UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________________________________________________________________

Form 10-K/A

(Amendment No. 1)

___________________________________________________________________________________

| ☑ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||||

For the fiscal year ended December 31, 2023

OR

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||||

For the transition period from_____________ to ________________

Commission file number: 001-36421

___________________________________________________________________________________

Aurinia Pharmaceuticals Inc.

(Exact name of registrant as specified in its charter)

___________________________________________________________________________________

| Alberta, Canada | Not applicable | ||||

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification Number) | ||||

#140, 14315 - 118 Avenue Edmonton, Alberta T5L 4S6 | 98-1231763 | ||||

| (Address of principal executive offices) | |||||

Registrant’s telephone number, including area code:

)(250) 744-2487

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Symbol | Name of Each Exchange on Which Registered | ||||||

| Common shares, no par value | AUPH | The Nasdaq Global Market LLC | ||||||

Securities registered pursuant to Section 12(g) of the Act: None

___________________________________________________________________________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☑ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☑

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ☑ | Accelerated filer | ☐ | |||||||||||

| Non-accelerated filer | ☐ | Smaller reporting company | ☐ | |||||||||||

| Emerging growth company | ☐ | |||||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☑

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing

reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☑

The aggregate market value of the common shares held by non-affiliates of the registrant as of June 30, 2023 totaled approximately $1.38 billion based on the closing price for the registrant’s common shares on that day as reported by the Nasdaq Global Market. Such value excludes common shares held by executive officers, and directors as of June 30, 2023.

As of April 26, 2024, there were 143,019,365 of the registrant’s common shares outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

None.

EXPLANATORY NOTE

The registrant is filing this Amendment No. 1 to Annual Report on Form 10-K/A, (this Amendment or this report), to amend the Annual Report on Form 10-K for the fiscal year ended December 31, 2023 (Commission File Number 001-36421), (the 2023 Annual Report on Form 10-K), as filed by the registrant with the Securities and Exchange Commission, (the SEC), on February 15, 2024. The purpose of this Amendment is to include in Part III the information that was to be incorporated by reference from the proxy statement for the registrant’s 2024 Annual General and Special Meeting of Shareholders, as well as to update certain of the information included on the cover page of the 2023 Annual Report on Form 10-K and in the list of exhibits included in Item 15 and the Exhibit Index of this report. The Part III information was previously omitted from the 2023 Annual Report on Form 10-K in reliance on General Instruction G(3) to Form 10-K, which permits the information in Items 10 through 14 of Part III of Form 10-K to be incorporated in the Form 10-K by reference from the registrant’s definitive proxy statement if such statement is filed not later than 120 days after the registrant’s fiscal year-end. The registrant is filing this Form 10-K/A to include Part III information in the 2023 Annual Report on Form 10-K because the registrant will not file a definitive proxy statement containing such information within 120 days after the end of the fiscal year covered by the 2023 Annual Report on Form 10-K. This Amendment hereby amends the cover page, Part III, Items 10 through 14, and Part IV, Item 15 of the 2023 Annual Report on Form 10-K. In addition, as required by Rule 12b-15 under the Securities Exchange Act of 1934, as amended, (the Exchange Act), new certifications by the registrant’s principal executive officer and principal financial officer are filed as exhibits to this Amendment.

No attempt has been made in this Amendment to modify or update the other disclosures presented in the 2023 Annual Report on Form 10-K. This Amendment does not reflect events occurring after the filing of the 2023 Annual Report on Form 10-K (i.e., those events occurring after February 15, 2024) or modify or update those disclosures that may be affected by subsequent events. Accordingly, this Amendment should be read in conjunction with the 2023 Annual Report on Form 10-K and the registrant’s other filings with the SEC.

In this report, unless otherwise indicated or the context otherwise requires, all references to “Aurinia,” “the registrant,” “the company,” “we,” “us,” and “our” refer to Aurinia Pharmaceuticals Inc. together with its subsidiaries. The term “CAD” refers to Canadian dollars, the lawful currency of Canada, and the terms “dollar,” "USD", “U.S. dollar” or “$” refer to United States dollars, the lawful currency of the United States. All references to “shares” or "Common Shares" in this report refer to common shares of Aurinia, with no par value per share.

AURINIA PHARMACEUTICALS INC.

2023 ANNUAL REPORT ON FORM 10-K

AMENDMENT NO. 1

TABLE OF CONTENTS

TABLE OF CONTENTS

| Page | ||||||||||||||

| PART III. | ||||||||||||||

| Item 10. | ||||||||||||||

| Item 11. | ||||||||||||||

| Item 12. | ||||||||||||||

| Item 13. | ||||||||||||||

| Item 14. | ||||||||||||||

| PART IV. | ||||||||||||||

| Item 15. | ||||||||||||||

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This report contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Exchange Act, which are subject to the “safe harbor” created by those sections, as well as “forward-looking information” as defined in applicable Canadian securities laws. These forward-looking statements or information include but are not limited to statements or information with respect to: estimates that we will cut $50 to $55 million in operating expenses between April 1, 2024 and March 31, 2025; estimates that we will produce net product revenue of $200 - $220 million in 2024; our estimates regarding patients based on average wallet utilization; our expectation to

be cash flow positive by the second half of 2024; and the size and timing of our share repurchase program. Forward-looking statements are based on our management’s beliefs and assumptions and on information currently available to our management. In some cases, you can identify forward-looking statements by terms such as “may,” “will,” “should,” “could,” “would,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “project,” “predict,” “propose,” “intend,” “continue,” “potential,” “possible,” “foreseeable,” “likely,” “unforeseen” and similar expressions intended to identify forward-looking statements. These statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance, time frames or achievements to be materially different from any future results, performance, time frames or achievements expressed or implied by the forward-looking statements. We discuss many of these risks, uncertainties and other factors in greater detail under the heading “Risk Factors” in Part I, Item 1A of our 2023 Annual Report on Form 10-K. Given these risks, uncertainties and other factors, you should not place undue reliance on these forward-looking statements. Also, these forward-looking statements represent our estimates and assumptions only as of the date of this filing. You should read this report completely and with the understanding that our actual future results may be materially different from what we expect. We hereby qualify our forward-looking statements by our cautionary statements. Except as required by law, we assume no obligation to update our forward-looking statements publicly, or to update the reasons that actual results could differ materially from those anticipated in these forward-looking statements, even if new information becomes available in the future.

1

PART III.

Item 10. Directors, Executive Officers, and Corporate Governance

DIRECTORS OF THE COMPANY

Set forth below are the names and other information pertaining to each of the directors of the Company:

| Name, Province, State and Country of Residence | Date First Elected / Appointed | Age | Present Principal Occupation | Position Held With the Company | ||||||||||||||||||||||

Dr. Daniel G. Billen Mississauga, Ontario Canada | April 29, 2019 | 70 | Retired, previously commercial GM/VP at Amgen Inc., a biotechnology company. | Chairman of the Board | ||||||||||||||||||||||

Peter Greenleaf Potomac, Maryland United States | April 29, 2019 | 54 | President and Chief Executive Officer (CEO) of the Company | Director, President and CEO | ||||||||||||||||||||||

Dr. David R. W. Jayne Cambridge United Kingdom | May 26, 2015 | 67 | Professor of Clinical Autoimmunity in the Department of Medicine at the University of Cambridge, UK; fellow of the Royal Colleges of Physicians of London and Edinburgh, and the Academy of Medical Science; certified nephrologist and an Honorary Consultant Physician at Addenbrooke’s Hospital, Cambridge UK | Director | ||||||||||||||||||||||

R. Hector MacKay-Dunn Vancouver, British Columbia Canada | June 26, 2019 | 73 | Senior Partner, Farris LLP | Director | ||||||||||||||||||||||

Jill Leversage Vancouver, British Columbia Canada | November 13, 2019 | 67 | Corporate Director | Director | ||||||||||||||||||||||

