Galaxy REIT LLC Combined Financial Statements December 31, 2023

Page Report of Independent Auditors 3 Combined Balance Sheets as of December 31, 2023 and 2022 5 Combined Statements of Operations and Comprehensive Loss for the Year Ended December 31, 2023 and for the Period from August 26, 2022 (Commencement of Operations) to December 31, 2022 6 Combined Statements of Changes in Owners' Equity for the Year Ended December 31, 2023 and for the Period from August 26, 2022 (Commencement of Operations) to December 31, 2022 7 Combined Statements of Cash Flows for the Year Ended December 31, 2023 and for the Period from August 26, 2022 (Commencement of Operations) to December 31, 2022 8 Notes to Combined Financial Statements 10 GALAXY REIT LLC INDEX TO COMBINED FINANCIAL STATEMENTS 2

3 Report of Independent Auditors To the Partners and Board of Managers of Galaxy REIT LLC Opinion We have audited the combined financial statements of Galaxy REIT, LLC (the Company), which comprise the combined balance sheets as of December 31, 2023 and 2022, and the related combined statements of operations and comprehensive loss, changes in owners’ equity and cash flows for the year ended December 31, 2023 and the period from August 26, 2022 (Commencement of Operations) to December 31, 2022, and the related notes (collectively referred to as the “financial statements”). In our opinion, the accompanying financial statements present fairly, in all material respects, the financial position of the Company at December 31, 2023 and 2022, and the results of its operations and its cash flows for the year ended December 31, 2023 and the period from August 26, 2022 (Commencement of Operations) to December 31, 2022 in accordance with accounting principles generally accepted in the United States of America. Basis for Opinion We conducted our audits in accordance with auditing standards generally accepted in the United States of America (GAAS). Our responsibilities under those standards are further described in the Auditor’s Responsibilities for the Audit of the Financial Statements section of our report. We are required to be independent of the Company and to meet our other ethical responsibilities in accordance with the relevant ethical requirements relating to our audits. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion. Responsibilities of Management for the Financial Statements Management is responsible for the preparation and fair presentation of the financial statements in accordance with accounting principles generally accepted in the United States of America, and for the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of financial statements that are free of material misstatement, whether due to fraud or error. In preparing the financial statements, management is required to evaluate whether there are conditions or events, considered in the aggregate, that raise substantial doubt about the Company’s ability to continue as a going concern for one year after the date that the financial statements are available to be issued. Auditor’s Responsibilities for the Audit of the Financial Statements Our objectives are to obtain reasonable assurance about whether the financial statements as a whole are free of material misstatement, whether due to fraud or error, and to issue an auditor’s report that includes our opinion. Reasonable assurance is a high level of assurance but is not absolute assurance and therefore is not a guarantee that an audit conducted in accordance with GAAS will always detect a material misstatement when it exists. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control. Misstatements are considered material if there is a substantial likelihood that, individually or in the aggregate, they would influence the judgment made by a reasonable user based on the financial statements. In performing an audit in accordance with GAAS, we: a. Exercise professional judgment and maintain professional skepticism throughout the audit. b. Identify and assess the risks of material misstatement of the financial statements, whether due to fraud or error, and design and perform audit procedures responsive to those risks. Such procedures include examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements.

4 c. Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control. Accordingly, no such opinion is expressed. d. Evaluate the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluate the overall presentation of the financial statements. e. Conclude whether, in our judgment, there are conditions or events, considered in the aggregate, that raise substantial doubt about the Company’s ability to continue as a going concern for a reasonable period of time. We are required to communicate with those charged with governance regarding, among other matters, the planned scope and timing of the audit, significant audit findings, and certain internal control-related matters that we identified during the audit. March 26, 2024

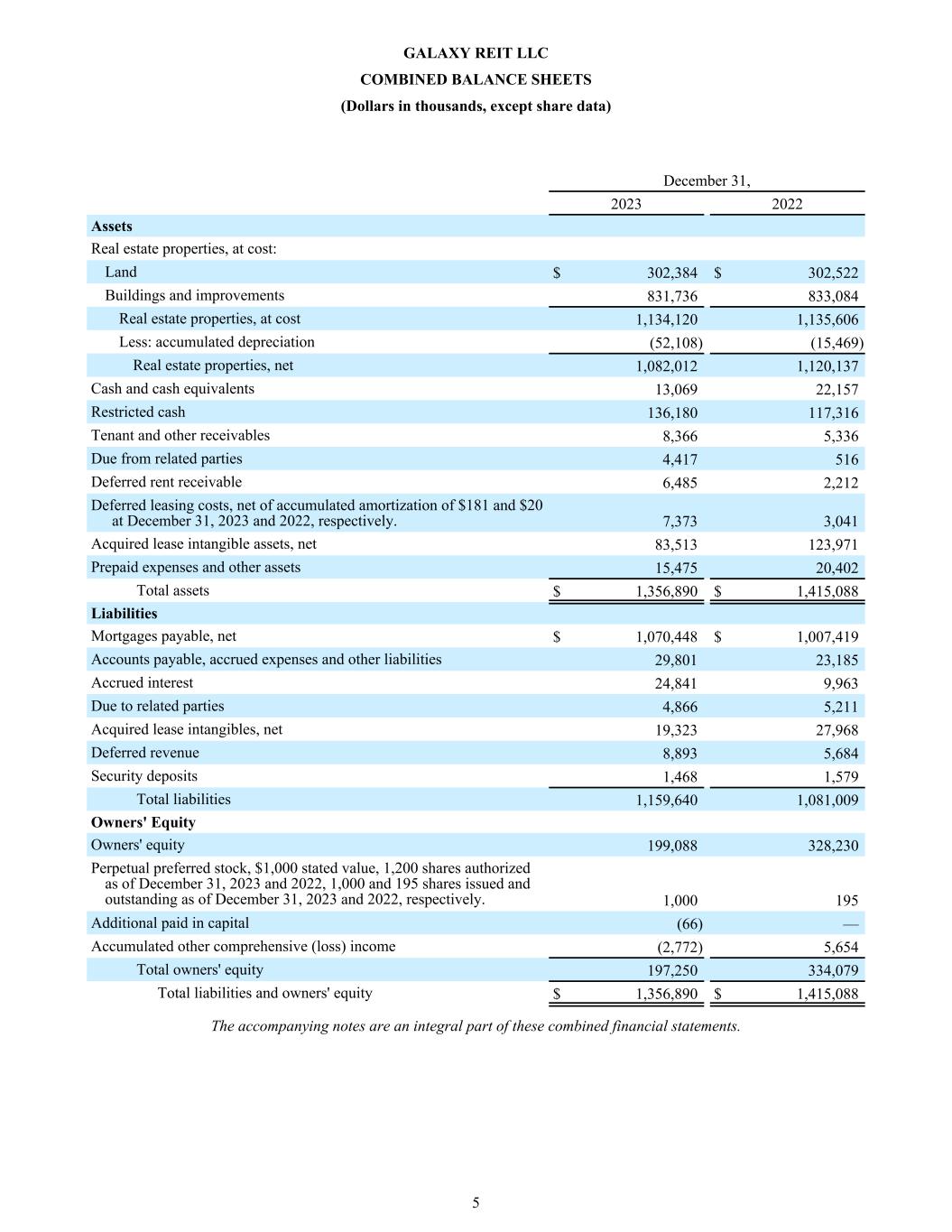

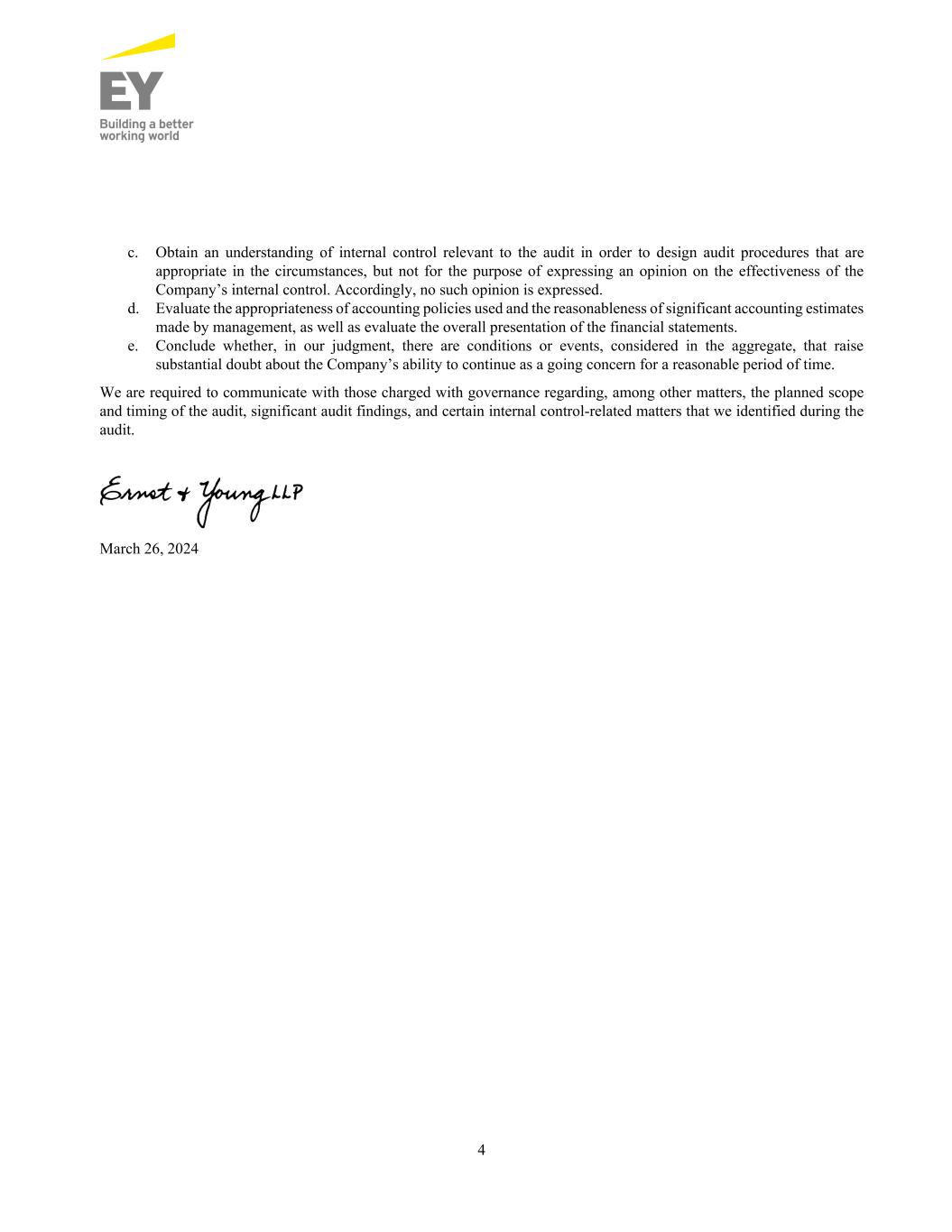

December 31, 2023 2022 Assets Real estate properties, at cost: Land $ 302,384 $ 302,522 Buildings and improvements 831,736 833,084 Real estate properties, at cost 1,134,120 1,135,606 Less: accumulated depreciation (52,108) (15,469) Real estate properties, net 1,082,012 1,120,137 Cash and cash equivalents 13,069 22,157 Restricted cash 136,180 117,316 Tenant and other receivables 8,366 5,336 Due from related parties 4,417 516 Deferred rent receivable 6,485 2,212 Deferred leasing costs, net of accumulated amortization of $181 and $20 at December 31, 2023 and 2022, respectively. 7,373 3,041 Acquired lease intangible assets, net 83,513 123,971 Prepaid expenses and other assets 15,475 20,402 Total assets $ 1,356,890 $ 1,415,088 Liabilities Mortgages payable, net $ 1,070,448 $ 1,007,419 Accounts payable, accrued expenses and other liabilities 29,801 23,185 Accrued interest 24,841 9,963 Due to related parties 4,866 5,211 Acquired lease intangibles, net 19,323 27,968 Deferred revenue 8,893 5,684 Security deposits 1,468 1,579 Total liabilities 1,159,640 1,081,009 Owners' Equity Owners' equity 199,088 328,230 Perpetual preferred stock, $1,000 stated value, 1,200 shares authorized as of December 31, 2023 and 2022, 1,000 and 195 shares issued and outstanding as of December 31, 2023 and 2022, respectively. 1,000 195 Additional paid in capital (66) — Accumulated other comprehensive (loss) income (2,772) 5,654 Total owners' equity 197,250 334,079 Total liabilities and owners' equity $ 1,356,890 $ 1,415,088 The accompanying notes are an integral part of these combined financial statements. GALAXY REIT LLC COMBINED BALANCE SHEETS (Dollars in thousands, except share data) 5

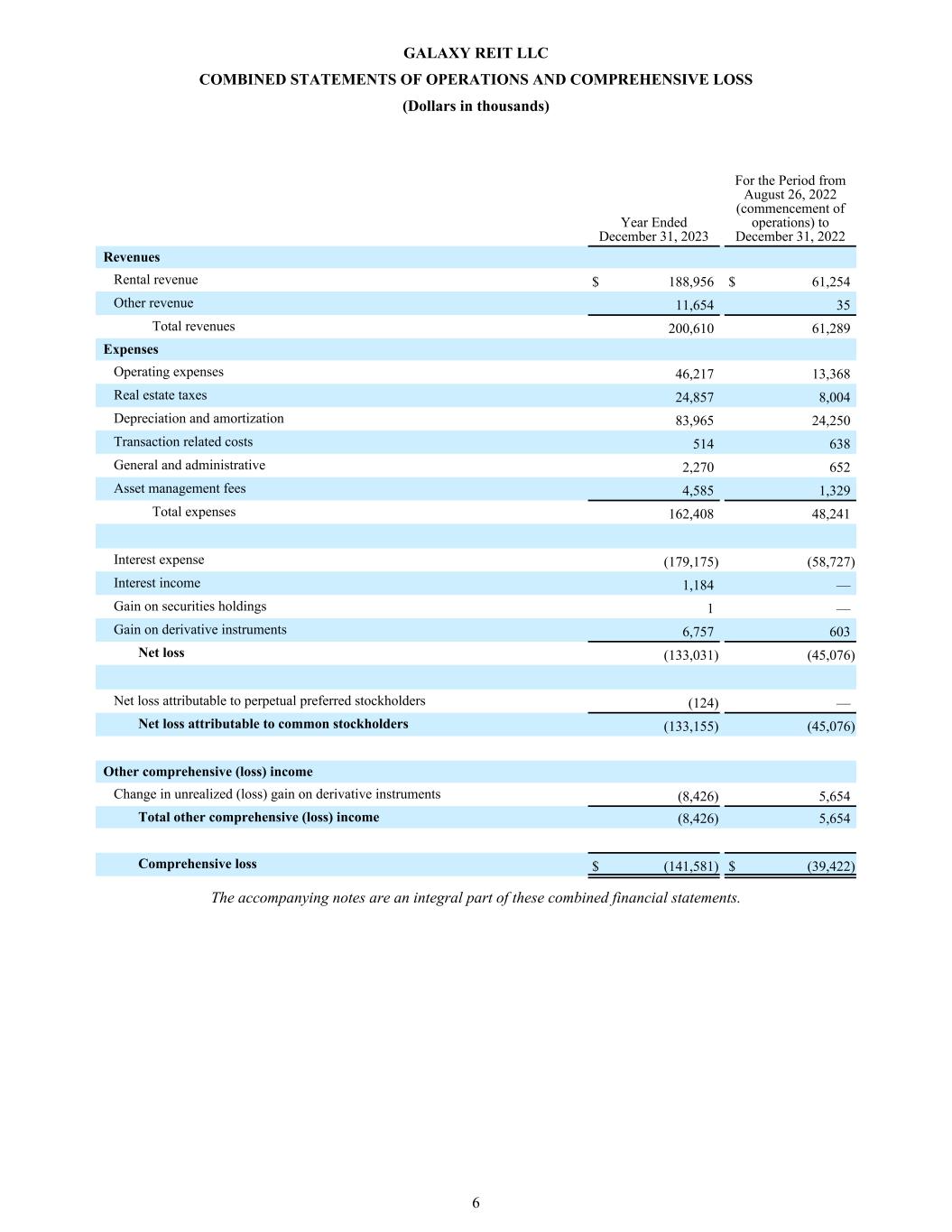

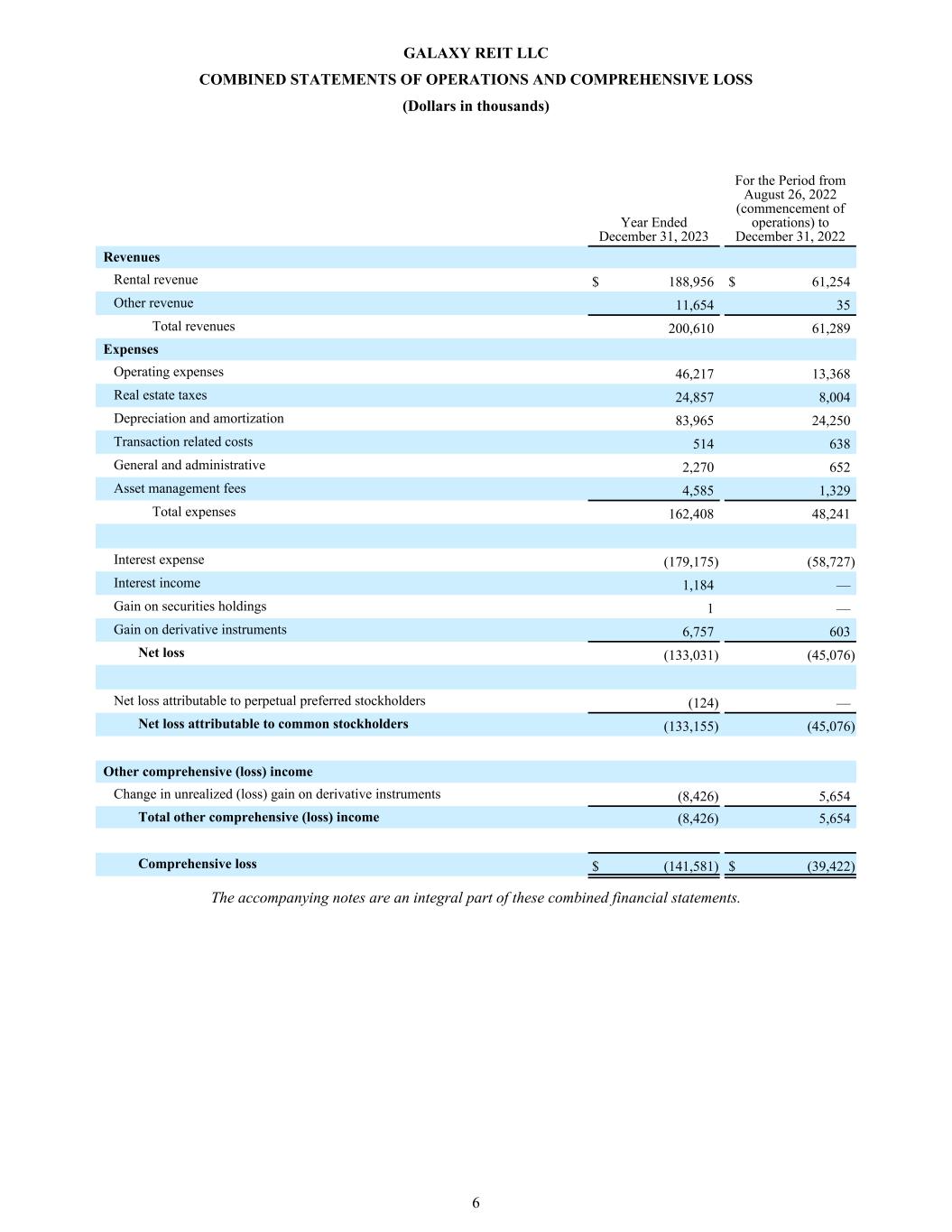

Year Ended December 31, 2023 For the Period from August 26, 2022 (commencement of operations) to December 31, 2022 Revenues Rental revenue $ 188,956 $ 61,254 Other revenue 11,654 35 Total revenues 200,610 61,289 Expenses Operating expenses 46,217 13,368 Real estate taxes 24,857 8,004 Depreciation and amortization 83,965 24,250 Transaction related costs 514 638 General and administrative 2,270 652 Asset management fees 4,585 1,329 Total expenses 162,408 48,241 Interest expense (179,175) (58,727) Interest income 1,184 — Gain on securities holdings 1 — Gain on derivative instruments 6,757 603 Net loss (133,031) (45,076) Net loss attributable to perpetual preferred stockholders (124) — Net loss attributable to common stockholders (133,155) (45,076) Other comprehensive (loss) income Change in unrealized (loss) gain on derivative instruments (8,426) 5,654 Total other comprehensive (loss) income (8,426) 5,654 Comprehensive loss $ (141,581) $ (39,422) The accompanying notes are an integral part of these combined financial statements. GALAXY REIT LLC COMBINED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS (Dollars in thousands) 6

