratio of 80-85% Expect to execute business plan with minimal additional equity issuances Opportunistic acquisitions originated by Brookfield would be upside to this plan $0.12 - $0.16 $1.12 - $1.20 $0.06 - $0.08 $0.09 - $0.11 ($0.05) $0.05 - $0.07 $0.85 $234-251M 209M Shares $126M 148M Shares TERP Standalone TERP Standalone Revenue Saeta Acquisition Other Growth Incremental Variable Pro Forma 2022 CAFD 2017 1 Cost Savings 2 Improvement 3 Initiatives Management Fee CAFD and Other 4 1. Pro forma for full year impact of capital structure changes executed in 2017. 2. Assumes $25M in annual G&A and O&M cost savings net of the Base Management Fee. 3. Considers potential revenue improvements from TERP’s standalone fleet (excludes any potential revenue improvements at Saeta). 23 4. Includes inflationary cost impacts.

Exhibit 99.1 D Revenue Improvement Potential CAFD growth of ~$20 million, driven by availability improvements and resource normalization 2017 Actual1 Projected Generation Target1 Improvements Average Average Long-term Adjusted Adjusted Generation Adjusted Resource Performance Average Revenue Revenue (GWh) Revenue (GWh) (GWh) Generation Improvement (per (per MWh) (GWh) ($M) MWh)2 Solar 1,786 47 52 1,885 Wind 5,381 205 107 5,693 Total 7,167 $87 252 159 7,578 $85 $20 1.TERP standalone target before pro forma consideration of the Saeta acquisition. 24 2.Adjusts 2017 actual average price for sale of Solar Renewable Energy Credits (“SRECs”) from inventory in 2017.

