FEATURING NEXTNAV™ Griffin Capital Essential Asset REIT Summary of Earnings Results and Portfolio Update Second Quarter 2019 Photo: Amazon Fulfillment | Pataskala, OH THIS IS NEITHER AN OFFER TO SELL NOR A SOLICITATION OF AN OFFER TO BUY THE SECURITIES DESCRIBED HEREIN. AN OFFERING IS MADE ONLY BY A PROSPECTUS. A PROSPECTUS MUST BE MADE AVAILABLE TO YOU IN CONNECTION WITH AN OFFERING. NO OFFERING IS MADE TO NEW YORK RESIDENTS EXCEPT BY A PROSPECTUS FILED WITH THE DEPARTMENT OF LAW OF THE STATE OF NEW YORK. NEITHER THE SECURITIES AND EXCHANGE COMMISSION, THE ATTORNEY GENERAL OF THE STATE OF NEW YORK NOR ANY OTHER STATE SECURITIES REGULATOR HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR DETERMINED IF THE PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE. AN INVESTMENT IN GRIFFIN CAPITAL ESSENTIAL ASSET REIT, INC. INVOLVES A HIGH DEGREE OF RISK AND THERE CAN BE NO ASSURANCE THAT THE INVESTMENT OBJECTIVES OF THIS PROGRAM WILL BE ATTAINED.

Conference Call Agenda TOPIC SPEAKER Michael Escalante Highlights & Portfolio Characteristics CEO & President Michael Escalante Acquisition & Portfolio Update CEO & President Financial Performance Review Javier Bitar Chief Financial Officer Michael Escalante & Questions & Answers Javier Bitar 2

Highlights & Portfolio Characteristics Michael Escalante | CEO & President Photo: Shaw Industries | Savannah, Georgia

Key Highlights • Completed merger between Griffin Capital Essential Asset REIT II, Inc. (the “REIT”) and Griffin Capital Essential Asset REIT, Inc. (“EA-1”) creating a $4.7 billion internally managed REIT. • The REIT subsequently changed its name to Griffin Capital Essential Asset REIT, Inc. • Significant decline in general and administrative expenses as a result of becoming self-administered which eliminated all third-party advisory fees, including asset management fees and performance fees. • Quarter over Quarter revenue growth of 20% and AFFO growth of 16%. • Executed 894,257 SF of new and renewal leases, including a 268,540 SF, full-building lease to a Fortune 100 Company. • Completed built-to-suit for Mercedes Benz Financial which was subsequently sold, resulting in an approximately $3.7 million gain on an approximately $3.3 million joint venture investment or a 2.1x equity multiple. 4

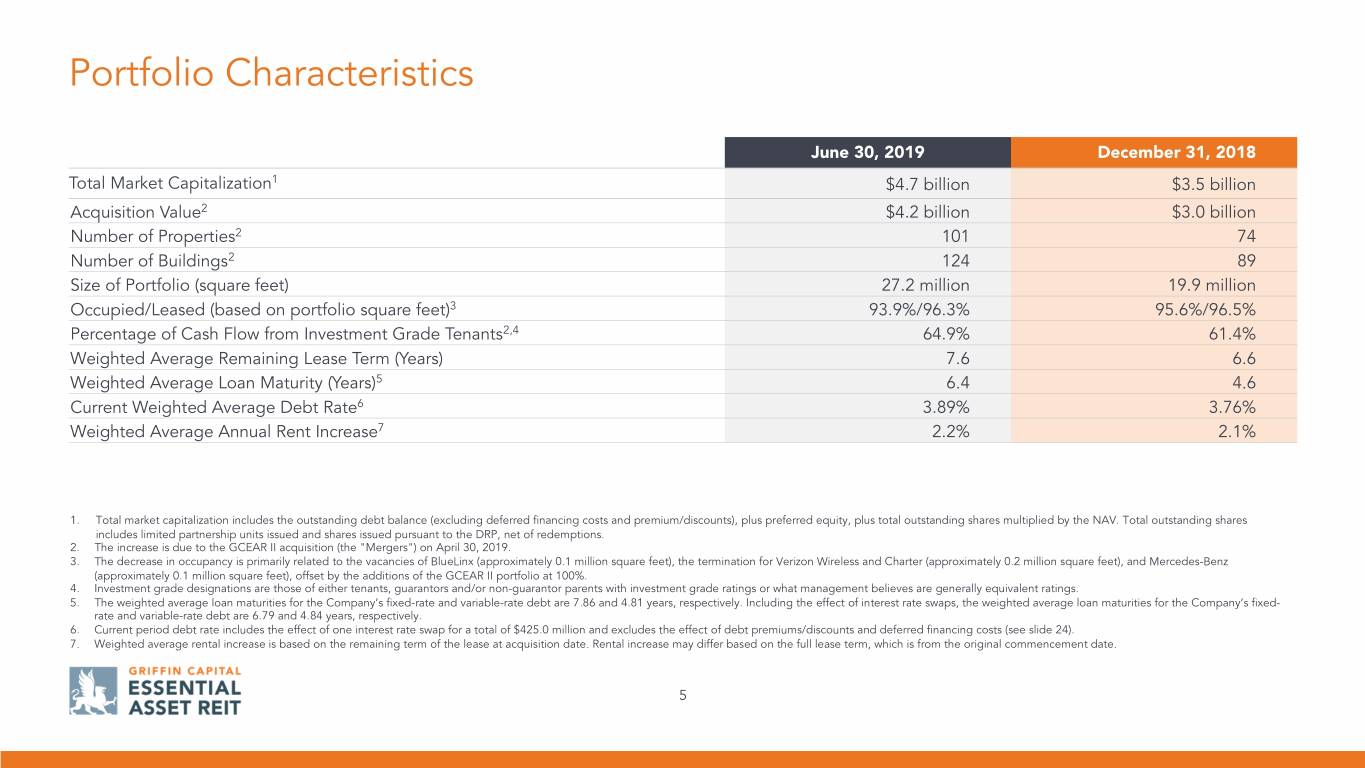

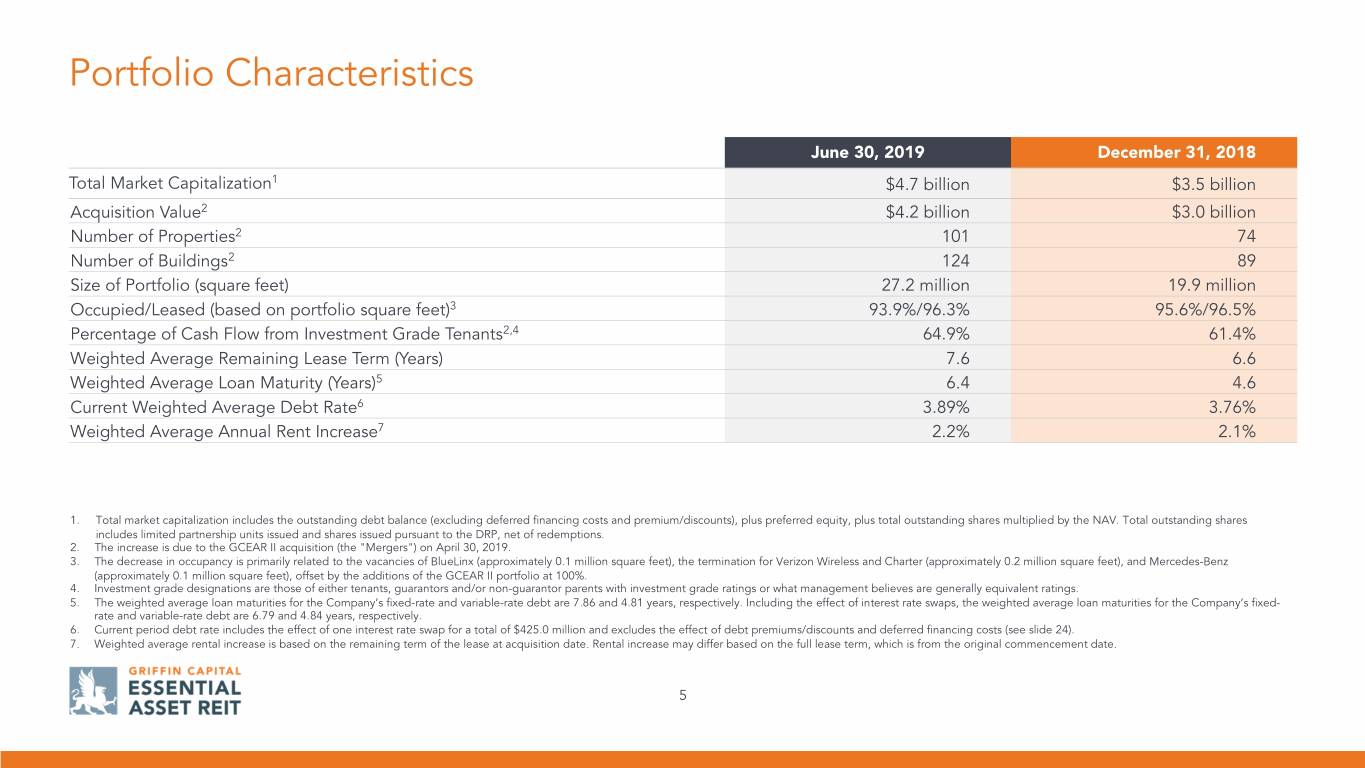

Portfolio Characteristics June 30, 2019 December 31, 2018 Total Market Capitalization 1 $4.7 billion $3.5 billion Acquisition Value2 $4.2 billion $3.0 billion Number of Properties2 101 74 Number of Buildings2 124 89 Size of Portfolio (square feet) 27.2 million 19.9 million Occupied/Leased (based on portfolio square feet)3 93.9%/96.3% 95.6%/96.5% Percentage of Cash Flow from Investment Grade Tenants2,4 64.9% 61.4% Weighted Average Remaining Lease Term (Years) 7.6 6.6 Weighted Average Loan Maturity (Years)5 6.4 4.6 Current Weighted Average Debt Rate6 3.89% 3.76% Weighted Average Annual Rent Increase7 2.2% 2.1% 1. Total market capitalization includes the outstanding debt balance (excluding deferred financing costs and premium/discounts), plus preferred equity, plus total outstanding shares multiplied by the NAV. Total outstanding shares includes limited partnership units issued and shares issued pursuant to the DRP, net of redemptions. 2. The increase is due to the GCEAR II acquisition (the "Mergers") on April 30, 2019. 3. The decrease in occupancy is primarily related to the vacancies of BlueLinx (approximately 0.1 million square feet), the termination for Verizon Wireless and Charter (approximately 0.2 million square feet), and Mercedes-Benz (approximately 0.1 million square feet), offset by the additions of the GCEAR II portfolio at 100%. 4. Investment grade designations are those of either tenants, guarantors and/or non-guarantor parents with investment grade ratings or what management believes are generally equivalent ratings. 5. The weighted average loan maturities for the Company’s fixed-rate and variable-rate debt are 7.86 and 4.81 years, respectively. Including the effect of interest rate swaps, the weighted average loan maturities for the Company’s fixed- rate and variable-rate debt are 6.79 and 4.84 years, respectively. 6. Current period debt rate includes the effect of one interest rate swap for a total of $425.0 million and excludes the effect of debt premiums/discounts and deferred financing costs (see slide 24). 7. Weighted average rental increase is based on the remaining term of the lease at acquisition date. Rental increase may differ based on the full lease term, which is from the original commencement date. 5