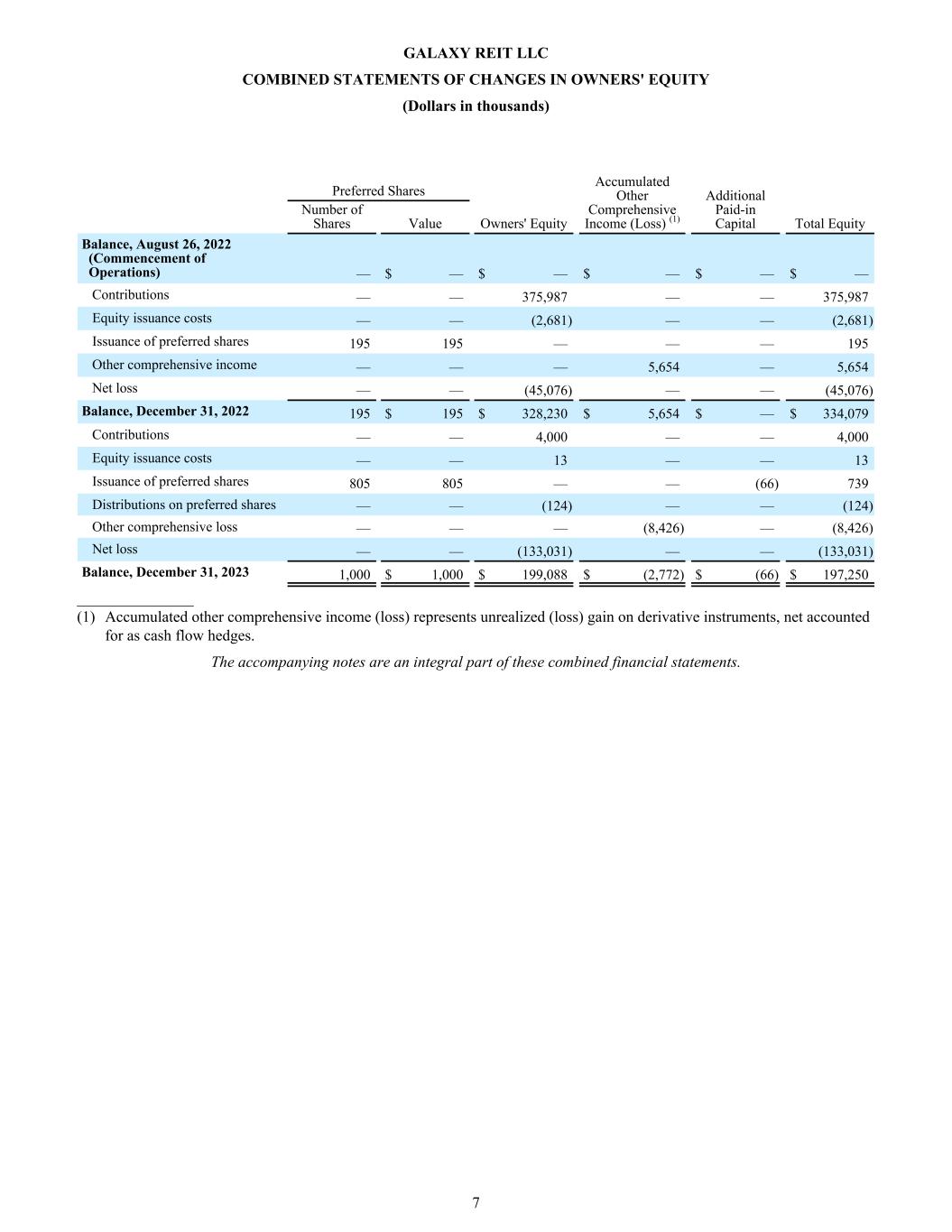

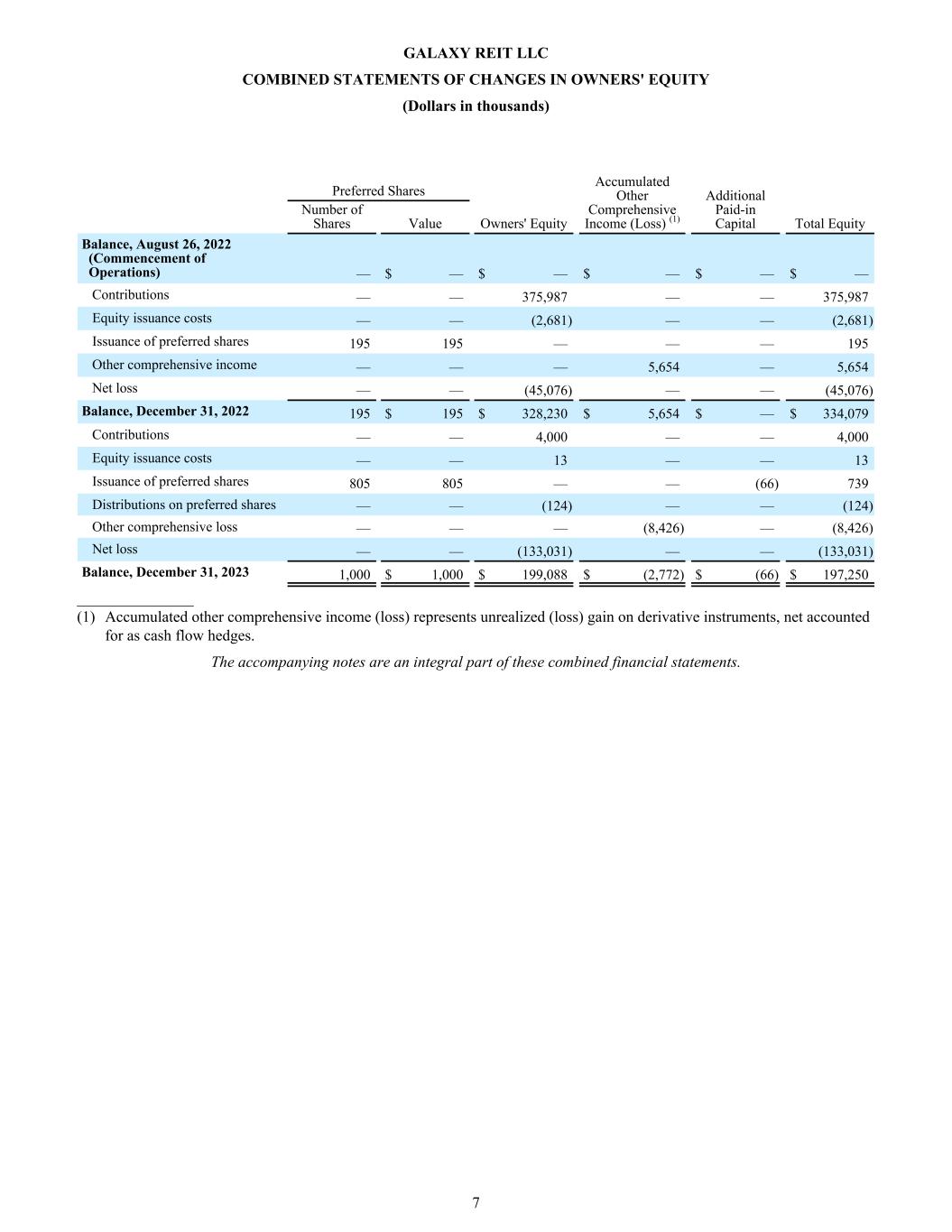

Preferred Shares Accumulated Other Comprehensive Income (Loss) (1) Additional Paid-in Capital Number of Shares Value Owners' Equity Total Equity Balance, August 26, 2022 (Commencement of Operations) — $ — $ — $ — $ — $ — Contributions — — 375,987 — — 375,987 Equity issuance costs — — (2,681) — — (2,681) Issuance of preferred shares 195 195 — — — 195 Other comprehensive income — — — 5,654 — 5,654 Net loss — — (45,076) — — (45,076) Balance, December 31, 2022 195 $ 195 $ 328,230 $ 5,654 $ — $ 334,079 Contributions — — 4,000 — — 4,000 Equity issuance costs — — 13 — — 13 Issuance of preferred shares 805 805 — — (66) 739 Distributions on preferred shares — — (124) — — (124) Other comprehensive loss — — — (8,426) — (8,426) Net loss — — (133,031) — — (133,031) Balance, December 31, 2023 1,000 $ 1,000 $ 199,088 $ (2,772) $ (66) $ 197,250 _______________ (1) Accumulated other comprehensive income (loss) represents unrealized (loss) gain on derivative instruments, net accounted for as cash flow hedges. The accompanying notes are an integral part of these combined financial statements. GALAXY REIT LLC COMBINED STATEMENTS OF CHANGES IN OWNERS' EQUITY (Dollars in thousands) 7

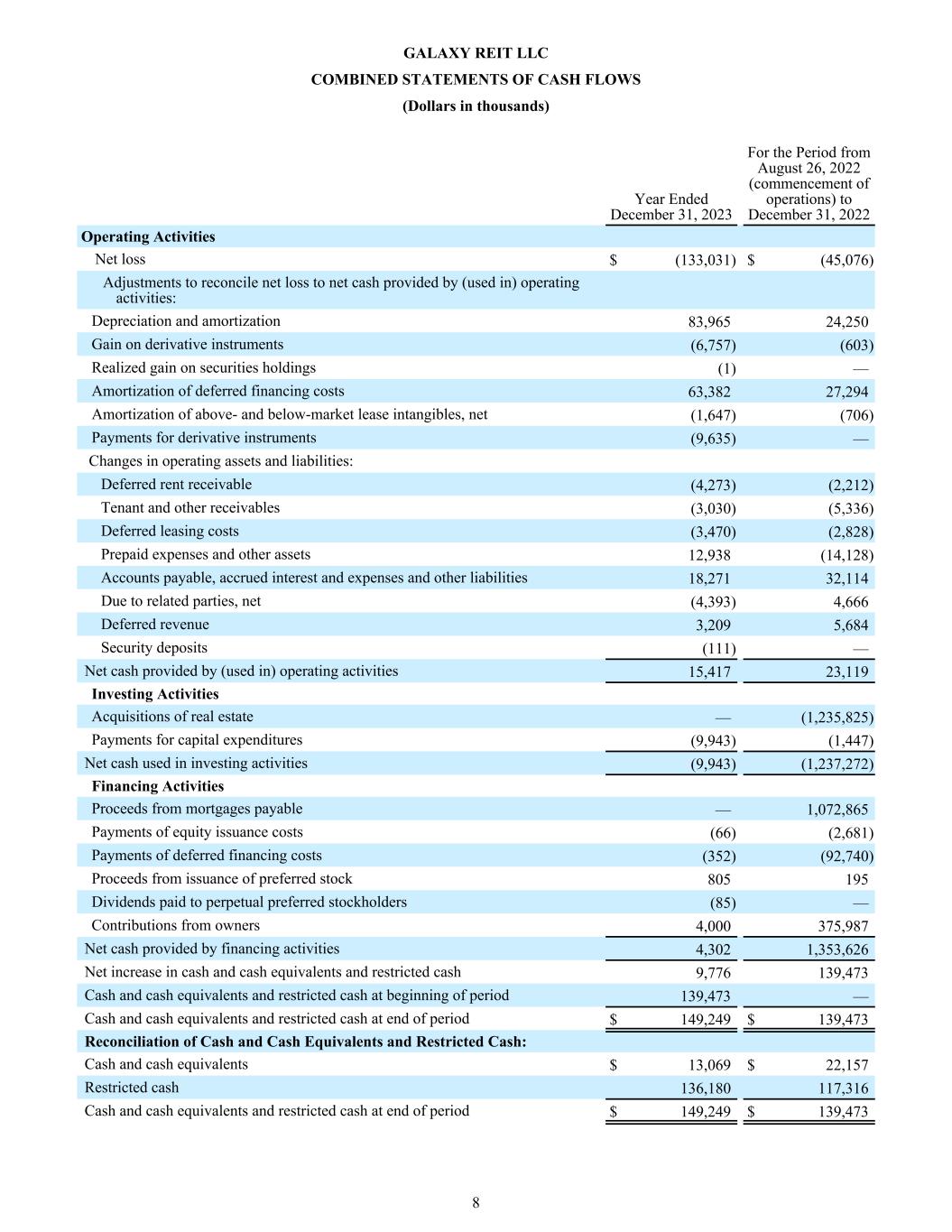

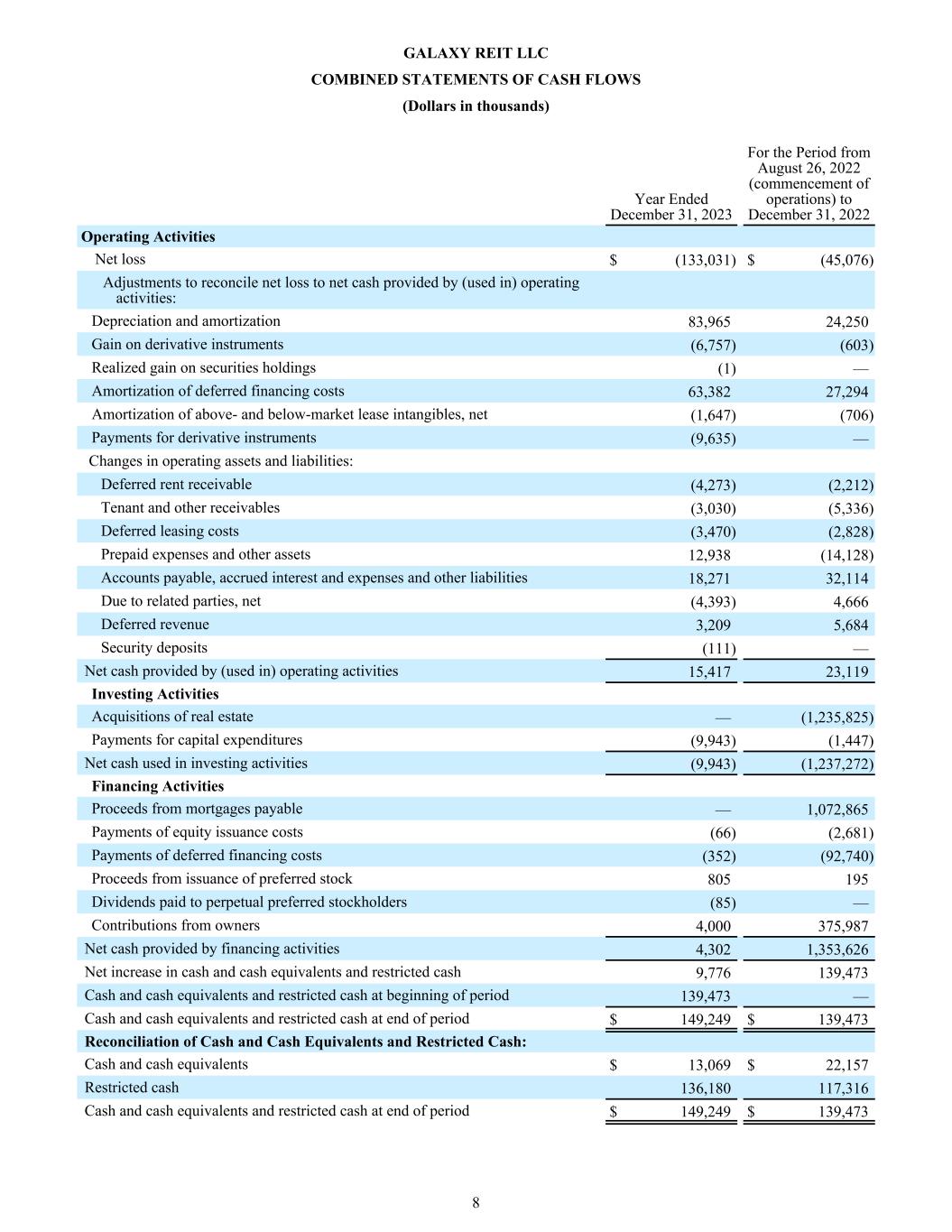

Year Ended December 31, 2023 For the Period from August 26, 2022 (commencement of operations) to December 31, 2022 Operating Activities Net loss $ (133,031) $ (45,076) Adjustments to reconcile net loss to net cash provided by (used in) operating activities: Depreciation and amortization 83,965 24,250 Gain on derivative instruments (6,757) (603) Realized gain on securities holdings (1) — Amortization of deferred financing costs 63,382 27,294 Amortization of above- and below-market lease intangibles, net (1,647) (706) Payments for derivative instruments (9,635) — Changes in operating assets and liabilities: Deferred rent receivable (4,273) (2,212) Tenant and other receivables (3,030) (5,336) Deferred leasing costs (3,470) (2,828) Prepaid expenses and other assets 12,938 (14,128) Accounts payable, accrued interest and expenses and other liabilities 18,271 32,114 Due to related parties, net (4,393) 4,666 Deferred revenue 3,209 5,684 Security deposits (111) — Net cash provided by (used in) operating activities 15,417 23,119 Investing Activities Acquisitions of real estate — (1,235,825) Payments for capital expenditures (9,943) (1,447) Net cash used in investing activities (9,943) (1,237,272) Financing Activities Proceeds from mortgages payable — 1,072,865 Payments of equity issuance costs (66) (2,681) Payments of deferred financing costs (352) (92,740) Proceeds from issuance of preferred stock 805 195 Dividends paid to perpetual preferred stockholders (85) — Contributions from owners 4,000 375,987 Net cash provided by financing activities 4,302 1,353,626 Net increase in cash and cash equivalents and restricted cash 9,776 139,473 Cash and cash equivalents and restricted cash at beginning of period 139,473 — Cash and cash equivalents and restricted cash at end of period $ 149,249 $ 139,473 Reconciliation of Cash and Cash Equivalents and Restricted Cash: Cash and cash equivalents $ 13,069 $ 22,157 Restricted cash 136,180 117,316 Cash and cash equivalents and restricted cash at end of period $ 149,249 $ 139,473 GALAXY REIT LLC COMBINED STATEMENTS OF CASH FLOWS (Dollars in thousands) 8

Year Ended December 31, 2023 For the Period from August 26, 2022 (commencement of operations) to December 31, 2022 Supplemental Information Interest paid $ 87,110 $ 15,412 Supplemental Disclosure of Non-cash Investing and Financing Activities: Capital expenditures payable $ 2,570 $ 783 Deferred leasing costs payable $ 904 $ 253 Deferred leasing costs due to related parties $ 147 $ 29 Deferred financing costs payable $ 10 $ — Purchase price adjustment $ (300) $ — Write off of equity issuance costs $ 13 $ — Perpetual preferred dividends payable $ 39 $ — The accompanying notes are an integral part of these combined financial statements. GALAXY REIT LLC COMBINED STATEMENTS OF CASH FLOWS (Dollars in thousands) 9

