- GMS Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

S-1/A Filing

GMS (GMS) S-1/AIPO registration (amended)

Filed: 21 Feb 17, 12:00am

Use these links to rapidly review the document

TABLE OF CONTENTS

As filed with the Securities and Exchange Commission on February 21, 2017

Registration No. 333-215890

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Amendment No. 1

to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

GMS INC.

(Exact name of registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation or organization) | 5030 (Primary Standard Industrial Classification Code Number) | 46-2931287 (I.R.S. Employer Identification No.) |

100 Crescent Centre Parkway, Suite 800

Tucker, Georgia 30084

(800) 392-4619

(Address, including zip code, and telephone number, including

area code, of registrant's principal executive offices)

G. Michael Callahan, Jr.

President and Chief Executive Officer

GMS Inc.

100 Crescent Centre Parkway, Suite 800

Tucker, Georgia 30084

(800) 392-4619

(Name, address, including zip code, and telephone number including area code, of agent for service)

| Copies of all communications, including communications sent to agent for service, should be sent to: | ||

Andrew B. Barkan, Esq. Fried, Frank, Harris, Shriver & Jacobson LLP One New York Plaza New York, New York 10004 (212) 859-8000 | Peter J. Loughran, Esq. Debevoise & Plimpton LLP 919 Third Avenue New York, New York 10022 (212) 909-6000 | |

Approximate date of commencement of proposed sale to the public:

As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act of 1933, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check One):

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer ý | Smaller reporting company o |

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities to be Registered | Amount to be Registered(1) | Proposed Maximum Aggregate Offering Price Per Share(1)(2) | Proposed Maximum Aggregate Offering Price(1)(2) | Amount of Registration Fee(3) | ||||

|---|---|---|---|---|---|---|---|---|

Common Stock, par value $0.01 per share | 6,900,000 | $29.04 | $200,376,000 | $23,223.58 | ||||

| ||||||||

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION. DATED FEBRUARY 21, 2017

6,000,000 Shares

GMS Inc.

Common Stock

The selling stockholders identified in this prospectus are offering 6,000,000 shares of common stock of GMS Inc. We are not selling any shares of common stock of GMS Inc. in this offering, and we will not receive any of the proceeds from the sale of shares of our common stock by the selling stockholders.

Our common stock is listed on the New York Stock Exchange under the symbol "GMS". The last reported sale price of our common stock on February 16, 2017 was $29.06 per share.

The underwriters have an option for a period of 30 days to purchase up to a maximum of 900,000 additional shares of our common stock from the selling stockholders.

Following this offering, we will continue to be a "controlled company" within the meaning of the corporate governance standards of the New York Stock Exchange.

Investing in our common stock involves risk. See "Risk Factors" beginning on page 25 to read about factors you should consider before buying shares of our common stock.

| | Price to Public | Underwriting Discounts and Commissions(1) | Proceeds to Selling Stockholders | ||||||

|---|---|---|---|---|---|---|---|---|---|

Per Share | $ | $ | $ | ||||||

Total | $ | $ | $ | ||||||

Delivery of the shares of common stock will be made on or about , 2017.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Barclays | Credit Suisse | RBC Capital Markets |

| Baird | SunTrust Robinson Humphrey |

| Raymond James | Stephens Inc. | Wells Fargo Securities |

The date of this prospectus is , 2017.

| | Page | |||

|---|---|---|---|---|

PROSPECTUS SUMMARY | 1 | |||

RISK FACTORS | 25 | |||

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS | 48 | |||

USE OF PROCEEDS | 50 | |||

PRICE RANGE OF COMMON STOCK | 51 | |||

DIVIDEND POLICY | 52 | |||

SELECTED CONSOLIDATED FINANCIAL AND OTHER DATA | 53 | |||

PRINCIPAL AND SELLING STOCKHOLDERS | 58 | |||

CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS | 62 | |||

DESCRIPTION OF CAPITAL STOCK | 66 | |||

DESCRIPTION OF CERTAIN INDEBTEDNESS | 70 | |||

SHARES ELIBIGLE FOR FUTURE SALE | 74 | |||

MATERIAL U.S. FEDERAL TAX CONSIDERATIONS FOR NON-U.S. HOLDERS OF OUR COMMON STOCK | 76 | |||

UNDERWRITING | 81 | |||

LEGAL MATTERS | 88 | |||

EXPERTS | 88 | |||

INCORPORATION BY REFERENCE | 88 | |||

WHERE YOU CAN FIND MORE INFORMATION | 89 | |||

You should rely only on the information contained or incorporated by reference in this prospectus and any free writing prospectus prepared by or on behalf of us that we have referred you to. We have not, the selling stockholders have not and the underwriters have not authorized anyone to provide you with additional information or information different from that contained or incorporated by reference in this prospectus or in any free writing prospectus prepared by or on behalf of us that we have referred you to. If anyone provides you with additional, different or inconsistent information, you should not rely on it. Offers to sell, and solicitations of offers to buy, shares of our common stock are being made only in jurisdictions where offers and sales are permitted. The information contained or incorporated by reference in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of our common stock. Our business and financial condition may have changed since such date.

No action is being taken in any jurisdiction outside the United States to permit a public offering of common stock or possession or distribution of this prospectus in that jurisdiction. Persons who come into possession of this prospectus in jurisdictions outside the United States are required to inform themselves about and to observe any restriction as to this offering and the distribution of this prospectus applicable to those jurisdictions.

This prospectus includes estimates regarding market and industry data that we prepared based on our management's knowledge and experience in the markets in which we operate, together with information obtained from various sources, including publicly available information, industry reports and publications, surveys, our customers, suppliers, trade and business organizations and other contacts in the markets in which we operate.

i

In presenting this information, we have made certain assumptions that we believe to be reasonable based on such data and other similar sources and on our knowledge of, and our experience to date in, the markets for the products we distribute. Market share data is subject to change and may be limited by the availability of raw data, the voluntary nature of the data gathering process and other limitations inherent in any statistical survey of market shares. In addition, customer preferences are subject to change. Accordingly, you are cautioned not to place undue reliance on such market share data. References herein to our being a leader in a market or product category refer to our belief that we have a leading market share position in each specified market based on volume, for our wallboard market share position, or sales dollars, for our ceilings market share position, unless the context otherwise requires. In addition, unless otherwise stated or the context otherwise requires, the discussions herein regarding (1) the wallboard market are based on the total volume of wallboard produced in U.S. manufacturing facilities, some of which is sold into Canada, and (2) the suspended ceilings systems, or ceilings, market are based on the total sales, in dollars, of ceilings distributed or otherwise sold in North America.

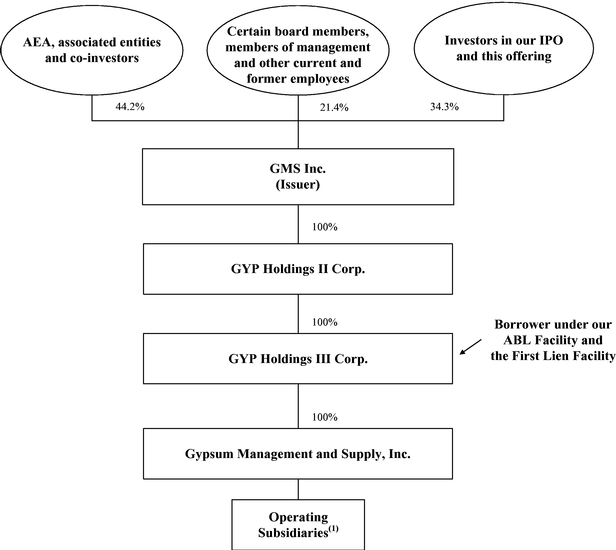

On April 1, 2014, GMS Inc., or the Successor, acquired, through its wholly-owned entities, GYP Holdings II Corp. and GYP Holdings III Corp., all of the capital stock of Gypsum Management and Supply, Inc., or the Predecessor. Successor is majority owned by certain affiliates of AEA Investors LP, which we refer to as "AEA" or our "Sponsor," and certain of our other stockholders. We refer to this acquisition as the "Acquisition."