Acquisition and Portfolio Update MichaelPhoto: Shaw Industries Escalante| Savannah, Georgia | CEO & President Photo: Zebra Technologies | Lincolnshire, IL

Diversified National Portfolio Portfolio as of June 30, 2019 The portfolio is comprised of 101 properties located in 25 states throughout the U.S. Logos shown are those of tenants, lease guarantors, or non-guarantor parent companies at our properties. 7

Portfolio Characteristics 2019 Acquisition (dollars in thousands) Net Rent – Initial 12 Months Number of Acquisition Date Purchase Price Approximate Capitalization Properties Square Feet Rate1 Subsequent to June 30, 2019 Total Portfolio as of December 31, 2018 $ 2,997,908 19,866,000 7.41% $ 199,565 Acquisition: EA II Merged Entity 27 4/30/2019 1,243,2802 7,340,600 6.64 78,917 3 Total Portfolio as of June 30, 2019 $ 4,241,188 27,206,600 7.17% $ 278,742 1. The initial capitalization rate is determined by dividing the projected net operating income for the first fiscal year we own the property by the acquisition price (exclusive of closing costs and acquisition expenses). The net operating income is calculated by totaling the sum of all the revenues from the tenant including base rental revenue, parking revenue and expense reimbursement revenue then deducting the total of all the property expenses including utilities, insurance, real estate taxes, repairs and maintenance and all property operating expenses. The projected net operating income includes assumptions that may not be indicative of the actual future performance of a property, including the assumption that the tenant will perform its obligations under its lease agreement during the next 12 months. The capitalization rate includes the fair value as of the Merger date. 2. Excludes $10.3 million of acquisition expenses. 3. Represents the weighted average initial capitalization rate based on total purchase price. 8

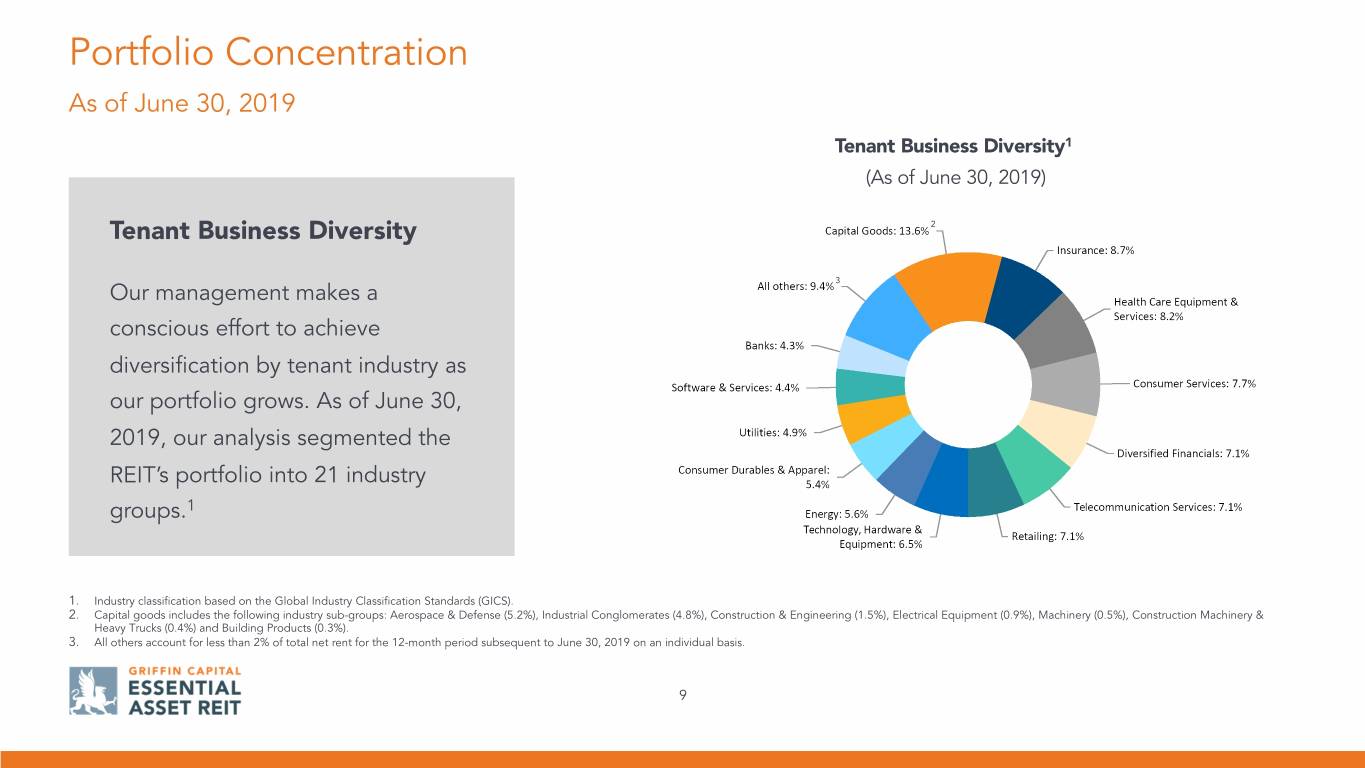

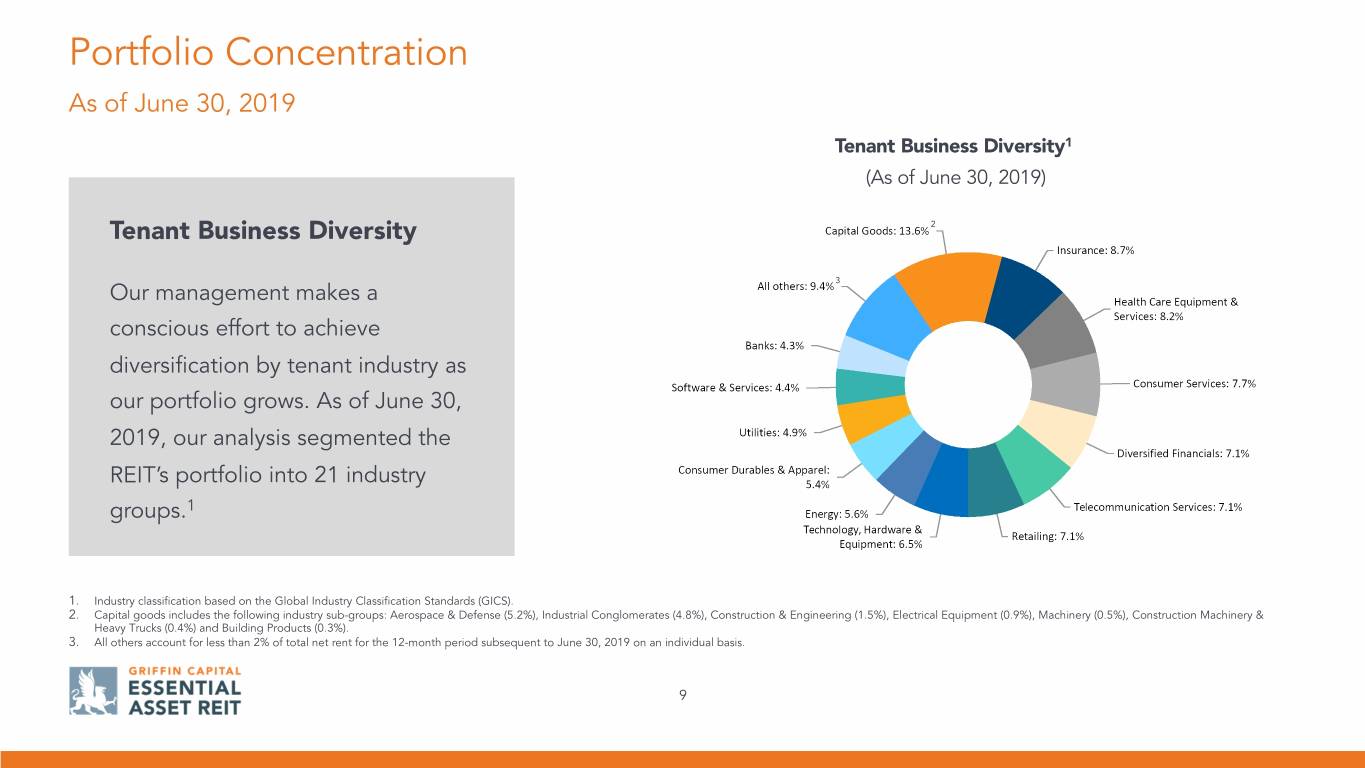

Portfolio Concentration As of June 30, 2019 Tenant Business Diversity 1 (As of June 30, 2019) Tenant Business Diversity 2 3 Our management makes a conscious effort to achieve diversification by tenant industry as our portfolio grows. As of June 30, 2019, our analysis segmented the REIT’s portfolio into 21 industry groups.1 1. Industry classification based on the Global Industry Classification Standards (GICS). 2. Capital goods includes the following industry sub-groups: Aerospace & Defense (5.2%), Industrial Conglomerates (4.8%), Construction & Engineering (1.5%), Electrical Equipment (0.9%), Machinery (0.5%), Construction Machinery & Heavy Trucks (0.4%) and Building Products (0.3%). 3. All others account for less than 2% of total net rent for the 12-month period subsequent to June 30, 2019 on an individual basis. 9