Dr. Brinda Balakrishnan San Francisco, California United States | June 14, 2021 | 44 | Executive Vice President, Chief Corporate Strategy and Business Development Officer of BioMarin Pharmaceutical Inc. | Director | ||||||||||||||||||||||

Dr. Karen Smith Snowmass Village, CO United States | August 18, 2023 | 56 | Independent Consultant | Director | ||||||||||||||||||||||

Jeffrey A. Bailey Melvin Village, NH United States | August 18, 2023 | 62 | Former CEO of BioDelivery Sciences International, Inc.; Corporate Director | Director | ||||||||||||||||||||||

Dr. Robert T. Foster Edmonton, Alberta Canada | September 21, 2023 | 65 | Adjunct Professor, Faculty of Pharmacy and Pharmaceutical Sciences, University of Alberta | Director | ||||||||||||||||||||||

Dr. Daniel G. Billen, Ph.D., Director, Chairman of the Board and Chair of the Compensation Committee

Dr. Daniel Billen has over 40 years of experience in commercialization of pharmaceutical and biotech products both in Europe and North America. He started with Janssen Pharmaceuticals in its Belgian headquarters in cardiovascular global marketing in 1979. Dr. Billen became head of marketing and sales for Janssen Pharmaceutical’s newly formed affiliate in Canada in 1983 launching multiple products into the Canadian market. In 1991, Dr. Billen moved to Amgen Inc. to lead its Canadian operations as their first General Manager. He moved to Amgen’s headquarters in California in 2011 where he led the U.S. Commercial Operations Business Unit and later the combined Nephrology and Inflammation business unit as their VP/GM. In 2017, Dr. Billen took on the role of VP of Global Commercial initiatives with focus on the evolving US payer landscape. Dr. Billen received his PhD in chemistry from the University of Louvain in Belgium. Our board of directors (the Board) believes Dr.

2

Billen’s background, corporate pharmaceutical experience, as well as the variety of skills identified in the table set out below under "Skills Matrix" qualifies him to serve on the Board.

Peter Greenleaf, MBA, Director, President and CEO

Peter Greenleaf currently serves as the President, CEO and member of the Board since April 29, 2019. From March 2018 to April 2019, Peter served as the Chief Executive Officer and a member of the board of directors of Cerecor, Inc.. From March 2014 to February 2018, Peter served as CEO and Chairman of Sucampo Pharmaceuticals, Inc. (Sucampo), a company that focused on the development and commercialization of medicines to meet major unmet medical needs of patients worldwide until it was sold in February 2018 to U.K. pharmaceutical giant Mallinckrodt plc. Peter also served as Chief Executive Officer and a member of the board of directors of Histogenics Corporation, a regenerative medicine company. From 2006 to 2013, Peter was employed by Medlmmune LLC, the global biologics arm of AstraZeneca, where he most recently served as President. From January 2010 to June 2013, Peter also served as President of Medlmmune Ventures, a wholly owned venture capital fund within the AstraZeneca Group. Prior to serving as President of Medlmmune, Peter was Senior Vice President, Commercial Operations of MedImmune, responsible for its commercial, corporate development and strategy functions. Peter has also held senior commercial roles at Centocor, Inc. (now Janssen Biotechnology, Johnson & Johnson) from 1998 to 2006, and at Boehringer Mannheim (now Roche Holdings) from 1996 to 1998. He was a member of the board of directors of Antares Pharmaceuticals, Inc. until its sale to Halozyme Therapeutics, Inc. on May 24, 2022, and was the Chairman of the board of directors of BioDelivery Sciences International, Inc until its sale to Collegium Pharmaceuticals in March 2022. Peter earned an MBA degree from St. Joseph’s University and a BS degree from Western Connecticut State University. Our Board believes Mr. Greenleaf’s background, role with the Company, corporate pharmaceutical experience as well as the variety of skills identified in the table set out below under "Skills Matrix" qualifies him to serve on the Board.

Dr. David R.W. Jayne, MD FRCP FRCPE FMedSci, Director

Dr. David Jayne has been a Professor of Clinical Autoimmunity in the Department of Medicine at the University of Cambridge, UK since 2017. Dr. Jayne received his MB BChir in Surgery and Medicine from Cambridge University, Cambridge, England. He received postgraduate training at several London hospitals and Harvard University. He is a fellow of the Royal College of Physicians of London and Edinburgh, and the Academy of Medical Science. He is a certified nephrologist and an Honorary Consultant Physician at Addenbrooke’s Hospital, Cambridge UK. Dr. Jayne is a medical advisor to UK, U.S. and EU regulatory bodies, patient groups and professional organizations. He has published more than 400 peer-reviewed journal articles, book chapters and reviews. He was elected the first President of the European Vasculitis Society in 2011 and is a member of the ERA-EDTA immunopathology working group and he co-chairs the European Alliance of Associations for Rheumatology (EULAR) and European Renal Association task force on lupus nephritis (LN). Dr. Jayne’s research includes investigator-initiated international trials and the introduction of newer therapies in vasculitis and SLE with collaborators on five continents. Our Board believes Dr. Jayne’s background and medical expertise in the nephrology area, as well as the variety of skills identified in the table set out below under "Skills Matrix" qualifies him to serve on the Board.

R. Hector MacKay-Dunn, J.D., K.C., Director, Chair of the Governance & Nomination Committee

Mr. MacKay-Dunn has over 30 years of practice experience providing legal advice to high-growth public and private companies and public institutions, over a broad range of industry sectors including early and advanced stage life sciences, health, technology, cleantech, exploration and development mining companies, large-scale long-term infrastructure services projects, many of which achieving valuations exceeding CDN$1 billion, advising on corporate domestic and cross border public and private securities offerings, mergers and acquisitions and international partnering and licensing transactions, and Boards of Directors and independent board committees on corporate governance matters. Mr. MacKay-Dunn is recognized in Lexpert® in Finance and M&A, Technology, Health Sciences and Mining; in The Best Lawyers in Canada 2024 and in Chambers Canada 2024. Mr. MacKay-Dunn received the 2014 Life Science Milton Wong Award, King’s Counsel (BC) designation in 2003 upon recommendation by the attorney general of British Columbia for exceptional merit and contribution to the legal profession and "AV" preeminent legal ability rating from Martindale-Hubbell. Mr. MacKay-Dunn has served as board member with a number of private and public companies including Arbutus Biopharma Corp., XBiotech Inc. and QLT Inc., and the Board of the BC (British Columbia) Tech Association, Chairman of LifeSciences British Columbia and Genome British Columbia and the Board of Tennis Canada. Our Board believes his background and broad legal practices as well as the variety of skills identified in the table set out below under "Skills Matrix" qualifies him to serve on the Board.

3

Jill Leversage, CPA, Director, Chair of the Audit Committee

Prior to retirement, Ms. Leversage was a senior investment banker with over 30 years of experience in investment banking and private equity. She was a Managing Director, Corporate and Investment Banking for TD Securities Inc. from May 2002 to May 2011 and Former Managing Director at Highland West Capital Ltd. from June 2013 to January 2016. She currently serves on several public and private company boards, including MAG Silver Corp. (a mining company) and RE Royalties Ltd. (a finance company specializing in renewable energy). She is a fellow of the Institute of Chartered Professional Accountants of British Columbia and also a Chartered Business Valuator (ret.) of the Canadian Institute of Chartered Business Valuators. Our Board believes her background, financial experience and qualifications as well as the variety of skills identified in the table set out below under "Skills Matrix" qualifies her to serve on the Board.

Dr. Brinda Balakrishnan, M.D., Ph.D., Director

Brinda Balakrishnan, M.D., Ph.D., has been at BioMarin since 2016 and currently serves as their Executive Vice President, Chief Corporate Strategy and Business Development Officer. Dr. Balakrishnan leads their initiatives on corporate strategy, mergers and acquisitions and licensing.