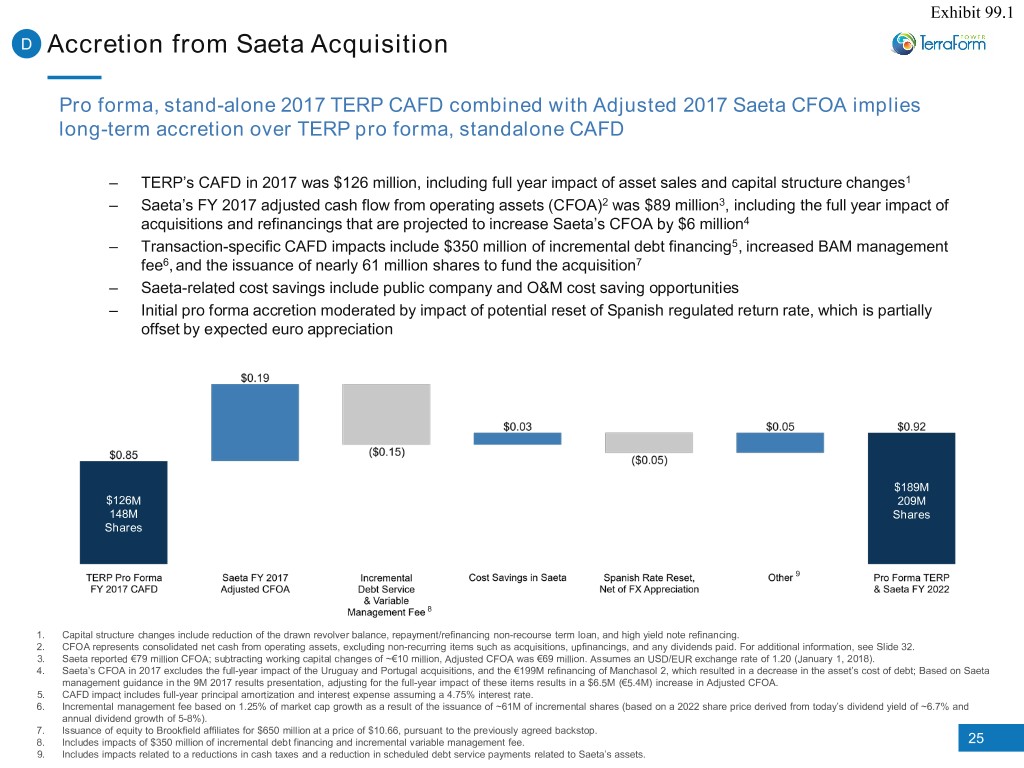

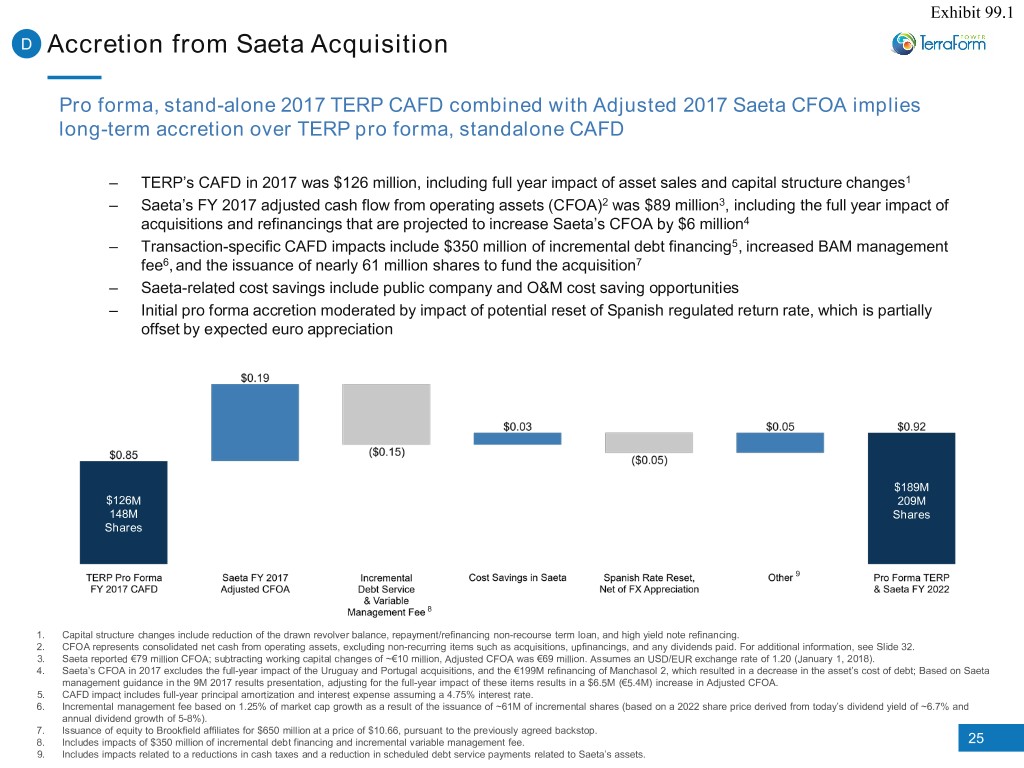

Exhibit 99.1 D Accretion from Saeta Acquisition Pro forma, stand-alone 2017 TERP CAFD combined with Adjusted 2017 Saeta CFOA implies long-term accretion over TERP pro forma, standalone CAFD – TERP’s CAFD in 2017 was $126 million, including full year impact of asset sales and capital structure changes1 – Saeta’s FY 2017 adjusted cash flow from operating assets (CFOA)2 was $89 million3, including the full year impact of acquisitions and refinancings that are projected to increase Saeta’s CFOA by $6 million4 – Transaction-specific CAFD impacts include $350 million of incremental debt financing5, increased BAM management fee6, and the issuance of nearly 61 million shares to fund the acquisition7 – Saeta-related cost savings include public company and O&M cost saving opportunities – Initial pro forma accretion moderated by impact of potential reset of Spanish regulated return rate, which is partially offset by expected euro appreciation $189M $126M 209M 148M Shares Shares 9 8 1. Capital structure changes include reduction of the drawn revolver balance, repayment/refinancing non-recourse term loan, and high yield note refinancing. 2. CFOA represents consolidated net cash from operating assets, excluding non-recurring items such as acquisitions, upfinancings, and any dividends paid. For additional information, see Slide 32. 3. Saeta reported €79 million CFOA; subtracting working capital changes of ~€10 million, Adjusted CFOA was €69 million. Assumes an USD/EUR exchange rate of 1.20 (January 1, 2018). 4. Saeta’s CFOA in 2017 excludes the full-year impact of the Uruguay and Portugal acquisitions, and the €199M refinancing of Manchasol 2, which resulted in a decrease in the asset’s cost of debt; Based on Saeta management guidance in the 9M 2017 results presentation, adjusting for the full-year impact of these items results in a $6.5M (€5.4M) increase in Adjusted CFOA. 5. CAFD impact includes full-year principal amortization and interest expense assuming a 4.75% interest rate. 6. Incremental management fee based on 1.25% of market cap growth as a result of the issuance of ~61M of incremental shares (based on a 2022 share price derived from today’s dividend yield of ~6.7% and annual dividend growth of 5-8%). 7. Issuance of equity to Brookfield affiliates for $650 million at a price of $10.66, pursuant to the previously agreed backstop. 8. Includes impacts of $350 million of incremental debt financing and incremental variable management fee. 25 9. Includes impacts related to a reductions in cash taxes and a reduction in scheduled debt service payments related to Saeta’s assets.

