UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-22939

| T. Rowe Price Credit Opportunities Fund, Inc. |

| (Exact name of registrant as specified in charter) |

| 100 East Pratt Street, Baltimore, MD 21202 |

| (Address of principal executive offices) |

| David Oestreicher |

| 100 East Pratt Street, Baltimore, MD 21202 |

| (Name and address of agent for service) |

Registrant’s telephone number, including area code: (410) 345-2000

Date of fiscal year end: May 31

Date of reporting period: November 30, 2018

|

| Credit Opportunities Fund | November 30, 2018 |

Beginning on January 1, 2021, as permitted by SEC regulations, paper copies of the T. Rowe Price funds’ annual and semiannual shareholder reports will no longer be mailed, unless you specifically request them. Instead, shareholder reports will be made available on the funds’ website (troweprice.com/prospectus), and you will be notified by mail with a website link to access the reports each time a report is posted to the site.

If you already elected to receive reports electronically, you will not be affected by this change and need not take any action. At any time, shareholders who invest directly in T. Rowe Price funds may generally elect to receive reports or other communications electronically by enrolling attroweprice.com/paperlessor, if you are a retirement plan sponsor or invest in the funds through a financial intermediary (such as an investment advisor, broker-dealer, insurance company, or bank), by contacting your representative or your financial intermediary.

You may elect to continue receiving paper copies of future shareholder reports free of charge. To do so, if you invest directly with T. Rowe Price, please call T. Rowe Price as follows: IRA, nonretirement account holders, and institutional investors,1-800-225-5132; small business retirement accounts,1-800-492-7670. If you are a retirement plan sponsor or invest in the T. Rowe Price funds through a financial intermediary, please contact your representative or financial intermediary or follow additional instructions if included with this document. Your election to receive paper copies of reports will apply to all funds held in your account with your financial intermediary or, if you invest directly in the T. Rowe Price funds, with T. Rowe Price. Your election can be changed at any time in the future.

| T. ROWE PRICE CREDIT OPPORTUNITIES FUND |

HIGHLIGHTS

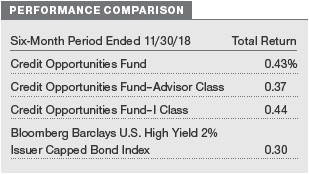

| ■ | The Credit Opportunities Fund generated a 0.43% return in the six-month period ended November 30, 2018, outperforming its benchmark, the Bloomberg Barclays U.S. High Yield 2% Issuer Capped Bond Index. |

| ■ | The fund’s off-index allocation to floating rate bank loans drove relative performance during the reporting period. |

| ■ | We have been harvesting some gains in the loan segment and are redeploying those assets into higher-quality BB rated bonds that appear to offer attractive relative value. |

| ■ | We are moving into a more challenging macroeconomic environment, and market volatility is likely to persist. |

Log in to your account attroweprice.comfor more information.

*Certain mutual fund accounts that are assessed an annual account service fee can also save money by switching to e-delivery.

CIO Market Commentary

Dear Shareholder

Financial markets were challenging for both bond and stock investors in the six months ended November 30, 2018, the first half of your fund’s fiscal year. Longer-term Treasury yields rose through most of the period, providing a general headwind to fixed income returns. The prospect of higher interest rates also weighed on stock prices, and investors faced additional tests from deepening U.S.-China trade tensions, a strengthening U.S. dollar, and signs of slowing global growth.

The weak performance of most asset classes over the past six months stood in stark contrast to solid fundamentals, particularly in the U.S. Thanks in part to recent fiscal stimulus, U.S. gross domestic product expanded at an annualized rate of 4.2% in the second quarter of the year and 3.5% in the third—the best back-to-back performance in four years. Profit growth in the two quarters was even more impressive, with earnings for the S&P 500 as a whole rising at the fastest pace since the recovery from the financial crisis nearly a decade ago.

As usual, the robust economy presented a mixed blessing for bond investors. The strong economic data—including signs that wage gains were finally taking root—fostered a rise in longer-term interest rates and weighed on bond prices. (Bond prices and yields move in opposite directions.) The yield on the benchmark 10-year Treasury note jumped from 2.83% at the end of May to 3.25% in intraday trading on October 5—its highest level since the summer of 2011.

On the positive side, healthy economic conditions also helped solidify borrowers’ balance sheets, bolstering corporate bonds and other credit-sensitive issues. Riskier bonds also typically sport higher coupons, which helped insulate total returns from a decline in bond prices. Indeed, asset-backed securities and better-rated (B and Ba) high yield corporate bonds were among the few fixed income sectors to record gains during the period. Leveraged loans, which feature floating interest rates, were also positive.

Solid economic data paired with tame overall inflation allowed the Federal Reserve to stick to its path of gradually raising short-term interest rates, boosting returns for those seeking current income. The Fed raised the federal funds rate again in June and September and, as of this writing, appears likely to do so again in December. The Fed’s rate increases and the strong U.S. economy attracted assets from overseas, where interest rates in most developed economies generally remained near zero. As a result, most currencies fell against the dollar, weighing on returns for U.S. investors in foreign markets.

The jump in interest rates eventually spilled over into U.S. equity markets, helping push the S&P 500 Index back into its second correction (down over 10% from its highs) for the year in the month of October. Rising trade tensions with China and slowing growth in Europe and Asia also contributed to the turn in sentiment.

In fact, worries about the U.S. economy overheating and sparking inflation dissipated in November, as investors grew more concerned that global growth would slow significantly in 2019. Some late disappointing economic data, along with investors shifting assets from stocks to bonds, caused longer-term bond yields to fall back sharply. In just a few weeks, the yield on the 10-year Treasury note retraced more than half of its advance since May and ended November just above 3%.

While a slowdown in the U.S. economy and corporate profit growth seems all but inevitable in 2019, it seems premature to conclude that the current expansion is coming to an end. Late-cycle markets such as this one tend to create challenges but also dislocations that savvy investors can exploit. You can be confident that your fund’s manager is drawing on the firm’s in-depth research and fundamental analysis in seeking to find opportunities in the coming year.

Thank you for your continued confidence in T. Rowe Price.

Sincerely,

Robert Sharps

Group Chief Investment Officer

Management’s Discussion of Fund Performance

INVESTMENT OBJECTIVE

The fundseeks a combination of long-termcapital appreciation andhigh income.

FUND COMMENTARY

How did the fund perform in the past six months?

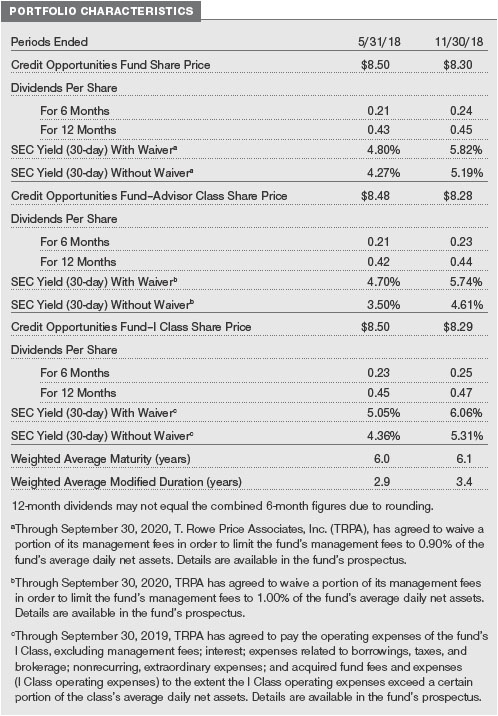

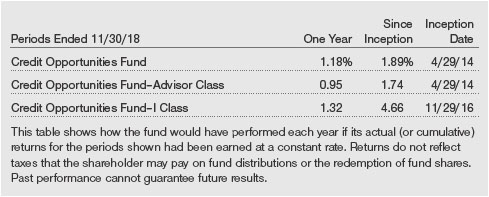

The Credit Opportunities Fundreturned0.43% in the sixmonths endedNovember 30, 2018, outperforming its benchmark, the Bloomberg Barclays U.S.High Yield2%Issuer CappedBond Index. (Returns for Advisor and IClass shares variedslightly,reflecting theirdifferent fee structures.Past performance cannot guarantee future results.)

What factors influenced the fund’s performance?

The fund’s off-index allocation to floating rate bank loansdrove relative performance in the pastsixmonths. The loan asset class has historically performedwell relative to other fixedincome segmentsduring periods of rising policy rates because floating rate coupons reset higher as rates rise.

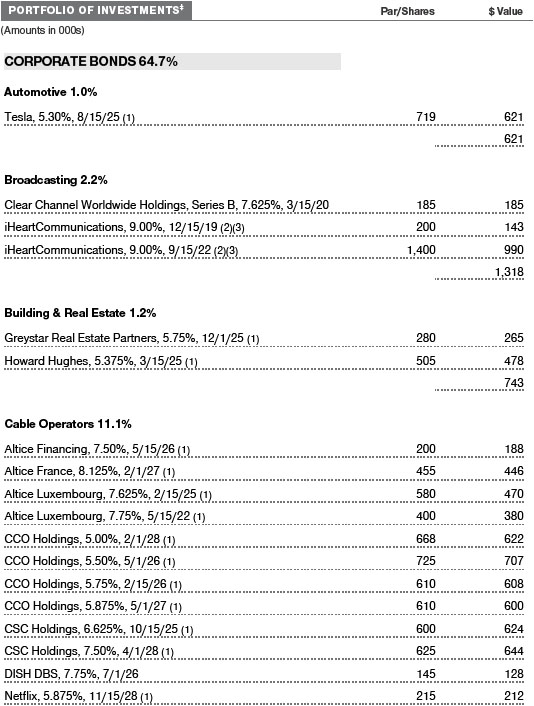

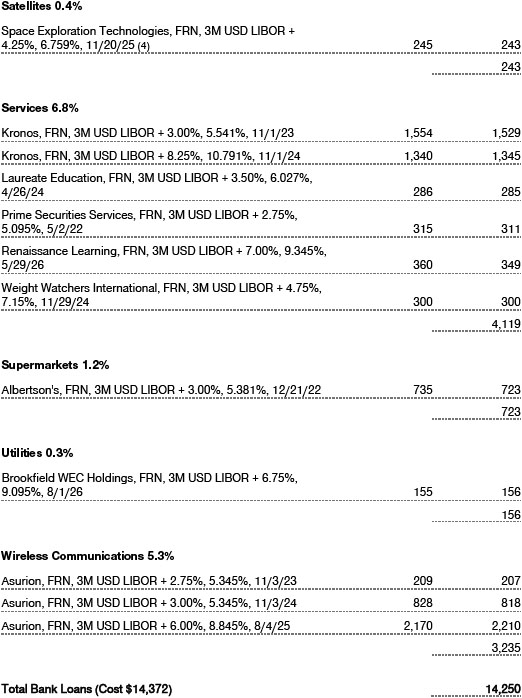

Our exposure toAsurion, a loan-only issuer andglobal provider of product protection andsupport services to the wireless, insurance, retail, andhome repair service industries, was the top contributor to relative performance. As a handset insurance provider, this company benefits fromsmartphone sales withoutdepending on the execution of one specific wireless carrier. Asurion’s scale acts as a significant barrier to entry, allowing the company to providemore valuable services to its carriers’ customers at a lower cost than competitors. (Please refer to the portfolio of investments for a complete list of holdings andthe amount each represents in the portfolio.)

