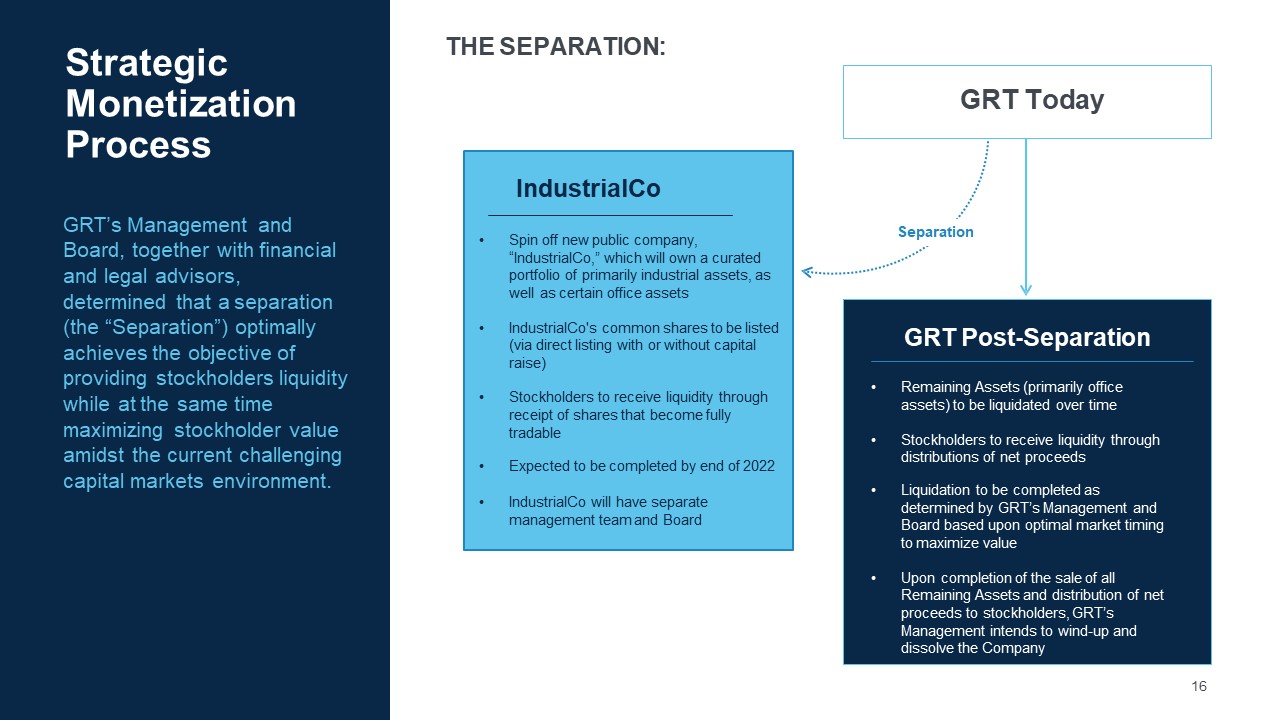

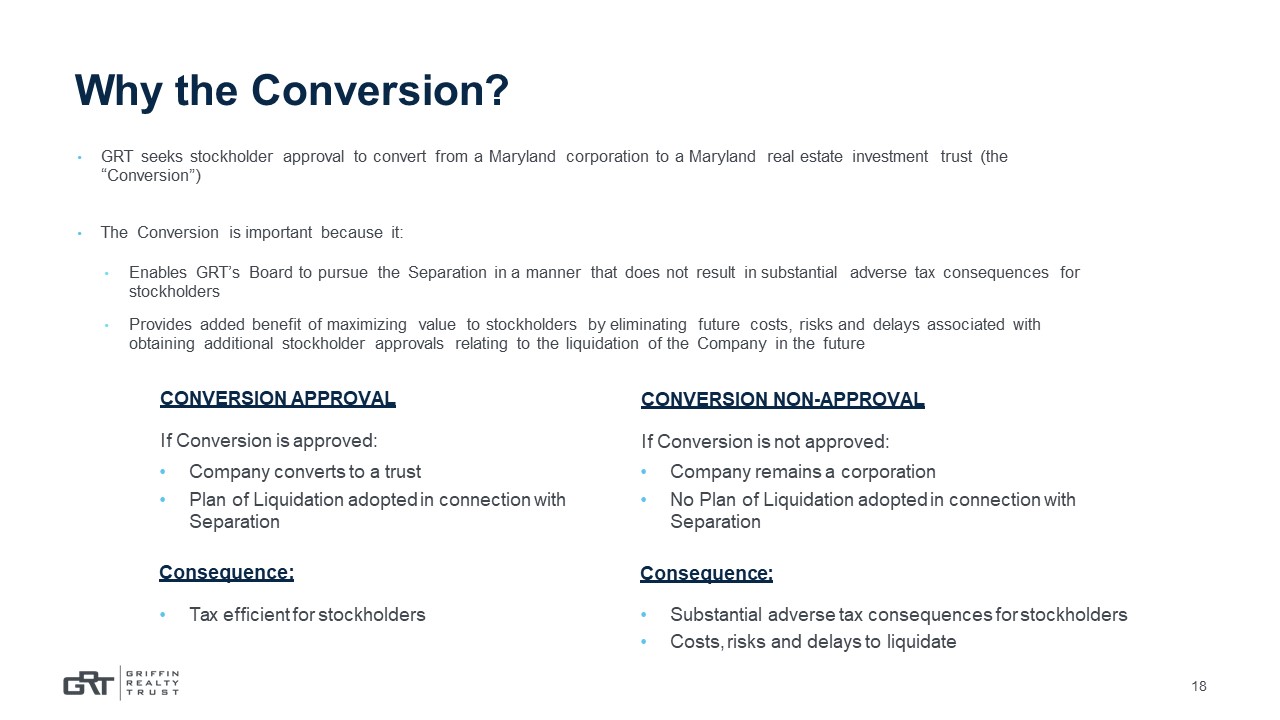

Disclosures 2 Forward-Looking Statements This presentation contains forw ard-looking statements w ithin the meaning of the Private Securities Litigation Reform Act of 1995 based on current expectations, forecasts and assumptions that involve risks and uncertainties that could cause actual outcomes and results to differ materially. Forw ard-looking statements relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends and similar expressions concerning matters that are not historical facts. In some cases, you can identify forw ard-looking statements by the use of forw ard-looking terminology such as “may,” “w ill,” “should,” “expects,” “intends,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” or “potential” or the negative of these w ords and phrases or similar w ords or phrases w hich are predictions of or indicate future events or trends and w hich do not relate solely to historical matters. You can also identify forw ard-looking statements by discussions of strategy, plans or intentions. The forw ard-looking statements contained in this presentation reflect the Company's current view s about future events and are subject to numerous know n and unknow n risks, uncertainties, assumptions and changes in circumstances that may cause the Company's actual results to differ significantly from those expressed in any forw ard-looking statement. The follow ing factors, among others, could cause actual results and future events to differ materially from those set forth or contemplated in the forw ard-looking statements: general economic and financial conditions; market volatility; inflation; any potential recession or threat of recession; interest rates; the impact of the COVID-19 pandemic and resulting economic disruption on the markets in w hich w e operate and on w ork-from-home trends, occupancy, rent deferrals and the financial condition of the Company’s tenants; w hether any easing of the pandemic or other factors w ill impact the attractiveness of industrial and/or office assets; w hether w e w ill be successful in renew ing leases as they expire, including the office leases in the approximately 10% of lease expirations scheduled to occur prior to or at the end of 2023 (as a percentage of our contractual base rent before abatements and deducting base year operating expenses for gross and modified gross leases); future financial and operating results, plans, objectives, expectations and intentions; expected sources of financing and the availability and attractiveness of the terms of any such financing; legislative and regulatory changes that could adversely affect our business; w hether w e w ill continue to publish our net asset value on an annual basis, more frequently or at all; our future capital expenditures, operating expenses, net income, operating income, cash flow and developments and trends of the real estate industry; w hether the Separation (as defined below ) w ill maximize stockholder value; w hether a national securities exchange admit IndustrialCo (as defined below ) shares for trading; w hether any listing of IndustrialCo shares on the New York Stock