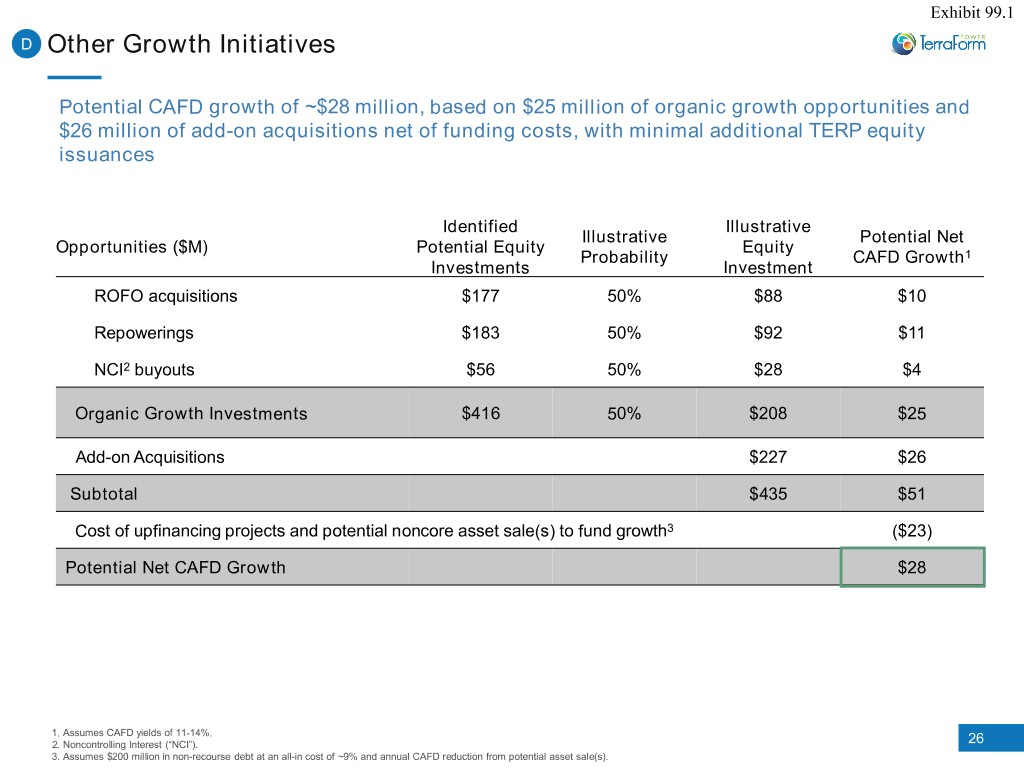

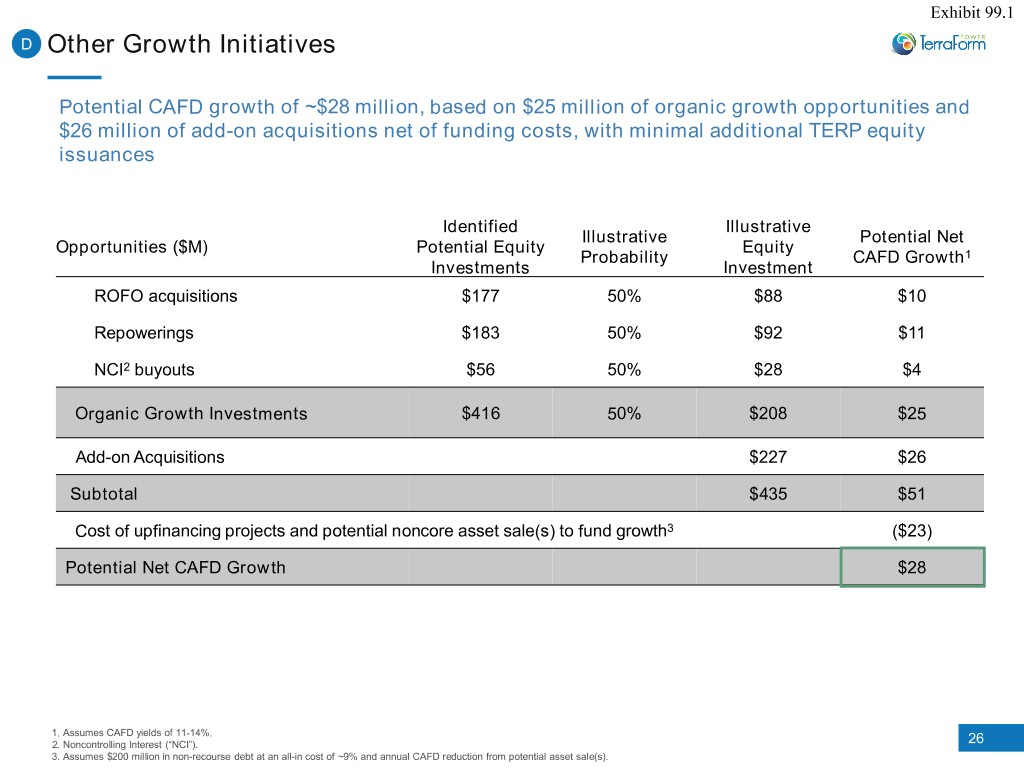

Exhibit 99.1 D Other Growth Initiatives Potential CAFD growth of ~$28 million, based on $25 million of organic growth opportunities and $26 million of add-on acquisitions net of funding costs, with minimal additional TERP equity issuances Identified Illustrative Illustrative Potential Net Opportunities ($M) Potential Equity Equity Probability CAFD Growth1 Investments Investment ROFO acquisitions $177 50% $88 $10 Repowerings $183 50% $92 $11 NCI2 buyouts $56 50% $28 $4 Organic Growth Investments $416 50% $208 $25 Add-on Acquisitions $227 $26 Subtotal $435 $51 Cost of upfinancing projects and potential noncore asset sale(s) to fund growth3 ($23) Potential Net CAFD Growth $28 1. Assumes CAFD yields of 11-14%. 2. Noncontrolling Interest (“NCI”). 26 3. Assumes $200 million in non-recourse debt at an all-in cost of ~9% and annual CAFD reduction from potential asset sale(s).