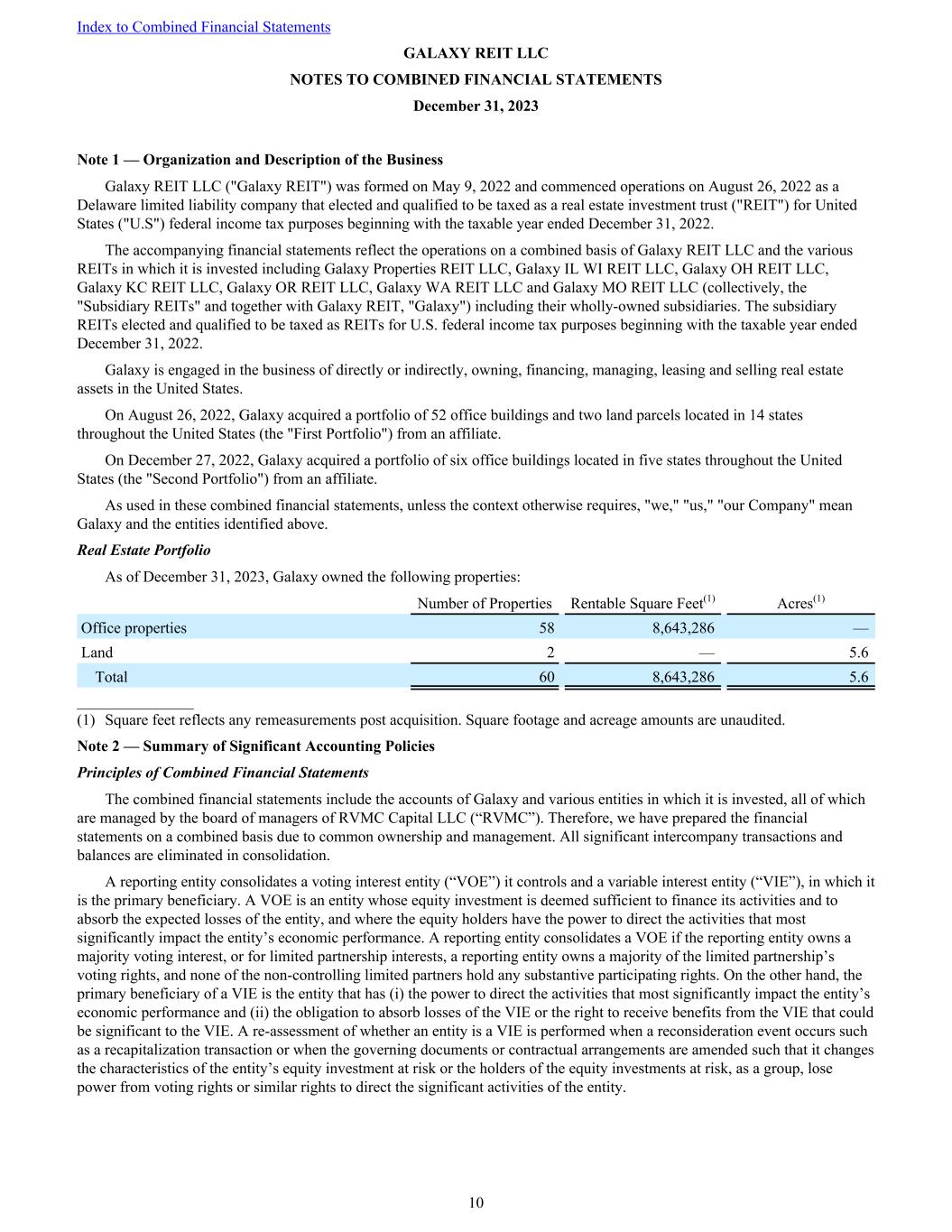

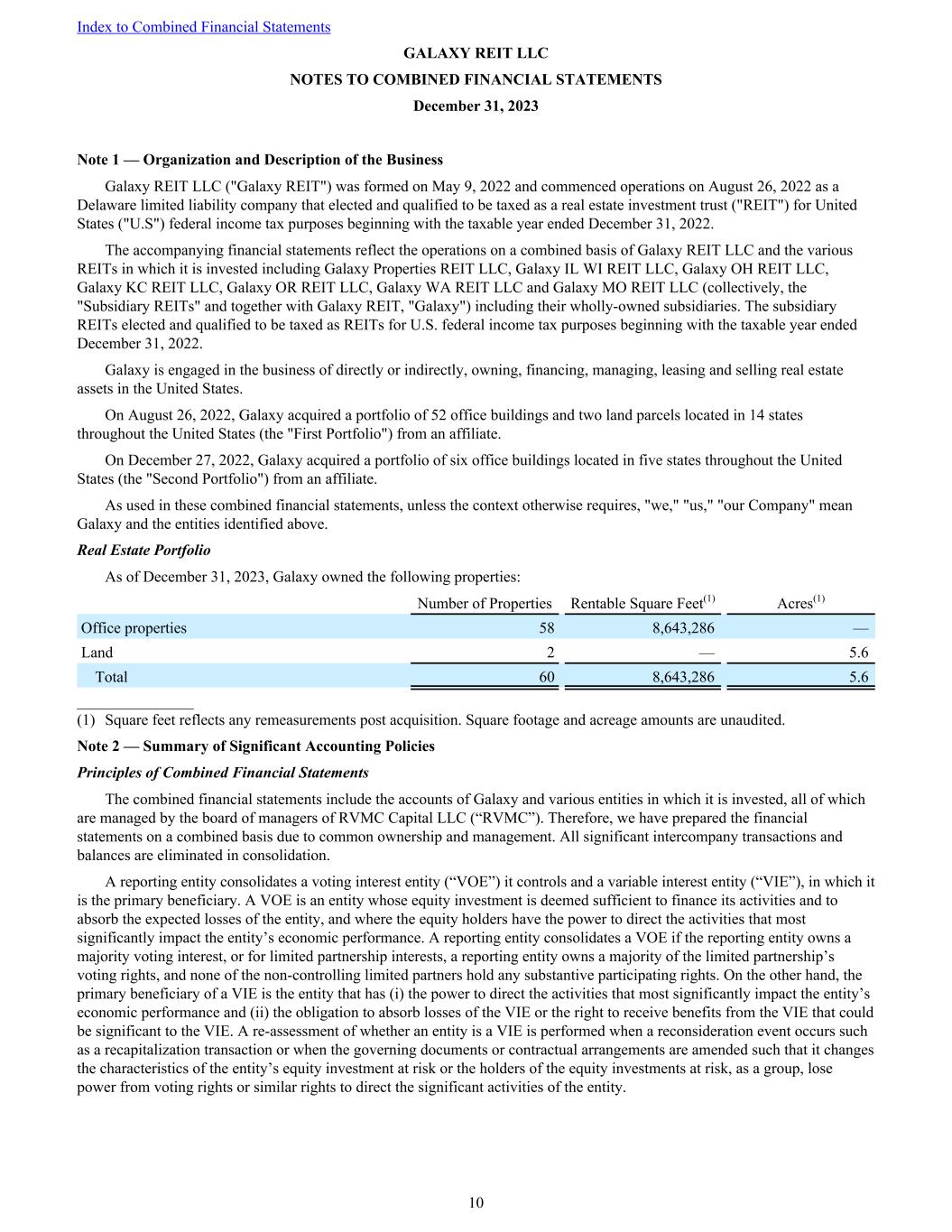

Note 1 — Organization and Description of the Business Galaxy REIT LLC ("Galaxy REIT") was formed on May 9, 2022 and commenced operations on August 26, 2022 as a Delaware limited liability company that elected and qualified to be taxed as a real estate investment trust ("REIT") for United States ("U.S") federal income tax purposes beginning with the taxable year ended December 31, 2022. The accompanying financial statements reflect the operations on a combined basis of Galaxy REIT LLC and the various REITs in which it is invested including Galaxy Properties REIT LLC, Galaxy IL WI REIT LLC, Galaxy OH REIT LLC, Galaxy KC REIT LLC, Galaxy OR REIT LLC, Galaxy WA REIT LLC and Galaxy MO REIT LLC (collectively, the "Subsidiary REITs" and together with Galaxy REIT, "Galaxy") including their wholly-owned subsidiaries. The subsidiary REITs elected and qualified to be taxed as REITs for U.S. federal income tax purposes beginning with the taxable year ended December 31, 2022. Galaxy is engaged in the business of directly or indirectly, owning, financing, managing, leasing and selling real estate assets in the United States. On August 26, 2022, Galaxy acquired a portfolio of 52 office buildings and two land parcels located in 14 states throughout the United States (the "First Portfolio") from an affiliate. On December 27, 2022, Galaxy acquired a portfolio of six office buildings located in five states throughout the United States (the "Second Portfolio") from an affiliate. As used in these combined financial statements, unless the context otherwise requires, "we," "us," "our Company" mean Galaxy and the entities identified above. Real Estate Portfolio As of December 31, 2023, Galaxy owned the following properties: Number of Properties Rentable Square Feet(1) Acres(1) Office properties 58 8,643,286 — Land 2 — 5.6 Total 60 8,643,286 5.6 _______________ (1) Square feet reflects any remeasurements post acquisition. Square footage and acreage amounts are unaudited. Note 2 — Summary of Significant Accounting Policies Principles of Combined Financial Statements The combined financial statements include the accounts of Galaxy and various entities in which it is invested, all of which are managed by the board of managers of RVMC Capital LLC (“RVMC”). Therefore, we have prepared the financial statements on a combined basis due to common ownership and management. All significant intercompany transactions and balances are eliminated in consolidation. A reporting entity consolidates a voting interest entity (“VOE”) it controls and a variable interest entity (“VIE”), in which it is the primary beneficiary. A VOE is an entity whose equity investment is deemed sufficient to finance its activities and to absorb the expected losses of the entity, and where the equity holders have the power to direct the activities that most significantly impact the entity’s economic performance. A reporting entity consolidates a VOE if the reporting entity owns a majority voting interest, or for limited partnership interests, a reporting entity owns a majority of the limited partnership’s voting rights, and none of the non-controlling limited partners hold any substantive participating rights. On the other hand, the primary beneficiary of a VIE is the entity that has (i) the power to direct the activities that most significantly impact the entity’s economic performance and (ii) the obligation to absorb losses of the VIE or the right to receive benefits from the VIE that could be significant to the VIE. A re-assessment of whether an entity is a VIE is performed when a reconsideration event occurs such as a recapitalization transaction or when the governing documents or contractual arrangements are amended such that it changes the characteristics of the entity’s equity investment at risk or the holders of the equity investments at risk, as a group, lose power from voting rights or similar rights to direct the significant activities of the entity. Index to Combined Financial Statements GALAXY REIT LLC NOTES TO COMBINED FINANCIAL STATEMENTS December 31, 2023 10

We review each operating agreement to understand our rights and the rights of our other partners or members and determine whether those rights are protective or participating. When approval of all the partners or a quorum is required for major decisions such as, among others, approval of operating budgets and business plan, settling disputes with taxing authorities or any other claims, sale or disposition of real estate, placement of new or additional financing secured by the assets of the entity or approval of significant leases and other significant contracts or related party agreements, we consider these to be substantive participating rights that result in shared power of the activities that most significantly impact the performance of the entity and as a result, we do not consolidate such entities. Operating agreements typically contain certain protective rights such as the ability to remove the managing partner in case of willful misconduct or bad acts, requiring partners or members to approve capital expenditures and operating expenditures greater than a particular amount and limitations on the operating activities of the entity. Reclassifications Certain prior year amounts within accounts payable, accrued expenses and other liabilities have been reclassified to accrued interest on the accompanying combined balance sheets to conform with the current year presentation. Real Estate and Depreciation Real estate properties are carried at cost less accumulated depreciation and impairment losses, if any. The cost of real estate properties reflects their purchase price or development cost. Galaxy evaluates each acquisition transaction to determine whether the acquired assets meet the definition of a business. If an acquisition does not meet the definition of a business, then it is considered an asset acquisition. An acquisition does not qualify as a business when substantially all of the fair value is concentrated in a single identifiable asset or group of similar identifiable assets or the acquisition does not include a substantive process in the form of an acquired workforce or an acquired contract that cannot be replaced without significant cost, effort or delay. Transaction costs related to acquisitions that are asset acquisitions are capitalized as part of the cost basis of the acquired assets, while transaction costs for acquisitions that are deemed to be acquisitions of a business are expensed as incurred and will be included in transaction related costs in the accompanying combined statements of operations and comprehensive loss. Ordinary repairs and maintenance are expensed as incurred. Major replacements and betterments, which improve or extend the life of the asset, are capitalized and depreciated over their estimated useful lives. Galaxy allocates the purchase price of real estate in a transaction accounted for as an asset acquisition to net tangible and identified intangible assets and liabilities acquired based on their relative fair values. Above-market and below-market in-place lease values of acquired properties are recorded based on the net present value (using a discount rate which reflects the risks associated with the leases acquired) of the difference between (i) the contractual amounts to be paid pursuant to the in-place leases and (ii) Galaxy’s estimate of the fair market lease rates for the corresponding in-place leases measured over a period equal to the remaining non-cancelable terms of the leases (including the below-market fixed-rate renewal period, if applicable). Capitalized above-market lease values are included in acquired lease intangible assets, net, on the accompanying combined balance sheets and are amortized on a straight-line basis as a reduction of rental revenue over the remaining non-cancelable terms of the respective leases, which generally range from less than one year to ten years. Capitalized below-market lease values are included in acquired lease intangibles, net, on the accompanying combined balance sheets and are amortized on a straight-line basis as an increase to rental revenue over the remaining non-cancelable terms of the respective leases including any below-market fixed-rate renewal periods that are considered probable, which generally range from less than one year to ten years. Intangible assets also include in-place leases based on Galaxy’s evaluation of the specific characteristics of each tenant’s lease. Galaxy estimates the cost to execute leases with terms similar to the remaining lease terms of the acquired in-place leases, including leasing commissions, incremental legal and other incremental related expenses. Recurring non-incremental legal and other costs are expensed to transaction costs on the accompanying combined statements of operations and comprehensive loss. In-place lease assets are included in acquired lease intangible assets, net, on the accompanying combined balance sheets and are amortized to depreciation and amortization expense on a straight-line basis over the remaining term of the respective leases and any fixed-rate bargain renewal periods, which generally range from less than one year to ten years. In the event that a tenant terminates its lease, the unamortized portion of each intangible, including in-place lease values and tenant relationship values, if any, is charged to amortization expense and above- and below-market leases adjustments, if any, are recorded in rental revenue. GALAXY REIT LLC NOTES TO COMBINED FINANCIAL STATEMENTS December 31, 2023 11

Galaxy’s estimates of fair value are made using methods similar to those used by independent appraisers or by using independent appraisals. Factors considered by Galaxy in this analysis include an estimate of the carrying costs during the expected lease-up periods considering current market conditions and costs to execute similar leases. In estimating carrying costs, Galaxy includes real estate taxes, insurance and other operating expenses and estimates of lost rentals at market rates during the expected lease-up periods, which primarily range from 12 to 24 months. Galaxy also considers information obtained about each property as a result of its pre-acquisition due diligence, marketing and leasing activities in estimating the fair value of the tangible and intangible assets acquired and liabilities assumed. Galaxy also uses the information obtained as a result of its pre-acquisition due diligence as part of its consideration of the accounting standard governing asset retirement obligations and when necessary, will record a conditional asset retirement obligation as part of its purchase price, if applicable. Though Galaxy considers the value of tenant relationships, the amounts are determined on a tenant-specific basis, if applicable. Galaxy may incur various costs in the development and leasing of our properties. The costs directly related to properties under development which include preconstruction costs essential to the development of the property, development costs, construction costs, interest costs, real estate taxes, salaries and related costs incurred during the period of development will be capitalized to construction in progress on the combined balance sheets. Development costs incurred associated with the leasing of our properties derived from tenant improvement allowances are capitalized to buildings and improvements on the accompanying combined balance sheets. After the determination is made to capitalize a cost, it is allocated to the specific component of a project that is benefited. Determination of when a development project commences and capitalization begins, and when a development project is substantially complete and held available for occupancy and when capitalization must cease, involves a degree of judgment. Depreciation on buildings and improvements is computed using the straight-line method. The estimated useful lives of buildings are 40 years. Improvements to buildings are capitalized and depreciated over useful lives ranging from three to 15 years. Tenant improvements are capitalized and depreciated over the non-cancelable remaining term of the related lease or their estimated useful life, whichever is shorter. Depreciation expense on buildings and improvements amounted to $50.3 million for the year ended December 31, 2023 and $15.5 million for the period from August 26, 2022 (commencement of operations) through December 31, 2022. Galaxy evaluates its real estate investments upon occurrence of a significant adverse change in its operations to assess whether any impairment indicators are present that affect the recovery of the recorded value. If indicators of impairment are identified, Galaxy estimates the future undiscounted cash flows from the use and eventual disposition of the property and compares this amount to the net carrying value of the property. If any real estate investment is considered impaired, a loss is recognized to reduce the net carrying value of the property to its estimated fair value. Estimated fair value is primarily determined by discounting the estimated future cash flows at a risk adjusted rate. Galaxy's strategy of holding properties over the long term directly decreases the likelihood of recording an impairment loss. If Galaxy's strategy changes or market conditions otherwise dictate an earlier sale date, an impairment loss may be recognized and such loss could have a material impact on the results of operations. Galaxy does not believe that the carrying value of any properties or intangible assets were impaired at December 31, 2023 or 2022, and no impairment charges have been recorded for the year ended December 31, 2023 or for the period from August 26, 2022 (commencement of operations) through December 31, 2022. Lessee Arrangements Galaxy reviews all leases and identifies certain service contracts and evaluates such contracts for the components of a lease, based on the definition that a lease involves a right to control use of the identified asset for a period of time in exchange for consideration. Galaxy records right-of-use ("ROU") assets and lease liabilities at the commencement or acquisition of the lease based on the present value of the lease payments over the lease term on our combined balance sheets. For our leases that do not provide an implicit rate, Galaxy uses a discount rate based on our incremental borrowing rates to determine the present value of lease payments. Galaxy records rental expense for lease payments related to operating leases on a straight-line basis over the lease term. Lease expense for land is included in operating expenses on the combined statements of operations and comprehensive loss. Cash and Cash Equivalents Cash and cash equivalents are highly-liquid investments with original maturities of three months or less. Galaxy maintains cash and cash equivalents in major financial institutions in excess of the insured limit of $0.3 million provided by the Federal Depository Insurance Corporation. Galaxy has not experienced any losses related to these excess balances and management believes its credit risk is minimal. GALAXY REIT LLC NOTES TO COMBINED FINANCIAL STATEMENTS December 31, 2023 12

