Exhibit 99.1

Gamida Cell ltd. and its subsidiary

CONSOLIDATED FINANCIAL STATEMENTS

AS OF DECEMBER 31, 2022

U.S. DOLLARS IN THOUSANDS

INDEX

- - - - - - - - - - - - - -

F-1

744

| Kost Forer Gabbay & Kasierer 144 Menachem Begin Road, Building A Tel-Aviv 6492102, Israel | Tel: +972-3-6232525 Fax: +972-3-5622555 ey.com |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Shareholders and the Board of Directors of

Gamida Cell ltd.

Opinion on the Financial Statements

We have audited the accompanying consolidated balance sheets of Gamida Cell Ltd. and its subsidiary (the Company) as of December 31, 2022 and 2021, the related consolidated statements of operations, changes in shareholders’ equity (deficit) and cash flows for each of the two years in the period ended December 31, 2022, and the related notes (collectively referred to as the “consolidated financial statements”). In our opinion, the consolidated financial statements present fairly, in all material respects, the financial position of the Company at December 31, 2022 and 2021, and the results of its operations and its cash flows for each of the two years in the period ended December 31, 2022, in conformity with U.S. generally accepted accounting principles.

The Company’s Ability to Continue as a Going Concern

The accompanying consolidated financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 1c to the financial statements, the Company has suffered recurring losses from operations, has negative cash flows from operating activities, and has stated that substantial doubt exists about the Company’s ability to continue as a going concern. Management’s evaluation of the events and conditions and management’s plans regarding these matters are also described in Note 1c. The consolidated financial statements do not include any adjustments that might result from the outcome of this uncertainty.

Basis for Opinion

These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on the Company’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures include examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

| /s/ KOST FORER GABBAY & KASIERER | |

| KOST FORER GABBAY & KASIERER | |

| A Member of Ernst & Young Global | |

| | |

| We have served as the Company’s auditor since 2000. | |

| | |

| Tel-Aviv, Israel | |

| March 31, 2023 | |

F-2

745

GAMIDA CELL LTD. AND ITS SUBSIDIARY

CONSOLIDATED BALANCE SHEETS

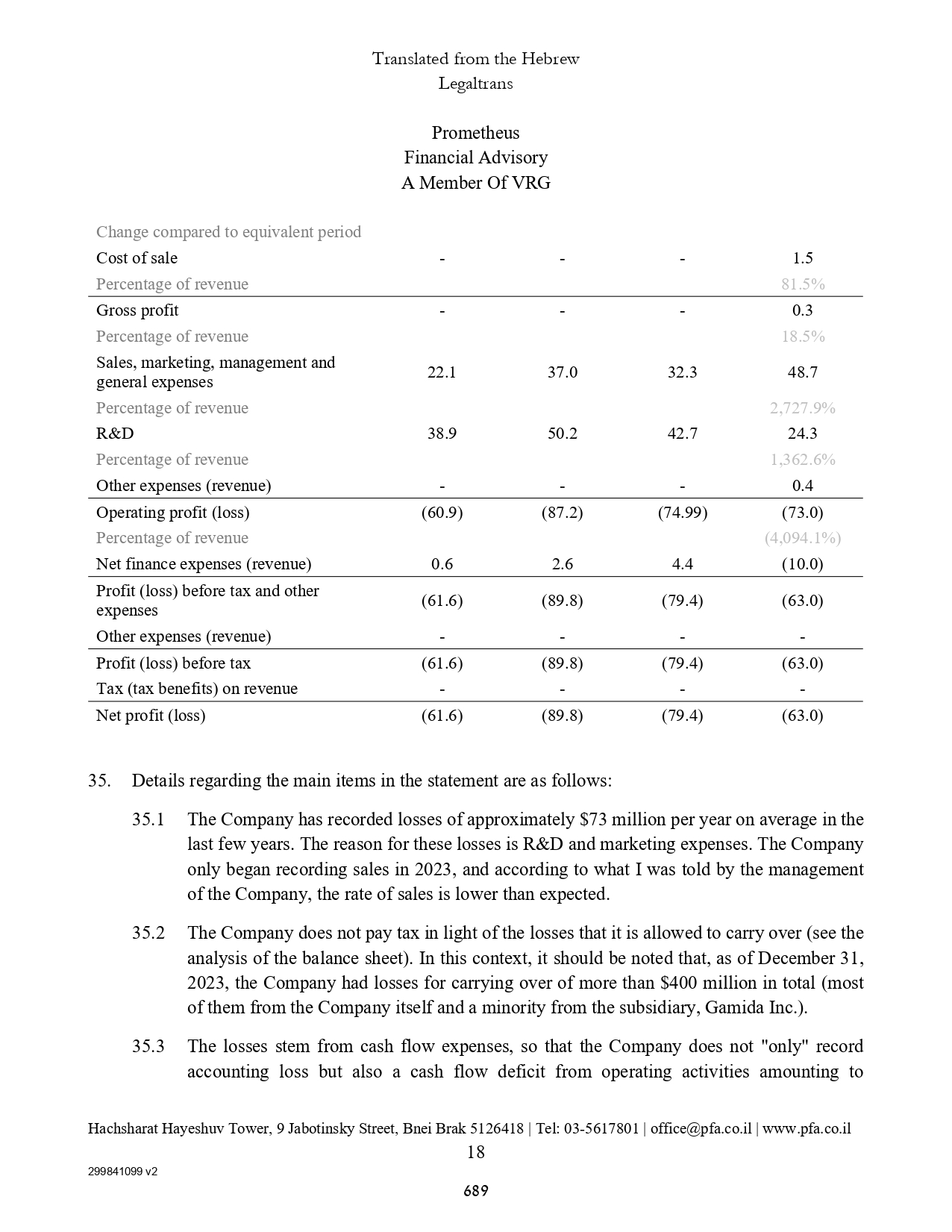

U.S. dollars in thousands (except share and per share data)

