Exhibit 99.2 America’s Blue-Chip LandlordTM November 2020 Griffin Capital Essential Asset REIT to Acquire CCIT II

Table of Contents I.I Transaction Overview II.II Market Opportunity V.III Combined Company Value Proposition 2

I. Transaction Overview NETGEAR San Jose, CA

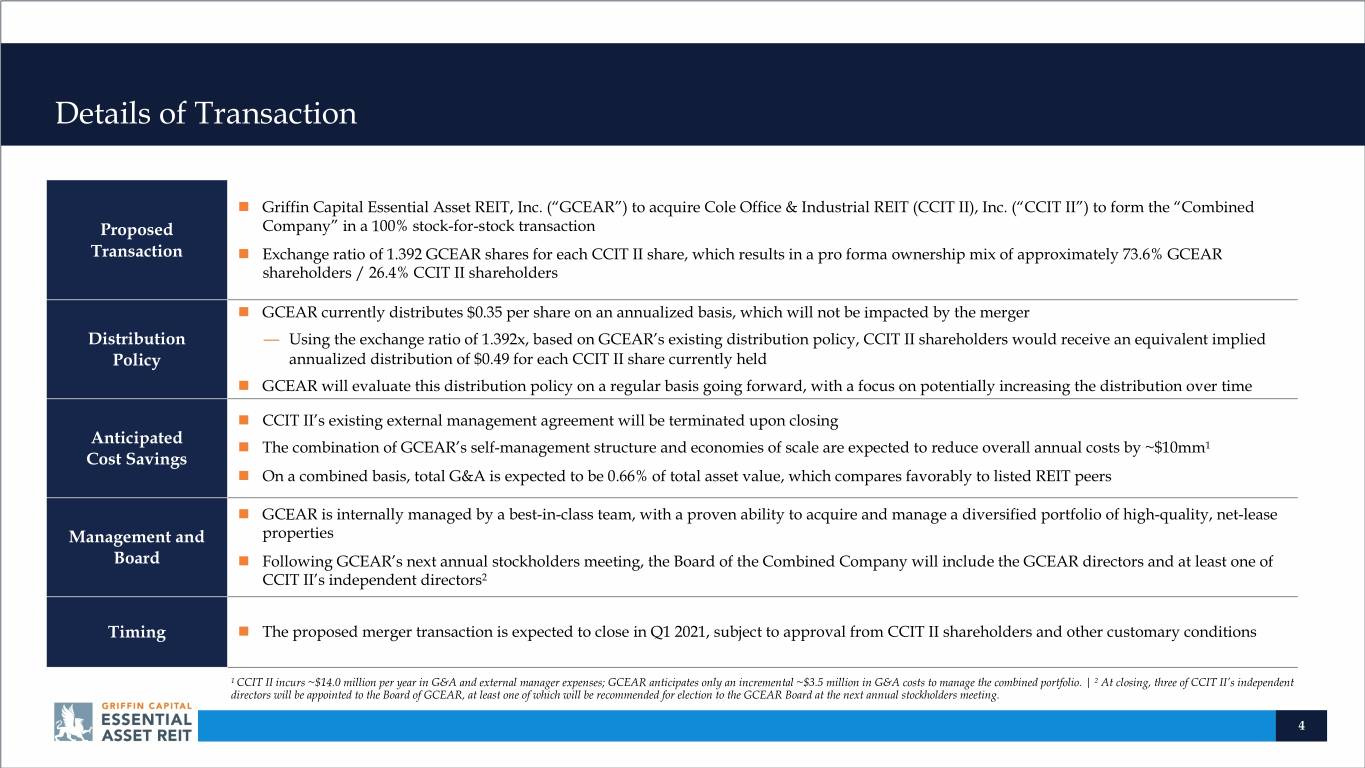

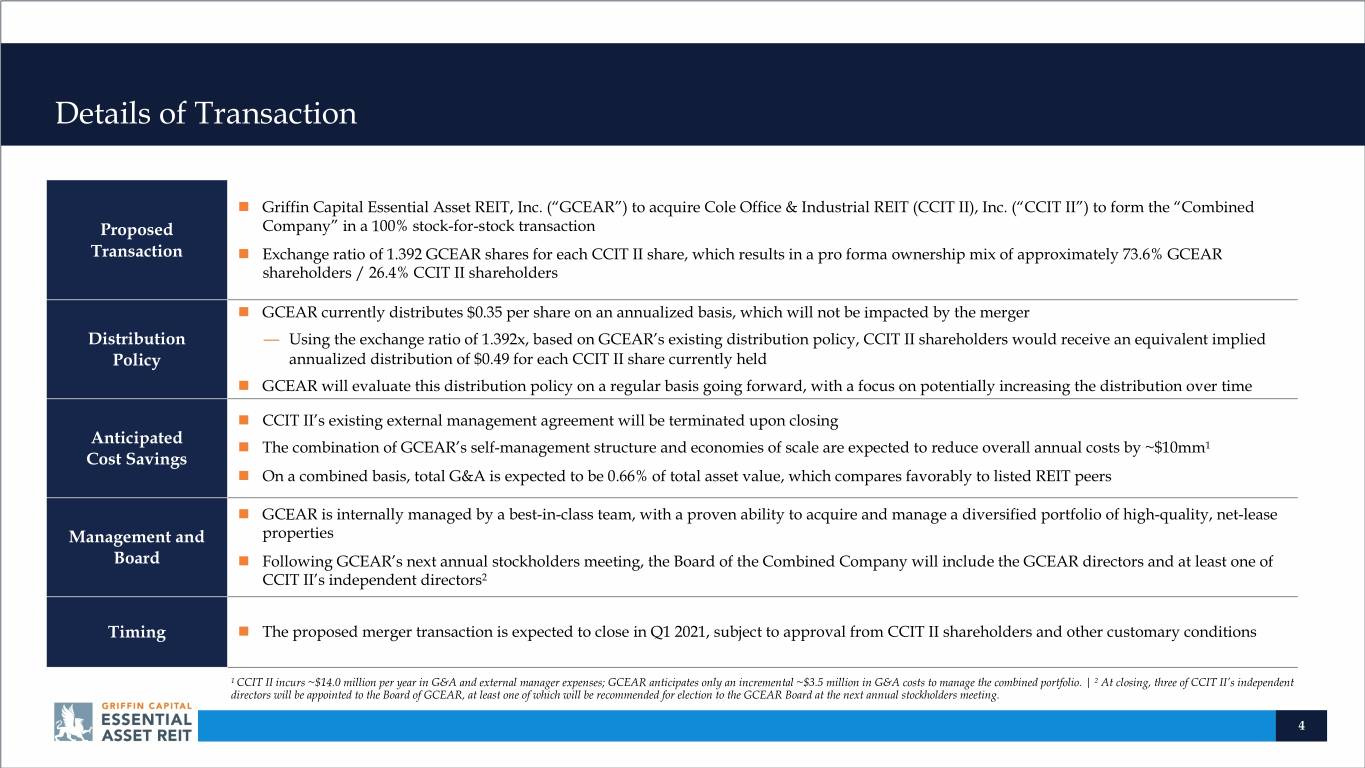

Details of Transaction n Griffin Capital Essential Asset REIT, Inc. (“GCEAR”) to acquire Cole Office & Industrial REIT (CCIT II), Inc. (“CCIT II”) to form the “Combined Proposed Company” in a 100% stock-for-stock transaction Transaction n Exchange ratio of 1.392 GCEAR shares for each CCIT II share, which results in a pro forma ownership mix of approximately 73.6% GCEAR shareholders / 26.4% CCIT II shareholders n GCEAR currently distributes $0.35 per share on an annualized basis, which will not be impacted by the merger Distribution — Using the exchange ratio of 1.392x, based on GCEAR’s existing distribution policy, CCIT II shareholders would receive an equivalent implied Policy annualized distribution of $0.49 for each CCIT II share currently held n GCEAR will evaluate this distribution policy on a regular basis going forward, with a focus on potentially increasing the distribution over time n CCIT II’s existing external management agreement will be terminated upon closing Anticipated n The combination of GCEAR’s self-management structure and economies of scale are expected to reduce overall annual costs by ~$10mm1 Cost Savings n On a combined basis, total G&A is expected to be 0.66% of total asset value, which compares favorably to listed REIT peers n GCEAR is internally managed by a best-in-class team, with a proven ability to acquire and manage a diversified portfolio of high-quality, net-lease Management and properties Board n Following GCEAR’s next annual stockholders meeting, the Board of the Combined Company will include the GCEAR directors and at least one of CCIT II’s independent directors2 Timing n The proposed merger transaction is expected to close in Q1 2021, subject to approval from CCIT II shareholders and other customary conditions 1 CCIT II incurs ~$14.0 million per year in G&A and external manager expenses; GCEAR anticipates only an incremental ~$3.5 million in G&A costs to manage the combined portfolio. | 2 At closing, three of CCIT II’s independent directors will be appointed to the Board of GCEAR, at least one of which will be recommended for election to the GCEAR Board at the next annual stockholders meeting. 4