Our investment inIntelsat, a leading satellite company, was another top contributor for the period. This issuer has benefitedfromthe industry’s high barriers to entry andlong-termcustomer contracts. Thediversification of its satellite fleet, customer type, andgeography has also been supportive. Asignificant part of the company’s turnaroundin 2018 has been its ownership of a large segment of C-bandspectrum, which is a crucial component in thedeployment of 5Gwireless technology. Monetizing its C-bandspectrumcapabilities is expectedto be highly profitable forIntelsat andshould drivemeaningfuldeleveraging over time.

Charter Communicationswas a significantdetractor in the 12months endedMay 31, 2018, as BB ratedcredits came under pressuredue to rising interest rates.However, this issuer performedwell amidbroadhigh yield market weaknessduring the last sixmonths andwas one of our top performers. Our credit analyst who covers Charter views it a blue chip crossover credit—the combination of a relatively high interest rate andlowdefault outlook—with the potential for further credit upgrades. The company shouldcontinue generating steady earnings andfree cash flow growth, andit benefits fromsignificant scale as the second-largest U.S. cable operator.

In the broadcasting segment,iHeartMediawas a notabledetractor. The company filedfor bankruptcy in the first quarter of 2018, so its bondsdon’t pay a coupon. Therefore, anymovement in the underlying pricedirectly weighs on performance. The bonds tradedlowerduring the period due to high yield market weakness. Additionally, investors weredisappointedthat the company’s bankruptcy confirmation hearing—a necessary step towardemerging frombankruptcy—wasdelayedfromearly December 2018 tomid-January 2019.T. Rowe Price has been an activemember of the iHeartMedia senior bondholder group formore than a year. We continue to be involvedandbelieve that ultimate recovery is not reflectedin the current value of the bonds.

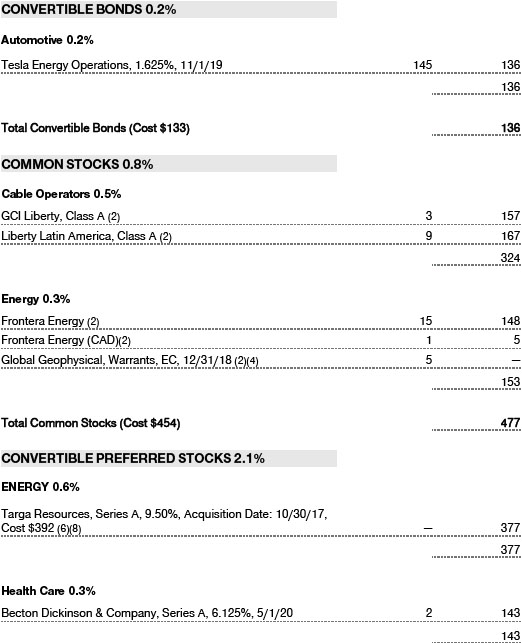

A residual equity position inFrontera Energywas anothermeaningfuldetractor for the six-month period. We receivedthese shares as part of the restructuring when the company—formerly known as Pacific Rubiales—emergedfrombankruptcy. Frontera is a Colombian petroleumexploration andproduction company with adiverse portfolio of assets andis publicly tradedon the Toronto Stock Exchange. The stock tradedlower because investors weredisappointedby the company’s limitedsuccess in finding new production sources.However, we believe that themarket is overlooking the fact that its existing production base shouldprovide steady operating performance for several years, even with no additionaldiscoveries.In addition to a very strong balance sheet, Frontera recently announcedthat it’s instituting adividendanda significant share buyback.

How is the fund positioned?

This portfolio is structuredto offer flexible andconcentratedexposure to our highest-conviction high yieldbonds andbank loans. Most of the portfolio taps in to the repeatable, traditional high yieldandbank loan credit research process thatdefines the T. Rowe Price high yieldplatform. The fund’s flexiblemandate allows formore aggressive or conservative positioning as the opportunity setdictates, andwe have the ability to layer in special credit situations.In these special situations, we look for jurisdictions in which we know our rights andremedies andspendsubstantial time on asset valuation andassessing potential outcomes. When wedo participate in selective situations, we stayin liquid, freely tradeable instruments andseek to be activemembers of creditor committees so that we can have a significant impact on our outcome. These holdings, while limitedin number, can offer the potential formeaningful total return, andthey are another factordifferentiating this portfolio fromtraditional high yieldbondfunds.

Most of the portfolio is composedof traditional high yieldbonds andbank loans sourcedfromthe combinedhigh yieldandbank loan investment team.However, this portfolio ismore focusedthan adiversifiedhigh yieldfund, andthe benchmarkdoes notdrive portfolio construction.If wedo not findcompelling value in a name, we simplydo not own it.

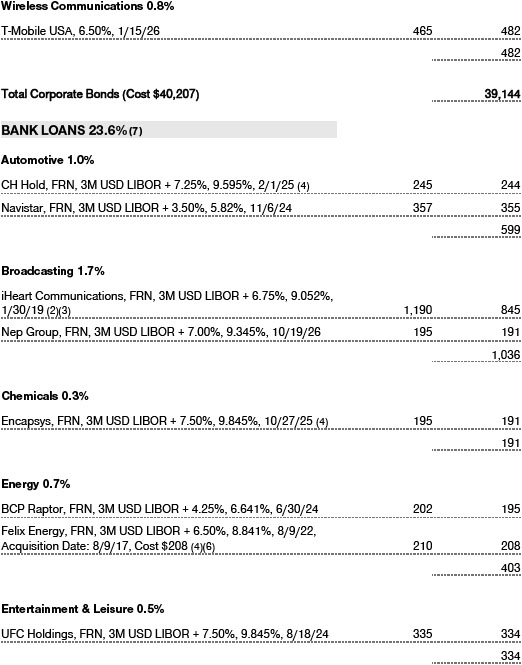

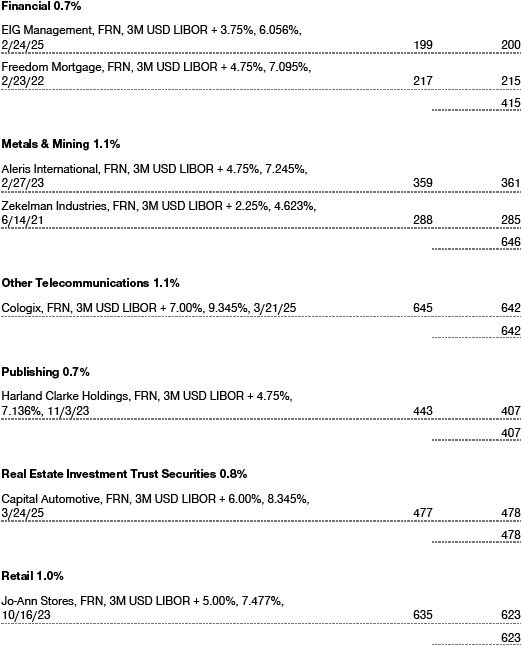

Bank loans were the fund’s largest off-index allocation as of November 30, 2018, at 23.2% of assets. Because of their senior securedstatus, loans provide compelling risk-adjustedexposure to the below investment-grademarket. Loans’defensive features are particularly attractive as the Federal Reserve tightensmonetary policy or in the event of a high yieldbond market correction.

Our bank loan holdings have performedextremely well in 2018. We have been harvesting some gains in the loan segment andare redeploying those assets into higher-quality BB ratedbonds. As the Fedapproaches the endof its tightening cycledue tomoderating economic growth, wemay begin to see interest rates trending lower.In our view, this is an opportune time to increase the portfolio’s holdings of BB ratedlower-coupon bonds, where we are finding value.

What is portfolio management’s outlook?

We believe that we have reachedthe point in the credit cycle where growth, corporate earnings, central bank stimulus, andliquidity have peaked, andwe are clearlymoving into amore challengingmacroeconomic environment. Whether policymakers will be able to orchestrate a“soft landing”andsustain the economy’smomentumat lower levels of growth while avoiding a recession is a key issue for 2019. There is some uncertainty surrounding the Fed’s interest rate strategy for next year.Given the recent volatility, the central bankmay attempt to stabilize financialmarkets by slowing the pace of rate hikes.

Fundamental conditions are supportive for high yieldissuers, andwe expect thedefault rate in 2019 to remain below the historical average. Nevertheless, we have temperedour near-termperformance expectations for the high yieldasset class. Tradedisputes with China are creating geopolitical challenges, andprivate corporations couldget caught in the crossfire. Market volatility is likely to persist as investors try to resolve the basic conflict between supportive fundamentals and macroeconomic conditions that have introducedconsiderable uncertainty.

The views expressed reflect the opinions of T. Rowe Price as of the date of this report and are subject to change based on changes in market, economic, or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

RISKS OF BOND INVESTING

Bonds are subject to interest rate risk, thedecline in bondprices that usually accompanies a rise in interest rates, andcredit risk, the chance that any fundholding couldhave its credit ratingdowngradedor that a bondissuer willdefault (fail tomake timely payments of interest or principal), potentially reducing the fund’s income level andshare price.High yieldcorporate bonds couldhave greater pricedeclines than funds that invest primarily in high-quality bonds. Companies issuing high yieldbonds are not as strong financially as those with higher credit ratings, so the bonds are usually consideredto be speculative investments. Bank loansmay at times becomedifficult to value andhighly illiquid, andthey are subject to credit risk such as nonpayment of principal or interest andrisks of bankruptcy andinsolvency.

