- PKST Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Peakstone Realty Trust (PKST) DEF 14ADefinitive proxy

Filed: 29 Apr 24, 4:34pm

☐ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material pursuant to Rule §240.14a-12 |

| ☒ | | | No fee required. |

| ☐ | | | Fee paid previously with preliminary materials. |

| ☐ | | | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a6(i)(1) and 0-11. |

| | | Sincerely, | |

| | |  | |

| | | Michael J. Escalante | |

| | | Chief Executive Officer & President |

| Proposal | | | Page # | | | Board Recommendation |

| #1 – Election of five trustees to our Board of Trustees, each to serve until the 2025 annual meeting of shareholders and until their successors are duly elected and qualify | | | | | VOTE FOR | |

| #2 – Ratification of the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2024 | | | | | VOTE FOR | |

| #3 – Approval of, on an advisory (non-binding) basis, the compensation paid to the Company’s Named Executive Officers as described in the proxy statement | | | | | VOTE FOR | |

| #4 – Approval of an amendment to the Peakstone Realty Trust Second Amended and Restated Employee and Trustee Long-Term Incentive Plan as described in the proxy statement | | | | | VOTE FOR |

| | | By Order of the Board of Trustees, | |

| | | ||

| | |  | |

| | | Nina Momtazee Sitzer | |

| | | Chief Operating Officer, Chief Legal Officer, and Secretary |

| • | Carrie DeWees, former Managing Principal, Allstate Investments |

| • | Michael J. Escalante, Chief Executive Officer and President, Peakstone Realty Trust |

| • | Jeffrey Friedman, Senior Advisor, Mesa West Capital |

| • | Samuel Tang, Managing Partner and Co-Founder, TriGuard Management LLC and Montauk TriGuard Management Inc. |

| • | Casey Wold, former Chief Executive Officer and Managing Partner, Vanderbilt Office Properties |

| • | presides at executive sessions of the independent trustees; |

| • | serves as the focal point of communication to the Board of Trustees regarding management plans and initiatives; |

| • | ensures that the role between Board of Trustees oversight and management operations is respected; |

| • | provides the medium for informal dialogue with and among independent trustees, allowing for free and open communication within that group; and |

| • | serves as the communication conduit for third parties who wish to communicate with the Board of Trustees. |

| • | high personal and professional ethics and integrity; |

| • | an ability to exercise sound judgment, including in relation to the Company’s business and strategy; |

| • | an ability to make independent analytical inquiries; |

| • | an ability and willingness to devote sufficient time and resources to diligently perform Board of Trustees duties, including attending regular and special Board of Trustees and/or committee meetings; |

| • | appropriate and relevant business experience and acumen; and |

| • | a reputation, both personal and professional, consistent with the image and reputation of the Company. |

| • | whether the person possesses specific industry knowledge, expertise and/or contacts, including in the real estate industry generally, and familiarity with general issues affecting the Company’s business; |

| • | whether the person’s nomination and election would enable the Board of Trustees to have a member that qualifies as an “audit committee financial expert” as such term is defined by the SEC in Item 407 of Regulation S-K; |

| • | whether the person would qualify as an “independent” trustee under the rules of the NYSE and the Company’s Corporate Governance Guidelines; |

| • | the importance of continuity of the existing composition of the Board of Trustees; |

| • | whether the person possesses knowledge and expertise in various areas deemed appropriate by the Board of Trustees; |

| • | fit of the individual’s skills, experience and personality with those of other trustees in maintaining an effective, collegial, and responsive Board of Trustees; and |

| • | diversity, age, background, education, skills and experience, as well as the restrictions, requirements and recommendations concerning those matters under applicable law and the NYSE rules in relation to the full Board of Trustees and/or the individual trustees. |

| Name | | | Age | | | Position(s) | | | Trustee Since |

| Carrie DeWees | | | 60 | | | Independent Trustee | | | 4/2023 - present |

| Michael J. Escalante | | | 63 | | | Chief Executive Officer, President and Trustee | | | 2/2015 - present |

| Jeffrey Friedman | | | 61 | | | - | | | - |

| Samuel Tang | | | 63 | | | Independent Trustee | | | 2/2015 - present |

| Casey Wold | | | 66 | | | Non-Executive Chairperson and Independent Trustee | | | 4/2023 - present |

| | | Carrie DeWees has been an independent trustee since April 2023 and is a member of our Audit Committee and Nominating and Corporate Governance Committee. Ms. DeWees served as a managing principal of Allstate Investments from 2011 to April 2023, where she managed an approximately $800 million commercial real estate portfolio including industrial, multi family, retail, office and self-storage assets. Ms. DeWees also served as director of asset management of Allstate’s direct $1.0 billion portfolio from 2012 to 2021. Prior to joining Allstate, DeWees spent the majority of her career working for real estate investment advisors including JMB Realty, Heitman, Henderson Global Investors |

| American Realty Advisors. Ms. DeWees is a graduate of Northern Illinois University where she received a Bachelor of Science degree in Accountancy and DePaul Driehaus College of Business where she received an MBA in Finance and Real Estate. Ms. DeWees is a Registered Certified Public Accountant. | |||

| | | Michael J. Escalante is our Chief Executive Officer, President and a trustee. He has been our President since November 2013, a trustee since February 2015, and our Chief Executive Officer since April 2019. Mr. Escalante served as Chief Executive Officer of Griffin Capital Essential Asset REIT, Inc. (“EA-1”), one of our predecessor entities, from December 2018 to April 2019; President of EA-1 from June 2015 to April 2019; Chief Investment Officer of EA-1 from August 2008 to December 2018; and Vice President of EA-1 from August 2008 to June 2014. Mr. Escalante also served as Chief Investment Officer of Griffin Capital Company, LLC (“GCC”), our former sponsor, |

| from June 2006 until December 2018. He also served as a member of the investment committee of the advisor of GIA Real Estate Fund from June 2014 to March 2020, as well as serving on the investment committee of various former Griffin American Healthcare REIT entities. Prior to joining GCC in June 2006, Mr. Escalante founded Escalante Property Ventures in March 2005, a real estate investment management company, to invest in value-added and development-oriented infill properties within California and other western states. From 1997 to March 2005, Mr. Escalante served eight years at Trizec Properties, Inc., previously one of the largest publicly-traded U.S. office real estate investment trusts (“REITs”), with his final position being Executive Vice President - Capital Transactions and Portfolio Management. While at Trizec, Mr. Escalante was directly responsible for all capital transaction activity for the Western U.S., which included the acquisition of several prominent office projects. Mr. Escalante’s work experience at Trizec also included significant hands-on operations experience as the firm’s Western U.S. Regional Director with bottom-line responsibility for asset and portfolio management of a 4.6 million square foot office/retail portfolio (11 projects/23 buildings) and associated administrative support personnel (110 total/65 company employees). Prior to joining Trizec, from 1987 to 1997, Mr. Escalante held various acquisitions, asset management and portfolio management positions with The Yarmouth Group, an international real estate investment advisor. Mr. Escalante holds an M.B.A. from the University of California, Los Angeles and a B.S. in Commerce, with an emphasis in finance and accounting, from Santa Clara University. Mr. Escalante is a full member of the Urban Land Institute and has been active in many charitable and civic organizations. | |||

| | | Jeffrey Friedman is a nominee for the Board of Trustees. Mr. Friedman is a Senior Advisor at Mesa West Capital, a private equity styled real estate investment firm that he co-founded in 2004 and was purchased by an affiliate of Morgan Stanley in 2018. Mr. Friedman served as the co-Chief Executive Officer of Mesa West from November 2004 to March 2023. Prior to co-founding Mesa West, Mr. Friedman was a principal at Maguire Partners, in charge of capital market activities from May 2000 to shortly after the firm’s $798 million IPO in June 2023. He was also a corporate lawyer |

| at Simpson Thacher & Barlett LLP before transitioning into real estate finance in 1994. Mr. Friedman has a J.D. and M.A. in Applied Economics from the University of Michigan and a B.A. from the University of California, Los Angeles (UCLA). Mr. Friedman is a member of the Mortgage Bankers Association Board of Directors and a board member of University of California, Los Angeles Ziman Real Estate Alumni Group. |

| | | Samuel Tang has been an independent trustee since 2015 and is the Chairperson of our Audit Committee and the Chairperson of our Compensation Committee. Mr. Tang has over 25 years of experience in private equity and real estate investing. From 2004 to the present, Mr. Tang has been a Managing Partner of TriGuard Management LLC and its affiliates, an entity which he co-founded and which acquires private equity secondary funds in the secondary market. He is responsible for capital raising, sourcing, analyzing, structuring and closing the acquisition of investments. From 1999 to 2004, Mr. Tang |

| was Managing Director, Equities, of Pacific Life Insurance Company, where he co-chaired the workout committee to maximize recovery on bond investments and worked on various strategic and direct equity investments. Before joining Pacific Life Insurance Company, from 1989 to 1999, he was a Managing Partner at The Shidler Group, a specialized private equity firm focused on finance, insurance and real estate companies. Mr. Tang was also previously a Manager in Real Estate Consulting with KPMG Peat Marwick Main and a Senior, CPA with Arthur Young. Mr. Tang has an M.B.A. in Finance from the University of California, Los Angeles and a B.S. in Accounting from the University of Southern California. Mr. Tang also currently serves in leadership positions, including as a member of both fiduciary and advisory boards with several real estate firms, corporate and non-profit entities. | |||

| | | Casey Wold has been an independent trustee and the non-executive Chairperson of the Board of Trustees since April 2023, and is the Chairperson of our Nominating and Corporate Governance Committee and a member of our Compensation Committee. Mr. Wold has over 40 years of real estate experience and most recently founded Vanderbilt Office Properties, a real estate investment and management company, where he has served as Chief Executive Officer and Managing Partner since 2014. Previously, Mr. Wold served as Senior Managing Director of Tishman Speyer and was a member |