As a result of the Acquisition and resulting change in control and changes due to the impact of purchase accounting, we are required to present separately the operating results for the Predecessor periods ending on or prior to March 31, 2014 and the Successor periods beginning on or after April 1, 2014. Accordingly, unless otherwise indicated or the context otherwise requires, all references to "the Company," "GMS," "we," "us," "our" and other similar terms mean (1) the Predecessor for periods ending on or prior to March 31, 2014 and (2) the Successor for periods beginning on or after April 1, 2014, in each case together with its consolidated subsidiaries.

Our fiscal year ends on April 30 of each year. References in this prospectus to a fiscal year mean the year in which that fiscal year ends. References in this prospectus to "fiscal 2015" or "FY 2015" relate to the year ended April 30, 2015, references in this prospectus to "fiscal 2016" or "FY 2016" relate to the fiscal year ended April 30, 2016 and references in this prospectus to "fiscal 2017" or "FY 2017" relate to the fiscal year ending April 30, 2017. References in this prospectus to "full year 2014" or "FY 2014" represent the sum of the results of the eleven month period from May 1, 2013 to March 31, 2014 and the one month period from April 1, 2014 to April 30, 2014.

The audited financial statements incorporated by reference in this prospectus include a black line division to indicate that the Predecessor and Successor reporting entities have applied different bases of accounting and are not comparable. Please note that our discussion of certain financial information for the full year ended April 30, 2014, specifically net sales and Adjusted EBITDA, includes data from the Predecessor and Successor periods on a combined basis for the full year 2014. The change in basis resulting from the Acquisition did not impact such financial information and, although this presentation of financial information on a combined basis does not comply with generally accepted accounting principles in the United States, or GAAP, we believe it provides a meaningful method of comparison to the other periods presented or incorporated by reference in this prospectus. The data is being presented for analytical purposes only. Combined operating results (1) have not been prepared on a pro forma basis as if the Acquisition occurred on the first day of the period, (2) may not reflect the actual results we would have achieved absent the Acquisition and (3) may not be predictive of future results of operations.

ii

Amounts presented or incorporated by reference in this prospectus in thousands or millions are approximations of the actual amounts in that they have been rounded.

This prospectus includes trademarks and service marks owned by us, including GMSTM and GMS Gypsum Management & Supply, Inc.®. This prospectus also contains trademarks, trade names and service marks of other companies, which are the property of their respective owners. Solely for convenience, trademarks, trade names and service marks referred to in this prospectus may appear without the ®,TM orSM symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the right of the applicable licensor to these trademarks, trade names and service marks. We do not intend our use or display of other parties' trademarks, trade names or service marks to imply, and such use or display should not be construed to imply, a relationship with, or endorsement or sponsorship of us by, these other parties.

iii

This summary highlights selected information contained elsewhere or incorporated by reference in this prospectus. Because this is only a summary, it does not contain all the information that may be important to you. You should read the entire prospectus carefully, especially "Risk Factors" beginning on page 25 of this prospectus and our consolidated financial statements and related notes incorporated by reference in this prospectus, before deciding to invest in our common stock.

We are the leading North American distributor of wallboard and suspended ceilings systems. Our product offering of wallboard, suspended ceilings systems, or ceilings, and complementary interior construction products is designed to provide a comprehensive solution for our core customer, the interior contractor who installs these products in commercial and residential buildings.

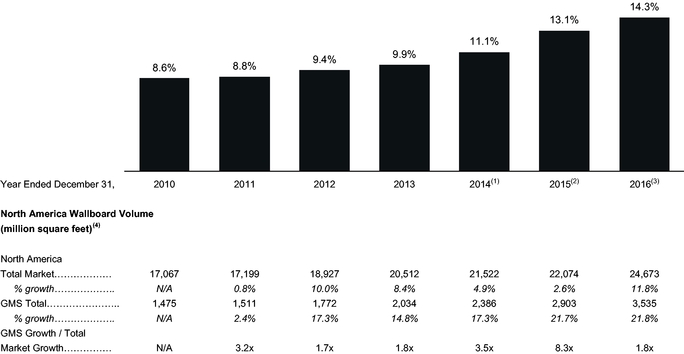

Since our founding in 1971, we have grown our business from a single location to over 200 branches across 42 states through a combination of both organic growth and acquisitions. Underpinning that growth is our entrepreneurial culture, which both enables us to drive organic growth by delivering outstanding customer service and makes us an attractive acquirer for smaller distributors whose owners are seeking liquidity. Over time, we have increased our market share in the distribution of wallboard and ceilings, which management currently estimates is 14% for wallboard, based on volume produced in the United States and Canada, and 16% for ceilings, based on sales dollars in North America.

We serve as a critical link between our suppliers and our highly fragmented customer base of over 20,000 contractors. Based on wallboard's unique product attributes and delivery requirements, distributing wallboard requires a higher degree of logistics and service expertise than most other building products. Wallboard has a high weight-to-value ratio, is easily damaged, cannot be left outside and often must be delivered to a job site before or after normal business hours. Due to the weight of the product, we are often required to deliver wallboard to the specific room where it will be installed. For example, we can place the precise amount and type of wallboard necessary for a second story room of a new building through the second story window using a specialized truck with an articulating boom loader. To do this effectively, we need to load the truck at the branch so that the precise amount and type of wallboard for each room of the building can be off-loaded by the articulating boom loader in the right sequence. Our sales, dispatch and delivery teams then coordinate an often complicated, customized delivery plan to ensure that our delivery schedule matches the customer's job site schedule, that deliveries are made with regard to the specific challenges of a customer's job site, that no damage occurs to the customer's property and, most importantly, that proper safety procedures are followed at all times. Often this requires us to send an employee to a job site before the delivery is made to document the specific requirements and safety considerations of a particular location. Given the logistical intensity of this process and the premium contractors place on distributors delivering the right product, at the right time, in the right place, we are able to differentiate ourselves based on service and can generate attractive gross profit margins. In addition to executing a logistics-intensive service, for all of our products we facilitate purchasing relationships between suppliers and our highly fragmented customer base by transferring technical product knowledge, educating contractors on proper installation techniques for new products, ensuring local product availability and extending trade credit.

We believe our strategic focus and operating model enable us to differentiate ourselves within our industry. Whereas several of our competitors are part of larger organizations that manufacture or distribute a wide variety of products, we focus on distributing wallboard, ceilings and complementary interior construction products. We believe this focus enables us to provide superior service and product expertise to our customers. In addition, our operating model combines a national platform with a local go-to-market strategy through over 200 branches across the country. We believe this combination enables us to generate economies of scale while maintaining the high service levels, entrepreneurial

1

culture and customer intimacy of a local business. In order to tailor its products and services to meet the needs of its local market, each of our branches operates with a significant amount of autonomy within the parameters of our overall business model. Branch managers are responsible for sales, pricing and staffing activities, and have full operational control of customer service and deliveries. They are compensated in part based on the profit they are able to achieve, which aligns their incentives with our financial goals. We believe our experienced, locally-focused teams, and our ability to develop, motivate and incentivize them, are key to our success. Through our Yard Support Center, which includes over 120 employees at our corporate office in Atlanta, we support our branches with various back office functions including accounting, information technology, or IT, legal, safety, human resources, marketing and risk management. We also use our Yard Support Center to generate purchasing efficiencies and share best practices across our branch network.

We have grown our Company and developed our distinctive culture under strong, consistent leadership. Our senior management team has been with us for an average of over 20 years. We have been able to retain top talent and incentivize managers through our entrepreneurial culture and broad-based equity ownership. Prior to this offering, 74 of our employees own approximately 27% of our common stock, including vested options. Together with our strong base of experienced operators, our management team has grown our Company from a single site location to the market leader we are today.