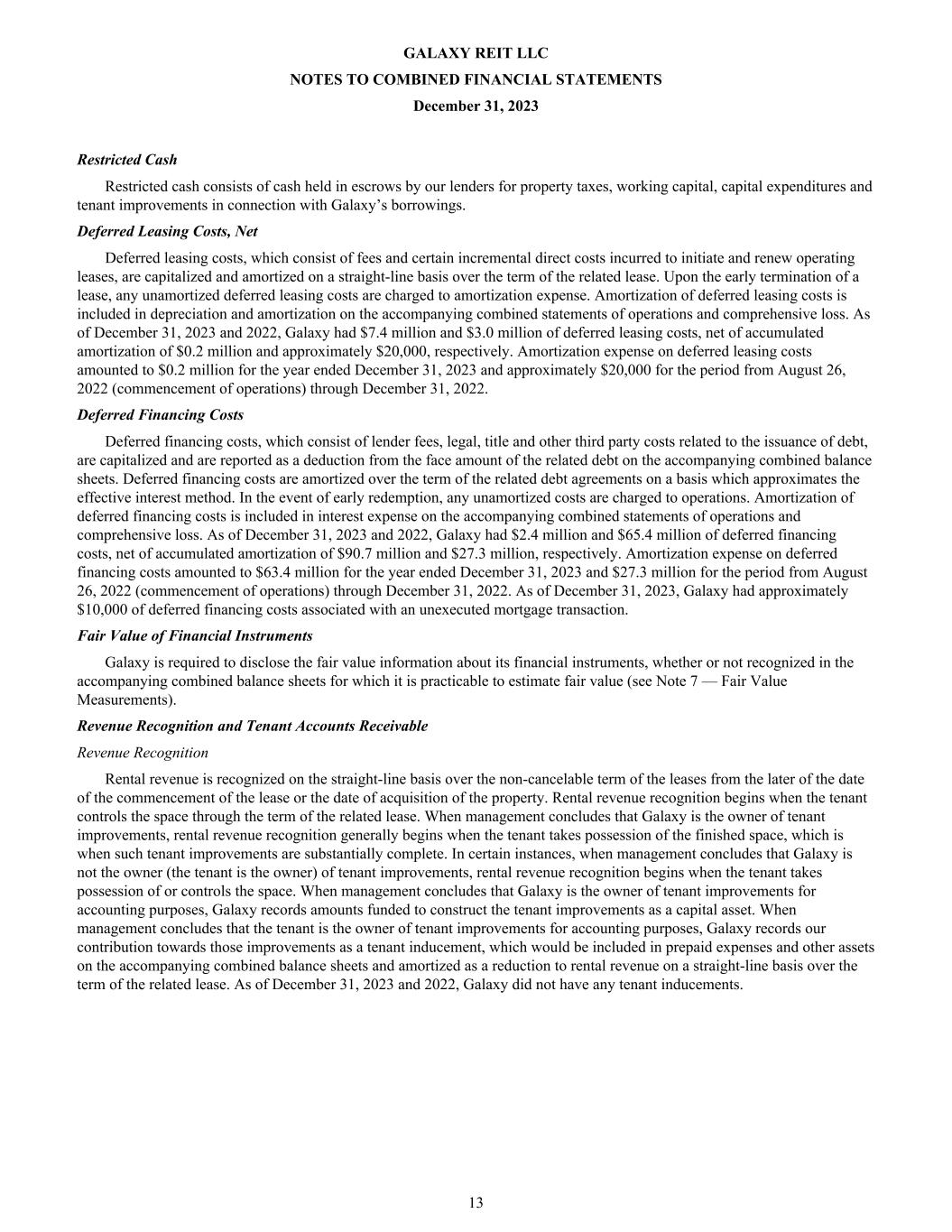

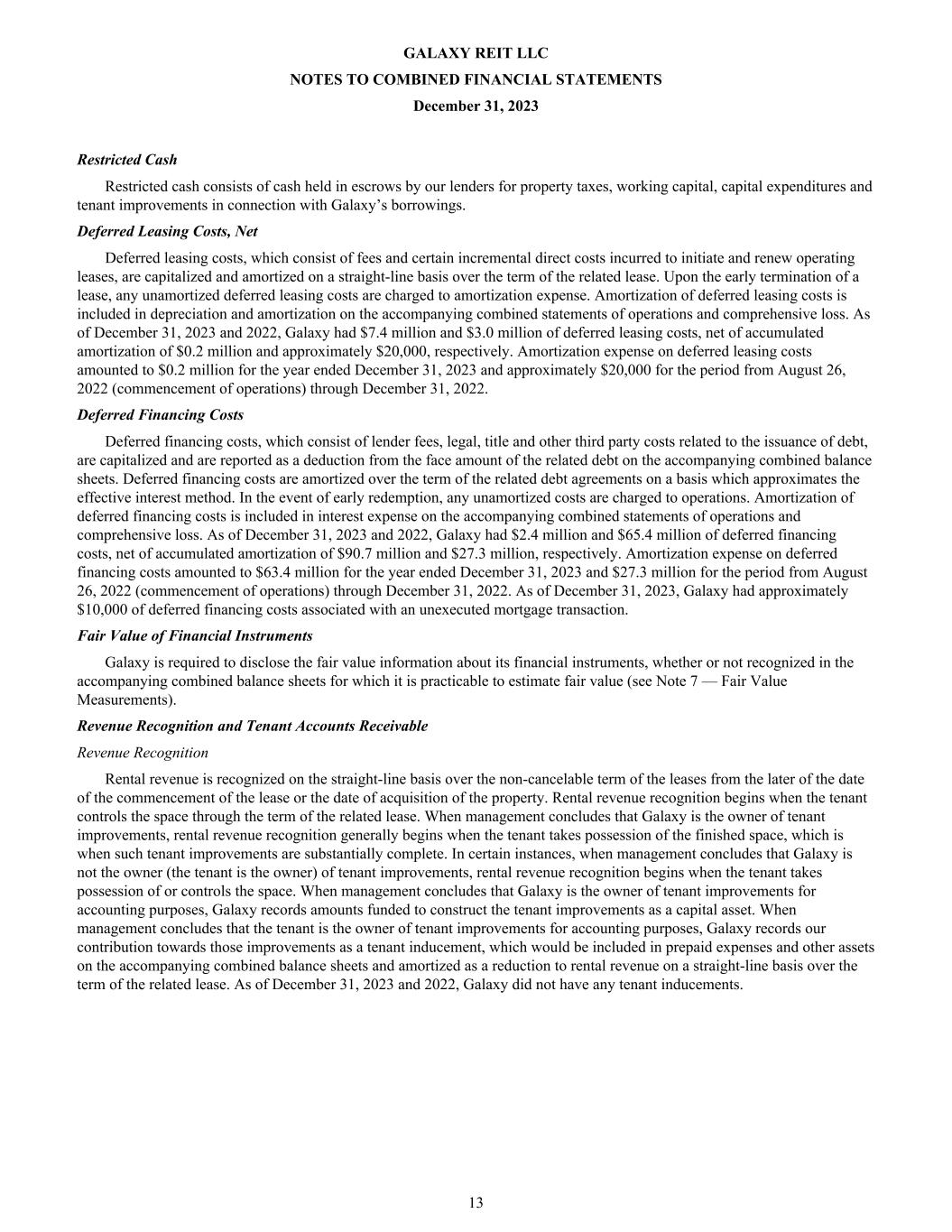

Restricted Cash Restricted cash consists of cash held in escrows by our lenders for property taxes, working capital, capital expenditures and tenant improvements in connection with Galaxy’s borrowings. Deferred Leasing Costs, Net Deferred leasing costs, which consist of fees and certain incremental direct costs incurred to initiate and renew operating leases, are capitalized and amortized on a straight-line basis over the term of the related lease. Upon the early termination of a lease, any unamortized deferred leasing costs are charged to amortization expense. Amortization of deferred leasing costs is included in depreciation and amortization on the accompanying combined statements of operations and comprehensive loss. As of December 31, 2023 and 2022, Galaxy had $7.4 million and $3.0 million of deferred leasing costs, net of accumulated amortization of $0.2 million and approximately $20,000, respectively. Amortization expense on deferred leasing costs amounted to $0.2 million for the year ended December 31, 2023 and approximately $20,000 for the period from August 26, 2022 (commencement of operations) through December 31, 2022. Deferred Financing Costs Deferred financing costs, which consist of lender fees, legal, title and other third party costs related to the issuance of debt, are capitalized and are reported as a deduction from the face amount of the related debt on the accompanying combined balance sheets. Deferred financing costs are amortized over the term of the related debt agreements on a basis which approximates the effective interest method. In the event of early redemption, any unamortized costs are charged to operations. Amortization of deferred financing costs is included in interest expense on the accompanying combined statements of operations and comprehensive loss. As of December 31, 2023 and 2022, Galaxy had $2.4 million and $65.4 million of deferred financing costs, net of accumulated amortization of $90.7 million and $27.3 million, respectively. Amortization expense on deferred financing costs amounted to $63.4 million for the year ended December 31, 2023 and $27.3 million for the period from August 26, 2022 (commencement of operations) through December 31, 2022. As of December 31, 2023, Galaxy had approximately $10,000 of deferred financing costs associated with an unexecuted mortgage transaction. Fair Value of Financial Instruments Galaxy is required to disclose the fair value information about its financial instruments, whether or not recognized in the accompanying combined balance sheets for which it is practicable to estimate fair value (see Note 7 — Fair Value Measurements). Revenue Recognition and Tenant Accounts Receivable Revenue Recognition Rental revenue is recognized on the straight-line basis over the non-cancelable term of the leases from the later of the date of the commencement of the lease or the date of acquisition of the property. Rental revenue recognition begins when the tenant controls the space through the term of the related lease. When management concludes that Galaxy is the owner of tenant improvements, rental revenue recognition generally begins when the tenant takes possession of the finished space, which is when such tenant improvements are substantially complete. In certain instances, when management concludes that Galaxy is not the owner (the tenant is the owner) of tenant improvements, rental revenue recognition begins when the tenant takes possession of or controls the space. When management concludes that Galaxy is the owner of tenant improvements for accounting purposes, Galaxy records amounts funded to construct the tenant improvements as a capital asset. When management concludes that the tenant is the owner of tenant improvements for accounting purposes, Galaxy records our contribution towards those improvements as a tenant inducement, which would be included in prepaid expenses and other assets on the accompanying combined balance sheets and amortized as a reduction to rental revenue on a straight-line basis over the term of the related lease. As of December 31, 2023 and 2022, Galaxy did not have any tenant inducements. GALAXY REIT LLC NOTES TO COMBINED FINANCIAL STATEMENTS December 31, 2023 13

Galaxy takes into account whether the collectability of rents is reasonably assured in determining the amount of straight- line rent to record. For the purpose of determining the straight-line period, the straight-line calculation will take into consideration bargain renewal options, leases where the renewal appears reasonably assured and any guarantees by the lessee and does not take into account any contingent rent. For certain leases, Galaxy makes significant assumptions and judgments in determining the lease term, including assumptions when the lease provides the tenant with an early termination option or an option to extend. The lease term impacts the period over which Galaxy determines and records minimum rents, the estimated fair value of lease intangibles upon acquisition and also impacts the period over which Galaxy amortizes lease-related costs. Galaxy recognizes the excess of rents recognized over the amounts contractually due pursuant to the underlying leases as part of deferred rent receivable, on the accompanying combined balance sheets. Any rental payments received prior to their due dates are reported in deferred revenue on the accompanying combined balance sheets. Galaxy’s leases also typically provide for tenant reimbursement of a portion of common area maintenance expenses and other operating expenses to the extent that the tenant has a lease on a triple net basis or to the extent that a tenant’s pro rata share of expenses exceeds a base year level set in the lease. Recoveries from tenants, consisting of amounts due from tenants for common area maintenance expenses, real estate taxes and other recoverable costs are recognized as revenue on an accrual basis over the periods in which the related expenditures are incurred. Tenant reimbursements are recognized on a gross basis because Galaxy is generally the primary obligor with respect to the goods and services, the purchase of which, gives rise to the reimbursement obligation; because Galaxy has discretion in selecting the vendors and suppliers; and because Galaxy bears the credit risk in the event the tenants do not reimburse Galaxy. Termination fees, which are included in other revenue on the accompanying combined statements of operations and comprehensive loss, are fees that Galaxy has agreed to accept in consideration for permitting certain tenants to terminate their lease prior to the contractual expiration date. Galaxy recognizes termination fees during the period in which the following conditions are met: (i) the termination agreement is executed, (ii) the termination fee is determinable, and (iii) collectability of the termination fee is assured. Tenant Accounts Receivable Galaxy reviews its tenant accounts receivable, including its straight-line rent receivable, related to base rents, straight-line rent, expense reimbursements and other revenues for collectability. Galaxy analyzes its accounts receivable, customer credit worthiness and current economic trends when evaluating the collectability of the tenant’s total future lease payments on a lease by lease basis. If a tenant’s future lease payments, after lease commencement, are determined to be not probable of collection, rental revenue is limited to the lesser of the lease payments, including variable lease payments, that have been collected from the tenant and the rental revenue recognized to date with any adjustment recognized as a current period adjustment to rental revenue. If Galaxy subsequently determines that it is probable it will collect substantially all of the tenant’s remaining lease payments under the lease term, Galaxy will then reinstate the straight-line balance as if the rental revenue had always been accounted for on a straight-line basis with any adjustment recognized as a current period adjustment to rental revenue. Galaxy's reported net earnings are directly affected by management’s estimate of the collectability of its tenant future lease payments. Tenant accounts receivable, primarily derived from expense reimbursements, that are being disputed by the lessee will not be written-off if it is presumed Galaxy will collect these receivables upon resolution with the tenant barring any concerns about the tenant's ability to pay these amounts. Derivative Instruments and Hedging Activities Galaxy is exposed to certain risks arising from both its business operations and economic conditions. Galaxy principally manages its exposures to a wide variety of business and operational risks through management of its core business activities. Galaxy manages economic risks, including interest rate, liquidity, and credit risk primarily by managing the amount, sources, and duration of its debt funding and the use of derivative financial instruments. Specifically, Galaxy enters into derivative financial instruments to manage exposures that arise from business activities that result in the receipt or payment of future known and uncertain cash amounts, the value of which are determined by variable interest rates. Galaxy’s derivative financial instruments are used to manage differences in the amount, timing, and duration of Galaxy’s known or expected cash receipts and its known or expected cash payments principally related to Galaxy’s borrowings. Certain of Galaxy’s borrowings bear interest at variable rates. Galaxy’s objective is to limit or manage its interest rate risk. To accomplish this objective, Galaxy primarily uses interest rate caps as part of its interest rate risk management strategy. Interest rate caps involve the receipt of variable-rate amounts from a counterparty if interest rates rise above the strike rate on the contract in exchange for an up-front premium. GALAXY REIT LLC NOTES TO COMBINED FINANCIAL STATEMENTS December 31, 2023 14

Galaxy records all derivatives at fair value. The accounting for changes in the fair value of derivatives depends on the intended use of the derivative, whether Galaxy has elected to designate a derivative in a hedging relationship and apply hedge accounting and whether the hedging relationship has satisfied, and continues to satisfy, the criteria necessary to apply hedge accounting. Derivatives designated and qualifying as a hedge of the exposure to changes in the fair value of an asset, liability, or firm commitment attributable to a particular risk, such as interest rate risk, are considered fair value hedges. Derivatives designated and qualifying as a hedge of the exposure to variability in expected future cash flows, or other types of forecasted transactions, are considered cash flow hedges. Hedge accounting generally provides for the matching of the timing of gain or loss recognition on the hedging instrument with the recognition of the changes in the fair value of the hedged asset or liability that are attributable to the hedged risk in a fair value hedge or the earnings effect of the hedged forecasted transactions in a cash flow hedge. Galaxy may enter into derivative contracts that are intended to economically hedge certain of its risks, even though hedge accounting does not apply or Galaxy elects not to apply hedge accounting. For qualifying cash flow hedges, the changes in fair value of derivatives are deferred into accumulated other comprehensive income (loss) in the accompanying combined balance sheets, which is subsequently reclassified into earnings in the period that the hedged transaction affects earnings. For fair value hedges and derivatives not designated as hedging instruments, the gain or loss, resulting from the change in the fair value of the derivatives, is recognized in earnings, as part of gain (loss) on derivative instruments in the accompanying combined statements of operations and comprehensive loss, during the period of change. Income Taxes Galaxy elected and qualified to be taxed as a REIT under sections 856 through 860 of the Internal Revenue Code ("Code"), commencing with the taxable year ended December 31, 2022. To qualify, and continue to qualify, as a REIT, Galaxy must meet certain organizational and operational requirements. Galaxy intends to continue to adhere to these requirements and maintain its REIT status for the current year and subsequent years. As a REIT, Galaxy generally will not be subject to federal income taxes on taxable income that is distributed to its partners and preferred stockholders. If Galaxy fails to continue to qualify as a REIT in any taxable year, Galaxy will then be subject to federal income taxes on the taxable income at regular corporate rates (including any applicable alternative minimum tax) and will not be permitted to qualify for treatment as a REIT for federal income tax purposes for four years following the year during which qualification is lost unless the Internal Revenue Service ("IRS") grants Galaxy relief under certain statutory provisions. Such an event could materially adversely affect net income and net cash available for distribution to partners. Galaxy REIT distributed to its partners and preferred stockholders 100.0% of its REIT taxable income for the year ended December 31, 2023 and for the period from August 26, 2022 (commencement of operations) through December 31, 2022. Accordingly, no provision for federal or state income tax related to such REIT taxable income was recorded in Galaxy's financial statements. Even if Galaxy continues to qualify for taxation as a REIT, it may be subject to certain state and local taxes on its income and property and federal income and excise tax on any undistributed income. As of December 31, 2023, 100.0% of the preferred distribution paid to preferred stockholders was considered a return of capital from a tax perspective. Galaxy’s policy is to classify interest in interest expense and penalties in general and administrative expenses in the accompanying combined statements of operations and comprehensive loss. There have been no interest or penalties recorded during the years ended December 31, 2023 or 2022. The 2023 and 2022 tax years remain open to examination by the domestic taxing jurisdictions to which Galaxy is subject. Use of Estimates The preparation of the accompanying combined financial statements in conformity with US GAAP requires management to make estimates and assumptions that, in certain circumstances, affect the reported amounts of assets and liabilities, disclosure of contingent assets and liabilities, and revenues and expenses. These estimates are prepared using management’s best judgment, after considering past and current events and economic conditions. Actual results could differ from these estimates. GALAXY REIT LLC NOTES TO COMBINED FINANCIAL STATEMENTS December 31, 2023 15

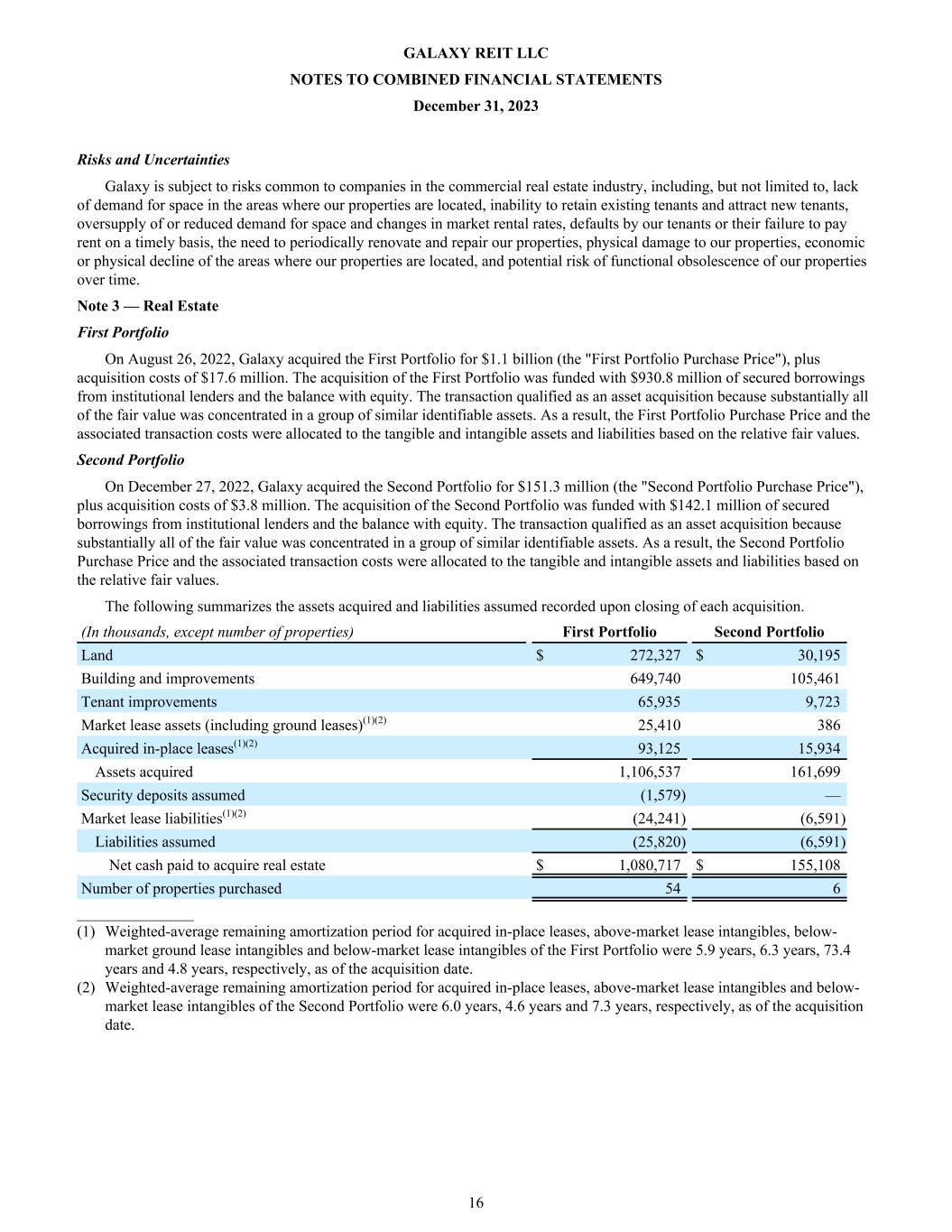

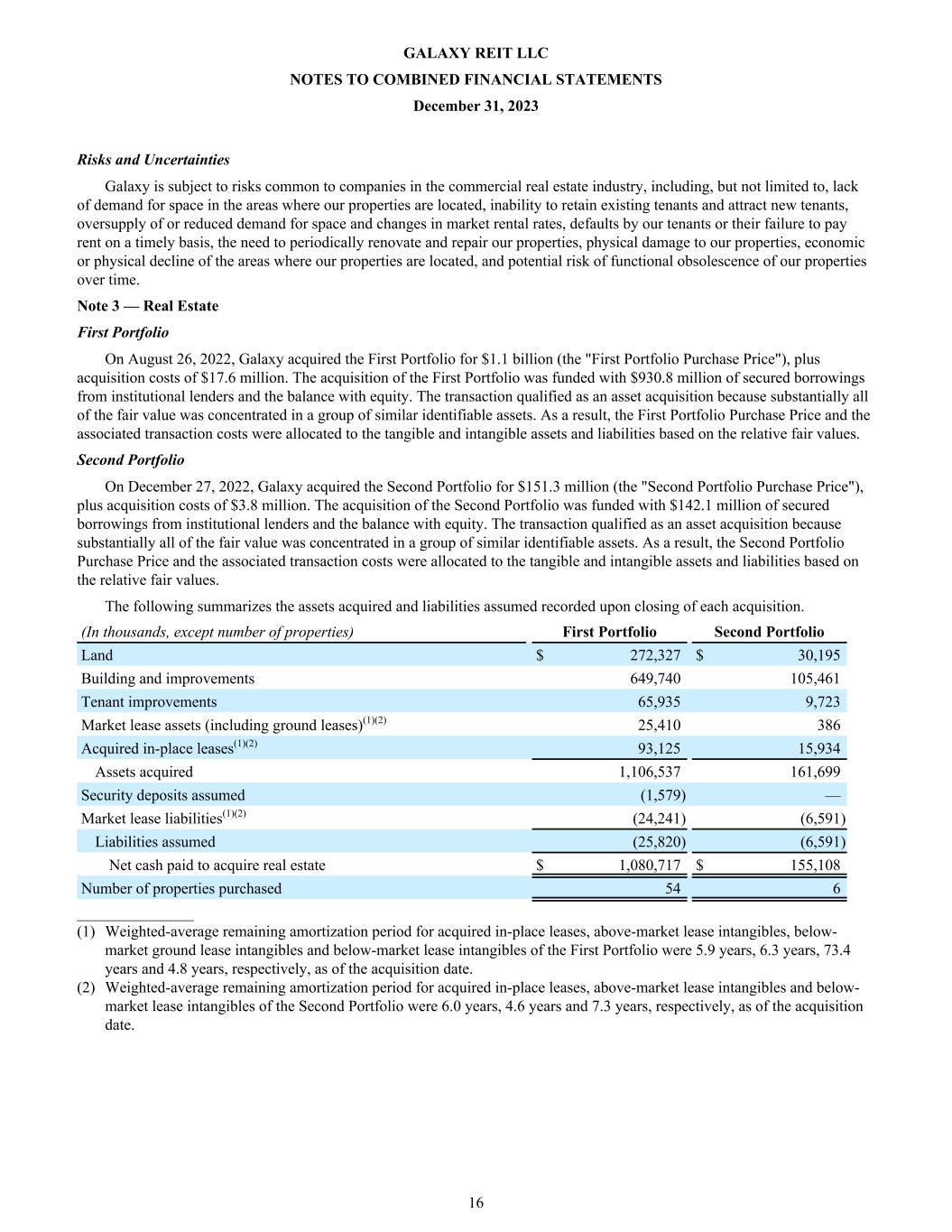

Risks and Uncertainties Galaxy is subject to risks common to companies in the commercial real estate industry, including, but not limited to, lack of demand for space in the areas where our properties are located, inability to retain existing tenants and attract new tenants, oversupply of or reduced demand for space and changes in market rental rates, defaults by our tenants or their failure to pay rent on a timely basis, the need to periodically renovate and repair our properties, physical damage to our properties, economic or physical decline of the areas where our properties are located, and potential risk of functional obsolescence of our properties over time. Note 3 — Real Estate First Portfolio On August 26, 2022, Galaxy acquired the First Portfolio for $1.1 billion (the "First Portfolio Purchase Price"), plus acquisition costs of $17.6 million. The acquisition of the First Portfolio was funded with $930.8 million of secured borrowings from institutional lenders and the balance with equity. The transaction qualified as an asset acquisition because substantially all of the fair value was concentrated in a group of similar identifiable assets. As a result, the First Portfolio Purchase Price and the associated transaction costs were allocated to the tangible and intangible assets and liabilities based on the relative fair values. Second Portfolio On December 27, 2022, Galaxy acquired the Second Portfolio for $151.3 million (the "Second Portfolio Purchase Price"), plus acquisition costs of $3.8 million. The acquisition of the Second Portfolio was funded with $142.1 million of secured borrowings from institutional lenders and the balance with equity. The transaction qualified as an asset acquisition because substantially all of the fair value was concentrated in a group of similar identifiable assets. As a result, the Second Portfolio Purchase Price and the associated transaction costs were allocated to the tangible and intangible assets and liabilities based on the relative fair values. The following summarizes the assets acquired and liabilities assumed recorded upon closing of each acquisition. (In thousands, except number of properties) First Portfolio Second Portfolio Land $ 272,327 $ 30,195 Building and improvements 649,740 105,461 Tenant improvements 65,935 9,723 Market lease assets (including ground leases)(1)(2) 25,410 386 Acquired in-place leases(1)(2) 93,125 15,934 Assets acquired 1,106,537 161,699 Security deposits assumed (1,579) — Market lease liabilities(1)(2) (24,241) (6,591) Liabilities assumed (25,820) (6,591) Net cash paid to acquire real estate $ 1,080,717 $ 155,108 Number of properties purchased 54 6 _______________ (1) Weighted-average remaining amortization period for acquired in-place leases, above-market lease intangibles, below- market ground lease intangibles and below-market lease intangibles of the First Portfolio were 5.9 years, 6.3 years, 73.4 years and 4.8 years, respectively, as of the acquisition date. (2) Weighted-average remaining amortization period for acquired in-place leases, above-market lease intangibles and below- market lease intangibles of the Second Portfolio were 6.0 years, 4.6 years and 7.3 years, respectively, as of the acquisition date. GALAXY REIT LLC NOTES TO COMBINED FINANCIAL STATEMENTS December 31, 2023 16