Benefits of the Combined Company High-Quality n GCEAR and CCIT II both own high-quality mission critical corporate office and industrial assets with long-term, net leases to creditworthy Complementary corporate tenants Portfolios n Both companies have national portfolios with similar investment strategies and meaningful overlap in target markets n Total assets of $5.8 billion1, total NAV of $3.0 billion1, comprised of 125 office and industrial net-lease properties totaling 31 million square feet Increased Scale and Diversification n The Combined Company will have increased diversification across lease maturities, tenants and tenant industries, with no tenant contributing more than 3.3% of total 12-month forward net rents as of June 30, 2020 n The Combined Company will become one of the largest publicly registered office and industrial net-lease REITs with an outsized focus on Market Leading investment grade rated tenants Platform n GCEAR and CCIT II have collected 100% of contractual rent due from their respective tenants since the onset of the pandemic as compared to the publicly traded net-lease REIT average of 82%2 Internalized n The merger results in the elimination of CCIT II’s external management structure Management with n The Combined Company will be managed by GCEAR’s in-house management team, an experienced and proven operator that specializes in Strong Track Record corporate net-lease office and industrial assets Enhanced Liquidity n Following the transaction, the Combined Company will have an unsecured asset base of $3.7 billion and no debt maturities until 2023 and Access to n The transaction is deleveraging for GCEAR and the Combined Company intends to further improve and strengthen the balance sheet over time Capital n The Combined Company’s larger scale is expected to facilitate better access and pricing in institutional debt and equity capital Note: All figures as of June 30, 2020, does not take into account effects of the transaction. | 1 Based on company filings, Gross Asset Value and Net Asset Value as of Q2 2020. | 2 Per Green Street Advisors, represents average of Q2 ‘20 rent collections for Green Street’s net-lease coverage universe. Net-lease REITs are defined as publicly traded net-lease REITs tracked by Green Street. 5