Prior to joining BioMarin, Dr. Balakrishnan was the Co-founder and Vice President of Corporate Strategy and Product Development at Vision Medicines, Inc., a start-up focused on developing treatments for rare ophthalmic diseases. Before Vision Medicines, she spent two years as a consultant at McKinsey & Company in the healthcare practice, serving clients across small biotechnical companies, large pharmaceutical companies and provider groups on topics related to corporate strategy, corporate and business development and operations. Prior to McKinsey, Dr. Balakrishnan was in business development at Genzyme.

Dr. Balakrishnan earned a B.S. from the Massachusetts Institute of Technology (MIT) in chemical engineering and a Ph.D. from MIT in biomedical engineering and chemical engineering. She also earned an M.D. from Harvard Medical School and conducted her medical training in internal medicine at Beth Israel Deaconess Medical Center in Boston, a Harvard hospital. Our Board believes Dr. Balakrishnan's background, corporate pharmaceutical experience as well as the variety of skills identified in the table set out below under "Skills Matrix" qualifies her to serve on the Board.

Dr. Karen Smith, M.D., Ph.D., M.B.A., L.L.M., Director

Karen L. Smith, M.D., Ph.D., M.B.A., L.L.M., has served on the Board since August 2023. Dr. Smith is a life sciences thought leader with over 20 years of biopharmaceutical experience bringing drugs into the clinic and through commercialization. She has been a key contributor to the successful development of multiple FDA and EMA approved products in several therapeutic areas, including oncology (Herceptin, Vyxeos), rare disease (Defitelio), cardiology (Irbesartan), dermatology (Voluma, Botox), neuroscience (Abilify) and anti-infectives (Teflaro). Since November 2018, Dr. Smith has been providing consulting services internationally. Dr. Smith currently acts as an independent consultant providing services to various pharmaceutical and biotechnology companies. From January 2022 to September 2023, Dr. Smith served as Chief Medical Officer of Quince Therapeutics, Inc., formerly Cortexyme, Inc., formerly Novosteo, Inc., a public biopharmaceutical company. From April 2020 to December 2021, Dr. Smith served as Chief Medical officer of Emergent BioSolutions, Inc., a public biopharmaceutical company. From May 2019 to January 2020, Dr. Smith served as President and Chief Executive Officer of Medeor Therapeutics, Inc., a biotechnology company. From June 2018 to May 2019, Dr. Smith served as Chief Executive Officer of Eliminate Cancer, Inc. Dr. Smith holds several degrees, including an M.D. from the University of Warwick, a Ph.D. in oncology from the University of Western Australia, an M.B.A. from the University of New England and an L.L.M. (Masters in Law) from the University of Salford. Dr. Smith serves on the board of directors of Sangamo Therapeutics, Inc., a publicly biopharmaceutical company and Capstan Therapeutics, a private biotechnology company. Dr. Smith previously served on the board of directors of Talaris Therapeutics, Inc., a public biotechnology company from May 2022 to December 2023, Antares Pharma, Inc., a public pharmaceutical company from March 2019 to May 2022, Acceleron Pharma, Inc., a public biopharmaceutical company from November 2017 to December 2021, Sucampo Pharmaceuticals, Inc. from July 2017 to February 2018, and Forward Pharma A/S, from June 2016 to June 2017, and serves as the chair of the Strategic Advisory Board of Emyria Limited, a healthcare technology and services company. Our Board believes Dr. Smith's background, corporate pharmaceutical experience as well as the variety of skills identified in the table set out below under "Skills Matrix" qualifies her to serve on the Board.

Jeffrey A. Bailey, Director

Jeffrey A. Bailey has significant pharmaceutical and biotechnical leadership experience, with expertise in supply chain, commercial, finance, business development, and product development. He has deep experience managing shareholder relations and company objectives to achieve a successful outcome. Mr. Bailey has held multiple President, Chief Executive Officer, and

4

leadership roles at biotechnical and pharmaceutical companies where he oversaw improvements in strategic operations and led the organizations through successful acquisitions. Since 2020, Mr. Bailey has served as Chairman of the Board at Tekla Capital Management (Tekla), a registered investment adviser with four, multi-billion dollar, closed-end funds that predominately invest in public and private healthcare companies. Tekla was acquired in 2023 by Abrdn Inc. and Mr. Bailey continues as a board member. He also served as Chairman of the Board of Aileron Therapeutics 2017 – 2023 before acquisition. Mr. Bailey began his career in 1984 at the Johnson & Johnson Family of Companies where he earned successive leadership roles over the course of 20 years. He holds a degree in Business Administration from Rutgers University in New Brunswick, NJ. Our Board believes Mr. Bailey's background, corporate pharmaceutical experience as well as the variety of skills identified in the table set out below under "Skills Matrix" qualifies him to serve on the Board.

Dr. Robert T. Foster, PharmaD, Ph.D., Director

Dr. Robert T. Foster was the CEO of Hepion Pharmaceuticals, based in Edison, New Jersey and Edmonton, Canada from October, 2018 to December, 2023. He is also an adjunct professor at the Faculty of Pharmacy and Pharmaceutical Sciences, at the University of Alberta, and is currently a Board member of Transcriptome Sciences Inc. Dr. Foster first began working on cyclophilin drug development in 1988 and has more than 30 years of pharmaceutical and biotech experience. Dr. Foster founded Isotechnika Pharma Inc. in 1993 and was its Chairman and CEO for approximately 21 years. During his tenure at Isotechnika, Dr. Foster discovered voclosporin. In 2002, Dr. Foster structured a USD $215 million licensing deal, Canada’s largest at the time, for voclosporin for kidney transplant immunosuppression with Hoffman-La Roche. He served as founding Chief Executive Officer, and subsequently Chief Scientific Officer, of Aurinia after it was acquired by Isotechnika in 2013. Today, voclosporin is Aurinia’s FDA-approved therapy for lupus nephritis, marketed under the brand name LUPKYNIS®. Dr. Foster holds undergraduate degrees in chemistry and pharmacy and has a post-graduate PharmD and Ph.D. in pharmaceutical sciences. Dr. Foster served as a tenured associate professor in the Faculty of Pharmacy and Pharmaceutical Sciences at the University of Alberta from 1988 to 1997. From 1990 to 1994, Dr. Foster was Medical Staff, Scientific and Research Associate in the Department of Laboratory Medicine at the Walter C. Mackenzie Health Sciences Centre. Dr. Foster has over 225 published papers, abstracts, and book chapters and is named on 207 patents as inventor. Our Board believes Dr. Foster's background, corporate pharmaceutical experience as well as the variety of skills identified in the table set out below under "Skills Matrix" qualifies him to serve on the Board.

5

Skills Matrix

The Company’s directors bring a number of skills and experience to the Board. The image below gives a snapshot of the top skills of each director. You can read about each director in the director profiles above.