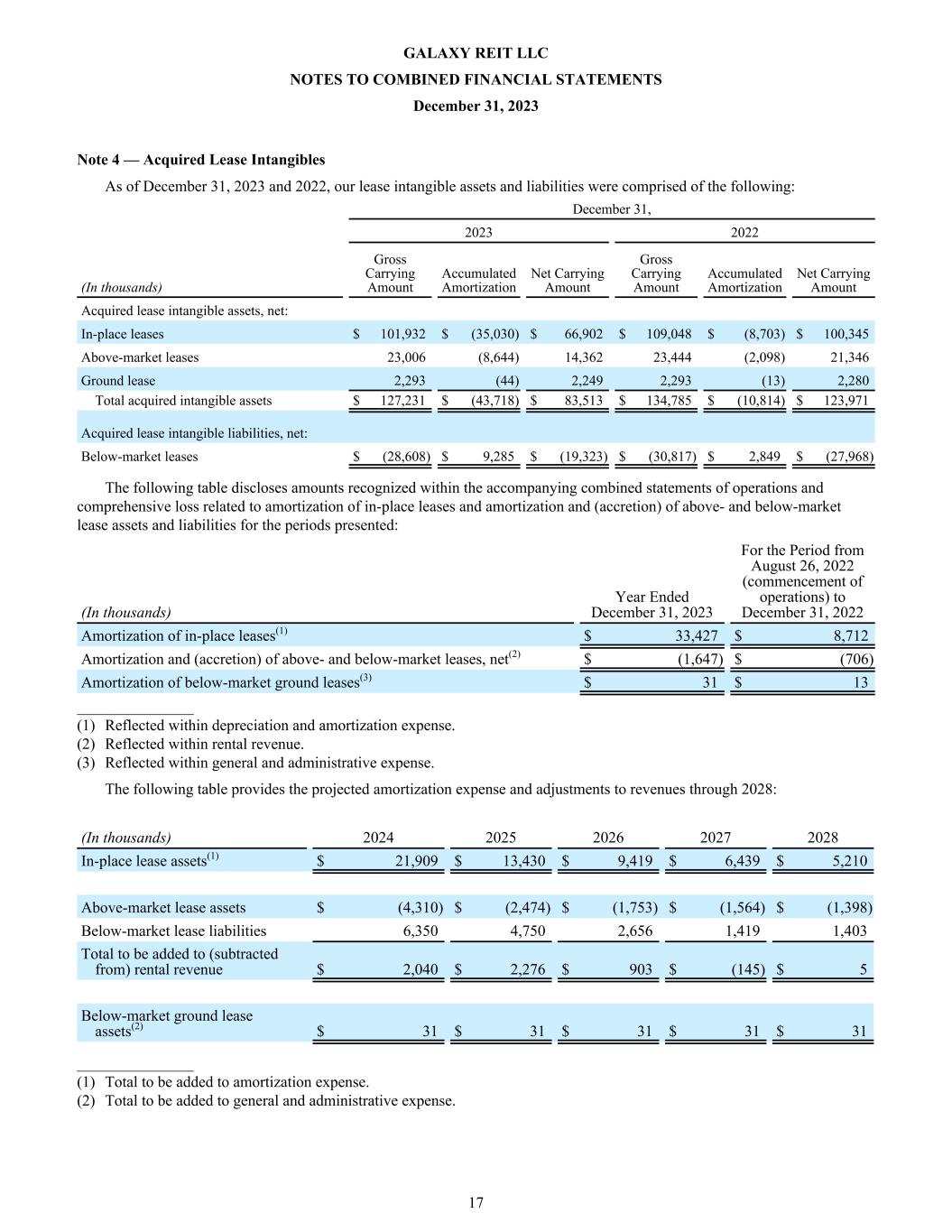

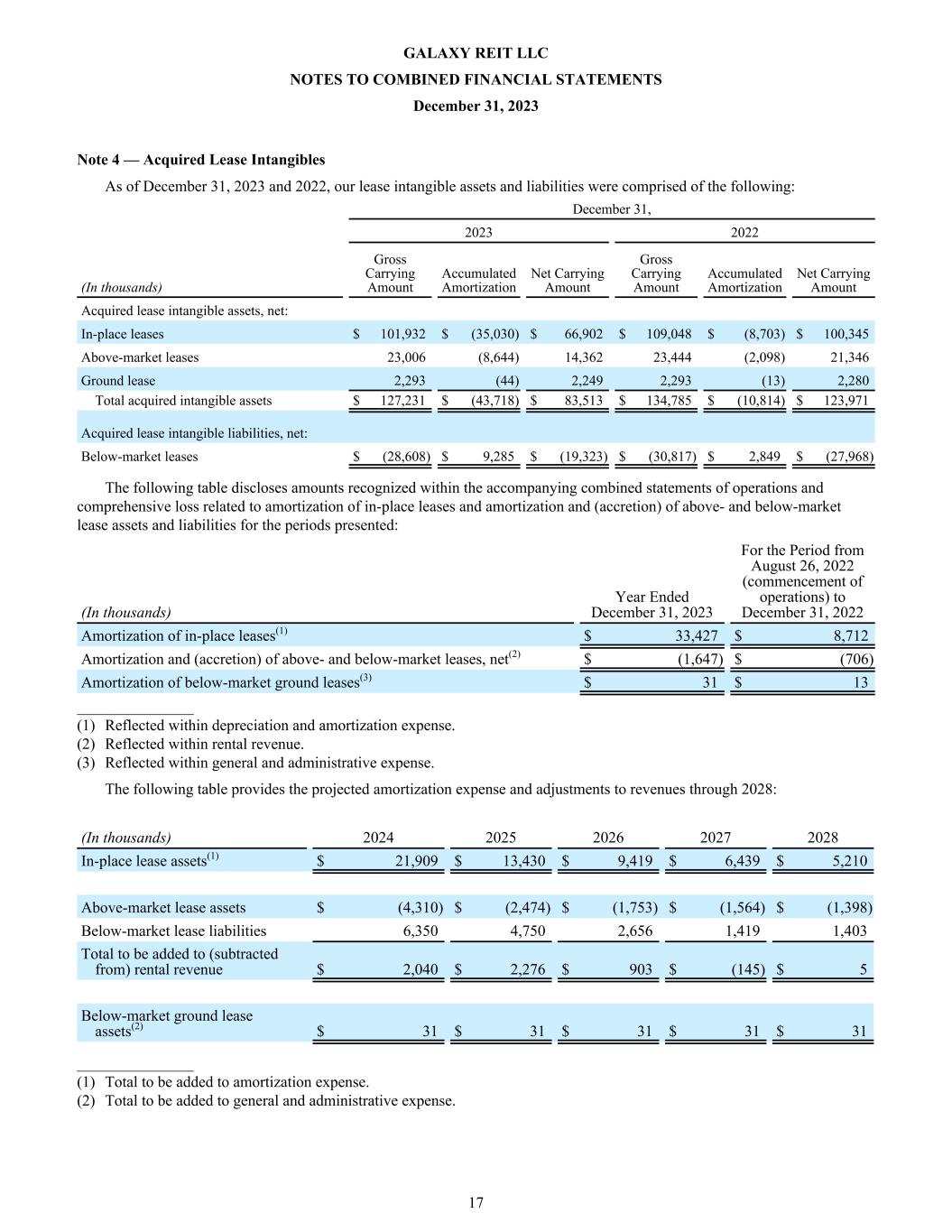

Note 4 — Acquired Lease Intangibles As of December 31, 2023 and 2022, our lease intangible assets and liabilities were comprised of the following: December 31, 2023 2022 (In thousands) Gross Carrying Amount Accumulated Amortization Net Carrying Amount Gross Carrying Amount Accumulated Amortization Net Carrying Amount Acquired lease intangible assets, net: In-place leases $ 101,932 $ (35,030) $ 66,902 $ 109,048 $ (8,703) $ 100,345 Above-market leases 23,006 (8,644) 14,362 23,444 (2,098) 21,346 Ground lease 2,293 (44) 2,249 2,293 (13) 2,280 Total acquired intangible assets $ 127,231 $ (43,718) $ 83,513 $ 134,785 $ (10,814) $ 123,971 Acquired lease intangible liabilities, net: Below-market leases $ (28,608) $ 9,285 $ (19,323) $ (30,817) $ 2,849 $ (27,968) The following table discloses amounts recognized within the accompanying combined statements of operations and comprehensive loss related to amortization of in-place leases and amortization and (accretion) of above- and below-market lease assets and liabilities for the periods presented: (In thousands) Year Ended December 31, 2023 For the Period from August 26, 2022 (commencement of operations) to December 31, 2022 Amortization of in-place leases(1) $ 33,427 $ 8,712 Amortization and (accretion) of above- and below-market leases, net(2) $ (1,647) $ (706) Amortization of below-market ground leases(3) $ 31 $ 13 _______________ (1) Reflected within depreciation and amortization expense. (2) Reflected within rental revenue. (3) Reflected within general and administrative expense. The following table provides the projected amortization expense and adjustments to revenues through 2028: (In thousands) 2024 2025 2026 2027 2028 In-place lease assets(1) $ 21,909 $ 13,430 $ 9,419 $ 6,439 $ 5,210 Above-market lease assets $ (4,310) $ (2,474) $ (1,753) $ (1,564) $ (1,398) Below-market lease liabilities 6,350 4,750 2,656 1,419 1,403 Total to be added to (subtracted from) rental revenue $ 2,040 $ 2,276 $ 903 $ (145) $ 5 Below-market ground lease assets(2) $ 31 $ 31 $ 31 $ 31 $ 31 _______________ (1) Total to be added to amortization expense. (2) Total to be added to general and administrative expense. GALAXY REIT LLC NOTES TO COMBINED FINANCIAL STATEMENTS December 31, 2023 17

Note 5 — Mortgages Payable The following table sets forth information regarding mortgages payable outstanding at December 31, 2023 and 2022: First Portfolio Mortgage Loan(1) $ 736,000 $ 736,000 9.25 % September 9, 2024 First Portfolio Mezzanine Loan(1) 194,765 194,765 12.19 % September 9, 2024 Second Portfolio Mortgage Loan(1) 142,100 142,100 9.60 % January 6, 2024 Gross mortgages payable 1,072,865 1,072,865 9.83%(2) Deferred financing costs, net (2,417) (65,446) Total mortgages payable, net $ 1,070,448 $ 1,007,419 (In thousands) December 31, Interest Rate Maturity Date2023 2022 _______________ (1) Interest rate was determined utilizing the respective SOFR rate plus the interest rate margin of each loan at December 31, 2023. (2) Interest rate on gross mortgages payable is calculated as a weighted-average for mortgages outstanding as of December 31, 2023. First Portfolio Galaxy Loans On August 26, 2022, in connection with the purchase of the First Portfolio, Galaxy, through certain entities in which it is invested, entered into loan agreements with JPMorgan Chase Bank, National Association, ("JPM") and Bank of Montreal ("BMO"), (together the "Lender"), for total borrowings in the amount of $930.8 million (the "First Portfolio Galaxy Loans"), comprised of a mortgage loan, representing $736.0 million of borrowings ("Mortgage Loan") and a mezzanine loan, representing $194.8 million of borrowings ("Mezzanine Loan"). The Mortgage Loan bears interest at a per annum variable rate equal to Term SOFR, capped at 4.4% with derivative instruments, plus a spread of 3.885%. The Mezzanine Loan bears interest at a per annum variable rate equal to Term SOFR, capped at 4.4% with derivative instruments, plus a spread of 6.824%. The First Portfolio Galaxy Loans provide for monthly interest only payments with all principal outstanding due on the maturity date. The First Portfolio Galaxy Loans were subject to two one-year extension options at Galaxy's option, subject to minimum debt yield tests and an increase to the interest rate spread of 0.25% for each extension. The extension options for the Mortgage Loan and Mezzanine Loan must be exercised simultaneously. On September 9, 2023, Galaxy exercised the first one-year extension option, extending the maturity dates to September 9, 2024. Galaxy expects to meet the requirements to exercise its remaining extension option and exercise such extension option prior to current maturity date. The First Portfolio Galaxy Loans may be prepaid at any time, in whole but not in part, unless necessary to meet a debt yield sufficient to exercise an extension option. The First Portfolio Galaxy Loans are subject to an exit fee upon any repayment or prepayment of the loans, equal to 2.0% of the amount of the First Portfolio Galaxy Loans that are being repaid. Such exit fee is being accrued monthly to accounts payable, accrued expenses and other liabilities on the accompanying combined balance sheets and expensed to interest expense on the accompanying combined statements of operations and comprehensive loss. At December 31, 2023, the gross carrying amount of real estate investments at cost and gross acquired lease intangible assets and liabilities of the properties collateralizing the First Portfolio Galaxy Loans was $1.1 billion. Second Portfolio Galaxy Loan On December 27, 2022, in connection with the purchase of the Second Portfolio, Galaxy, through certain entities in which it is invested, entered into a loan agreement with UBS AG ("UBS") for total borrowings in the amount of $142.1 million (the "the Second Portfolio Galaxy Loan"). The Second Portfolio Galaxy Loan bears interest at a per annum variable rate equal to Term SOFR, capped at 4.00% with derivative instruments, plus a spread of 4.25%. The Second Portfolio Galaxy Loan provides for monthly interest only payments with all principal outstanding due on the maturity date. GALAXY REIT LLC NOTES TO COMBINED FINANCIAL STATEMENTS December 31, 2023 18