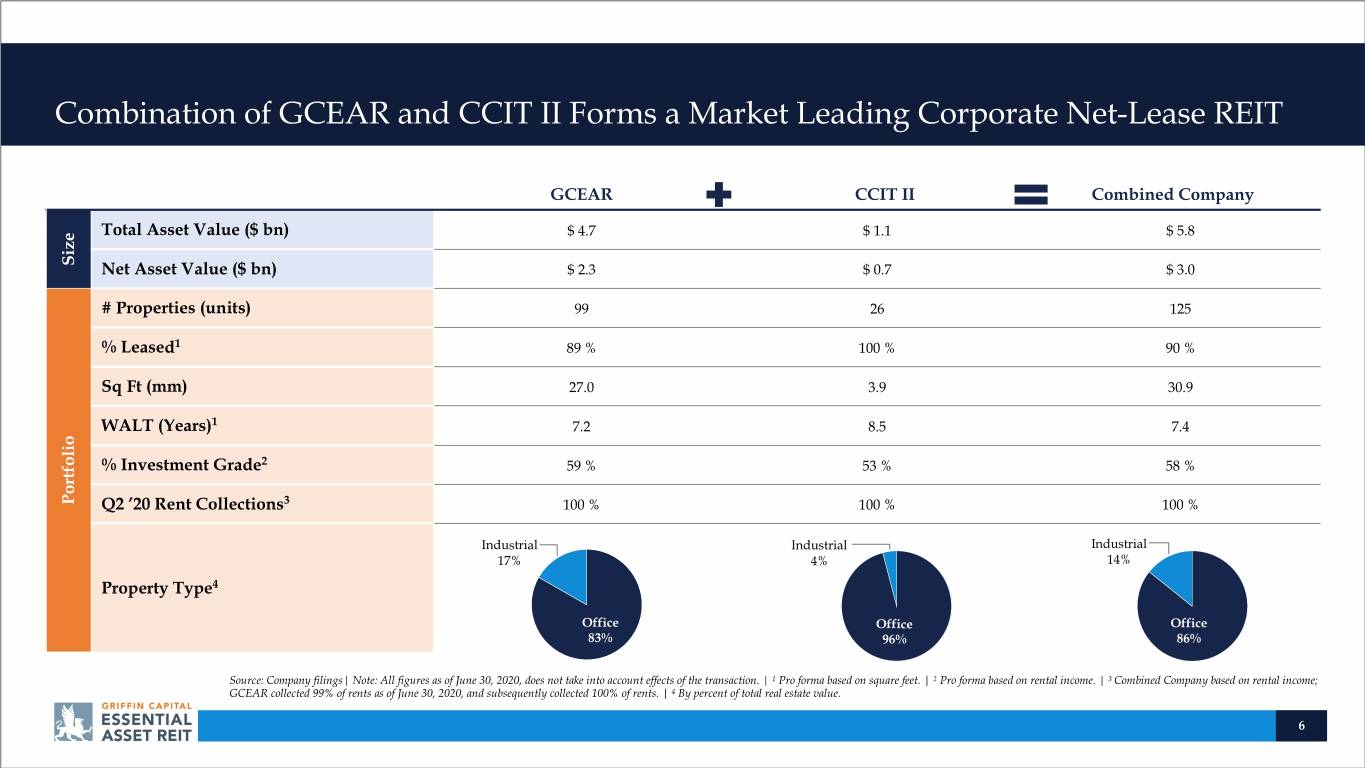

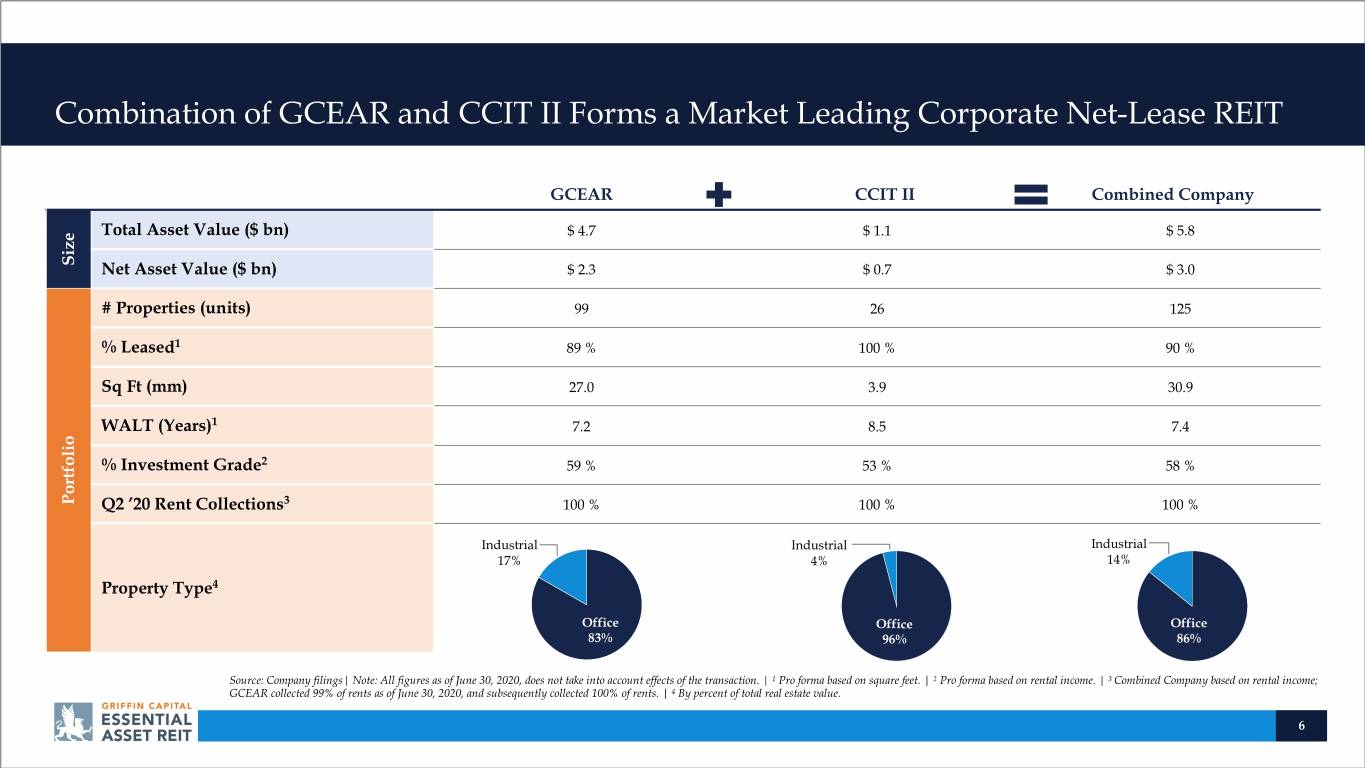

Combination of GCEAR and CCIT II Forms a Market Leading Corporate Net-Lease REIT GCEAR CCIT II Combined Company Total Asset Value ($ bn) $ 4.7 $ 1.1 $ 5.8 Size Net Asset Value ($ bn) $ 2.3 $ 0.7 $ 3.0 # Properties (units) 99 26 125 % Leased1 89 % 100 % 90 % Sq Ft (mm) 27.0 3.9 30.9 WALT (Years)1 7.2 8.5 7.4 % Investment Grade2 59 % 53 % 58 % Portfolio Q2 ’20 Rent Collections3 100 % 100 % 100 % Industrial Industrial Industrial 17% 4% 14% Property Type4 Office Office Office 83% 96% 86% Source: Company filings| Note: All figures as of June 30, 2020, does not take into account effects of the transaction. | 1 Pro forma based on square feet. | 2 Pro forma based on rental income. | 3 Combined Company based on rental income; GCEAR collected 99% of rents as of June 30, 2020, and subsequently collected 100% of rents. | 4 By percent of total real estate value. 6