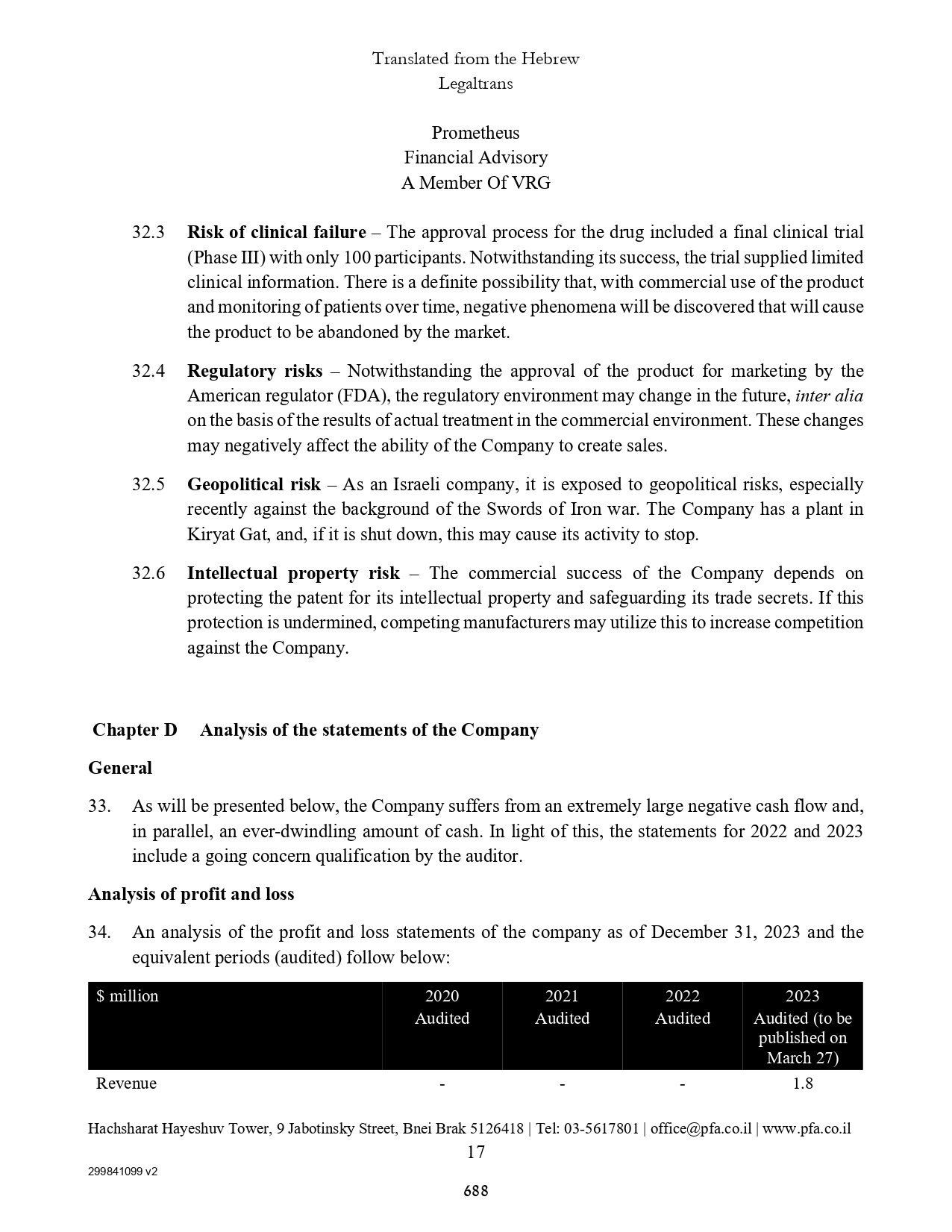

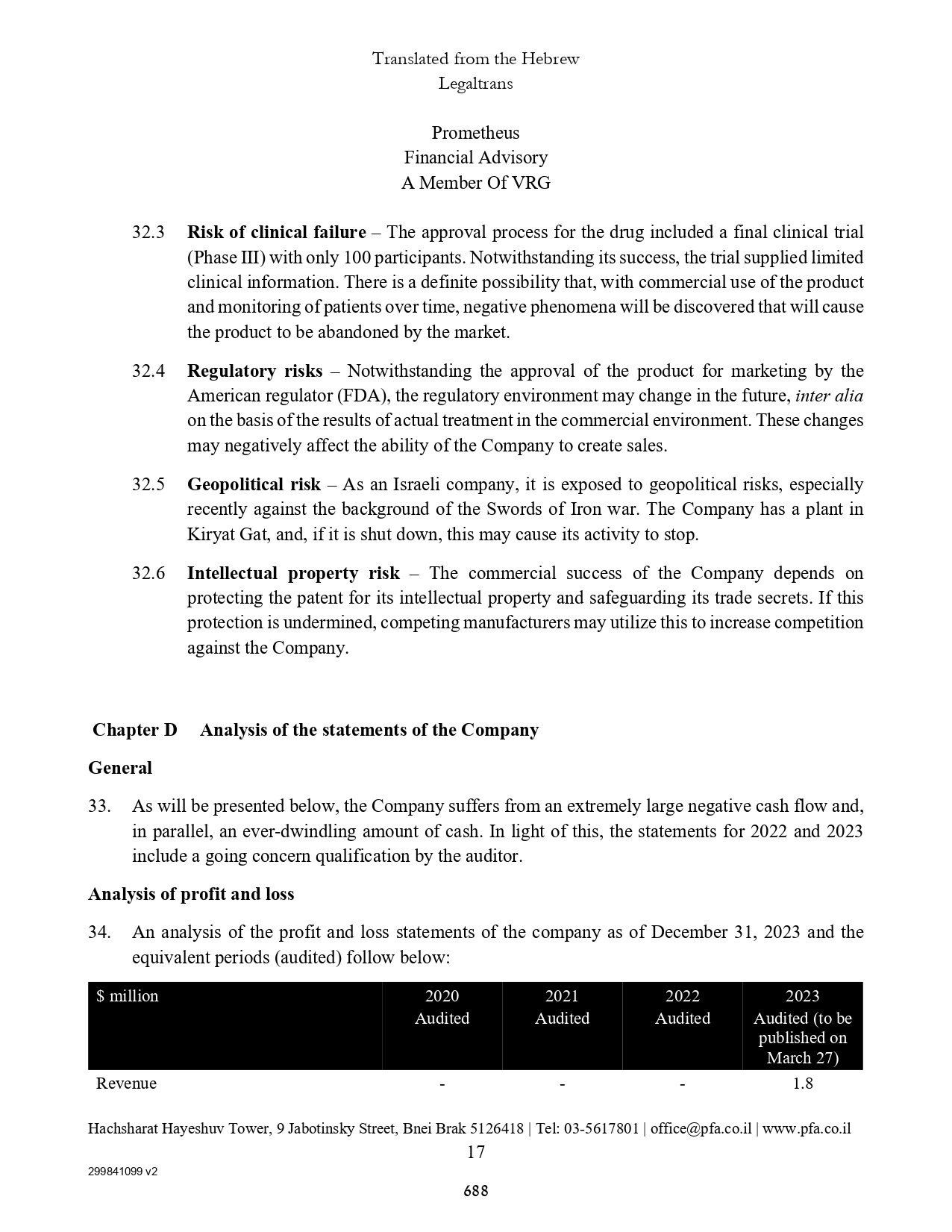

| | | December 31, | |

| | | 2022 | | | 2021 | |

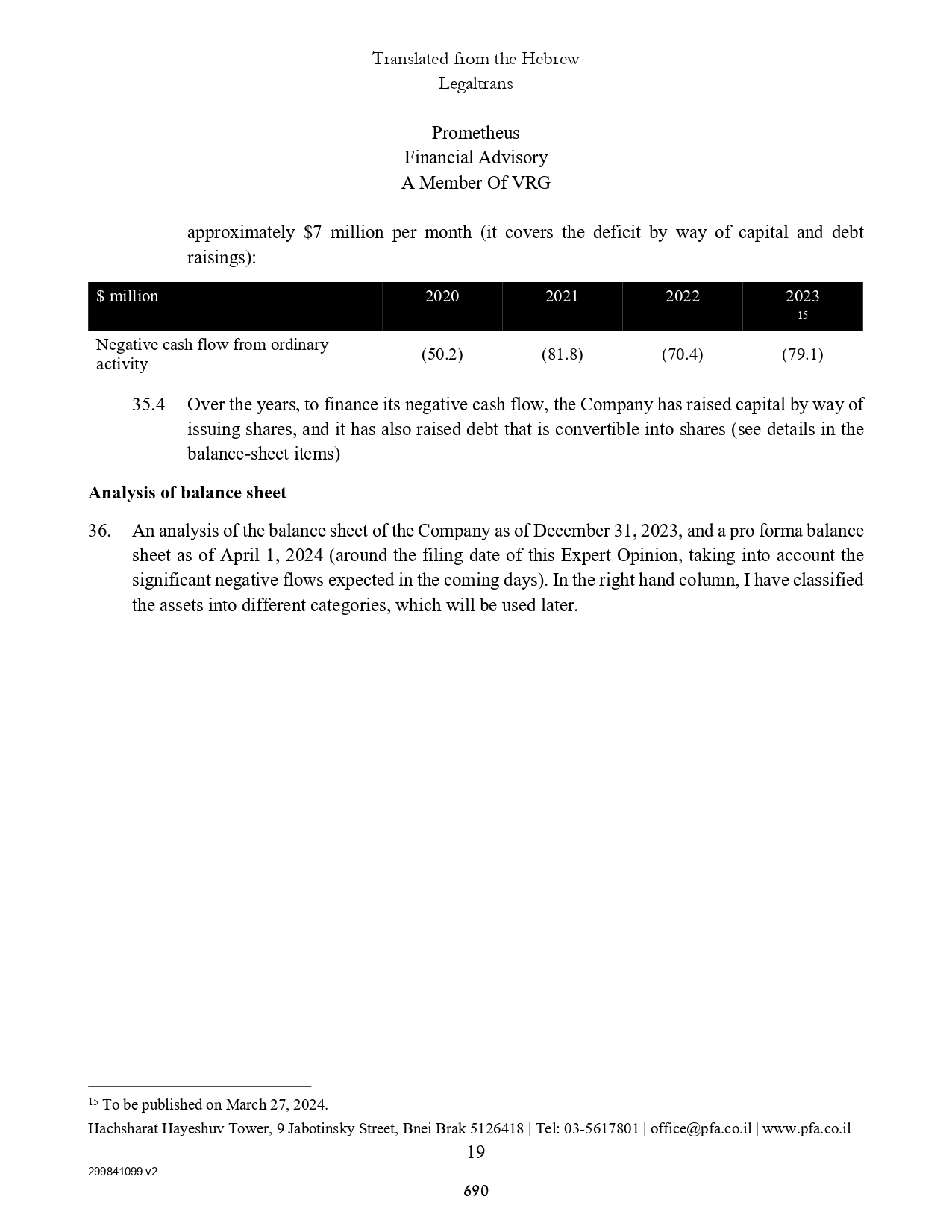

| ASSETS | | | | | | |

| | | | | | | |

| CURRENT ASSETS: | | | | | | |

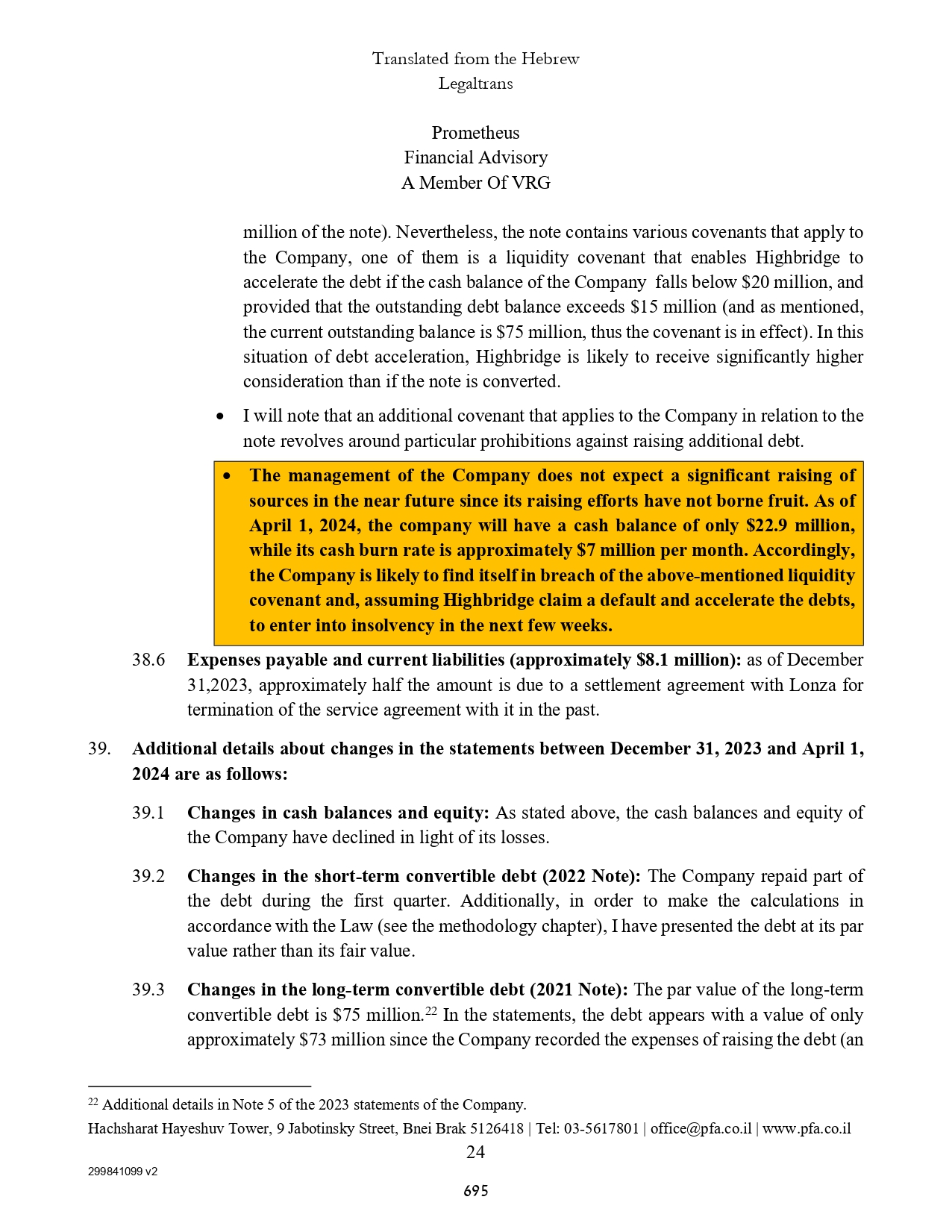

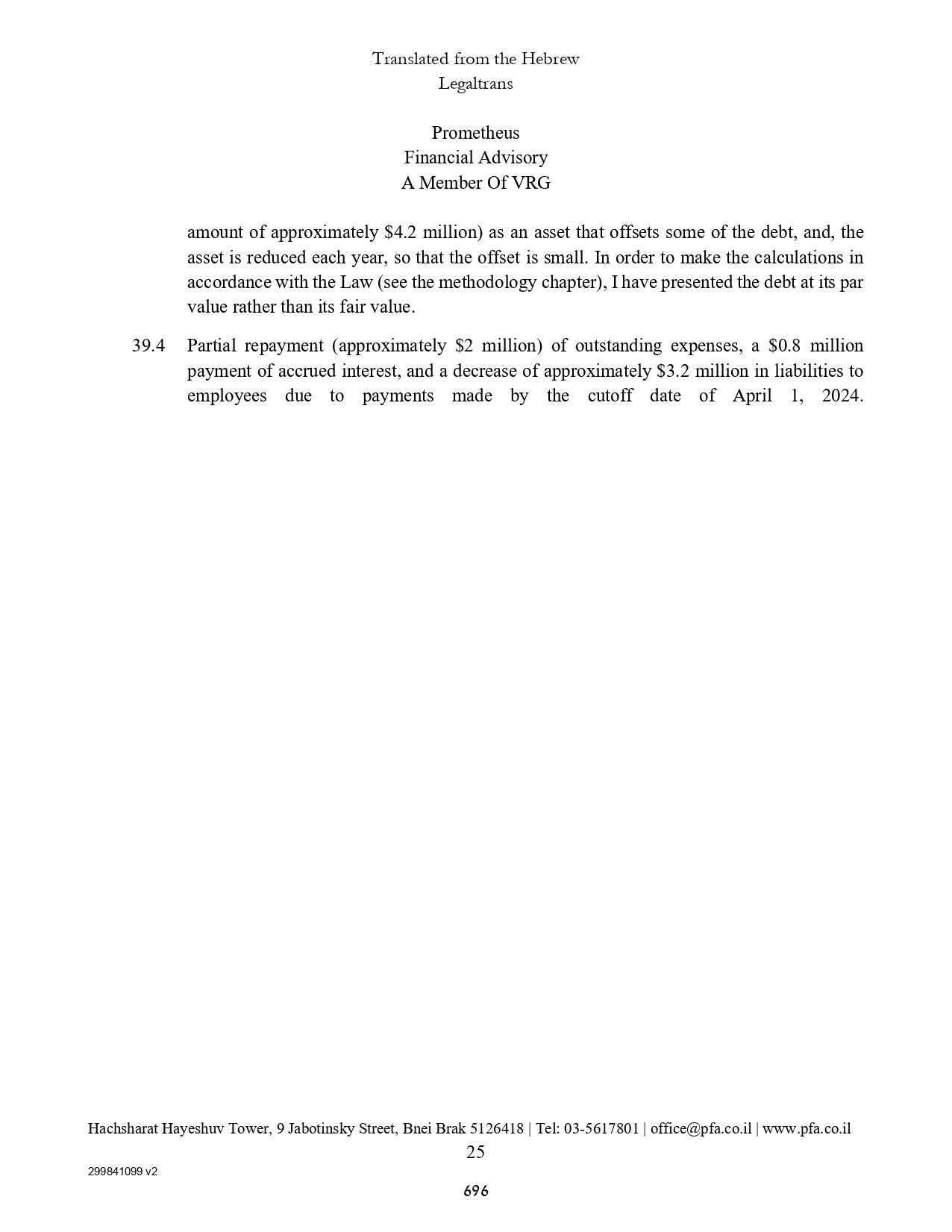

| Cash and cash equivalents | | $ | 64,657 | | | $ | 55,892 | |

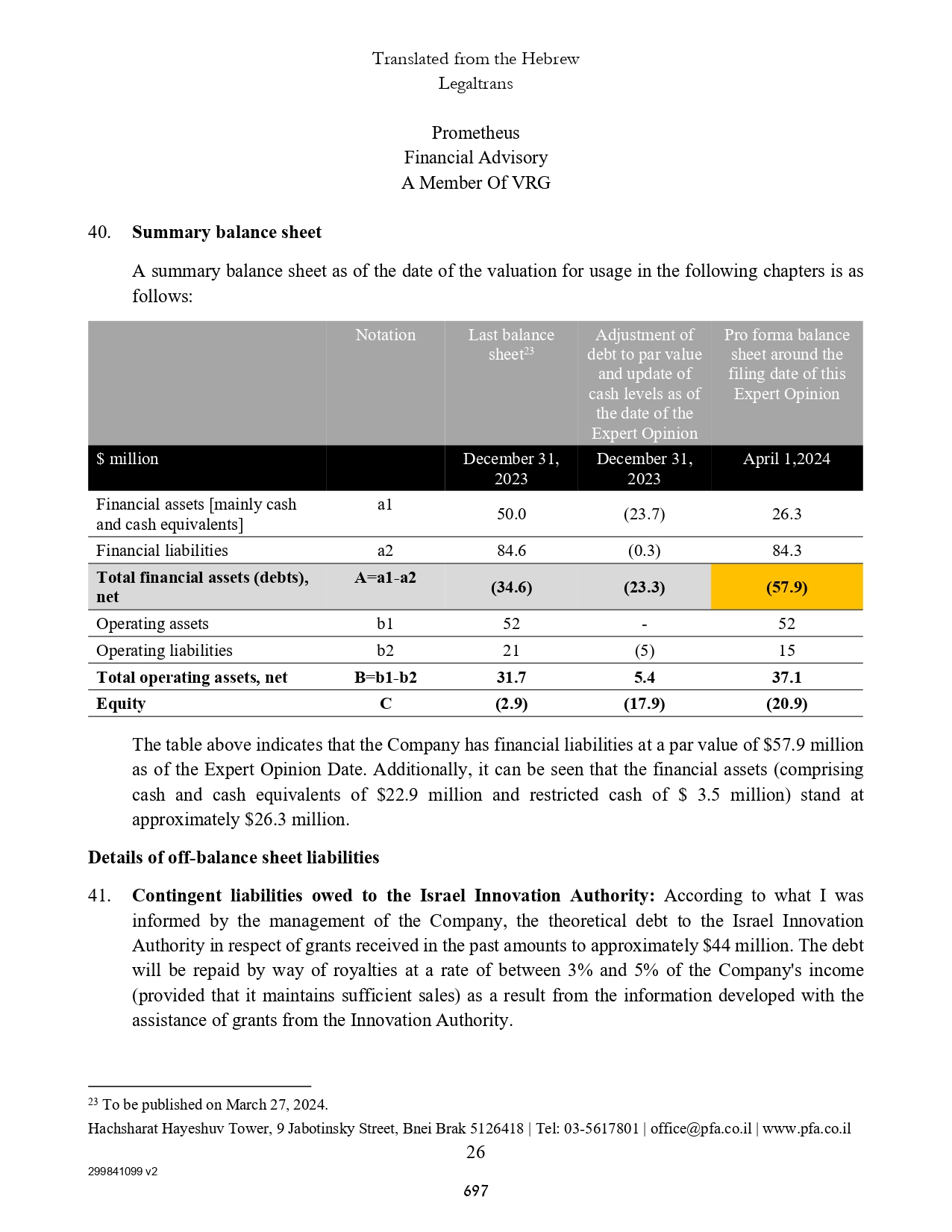

| Marketable securities | | | - | | | | 40,034 | |

| Prepaid expenses and other current assets | | | 1,889 | | | | 2,688 | |

| | | | | | | | | |

| Total current assets | | | 66,546 | | | | 98,614 | |

| | | | | | | | | |

| NON-CURRENT ASSETS: | | | | | | | | |

| Restricted deposits | | | 3,668 | | | | 3,961 | |

| Property, plant and equipment, net | | | 44,319 | | | | 35,180 | |

| Operating lease right-of-use assets | | | 7,024 | | | | 7,236 | |

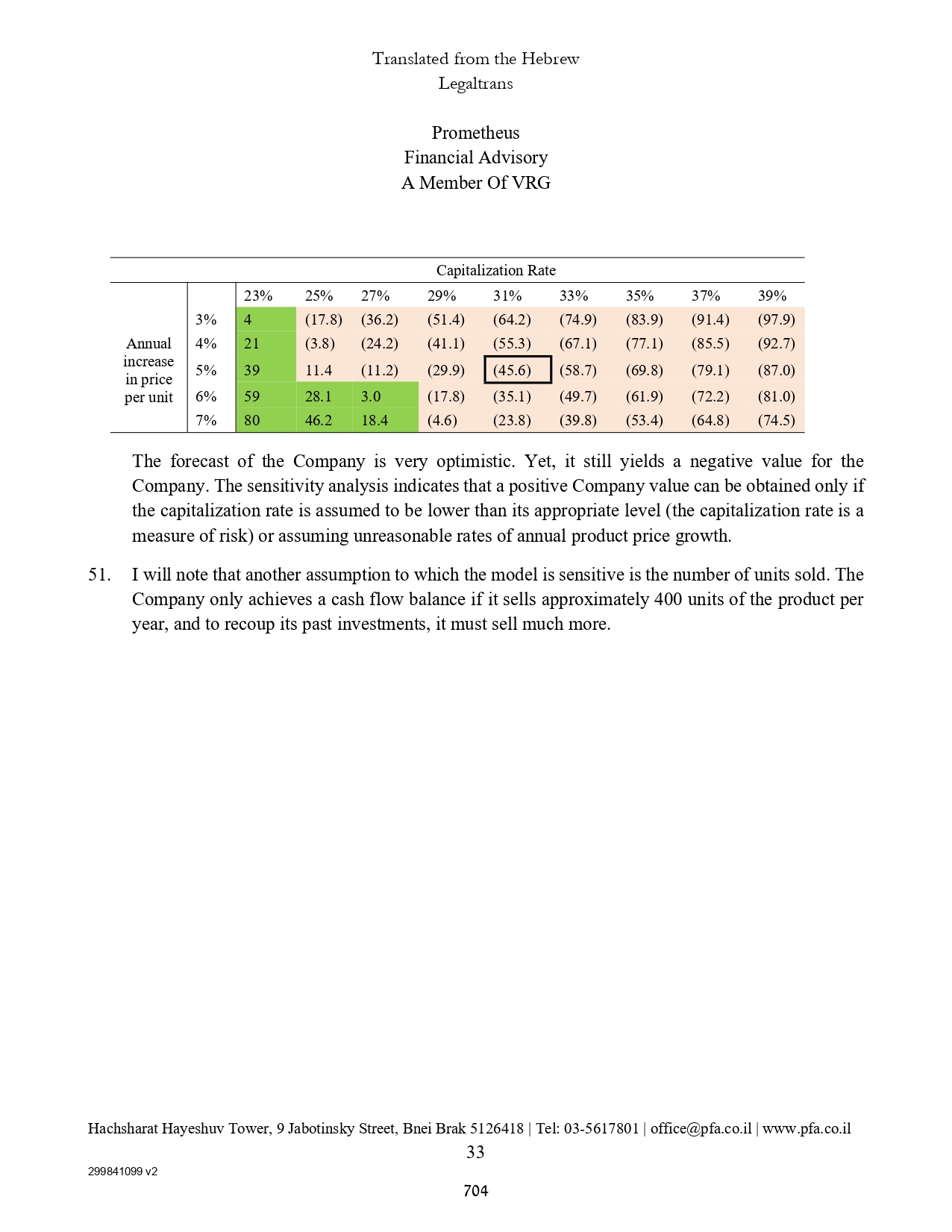

| Severance pay fund | | | 1,703 | | | | 2,148 | |

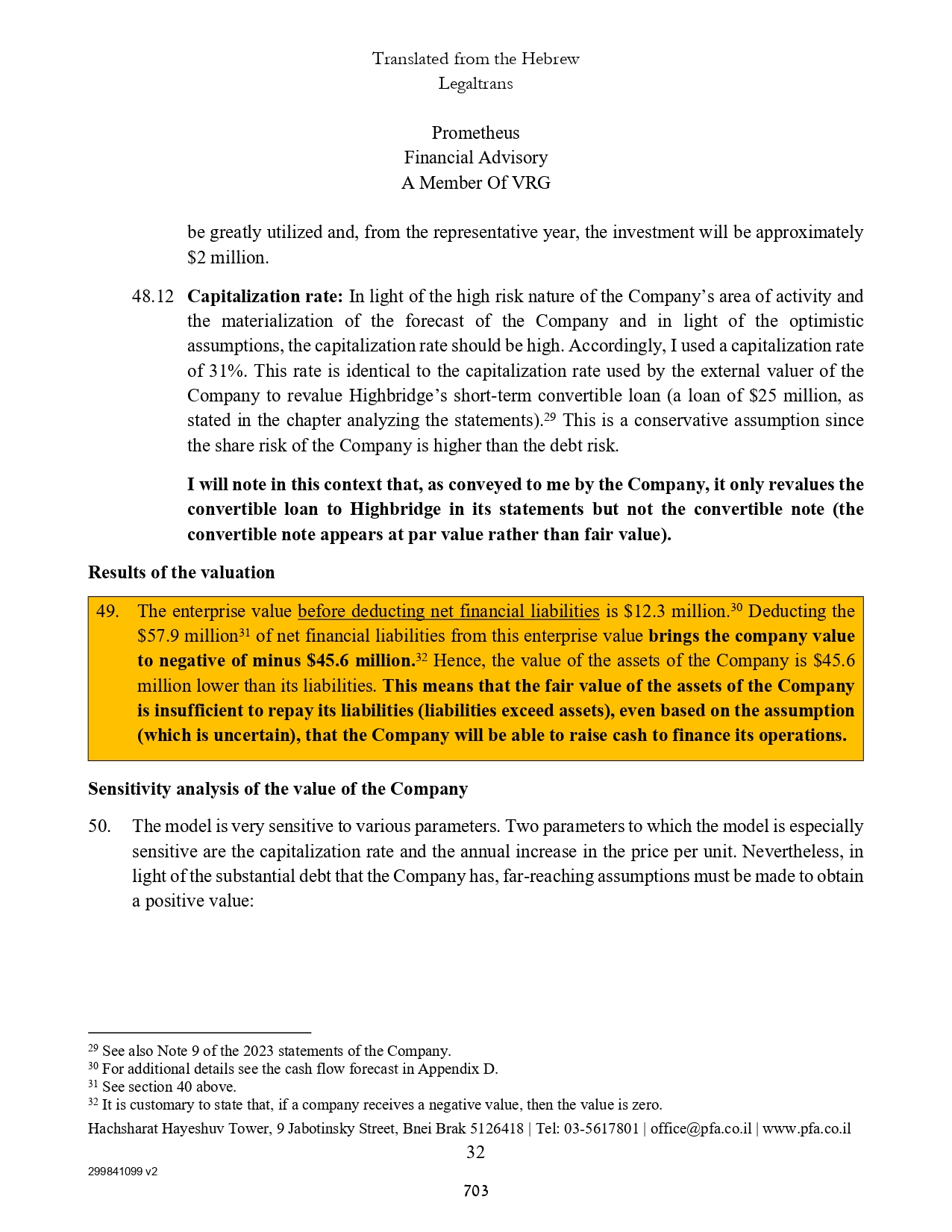

| Other long-term assets | | | 1,513 | | | | 1,647 | |

| | | | | | | | | |

| Total non-current assets | | | 58,227 | | | | 50,172 | |

| | | | | | | | | |

| Total assets | | $ | 124,773 | | | $ | 148,786 | |

The accompanying notes are an integral part of the consolidated financial statements.