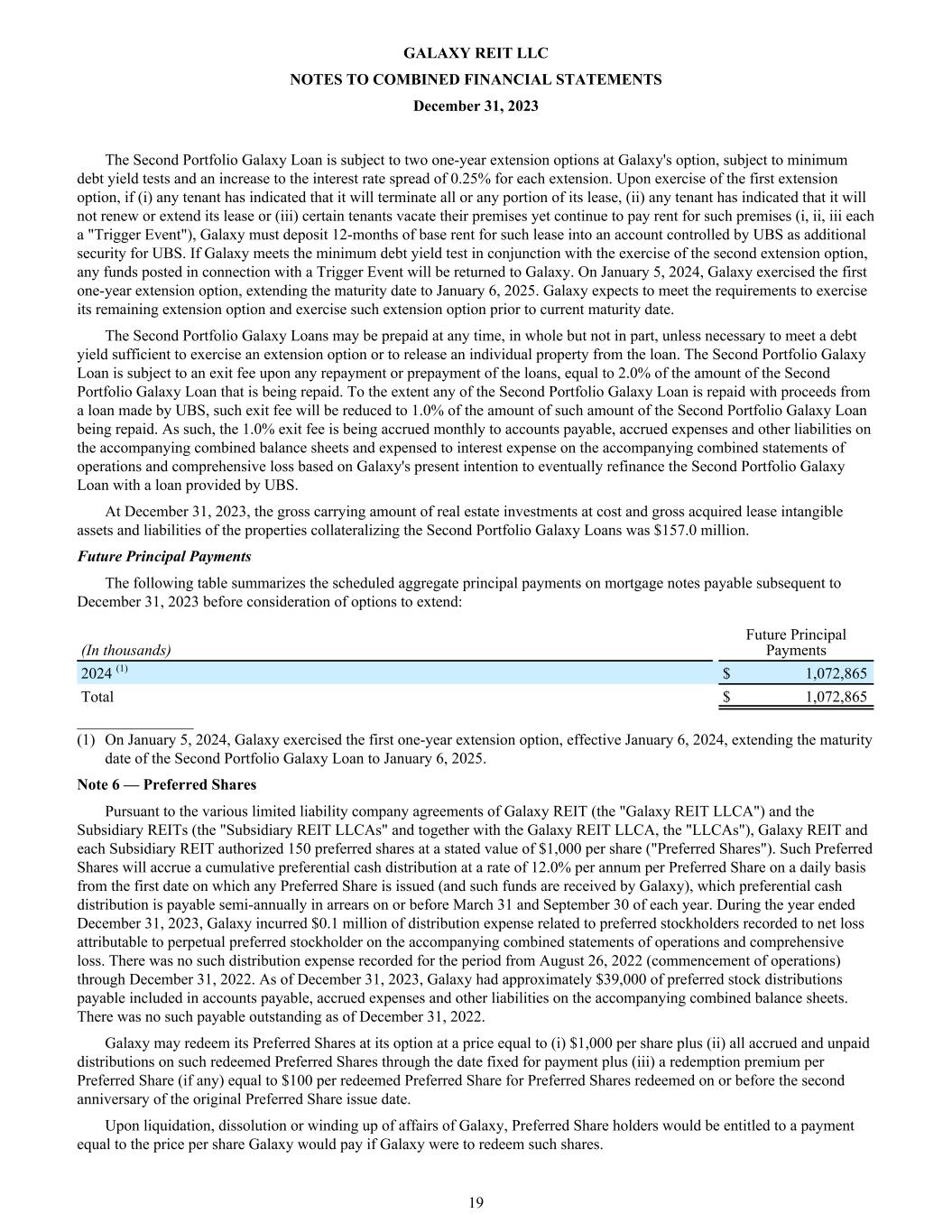

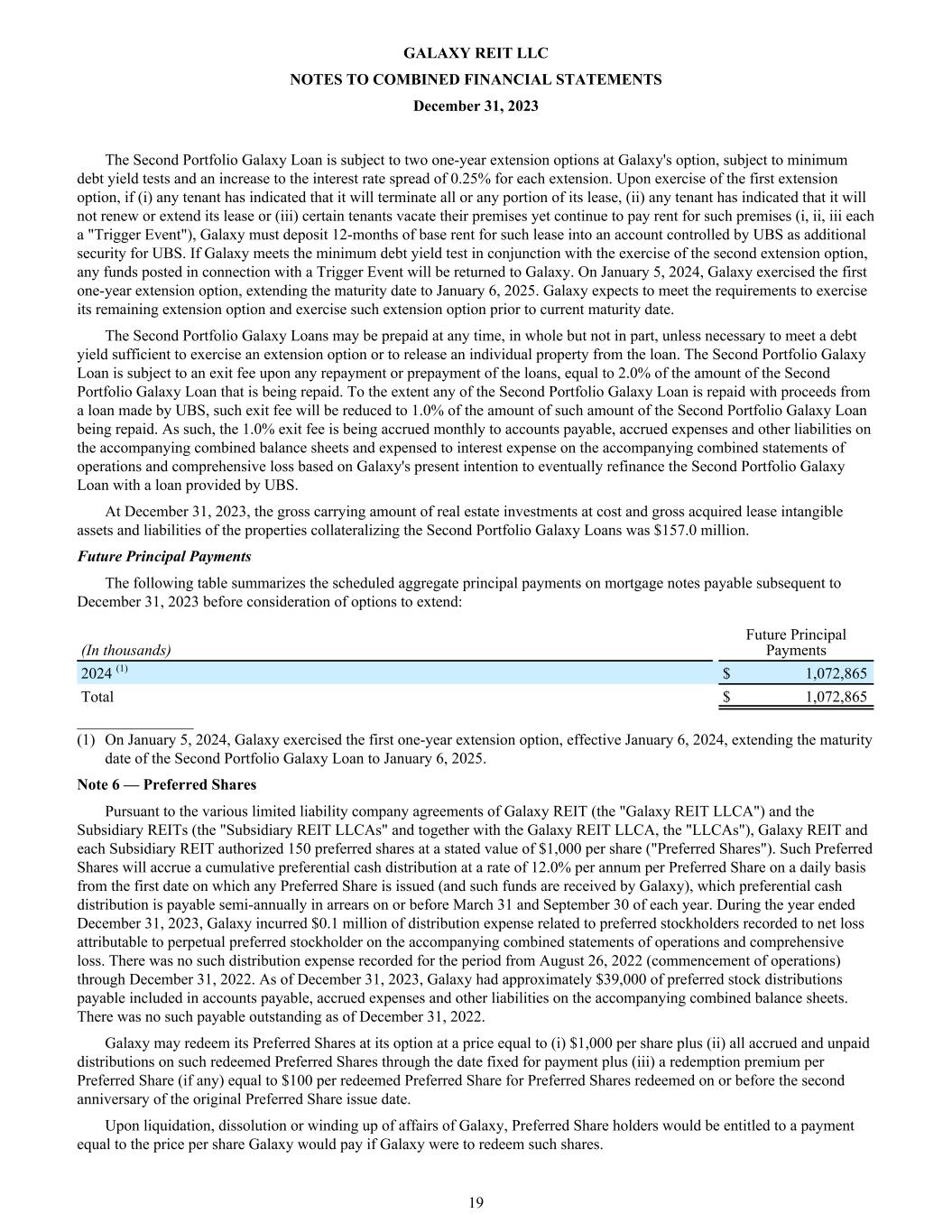

The Second Portfolio Galaxy Loan is subject to two one-year extension options at Galaxy's option, subject to minimum debt yield tests and an increase to the interest rate spread of 0.25% for each extension. Upon exercise of the first extension option, if (i) any tenant has indicated that it will terminate all or any portion of its lease, (ii) any tenant has indicated that it will not renew or extend its lease or (iii) certain tenants vacate their premises yet continue to pay rent for such premises (i, ii, iii each a "Trigger Event"), Galaxy must deposit 12-months of base rent for such lease into an account controlled by UBS as additional security for UBS. If Galaxy meets the minimum debt yield test in conjunction with the exercise of the second extension option, any funds posted in connection with a Trigger Event will be returned to Galaxy. On January 5, 2024, Galaxy exercised the first one-year extension option, extending the maturity date to January 6, 2025. Galaxy expects to meet the requirements to exercise its remaining extension option and exercise such extension option prior to current maturity date. The Second Portfolio Galaxy Loans may be prepaid at any time, in whole but not in part, unless necessary to meet a debt yield sufficient to exercise an extension option or to release an individual property from the loan. The Second Portfolio Galaxy Loan is subject to an exit fee upon any repayment or prepayment of the loans, equal to 2.0% of the amount of the Second Portfolio Galaxy Loan that is being repaid. To the extent any of the Second Portfolio Galaxy Loan is repaid with proceeds from a loan made by UBS, such exit fee will be reduced to 1.0% of the amount of such amount of the Second Portfolio Galaxy Loan being repaid. As such, the 1.0% exit fee is being accrued monthly to accounts payable, accrued expenses and other liabilities on the accompanying combined balance sheets and expensed to interest expense on the accompanying combined statements of operations and comprehensive loss based on Galaxy's present intention to eventually refinance the Second Portfolio Galaxy Loan with a loan provided by UBS. At December 31, 2023, the gross carrying amount of real estate investments at cost and gross acquired lease intangible assets and liabilities of the properties collateralizing the Second Portfolio Galaxy Loans was $157.0 million. Future Principal Payments The following table summarizes the scheduled aggregate principal payments on mortgage notes payable subsequent to December 31, 2023 before consideration of options to extend: (In thousands) Future Principal Payments 2024 (1) $ 1,072,865 Total $ 1,072,865 _______________ (1) On January 5, 2024, Galaxy exercised the first one-year extension option, effective January 6, 2024, extending the maturity date of the Second Portfolio Galaxy Loan to January 6, 2025. Note 6 — Preferred Shares Pursuant to the various limited liability company agreements of Galaxy REIT (the "Galaxy REIT LLCA") and the Subsidiary REITs (the "Subsidiary REIT LLCAs" and together with the Galaxy REIT LLCA, the "LLCAs"), Galaxy REIT and each Subsidiary REIT authorized 150 preferred shares at a stated value of $1,000 per share ("Preferred Shares"). Such Preferred Shares will accrue a cumulative preferential cash distribution at a rate of 12.0% per annum per Preferred Share on a daily basis from the first date on which any Preferred Share is issued (and such funds are received by Galaxy), which preferential cash distribution is payable semi-annually in arrears on or before March 31 and September 30 of each year. During the year ended December 31, 2023, Galaxy incurred $0.1 million of distribution expense related to preferred stockholders recorded to net loss attributable to perpetual preferred stockholder on the accompanying combined statements of operations and comprehensive loss. There was no such distribution expense recorded for the period from August 26, 2022 (commencement of operations) through December 31, 2022. As of December 31, 2023, Galaxy had approximately $39,000 of preferred stock distributions payable included in accounts payable, accrued expenses and other liabilities on the accompanying combined balance sheets. There was no such payable outstanding as of December 31, 2022. Galaxy may redeem its Preferred Shares at its option at a price equal to (i) $1,000 per share plus (ii) all accrued and unpaid distributions on such redeemed Preferred Shares through the date fixed for payment plus (iii) a redemption premium per Preferred Share (if any) equal to $100 per redeemed Preferred Share for Preferred Shares redeemed on or before the second anniversary of the original Preferred Share issue date. Upon liquidation, dissolution or winding up of affairs of Galaxy, Preferred Share holders would be entitled to a payment equal to the price per share Galaxy would pay if Galaxy were to redeem such shares. GALAXY REIT LLC NOTES TO COMBINED FINANCIAL STATEMENTS December 31, 2023 19

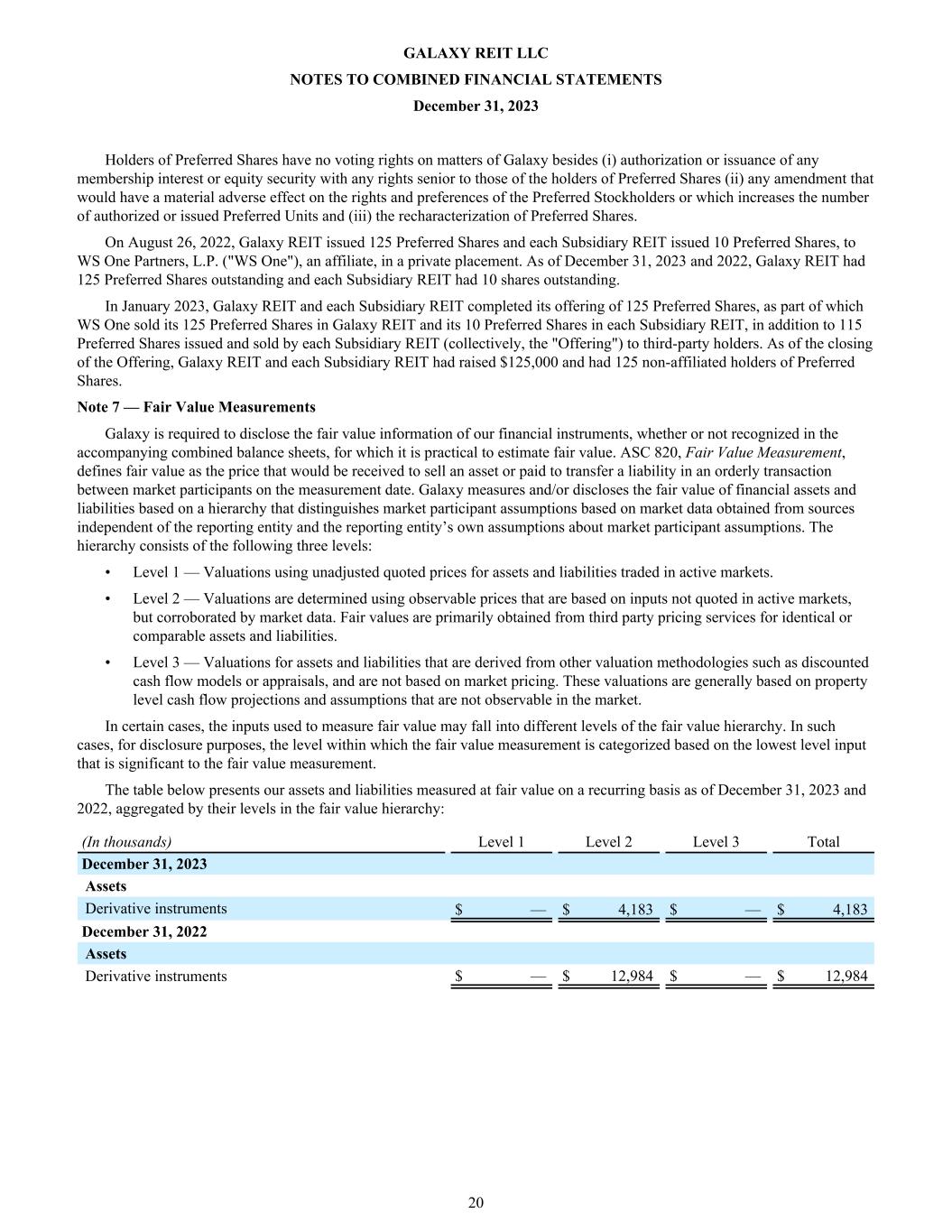

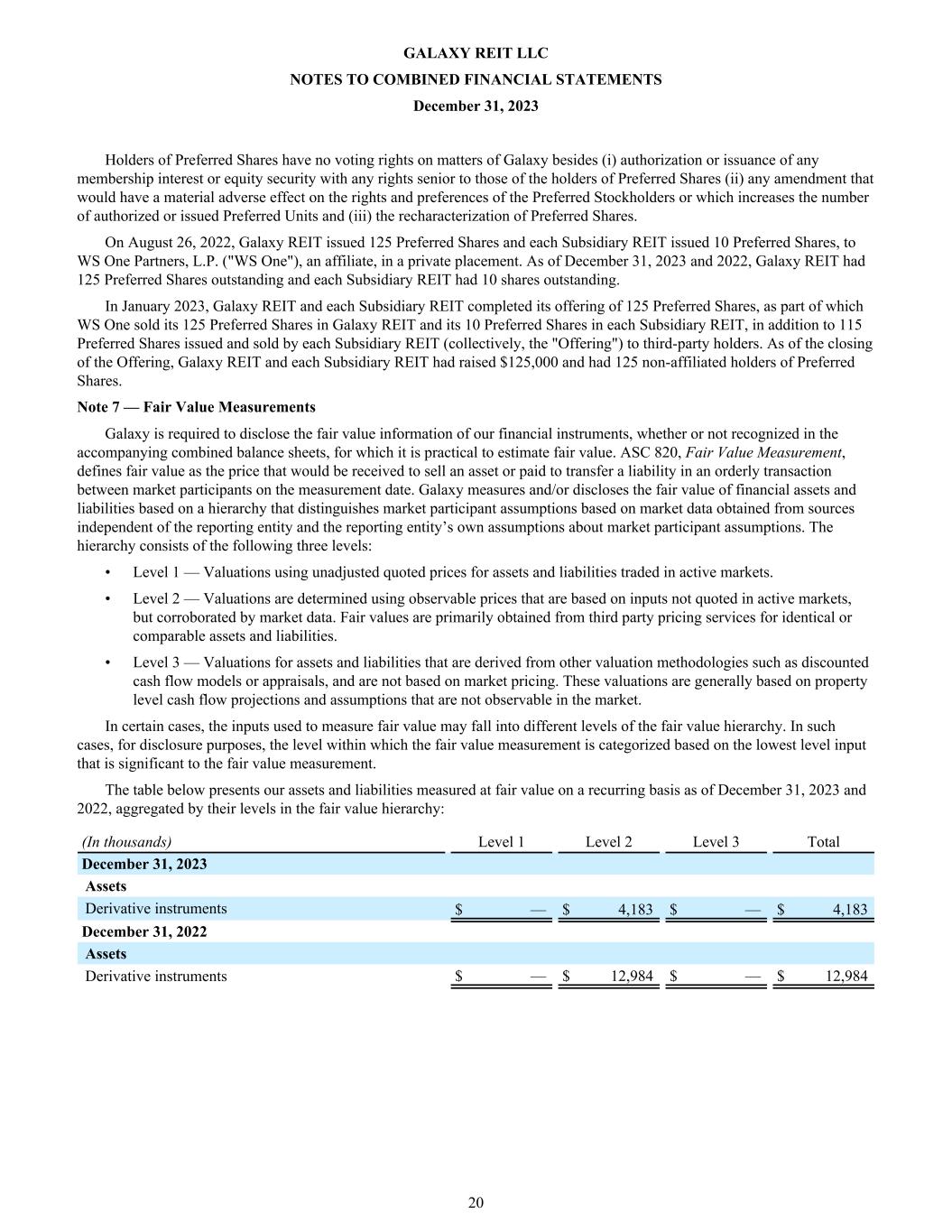

Holders of Preferred Shares have no voting rights on matters of Galaxy besides (i) authorization or issuance of any membership interest or equity security with any rights senior to those of the holders of Preferred Shares (ii) any amendment that would have a material adverse effect on the rights and preferences of the Preferred Stockholders or which increases the number of authorized or issued Preferred Units and (iii) the recharacterization of Preferred Shares. On August 26, 2022, Galaxy REIT issued 125 Preferred Shares and each Subsidiary REIT issued 10 Preferred Shares, to WS One Partners, L.P. ("WS One"), an affiliate, in a private placement. As of December 31, 2023 and 2022, Galaxy REIT had 125 Preferred Shares outstanding and each Subsidiary REIT had 10 shares outstanding. In January 2023, Galaxy REIT and each Subsidiary REIT completed its offering of 125 Preferred Shares, as part of which WS One sold its 125 Preferred Shares in Galaxy REIT and its 10 Preferred Shares in each Subsidiary REIT, in addition to 115 Preferred Shares issued and sold by each Subsidiary REIT (collectively, the "Offering") to third-party holders. As of the closing of the Offering, Galaxy REIT and each Subsidiary REIT had raised $125,000 and had 125 non-affiliated holders of Preferred Shares. Note 7 — Fair Value Measurements Galaxy is required to disclose the fair value information of our financial instruments, whether or not recognized in the accompanying combined balance sheets, for which it is practical to estimate fair value. ASC 820, Fair Value Measurement, defines fair value as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants on the measurement date. Galaxy measures and/or discloses the fair value of financial assets and liabilities based on a hierarchy that distinguishes market participant assumptions based on market data obtained from sources independent of the reporting entity and the reporting entity’s own assumptions about market participant assumptions. The hierarchy consists of the following three levels: • Level 1 — Valuations using unadjusted quoted prices for assets and liabilities traded in active markets. • Level 2 — Valuations are determined using observable prices that are based on inputs not quoted in active markets, but corroborated by market data. Fair values are primarily obtained from third party pricing services for identical or comparable assets and liabilities. • Level 3 — Valuations for assets and liabilities that are derived from other valuation methodologies such as discounted cash flow models or appraisals, and are not based on market pricing. These valuations are generally based on property level cash flow projections and assumptions that are not observable in the market. In certain cases, the inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level within which the fair value measurement is categorized based on the lowest level input that is significant to the fair value measurement. The table below presents our assets and liabilities measured at fair value on a recurring basis as of December 31, 2023 and 2022, aggregated by their levels in the fair value hierarchy: (In thousands) Level 1 Level 2 Level 3 Total December 31, 2023 Assets Derivative instruments $ — $ 4,183 $ — $ 4,183 December 31, 2022 Assets Derivative instruments $ — $ 12,984 $ — $ 12,984 GALAXY REIT LLC NOTES TO COMBINED FINANCIAL STATEMENTS December 31, 2023 20