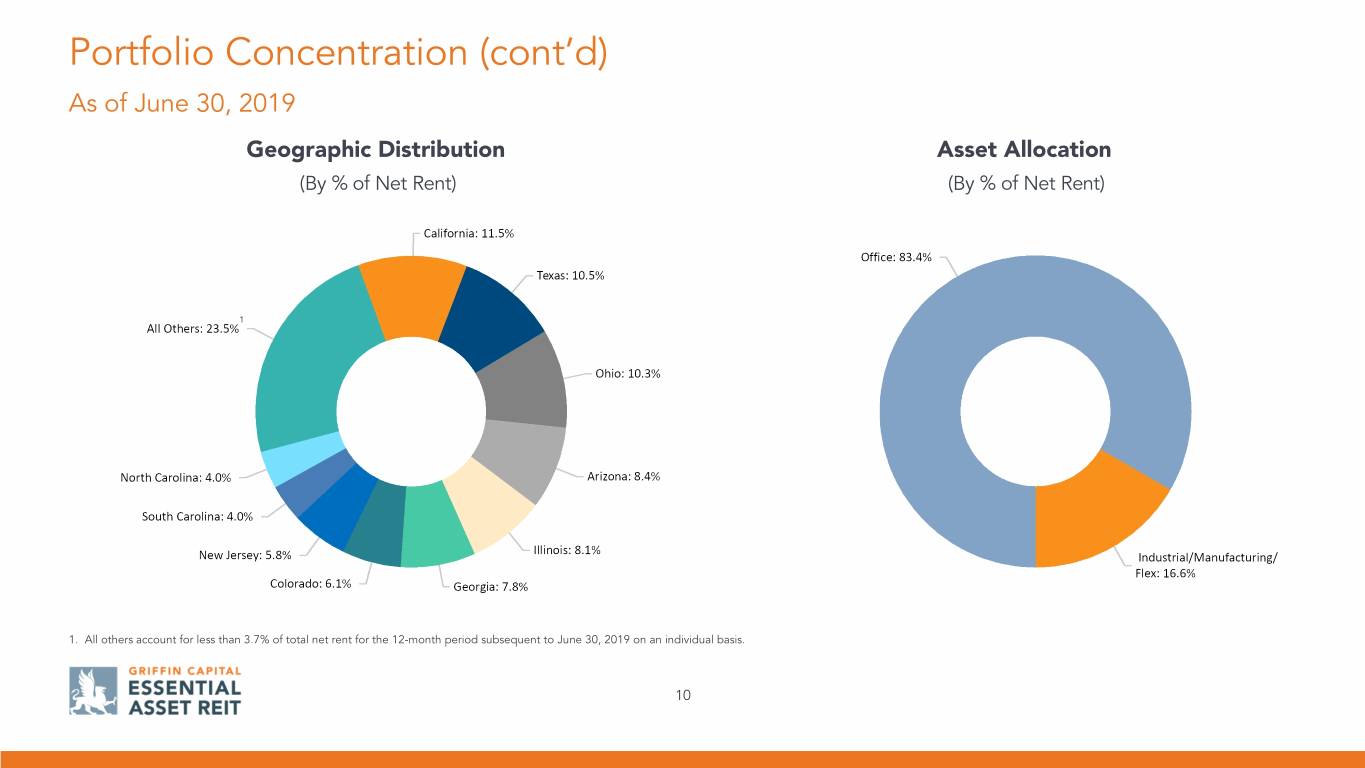

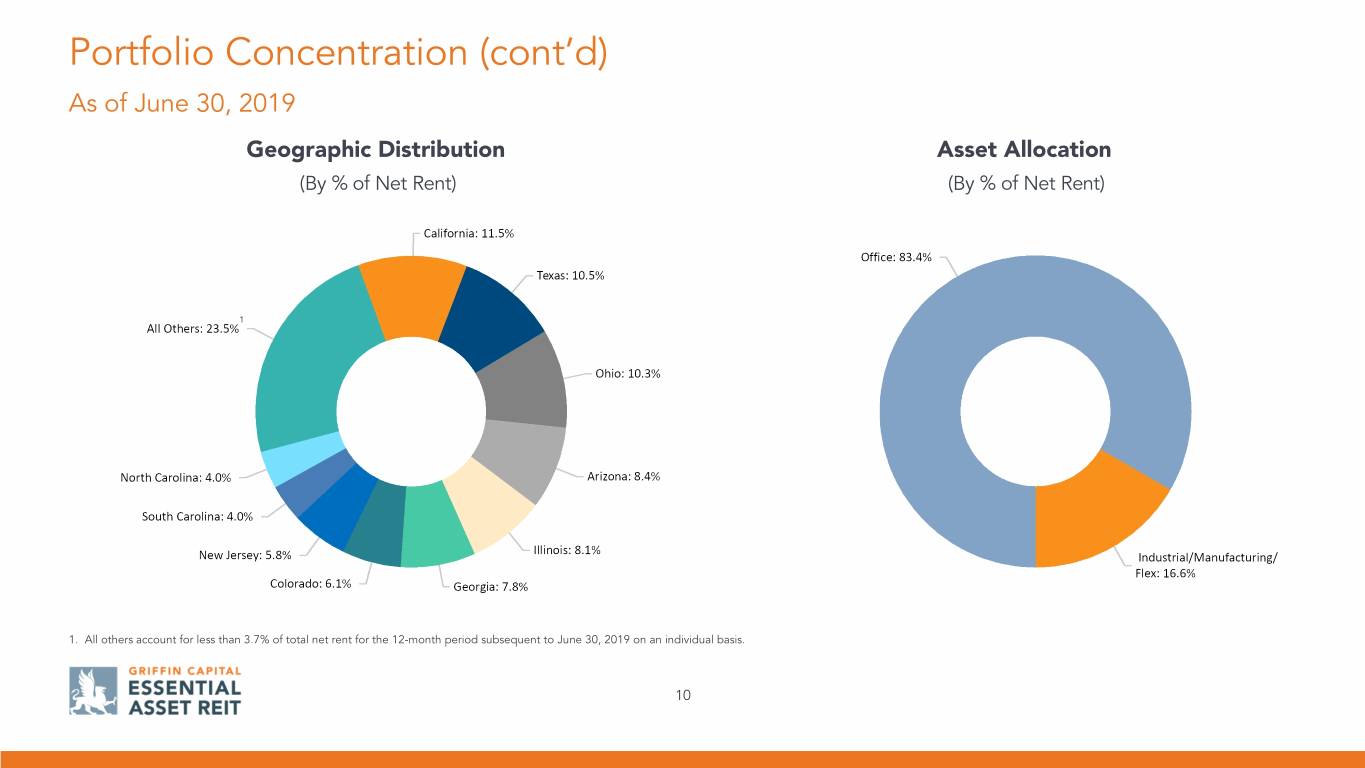

Portfolio Concentration (cont’d) As of June 30, 2019 Geographic Distribution Asset Allocation (By % of Net Rent) (By % of Net Rent) 1 1. All others account for less than 3.7% of total net rent for the 12-month period subsequent to June 30, 2019 on an individual basis. 10

Portfolio Concentration (cont’d) As of June 30, 2019 Credit Characteristics (By % of Net Rent) 1 1. Investment grade descriptions are those of either tenants, guarantors, and/or non-guarantor parents with investment grade ratings or what management believes are generally equivalent ratings. 11

Strong Tenant Profile - Top 10 Tenants As of June 30, 2019 Top Tenants % of Portfolio1 Ratings 2 3 3.6% BBB+ 3.4% IG104 3.1% A- 2.9% BB 2.8% A25 2.5% AA 1. Based on net rental payment 12-month 2.5% B period subsequent to June 30, 2019. 2. Represents S&P ratings of tenants, 4 guarantors, or non-guarantor parent 2.5% HY2 entities, unless otherwise noted. 3. Represents the combined net rental revenue for the Atlanta, GA; West 2.5% BB+ Chester, OH; and Houston, TX properties. 4. Represents Bloomberg's rating. 2.1% AA- 5. Represents Moody's rating. Total 27.9% 12