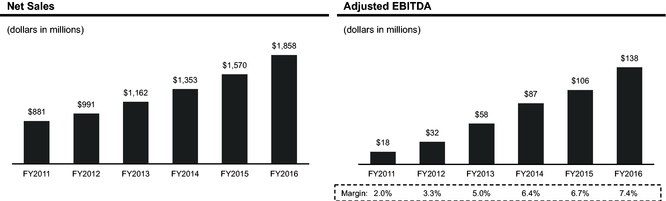

For fiscal 2016, we generated $1.9 billion in net sales, $12.6 million of net income and $138.2 million of Adjusted EBITDA. For a discussion of our use of Adjusted EBITDA and a reconciliation to net income (loss), please refer to "—Summary Financial and Other Data." Net sales and Adjusted EBITDA grew 18.3% and 32.0%, respectively, in fiscal 2016 as compared to fiscal 2015. Over the past four years, net sales and Adjusted EBITDA have grown at a compound annual growth rate, or CAGR, of 17.0% and 43.7%, respectively.

2

The table below summarizes our major product categories:

(dollars in millions) | Wallboard | Ceilings | Steel Framing | Other Products | ||||

|---|---|---|---|---|---|---|---|---|

Fiscal 2016 Net Sales | $871.0 | $297.1 | $281.3 | $408.8 | ||||

% of Fiscal 2016 Net Sales | 46.9% | 16.0% | 15.1% | 22.0% | ||||

Description(1) | • #1 market position • Used to finish the interior walls and ceilings in residential, commercial and institutional construction projects | • #1 market position • Suspended ceiling systems primarily comprised of mineral fiber ceiling tile and grid • Architectural specialty ceilings systems | • Steel framing products for interior walls • Sold into commercial applications, typically as part of a package with wallboard, ceilings and other products | • Primarily consists of complementary interior construction products, including joint compound, finishing materials, tools and fasteners, safety products and EIFS (exterior insulation and finishing system) | ||||

Products | • Various types of wallboard including:1/2 inch standard (residential),5/8 inch fire-rated (commercial), foil-backed, lead-lined, moisture-resistant, mold-resistant and vinyl-covered • Tile backer | • Acoustical ceiling tiles (standard and architectural specialty) • Clips • Covered fiberglass • Ceiling tile grid • Hangers | • Beads, clips, furring, hangers, joists, lath, mesh and trim • Control joint • Drywall steel • Flat stock • Plastering steel • Structural • Studs and track | • Adhesives • EIFS • Fasteners • Insulation • Joint compound • Plaster • Safety equipment • Tools • Trims | ||||

Primary End Markets | • Residential New Construction • Residential Repair and Remodeling, or R&R • Commercial New Construction • Commercial R&R | • Commercial New Construction • Commercial R&R | • Commercial New Construction • Commercial R&R | • Commercial New Construction • Commercial R&R • Residential New Construction • Residential R&R | ||||

Key Manufacturers | • American Gypsum Company, LLC, or American Gypsum • CertainTeed Corporation, or CertainTeed • Continental Building Products Inc., or Continental • Georgia-Pacific Corporation, or Georgia-Pacific • National Gypsum Company, or National Gypsum • Pabco Building Products, LLC, or Pabco • USG Corporation, or USG | • Armstrong World Industries, Inc., or Armstrong • CertainTeed • USG | • ClarkDietrich Building Systems LLC • Marino\WARE Industries, Inc. • Super Stud Building Products, Inc. • Telling Industries LLC | • Dryvit Systems, Inc. • Grabber Construction Products, Inc. • Johns Manville • Knauf Gips KG • PrimeSource Building Products, Inc. • Stanley Black & Decker, Inc. • Sto Corp. |

3

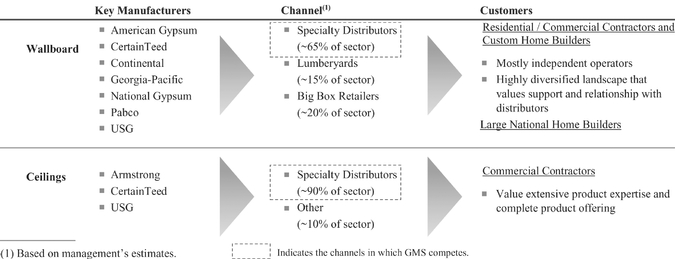

As the U.S. construction market evolved during the second half of the 20th century, contractors began to specialize in specific trades within the construction process, and specialty distributors emerged to supply them. One of these trades was wallboard and ceilings installation, and we, along with other specialty distributors, tailored our product offerings and service capabilities to meet the unique needs of that trade. Today, specialty distributors comprise the preferred distribution channel for wallboard and ceilings in both the commercial and residential construction markets.

We believe the success of the specialty distribution model in wallboard and ceilings is driven by the strong value proposition provided to our customers. Given the logistical complexity of the distribution services we provide, the expertise needed to execute effectively, and the special equipment required, we believe specialty distributors focused on wallboard and ceilings are best suited to meet contractors' needs.

The table below provides an overview of the supply chain in our industry, which illustrates management's estimate of the share of the supply channel that is represented by specialty distributors.

Supply Chain Overview

We estimate the North American market for the distribution of wallboard, ceilings and complementary interior construction products generated approximately $15 billion in sales for the twelve months ended September 30, 2016. Of that market, we believe approximately $12 billion was served through specialty distributors like GMS, while the remaining approximately $3 billion was served by big box retailers, lumberyards and other channels. Despite continued consolidation among our competitors, we believe the North American specialty distribution industry remains highly fragmented and consists of approximately 400 local or regional participants. Our largest competitors in the North American specialty distribution industry include Allied Building Products (a subsidiary of CRH plc), Foundation Building Materials and L&W Supply. However, we believe smaller, regional or local competitors still comprise nearly half of the industry. In contrast, the manufacturers of wallboard and ceilings products are highly consolidated. Since the late 1990s, the number of North American wallboard manufacturers has been reduced from twelve to seven, with the top four manufacturers representing approximately 76% of the wallboard market in 2015. Similarly, management estimates that three ceilings manufacturers accounted for approximately 95% of the ceilings products manufactured in North America during 2015.

The main drivers for our products are commercial new construction, commercial repair and remodeling, or R&R, residential new construction and residential R&R. We believe all four end

4

markets have begun an extended period of expansion. From 2011 through 2016, commercial construction square footage put in place has increased 34% to 0.9 billion. Despite this progress, for 2016, commercial construction square footage put in place still would have needed to increase by an additional 34% in order to achieve the annual average of 1.3 billion square feet (measured as the average from 1970 to 2016). Related to the residential new construction market, housing starts of 1.2 million increased 92% from 2011 to 2016. In order to reach the historic market average of 1.4 million annual starts (measured as the average from 1970 to 2016), however, housing starts would have needed to increase by an additional 24%. In addition, private residential fixed investment as a percentage of U.S. GDP, a measure of residential R&R activity, equaled 3.8% in 2016, which is over 17% lower than the historic annual average of 4.6% (measured as the average from 1950 to 2016). Demand for our interior building products has historically correlated closely with construction activity, typically trailing housing starts and commercial construction square footage put in place by approximately six to nine months. As commercial and residential new construction activity approaches historical levels, we expect a corresponding increase in demand for the products we distribute.

We believe that the following competitive strengths will drive our future growth:

Entrepreneurial culture. We believe our entrepreneurial, results-driven culture fosters highly dedicated employees who provide our customers with outstanding service that differentiates us from our competition. We empower managers with the independence and authority to make decisions locally. Further, we incentivize employees throughout our Company to generate business and execute it profitably through a compensation program that includes variable compensation and equity ownership. Prior to this offering, 74 of our employees own approximately 27% of our common stock, including vested options. We also believe our entrepreneurial culture, combined with our dedication to developing, training and providing opportunities for all of our employees, helps us attract and retain top talent. Similarly, we believe these characteristics have also positioned us as an attractive acquirer for smaller distributors whose owners are seeking liquidity.