Exhibit 99.1 E Prudent Financing Strategy • Simplified capital structure ‒ No debt between project level and holding company ‒ Acquisitions will be financed primarily using non-recourse debt with investment grade metrics • Plan to further reduce corporate leverage to improve TERP’s credit rating ‒ Significant debt capacity at unlevered projects ‒ Further corporate deleveraging as we deploy capital into new investments • Plan to recycle capital on an opportunistic basis, including the sale of non-core assets 27

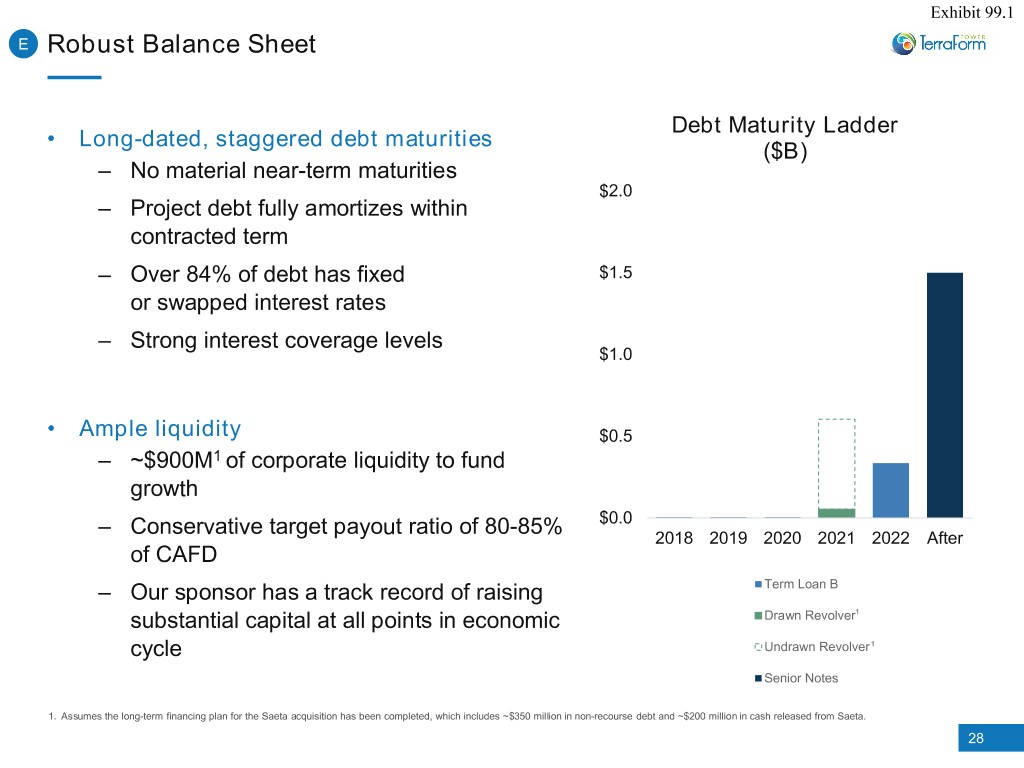

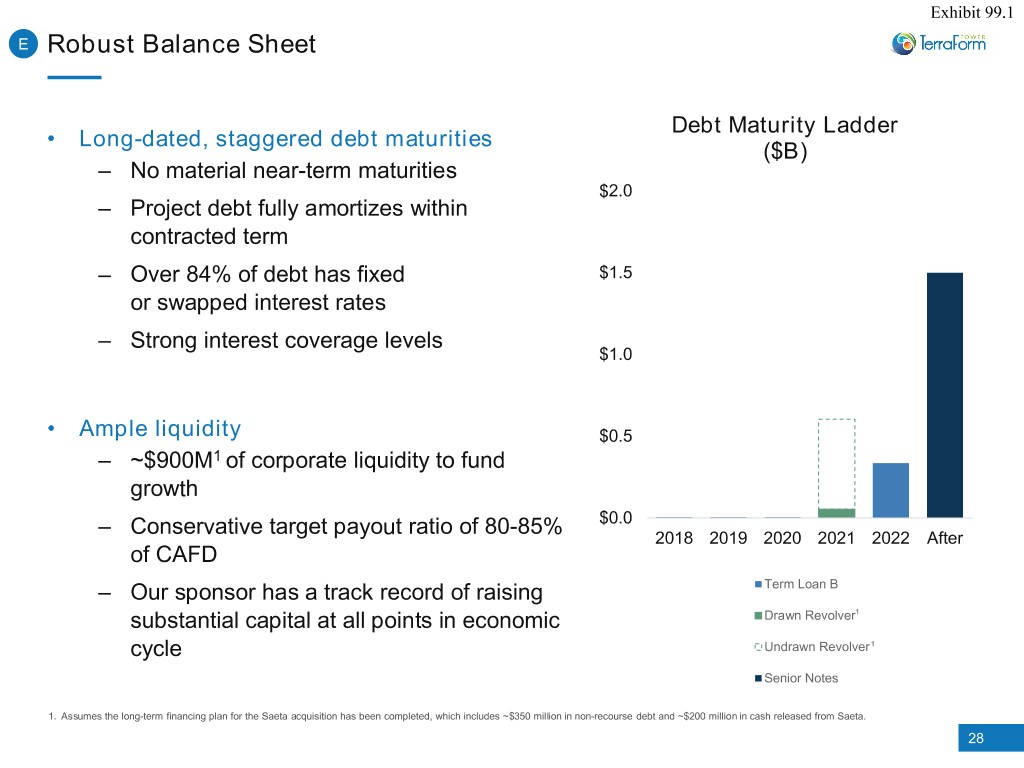

Exhibit 99.1 E Robust Balance Sheet Debt Maturity Ladder • Long-dated, staggered debt maturities ($B) ‒ No material near-term maturities $2.0 ‒ Project debt fully amortizes within contracted term ‒ Over 84% of debt has fixed $1.5 or swapped interest rates ‒ Strong interest coverage levels $1.0 • Ample liquidity $0.5 ‒ ~$900M1 of corporate liquidity to fund growth $0.0 ‒ Conservative target payout ratio of 80-85% 2018 2019 2020 2021 2022 After of CAFD ‒ Our sponsor has a track record of raising Term Loan B substantial capital at all points in economic Drawn Revolver1 cycle Undrawn Revolver 1 Senior Notes 1. Assumes the long-term financing plan for the Saeta acquisition has been completed, which includes ~$350 million in non-recourse debt and ~$200 million in cash released from Saeta. 28