| of its Investment and Management committees from 2004 to 2014. He was responsible for the Midwest, Atlanta, Boston and Washington, DC, regions that included over $5.0 billion of real estate acquisitions and developments. Before joining Tishman, Mr. Wold served as President of TrizecHahn Office Properties, where he spearheaded the investment strategy and growth of its office portfolio, which totaled $5.0 billion in assets (50 million square feet) and Chief Investment Officer and Chief Operating Officer of Trizec Office Properties. Mr. Wold also previously served as Executive Vice President and the head of the U.S. Acquisition Group for Equity Office Properties (a Sam Zell entity), which eventually became the largest U.S. office REIT in the country. Prior to Equity Office Properties, Mr. Wold held executive positions with the Cambridge Companies, Wells Fargo Realty Advisors and First National Bank of Chicago. Mr. Wold has previously served on the boards of Trizec Properties (NYSE) and Captivate Networks, Inc. and most recently with CTO Realty Growth, Inc. (NYSE), serving on the Governance and Compensation Committees. Mr. Wold is a graduate of the University of Illinois where he received a Bachelor of Science degree in Finance and Southern Methodist University where he received a M.S. in Real Estate. | |||

| • | For each member of the Board of Trustees: |

| ○ | An annual cash retainer of $90,000 for each non-employee trustee, prorated for any partial year during which the trustee serves on the Board of Trustees. |

| ○ | An annual equity award of restricted common shares with a dollar denominated value of $90,000, 50% of which vests immediately upon grant and 50% of which vests upon the one-year anniversary of the grant. |

| • | For the non-executive chairperson of the Board of Trustees: |

| ○ | An additional $60,000 annual cash retainer, prorated for any partial year during which the non-employee trustee serves as non-executive chairperson of the Board of Trustees. |

| ○ | An additional annual equity award of restricted common shares with a dollar denominated value of $60,000, 50% of which vests immediately upon grant and 50% of which vests upon the one-year anniversary of the grant. |

| • | For the chairperson of each of the Audit, Compensation, and Nominating and Corporate Governance Committee: |

| ○ | An additional annual cash retainer of $20,000, $15,000, and $15,000, respectively, prorated for any partial year during which the trustee serves as such chairperson. |

Name(1) | | | Fees Earned or Paid in Cash ($) | | | Stock Awards(4) ($) | | | Total ($) |

Kathleen S. Briscoe(2) | | | $42,500 | | | $— | | | $42,500 |

| Gregory M. Cazel | | | $90,000 | | | $90,006 | | | $180,006 |

Carrie DeWees(3) | | | $64,500 | | | $90,006 | | | $154,506 |

Ranjit M. Kripalani(2) | | | $42,500 | | | $— | | | $42,500 |

James F. Risoleo(2) | | | $42,500 | | | $— | | | $42,500 |

J. Grayson Sanders(2) | | | $42,500 | | | $— | | | $42,500 |

Kevin A. Shields(2) | | | $— | | | $— | | | $— |

| Samuel Tang | | | $115,083 | | | $90,006 | | | $205,089 |

Casey Wold(3) | | | $118,250 | | | $150,036 | | | $268,286 |

| (1) | Michael J. Escalante, our Chief Executive Officer and President and a member of our Board of Trustees, is not included in the table above as he was an executive officer of the Company during 2023 and, therefore, did not receive any additional compensation for the services that he provided as a trustee. The compensation paid to or earned by Mr. Escalante as our Chief Executive Officer and President is included in the Summary Compensation Table. |

| (2) | Kathleen S. Briscoe, Ranjit M. Kripalani, James F. Risoleo, J. Grayson Sanders and Kevin A. Shields each resigned from the Board of Trustees on April 13, 2023. In connection with such resignations, all unvested restricted shares held by such trustees as of his or her resignation date vested in full as of such date. None of such trustees received a restricted share award in 2023. |

| (3) | Carrie DeWees and Casey Wold were appointed to the Board of Trustees on April 13, 2023. |

| (4) | The amounts shown in this column reflect the grant date fair value of restricted share awards granted to each of our non-employee trustees calculated in accordance with ASC Topic 718. As of December 31, 2023, our non-employee trustees held the following numbers of unvested restricted shares: Mr. Cazel – 1,135 shares; Ms. DeWees – 1,135 shares; Mr. Tang – 1,135 shares; and Mr. Wold – 1,892 shares. |

| • | the responsibilities and qualifications of trustees, including trustee independence; |

| • | the functioning of the Board of Trustees; |

| • | the election and role of the Chairperson or Lead Trustee, as applicable; |

| • | the responsibilities, composition and functioning of the Board of Trustees’ committees; |

| • | principles of and policies relating to trustee compensation, orientation and continuing education, retention of outside advisors, related party transactions and resignation (as further detailed below); |

| • | share ownership requirements; |

| • | executive compensation and chief executive officer succession planning; |

| • | the annual review and self-evaluation of the Board of Trustees and its committees. |

| • | honest and ethical conduct, including the ethical handling of actual or apparent conflicts of interest between personal and professional relationships; |

| • | full, fair, accurate, timely and understandable disclosure in our SEC reports and other public communications; |

| • | compliance with applicable governmental laws, rules and regulations; |

| • | prompt internal reporting of violations of the Code to appropriate persons identified in the Code; and |

| • | accountability for adherence to the Code. |

| • | our accounting and financial reporting processes and discussing these with senior management; |

| • | the integrity and audits of our consolidated financial statements and financial reporting process; |

| • | the annual independent audit of our financial statements, the engagement and retention of our registered independent public accounting firm and the evaluation of the qualifications, independence and performance of our independent registered public accounting firm, including the provision of non-audit services; |

| • | our compliance with the recommendations and observations of our internal auditor and independent registered public accounting firm; |

| • | the role and performance of our internal audit function; |

| • | our systems of disclosure controls and procedures, internal control over financial reporting and other financial information; |

| • | our compliance with financial, legal and regulatory requirements related to our consolidated financial statements and other public financial disclosures, our compliance with our policies related thereto and our policy in respect of tax planning; |

| • | our overall risk profile and risk management policies, including matters related to cybersecurity; |

| • | the fulfillment of the other responsibilities set forth in the charter of our Audit Committee or otherwise assigned to it by the Board of Trustees; and |

| • | preparation of an Audit Committee report as required by the SEC for inclusion in our annual proxy statement. |

| • | responsibility for matters relating to compensation of the Company’s Chief Executive Officer, other executive officers and trustees, taking into consideration, among other factors, any shareholder vote on compensation; |

| • | implementation and administration of our incentive compensation plans and equity-based plans; |

| • | oversight of the Company’s preparation of the Compensation Discussion & Analysis for inclusion in our proxy statement and/or annual report on Form 10-K; and |

| • | preparation and submission of a Compensation Committee report for inclusion in our proxy statement and/or annual report on Form 10-K. |

| • | identifying, recruiting and recommending to the full Board of Trustees qualified candidates for nomination by the Board of Trustees to be elected as trustees by the Company’s shareholders at the annual meeting of shareholders or to fill Board of Trustees vacancies consistent with criteria approved by the Board of Trustees; |

| • | recommending to the Board of Trustees nominees for each Board of Trustees committee and ensuring that such nominees and any incumbent members comply with any legal or regulatory membership criteria; |

| • | developing and recommending to the Board of Trustees a set of Corporate Governance Guidelines applicable to the Company and implementing and monitoring such guidelines as adopted by the Board of Trustees; |

| • | overseeing the Board of Trustees’ compliance with financial, legal and regulatory requirements, including applicable NYSE requirements and its ethics program as set forth in the Code of Business Conduct and Ethics; |

| • | reviewing and making recommendations to the Board of Trustees on matters involving the general operation of the Board of Trustees, including the Board of Trustees’ size and composition (subject to the Company’s Declaration of Trust and applicable laws) and committee structure and composition; |

| • | assisting management in the preparation of the disclosure regarding trustee independence and the operations of the Nominating and Corporate Governance Committee as required by the SEC to be included in the Company’s annual proxy statement; |

| • | reviewing all related party transactions in accordance with the Company’s Related Party Transaction Policy; |

| • | overseeing the Board of Trustees’ evaluation of management; |

| • | periodically, but no less than annually facilitating the assessment of the Board of Trustees’ performance as a whole and of individual trustees and the Board of Trustee’s committees, as required by applicable law, regulations and the NYSE corporate governance standards; |

| • | overseeing and periodically reviewing and discussing with management and the Board of Trustee’s policies, programs and practices relating to ESG matters; and |

| • | considering corporate governance issues that may arise from time to time and making recommendations to the Board of Trustee’s with respect thereto. |

| Name | | | Age | | | Position(s) | | | Period with Company |

| Michael J. Escalante | | | 63 | | | Chief Executive Officer, President, and Trustee | | | 11/2013 - present |

| Javier F. Bitar | | | 62 | | | Chief Financial Officer and Treasurer | | | 6/2016 - present |

| Nina Momtazee Sitzer | | | 56 | | | Chief Operating Officer, Chief Legal Officer, and Secretary | | | 6/2019 - present |

Name and Address of Beneficial Owner(1) | | | Number of Common Shares and OP Units(2) | | | Percentage of all Common Shares(3) | | | Percentage of all Common Shares and OP Units(4) |