Investing in the securities of non-U.S. issuers involves special risks not typically associatedwith investing in U.S. issuers. Foreign securities tendto bemore volatile andless liquidthan investments in U.S. securities and may lose value because of adverse local, political, social, or economicdevelopments overseas, ordue to changes in the exchange rates between foreign currencies andthe U.S.dollar.In addition, foreign investments are subject to settlement practices andregulatory andfinancial reporting standards thatdiffer fromthose of the U.S. These risks are heightenedfor the fund’s investments in emergingmarkets, which aremore susceptible to governmental interference, less efficient tradingmarkets, andthe imposition of local taxes or restrictions on gaining access to sales proceeds for foreign investors.

BENCHMARK INFORMATION

Note:BloombergIndex Services Ltd. Copyright©2018, BloombergIndex Services Ltd. Usedwith permission.

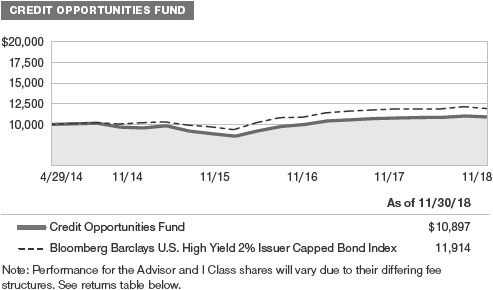

GROWTH OF $10,000

This chart shows the value of a hypothetical $10,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The result is compared with benchmarks, which include a broad-based market index and may also include a peer group average or index. Market indexes do not include expenses, which are deducted from fund returns as well as mutual fund averages and indexes.

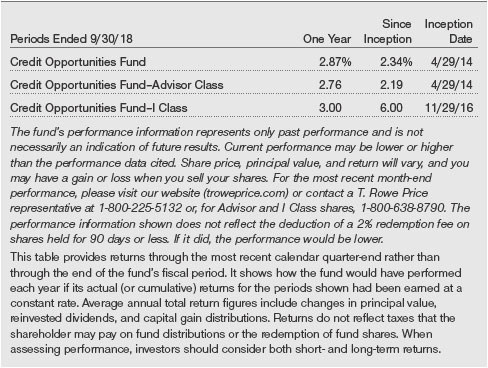

AVERAGE ANNUAL COMPOUND TOTAL RETURN

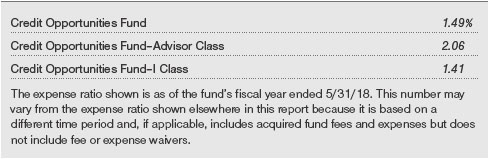

EXPENSE RATIO

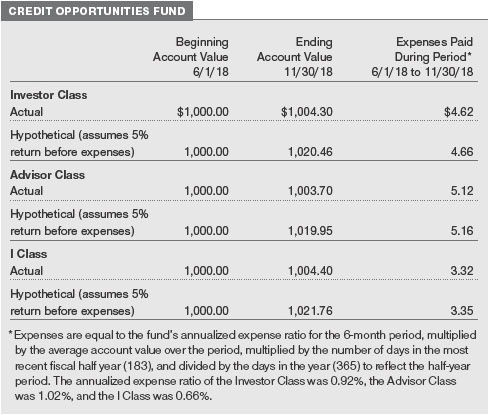

FUND EXPENSE EXAMPLE

As a mutual fund shareholder, you may incur two types of costs: (1) transaction costs, such as redemption fees or sales loads, and (2) ongoing costs, including management fees, distribution and service (12b-1) fees, and other fund expenses. The following example is intended to help you understand your ongoing costs (in dollars) of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the most recent six-month period and held for the entire period.

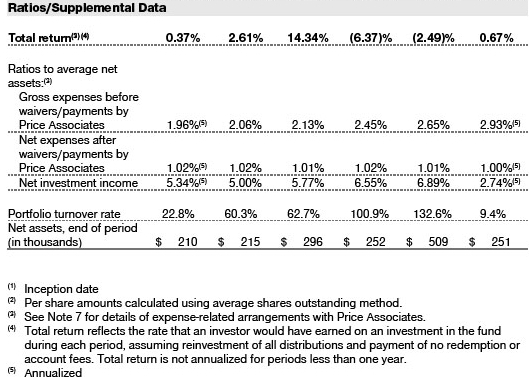

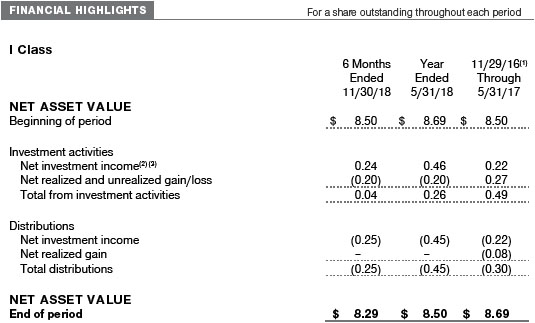

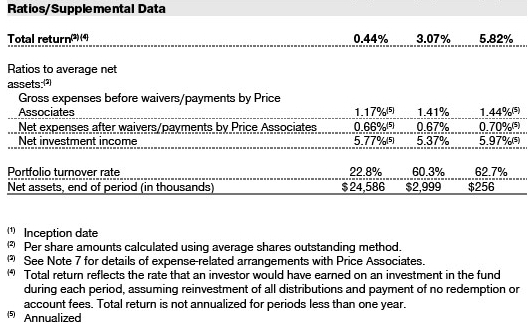

Please note that the fund has three share classes: The original share class (Investor Class) charges no distribution and service (12b-1) fee, the Advisor Class shares are offered only through unaffiliated brokers and other financial intermediaries and charge a 0.25% 12b-1 fee, and I Class shares are available to institutionally oriented clients and impose no 12b-1 or administrative fee payment. Each share class is presented separately in the table.

Actual Expenses

The first line of the following table (Actual) provides information about actual account values and expenses based on the fund’s actual returns. You may use the information on this line, together with your account balance, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number on the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The information on the second line of the table (Hypothetical) is based on hypothetical account values and expenses derived from the fund’s actual expense ratio and an assumed 5% per year rate of return before expenses (not the fund’s actual return). You may compare the ongoing costs of investing in the fund with other funds by contrasting this 5% hypothetical example and the 5% hypothetical examples that appear in the shareholder reports of the other funds. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

Note:T. Rowe Price charges an annual account service fee of $20, generally for accounts with less than $10,000. The fee is waived for any investor whose T. Rowe Price mutual fund accounts total $50,000 or more; accounts electing to receive electronic delivery of account statements, transaction confirmations, prospectuses, and shareholder reports; or accounts of an investor who is a T. Rowe Price Personal Services or Enhanced Personal Services client (enrollment in these programs generally requires T. Rowe Price assets of at least $250,000). This fee is not included in the accompanying table. If you are subject to the fee, keep it in mind when you are estimating the ongoing expenses of investing in the fund and when comparing the expenses of this fund with other funds.

You should also be aware that the expenses shown in the table highlight only your ongoing costs and do not reflect any transaction costs, such as redemption fees or sales loads. Therefore, the second line of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. To the extent a fund charges transaction costs, however, the total cost of owning that fund is higher.