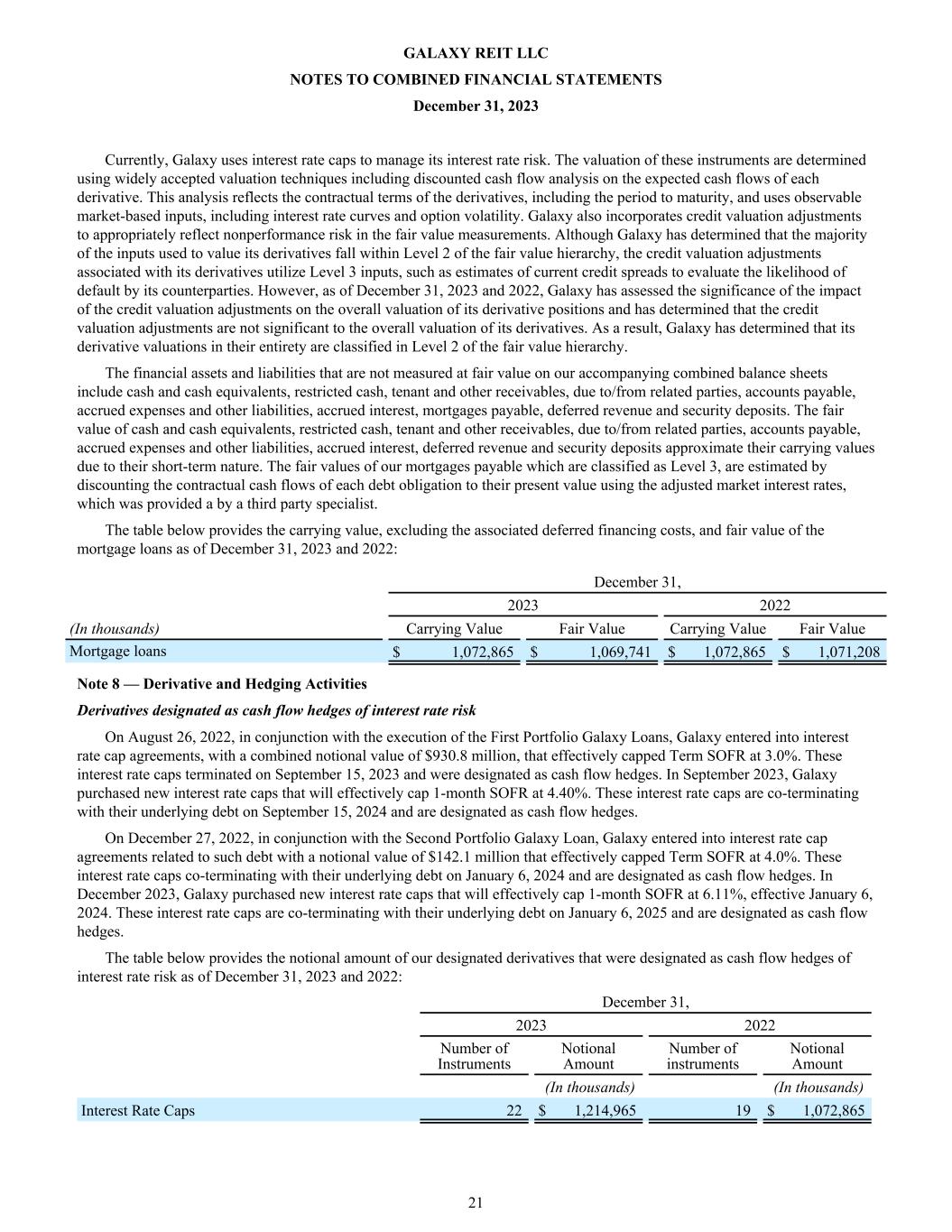

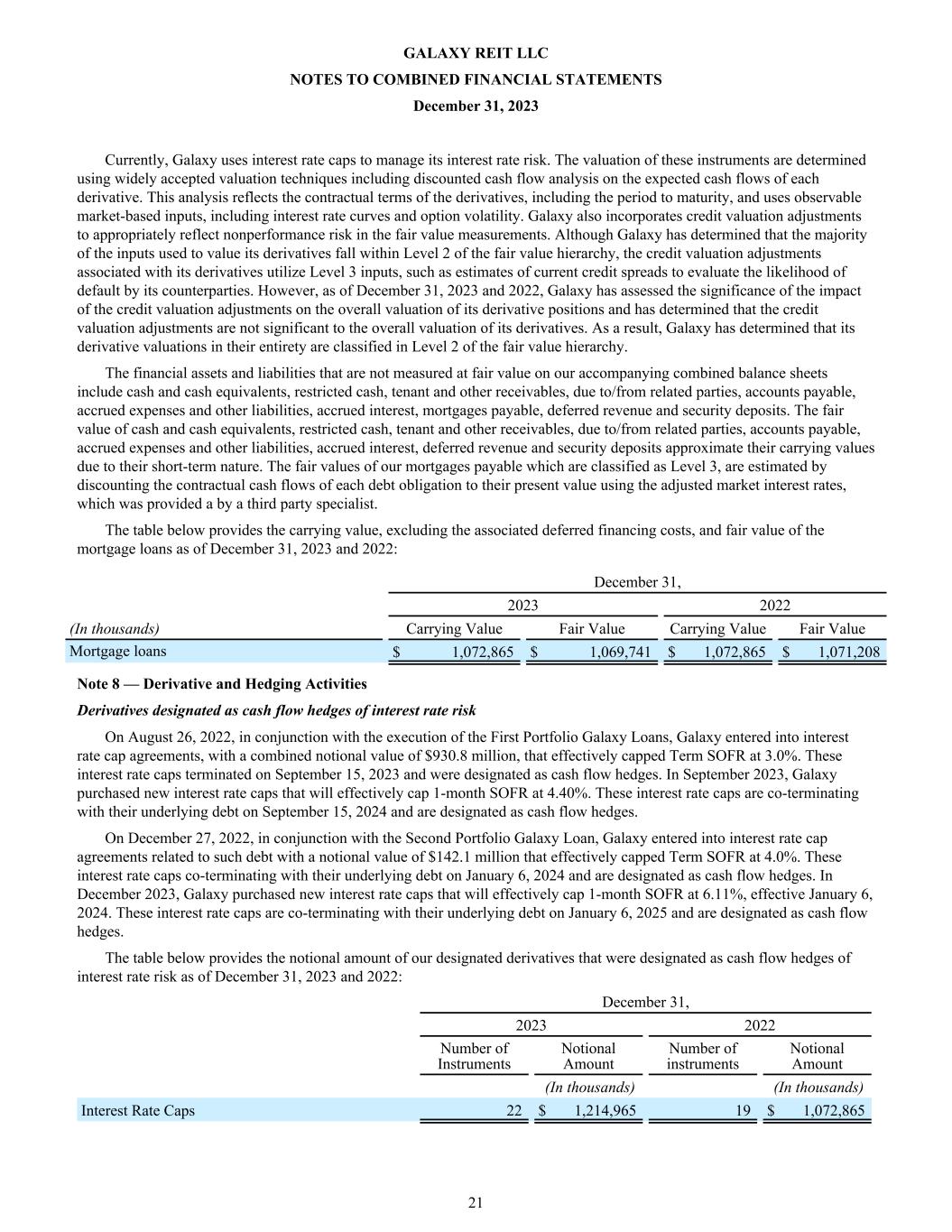

Currently, Galaxy uses interest rate caps to manage its interest rate risk. The valuation of these instruments are determined using widely accepted valuation techniques including discounted cash flow analysis on the expected cash flows of each derivative. This analysis reflects the contractual terms of the derivatives, including the period to maturity, and uses observable market-based inputs, including interest rate curves and option volatility. Galaxy also incorporates credit valuation adjustments to appropriately reflect nonperformance risk in the fair value measurements. Although Galaxy has determined that the majority of the inputs used to value its derivatives fall within Level 2 of the fair value hierarchy, the credit valuation adjustments associated with its derivatives utilize Level 3 inputs, such as estimates of current credit spreads to evaluate the likelihood of default by its counterparties. However, as of December 31, 2023 and 2022, Galaxy has assessed the significance of the impact of the credit valuation adjustments on the overall valuation of its derivative positions and has determined that the credit valuation adjustments are not significant to the overall valuation of its derivatives. As a result, Galaxy has determined that its derivative valuations in their entirety are classified in Level 2 of the fair value hierarchy. The financial assets and liabilities that are not measured at fair value on our accompanying combined balance sheets include cash and cash equivalents, restricted cash, tenant and other receivables, due to/from related parties, accounts payable, accrued expenses and other liabilities, accrued interest, mortgages payable, deferred revenue and security deposits. The fair value of cash and cash equivalents, restricted cash, tenant and other receivables, due to/from related parties, accounts payable, accrued expenses and other liabilities, accrued interest, deferred revenue and security deposits approximate their carrying values due to their short-term nature. The fair values of our mortgages payable which are classified as Level 3, are estimated by discounting the contractual cash flows of each debt obligation to their present value using the adjusted market interest rates, which was provided a by a third party specialist. The table below provides the carrying value, excluding the associated deferred financing costs, and fair value of the mortgage loans as of December 31, 2023 and 2022: December 31, 2023 2022 (In thousands) Carrying Value Fair Value Carrying Value Fair Value Mortgage loans $ 1,072,865 $ 1,069,741 $ 1,072,865 $ 1,071,208 Note 8 — Derivative and Hedging Activities Derivatives designated as cash flow hedges of interest rate risk On August 26, 2022, in conjunction with the execution of the First Portfolio Galaxy Loans, Galaxy entered into interest rate cap agreements, with a combined notional value of $930.8 million, that effectively capped Term SOFR at 3.0%. These interest rate caps terminated on September 15, 2023 and were designated as cash flow hedges. In September 2023, Galaxy purchased new interest rate caps that will effectively cap 1-month SOFR at 4.40%. These interest rate caps are co-terminating with their underlying debt on September 15, 2024 and are designated as cash flow hedges. On December 27, 2022, in conjunction with the Second Portfolio Galaxy Loan, Galaxy entered into interest rate cap agreements related to such debt with a notional value of $142.1 million that effectively capped Term SOFR at 4.0%. These interest rate caps co-terminating with their underlying debt on January 6, 2024 and are designated as cash flow hedges. In December 2023, Galaxy purchased new interest rate caps that will effectively cap 1-month SOFR at 6.11%, effective January 6, 2024. These interest rate caps are co-terminating with their underlying debt on January 6, 2025 and are designated as cash flow hedges. The table below provides the notional amount of our designated derivatives that were designated as cash flow hedges of interest rate risk as of December 31, 2023 and 2022: December 31, 2023 2022 Number of Instruments Notional Amount Number of instruments Notional Amount (In thousands) (In thousands) Interest Rate Caps 22 $ 1,214,965 19 $ 1,072,865 GALAXY REIT LLC NOTES TO COMBINED FINANCIAL STATEMENTS December 31, 2023 21

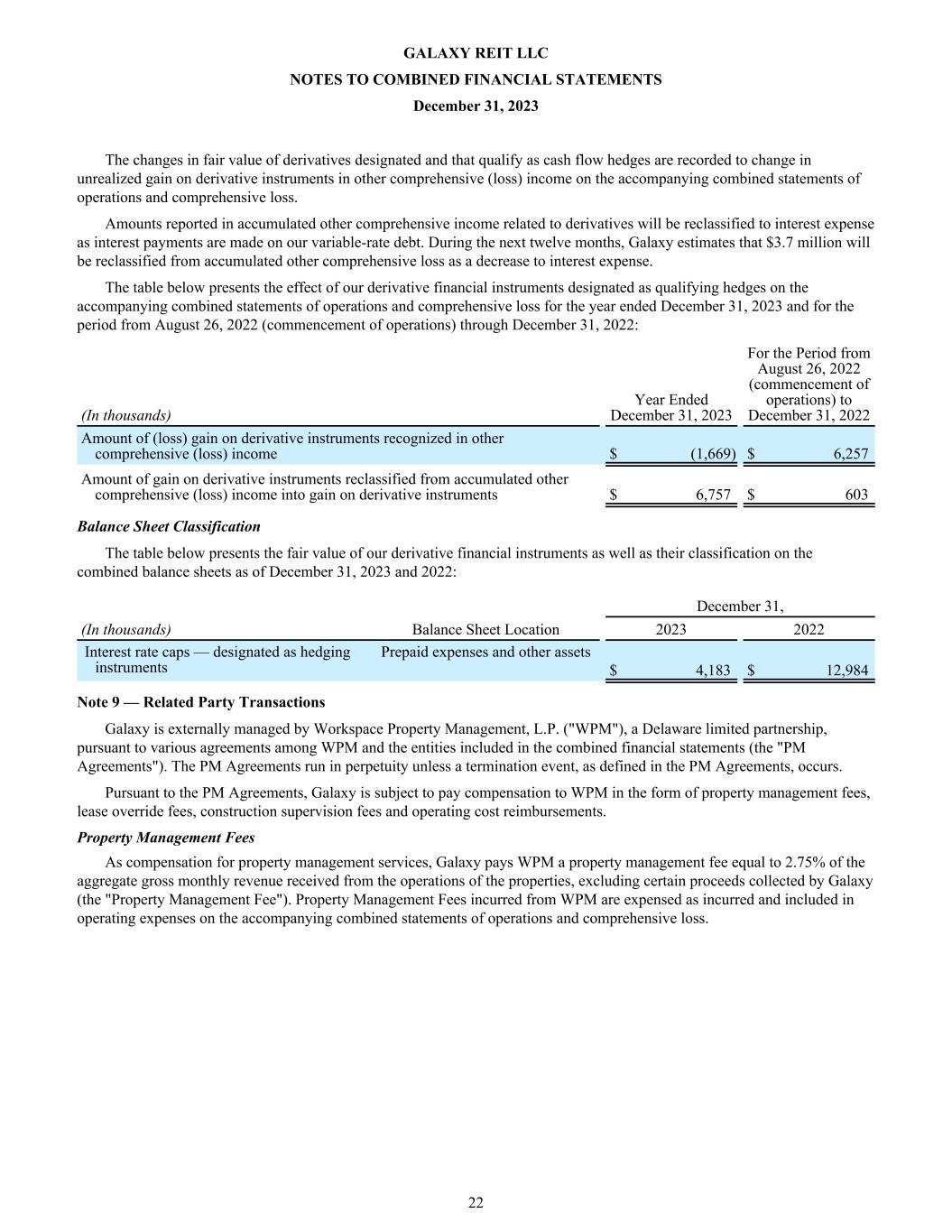

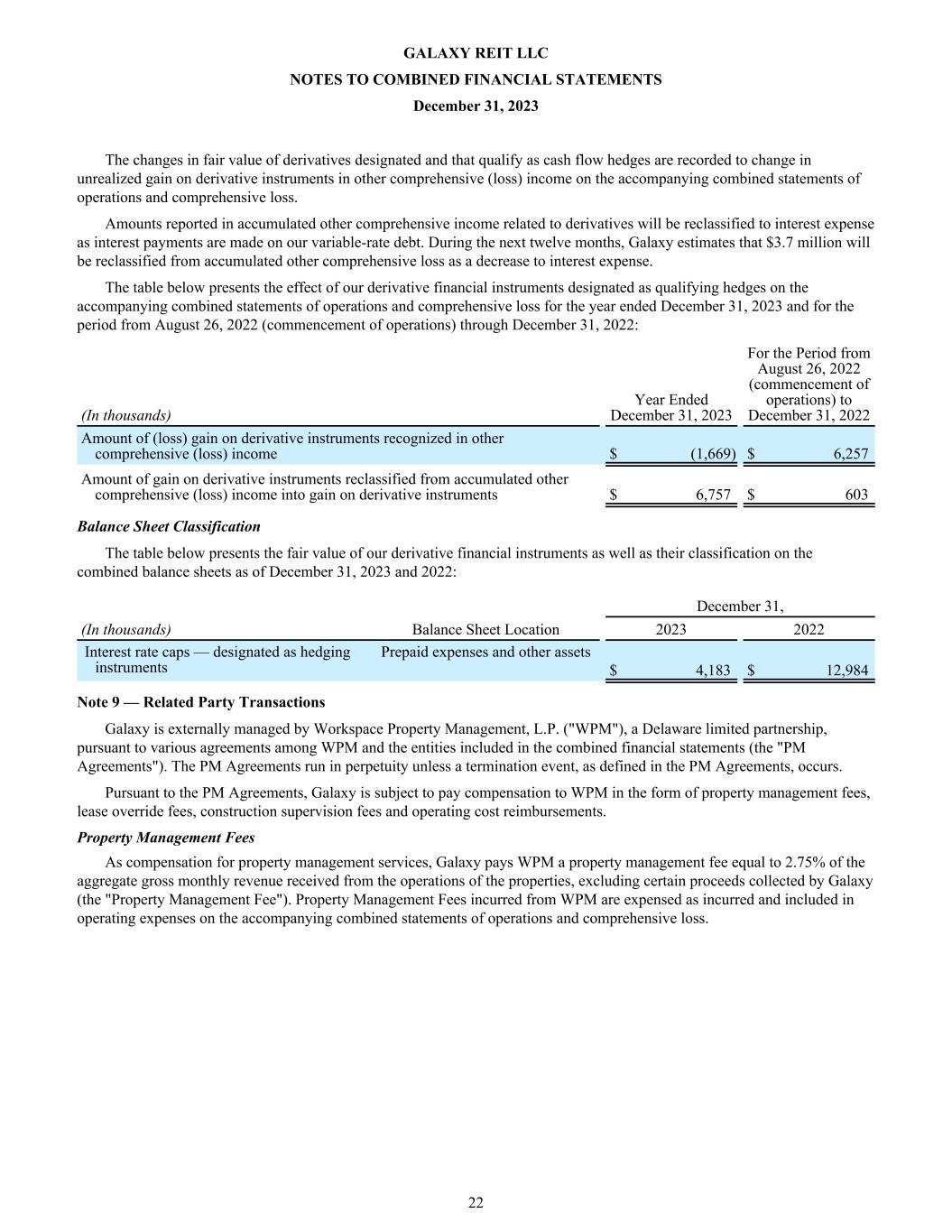

The changes in fair value of derivatives designated and that qualify as cash flow hedges are recorded to change in unrealized gain on derivative instruments in other comprehensive (loss) income on the accompanying combined statements of operations and comprehensive loss. Amounts reported in accumulated other comprehensive income related to derivatives will be reclassified to interest expense as interest payments are made on our variable-rate debt. During the next twelve months, Galaxy estimates that $3.7 million will be reclassified from accumulated other comprehensive loss as a decrease to interest expense. The table below presents the effect of our derivative financial instruments designated as qualifying hedges on the accompanying combined statements of operations and comprehensive loss for the year ended December 31, 2023 and for the period from August 26, 2022 (commencement of operations) through December 31, 2022: (In thousands) Year Ended December 31, 2023 For the Period from August 26, 2022 (commencement of operations) to December 31, 2022 Amount of (loss) gain on derivative instruments recognized in other comprehensive (loss) income $ (1,669) $ 6,257 Amount of gain on derivative instruments reclassified from accumulated other comprehensive (loss) income into gain on derivative instruments $ 6,757 $ 603 Balance Sheet Classification The table below presents the fair value of our derivative financial instruments as well as their classification on the combined balance sheets as of December 31, 2023 and 2022: December 31, (In thousands) Balance Sheet Location 2023 2022 Interest rate caps — designated as hedging instruments Prepaid expenses and other assets $ 4,183 $ 12,984 Note 9 — Related Party Transactions Galaxy is externally managed by Workspace Property Management, L.P. ("WPM"), a Delaware limited partnership, pursuant to various agreements among WPM and the entities included in the combined financial statements (the "PM Agreements"). The PM Agreements run in perpetuity unless a termination event, as defined in the PM Agreements, occurs. Pursuant to the PM Agreements, Galaxy is subject to pay compensation to WPM in the form of property management fees, lease override fees, construction supervision fees and operating cost reimbursements. Property Management Fees As compensation for property management services, Galaxy pays WPM a property management fee equal to 2.75% of the aggregate gross monthly revenue received from the operations of the properties, excluding certain proceeds collected by Galaxy (the "Property Management Fee"). Property Management Fees incurred from WPM are expensed as incurred and included in operating expenses on the accompanying combined statements of operations and comprehensive loss. GALAXY REIT LLC NOTES TO COMBINED FINANCIAL STATEMENTS December 31, 2023 22

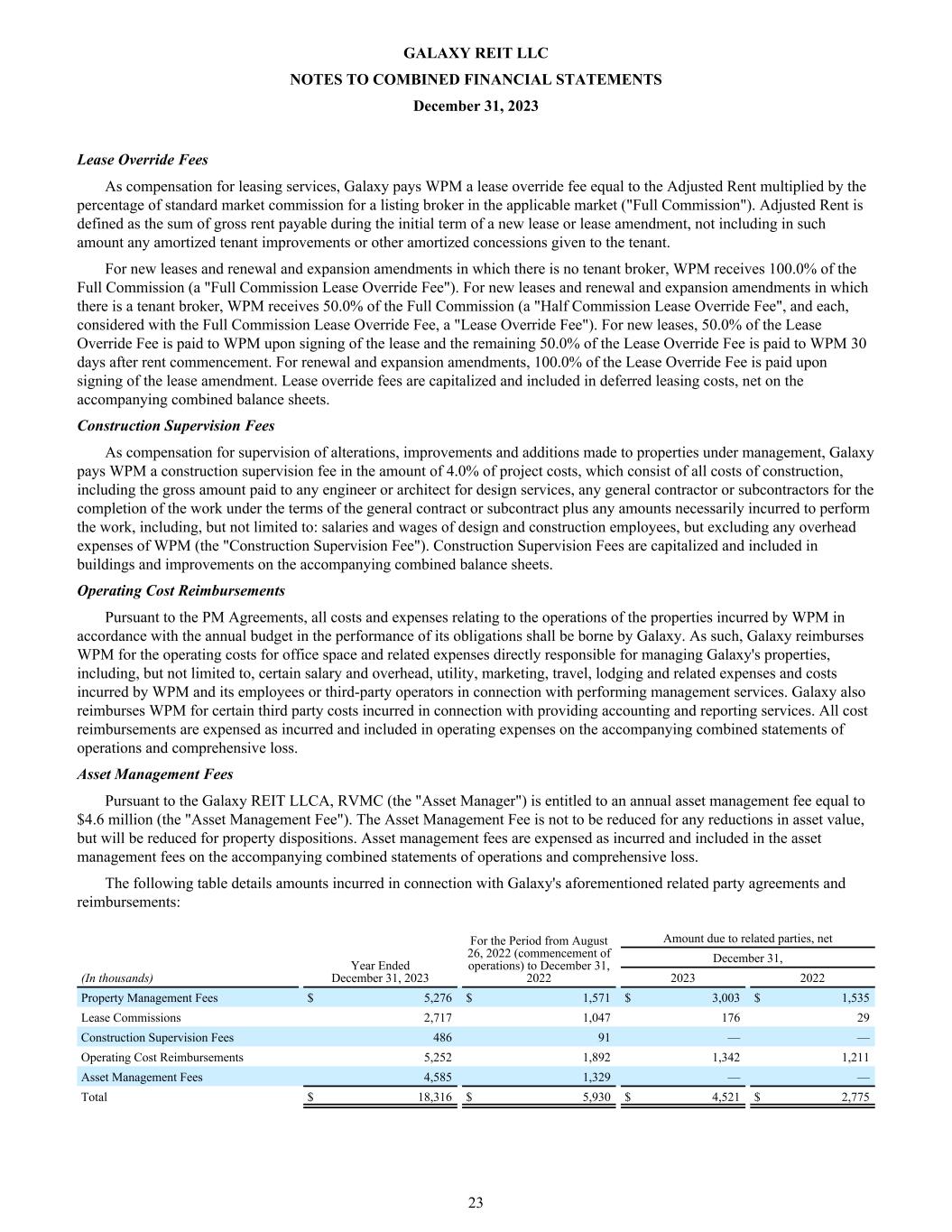

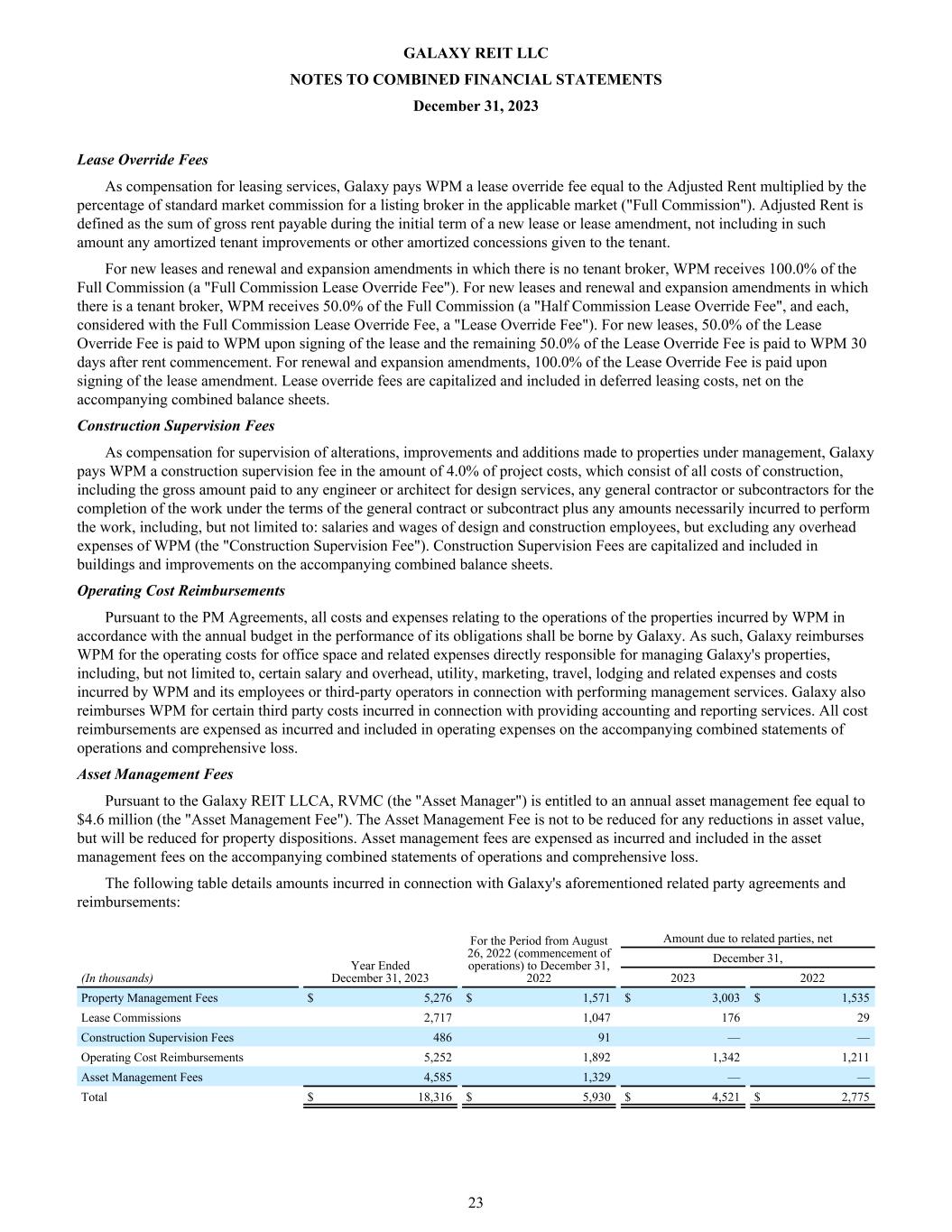

Lease Override Fees As compensation for leasing services, Galaxy pays WPM a lease override fee equal to the Adjusted Rent multiplied by the percentage of standard market commission for a listing broker in the applicable market ("Full Commission"). Adjusted Rent is defined as the sum of gross rent payable during the initial term of a new lease or lease amendment, not including in such amount any amortized tenant improvements or other amortized concessions given to the tenant. For new leases and renewal and expansion amendments in which there is no tenant broker, WPM receives 100.0% of the Full Commission (a "Full Commission Lease Override Fee"). For new leases and renewal and expansion amendments in which there is a tenant broker, WPM receives 50.0% of the Full Commission (a "Half Commission Lease Override Fee", and each, considered with the Full Commission Lease Override Fee, a "Lease Override Fee"). For new leases, 50.0% of the Lease Override Fee is paid to WPM upon signing of the lease and the remaining 50.0% of the Lease Override Fee is paid to WPM 30 days after rent commencement. For renewal and expansion amendments, 100.0% of the Lease Override Fee is paid upon signing of the lease amendment. Lease override fees are capitalized and included in deferred leasing costs, net on the accompanying combined balance sheets. Construction Supervision Fees As compensation for supervision of alterations, improvements and additions made to properties under management, Galaxy pays WPM a construction supervision fee in the amount of 4.0% of project costs, which consist of all costs of construction, including the gross amount paid to any engineer or architect for design services, any general contractor or subcontractors for the completion of the work under the terms of the general contract or subcontract plus any amounts necessarily incurred to perform the work, including, but not limited to: salaries and wages of design and construction employees, but excluding any overhead expenses of WPM (the "Construction Supervision Fee"). Construction Supervision Fees are capitalized and included in buildings and improvements on the accompanying combined balance sheets. Operating Cost Reimbursements Pursuant to the PM Agreements, all costs and expenses relating to the operations of the properties incurred by WPM in accordance with the annual budget in the performance of its obligations shall be borne by Galaxy. As such, Galaxy reimburses WPM for the operating costs for office space and related expenses directly responsible for managing Galaxy's properties, including, but not limited to, certain salary and overhead, utility, marketing, travel, lodging and related expenses and costs incurred by WPM and its employees or third-party operators in connection with performing management services. Galaxy also reimburses WPM for certain third party costs incurred in connection with providing accounting and reporting services. All cost reimbursements are expensed as incurred and included in operating expenses on the accompanying combined statements of operations and comprehensive loss. Asset Management Fees Pursuant to the Galaxy REIT LLCA, RVMC (the "Asset Manager") is entitled to an annual asset management fee equal to $4.6 million (the "Asset Management Fee"). The Asset Management Fee is not to be reduced for any reductions in asset value, but will be reduced for property dispositions. Asset management fees are expensed as incurred and included in the asset management fees on the accompanying combined statements of operations and comprehensive loss. The following table details amounts incurred in connection with Galaxy's aforementioned related party agreements and reimbursements: Year Ended December 31, 2023 For the Period from August 26, 2022 (commencement of operations) to December 31, 2022 Amount due to related parties, net December 31, (In thousands) 2023 2022 Property Management Fees $ 5,276 $ 1,571 $ 3,003 $ 1,535 Lease Commissions 2,717 1,047 176 29 Construction Supervision Fees 486 91 — — Operating Cost Reimbursements 5,252 1,892 1,342 1,211 Asset Management Fees 4,585 1,329 — — Total $ 18,316 $ 5,930 $ 4,521 $ 2,775 GALAXY REIT LLC NOTES TO COMBINED FINANCIAL STATEMENTS December 31, 2023 23