Trustees and Executive Officers | | | | | | | |||

Michael J. Escalante, Chief Executive Officer and President(5) | | | 120,390 | | | * | | | * |

| Javier F. Bitar, Chief Financial Officer and Treasurer | | | 28,164 | | | * | | | * |

| Nina Momtazee Sitzer, Chief Operating Officer, Chief Legal Officer, and Secretary | | | 13,865 | | | * | | | * |

| Louis K. Sohn, Executive Vice President | | | 11,100 | | | * | | | * |

| Scott A. Tausk, Executive Vice President | | | — | | | * | | | * |

| Gregory M. Cazel, independent trustee | | | 7,285 | | | * | | | * |

| Carrie DeWees, independent trustee | | | 1,135 | | | * | | | * |

| Samuel Tang, independent trustee | | | 6,202 | | | * | | | * |

| Casey Wold, independent trustee | | | 1,892 | | | * | | | * |

| Jeffrey Friedman, trustee nominee | | | — | | | * | | | * |

All trustees and executive officers as a group (seven persons)(6) | | | 178,933 | | | 0.5% | | | 0.5% |

| 5% Shareholder | | | | | | | |||

The Vanguard Group(7) | | | 3,571,925 | | | 9.1% | | | 9.0% |

Kevin A. Shields(8) | | | 2,900,339 | | | 7.4% | | | 7.3% |

BlackRock, Inc.(9) | | | 2,720,467 | | | 6.9% | | | 6.9% |

| * | Represents less than 1% of our outstanding common shares as of April 16, 2024. |

| (1) | The address of each trustee, trustee nominee and NEO listed is 1520 E. Grand Avenue, El Segundo, California 90245. The address of Kevin A. Shields is 266 Kansas Street, El Segundo, California 90245. |

| (2) | The number of common shares and OP Units refers to beneficial ownership, which is determined in accordance with SEC rules and generally includes voting or investment power with respect to common shares and common shares issuable to the named person upon exchange of OP Units and common shares issuable pursuant to options, warrants and similar rights held by the respective person or group, in each case, that may be exercised or redeemed within 60 days following April 16, 2024). Except as otherwise indicated by footnote, (i) amounts represent common shares, and (ii) subject to community property laws where applicable, the persons named in the table above have sole voting and investment power with respect to all common shares shown as beneficially owned by them. |

| (3) | The total number of common shares deemed outstanding and used in calculating this percentage for the named person(s) is the sum of (a) 36,346,621 common shares outstanding as of April 16, 2024, (b) the number of common shares issuable to the named person pursuant to options, warrants and similar rights that may be exercised or redeemed within 60 days following April 16, 2024, and (c) the number of common shares issuable to the named person upon exchange of OP Units. All OP Units held by the named persons are currently redeemable for common shares or cash at our option. |

| (4) | The total number of common shares and OP Units deemed outstanding and used in calculating this percentage for the named person(s) is the sum of (a) 36,346,621 common shares outstanding as of April 16, 2024, (b) the number of common shares issuable to the named person pursuant to options, warrants and similar rights that may be exercised or redeemed within 60 days following April 16, 2024, and (c) 3,213,327 OP Units outstanding as of April 16, 2024 (other than OP Units held by us). |

| (5) | Excludes shares owned directly by Mr. Escalante’s spouse. |

| (6) | Includes trustees and current NEOs as of April 16, 2024. |

| (7) | Derived solely from information contained in a Schedule 13G filed with the SEC on February 13, 2024 by The Vanguard Group (“Vanguard”). Address: 100 Vanguard Boulevard, Malvern, Pennsylvania 19355. According to the Schedule 13G, Vanguard has shared voting power over 24,034 shares and sole and shared dispositive power over 3,514,556 and 57,369 shares, respectively. |

| (8) | Derived solely from information provided by Mr. Shields. According to Mr. Shields, this includes (i) 2,486,517 OP Units owned by Griffin Capital, LLC, (ii) 62,256 OP Units and 67,925 common shares owned by Griffin Capital Vertical Partners, L.P., (iii) 261,964 OP Units owned by The Shields 2009 Irrevocable Trust, and (iv) 10,529 OP Units and 11,148 common shares owned by Kevin A. Shields Family Trust, all of which are indirectly owned by Mr. Shields. |

| (9) | Derived solely from information contained in a Schedule 13G filed with the SEC on January 26, 2024 by BlackRock, Inc. Address: 50 Hudson Yards, New York, New York 10001. According to the Schedule 13G, BlackRock, Inc. has sole voting power over 2,651,831 shares and sole dispositive power over 2,720,467 shares. |

| | | 2023 | | | 2022 | |

| Audit Fees | | | $2,409,738 | | | $2,003,453 |

| Audit-Related Fees | | | 33,000 | | | 14,100 |

| Tax Fees | | | 669,537 | | | 847,548 |

| All Other Fees | | | — | | | 2,000 |

| Total | | | $3,112,275 | | | $2,867,101 |

| • | Audit Fees - These are fees for professional services performed for the audit of our annual financial statements and the required review of our quarterly financial statements and other procedures performed by the independent auditors to be able to form an opinion on our consolidated financial statements. These fees also cover services that are normally provided by independent auditors in connection with statutory and regulatory filings or engagements, and services that generally only an independent auditor reasonably can provide, such as services associated with filing registration statements, periodic reports and other filings with the SEC. These fees also include testing for REIT compliance. |

| • | Audit-Related Fees - These are fees for assurance and related services that traditionally are performed by an independent auditor. These fees include examination of operating expense reconciliation, audit of schedule of certain operating expenses and real estate taxes and access to an accounting research database. |

| • | Tax Fees - These are fees for all professional services performed by professional staff in our independent auditor’s tax division, which do not include services related to the audit of our financial statements. These include fees for tax compliance and routine on-call tax services. |

| • | All Other Fees - These are fees for other permissible services that do not meet one of the above-described categories, including assistance with internal audit plans and risk assessments. |

| | | Audit Committee: | |

| | | Samuel Tang (Chairperson) | |

| | | Gregory M. Cazel | |

| | | Carrie DeWees |

| • | attract, retain and motivate highly-skilled executives; |

| • | encourage management to balance short-term goals against longer-term objectives without incentivizing excessive risk-taking; |

| • | achieve an appropriate balance between risk and reward that does not incentivize excessive risk-taking; and |

| • | align the interests of management and shareholders through the use of equity-based compensation with multi-year vesting requirements. |

| • | Michael J. Escalante - Chief Executive Officer and President; |

| • | Javier F. Bitar - Chief Financial Officer and Treasurer; |

| • | Nina Momtazee Sitzer - Chief Operating Officer, Chief Legal Officer, and Secretary; |

| • | Louis K. Sohn - Former Executive Vice President(1); and |

| • | Scott A. Tausk - Former Executive Vice President(2). |

| (1) | On December 29, 2023, the Company and Mr. Sohn entered into a Separation Agreement, as described below, pursuant to which Mr. Sohn’s employment was terminated by the Company without cause on December 31, 2023. |

| (2) | On June 22, 2023, the Company and Mr. Tausk entered into a Separation and Consulting Agreement, pursuant to which Mr. Tausk’s employment was terminated by the Company without cause on June 30, 2023. |

| ○ | They found the Company’s executive compensation well aligned with performance and shareholder expectations; and |

| ○ | They appreciated that our 2023 Annual Meeting of Shareholders occurred shortly following the Listing and, at that time, more than 75% of our outstanding shares were held by retail shareholders, whose vote considerations often do not take into account best governance practices and peer group benchmarks. |

| • | attract, retain and motivate highly-skilled executives; |

| • | encourage management to balance short-term goals against longer-term objectives without incentivizing excessive risk-taking; |

| • | achieve an appropriate balance between risk and reward that does not incentivize excessive risk-taking; and |

| • | align the interests of management and shareholders through the use of equity-based compensation with multi-year vesting requirements. |

| • | We determine compensation arrangements for our executives based on market data and current market compensation trends, in consultation with our independent compensation consultant, as discussed under the headings “Peer Group” and “Elements of Compensation” below. |

| • | We reward our NEOs using a balanced approach that incorporates cash incentives and long-term equity and includes an assessment of the Company’s financial and operational results as well as individual performance achievements. |

| • | Approximately 45% of our CEO’s total target compensation and on average 33% of our other NEOs’ total target compensation (for the NEOs who were active at the end of the fiscal year 2023) is delivered in the form of equity incentives with three-year vesting to promote retention and alignment with the interests of our shareholders. |

| What We Do | | | What We Do Not Do | ||||||

| ✓ | | | Compensation Committee comprised solely of independent trustees | | | X | | | No guarantees for salary increases or uncapped bonus payments |

| ✓ | | | Advised by independent compensation consultant | | | X | | | No single-trigger change in control severance payments |

| ✓ | | | Performance metrics aligned with business objectives and strategic priorities | | |||||

| | X | | | No repricing or cash buyout of stock options or share appreciation rights without shareholder approval | |||||

| ✓ | | | Significant portion of total compensation allocated to equity awards with long-term vesting | | |||||

| ✓ | | | Share ownership guidelines for executive officers, with ownership requirement of 5x annual base salary for the CEO | | | | | ||

| ✓ | | | Annually assess risk in compensation programs | | | | | ||

| • | We removed several companies that were outside of the market capitalization range from the 2022 Executive Compensation Peer Group, including Douglas Emmett, Inc., First Industrial Realty Trust, Inc., Highwoods Properties, Inc., Kilroy Realty Corporation, Rexford Industrial Realty, Inc., Spirit Realty Capital, Inc. and STAG Industrial, Inc. Additionally, PS Business Parks, Inc. and STORE Capital Corporation were acquired and accordingly removed from the Peer Group. |

| • | To ensure balance in respect of the selection criteria above, we added: CareTrust REIT, Inc., Equity Commonwealth, Innovative Industrial Properties, LTC Properties, Inc., Orion Office REIT Inc., Paramount Group, Inc., Plymouth Industrial REIT, Inc. and Retail Opportunity Investments Group. |

| 2023 Executive Compensation Peer Group | ||||||

| Brandywine Realty Trust | | | Innovative Industrial Properties, Inc. | | | Paramount Group, Inc. |

| CareTrust REIT, Inc. | | | JBG SMITH Properties | | | Plymouth Industrial REIT, Inc. |

| Empire State Realty Trust, Inc. | | | LTC Properties, Inc. | | | Retail Opportunity Investments Group |