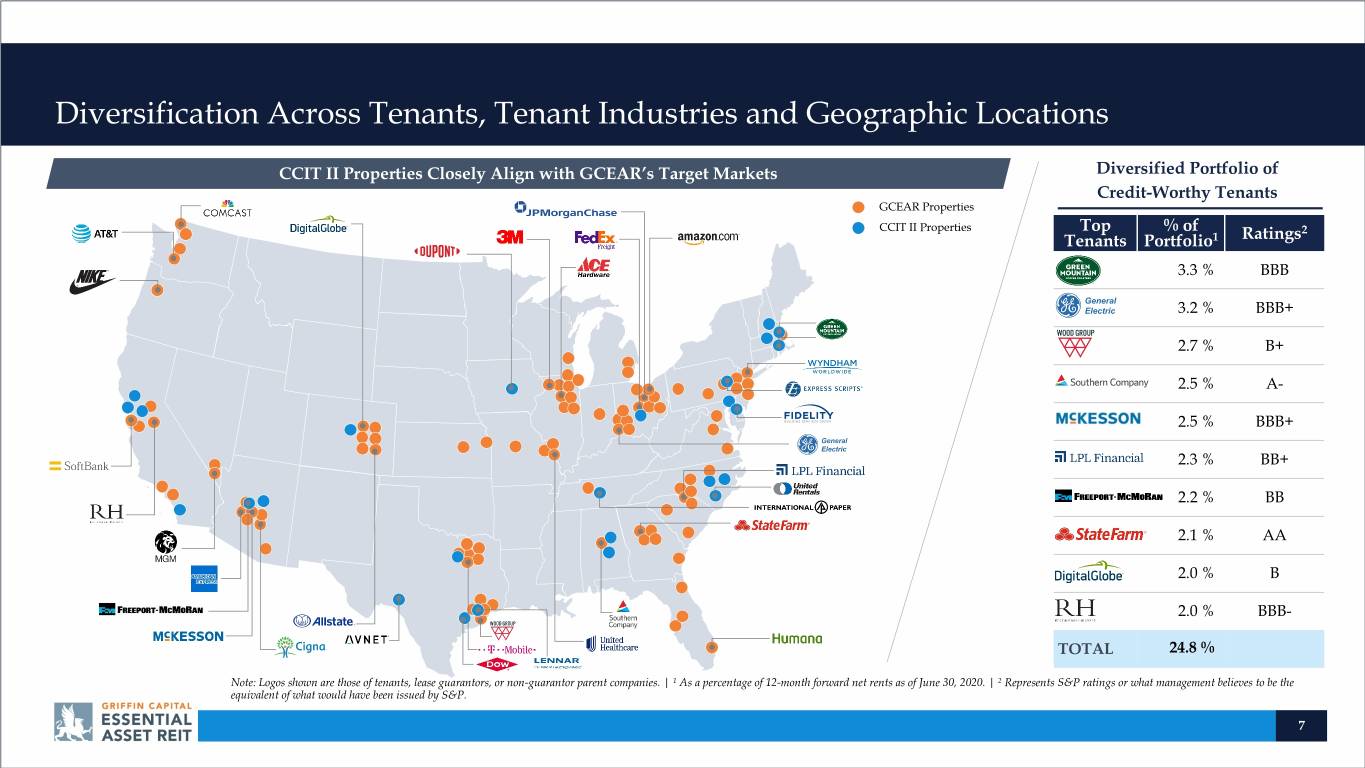

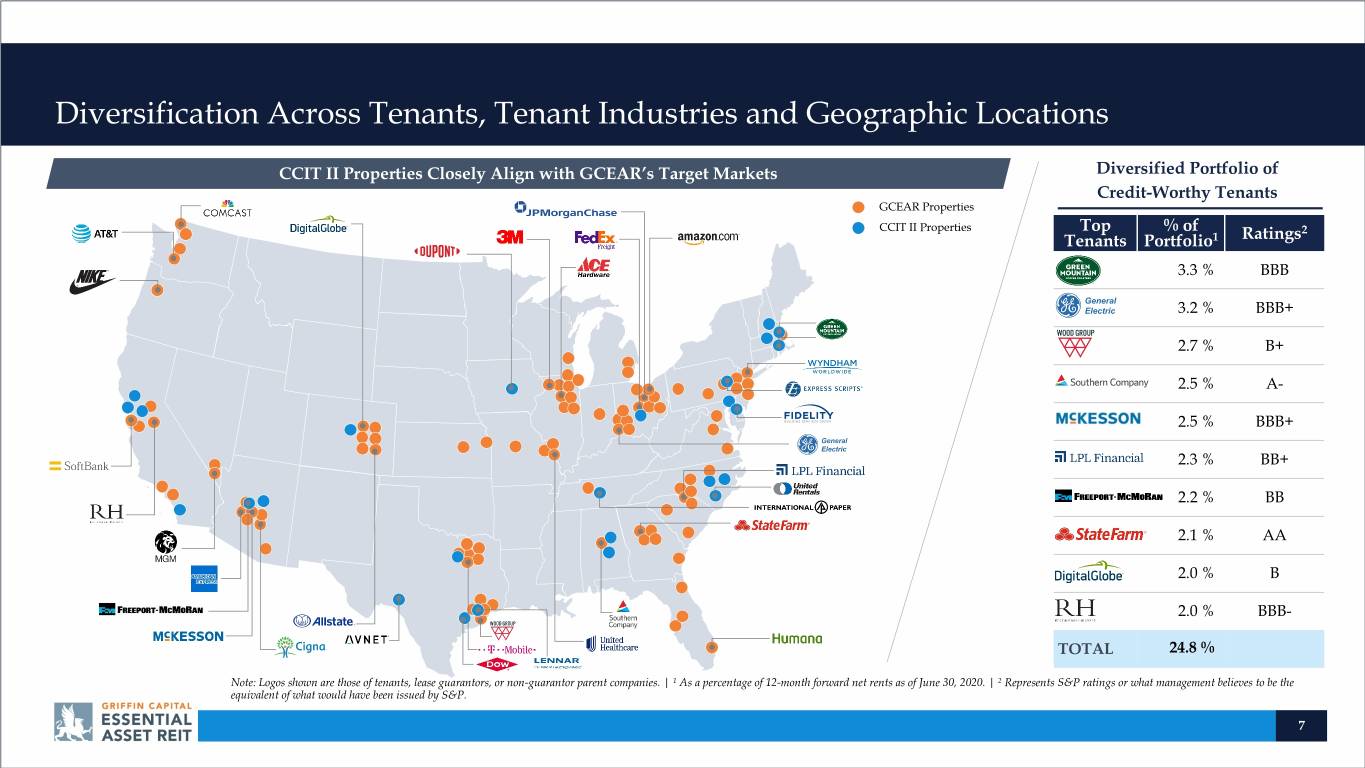

Diversification Across Tenants, Tenant Industries and Geographic Locations CCIT II Properties Closely Align with GCEAR’s Target Markets Diversified Portfolio of Credit-Worthy Tenants GCEAR Properties CCIT II Properties Top % of 2 Tenants Portfolio1 Ratings 3.3 % BBB 3.2 % BBB+ 2.7 % B+ 2.5 % A- 2.5 % BBB+ 2.3 % BB+ 2.2 % BB 2.1 % AA 2.0 % B 2.0 % BBB- TOTAL 24.8 % Note: Logos shown are those of tenants, lease guarantors, or non-guarantor parent companies. | 1 As a percentage of 12-month forward net rents as of June 30, 2020. | 2 Represents S&P ratings or what management believes to be the equivalent of what would have been issued by S&P. 7