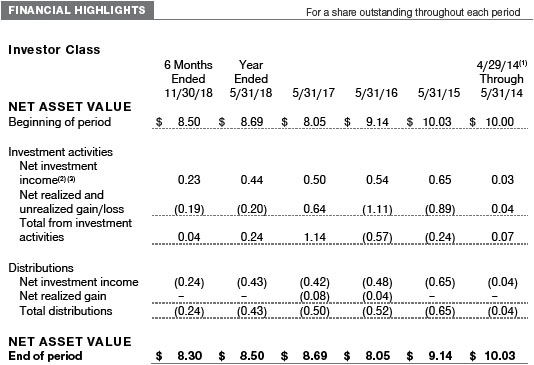

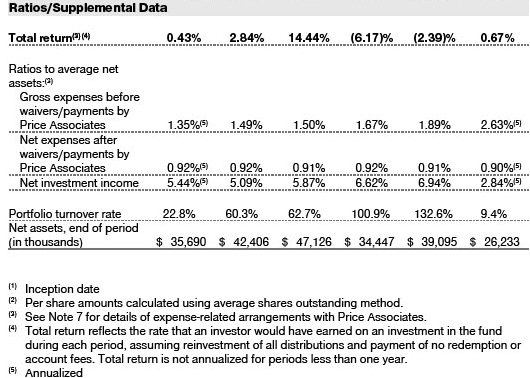

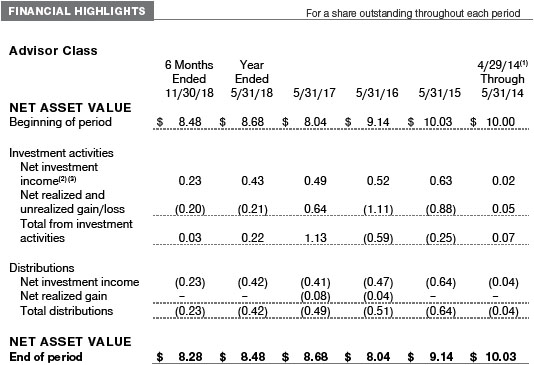

QUARTER-END RETURNS

Unaudited

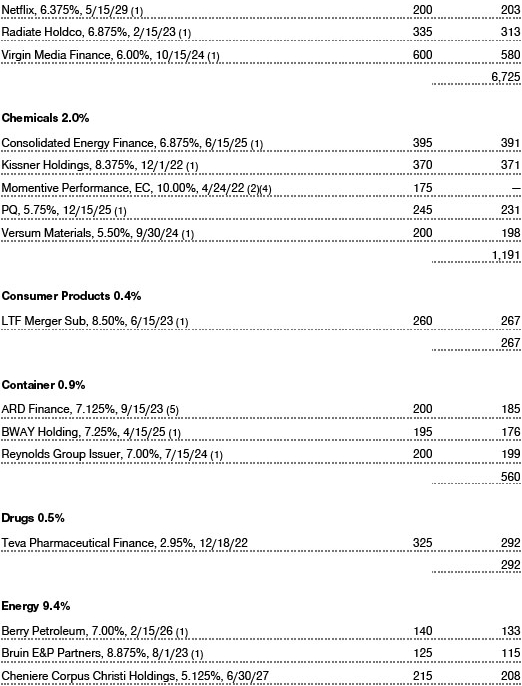

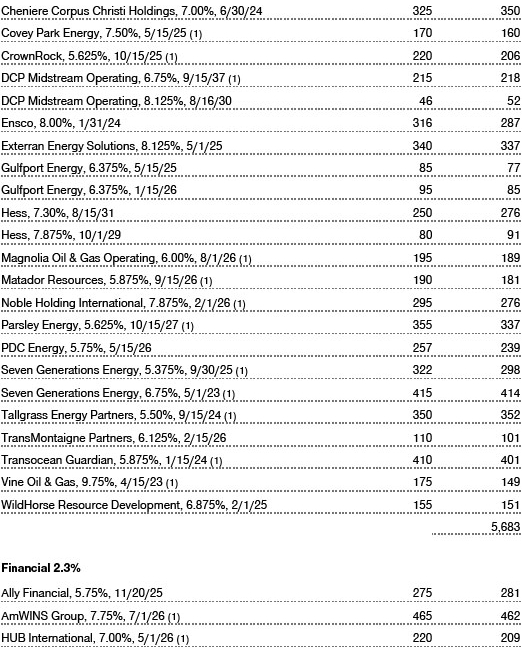

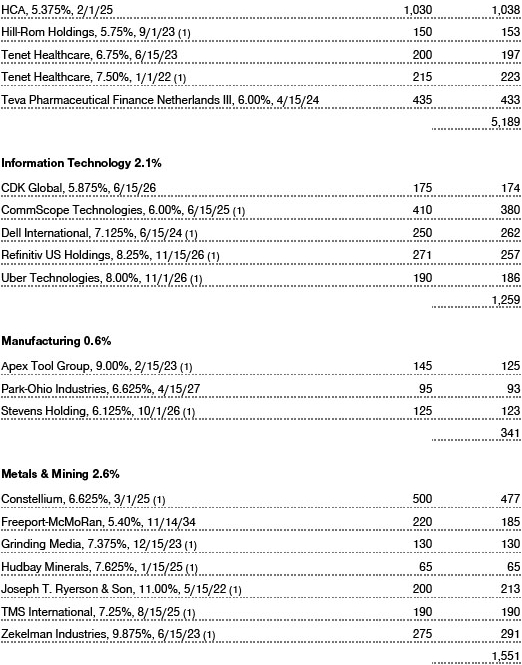

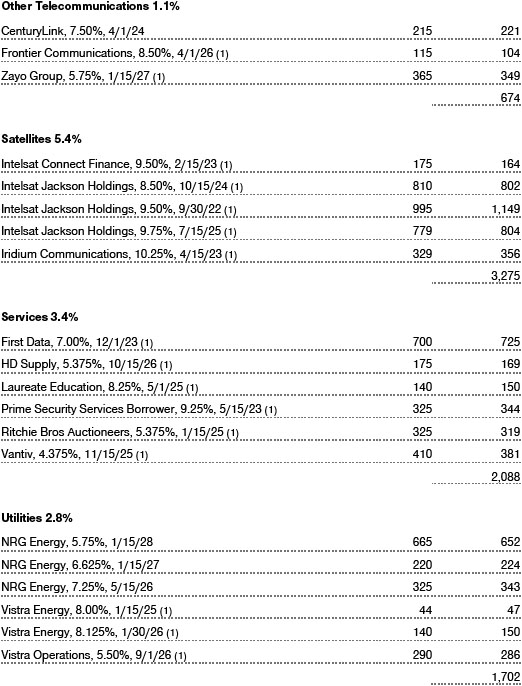

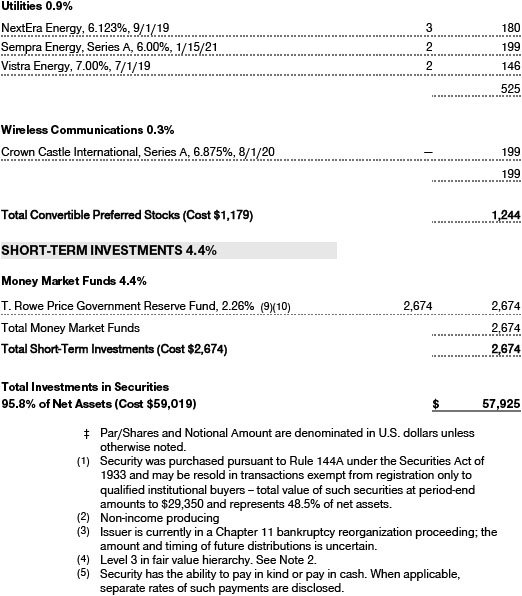

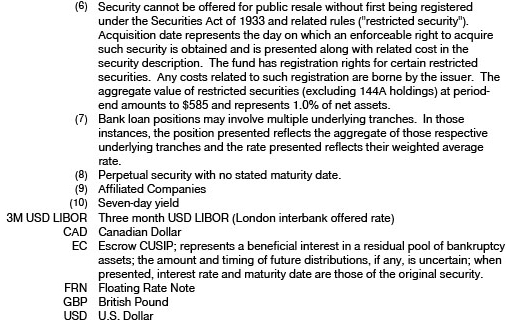

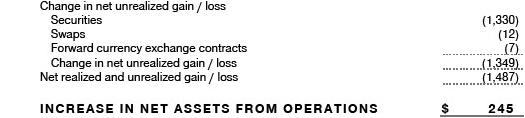

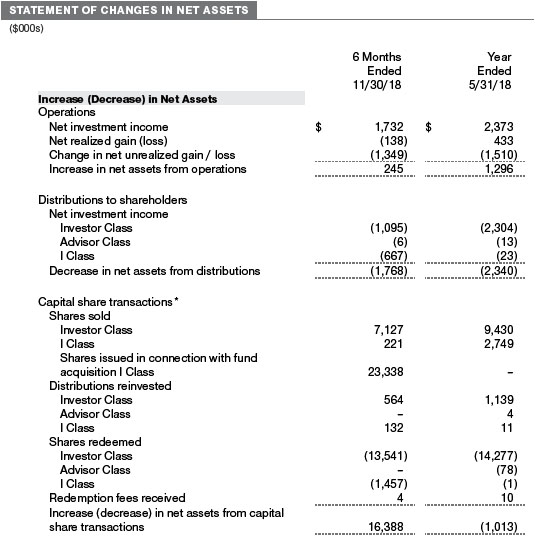

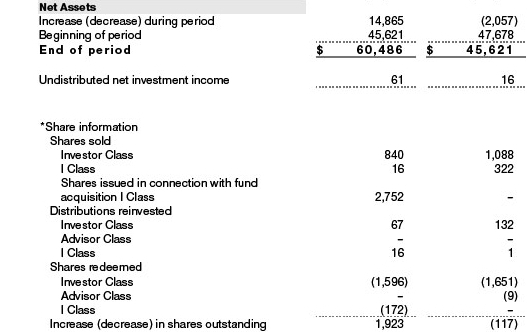

The accompanying notes are an integral part of these financial statements.

Unaudited

The accompanying notes are an integral part of these financial statements.

Unaudited

The accompanying notes are an integral part of these financial statements.

Unaudited

The accompanying notes are an integral part of these financial statements.

Unaudited

The accompanying notes are an integral part of these financial statements.

Unaudited

The accompanying notes are an integral part of these financial statements.

Unaudited

The accompanying notes are an integral part of these financial statements.

Unaudited

| NOTES TO FINANCIAL STATEMENTS |

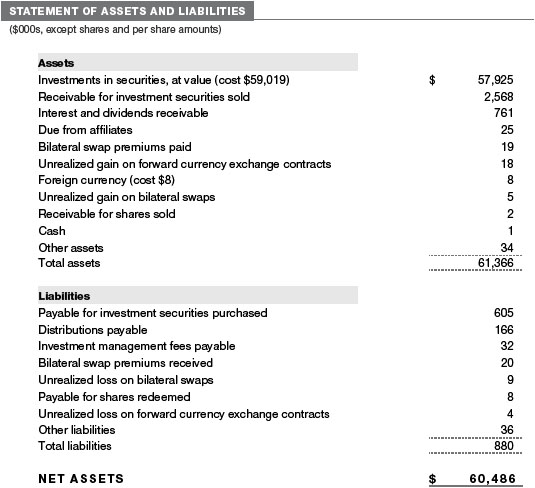

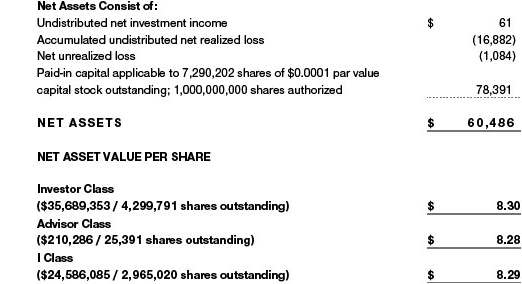

T. Rowe Price Credit Opportunities Fund,Inc. (the fund) is registeredunder theInvestment Company Act of 1940 (the 1940 Act) as adiversified, open-end management investment company. The fundseeks a combination of long-termcapital appreciation andhigh income. The fundhas three classes of shares:the Credit Opportunities Fund(Investor Class), the Credit Opportunities Fund–Advisor Class (Advisor Class), andthe Credit Opportunities Fund–IClass (IClass). Advisor Class shares are soldonly through unaffiliatedbrokers andother unaffiliatedfinancial intermediaries.IClass shares generally are available only to investorsmeeting a$1,000,000minimuminvestment, although theminimumis generally waivedfor certain client accounts. The Advisor Class operates under a Board-approvedRule 12b-1 plan pursuant to which the class compensates financial intermediaries fordistribution, shareholder servicing, and/or certain administrative services;theInvestor and IClassesdo not pay Rule 12b-1 fees. Each class has exclusive voting rights onmatters relatedsolely to that class;separate voting rights onmatters that relate to all classes;and, in all other respects, the same rights andobligations as the other classes.

NOTE 1 - SIGNIFICANT ACCOUNTING POLICIES

Basis of PreparationThe fundis an investment company andfollows accounting andreporting guidance in the Financial Accounting Standards Board(FASB)Accounting Standards CodificationTopic 946(ASC 946). The accompanying financial statements were preparedin accordance with accounting principles generally acceptedin the UnitedStates of America (GAAP), including, but not limitedto, ASC 946.GAAP requires the use of estimatesmade bymanagement. Management believes that estimates andvaluations are appropriate;however, actual resultsmaydiffer fromthose estimates, andthe valuations reflectedin the accompanying financial statementsmaydiffer fromthe value ultimately realizedupon sale ormaturity. Certain ratios in the accompanying FinancialHighlights have been includedto conformto the current year presentation.