Market leader with significant scale advantages. We are the largest North American specialty distributor of wallboard, ceilings and complementary interior construction products. Our industry is characterized by a large number of smaller, local distributors, which generally lack our level of scale and resources. We believe our leading market position, national reach and differentiated platform provide us significant advantages relative to these competitors, including:

Unwavering focus on relationships and superior service. We aim to be the premier partner of choice for our customers, suppliers and employees as well as smaller distributors whose owners may be seeking liquidity.

5

Differentiated operating model. We believe the combination of our national scale with our local go-to-market strategy helps to drive our growth and attractive margin profile. Specifically, through our Yard Support Center we are able to benefit from scaled purchasing efficiencies, integrated technology systems and shared best practices across our branch network, while still tailoring our service and product offering to the local preferences of each market. By retaining local brands and substantial autonomy in our branches, we are able to leverage local relationships and generate strong customer loyalty. In addition, we believe the inherent diversity in our model across customers, geographies and end markets offers lower volatility and less cyclicality than less diversified distributors in the building materials industry. We have low customer concentration with our largest customer representing less than 3% of our sales in fiscal 2016; we have geographic diversity with operations in 42 states; and based on certain assumptions by management as to the application of our products and our end markets, we believe that we have a balanced mix of business between the commercial and residential markets as well as between the new construction and R&R markets.

Multi-faceted growth. We have a track record of achieving above-market growth by capturing market share within our existing footprint, opening new branches and making selective acquisitions. Based on market data from the Gypsum Association and management's estimates, our volume growth outpaced the wallboard market by an average of approximately 950 basis points annually from 2010 through 2016, and we have increased our market share by approximately 570 basis points over the same period. We believe our success in capturing market share is due to our differentiated culture, superior customer service, national scale and strong supplier relationships. We also have a successful history of growth through opening new branches in select locations where we have identified opportunities in underserved markets. Since May 1, 2013 through the date of this prospectus, we have opened 24 new branches and we currently expect to open several new branches each year depending on market conditions. The new branches we have opened since 2013 have typically delivered attractive returns on invested capital in these markets within a few years. In addition, we complement our organic growth strategy with tuck-in acquisitions, of which we completed 21, constituting 52 new branches, from the beginning of full year 2014 through October 31, 2016. We believe our success in acquiring smaller distributors has been the result of our highly selective acquisition criteria, our focus on culture, our strategy of maintaining the acquisition's existing brand, when appropriate, to help ensure customer and employee continuity, our experience with integration, our national scale and our competitive position.

6

Wallboard Volume Market Share

Source: Gypsum Association and Company data.

Our objective is to strengthen our competitive position, achieve above-market rates of profitable growth and increase stockholder value through the following key strategies:

Continue to invest in our employees, assets and infrastructure. We believe our above-market growth is driven by the quality of our employees and our ability to continuously develop outstanding talent. Each year, we target graduates from premier universities to enter our training program and spend considerable time and resources training them across all major functions of our operations. In addition to recruiting and training new talent, we have developed an extensive management training program for existing, high potential employees which is focused on developing sales capabilities, financial acumen and operational and safety expertise. While these programs represent a considerable investment, we believe they are critical to supporting our growth strategy by providing managers for new branches and increasing the overall capacity of our management team. Many of our former trainees have been promoted to run branches, regions and even divisions throughout our Company. We also believe the size and growth of our Company provide our employees with superior career opportunities than many of our competitors, which further enables us to recruit and retain top talent. To ensure that we support

7

our employees with the best equipment, systems and infrastructure, we also continue to invest in other key areas of our business. We have a young and well maintained fleet of trucks and delivery equipment and have also made significant investments in our IT infrastructure and continuously improve our IT capabilities.

Grow market share within our existing geographic footprint. We expect to continue to capture profitable market share from competitors within our existing geographic footprint. We believe that our dedication to delivering superior customer service and our national scale differentiates us from our competitors. We also continue to provide strong financial incentives, support and technology to maximize the efficiency and effectiveness of our experienced salesforce as they work to provide local market expertise and tailored solutions for our customers. For example, our salesforce will provide our customers with leads on new job activity that helps them grow their businesses. Additionally, we have a strategic initiative to leverage our national capabilities to serve large homebuilders throughout their operations that we believe will increase our penetration of those accounts. We believe this provides a compelling value proposition for our homebuilder customers by ensuring consistent service levels across their footprint.

Accelerate growth by selectively opening new branches and executing acquisitions. We believe that significant opportunities exist to expand our geographic footprint by opening new branches and executing selective, tuck-in acquisitions.

Capitalize on accelerating growth across distinct end markets. We believe the new commercial and residential construction markets have both begun an extended period of expansion. Given the extreme depth of the last recession, despite the growth to date, activity in both markets remains well below average historical levels. As such, we believe both markets will experience an extended, sustained period of growth in the future. In addition, while R&R activity has historically been more stable than new construction activity, we believe the prolonged period of under-investment during the downturn will result in above-average growth in both commercial and residential R&R activity in the near term.

Achieve improved financial performance through operational excellence and operating leverage. Over the past five years, as volumes have recovered and as we have streamlined our operating model, our

8

Adjusted EBITDA margins have improved significantly. Our Yard Support Center continues to drive procurement savings and operational excellence across our branch network. Our operational initiatives include optimizing pricing, improving fleet utilization and maximizing working capital efficiency. As our volumes continue to grow, we expect margins to improve from the inherent operating leverage in our business. In the past, our existing branch network has supported substantially higher volumes per branch. As our end markets continue to recover, we expect to generate higher operating margins on incremental volume as we leverage our fixed costs at our existing branches. Similarly, we have made significant investments in our Yard Support Center over the past few years to prepare for significant growth in our business. As we continue to grow our volumes, we expect to gain operating leverage on that investment in the years ahead.

Capitalize on our deep customer relationships to drive sales of other products. In addition to our core product categories, wallboard, ceilings, and steel framing, we also sell our customers a wide assortment of other products, including joint compound, tools, insulation, fasteners, safety products and many others. Driving growth in these product categories is strategically important to us for three key reasons. First, by selling these product categories, we are able to better serve our customers by creating a "one-stop-shop" for everything they need to complete their jobs. Second, other products typically generate attractive margins as they are generally less price sensitive items that individually represent a relatively small portion of the total order. Further, they can be delivered on the same truck that is delivering the rest of the order or picked up at our branches, which makes the incremental cost to deliver the product very low and increases the profitability of the overall sale. Third, because these product categories represent very large markets, broadening our capabilities to sell them expands our addressable market and improves our overall growth profile. We are executing multiple strategic initiatives aimed at driving further growth of this category, including selectively introducing new products, building out and upgrading our retail showrooms across our branch network, expanding our distribution of tools and safety products, driving growth of insulation products, and further improving pricing practices.

Preliminary Financial Results for the Three and Nine Months Ended January 31, 2017

Our preliminary estimated unaudited financial results as of and for the three and nine months ended January 31, 2017 are set forth below. Our estimates of results are based solely on information available to us as of the date of this prospectus and are inherently uncertain and subject to change due to a variety of business, economic and competitive risks and uncertainties, many of which are not within our control, and we undertake no obligation to update this information. Accordingly, you should not place undue reliance on this preliminary data. Our estimates contained in this prospectus are forward-looking statements and may differ from actual results. Actual results remain subject to the completion of management's and the audit committee's final reviews, as well as the review by our independent registered public accountants and our other financial closing procedures. Our actual consolidated financial statements and related notes as of and for the three and nine months ended January 31, 2017 are not expected to be filed with the SEC until after this offering is completed. During the course of the preparation of our actual consolidated financial statements and related notes, additional items that would require material adjustments to the preliminary financial information presented below may be identified. See "Management's Discussion and Analysis of Financial Condition and Results of Operations—Critical Accounting Policies—Use of Estimates" included in our Annual Report on Form 10-K for the fiscal year ended April 30, 2016 incorporated by reference in this prospectus and "Risk Factors—Risks Relating to Our Business and Industry" and "Cautionary Note Regarding Forward-Looking Statements" included elsewhere in this prospectus.