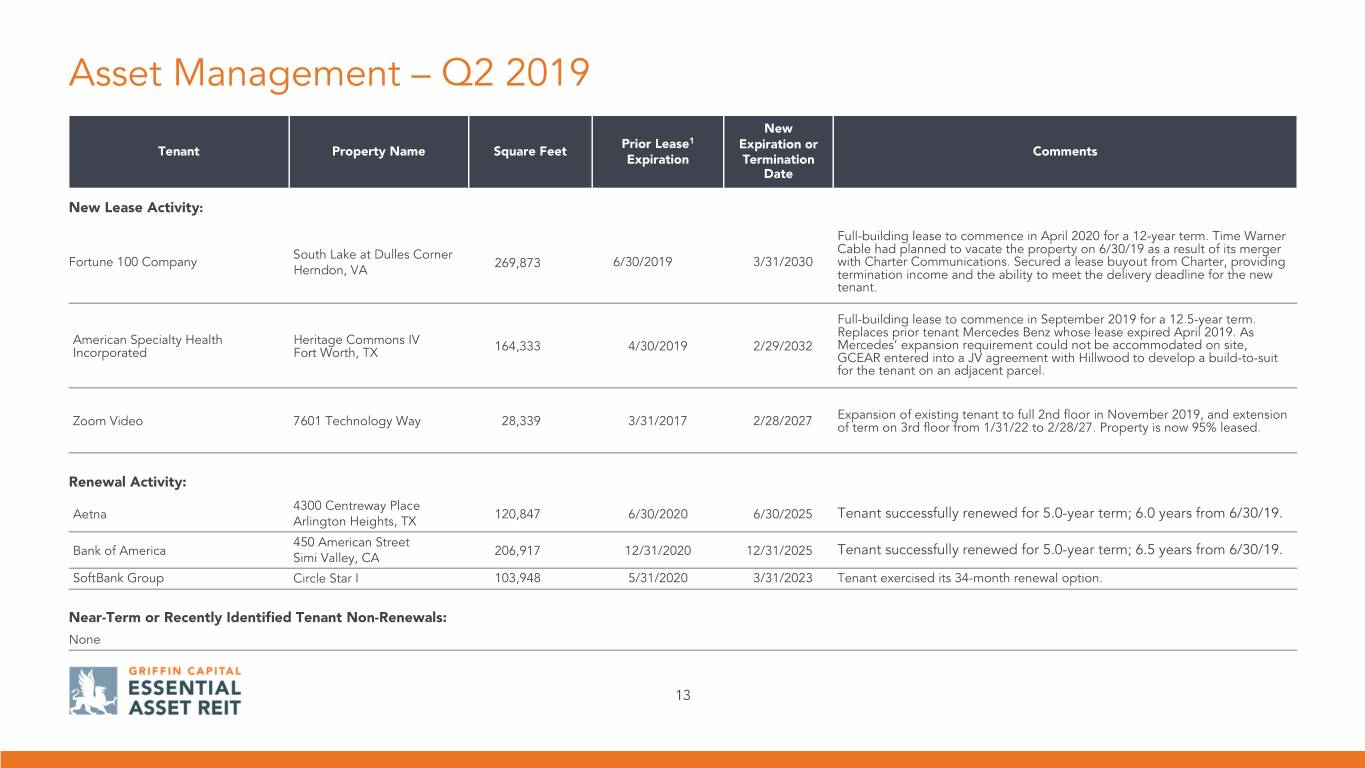

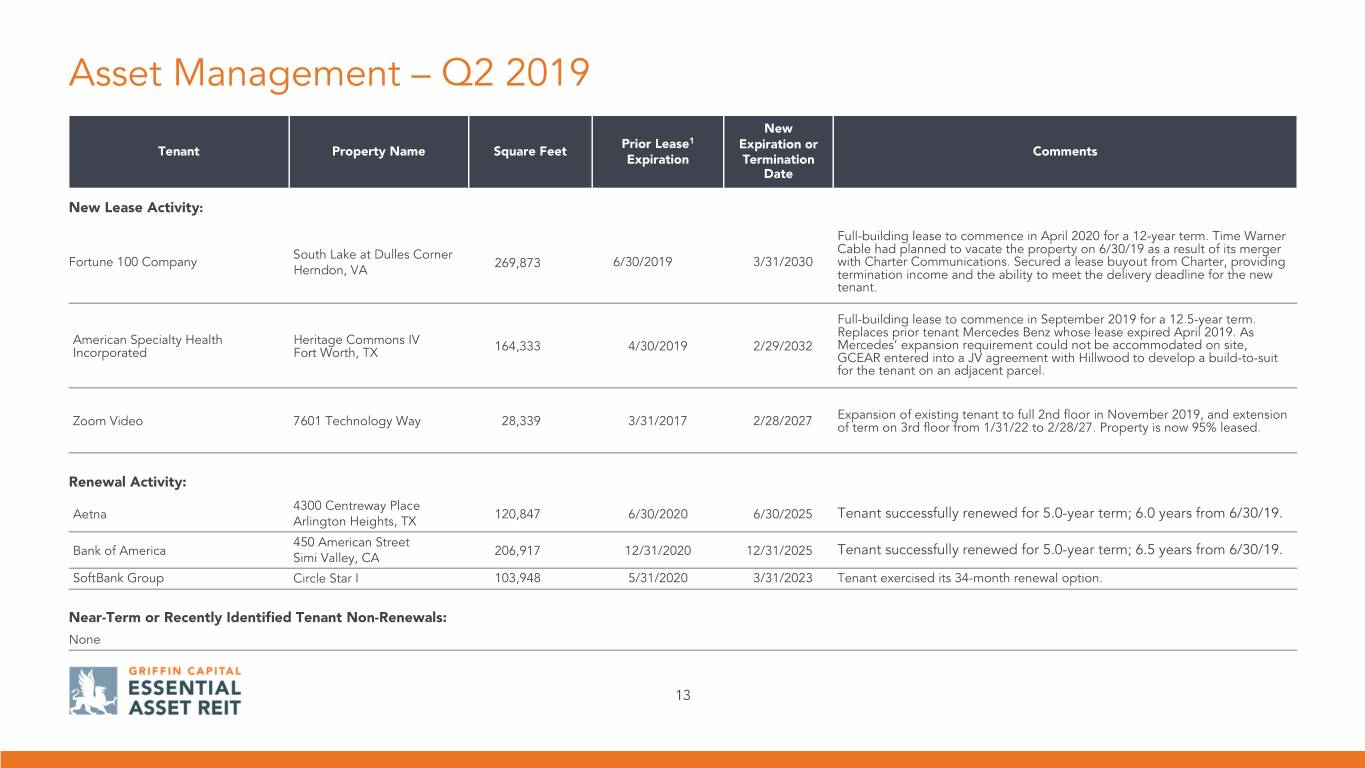

Asset Management – Q2 2019 New Prior Lease1 Expiration or Tenant Property Name Square Feet Comments Expiration Termination Date New Lease Activity: Full-building lease to commence in April 2020 for a 12-year term. Time Warner South Lake at Dulles Corner Cable had planned to vacate the property on 6/30/19 as a result of its merger Fortune 100 Company 269,873 6/30/2019 3/31/2030 with Charter Communications. Secured a lease buyout from Charter, providing Herndon, VA termination income and the ability to meet the delivery deadline for the new tenant. Full-building lease to commence in September 2019 for a 12.5-year term. Replaces prior tenant Mercedes Benz whose lease expired April 2019. As American Specialty Health Heritage Commons IV 164,333 4/30/2019 2/29/2032 Mercedes’ expansion requirement could not be accommodated on site, Incorporated Fort Worth, TX GCEAR entered into a JV agreement with Hillwood to develop a build-to-suit for the tenant on an adjacent parcel. Expansion of existing tenant to full 2nd floor in November 2019, and extension Zoom Video 7601 Technology Way 28,339 3/31/2017 2/28/2027 of term on 3rd floor from 1/31/22 to 2/28/27. Property is now 95% leased. Renewal Activity: 4300 Centreway Place Aetna 120,847 6/30/2020 6/30/2025 Tenant successfully renewed for 5.0-year term; 6.0 years from 6/30/19. Arlington Heights, TX 450 American Street Bank of America 206,917 12/31/2020 12/31/2025 Tenant successfully renewed for 5.0-year term; 6.5 years from 6/30/19. Simi Valley, CA SoftBank Group Circle Star I 103,948 5/31/2020 3/31/2023 Tenant exercised its 34-month renewal option. Near-Term or Recently Identified Tenant Non-Renewals: None 13