Exchange w ill be accompanied by a capital raise; w hether w e w ill be successful in liquidating the Company follow ing the Separation by selling the remaining assets of the Company (the “Remaining Assets”) at the optimal time and in the optimal manner, as determined by our management and Board; w hether the Conversion (as defined below ) w ill qualify as a tax-free F reorganization; w hether the Separation w ill occur before the end of 2022 or at all; w hether w e w ill effect the Separation at the time and in a manner that maximizes value for the Company’s stockholders; w hether the Board w ill abandon the Separation after determining that it is no longer inthe best interests of our stockholders to pursue the Separation; w hen stockholders w ill receive any net proceeds in connection w ith the disposition of the Remaining Assets; w hether w e w ill succeed in our investment objectives; w hether the combination of net proceeds from the ultimate sale of your shares of IndustrialCo and the distribution of the net proceeds by the Company from the sale of the Remaining Assetsw ill equal our current NAV; any fluctuation and/or volatility of the trading price of IndustrialCo shares; the amount of the net proceeds to be received by our stockholders from the sale of the Remaining Assets;statements about the expected benefits of the Conversion and/or the Separation; our ability to find purchasers for the Remaining Assets on such terms as our Board determines to be in the best ni terests of our stockholders; unanticipated difficulties or expenditures relating to the Conversion and/or the Separation or the pursuit of sales of our Remaining Assets; the response of stockholders, tenants, business partners and competitors to the announcement of the Conversion and/or the Separation; legal proceedings that may be instituted against us and others related to the Conversion and/or the Separation; risks associated w ith our dependence on key personnel w hose continued service is not guaranteed; risks related to the disruption of management’s attention from ongoing business operations due to pursuit of strategic initiatives; and other factors, including those risks disclosed in Part I, Item 1A. “Risk Factors” and Part II, Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations” of the Company's most recent Annual Report on Form 10-K and Part I, Item 2. “Management’s Discussion and Analysis of Financial Condition and Results of Operations” of the Company's Quarterly Reports on Form 10-Q filed w ith the U.S. Securities and Exchange Commission. The Company cautions investors not to place undue reliance on these forw ard-looking statements and urge you to carefully review the disclosures it makes concerning risks. While forw ard- looking statements reflect the Company's good faith beliefs, assumptions and expectations, they are not guarantees of futureperformance. The forw ard-looking statements speak only as of the date of this presentation. Furthermore, the Company disclaims any obligation to publicly update or revise any forw ard- looking statement to reflect changes in underlying assumptions or factors, of new information, data or methods, future events or other changes.