The preliminary financial data included in this prospectus have been prepared by and are the responsibility of our management. Our independent accountant, PricewaterhouseCoopers LLP, has not

9

audited, reviewed, compiled or performed any procedures with respect to the preliminary financial data. Accordingly, PricewaterhouseCoopers LLP does not express an opinion or any other form of assurance with respect thereto.

These estimates are not a comprehensive statement of our financial results as of and for the three months and the nine months ended January 31, 2017, and should not be viewed as a substitute for full financial statements prepared in accordance with GAAP. In addition, these preliminary estimates as of and for the three and nine months ended January 31, 2017 are not necessarily indicative of the results to be achieved in any future period.

As reflected below, we expect to report each of net sales, gross profit, net income and Adjusted EBITDA for the three and nine months ended January 31, 2017 as compared to the comparable prior periods.

| | Nine Months Ended January 31, | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| | 2017 | | ||||||||

| | 2016 | |||||||||

| | Low | High | ||||||||

| | (estimated) | (actual) | ||||||||

| | (in thousands) | |||||||||

Wallboard | $ | 776,000 | $ | 776,500 | $ | 622,123 | ||||

Ceilings | 253,250 | 253,750 | 218,951 | |||||||

Steel framing | 273,750 | 274,250 | 203,571 | |||||||

Other products | 400,000 | 400,500 | 286,355 | |||||||

| | | | | | | | | | | |

Total | $ | 1,703,000 | $ | 1,705,000 | $ | 1,331,000 | ||||

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

10

$35.4 million for the nine months ended January 31, 2017 as compared to net income of $3.6 million for the nine months ended January 31, 2016. Our improved financial results in both periods were driven primarily by higher sales for many of the products we distribute, as well as to the improved leverage on fixed costs. In addition, for the twelve months ended January 31, 2017, we expect net income in the range of $42.4 million to $44.4 million.

The following information as of and for the three and nine months ended January 31, 2017 sets forth our preliminary financial data. As noted above, each of the line items presented below represents preliminary estimated unaudited financial results which remain subject to the completion of management's and the audit committee's final reviews, as well as the review by our independent registered public accountants and our other financial closing procedures. During the course of the preparation of the consolidated financial statements and related notes, additional information may cause a change in, or require material adjustments to, certain accounting estimates and other financial information, in particular, estimates and financial information related to our stock appreciation rights (income) expense, noncontrolling interests and income tax expense (benefit), which would impact net income (loss) and Adjusted EBITDA.

| | Three Months Ended January 31, | Nine Months Ended January 31, | |||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | 2017 | 2016 | 2017 | 2016 | |||||||||||||||

| | Low | High | | Low | High | | |||||||||||||

| | (estimated) | (actual) | (estimated) | (actual) | |||||||||||||||

| | (in thousands) | (in thousands) | |||||||||||||||||

Net sales | $ | 561,500 | $ | 563,500 | $ | 420,482 | $ | 1,703,000 | $ | 1,705,000 | $ | 1,331,000 | |||||||

Gross profit | $ | 181,000 | $ | 191,000 | $ | 134,160 | $ | 552,800 | $ | 562,800 | $ | 418,961 | |||||||

Net income (loss) | $ | 7,000 | $ | 9,000 | $ | (2,212 | ) | $ | 33,400 | $ | 35,400 | $ | 3,624 | ||||||

Adjusted EBITDA(1) | $ | 38,700 | $ | 42,700 | $ | 25,686 | $ | 134,200 | $ | 138,200 | $ | 94,601 | |||||||

| | January 31, | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| | 2017 | 2016 | ||||||||

| | Low | High | | |||||||

| | (estimated) | (actual) | ||||||||

| | (in thousands) | |||||||||

Cash and cash equivalents | $ | 10,000 | $ | 12,000 | $ | 7,383 | ||||

Total debt(2) | $ | 612,000 | $ | 612,000 | $ | 626,281 | ||||

11

The following is a reconciliation of our net income (loss) to our Adjusted EBITDA for the periods presented:

| | Three Months Ended January 31, | Nine Months Ended January 31, | Twelve Months Ended January 31, | |||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | 2017 | 2016 | 2017 | 2016 | 2017(a) | |||||||||||||||||||||

| | Low | High | | Low | High | | Low | High | ||||||||||||||||||

| | (estimated) | (actual) | (estimated) | (actual) | (estimated) | |||||||||||||||||||||

| | (in thousands) | (in thousands) | (in thousands) | |||||||||||||||||||||||

Net income (loss) | $ | 7,000 | $ | 9,000 | $ | (2,212 | ) | $ | 33,400 | $ | 35,400 | $ | 3,624 | $ | 42,400 | $ | 44,400 | |||||||||

Interest expense | 7,400 | 7,500 | 9,473 | 22,100 | 22,200 | 27,990 | 31,500 | 31,600 | ||||||||||||||||||

Write-off of debt discount and deferred financing fees | 200 | 200 | — | 7,100 | 7,100 | — | 7,100 | 7,100 | ||||||||||||||||||

Interest income | — | — | (247 | ) | (100 | ) | (100 | ) | (685 | ) | (300 | ) | (300 | ) | ||||||||||||

Income tax expense (benefit) | 5,200 | 5,900 | (819 | ) | 12,100 | 12,800 | 4,659 | 20,000 | 20,700 | |||||||||||||||||

Depreciation expense | 6,400 | 6,600 | 6,469 | 19,300 | 19,500 | 20,207 | 25,800 | 26,000 | ||||||||||||||||||

Amortization expense | 11,800 | 11,900 | 9,540 | 32,000 | 32,100 | 27,129 | 42,400 | 42,500 | ||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

EBITDA | 38,000 | 41,100 | 22,204 | 125,900 | 129,000 | 82,924 | 168,900 | 172,000 | ||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Stock appreciation rights (income) expense(b) | (800 | ) | (300 | ) | 337 | (1,000 | ) | (500 | ) | 1,623 | (600 | ) | (100 | ) | ||||||||||||

Redeemable noncontrolling interests(c) | 150 | 450 | 167 | 3,000 | 3,300 | 1,172 | 2,600 | 2,900 | ||||||||||||||||||

Equity-based compensation(d) | 600 | 600 | 728 | 2,000 | 2,000 | 2,089 | 2,600 | 2,600 | ||||||||||||||||||

Severance, other costs related to discontinued operations and closed branches and certain other costs(e) | 50 | 50 | 52 | 300 | 300 | 1,433 | (700 | ) | (700 | ) | ||||||||||||||||

Transaction costs (acquisitions and other)(f) | 500 | 600 | 1,057 | 3,000 | 3,100 | 2,812 | 3,900 | 4,000 | ||||||||||||||||||

(Gain) loss on disposal of assets | (100 | ) | (100 | ) | (205 | ) | (200 | ) | (200 | ) | 75 | (1,000 | ) | (1,000 | ) | |||||||||||

Management fee to related party(g) | — | — | 562 | 200 | 200 | 1,687 | 800 | 800 | ||||||||||||||||||

Effects of fair value adjustments to inventory(h) | 200 | 200 | 786 | 800 | 800 | 786 | 1,000 | 1,000 | ||||||||||||||||||

Interest rate swap and cap mark-to-market(i) | 100 | 100 | — | 200 | 200 | — | 300 | 300 | ||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Adjusted EBITDA | $ | 38,700 | $ | 42,700 | $ | 25,688 | $ | 134,200 | $ | 138,200 | $ | 94,601 | 177,800 | 181,800 | ||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Contributions from acquisitions(j) | 14,700 | 14,700 | ||||||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Adjusted EBITDA (with contributions from acquisitions) | $ | 192,500 | $ | 196,500 | ||||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

12

Recent Acquisitions

Subsequent to October 31, 2016, we acquired Interior Products Supply, or IPS, and certain Hawaii based distribution assets and the related business from Grabber Construction Products, Inc., or GHI, for an aggregate purchase price of $11.9 million. IPS distributes wallboard and related building materials from one location in Indiana. GHI distributes wallboard and related building materials from one location in Hawaii.