| Dr. Daniel G. Billen | Peter Greenleaf | Jill Leversage | Dr. David R.W. Jayne | R. Hector MacKay-Dunn | Dr. Brinda Balakrishnan | Dr. Karen Smith | Jeffrey A. Bailey | Dr. Robert T. Foster | |||||||||||||||||||||

| Management/Operations | √ | √ | √ | √ | √ | √ | √ | √ | |||||||||||||||||||||

| CEO/CFO/COO experience | √ | √ | √ | √ | √ | √ | |||||||||||||||||||||||

| Industry Experience | √ | √ | √ | √ | √ | √ | √ | ||||||||||||||||||||||

| Commercialization | √ | √ | √ | √ | √ | ||||||||||||||||||||||||

| Manufacturing/Supply Chain | √ | √ | √ | ||||||||||||||||||||||||||

| Government Relations | √ | √ | √ | √ | |||||||||||||||||||||||||

| Finance/Financial Industry | √ | √ | √ | √ | √ | √ | √ | √ | |||||||||||||||||||||

| Accounting/Auditing | √ | √ | √ | ||||||||||||||||||||||||||

| Risk Management | √ | √ | √ | √ | √ | √ | |||||||||||||||||||||||

| Mergers & Acquisitions | √ | √ | √ | √ | √ | √ | √ | √ | |||||||||||||||||||||

| Legal/Regulatory | √ | √ | √ | √ | |||||||||||||||||||||||||

| Corporate Governance | √ | √ | √ | √ | √ | √ | √ | √ | |||||||||||||||||||||

| Capital Markets | √ | √ | √ | √ | √ | √ | √ | ||||||||||||||||||||||

| Executive Compensation | √ | √ | √ | √ | √ | √ | |||||||||||||||||||||||

| Information Technology/ Cyber Security | √ | √ | √ | √ | |||||||||||||||||||||||||

| Research/Development | √ | √ | √ | √ | √ | ||||||||||||||||||||||||

| Clinical Development | √ | √ | √ | √ | √ | √ | |||||||||||||||||||||||

| Business Development/ Strategy Development | √ | √ | √ | √ | √ | √ | √ | √ | |||||||||||||||||||||

| Health & Safety | √ | √ | |||||||||||||||||||||||||||

| International Markets | √ | √ | √ | √ | |||||||||||||||||||||||||

Board Diversity Matrix (as of December 31, 2023)

We have adopted a written Diversity Policy, which focuses on the identification and nomination of directors and executive officers, and requires that the Board consider diversity on the Board from several aspects, including but not limited to gender, age, ethnicity and cultural diversity. In addition, when assessing and identifying potential new members to join the Board or our executive team, the Board shall consider the current level of diversity on the Board and the executive team. The Board follows our Diversity Policy in considering the pool of potential candidates for election and appointment of members of the Board and the executive team.

The Governance & Nomination Committee of the Board regularly considers our Diversity Policy and our diversity needs, and reports to the Board as needed on our advancements related to this policy. In connection with such reviews, the Governance & Nomination Committee will consider the effectiveness of our approach to diversity and will recommend to the Board any changes that it considers appropriate. The Board continues to seek more diversity on the Board and in senior executive positions.

6

The following table sets out voluntarily disclosed information regarding certain diversity elements for our Board of Directors.

| Board Size | ||||||||||||||

| Total Number of Directors | 9 | |||||||||||||

| Gender: | Female | Male | Non-Binary | Did not Disclose Gender | ||||||||||

| Directors | 3 | 6 | — | — | ||||||||||

| Number of Directors who identify in Any of the Categories Below: | ||||||||||||||

| Asian | 1 | — | — | — | ||||||||||

| White | 2 | 6 | — | — | ||||||||||

| LGBTQ+ | — | — | — | — | ||||||||||

| Persons with Disabilities | — | — | — | — | ||||||||||

As set out in our prior year proxy, we intended to increase female representation on our Board to over 30% prior to the Meeting. Our Board is now made up of 33% female board members. We believe in the efficacy of a right-sized, highly engaged Board in which our three existing female members with critical skills (as set out in our Skills Matrix above) play a significant role in achieving this important goal of the Company.

CORPORATE GOVERNANCE

Committee Composition

The following table provides our current committee membership for each of the committees of our Board.

| Director | Audit | Compensation | Governance and Nomination | |||||||||||||||||

| Dr. David R.W. Jayne | X | |||||||||||||||||||

| Dr. Brinda Balakrishnan | X | |||||||||||||||||||

| Dr. Karen Smith | X | |||||||||||||||||||

| Jeffrey A. Bailey | X | X | ||||||||||||||||||

| Dr. Daniel Billen | X | X* | ||||||||||||||||||

| R. Hector MacKay-Dunn | X | X* | ||||||||||||||||||

| Jill Leversage | X* | X | ||||||||||||||||||

| Dr. Robert T. Foster | ||||||||||||||||||||

* Committee Chairperson

Other Board Membership

The following table identifies the directors who also act as directors for other reporting issuers.

| Name | Name of Issuer | Name of Exchange of Market | ||||||||||||

| R. Hector MacKay-Dunn | Copper Fox Metals Inc. | TSXV:CUU | ||||||||||||

| Dr. Karen Smith | Sangamo Therapeutics, Inc. | NASDAQ: SGMO | ||||||||||||

| Jill Leversage | Mag Silver Corp. RE Royalties Ltd. | TSX/NYSE A:MAG TSXV:RE | ||||||||||||

Audit Committee

Our Audit Committee consists of Jill Leversage, Dr. Karen Smith, Jeff Bailey and Dr. Daniel Billen. Jill Leversage serves as chairperson of the Audit Committee. All members of our Audit Committee meet the requirements for financial literacy under the applicable rules and regulations of the SEC and the Nasdaq Stock Market. Our Board has determined that Jill Leversage is an audit committee financial expert as such term is defined by the SEC rules and has the requisite financial experience as defined by the applicable Nasdaq Rules and applicable Canadian securities laws. Each of the members of our Audit Committee

7

is “independent” as such term is defined in Rule 10A-3(b)(1) under the Exchange Act and satisfies the independent director requirements under the Nasdaq Rules.

Ethical Business Conduct

We have adopted a Corporate Code of Ethics and Conduct, (the Code of Conduct) applicable to all of our employees, executive officers and directors. The Code of Conduct is available on our website at http://www.auriniapharma.com under the Corporate Governance section of our Investors page. The Audit Committee is responsible for monitoring the implementation of the Code of Conduct and must approve any material changes to or waivers of the Code of Conduct regarding our directors or executive officers, and disclosures made in the Company’s annual report in such regard. In addition, we intend to post on our website all disclosures that are required by law or the listing standards of the applicable stock exchange concerning any amendments to, or waivers from, any provision of the Code of Conduct.

The Code of Conduct is part of our commitment to adhere to the highest levels of ethical, compliance and legal standards. Detailed information on other aspects of our corporate governance policies and programs are available on our website at www.auriniapharma.com. In addition to these corporate governance policies, we also maintain written policies and procedures that are established to ensure all of our interactions with health care practitioners are ethical and in line with ever evolving laws and guidance in the United States. Each of these are reviewed on a regular basis to ensure they are up to date, and all applicable members of our team are trained on them.

To help foster a culture of openness, integrity and accountability, we have a Board that is comprised of accomplished leaders from various backgrounds and a breadth of experience in scientific and corporate matters. They set our goals and make determinations on material business initiatives and decisions, as well as set the direction for our business. They also act as an oversight function for our management team. The skills that each of our directors brings are included under the heading "Skills Matrix".

We will promptly disclose on our website (i) the nature of any amendment to the policy that applies to our principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions and (ii) the nature of any waiver, including an implicit waiver, from a provision of the policy that is granted to one of these specified individuals, the name of such person who is granted the waiver and the date of the waiver. Shareholders may request a free copy of the Code of Conduct from c/o Aurinia Pharmaceuticals Inc., #140, 14315 - 118 Avenue, Edmonton, Alberta, Canada T5L 4S6, Attn: Corporate Secretary.

EXECUTIVE OFFICERS OF THE COMPANY

The following table sets forth information concerning our executive officers, including their ages, as of the date of this report.

| Name of Executive Officer | Age | Position(s) | ||||||||||||

| Peter Greenleaf | 54 | President, Chief Executive Officer and Director | ||||||||||||

| Joe Miller | 50 | Chief Financial Officer | ||||||||||||

| Matthew ("Max") Donley | 55 | Executive Vice President, Operations and Strategy | ||||||||||||

| Stephen P. Robertson | 42 | Executive Vice President, General Counsel, Corporate Secretary and Chief Compliance Officer | ||||||||||||

| Scott Habig | 64 | Chief Commercial Officer | ||||||||||||

The brief biographies below include information, as of the date of this report, regarding the specific and particular experience, qualifications, attributes or skills of each executive officer of our Company.

Peter Greenleaf, MBA, President, Chief Executive Officer and Director

Refer above to the "Directors of the Company" biographies section for Peter Greenleaf's biography.