F-3

746

GAMIDA CELL LTD. AND ITS SUBSIDIARY

CONSOLIDATED BALANCE SHEETS

U.S. dollars in thousands (except share and per share data)

| | | December 31, | |

| | | 2022 | | | 2021 | |

| LIABILITIES AND SHAREHOLDERS’ EQUITY | | | | | | |

| | | | | | | |

| CURRENT LIABILITIES: | | | | | | |

| Trade payables | | $ | 6,384 | | | $ | 8,272 | |

| Employees and payroll accruals | | | 5,300 | | | | 4,957 | |

| Operating lease liabilities | | | 2,648 | | | | 2,699 | |

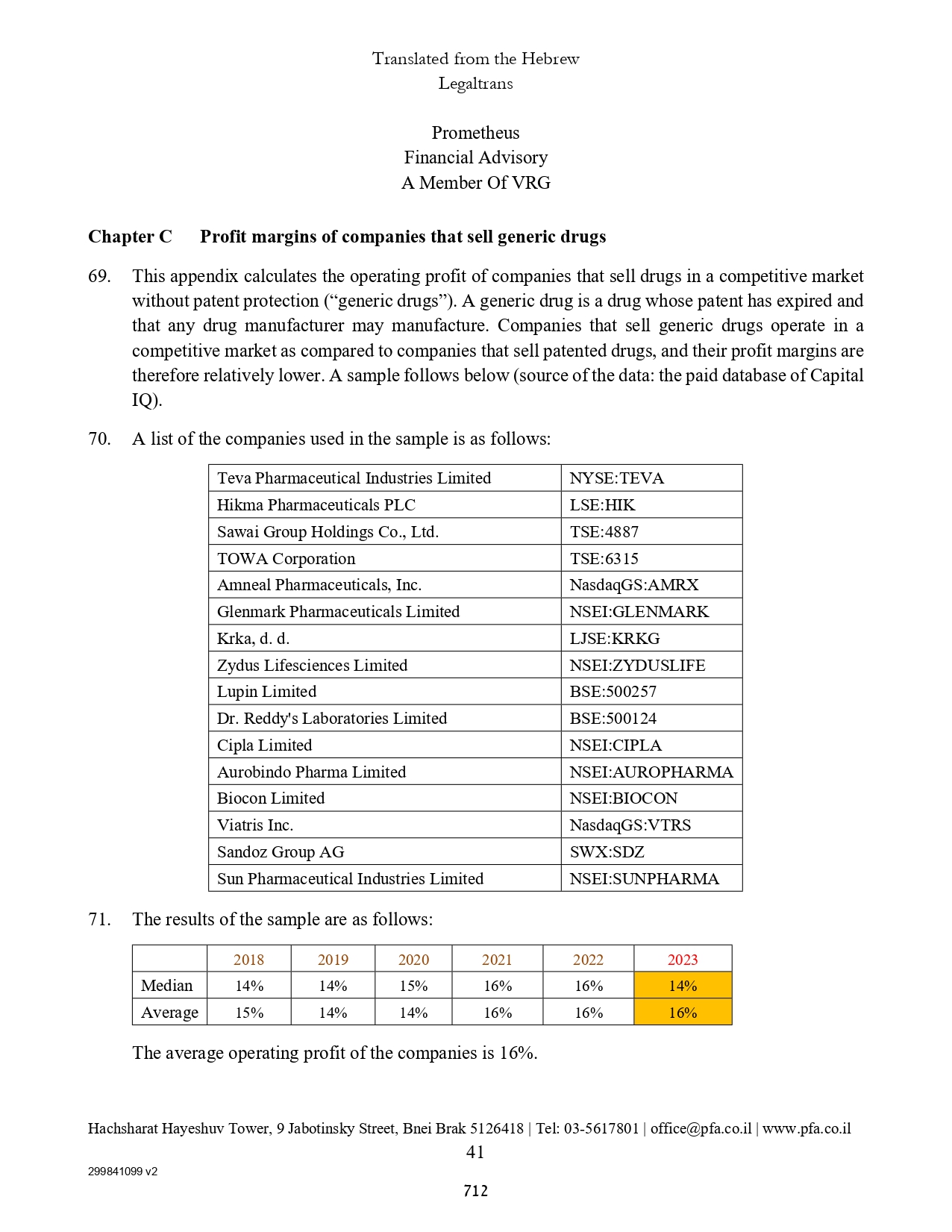

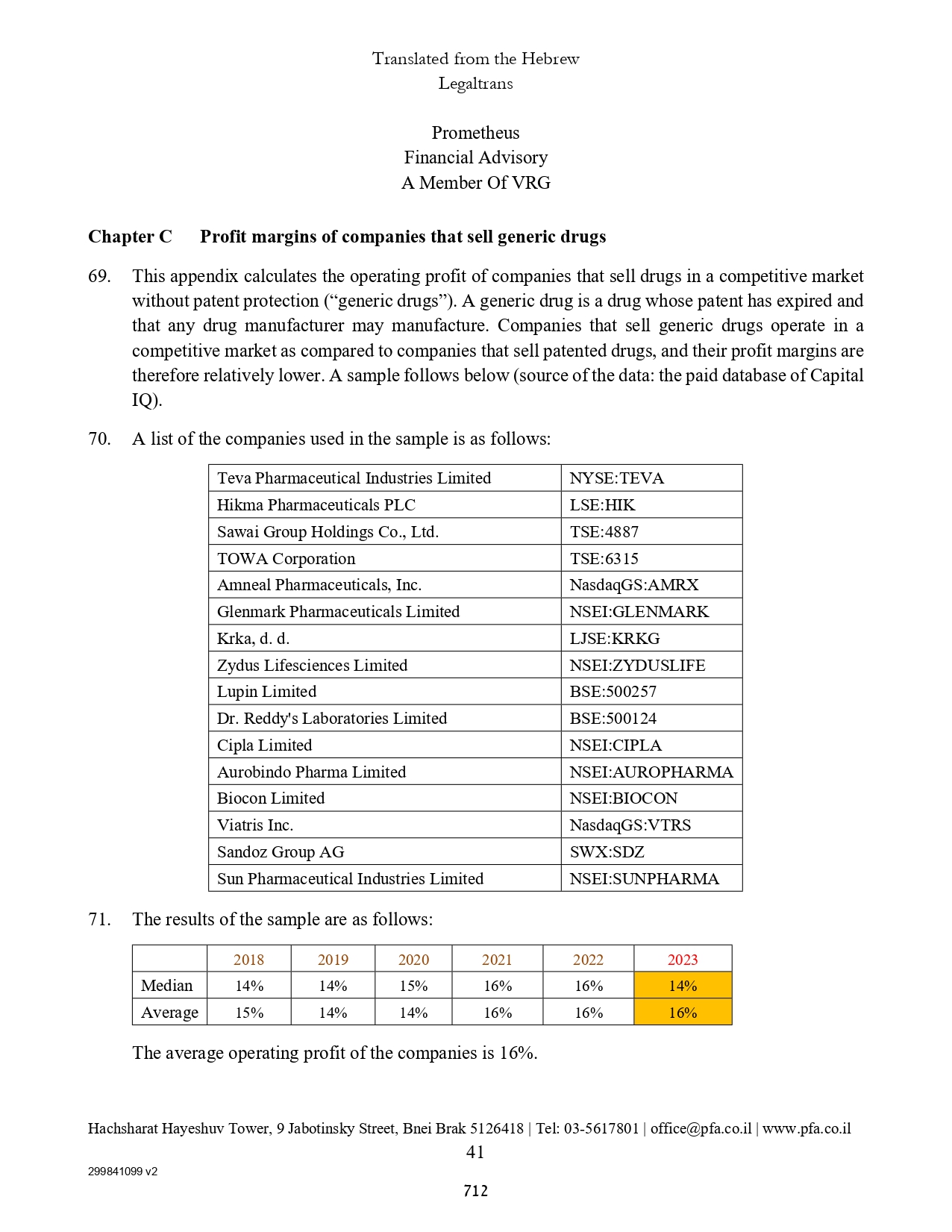

| Accrued interest of convertible senior notes | | | 1,652 | | | | 1,640 | |

| Accrued expenses and current liabilities | | | 8,891 | | | | 7,865 | |

| | | | | | | | | |

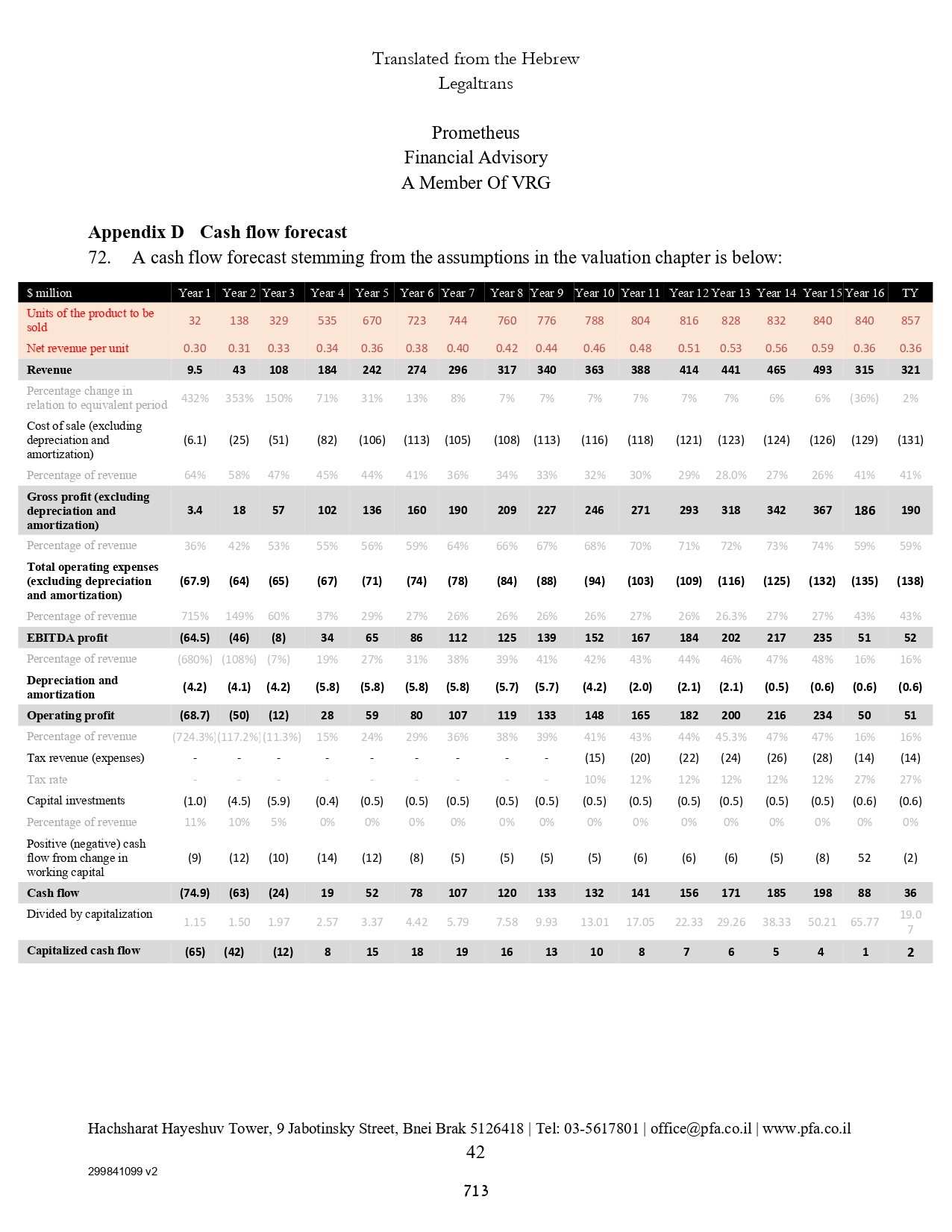

| | | | 24,875 | | | | 25,433 | |

| | | | | | | | | |

| NON-CURRENT LIABILITIES: | | | | | | | | |

| Convertible senior notes, net | | | 96,450 | | | | 71,417 | |

| Accrued severance pay | | | 1,914 | | | | 2,396 | |

| Long-term operating lease liabilities | | | 4,867 | | | | 5,603 | |

| Other long-term liabilities | | | 4,690 | | | | - | |

| | | | | | | | | |

| Total non-current liabilities | | | 107,921 | | | | 79,416 | |

| | | | | | | | | |

| CONTINGENT LIABILITIES AND COMMITMENTS | | | | | | | | |

| | | | | | | | | |

| SHAREHOLDERS’ EQUITY (DEFICIT): | | | | | | | | |

Ordinary shares of NIS 0.01 par value -

Authorized: 150,000,000 shares at December 31, 2022 and 2021; Issued: 74,703,030 and 59,970,389 shares at December 31, 2022 and 2021, respectively; Outstanding: 74,583,026 and 59,970,389 shares at December 31, 2022 and 2021, respectively | | | 211 | | | | 169 | |

| Treasury ordinary shares of NIS 0.01 par value; 120,004 and 0 shares at December 31, 2022 and 2021, respectively | | | * | | | | - | |

| Additional paid-in capital | | | 408,598 | | | | 381,225 | |

| Accumulated deficit | | | (416,832 | ) | | | (337,457 | ) |

| | | | | | | | | |

| Total shareholders’ equity (deficit) | | | (8,023 | ) | | | 43,937 | |

| | | | | | | | | |

| Total liabilities and shareholders’ equity | | $ | 124,773 | | | $ | 148,786 | |

| * | Represents an amount lower than $1. |

The accompanying notes are an integral part of the consolidated financial statements.

F-4

747

GAMIDA CELL LTD. AND ITS SUBSIDIARY

CONSOLIDATED STATEMENTS OF OPERATIONS

U.S. dollars in thousands (except share and per share data)

| | | Year ended

December 31, | |

| | | 2022 | | | 2021 | |

| | | | | | | |

| Research and development expenses, net | | $ | 42,692 | | | $ | 50,177 | |

| Commercial expenses | | | 12,900 | | | | 20,013 | |

| General and administrative expenses | | | 19,401 | | | | 16,977 | |

| | | | | | | | | |

| Total operating loss | | | 74,993 | | | | 87,167 | |

| | | | | | | | | |

| Financial expenses, net | | | 4,382 | | | | 2,626 | |

| | | | | | | | | |

| Loss | | $ | 79,375 | | | $ | 89,793 | |

| | | | | | | | | |

| Net loss per share attributable to ordinary shareholders, basic and diluted | | $ | 1.24 | | | $ | 1.52 | |

| | | | | | | | | |

| Weighted average number of shares used in computing net loss per share attributable to ordinary shareholders, basic and diluted | | | 63,826,295 | | | | 59,246,803 | |

The accompanying notes are an integral part of the consolidated financial statements.

F-5

748

GAMIDA CELL LTD. AND ITS SUBSIDIARY

CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS’ EQUITY (DEFICIT)

U.S. dollars in thousands (except share and per share data)

| | | Ordinary shares | | | Additional

paid-in | | | Treasury | | | Accumulated | | | Total

shareholders’ | |

| | | Number | | | Amount | | | capital | | | shares | | | deficit | | | equity (deficit) | |

| | | | | | | | | | | | | | | | | | | |

| Balance as of January 1, 2021 | | | 59,000,153 | | | $ | 166 | | | $ | 376,369 | | | $ | - | | | $ | (247,664 | ) | | $ | 128,871 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Loss | | | - | | | | - | | | | - | | | | - | | | | (89,793 | ) | | | (89,793 | ) |

| Grant of restricted shares | | | 531,477 | | | | 2 | | | | (2 | ) | | | - | | | | - | | | | - | |

| Exercise of options | | | 438,759 | | | | 1 | | | | 625 | | | | - | | | | - | | | | 626 | |

| Share-based compensation | | | - | | | | - | | | | 4,233 | | | | - | | | | - | | | | 4,233 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance as of December 31, 2021 | | | 59,970,389 | | | | 169 | | | | 381,225 | | | | - | | | | (337,457 | ) | | | 43,937 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Loss | | | - | | | | - | | | | - | | | | - | | | | (79,375 | ) | | | (79,375 | ) |

| Grant of restricted shares and vested restricted share units | | | 240,050 | | | | 1 | | | | (1 | ) | | | - | | | | - | | | | - | |

| Issuance of ordinary shares, net of issuance expenses ** | | | 14,445,165 | | | | 41 | | | | 22,257 | | | | - | | | | - | | | | 22,298 | |

| Exercise of options | | | 47,426 | | | | * | | | | 76 | | | | - | | | | - | | | | 76 | |

| Treasury shares | | | (120,004 | ) | | | - | | | | * | | | | * | | | | - | | | | - | |

| Share-based compensation | | | - | | | | - | | | | 5,041 | | | | - | | | | - | | | | 5,041 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance as of December 31, 2022 | | | 74,583,026 | | | $ | 211 | | | $ | 408,598 | | | $ | * | | | $ | (416,832 | ) | | $ | (8,023 | ) |

| * | Represents an amount lower than $1 |

| ** | Issuance expenses of $4,160 |

The accompanying notes are an integral part of the consolidated financial statements.