| Equity Commonwealth | | | LXP Industrial Trust | | | Terreno Realty Corporation |

| Hudson Pacific Properties, Inc. | | | Orion Office REIT Inc. | | | |

| Named Executive Officer | | | 2022 Salary | | | 2023 Salary | | | % Change |

| Michael J. Escalante | | | $925,000 | | | $925,000 | | | 0% |

| Javier F. Bitar | | | $525,000 | | | $525,000 | | | 0% |

| Nina Momtazee Sitzer | | | $500,000 | | | $500,000 | | | 0% |

| Louis K. Sohn | | | $350,000 | | | $350,000 | | | 0% |

| Scott A. Tausk | | | $350,000 | | | $350,000 | | | 0% |

| Named Executive Officer | | | Threshold | | | Target | | | Maximum |

| Michael J. Escalante | | | 175% | | | 250% | | | 325% |

| Javier F. Bitar | | | 100% | | | 150% | | | 200% |

| Nina Momtazee Sitzer | | | 100% | | | 150% | | | 200% |

| Louis K. Sohn | | | 75% | | | 125% | | | 175% |

| Scott A. Tausk | | | 75% | | | 125% | | | 175% |

| | | Strategic Objective | | | Points Assigned (#) | | | Achieved Results | | | Points Earned (#) | |

| 1 | | | Listing | | | 1 | | | Completed Listing and began trading on 4/13/23. | | | 1 |

| | | | | | | | | |||||

| 2 | | | Successfully establish new institutional investor relationships and maintain current retail investor relationships | | | 1 | | | • Successfully completed non-deal roadshow prior to Listing, which included over 40 virtual and in-person investor meetings. • Held over 40 one-on-one meetings at NAREIT, Bank of America REIT, and Wells Net Lease Conferences. • Based on fourth quarter results, achieved institutional buying that has continued to outweigh selling. • Closed the year with a shareholder base that was approximately 40% institutional and 60% retail, reflecting robust growth in institutional ownership since Listing. | | | 1 |

| | | | | | | | | |||||

| 3 | | | Maintain strong banking relationships | | | 1 | | | Communication: Held meetings with all of our major banks regularly in NYC and LA throughout the year including at the NAREIT Conferences; maintained ongoing regular dialogue with all our banks. Secured Debt Success: We entered into an agreement with AIG that is intended to facilitate the disposition of the mortgaged properties under the Company’s two non-recourse portfolio mortgage loans with AIG without regard to the original release prices, and support the repayment of such loans. | | | 1 |

| | | | | | | | | |||||

| 4 | | | Establish research coverage | | | 1 | | | • Secured analyst coverage from both Truist and Bank of America. • Engaged with several other firms to potentially expand analyst coverage in the future. | | | 1 |

| | | | | | | | |

| | | Strategic Objective | | | Points Assigned (#) | | | Achieved Results | | | Points Earned (#) | |

| 5 | | | Set stage / meaningful progress for inclusion in REIT and non-REIT industry index | | | 1 | | | • Achieved inclusion in 119 separate indices as of year-end including the indices that are perceived to be the most important in the REIT industry (i.e., the MSCI US REIT index) and the non-REIT industry (i.e., the Russell 2000 index). | | | 1 |

| | | | | | | | | |||||

| 6 | | | Successfully operate as a publicly listed company, including compliance with regulatory environment, effective board engagement and communication, and effective shareholder communication | | | 1 | | | Financial Metrics: • Improved our Net Debt/EBITDA ratio from 7.7x to 6.2x (which is on the precipice of our 6.0 stated target range). • Closed the year with $392 million in cash on hand and $159 million of available undrawn capacity under our credit facility, for total liquidity of approximately $551 million. Market Preparation: Prepared to take advantage of efficient ways to raise capital in the public markets by putting a $200 million ATM equity program in place for use when the timing is right. Risk Management: Implemented controls to meet standards of SOX 404B and finished the year with no significant or material deficiencies. Board of Trustees Communication: • Provided comprehensive materials for all Board of Trustees and Committee meetings and updated the Board of Trustees between meetings. IR: • Established an effective communication system to address shareholder inquiries. • Maintained retail investor support (60% of our shareholder base at year end 2023) through this communication system. Reporting: • Revamped and rebranded the Company to Peakstone and launched a fully redesigned website (updated quarterly) to reposition the Company post-Listing in a manner consistent with the market and our strategy. • Implemented the quarterly production and presentation of the Supplemental, which is utilized by the institutional investor and analyst communities to assist with the valuation and understanding of the Company’s underlying business and financial condition using many GAAP and Non-GAAP metrics. | | | 1 |

| | | | | | | | |

| | | Strategic Objective | | | Points Assigned (#) | | | Achieved Results | | | Points Earned (#) | |

| 7 | | | Establish relationship with credit rating agency | | | 1 | | | • Met with rating agencies and Rating Agency groups within our banker group on multiple occasions. • We are positioned to move forward with achieving an Investment Grade Rating at the right time. | | | 1 |

| | | | | | | | ||||||

| 8/9 | | | Execute Strategic Disposition Program | | | 1 - $200 mm gross sales price 1 - $300 mm gross sales price | | | • Sold 11 properties totaling $326 million in gross proceeds. • Despite challenging markets, we successfully met this goal by employing various creative tactics to effectuate sales while limiting risks. | | | 2 |

| | | | | | | | | |||||

| 10 | | | Preferred shares payoff | | | 1 | | | • Completed payoff at Par ($125 million) prior to 4/10/23 (three days before the Listing). | | | 1 |

| | | | | | | | | |||||

| 11/12 | | | Amend and extend Credit Facility | | | 2 | | | • In March 2023, completed an amendment extending the revolver to January 2026 and modifying certain covenants. • 15 of 15 banks supported the extension. | | | 2 |

| TOTAL POINTS EARNED | | | | | 12 | |||||||

| Performance Assessment | | | Threshold | | | Target | | | Maximum | | | Actual |

| Objectives Achieved | | | 4 of 12 | | | 7 of 12 | | | 11 of 12 | | | 12 of 12 |

| Named Executive Officer | | | 2023 Base Salary | | | Target Award Opportunity (% of base salary) | | | Target Award Opportunity ($) | | | Performance Factor (% of target) | | | Final Annual 2023 Bonus ($) |

| Michael J. Escalante | | | $925,000 | | | 250% | | | $2,312,500 | | | 130% | | | $3,006,250 |

| Javier F. Bitar | | | $525,000 | | | 150% | | | $787,500 | | | 133% | | | $1,050,000 |

| Nina Momtazee Sitzer | | | $500,000 | | | 150% | | | $750,500 | | | 133% | | | $1,000,000 |

| Named Executive Officer | | | Value of RSUs ($) | | | Number of RSUs(1) |

| Michael J. Escalante | | | $3,499,976 | | | 52,340 |

| Javier F. Bitar | | | $999,974 | | | 14,954 |

| Nina Momtazee Sitzer | | | $999,974 | | | 14,954 |

| Louis K. Sohn | | | $499,987 | | | 7,477 |

| Scott A. Tausk | | | $499,987 | | | 7,477 |

| (1) | The number of RSUs granted was determined by dividing the dollar denominated value of the award by the Company’s published NAV as of June 30, 2022. |

| Named Executive Officer | | | Value of RSUs ($) | | | Number of RSUs(1) |

| Michael J. Escalante | | | $3,500,000 | | | 216,987 |

| Javier F. Bitar | | | $1,000,000 | | | 61,996 |

| Nina Momtazee Sitzer | | | $1,000,000 | | | 61,996 |

| (1) | The number of RSUs granted was determined by dividing the dollar denominated value of the award by the per share closing price of our common shares on the last trading date prior to the grant date. |

| Executive Level | | | Equity Ownership Level |

| Chief Executive Officer | | | 5x base salary |

| All Other Executive Officers | | | 3x base salary |

| • | none of our executive officers was a trustee of another entity where one of that entity’s executive officers served on our Compensation Committee; |

| • | no member of the Compensation Committee was an officer or employee of the Company or any of its subsidiaries, nor was any member of the Compensation Committee formerly an officer or employee of the Company or any of its subsidiaries; |

| • | no member of the Compensation Committee entered into any transaction with our Company in which the amount involved exceeded $120,000; |

| • | none of our executive officers served on the compensation committee of any entity where one of that entity’s executive officers served on our Compensation Committee; and |

| • | none of our executive officers served on the compensation committee of another entity where one of that entity’s executive officers served as a trustee on our Board of Trustees. |

| Name and principal position | | | Year | | | Salary | | | Bonus | | | Stock Awards(1) | | | Non-Equity Incentive Plan Compensation(2) | | | All Other Compensation(3)(4) | | | Total Compensation |

Michael J. Escalante Chief Executive Officer and President | | | 2023 | | | $925,000 | | | $— | | | $3,499,976 | | | $3,006,250 | | | $412,631 | | | $7,843,857 |

| | 2022 | | | $925,000 | | | $2,312,500 | | | $3,499,998 | | | $— | | | $752,711 | | | $7,490,209 | ||

| | 2021 | | | $925,000 | | | $2,200,000 | | | $5,075,001 | | | $— | | | $634,454 | | | $8,834,455 | ||

Javier F. Bitar Chief Financial Officer and Treasurer | | | 2023 | | | $525,000 | | | $— | | | $999,974 | | | $1,050,000 | | | $183,893 | | | $2,758,867 |

| | 2022 | | | $525,000 | | | $1,000,000 | | | $1,000,004 | | | $— | | | $275,363 | | | $2,800,367 | ||

| | 2021 | | | $500,000 | | | $750,000 | | | $1,450,001 | | | $— | | | $226,990 | | | $2,926,991 | ||