Our business is subject to a number of risks of which you should be aware before deciding to invest in our common stock. The risks are discussed more fully in the "Risk Factors" section of this prospectus immediately following this prospectus summary. These risks include, but are not limited to, the following:

13

GMS Inc. is a Delaware corporation. Our Predecessor was founded in 1971. Our principal executive office is located at 100 Crescent Centre Parkway, Suite 800, Tucker, Georgia 30084, and our telephone number at that address is (800) 392-4619. We maintain a website on the Internet at www.gms.com. The information contained on, or that can be accessed through, our website is not a part of, and should not be considered as being incorporated by reference into, this prospectus. For a chart illustrating our organizational structure, see "—Organizational Structure."

AEA is one of the most experienced global private investment firms. Founded in 1968, AEA currently manages over $10 billion of capital for an investor group that includes former and current chief executive officers of major multinational corporations, family groups, and institutional investors from around the world. With a staff of approximately 70 investment professionals and offices in New York, Stamford, London, Munich and Shanghai, AEA focuses on investing in companies in the consumer products/retail, industrial products, specialty chemicals and related services sectors.

14

The chart below summarizes our ownership and corporate structure, after giving effect to this offering.

15

| Common stock offered by the selling stockholders | 6,000,000 shares. | |

Common stock to be outstanding after this offering | 40,942,905 shares. | |

Option to purchase additional shares | The underwriters have an option to purchase up to an aggregate of 900,000 additional shares of common stock from the selling stockholders. The underwriters can exercise this option at any time within 30 days from the date of this prospectus. | |

Use of proceeds | The selling stockholders will receive all of the net proceeds from this offering. We will not receive any of the proceeds from the sale of shares of common stock offered by the selling stockholders. See "Use of Proceeds." | |

Dividend policy | We do not expect to pay any dividends on our common stock for the foreseeable future. See "Dividend Policy." | |

New York Stock Exchange symbol | "GMS" | |

Risk factors | Investing in our common stock involves a high degree of risk. See "Risk Factors" beginning on page 25 of this prospectus for a discussion of factors you should carefully consider before investing in our common stock. |

The number of shares of common stock to be outstanding after this offering excludes:

Unless otherwise indicated, all information contained in this prospectus assumes the underwriters' option to purchase additional shares will not be exercised.

16

Summary Financial and Other Data

The summary consolidated financial information of Successor presented below as of October 31, 2016 and for the six months ended October 31, 2016 and 2015 has been derived from our unaudited condensed consolidated financial statements incorporated by reference in this prospectus. The summary consolidated financial information of Successor presented below for the fiscal years ended April 30, 2016 and 2015, the one month ended April 30, 2014 and as of April 30, 2016 and 2015 has been derived from our audited consolidated financial statements incorporated by reference in this prospectus. The summary consolidated financial information of Predecessor presented below for the eleven months ended March 31, 2014 has been derived from our audited consolidated financial statements incorporated by reference in this prospectus. The summary consolidated financial information of Successor presented below as of April 30, 2014 has been derived from our consolidated financial statements not included or incorporated by reference in this prospectus. As discussed elsewhere in this prospectus, on April 1, 2014, GMS Inc., or the Successor, acquired, through its wholly-owned entities, GYP Holdings II Corp. and GYP Holdings III Corp., all of the capital stock of Gypsum Management and Supply, Inc., or the Predecessor. Successor is majority owned by certain affiliates of AEA and certain of our other stockholders. We refer to this transaction as the "Acquisition." As a result of the Acquisition and the resulting change in control and changes due to the impact of purchase accounting, we are required to present separately the operating results for the Predecessor periods ending on or prior to March 31, 2014 and the Successor periods beginning on or after April 1, 2014. For a discussion of our Predecessor and Successor periods, see "Basis of Presentation."

The historical data presented below has been derived from financial statements that have been prepared using GAAP. This data should be read in conjunction with "Management's Discussion and Analysis of Financial Condition and Results of Operations" and our consolidated financial statements and related notes included in our Annual Report on Form 10-K for the fiscal year ended April 30, 2016 and our Quarterly Report on Form 10-Q for the quarterly period ended October 31, 2016 incorporated by reference in this prospectus. The selected operating data has been prepared on an unaudited basis.

17

| | Successor | Predecessor | |||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | Six Months Ended October 31, 2016 | Six Months Ended October 31, 2015 | Fiscal Year Ended April 30, 2016 | Fiscal Year Ended April 30, 2015 | One Month Ended April 30, 2014 | Eleven Months Ended March 31, 2014 | |||||||||||||

| | (in thousands, except share, per share and margin data) | | |||||||||||||||||

Statement of Operations Data: | |||||||||||||||||||

Net sales | $ | 1,141,646 | $ | 910,518 | $ | 1,858,182 | $ | 1,570,085 | $ | 127,332 | $ | 1,226,008 | |||||||

Cost of sales (exclusive of depreciation and amortization shown separately below) | 769,837 | 625,717 | 1,265,018 | 1,091,114 | 97,955 | 853,020 | |||||||||||||

| | | | | | | | | | | | | | | | | | | | |

Gross profit | 371,809 | 284,801 | 593,164 | 478,971 | 29,377 | 372,988 | |||||||||||||

| | | | | | | | | | | | | | | | | | | | |

Operating expenses: | |||||||||||||||||||

Selling, general and administrative expenses | 284,856 | 224,562 | 470,035 | 396,155 | 46,052 | 352,930 | |||||||||||||

Depreciation and amortization | 33,163 | 31,327 | 64,215 | 64,165 | 6,336 | 12,253 | |||||||||||||

| | | | | | | | | | | | | | | | | | | | |

Total operating expenses | 318,019 | 255,889 | 534,250 | 460,320 | 52,388 | 365,183 | |||||||||||||

| | | | | | | | | | | | | | | | | | | | |

Operating income (loss) | 53,790 | 28,912 | 58,914 | 18,651 | (23,011 | ) | 7,805 | ||||||||||||

Other (expense) income: | |||||||||||||||||||

Interest expense | (14,731 | ) | (18,517 | ) | (37,418 | ) | (36,396 | ) | (2,954 | ) | (4,226 | ) | |||||||

Change in fair value of financial instruments | — | — | (19 | ) | (2,494 | ) | — | — | |||||||||||

Change in fair value of mandatorily redeemable common shares(1) | — | — | — | — | — | (200,004 | ) | ||||||||||||

Write-off of debt discount and deferred financing fees | (6,892 | ) | — | — | — | — | — | ||||||||||||

Other income, net | 1,089 | 919 | 3,671 | 1,916 | 149 | 2,187 | |||||||||||||

| | | | | | | | | | | | | | | | | | | | |

Total other (expense), net | (20,534 | ) | (17,598 | ) | (33,766 | ) | (36,974 | ) | (2,805 | ) | (202,043 | ) | |||||||

| | | | | | | | | | | | | | | | | | | | |

Income (loss) before tax | 33,256 | 11,314 | 25,148 | (18,323 | ) | (25,816 | ) | (194,238 | ) | ||||||||||

Income tax expense (benefit) | 6,869 | 5,478 | 12,584 | (6,626 | ) | (6,863 | ) | 6,623 | |||||||||||

| | | | | | | | | | | | | | | | | | | | |

Net income (loss) | $ | 26,387 | $ | 5,836 | $ | 12,564 | $ | (11,697 | ) | $ | (18,953 | ) | $ | (200,861 | ) | ||||

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

Weighted average shares outstanding: | |||||||||||||||||||

Basic | 39,579,244 | 32,707,297 | 32,799,098 | 32,450,401 | 32,341,751 | ||||||||||||||

Diluted | 39,955,990 | 32,915,871 | 33,125,242 | 32,450,401 | 32,341,751 | ||||||||||||||