F-6

749

GAMIDA CELL LTD. AND ITS SUBSIDIARY

CONSOLIDATED STATEMENTS OF CASH FLOWS

U.S. dollars in thousands (except share and per share data)

| | | Year ended December 31, | |

| | | 2022 | | | 2021 | |

| Cash flows from operating activities: | | | | | | |

| | | | | | | |

| Loss | | $ | (79,375 | ) | | $ | (89,793 | ) |

| | | | | | | | | |

| Adjustments to reconcile loss to net cash used in operating activities: | | | | | | | | |

| | | | | | | | | |

| Depreciation of property, plant and equipment | | | 440 | | | | 431 | |

| Financing expense (income), net | | | (375 | ) | | | 359 | |

| Share-based compensation | | | 5,041 | | | | 4,233 | |

| Amortization of debt discount and issuance costs | | | 783 | | | | 638 | |

| Operating lease right-of-use assets | | | 2,494 | | | | 2,109 | |

| Operating lease liabilities | | | (3,069 | ) | | | (2,193 | ) |

| Decrease (increase) accrued severance pay, net | | | (37 | ) | | | 12 | |

| Decrease in prepaid expenses and other assets | | | 224 | | | | 1,008 | |

| Increase (decrease) in trade payables | | | (1,888 | ) | | | 1,941 | |

| Increase (decrease) in accrued expenses and current liabilities | | | 5,339 | | | | (505 | ) |

| | | | | | | | | |

| Net cash used in operating activities | | | (70,423 | ) | | | (81,760 | ) |

| | | | | | | | | |

| Cash flows from investing activities: | | | | | | | | |

| | | | | | | | | |

| Purchase of property, plant and equipment | | | (6,354 | ) | | | (15,054 | ) |

| Purchase of marketable securities | | | (5,037 | ) | | | (102,179 | ) |

| Proceeds from maturity of marketable securities | | | 45,029 | | | | 61,534 | |

| Investment in restricted deposits | | | - | | | | (5,222 | ) |

| Proceeds from restricted deposits | | | 406 | | | | - | |

| | | | | | | | | |

| Net cash provided by (used in) investing activities | | $ | 34,044 | | | $ | (60,921 | ) |

The accompanying notes are an integral part of the consolidated financial statements.

F-7

750

GAMIDA CELL LTD. AND ITS SUBSIDIARY

CONSOLIDATED STATEMENTS OF CASH FLOWS

U.S. dollars in thousands (except share and per share data)

| | | Year ended

December 31, | |

| | | 2022 | | | 2021 | |

| Cash flows from financing activities: | | | | | | |

| | | | | | | |

| Proceeds from exercise of options | | $ | 76 | | | $ | 626 | |

| Proceeds from share issuance, net | | | 22,298 | | | | - | |

| Proceeds from issuance of convertible senior notes, net | | | 22,770 | | | | 70,777 | |

| | | | | | | | | |

| Net cash provided by financing activities | | | 45,144 | | | | 71,403 | |

| | | | | | | | | |

| Increase (decrease) in cash and cash equivalents | | | 8,765 | | | | (71,278 | ) |

| Cash and cash equivalents at beginning of year | | | 55,892 | | | | 127,170 | |

| | | | | | | | | |

| Cash and cash equivalents at end of year | | $ | 64,657 | | | $ | 55,892 | |

| | | | | | | | | |

| Significant non-cash transactions: | | | | | | | | |

| | | | | | | | | |

| Lease liabilities arising from new right-of-use asset | | $ | 2,282 | | | $ | 2,503 | |

| | | | | | | | | |

| Purchase of property, plant and equipment on credit | | $ | 720 | | | $ | 634 | |

| | | | | | | | | |

| Supplemental disclosures of cash flow information: | | | | | | | | |

| | | | | | | | | |

| Cash paid for interest | | $ | 4,406 | | | $ | 2,572 | |

The accompanying notes are an integral part of the consolidated financial statements.

F-8

751

GAMIDA CELL LTD. and its subsidiary

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

U.S. dollars in thousands (except share and per share data and unless otherwise indicated)

NOTE 1:- GENERAL

| a. | Gamida Cell Ltd. (the “Company”), founded in 1998, is an advanced cell therapy company committed to finding cures for patients with blood cancers and serious blood diseases. The Company develops novel curative treatments using stem cells and Natural Killer (NK) cells. |

| b. | The Company has created a novel NAM cell expansion technology platform that is designed to enhance the number and functionality of allogenic donor cells. This proprietary therapeutic platform may enable the development of therapies with the potential to improve treatment outcomes beyond what is possible with current donor-derived therapies. |

The lead product candidate, omidubicel, is an advanced cell therapy in development as a potential life-saving treatment option for patients in need of a bone marrow transplant (BMT). In May 2020, the Company reported that omidubicel met its primary endpoint in an international, randomized, multi-center Phase 3 clinical study in 125 patients with high-risk hematologic malignancies undergoing bone marrow transplant and who had no available matched donor. The study evaluated the safety and efficacy of omidubicel compared to standard umbilical cord blood. BMT with a graft derived from bone marrow or peripheral blood cells of a matched donor is currently the standard of care treatment for many of these patients, but there is a significant unmet need for patients who cannot find a fully matched donor.

In October 2020, the Company reported that omidubicel met all three of its secondary endpoints.

In October 2021, the complete results from our pivotal Phase 3 clinical study of omidubicel in 125 patients with various hematologic malignancies were published in the peer-reviewed medical journal Blood. The trial achieved its primary endpoint of time to neutrophil engraftment as well as all three of the prespecified secondary endpoints. These secondary endpoints were the proportion of patients who achieved platelet engraftment by day 42, the proportion of patients with grade 2 or grade 3 bacterial or invasive fungal infections in the first 100 days following transplant, and the number of days alive and out of the hospital in the first 100 days following transplant. All three secondary endpoints demonstrated statistical significance in an intent-to-treat analysis.

Omidubicel is the first bone marrow transplant product to receive Breakthrough Therapy Designation from the U.S. Food and Drug Administration and has received orphan drug designation in the U.S. and in Europe.

In June 2022, the Company announced completion of the rolling Biologics License Application (BLA) submission to the FDA for omidubicel for the treatment of patients with blood cancers in need of an allogenic hematopoietic stem cell transplant.

F-9

752

GAMIDA CELL LTD. and its subsidiary

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

U.S. dollars in thousands (except share and per share data and unless otherwise indicated)

NOTE 1:- GENERAL (Cont.)

In August 2022, the Company announced the FDA had accepted for filing the Company’s BLA for omidubicel for the treatment of patients with blood cancers in need of an allogenic hematopoietic stem cell transplant. The FDA granted Priority Review for the BLA and had set a Prescription Drug User Fee Act (PDUFA) target action date of January 30, 2023. Subsequently, the FDA issued an information request and viewed the volume of data required to address the information request in the Company’s response as a major amendment. On November 18, 2022, the Company received a correspondence from the FDA that the agency had updated their previous target action date under the PDUFA from January 30, 2023 to May 1, 2023, for the BLA for omidubicel.

In addition to omidubicel, the Company is developing GDA-201, an investigational NK cell-based cancer immunotherapy to be used in combination with standard-of-care therapeutic antibodies. NK cells have potent anti-tumor properties and have the advantage over other oncology cell therapies of not requiring genetic matching, potentially enabling NK cells to serve as a universal donor-based therapy when combined with certain antibodies. GDA-201 is currently in an investigator-sponsored Phase 1/2 study for the treatment of relapsed or refractory non-Hodgkin lymphoma (NHL). In December 2020, the Company reported updated and expanded results from the Phase 1 clinical study at the Annual Meeting of the American Society of Hematology, or ASH. The data from the first 35 patients demonstrated that GDA-201 was clinically active and generally well tolerated. Among the 19 patients with NHL, 13 complete responses and one partial response were observed, with an overall response rate of 74 percent and a complete response rate of 68 percent.

At the December 2021 Annual Meeting of American Society of Hematology the Company reported two-year follow-up data from this clinical trial on outcomes and cytokine biomarkers associated with survival. The data demonstrated a median duration of response of 16 months (range 5-36 months), an overall survival at two years of 78% (95% CI, 51%–91%) and a safety profile similar to that reported previously.

On April 26, 2022, the Company announced that the FDA cleared its investigational new drug (IND) application and removed the clinical hold for a cryopreserved formulation of GDA-201. In June 2022, the Company announced the activation of the initial clinical sites to screen and enroll patients in the company-sponsored Phase 1/2 study evaluating a cryopreserved formulation of GDA-201, a readily available cell therapy candidate for the treatment of follicular and diffuse large B cell lymphomas.

| c. | The Company is devoting substantially all of its efforts toward research and development activities. In the course of such activities, the Company has sustained operating losses and expects such losses to continue in the foreseeable future. The Company’s accumulated deficit as of December 31, 2022 was $416,832 and negative cash flows from operating activities during the year ended December 31, 2022 was $70,423. The Company’s management plans to seek additional financing as required to fund its operations until achieving positive cash flows. However, there is no assurance that additional capital and/or financing will be available to the Company, and even if available, whether it will be on terms acceptable to the Company or in the amounts required. |

F-10

753

GAMIDA CELL LTD. and its subsidiary

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

U.S. dollars in thousands (except share and per share data and unless otherwise indicated)

NOTE 1:- GENERAL (Cont.)

These conditions raise substantial doubt about the Company’s ability to continue as a going concern. The consolidated financial statements do not include any adjustments to the carrying amounts and classifications of assets and liabilities that would result if the Company were unable to continue as a going concern.

| d. | The Company has a wholly-owned U.S. subsidiary, Gamida Cell Inc. (the “Subsidiary”), which was incorporated in 2000, under the laws of the State of Delaware. The Company has one operating segment and reporting unit. |

NOTE 2:- SIGNIFICANT ACCOUNTING POLICIES

| a. | Basis of presentation of the financial statements: |

The Company’s consolidated financial statements have been prepared in accordance with United States generally accepted accounting principles (U.S. GAAP) as set forth in the Financial Accounting Standards Board (the “FASB”) Accounting Standards Codification (ASC).

The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates, judgments and assumptions that affect the amounts reported in the consolidated financial statements and accompanying notes. The Company’s management believes that the estimates, judgment and assumptions used are reasonable based upon information available at the time they are made. These estimates, judgments and assumptions can affect the reported amounts of assets and liabilities at the dates of the consolidated financial statements, and the reported amount of expenses during the reporting periods. Actual results could differ from those estimates.

| c. | Principles of consolidation: |

The consolidated financial statements include the accounts of the Company and its subsidiary. Intercompany balances have been eliminated upon consolidation.

| d. | Consolidated financial statements in U.S dollars: |

The functional currency is the currency that best reflects the economic environment in which the Company and its subsidiary operates and conducts their transactions. Most of the Company’s costs are incurred in U.S. dollar. In addition, the Company’s financing activities are incurred in U.S. dollars. The Company’s management believes that the functional currency of the Company is the U.S. dollar.

Accordingly, monetary accounts maintained in currencies other than the U.S. dollar are remeasured into U.S. dollars in accordance with ASC No. 830 “Foreign Currency Matters.” All transaction gains and losses of the remeasured monetary balance sheet items are reflected in the statements of operations as financing income or expenses as appropriate.

F-11

754

GAMIDA CELL LTD. and its subsidiary

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

U.S. dollars in thousands (except share and per share data and unless otherwise indicated)

NOTE 2:- SIGNIFICANT ACCOUNTING POLICIES (Cont.)

| e. | Cash and cash equivalents: |

Cash equivalents are short-term highly liquid deposits that are readily convertible to cash with original maturities of three months or less, at the date acquired.

| f. | Investments in marketable securities: |

The Company’s investment in marketable securities consist primarily of trading bonds with a quoted market price that are classified as trading securities pursuant to ASC No. 320 “Investments — Debt Securities.” Marketable securities are stated at fair value as determined by the closing price of each security at balance sheet date. Unrealized gains and losses on these securities are included in financial expenses, net in the consolidated statements of operations.

| g. | Restricted short-term and long-term deposits: |

Restricted short-term deposits are deposits with maturities of up to one year and are used as security for the Company’s credit cards. Restricted short-term deposits amounted to $0 and $500 as of December 31, 2022 and 2021, respectively, and are included in prepaid expenses and other current assets in the consolidated balance sheets.

Restricted long-term deposits are deposits with maturities of more than one year and are used as guarantee for the Israeli Investment Center grant received partially in 2022 and expected to be received in 2023, security for the rental of premises and for the Company’s credit cards. Restricted long-term deposits amounted to $3,668 as of December 31, 2022, as presented in the consolidated balance sheet.

| h. | Property, plant and equipment: |

Property, plant and equipment are measured at cost, including directly attributable costs, less accumulated depreciation, accumulated impairment losses and any related investment grants, excluding day-to-day servicing expenses.

Depreciation is calculated on a straight-line basis over the useful life of the assets at annual rates as follows:

| | | | % | |

| | | | | |

| Machinery | | | 10 - 15 | |

| Office, furniture and equipment | | | 6 - 33 | |

| Leasehold improvements | | | (*) | |

| Project in process- manufacturing plant | | | (**) | |

| (*) | Over the shorter of the term of the lease or its useful life. |

| (**) | As of December 31, 2022, the manufacturing plant is under validation process and therefore is not yet ready for production. Depreciation of the manufacturing plant will commence upon completion of the validation process. |

F-12

755

GAMIDA CELL LTD. and its subsidiary

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

U.S. dollars in thousands (except share and per share data and unless otherwise indicated)

NOTE 2:- SIGNIFICANT ACCOUNTING POLICIES (Cont.)

| i. | Impairment of long-lived assets: |

The Company’s long-lived assets are reviewed for impairment in accordance with ASC No. 360 “Property, Plant and Equipment,” whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. If indicators of impairment exist and the undiscounted future cash flows that the assets are expected to generate are less than the carrying value of the assets, the Company reduces the carrying amount of the assets through an impairment charge, to their estimated fair values. During the years ended December 31, 2022 and 2021, no impairment indicators have been identified.

The Company repurchased its ordinary shares and holds them as treasury shares. The Company presents the cost to repurchase treasury shares as a reduction of shareholders’ equity.

| k. | Research and development expenses: |

Research and development expenses net of grants are recognized in the consolidated statements of operations when incurred. Research and development expenses consist of personnel costs (including salaries, benefits and share-based compensation), materials, consulting fees and payments to subcontractors, costs associated with obtaining regulatory approvals, and executing pre-clinical and clinical studies. In addition, research and development expenses include overhead allocations consisting of various administrative and facilities related costs. The Company charges research and development expenses as incurred.

Royalty-bearing grants from the Israeli Innovation Authority (the “IIA”) of the Ministry of Economy and Industry in Israel for funding of approved research and development projects are recognized at the time the Company is entitled to such grants, on the basis of the costs incurred, and are presented as a reduction from research and development expenses.

Since the payment of royalties is not probable when the grants are received, the Company does not record a liability for amounts received from IIA until the related revenues are recognized. In the event of failure of a project that was partly financed by the IIA, the Company will not be obligated to pay any royalties or repay the amounts received. The Company recognized the amounts of grants received in research and development as a reduction from research and development expenses in the amount of $978 and $2,189 for the years ended December 31, 2022 and 2021, respectively.

F-13

756

GAMIDA CELL LTD. and its subsidiary

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

U.S. dollars in thousands (except share and per share data and unless otherwise indicated)

NOTE 2:- SIGNIFICANT ACCOUNTING POLICIES (Cont.)

| l. | Share-based compensation: |

The Company accounts for share-based compensation in accordance with ASC No. 718, “Compensation - Stock Compensation”, which requires companies to estimate the fair value of equity-based payment awards on the date of grant using an option-pricing model. The value of the award is recognized as an expense over the requisite service periods, which is the vesting period of the respective award, on a straight-line basis when the only condition to vesting is continued service.

The Company has selected the binominal option-pricing model as the most appropriate fair value method for its option awards. The fair value of restricted shares is based on the closing market value of the underlying shares at the date of grant. The Company recognizes forfeitures of equity-based awards as they occur.

| m. | Employee benefit liabilities: |

The Company has several employee benefit plans:

| 1. | Short-term employee benefits |

Short-term employee benefits are benefits that are expected to be settled entirely before twelve months after the end of the annual reporting period in which the employees render the related services. These benefits include salaries, paid annual leave, paid sick leave, recreation and social security contributions and are recognized as expenses as the services are rendered.

The majority of the Company’s employees who are Israeli citizens have subscribed to Section 14 of Israel’s Severance Pay Law, 5723-1963 (the “Severance Pay Law”). Pursuant to Section 14 of the Severance Pay Law, employees covered by this section are entitled to monthly deposits at a rate of 8.33% of their monthly salary, made on their behalf by the Company. Payments made to employees in accordance with this section release the Company from any future severance liabilities with respect to such employees. Neither severance pay liability nor severance pay fund under Section 14 of the Severance Pay Law is recorded on the Company’s consolidated balance sheets.

For the Company’s employees in Israel who are not subject to Section 14 of the Severance Pay Law, the Company has a liability for severance pay pursuant to the Severance Pay Law based on the most recent salary of these employees multiplied by the number of years of employment as of the balance sheet date. The Company’s liability for these employees is fully provided for by monthly deposits with severance pay funds, insurance policies and accruals. The deposited funds include profits accumulated up to the balance sheet date. The deposited funds may be withdrawn only upon the fulfillment of the obligation pursuant to the Severance Pay Law or labor agreements. The severance pay fund amounted to $1,703 and $2,148 as of December 31, 2022 and 2021, respectively.

F-14

757

GAMIDA CELL LTD. and its subsidiary

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

U.S. dollars in thousands (except share and per share data and unless otherwise indicated)

NOTE 2:- SIGNIFICANT ACCOUNTING POLICIES (Cont.)

Accrued severance pay is $1,914 and $2,396 as of December 31, 2022 and 2021, respectively. Severance expense for the years ended December 31, 2022 and 2021, is $895 and $427, respectively.

| n. | Fair value of financial instruments: |

The accounting guidance for fair value provides a framework for measuring fair value, clarifies the definition of fair value, and expands disclosures regarding fair value measurements. Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability (an exit price) in an orderly transaction between market participants at the reporting date. The accounting guidance establishes a three-tiered hierarchy, which prioritizes the inputs used in the valuation methodologies in measuring fair value as follows:

Level 1: Quoted prices (unadjusted) in active markets that are accessible at the measurement date for assets or liabilities. The fair value hierarchy gives the highest priority to Level 1 inputs.

Level 2: Observable inputs that are based on inputs not quoted on active markets but corroborated by market data.

Level 3: Unobservable inputs are used when little or no market data are available.