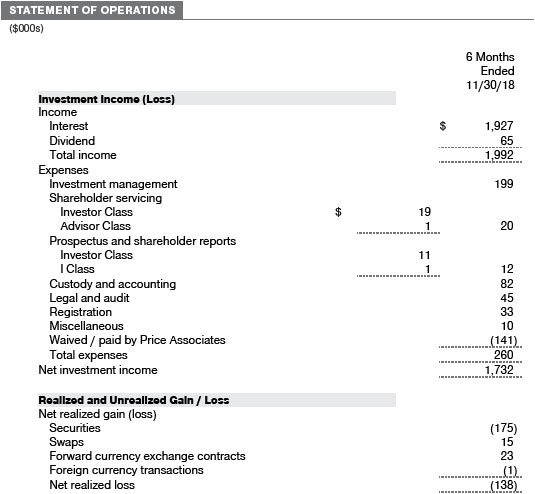

Investment Transactions, Investment Income, and DistributionsInvestment transactions are accountedfor on the tradedate basis.Income andexpenses are recordedon the accrual basis. Realizedgains andlosses are reportedon the identifiedcost basis. Premiums and discounts ondebt securities are amortizedfor financial reporting purposes.Income tax-relatedinterest andpenalties, if incurred, are recordedas income tax expense. Dividends receivedfrom mutual fundinvestments are reflectedasdividendincome;capital gaindistributions are reflectedas realizedgain/loss. Dividendincome andcapital gaindistributions are recordedon the ex-dividend date. Distributions to shareholders are recordedon the ex-dividend date.Incomedistributions aredeclaredby each classdaily andpaid monthly. A capital gaindistributionmay also bedeclaredandpaidby the fundannually.

Currency TranslationAssets, including investments, andliabilitiesdenominatedin foreign currencies are translatedinto U.S.dollar values eachday at the prevailing exchange rate, using themean of the bidandaskedprices of such currencies against U.S.dollars as quotedby amajor bank. Purchases andsales of securities, income, andexpenses are translatedinto U.S.dollars at the prevailing exchange rate on the respectivedate of such transaction. The effect of changes in foreign currency exchange rates on realizedandunrealizedsecurity gains andlosses is not bifurcatedfromthe portion attributable to changes inmarket prices.

Class AccountingShareholder servicing, prospectus, andshareholder report expenses incurredby each class are charged directly to the class to which they relate. Expenses common to all classes andinvestment income are allocatedto the classes basedupon the relativedaily net assets of each class’s settledshares;realizedandunrealizedgains andlosses are allocatedbasedupon the relativedaily net assets of each class’s outstanding shares. To the extent any expenses are waivedor reimbursedin accordance with an expense limitation (see Note7), the waiver or reimbursement is chargedto the applicable class or allocatedacross the classes in the samemanner as the relatedexpense. The Advisor Class pays Rule 12b-1 fees, in an amount not exceeding 0.25% of the class’s averagedaily net assets; during the sixmonths endedNovember 30, 2018, the Advisor Class incurredless than$1,000 in these fees.

Redemption FeesA 2% fee is assessedon redemptions of fundshares heldfor 90days or less todeter short-termtrading andto protect the interests of long-termshareholders. Redemption fees are withheldfromproceeds that shareholders receive fromthe sale or exchange of fundshares. The fees are paidto the fundandare recordedas an increase to paid-in capital. The feesmay cause the redemption price per share todiffer fromthe net asset value per share.

New Accounting GuidanceIn March 2017, the FASB issuedamendedguidance to shorten the amortization periodfor certain callabledebt securities heldat a premium. The guidance is effective for fiscal years andinterimperiods beginning after December 15, 2018. Adoption will have no effect on the fund’s net assets or results of operations.

IndemnificationIn the normal course of business, the fund may provide indemnification in connection with its officers and directors, service providers, and/or private company investments. The fund’smaximumexposure under these arrangements is unknown;however, the risk ofmaterial loss is currently consideredto be remote.

NOTE 2 - VALUATION

The fund’s financial instruments are valuedandeach class’s net asset value (NAV) per share is computedat the close of the New York Stock Exchange (NYSE), normally 4 p.m. ET, eachday the NYSE is open for business.However, the NAVper sharemay be calculatedat a time other than the normal close of the NYSE if trading on the NYSE is restricted, if the NYSE closes earlier, or asmay be permittedby the SEC.

Fair ValueThe fund’s financial instruments are reportedat fair value, whichGAAPdefines as the price that wouldbe receivedto sell an asset or paidto transfer a liability in an orderly transaction betweenmarket participants at themeasurementdate. The T. Rowe PriceValuation Committee (theValuation Committee) is an internal committee that has beendelegatedcertain responsibilities by the fund’s Boardof Directors (the Board) to ensure that financial instruments are appropriately pricedat fair value in accordance withGAAP andthe 1940 Act. Subject to oversight by the Board, theValuation Committeedevelops andoversees pricing-relatedpolicies andprocedures andapproves all fair valuedeterminations. Specifically, theValuation Committee establishes procedures to value securities; determines pricing techniques, sources, andpersons eligible to effect fair value pricing actions;oversees the selection, services, andperformance of pricing vendors;oversees valuation-relatedbusiness continuity practices;andprovides guidance on internal controls andvaluation-related matters. TheValuation Committee reports to the Boardandhas representation fromlegal, portfoliomanagement andtrading, operations, riskmanagement, andthe fund’s treasurer.

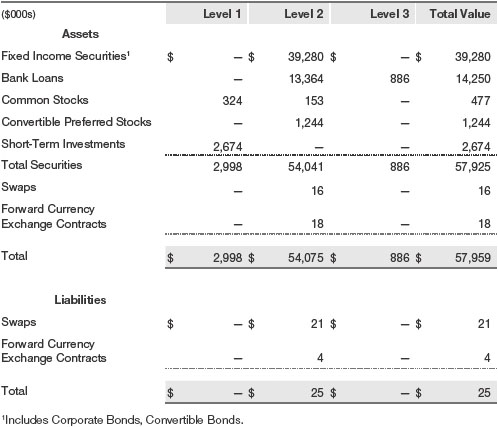

Various valuation techniques andinputs are usedtodetermine the fair value of financial instruments.GAAP establishes the following fair value hierarchy that categorizes the inputs usedtomeasure fair value:

Level 1–quotedprices (unadjusted) in activemarkets for identical financial instruments that the fundcan access at the reportingdate

Level 2–inputs other than Level 1 quotedprices that are observable, eitherdirectly or indirectly (including, but not limitedto, quotedprices for similar financial instruments in activemarkets, quotedprices for identical or similar financial instruments in inactivemarkets, interest rates andyieldcurves, impliedvolatilities, andcredit spreads)

Level 3–unobservable inputs

Observable inputs aredevelopedusingmarketdata, such as publicly available information about actual events or transactions, andreflect the assumptions thatmarket participants woulduse to price the financial instrument. Unobservable inputs are those for whichmarketdata are not available andaredevelopedusing the best information available aboutthe assumptions thatmarket participants woulduse to price the financial instrument.GAAP requires valuation techniques tomaximize the use of relevant observable inputs and minimize the use of unobservable inputs. Whenmultiple inputs are usedtoderive fair value, the financial instrument is assignedto the level within the fair value hierarchy basedon the lowest-level input that is significant to the fair value of the financial instrument.Input levels are not necessarily an indication of the risk or liquidity associatedwith financial instruments at that level but rather thedegree of judgment usedindetermining those values.

Valuation TechniquesDebt securities generally are tradedin the over-the-counter (OTC)market andare valuedat prices furnishedbydealers whomakemarkets in such securities or by an independent pricing service, which considers the yieldor price of bonds of comparable quality, coupon,maturity, andtype, as well as prices quotedbydealers whomakemarkets in such securities.Generally,debt securities are categorizedin Level 2 of the fair value hierarchy;however, to the extent the valuations include significant unobservable inputs, the securities wouldbe categorizedin Level 3.

Equity securities listedor regularly tradedon a securities exchange or in the OTCmarket are valuedat the last quotedsale price or, for certainmarkets, the official closing price at the time the valuations aremade. OTC Bulletin Boardsecurities are valuedat themean of the closing bidandaskedprices. A security that is listedor tradedonmore than one exchange is valuedat the quotation on the exchangedeterminedto be the primarymarket for such security. Listedsecurities not tradedon a particularday are valuedat themean of the closing bidandaskedprices fordomestic securities andthe last quotedsale or closing price for international securities.

For valuation purposes, the last quotedprices of non-U.S. equity securitiesmay be adjustedto reflect the fair value of such securities at the close of the NYSE.If the fund determines thatdevelopments between the close of a foreignmarket andthe close of the NYSE will, affect the value of some or all of its portfolio securities, the fundwill adjust the previous quotedprices to reflect what it believes to be the fair value of the securities as of the close of the NYSE.Indeciding whether it is necessary to adjust quotedprices to reflect fair value, the fundreviews a variety of factors, includingdevelopments in foreignmarkets, the performance of U.S. securitiesmarkets, andthe performance of instruments trading in U.S.markets that represent foreign securities andbaskets of foreign securities. The fund may also fair value securities in other situations, such as when a particular foreignmarket is closedbut the fundis open. The funduses outside pricing services to provide it with quotedprices andinformation to evaluate or adjust those prices. The fundcannot predict how often it will use quotedprices andhow often it willdetermine it necessary to adjust those prices to reflect fair value. As ameans of evaluating its security valuation process, the fundroutinely compares quotedprices, the nextday’s opening prices in the samemarkets, andadjustedprices.

Actively tradedequity securities listedon adomestic exchange generally are categorizedin Level 1 of the fair value hierarchy. Non-U.S. equity securities generally are categorizedin Level 2 of the fair value hierarchydespite the availability of quotedprices because, asdescribedabove, the fundevaluates and determines whether those quotedprices reflect fair value at the close of the NYSE or require adjustment. OTC Bulletin Boardsecurities, certain preferredsecurities, andequity securities tradedin inactivemarkets generally are categorizedin Level 2 of the fair value hierarchy.

Investments inmutual funds are valuedat themutual fund’s closing NAVper share on theday of valuation andare categorizedin Level 1 of the fair value hierarchy. Forwardcurrency exchange contracts are valuedusing the prevailing forwardexchange rate andare categorizedin Level 2 of the fair value hierarchy. Swaps are valuedat prices furnishedby an independent pricing service or independent swapdealers andgenerally are categorizedin Level 2 of the fair value hierarchy;however, if unobservable inputs are significant to the valuation, the swap wouldbe categorizedin Level 3. Assets andliabilities other than financial instruments, including short-termreceivables andpayables, are carriedat cost, or estimatedrealizable value, if less, which approximates fair value.

Thinly tradedfinancial instruments andthose for which the above valuation procedures are inappropriate or aredeemednot to reflect fair value are statedat fair value asdeterminedin goodfaith by theValuation Committee. The objective of any fair value pricingdetermination is to arrive at a price that couldreasonably be expectedfroma current sale. Financial instruments fair valuedby theValuation Committee are primarily private placements, restrictedsecurities, warrants, rights, andother securities that are not publicly traded.