Net income (loss) per share: | |||||||||||||||||||

Basic | $ | 0.67 | $ | 0.18 | $ | 0.38 | $ | (0.36 | ) | $ | (0.59 | ) | |||||||

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

Diluted | $ | 0.66 | $ | 0.18 | $ | 0.38 | $ | (0.36 | ) | $ | (0.59 | ) | |||||||

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

Other Financial Data: | |||||||||||||||||||

Adjusted EBITDA(2) | $ | 95,460 | $ | 68,913 | $ | 138,183 | $ | 105,796 | $ | 8,372 | $ | 78,690 | |||||||

Adjusted EBITDA margin(2) | 8.4 | % | 7.6 | % | 7.4 | % | 6.7 | % | 6.6 | % | 6.4 | % | |||||||

| | Successor | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | October 31, 2016 | April 30, 2016 | April 30, 2015 | April 30, 2014 | |||||||||

| | (in thousands) | ||||||||||||

Balance Sheet Data: | |||||||||||||

Cash and cash equivalents | $ | 16,387 | $ | 19,072 | $ | 12,284 | $ | 32,662 | |||||

Total assets(3) | 1,414,713 | 1,240,814 | 1,151,140 | 1,114,551 | |||||||||

Total debt(4) | 644,493 | 644,610 | 556,984 | 538,785 | |||||||||

Total stockholders' equity | 490,254 | 311,160 | 299,572 | 299,434 | |||||||||

18

| | Six Months Ended October 31, 2016 | Fiscal Year Ended April 30, 2016 | |||||

|---|---|---|---|---|---|---|---|

| | (in thousands, except share and per share data) | ||||||

Pro Forma Statement of Operations Data(5): | |||||||

Pro forma net income(5) | $ | 27,191 | $ | 22,058 | |||

Pro forma weighted average shares outstanding(6) | |||||||

Basic | 39,579,244 | 32,799,098 | |||||

Diluted | 39,955,990 | 33,125,242 | |||||

Pro forma net income per share(5)(6) | |||||||

Basic | $ | 0.69 | $ | 0.67 | |||

Diluted | $ | 0.68 | $ | 0.67 | |||

| | Six Months Ended | Fiscal Year Ended | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | October 31, 2016 | October 31, 2015 | April 30, 2016 | April 30, 2015 | April 30, 2014 | |||||||||||

Selected Operating Data: | ||||||||||||||||

Branches (at period end) | 203 | 159 | 186 | 156 | 140 | |||||||||||

Employees (at period end) | 4,360 | 3,246 | 3,934 | 3,088 | 2,621 | |||||||||||

Wallboard volume (million square feet) | 1,708 | 1,381 | 2,843 | 2,328 | 2,088 | |||||||||||

19

will be unaffected by unusual or non-recurring items. In addition, Adjusted EBITDA may not be comparable to similarly titled measures used by other companies in our industry or across different industries.

20

The following is a reconciliation of our net income (loss) to Adjusted EBITDA:

| | Successor | Predecessor | |||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | Six Months Ended October 31, 2016 | Six Months Ended October 31, 2015 | Fiscal Year Ended April 30, 2016 | Fiscal Year Ended April 30, 2015 | One Month Ended April 30, 2014 | Eleven Months Ended March 31, 2014 | |||||||||||||

| | (in thousands) | ||||||||||||||||||

Net income (loss) | $ | 26,387 | $ | 5,836 | $ | 12,564 | $ | (11,697 | ) | $ | (18,953 | ) | $ | (200,861 | ) | ||||

Interest expense | 14,731 | 18,517 | 37,418 | 36,396 | 2,954 | 4,226 | |||||||||||||

Write-off of debt discount and deferred financing fees | 6,892 | — | — | — | — | — | |||||||||||||

Change in fair value of mandatorily redeemable shares | — | — | — | — | — | 200,004 | |||||||||||||

Interest income | (78 | ) | (438 | ) | (928 | ) | (1,010 | ) | (76 | ) | (846 | ) | |||||||

Income tax expense (benefit) | 6,869 | 5,478 | 12,584 | (6,626 | ) | (6,863 | ) | 6,623 | |||||||||||

Depreciation expense | 12,930 | 13,738 | 26,667 | 32,208 | 3,818 | 12,224 | |||||||||||||

Amortization expense | 20,233 | 17,589 | 37,548 | 31,957 | 2,518 | 38 | |||||||||||||

| | | | | | | | | | | | | | | | | | | | |

EBITDA | $ | 87,964 | $ | 60,720 | $ | 125,853 | $ | 81,228 | $ | (16,602 | ) | $ | 21,408 | ||||||

| | | | | | | | | | | | | | | | | | | | |

Executive compensation(a) | $ | — | $ | — | $ | — | $ | — | $ | 20 | $ | 2,427 | |||||||

Stock appreciation rights (income) expense(b) | (236 | ) | 1,286 | 1,988 | 2,268 | 80 | 1,288 | ||||||||||||

Redeemable noncontrolling interests(c) | 2,823 | 1,005 | 880 | 1,859 | 71 | 2,957 | |||||||||||||

Equity-based compensation(d) | 1,359 | 1,361 | 2,699 | 6,455 | 1 | 27 | |||||||||||||

Acquisition related costs(e) | — | — | — | 837 | 16,155 | 51,809 | |||||||||||||

Severance, other costs related to discontinued operations and closed branches and certain other costs(f) | 258 | 1,381 | 379 | 413 | — | — | |||||||||||||

Transaction costs (acquisitions and other)(g) | 2,481 | 1,755 | 3,751 | 1,891 | — | — | |||||||||||||

Loss (gain) on disposal of assets | (130 | ) | 280 | (645 | ) | 1,089 | 170 | (1,034 | ) | ||||||||||

Management fee to related party(h) | 188 | 1,125 | 2,250 | 2,250 | 188 | — | |||||||||||||

Effects of fair value adjustments to inventory(i) | 621 | — | 1,009 | 5,012 | 8,289 | — | |||||||||||||

Interest rate swap and cap mark-to-market(j) | 132 | — | 19 | 2,494 | — | (192 | ) | ||||||||||||

| | | | | | | | | | | | | | | | | | | | |

Adjusted EBITDA(k) | $ | 95,460 | $ | 68,913 | $ | 138,183 | $ | 105,796 | $ | 8,372 | $ | 78,690 | |||||||

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

21

22

Second Lien Facility from the proceeds of our IPO, together with cash on hand, and (iii) each of the related adjustments mentioned below.

| (in thousands) | Six Months Ended October 31, 2016 | Fiscal Year Ended April 30, 2016 | |||||

|---|---|---|---|---|---|---|---|

Net income (loss) | $ | 26,387 | $ | 12,564 | |||

Decrease in interest expense(a) | 1,152 | 13,573 | |||||

Increase in income tax expense(b) | (536 | ) | (6,329 | ) | |||

Removal of management fee(c) | 188 | 2,250 | |||||

| | | | | | | | |

Pro forma net income (loss) | $ | 27,191 | $ | 22,058 | |||

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| (in thousands) | Six Months Ended October 31, 2016 | Fiscal Year Ended April 30, 2016 | |||||

|---|---|---|---|---|---|---|---|

Interest expense | $ | 14,731 | $ | 37,418 | |||

Decrease resulting from repayment of Second Lien Facility(a) | 1,152 | 13,573 | |||||

| | | | | | | | |

Pro forma interest expense | $ | 13,579 | $ | 23,845 | |||

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

23

24

Investing in our common stock involves a high degree of risk. You should carefully consider the following factors, as well as other information contained or incorporated by reference in this prospectus, before deciding to invest in shares of our common stock. The trading price of our common stock could decline due to any of these risks, and you may lose all or part of your investment in our common stock.

Risks Relating to Our Business and Industry

Our business is affected by general business, financial market and economic conditions, which could adversely affect our results of operations.

Our business and results of operations are significantly affected by general business, financial market and economic conditions. General business, financial market and economic conditions that could impact the level of activity in the commercial and residential construction and the repair and remodeling, or R&R, markets include, among others, interest rate fluctuations, inflation, unemployment levels, tax rates, capital spending, bankruptcies, volatility in both the debt and equity capital markets, liquidity of the global financial markets, the availability and cost of credit, investor and consumer confidence, global economic growth, local, state and federal government regulation and the strength of regional and local economies in which we operate.