8

Joe Miller, Chief Financial Officer

Joe Miller has served as Chief Financial Officer of the Company since April of 2020. Joe has over two decades of experience in both public and private biotech and commercial stage companies across the health sciences, biotech, and pharmaceutical sectors.

Most recently, Joe served as Chief Financial Officer, Principal Executive Officer, and Corporate Secretary at Avalo Therapeutics, (formerly Cerecor, Inc.), a publicly traded biotechnical company. Before Cerecor, Joe was the Vice President of Finance at Sucampo, where he was responsible for building out the finance organization to effectively support the company’s rapid growth, Before Sucampo, he served in various progressive finance and management roles at QIAGEN, and Eppendorf. Joe began his career in the audit practice of KPMG LLP. Joe earned his B.S. in accounting from Villanova University and is a Certified Public Accountant.

Matthew ("Max") Donley, Executive Vice President, Operations and Strategy

Max Donley has served as Executive Vice President, Operations and Strategy of the Company since July 2019. He most recently led Human Resources, Information Technology and Facilities at Senseonics from December 2018 to May 2019. Prior to that, Max was Executive Vice President of Global Human Resources, Information Technology, and Corporate Strategy at Sucampo until its acquisition in February 2018 to U.K. pharmaceutical company Mallinckrodt plc. Max also served as Executive Vice President, Human Resources and Corporate Affairs at MedImmune from July 2000 to May 2013 where he provided business-integrated leadership and delivered professional tools, programs and services to optimize MedImmune’s human capital investments worldwide. Max received his B.A. from the University of Michigan and his M.B.A from George Mason University.

Scott Habig, Chief Commercial Officer

Scott Habig has served as Chief Commercial Officer of the Company since July 2022. He has more than 20 years of global and U.S. sales and marketing experience and relevant expertise in Rheumatology and Lupus markets. Over the past ten years, Scott has held numerous leadership roles at UCB, Inc and most recently was Head of Global SLE, maintaining full responsibility for pre-launch and commercial launch activities of a novel CD40 ligand currently in Phase III of clinical development for Systemic Lupus Erythematosus (SLE). His previous roles include Vice President, Sales at Human Genome Sciences, where he led the development and execution of organizational capabilities and infrastructure to support the company’s first sales team and led organizational and operational initiatives to guide the first major Lupus drug launch in more than 50 years. Prior to this role, Scott spent nine years at Centocor, Inc. where he led development and execution of sales and marketing strategies for one of the first biologic therapies approved for multiple autoimmune disorders. Under Scott’s sales and marketing leadership at Centocor, Inc., the company transformed a multimillion-dollar pipeline into a multibillion-dollar product. Scott received his B.A. from the University of Akron.

Stephen P. Robertson, Executive Vice President, General Counsel, Corporate Secretary and Chief Compliance Officer

Stephen Robertson has served as Executive Vice President, General Counsel, Corporate Secretary and Chief Compliance Officer of the Company since November 2020. Stephen is responsible for all legal and compliance matters related to Aurinia. Stephen brings more than 13 years of corporate law experience across various roles with the law firm Borden Ladner Gervais LLP, where he had been a Partner since 2014. While there, he focused on advising clients on securities, corporate and commercial legal matters, including extensive experience with mergers and acquisitions and commercial agreements. Stephen has served as Corporate Secretary for Aurinia since 2014. Stephen received his Bachelor of Laws degree from the University of Manitoba, and his B.A. from Simon Fraser University. He has been recognized with a number of awards and honors, including being included in the 2020 edition of the Best Lawyers in Canada for Securities Law.

9

Item 11. Executive Compensation

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

Aurinia Corporate Strategy

At Aurinia, we are dedicated to transforming the lives of people living with lupus nephritis (LN). We are committed to serving the interests of the patient community and supporting the healthcare providers in delivering this important therapy to patients in need, which allows us in turn to deliver value to all stakeholders, including our shareholders.

With these goals in mind, the Board and management are focused on acting in the best interests of the Company to enable sustainable long-term value for shareholders, while staying true to our core mission of changing the trajectory of autoimmune disease. To help drive both near- and long-term value, our strategy is directed across three key areas: excellence in commercial execution, streamlining operations, and maximizing free cash flows that contributes to value and potential growth.

Commercial Execution

We are focused on driving LUPKYNIS® revenues through excellence in commercial execution. LUPKYNIS is a best-in-class medicine with a strong and supportive base of clinical evidence. LUPKYNIS has a significant role in LN treatment that aligns with the most current medical guidelines. As the LN population can be characterized as both under-diagnosed and underserved, and as suggested by the consistent and strong growth in sales, we believe there remains significant untapped potential in the LN market.

An established body of research, including recent peer-reviewed reports and claims data audits, shows that a high percentage of systemic lupus erythematosus (SLE) patients and LN patients do not receive urinary screenings at every visit. In LN, routine screenings at every visit are recommended by current evidence-based guidelines. If these patients are screened, they are frequently going untreated, even when proteinuria levels indicate treatment is necessary. Therefore, to develop the LN market and ensure LUPKYNIS achieves full commercial potential, our commercial strategy focuses on educating physicians about the seriousness of LN and the importance of adhering to established disease management guidelines. We aim to position LUPKYNIS as a vital component of therapy for LN by presenting compelling clinical data that showcases its differentiated, long-term efficacy and safety profile.

Additionally, because the LN patient population has historically been underserved and often faces significant barriers to receiving care, reaching these patients requires multiple forms of outreach and engagement. This patient population requires a range of support in terms of disease education and how to access treatment. We have several initiatives, from the grassroots level to broader digital and social campaigns, designed to encourage patients to proactively discuss screening and treatment with their physicians. These include our “All In” and “Get Uncomfortable” awareness campaigns, providing LN patient support and engagement on the importance of screening, applying best industry practices in pharmaceutical outreach and advocacy.

Streamlined Operations

We have recently streamlined operations through a corporate restructuring that eliminated the majority of our research and development infrastructure and reduced employee headcount by approximately 25%. This will result in one-time charges of approximately $11 - $15 million. Streamlining operations has allowed us to dedicate resources to our commercial activities and increase options for future growth by strengthening our balance sheet. Taking decisive action to preserve the long-term value of Aurinia and enable growth is a key component of our commitment to responsible stewardship of the company’s future.

Generating Free Cash Flow

We have estimated that we will cut $50 to $55 million in operating expenses and expect approximately 75% of that will be recognized during 2024. With this reduction in operating expenses and our focus on LUPKYNIS growth, we expect to be cash flow positive by the second half of 2024. We have also initiated a share repurchase program of up to either 15% of our share capital in any 12-month period over the next 36 months, or $150 million, whichever is less, affirming our confidence in our growth prospects.

10

2023 Accomplishments

In 2023, Aurinia generated $175.5 million in total net revenue, a 31% increase over the previous year. In LUPKYNIS specific net product revenue, we generated $158.5 million in 2023, representing a 53% increase over the previous year. We estimate net product revenue guidance of $200 - $220 million in 2024 an increase of 26% - 39% over 2023 net product revenue. We have seen consistent, strong growth over time in LUPKYNIS sales revenues since commercial launch with an annual growth rate in excess of 53%. We also hold cash, cash equivalents, restricted cash, and investments of approximately $350.7 million as of December 31, 2023. A strong balance sheet reflects a commitment to delivering long-term, sustainable value and allows us freedom to execute and potentially diversify in the future.

Product Performance Key Highlights

•More Patients on Therapy: Approximately 2,066 patients are actively receiving LUPKYNIS therapy as of December 31, 2023, compared to 1,525 at the end of 2022. From January 1 through the end of December 2023, we recorded 1,791 Patient Start Forms (PSFs), compared to 1,650 in the prior year. Since launch, we have achieved over 5,000 total PSFs and over 4,500 total patients have been exposed to LUPKYNIS.