Nina Momtazee Sitzer Chief Operating Officer, Chief Legal Officer, and Secretary | | | 2023 | | | $500,000 | | | $— | | | $999,974 | | | $1,000,000 | | | $166,259 | | | $2,666,233 |

| | 2022 | | | $500,000 | | | $1,000,000 | | | $749,999 | | | $— | | | $187,525 | | | $2,437,524 | ||

| | 2021 | | | $450,000 | | | $750,000 | | | $799,999 | | | $— | | | $148,162 | | | $2,148,161 | ||

Louis K. Sohn(5) Executive Vice President | | | 2023 | | | $350,000 | | | $— | | | $499,987 | | | $— | | | $1,255,142 | | | $2,105,129 |

| | 2022 | | | $350,000 | | | $300,000 | | | $500,002 | | | $— | | | $169,967 | | | $1,319,969 | ||

| | 2021 | | | $350,000 | | | $437,500 | | | $725,000 | | | $— | | | $150,730 | | | $1,663,230 | ||

Scott Tausk(6) Executive Vice President | | | 2023 | | | $175,000(7) | | | $— | | | $499,987 | | | $— | | | $1,094,668 | | | $1,769,655 |

| | 2022 | | | $350,000 | | | $437,500 | | | $500,002 | | | $— | | | $173,468 | | | $1,460,970 | ||

| | 2021 | | | $350,000 | | | $437,500 | | | $725,000 | | | $— | | | $152,292 | | | $1,664,792 |

| (1) | Reflects the aggregate grant date fair value of RSUs granted in March 2023 (i.e., prior to the Listing) with respect to 2022 performance calculated in accordance with FASB ASC Topic 718 based on the most recently published NAV as of June 30, 2022 ($7.43), which was prior to the one-for-nine reverse share split of the Company’s common shares that was effective as of March 10, 2023. Additional information regarding these awards appears under the heading “Compensation Discussion and Analysis-Elements of Compensation-Long-Term Incentive Program (Equity-Based Compensation)”. |

| (2) | Reflects the cash bonus earned by our NEOs with respect to 2023 performance which was paid in the first quarter of 2024 based on the Compensation Committee’s review of the NEO’s achievements relative to a scorecard that included twelve strategic objectives, encompassing both pre-set financial and strategic performance goals. Additional information regarding our annual cash bonus program appears under the heading “Compensation Discussion and Analysis-Elements of Compensation-Annual Incentive Program”. |

| (3) | The following table sets forth the amount of each item contained in All Other Compensation paid to, or on behalf of, our NEOs during the fiscal year ended December 31, 2023. Amounts for each item of compensation shown below are valued based on the aggregate incremental cost to the Company, in each case without taking into account the value of any income tax deduction for which we may be eligible. |

| Name | | | Employer Contributions to Executive Deferred Compensation Plan(a) ($) | | | Employer Contributions to 401(k) Plan(b) ($) | | | Distribution Equivalent Payments on RSUs ($) | | | Health Insurance Premiums ($) | | | Life Insurance Premiums ($) | | | Tax Gross-Ups(c) ($) | | | Severance Payments(d) ($) | | | Total ($) |

| Michael J. Escalante | | | $196,563 | | | $61,783 | | | $132,425 | | | $12,124(e) | | | $9,736 | | | $— | | | $— | | | $412,631 |

| Javier F. Bitar | | | $78,750 | | | $61,750 | | | $36,501 | | | $— | | | $6,892 | | | $— | | | $— | | | $183,893 |

| Nina Momtazee Sitzer | | | $75,000 | | | $61,750 | | | $24,727 | | | $— | | | $4,782 | | | $— | | | $— | | | $166,259 |

| Louis K. Sohn | | | $— | | | $61,542 | | | $18,250 | | | $— | | | $1,338 | | | $5,497 | | | $1,168,515 | | | $1,255,142 |

| Scott A. Tausk | | | $— | | | $57,100 | | | $11,058 | | | $— | | | $1,461 | | | $5,508 | | | $1,019,541 | | | $1,094,668 |

| (a) | For a description of the employer contributions to the Company’s Executive Deferred Compensation Plan, see “Executive Deferred Compensation Plan” in the Compensation Discussion and Analysis. |

| (b) | For a description of the employer contributions to the Company’s 401(k) Plan, see”401(k) Profit Sharing Plan” in the Compensation Discussion and Analysis. |

| (c) | Amounts reflect tax gross-ups relating to healthcare severance benefits for Messrs. Sohn and Tausk. |

| (d) | For a description of the severance payments and benefits paid to Messrs. Sohn and Tausk, see, respectively, “Potential Payments Upon Termination or Change in Control – Sohn Separation Agreement” and “Potential Payments Upon Termination or Change in Control – Tausk Separation and Consulting Agreement” below. |

| (e) | Amounts reflect the payment of premiums under the Company’s group medical plan for Mr. Escalante’s spouse and dependents. |

| (4) | Amounts reported in the “All Other Compensation” column for Mr. Escalante for 2022 and 2021 have been adjusted to include the payment of premiums under the Company’s group medical plan for Mr. Escalante’s spouse and dependents that were inadvertently not included for 2022 or 2021 in prior years’ compensation disclosures in the amount of $11,428 and $28,864, respectively. |

| (5) | Mr. Sohn’s employment with the Company terminated on December 31, 2023. |

| (6) | Mr. Tausk’s employment with the Company terminated on June 30, 2023 and, commencing July 1, 2023 and ending March 15, 2024, Mr. Tausk served as a consultant to the Company. |

| (7) | Reflects Mr. Tausk’s annual base salary of $350,000 pro-rated for the period during which he was an employee of the Company (i.e., January 1, 2023 through June 30, 2023). |

| Name | | | Grant Date | | | Estimated Future Payouts Under Non-Equity Incentive Plan Awards(1) | | | All other stock awards: number of shares of stock or units(2) (#) | | | Grant date fair value of stock and option awards(3) ($) | ||||||

| | Threshold ($) | | | Target ($) | | | Maximum ($) | | ||||||||||

| Michael J. Escalante | | | 3/20/2023 | | | $1,618,750 | | | $2,312,500 | | | $3,006,250 | | | — | | | — |

| | | 3/23/2023 | | | — | | | — | | | — | | | 52,340 | | | $3,499,976 | |

| Javier F. Bitar | | | 3/20/2023 | | | $525,000 | | | $787,500 | | | $1,050,000 | | | — | | | — |

| | | 3/23/2023 | | | — | | | — | | | — | | | 14,954 | | | $999,974 | |

| Nina Momtazee Sitzer | | | 3/20/2023 | | | $500,000 | | | $750,000 | | | $1,000,000 | | | — | | | — |

| | | 3/23/2023 | | | — | | | — | | | — | | | 14,954 | | | $999,974 | |

| Louis K. Sohn | | | 3/20/2023 | | | $262,500 | | | $437,500 | | | $612,500 | | | — | | | — |

| | | 3/23/2023 | | | — | | | — | | | — | | | 7,477 | | | $499,987 | |

| Scott A. Tausk | | | 3/20/2023 | | | $262,500 | | | $437,500 | | | $612,500 | | | — | | | — |

| | | 3/23/2023 | | | — | | | — | | | — | | | 7,477 | | | $499,987 | |

| (1) | Amounts represent threshold, target and maximum annual bonus opportunities for our NEOs with respect to 2023 performance. For a description of our annual bonus program, please see “Compensation Discussion and Analysis - Elements of Compensation - Annual Incentive Program (Cash Bonuses)” above. The annual incentive bonuses earned by our NEOs for performance in 2023 are included in “Non-Equity Incentive Compensation” in the Summary Compensation Table for 2023. |

| (2) | Amount represents RSUs awarded based on performance for fiscal year 2022, one-third of which vested on December 31, 2023 and the balance vesting equally on each of December 31, 2024 and 2025, based on continued service. |

| (3) | Reflects the aggregate grant date fair value of RSUs granted in March 2023 (i.e., prior to the Listing) calculated in accordance with FASB ASC Topic 718 based on the most recently published NAV as of June 30, 2022 ($7.43), which was prior to the one-for-nine reverse share split of the Company’s common shares that was effective as of March 10, 2023. Additional information regarding these awards appears under the heading “Compensation Discussion and Analysis-Elements of Compensation-Long-Term Incentive Program (Equity-Based Compensation)”. |

| • | an initial annual base salary (“Base Salary”) equal to $925,000, subject to annual review for increase (but not decrease) by our Board of Trustees or a committee thereof; |

| • | eligibility for an annual cash bonus (“Incentive Bonus”) for 2023 with threshold, target and maximum award opportunity levels of 175%, 250% and 325%, respectively, of the Base Salary actually paid for such year. The threshold, target and maximum award opportunity levels of annual Incentive Bonus opportunity for 2024 and each year thereafter will be established by the Compensation Committee in its sole discretion; and |

| • | eligibility to receive equity awards, as determined by the Compensation Committee in its sole discretion. |

| • | The initial five-year term of Mr. Escalante’s employment under the Original Escalante Agreement commenced on December 14, 2018; |

| • | Mr. Escalante’s initial annual Base Salary under the Original Escalante Agreement was $800,000; |

| • | Pursuant to the Original Escalante Agreement, for 2019 and 2020, Mr. Escalante was guaranteed to receive an Incentive Bonus equal to at least the applicable target level for each such year; |

| • | The Original Escalante Agreement included provisions regarding equity-based awards previously granted to Mr. Escalante in 2019 and 2021; |

| • | The Original Escalante Agreement did not include the Change in Control Pro Rata Calculation or the Liquidation Event Benefit as described and defined under “Potential Payments Upon Termination or Change in Control – Employment Agreement with Our Chief Executive Officer”; |

| • | The Original Escalante Agreement provided that all outstanding equity awards held by Mr. Escalante as of the date immediately prior to a Change in Control fully vested, provided that to the extent any such awards were subject to performance-based vesting requirements, performance was assumed to be at target performance for any performance period that had not yet ended; and |