II. Market Opportunity RESTORATION HARDWARE Patterson, CA

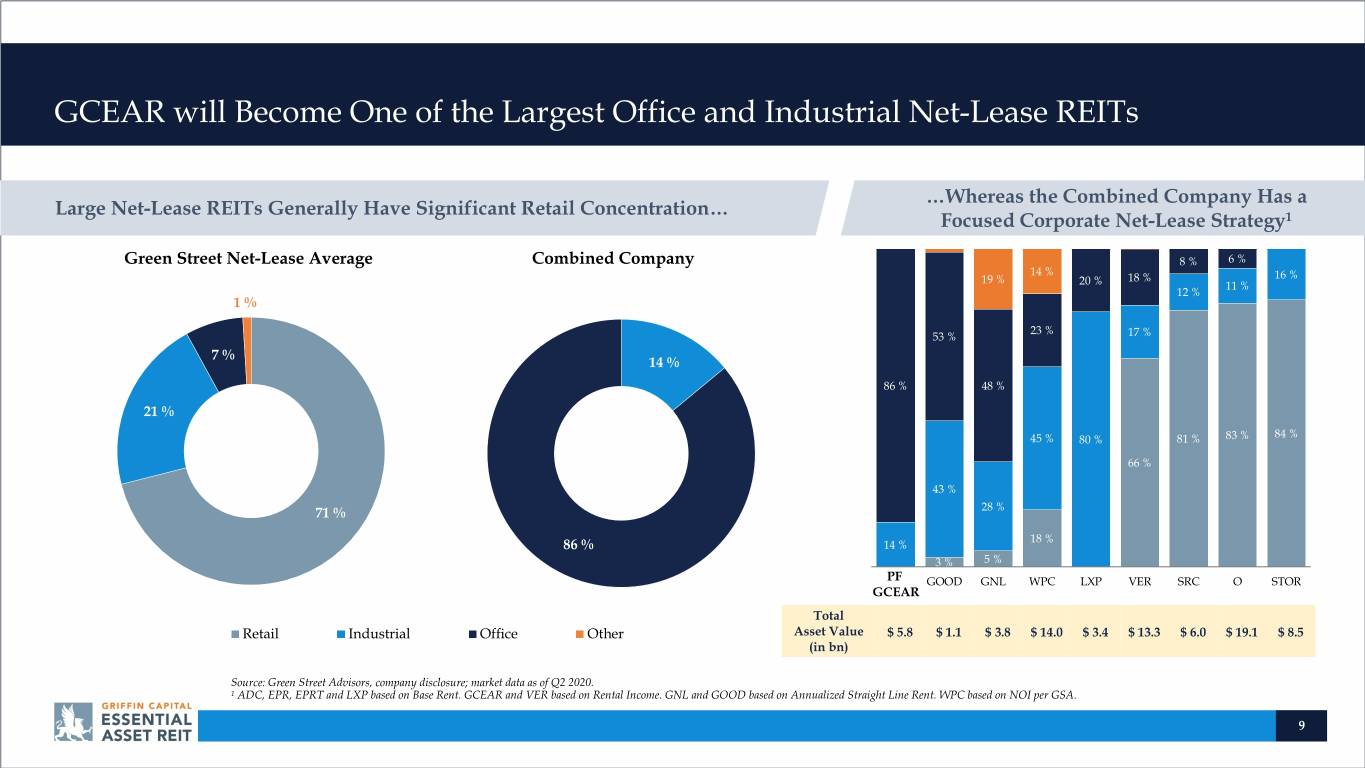

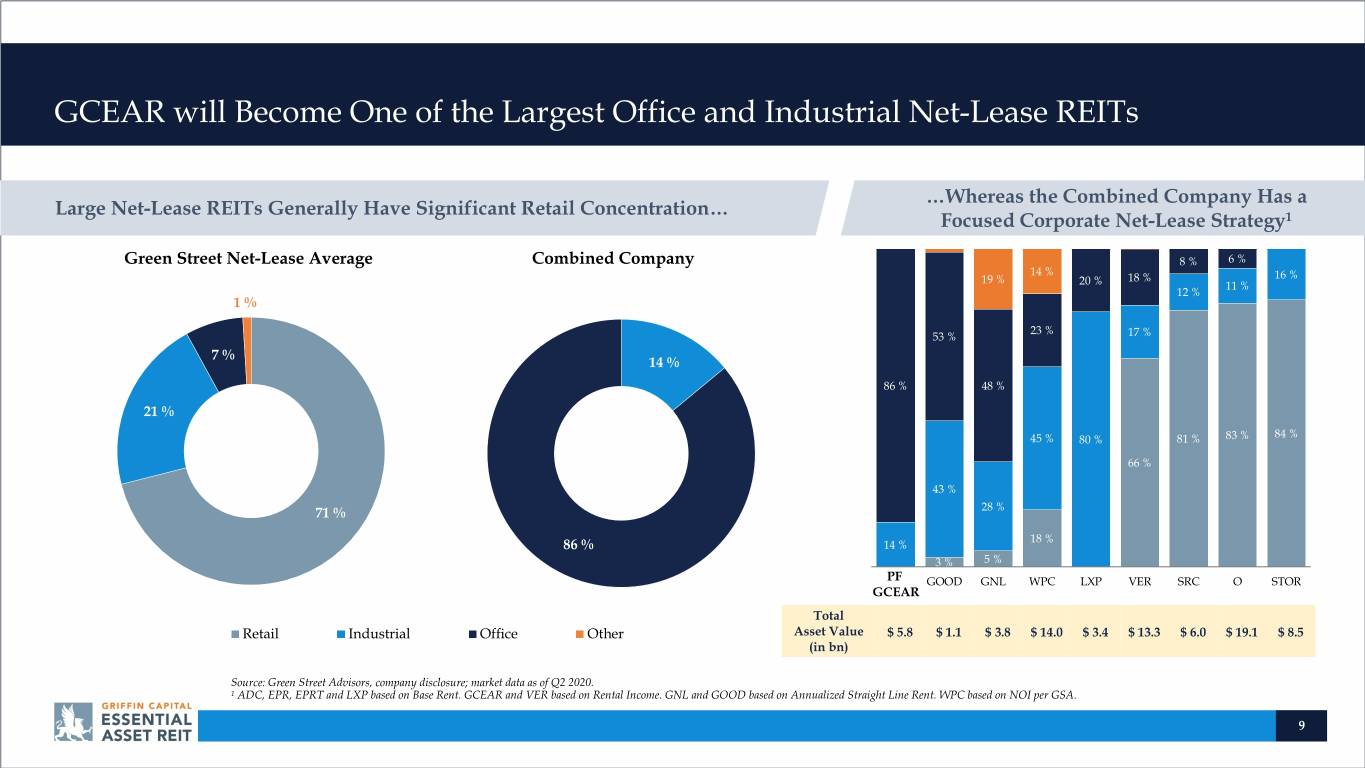

GCEAR will Become One of the Largest Office and Industrial Net-Lease REITs …Whereas the Combined Company Has a Large Net-Lease REITs Generally Have Significant Retail Concentration… Focused Corporate Net-Lease Strategy1 Green Street Net-Lease Average Combined Company 8 % 6 % 14 % 19 % 18 % 16 % 20 % 11 % 12 % 1 % 23 % 53 % 17 % 7 % 14 % 86 % 48 % 21 % 84 % 45 % 80 % 81 % 83 % 66 % 43 % 71 % 28 % 18 % 86 % 14 % 3 % 5 % PFPF GOOD GNL WPC LXP VER SRC O STOR GCEARGCEAR Total Retail Industrial Office Other Asset Value $ 5.8 $ 1.1 $ 3.8 $ 14.0 $ 3.4 $ 13.3 $ 6.0 $ 19.1 $ 8.5 (in bn) Source: Green Street Advisors, company disclosure; market data as of Q2 2020. 1 ADC, EPR, EPRT and LXP based on Base Rent. GCEAR and VER based on Rental Income. GNL and GOOD based on Annualized Straight Line Rent. WPC based on NOI per GSA. 9