The carrying amounts of cash and cash equivalents, marketable securities, other receivables, short-term deposits, prepaid expenses and other current assets, trade payables, accrued expenses and other payables approximate their fair value due to the short-term maturity of such instruments.

The Company accounts for leases according to ASC 842, “Leases”. The Company determines if an arrangement is a lease and the classification of that lease at inception based on: (1) whether the contract involves the use of a distinct identified asset, (2) whether the Company obtains the right to substantially all the economic benefits from the use of the asset throughout the period, and (3) whether the Company has a right to direct the use of the asset. The Company elected the practical expedient for lease agreements with a term of twelve months or less and does not recognize right-of-use (“ROU”) assets and lease liabilities in respect of those agreements. The Company also elected the practical expedient to not separate lease and non-lease components for its leases.

F-15

758

GAMIDA CELL LTD. and its subsidiary

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

U.S. dollars in thousands (except share and per share data and unless otherwise indicated)

NOTE 2:- SIGNIFICANT ACCOUNTING POLICIES (Cont.)

An ROU asset represents the right to use an underlying asset for the lease term and lease liabilities represent the Company’s obligation to make lease payments arising from the lease agreement. An ROU asset is measured based on the discounted present value of the remaining lease payments, plus any initial direct costs incurred and prepaid lease payments, excluding lease incentives. The lease liability is measured at lease commencement date based on the discounted present value of the remaining lease payments. The implicit rate within the operating leases is generally not determinable, therefore the Company uses the Incremental Borrowing Rate (“IBR”) based on the information available at commencement date in determining the present value of lease payments. The Company’s IBR is estimated to approximate the interest rate for collateralized borrowing with similar terms and payments and in economic environments where the leased asset is located. Certain leases include options to extend the lease. An option to extend the lease is considered in connection with determining the ROU asset and lease liability when it is reasonably certain that the Company will exercise that option. An option to terminate is considered unless it is reasonably certain that the Company will not exercise the option.

Payments under the Company’s lease arrangements are primarily fixed however, certain lease agreements contain variable payments, which are expensed as incurred and not included in the operating lease right-of-use assets and liabilities. Variable lease payments are primarily comprised of payments affected by common area maintenance and utility charges.

The Company accounts for income taxes in accordance with ASC 740, “Income Taxes”, which prescribes the use of the liability method whereby deferred tax asset and liability account balances are determined based on differences between the financial reporting and tax bases of assets and liabilities and are measured using the enacted tax rates and laws that will be in effect when the differences are expected to reverse. The Company provides a valuation allowance, to reduce deferred tax assets to their estimated realizable value, if needed.

ASC 740 offers a two-step approach for recognizing and measuring a liability for uncertain tax positions. The first step is to evaluate the tax position taken or expected to be taken in a tax return by determining if the weight of available evidence indicates that it is more likely than not that, on an evaluation of the technical merits, the tax position will be sustained on audit, including resolution of any related appeals or litigation processes. The second step is to measure the tax benefit as the largest amount that is more than 50% likely to be realized upon ultimate settlement. As of December 31, 2022 and 2021, no liability for unrecognized tax benefits was recorded as a result of ASC 740.

F-16

759

GAMIDA CELL LTD. and its subsidiary

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

U.S. dollars in thousands (except share and per share data and unless otherwise indicated)

NOTE 2:- SIGNIFICANT ACCOUNTING POLICIES (Cont.)

| q. | Basic and diluted net loss per share: |

The Company computes net loss per share using the two-class method required for participating securities. The two-class method requires income available to ordinary shareholders for the period to be allocated between ordinary shares and participating securities based upon their respective rights to receive dividends as if all income for the period had been distributed. The Company considers its restricted shares to be participating securities as the holders of the restricted shares would be entitled to dividends that would be distributed to the holders of ordinary shares, on a pro-rata basis. These participating securities do not contractually require the holders of such shares to participate in the Company’s losses. As such, net loss for the periods presented was not allocated to the Company’s participating securities.

The Company’s basic net loss per share is calculated by dividing net loss attributable to ordinary shareholders by the weighted-average number of ordinary shares outstanding for the period, without consideration of potentially dilutive securities. The diluted net loss per share is calculated by giving effect to all potentially dilutive securities outstanding for the period using the treasury share method or the if-converted method for the convertible senior notes if the assumed conversion into ordinary shares is dilutive. Diluted net loss per share is the same as basic net loss per share in periods when the effects of potentially dilutive ordinary shares are anti-dilutive.

| r. | Recently issued accounting standards not yet adopted: |

In June 2016, FASB issued ASU 2016-13, Financial Instruments - Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments. ASU 2016-13 amends the impairment model to utilize an expected loss methodology in place of the currently used incurred loss methodology, which will result in the more timely recognition of losses. Topic 326 will be effective for the Company beginning on January 1, 2023. The adoption is not expected to result in a material impact on the Company’s consolidated financial statements.

F-17

760

GAMIDA CELL LTD. and its subsidiary

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

U.S. dollars in thousands (except share and per share data and unless otherwise indicated)

NOTE 3:- PROPERTY, PLANT AND EQUIPMENT, NET

The composition of property, plant and equipment is as follows:

| | | December 31, | |

| | | 2022 | | | 2021 | |

| Cost: | | | | | | |

| | | | | | | |

| Machinery | | $ | 4,383 | | | $ | 4,345 | |

| Leasehold improvements | | | 1,447 | | | | 1,447 | |

| Office, furniture and equipment | | | 1,014 | | | | 800 | |

| Production plant in process | | | 41,971 | | | | 32,644 | |

| | | | | | | | | |

| | | | 48,815 | | | | 39,236 | |

| | | | | | | | | |

| Less - accumulated depreciation | | | (4,496 | ) | | | (4,056 | ) |

| | | | | | | | | |

| Depreciated cost | | $ | 44,319 | | | $ | 35,180 | |

Depreciation expense amounted to $440 and $431 for the years ended December 31, 2022 and 2021, respectively.

NOTE 4:- LEASES

The Company entered into operating leases primarily for its in-process production plant, and its laboratories and offices. The leases have remaining lease terms of up to six years, The Company does not assume renewals in its determination of the lease term unless the renewals are considered as reasonably certain at lease commencement.

The components of operating lease costs were as follows:

| | | Year ended December 31, | |

| | | 2022 | | | 2021 | |

| | | | | | | |

| Operating lease costs | | $ | 2,833 | | | $ | 2,391 | |

| Short-term lease costs | | | 91 | | | | 103 | |

| | | | | | | | | |

| Total lease costs | | $ | 2,924 | | | $ | 2,494 | |

F-18

761

GAMIDA CELL LTD. and its subsidiary

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

U.S. dollars in thousands (except share and per share data and unless otherwise indicated)

NOTE 4:- LEASES (Cont.)

Supplemental balance sheet information related to operating leases is as follows:

| | | Year ended

December 31, | |

| | | 2022 | | | 2021 | |

| | | | | | | |

| Weighted average remaining lease term (in years) | | | 3.28 | | | | 4.31 | |

| Weighted average discount rate | | | 3.56 | % | | | 2.54 | % |

Maturities of lease liabilities were as follows:

| December 31, | | | |

| | | | |

| 2023 | | $ | 2,739 | |

| 2024 | | | 2,745 | |

| 2025 | | | 1,201 | |

| 2026 | | | 704 | |

| 2027 | | | 541 | |

| | | | | |

| Total undiscounted lease payments | | | 7,930 | |

| Less - imputed interest | | | (415 | ) |

| | | | | |

| Present value of lease liabilities | | $ | 7,515 | |

NOTE 5: OTHER LONG-TERM LIABILITIES

In December 2022, the Company signed an agreement with Lonza Netherlands B.V., or Lonza, to mutually terminate their Service Agreement, whereas the Company shall pay Lonza an aggregate amount of 8 million Euro. As of December 31, 2022, the Company paid the first payment of 1.5 million Euro, 2.5 million Euro will be paid in 2023 and the remaining 4 million Euro will be paid in 2024.

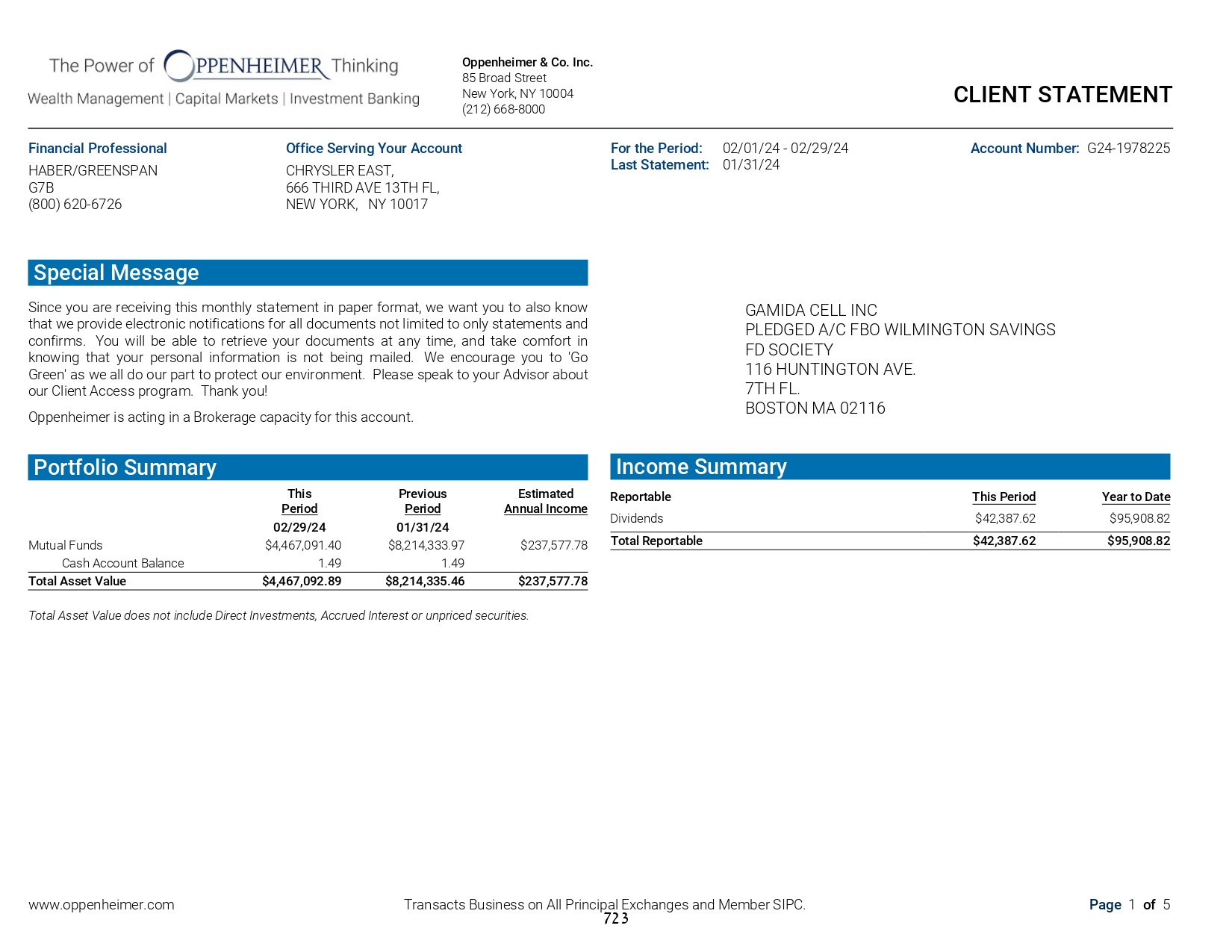

NOTE 6:- CONVERTIBLE SENIOR NOTES, NET

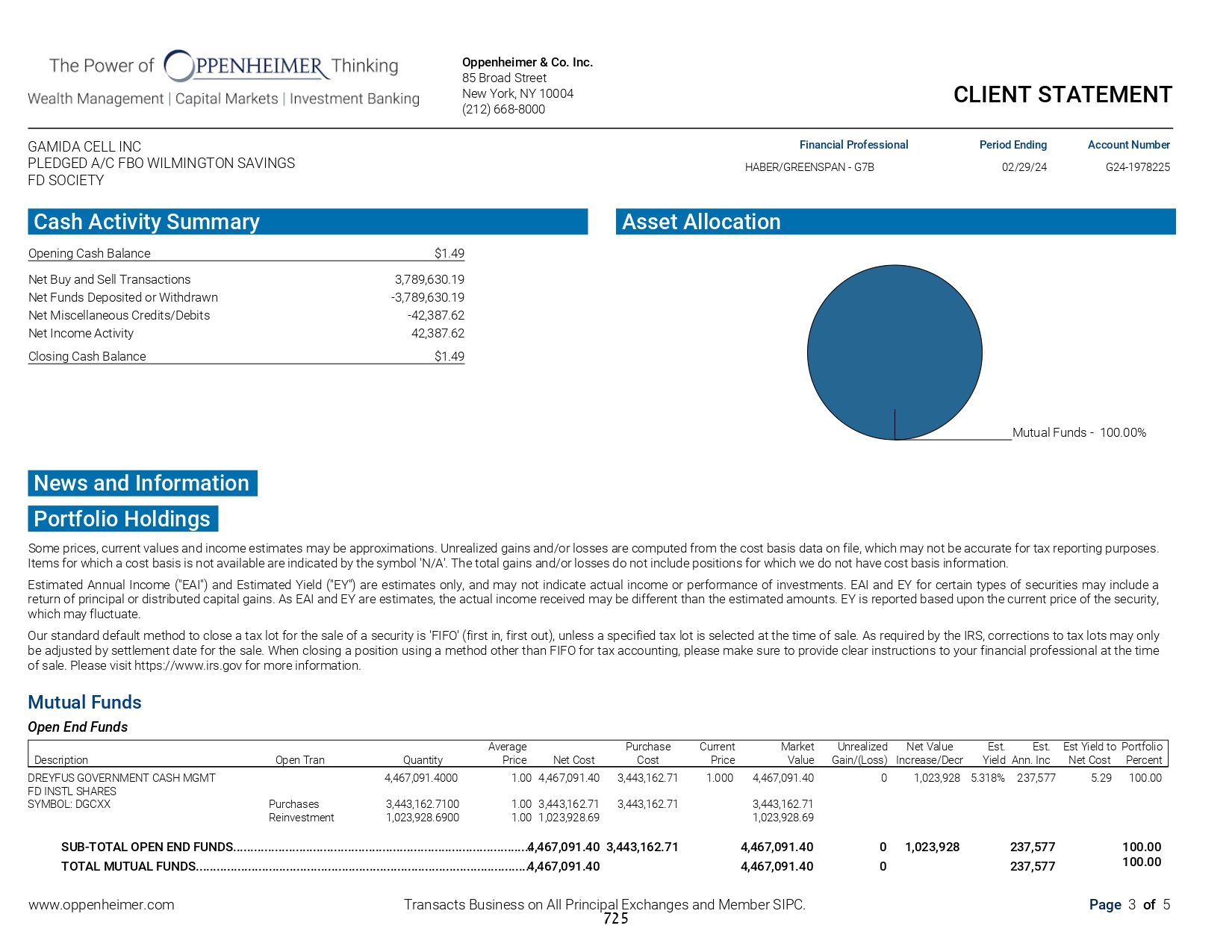

| a. | On February 16, 2021, the Subsidiary issued convertible senior notes (the “2021 Notes”) due in 2026, in the aggregate principal amount of $75 million, pursuant to an Indenture between the Company, the Subsidiary, and Wilmington Savings Fund Society, FSB, dated February 16, 2021 (the “Indenture”). The 2021 Notes bear interest payable semiannually in arrears, at a rate of 5.875% per year. The 2021 Notes will mature on February 15, 2026, unless earlier converted, redeemed or repurchased in accordance with their terms. |

F-19

762

GAMIDA CELL LTD. and its subsidiary

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

U.S. dollars in thousands (except share and per share data and unless otherwise indicated)

NOTE 6:- CONVERTIBLE SENIOR NOTES, NET (Cont.)

Subject to the provisions of the Indenture, the holders of the 2021 Notes have the right, prior to the close of business on the second scheduled trading day immediately preceding February 15, 2026, to convert any 2021 Notes or portion thereof that is $1,000 or an integral multiple thereof, into the Company’s ordinary shares at an initial conversion rate of 56.3063 shares per $1,000 principal amount of 2021 Notes (equivalent to an exchange price of $17.76 per share). The conversion rate is subject to adjustment in specified events.

Upon the occurrence of a fundamental change (as defined in the Indenture), holders of the 2021 Notes may require the Company to repurchase for cash all or a portion of their 2021 Notes, in multiples of $1,000 principal amount, at a repurchase price equal to 100% of the principal amount of the 2021 Notes, plus any accrued and unpaid interest, if any, to, but excluding, interest accrued after the date of such repurchase notice. If certain fundamental changes referred to as make-whole fundamental changes occur, the conversion rate for the 2021 Notes may be increased.

Subject to the provisions of the Indenture, the Subsidiary may redeem for cash all or a portion of the 2021 Notes for cash, at its option, at a redemption price equal to 100% of the principal amount of the 2021 Notes to be redeemed, plus accrued and unpaid interest on the notes to be redeemed, if the last reported closing price of the Company’s ordinary shares has been at least 130% of the exchange price then in effect for at least 20 trading days during any 30 consecutive trading day period, and in the event of certain tax law changes.

The Company accounts for its 2021 Notes in accordance with ASC 470-20 “Debt with Conversion and Other Options”. The Convertible Notes are accounted for as a single liability measured at its amortized cost, as no other embedded features require bifurcation and recognition as derivatives according to ASC 815-40.

| | | December 31, | |

| | | 2022 | | | 2021 | |

| Liability component: | | | | | | |

| | | | | | | |

| Principal amount | | $ | 75,000 | | | $ | 75,000 | |

| Issuance costs | | | (4,223 | ) | | | (4,223 | ) |

| Net issuance costs | | | 70,777 | | | | 70,777 | |

| Amortized issuance costs | | | 1,423 | | | | 640 | |

| | | | | | | | | |

| Net carrying amount | | $ | 72,200 | | | $ | 71,417 | |

The total issuance costs of the 2021 Notes amounted to $4,223 and are amortized to interest expense at an annual effective interest rate of 7.37%, over the term of the 2021 Notes.