| • | In the event Mr. Escalante’s termination occurred prior to the end of two years after the effective date of the Original Escalante Agreement, the Average Incentive Bonus (as described and defined under “Potential Payments Upon Termination or Change in Control – Employment Agreement with Our Chief Executive Officer”) was determined based on the target Incentive Bonus for any such years that had not yet elapsed. |

| • | an initial annual Base Salary of $525,000 and $500,000 for Mr. Bitar and Ms. Sitzer, respectively, subject to annual review for increase (but not decrease) by our Board of Trustees or a committee thereof; |

| • | eligibility for an annual Incentive Bonus opportunity for 2023 at the threshold, target and maximum award opportunity levels of 100%, 150%, and 200%, respectively, of the Base Salary actually paid for such year, with eligibility for an annual Incentive Bonus opportunity for 2024 and each year thereafter at threshold, target and maximum award opportunity levels to be established by the Compensation Committee in its sole discretion; and |

| • | eligibility to receive equity awards to be determined by the Compensation Committee in its sole discretion. |

| • | The initial five-year term of Mr. Bitar’s employment under the Original Bitar Agreement commenced on December 14, 2018, and the initial five-year term of Ms. Sitzer’s employment under the Original Sitzer Agreement commenced on May 10, 2019; |

| • | Mr. Bitar’s initial annual Base Salary under the Original Bitar Agreement was $450,000, and Ms. Sitzer’s initial annual Base Salary under the Original Sitzer Agreement was $350,000, each subject to annual review for increase (but not decrease) by our Board of Trustees or a committee thereof; |

| • | Pursuant to the Original Bitar Agreement, for 2019 and 2020, Mr. Bitar was guaranteed to receive an annual Incentive Bonus equal to at least the applicable target award opportunity level for each such year; |

| • | Pursuant to the Original Sitzer Agreement, for 2019, Ms. Sitzer was guaranteed to receive an Incentive Bonus equal to at least $400,000; |

| • | Ms. Sitzer’s annual Incentive Bonus threshold, target and maximum award opportunity levels were 75%, 125%, and 175%, respectively, under the Original Sitzer Agreement; |

| • | The Original Executive Employment Agreements included provisions regarding equity-based awards previously granted to Mr. Bitar in 2019, 2020 and 2021 and Ms. Sitzer in 2020 and 2021, respectively; |

| • | The Original Executive Employment Agreements did not include the Change in Control Pro Rata Calculation or the Liquidation Event Benefit as described and defined under “Potential Payments Upon Termination or Change in Control – Employment Agreements with Our Other Named Executive Officers”; |

| • | The Original Executive Employment Agreements provided that all outstanding equity awards held by Mr. Bitar or Ms. Sitzer, as applicable, as of the date immediately prior to a Change in Control fully vested, provided that to the extent any such awards were subject to performance-based vesting requirements, performance was assumed to be at target performance for any performance period that had not yet ended; and |

| • | In the event Mr. Bitar’s or Ms. Sitzer’s termination, as applicable, occurred prior to the end of two years after the effective date of the Original Executive Employment Agreements, the Average Incentive Bonus (as described and defined under “Potential Payments Upon Termination or Change in Control – Employment Agreement with Our Chief Executive Officer”) was determined based on the target Incentive Bonus for any such years that had not yet elapsed. |

| | | Stock Awards | ||||

| Name | | | Number of shares or units of stock that have not vested (#) | | | Market value of shares or units of stock that have not vested(1) ($) |

| Michael J. Escalante | | | 62,095(2) | | | $1,237,553 |

| Javier F. Bitar | | | 17,741(3) | | | $353,578 |

| Nina Momtazee Sitzer | | | 15,566(4) | | | $310,230 |

| Louis K. Sohn | | | — | | | — |

| Scott Tausk | | | — | | | — |

| (1) | Market value was determined based on the per share closing price of our common stock of $19.93 on December 29, 2023. |

| (2) | Consists of (i) 9,755 unvested RSUs granted on March 25, 2021, which vest in two remaining equal installments on each of March 25, 2024, and 2025, (ii) 17,447 unvested RSUs granted on August 5, 2022, which vest in one remaining installment on December 31, 2024, and (iii) 34,893 unvested RSUs granted on March 23, 2023, which vest in two remaining equal installments on each of December 31, 2024 and 2025. In each case, vesting of the award requires that the NEO remain continuously employed by us on each such date, subject to certain accelerated vesting provisions as provided in the respective award agreement for the RSUs and/or the NEO’s employment agreement, as applicable. |

| (3) | Consists of (i) 2,787 unvested RSUs granted on March 25, 2021, which vest in two remaining equal installments on each of March 25, 2024, and 2025, (ii) 4,985 unvested RSUs granted on August 5, 2022, which vest in one remaining installment on December 31, 2024, and (iii) 9,969 unvested RSUs granted on March 23, 2023, which vest in two remaining equal installments on each of December 31, 2024 and 2025. In each case, vesting of the award requires that the NEO remain continuously employed by us on each such date, subject to certain accelerated vesting provisions as provided in the respective award agreement for the RSUs and/or the NEO’s employment agreement, as applicable. |

| (4) | Consists of (i) 1,858 unvested RSUs granted on March 25, 2021, which vest in two remaining equal installments on each of March 25, 2024, and 2025, (ii) 3,739 unvested RSUs granted on August 5, 2022, which vest in one remaining installment on December 31, 2024, and (iii) 9,969 unvested RSUs granted on March 23, 2023, which vest in two remaining equal installments on each of December 31, 2024 and 2025. In each case, vesting of the award requires that the NEO remain continuously employed by us on each such date, subject to certain accelerated vesting provisions as provided in the respective award agreement for the RSUs and/or the NEO’s employment agreement, as applicable. |

| | | Stock Awards | ||||

| Name | | | Number of shares acquired on vesting (#) | | | Value realized on vesting(1) ($) |

| Michael J. Escalante | | | 54,223(2) | | | $1,309,591 |

| Javier F. Bitar | | | 18,463(3) | | | $433,355 |

| Nina Momtazee Sitzer | | | 12,608(4) | | | $294,885 |

| Louis K. Sohn | | | 18,102(5) | | | $393,490 |

| Scott A. Tausk | | | 19,552(6) | | | $573,040 |

| (1) | For awards that vested prior to our listing date (April 13, 2023), value realized upon vesting is calculated as the gross number (i.e., including shares withheld to satisfy tax obligations) of shares that vested on the applicable vesting date multiplied by our most recently published per share NAV immediately prior to the vesting date (i.e., NAV as of June 30, 2022 ($7.43), which was prior to the one-for-nine reverse share split of the Company’s common shares that was effective as of March 10, 2023). For awards that vested on or after our listing date (April 13, 2023), value realized upon vesting is calculated as the gross number of shares that vested on the applicable vesting date multiplied by the per share closing price of our common stock on the NYSE on the vesting date (or if such date was not a trading day, then the last trading day immediately prior thereto). |

| (2) | Consists of (i) 4,877 RSUs that vested on March 25, 2023, and (ii) 49,346 RSUs that vested on December 31, 2023. |

| (3) | Consists of (i) 1,393 RSUs that vested on March 25, 2023, and (ii) 17,070 RSUs that vested on December 31, 2023. |

| (4) | Consists of (i) 929 RSUs that vested on March 25, 2023, and (ii) 11,679 RSUs that vested on December 31, 2023. |

| (5) | Consists of (i) 697 RSUs that vested on March 25, 2023, and (ii) 17,405 RSUs that vested on December 31, 2023. |

| (6) | Consists of (i) 697 RSUs that vested on March 25, 2023, and (ii) 18,855 RSUs that vested on June 30, 2023. |

| Name | | | NEO Contributions in Last FY (2023)(1) | | | Registrant Contributions in Last FY (2023)(2) | | | Aggregate Earnings (Losses) in Last FY (2023) | | | Aggregate Withdrawals/ Distributions in 2023 | | | Aggregate Balance at Last FYE (December 31, 2023)(6) |

| Michael J. Escalante | | | | | | | | | | | |||||

Deferred Compensation | | | $511,063 | | | $196,563 | | | $118,429(3) | | | $405,381 | | | $2,835,849 |

Delivered RSUs | | | — | | | — | | | $(3,521,488) (4) | | | $1,667,624(5) | | | — |

| Javier F. Bitar | | | | | | | | | | | |||||

| Deferred Compensation | | | $157,500 | | | $78,750 | | | $131,316(3) | | | $39,729 | | | $1,054,967 |

| Delivered RSUs | | | — | | | — | | | $(503,083) (4) | | | $238,238(5) | | | — |

| Nina Momtazee Sitzer | | | | | | | | | | | |||||

Deferred Compensation | | | $150,000 | | | $75,000 | | | $67,799(3) | | | $72,684 | | | $600,786 |

| Name | | | NEO Contributions in Last FY (2023)(1) | | | Registrant Contributions in Last FY (2023)(2) | | | Aggregate Earnings (Losses) in Last FY (2023) | | | Aggregate Withdrawals/ Distributions in 2023 | | | Aggregate Balance at Last FYE (December 31, 2023)(6) |

| Louis K. Sohn | | | | | | | | | | | |||||

| Deferred Compensation | | | $35,000 | | | — | | | $40,145(3) | | | $226,291 | | | $745,893 |

| Delivered RSUs | | | — | | | — | | | $(251,541) (4) | | | $119,119(5) | | | — |

| Scott A. Tausk | | | | | | | | | | | |||||

| Deferred Compensation | | | $17,500 | | | — | | | $398,762(3) | | | $84,771 | | | $2,513,450 |

| Delivered RSUs | | | — | | | — | | | $(252,994) (4) | | | $119,807(5) | | | — |

| (1) | Represents voluntary executive contributions from 2023 salary and/or bonus. |

| (2) | These amounts are included in “All Other Compensation” in the Summary Compensation Table for 2023 for the respective NEOs. |