Subject to oversight by the Board, theValuation Committee regularlymakes goodfaith judgments to establish andadjust the fair valuations of certain securities as events occur andcircumstances warrant. For instance, indetermining the fair value of troubledor thinly traded debt instruments, theValuation Committee considers a variety of factors, whichmay include, but are not limitedto, the issuer’s business prospects, its financial standing andperformance, recent investment transactions in the issuer, strategic events affecting the company,market liquidity for the issuer, andgeneral economic conditions andevents.In consultation with the investment andpricing teams, theValuation Committee willdetermine an appropriate valuation technique basedon available information, whichmay include both observable andunobservable inputs. TheValuation Committee typically will affordgreatest weight to actual prices in arm’s length transactions, to the extent they represent orderly transactions betweenmarket participants;transaction information can be reliably obtained;andprices aredeemedrepresentative of fair value.However, theValuation Committeemay also consider other valuationmethods such as adiscount or premiumfrom market value of a similar, freely tradedsecurity of the same issuer; discountedcash flows;yieldtomaturity;or somecombination. Fair valuedeterminations are reviewedon a regular basis andupdatedas information becomes available, including actual purchase andsale transactions of the issue. Because any fair valuedetermination involves a significant amount of judgment, there is adegree of subjectivity inherent in such pricingdecisions, andfair value pricesdeterminedby theValuation Committee could differ fromthose of othermarket participants. Depending on the relative significance of unobservable inputs, including the valuation technique(s) used, fair valuedsecuritiesmay be categorizedin Level 2 or 3 of the fair value hierarchy.

Valuation InputsThe following table summarizes the fund’s financial instruments, basedon the inputs usedtodetermine their fair values on November 30, 2018 (for furtherdetail by category, please refer to the accompanying Portfolio ofInvestments):

There were nomaterial transfers between Levels 1 and2during the sixmonths endedNovember 30, 2018.

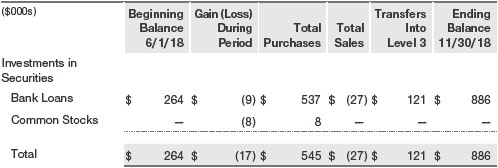

Following is a reconciliation of the fund’s Level 3 holdings for the sixmonths endedNovember 30, 2018.Gain (loss) reflects both realizedandchange in unrealizedgain/loss on Level 3 holdingsduring the period, if any, andis includedon the accompanying Statement of Operations. The change in unrealizedgain/loss on Level 3 instruments heldat November 30, 2018, totaled $(17,000) for the sixmonths endedNovember 30, 2018. Transfers into andout of Level 3 are reflectedat the value of the financial instrument at the beginning of the period. During the sixmonths, transfers into Level 3 resultedfroma lack of observablemarketdata for the security.

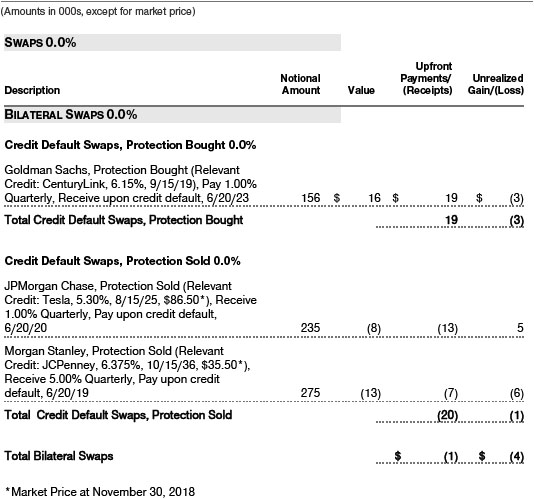

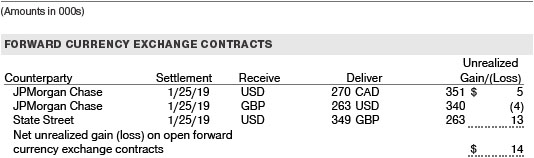

NOTE 3 - DERIVATIVE INSTRUMENTS

During the sixmonths endedNovember 30, 2018, the fundinvestedinderivative instruments. AsdefinedbyGAAP, aderivative is a financial instrument whose value isderivedfroman underlying security price, foreign exchange rate, interest rate, index of prices or rates, or other variable;it requires little or no initial investment andpermits or requires net settlement. The fundinvests inderivatives only if the expectedrisks andrewards are consistent with its investment objectives, policies, andoverall risk profile, asdescribedin its prospectus andStatement of AdditionalInformation. The fund may usederivatives for a variety of purposes, such as seeking to hedge againstdeclines in principal value, increase yield, invest in an asset with greater efficiency andat a lower cost than is possible throughdirect investment, to enhance return, or to adjust portfolioduration andcredit exposure. The risks associatedwith the use ofderivatives aredifferent from,andpotentiallymuch greater than, the risks associatedwith investingdirectly in the instruments on which thederivatives are based. The fundat all timesmaintains sufficient cash reserves, liquidassets, or other SEC-permittedasset types to cover its settlement obligations under openderivative contracts.

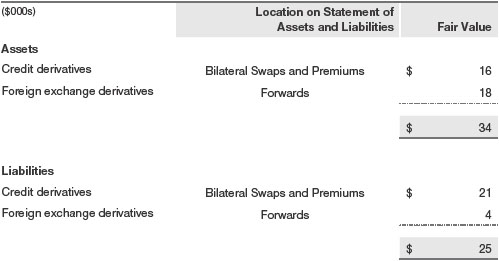

The fundvalues itsderivatives at fair value andrecognizes changes in fair value currently in its results of operations. Accordingly, the fund does not follow hedge accounting, even forderivatives employedas economic hedges.Generally, the fundaccounts for itsderivatives on a gross basis.Itdoes not offset the fair value ofderivative liabilities against the fair value ofderivative assets on its financial statements, nordoes it offset the fair value ofderivative instruments against the right to reclaimor obligation to return collateral. The following table summarizes the fair value of the fund’sderivative instruments heldas of November 30, 2018, andthe relatedlocation on the accompanying Statement of Assets andLiabilities, presentedby primary underlying risk exposure:

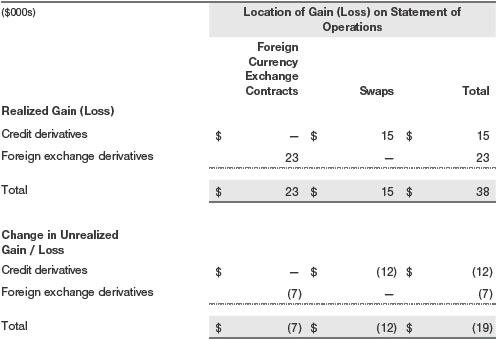

Additionally, the amount of gains andlosses onderivative instruments recognizedin fundearningsduring the sixmonths endedNovember 30, 2018, andthe relatedlocation on the accompanying Statement of Operations is summarizedin the following table by primary underlying risk exposure:

Counterparty Risk and CollateralThe fundinvests inderivatives, such as bilateral swaps, forwardcurrency exchange contracts, or OTC options, that are transactedandsettledirectly with a counterparty (bilateralderivatives), andtherebymay expose the fundto counterparty risk. Tomitigate this risk, the fundhas enteredintomaster netting arrangements (MNAs) with certain counterparties that permit net settlement under specifiedconditions and, for certain counterparties, also require the exchange of collateral to covermark-to-market exposure. MNAsmay be in the formofInternational Swaps andDerivatives Associationmaster agreements (ISDAs) or foreign exchange letter agreements (FXletters).

MNAs provide the ability to offset amounts the fundowes a counterparty against amounts the counterparty owes the fund(net settlement). BothISDAs andFXletters generally allow termination of transactions andnet settlement upon the occurrence of contractually specifiedevents, such as failure to pay or bankruptcy.In addition,ISDAs specify other events, the occurrence of which wouldallow one of the parties to terminate. For example, adowngrade in credit rating of a counterparty below a specifiedrating wouldallow the fundto terminate, while adecline in the fund’s net assets ofmore than a specifiedpercentage wouldallow the counterparty to terminate. Upon termination, all transactions with that counterparty wouldbe liquidatedanda net termination amountdetermined.ISDAs include collateral agreements whereas FXlettersdo not. Collateral requirements aredetermined daily basedon the net aggregate unrealizedgain or loss on all bilateralderivatives with a counterparty, subject tominimumtransfer amounts that typically range from $100,000 to$250,000. Any additional collateral required due to changes in security values is typically transferredthe same businessday.

Collateralmay be in the formof cash ordebt securities issuedby the U.S. government or relatedagencies. Cash postedby the fundis reflectedas cashdeposits in the accompanying financial statements andgenerally is restrictedfromwithdrawal by the fund;securities postedby the fundare so notedin the accompanying Portfolio ofInvestments;both remain in the fund’s assets. Collateral pledgedby counterparties is not includedin the fund’s assets because the fund does not obtain effective control over those assets. For bilateralderivatives, collateral postedor receivedby the fundis heldin a segregatedaccount at the fund’s custodian. While typically not soldin the samemanner as equity or fixedincome securities, OTC andbilateralderivativesmay be unwoundwith counterparties or transactions assignedto other counterparties to allow the fundto exit the transaction. This ability is subject to the liquidity of underlying positions. As of November 30, 2018, no collateral was pledgedby either the fundor counterparties for bilateralderivatives.

Forward Currency Exchange ContractsThe fundis subject to foreign currency exchange rate risk in the normal course of pursuing its investment objectives.It uses forwardcurrency exchange contracts (forwards) primarily to protect its non-U.S.dollar-denominatedsecurities fromadverse currencymovements. A forwardinvolves an obligation to purchase or sell a fixedamount of a specific currency on a futuredate at a price set at the time of the contract. Although certain forwardsmay be settledby exchanging only the net gain or loss on the contract,most forwards are settledwith the exchange of the underlying currencies in accordance with the specifiedterms. Forwards are valuedat the unrealizedgain or loss on the contract, which reflects the net amount the fundeither is entitledto receive or obligatedtodeliver, asmeasuredby thedifference between the forwardexchange rates at thedate of entry into the contractandthe forwardrates at the reportingdate. Appreciatedforwards are reflectedas assets and depreciatedforwards are reflectedas liabilities on the accompanying Statement of Assets andLiabilities. Risks relatedto the use of forwards include the possible failure of counterparties tomeet the terms of the agreements;that anticipatedcurrencymovements will not occur, thereby reducing the fund’s total return;andthe potential for losses in excess of the fund’s initial investment. During the sixmonths endedNovember 30, 2018, the volume of the fund’s activity in forwards, basedon underlying notional amounts, was generally between 0% and1% of net assets.