As of December 31, 2022, and 2021, the total estimated fair value of the 2021 Notes was $73,331 and $70,629, respectively. The fair value was determined using the Company’s effective rates for December 31, 2022, and 2021.

F-20

763

GAMIDA CELL LTD. and its subsidiary

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

U.S. dollars in thousands (except share and per share data and unless otherwise indicated)

NOTE 6:- CONVERTIBLE SENIOR NOTES, NET (Cont.)

| b. | In December 2022, the Company, as guarantor, and the Subsidiary entered into a Loan and Security Agreement (the “Loan Agreement”) with certain funds managed by Highbridge Capital Management, LLC (collectively, “Highbridge”), as the lenders (together with the other lenders from time to time party thereto, the “Lenders”), and Wilmington Savings Fund Society, FSB, as collateral agent and administrative agent. Pursuant to the Loan Agreement, the Subsidiary issued $25 million aggregate principal amount of convertible senior notes (the “2022 Notes”). The 2022 Notes bear interest of 7.5% which will be paid on a quarterly basis and monthly principal installment payments. |

The 2022 Notes are exchangeable, at the option of the Lenders, into ordinary shares at an exchange rate of 0.52356 ordinary shares per $1.00 principal amount, together with a make-whole premium equal to all accrued and unpaid and remaining coupons due through the maturity date. The exchange rate is subject to adjustment in the event of ordinary share dividends, reclassifications and certain other fundamental transactions affecting the ordinary shares.

The Loan Agreement contains customary representations and warranties and covenants, including a $20.0 million minimum liquidity covenant and certain negative covenants restricting dispositions, changes in business and business locations, mergers and acquisitions, indebtedness, issuances of preferred stock, liens, collateral accounts, restricted payments, transactions with affiliates, compliance with laws, and issuances of capital stock. Most of these restrictions are subject to certain minimum thresholds and exceptions. Certain of the negative covenants will terminate when less than $5.0 million of principal amount is outstanding under the Loan Agreement. As of December 31, 2022, the Company is in compliance with such covenants.

The Company has elected the fair value option to measure the 2022 Notes upon issuance, in accordance with ASC 825-10. Under the fair value option, the 2022 Notes are measured at fair value each period with changes in fair value reported in the statements of operations. According to ASC 825-10, changes in fair value that are caused by changes in the instrument-specific credit risk will be presented separately in other comprehensive income (loss). As of December 31, 2022, the fair value of the 2022 Notes was $24,250, approximating the proceeds from the issuance of the 2022 Notes.

Subsequent to balance sheet date, in January and March 2023, the Company issued 3,141,360 and 633,185 ordinary shares in exchange of the discharge of $6,000 of the aggregate outstanding balance and the discharge of $900 interest make-whole payment, respectively, in respect of the 2022 Notes.

NOTE 7:- ACCRUED EXPENSES AND CURRENT LIABILITIES

| | | December 31, | |

| | | 2022 | | | 2021 | |

| | | | | | | |

| Subcontractors | | $ | 794 | | | $ | 517 | |

| Clinical activities | | | 5,375 | | | | 5,445 | |

| Professional services | | | 1,561 | | | | 740 | |

| Production plant in process | | | 790 | | | | 983 | |

| Other | | | 371 | | | | 180 | |

| | | | | | | | | |

| | | $ | 8,891 | | | $ | 7,865 | |

F-21

764

GAMIDA CELL LTD. and its subsidiary

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

U.S. dollars in thousands (except share and per share data and unless otherwise indicated)

NOTE 8:- FAIR VALUE MEASUREMENTS

The following tables present the fair value of money market funds and marketable securities for the years ended December 31, 2022 and 2021:

| | | December 31, | |

| | | 2022 | | | 2021 | |

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Financial Assets: | | | | | | | | | | | | | | | | | | | | | | | | |

| Cash equivalents: | | | | | | | | | | | | | | | | | | | | | | | | |

| Money market funds | | $ | 58,827 | | | $ | - | | | $ | - | | | $ | 58,827 | | | $ | 51,021 | | | $ | - | | | $ | - | | | $ | 51,021 | |

| Marketable securities: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Corporate debentures | | | - | | | | - | | | | - | | | | - | | | | - | | | | 19,605 | | | | - | | | | 19,605 | |

| Government debentures | | | | | | | | | | | | | | | | | | | | | | | 20,429 | | | | - | | | | 20,429 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total assets measured at fair value | | | 58,827 | | | | - | | | | - | | | | 58,827 | | | | 51,021 | | | | 40,034 | | | | - | | | | 91,055 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Financial Liabilities: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 2022 Notes | | | - | | | | - | | | | 24,250 | | | | 24,250 | | | | - | | | | - | | | | - | | | | - | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total liabilities measured at fair value | | $ | - | | | $ | - | | | $ | 24,250 | | | $ | 24,250 | | | $ | - | | | $ | - | | | $ | - | | | $ | - | |

See Note 6 “Convertible Senior Notes” for the carrying amount and estimated fair value of the Company’s 2021 Notes as of December 31, 2022 and 2021.

The Company classifies the cash equivalents, marketable securities and 2022 Notes within Level 1, Level 2 or Level 3 because the Company uses quoted market prices, alternative pricing sources and models utilizing market observable inputs or unobservable inputs to determine their fair value.

NOTE 9:- CONTINGENT LIABILITIES AND COMMITMENTS

From time to time the Company or its subsidiaries may be involved in legal proceedings and/or litigation arising in the ordinary course of business. While the outcome of these matters cannot be predicted with certainty, the Company does not believe it will have a material effect on its consolidated financial position, results of operations, or cash flows.

As of December 31, 2022, the Company obtained bank guarantees in the amount of $2,897, primarily in connection with an Investment Center grant in order to ensure the fulfillment of the grant terms. As of December 31, 2022, $1,826 has been received, and an additional $1,071 is expected to be received in 2023.

F-22

765

GAMIDA CELL LTD. and its subsidiary

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

U.S. dollars in thousands (except share and per share data and unless otherwise indicated)

NOTE 9:- CONTINGENT LIABILITIES AND COMMITMENTS (Cont.)

The Company has received grants from the IIA to finance its research and development programs in Israel, through which the Company received IIA participation payments in the aggregate amount of $37.7 million through December 31, 2022, of which $35.1 million is royalty-bearing grants and $2.6 million is non-royalty-bearing grants. In return, the Company is committed to pay IIA royalties at a rate of 3-3.5% of future sales of the developed products, up to 100% of the amount of grants received plus interest at LIBOR rate. Through December 31, 2022, no royalties have been paid or accrued. The Company’s contingent royalty liability to the IIA at December 31, 2022, including grants received by the Company and the associated LIBOR interest on all such grants totaled to $43.5 million.

NOTE 10:- SHAREHOLDERS’ EQUITY

Subject to the Company’s amended and restated Articles of Association, the holders of the Company’s ordinary shares have the right to receive notices to attend and vote in general meetings of the Company’s shareholders, and the right to share in dividends and other distributions upon liquidation.

On September 27, 2022, the Company entered into an underwriting agreement with certain underwriters, pursuant to which the Company issued and sold, in an underwritten public offering, an aggregate of 12,905,000 of its ordinary shares at a public offering price of $1.55 per share. During 2022, the Company issued 1,540,165 additional ordinary shares via an at-the-market (ATM) offering, at an average public offering price of $2.84.

As part of its 2017 investment round, the Company granted certain investors 4,323,978 warrants that expired in July 2022. As of December 31, 2022, 1,010,466 of the warrants were exercised into the Company’s ordinary shares and the remaining 3,313,512 outstanding warrants expired.

During the year ended December 31, 2022, the Company cancelled 120,004 outstanding restricted shares

F-23

766

GAMIDA CELL LTD. and its subsidiary

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

U.S. dollars in thousands (except share and per share data and unless otherwise indicated)

NOTE 11:- SHARE-BASED COMPENSATION

On November 23, 2014, the Company’s Board of Directors approved, subject to the approval of the shareholders, creation of the Company’s ordinary C share class, with nominal value NIS 0.01 per share and classification of 1,500,000 ordinary shares for such class of shares, whereby 1,152,044 of such shares were allocated to the Company’s employees under the amended 2014 Israel Share Option Plan (the “2014 Plan”). The exercise price of the options granted under the 2014 Plan may not be less than the nominal value of the shares into which the options are exercised.

The options vest primarily over three years. There are no cash settlement alternatives. On December 29, 2014, the Company’s shareholders ratified and approved the aforesaid actions.

On January 23, 2017, the Company’s Board of Directors approved the Company’s 2017 Share Incentive Plan (the “2017 Plan” and together with the 2014 Plan, the “Option Plans”), and the subsequent grant of options to the Company’s employees, officers and directors. Pursuant to the 2017 Plan, the Company initially reserved for issuance 312,867 ordinary shares, nominal value NIS 0.01 each. On February 28, 2017, the Company’s shareholders approved the 2017 Plan.

The 2017 Plan provides for the grant of awards, including options, restricted shares and restricted share units to the Company’s directors, employees, officers, consultants and advisors.

On June 26, 2017, and on December 28, 2017, the Company’s Board of Directors approved the reservation of 463,384 and 559,764 additional ordinary shares, respectively, for issuance under the 2017 Plan (totaling, including previous plans, an aggregate of 1,336,015 ordinary shares).

On February 25, 2021 and November 17, 2021, the board of directors and shareholders, respectively, approved an amendment and restatement of the 2017 Plan. The 2017 Plan, as amended, also contains an “evergreen” provision, which provides for an automatic allotment of ordinary shares to be added every year to the pool of ordinary shares available for grant under the 2017 Plan. Under the evergreen provision, on January 1 of each year (beginning January 1, 2022), the number of ordinary shares available under the 2017 Plan automatically increases by the lesser of the following: (i) 4% of our outstanding ordinary shares on the last day of the immediately preceding year; and (ii) an amount determined in advance of January 1 by the board of directors.

The Company estimates the fair value of stock options granted using the binominal option-pricing model. The option-pricing model requires a number of assumptions, of which the most significant are the expected stock price volatility and the expected option term.

F-24

767

GAMIDA CELL LTD. and its subsidiary

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

U.S. dollars in thousands (except share and per share data and unless otherwise indicated)

NOTE 11:- SHARE-BASED COMPENSATION (Cont.)

Expected volatility was calculated based upon the Company’s historical share price and historical volatilities of similar entities in the related sector index. The expected term of the options granted is derived from output of the option valuation model and represents the period of time that options granted are expected to be outstanding. The risk-free interest rate is based on the yield from U.S. treasury bonds with an equivalent term. The Company has historically not paid dividends and has no foreseeable plans to pay dividends.

The following table lists the inputs to the binomial option-pricing model used for the fair value measurement of equity-settled share options for the above Options Plans for the years 2022 and 2021:

| | | December 31, | |

| | | 2022 | | | 2021 | |

| | | | | | | |

| Dividend yield | | | 0 | % | | | 0 | % |

| Expected volatility of the share prices | | | 66%-67 | % | | | 65 | % |

| Risk-free interest rate | | | 1.8%-3.8 | % | | | 1.4%-1.5 | % |

| Expected term (in years) | | | 8 | | | | 8 | |

Based on the above inputs, the fair value of the options was determined to be $0.99- $1.85 per option at the grant date.

| b. | The following table summarizes the number of options granted to employees under the Option Plans for the year ended December 31, 2022 and related information: |

| | | Number of

options | | | Weighted

average

exercise

price | | | Weighted

average

remaining

contractual

term

(in years) | | | Aggregate

intrinsic

value | |

| | | | | | | | | | | | | |

| Balance as of December 31, 2021 | | | 4,411,424 | | | $ | 6.01 | | | | 8.19 | | | $ | 92,507 | |

| | | | | | | | | | | | | | | | | |

| Granted | | | 2,412,950 | | | | 2.55 | | | | - | | | | - | |

| Exercised | | | (47,426 | ) | | | 1.60 | | | | - | | | | - | |

| Forfeited | | | (483,683 | ) | | | 6.15 | | | | - | | | | - | |

| Expired | | | (159,362 | ) | | | 5.36 | | | | - | | | | - | |

| | | | | | | | | | | | | | | | | |

| Balance as of December 31, 2022 | | | 6,133,903 | | | | 4.62 | | | | 7.51 | | | | 8,939 | |

| | | | | | | | | | | | | | | | | |

| Exercisable as of December 31, 2022 | | | 2,840,554 | | | $ | 5.90 | | | | 5.78 | | | $ | 8,939 | |

As of December 31, 2022, there are $9,269 of total unrecognized costs related to share-based compensation that is expected to be recognized over a period of up to four years.

F-25

768

GAMIDA CELL LTD. and its subsidiary

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

U.S. dollars in thousands (except share and per share data and unless otherwise indicated)

NOTE 11:- SHARE-BASED COMPENSATION (Cont.)

| c. | The following table summarizes information about the Company’s outstanding and exercisable options granted to employees as of December 31, 2022: |

| Exercise price | | Options

outstanding

as of

December 31,

2022 | | | Weighted

average

remaining

contractual

term

(years) | | | Options

exercisable

as of

December 31,

2022 | | | Weighted

average

remaining

contractual

term

(years) | |

| | | | | | | | | | | | | |

| $ 0.25- 3.80 | | | 2,713,020 | | | | 9.19 | | | | 254,626 | | | | 7.33 | |

| $ 4.15- 4.95 | | | 2,056,729 | | | | 5.63 | | | | 1,714,926 | | | | 5.26 | |

| $ 5.21- 7.56 | | | 442,437 | | | | 6.97 | | | | 281,984 | | | | 6.17 | |

| $ 8.00-11.01 | | | 921,717 | | | | 6.93 | | | | 589,018 | | | | 6.43 | |

| | | | | | | | | | | | | | | | | |

| | | | 6,133,903 | | | | | | | | 2,840,554 | | | | | |

| d. | A summary of restricted shares and restricted share units activity for the year ended December 31, 2022 is as follows: |

| | | Number of

restricted

shares and

restricted

share units | | | Weighted average grant date fair

value | |

| | | | | | | |

| Unvested as of December 31, 2021 | | | 531,477 | | | $ | 5.48 | |

| | | | | | | | | |

| Granted | | | 1,243,250 | | | | 2.74 | |

| Vested | | | (370,880 | ) | | | 3.94 | |

| Forfeited | | | (277,104 | ) | | | 4.16 | |

| | | | | | | | | |

| Unvested as of December 31, 2022 | | | 1,126,743 | | | $ | 3.29 | |

| e. | The total share-based compensation expense related to all of the Company’s equity-based awards, recognized for the years ended December 31, 2022 and 2021 is comprised as follows: |

| | | Year ended

December 31, | |

| | | 2022 | | | 2021 | |

| | | | | | | |

| Research and development expenses, net | | $ | 1,890 | | | $ | 1,384 | |

| Commercial expenses | | | 1,284 | | | | 947 | |

| General and administrative expenses | | | 1,867 | | | | 1,902 | |

| | | | | | | | | |

| Total share-based compensation | | $ | 5,041 | | | $ | 4,233 | |

F-26

769

GAMIDA CELL LTD. and its subsidiary

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

U.S. dollars in thousands (except share and per share data and unless otherwise indicated)

NOTE 12:- TAXES ON INCOME

| a. | Tax rates applicable to the income of the Company: |

Taxable income of the Israeli parent is subject to the Israeli corporate tax at the rate of 23% in 2022 and 2021.

The Subsidiary is taxed according to the tax laws in its country of residence.

Income is subject to tax benefits under the Law for Encouragement of Capital Investments, 1959 (the “Investment Law”), which provides tax benefits for Israeli companies meeting certain requirements and criteria. The Investment Law has undergone certain amendments and reforms in recent decades.

The Israeli parliament enacted a reform to the Investment Law, effective January 2011. According to the reform, a flat rate tax applies to companies eligible for the “Preferred Enterprise” status. In order to be eligible for Preferred Enterprise status, a company must meet minimum requirements to establish that it contributes to the country’s economic growth and is a competitive factor for the gross domestic product.

The Company’s Israeli operations elected “Preferred Enterprise” status, starting in 2017.

Benefits granted to a Preferred Enterprise include reduced tax rates. As part of the Economic Efficiency Law (Legislative Amendments for Accomplishment of Budgetary Targets for Budget Years 2017-2018), 5777-2016, the tax rate for Area A will be 7.5% in 2017 onwards. In other regions, the tax rate is 16%. Preferred Enterprises in peripheral regions will be eligible for Investment Center grants, as well as the applicable reduced tax rates.

| b. | The Law for the Encouragement of Industry (Taxation), 1969: |

The Company has the status of an “industrial company”, under this law. According to this status and by virtue of regulations published thereunder, the Company is entitled to claim a deduction of accelerated depreciation on equipment used in industrial activities, as determined in the regulations issued under the law. The Company is also entitled to amortize a patent or knowhow usage right that is used in the enterprise’s development or promotion, to deduct listed share issuance expenses and to file consolidated financial statements under certain conditions.

F-27

770

GAMIDA CELL LTD. and its subsidiary

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

U.S. dollars in thousands (except share and per share data and unless otherwise indicated)

NOTE 12:- TAXES ON INCOME (Cont.)

| c. | The components of the loss were as follows: |

| | | Year ended

December 31, | |

| | | 2022 | | | 2021 | |

| | | | | | | |

| Domestic | | $ | 66,137 | | | $ | 55,853 | |

| Foreign | | | 13,238 | | | | 33,940 | |

| | | | | | | | | |

| | | $ | 79,375 | | | $ | 89,793 | |

| d. | Net operating losses carryforward: |

The Company has net operating losses and capital losses for tax purposes as of December 31, 2022 totaling approximately $274,384 and $507, respectively, which may be carried forward and offset against taxable income in the future for an indefinite period.

As of December 31, 2022, the Subsidiary has net operating losses carryforwards of $37,458 for federal tax purposes.