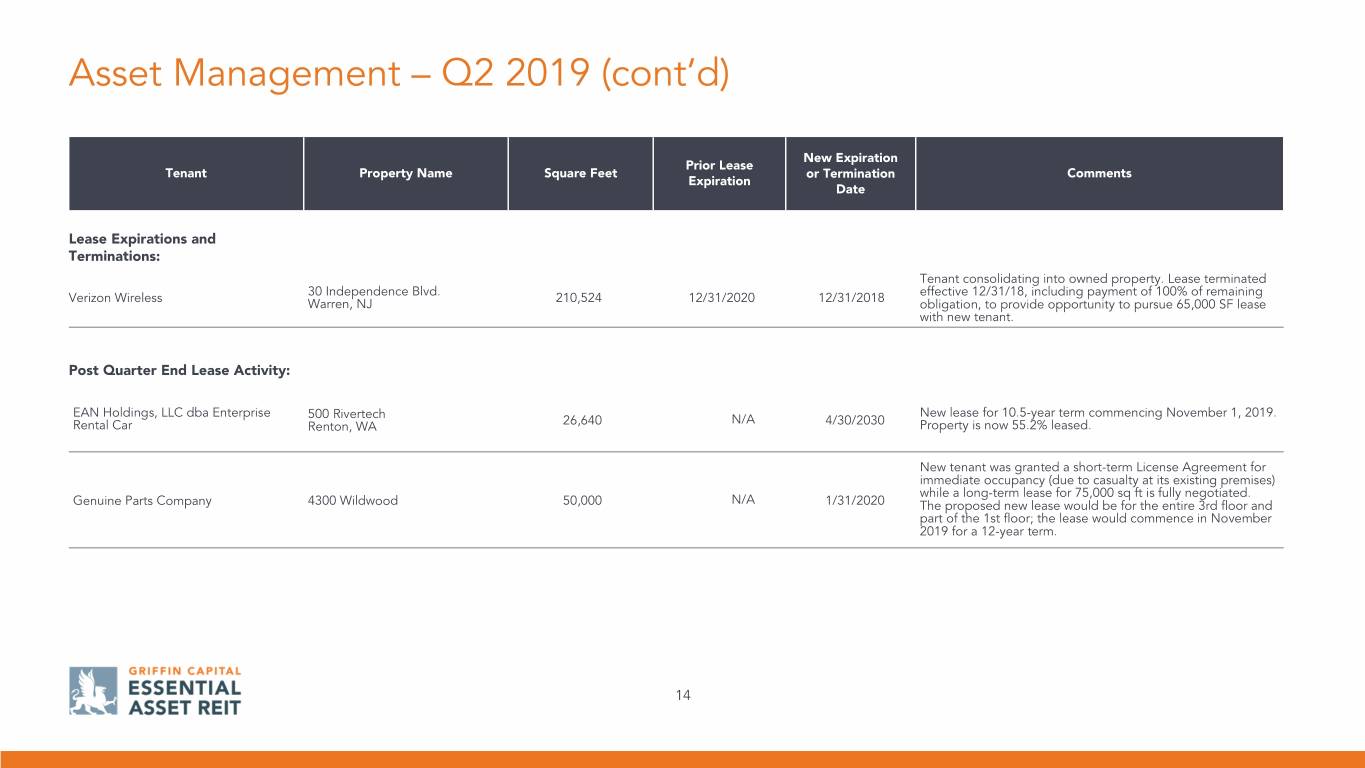

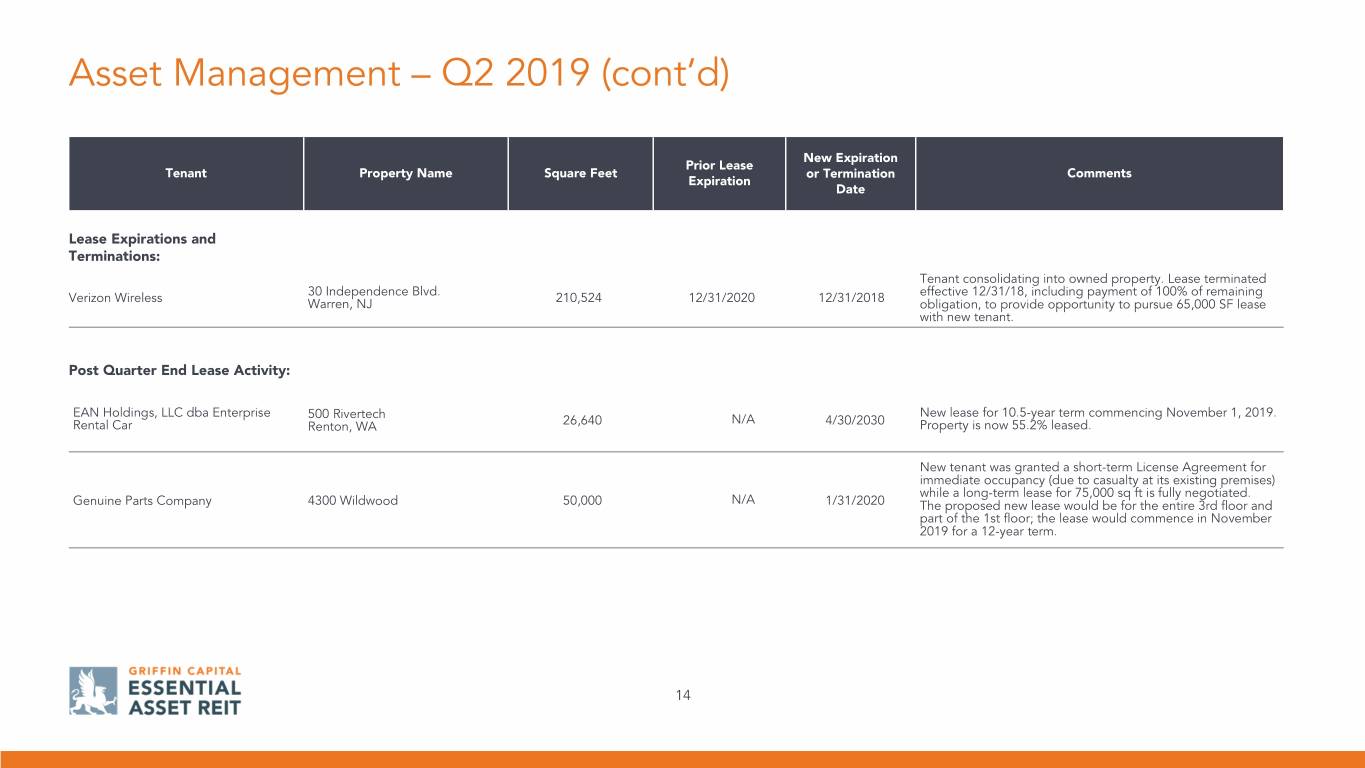

Asset Management – Q2 2019 (cont’d) New Expiration Prior Lease Tenant Property Name Square Feet or Termination Comments Expiration Date Lease Expirations and Terminations: Tenant consolidating into owned property. Lease terminated 30 Independence Blvd. effective 12/31/18, including payment of 100% of remaining Verizon Wireless 210,524 12/31/2020 12/31/2018 Warren, NJ obligation, to provide opportunity to pursue 65,000 SF lease with new tenant. Post Quarter End Lease Activity: EAN Holdings, LLC dba Enterprise New lease for 10.5-year term commencing November 1, 2019. 500 Rivertech N/A Rental Car Renton, WA 26,640 4/30/2030 Property is now 55.2% leased. New tenant was granted a short-term License Agreement for immediate occupancy (due to casualty at its existing premises) while a long-term lease for 75,000 sq ft is fully negotiated. Genuine Parts Company 4300 Wildwood 50,000 N/A 1/31/2020 The proposed new lease would be for the entire 3rd floor and part of the 1st floor; the lease would commence in November 2019 for a 12-year term. 14