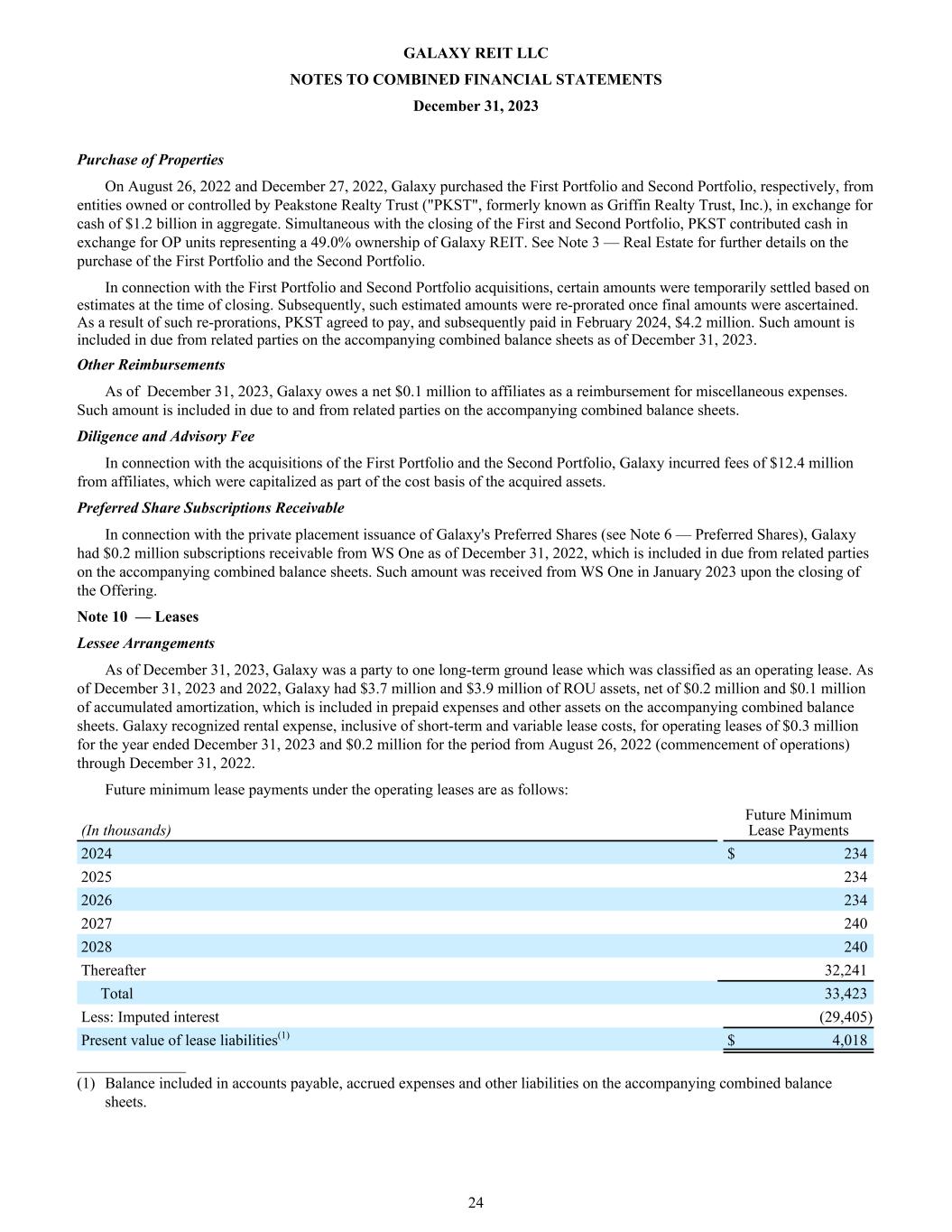

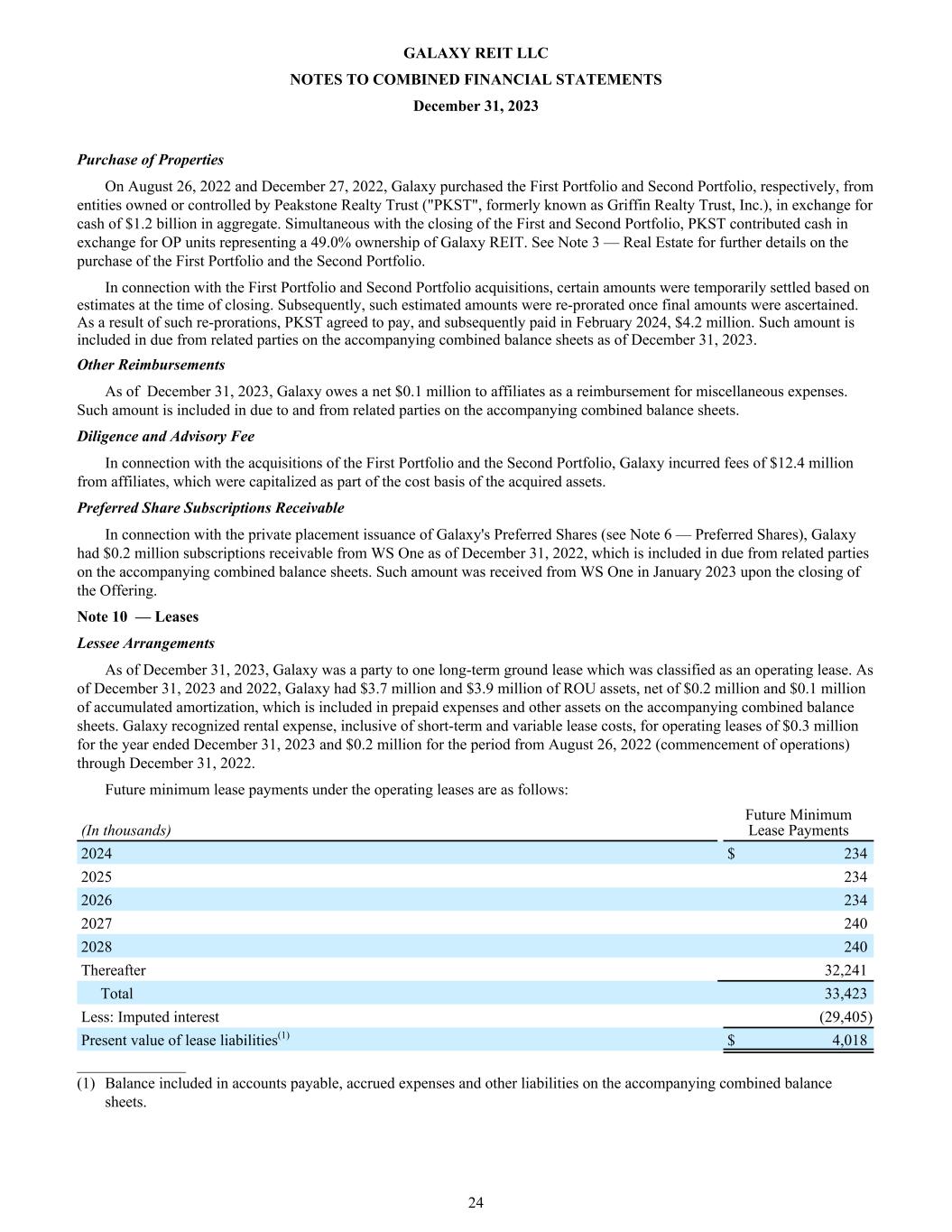

Purchase of Properties On August 26, 2022 and December 27, 2022, Galaxy purchased the First Portfolio and Second Portfolio, respectively, from entities owned or controlled by Peakstone Realty Trust ("PKST", formerly known as Griffin Realty Trust, Inc.), in exchange for cash of $1.2 billion in aggregate. Simultaneous with the closing of the First and Second Portfolio, PKST contributed cash in exchange for OP units representing a 49.0% ownership of Galaxy REIT. See Note 3 — Real Estate for further details on the purchase of the First Portfolio and the Second Portfolio. In connection with the First Portfolio and Second Portfolio acquisitions, certain amounts were temporarily settled based on estimates at the time of closing. Subsequently, such estimated amounts were re-prorated once final amounts were ascertained. As a result of such re-prorations, PKST agreed to pay, and subsequently paid in February 2024, $4.2 million. Such amount is included in due from related parties on the accompanying combined balance sheets as of December 31, 2023. Other Reimbursements As of December 31, 2023, Galaxy owes a net $0.1 million to affiliates as a reimbursement for miscellaneous expenses. Such amount is included in due to and from related parties on the accompanying combined balance sheets. Diligence and Advisory Fee In connection with the acquisitions of the First Portfolio and the Second Portfolio, Galaxy incurred fees of $12.4 million from affiliates, which were capitalized as part of the cost basis of the acquired assets. Preferred Share Subscriptions Receivable In connection with the private placement issuance of Galaxy's Preferred Shares (see Note 6 — Preferred Shares), Galaxy had $0.2 million subscriptions receivable from WS One as of December 31, 2022, which is included in due from related parties on the accompanying combined balance sheets. Such amount was received from WS One in January 2023 upon the closing of the Offering. Note 10 — Leases Lessee Arrangements As of December 31, 2023, Galaxy was a party to one long-term ground lease which was classified as an operating lease. As of December 31, 2023 and 2022, Galaxy had $3.7 million and $3.9 million of ROU assets, net of $0.2 million and $0.1 million of accumulated amortization, which is included in prepaid expenses and other assets on the accompanying combined balance sheets. Galaxy recognized rental expense, inclusive of short-term and variable lease costs, for operating leases of $0.3 million for the year ended December 31, 2023 and $0.2 million for the period from August 26, 2022 (commencement of operations) through December 31, 2022. Future minimum lease payments under the operating leases are as follows: (In thousands) Future Minimum Lease Payments 2024 $ 234 2025 234 2026 234 2027 240 2028 240 Thereafter 32,241 Total 33,423 Less: Imputed interest (29,405) Present value of lease liabilities(1) $ 4,018 ______________ (1) Balance included in accounts payable, accrued expenses and other liabilities on the accompanying combined balance sheets. GALAXY REIT LLC NOTES TO COMBINED FINANCIAL STATEMENTS December 31, 2023 24

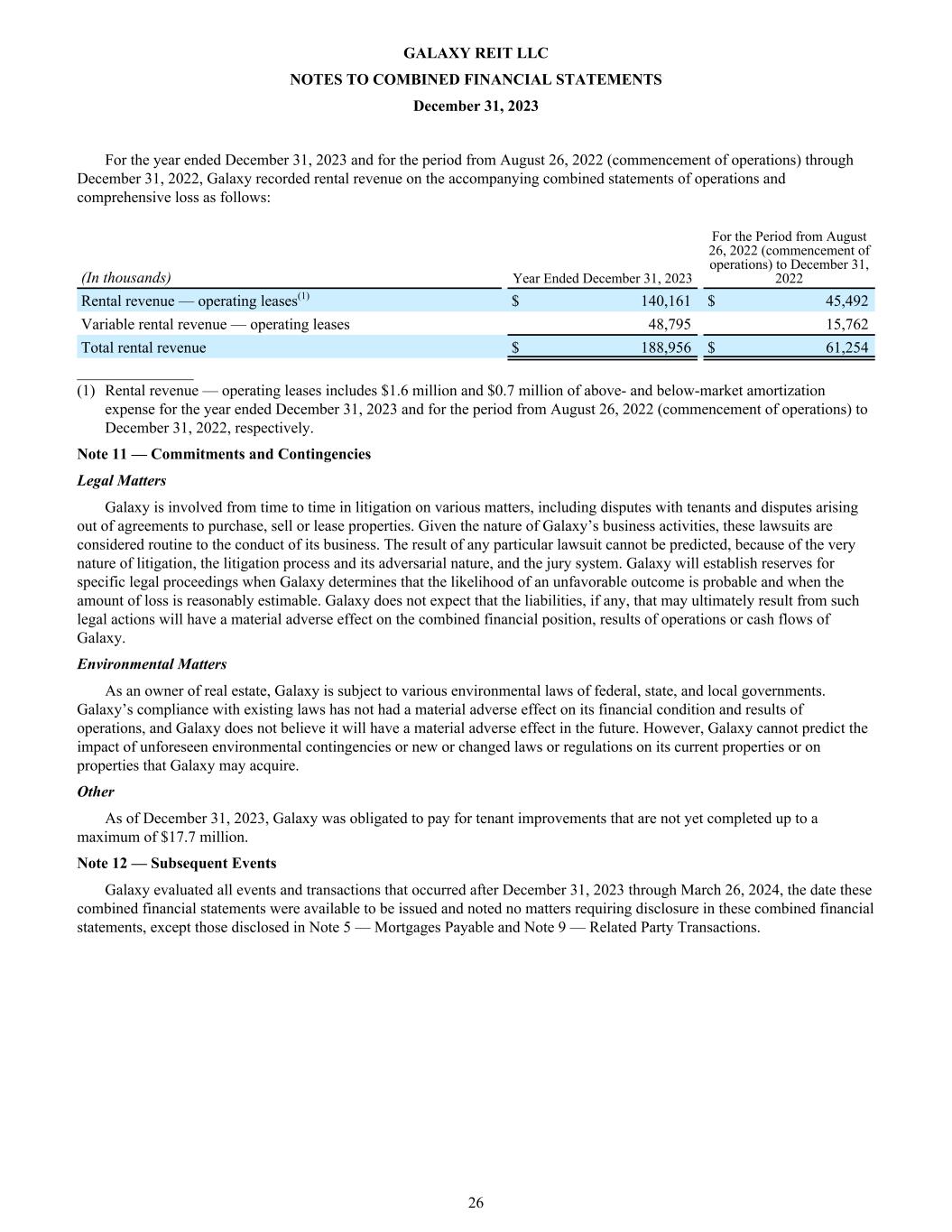

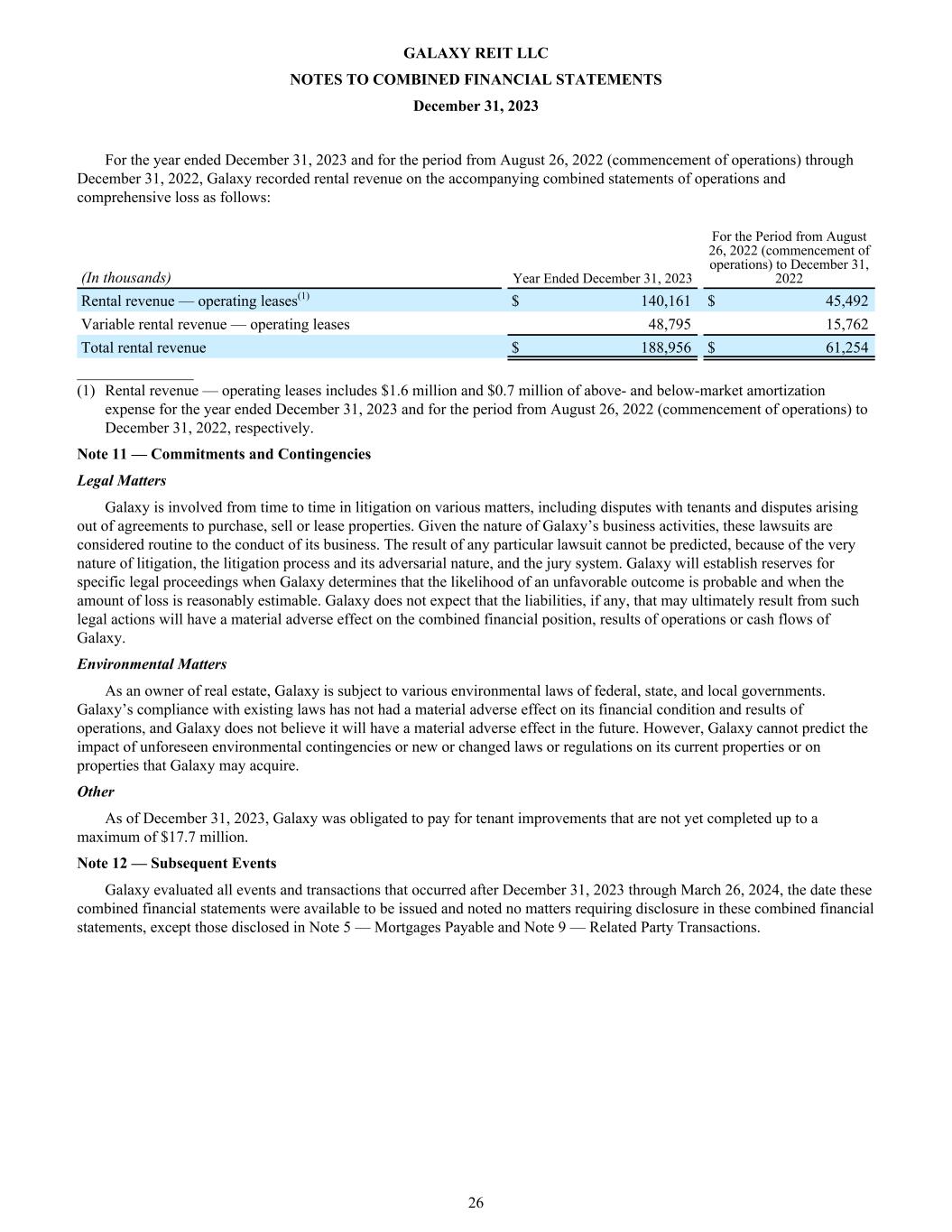

Lease term and discount rate information for leases as of December 31, 2023 are as follows: December 31, 2023 Remaining lease term (years) Operating leases(1) 72.0 Discount rate Operating leases 7.5 % ______________ (1) Remaining term does not reflect any termination or extension options, as we have determined that we would not exercise such options, to the extent they are offered. Lessor Arrangements Galaxy leases properties to tenants under operating leases with various expiration dates through 2034. Most of Galaxy’s leases require tenants to pay fixed annual rental payments that may escalate on an annual basis and variable payments for other operating expenses, such as real estate taxes, insurance, common area maintenance, and utilities, that are based on the actual expenses incurred. There was no single tenant that made up more than 10% of the revenues in aggregate. At December 31, 2023, future minimum cash rental payments due to us over the next five years and thereafter for non- cancelable operating leases, excluding operating expense reimbursements and increases in annual rent based on exceeding certain economic indexes, are as follows: (In thousands) Future Minimum Cash Rental Payments 2024 $ 110,470 2025 80,913 2026 62,678 2027 52,431 2028 47,699 Thereafter 133,636 Total $ 487,827 Certain of our operating leases include tenant options to extend or terminate the lease term. For purposes of determining the lease term, Galaxy excludes these option periods unless it is reasonably assured at lease commencement that the option will be exercised. As of December 31, 2023, Galaxy has two leases that contain an option to purchase the associated property, one is a right of first offer and the other is right of first refusal. These options are not expected to be exercised and therefore have no effect on the lease terms. Galaxy combines our lease and non-lease components that have the same timing and pattern of transfer when the lease component is classified as an operating lease. The non-lease components of our leases primarily consist of common area maintenance, real estate taxes, and insurance reimbursements from our tenants. GALAXY REIT LLC NOTES TO COMBINED FINANCIAL STATEMENTS December 31, 2023 25