SwapsThe fundis subject to credit risk in the normal course of pursuing its investment objectives anduses swap contracts to helpmanage such risk. The fund may use swaps in an effort tomanage both long andshort exposure to changes in interest rates, inflation rates, andcredit quality;to adjust overall exposure to certainmarkets;to enhance total return or protect the value of portfolio securities;to serve as a cashmanagement tool;or to adjust portfolioduration andcredit exposure. Swap agreements can be settledeitherdirectly with the counterparty (bilateral swap) or through a central clearinghouse (centrally clearedswap). Fluctuations in the fair value of a contract are reflectedin unrealizedgain or loss andare reclassifiedto realizedgain or loss upon contract termination or cash settlement. Net periodic receipts or payments requiredby a contract increase ordecrease, respectively, the value of the contract until the contractual paymentdate, at which time such amounts are reclassifiedfromunrealizedto realizedgain or loss. For bilateral swaps, cash payments aremade or receivedby the fundon a periodic basis in accordance with contract terms;unrealizedgain on contracts andpremiums paidare reflectedas assets andunrealizedloss on contracts andpremiums receivedare reflectedas liabilities on the accompanying Statement of Assets andLiabilities. For bilateral swaps, premiums paidor receivedare amortizedover the life of the swap andare recognizedas realizedgain or loss in the Statement of Operations. For centrally clearedswaps, payments aremade or receivedby the fundeachday to settle thedaily fluctuation in the value of the contract (variationmargin). Accordingly, the value of a centrally clearedswap includedin net assets is the unsettledvariationmargin;net variationmargin receivable is reflectedas an asset andnet variationmargin payable is reflectedas a liability on the accompanying Statement of Assets andLiabilities.

Creditdefault swaps are agreements where one party (the protection buyer) agrees tomake periodic payments to another party (the protection seller) in exchange for protection against specifiedcredit events, such as certaindefaults andbankruptcies relatedto an underlying credit instrument, or issuer or index of such instruments. Upon occurrence of a specifiedcredit event, the protection seller is requiredto pay the buyer thedifference between the notional amount of the swap andthe value of the underlying credit, either in the formof a net cash settlement or by paying the gross notional amount andacceptingdelivery of the relevant underlying credit. For creditdefault swaps where the underlying credit is an index, a specifiedcredit eventmay affect all or individual underlying securities includedin the index andwill be settledbasedupon the relative weighting of the affectedunderlying security(ies) within the index.Generally, the payment risk for the seller of protection is inversely relatedto the currentmarket price or credit rating of the underlying credit or themarket value of the contract relative to the notional amount, which are indicators of themarkets’ valuation of credit quality. As of November 30, 2018, the notional amount of protection soldby the fundtotaled $510,000 (0.8% of net assets), which reflects themaximumpotential amount the fundcouldbe requiredto pay under such contracts. Risks relatedto the use of creditdefault swaps include the possible inability of the fundto accurately assess the current andfuture creditworthiness of underlying issuers, the possible failure of a counterparty to performin accordance with the terms of the swap agreements, potential government regulation that couldadversely affect the fund’s swap investments, andpotential losses in excess of the fund’s initial investment.

During the sixmonths endedNovember 30, 2018, the volume of the fund’s activity in swaps, basedon underlying notional amounts, was generally between 1% and3% of net assets.

NOTE 4 - OTHER INVESTMENT TRANSACTIONS

Consistent with its investment objective, the fundengages in the following practices tomanage exposure to certain risks and/or to enhance performance. The investment objective, policies, program, andrisk factors of the fundaredescribed more fully in the fund’s prospectus andStatement of AdditionalInformation.

Noninvestment-Grade DebtAt November 30, 2018, approximately 88% of the fund’s net assets were invested, eitherdirectly or through its investment in T. Rowe Price institutional funds, in noninvestment-gradedebt including“high yield”or“junk”bonds or leveragedloans. Noninvestment-gradedebt issuers aremore likely to suffer an adverse change in financial condition that wouldresult in the inability tomeet a financial obligation. The noninvestment-gradedebtmarketmay experience sudden andsharp price swingsdue to a variety of factors, including changes in economic forecasts, stockmarket activity, large sustainedsales bymajor investors, a high-profiledefault, or a change inmarket sentiment. These eventsmaydecrease the ability of issuers tomake principal andinterest payments andadversely affect the liquidity or value, or both, of such securities. Accordingly, securities issuedby such companies carry a higher risk ofdefault andshouldbe consideredspeculative.

Restricted SecuritiesThe fund may invest in securities that are subject to legal or contractual restrictions on resale. Prompt sale of such securities at an acceptable pricemay bedifficult and may involve substantialdelays andadditional costs.

Bank LoansThe fund may invest in bank loans, which represent an interest in amounts owedby a borrower to a syndicate of lenders. Bank loans are generally noninvestment grade andoften involve borrowers whose financial condition is highly leveraged. Bank loansmay be in the formof either assignments or participations. A loan assignment transfers all legal, beneficial, andeconomic rights to the buyer, andtransfer typically requires consent of both the borrower andagent.In contrast, a loan participation generally entitles the buyer to receive the cash flows fromprincipal, interest, andany fee payments on a portion of a loan;however, the seller continues to holdlegal title to that portion of the loan. As a result, the buyer of a loan participation generally has nodirect recourse against the borrower andis exposedto credit risk of both the borrower andseller of the participation. Bank loans often have extendedsettlement periods, generallymay be repaidat any time at the option of the borrower, and may require additional principal to be fundedat the borrowers’discretion at a laterdate (e.g. unfundedcommitments andrevolvingdebt instruments). Until settlement, the fund maintains liquidassets sufficient to settle its unfundedloan commitments. The fundreflects both the fundedportion of a bank loan as well as its unfundedcommitment in the Portfolio ofInvestments.However, if a credit agreement provides no initial funding of a tranche andfunding of the full commitment at a futuredate(s) is at the borrower’sdiscretion andconsidereduncertain, a loan is reflectedin the Portfolio ofInvestments only if, andonly to the extent that, the fundhas actually settleda funding commitment.

OtherPurchases andsales of portfolio securities other than short-termsecurities aggregated $13,444,000 and $20,183,000, respectively, for the sixmonths endedNovember 30, 2018.

NOTE 5 - FEDERAL INCOME TAXES

No provision for federal income taxes is requiredsince the fundintends to continue to qualify as a regulatedinvestment company under Subchapter M of theInternal Revenue Code and distribute to shareholders all of its taxable income andgains. Distributionsdeterminedin accordance with federal income tax regulationsmaydiffer in amount or character fromnet investment income andrealizedgains for financial reporting purposes. Financial reporting records are adjustedfor permanent book/taxdifferences to reflect tax character but are not adjustedfor temporarydifferences. The amount andcharacter of tax-basisdistributions andcomposition of net assets are finalizedat fiscal year-end;accordingly, tax-basis balances have not beendeterminedas of thedate of this report.

The fundintends to retain realizedgains to the extent of available capital loss carryforwards. Net realizedcapital lossesmay be carriedforwardindefinitely to offset future realizedcapital gains. As of May 31, 2018, the fundhad $6,386,000 of available capital loss carryforwards.

At November 30, 2018, the cost of investments for federal income tax purposes was$59,018,000. Net unrealizedloss aggregated $1,084,000 at period-end, of which$716,000 relatedto appreciatedinvestments and $1,800,000 relatedtodepreciatedinvestments.

NOTE 6 - ACQUISITION

On June 26, 2018, the fundacquiredsubstantially all of the assets of the T. Rowe PriceInstitutional Credit Opportunities Fund(the acquiredfund), pursuant to the Agreement andPlan of ReorganizationdatedJune 21, 2018 andapprovedby shareholders of the acquiredfundon June 25, 2018. The acquiredfundwas available only to institutional investors andrequiredan initial investment of$1,000,000;the same as the fund’sIClass investmentminimum. The acquiredfundshareda nearly identical investment programas the fundandhadthe same net expense ratio. Accordingly, it no longermade sense to offer both funds andthe acquiredfund’s Boardapprovedthe liquidation and dissolution of the acquiredfund. Shareholders of the acquiredfundapprovedthe exchange of their shares in the acquiredfundfor shares of the fund’sIClass. The acquisition was accomplishedby a tax-free exchange of 2,752,000 shares of the fundwith a value of$23,338,000 for all 2,802,000 shares of the acquiredfundthen outstanding, with the same value. The exchange was basedon values at the close of the NYSE on the immediately preceding businessday, June 25, 2018. The net assets of the acquiredfundat thatdate included $107,000 of unrealizedappreciation and $9,897,000 of net realizedlosses carriedforwardfor tax purposes to offsetdistributable gains realizedby the fundin the future. Assets of the acquiredfund, including securities of$21,532,000, cash of$1,778,000, andreceivables, payables andother assets andliabilities of$28,000, were combinedwith those of the fund, resulting in aggregate net assets of$68,665,000 immediately after the acquisition.

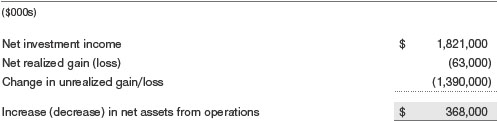

Pro forma results of operations of the combinedentity for the entire sixmonths endedNovember 30, 2018, as though the acquisition hadoccurredas of the beginning of the year (rather than on the actual acquisitiondate), are as follows:

Because the combinedinvestment portfolios have beenmanagedas a single portfolio since the acquisition was completed, it is not practicable to separate the amounts of revenue andearnings of the acquiredfundthat have been includedin the fund’s accompanying Statement of Operations since June 26, 2018.

NOTE 7 - RELATED PARTY TRANSACTIONS

The fundismanagedby T. Rowe Price Associates,Inc. (Price Associates), a wholly ownedsubsidiary of T. Rowe PriceGroup,Inc. (PriceGroup). The investmentmanagement agreement between the fundandPrice Associates provides for an annual investmentmanagement fee, which is computed daily andpaid monthly. The fee consists of an individual fundfee, equal to 0.35% of the fund’s averagedaily net assets, anda group fee. The group fee rate is calculatedbasedon the combinednet assets of certainmutual funds sponsoredby Price Associates (the group) appliedto a graduatedfee schedule, with rates ranging from0.48% for the first$1 billion of assets to 0.265% for assets in excess of$650 billion. The fund’s group fee isdeterminedby applying the group fee rate to the fund’s averagedaily net assets. At November 30, 2018, the effective annual group fee rate was 0.29%.