| (3) | Represents investment earnings (losses) for 2023 under the Executive Deferred Compensation Plan. These amounts are not included in the Summary Compensation Table as they do not qualify as above market or preferential earnings. |

| (4) | Represents the aggregate change in value of common shares underlying the deferred RSUs that were awarded on May 1, 2019 and distributed to the NEO on May 1, 2023, based on the difference between our per share NAV as of December 31, 2022 and the per share closing price of our common stock on the NYSE as of the date on which the shares underlying the RSUs were distributed. |

| (5) | Represents the aggregate value on the date of distribution of common shares underlying the deferred RSUs that were awarded on May 1, 2019 and distributed to the NEO on May 1, 2023, based on the per share closing price of our common stock on the NYSE as of the date on which the shares underlying the RSUs were distributed. Original value of the deferred RSUs was $7,000,000 for Mr. Escalante, $1,000,000 for Mr. Bitar, and $500,000 for each of Messrs. Sohn and Tausk. |

| (6) | Represents the aggregate balance of the NEOs’ accounts under the Executive Deferred Compensation Plan as of December 31, 2023, and includes the vested and unvested amounts for each NEO. Amounts in this column, other than earnings/losses on deferred amounts, have all been previously disclosed in Summary Compensation Tables in our prior proxy statements (to the extent the NEO was an NEO in prior proxy statements) or in Column (1) above. |

| i. | Death or Disability: (i) base salary earned but not paid as of the termination date, any Incentive Bonus earned by Mr. Escalante for the prior calendar year but not yet paid, reimbursement for unpaid expenses to which Mr. Escalante is entitled to reimbursement, and any accrued or vested compensation or benefits to which Mr. Escalante is entitled under any benefits plans (collectively, the “Accrued Obligations”); (ii) the Incentive Bonus for the calendar year in which the termination occurs, pro-rated for the amount of time Mr. Escalante was employed during such calendar year, assuming target performance; (iii) a lump sum payment equal to 24 months of Healthcare Benefits (as defined in the Amended Escalante Agreement); (iv) the automatic vesting of all outstanding equity awards held by Mr. Escalante as of immediately prior to his termination, assuming target performance for any performance period that has not yet ended (the “Equity Award Vesting”); and (v) the vesting in full of Mr. Escalante’s account under our Executive Deferred Compensation Plan. |

| ii. | Without Cause or with Good Reason: (i) the Accrued Obligations; (ii) a pro-rated Incentive Bonus for the calendar year in which such termination occurs (assuming target individual performance and actual Company performance), pro-rated for the amount of time Mr. Escalante was employed during such calendar year; (iii) a lump sum payment equal to three times the sum of (A) his base salary then in effect plus (B) the average of Mr. Escalante's target Incentive Bonus for the prior two calendar years preceding the year in which such termination occurs (the “Average Incentive Bonus”); (iv) a lump sum payment equal to 24 months of Healthcare Benefits (as defined in the Amended Escalante Agreement); (v) the Equity Award Vesting; and (vi) the vesting in full of Mr. Escalante’s account under our Executive Deferred Compensation Plan. |

| iii. | Termination by the Company without Cause or by Mr. Escalante with Good Reason within six months preceding or 12 months following a Change in Control of the Company: all of the benefits and payments described in the paragraph “Without Cause or with Good Reason” above, except that (i) Mr. Escalante’s pro-rated Incentive Bonus will be calculated using the greater of actual Company performance or target Company performance (the “Change in Control Pro Rata Calculation”), and (ii) the Healthcare Benefits will be calculated to cover 36 months. |

| iv. | Change in Control: the automatic vesting of all outstanding equity awards held by Mr. Escalante as of the date immediately prior to a Change in Control, provided that to the extent any such awards were subject to performance-based vesting requirements, performance will be assumed to be at the greater of target or actual performance for any performance period that has not yet ended. |

| v. | Following the occurrence of a Liquidation Event (as defined in the Amended Escalante Agreement to include the earlier of the Board of Trustees’ approval of a plan of liquidation or dissolution of the Company or the total combined book value of the assets of the Company, along with the Company’s management and operating companies, falling below $250 million) if: (A) the term of the Amended Escalante Agreement expires (other than due to Mr. Escalante’s election not to renew), (B) Mr. Escalante is terminated by the Company without Cause (as defined in the Amended Escalante Agreement), (C) Mr. Escalante terminates for Good Reason (as defined in the Amended Escalante Agreement) within six months preceding or 12 months following a Change in Control, or (D) Mr. Escalante terminates for Good Reason, other than for a Duty Diminution (as defined in the Amended Escalante Agreement) ((A) – (D) a “Liquidation Event Termination”), Mr. Escalante will receive all of the payments and benefits due in connection with an involuntary termination that occurs within six months preceding or 12 months following a Change in Control of the Company, as set forth |

| • | Upon termination for Death or Disability, Mr. Bitar or Ms. Sitzer will receive a lump sum payment equal to 18 months of Healthcare Benefits. |

| • | Upon termination Without Cause or with Good Reason, Mr. Bitar or Ms. Sitzer will receive a lump sum payment equal to 1.5 times his or her base salary plus Average Incentive Bonus (as described above) and a lump sum payment equal to 18 months of Healthcare Benefits. |

| • | Upon termination within six months preceding or 12 months following a Change in Control, Mr. Bitar or Ms. Sitzer will receive a lump sum payment equal to 2.5 times his or her base salary plus Average Incentive Bonus (as described above) and a lump sum payment equal to 30 months of Healthcare Benefits. |

| Name | | | Benefits | | | Death or Disability ($) | | | Termination without Cause or Resignation with Good Reason (no Change in Control or Liquidation Event Termination) ($) | | | Termination without Cause or Resignation with Good Reason in connection with a Change in Control or Liquidation Event Termination; Expiration of Term following Liquidation Event ($) | | | Change in Control without Termination of Employment ($) |

| Michael J. Escalante | | | Base Severance Payment | | | $2,312,500 | | | $12,025,000 | | | $12,025,000 | | | $— |

| | Accelerated Vesting of RSUs | | | 1,237,553 | | | 1,237,553 | | | 1,237,553 | | | 1,237,553 | ||

| | Other(1) | | | 107,040 | | | 107,040 | | | 160,561 | | | — | ||

| | Total | | | $3,657,093 | | | $13,369,593 | | | $13,423,114 | | | $1,237,553 | ||

| Javier F. Bitar | | | Base Severance Payment | | | $787,500 | | | $2,728,125 | | | $4,021,875 | | | $— |

| | Accelerated Vesting of RSUs | | | 353,578 | | | 353,578 | | | 353,578 | | | 353,578 | ||

| | Other(1) | | | 354,409 | | | 354,409 | | | 391,849 | | | — | ||

| | Total | | | $1,495,487 | | | $3,436,112 | | | $4,767,302 | | | $353,578 | ||

| Nina Momtazee Sitzer | | | Base Severance Payment | | | $750,000 | | | $2,568,750 | | | $3,781,250 | | | $— |

| | Accelerated Vesting of RSUs | | | 310,230 | | | 310,230 | | | 310,230 | | | 310,230 | ||

| | Other(1)(2) | | | 319,802 | | | 319,802 | | | 373,322 | | | — | ||

| | Total | | | $1,380,032 | | | $3,198,782 | | | $4,464,802 | | | $310,230 |

| (1) | Includes company-paid healthcare coverage pursuant to the terms of the NEOs’ respective employment agreements. |

| (2) | Includes accelerated vesting of unvested amounts in Mr. Bitar’s and Ms. Sitzer’s accounts under our Executive Deferred Compensation Plan pursuant to the Executive Deferred Compensation Plan or the Amended Executive Employment Agreements, as applicable. Mr. Escalante was fully vested in his account under our Executive Deferred Compensation Plan as of December 31, 2023. |

| • | The date of the applicable triggering event is December 31, 2023. |

| • | The payments are based on the terms of the NEOs’ respective employment agreements as of December 31, 2023 and the applicable award agreements governing unvested equity awards; |

| • | The NEOs’ respective RSU awards were not assumed, continued, converted or replaced with a substantially similar award by the Company or a successor entity or its parent or subsidiary in connection with a Change in Control; |

| • | There is no earned, accrued but unpaid Incentive Bonus for the prior year; |

| • | The Section 280G “best pay” cap under the Amended Escalante Agreement or the Amended Executive Employment Agreements would not apply; and |

| • | The premiums for the NEO’s health plan coverage, life insurance, long-term disability insurance and accidental death and dismemberment insurance is constant throughout the year. |

| • | Our Compensation Committee did not exercise its discretion to accelerate the unvested portion of the applicable NEO’s deferred compensation account under our Executive Deferred Compensation Plan in the event of a termination of employment. Under the Executive Deferred Compensation Plan, unvested employer contributions will automatically vest in full upon (i) the participant’s death (see note (1) to the immediately preceding table), or (ii) the participant attaining the age of 60 years old and 10 years of service with the Company (prior to the participant’s termination of employment). Acceleration of unvested employer contributions pursuant to our Deferred Compensation Plan under other circumstances (including termination of the participant’s employment) is at the sole discretion of our Compensation Committee. |