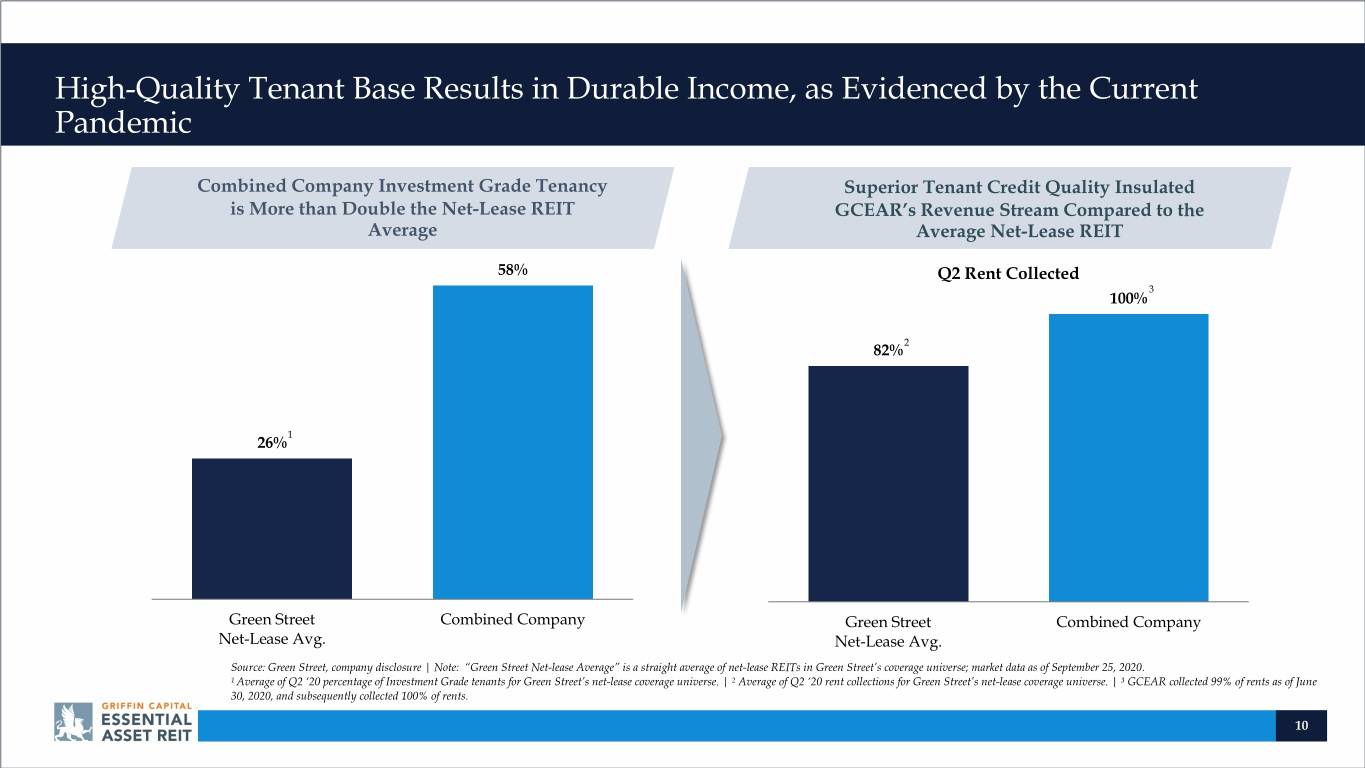

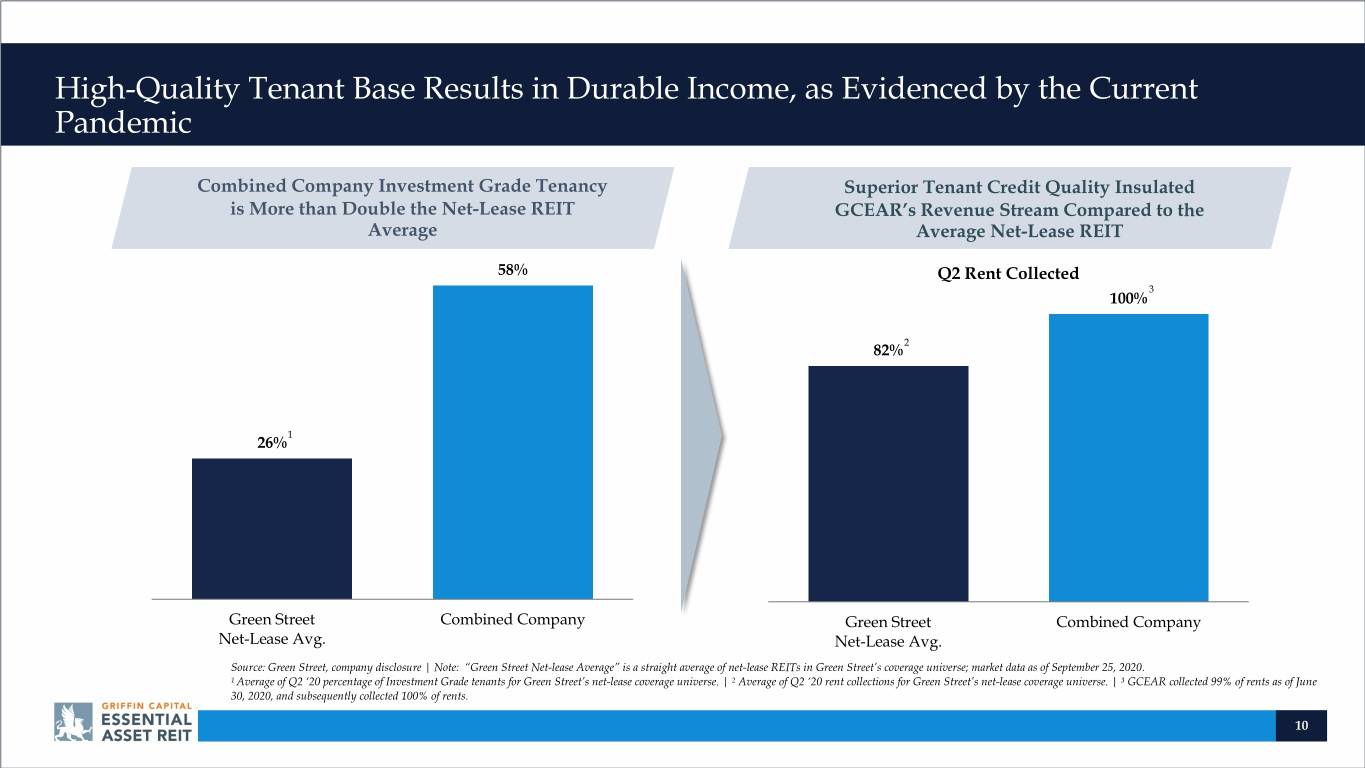

High-Quality Tenant Base Results in Durable Income, as Evidenced by the Current Pandemic Combined Company Investment Grade Tenancy Superior Tenant Credit Quality Insulated is More than Double the Net-Lease REIT GCEAR’s Revenue Stream Compared to the Average Average Net-Lease REIT 58% Q2 Rent Collected 3 100% 2 82% 1 26% Green Street Combined Company Green Street Combined Company Net-Lease Avg. Net-Lease Avg. Source: Green Street, company disclosure | Note: “Green Street Net-lease Average” is a straight average of net-lease REITs in Green Street’s coverage universe; market data as of September 25, 2020. 1 Average of Q2 ‘20 percentage of Investment Grade tenants for Green Street’s net-lease coverage universe. | 2 Average of Q2 ‘20 rent collections for Green Street’s net-lease coverage universe. | 3 GCEAR collected 99% of rents as of June 30, 2020, and subsequently collected 100% of rents. 10

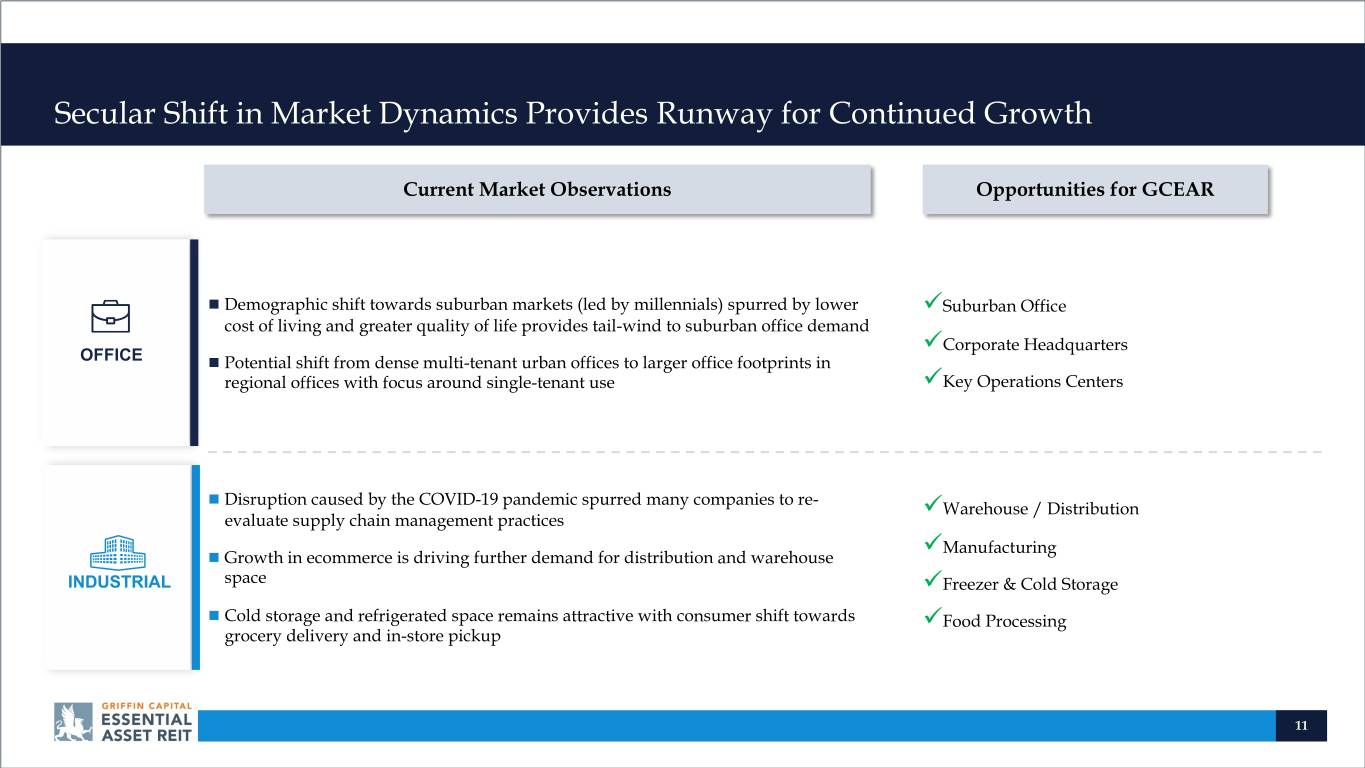

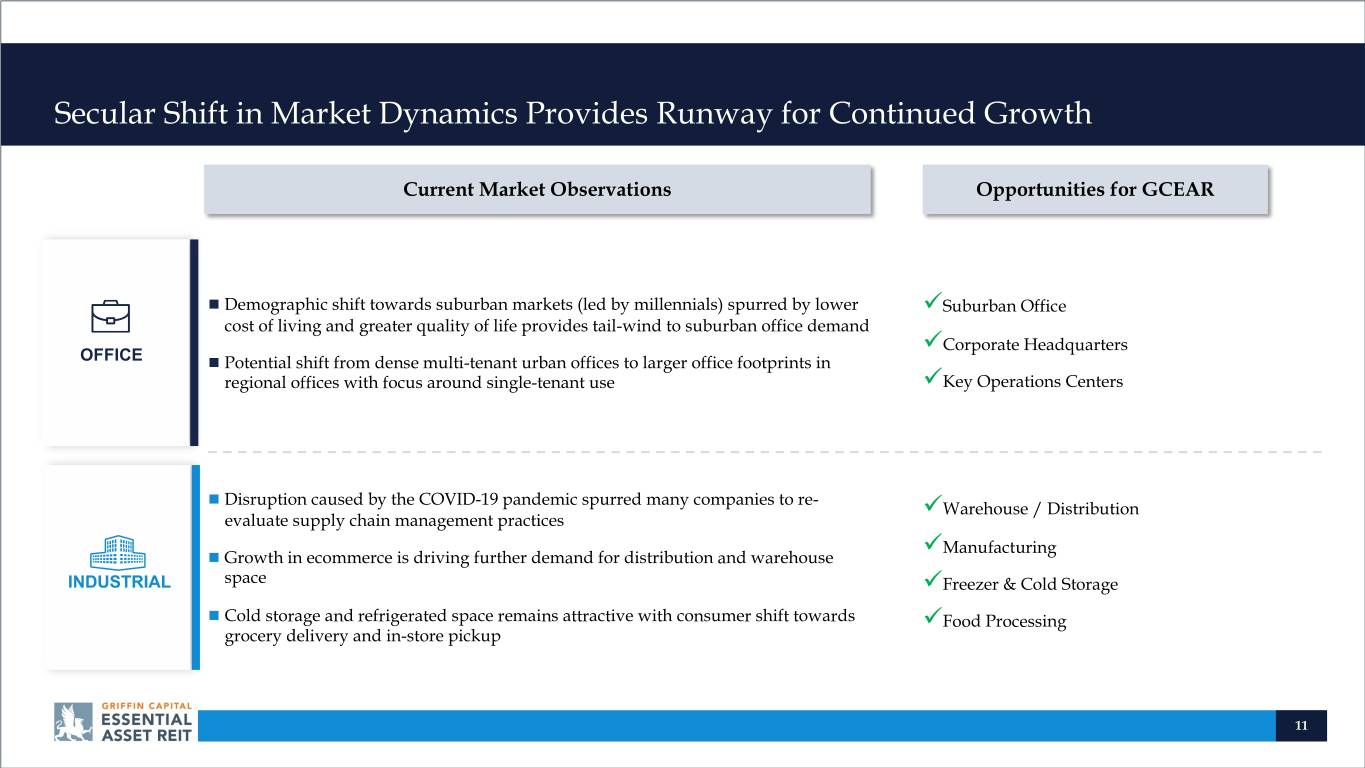

Secular Shift in Market Dynamics Provides Runway for Continued Growth Current Market Observations Opportunities for GCEAR n Demographic shift towards suburban markets (led by millennials) spurred by lower üSuburban Office cost of living and greater quality of life provides tail-wind to suburban office demand üCorporate Headquarters OFFICE n Potential shift from dense multi-tenant urban offices to larger office footprints in regional offices with focus around single-tenant use üKey Operations Centers n Disruption caused by the COVID-19 pandemic spurred many companies to re- üWarehouse / Distribution evaluate supply chain management practices üManufacturing n Growth in ecommerce is driving further demand for distribution and warehouse INDUSTRIAL space üFreezer & Cold Storage n Cold storage and refrigerated space remains attractive with consumer shift towards üFood Processing grocery delivery and in-store pickup 11