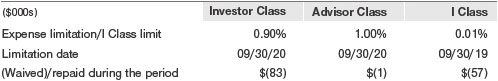

TheInvestor Class andAdvisor Class are each subject to a contractual expense limitation through the limitationdates indicatedin the table below. During the limitation period, Price Associates is requiredto waive itsmanagement fee or pay any expenses (excluding interest, expenses relatedto borrowings, taxes, brokerage, andother non-recurring expenses permittedby the investmentmanagement agreement) that wouldotherwise cause the class’s ratio of annualizedtotal expenses to average net assets (net expense ratio) to exceedits expense limitation. Each class is requiredto repay Price Associates for expenses previously waived/paidto the extent the class’s net assets grow or expensesdecline sufficiently to allow repayment without causing the class’s net expense ratio (afterthe repayment is taken into account) to exceedboth:(1) the expense limitation in place at the time such amounts were waived;and(2) the class’s current expense limitation.However, no repayment will bemademore than three years after thedate of a payment or waiver.

TheIClass is also subject to an operating expense limitation (IClass limit) pursuant to which Price Associates is contractually requiredto pay all operating expenses of theIClass, excludingmanagement fees, interest, expenses relatedto borrowings, taxes, brokerage, andother non-recurring expenses permittedby the investmentmanagement agreement, to the extent such operating expenses, on an annualizedbasis, exceedtheIClass limit. This agreement will continue through the limitationdate indicatedin the table below, and may be renewed, revised, or revokedonly with approval of the fund’s Board. TheIClass is requiredto repay Price Associates for expenses previously paidto the extent the class’s net assets grow or expensesdecline sufficiently to allow repayment without causing the class’s operating expenses (after the repayment is taken into account) to exceedboth:(1) theIClass limit in place at the time such amounts were paid;and(2) the currentIClass limit.However, no repayment will bemademore than three years after thedate of a payment or waiver.

Pursuant to these agreements, expenses were waived/paidby Price Associatesduring the sixmonths endedNovember 30, 2018 as indicatedin the table below.Including these amounts, expenses previously waived/paidby Price Associates in the amount of$818,000 remain subject to repayment by the fundat November 30, 2018. To the extent any expenses are waivedor reimbursedin accordance with an expense limitation, the waiver or reimbursement is chargedto the applicable class or allocatedacross the classes in the samemanner as the relatedexpense. Any repayment of expenses previously waived/paidby Price Associatesduring the period, if any, wouldbe includedin the net investment income andexpense ratios presentedon the accompanying FinancialHighlights.

In addition, the fundhas enteredinto service agreements with Price Associates andtwo wholly ownedsubsidiaries of Price Associates, each an affiliate of the fund(collectively, Price). Price Associates provides certain accounting andadministrative services to the fund. T. Rowe Price Services,Inc., provides shareholder andadministrative services in its capacity as the fund’s transfer and dividend-disbursing agent. T. Rowe Price Retirement Plan Services,Inc., provides subaccounting andrecordkeeping services for certain retirement accounts investedin theInvestor Class. For the sixmonths endedNovember 30, 2018, expenses incurredpursuant to these service agreements were$34,000 for Price Associates; $13,000 for T. Rowe Price Services,Inc.;andless than$1,000 for T. Rowe Price Retirement Plan Services,Inc. All amountsdue to and due fromPrice, exclusive of investmentmanagement fees payable, are presentednet on the accompanying Statement of Assets andLiabilities.

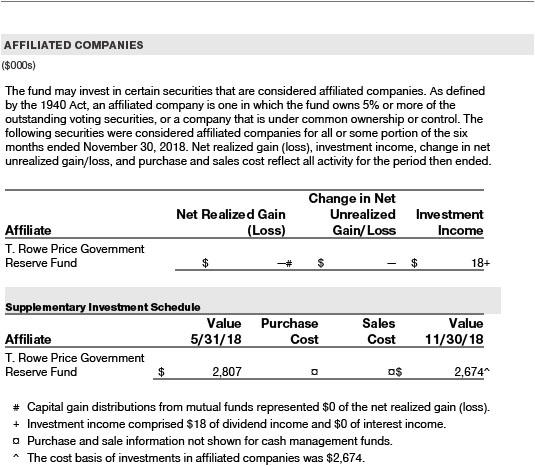

The fund may invest its cash reserves in certain open-end management investment companiesmanagedby Price Associates andconsideredaffiliates of the fund:the T. Rowe PriceGovernment Reserve Fundor the T. Rowe Price Treasury Reserve Fund, organizedasmoneymarket funds, or the T. Rowe Price Short-TermFund, a short-termbondfund(collectively, the Price Reserve Funds). The Price Reserve Funds are offeredas short-terminvestment options tomutual funds, trusts, andother accountsmanagedby Price Associates or its affiliates andare not available fordirect purchase bymembers of the public. Cash collateral fromsecurities lending is investedin the T. Rowe Price Short-TermFund. The Price Reserve Funds pay no investmentmanagement fees.

As of November 30, 2018, T. Rowe PriceGroup,Inc., or its wholly ownedsubsidiaries owned1,416,429 shares of theInvestor Class, representing 33% of theInvestor Class’s net assets and25,000 shares of the Advisor Class, representing 98% of the Advisor Class’s net assets, and2,484,689 shares of theIClass, representing 84% of theIClass’s net assets.

The fund may participate in securities purchase andsale transactions with other funds or accounts advisedby Price Associates (cross trades), in accordance with procedures adoptedby the fund’s BoardandSecurities andExchange Commission rules, which require, among other things, that such purchase andsale cross trades be effectedat the independent currentmarket price of the security. During the sixmonths endedNovember 30, 2018, the fundhadno purchases or sales cross trades with other funds or accounts advisedby Price Associates.

NOTE 8 - BORROWING

Prior to October 19, 2018, the fund, along with several other T. Rowe Price-sponsored mutual funds (collectively, the participating funds), participatedin a$650million, 364-day, syndicatedcredit facility (the facility) pursuant to which the participating funds couldborrow on a first-come, first-servedbasis up to the full amount of the facility.Interest was chargedto borrowing funds at a rate equal to 1.00% plus the Federal Funds rate. A commitment fee, equal to 0.15% per annumof the averagedaily undrawn commitment was accrued daily andpaidquarterly;legal andadministrative fees were recognizedas incurred. All fees were allocatedto the participating funds basedon each fund’s relative net assets andare reflectedas a component of interest expense in the accompanying financial statements. Loans were generally unsecured;however, the fundwas requiredto collateralize any borrowings under the facility on an equivalent basis if it hadother collateralizedborrowings. During the sixmonths endedNovember 30, 2018, the fundincurred $3,000 in commitment fees. Effective October 19, 2018, the fundno longer participates in this credit facility.

INFORMATION ON PROXY VOTING POLICIES, PROCEDURES, AND RECORDS

A description of the policies and procedures used by T. Rowe Price funds and portfolios to determine how to vote proxies relating to portfolio securities is available in each fund’s Statement of Additional Information. You may request this document by calling 1-800-225-5132 or by accessing the SEC’s website, sec.gov.

The description of our proxy voting policies and procedures is also available on our corporate website. To access it, please visit the following Web page:

https://www3.troweprice.com/usis/corporate/en/utility/policies.html

Scroll down to the section near the bottom of the page that says, “Proxy Voting Policies.” Click on the Proxy Voting Policies link in the shaded box.

Each fund’s most recent annual proxy voting record is available on our website and through the SEC’s website. To access it through T. Rowe Price, visit the website location shown above, and scroll down to the section near the bottom of the page that says, “Proxy Voting Records.” Click on the Proxy Voting Records link in the shaded box.

HOW TO OBTAIN QUARTERLY PORTFOLIO HOLDINGS

The fund files a complete schedule of portfolio holdings with the Securities and Exchange Commission for the first and third quarters of each fiscal year on Form N-Q. The fund’s Form N-Q is available electronically on the SEC’s website (sec.gov); hard copies may be reviewed and copied at the SEC’s Public Reference Room, 100 F St. N.E., Washington, DC 20549. For more information on the Public Reference Room, call 1-800-SEC-0330.

Item 2. Code of Ethics.

A code of ethics, as defined in Item 2 of Form N-CSR, applicable to its principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions is filed as an exhibit to the registrant’s annual Form N-CSR. No substantive amendments were approved or waivers were granted to this code of ethics during the registrant’s most recent fiscal half-year.

Item 3. Audit Committee Financial Expert.

Disclosure required in registrant’s annual Form N-CSR.

Item 4. Principal Accountant Fees and Services.

Disclosure required in registrant’s annual Form N-CSR.

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Investments.

(a) Not applicable. The complete schedule of investments is included in Item 1 of this Form N-CSR.

(b) Not applicable.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

Not applicable.

Item 10. Submission of Matters to a Vote of Security Holders.

Not applicable.

Item 11. Controls and Procedures.

(a) The registrant’s principal executive officer and principal financial officer have evaluated the registrant’s disclosure controls and procedures within 90 days of this filing and have concluded that the registrant’s disclosure controls and procedures were effective, as of that date, in ensuring that information required to be disclosed by the registrant in this Form N-CSR was recorded, processed, summarized, and reported timely.

(b) The registrant’s principal executive officer and principal financial officer are aware of no change in the registrant’s internal control over financial reporting that occurred during the registrant’s second fiscal quarter covered by this report that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting.

Item 12. Exhibits.

(a)(1) The registrant���s code of ethics pursuant to Item 2 of Form N-CSR is filed with the registrant’s annual Form N-CSR.

(2) Separate certifications by the registrant's principal executive officer and principal financial officer, pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 and required by Rule 30a-2(a) under the Investment Company Act of 1940, are attached.

(3) Written solicitation to repurchase securities issued by closed-end companies: not applicable.

(b) A certification by the registrant's principal executive officer and principal financial officer, pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 and required by Rule 30a-2(b) under the Investment Company Act of 1940, is attached.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

T. Rowe Price Credit Opportunities Fund, Inc.

| By | /s/ David Oestreicher | |||||

| David Oestreicher | ||||||

| Principal Executive Officer | ||||||

| Date | January 18, 2019 | |||||

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| By | /s/ David Oestreicher | |||||

| David Oestreicher | ||||||

| Principal Executive Officer | ||||||

| Date | January 18, 2019 | |||||

| By | /s/ Catherine D. Mathews | |||||

| Catherine D. Mathews | ||||||

| Principal Financial Officer | ||||||

| Date | January 18, 2019 | |||||