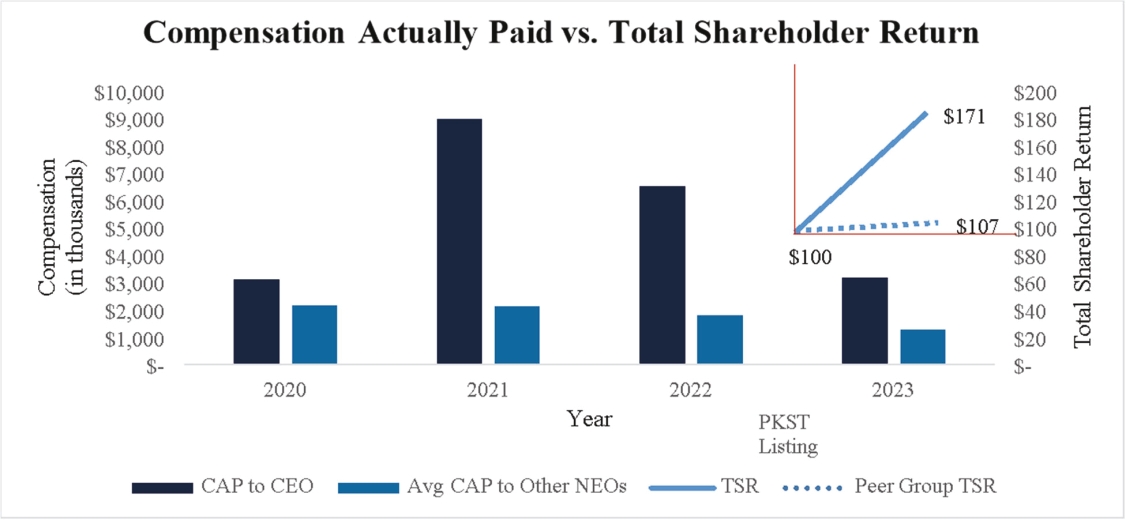

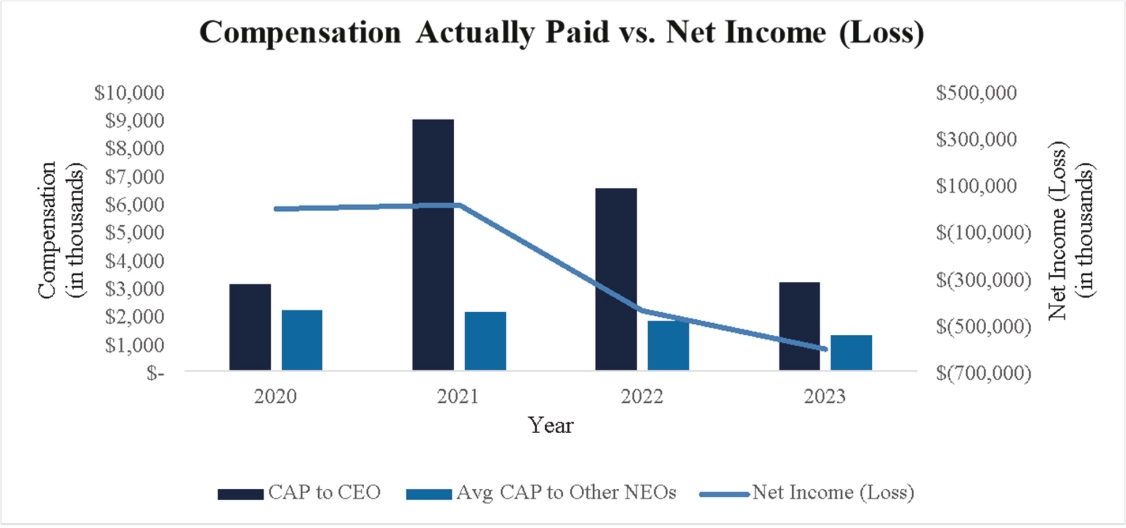

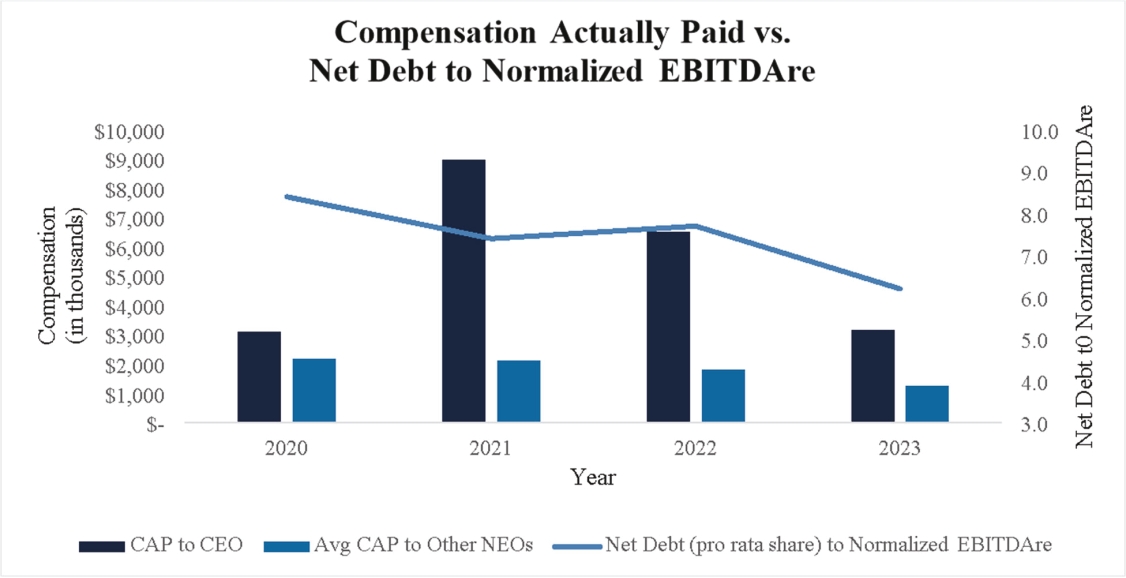

| Year | | | Summary Compensation Table Total for CEO(1)(2) | | | CAP to CEO(3)(4) | | | Average Summary Compensation Table Total Pay for other NEOs(1)(2) | | | Average CAP to other NEOs(5) | | | Value of Initial Fixed $100 Investment Based on: | | | Net Income (Loss) (in thousands) | | | Net Debt to Normalized EBITDAre(8) | |||

| | Total Shareholder Return(6) | | | Peer Group Total Shareholder Return(7) | | |||||||||||||||||||

| 2023 | | | $7,843,857 | | | $3,192,694 | | | $2,324,971 | | | $1,277,914 | | | $171 | | | $107 | | | $(605,102) | | | 6.2x |

| 2022 | | | $7,490,209 | | | $6,518,679 | | | $2,004,708 | | | $1,809,752 | | | N/A | | | N/A | | | $(441,382) | | | 7.7x |

| 2021 | | | $8,834,455 | | | $8,992,544 | | | $2,100,793 | | | $2,130,716 | | | N/A | | | N/A | | | $11,570 | | | 7.4x |

| 2020 | | | $3,336,464 | | | $3,105,815 | | | $2,232,728 | | | $2,180,430 | | | N/A | | | N/A | | | $(5,774) | | | 8.4x |

| (1) | For 2023, 2022 and 2021, the CEO was Michael J. Escalante and the other NEOs were Javier F. Bitar, Nina Momtazee Sitzer, Louis K. Sohn and Scott A. Tausk. For 2020, the CEO was Michael J. Escalante and the other NEOs were Javier F. Bitar, Howard S. Hirsch, Louis K. Sohn and Scott A. Tausk. |

| (2) | The values reflected in this column reflect the “Total Compensation” set forth in the Summary Compensation Table (“SCT”) on page 34 of this proxy statement. See the footnotes to the SCT for further detail regarding the amounts in this column. |

| (3) | Compensation Actually Paid (“CAP”) to our CEO represents the “Total Compensation” reported in the Summary Compensation Table for the applicable fiscal year, adjusted for 2023 as follows: |

| | | Reconciliation of SCT “Total Compensation” to Compensation Actually Paid (CEO) | |

| | | 2023 | |

| SCT Total Compensation | | | $7,843,857 |

| Minus: SCT Stock Awards Value | | | (3,499,976) |

| Plus: Fair Value as of 12/31 of Unvested Equity Awards Granted in 2023 | | | 695,417 |

| Plus: Change in Fair Value of Unvested Equity Awards Granted in Prior Years | | | (697,018) |

| Plus: Fair Value of Equity Awards Granted and Vested in 2023 | | | 347,719 |

| Plus: Change in Fair Value of Equity Awards Granted in Prior Years that Vested During 2023 | | | (1,497,305) |

| Total Compensation Actually Paid (CAP) | | | $3,192,694 |

| (4) | Because the Company was not listed at the time, equity awards included in CAP to CEO for 2020, 2021 and 2022 were valued based on the most recently published NAVs for each fiscal year end. |

| (5) | Average CAP to our other NEOs represents the average “Total Compensation” reported in the Summary Compensation Table for the applicable fiscal year, adjusted for 2023 as follows: |

| | | Reconciliation of SCT “Total Compensation” to Compensation Actually Paid (Other NEOs) | |

| | | 2023 | |

| SCT Total Compensation | | | $2,324,971 |

| Minus: SCT Stock Awards Value | | | (749,981) |

| Plus: Fair Value as of 12/31 of Unvested Equity Awards Granted in 2023 | | | 99,341 |

| Plus: Change in Fair Value of Unvested Equity Awards Granted in Prior Years | | | (87,854) |

| Plus: Fair Value of Equity Awards Granted and Vested in 2023 | | | 139,119 |

| Plus: Change in Fair Value of Equity Awards Granted in Prior Years that Vested During 2023 | | | (447,682) |

| Total Compensation Actually Paid (CAP) | | | $1,277,914 |

| (6) | For the fiscal year ended December 31, 2023, the return represents the Company’s cumulative TSR with an initial investment of $100 on April 13, 2023, the first day on which our common shares began trading on the NYSE. |

| (7) | For the fiscal year ended December 31, 2023, the return represents the cumulative TSR of the FTSE NAREIT All Equity REITs index with an initial investment of $100 on April 13, 2023, the first day on which our common shares began trading on the NYSE. |

| (8) | See Appendix A to this proxy statement for our definitions of Net Debt and Normalized EBITDAre. |

| | | Significant Financial Performance Measures(1) | | | ||

| | | Net Debt to Normalized EBITDAre | | | ||

| | | Gross asset sales | | | ||

| | | Same store cash NOI | | |