III. Combined Company Value Proposition WASTE MANAGEMENT Phoenix, AZ

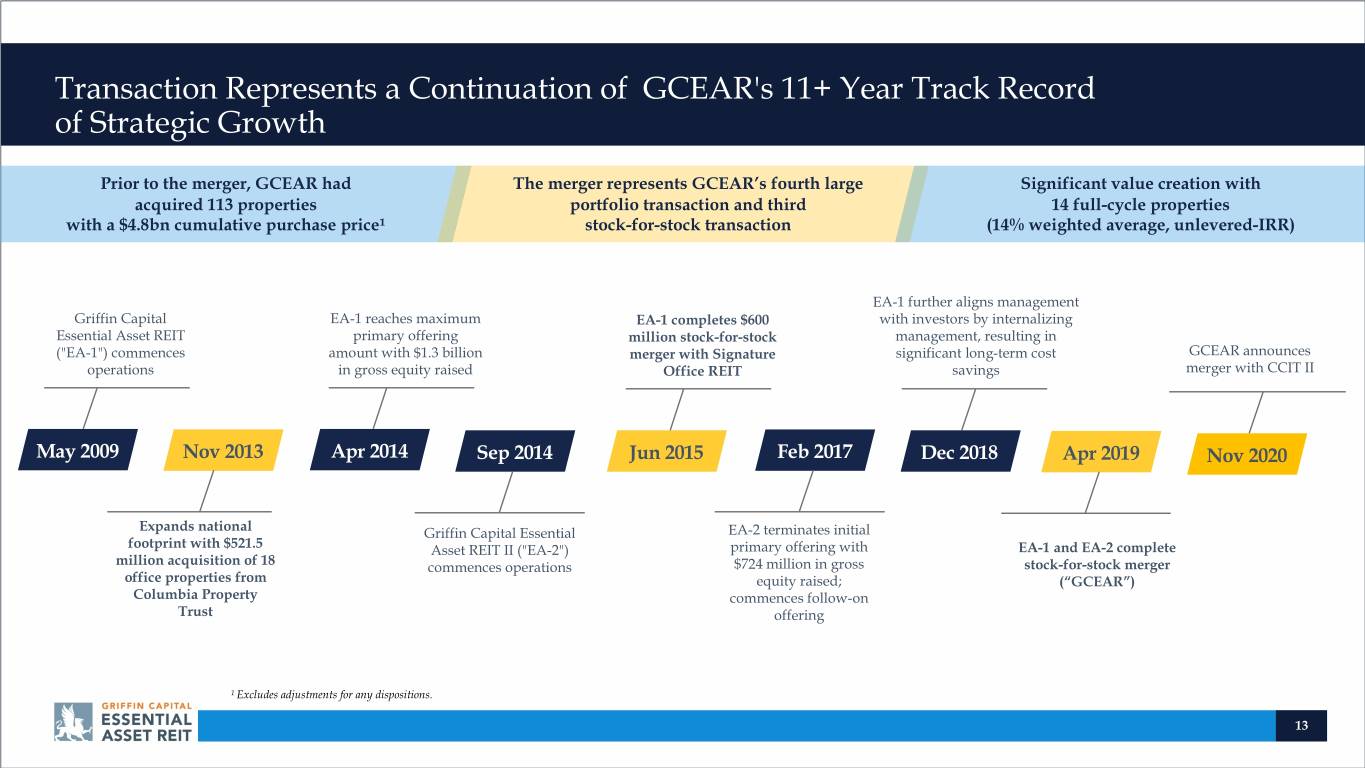

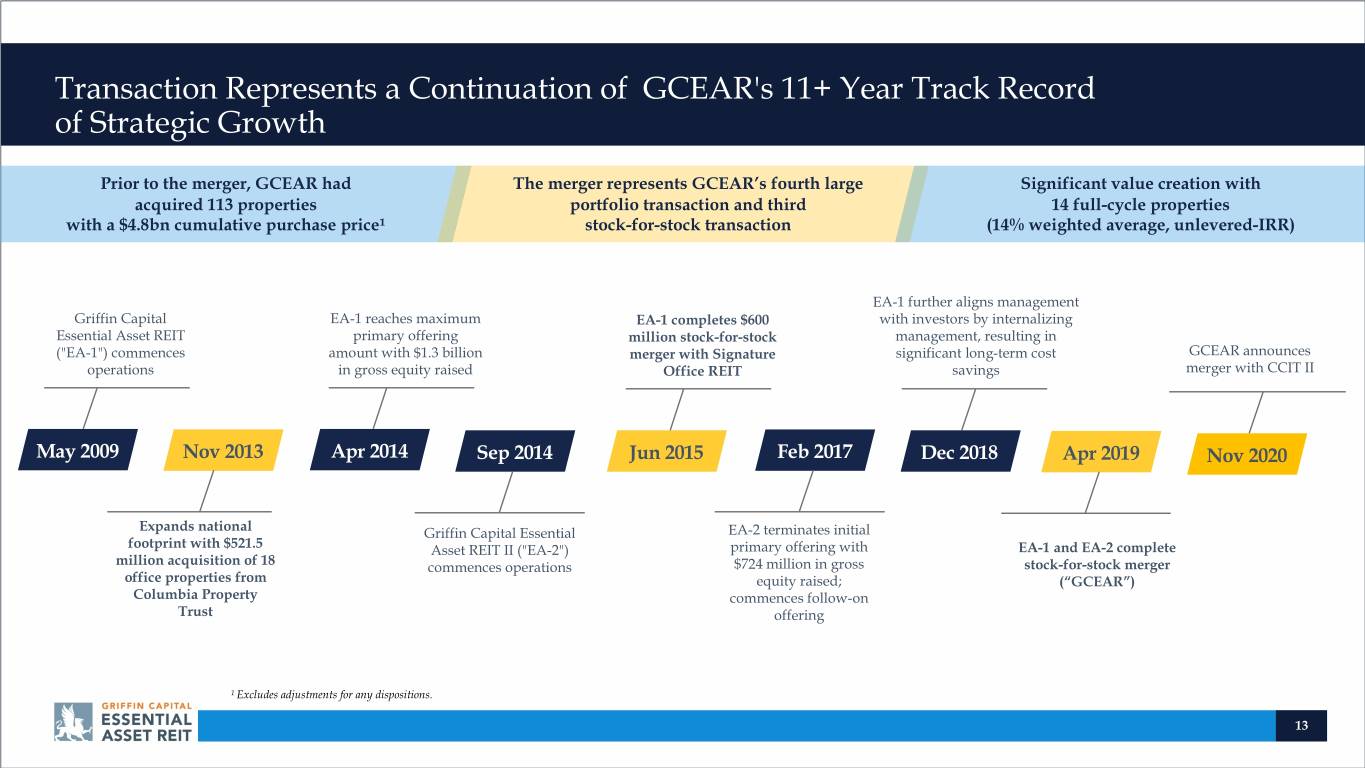

Transaction Represents a Continuation of GCEAR's 11+ Year Track Record of Strategic Growth Our PriorOrigins to the merger, GCEAR had The merger represents GCEAR’s fourth large Significant value creation with acquired 113 properties portfolio transaction and third 14 full-cycle properties with a $4.8bn cumulative purchase price¹ stock-for-stock transaction (14% weighted average, unlevered-IRR) EA-1 further aligns management Griffin Capital EA-1 reaches maximum EA-1 completes $600 with investors by internalizing Essential Asset REIT primary offering million stock-for-stock management, resulting in ("EA-1") commences amount with $1.3 billion merger with Signature significant long-term cost GCEAR announces operations in gross equity raised Office REIT savings merger with CCIT II May 2009 Nov 2013 Apr 2014 Sep 2014 Jun 2015 Feb 2017 Dec 2018 Apr 2019 Nov 2020 Expands national Griffin Capital Essential EA-2 terminates initial footprint with $521.5 Asset REIT II ("EA-2") primary offering with EA-1 and EA-2 complete million acquisition of 18 commences operations $724 million in gross stock-for-stock merger office properties from equity raised; (“GCEAR”) Columbia Property commences follow-on Trust offering 1 Excludes adjustments for any dispositions. 13