•Increased Patient Restarts: In the fourth quarter of 2023, the Company reported patient restarts as a new leading metric, as prior to the fourth quarter, the number of restarts was immaterial. In the fourth quarter of 2023, approximately 101 patients either restarted LUPKYNIS therapy or began receiving LUPKYNIS through a hospital pharmacy.

◦Restarts represent patients who have ceased therapy for an extended period of time and have now come back onto therapy.

◦Restarts in particular help demonstrate that physicians are comfortable using LUPKYNIS in a first line treatment setting.

◦Restarts also likely indicate broadening recognition of the importance of maintaining LUPKYNIS treatment for individual patients over a sustained period.

11

•Hospital Channel Approach: Regarding sales from the hospital distribution channel, we ship a known quantity of wallet packages to hospital pharmacies, allowing us to estimate how many patients are addressed based on average wallet utilization across all patients.

◦We are exploring strategic approaches to this channel and addressing some of the complexities inherent in hospital systems and integrated healthcare networks.

•Strong Conversion Rates: We continued to strongly support the evidence-based, appropriate, conversion of patients receiving other medications to LUPKYNIS, and significantly improved the time it takes to get patients on therapy. Conversion rates were sustained, with approximately 85% of PSFs converted to patients on therapy. Time to convert improved to an all-time high, with approximately 63% of patients on therapy by 20 days.

•Long-term Adherence: Patients remain on therapy over the long term, in a manner consistent with treatment guidelines. The overall adherence rate remained high at 86% through the fourth quarter of 2023. Persistency at 12 months was 55% and remained fairly stable, with 49% of patients remaining on therapy at 15 months and 44% at 18 months.

Corporate Milestones

Thanks to strong leadership, resilience, and dedication to excellence in operational and commercial execution, Aurinia achieved significant corporate milestones in 2023.

•Several significant data publications and presentations demonstrate the ongoing clinical value of LUPKYNIS. Arthritis & Rheumatology published the full results of the AURORA 2 Phase 3 extension study showing that kidney preservation, sustained renal response, and reductions in steroid use were achieved with LUPKYNIS for up to three years.

•A biopsy sub-study of the AURORA 1 Phase 3 trial, presented at the Congress of Clinical Rheumatology East, American College of Rheumatology Convergence 2023, and American Society of Nephrology Kidney Week 2023 Convergence, showed that LUPKYNIS can provide significantly earlier and greater reductions in proteinuria while allowing patients to maintain stable renal function with no evidence of chronic injury, further strengthening the overall evidence supporting the long-term safety of LUPKYNIS.

•Updated EULAR (European Alliance of Associations for Rheumatology) and KDIGO (Kidney Disease Improving Global Outcomes) guidelines call for a new treatment paradigm for LN, including routine screenings at every visit, using LUPKYNIS as a first line treatment with standard of care therapies, significantly reducing steroid dosing, and remaining on treatment for three to five years.

•LUPKYNIS continued commercial introduction and uptake in regions outside the U.S. Aurinia’s collaboration partner, Otsuka Pharmaceutical Ltd. (Otsuka), achieved several regulatory approvals for LUPKYNIS in Europe, including in the UK, Scotland, Switzerland, and Italy, triggering a $10 million pricing and reimbursement milestone payment. Otsuka also filed a new drug application for voclosporin for the treatment of LN with Japanese Regulatory authorities in November 2023.

•Aurinia is leading the way in implementing innovative disease awareness and patient activation initiatives that reach patients with critical messages about the seriousness of LN and the urgent need to be screened at every clinic visit. In the first half of 2023, Aurinia launched “Get Uncomfortable,” an LN disease awareness campaign, with Grammy Award winning singer Toni Braxton, who has been living with lupus since 2008, as the campaign spokesperson. To-date, the campaign has generated millions of impressions and hundreds of thousands of visits to the campaign website, GetUncomfortable.com.

•Importantly, Aurinia has and continues to build a robust patent portfolio covering LUPKYNIS for composition of matter and methods of use. Most notably, in April 2023, the United States Patent and Trademark Office issued a new and refined method of use patent for LUPKYNIS that provides patent protection up to 2037, which is listed in the Orange Book.

12

Board Evolution

In 2023, the Board appointed Karen Smith, M.D., Ph.D., Jeffrey A. Bailey and Robert Foster, Pharm. D., Ph.D. to the Board, bringing with them decades of combined leadership experience in the pharmaceutical and biotechnical industry. Dr. Foster’s appointment occurred in connection with a cooperation agreement entered into among MKT Capital Ltd., MKT Tactical Fund, SP, Antoine Khalife and the Company on September 21, 2023.

Conclusion

At Aurinia, we have a deeply experienced team that is dedicated to ensuring that every appropriate LN patient can access LUPKYNIS. We are driven to make an impact for our patient communities as advocates and partners in innovation, and for our employees by ensuring they have a sense of fulfillment and purpose in their work, particularly in a shared vision of how we can improve patient care.

We thank our shareholders for trusting us with capital as we build a sustainable company. We are working with urgency to execute actions focused on enhancing value for all shareholders.

Engaging with our Shareholders and Maintaining High Standards of Corporate Governance

During the past year, our management team and directors have had over 170 touchpoints with investors and potential investors, including investors representing in aggregate approximately 25% of our shares outstanding as of December 31, 2023. Representatives of Aurinia have made a concentrated effort to engage with our shareholders to ensure they were properly apprised of our corporate strategy, recent developments, and to hear our investors’ views on matters important to the business.

In the lead up to the 2023 AGM, certain shareholders made public requests for the Company to initiate a strategic review process. After the 2023 AGM, the Board initiated a robust strategic review at the end of June 2023 to review all strategic options for the Company. Together with management, JP Morgan, the Company’s financial advisor in the strategic review process, engaged with more than 60 parties, receiving only one non-binding expression of interest, which included a due diligence process, but did not result in a formal offer.

We are committed to ensuring we maintain strong corporate governance and as part of that commitment, we appointed 3 new board members in 2023. In 2023, the Board appointed Karen Smith, M.D., Ph.D., Robert Foster, Pharm. D., Ph.D., and Jeffrey A. Bailey to the Board, bringing with them decades of combined leadership experience in the pharmaceutical and biotechnical industry. Dr. Foster’s appointment occurred in connection with a cooperation agreement entered into among MKT Capital Ltd., MKT Tactical Fund, SP, Antoine Khalife and the Company on September 21, 2023.

Our strong corporate governance is coupled by our commitment to Board refreshment – all of Aurinia’s current directors have joined the Board within the last nine years.

Advisory Vote on Executive Compensation

In keeping with our commitment to high standards of corporate governance, our goal is to provide clear and comprehensive disclosure of Aurinia’s executive compensation and approach so shareholders can make an informed decision when casting an advisory vote on executive compensation (say-on-pay) at the Meeting.

We submitted our approach to compensation to an advisory say on pay vote at the annual general meeting for the year ended December 31, 2022, held in May 2023 (the "2023 AGM"). Of the common shares voted at that meeting, 38.6% of shareholders voted in favor of the approach to compensation. While the vote was advisory and non-binding, our Board and Compensation Committee took this vote into account when planning matters relating to the Company's approach to executive compensation for compensation matters determined following the 2023 AGM.

Continuing the shareholder engagement that had resulted from the outcome of the advisory vote on executive compensation following the 2022 AGM, our Chairman of the Board and Chair of the Compensation Committee reached out to 50 of our largest shareholders (based on available records) to bolster these discussions, specifically directed to discuss our approach to executive compensation.

Our Chairman of the Board has initiated a similar approach this year, connecting with our investors, to ensure we are aligned with our shareholder’s expectations and providing an opportunity to share more in-depth information on our strategy.

13

While this vote is not binding on the Board or Aurinia, the views expressed by our shareholders, whether through this vote or otherwise, are important to management and the Board. Accordingly, the Board and the Compensation Committee intend to consider the results of this vote in making determinations in the future regarding executive compensation and compensation philosophy.