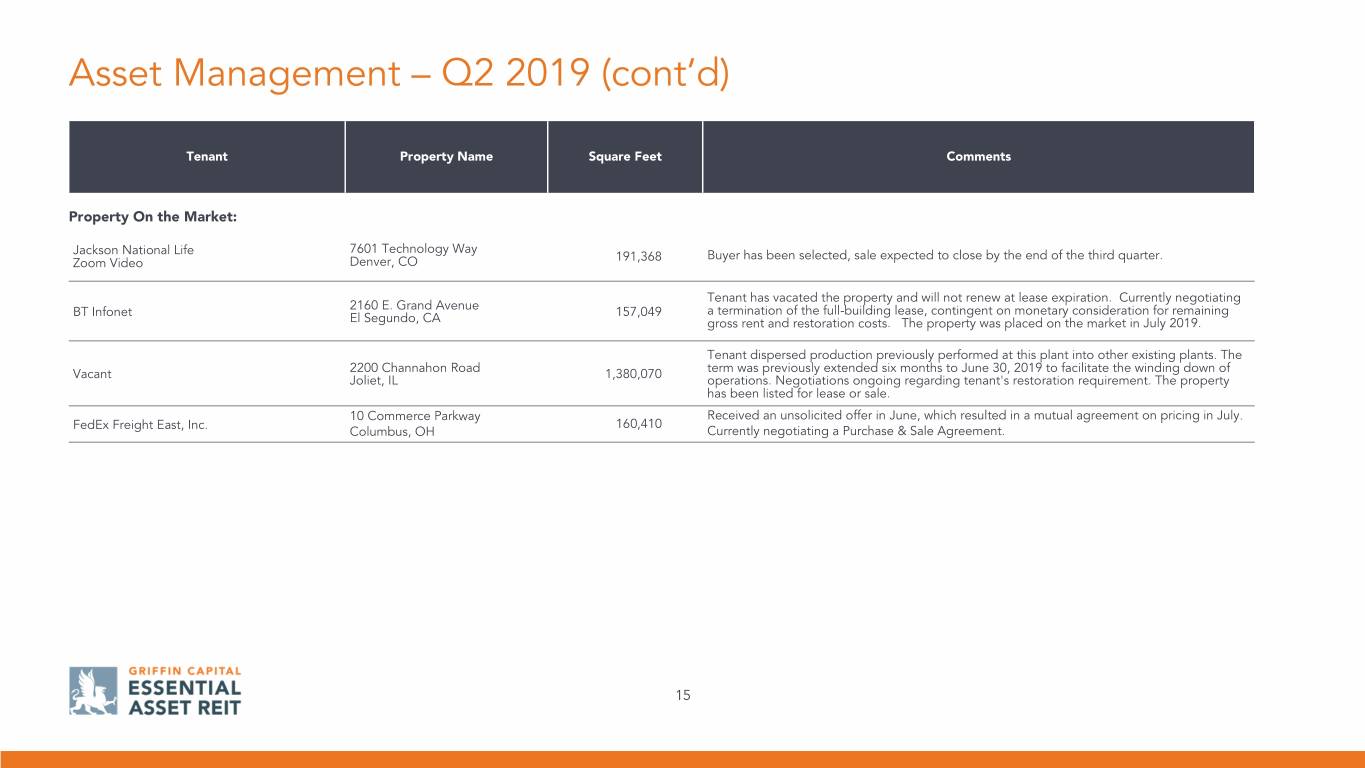

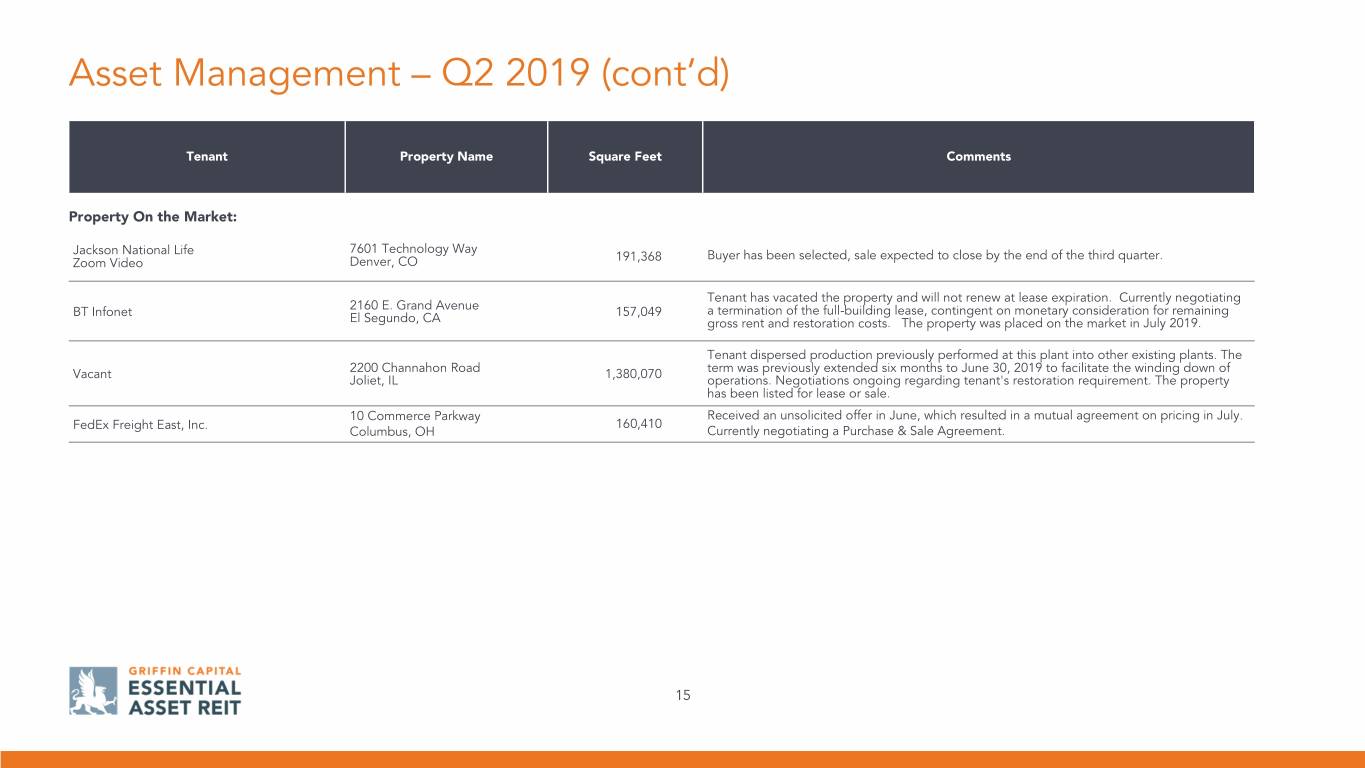

Asset Management – Q2 2019 (cont’d) Tenant Property Name Square Feet Comments Property On the Market: Jackson National Life 7601 Technology Way 191,368 Buyer has been selected, sale expected to close by the end of the third quarter. Zoom Video Denver, CO Tenant has vacated the property and will not renew at lease expiration. Currently negotiating 2160 E. Grand Avenue BT Infonet 157,049 a termination of the full-building lease, contingent on monetary consideration for remaining El Segundo, CA gross rent and restoration costs. The property was placed on the market in July 2019. Tenant dispersed production previously performed at this plant into other existing plants. The Vacant 2200 Channahon Road 1,380,070 term was previously extended six months to June 30, 2019 to facilitate the winding down of Joliet, IL operations. Negotiations ongoing regarding tenant's restoration requirement. The property has been listed for lease or sale. 10 Commerce Parkway Received an unsolicited offer in June, which resulted in a mutual agreement on pricing in July. FedEx Freight East, Inc. 160,410 Columbus, OH Currently negotiating a Purchase & Sale Agreement. 15

Financial Performance Review Javier Bitar | Chief Financial Officer Photo: Schlumberger Technologies Corp. | Houston, Texas

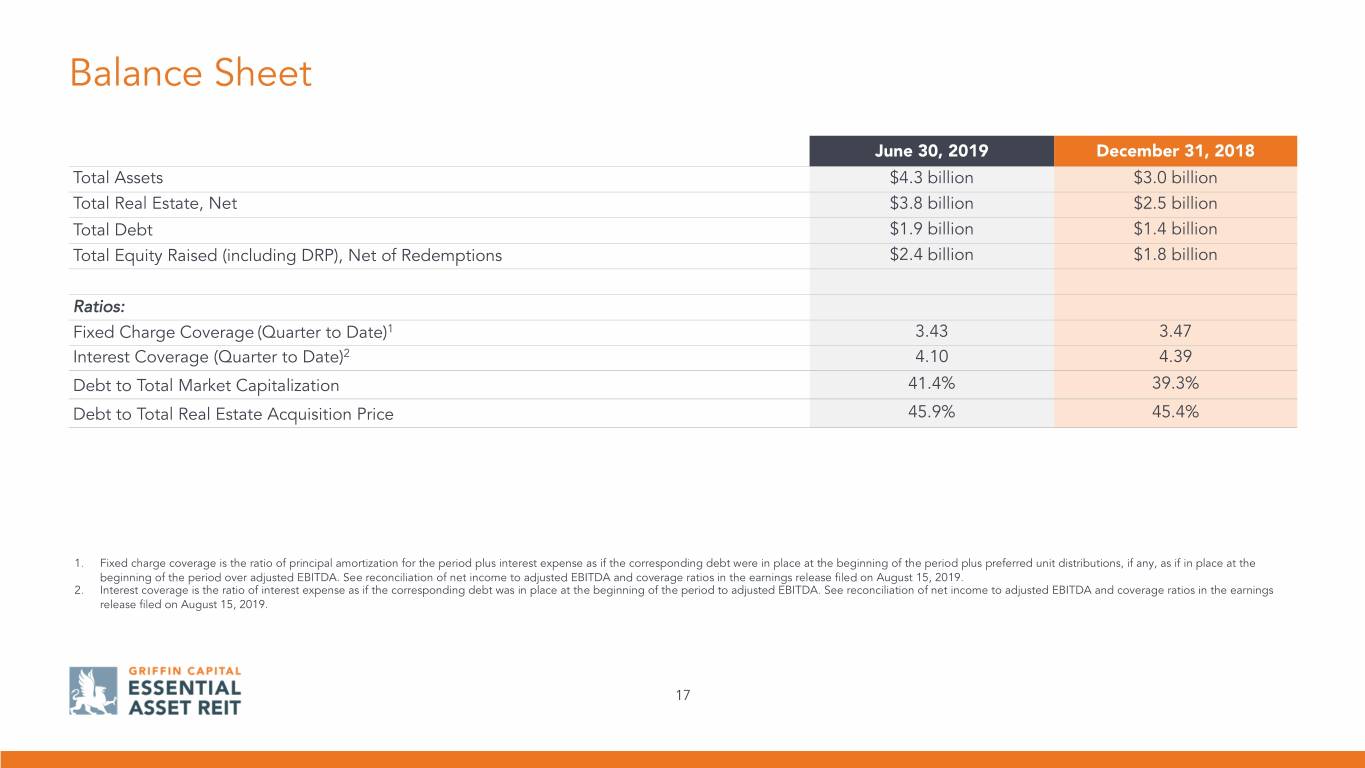

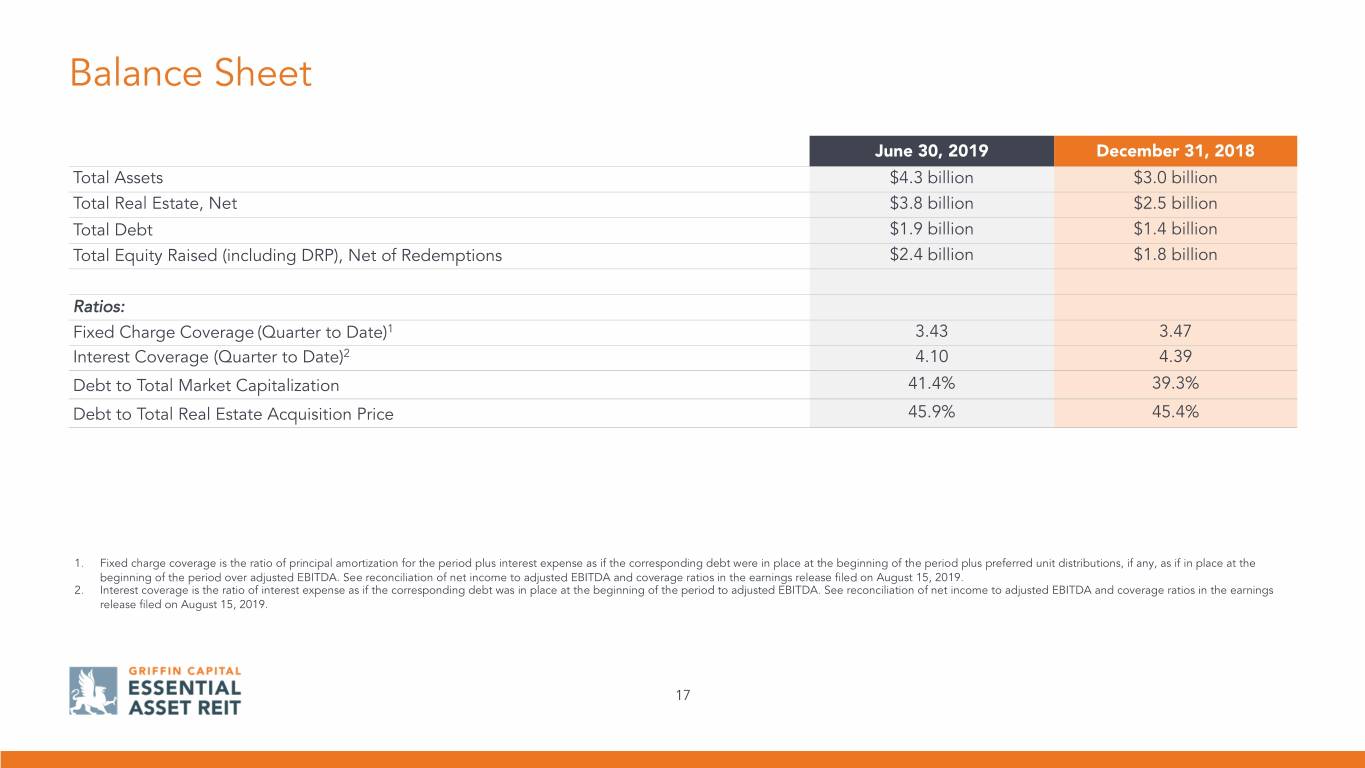

Balance Sheet June 30, 2019 December 31, 2018 Total Assets $4.3 billion $3.0 billion Total Real Estate, Net $3.8 billion $2.5 billion Total Debt $1.9 billion $1.4 billion Total Equity Raised (including DRP), Net of Redemptions $2.4 billion $1.8 billion Ratios: Fixed Charge Coverage (Quarter to Date)1 3.43 3.47 Interest Coverage (Quarter to Date)2 4.10 4.39 Debt to Total Market Capitalization 41.4% 39.3% Debt to Total Real Estate Acquisition Price 45.9% 45.4% 1. Fixed charge coverage is the ratio of principal amortization for the period plus interest expense as if the corresponding debt were in place at the beginning of the period plus preferred unit distributions, if any, as if in place at the beginning of the period over adjusted EBITDA. See reconciliation of net income to adjusted EBITDA and coverage ratios in the earnings release filed on August 15, 2019. 2. Interest coverage is the ratio of interest expense as if the corresponding debt was in place at the beginning of the period to adjusted EBITDA. See reconciliation of net income to adjusted EBITDA and coverage ratios in the earnings release filed on August 15, 2019. 17