GCEAR’s Hands-On Asset Management Platform Provides Combined Company Opportunity for Internal Growth While Maintaining Stability Best-in-Class Asset Management Team Focused on Minimizing Risk & Maximizing Value Minimizing Downtime Diligent Risk Monitoring n Pre-identifying vacancy n Continual credit review and n Leverage network of local market monitoring of company news and relationships and digital market corporate actions monitoring to identify replacement n Regular financial health assessment tenants including liquidity, leverage and n Opportunistically negotiate lease profitability metrics buyouts to maximize revenue, and accelerate replacement Maximizing Value While Minimizing Risk Strategic CapEx Hands-On Management n Low cost, high impact property n Development of mutually improvements beneficial relationships with tenants through consistent n Opportunistic repositionings communication n Build-to-suit development n Property visits and face-to-face tenant meetings at least annually n In-depth, real time knowledge of property activities 14

Combined Company Value Proposition 1 One of the Largest Publicly Registered, Internally-Managed, Office and Industrial Net-Lease REITs ü Internal management results in superior alignment of interests with shareholders and lower overhead costs ü Scale and flexible balance sheet allows for opportunity to strategically sell assets and redeploy capital into high ROI investments 2 Best-in-Class Asset Management Team ü Managed by an experienced and proven operator that specializes in net-lease office and industrial assets ü Achieve superior risk-adjusted returns through proactive asset management, strategic capital investments, and diligent risk monitoring 3 Scaled Portfolio with Diversification Across Tenants, Tenant Industries and Geographic Locations ü Thoughtful acquisition framework results in curated portfolio of institutional-quality assets with long-term net leases to Blue-Chip corporate tenants with quality credit 4 Clear and Focused Go-Forward Strategy ü Continue to improve portfolio statistics and strengthen the balance sheet to maximize shareholder value 15

Disclaimer ADDITIONAL INFORMATION ABOUT THE MERGER In connection with the proposed merger, GCEAR intends to file a registration statement on Form S-4 with the SEC that will include a proxy statement of CCIT II and will also constitute a prospectus of GCEAR. This communication is not a substitute for the registration statement, the proxy statement/prospectus or any other documents that will be made available to the stockholders of CCIT II. In connection with the proposed merger, GCEAR and CCIT II also plan to file relevant materials with the SEC. STOCKHOLDERS OF CCIT II ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH THE SEC, INCLUDING THE RELEVANT PROXY STATEMENT/PROSPECTUS, WHEN THEY BECOME AVAILABLE, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED MERGER. A definitive proxy statement/prospectus will be sent to CCIT II’s stockholders. Investors may obtain a copy of the proxy statement/prospectus (if and when it becomes available) and other relevant documents filed by GCEAR and CCIT II free of charge at the SEC’s website, www.sec.gov. Copies of the documents filed by GCEAR with the SEC will be available free of charge on GCEAR’s website at http://www.gcear.com or by contacting GCEAR’s Investor Services at (888) 926-2688, as they become available. Copies of the documents filed by CCIT II with the SEC will be available free of charge on CCIT II’s external advisor’s website, at https://www.cimgroup.com/investment-strategies/individual/for-shareholders, as they become available. PARTICIPANTS IN SOLICITATION RELATING TO THE MERGER CCIT II, GCEAR and their respective directors and executive officers and other members of management and employees, as well as certain affiliates of CIM Group, LLC serving as CCIT II’s external advisor, may be deemed to be participants in the solicitation of proxies from CCIT II stockholders in respect of the proposed merger among GCEAR, CCIT II and their respective subsidiaries. Information regarding the directors, executive officers and external advisor of CCIT II is contained in the Annual Report on Form 10-K for the year ended December 31, 2019 filed with the SEC on March 30, 2020, as amended on April 27, 2020. Information about directors and executive officers of GCEAR is available in the proxy statement for its 2020 annual meeting of stockholders, which was filed with the SEC on April 15, 2020. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement/prospectus and other relevant materials filed with the SEC regarding the proposed merger when they become available. Stockholders of CCIT II should read the proxy statement/prospectus carefully when it becomes available before making any voting or investment decisions. Investors may obtain free copies of these documents from GCEAR or CCIT II using the sources indicated above. NO OFFER OR SOLICITATION This communication and the information contained herein does not constitute an offer to sell or the solicitation of an offer to buy or sell any securities or a solicitation of a proxy or of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. This communication may be deemed to be solicitation material in respect of the proposed merger. 16

Disclaimer on Forward-Looking Statements This presentation contains statements that constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Statements can generally be identified as forward-looking because they include words such as “believes,” “anticipates,” “expects,” “would,” “could,” or words of similar meaning. Statements that describe future plans and objectives are also forward-looking statements. These statements are based on management’s current expectations and beliefs and are subject to a number of trends and uncertainties that could cause actual results to differ materially from those described in the forward-looking statements; GCEAR can give no assurance that its expectations will be attained. Factors that could cause actual results to differ materially from GCEAR’s expectations include, but are not limited to, the risk that the merger will not be consummated within the expected time period or at all; the occurrence of any event, change or other circumstance that could give rise to the termination of the merger agreement; the failure to satisfy the conditions to the consummation of the proposed merger, including the approval of the stockholders of CCIT II; statements about the benefits of the proposed merger involving GCEAR and CCIT II and statements that address operating performance, events or developments that GCEAR expects or anticipates will occur in the future, including but not limited to statements regarding anticipated synergies and G&A savings, future financial and operating results, plans, objectives, expectations and intentions, expected sources of financing, anticipated asset dispositions, anticipated leadership and governance, creation of value for stockholders, benefits of the proposed merger to customers, employees, stockholders and other constituents of the Combined Company, the integration of GCEAR and CCIT II, cost savings and the expected timetable for completing the proposed merger, and other non-historical statements; risks related to the disruption of management’s attention from ongoing business operations due to the proposed merger; the availability of suitable investment or disposition opportunities; changes in interest rates; the availability and terms of financing; the impact of the COVID-19 pandemic on the operations and financial condition of each of GCEAR and CCIT II and the real estate industries in which they operate, including with respect to occupancy rates, rent deferrals and the financial condition of their respective tenants; general financial and economic conditions, which may be affected by government responses to the COVID-19 pandemic; market conditions; legislative and regulatory changes that could adversely affect the business of GCEAR or CCIT II; and other factors, including those set forth in the section entitled “Risk Factors” in GCEAR’s and CCIT II’s most recent Annual Reports on Form 10-K, as amended, and Quarterly Reports on Form 10-Q filed with the SEC, and other reports filed by GCEAR and CCIT II with the SEC, copies of which are available on the SEC’s website, www.sec.gov. Forward-looking statements are not guarantees of performance or results and speak only as of the date such statements are made. Except as required by law, neither GCEAR nor CCIT II undertakes any obligation to update or revise any forward-looking statement in this communication, whether to reflect new information, future events, changes in assumptions or circumstances or otherwise. 17