Exhibit 99.1 TerraForm Power Recap • Significant deal sourcing capabilities and deep expertise in owning, operating and developing renewable power assets First class sponsor • Provides M&A and capital markets support • Demonstrated ability to provide significant capital to support growth • Expected to be immediately accretive • High quality asset base in attractive target market of Western Saeta Acquisition Europe • Stable and predictable cash flows • Accelerates achievement of deleveraging objective • Over 3,600 MW across one dozen different geographic sub- Diversified, high-quality asset base regions underpinned by contracted cash flows • 96% of cash flows under long-term contract or regulatory frameworks • Organic growth through margin enhancement and investments in existing fleet Multiple growth avenues • Value-oriented acquisitions originated by Brookfield • Access to Brookfield and third party ROFO pipelines • ~$900M1 of available corporate liquidity to fund growth Strong balance sheet and liquidity • No near term maturities position • Over 84% of debt has fixed or swapped interest rates • Projects financed in line with investment grade metrics 1. Assumes the long-term financing plan for the Saeta acquisition has been completed, which includes ~$350 million in non-recourse debt and ~$200 million in cash released from Saeta. 29

Exhibit 99.1 Contacts Contact Title Email John Stinebaugh Chief Executive Officer jstinebaugh@terraform.com Matt Berger Chief Financial Officer mberger@terraform.com Chad Reed Director of Investor Relations creed@terraform.com 30