The Company’s tax assessments through the 2017 tax year are considered final.

The Company provided a full valuation allowance, to reduce deferred tax assets to their estimated realizable value, since it is more likely than not that all of the deferred tax assets will not be realized.

F-28

771

GAMIDA CELL LTD. and its subsidiary

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

U.S. dollars in thousands (except share and per share data and unless otherwise indicated)

NOTE 13:- BASIC AND DILUTED NET LOSS PER SHARE

Basic net loss per ordinary share is computed by dividing net loss for each reporting period by the weighted-average number of ordinary shares outstanding during each year. Diluted net loss per ordinary share is computed by dividing net loss for each reporting period by the weighted average number of ordinary shares outstanding during the period, plus dilutive potential ordinary shares considered outstanding during the period, in accordance with ASC No. 260-10 “Earnings Per Share”. The Company incurred a loss in the year ended December 31, 2022; hence all potentially dilutive ordinary shares were excluded due to their anti-dilutive effect.

Details of the number of shares and loss used in the computation of net loss per share:

| | | Year ended December 31, | |

| | | 2022 | | | 2021 | |

| | | Weighted

number of

shares | | | Net loss

attributable

to equity

holders of

the

Company | | | Weighted

number of

shares | | | Net loss

attributable

to equity

holders of

the

Company | |

| For the computation of basic and diluted net loss | | | 63,826,295 | | | $ | 79,375 | | | | 59,246,803 | | | $ | 89,793 | |

All outstanding convertible senior note options, warrants, outstanding share options, and restricted shares for the three and nine months ended December 31, 2022 and 2021 have been excluded from the calculation of the diluted net loss per share, because all such securities are anti-dilutive for all periods presented. The total number of potential shares excluded from the calculation of diluted net loss per share are as follows:

| | | Year ended

December 31, | |

| | | 2022 | | | 2021 | |

| | | | | | | |

| Convertible senior notes | | | 4,904,318 | | | | 3,690,763 | |

| Warrants | | | 1,670,373 | | | | 3,313,512 | |

| Outstanding share options | | | 5,396,583 | | | | 4,349,876 | |

| Restricted shares | | | 1,289,395 | | | | 233,475 | |

| | | | | | | | | |

| Total | | | 13,260,669 | | | | 11,587,626 | |

F-29

772

GAMIDA CELL LTD. and its subsidiary

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

U.S. dollars in thousands (except share and per share data and unless otherwise indicated)