Over the past few years, in response to our shareholder discussions, we have:

•Adopted a share ownership policy for our directors and executive officers

•Adopted a clawback policy applicable to our executive officers

•Returned to a regular cadence for equity grants for our executive officers

•Included more performance-based metrics into our equity awards for our executive officers

•Involved our Board of Directors in shareholder outreach efforts

The Compensation Committee has also implemented 2024 goals, aligned with the imperatives on sales acceleration and cash flow positivity. Importantly, all compensation decisions are based on advice from an independent compensation consultant, Willis Towers Watson, in terms of maintaining market competitiveness.

Overview of Executive Compensation

This CD&A discusses our executive compensation policies and how and why our Compensation Committee arrived at specific compensation decisions for the year ended December 31, 2023. It provides qualitative information on the factors relevant to these decisions and the manner in which compensation is awarded to our named executive officers (NEOs) for the fiscal year ended December 31, 2023, which consist of our principal executive officer, our principal financial officer and our three other most highly compensated executive officers as of December 31, 2023. Our NEOs for 2023 were:

| Name | Position(s) | |||||||

| Peter Greenleaf | Chief Executive Officer and Director | |||||||

| Joe Miller | Chief Financial Officer | |||||||

| Max Donley | Executive Vice President, Operations and Strategy | |||||||

| Stephen Robertson | Executive Vice President, General Counsel, Corporate Secretary and Chief Compliance Officer | |||||||

Volker Knappertz(1) | Executive Vice President, Research and Development | |||||||

(1)Volker Knappertz was appointed as the Company's Executive Vice President, Research & Development effective July 14, 2022. His employment with the Company ceased on March 4, 2024.

Information about the compensation awarded to the NEOs can be found in the "Summary Compensation Table" and related compensation tables below.

Executive Summary

The important features of our executive compensation program include the following:

•A substantial portion of executive pay is tied to performance. We structure a significant portion of our NEOs’ compensation to be variable, at risk and tied directly to our measurable performance.

•Our executive bonuses are dependent on the Company's and the officer's executive's performance in achieving annually determined goals and objectives. Our annual performance-based bonus opportunities for all of our non-CEO NEOs are determined by the Compensation Committee in its sole discretion based upon the Company’s and the NEO's achievement of goals and objectives determined on an annual basis by our Board on the recommendation of the Compensation Committee. The CEO does not have any individual goals, as the CEO's goals are solely based on the overall corporate goals, which are determined by the entire Board on recommendation from the Compensation Committee. For the other NEOs, the weighting for corporate goals is 80% and individual goals is 20%.

•We emphasize long-term equity incentives. Equity awards such as restricted stock units (RSUs) and performance awards (PAs) are an integral part of our executive compensation program and comprise the most significant “at-risk” portion of our NEOs compensation package. These awards strongly align our NEOs' interests with those of the

14

Company by providing a continuing financial incentive to maximize long-term value of the Company and by encouraging our NEOs to remain in our long-term employment.

•Our Compensation Committee is advised by an independent third-party compensation consultant and retained by the Compensation Committee (not management) for guidance in making compensation decisions. The compensation consultant advises the Compensation Committee on market practices, including identifying a peer group of companies and their compensation practices so that our Compensation Committee can regularly assess the Company’s individual and total compensation programs against these peer companies, the general marketplace and other industry data points, as appropriate.

•We generally do not provide executive fringe benefits or perquisites to our executives. Any perquisites provided to our executives are for matters in conjunction with their services as executives of the Company.

•We generally do not provide our executive officers with any excise tax gross ups.

Objectives, Philosophy and Elements of Executive Compensation

The Company’s executive compensation program and strategy is designed to:

•support the attraction, retention and engagement of global talent and talent mobility while recognizing differences across labor markets, where appropriate;

•engage our talent to achieve critical business and financial objectives, R&D and product milestones that are set by management and the Board, through strategically-aligned annual and long-term incentive programs, as appropriate;

•provide target total direct compensation opportunities that are generally aligned with the competitive market 50th percentile and provide both upside and downside earning potential around the 50th percentile based on company and individual performance; and

•maintain a disciplined use of equity while appropriately recognizing performance, ensuring alignment with the competitive labor market and long-term shareholder interests.

To further these objectives, the Compensation Committee designs pay and performance programs that reflect the level of job responsibility with specific considerations while aligning the Company’s compensation programs with those of pharmaceutical companies of similar size and clinical stage. It also aligns the annual cash incentive (bonus) program to the achievement of objectives that will drive future success and enhance shareholder value by linking a significant portion of the bonus program to overall corporate performance and attainment of specific value enhancing goals and milestones. The Compensation Committee assesses the performance of the Company’s CEO in accordance with these objectives and makes recommendations to the Board, and the Board approves all decisions regarding the CEO's compensation.

Annually, specific and measurable performance objectives are defined for each executive officer that align to corporate objectives, underscoring the Company's pay for performance philosophy.

For 2023, the overall corporate level objectives against which the executive officers were evaluated, included financial and shareholder value targets, commercialization of LUPKYNIS, R&D development/pipeline progression, LUPKYNIS portfolio progression and business development.

The Company’s compensation program and strategy for its executive officers consists primarily of three main elements: base salary, an annual cash incentive (bonus) and equity-based compensation.

15

Element of Compensation | Objectives | Key Features | ||||||||||||

Base Salary (fixed cash) | Provides a base compensation that reflects the executive’s experience and responsibilities, and which is competitive with salaries of executives with similar responsibilities and experience at comparable companies. | •Reviewed annually •Determined based on a number of factors (including individual performance and the overall performance of our Company) and by reference, in part, to market data provided by our independent compensation consultant. | ||||||||||||

Performance Bonus (at-risk cash) | Motivates executive officers to work toward achievement of the Company’s goals and strategic objectives. Underscores pay for performance philosophy. | •Reviewed annually •Target bonus amounts are determined based on a combination of internal equity and external market competitiveness. •Bonus payouts are dependent upon achievement of specific corporate performance objectives consistent with our long-term strategic plan and individual performance objectives. | ||||||||||||

Long-Term Incentive (at-risk equity) | Aligns the compensation of the CEO, other executive officers and key employees with the long-term interests of our shareholders and rewards the achievement of the long-term strategic goals and objectives of the Company. Underscores pay for performance philosophy. Attracts highly qualified executives and encourages their continued employment over the long-term. | •Reviewed annually •Equity awarded by the Compensation Committee (other than to the CEO, which are awarded by the Board, on recommendation from the Compensation Committee). •Individual awards are determined based on a number of factors, including internal equity and external market competitiveness, individual and/or company performance, contractual requirements and/or other inputs. | ||||||||||||

We focus on providing a market-aligned compensation package to our executive officers which provides competitive base compensation along with significant short-term and long-term incentives for the achievement of measurable Company and individual goals and objectives. We believe that this approach provides an appropriate blend of short-term and long-term incentives to maximize alignment between management and the best interests of the Company.

We have a compensation philosophy for allocating total compensation among salary, performance bonus awards and long-term equity grants (a portion of which are performance-based grants). The Compensation Committee with input from its independent compensation consultant regarding market competitive assessments of the Company's peer group, uses its judgment to establish a total compensation program for each NEO that is a mix of base salary, short-term and long-term incentive compensation, and cash compensation, that it believes appropriate to achieve the goals of the executive compensation program and our corporate objectives.