Exhibit 99.1 Appendix 31

Exhibit 99.1 Reconciliation of Non-GAAP Measures: Pro Forma 2017 Reconciliation of Operating Revenues to Adjusted Revenue TERP TERP TERP (MILLIONS, EXCEPT AS NOTED) 2017 Actual Capital Structure 2017 Pro Forma Operating Revenues, net $610 - $610 Unrealized (gain) loss on commodity contract derivatives, net (a) $7 - $7 Amortization of favorable and unfavorable rate revenue contracts, net (b) $40 - $40 Other non-cash items (c) ($16) - ($16) Adjustment for asset sales ($15) - ($15) Adjusted revenues $626 - $626 Reconciliation of Net Income (Loss) to Adjusted EBITDA/CAFD 2017 Actual Capital Structure 2017 Pro Forma Net income (loss) ($233) $33 ($200) Interest expense, net 262 (33) $229 Income tax (benefit) expense (23) - ($23) Depreciation, accretion and amortization expense (d) 287 - $287 Non-operating general and administrative expenses (e) 72 - $72 Stock-based compensation expense 17 - $17 Acquisition and related costs, including affiliate 27 - $27 Impairment charges 1 - $1 Loss on extinguishment of debt 81 - $81 Gain on sale of U.K. renewable energy facilities (37) - ($37) Adjustment for asset sales (10) - ($10) Other non-cash or non-operating items (f) (7) - ($7) Adjusted EBITDA $437 - $437 Fixed Management Fee (2) - ($2) Variable Management Fee (1) - ($1) Interest payments (234) 33 ($201) Principal payments (99) 5 ($94) Cash distributions to non-controlling interests (30) - ($30) Sustaining capital expenditures (g) (2) - ($2) Other 19 - $19 Cash available for distribution (CAFD) $88 $38 $126 a) Represents unrealized loss on commodity contracts associated with energy derivative contracts that are for accounting purposes whereby the change in fair value is recorded in operating revenues, net. b) Represents net amortization of purchase accounting related intangibles arising from past business combinations related to favorable and unfavorable rate revenue contracts. c) Primarily represents recognized deferred revenue related to the upfront sale of investment tax credits. d) Includes reductions (increases) within operating revenues due to net amortization of favorable and unfavorable rate revenue contracts as detailed in the reconciliation of Adjusted Revenue. e) Non-operating items and other items incurred directly by TerraForm Power that we do not consider indicative of our core business operations are treated as an addback in the reconciliation of net income (loss) to Adjusted EBITDA. In the forecasted period ended December 31, 2017, these items include extraordinary costs and expenses related primarily to restructuring, legal, advisory and contractor fees associated with the bankruptcy of SunEdison and certain of its affiliates (the “SunEdison bankruptcy”) and investment banking, legal, third party diligence and advisory fees associated with the Brookfield transaction, dispositions and financings. f) Represents other non-cash items as detailed in the reconciliation of Adjusted Revenue and associated footnote and certain other items that we believe are not representative of our core business or future operating performance, including but not limited to: loss (gain) on FX, unrealized loss on commodity contracts, and loss on investments and receivables with affiliate. g) Reclassifies wind sustaining capital expenditure into direct operating costs, which will now be covered under new Full Service Agreement. 32