Financial Performance (in thousands, except per share amounts) Three Months Ended June Six Months Ended June 30, 30, 2019 2018 2019 2018 Total Revenue $ 103,356 $ 85,991 $ 179,841 $ 166,390 Net Income Attributable to Common Stockholders $ 14,208 $ 7,431 $ 19,541 $ 13,750 Net Income Attributable to Common Stockholders Per Share, Basic and Diluted $ 0.06 $ 0.04 $ 0.10 $ 0.08 Adjusted EBIDTA (per loan agreement)1 $ 78,350 $ 59,819 $ 146,318 $ 114,621 FFO2 $ 49,635 $ 39,101 $ 88,167 $ 73,682 AFFO3 $ 38,727 $ 33,263 $ 71,744 $ 67,625 Distributions:4 Cash Distributions $ 21,920 $ 17,831 $ 43,723 $ 35,706 Distribution Reinvestment Plan (DRP) 13,182 11,219 19,855 22,653 Total Distributions $ 35,102 $ 29,050 $ 63,578 $ 58,359 1. See reconciliation of net income to adjusted EBITDA and coverage ratios in the earnings release filed on August 15, 2019. 2. FFO reflects distributions paid to noncontrolling interests and redeemable preferred shareholders. 3. See reconciliation of AFFO in the earnings release filed on August 15, 2019. No adjustments were required to the prior periods for this change. 4. Represents distributions paid and declared to common stockholders. 18

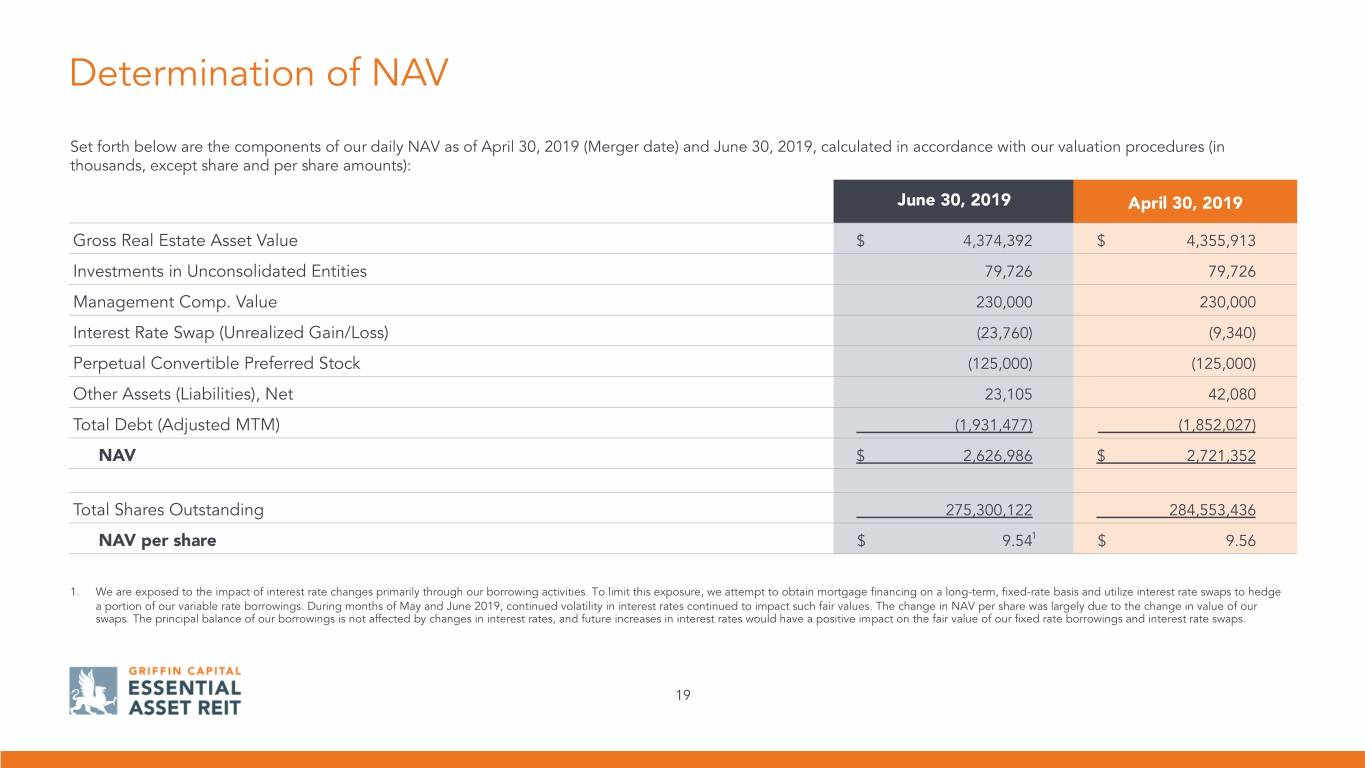

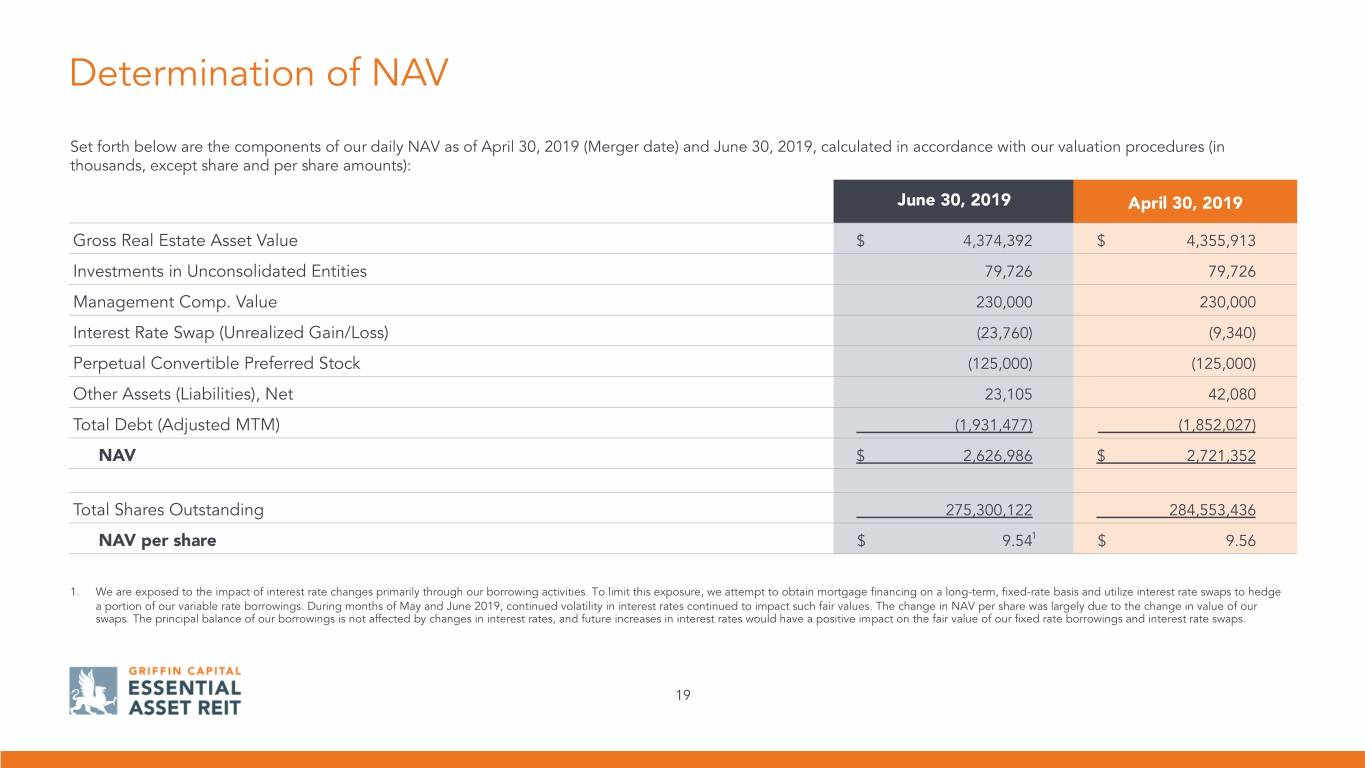

Determination of NAV Set forth below are the components of our daily NAV as of April 30, 2019 (Merger date) and June 30, 2019, calculated in accordance with our valuation procedures (in thousands, except share and per share amounts): June 30, 2019 April 30, 2019 Gross Real Estate Asset Value $ 4,374,392 $ 4,355,913 Investments in Unconsolidated Entities 79,726 79,726 Management Comp. Value 230,000 230,000 Interest Rate Swap (Unrealized Gain/Loss) (23,760) (9,340) Perpetual Convertible Preferred Stock (125,000) (125,000) Other Assets (Liabilities), Net 23,105 42,080 Total Debt (Adjusted MTM) (1,931,477) (1,852,027) NAV $ 2,626,986 $ 2,721,352 Total Shares Outstanding 275,300,122 284,553,436 NAV per share $ 9.541 $ 9.56 1. We are exposed to the impact of interest rate changes primarily through our borrowing activities. To limit this exposure, we attempt to obtain mortgage financing on a long-term, fixed-rate basis and utilize interest rate swaps to hedge a portion of our variable rate borrowings. During months of May and June 2019, continued volatility in interest rates continued to impact such fair values. The change in NAV per share was largely due to the change in value of our swaps. The principal balance of our borrowings is not affected by changes in interest rates, and future increases in interest rates would have a positive impact on the fair value of our fixed rate borrowings and interest rate swaps. 19