16

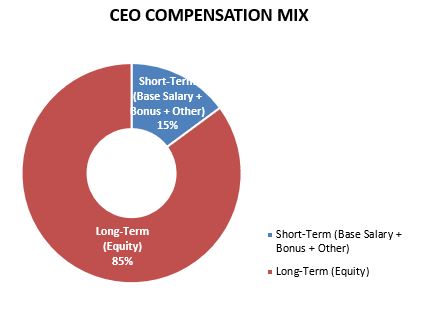

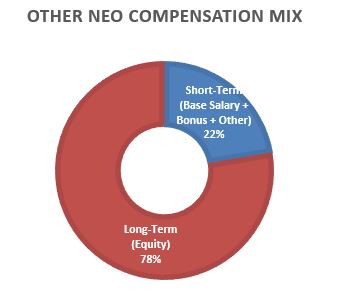

The below charts illustrate the CEO and average NEO compensation mix between short-term (base salary, annual performance incentive and other pay) and at-risk long-term incentives for 2023.

How We Determine Executive Compensation

Role of our Compensation Committee, Management and the Board

The Compensation Committee is appointed by the Board and has responsibilities related to the compensation of the Company’s directors, officers, and employees and the development and administration of the Company’s compensation plans. Our Compensation Committee consists solely of independent members of the Board.

The Compensation Committee meets periodically throughout the year to manage and evaluate our executive compensation program, and generally determines the principal components of compensation (base salary, performance bonus and equity awards) for our executive officers on an annual basis; In certain cases, decisions may occur at other times for new hires, promotions or other special circumstances as our Compensation Committee determines appropriate. The Compensation Committee does not delegate authority to approve executive officer compensation. The Compensation Committee does not maintain a formal policy regarding the timing of equity awards to our executive officers.

Role of Executive Officers in Compensation Decisions

The Compensation Committee assesses the performance of the Company’s CEO and makes recommendations to the Board, and the Board approves all decisions regarding the CEO's compensation. The Compensation Committee consults with and receives input and recommendations from the CEO regarding the performance, assessment and compensation of all the other executive officers and determines the compensation of such executives. From time to time, various other members of management and other employees as well as outside advisors or consultants may be invited by the Compensation Committee to make presentations, provide financial or other background information or advice or otherwise participate in the Compensation Committee meetings. Although the Compensation Committee generally considers recommendations from the CEO, decisions regarding the compensation of the Company’s executive officers are made by the Compensation Committee and may reflect factors and consideration other than information and recommendations provided by the CEO.

Role of Compensation Consultant

The Compensation Committee has the sole authority to retain compensation consultants to assist in its evaluation of executive compensation, including the authority to approve the consultant’s reasonable fees and other retention terms. The Compensation Committee has retained Willis Towers Watson US LLC ("WTW") as its independent compensation consultant. A representative of WTW generally attends meetings of the Compensation Committee. In addition, WTW supports the selection of companies included in our compensation peer group, provides competitive market assessments of the compensation of our executive officers and non-employee director compensation programs, reviews the CD&A section of our annual reports or proxy statements, and provides support on other matters as requested by the Compensation Committee.

17

The Compensation Committee has analyzed whether the work of WTW as compensation consultant raises any conflict of interest, taking into account relevant factors in accordance with SEC guidelines. Based on its analysis, our Compensation Committee determined that the work of WTW and the individual compensation advisors employed by WTW does not create any conflict of interest pursuant to the SEC rules and Nasdaq listing standards.

Factors Used in Determining Executive Compensation

Our Compensation Committee sets the compensation of our executive officers at levels they determine to be competitive and appropriate for each executive officer, using their professional experience and judgment. Pay decisions are not made by use of a formulaic approach or benchmark. Rather the Compensation Committee believes that executive pay decisions require consideration of a multitude of relevant factors that may vary from year to year. In making executive compensation decisions, the Compensation Committee generally takes into consideration the factors listed below.

•Company performance and existing business needs;

•Each NEO’s individual performance, scope of job function and the critical skill set of the NEO to the Company’s future performance;

•The need to attract new talent to our executive team and retain existing talent in a highly competitive industry;

•A range of market data reference points; and

•Recommendations from consultants on compensation policy determinations for the executive officer group.

Setting Executive Compensation

Performance goals are determined early in the year for each executive officer and relate to milestones and/or achievements, which aim to facilitate the Company’s overall goals and objectives. These performance goals are assessed by the Compensation Committee. The Board makes the final determination in respect of setting the Company’s goals each year, based on the recommendation of the Compensation Committee. These objectives can be altered at the discretion of the Board if appropriate due to changes in business factors or conditions.

Following the end of the year, the Compensation Committee assesses the achievement of such objectives with input from the CEO and based on such assessment, determines an aggregate cash incentive bonus for each executive officer. The Compensation Committee approves the cash incentive bonus for the Company’s executive officers (other than the CEO), and recommends the cash incentive bonus for the CEO to the Board for approval. The Board has final approval authority for the cash incentive bonus for the CEO.

Grants of equity-based compensation is subject to the discretion of the Compensation Committee and Board, which is determined annually based on the consideration of a variety of factors and is not subject to any minimum amount.

As part of its review of the executive compensation and incentive programs, the Compensation Committee retains external independent consultants to review and provide benchmark data of a comparable group of companies. The Compensation Committee believes that it is important when making its compensation decisions to be informed as to the current practices of comparable public companies with which we compete for top talent.

During 2023, the Compensation Committee engaged WTW to assist in updating the benchmarking data and provide advice on the total direct compensation (base salary, annual short and long-term incentives) for the NEOs (and the Company’s other officers) for the 2023 fiscal year. The Compensation Committee must pre-approve any additional services that WTW would provide to the Company at the request of management of the Company.

As part of its 2023 benchmarking and review process, WTW (in consultation with the Compensation Committee) developed a comparator group, comprising 22 Canadian and U.S.-listed companies (the "2023 Peer Group"). The 2023 Peer Group includes multiple entities from the peer group selected for the 2022 compensation review but has removed and added various entities that are more comparable to the Company's size and status of operations. Selection for the 2023 Peer Group included industry classification, revenue, market capitalization, trailing 12-month market capitalization, employee base, research and development expenses, and business focus. The Company’s market capitalization at the time of selecting the 2023 Peer Group slightly fell below into the middle of the market cap range. The equity data used by WTW was obtained from public proxy filings and Radford’s 2022 Global Life Sciences survey (mid-size public company data used for equity benchmarking). The 2023 Peer Group consisted of the following 22 public companies:

18

| AbCellera Biologics Inc. | Kymera Therapeutics, Inc. | Travere Therapeutics, Inc. | ||||||

| Aerie Pharmaceuticals, Inc. | MacroGenics, Inc. | Xencor, Inc. | ||||||

| Akebia Therapeutics, Inc. | Nektar Therapeutics | Y-mAbs Therapeutics, Inc. | ||||||

| Apellis Pharmaceuticals, Inc. | Omeros Corporation | Zymeworks Inc. | ||||||

| ChemoCentryx, Inc. | Reata Pharmaceuticals, Inc. | |||||||

| Chinook Therapeutics, Inc. | REGENXBIO Inc. | |||||||

| Insmed Incorporated | Revance Therapeutics, Inc. | |||||||

| Halozyme Therapeutics, Inc. | Sorrento Therapeutics, Inc. | |||||||

| Karyopharm Therapeutics Inc. | TG Therapeutics, Inc. | |||||||

WTW provided the Compensation Committee with its assessment of competitive market practice with respect to NEO total direct compensation based on the benchmarking work it performed. The Compensation Committee considered the competitive market data provided by WTW where appropriate and in conjunction with its own assessment of competitive compensation requirements as well as management recommendations.

The elements of compensation are targeted at ensuring that the compensation paid by the Company to its executive officers remains in a reasonably competitive range as compared to its comparator group. The compensation philosophy at a minimum is to focus on 50th percentile positioning for comparable roles in the comparator group with upside or downside based on performance, market demand and recognition of other inputs.

2023 Executive Compensation Program

Base Salary

The base salaries of our executive officers are designed to compensate them for day-to-day services rendered during the fiscal year. Appropriate base salaries are used to recognize the experience, skills, knowledge and responsibilities required of each executive officer and to allow us to attract and retain individuals capable of leading us to achieve our business goals in competitive market conditions.