Exhibit 99.1 Calculation and Use of Non-GAAP Measures Adjusted Revenue, CAFD and CFOA are supplemental non-GAAP measures that should not be viewed as alternatives to GAAP measures of performance, including revenue, net income (loss), operating income or net cash provided by operating activities. Our definitions and calculation of these non-GAAP measures may not necessarily be the same as those used by other companies. These non-GAAP measures have certain limitations, which are described below, and they should not be considered in isolation. We encourage you to review, and evaluate the basis for, each of the adjustments made to arrive at Adjusted Revenue, CAFD and CFOA. Calculation of Non-GAAP Measures We define Adjusted Revenue as operating revenues, net, adjusted for non-cash items including unrealized gain/loss on derivatives, amortization of favorable and unfavorable rate revenue contracts, net and other non-cash revenue items. We define Adjusted EBITDA as net income (loss) plus depreciation, accretion and amortization, non-cash general and administrative costs, interest expense, income tax (benefit) expense, acquisition related expenses, and certain other non-cash charges, unusual or non-recurring items and other items that we believe are not representative of our core business or future operating performance. We define “cash available for distribution” or “CAFD” as Adjusted EBITDA (i) minus cash distributions paid to non-controlling interests in our renewable energy facilities, if any, (ii) minus annualized scheduled interest and project level amortization payments in accordance with the related borrowing arrangements, (iii) minus average annual sustaining capital expenditures (based on the long- sustaining capital expenditure plans) which are recurring in nature and used to maintain the reliability and efficiency of our power generating assets over our long-term investment horizon, (iv) plus or minus operating items as necessary to present the cash flows we deem representative of our core business operations. As compared to 2017 reporting, we revised our definition of CAFD to (i) exclude adjustments related to deposits into and withdrawals from restricted cash accounts, required by project financing arrangements, (ii) replace sustaining capital expenditures payment made in the year with the average annualized long-term sustaining capital expenditures to maintain reliability and efficiency of our assets, and (iii) annualized debt service payments. We revised our definition as we believe it provides a more meaningful measure for investors to evaluate our financial and operating performance and ability to pay dividends. For items presented on an annualized basis, we will present actual cash payments as a proxy for an annualized number until the period commencing January 1, 2018. We refer to “adjusted cash from operating activities” or “Adjusted CFOA” as (i) CFOA as that measure is used by Saeta Yield, S.A. (“Saeta”) in its public filings with the European Securities and Markets Authority (ESMA) (ii) minus €10.0 million as a one-time adjustment for certain of Saeta’s working capital changes. Saeta defines CFOA as (i) cash flow from operating activities, (i) plus cash flow from investing activities, (ii) plus cash flow from financing activities. For a full description of Saeta’s CFOA, please refer to Saeta’s public filings with ESMA. Use of Non-GAAP Measures We disclose Adjusted Revenue because it presents the component of operating revenue that relates to energy production from our plants, and is, therefore, useful to investors and other stakeholders in evaluating performance of our renewable energy assets and comparing that performance across periods in each case without regard to non-cash revenue items. We disclose Adjusted EBITDA because we believe it is useful to investors and other stakeholders as a measure of financial and operating performance and debt service capabilities. We believe Adjusted EBITDA provides an additional tool to investors and securities analysts to compare our performance across periods and among us and our peer companies without regard to interest expense, taxes and depreciation and amortization. Adjusted EBITDA has certain limitations, including that it: (i) does not reflect cash expenditures or future requirements for capital expenditures or contractual liabilities or future working capital needs, (ii) does not reflect the significant interest expenses that we expect to incur or any income tax payments that we may incur, and (iii) does not reflect depreciation and amortization and, although these charges are non-cash, the assets to which they relate may need to be replaced in the future, and (iv) does not take into account any cash expenditures required to replace those assets. Adjusted EBITDA also includes adjustments for goodwill impairment charges, gains and losses on derivatives and foreign currency swaps, acquisition related costs and items we believe are infrequent, unusual or non-recurring, including adjustments for general and administrative expenses we have incurred as a result of the SunEdison bankruptcy. We disclose CAFD because we believe cash available for distribution is useful to investors in evaluating our operating performance and because securities analysts and other stakeholders analyze CAFD as a measure of our financial and operating performance and our ability to pay dividends. CAFD is not a measure of liquidity or profitability, nor is it indicative of the funds needed by us to operate our business. CAFD has certain limitations, such as the fact that CAFD includes all of the adjustments and exclusions made to Adjusted EBITDA described above. We disclose Adjusted CFOA because we believe this measure is useful to investors in evaluating the impact of the Saeta acquisition on CAFD. The adjustments made to Adjusted EBITDA and CAFD for infrequent, unusual or non-recurring items and items that we do not believe are representative of our core business involve the application of management judgment, and the presentation of Adjusted EBITDA and CAFD should not be construed to infer that our future results will be unaffected by infrequent, non-operating, unusual or non- recurring items. In addition, these measures are used by our management for internal planning purposes, including for certain aspects of our consolidated operating budget, as well as evaluating the attractiveness of investments and acquisitions. We believe these Non-GAAP measures are useful as a planning tool because it allows our management to compare performance across periods on a consistent basis in order to more easily view and evaluate operating and performance trends and as a means of forecasting operating and financial performance and comparing actual performance to forecasted expectations. For these reasons, we also believe these Non-GAAP measures are also useful for communicating with investors and other stakeholders. 33