There was a significant decline in economic growth, both in the United States and worldwide, that began in the second half of 2007 and continued through 2011. During this period, the U.S. construction markets we serve experienced unprecedented declines since the post-World War II era. There can be no guarantee that any improvement in these markets will be sustained or continue.

Our sales are in part dependent upon the commercial new construction market and the commercial R&R market.

The recent downturn in the U.S. commercial new construction market was one of the most severe of the last 40 years. Previously, such downturns in the construction industry have typically lasted about 2 to 3 years, resulting in market declines of approximately 20% to 40%, while the recent downturn in the commercial construction market lasted over 4 years, resulting in a market decline of approximately 60%. According to Dodge Data & Analytics, commercial construction put in place began to recover in 2013 and continued to increase 7% in 2015. However, 2015 levels of new commercial construction square footage put in place, measured by square footage of construction, are still well below the historical market average of 1.3 billion square feet annually since 1970. We cannot predict the duration of the current market conditions or the timing or strength of any future recovery of commercial construction activity in our markets. Continued weakness in the commercial construction market and the commercial R&R market, would have a significant adverse effect on our business, financial condition and operating results. Continued uncertainty about current economic conditions will continue to pose a risk to our business that serves the commercial construction and R&R markets as participants in this industry may postpone spending in response to tighter credit, negative financial news and/or declines in income or asset values, which could have a continued material negative effect on the demand for our products and services.

Our sales are also in part dependent upon the residential new construction market and home R&R activity.

The distribution of our products, particularly wallboard, to contractors serving the residential market represents a significant portion of our business. Though its cyclicality has historically been somewhat moderated by R&R activity, wallboard demand is highly correlated with housing starts. Housing starts and R&R activity, in turn, are dependent upon a number of factors, including housing demand, housing inventory levels, housing affordability, foreclosure rates, geographical shifts in the

25

population and other changes in demographics, the availability of land, local zoning and permitting processes, the availability of construction financing and the health of the economy and mortgage markets. Unfavorable changes in any of these factors beyond our control could adversely affect consumer spending, result in decreased demand for homes and adversely affect our business.

Beginning in mid-2006 and continuing through late-2011, the homebuilding industry experienced a significant downturn. This decrease in homebuilding activity led to a steep decline in wallboard demand which, in turn, had a significant adverse effect on our business during this time. According to the U.S. Census Bureau, 1.2 million housing units were started in 2016, representing an increase of 5% from 2015. Nevertheless, housing starts in 2016 remained below their historical long-term average. In addition, some analysts project that the demand for residential construction may be negatively impacted as the number of renting households has increased in recent years and a shortage in the supply of affordable housing is expected to result in lower home ownership rates. The timing and extent of a recovery, if any, in homebuilding and the resulting impact on demand for our products are uncertain. Further, even if homebuilding activity fully recovers, the impact of such recovery on our business may be suppressed if, for example, the average selling price or average size of new single family homes decreases, which could cause homebuilders to decrease spending on our services and the products we distribute.

Beginning in 2007, the mortgage markets were also substantially disrupted as a result of increased defaults, primarily due to weakened credit quality of homeowners. In reaction to the disruption in the mortgage markets, stricter regulations and financial requirements were adopted and the availability of mortgages for potential homebuyers was significantly reduced as a result of a limited credit market and stricter standards to qualify for mortgages. Mortgage financing and commercial credit for smaller homebuilders, as well as for the development of new residential lots, continue to be constrained. If the residential construction industry continues to experience weakness and a reduction in activity, our business, financial condition and operating results will be significantly and adversely affected.

We also rely, in part, on home R&R activity. High unemployment levels, high mortgage delinquency and foreclosure rates, lower home prices, limited availability of mortgage and home improvement financing and significantly lower housing turnover, may restrict consumer spending, particularly on discretionary items such as home improvement projects, and affect consumer confidence levels leading to reduced spending in the R&R end markets. We cannot predict the timing or strength of a significant recovery in R&R activity, if any. Furthermore, without a significant recovery of the general economy, consumer preferences and purchasing practices and the strategies of our customers may adjust in a manner that could result in changes to the nature and prices of products demanded by the end consumer and our customers and could adversely affect our business and results of operations.

Our industry and the markets in which we operate are highly fragmented and competitive, and increased competitive pressure may adversely affect our results.

We currently compete in the wallboard, ceilings and complementary interior construction products distribution markets primarily with smaller distributors, but we also face competition from a number of national and multi-regional distributors of building materials, some of which are larger and have greater financial resources than us.

Competition varies depending on product line, type of customer and geographic area. If our competitors have greater financial resources, they may be able to offer higher levels of service or a broader selection of inventory than we can. As a result, we may not be able to continue to compete effectively with our competitors. Any of our competitors may (i) foresee the course of market development more accurately than we do, (ii) provide superior service and sell or distribute superior products, (iii) have the ability to supply or deliver similar products and services at a lower cost, (iv) develop stronger relationships with our customers and other consumers in the industry in which we

26

operate, (v) adapt more quickly to evolving customer requirements than we do, (vi) develop a superior network of distribution centers in our markets or (vii) access financing on more favorable terms than we can obtain. As a result, we may not be able to compete successfully with our competitors.

Competition can also reduce demand for our products, negatively affect our product sales or cause us to lower prices. The consolidation of homebuilders may result in increased competition for their business. Certain product manufacturers that sell and distribute their products directly to homebuilders may increase the volume of such direct sales. Our suppliers may also elect to enter into exclusive supplier arrangements with other distributors.

Our customers consider the performance of the products we distribute, our customer service and price when deciding whether to use our services or purchase the products we distribute. Excess industry capacity for certain products in several geographic markets could lead to increased price competition. We may be unable to maintain our operating costs or product prices at a level that is sufficiently low for us to compete effectively. If we are unable to compete effectively with our existing competitors or new competitors enter the markets in which we operate, our financial condition, operating results and cash flows may be adversely affected.

We are subject to significant pricing pressures.

Large contractors and homebuilders in both the commercial and residential industries have historically been able to exert significant pressure on their outside suppliers and distributors to keep prices low in the highly fragmented building products supply and services industry. The recent construction industry downturn significantly increased the pricing pressures from homebuilders and other customers. In addition, continued consolidation in the commercial and residential industries and changes in builders' purchasing policies and payment practices could result in even further pricing pressure. A decline in the prices of the products we distribute could adversely impact our operating results. When the prices of the products we distribute decline, customer demand for lower prices could result in lower sales prices and, to the extent that our inventory at the time was purchased at higher costs, lower margins. Alternatively, due to the rising market price environment, our suppliers may increase prices or reduce discounts on the products we distribute and we may be unable to pass on any cost increase to our customers, thereby resulting in reduced margins and profits. Overall, these pricing pressures may adversely affect our operating results and cash flows.

The trend toward consolidation in our industry may negatively impact our business.

Customer demands and supplier capabilities have resulted in consolidation in our industry, which could cause markets to become more competitive as greater economies of scale are achieved by distributors that are able to efficiently expand their operations. We believe these customer demands could result in fewer overall distributors operating multiple locations. There can be no assurance that we will be able to effectively take advantage of this trend toward consolidation which may make it more difficult for us to maintain operating margins and could also increase the competition for acquisition targets in our industry, resulting in higher acquisition costs and prices.

We may be unable to successfully implement our growth strategy, which includes pursuing strategic acquisitions and opening new branches.

Our long-term business strategy depends in part on increasing our sales and growing our market share through strategic acquisitions and opening new branches. If we fail to identify and acquire suitable acquisition targets on appropriate terms, our growth strategy may be materially and adversely affected. Further, if our operating results decline as a result of reduced activity in the residential or commercial construction markets, we may be unable to obtain the capital required to effect new acquisitions or open new branches.

27