Performance Report (in thousands, except per share amounts) Total Return as of June 30, 2019(%)1 Excluding Sales Load2 Including Sales Load Quarter Ended Since Inception Since Inception Share Class/ Index Ticker Inception Date3 June 30, 2019 (Annualized) (Annualized) Class T ZGEATX 9/20/2017 0.62 5.96 3.85 Class S ZGEASX 9/20/2017 0.72 5.96 3.86 Class D ZGEADX 9/20/2017 0.81 6.63 6.63 Class I ZGEAIX 9/20/2017 0.87 6.90 6.90 Class A ZGEAAX 9/23/2014 0.67 7.74 5.14 Class AA ZGEAQX 11/2/2015 0.67 6.03 4.86 Class AAA ZGEAPX 4/25/2016 0.77 7.37 7.03 Class E ZGEAEX 11/6/2009 1.20 8.55 7.15 1. Future performance may be lower or higher than the performance quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Returns reflect the percent change in the net asset value per share from the beginning of the applicable period, plus the amount of any distributions paid during the period and assumes distributions are reinvested pursuant to our distribution reinvestment plan. Performance for Class E shares includes the performance of common in EA-1, prior to the Mergers on April 30, 2019. Please consult your financial professional for more information. 2. Returns exclude the impact of applicable sales load. Sales load for Class T, S, D and I shares are defined as the amount of selling commissions and dealer manager fees, as applicable, consistent with the calculation of gross offering price for such shares. For Class A, AA, AAA and E shares, sales load is defined as applicable front-end selling commissions, dealer-manager fees and estimated issuer offering and organizational expenses in conformity with the definition of "Net Investment" set forth in NASD Rule 2340. 3. Inception date for Class AA, AAA, T, S, D and I shares is the date upon which we began offering such share classes in our initial and follow-on primary offerings, as applicable. Inception date for Class A shares is the date upon which we satisfied our minimum offering requirement in our initial public offering, which occurred on September 23, 2014. Inception date for Class E shares is the date upon which EA-1 began offering shares of common stock in its initial public offering, which occurred on November 6, 2009. 20

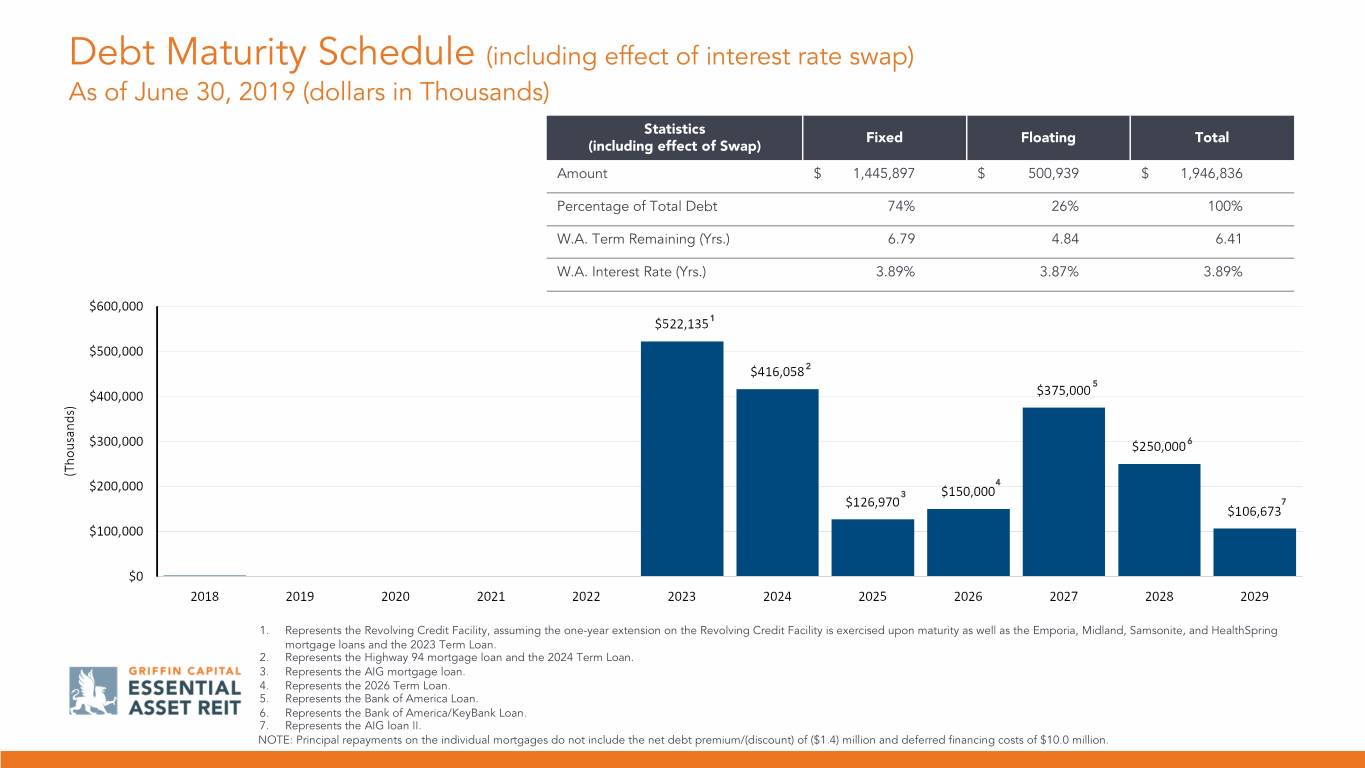

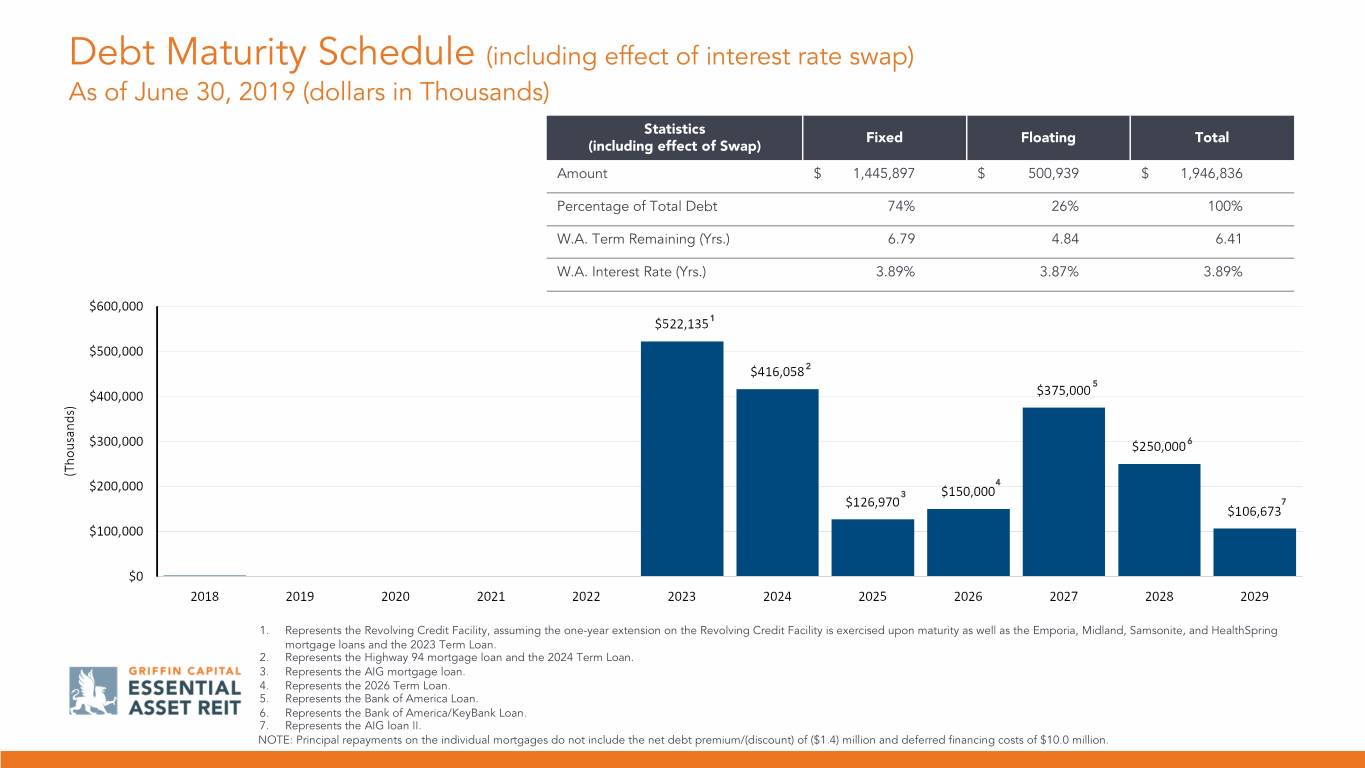

Debt Maturity Schedule (including effect of interest rate swap) As of June 30, 2019 (dollars in Thousands) Statistics Fixed Floating Total (including effect of Swap) Amount $ 1,445,897 $ 500,939 $ 1,946,836 Percentage of Total Debt 74% 26% 100% W.A. Term Remaining (Yrs.) 6.79 4.84 6.41 W.A. Interest Rate (Yrs.) 3.89% 3.87% 3.89% 1 2 5 6 4 3 7 1. Represents the Revolving Credit Facility, assuming the one-year extension on the Revolving Credit Facility is exercised upon maturity as well as the Emporia, Midland, Samsonite, and HealthSpring mortgage loans and the 2023 Term Loan. 2. Represents the Highway 94 mortgage loan and the 2024 Term Loan. 3. Represents the AIG mortgage loan. 4. Represents the 2026 Term Loan. 5. Represents the Bank of America Loan. 6. Represents the Bank of America/KeyBank Loan. 7. Represents the AIG loan II. NOTE: Principal repayments on the individual mortgages do not include the net debt premium/(discount) of ($1.4) million and deferred financing costs of $10.0 million.

Questions & Answers Michael Escalante | CEO & President Javier Bitar | Chief Financial Officer Photo: Shaw Industries | Savannah, Georgia

310.469.6100 1520 E. Grand Avenue www.gcear.com El Segundo, CA 90245 Thank you for your participation. For more information visit www.gcear.com. Griffin Capital Securities, Member FINRA/SIPC, is the dealer manager for the Griffin Capital Essential Asset REIT, Inc. offering. © 2019 Griffin Capital Securities, LLC. All rights reserved.