NOTE 14: SUBSEQUENT EVENTS

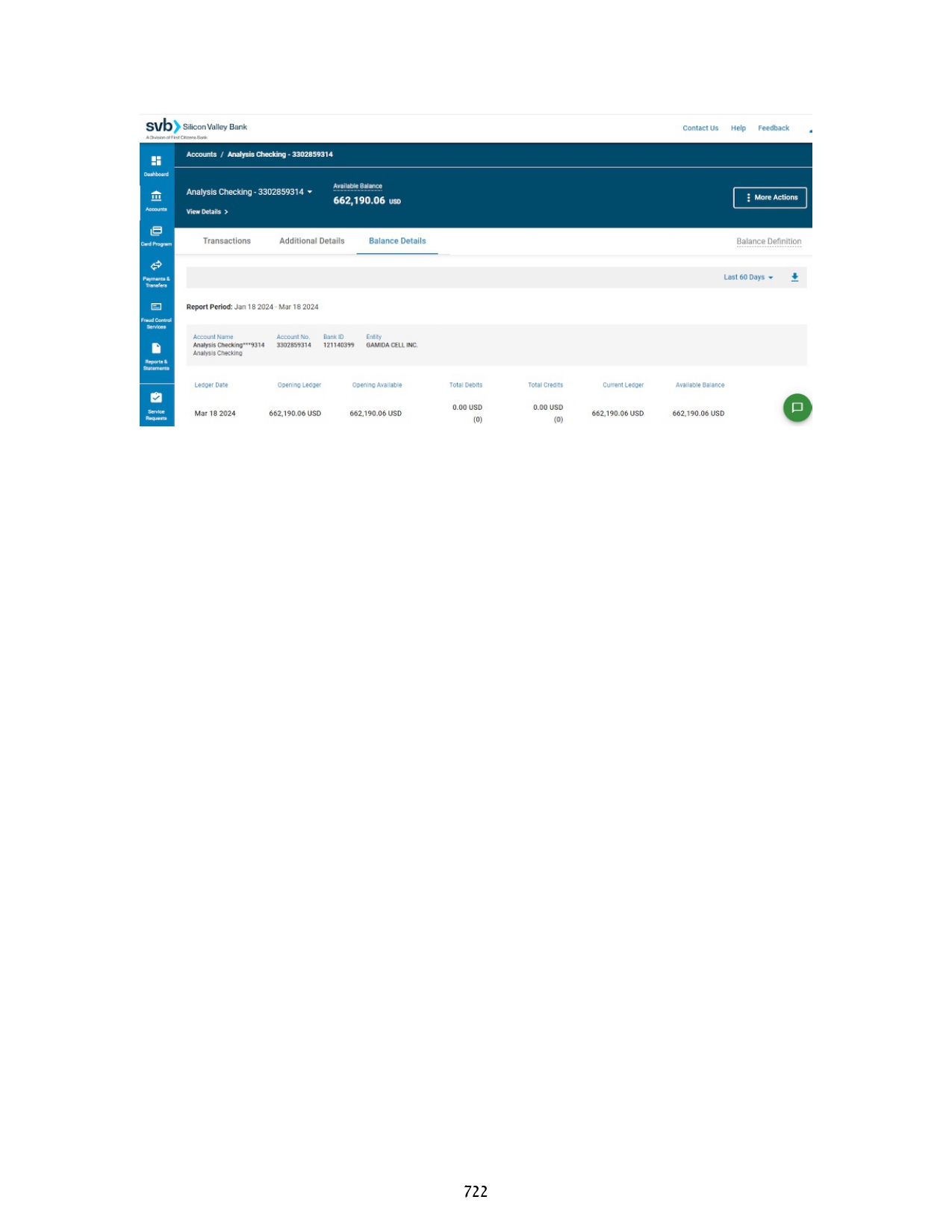

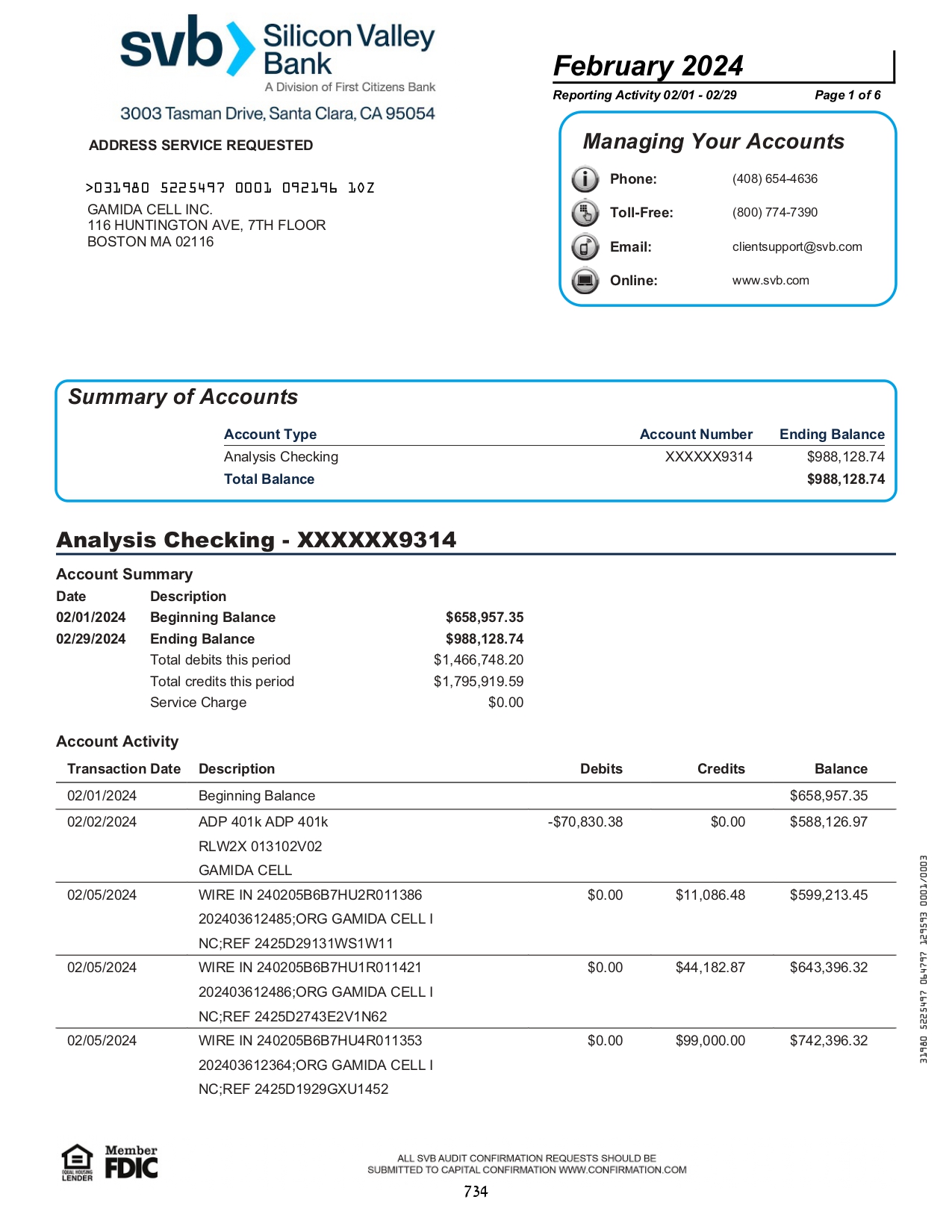

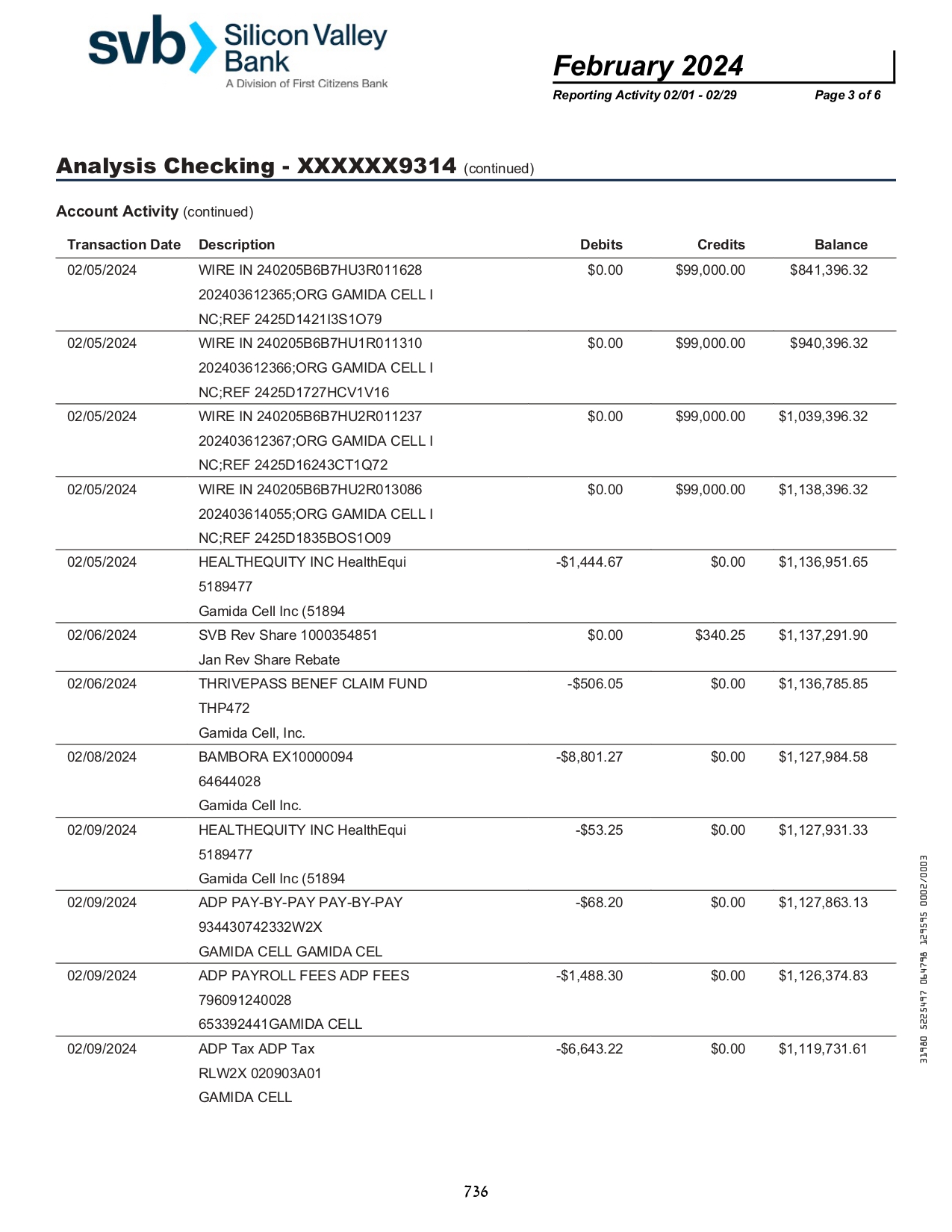

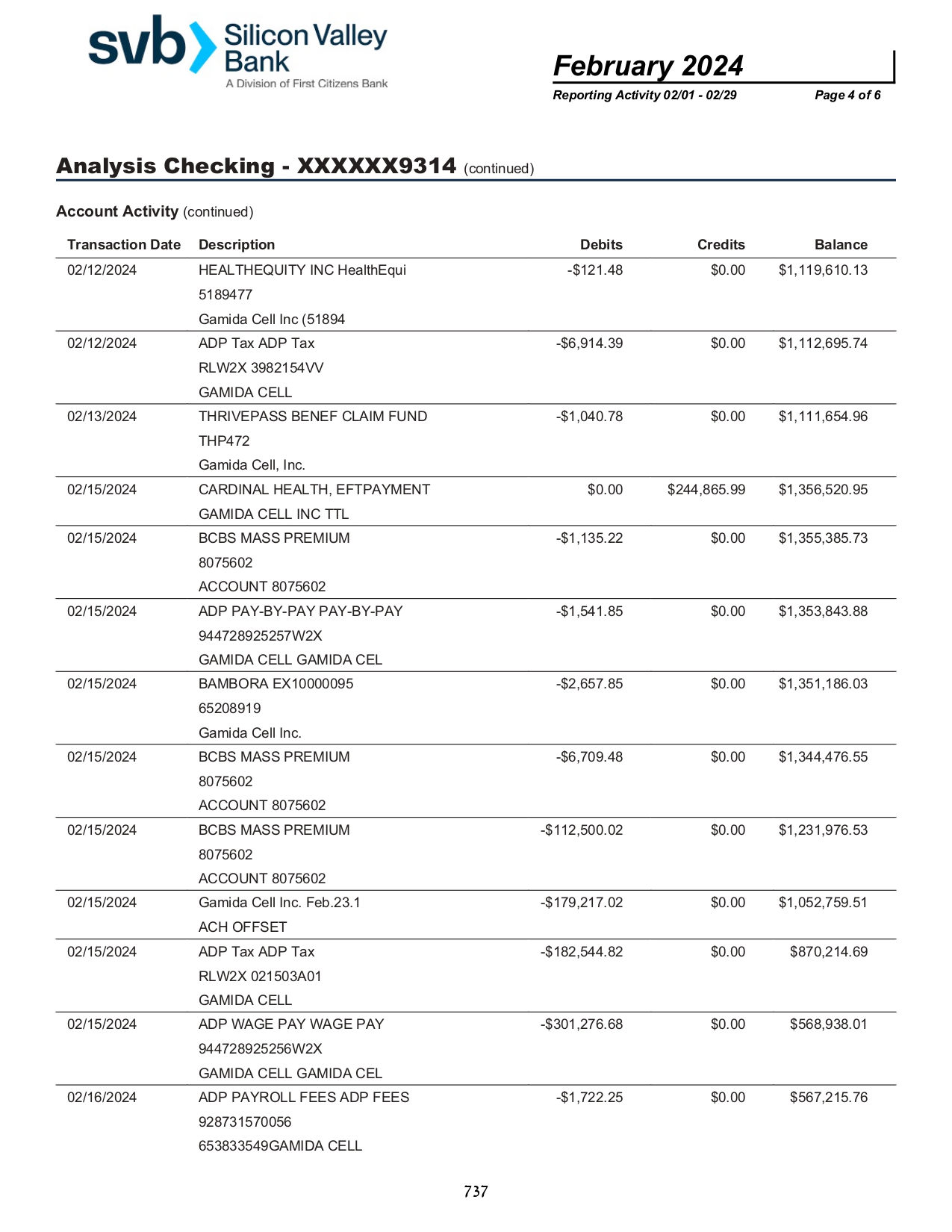

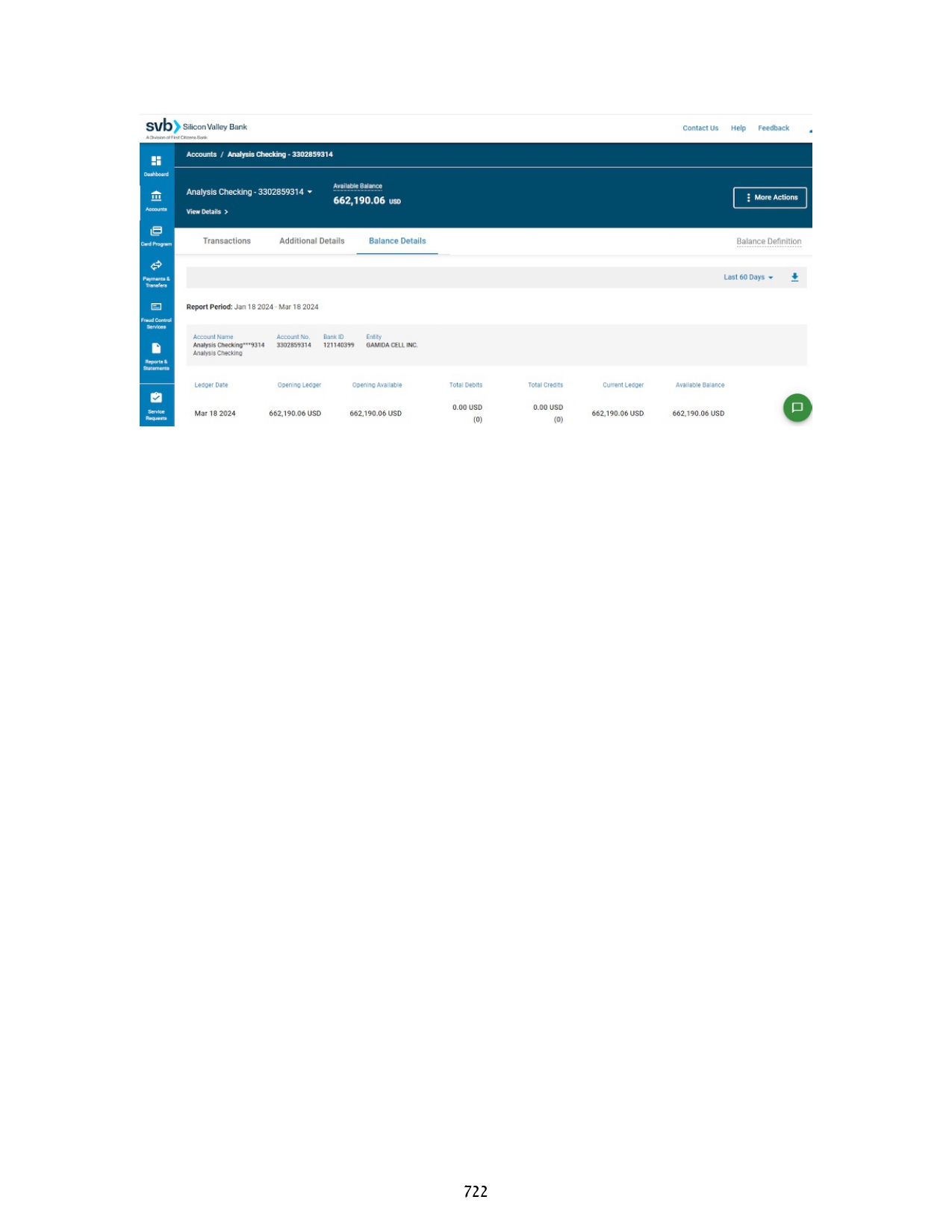

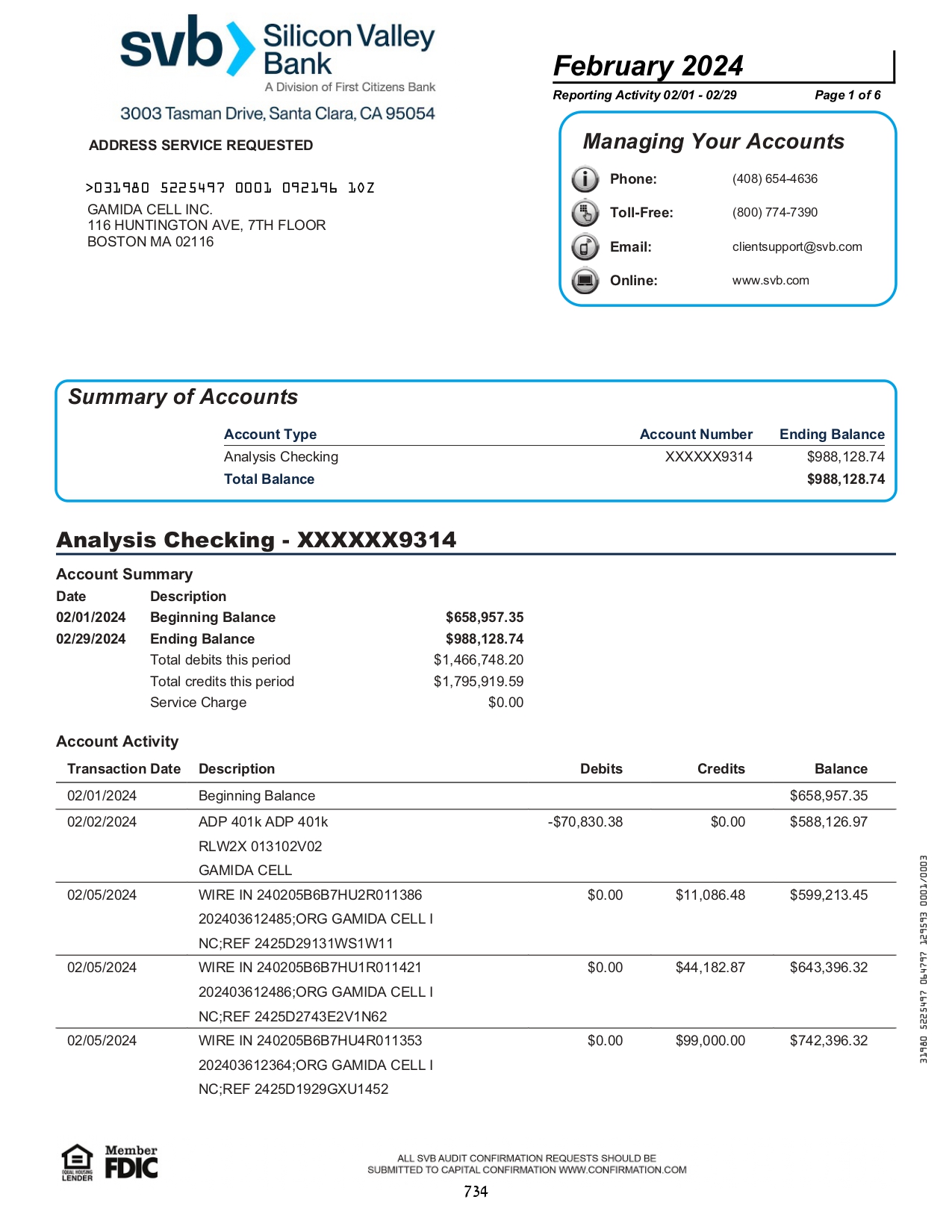

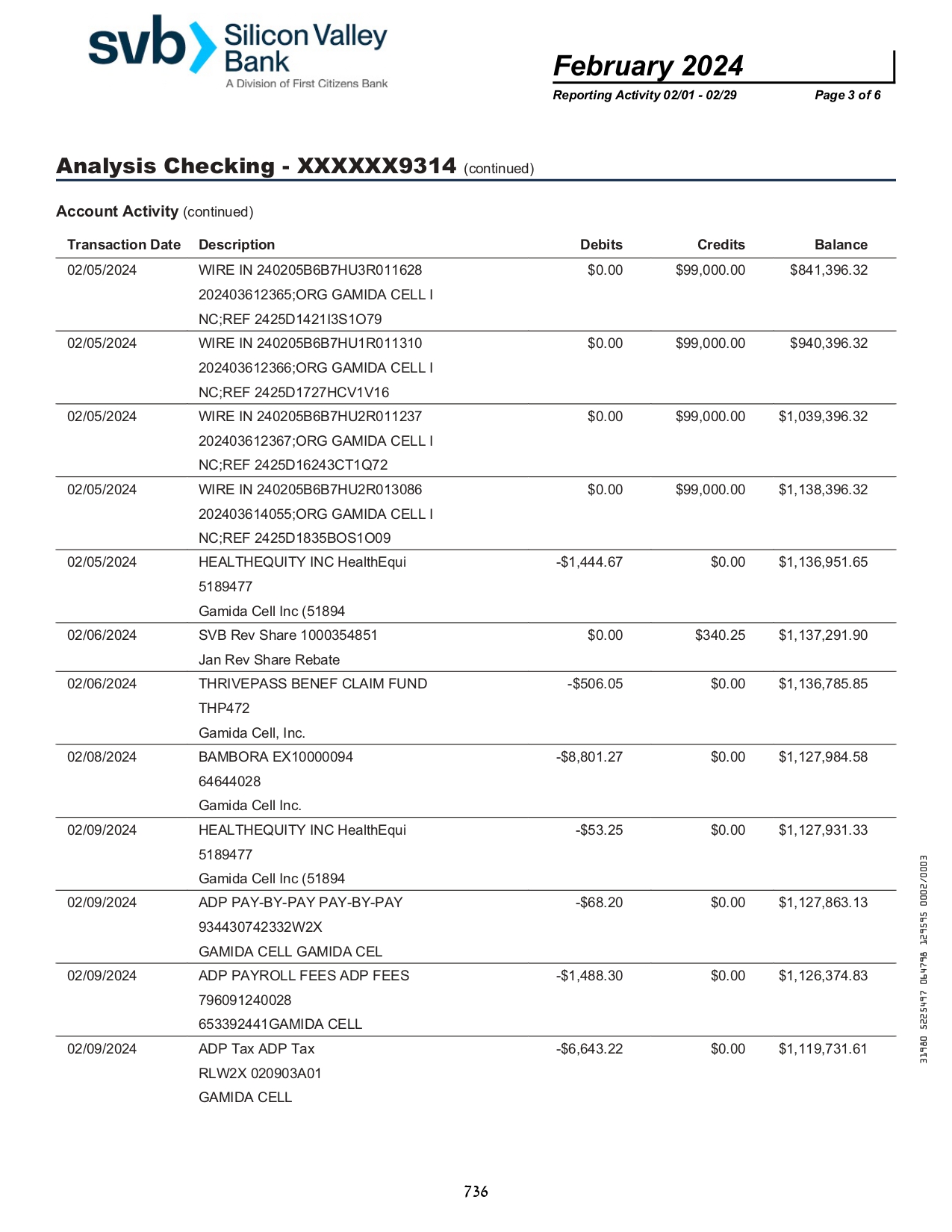

| 1. | On March 10, 2023, Silicon Valley Bank (“SVB”) was closed by the California Department of Financial Protection and Innovation, which appointed the Federal Deposit Insurance Corporation (“FDIC”) as receiver. As of March 31, 2023, the Company’s exposure to SVB is immaterial, and consists mainly on customary business related deposits, which the impact of any amounts that the Company is unable to recover will not have a significant disruption on ongoing business activities. |

| 2. | In 2023, the Company raised an additional $5.0 million by issuing 3.1 million ordinary shares via an ATM offering, at an average public offering price of $1.61. |

| 3. | On March 27, 2023, the Company implemented a strategic restructuring of its operations to prioritize launch of omidubicel to ensure that, if approved, patients who may potentially benefit will have access to therapy. In connection with this strategic restructuring, the Company has taken decisive actions to: (1) prioritize resources toward the launch; (2) reduce expenses across the board; and (3) seek potential commercial or strategic partnerships to maximize patient access to omidubicel, a potentially lifesaving therapy. To reduce operating expenses, the Company will: (1) suspend the development of its engineered NK cell therapy preclinical pipeline, including GDA-301, GDA-501 and GDA-601, while maintaining the rights to this intellectual property; (2) implement a headcount reduction of 17% with the majority of impacted headcount tied to the discontinuation of the pre-clinical NK cell therapy candidates; and (3) the Company will also close its operations in Jerusalem and consolidate Israeli operations at its state-of-the-art manufacturing facility in Kiryat Gat. |

- - - - - - - - - - - - - -

F-30

773

TABLE OF CONTENTS

i

774

Trademarks and Trade Names

Unless the context requires otherwise, “Gamida,” “Gamida Cell,” “we,” “us,” “our” or the “Company” mean Gamida Cell Ltd. and its wholly-owned subsidiary, Gamida Cell Inc.

Gamida Cell and Omisirge are trademarks of ours that we use in this quarterly report on Form 10-Q, or Quarterly Report. This Quarterly Report also includes trademarks, tradenames, and service marks that are the property of other organizations. Solely for convenience, our trademarks and tradenames referred to in this Quarterly Report appear without the ® or ™ symbols, but those references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights, or the right of the applicable licensor to our trademark and tradenames. We do not intend our use or display of other companies’ trade names or trademarks to imply a relationship with, or endorsement or sponsorship of us by, any other companies.

ii

775

PART I-FINANCIAL INFORMATION

Item 1. Financial Statements.

Gamida Cell ltd. AND ITS SUBSIDIARY

INTERIM CONSOLIDATED FINANCIAL STATEMENTS

AS OF SEPTEMBER 30, 2023

U.S. DOLLARS IN THOUSANDS

UNAUDITED

INDEX

1

776

CONDENSED CONSOLIDATED BALANCE SHEETS

U.S. dollars in thousands

| | | | | | September 30, | | | December 31, | |

| | | Note | | | 2023 | | | 2022 | |

| | | | | | Unaudited | | | | |

| ASSETS | | | | | | | | | |

| | | | | | | | | | |

| CURRENT ASSETS: | | | | | | | | | |

| Cash and cash equivalents | | | | | | $ | 60,431 | | | $ | 64,657 | |

| Short-term restricted deposit | | | | | | | 2,723 | | | | - | |

| Inventory | | | | | | | 2,324 | | | | - | |

| Accounts receivable | | | | | | | 676 | | | | - | |

| Prepaid expenses and other current assets | | | | | | | 2,355 | | | | 1,889 | |

| | | | | | | | | | | | | |

| Total current assets | | | | | | | 68,509 | | | | 66,546 | |

| | | | | | | | | | | | | |

| NON-CURRENT ASSETS: | | | | | | | | | | | | |

| Restricted deposits | | | | | | | 377 | | | | 3,668 | |

| Property, plant and equipment, net | | | | | | | 42,667 | | | | 44,319 | |

| Operating lease right-of-use assets | | | 3 | | | | 3,706 | | | | 7,024 | |

| Severance pay fund | | | | | | | 1,288 | | | | 1,703 | |

| Other long-term assets | | | | | | | 1,201 | | | | 1,513 | |

| | | | | | | | | | | | | |

| Total non-current assets | | | | | | | 49,239 | | | | 58,227 | |

| | | | | | | | | | | | | |

| Total assets | | | | | | $ | 117,748 | | | $ | 124,773 | |

The accompanying notes are an integral part of the condensed consolidated financial statements.

2

777

CONDENSED CONSOLIDATED BALANCE SHEETS

U.S. dollars in thousands (except share and per share data)

| | | | | | September 30, | | | December 31, | |

| | | Note | | | 2023 | | | 2022 | |

| | | | | | Unaudited | | | | |

| LIABILITIES AND SHAREHOLDERS’ EQUITY (DEFICIT) | | | | | | | | | |

| | | | | | | | | | |

| CURRENT LIABILITIES: | | | | | | | | | |

| Trade payables | | | | | | $ | 1,664 | | | $ | 6,384 | |

| Employees and payroll accruals | | | | | | | 6,058 | | | | 5,300 | |

| Operating lease liabilities | | | 3 | | | | 1,497 | | | | 2,648 | |

| Accrued interest of convertible senior notes | | | 4 | | | | 710 | | | | 1,652 | |

| Accrued expenses and other current liabilities | | | | | | | 10,725 | | | | 8,891 | |

| | | | | | | | | | | | | |

| Total current liabilities | | | | | | | 20,654 | | | | 24,875 | |

| | | | | | | | | | | | | |

| NON-CURRENT LIABILITIES: | | | | | | | | | | | | |

| Convertible senior notes, net | | | 4, 5 | | | | 81,419 | | | | 96,450 | |

| Warrants liability | | | 5 | | | | 11,610 | | | | - | |

| Accrued severance pay | | | | | | | 1,381 | | | | 1,914 | |

| Long-term operating lease liabilities | | | 3 | | | | 2,302 | | | | 4,867 | |

| Other long-term liabilities | | | | | | | - | | | | 4,690 | |

| | | | | | | | | | | | | |

| Total non-current liabilities | | | | | | | 96,712 | | | | 107,921 | |

| | | | | | | | | | | | | |

| CONTINGENT LIABILITIES AND COMMITMENTS | | | 6 | | | | | | | | | |

| | | | | | | | | | | | | |

| SHAREHOLDERS’ EQUITY (DEFICIT): | | | 7, 8 | | | | | | | | | |

| Share capital - | | | | | | | | | | | | |

| Ordinary shares of NIS 0.01 par value - Authorized: 225,000,000 and 150,000,000 shares at September 30, 2023 (unaudited) and December 31, 2022; Issued: 132,083,914 and 74,703,030 at September 30, 2023 (unaudited) and December 31, 2022, respectively; Outstanding: 131,931,600 and 74,583,026 shares at September 30, 2023 (unaudited) and December 31, 2022, respectively | | | | | | | 357 | | | | 211 | |

| Treasury Ordinary shares of NIS 0.01 par value – 152,314 and 120,004 shares at September 30, 2023 (unaudited) and December 31, 2022, respectively | | | | | | | * | | | | * | |

| Additional paid-in capital | | | | | | | 471,012 | | | | 408,598 | |

| Accumulated deficit | | | | | | | (470,987 | ) | | | (416,832 | ) |

| | | | | | | | | | | | | |

| Total shareholders’ equity (deficit) | | | | | | | 382 | | | | (8,023 | ) |

| | | | | | | | | | | | | |

| Total liabilities and shareholders’ equity (deficit) | | | | | | $ | 117,748 | | | $ | 124,773 | |

| * | Represents less than $1. |

The accompanying notes are an integral part of the condensed consolidated financial statements.

3

778

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

U.S. dollars in thousands

| | | Three months ended September 30, | | | Nine months ended September 30, | |

| | | 2023 | | | 2022 | | | 2023 | | | 2022 | |

| | | Unaudited | |

| | | | | | | | | | | | | |

| Net revenue | | $ | 673 | | | $ | - | | | $ | 673 | | | $ | - | |

| Cost of sales | | | 626 | | | | - | | | | 626 | | | | - | |

| | | | | | | | | | | | | | | | | |